U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM SB-2

Amendment No. 3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CHUBASCO RESOURCES CORP.

(Exact name of Registrant as specified in its charter)

NEVADA 43-2053462

(State or other jurisdiction of (I.R.S. Employer

incorporation or organization) Identification Number)

509 - 4438 West 10th Avenue

Vancouver, B.C., Canada V6R 4R8

(Name and address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: 604-669-9740

Commission Registration Number: 333-119632

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration

Statement.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |__|

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |__|

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. |__|

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. |__|

CALCULATION OF REGISTRATION FEE

---------------------------------------------------------------------------------------------------------------------------------------------------------------

TITLE OF EACH PROPOSED PROPOSED

CLASS OF MAXIMUM MAXIMUM

SECURITIES OFFERING AGGREGATE AMOUNT OF

TO BE AMOUNT TO BE PRICE PER OFFERING REGISTRATION

REGISTERED REGISTERED SHARE (1) PRICE (2) FEE (3)

---------------------------------------------------------------------------------------------------------------------------------------------------------------

Common Stock 3,216,500 shares $0.50 $1,608,250 $230.77

---------------------------------------------------------------------------------------------------------------------------------------------------------------

(1) This price was arbitrarily determined by Chubasco Resources Corp.

(2) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) under the Securities Act.

(3) Previously paid.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

COPIES OF COMMUNICATIONS TO:

Cane & Associates, LLP

3273 East Warm Springs Rd.

Las Vegas, NV 89102

(702) 312-6255 Fax: (702) 944-7100

Agent for service of process

SUBJECT TO COMPLETION, Dated February 9, 2005

PROSPECTUS

CHUBASCO RESOURCES CORP

3,216,500

COMMON STOCK

INITIAL PUBLIC OFFERING

___________________

The selling shareholders named in this prospectus are offering all of the shares of common stock offered through this prospectus. Chubasco Resources Corp. will not receive any proceeds from this offering and has not made any arrangements for the sale of these securities. We have, however, set an offering price for these securities of $0.50 per share. This offering will expire unless extended by the board of directors on June 30, 2005. The board of directors has discretion to extend the offering period for a maximum of an additional 90 days.

| | Offering Price | Underwriting Discounts and Commissions | Proceeds to Selling Shareholders |

| Per Share | $0.50 | None | $0.50 |

| Total | $1,608,250 | None | $1,608,250 |

Our common stock is presently not traded on any market or securities exchange. The sales price to the public is fixed at $0.50 per share until such time as the shares of our common stock are traded on the NASD Over-The-Counter Bulletin Board. Although we intend to apply for trading of our common stock on the NASD Over-The-Counter Bulletin Board, public trading of our common stock may never materialize. If our common stock becomes traded on the NASD Over-The-Counter Bulletin Board, then the sale price to the public will vary according to prevailing market prices or privately negotiated prices by the selling shareholders.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section entitled "Risk Factors" on page 7 - 11.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The Date of This Prospectus Is: February 9, 2005

Table of Contents

| | Page |

| Summary | 4 |

| Risk Factors | 7 |

Risks Related To Our Financial Condition and Business Model | 7 |

| If we do not obtain additional financing, our business will fail | 7 |

| Because we will need additional financing to fund our extensive exploration activities, our auditors believe there is substantial doubt about our ability to continue as a going concern | 7 |

| Because we have only recently commenced business operations, we face a high risk of business failure due to our inability to predict the success of our business | 7 |

| Because our executive officers do not have formal training specific to the technicalities of mineral exploration, there is a higher risk our business will fail | 8 |

| Because we conduct our business through verbal agreements with consultants and arms-length third parties, there is a substantial risk that such persons may not be readily available to us and the implementation of our business plan could be impaired. | 8 |

| Because of the unique difficulties and uncertainties inherent in mineral exploration and the commercial production business, we face a high risk of business failure | 8 |

| Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability | 9 |

| Because access to our mineral claims may be restricted by inclement weather, we may be delayed in our exploration efforts | 9 |

| Because our president has agreed to provide his services on a part-time basis, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail | 9 |

| Because our president, Mr. Scott Young, owns 67.88% of our outstanding common stock and serves as our sole director, investors may find that corporate decisions influenced by Mr. Young are inconsistent with the best interests of other stockholders | 10 |

| Because our mineral claims are not registered in our name but in the name of Marvin Mitchell, our agent, there is a risk that a difficulty could arise when registering the mineral claims to us | 10 |

Risks Related To Legal Uncertainty | 10 |

Because we will be subject to compliance with government regulation which may change, the anticipated costs of our exploration program may increase | 10 |

| Because the Province of British Columbia owns the land covered by our mineral claims and Native land claims might affect our title to the mineral claims or to British Columbia’s title of the property, our business plan may fail | 11 |

Risks Related To This Offering | 11 |

| If a market for our common stock does not develop, shareholders may be unable to sell their shares | 11 |

| If the selling shareholders sell a large number of shares all at once or in blocks, the market price of our shares would most likely decline | 11 |

| Forward-Looking Statements | 11 |

| Use of Proceeds | 12 |

| Determination of Offering Price | 12 |

| Dilution | 12 |

| Selling Shareholders | 12 |

| Plan of Distribution | 19 |

| Legal Proceedings | 20 |

| Directors, Executive Officers, Promoters and Control Persons | 21 |

| Security Ownership of Certain Beneficial Owners and Management | 22 |

| Description of Securities | 23 |

| Interest of Named Experts and Counsel | 26 |

| Disclosure of Commission Position of Indemnification for Securities Act Liabilities | 26 |

| Organization Within the Last Five Years | 26 |

| Description of Business | 27 |

| Plan of Operations | 38 |

| Description of Property | 41 |

| Certain Relationships and Related Transactions | 44 |

| Market for Common Equity and Related Stockholder Matters | 44 |

| Executive Compensation | 47 |

| Financial Statements | 48 |

| Changes in and Disagreements with Accountants | 49 |

| Available Information | 49 |

Summary

Chubasco Resources Corp.

We are in the business of mineral exploration. We are not a blank check company as defined in Rule 419 of Regulation C and we have not been formed for the purpose of arranging an acquisition. On September 14, 2004, we acquired through our agent, Mr. Marvin A. Mitchell, P.Eng., a 100% interest in fourteen mineral claims which we refer to as the Chub mineral claims. We purchased the Chub mineral claims based upon a geological report prepared by Mr. Eric A. Ostensoe, P. Eng., our consulting geologist. We hold these claims pursuant to a Bill of Sale Absolute between Mr. Mitchell our agent, and our wholly owned subsidiary, Chub Explorations Ltd. We refer to our subsidiary as CEL. In order to minimize cost and any inconvenience, we have not registered the Chub mineral claims in the name of CEL with the B.C. Mineral Titles Branch. Our agent’s firm, Mitchell Geological Services Inc., is the operator of the property and is responsible for filing geological assessment reports with the B.C. Mineral Titles Branch in respect of our exploration expenditures. The Chub mineral claims are located near the town of Tulameen in the Similkameen Mining Division of the Province of British Columbia. On September 14, 2004, we entered into a Property Acquisition Agreement (“Property Acquisition Agreement”). Pursuant to the Property Acquisition Agreement, we have received and executed a Bill of Sale Absolute in the proper form transferring all rights, title and interest in the Chub Mineral Claims to CEL. We have expended approximately $1,291 in relation to our acquisition of the Chub mineral claims.

On September 14, 2004 we entered into a Property Operating Agreement (‘Property Operating Agreement”). Pursuant to this Property Operating Agreement, Mitchell Geological Services Inc. became our operator and will thus oversee our initial phase mineral exploration project conducted on the Chub mineral claims in exchange for a 15% joint venture interest in the claims The 15% being paid to Mitchell Geological Services Inc. is dependent upon it serving as operator for the duration of our initial exploration program on the property.

The Property Operating Agreement, dated September 14, 2004, obligates us to incur exploration expenditures of no more than $9,120, on our first phase exploration program. Any exploration costs in excess of $9,120 will require our prior approval and we will be required to pay only 85% of the additional costs.

We have commenced our exploration program. Prior to acquiring the Chub mineral claims we incorporated a wholly owned subsidiary, Chub Exploration Ltd., a British Columbia corporation. Our subsidiary, which we refer to as CEL, was formed for the purpose of carrying out our mineral exploration program. We have transferred all of our 100% ownership interest in the Chub mineral claims to CEL.

Our plan of operations is to conduct mineral exploration activities on the Chub mineral claims in order to assess whether these claims possess commercially exploitable mineral deposits. Our exploration program is designed to explore for commercially viable deposits of copper, lead/zinc, gold and other metallic minerals. We have not, nor has any predecessor, identified any commercially exploitable reserves of these minerals on our mineral claims. We are an exploration

stage company and there is no assurance that a commercially viable mineral deposit exists on our mineral claims.

Prior to acquiring the Chub mineral claims, we retained the service Eric A. Ostensoe, P. Geo., a professional consulting geologist. Our consultant prepared a geological report for us on the mineral exploration potential of the claims. Included in this report is a recommended initial exploration program with a budget of $9,120. Exploration costs are billed to us in Canadian dollars, but the Company pays those costs in U.S. dollars. The value of Canadian dollars when converted into U.S. currency can fluctuate greatly. In an effort to reduce any risk created by fluctuations in the exchange rate, we have committed in the Property Operating Agreement, dated September 14, 2004, to expend no more than $9,120 U.S. dollars during the initial exploration program after the exploration expenditures have been converted from Canadian dollars into U.S. dollars without prior approval.All dollar amounts p rovided in this prospectus are stated or quantified in U.S. currency.

The mineral exploration program, consisting of geological mapping and sampling is oriented toward defining drill targets on mineralized zones within the Chub mineral claims.

At this time we are uncertain of the number of mineral exploration phases we will conduct before concluding that there are, or are not, commercially viable minerals on our claims. Further phases beyond the current exploration program will be dependent upon a number of factors such as our consulting geologist’s recommendations based upon ongoing exploration program results and our available funds.

Since we are in the exploration stage of our business plan, we have not yet earned any revenues from our planned operations. As of October 31, 2004, we had $86,058 cash on hand and liabilities in the amount of $7,699. Accordingly, our working capital position as of October 31, 2004 was $78,489. Since our inception through October 31, 2004, we have incurred a net loss of $25,309. We attribute our net loss to having no revenues to offset our expenses and the professional fees related to the creation and operation of our business. We have sufficient funds to take us through our initial exploration program which, under the terms of the Property Operating Agreement must be completed by December 31, 2005. Our working capital may be sufficient to enable us to perform limited exploration phases beyond the first geological exploration phase on the property. Accordingly, we may require additional financing in the event that further exploration is needed.

Our fiscal year ended is July 31.

We were incorporated on April 27, 2004, under the laws of the state of Nevada. Our principal offices are located at 509 - 4438 West 10th, Avenue, Vancouver, B.C., V6R 4R8, Canada. Our phone number is 604-669-9740 and our facsimile number is 604-681-6329.

The Offering

Securities Being Offered Up to 3,216,500 shares of our common stock.

Offering Price and Alternative Plan The offering price of the common stock is $0.50 per share. We intend to apply to the NASD

of Distribution over-the-counter bulletin board to allow the trading of our common stock upon our becoming a

reporting entity under the Securities Exchange Act of 1934. If our common stock becomes so

traded and a market for the stock develops, the actual price of stock will be determined by

prevailing market prices at the time of sale or by private transactions negotiated by the selling

shareholders. The offering price would thus be determined by market factors and the

independent decisions of the selling shareholders.

Minimum Number of Shares To Be None

Sold in This Offering

Securities Issues and to be Issued 10,016,500 shares of our common stock are issued and outstanding as of the date of this

prospectus. All of the common stock to be sold under this prospectus will be sold by existing

shareholders and thus there will be no increase in our issued and outstanding shares as a result of

this offering.

Use of Proceeds We will not receive any proceeds from the sale of the common stock by the selling

shareholders.

Summary Financial Information

Balance Sheet Data | From inception April 27, 2004, to our first fiscal year ended July 31, 2004, (Audited). | Three month period ended October 31, 2004 (unaudited). |

| Cash | $ 102,496 | $ 86,058 |

| Total Assets | $ 102,496 | $ 86,188 |

| Liabilities | $ 12,142 | $ 7,699 |

| Total Stockholder’s Equity | $ 90,354 | $ 78,489 |

| | | |

| Statement of Loss and Deficit | From inception April 27, 2004, to our first fiscal year ended July 31, 2004, (Audited). | Three month period ended October 31, 2004 (unaudited). |

| Revenue | $ 0 | $ 0 |

| Loss for the Period | $ 13,444 | $ 11,865 |

Risk Factors

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below and the other information in this prospectus before investing in our common stock. If any of the following risks occur, our business, operating results and financial condition could be seriously harmed. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Related To Our Financial Condition and Business Model

If we do not obtain additional financing, our business will fail

For the next year of operations, our current operating funds should be sufficient to cover the first phase of our exploration program, and a contemplated second phase exploration program of similar scope, in addition to providing funds for anticipated operating overheads, professional fees and regulatory filing fees. In order for us to perform any further exploration or extensive testing past the first two phases we will need to obtain additional financing. As of October 31, 2004, we had cash in the amount of $86,058. We currently do not have any operations and we have no income. Our business plan calls for significant expenses in connection with the exploration of our mineral claims. While we have sufficient funds to carry out our initial exploration program and, if warranted, a follow-up program of a similar scale, on the Chub mineral claims, we will require additional financing if further explo ration programs are necessary. We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. If our exploration programs are successful in discovering reserves of commercial tonnage and grade, we will require additional funds in order to place the Chub mineral claim into commercial production. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Obtaining additional financing would be subject to a number of factors, including the market prices for copper, lead, zinc, gold and other metallic minerals and the costs of exploring for or commercial production of these materials. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

Because we will need additional financing to fund our extensive exploration activities, our accountants believe there is substantial doubt about our ability to continue as a going concern

We have incurred a net loss of $25,309 for the period from April 27, 2004, our inception, to October 31, 2004, and have no sales. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the commercial exploitation of our mineral claims. These factors raise substantial doubt that we will be able to continue as a going concern.

Because we have only recently commenced business operations, we face a high risk of business failure due to our inability to predict the success of our business.

We have just begun the initial stages of exploration of our mineral claims, and thus have no way to evaluate the likelihood that we will be able to operate the business successfully. We were incorporated on April 27, 2004, and to date have been involved primarily in organizational

activities, the acquisition of the mineral claims and obtaining independent consulting geologist’s report on our mineral claims. We have not earned any revenues as of the date of this prospectus.

Because our executive officers do not have formal training specific to the technicalities of mineral exploration, there is a higher risk our business will fail

Mr. Scott Young, our president and director, does not have formal training as a geologist or an engineer. Additionally, Mr. Young has never managed any company involved in starting or operating a mine. With no direct training or experience in these areas, our management may not be fully aware of many of the specific requirements related to working within this industry and hence may lack certain skills that are advantageous in managing an exploration company. In addition, Mr. Young’s decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use.

Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management’s lack of experience in this industry.

Because we conduct our business through verbal agreements with consultants and arms-length third parties, there is a substantial risk that such persons may not be readily available to us and the implementation of our business plan could be impaired.

We have a verbal agreement with our consulting geologist that requires him to review all of the results from the exploration work performed upon our mineral claims and then make recommendations based upon those results. In addition, we have a verbal agreement with our accountants to perform requested financial accounting services and our outside auditors to perform auditing functions. We have a verbal agreement with a firm that provides us with office space, telephone answering and secretarial services. Each of these functions requires the services of persons in high demand and these persons may not always be available. The implementation of our business plan may be impaired if these parties do not perform in accordance with our verbal agreement. In addition, it may be hard to enforce a verbal agreement in the event that any of these parties fail to perform.

Because of the unique difficulties and uncertainties inherent in mineral exploration business, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The search for valuable minerals also involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of suc h liabilities may have a material adverse effect on our financial position. In addition, there is no assurance that the expenditures to be made by us in the

exploration of the mineral claims will result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts.

Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims and the production of minerals thereon, if any, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we may not be able to generate any operating

revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

Because access to our mineral claims may be restricted by inclement weather, we may be delayed in our exploration efforts

Access to the Chub mineral claim may be restricted through some of the year due to weather in the area. The property is in south-central British Columbia. The terrain is mostly gentle slopes with steeper pitches. Access to the property from the end of paved roads is by way approximately 10 miles of gravel logging road and branches therefrom. These roads are best traveled by four wheel drive vehicles. During the winter months heavy snowfall can make it difficult if not impossible to undertake work programs. As a result, any attempt to test or explore the property is largely limited to the times when weather permits such activities. Generally speaking, the most efficient time for us to conduct our work programs will be during May through November. These limitations can result in significant delays in exploration efforts, as well as production in the event that commercial amounts of minerals are foun d. Such delays can have a significant negative effect on our results of operations.

Because our president has only agreed to provide his services on a part-time basis, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail

Mr. Young, our president and chief financial officer devotes 5 to 10 hours per week to our business affairs. If the demands of our business require the full business time of Mr. Young, he is prepared to adjust his timetables to devote more time to our business; however, Mr. Young may not be able to devote sufficient time to the management of our business, as and when needed. It is possible that the demands of Mr. Young’s other interests will increase with the result that he would no longer be able to devote sufficient time to the management of our business. Competing demands on Mr. Young’s time may lead to a divergence between his interests and the interests of other shareholders.

Because our president, Mr. Scott Young, owns 67.88% of our outstanding common stock, investors may find that corporate decisions influenced by Mr. Young are inconsistent with the best interests of other stockholders.

Mr. Young is our president, chief financial officer and sole director. He owns approximately 67.88% of the outstanding shares of our common stock. Accordingly, he will have a significant influence in determining the outcome of all corporate transactions or other matters, including mergers, consolidations and the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. While we have no current plans with regard to any merger, consolidation or sale of substantially all of its assets, the interests of Mr. Young may still differ from the interests of the other stockholders. Factors which could cause the interests of Mr. Young to differ from the interest of other stockholders include his ability to devote the time required to run our mineral exploration activities.

Because our mineral claims are not registered in our name but in the name of Marvin Mitchell, our agent, there is a risk that a difficulty could arise when registering the mineral claims in our name.

In order to minimize cost and any inconvenience, we have not registered the Chub mineral claims in the name of our subsidiary which refer to as CEL with the B.C. Mineral Titles Branch. Our agent’s firm, Mitchell Geological Services Inc. is the operator of the property and is responsible for filing geological assessment reports with the B.C. Mineral Titles Branch with respect to our exploration expenditures. We have in proper form an executed Bill of Sale Absolute between Mr. Mitchell and CEL with respect to these mineral claims. In order to register these claims in the name of CEL, we must first apply at considerable cost to the B.C. Minerals Titles Branch for a Client Number. We intend to register these claims in the name of CEL following the completion of our initial exploration program. Unforeseen disputes or difficulties could arise in transferring the mineral properties to us.

Risks Related To Legal Uncertainty

Because we will be subject to compliance with government regulation which may change, the anticipated costs of our exploration program may increase

There are several governmental regulations that materially restrict mineral exploration or exploitation. We will be subject to the Mining Act of British Columbia as we carry out our exploration program.

We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these regulations. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program.

Because the Province of British Columbia owns the land covered by our mineral claims and Native land claims might affect our title to the mineral claims or to British Columbia’s title of the property, our business plan may fail.

We are unaware of any outstanding native land claims on the Chub mineral claims; however it is possible that a native land claim could be made in the future. The federal and provincial government policy is at this time is to consult with all potentially affected native bands and other stakeholders in the area of any potential commercial production. Should we encounter a situation where a native person or group claims an interest in our claims, we may unable to provide compensation to the affected party in order to continue with our exploration work, or if such an option is not available, we may have to relinquish our interest in these claims. In either case, the costs and/or losses could be greater than our financial capacity and our business would fail.

Risks Related To This Offering

If a market for our common stock does not develop, shareholders may be unable to sell their shares

A market for our common stock may never develop. We currently plan to apply for listing of our common stock on the NASD over-the-counter bulletin board upon the effectiveness of the registration statement of which this prospectus forms a part. However, our shares may never be traded on the bulletin board, or, if traded, a public market may not materialize. If our common stock is not traded on the bulletin board or if a public market for our common stock does not develop, investors may not be able to re-sell the shares of our common stock that they have purchased and may lose all of their investment.

If the selling shareholders sell a large number of shares all at once or in blocks, the market price of our shares would most likely decline.

The selling shareholders are offering 3,216,500 shares of our common stock through this prospectus. Our common stock is presently not traded on any market or securities exchange, but should a market develop, shares sold at a price below the current market price at which the common stock is trading will cause that market price to decline. Moreover, the offer or sale of a large number of shares at any price may cause the market price to fall. The outstanding shares of common stock covered by this prospectus represent approximately 32.11% of the common shares outstanding as of the date of this prospectus.

Forward-Looking Statements

This prospectus contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe, plan, expect, future, intend and similar expressions to identify such forward-looking statements. You should not place too much reliance on these forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described in this Risk Factors section and elsewhere in this prospectus.

Use of Proceeds

We will not receive any proceeds from the sale of the common stock offered through this prospectus by the selling shareholders.

Determination of Offering Price

The $0.50 per share offering price of our common stock was arbitrarily chosen using the last sales price of our stock from our most recent private offering of common stock. There is no relationship whatsoever between this price and our assets, earnings, book value or any other objective criteria of value.

We intend to apply to the NASD over-the-counter bulletin board for the trading of our common stock upon our becoming a reporting entity under the Securities Exchange Act of 1934. We intend to file a registration statement under the Exchange Act concurrently with the effectiveness of the registration statement of which this prospectus forms a part. If our common stock becomes so traded and a market for the stock develops, the actual price of stock will be determined by prevailing market prices at the time of sale or by private transactions negotiated by the selling shareholders. The offering price would thus be determined by market factors and the independent decisions of the selling shareholders.

Dilution

The common stock to be sold by the selling shareholders is common stock that is currently issued and outstanding. Accordingly, there will be no dilution to our existing shareholders.

Selling Shareholders

The selling shareholders named in this prospectus are offering all of the 3,216,500 shares of common stock offered through this prospectus. The shares include the following:

a. 3,210,000 shares that the selling shareholders acquired from us in an offering that was exempt from registration under Regulation S of the Securities

Act of 1933 and completed on June 8, 2004;

b. 6,500 shares that the selling shareholders acquired from us in an offering that was exempt from registration under Regulation S of the Securities Act of

1933 and completed on July 30, 2004.

The following table provides information regarding the beneficial ownership of our common stock held by each of the selling shareholders as of February 9, 2005 including:

1. the number of shares owned by each prior to this offering;

2. the total number of shares that are to be offered by each;

3. the total number of shares that will be owned by each upon completion of the offering;

4. the percentage owned by each upon completion of the offering; and

5. the identity of the beneficial holder of any entity that owns the shares.

The named party beneficially owns and has sole voting and investment power over all shares or rights to the shares, unless otherwise shown in the table. The numbers in this table assume that none of the selling shareholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold. The percentages are based on 10,016,500 shares of common stock outstanding on February 9, 2005.

Name of Selling Shareholder | Shares Owned Prior to this Offering | Total Number of Shares to be Offered for Selling Shareholder Account | Total Shares to be Owned Upon Completion of this Offering | Percent Owned Upon Completion of this Offering |

Ms. Janis Cardiff 102-1134 Burnaby Street Vancouver B.C. V6E 1P1 | 400 | 400 | Nil | Nil |

Mr. Robert L Chalmers 505-1755 Robson Street Vancouver B.C. V6G 3B7 | 400 | 400 | Nil | Nil |

Mr. Peter Chen 12-7733 Heather Street Richmond B.C. V6Y 4J1 | 200 | 200 | Nil | Nil |

Ms. Wendy Christine Chen 12-7733 Heather Street Richmond B.C. V6Y 4J1 | 200 | 200 | Nil | Nil |

Ms. Teresa Jane Duncan 995 Melbourne Ave North Vancouver B.C. V7R 1P1 | 480,000 | 480,000 | Nil | Nil |

Ms. Sonia Duwel 3395 West 23rd Ave Vancouver B.C. V6S 1K2 | 100 | 100 | Nil | Nil |

Name of Selling Shareholder | Shares Owned Prior to this Offering | Total Number of Shares to be Offered for Selling Shareholder Account | Total Shares to be Owned Upon Completion of this Offering | Percent Owned Upon Completion of this Offering |

Mr. Robert Leonard Andrew Faris 516 Cochrane Ave Coquitlam B.C. V3J 1Z9 | 450,000 | 450,000 | Nil | Nil |

Ms. Marry Fierro 424 East 36th Ave Vancouver B.C. V5W 1C8 | 100 | 100 | Nil | Nil |

Ms. Angela Fierro 798 Wain Road North Saanich B.C. V8L 5N8 | 100 | 100 | Nil | Nil |

Mr. Anthony P Fierro 428 East 36th Ave Vancouver B.C. V5W 1C8 | 100 | 100 | Nil | Nil |

Ms. Michell J Fierro 428 East 36th Ave Vancouver B.C. V5W 1C8 | 100 | 100 | Nil | Nil |

Ms. Sharon L Fleming 1550 - 625 Howe Street Vancouver B.C. V6C 2T6 | 500 | 500 | Nil | Nil |

Ms. Meagan Friesen 2313 Victoria Drive Vancouver B.C. V5N 4K8 | 100 | 100 | Nil | Nil |

Mr. Aaron Genereaux 71-1801 Jamieson Court New Westminster B.C. V3L 5R4 | 100 | 100 | Nil | Nil |

Name of Selling Shareholder | Shares Owned Prior to this Offering | Total Number of Shares to be Offered for Selling Shareholder Account | Total Shares to be Owned Upon Completion of this Offering | Percent Owned Upon Completion of this Offering |

Ms. Patricia Genereaux 1801-71 Jamieson Court New Westminster B.C. V3L 5R4 | 100 | 100 | Nil | Nil |

Ms. Corri Ann George 3001 Surf Cres. Coquitlam B.C. V3C 3S7 | 100 | 100 | Nil | Nil |

Ms.Lorie Gray 11845 Springdale Drive Pitt Medows B.C. V3Y 2S5 | 100 | 100 | Nil | Nil |

Mr. Robert Gray 11845 Springdale Drive Pitt Meadows B.C. V3Y 2S5 | 100 | 100 | Nil | Nil |

Ms. Melanee Henderson 1106-2040 Nelson Street Vancouver B.C. V6G 1N8 | 100 | 100 | Nil | Nil |

Mr. Bradley Robert Hersack 409-1428 Parkway Boulevard Coquitlam B.C. V3E 3L8 | 100 | 100 | Nil | Nil |

Ms. Kathryn E Hewitson Unit 43 600 Falcon Drive Port Mody B.C. V3H 4E1 | 420,000 | 420,000 | Nil | Nil |

Mr. Gregory H Iftody 307-699 Cardero Street Vancouver B.C. V6G 3H7 | 100 | 100 | Nil | Nil |

Name of Selling Shareholder | Shares Owned Prior to this Offering | Total Number of Shares to be Offered for Selling Shareholder Account | Total Shares to be Owned Upon Completion of this Offering | Percent Owned Upon Completion of this Offering |

Ms. Nadine A Joa 308-145 St Georges Street North Vancouver B.C. V7L 3G8 | 100 | 100 | Nil | Nil |

Ms. Lynn Kozmak 16760 61st Ave Suite 34 Surrey B.C. V3S 3V3 | 100 | 100 | Nil | Nil |

Mr. John Crispin Lavers 3559 Bedwell Bay Road Belcarra B.C. V3C 4RC | 500,000 | 500,000 | Nil | Nil |

Ms. Leone LeGree 5450 Parker Street Burnaby B.C. V5B 1Z7 | 100 | 100 | Nil | Nil |

Mr. Sam McRae 1197 Lillooet Road North Vancouver B.C. V7J 3H7 | 100 | 100 | Nil | Nil |

Mr. Graham Moore 8884 Robins Court Burnaby B.C. V5A 4K8 | 100 | 100 | Nil | Nil |

Mr. David Murdoch 14677 Wellington Dr Surrey B.C. V3R 9H1 | 300 | 300 | Nil | Nil |

Ms. Jennifer L Murdoch 14677 Wellingtion Drive Surrey B.C. V3R 9H1 | 200 | 200 | Nil | Nil |

Name of Selling Shareholder | Shares Owned Prior to this Offering | Total Number of Shares to be Offered for Selling Shareholder Account | Total Shares to be Owned Upon Completion of this Offering | Percent Owned Upon Completion of this Offering |

Mr. Terrance G Owen 1801-71 Jamieson Court New Westminster B.C. V3L 5R4 | 100 | 100 | Nil | Nil |

Ms. Diane Pais 2736 Westlake Drive Coquitlam B.C. V3C 5J7 | 100 | 100 | Nil | Nil |

Mr. Dale Prentice 2206-1033 Marinaside Cr Vancouver B.C. V6Z 3A3 | 100 | 100 | Nil | Nil |

Ms. Sylvia J Rayer 1 - 1301 Johnston Street Vancouver B.C. V6H 3R9 | 460,000 | 460,000 | Nil | Nil |

Mr. James D Romano 4 - 1126 West 12th Ave Vancouver B.C. V6H 1L6 | 100 | 100 | Nil | Nil |

Ms. Michelle A Salera 117-1288 Marinaside Cres. Vancouver B.C. V6Z 2W5 | 100 | 100 | Nil | Nil |

Mr. Santo Sandhu 1334 West 59th Ave Vancouver B.C. V6P 1Y5 | 200 | 200 | Nil | Nil |

Mr. Brian Eric Sellstedt #105 - 330 West 2nd Street North Vancouver B.C. V7M 1E1 | 500,000 | 500,000 | Nil | Nil |

Name of Selling Shareholder | Shares Owned Prior to this Offering | Total Number of Shares to be Offered for Selling Shareholder Account | Total Shares to be Owned Upon Completion of this Offering | Percent Owned Upon Completion of this Offering |

Ms. Dorothy Isobell Sherritt 311 - 19835 64th Ave. Langley B.C. V2Y 1L8 | 400,000 | 400,000 | Nil | Nil |

Mr. Danny Chin Kiong Sng 138 Parkside Drive Port Mody B.C. V3H 4X5 | 100 | 100 | Nil | Nil |

Ms. Alecia Ann Susi 117-1288 Marinaside Crescent Vancouver B.C. V6Z 2W5 | 100 | 100 | Nil | Nil |

Ms .Christine Marie Swinton 407-939 Homer St Vancouver B.C. V6B 2W6 | 400 | 400 | Nil | Nil |

Ms. Lyliane Thal 1107 West 47th Ave Vancouver B.C. V6M 3N9 | 100 | 100 | Nil | Nil |

Ms. Ricki Jacqueline Thal 506-1067 Marinaside Cr. Vancouver B.C. V6Z 3A4 | 200 | 200 | Nil | Nil |

Mr. Peter Theodoropoulos 2431 East 24th Ave Vancouver B.C. V5R 1C7 | 100 | 100 | Nil | Nil |

Mr. Darryl Brent Turner 642 Newport Street Coquitlam B.C. V3J 7H7 | 100 | 100 | Nil | Nil |

Name of Selling Shareholder | Shares Owned Prior to this Offering | Total Number of Shares to be Offered for Selling Shareholder Account | Total Shares to be Owned Upon Completion of this Offering | Percent Owned Upon Completion of this Offering |

Mr. Wei-Chen Wang 204-450 Westview Street Coquitlam B.C. V3K 6C3 | 100 | 100 | Nil | Nil |

Ms. Anita Welke 5541 Broadway Burnaby B.C. V5B 2X8 | 300 | 300 | Nil | Nil |

Mr. Christopher James Wensley 403 - 1765 Duchess Ave West Vancouver B.C. V7V 1P8 | 100 | 100 | Nil | Nil |

Mr. Franklin Alex Wiener 5580 Linscott Court Richmond B.C. V7C 2W9 | 100 | 100 | Nil | Nil |

None of the selling shareholders;

(1) has had a material relationship with us other than as a shareholder at any time within the past three years, or;

(2) has been one of our officers or directors.

Plan of Distribution

We will pay the entire costs of this offering on behalf of the selling shareholders. These costs are estimated to be $26,231.

The selling shareholders may sell some or all of their common stock in one or more transactions, including block transactions:

1. on such public markets or exchanges as the common stock may from time to time be trading;

2. in privately negotiated transactions;

3. through the writing of options on the common stock;

4. in short sales, or;

5. in any combination of these methods of distribution.

The sales price to the public is fixed at $0.50 per share until such time as the shares of our common stock become traded on the NASD Over-The-Counter Bulletin Board or another exchange.

Although we intend to apply for trading of our common stock on the NASD Over-The-Counter Bulletin Board, public trading of our common stock may never materialize. If our common stock becomes traded on the NASD Over-The-Counter Bulletin Board, or another exchange, then the sales price to the public will vary according to the selling decisions of each selling shareholder and the market for our stock at the time of resale. In these circumstances, the sales price to the public may be:

1. the market price of our common stock prevailing at the time of sale;

2. a price related to such prevailing market price of our common stock, or;

3. such other price as the selling shareholders determine from time to time.

The shares may also be sold in compliance with the Securities and Exchange Commission's Rule 144.

The selling shareholders may also sell their shares directly to market makers acting as agents in unsolicited brokerage transactions. Any broker or dealer participating in such transactions as an agent may receive a commission from the selling shareholders or from such purchaser if they act as agent for the purchaser. If applicable, the selling shareholders may distribute shares to one or more of their partners who are unaffiliated with us. Such partners may, in turn, distribute such shares as described above.

We are bearing all costs relating to the registration of the common stock. The selling shareholders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the common stock.

The selling shareholders must comply with the requirements of the Securities Act of 1933 and the Securities Exchange Act in the offer and sale of the common stock. In particular, during such times as the selling shareholders may be deemed to be engaged in a distribution of the common stock, and therefore be considered to be an underwriter, they must comply with applicable law and may, among other things:

1. not engage in any stabilization activities in connection with our common stock;

2. furnish each broker or dealer through which common stock may be offered, such copies of this prospectus, as amended from time to time, as may be required

by such broker or dealer; and;

3. not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Securities

Exchange Act.

Legal Proceedings

We are not currently a party to any legal proceedings.

Our agent for service of process in Nevada is Cane & Associates, LLP, 3273 E. Warm Springs Rd., Las Vegas, Nevada 89120.

Directors, Executive Officers, Promoters And Control Persons

Our executive officers and directors and their respective ages as of February 9, 2005 are as follows:

Director:

Name of Director Age

Scott Young 53

Executive Officers:

Name of Officer Age Office

Scott Young 53 President, Chief Financial Officer

Set forth below is a brief description of the background and business experience of executive officers and directors.

Mr. Scott Young is our president and chief financial officer and our sole director. Mr. Young was appointed to that position on April 27, 2004. For the past nine years, Mr. Young has been employed as a broker with a securities firm and is currently employed by an investor relations firm. From 1995 to 2000, he was a broker at Georgia Pacific Securities Ltd., a Vancouver, B.C. based Securities firm. During that time he participated in numerous public financings with a focus on oil, gas and mining projects. From 2000 to 2003, Mr. Young was hired personally on a project basis to serve as a consultant to both public and private corporate clients in Canada and the United States engaged in debt and equity financings, mergers, acquisitions, and corporate structuring. During this period, Mr. Young’s primary clients consisted of Cohy China Communications, Inc., In-Motion Media Cor p., and Coal River Resources Inc. Commencing in January 2004, Mr. Young has acted in the capacity of vice president and an account executive with Freeform Communications Inc. which provides Investor Relations services to both Canadian and United States public companies. Freeform Communications Inc. is an Investor Relations firm registered with the B.C. Securities Commission. Mr. Young does not hold an equity interest in Freeform Communications Inc.

We presently do not pay our officer and director any salary or consulting fee.

Term of Office

Our Officer and Director is appointed for a one-year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with our bylaws.

Significant Employees

We have no significant employees other than Scott Young. Mr. Young devotes approximately 5 hours per week of business time to our company.

We conduct our business through verbal agreements with consultants and arms-length third parties. Current arrangements in place include the following:

1. A verbal agreement with our consulting geologist, Mr. Eric A. Ostensoe, P Eng., provides that he will review all of the results from the exploratory work

performed upon the site and make recommendations based on those results in exchange for payments equal to the usual and customary rates received by

geologists performing similar consulting services. The rates charged by geologists with a professional background consistent with Mr. Ostensoe range

from between $300 to $500 per day plus travel costs and other out-of-pocket disbursements. We paid our consulting geologist $1,179 for the

preparation of the initial Geological Report. Our consulting geologist had advised us that the cost of his report upon the completion of our initial

exploration program will be approximately the same amount.

2. Verbal agreements with our accountants to perform requested financial accounting services and our outside auditors to perform audit functions at their

respective normal and customary rates.

3. A verbal agreement with Pendrell Management Corp. to provide us with office space, telephone answering and secretarial services on a month to month

basis at a rate of $1,300 per month.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information concerning the number of shares of our common stock owned beneficially as of February 9, 2005 by:

1. each person (including any group) known to us to own more than five percent (5%) of any class of our voting securities,

2. each of our directors,

3. named executive officers and;

4. officers and directors as a group.

At this time, only one shareholder falls within these categories, Mr. Scott Young, Director, President, and Chief Financial Officer. The shareholder listed possess sole voting and investment power with respect to the shares shown.

Title of Class | Name and address of beneficial owner | Number of Shares of Common Stock | Percentage of Common Stock (1) |

| Common Stock | Scott Young Director, President and Chief Financial Officer 6130 Eastmont Drive West Vancouver, B.C., V7W 1X3 Canada | 6,800,000 | 67.88% |

| Common Stock | All Officers and Directors as a Group (one person) | 6,800,000 | 67.88% |

(1) The percent of class is based on 10,016,500 shares of common stock issued and outstanding as of February 9, 2005.

The persons named above have full voting and investment power with respect to the shares indicated. Under the rules of the Securities and Exchange Commission, a person (or group of persons) is deemed to be a "beneficial owner" of a security if he or she, directly or indirectly, has or shares the power to vote or to direct the voting of such security, or the power to dispose of or to direct the disposition of such security. Accordingly, more than one person may be deemed to be a beneficial owner of the same security. A person is also deemed to be a beneficial owner of any security, which that person has the right to acquire within 60 days, such as options or warrants to purchase our common stock.

Description of Securities

Our authorized capital stock consists of 90,000,000 shares of common stock, with a par value of $0.001 per share, and 10,000,000 shares of preferred stock, with a par value of $0.001 per share. As of February 9, 2005, there were 10,016,500 shares of our common stock issued and outstanding were held by fifty one (51) stockholders of record. We have not issued any shares of preferred stock.

Common Stock

Our common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Except as otherwise required by law or provided in any resolution adopted by our board of directors with respect to any series of preferred stock, the holders of our common stock will possess all voting power. Generally, all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of the votes entitled to be cast by all shares of our common stock that are present in person or represented by proxy, subject to any voting rights granted to holders of any preferred stock. Holders of our common stock representing thirty three and one-third percent (33 1/3%) of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a

majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation. Our Articles of Incorporation do not provide for cumulative voting in the election of directors.

Subject to any preferential rights of any outstanding series of preferred stock created by our board of directors from time to time, the holders of shares of our common stock will be entitled to such cash dividends as may be declared from time to time by our board of directors from funds available therefore.

Subject to any preferential rights of any outstanding series of preferred stock created from time to time by our board of directors, upon liquidation, dissolution or winding up, the holders of shares of our common stock will be entitled to receive pro rata all assets available for distribution to such holders.

In the event of any merger or consolidation with or into another company in connection with which shares of our common stock are converted into or exchangeable for shares of stock, other securities or property (including cash), all holders of our common stock will be entitled to receive the same kind and amount of shares of stock and other securities and property (including cash).

Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Preferred Stock

Our board of directors is authorized by our articles of incorporation to divide the authorized shares of our preferred stock into one or more series, each of which must be so designated as to distinguish the shares of each series of preferred stock from the shares of all other series and classes. Our board of directors is authorized, within any limitations prescribed by law and our articles of incorporation, to fix and determine the designations, rights, qualifications, preferences, limitations and terms of the shares of any series of preferred stock including, but not limited to, the following:

1. The number of shares constituting that series and the distinctive designation of that series, which may be by distinguishing number, letter or title;

2. The dividend rate on the shares of that series, whether dividends will be cumulative, and if so, from which date(s), and the relative rights of priority, if any, of payment of dividends on shares of that series;

3. Whether that series will have voting rights, in addition to the voting rights provided by law, and, if so, the terms of such voting rights;

4. Whether that series will have conversion privileges, and, if so, the terms and conditions of such conversion, including provision for adjustment of the conversion rate in such events as the Board of Directors determines;

5. Whether or not the shares of that series will be redeemable, and, if so, the terms and conditions of such redemption, including the date or date upon or after which they are redeemable, and the amount per share payable in case of redemption, which amount may vary under different conditions and at different redemption dates;

6. Whether that series will have a sinking fund for the redemption or purchase of shares of that series, and, if so, the terms and amount of such sinking fund;

7. The rights of the shares of that series in the event of voluntary or involuntary liquidation, dissolution or winding up of the corporation, and the relative rights of priority, if any, of payment of shares of that series;

8. Any other relative rights, preferences and limitations of that series.

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

Nevada Anti-Takeover Laws

Nevada Revised Statutes sections 78.378 to 78.379 provide state regulation over the acquisition of a controlling interest in certain Nevada corporations unless the articles of incorporation or bylaws of the corporation provide that the provisions of these sections do not apply. Our articles of incorporation and bylaws do not state that these provisions do not apply. The statute creates a number of restrictions on the ability of a person or entity to acquire control of a Nevada company by setting down certain rules of conduct and voting restrictions in any acquisition attempt, among other things. The statute is limited to corporations that are organized in the state of Nevada and that have 200 or more stockholders, at least 100 of whom are stockholders of record and residents of the

State of Nevada; and does business in the State of Nevada directly or through an affiliated corporation. Because of these conditions, the statute currently does not apply to our company.

Interests of Named Experts and Counsel

No expert or counsel named in this prospectus as having prepared or certified any part of this prospectus or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of the common stock was employed on a contingency basis, or had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in the registrant or any of its parents or subsidiaries. Nor was any such person connected with the registrant or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer, or employee.

Cane & Associates, LLP, our independent legal counsel, has provided an opinion on the validity of our common stock.

Morgan & Company, independent chartered accountants, has audited our financial statements included in this prospectus and registration statement to the extent and for the periods set forth in their audit report. Morgan & Company has presented their report with respect to our audited

financial statements. The report of Morgan & Company is included in reliance upon their authority as experts in accounting and auditing.

Erik A. Ostensoe, P. Geo., consulting geologist, has provided us with a geological evaluation report on the mineral claims. We employed Mr. Ostensoe on a flat rate consulting fee and he has no interest, nor does it expect any interest in the property or securities of Chubasco Resources Corp.

Disclosure of Commission Position of Indemnification for Securities Act Liabilities

Our articles of incorporation provide that we will indemnify an officer, director, or former officer or director, to the full extent permitted by law. We have been advised that in the opinion of the Securities and Exchange Commission indemnification for liabilities arising under the Securities Act of 1933 is against public policy as expressed in the Securities Act of 1933, and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities is asserted by one of our directors, officers, or controlling persons in connection with the securities being registered, we will, unless in the opinion of our legal counsel the matter has been settled by controlling precedent, submit the question of whether such indemnification is against public policy to a court of appropriate jurisdiction. We will then be governed by the court's decision.

Organization within the Last Five Years

We were incorporated on April 27, 2004 under the laws of the state of Nevada. On August 2nd, 2004 we formed a wholly subsidiary known as Chub Exploration Ltd. (CEL), a British Columbia corporation. CEL was formed to conduct our exploration business within the Province of British Columbia. On September 14, 2004 our subsidiary through our agent Mr. Marvin A. Mitchell, purchased all right title and interest in fourteen mineral claims, located in the Similkameen Mining

Division of the Province of British Columbia from Mr. Thomas E. Lisle. This purchase was made through to a Property Acquisition Agreement whereby Mr. Lisle sold us the Chub mineral claims which are held in the name of our agent. Our agents’ geological services firm became the operator of the exploration program to be conducted on the claims. The Property Operating Agreement sets forth each party's rights and responsibilities relating to both the exploration and potential mining stages of the operations to be conducted on our mineral claims.

Mr. Scott Young, our president, chief financial officer, and sole director has been a promoter of our company since its inception.

Ms. Maxine Cooper, joined us as corporate secretary for the period May 17th, 2004 to June 9th, 2004 in order to assist Mr. Young in dealing with corporate organizational matters.

Description of Business

In General

We are an exploration stage company engaged in the acquisition and exploration of mineral properties. We own a 100% interest in fourteen mineral claims that we refer to as the Chub mineral claims. Further exploration of these mineral claims is required before a final determination

as to their viability can be made. Although there is evidence of exploratory work on the claims conducted by prior owners, reliable records of this work has not been found. Exploration since discovery in the late 1890’s or early 1900’s has included geological mapping, poorly documented geophysical surveys, short adits, trenching and diamond drilling. This work indicates that the mineral zone has a width of as much as 600 feet and a length of about 3,600 feet. Possible extensions to the north are obscured by overburden. We are uncertain as to the potential existence of a commercially viable mineral deposit existing on our mineral claims.

Our plan of operations is to carry out exploration work on these claims in order to ascertain whether they possess commercially exploitable quantities of copper, lead/zinc, and gold. We will not be able to determine whether or not our mineral claims contain a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on that work concludes economic viability. Mr. Young, our president, has not visited our mineral claims.

Once we receive the results of our first exploration program, our board of directors in consultation with our consulting geologist will assess whether to proceed with further exploration. Our initial program will cost approximately $9,120 and the report of our consulting geologist should be available in April, 2005. In the event that a follow-up exploration program is undertaken, the costs are expected to be similar to the first exploration program, and the geologist’s report should be available by June 2005. A third exploration program, if undertaken, would cost approximately $38,000, with the results available in November, 2005. The existence of commercially exploitable mineral deposits in the Chub mineral claims is unknown at the present time and we will not be able to ascertain such information until we receive and evaluate the results of our exploration program.

Acquisition of the Chub mineral claims, the property acquisition agreement and the property operating agreement.

Upon our agent, Mr. Marvin A. Mitchell closing a property acquisition agreement with Mr. Thomas E. Lisle on September 14, 2004, Mr. Mitchell obtained a Bill of Sale Absolute for the 14 Chub mineral claims located in the Similkameen Mining Division of the Province of British Columbia, and registered these claims in his name. Mr. Mitchell used funds which we advanced to him to purchase the 14 Chub mineral claims. There was no written agreement with Mr. Mitchell for the advancement of funds used to acquire the 14 Chub mineral claims. Mr. Mitchell paid $1,179 to Mr. Lisle, which was his cost in staking the Chub mineral claims. We also reimbursed Mr. Mitchell approximately $111 for the costs charged by the B.C. Mineral Titles Branch for transferring the Chub mineral claims from Mr. Lisle to Mr. Mitchell. Concurrently, pursuant to our Property Operating Agreement and for additional consideration of $0.8 0 (approximately one dollar Canadian) paid to Mr. Mitchell, we received an executed Bill of Sale Absolute on September 21, 2004 in the proper from Mr. Mitchell for the Chub claims. Although we have purchased the Chub claims, we have not registered the Chub mineral claims in our name. In order to minimize cost and any inconvenience, we have not registered the Chub mineral claims in the name of CEL with the B.C. Mineral Titles Branch. We intend to register these claims in the name of CEL following the completion of our initial exploration program.

Mr. Mitchell’s company, Mitchell Geological Services Inc., is the operator of the exploration program on the claims, pursuant to the Property Operating Agreement. Mitchell Geological Services Inc. is responsible for filing geological assessment reports with the B.C. Mineral Titles Branch in respect of our exploration expenditures.

We selected these properties based upon an independent geological report which we commissioned from Eric A. Ostensoe, P. Eng. on our claims. Our consultant recommended that we launch an initial exploration program on our claims which will cost us approximately $9,120. We will pay the entire amount of the first $9,120 of mineral exploration expenses on our mineral claims prior to December 31, 2005, half of which must be expended prior to December 31, 2004. Prior to December 31, 2004, we expended at least half of the first $9,120 of mineral exploration expenses on our mineral claims. Expenditures in excess of $9,120 will require our prior approval. We will pay 85% of such approved excess costs and Mitchell Geological Services Ins. will pay 15%. Our initial exploration program was recently commenced. To date, we have advanced $5,000 to Mitchell Geological Services Inc. for services rendered as operat or of the Chub mineral claims. As operator, Mitchell Geological Services Inc. has performed the research of public exploration documents as set forth in the first phase of the initial exploration program. Due to inclement weather, Mitchell Geological Services Inc. has not been able to conduct the prospecting, mapping, and sampling or rock and soil sample assays which are required to complete the first phase of the initial exploration program. We expect that this work will be completed prior to the end of March 2005.

Prior to acquiring the Chub mineral claims, we incorporated a wholly owned subsidiary company Chub Exploration Ltd., a British Columbian corporation which we refer to as CEL. CEL was formed for the purpose of carrying out our mineral exploration program in British Columbia. Upon

forming CEL, we transferred all of our 100% ownership interest in the Chub mineral claims to CEL.

Further provisions of the Property Operating Agreement stipulate that Mitchell Geological Service Ind. is to govern the initial exploration program operations to be conducted on the Chub mineral claims. The position of Mitchell Geological Service Ind. is generally referred to as the operator within the mineral exploration industry. In the event that Mitchell Geological Services Inc. remains the operator throughout the initial exploration program, it will be entitled to receive as partial compensation for its services, a 15% undivided interest in the Chub mineral claims. Mitchell Geological Services Inc. will also be entitled to charge a fee for its services as operator equaling 7½% of the first $7,500 dollars of exploration expenditures and 5% of exploration expenditures thereafter.

Mitchell Geological Services Inc. is a privately owned, independent firm offering professional geological, exploration, and consulting services. Mitchell Geological Services has been in business for 19 years. As such, it has been engaged to provide these services for various clients located in North America, Central America and Africa. Mr. Marvin A. Mitchell, the principal of Mitchell Geological Services Inc., is a graduate of the Montana College of Mineral Science & Technology, Butte, Montana, USA, B.Sc., Geological Engineering (Mining Option). He is a member of the Association of Professional Engineers and Geoscientists of British Columbia, and a member of the Canadian Institute of Mining and Metallurgy. He is capable of developing mineral projects, initiating exploration programs from the “grass roots” level and carrying these projects through all phases of exploration to the mini ng feasibility stage. In addition, his broad practical background and marketing experience is an asset in the supervision of the later stages of project development because we will require expertise in marketing finished mineral products or other semi-refined mineral products in the event that commercially exploitable mineral deposits exist. Currently, Mr. Mitchell is not providing us with any marketing services. Mr. Mitchell is also a free miner in British Columbia. He is qualified to write and submit reports to the British Columbia Ministry of Energy and Mines for assessment work purposes.

Upon the completion of the initial exploration phase, we intend to request that our consulting geologist review the results of the exploration program and report back to us with his recommendations, if any, with regard to further exploration programs. To date, we completed the research of public exploration documents as set forth in the first phase of the initial exploration program. Due to inclement weather, we have not been able to conduct the prospecting, mapping, and sampling or rock and soil sample assays which are required to complete the first phase of the initial exploration program. We expect that this work will be completed prior to the end of March 2005. The report of our consulting geologist should be available in April, 2005. Provided that further exploration programs are recommended and provided that Mitchell Geological Service Inc. has remained the operator throughout the initial ph ase, the Property Operating Agreement requires that our company and a sole purpose company to be formed by our operator will enter into a formalized joint venture. In the event that Mitchell Geological Services Inc. has not remained the operator throughout the initial exploration period and has not earned the 15% undivided interest in the Chub mineral claims, provided that the recommendations of our consulting geologists favors further exploration, we intend to seek out a candidate with similar qualifications to those of Mitchell Geological Services Inc. and form a new joint venture with that organization.

The purpose of the joint venture will be to further explore the property containing the Chub mineral claims with the eventual goal of putting the property into commercial production should both a feasibility report recommending commercial production be obtained and a decision to commence commercial production be made. The feasibility report refers to a detailed written report of the results of a comprehensive study on the economic feasibility of placing the property or a portion of the property into commercial production. It is possible that results may be positive from the exploration program, but not sufficiently positive to warrant proceeding at a particular point in time. World prices for minerals may dictate not proceeding. Due to the fluctuation in the prices for minerals, it is also possible that mineral exploration ventures may not be profitable resulting in our inability to attract funding from investors to finance further exploration.

Under the terms of the joint venture agreement, both parties agree to associate and participate in a single purpose joint venture to carry out the project. Beneficial ownership of the property remains in each party’s name proportional to its respective interest. Also, subsequent to the initial exploration program costs that we will bear, future costs are to be met by each party in proportion to its interest.

Our initial joint venture interest shall be 85% and Mitchell Geological Services Inc.’s company, which we refer to as Mitchellco, will be 15%. The interest of each party may be reduced and the other party’s interest increased by an amount equal to the share of the exploration costs they were obliged to pay. If the interest of either us or Mitchellco is reduced to less than 5%, then that party will be deemed to have assigned their interest to the other party, and their sole remuneration and benefit from the joint venture agreement will be a Royalty equal to 2½% of net profits. The respective interest of each party could be increased or decreased form time to time if any or all of the following events occur: (1) a party fails to pay its proportionate share of the costs; (2) a party elects not to participate in the program, and/or; (3) a party elects to pay less than its proportionate share of the costs for a program. If these terms operate to cause a party’ interest in the Chub mineral claims to be reduced to 5% or less, that party will assign and convey its interest to the other party and will receive a royalty equal to 5 % of the net profits of production.

The property operating agreement provides that Mitchell Geological Services Inc., as the initial operator, will have the same rights, duties, and responsibilities as it would have were it the operator pursuant to the proposed joint venture agreement.

The operator has the full right, power and authority to do everything necessary or desirable to carry out a program and the project and to determine the manner of exploration of the property. A management committee consisting of one representative of each party will oversee the operator and manage or supervise the management of the business and affairs of the joint venture. Each representative may cast that number of votes that is equal to that party’s interest. A simple majority of the management committee prevails and the management committee’s decisions made in accordance with the joint venture agreement are binding on all parties. The proposed joint venture agreement contemplates that the agreement will stay in effect for so long as any part of the property or project is held in accordance with the agreement, unless earlier terminated by agreement of all parties.

Description and Location of the Chub mineral claims

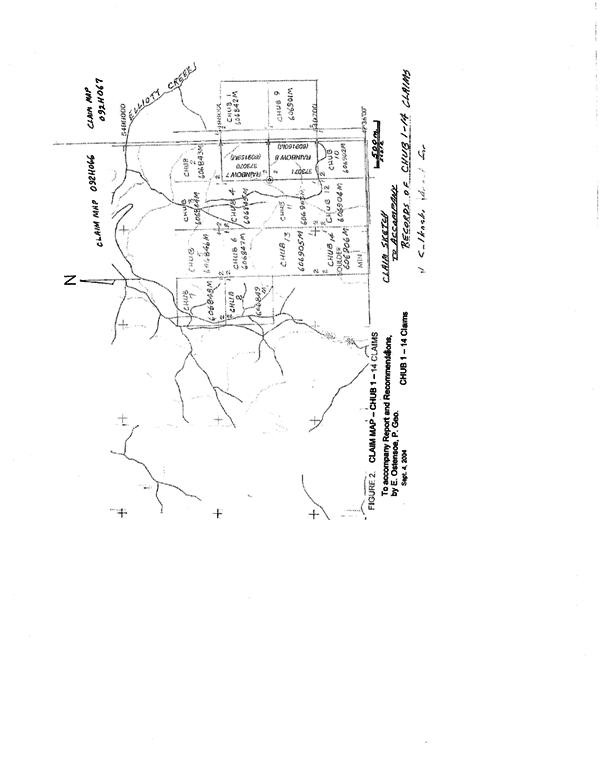

The Chub mineral claims consists of fourteen two-post mineral claims within the Similkameen Mining Division of British Columbia.

Tenure | Claim Name | Owner | Expiry | Area | Tag Number |

| 413776 | Chub 1 | 118613 | August 28th, 2005 | 1 unit | 606842M |

| 413777 | Chub 2 | 118613 | August 28th, 2005 | 1 unit | 606843M |

| 413778 | Chub 3 | 118613 | August 28th, 2005 | 1 unit | 606844M |

| 413779 | Chub 4 | 118613 | August 28th, 2005 | 1 unit | 606845M |

| 413780 | Chub 5 | 118613 | August 28th, 2005 | 1 unit | 606846M |

| 413781 | Chub 6 | 118613 | August 28th, 2005 | 1 unit | 606847M |

| 413782 | Chub 7 | 118613 | August 28th, 2005 | 1 unit | 606848M |

| 413783 | Chub 8 | 118613 | August 28th, 2005 | 1 unit | 606849M |

| 413784 | Chub 9 | 118613 | August 28th, 2005 | 1 unit | 606901M |

| 413785 | Chub 10 | 118613 | August 28th, 2005 | 1 unit | 606902M |

| 413786 | Chub 11 | 118613 | August 28th, 2005 | 1 unit | 606903M |

| 413787 | Chub 12 | 118613 | August 28th, 2005 | 1 unit | 606904M |

| 413788 | Chub 13 | 118613 | August 28th, 2005 | 1 unit | 606905M |

| 413789 | Chub 14 | 118613 | August 28th, 2005 | 1 unit | 606906M |

The claims are approximately 500 yards square each and cover a total of about 363 acres or about 0.60 square miles. Exploration work to the extent of $70.00 per unit will be required prior to the expiry date of August 28, 2005, or equivalent cash paid in lieu of work. It is our intention to continue exploration work and expend the necessary amount to maintain our claims in good standing. Precise claim surveying by Global Positioning Satellite Survey instrument may be filed for 1 year of work per unit.