(d) Options written for the period October 29, 2004 (commencement of operations) through February 28, 2005:

PIMCO Floating Rate Strategy Fund Notes to Financial Statements

February 28, 2005 (unaudited)

3. Investment in Securities (continued)

(f) At February 28, 2005, the Fund held the following unfunded loan commitments which could be extended at the option of the borrower:

| Borrower | | Unfunded Commitments |

|

|

|

|

|

| Advanced Medical Products, Term B | | $ | 1,765,313 | |

| Celanese AG | | | 3,188,669 | |

| Host Marriott, Term A | | | 3,225,000 | |

| Host Marriott, Term B | | | 1,612,500 | |

| Venetian Casino, Term D | | | 2,607,692 | |

| Warner Chilcott plc | | | 1,440,883 | |

| Wynn Resorts Ltd., Term B | | | 5,086,719 | |

| |

|

| |

| | | $ | 18,926,776 | |

| |

|

| |

4. Income Tax Information

The cost basis of portfolio securities for federal income tax purposes is $1,340,174,889. Aggregated gross unrealized appreciation for securities in which there is an excess value over tax cost is $8,687,253, aggregate gross unrealized depreciation for securities in which there is an excess of tax cost over value is $1,327,693, unrealized appreciation for federal income tax purposes is $7,359,560.

5. Auction Preferred Shares

The Fund has issued 3,840 shares of Preferred Shares Series M, 3,840 shares of Preferred Shares Series T, 3,840 shares of Preferred Shares Series W, 3,840 shares of Preferred Shares Series Th and 3,840 shares of Preferred Shares Series F, each with a net asset and liquidation value of $25,000 per share plus accrued dividends.

Dividends and distributions of net realized capital gains if any, are accumulated daily at an annual rate set through auction procedures.

For the period October 29, 2004 (commencement of operations) through February 28, 2005, the annualized dividend rate ranged from:

| | | High | | Low | | At February 28, 2005 |

|

|

|

|

|

|

|

|

|

|

| Series M | | 2.57 | % | | 2.22 | % | | 2.52 | % |

| Series T | | 2.57 | % | | 2.24 | % | | 2.55 | % |

| Series W | | 2.55 | % | | 2.19 | % | | 2.55 | % |

| Series TH | | 2.58 | % | | 2.19 | % | | 2.58 | % |

| Series F | | 2.62 | % | | 2.22 | % | | 2.62 | % |

The Fund is subject to certain limitations and restrictions while Preferred Shares are outstanding. Failure to comply with these limitations and restrictions could preclude the Fund from declaring any dividends or distributions to common shareholders or repurchasing common shares and/or could trigger the mandatory redemption of Preferred Shares at their liquidation value.

Preferred Shares, which are entitled to one vote per share, generally vote with the common stock but vote separately as a class to elect two Trustees and on any matters affecting the rights of the Preferred Shares.

6. Subsequent Common Dividend Declarations

On March 4, 2005, a dividend of $0.101157 per share was declared to common shareholders payable April 1, 2005 to shareholders of record on March 18, 2005.

On April 1, 2005, a dividend of $0.101157 per share was declared to common shareholders payable May 6, 2005 to shareholders of record on April 15, 2005.

7. Legal Proceedings

On September 13, 2004, the Securities and Exchange Commission (the “Commission”) announced that the Investment Manager and certain of its affiliates had agreed to a settlement of charges that they and certain of their officers had, among other things, violated various antifraud provisions of the federal securities laws in connection with an alleged market-timing arrangement involving trading of shares of various open-end investment companies (”open-end” funds) advised or distributed by the Investment Manager and certain of its affiliates. In their settlement with the Commission, the Investment Manager and their affiliates consented to the entry of an order by the Commission and, without admitting or denying the findings contained in the order, agreed to implement certain compliance and governance changes and consented to cease-

| 22 PIMCO Floating Rate Strategy Fund Semi-Annual Report | 02.28.05 | |

PIMCO Floating Rate Strategy Fund Notes to Financial Statements

February 28, 2005 (unaudited)

7. Legal Proceedings (continued)and-desist orders and censures. In addition, the Investment Manager and its affiliates agreed to pay civil money penalties in the aggregate amount $40 million and to pay disgorgement in the amount of $10 million, for an aggregate payment of $50 million. In connection with the settlement, the Investment Manager and its affiliates have been dismissed from the related complaint the Commission filed on May 6, 2004 in the U.S. District Court in the Southern District of New York. Neither the complaint nor the order alleges any inappropriate activity took place with respect to the Fund.

In a related action on June 1, 2004, the Attorney General of the State of New Jersey announced that it had entered into a settlement agreement with Allianz Global and certain other affiliates of the Investment Manager, in connection with a complaint filed by the New Jersey Attorney General (“NJAG”) on February 17, 2004. The NJAG dismissed claims against the Sub-Adviser, which had been part of the same complaint. In the settlement, Allianz Global and other named affiliates neither admitted nor denied the allegations or conclusions of law, but did agree to pay New Jersey a civil fine of $15 million and $3 million for investigative costs and further potential enforcement initiatives against unrelated parties. They also undertook to implement certain governance changes. The complaint relating to the settlement contained allegations arising out of the same matters that were subject of the Commission order regarding market timing described above.

On September 15, 2004, the Commission announced that the Investment Manager and certain of its affiliates agreed to settle an enforcement action in connection with charges that they violated various antifraud and other provisions of federal securities laws as a result of, among other things, their failure to disclose to the board of trustees and shareholders of various open-end funds advised or distributed by the Investment Manager and its affiliates material facts and conflicts of interest that arose from their use of brokerage commissions on portfolio transactions to pay for so-called “shelf space” arrangements with certain broker-dealers. In the settlement, the Investment Manager and its affiliates consented to the entry of an order by the Commission without admitting or denying the findings contained in the order. In connection with the settlement, the Investment Manager and its affiliates agreed to undertake certain compliance and disclosure reforms and consented to cease-and-desist orders and censures. In addition, the Manager and these affiliates agreed to jointly pay a civil money penalty of $5 million and to pay disgorgement of $6.6 million based upon the amount of brokerage commissions alleged to have been paid by such open-end funds in connection with these arrangements (and related interest). In a related action, the California Attorney General announced on September 15, 2004 that it had entered an agreement with an affiliate of the Investment Manager in resolution of an investigation into matters that are similar to those discussed in the Commission’s order. The settlement agreement resolves matters described in the complaint filed by the California Attorney General in the Superior Court of the State of California alleging, among other things, that this affiliate violated certain antifraud provisions of California law by failing to disclose matters related to the shelf-space arrangements described above. In the settlement agreement, the affiliate did not admit to any liability but agreed to pay $5 million in civil penalties and $4 million in recognition of the California Attorney General’s fees and costs associated with the investigation and related matters. Neither the Commission’s order nor the California Attorney General’s complaint alleges any inappropriate activity took place with respect to the Fund.

Since February 2004, the Investment Manager, the Sub-Adviser and certain of their affiliates have been named as defendants in 14 lawsuits filed in U.S. District Court in the Southern District of New York, the Central District of California and the Districts of New Jersey and Connecticut. Ten of those lawsuits concern “market timing,” and they have been transferred to and consolidated for pre-trial proceedings in the U.S. District Court for the District of Maryland; the remaining four lawsuits concern “revenue sharing” with brokers offering “shelf space” and have been consolidated into a single action in the U.S. District Court for the District of Connecticut. The lawsuits have been commenced as putative class actions on behalf of investors who purchased, held or redeemed shares of affiliated funds during specified periods or as derivative actions on behalf of the funds. The lawsuits generally relate to the same facts that are the subject of the regulatory proceedings discussed above. The lawsuits seek, among other things, unspecified compensatory damages plus interest and, in some cases, punitive damages, the rescission of investment advisory contracts, the return of fees paid under those contracts and restitution. The Investment Manager and the Sub-Adviser believe that other similar lawsuits may be filed in U.S. federal or state courts naming as defendants the Investment Manager, the Sub-Adviser, Allianz Global, the Fund, other open- and closed-end funds advised or distributed by the Investment Manager, the SubAdviser and/or their affiliates, the boards of trustees of those funds, and/or other affiliates and their employees.

Under Section 9(a) of the Investment Company Act of 1940, if any of the various regulatory proceedings or lawsuits were to result in a court injunction against the Investment Manager, the Sub-Adviser, Allianz Global and/or their affiliates, they and their affiliates would, in the absence of exemptive relief granted by the Commission, be barred from serving as an investment adviser/sub-adviser or principal underwriter for any registered investment company, including the Fund.

In connection with an inquiry from the Commission concerning the status of the New Jersey settlement described above under Section 9(a), the Investment Manager, the Sub-Adviser, and certain of their affiliates (together, the “Applicants”)

| | 02.28.05 | PIMCO Floating Rate Strategy Fund Semi-Annual Report 23 |

PIMCO Floating Rate Strategy Fund Notes to Financial Statements

February 28, 2005 (unaudited)

7. Legal Proceedings (continued)

have sought exemptive relief from the Commission under Section 9(c) of the Investment Company Act of 1940. The Commission has granted the Applicants a temporary exemption from the provisions of Section 9(a) with respect to the New Jersey settlement until the earlier of (i) September 13, 2006 and (ii) the date on which the Commission takes final action on their application for a permanent order. There is no assurance that the Commission will issue a permanent order.

It is possible that these matters and/or other developments resulting from these matters could lead to a decrease in the market price of the Fund’s shares or other adverse consequences to the Fund and its shareholders. However, the Investment Manager and the Sub-Adviser believe that these matters are not likely to have a material adverse effect on the Fund or on the Investment Manager’s or the Sub-Adviser’s ability to perform its respective investment advisory services relating to the Fund.

8. Corporate Changes

On December 14, 2004, Thomas J. Fuccillo was appointed as the Fund’s Secretary. On February 16, 2005, David C. Flattum was appointed to the Board of Trustees.

| 24 PIMCO Floating Rate Strategy Fund Semi-Annual Report | 02.28.05 | |

PIMCO Floating Rate Strategy Fund Financial Highlights

(unaudited)

| | | For the Period |

| | | October 29, 2004* |

| | | through |

| | | February 28, 2005 |

| |

|

|

|

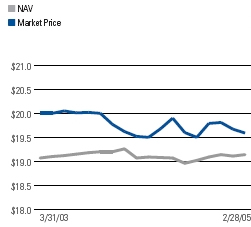

| Net asset value, beginning of period | | $ | 19.10 | |

| |

|

|

|

| Investment Operations: | | | | |

| Net investment income | | | 0.23 | |

| |

|

|

|

| Net realized and unrealized gain on investments, swaps and | | | | |

| foreign currency transactions | | | 0.30 | |

| |

|

|

|

| Total from investment operations | | | 0.53 | |

| |

|

|

|

| Dividends on Preferred Shares from Net Investment Income | | | (0.05 | ) |

| |

|

|

|

| Net increase in net assets applicable to common shares resulting from | | | | |

| investment operations | | | 0.48 | |

| |

|

|

|

| Dividends to Common Shareholders from Net Investment Income | | | (0.28 | ) |

| |

|

|

|

| Capital Share Transactions: | | | | |

| Common stock offering costs charged to paid-in capital in excess of par | | | (0.03 | ) |

| |

|

|

|

| Preferred shares offering costs/underwriting discount charged to paid-in | | | | |

| capital in excess of par | | | (0.13 | ) |

| |

|

|

|

| Total capital share transactions | | | (0.16 | ) |

| |

|

|

|

| Net asset value, end of period | | $ | 19.14 | |

| |

|

|

|

| Market price, end of period | | $ | 19.54 | |

| |

|

|

|

| Total Investment Return (1) | | | (0.85 | )% |

| |

|

|

|

| RATIO/SUPPLEMENTAL DATA: | | | | |

| Net assets applicable to common shareholders, end of period (000) | | $ | 793,240 | |

| |

|

|

|

| Ratio of expenses to average net assets (2)(3)(4) | | | 1.16 | % |

| |

|

|

|

| Ratio of net investment income to average net assets (2)(4) | | | 3.71 | % |

| |

|

|

|

| Preferred shares asset coverage per share | | $ | 66,301 | |

| |

|

|

|

| Portfolio turnover | | | 11 | % |

| |

|

|

|

| * | Commencement of operations. |

| |

| ** | Initial public offering price of $20.00 per share less underwriting discount of $0.90 per share. |

| |

| (1) | Total investment return is calculated assuming a purchase of common stock at the current market price on the first day and a sale at the current market price on the last day of the period reported. Dividends are assumed, for purposes of this calculation, to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. Total investment return does not reflect brokerage commissions or sales charges. Total investment return for a period of less than one year is not annualized. |

| |

| (2) | Calculated on the basis of income and expenses applicable to both common and preferred shares relative to the average net assets of common shareholders. |

| |

| (3) | Inclusive of expenses offset by custody credits earned on cash balances at the custodian bank. (See note 1(m) in Notes to Financial Statements). |

| |

| (4) | Annualized. |

| |

| See accompanying Notes to Financial Statements | 02.28.05 | PIMCO Floating Rate Strategy Fund Semi-Annual Report 25 |

(This Page Intentionally Left Blank)

(This Page Intentionally Left Blank)

(This Page Intentionally Left Blank)

Trustees and Principal Officers

Robert E. Connor

Chairman of the Board of Trustees

John J. Dalessandro II

Trustee

David C. Flattum

Trustee

Hans W. Kertess

Trustee

Brian S. Shlissel

President & Chief Executive Officer

Raymond G. Kennedy

Vice President

Newton B. Schott, Jr.

Vice President

Lawrence G. Altadonna

Treasurer, Principal Financial & Accounting Officer

Thomas J. Fuccillo

Secretary

Youse Guia

Chief Compliance Officer

Jennifer A. Patula

Assistant Secretary

Investment Manager

Allianz Global Investors Fund Management LLC

1345 Avenue of the Americas

New York, NY 10105

Sub-Adviser

Pacific Investment Management Company LLC

840 Newport Center Drive

Newport Beach, CA 92660

Transfer Agent, Dividend Paying Agent and Registrar

PFPC Inc.

P.O. Box 43027

Providence, RI 02940-3027

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP

300 Madison Avenue

New York, NY 10017

Legal Counsel

Ropes & Gray LLP

One International Place

Boston, MA 02210-2624

This report, including the financial information herein, is transmitted to the shareholders of PIMCO Floating Rate Strategy Fund for their information. It is not a prospectus, circular or representation intended for use in the purchase of shares of the Fund or any securities mentioned in this report.

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940, as amended, that from time to time the Fund may purchase shares of its common stock in the open market.

The financial information included herein is taken from the records of the Fund without examination by an independent registered public accounting firm, who did not express an opinion hereon.

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarter of its fiscal year on Form N-Q Form N-Q is available (i) on the Fund’s website at www.allianzinvestors.com (ii) on the Commission’s website at www.sec.gov, and (iii) at the Commission’s Public Reference Room which is located at the Commission’s headquarters’ office, 450 5th Street N.W., Room 1200, Washington D.C. 20459, (202) 942-8090.

A description of the policies and procedures that the Fund has adopted to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling the Fund’s transfer agent at (800) 331-1710 and (ii) on the Fund’s website at www.allianzinvestors.com.

Information on the Fund is available at www.allianzinvestors.com or by calling the Fund’s transfer agent at 1-800-331-1710.

ITEM 2. CODE OF ETHICS

Not required in this filing.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT

Not required in this filing

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES

Not required in this filing

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANT

Not required in this filing

ITEM 6. SCHEDULE OF INVESTMENTS Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this form.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED-END

MANAGEMENT INVESTMENT COMPANIES

Not required in this filing

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES

Not effective at the time of this filing

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT

COMPANY AND AFFILIATED COMPANIES.

| | | | | | | Total Number | | |

| | | | | | | of Shares Purchased | | Maximum Number of |

| | | Total Number | | Average | | as Part of Publicly | | Shares that May yet Be |

| | | of Shares | | Price Paid | | Announced Plans or | | Purchased Under the Plans |

| Period | | Purchased | | Per Share | | Programs | | or Programs |

| |

| |

| |

| |

|

| November 2004 | | N/A | | N/A | | N/A | | N/A |

| December 2004 | | N/A | | N/A | | N/A | | N/A |

| January 2005 | | N/A | | 19.08 | | 1,329,337 | | N/A |

| February 2005 | | N/A | | 19.09 | | 1,318,842 | | N/A |

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

In January 2004, the Registrant's Board of Trustees adopted a Nominating Committee Charter governing the affairs of the Nominating Committee of the Board, which is posted on the Allianz Investors website at www.allianzinvestors.com. Appendix B to the Nominating Committee Charter includes “Procedures for Shareholders to Submit Nominee Candidates,” which sets forth the procedures by which shareholders may recommend nominees to the Registrant's Board of Trustees. Among other requirements, the procedures provide that the recommending shareholder must submit any recommendation in writing to the Registrant to the attention of the Registrant's Secretary, at the address of the principal executive offices of the Registrant and that such submission must be received at such offices not less than 45 days

nor more than 75 days prior to the date of the Board or shareholder meeting at which the nominee would be elected. Any recommendation must include certain biographical and other information regarding the candidate and the recommending shareholder, and must include a written and signed consent of the candidate to be named as a nominee and to serve as a Trustee if elected. The foregoing description of the requirements is only a summary and is qualified in its entirety by reference to Appendix B of the Nominating Committee Charter.

ITEM 11. CONTROLS AND PROCEDURES

(a) The registrant's President and Chief Executive Officer and Principal Financial Officer have concluded that the registrant's disclosure controls and procedures (as defined in Rule 30a-2(c) under the Investment Company Act of 1940, as amended are effective based on their evaluation of these controls and procedures as of a date within 90 days of the filing date of this document.

(b) There were no significant changes in the registrant's internal controls or in factors that could affect these controls subsequent to the date of their evaluation, including any corrective actions with regard to significant deficiencies and material weaknesses.

ITEM 12. EXHIBITS

| (a)(1) | Exhibit 99.CERT - Certification pursuant to Section 302 of the |

| | Sarbanes-Oxley Act of 2002 |

| | |

| (b) | Exhibit 99.906CERT - Certification pursuant to Section 906 of |

| | the Sarbanes-Oxley Act of 2002 |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

PIMCO Floating Rate Strategy Fund

By /s/ Brian S. Shlissel

Brian S. Shlissel, President & Chief Executive Officer

Date: May 10, 2005

By /s/ Lawrence G. Altadonna

Lawrence G. Altadonna, Treasurer, Principal Financial & Accounting Officer

Date: May 10, 2005

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By /s/ Brian S. Shlissel

Brian S. Shlissel, President & Chief Executive Officer

Date: May 10, 2005

By /s/ Lawrence G. Altadonna

Lawrence G. Altadonna, Treasurer, Principal Financial & Accounting Officer

Date: May 10, 2005