Exhibit 99.1

INVESTOR PRESENTATION JUNE 2016

This presentation includes "forward - looking statements" within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. These statements are based upon the current beliefs and expectations of Zagg's management and are subject to significant risks and uncertainties. If underlying assumptions prove inaccurate or risks or uncertainties materialize, actual results may differ materially from those set forth in the forward - looking statements. Risks and uncertainties include but are not limited to general industry conditions and competition; general economic factors; timely introduction of product solutions required to retain existing customers and attract new customers; achieving meaningful international market share for our products; challenges inherent in new product development including the ability to respond quickly with appropriate products after new mobile devices launches by major manufacturers like Samsung and Apple; manufacturing difficulties or delays; a shift in product mix to lower margin products; inventory management; and the failure of information systems or technology solutions or the effect of cyber - attacks or similar incidents. Zagg undertakes no obligation to publicly update any forward - looking statement, whether as a result of new information, future events or otherwise. Additional factors that could cause results to differ materially from those described in the forward - looking statements can be found in Zagg's 2014 Annual Report on Form 10 - K and the company's other filings with the Securities and Exchange Commission (SEC) available at the SEC's Internet site ( www.sec.gov ). Safe Harbor 6/14/2016 2

• Global leader in accessories and technologies that empower mobile lifestyles. • Diversified portfolio with leadership in high growth categories. • Leading market share brands: • #1 selling screen protection • #1 selling battery cases & external power • #2 selling folio tablet keyboards • Top 5 in personal audio ZAGG Today 3 6/14/2016

mophie Acquisition 4 6/14/2016 • Market share leader in the power management. • Accretive to Adjusted EBITDA with no share dilution. • Increased product diversification. • Adds best - in - class product development platform. • Strengthened manufacturing resources in China. • Strong Apple relationship. • Distribution expansion opportunities in both the domestic and international markets.

What’s Impacted ZAGG Stock Price? 5 6/14/2016 • Apple headwinds; a nalyst lowers 16Q1 forecast. • ZAGG misses consensus; analysts mophie contribution high for 16Q1. • Company guided to low end of range for net sales and Adjusted EBITDA. • Stock price fell below 200 day moving average; triggered quant fund selling. • Filed 8KA with mophie historical financials. • Analyst lowers price target to $5.00.

ZAGG’s Corporate Objectives • Corporate objectives introduced in 2012 continue to serve as our foundation for growth and value creation. 6/14/2016 6

• Introducing Creative Product Solutions is the foundation that drives our brand strength and distribution growth. • Strong new product pipeline extending through 2017. • Opportunities to further strengthen existing categories while exploring new ones. Creative Product Solutions 6/14/2016

Screen Protection Battery Cases External Power Folio Tablet Keyboards Audio Misc. Accessories & Cases #1 #1 #1 #1 Top 5 Storage, Docks & Cables Creative Product Solutions 6/14/2016 8

• One company with several industry leading brands. • Broad and expanding retail presence . • In - store consumer experience: • Increased merchandising and training. • Improving on - line experience through better content and social media awareness T he Preferred Brand 6/14/2016

• Expanding global distribution: • Opened 9 0 + new customers with over 15,000 doors globally in 2015. • Expanding with existing retail customers. • Adding new strategic distribution channels: pharmacy, travel, grocery, department stores, DYI, B2B and franchise. Targeted Global Distribution 6/14/2016

• Experienced leadership across all functional teams. • Diversified business with multi - category product strategy. • Recognized global brands centered around mobile lifestyles. • Strong retail relationships. • International growth opportunities. • Strengthening operational platform. • Profitable, generating cash with strong balance sheet. Positioned for Long Term Growth 6/14/2016 1 1

• Strengthening processes to improve forecasting and inventory management controls. • Leveraging purchasing strength with contract manufacturing partners. • Acquisition has created strengthened freight and logistics purchasing power. • Company - wide cost reduction initiatives being implemented. • Operating with an established culture of continuous improvement. Strengthening Operational Performance 6/14/2016 12

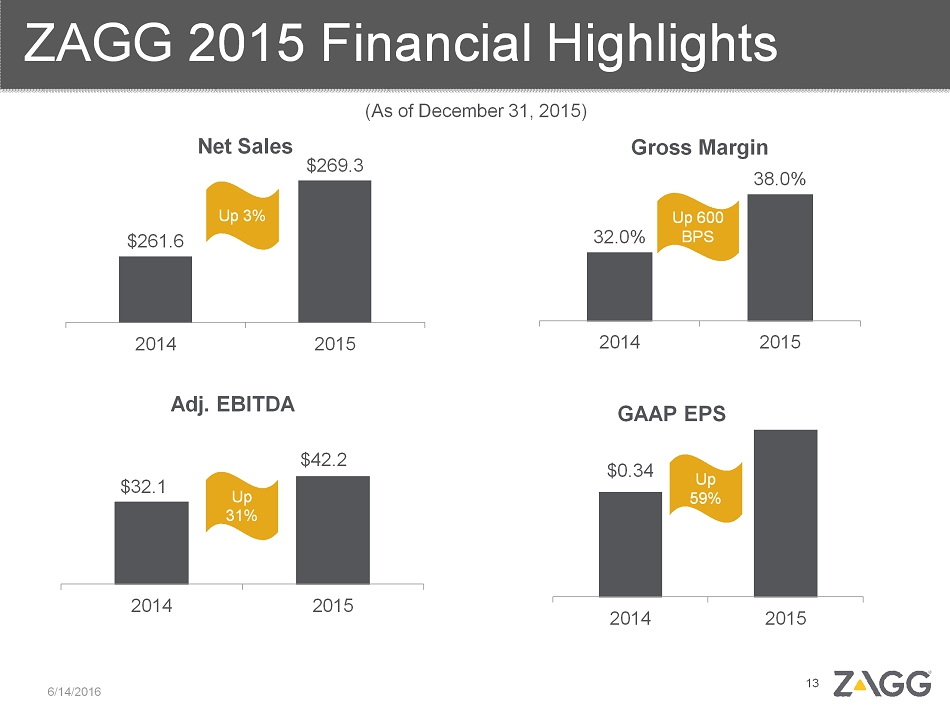

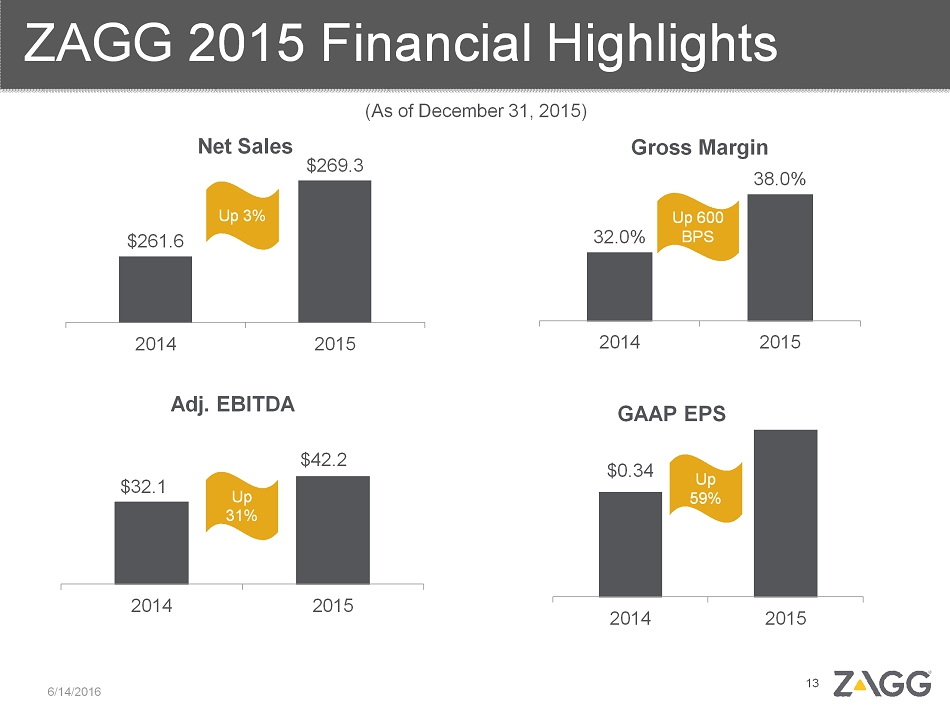

ZAGG 2015 Financial Highlights $261.6 $269.3 2014 2015 Net Sales 32.0% 38.0% 2014 2015 Gross Margin $32.1 $42.2 2014 2015 Adj. EBITDA 2014 2015 GAAP EPS 6/14/2016 Up 31% Up 600 BPS Up 59% Up 3% 13 (As of December 31, 2015) $0.34

Strong Balance Sheet & Cash Flow • Cash balance of $13.0 million at year end. • No outstanding debt; $25 million available on credit facility. • Reduced inventory balance to $ 46 million versus $48 million on increased sales. • Accounts receivable of $58 million; DSO of 67. • TTM cash flow from operations of $25 million. • Improved Adjusted EBITDA margin of 16% versus 12%. 6/14/2016 14 (As of December 31, 2015)

2016 Guidance* 6/14/2016 15 • Net sales of $460 - $500 million. • Gross margins in a range of low to mid 30’ s. • Adjusted EBITDA of $60 - $65 million. *Reflects a 10 - months of mophie performance.

Why Invest in ZAGG? • Global leader in mobile accessories. • Focus on new products and technologies. • Strong portfolio of brands with global retail presence. • Long term focus on driving shareholder value: • Active business development process. • Significant share repurchase program. • Strong cash flow. • Strategic acquisition of mophie strengthens business, reduces category risk, increases EBITDA with no share dilution. • Market cap expansion potential as a result of the acquisition . • Attractive valuation; low EBITDA multiple. 6/14/2016 16

Investor Presentation JUNE 2016 investors.zagg.com