UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive Proxy Statement

x Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

DWS ENHANCED COMMODITY STRATEGY FUND, INC.

(Name of Registrant as Specified In Its Charter)

______________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

o Fee paid previously with preliminary materials.

| | o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

(1) | Amount Previously Paid: |

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

DWS Enhanced Commodity Strategy Fund, Inc.

Doug Beck, Managing Director, Head of Product Management

Michael Clark, Managing Director, President of DWS Funds

Paul Schubert, Managing Director, Treasurer & Chief Financial Officer of DWS Funds

Kenneth C. Froewiss, Independent Board Member

June 9, 2010

Page 4

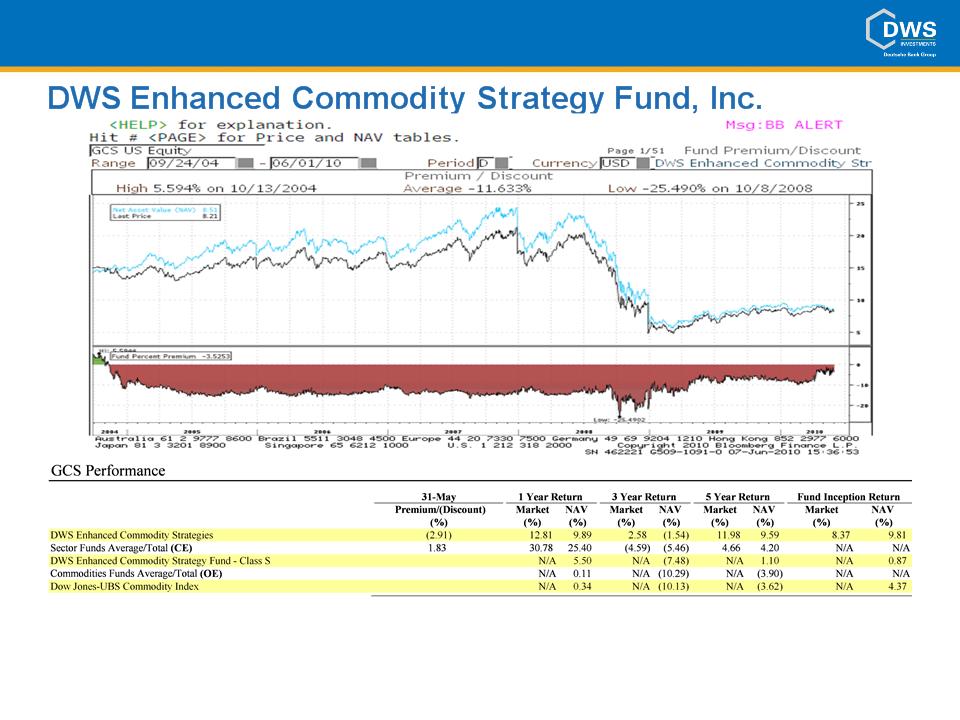

DWS Enhanced Commodity Strategy Fund, Inc.

Investment Objective: The Fund seeks capital appreciation with total return as a secondary objective. The

Fund seeks to meet its objective by investing in commodity-linked derivative I

nstruments backed by a portfolio of fixed-income instruments.

NYSE Symbol: GCS

Portfolio Manager: Bill Chepolis, Darwei Kung

May 28, 2010 NAV: $8.51

May 28, 2010 Market Price: $8.21

May 28, 2010 Discount: -3.53%

Discount Trend: Even before the merger was proposed, the Board took actions including

share buybacks that resulted in a reduction of the discount. The one year

discount average was -6.63% for the year ending June 1, 2010, with the fund

often trading below 6%.

May 28, 2010 Market Yield: 1.68%

May 28, 2010 NAV Yield: 1.62%

May 28, 2010 TNA (MM): $135.8 million

Dividend: The Fund intends to declare regular annual cash distributions to common

shareholders in December.

Prices and net asset value fluctuate and are not guaranteed. Yields fluctuate and are not guaranteed. Annualized dividend yield is the latest monthly

dividend shown as an annualized percentage of net asset value and market price as of 5/28/10. Annualized dividend yield is simply measures the level of

dividends and is not a complete measure of performance.

Page 5

Source: Lipper and DWS Investments. Performance is historical and does not guarantee future results. Investment return and principal value

fluctuate so your shares may be worth more or less when redeemed. Current performance may differ from data shown. Please visit

www.dws-investments.com for the fund’s most recent month-end performance.

Source: Bloomberg

1Fund Inception for DWS Enhanced Commodity Strategy Fund - Class S (Open-End Fund) is 2/14/2005

2Fund Inception for DWS Enhanced Commodity Strategy Fund (Closed-End Fund) is 9/24/2004

3DWS Enhanced Commodity Strategy Fund (Closed-End Fund) implemented changes to the investment approach similar to the DWS Enhanced Commodity Strategy Fund (Open-End Fund) on April 1, 2010.

The gross and net expense ratios for The DWS Enhanced Commodity Strategy Fund Class S shares are 1.63% and 1.40%, respectively as of the latest prospectus, There is a contractual waiver through

9/30/10. Without this waiver, returns would have been lower.

Page 6

Changes to Investment Strategies, Policies and Fund Name

§ In January 2010, the Fund’s Board of Directors approved a change in the Fund’s investment strategy,

from a blended approach involving investments in companies in commodities-related industries and

direct commodity investments, to an actively-managed direct commodity strategy.

§ This change in investment strategy is intended to provide greater potential to deliver out-performance

relative to the Fund’s benchmark which is now the DJ UBS Commodity Index. It is believed that the

change in investment strategy offers an opportunity for a more direct, purer commodity exposure as

compared to the previous blended approach and is also intended to enable the Fund to better take

advantage of inefficiencies in the volatile commodity markets. The new strategy also creates potential

for the portfolio management team to reduce the Fund’s commodity exposure when commodities

appear overvalued.

§ In connection with the implementation of the Fund’s new strategy, the Fund’s name was changed

from DWS Global Commodities Stock Fund, Inc. to DWS Enhanced Commodity Strategy Fund, Inc.

§ These changes were effective March 31, 2010

DWS Enhanced Commodity Strategy Fund, Inc.

Page 7

Bill J. Chepolis, CFA, Managing Director

■ Portfolio manager for Retail Fixed Income.: New York

■ Joined the Company in 1998 after 13 years of experience as vice

president/portfolio manager and foreign exchange trader for Norwest

Bank Minnesota, N.A.

■ BIS from University of Minnesota

DWS Enhanced Commodity Strategy Fund, Inc.

Darwei Kung, Vice President

■ Portfolio manager.: New York

■ Joined the Company in 2006

■ BS in Computational Finance and MS in Electrical Engineering from

University of Washington (Seattle, WA); MS in Computational Finance

and MBA in Business Administration from Carnegie Mellon University

Page 8

DWS Enhanced Commodity Strategy Fund, Inc.

Performance data source is Unimputed and Unadjusted from State

Street Performance.

Performance is historical and does not guarantee future results. See page 5 for complete standardized performance information.

Fund Facts

■ For the 1-, 3-, and 5-year time period ending May 31, 2010, the Fund has outperformed its benchmark on a net asset

value basis. The Fund returned 9.89%, (1.54)%, 9.59% and 9.81% versus 0.34%, (10.13)%, (3.62)% and 4.37% for

the benchmark respectively.

■ The Fund has a share repurchase plan to effect periodic repurchases of its shares in the open market from time to

time when the Fund’s shares trade at a discount to their net asset value per share in an amount up to 20% of its

outstanding shares over a 12-month period.

■ The Fund changed its investment strategy, from a blended approach involving investments in companies in

commodities-related industries and direct commodity investments, to an actively-managed direct commodity strategy

effective March 31, 2010.

■ Programs to maintain market awareness including:

■ Participation in industry conferences

■ Comprehensive website: www.dws-investments.com

■ Dedicated Toll-free shareholder line: 1-800-349-4281

■ S&P Independent Fund Research Reports

Page 9

What is the Board Proposing?

On June 28, 2010 GCS will hold its Annual Meeting of Stockholders

■ To re-elect 3 current directors to three year terms on the Board of the Fund

■ To re-elect 5 current directors to two year terms on the Board of the Fund

■ To approve an agreement and plan of reorganization calling for the merger of GCS into DWS

Enhanced Commodity Strategy Fund, an open investment company

■ This provides stockholders the opportunity to transfer their investment on a tax-free

basis into an open-end fund managed in a substantially similar manner by the same

portfolio management team

■ Shareholder approval of the merger would allow stockholders to choose between

remaining invested in an open-end fund with a similar commodity strategy or

redeeming their shares at NAV (subject to a 1% redemption fee for the first year

following the merger to protect existing and remaining shareholders)

■ The total expense ratio for the combined fund is expected to be lower than future

anticipate expense ratios for GCS due to the elimination of insurgent activities and

related costs, which is likely to create a significant expense and drag of performance

of GCS in the future

■ Vote against a stockholder proposal to terminate the existing Investment Management Agreement

between the Fund and Deutsche Investment Management Americas Inc.

■ The termination of the management agreement would require the hiring of an interim

investment adviser, which could be costly and disruptive for GCS.

Page 10

What is the Dissident Proposing?

■ Elect three Western Investment nominees to the Board to serve as Class I Directors of the Fund

until the Fund’s annual meeting of stockholders held during its 2012-2013 fiscal year and until their

respective successors have been duly elected and qualify

■ Elect five Western Investment nominees to the Board to serve as Class III Directors of the Fund until

the Fund’s annual meeting of stockholders held during its 2011-2012 fiscal year and until their

respective successors have been duly elected and qualify

■ Oppose the Fund’s proposed Agreement and Plan of Reorganization and the transactions it

contemplates

■ Approve Western Investment stock holder proposal to terminate the Fund’s investment

management agreement

■ Transact such other business as may properly come before the meeting or any adjournment or

postponement thereof.

■ Western spends over a page describing historic legal and regulatory actions that are totally

unrelated to the Fund and irrelevant to the election of directors at the Meeting, the merger or

the termination of the investment management agreement.

■ Western’s nominees plan to support tender offers followed by a liquidation - which we

believe will take longer and be more expensive then the proposed merger. A liquidation is

forcing a taxable event on a stockholder, and does not provide an opportunity for those

stockholders to remain invested in commodities

Page 11

Dissident Class I Nominees

Arthur D. Lipson

Richard A. Rappaport

William J. Roberts

Dissident Class III Nominees

Neil Chelo

Matthew S. Crouse

Robert H. Daniels

Gregory R. Dube

Robert A. Wood

Mr. Lipson’s nominees have no meaningful experience serving as directors of registered investment

companies

■ With the exception of Mr. Lipson’s brief tenure as a dissident director of one Pioneer Fund, none

of them have any experience dealing with the many complex regulatory and compliance issues

facing fund directors today.

■ With the exception of Mr. Lipson, none of the dissident nominees own any shares of the Fund

except for Mr. Daniels who holds 0.01% of the outstanding shares.

Mr. Lipson and his nominees do not share the interests of all shareholders

■ Mr. Lipson’s nominees are not capable of fairly and dispassionately considering the interests of

all shareholders. They are committed to a single, announced course of action.

■ Mr. Lipson is seriously conflicted because of his duties to Western. He is focused on the short-

term gains of his hedge funds versus the long-term interests of shareholders in the Funds.

■ The other dissident nominees are seriously conflicted because they owe their nominations solely

to Mr. Lipson.

What is the dissident experience and interest?

Page 12

The Board is composed of thirteen members, twelve of whom meet the conditions imposed by the Investment

Company Act of 1940 for being “disinterested” (“independent”) Board members. The nominees, all of whom

are currently independent Board members, were nominated by the Board’s Nominating and Governance

Committee, which is composed entirely of independent Board members.

Aligned Shareholder Interest

■ In contrast to Mr. Lipson’s nominees, the current Board’s nominees have combined 86 years of

experience in protecting the interest of shareholders of many different types of funds and under

many different challenging circumstances.

■ In contrast to Mr. Lipson’s nominees, each Board nominee has at least $200,000 of his or her own

assets invested in the various DWS funds he or she oversees.

■ In contrast to Mr. Lipson’s nominees, our Board nominees are not beholden to any special

interest. They are completely independent of the advisor and owe their allegiance solely to the

Fund and its shareholders.

The re-election of the current Board members is in the best interests of the Funds and its stockholders

because they will fairly and objectively consider the interests of all stockholders in determining the future

direction of the Funds, including the interests of those stockholders who have purchased Fund shares

seeking a long-term investment opportunity and the special advantages provided by the closed-end fund

structure.

Incumbent Director Candidates Are Better Qualified

Page 13

Class I Nominees

John W. Ballantine - Board member since 2008. Retired; formerly, Executive Vice President and Chief Risk

Management Officer, First Chicago NBD Corporation/The First National Bank of Chicago (1996-1998);

Executive Vice President and Head of International Banking (1995-1996). Directorships: Healthways Inc.

(provider of disease and care management services); Portland General Electric (utility company); Stockwell

Capital Investments PLC (private equity); former Directorships: First Oak Brook Bancshares, Inc. and Oak

Brook Bank; Prisma Energy International

Henry P. Becton, Jr. - Board member since 1990. Vice Chair and former President, WGBH Educational

Foundation; Directorships: Association of Public Television Stations; Lead Director, Becton Dickinson and

Company (medical technology company); Lead Director, Belo Corporation (media company); Public Radio

International; Public Radio Exchange (PRX); The PBS Foundation; former Directorships: Boston Museum of

Science; American Public Television; Concord Academy; New England Aquarium; Mass. Corporation for

Educational Telecommunications; Committee for Economic Development; Public Broadcasting Service.

Dawn-Marie Driscoll - - Board member since 2005. President, Driscoll Associates (consulting firm);

Executive Fellow, Center for Business Ethics, Bentley University; formerly, Partner, Palmer & Dodge (1988-

1990); Vice President of Corporate Affairs and General Counsel, Filene’s (1978-1988). Directorships: Trustee

of 20 open-end mutual funds managed by Sun Capital Advisers, Inc. (since 2007); Director of ICI Mutual

Insurance Company (since 2007); Advisory Board, Center for Business Ethics, Bentley University; Trustee,

Southwest Florida Community Foundation (charitable organization); former Directorships: Investment

Company Institute (audit, executive, nominating committees) and Independent Directors Council

(governance, executive committees)

Incumbent Director Candidates

Page 14

Class III Nominees

Paul Freeman - Board member since 1993. Chair-person since 2009. Consultant, World Bank/Inter-American Development

Bank; formerly, Project Leader, International Institute for Applied Systems Analysis (1998-2001); Chief Executive Officer, The

Eric Group, Inc. (environmental insurance) (1986-1998); Member, Governing Council of Independent Directors Council (national

organization for independent directors of mutual funds that is supported by the Investment Company Institute) (2008).

William McClayton - Board member since 2004. Managing Director, Diamond Management & Technology Consultants, Inc.

(global management consulting firm) (2001-present); Directorship: Board of Managers, YMCA of Metropolitan Chicago;

formerly, Senior Partner, Arthur Andersen LLP (accounting) (1966 -2001); Trustee, Ravinia Festival.

Rebecca W. Rimel - Board member of GCS since 2004. President and Chief Executive Officer, The Pew Charitable Trusts

(charitable organization) (1994 to present);Trustee, Thomas Jefferson Foundation (charitable organization)(1994 to present);

Trustee, Executive Committee, Philadelphia Chamber of Commerce (2001-2007); Trustee, Pro Publica (charitable

organization)(2007- present) formerly, Executive Vice President, The Glenmede Trust Company (investment trust and wealth

management)(1983-2004); Board Member, Investor Education (charitable organization)(2004-2005); Director, Viasys Health

Care (January 2007-June 2007); Over $100,000 personal assets invested in the various DWS funds overseen and 25 years

experience.

Willliam N. Searcy, Jr. - Board member since 2005. Private investor since October 2003; Trustee of 20 open-end mutual funds

managed by Sun Capital Advisers, Inc. (since October 1998); formerly, Pension & Savings Trust Officer, Sprint Corporation

(telecommunications) (November 1989-September 2003)

Robert H. Wadsworth - Board member since 2008. President, Robert H. Wadsworth & Associates, Inc. (consulting firm) (1983

to present); Director, The Phoenix Boys Choir Association

Incumbent Director Candidates

Page 15

Efforts by the current Board to Address the Discount

Tender Offer Program*: 6,871,192 shares repurchased, valued at $131,011,230

■ 2006: 2,523,268 shares repurchased valued at $46,625,955

■ 2007: 2,285,374 shares repurchased valued at $44,717,150

■ 2008: 2,062,550 shares repurchased valued at $39,668,125

Share Repurchase Program

■ Authorized two successive annual repurchase programs each to purchase up to 20% of

outstanding common shares in open market over a twelve month period (9/08 - 8/10). Actual

shares repurchased since September 2008 total 3,107,738 shares valued at $24,485,900

Merger

■ The Board approved a proposal to merge the Fund into the open end fund DWS Commodity

Strategy Fund, pending stockholder approval

This demonstrates the Board is committed to continued review of all available

alternatives for the best interest of the stockholders

September 2008 Proxy Contest:

■ “Western believes it is time to consider meaningful measures to address the persistent discount to

NAV”.

■ “ Western believes the Board has a duty to shareholders to consider all options to address the

Fund’s discount to NAV”

*The Fund conducted six, consecutive semi-annual tender offers between December 2005 - July 2008, all results included.

Page 16

Primary risk considerations

Closed-end funds, unlike open-end funds, are not continuously offered. There is a one time public offering and, once issued, shares of

closed-end funds are traded in the open market generally through a stock exchange. Shares of closed-end funds frequently trade at a

discount to net asset value. The price of the fund’s shares is determined by a number of factors, several of which are beyond the control of

the fund. Therefore, the fund cannot predict whether its shares will trade at, below, or above net asset value.

DWS Enhanced Commodity Strategy Fund, Inc. is a non-diversified, closed-end investment company currently invested in commodity-linked

derivative instruments backed by a portfolio of fixed income securities, including inflation indexed securities, of varying maturities issued by the US

government, non-US governments, their agencies or instrumentalities, and US and non-US corporations and derivatives related to each of these

types of securities. The investment objective of the Fund is capital appreciation with total return as a secondary objective. The fund invests in

commodity-related securities, including commodity-linked derivatives which may subject the fund to special risks. Market price movements or

regulatory and economic changes will have a significant impact on the fund’s performance. Any fund that concentrates in a particular segment of the

market will generally be more volatile than a fund that invests more broadly. Bond investments are subject to interest-rate and credit risks. When

interest rates rise, bond prices generally fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. This fund is

non-diversified and can take larger positions in fewer issues, increasing its potential risk. Stocks may decline in value. Leverage results in additional

risks and can magnify the effect of any losses.

This presentation is intended only for the exclusive benefit and use of RiskMetrics Group. This presentation was prepared in order to illustrate, on a

preliminary basis, a specific investment strategy and does not carry any right of publication or disclosure. Neither this presentation nor any of its

contents may be used for any other purpose without the prior written consent of Deutsche Asset Management.

The information in this presentation reflects prevailing market conditions and our judgment as of this date, which are subject to change. In preparing

this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available

from public sources. We consider the information in this update to be accurate, but we do not represent that it is complete or should be relied upon as

the sole source of composite performance or suitability for investment.

The opinions and forecasts expressed are those of DWS Investments as of June 9, 2010 and may not actually come to pass. This information is

subject to change at any time, based on market and other conditions.

Past performance is not indicative of future results. No representation or warranty is made as to the efficacy

of any particular strategy or the actual returns that may be achieved. An investment is not a deposit and is not insured by the Federal

Deposit Insurance Corporation or any other government agency or by Deutsche Bank AG or any of its affiliates.

Important information

DWS Investments is part of Deutsche Bank’s Asset

Management division and, within the US, represents the

retail asset management activities of Deutsche Bank

AG, Deutsche Bank Trust Company Americas,

Deutsche Investment Management Americas Inc. and

DWS Trust Company.

NOT FDIC/NCUA INSURED MAY LOSE VALUE

NO BANK GUARANTEE NOT A DEPOSIT

NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY

OBTAIN A PROSPECTUS

To obtain a summary prospectus, if available, or prospectus, download one from www.dws-investments.com, talk to

your financial representative or call (800) 621-1048. We advise you to carefully consider the product’s objectives, risks,

charges and expenses before investing. The summary prospectus and prospectus contain this and other important

information about the investment product. Please read the prospectus carefully before you invest.

©2010 DWS Investments Distributors, Inc. All rights reserved. (6/10) R-6664-2

DWS Investments Distributors, Inc.

Tel (800) 349-4281 (Closed-end Funds)

Online: www.dws-investments.com

345 Park Avenue

New York, NY 10154

The DWS Enhanced Commodity Strategy Fund invests in commodity-related securities, including commodity-linked

derivatives which may subject the fund to special risks. Market price movements or regulatory and economic changes

will have a significant impact on the fund’s performance. Any fund that concentrates in a particular segment of the

market will generally be more volatile than a fund that invests more broadly. A counterparty with whom the fund does

business may decline in financial health and become unable to honor its commitments, which could cause losses for

the fund. Bond investments are subject to interest-rate and credit risks. When interest rates rise, bond prices generally

fall. Credit risk refers to the ability of an issuer to make timely payments of principal and interest. Investing in

derivatives entails special risks relating to liquidity, leverage and credit that may reduce returns and/or increase

volatility. Investing in foreign securities, particularly those of emerging markets, presents certain risks, such as

currency fluctuations, political and economic changes, and market risks. This fund is non-diversified and can take

larger positions in fewer issues, increasing its potential risk. See the prospectus for details.