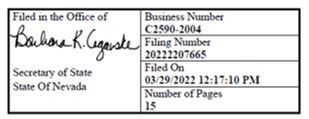

Exhibit 3.13

Amended and Restated Articles of Incorporation

AMENDED AND RESTATED

ARTICLES OF INCORPORATION

OF

QUANTUM ENERGY, INC.

The following Amended and Restated Articles of Incorporation supersede the previous Articles of Incorporation as amended of Quantum Energy, Inc. and they shall be the current Articles of Incorporation of the Corporation effective as of the date of filing:

ARTICLE I

Name

The name of this Corporation shall be Quantum Energy, Inc.

ARTICLE II

The purposes for which the corporation is organized are to engage in any activity or business not in conflict with the laws of the State of Nevada or of the United States of America, and without limiting the generality of the foregoing, specifically:

| | 1. | To have to exercise all the powers now or hereafter conferred by the laws of the State of Nevada upon corporations organized pursuant to the laws under which the corporation is organized and any and all acts amendatory thereof and supplemental thereto. |

| | 2. | To conduct and carry on its business or any branch thereof in any state or territory of the United States or in any foreign country in conformity with the laws of such state, territory, or foreign country, and to have and maintain in any state, territory, or foreign country a business office, plant, store or other facility. |

| | 3. | The purposes specified herein shall be construed both as purposes and powers and shall be in no wise limited or restricted by reference to, or inference from, the terms of any other clause in this or any other article, but the purposes and powers specified in each of the clauses herein shall be regarded as independent purposes and powers, and the enumeration of specific purposes and powers shall not be construed to limit or restrict in any manner the meaning of general terms or of the general powers of the corporation; nor shall the expression of one thing be deemed to exclude another, although it be of like nature not expressed. |

ARTICLE III

Capital

A. Authorized Capital

The total authorized number of shares of this corporation is Five Hundred Million (500,000,000) divided into Four Hundred Ninety Five Million (495,000,000) shares of common stock with a par value of $.001 per share and Five Million (5,000,000) shares of preferred stock with a par value of $.001 per share. The Board of Directors has the authority to establish more than one class or series of shares and to set the relative rights and preferences of any such different class or series.

B. Common Shares

Section 1.

General.

The voting, dividend and liquidation rights of the holders of the Common Shares are subject to and qualified by the rights, powers and preferences of the holders of the Preferred Shares set forth herein.

Section 2.

Voting.

The holders of the Common Shares are entitled to one vote for each Common Share held at all meetings of shareholders (and written consents in lieu of meetings); provided, however, that, except as otherwise required by law, holders of Common Shares, as such, shall not be entitled to vote on any amendment to these Articles of Incorporation that relates solely to the terms of one or more outstanding series of Preferred Shares if the holders of such affected series are entitled, either separately or together with the holders of one or more other such series, to vote thereon pursuant to these Articles of Incorporation or pursuant to the Nevada Revised Statutes ("NRS"). There shall be no cumulative voting.

C. Preferred Shares

The Preferred Stock may be issued from time to time by the Board of Directors as shares of one or more series. The description of shares of Preferred Stock, including any preferences, conversion and other rights, voting powers, restrictions, limitations as to dividends, qualifications, and terms and conditions of redemption shall be as set forth in resolutions adopted by the Board of Directors, and Articles of Amendment shall be filed as required by law with respect to issuance of such Preferred Stock, prior to the issuance of any shares of Preferred Stock.

The Board of Directors is expressly authorized, at any time, by adopting resolutions providing for the issuance of, dividing of such shares into series or providing for a change in the number of, shares of any Preferred Stock and, if and to the extent from time to time required by law, by filing Articles of Amendment which are effective without Shareholder action to increase or decrease the number of shares included in the Preferred Stock, but not below the number of shares then issued, and to set or change in any one or more respects the designations, preferences, conversion or other rights, voting powers, restrictions, limitations as to dividends, qualifications, or terms and conditions of redemption relating to the shares of Preferred Stock. Notwithstanding the foregoing, the Board of Directors shall not be authorized to change the rights of holders of the Common Stock of the Corporation to vote one vote per share on all matters submitted for shareholder action. The authority of the Board of Directors with respect to the Preferred Stock shall include, but not be limited to, setting or changing the following:

1. The annual dividend rate, if any, on shares of Preferred Stock, the times of payment and the date from which dividends shall be accumulated, if dividends are to be cumulative;

2. Whether the shares of Preferred Stock shall be redeemable and, if so, the redemption price and the terms and conditions of such redemption;

3. The obligation, if any, of the Corporation to redeem shares of Preferred Stock pursuant to a sinking fund;

4. Whether shares of Preferred Stock shall be convertible into, or exchangeable for, shares of stock of any other class or classes and, if so, the terms and conditions of such conversion or exchange, including the price or prices or the rate or rates of conversion or exchange and the terms of adjustment, if any;

5. Whether the shares of Preferred Stock shall have voting rights, in addition to the voting rights provided by law, and, if so, the extent of such voting rights;

6. The rights of the shares of Preferred Stock in the event of voluntary or involuntary liquidation, dissolution or winding-up of the Corporation; and

7. Any other relative rights, powers, preferences, qualifications, limitations or restrictions thereof relating to the Preferred Stock.

The shares of Preferred Stock of any one series shall be identical with each other in all respects except as to the dates from and after which dividends thereon shall cumulate, if cumulative.

D. Series D Preferred Shares

The “Series D Preferred Shares” shall have all the following rights, preferences, powers, privileges, and restrictions, qualifications and limitations:

Section 1.

Designation. Amount and Par value.

This series of preferred stock shall be designated as the Corporation’s Series D Preferred Stock and the number of shares so designated shall be up to 1,500,000. Each share of Series D Preferred Stock shall have a par value of $.001 per share and a stated value equal to $.001.

Section 2.

Dividends.

The Holders of Series D Preferred Stock shall be entitled to participate in any dividends declared on the Corporation's common stock on the basis that one share of Series D Preferred Stock shall receive dividends equivalent to 100 shares of common stock.

Section 3.

Voting Rights.

In addition to voting as a class as to all matters that require class voting under the Nevada Revised Statures (“NRS”) 78 of the laws of the State of Nevada, the holders of the Series D Preferred Stock shall vote on all matters with the holders of the Common Stock (and not as a separate class) on a one hundred votes per share (100: 1) basis. The holders of the Series D Preferred Stock shall be entitled to receive all notices relating to voting as are required to be given to the holders of the Common Stock.

Section 4.

Rank.

The Series D Preferred Stock shall, with respect to rights on liquidation, be entitled to receive 100 for 1 share of liquidation proceeds as compared to each share of common stock, $.001 par value per share.

Section 5.

Redemption.

Shares of Series D Preferred Stock may not be redeemed by the Corporation absent the consent of the holder of such shares.

Section 6.

Conversion.

(a) Series D Preferred Stock shall not be convertible into the Corporation’s Common Stock.

(b) The Corporation will not, by amendment of its Certificate of Incorporation or through any reorganization, recapitalization, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Corporation, but will at all times in good faith assist in the carrying out of all the provisions of this Section 6 and in the taking of all such action as may be necessary or appropriate in order to protect the voting rights of the holders of the Series D Preferred Stock against impairment.

(d) In the event of any taking by the Corporation of a record of the holders of any class of securities for the purpose of determining the holders thereof who are entitled to receive any dividend or other distribution, the Corporation shall mail to each holder of Series D Preferred Stock a notice specifying the date on which any such record is to be taken for the purpose of such dividend or distribution at least ten (10) days prior to such record date.

E. Series E Preferred Stock

The Series E Preferred Shares shall have the following rights, preferences, powers, privileges, restrictions, qualifications and limitations:

1. Designations and Amount. One Million Five Hundred (1,500,000) shares of the Preferred Stock of the Corporation, $0.001 par value per share, shall constitute a class of Preferred Stock designated as "Series E Preferred Stock" (the "Series E Preferred Stock") with a face value of $0.001 per share (the "Face Amount").

Section 2. Dividends.

The Holders of outstanding Series E Preferred Stock shall be entitled to receive 100 times the dividends per share of Series E Stock as are paid for each share of the Corporation's common stock.

Section 3. Voting Rights.

In addition to voting as a class as to all matters that require class voting under the Nevada Revised Statutes, the holders of the Series E Stock shall vote on all matters with the holders of the Common Stock (and not as a separate class) on one vote per Series E shares of Stock (1:1) basis. The holders of the Series E Stock shall be entitled to receive all notices relating to voting as are required to be given to the holders of the Common Stock.

Section 4. Rank.

The Series E Stock shall, with respect to the rights on liquidation be entitled to receive 100 for 1 Share of liquidation proceeds as compared to each share of common stock, $.001 par value per share.

Section 5. Redemption.

Shares of Series E Preferred Stock may not be redeemed by the Corporation absent the consent of the holder thereof.

Section 6. Conversion.

(a) Each share of Series E Stock shall be convertible, without any payment of additional consideration by the holder thereof and at the option of the holder thereof, at any time after the Series E Issue Date at the conversion ratio of one (1) share of Series E Stock for one hundred (100) shares of Common Stock.

(b) The Conversion Ratio shall be subject to adjustment in accordance with the

following:

i. In case the Corporation shall have at any time or from time to time after the Series E Issue Date, paid a dividend, or made a distribution, on the outstanding shares of Common Stock in shares of Common Stock, subdivided the outstanding shares of Common Stock, combined the outstanding shares of Common Stock into a smaller number of shares of issued by reclassification of the shares of Common Stock any shares of capital stock of the Corporation, then, and with respect to each such case, the Conversion Ratio shall be adjusted so that the holder of any shares of Series E Stock shall be entitled to receive upon conversion the number of shares of Common Stock or other securities of the Corporation which such holder would have owned or have been entitled to receive immediately prior to such events or the record date therefor, whichever is earlier, assuming the Series E Stock had been converted into Common Stock, it being the intention of the foregoing, to provide the holders of Series E Stock with the same benefits and securities as such holders would have received as holders of Common Stock if the Series E Stock had been converted into Common Stock at the Conversion Ratio on the Series E Issue Date and such holders had continued to hold such Common Stock.

ii. In case the Corporation shall at any time or from time to time after the Series E Issue Date declare, order, pay or make a dividend or other distribution (including, without limitation, any distribution of stock or other securities or property or rights or warrants to subscribe for securities of the Corporation or any of its subsidiaries by way of dividend or spin-oft), on its Common Stock, other than dividends or distributions of shares of Common Stock which are referred to in clause (i) of this section (b), then the holders of the Series E Stock shall be entitled to receive upon conversion their pro rata share of any such dividend or other distribution on an as converted basis; provided, however, that any plan or declaration of a dividend or distribution shall not have been abandoned or rescinded.

iii. If the Corporation shall be a party to any transaction including without limitation, a merger, consolidation, sale of all or substantially all of the Corporation's assets or a reorganization, reclassification or recapitalization of the capital stock, (such actions being referred to as a "Transaction), in each case, as a result of which shares of Common Stock are converted into the right to receive stock securities or other property (including cash or any combination thereof), each share of Series E Stock shall thereafter be convertible into the number of shares of stock or securities or property to which a holder of one hundred times the number of shares of Common Stock of the Corporation deliverable upon conversion of such Series E Stock would have been entitled to upon such Transaction; and, in any such case, appropriate adjustment (as determined by the Board) shall be made in the application of the provisions set forth in this Subsection, with respect to the rights and interest thereafter of the holders of the Series E Preferred Stock, to the end that the provisions set forth in this Subsection shall thereafter be applicable, as nearly as reasonably may be, in relation to any shares of stock or other property thereafter deliverable upon the conversion of the Series E Stock. The Corporation shall not effect any Transaction (other than a consolidation or merger in which the Corporation is the continuing corporation) unless prior to or simultaneously with the consummation thereof the Corporation, or the successor corporation or purchaser, as the case may be, shall provide in its charter document that each share of Series E Stock shall be converted into such shares of stock, securities or property as, in accordance with the foregoing provisions, each such holder is entitled to receive. The provisions of this paragraph shall similarly apply to successive Transactions.

(c) The Corporation will not, by amendment of its Certificate of Incorporation or through any reorganization, recapitalization, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Corporation, but will at all times in good faith assist in the carrying out of all the provisions of this Section (b) and in taking of all such action as may be necessary or appropriate in order to protect the conversion rights of the holders of the Series E Stock against impairment.

(d) In the event of any taking by the Corporation of a record of the holders of any class of securities for the purpose of determining the holders thereof who are entitled to receive any dividend or other distribution, the Corporation shall mail to each holder of Series E Stock a notice specifying the date on which any such record is to be taken for the purpose of such dividend or distribution at least ten (10) day prior to such record date.

(e) The Corporation shall, at or prior to the time of any conversion, take any and all action necessary to increase its authorized, but unissued Common Stock and to reserve and keep available out of its authorized, but unissued Common Stock, such number of shares of Common Stock as shall, from time to time, be sufficient to effect conversion of the outstanding shares of Series E Stock.

F. Reverse Split

“Reverse Split. Simultaneously with the effective date of this Amendment (the “Effective Time”) each of one hundred fifty (150) shares of the Company’s Common Stock, par value $.001 per share, issued and outstanding immediately prior to the Effective Time (the “Old Common Stock”) shall automatically and without any action on the part of the holder thereof, be reclassified as and changed, pursuant to a reverse stock split (the “Reverse Split”), into one (1) share of the Company’s outstanding Common Stock (the “New Common Stock”), subject to the treatment of fractional share interests as described below. Each holder of a certificate or certificates which immediately prior to the Effective Time represented outstanding shares of Old Common Stock (“Old Certificates,” whether one or more) shall be entitled to receive upon surrender of such Old Certificates to the Company’s transfer agent for cancellation, a certificate or certificates (the “New Certificates,” whether one or more) representing the number of whole shares of the New Common Stock into and for which the shares of the Old Common Stock formerly represented by such Old Certificates so surrendered are reclassified under the terms hereof. From and after the Effective Time each outstanding option to purchase common stock and each security or debt instrument convertible into common stock will automatically be adjusted so that the number of shares of common stock issuable upon their exercise or conversion shall be divided by 150 and corresponding adjustment will be made to the number of shares vested under each outstanding option and the exercise price or conversion shall be multiplied by 150, subject to rounding. From and after the Effective Time, Old Certificates shall thereupon be deemed for all corporate purposes to evidence ownership of New Common Stock in the appropriately reduced whole number of shares. No certificates or script representing fractional share interests in New Common Stock will be issued, and no cash payments will be made therefore. In lieu of any fraction of a share of New Common Stock to which the holder would otherwise be entitled, the holder will receive one (1) whole share of the Company’s New Common Stock. If more than one (1) Old Certificate shall be surrendered at one time for the account of the same Shareholder, the number of full shares of New Common Stock for which New Certificates shall be issued shall be computed on the basis of the aggregate number of shares represented by the Old Certificates so surrendered. In the event that the Company’s transfer agent determines that a holder of Old Certificates has not surrendered all of his certificates for exchange, the transfer agent shall carry forward any fractional share until all certificates of that holder have been presented for exchange such that consideration for fractional shares for any one person shall not exceed the value of one (1) share of New Common Stock. If any New Certificate is to be issued in a name other than that in which the Old Certificate was issued, the Old Certificates so surrendered shall be properly endorsed and otherwise in proper form for transfer, and the stock transfer tax stamps to the Old Certificates so surrendered shall be properly endorsed and otherwise in proper form for transfer, and the person or persons requesting such exchange shall affix any requisite stock or transfer tax stamps to the Old Certificates surrendered, or provide funds for their purchase, or establish to the satisfaction of the transfer agent that such taxes are not payable. From and after the Effective Time, the amount of capital shall be represented by the shares of the New Common Stock into which and for which the shares of the Old Common Stock are reclassified, until thereafter reduced or increased in accordance with applicable law. All references elsewhere in these Articles of Incorporation, as amended, to the “Common Stock” shall, after the Effective Time, refer to the “New Common Stock.” The filing of the Amendment shall not cause any change in the number of shares of any series of Preferred Stock that are issued and outstanding at the time the Amendment is filed.”

ARTICLE IV

Cumulative Voting Prohibition

Shareholders shall have no rights of cumulative voting.

ARTICLE V

Preemptive Rights Prohibition

Shareholders shall have no rights, preemptive or otherwise, NRS 78.267 of Chapter 78 of the Nevada Revised Statutes (or similar provisions of future law) to acquire any part of any unissued shares or other securities of this Corporation or any rights to purchase shares or other securities of this Corporation before the Corporation may offer them to other persons.

ARTICLE VI

Directors’ Action by Written Consent

Any action required or permitted to be taken at a meeting of the Board of Directors may be taken by written action signed by all of the directors then in office, unless the action is one which need not be approved by the shareholders, in which case such action shall be effective if signed by the number of directors that would be required to take the same action at a meeting at which all directors are present.

ARTICLE VII

Shareholders Action by Written Consent

Action required or permitted to be taken by the shareholders of the Corporation pursuant to the provisions of the NRS may be taken without a meeting of the shareholders by persons who would be entitled to vote at a meeting share having voting power to cast not less than the minimum number of votes that would be necessary to authorize the action at a meeting at which all shareholders entitled to vote were present and voted. Any such action shall be evidenced by one or more written consents or by authenticated electronic communication describing the action taken, signed by shareholders entitled to take action, and shall be delivered to the Corporation for inclusion in the minutes or filing with the corporate records. The record date of any action taken by written consent shall be the date on which the first shareholder signs the consent. No such consent shall be valid unless (A) the consenting shareholders have been furnished the same material that would have been required to be sent to shareholders in a notice of a meeting at which the proposed action would have been submitted to the shareholders for action, including notice of any applicable dissenters' rights as provided in the Nevada Revised Statutes or (B) the written consent contains an express waiver of the right to receive the material otherwise required to be furnished. Any shareholders who do not participate in the taking of any such action by written consent shall be given written notice of the action taken together with any materials required to be delivered pursuant to the NRS.

ARTICLE VIII

Legal Adoption

The execution, filing and performance of this Amended and Restated Articles of Incorporation, has been duly adopted in accordance with the Nevada Revised Statutes and the Bylaws and Articles of Incorporation of the Corporation.

ARTICLE IX

Election of Directors

1. Governing Board The governing board of the Corporation shall be styled as a "Board of Directors", and any member of said Board shall be styled as a "Director."

2. Number. The business and affairs of the Corporation shall be conducted and managed by, or under the direction of, the Board of Directors. The total number of directors constituting the entire Board of Directors shall be fixed and may be altered from time to time by or pursuant to a resolution passed by the Board of Directors, but shall not be less than one.

3. Vacancies. Except as otherwise provided for herein, newly created directorships resulting from any increase in the authorized number of directors, and any vacancies on the Board of Directors resulting from death, resignation, disqualification, removal or other cause, may be filled only by the affirmative vote of a majority of the remaining directors then in office, even though less than a quorum of the Board of Directors. Any director elected in accordance with the preceding sentence shall hold office for the remainder of the full term of the newly created directorship or for the directorship in which the vacancy occurred, and until such director’s successor shall have been duly elected and qualified, subject to his earlier death, disqualification, resignation or removal. Subject to the provisions of these Articles of Incorporation, no decrease in the number of directors constituting the Board of Directors shall shorten the term of any incumbent director.

4. Removal of Directors. Except as otherwise provided in any Preferred Stock Designation, any director may be removed from office only by the affirmative vote of the holders of a majority or more of the combined voting power of the then outstanding shares of capital stock of the Corporation entitled to vote at a meeting of stockholders called for that purpose, voting together as a single class.

ARTICLE X

Personal Liability

Except as otherwise provided in the NRS, a director or officer of the Corporation shall not be personally liable to the Corporation or its stockholders for damages as a result of any act or failure to act in his capacity as a director or officer; provided, however, that this Article shall not eliminate or limit the liability of a director or officer to the extend prohibited by the NRS

If the NRS is amended after the date of filing of these Articles of Incorporation to authorize corporate action further limiting or eliminating the personal liability of a director, then the liability of the directors of the Corporation shall be limited or eliminated to the fullest extent permitted by the NRS, as so amended, or a similar successor provision. Any repeal or modification of this Article by the stockholders of the Corporation or otherwise shall not adversely affect any right or protection of a director of the Corporation existing at the time of such repeal or modification.

ARTICLE XI

Indemnification

1. Discretionary Indemnification. (a) The Corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, except an action by or in the right of the Corporation, by reason of the fact that he is or was a director, officer, employee or agent of the Corporation, or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement actually and reasonably incurred by him in connection with the action, suit or proceeding if he: (i) is not liable pursuant to Section 78.138 of the NRS; or (ii) acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the Corporation, and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. The termination of any action, suit or proceeding by judgment, order, settlement, conviction or upon a plea of nolo contendere or its equivalent, does not, of itself, create a presumption that the person is liable pursuant to Section 78.138 of the NRS or did not act in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the Corporation, or that, with respect to any criminal action or proceeding, he had reasonable cause to believe that his conduct was unlawful.

(b) The Corporation may indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the Corporation to procure a judgment in its favor by reason of the fact that he is or was a director, officer, employee or agent of the Corporation, or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation. partnership, joint venture, trust or other enterprise against expenses, including amounts paid in settlement and attorneys’ fees actually and reasonably incurred by him in connection with the defense or settlement of the action or suit if he: (i) is not liable pursuant to Section 78.138 of the NRS; or (ii) acted in good faith and in a manner which he reasonably believed to be in or not opposed to the best interests of the Corporation. Indemnification may not be made for any claim, issue or matter as to which such a person has been adjudged by a court of competent jurisdiction, after exhaustion of all appeals therefrom, to be liable to the Corporation or for amounts paid in settlement to the Corporation, unless and only to the extent that the court in which the action or suit was brought or other court of competent jurisdiction determines upon application that in view of all the circumstances of the case, the person is fairly and reasonably entitled to indemnity for such expenses as the courts deem proper.

2. Determination of Discretionary Indemnification. Any discretionary indemnification pursuant to Section 1 of this Article XI, unless ordered by a court or advanced pursuant to this Section 2, may be made by the Corporation only as authorized in the specific case upon a determination that indemnification of the director, officer, employee or agent is proper in the circumstances. The determination must be made:

(a) By the stockholders; or

(b) By the Board of Directors by majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding; or

(c) If a majority vote of a quorum consisting of directors who were not parties to the action, suit or proceeding so orders, by independent legal counsel in a written opinion; or

(d) If a quorum consisting of directors who were not parties to the action, suit or proceeding cannot be obtained, by independent legal counsel in a written opinion.

The expenses of officers and directors incurred in defending a civil or criminal action, suit or proceeding must be paid by the Corporation as they are incurred in advance of the final disposition of the action, suit or proceeding, upon receipt of an undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that he is not entitled to be indemnified by the Corporation.

ARTICLE XII

Purchase of Shares

The Board of Directors of the Corporation may, from time to time, and at its discretion, cause the Corporation to purchase its own shares and such shares may be reissued by the Corporation.

ARTICLE XIII

Amendment of Corporate Documents

1. Articles of Incorporation. Whenever any vote of the holders of voting shares of the capital stock of the Corporation is required by law to amend, alter, repeal or rescind any provision of these Articles of Incorporation, such alteration, amendment, repeal or rescission of any provision of these Articles of Incorporation must be approved by the affirmative vote of the holders of at least a majority of the combined voting power of the then outstanding voting shares of capital stock of the Corporation, voting together as a single class. Subject to the provisions hereof, the Corporation reserves the right at any time, and from time to time, to amend, alter, repeal or rescind any provision contained in these Articles of Incorporation in the manner now or hereafter prescribed by law, and other provisions authorized by the laws of the State of Nevada at the time in force may be added or inserted, in the manner now or hereafter prescribed by law; and all rights, preferences and privileges of whatsoever nature conferred upon stockholders, directors or any other persons whomsoever by and pursuant to these Articles of Incorporation in their present form or as hereafter amended are granted subject to the rights reserved in this Article.

2. Bylaws. In addition to any affirmative vote required by law, any change of the Bylaws may be adopted either (a) by the affirmative vote of a majority of the Board of Directors, or (b) by the stockholders by the affirmative vote of the holders of at least a majority of the combined voting power of the then outstanding voting shares of capital stock of the Corporation, voting together as a single class.

ARTICLE XIV

Application of NRS

These Articles of Incorporation expressly provide that the Corporation shall not be governed by Sections 78.411 to 78.444 of the NRS, inclusive.

ARTICLE XV

Board Changes to Articles

The Board of Directors is hereby authorized to make Non-Material changes to these Articles of Incorporation and to take any and all actions without shareholder approval, which are allowed by the General Corporation Law of the state of Nevada. “Non-Material” for the purpose of this paragraph shall be construed to mean a change that does not affect the rights or benefits of the shareholders.

ARTICLE XVI

Existence

The Corporation is to have perpetual existence.

ARTICLE XVII

Meeting of Stockholders

Meetings of stockholders of the Corporation (the “Stockholder Meetings”) may be held within or without the State of Nevada. Special Stockholder Meetings may be called only by (a) the Chairman of the Board, (b) the Chief Executive Officer, (c) the President, (d) the holders of at least 10 percent of all of the shares of capital stock entitled to vote at the proposed special meeting, or (e) the Board of Directors pursuant to a duly adopted resolution. Special Stockholder Meetings may not be called by any other person or persons or in any other manner. Elections of directors need not be by written ballot unless the Bylaws shall so provide.

Certification

The undersigned Chief Executive Officer of Quantum Energy, Inc. hereby certifies that the foregoing Amended and Restated Articles of Incorporation have been adopted pursuant to the Nevada Revised Statutes and the laws of the State of Nevada.

| QUANTUM ENERGY, INC. | |

| | | |

Date: March 29, 2022 | | | |

| By: |  | |

| | Harry Ewert | |

| | Chief Executive Officer | |