Washington, D.C. 20549

(Amendment No. 1)

Action Industries, Inc.

ACTION INDUSTRIES, INC.

This Information Statement is first being mailed on or about _______, to the holders of record of the outstanding common stock, $0.001 par value per share (the “Common Stock”) and Series A Convertible Preferred Stock, par value $0.001 per share (“Series A Preferred Stock”), of Action Industries, Inc., a Nevada corporation (the “Company”), as of the close of business on _________, 2010 (the “Record Date”), pursuant to Rule 14c-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

This Information Statement relates to a written consent in lieu of a meeting, dated March 26, 2010 (the “Written Consent”), of stockholders of the Company owning at least a majority of the outstanding shares of Common Stock and Series A Preferred Stock of the Company, voting together as a single class on an as-converted to Common Stock basis, as of the Record Date (the “Majority Stockholders”). Except as otherwise indicated by the context, references in this Information Statement to “Company,” “we,” “us,” or “our” are references to Action Industries, Inc.

The Written Consent authorized an amendment to our Articles of Incorporation (the “Amendment”), which amends our current Articles of Incorporation to:

A copy of the substantive text of the Amendment is attached to this Information Statement as Appendix A.

These corporate actions will become effective on the filing of a certificate of amendment to our articles of incorporation with the Secretary of State of Nevada which filing will occur at least 20 days after the date of the mailing of this Information Statement to our stockholders.

PLEASE NOTE THAT THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS MEETING WILL BE HELD TO CONSIDER THE MATTERS DESCRIBED HEREIN. THIS INFORMATION STATEMENT IS BEING FURNISHED TO YOU SOLELY FOR THE PURPOSE OF INFORMING STOCKHOLDERS OF THE MATTERS DESCRIBED HEREIN PURSUANT TO SECTION 14(C) OF THE EXCHANGE ACT AND THE REGULATIONS PROMULGATED THEREUNDER, INCLUDING REGULATION 14C.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

On March 26, 2010, the Company entered into a Share Exchange Agreement with Kalington Limited, a Hong Kong limited company , its shareholders , Goodwin Ventures, Inc. and Kalington’s affiliate, Xingtai Longhai Wire Co., Ltd., a People’s Republic of China limited company.

Therefore, Kalington became a wholly-owned subsidiary of the Company. The share exchange resulted in a change in control of the Company.

Additional information concerning the transactions relating to the reverse acquisition, the related transactions and the current operating business of the Company is set forth under the heading of "Share Exchange and Acquisition of Longhai Steel" in this Information Statement. We urge you to read this Information Statement in its entirety.

On March 26, 2010, Inna Sheveleva, our former Secretary and current Director, submitted a resignation letter pursuant to which she resigned from all offices that she held effective immediately and from her position as our director that will become effective onApril 19, 2010. In addition, our board of directors on March 25, 2010 increased the size of the Board of Directors to three directors and appointed Chaojun Wang (Chairman), Jing Shen and Chaoshui Wang to fill the vacancies created by such resignation and increase, which appointments will become effective upon the effectiveness of the resignation of Inna Sheveleva.

On March 26, 2010, we filed an Information Statement on Schedule 14F with the SEC relating to a potential change in control of our board of directors containing the information required under Rule 14f-1 of the Exchange Act.

On March 26, 2010, Merry Success Limited (“Merry Success”), being the record holder of 5,178 shares of our Series A Convertible Preferred Stock, constituting 51.0% of the voting power of our issued and outstanding shares of our Common Stock and Series A Preferred Stock, voting together as a single class consented in writing to the Amendment. The Written Consent authorized an amendment to our Articles of Incorporation to:

A copy of the substantive text of the Amendment is attached to this Information Statement as Appendix A. These corporate actions will become effective on the filing of a certificate of amendment to our articles of incorporation with the Secretary of State of Nevada which filing will occur at least 20 days after the date of the mailing of this Information Statement to our stockholders.

Under the Nevada Revised Statutes and the Company’s Bylaws, any action that can be taken at an annual or special meeting of stockholders may be taken without a meeting, without prior notice and without a vote, if the holders of outstanding stock having not less than the minimum number of votes that will be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted consent to such action in writing. The approval of the Amendment requires the affirmative vote or written consent of a majority of the voting power of the issued and outstanding shares of Common Stock and Series A Preferred Stock, voting together as a single class. Each Stockholder is entitled to one vote per share of Common Stock and 123,125 votes per share of Series A Preferred Stock held of record on any matter which may properly come before the stockholders.

On the Record Date, the Company had 18,750,000 shares of Common Stock issued and outstanding with the holders thereof being entitled to cast one vote per share and 10,000 shares of Series A Preferred Stock with the holders thereof being entitled to cast 123,125 votes per share.

Our Board of Directors has determined that the change of our name to “Longhai Steel Inc.” is in the best interest of our stockholders and will more accurately reflect, and allow us to engage in, our business operations as described under the heading of "Share Exchange and Acquisition of Longhai Steel" in this Information Statement.

The reverse stock split (the “Reverse Stock Split”) will reduce the number of issued and outstanding shares of our Common Stock outstanding prior to the split and decrease the total number of issued and outstanding shares of our Common Stock subsequent to the split by triggering the automatic conversion of our Series A Preferred Stock into 9,850,000 shares of Common Stock. The Reverse Stock Split has been implemented to facilitate the automatic conversion of our Series A Preferred Stock and provide us with greater flexibility with respect to our capital structure for such purposes as additional equity financings and future stock based acquisitions.

On March 26, 2010, Merry Success Limited, being the record holder of 5,178 shares of our Series A Preferred Stock, constituting 51.0% of the voting power of the issued and outstanding shares of our Common Stock and Series A Preferred Stock, voting together as a single class, consented in writing to the Amendment.

Accordingly, we have obtained all necessary corporate approvals in connection with the Amendment. We are not seeking written consent from any other stockholder, and the other stockholders will not be given an opportunity to vote with respect to the actions described in this Information Statement. All necessary corporate approvals have been obtained. This Information Statement is furnished solely for the purposes of advising stockholders of the action taken by written consent and giving stockholders notice of such actions taken as required by the Exchange Act.

We will, when permissible following the expiration of the 20 day period mandated by Rule 14c of the Exchange Act and the provisions of the Nevada Revised Statutes, file the Amendment with the Nevada Secretary of State’s Office. The Amendment will become effective upon such filing (the “Effective Date”) and we anticipate that such filing will occur approximately 20 days after this Information Statement is first mailed to our stockholders.

We are authorized to issue up to 100,000,000 shares of common stock, par value $0.001 per share. Each outstanding share of common stock entitles the holder thereof to one vote per share on all matters. Our bylaws provide that any vacancy occurring in the board of directors may be filled by the affirmative vote of a majority of the remaining directors though less than a quorum of the board of directors. Shareholders do not have preemptive rights to purchase shares in any future issuance of our common stock.

The holders of shares of our common stock are entitled to dividends out of funds legally available when and as declared by our board of directors. Our board of directors does not anticipate declaring a dividend in the foreseeable future. Should we decide in the future to pay dividends, as a holding company, our ability to do so and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiary and our controlled affiliate and other holdings and investments. In addition, our operating subsidiary and our controlled affiliate in the PRC, from time to time, may be subject to restrictions on their ability to make distributions to us, including as a result of restrictive covenants in loan agreements, restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions. In the event of our liquidation, dissolution or winding up, holders of our common stock are entitled to receive, ratably, the net assets available to shareholders after payment of all creditors.

All of the issued and outstanding shares of our common stock are duly authorized, validly issued, fully paid and non-assessable. To the extent that additional shares of our common stock are issued, the relative interests of existing shareholders will be diluted.

As March 26, 2010, we had a total of 18,750,000 shares of common stock outstanding.

We are authorized to issue up to 10,000,000 shares of preferred stock, par value $0.001 per share, in one or more series as may be determined by our board of directors, who may establish, from time to time, the number of shares to be included in each series, may fix the designation, powers, preferences and rights of the shares of each such series and any qualifications, limitations or restrictions thereof. Any preferred stock so issued by the board of directors may rank senior to the common stock with respect to the payment of dividends or amounts upon liquidation, dissolution or winding up of us, or both. Moreover, while providing desirable flexibility in connection with possible acquisitions and other corporate purposes, under certain circumstances, the issuance of preferred stock or the existence of the unissued preferred stock might tend to discourage or render more difficult a merger or other change of control.

In accordance with our Articles of Incorporation, our Board of Directors unanimously approved the filing of a Certificate of Designation designating and authorizing the issuance of up to 10,000 shares of our Series A Preferred Stock. The Certificate of Designation was filed on March 25, 2010.

Shares of Series A Preferred Stock will automatically convert into shares of common stock on the basis of one share of Series A Preferred Stock for 985 shares of common stock immediately subsequent to the effectiveness of a planned 1-for-125 reverse split of our outstanding common stock, which will become effective on the Effective Date (the “Reverse Stock Split”). Upon the Reverse Stock Split the 10,000 outstanding shares of Series A Preferred Stock will automatically convert into 9,850,000 shares of common stock, which will constitute 98.5% of the outstanding common stock of Action Industries, Inc. subsequent to the Reverse Stock Split.

Holders of Series A Preferred Stock vote with the holders of common stock on all matters on an as-converted to common stock basis, based on an assumed post 1-for-125 reverse split (to retroactively take into account the Reverse Stock Split).

The holders of our Series A Preferred Stock are entitled to vote on all matters together with all other classes of stock. Holders of Series A Preferred Stock have protective class voting veto rights on certain matters, such as increasing the authorized shares of Series A Preferred Stock and modifying the rights of Series A Preferred Stock.

Following the effectiveness of the Reverse Stock Split and conversion of Series A Preferred Stock into common stock, there will be approximately 10,000,000 shares of our common stock issued and outstanding and no shares of preferred stock issued and outstanding.

At the close of business on the Record Date, we had 18,750,000 shares of Common Stock and 10,000 shares of Series A Preferred Stock issued and outstanding.

The Reverse Stock Split provision in the Amendment has been adopted to provide us with greater flexibility with respect to our capital structure for such purposes as additional equity financings and future stock based acquisitions, and to facilitate the conversion of our Series A Preferred Stock contemplated in the Share Exchange, which is generally described in the following paragraphs.

On March 26, we completed a reverse acquisition transaction through a share exchange with Kalington Limited and its shareholders, whereby we acquired 100% of the issued and outstanding capital stock of Kalington in exchange for 10,000 shares of our Series A Preferred Stock, which constituted 98.5% of our issued and outstanding capital stock on an as-converted to common stock basis as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Kalington became our wholly-owned subsidiary and the former shareholders of Kalington became our controlling stockholders. The Share Exchange with Kalington’s shareholders was treated as a reverse acquisition, with Kalington as the acquirer and Action Industries, Inc. as the acquired party.

Immediately following closing of the reverse acquisition of Kalington, certain shareholders transferred 625 of the shares of Series A Preferred Stock issued to them under the Share Exchange to certain persons who provided services to Kalington’s subsidiary and controlled affiliate, pursuant to share allocation agreements that the shareholders entered into with such service providers.

Our current Articles of Incorporation state that the name of the Company is “Action Industries, Inc.”

Our Board of Directors unanimously approved, subject to stockholder approval, the Amendment to change our name from “Action Industries, Inc.” to “Longhai Steel Inc.”

Stockholder approval for the Amendment changing our name was obtained by Written Consent of stockholders holding at least a majority of the voting power of our issued and outstanding Common Stock and Series A Preferred Stock, voting together as a single class, as of the Record Date. The Amendment effecting the name change will become effective following filing with the Secretary of State of the State of Nevada, which will occur promptly following the 20th day after the mailing of this Information Statement to our stockholders as of the Record Date.

Following the change of control of our Company and reverse acquisition of Kalington Limited effected by the Share Exchange, our Board of Directors has determined that the change of our name to “Longhai Steel Inc.” is in the best interest of our stockholders and will more accurately reflect, and allow us to engage in, our new business operations as described under the heading of "Share Exchange and Acquisition of Longhai Steel" in this Information Statement.

Our Board of Directors unanimously approved, subject to Stockholder approval, the 1-for-125 Reverse Stock Split of our issued and outstanding Common Stock, which will be effectuated in conjunction with the adoption of the Amendment. The majority shareholder Merry Success Limited also approved this action in the Written Consent.

The Reverse Stock Split will reduce the number of issued and outstanding shares of our Common Stock outstanding prior to the split. The Reverse Stock Split will trigger the automatic conversion of our Series A Preferred Stock into 9,850,000 shares of Common Stock. The Reverse Stock Split will become effective on the Effective Date which occurs when the Amendment is filed with the Secretary of State of the State of Nevada following the expiration of the 20 day period mandated by Rule 14c of the Exchange Act. We currently have no plans, agreements, proposals, arrangements, or understandings for the issuance of additional shares of Common Stock for any purpose, including future acquisitions or financing transactions. We may consider issuing additional shares in the future, but at this time we have no definite plans in this regard.

As shown in the table above, the Reverse Stock Split will trigger the automatic conversion of our Series A Preferred Stock into 9,850,000 shares of the Company’s Common Stock and decrease the total number of issued and outstanding shares of our Common Stock. The pre-split holders of our common stock will hold 150,000 shares of common stock subsequent to the Reverse Stock Split. The Reverse Stock Split has been implemented to facilitate the automatic conversion of our Series A Preferred Stock and provide us with greater flexibility with respect to our capital structure for such purposes as additional equity financings and future stock based acquisitions.

On the Effective Date, 125 shares of Common Stock will automatically be combined and changed into one share of Common Stock. No additional action on our part or any stockholder will be required in order to effect the Reverse Stock Split.

No fractional shares of post-Reverse Stock Split Common Stock will be issued to any stockholder. Accordingly, stockholders of record who would otherwise be entitled to receive fractional shares of post-Reverse Stock Split Common Stock, will, if they hold a fractional share, receive a full share of our Common Stock.

We will obtain a new CUSIP number for our Common Stock at the time of the Reverse Stock Split. Following the effectiveness of the Reverse Stock Split, every 125 shares of Common Stock presently outstanding, without any action on the part of the stockholder, will represent one share of Common Stock. Subject to the provisions for elimination of fractional shares, as described above, consummation of the Reverse Stock Split will not result in a change in the relative equity position or voting power of the holders of Common Stock.

There are no arrears in dividends or defaults in principal or interest in respect to the securities which are to be exchanged.

The combination of 125 shares of pre-Reverse Stock Split Common Stock into one share of post-Reverse Stock Split Common Stock should be a tax-free transaction under the Internal Revenue Code of 1986, as amended, and the holding period and tax basis of the pre-Reverse Stock Split Common Stock will be transferred to the post-Reverse Stock Split Common Stock.

This discussion should not be considered as tax or investment advice, and the tax consequences of the Reverse Stock Split may not be the same for all stockholders. Stockholders should consult their own tax advisors to know their individual Federal, state, local and foreign tax consequences.

We will pay the cost of preparing, printing and distributing this Information Statement.

Neither the adoption by the board of directors, nor the approval by the majority shareholders of the Reverse Stock Split or the name change provides stockholders any right to dissent and obtain appraisal of or payment for such shareholder's shares under the Nevada Revised Statutes, the articles of incorporation or the bylaws.

Release No. 34-15230 of the staff of the SEC requires disclosure and discussion of the effects of any stockholder proposal that may be used as an anti-takeover device. The Reverse Stock Split could have an anti-takeover effect because the authorized shares are not being reduced by the reverse stock split, in that additional shares could be issued (within the limits imposed by applicable law) in one or more transactions that could make a change in control or takeover of the Company more difficult then if the authorized shares were also reduced by a reverse stock split. For example, we could issue additional shares so as to dilute the stock ownership or voting rights of persons seeking to obtain control of the Company. Similarly, the issuance of additional shares to certain persons allied with our management could have the effect of making it more difficult to remove our current management by diluting the stock ownership or voting rights of persons seeking to cause such removal. However, the Reverse Stock Split has been effected for the primary purpose of facilitating the conversion of the Series A Preferred Stock, as well as to provide us with greater flexibility with respect to our capital structure for such purposes as additional equity financings and future stock based acquisitions, and not to construct or enable any anti-takeover defense or mechanism on behalf of the Company. Although the remainder of significant amounts of authorized shares of common stock could, under certain circumstances, have an anti-takeover effect, the Reverse Stock Split proposal is not being undertaken in response to any effort of which our Board of Directors is aware to accumulate shares of our Common Stock or obtain control of the Company.

Our Articles of Incorporation and Bylaws contain certain provisions that may have anti-takeover effects, making it more difficult for or preventing a third party from acquiring control of the Company or changing its board of directors and management. According to our Bylaws and Articles of Incorporation, neither the holders of the Company’s common stock nor the holders of the Company’s preferred stock have cumulative voting rights in the election of our directors. The combination of the present ownership by a few stockholders of a significant portion of the Company’s issued and outstanding common stock and lack of cumulative voting makes it more difficult for other stockholders to replace the Company’s board of directors or for a third party to obtain control of the Company by replacing its board of directors. In addition, our Board of Directors may issue, without further stockholder approval, up to 10,000,000 shares of Preferred Stock, par value $0.001 per share, in one or more series. Any Preferred Stock issued in the future may rank senior to our Common Stock with respect to the payment of dividends or amounts upon liquidation, dissolution or winding up of us, or both. In addition, any such shares of Preferred Stock may have series voting rights. The issuance of Preferred Stock, while providing desirable flexibility in connection with possible acquisitions and other corporate purposes, could have the effect of making it more difficult for a third party to acquire, or of discouraging a third party from acquiring, a majority of our outstanding voting stock.

The following table sets forth, as of March 26, 2010, certain information with respect to the beneficial ownership of our common stock, by (i) any person or group with more than 5% of any class of voting securities, (ii) each director, (iii) our chief executive officer and each other executive officer whose cash compensation for the most recent fiscal year exceeded $100,000 and (iv) all executive officers and directors as a group. The table reflects the ownership of our equity securities by the foregoing parties before and after the 1 for 125 reverse stock split which will occur on the filing of Articles of Amendment with the Secretary of State of the State of Nevada which filing will be made no earlier than 20 days after the date the Information Statement on Schedule 14C is first mailed to the our stockholders. Unless otherwise specified, the address of each of the persons set forth below is in care of the Company, No. 1 Jingguang Road, Neiqiu County, Xingtai City, Hebei Province, China. Except as indicated in the footnotes to this table and subject to applicable community property laws, the persons named in the table to our knowledge have sole voting and investment power with respect to all shares of securities shown as beneficially owned by them. The information in this table is as of March 26, 2010 based upon (i) 18,750,000 shares of common stock outstanding prior to the Reverse Stock Split and 10,000,000 shares of common stock outstanding after the Reverse Stock Split and (ii) 10,000 shares of Series A Preferred Stock outstanding prior to the Reverse Stock Split and 0 shares of Series A Preferred Stock outstanding after the Reverse Stock Split.

(1) Common Stock shares have one vote per share. Shares of Series A Convertible Preferred Stock will automatically convert into shares of common stock on the basis of one share of Series A Preferred Stock for 985 shares of common stock upon the effectiveness of a planned 1-for-125 reverse split of our outstanding common stock. Holders of Series A Preferred Stock vote with the holders of common stock on all matters on an as-converted to common stock based on an assumed post 1-for-125 reverse split basis.

(2) Based on an option to purchase all of the shares of Merry Success Limited, a British Virgin Islands limited company, which owns 5,178 shares of Series A Convertible Preferred. Chaojun Wang also serves as Chief Executive Officer and Director of Merry Success Limited.

(3) Such shares are owned by Belmont Partners, LLC, of which Mr. Meuse is a managing director.

(4) Jinhai Guo is the sole owner of Merry Success Limited, and has granted Chaojun Wang an option to purchase the entire ownership interest.

(5) Xingfang Zhang is the nephew of Chaojun Wang, our Chief Executive Officer and beneficially controlling shareholder.

SHARE EXCHANGE AND ACQUISITION OF LONGHAI STEEL

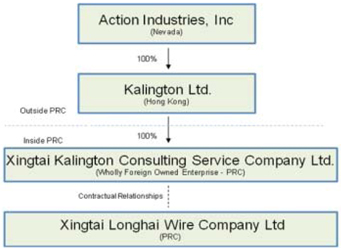

On March 26, 2010, the Company entered into and closed a Share Exchange Agreement (the “Share Exchange Agreement”) with Kalington Limited, a Hong Kong limited company (“Kalington”), its shareholders (the “Kalington Shareholders”), Goodwin Ventures, Inc. and Kalington’s affiliate, Xingtai Longhai Wire Co., Ltd., a People’s Republic of China (“PRC”) limited company (“Longhai”). Pursuant to the Share Exchange Agreement, we acquired 100% of the issued and outstanding capital stock of Kalington in exchange for 10,000 shares of our Series A Convertible Preferred Stock (Series A Preferred Stock), which constituted 98.5% of our issued and outstanding capital stock on an as-converted to common stock basis. As a result of our acquisition of Kalington, we now own all of the issued and outstanding capital stock of Kalington, which in turn owns all of the outstanding capital stock of Xingtai Kalington Consulting Service Co., Ltd. (“Kalington Consulting”). In addition, we effectively and substantially control Longhai through a series of captive agreements with Kalington Consulting.

Contact Information

The Company is currently located at No. 1 Jingguang Road, Neiqiu County, Xingtai City, Hebei Province, People’s Republic of China. The Company’s phone number is (86) 0319-686-1111.

Kalington’s principal executive office is also located at No. 1 Jingguang Road, Neiqiu County, Xingtai City, Hebei Province, People’s Republic of China. Kalington’s phone number is (86) 0319-686-1111.

Business Conducted

Prior to the Share Exchange, the Company was primarily in the business of providing prepaid long distance calling cards and other telecommunication products and was in the development stage and had not commenced planned principal operations.

Kalington is a holding company formed in Hong Kong that operates through its wholly owned operating subsidiary in China, Xingtai Longhai Wire Co., Ltd. (Longhai). Longhai was established in August 2008 as a result of the separation of Longhai from Xingtai Longhai Steel Group Co., Ltd. (the “Longhai Steel Group”) at that time. Prior to its establishment as a stand-alone company, Longhai was a division within the Longhai Steel Group.

Longhai’s principal business is the production of steel wire ranging from 6mm to 10mm in diameter. It operates two wire production lines which have a combined annual capacity of approximately nine hundred thousand tons per year. Its products are sold to a number of distributors who transport the wire to nearby wire processing facilities. The wire is then further processed by third party wire refiners into a variety of products such as nails, screws, and wire mesh for use in reinforced concrete and fencing.

Terms of the Transaction

A brief description of the transaction

On March 26, 2010, we completed a reverse acquisition transaction through a share exchange with Kalington and its shareholders, or the Shareholders, whereby we acquired 100% of the issued and outstanding capital stock of Kalington in exchange for 10,000 shares of our Series A Preferred Stock which constituted 98.5% of our issued and outstanding capital stock on a as-converted basis as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Kalington became our wholly-owned subsidiary and the former shareholders of Kalington became our controlling stockholders. The share exchange transaction with Kalington and the Shareholders, or Share Exchange, was treated as a reverse acquisition, with Kalington as the acquirer and Action Industries, Inc. as the acquired party. Unless the context suggests otherwise, when we refer in this Information Statement to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Kalington and its consolidated subsidiaries.

Immediately prior to the Share Exchange, the common stock of Kalington was owned by the following persons in the indicated percentages: William Hugh Luckman (3.51%); Wealth Index Capital Group LLC (a US company) (7.3%); K International Consulting Ltd. (a BVI company) (2.08%); Merrill King International Investment Consulting Ltd. (a BVI company) (0.31%); Shanchun Huang (3.12%); Xiucheng Yang (1.53%); Jianxin Wang (0.92%); Xingfang Zhang (29.45%); and Merry Success Limited (a BVI company) (51.78%). Jinhai Guo, a U.S. citizen, owns 100% of the capital stock of Merry Success Limited. Jinhai Guo and Chaojun Wang, our Chief Executive Officer, are the directors of Merry Success Limited. On March 18, 2010, Chaojun Wang, our Chief Executive Officer, entered into a call option agreement (the “Merry Success Option Agreement”) with Jinhai Guo, the sole shareholder of Merry Success Limited, our principal shareholder after the reverse acquisition. Under the Merry Success Option Agreement, Mr. Wang has the right to acquire up to 100% or the shares of Merry Success Limited for fixed consideration within the next three years. The Merry Success Option Agreement also provides that Mr. Guo shall not dispose any of the shares of Merry Success Limited without Mr. Wang’s consent. As a result of the Merry Success Option Agreement, Chaojun Wang, our Chief Executive Officer, beneficially owns a majority of the capital stock and voting power of Action Industries, Inc., as well as Longhai and the Longhai Steel Group.

Immediately following closing of the reverse acquisition of Kalington, certain Shareholders transferred 625 of the shares of Series A Convertible Preferred Stock issued to them under the Share Exchange to certain persons who provided services to Kalington’s subsidiary and/or controlled affiliate.

Upon the closing of the reverse acquisition, Inna Sheveleva, our sole director and officer, submitted a resignation letter pursuant to which she resigned from all offices that she held effective immediately and from her position as our director that will become effective on April 19, 2010. In addition, our board of directors on March 25, 2010 increased the size of our board of directors to three directors and appointed Chaojun Wang, Jing Shen and Chaoshui Wang to fill the vacancies created by such increase, which appointments will become effective upon the effectiveness of the resignation of Inna Sheveleva. In addition, our executive officers were replaced by Longhai’s executive officers upon the closing of the reverse acquisition as indicated in more detail below.

As a result of our acquisition of Kalington, we now own all of the issued and outstanding capital stock of Kalington, which in turn owns all of the issued and outstanding capital stock of Kalington Consulting. In addition, we effectively and substantially control Longhai through a series of captive agreements with Kalington Consulting.

Kalington was established in Hong Kong on November 5, 2009 to serve as an intermediate holding company. Chaojun Wang and William Hugh Luckman currently serve as the directors of Kalington. Kalington Consulting was established in the PRC on March 18, 2010. Kalington currently owns 100% of Kalington Consulting. On March 5, 2010, the local government of the PRC issued a certificate of approval regarding the foreign ownership of Kalington Consulting by Kalington, a Hong Kong entity. Chaojun Wang serves as the executive director of Kalington Consulting.

Longhai, our operating affiliate, was established in the PRC on August 26, 2008 as a division of the Longhai Steel Group for the purpose of engaging in the production of steel wire. Chaojun Wang serves as the Chairman of the Board of Directors and General Manager of Longhai and owns 80% of the capital stock in Longhai. Longhai’s additional shareholders are Wealth Index International (Beijing) Investment Co., Ltd. (15% owner) and Wenyi Chen (5% owner). Chaojun Wang also owns 80% of the capital stock of and is the chief executive officer of the Longhai Steel Group.

On March 19, 2010, prior to the reverse acquisition transaction, Kalington Consulting and Longhai entered into a series of agreements known as variable interest agreements (the “VIE Agreements”) pursuant to which Longhai became Kalington Consulting’s contractually controlled affiliate. The use of VIE agreements is a common structure used to acquire PRC corporations, particularly in certain industries in which foreign investment is restricted or forbidden by the PRC government. The VIE Agreements included:

| | (1) | A Consulting Services Agreement through which Kalington Consulting has the right to advise, consult, manage and operate Longhai and collect and own all of the net profits of Longhai; |

| | (2) | an Operating Agreement through which Kalington Consulting has the right to recommend director candidates and appoint the senior executives of Longhai, approve any transactions that may materially affect the assets, liabilities, rights or operations of Longhai, and guarantee the contractual performance by Longhai of any agreements with third parties, in exchange for a pledge by Longhai of its accounts receivable and assets; |

| | (3) | a Proxy Agreement under which the three owners of Longhai have vested their collective voting control over Longhai to Kalington Consulting and will only transfer their respective equity interests in Longhai to Kalington Consulting or its designee(s); |

| | (4) | an Option Agreement under which the owners of Longhai have granted to Kalington Consulting the irrevocable right and option to acquire all of their equity interests in Longhai; and |

| | (5) | an Equity Pledge Agreement under which the owners of Longhai have pledged all of their rights, titles and interests in Longhai to Kalington Consulting to guarantee Longhai’s performance of its obligations under the Consulting Services Agreement. |

The Consideration Offered to Security Holders

The security holders of the Company received no consideration as a result of the Share Exchange.

The Reasons for Engaging in the Transaction

Action Industries, Inc. was originally incorporated under the laws of the State of Georgia on December 4, 1995. On March 14, 2008, the Georgia corporation was merged with and into a newly formed Nevada corporation also named Action Industries, Inc. and all of the outstanding shares of the Georgia corporation were exchanged for shares in the surviving Nevada corporation. Prior to our reverse acquisition of Kalington, Action Industries was primarily in the business of providing prepaid long distance calling cards and other telecommunication products and was in the development stage and had not commenced planned principal operations. As a result of our reverse acquisition of Kalington, Action Industries is no longer a shell company and now has active business operations. Our principal business is now the production of steel wire ranging from 6mm to 10mm in diameter.

Approval of the Share Exchange

The Share Exchange was approved by the Board of Directors of Action Industries, Inc. on March 25, 2010. Approval by the stockholders of Action Industries, Inc. of the Share Exchange was not required under applicable state and federal law.

Explanation of Any Material Differences in the Rights of Security Holders as a Result of the Transaction, if Material

Pursuant to the Share Exchange Agreement, we issued 10,000 shares of our Series A Preferred Stock, which constituted 98.5% of our issued and outstanding capital stock on an as-converted to common stock basis. Each holder of Series A Preferred Stock is entitled to 123,125 votes per share. The holders of our Series A Preferred Stock are entitled to vote on all matters together with all other classes of stock. Holders of Series A Preferred Stock have protective class voting veto rights on certain matters, such as increasing the authorized shares of Series A Preferred Stock and modifying the rights of Series A Preferred Stock.

There are no other material differences in the rights of the stockholders of the Company as a result of the Share Exchange.

Brief statement as to the Accounting Treatment of the Share Exchange, if Material

The share exchange transaction with Kalington and the Shareholders, or Share Exchange, was treated as a reverse acquisition, with Kalington as the acquirer and Action Industries, Inc. as the acquired party. Unless the context suggests otherwise, when we refer in this Information Statement to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Kalington and its consolidated subsidiaries.

Because of the common control between Kalington, Kalington Consulting and Longhai, for accounting purposes, the acquisition of these entities has been treated as a recapitalization with no adjustment to the historical basis of their assets and liabilities. The restructuring has been accounted for using the “as if” pooling method of accounting and the operations were consolidated as if the restructuring had occurred as of the beginning of the earliest period presented in our consolidated financial statements and the current corporate structure had been in existence throughout the periods covered by our consolidated financial statements.

U.S. Federal Income Tax Consequences of the Share Exchange, if Material

The federal income tax consequences of the Share Exchange are not material.

Regulatory Approvals

No United States federal or state regulatory requirements must be complied with or approvals obtained as a condition of the Share Exchange.

Reports, Opinions, Appraisals

No reports, opinions (other than opinions of counsel) or appraisals materially relating to the Share Exchange have been received from an outside party or are referred to in this Information Statement.

Past Contacts, Transactions or Negotiations

Not Applicable.

INFORMATION OF THE COMPANY

Business Overview

Xingtai Longhai Wire Co., Ltd. (Longhai) was established in August 2008 as a result of the separation of Longhai from Xingtai Longhai Steel Group Co., Ltd. (the “Longhai Steel Group”) at that time. Prior to its establishment as a stand-alone company, Longhai was a division within the Longhai Steel Group. The Longhai Steel Group was founded in 2003. Longhai is a leading producer of steel wire products in northeastern China.

Our principal business is the production of steel wire ranging from 6mm to 10mm in diameter. We operate two wire production lines which have a combined annual capacity of approximately nine hundred thousand tons per year. Our products are sold to a number of distributors who transport the wire to nearby wire processing facilities. Our wire is then further processed by third party wire refiners into a variety of products such as nails, screws, and wire mesh for use in reinforced concrete and fencing. Our facilities and head offices are located in the town of Xingtai in southern Hebei.

Our Corporate History and Background

Action Industries, Inc. was originally incorporated under the laws of the State of Georgia on December 4, 1995. On March 14, 2008, the Georgia corporation was merged with and into a newly formed Nevada corporation also named Action Industries, Inc. and all of the outstanding shares of the Georgia corporation were exchanged for shares in the surviving Nevada corporation. Prior to the reverse acquisition of Kalington, Action Industries was primarily in the business of providing prepaid long distance calling cards and other telecommunication products and was in the development stage and had not commenced planned principal operations.

As a result of our reverse acquisition of Kalington, we are no longer a shell company and active business operations were revived.

Acquisition of Kalington Limited

On March 26, 2010, we completed a reverse acquisition transaction through a share exchange with Kalington and its shareholders, or the Shareholders, whereby we acquired 100% of the issued and outstanding capital stock of Kalington in exchange for 10,000 shares of our Series A Preferred Stock which constituted 98.5% of our issued and outstanding capital stock on a as-converted basis as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Kalington became our wholly-owned subsidiary and the former shareholders of Kalington became our controlling stockholders. The share exchange transaction with Kalington and the Shareholders, or Share Exchange, was treated as a reverse acquisition, with Kalington as the acquirer and Action Industries, Inc. as the acquired party. Unless the context suggests otherwise, when we refer in this Information Statement to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Kalington and its consolidated subsidiaries.

Immediately prior to the Share Exchange, the common stock of Kalington was owned by the following persons in the indicated percentages: William Hugh Luckman (3.51%); Wealth Index Capital Group LLC (a US company) (7.3%); K International Consulting Ltd. (a BVI company) (2.08%); Merrill King International Investment Consulting Ltd. (a BVI company) (0.31%); Shanchun Huang (3.12%); Xiucheng Yang (1.53%); Jianxin Wang (0.92%); Xingfang Zhang (29.45%); and Merry Success Limited (a BVI company) (51.78%). Jinhai Guo, a U.S. citizen, owns 100% of the capital stock of Merry Success Limited. Jinhai Guo and Chaojun Wang, our Chief Executive Officer, are the directors of Merry Success Limited. On March 18, 2010, Chaojun Wang, our Chief Executive Officer, entered into a call option agreement (the “Merry Success Option Agreement”) with Jinhai Guo, the sole shareholder of Merry Success Limited, our principal shareholder after the reverse acquisition. Under the Merry Success Option Agreement, Mr. Wang has the right to acquire up to 100% or the shares of Merry Success Limited for fixed consideration within the next three years. The Merry Success Option Agreement also provides that Mr. Guo shall not dispose any of the shares of Merry Success Limited without Mr. Wang’s consent. As a result of the Merry Success Option Agreement, Chaojun Wang, our Chief Executive Officer, beneficially owns a majority of the capital stock and voting power of Action Industries, Inc., as well as Longhai and the Longhai Steel Group.

Immediately following closing of the reverse acquisition of Kalington, certain Shareholders transferred 625 of the shares of Series A Convertible Preferred Stock issued to them under the Share Exchange to certain persons who provided services to Kalington’s subsidiary and/or controlled affiliate.

Upon the closing of the reverse acquisition, Inna Sheveleva, our sole director and officer, submitted a resignation letter pursuant to which she resigned from all offices that she held effective immediately and from her position as our director that will become effective on April 19, 2010. In addition, our board of directors on March 25, 2010 increased the size of our board of directors to three directors and appointed Chaojun Wang, Jing Shen and Chaoshui Wang to fill the vacancies created by such increase, which appointments will become effective upon the effectiveness of the resignation of Inna Sheveleva. In addition, our executive officers were replaced by Longhai’s executive officers upon the closing of the reverse acquisition as indicated in more detail below.

As a result of our acquisition of Kalington, we now own all of the issued and outstanding capital stock of Kalington, which in turn owns all of the issued and outstanding capital stock of Kalington Consulting. In addition, we effectively and substantially control Longhai through a series of captive agreements with Kalington Consulting.

Kalington was established in Hong Kong on November 5, 2009 to serve as an intermediate holding company. Chaojun Wang and William Hugh Luckman currently serve as the directors of Kalington. Kalington Consulting was established in the PRC on March 18, 2010. Kalington currently owns 100% of Kalington Consulting. On March 5, 2010, the local government of the PRC issued a certificate of approval regarding the foreign ownership of Kalington Consulting by Kalington, a Hong Kong entity. Chaojun Wang serves as the executive director of Kalington Consulting.

Longhai, our operating affiliate, was established in the PRC on August 26, 2008 as a result of the division of the Longhai Steel Group for the purpose of engaging in the production of steel wire. Chaojun Wang serves as the Chairman of the Board of Directors and General Manager of Longhai and owns 80% of the capital stock in Longhai. Longhai’s additional shareholders are Wealth Index International (Beijing) Investment Co., Ltd. (15% owner) and Wenyi Chen (5% owner). Chaojun Wang also owns 80% of the capital stock of and is the chief executive officer of the Longhai Steel Group.

Longhai leases a five-story office space and the building which houses our production facilities from the Longhai Steel Group. Longhai purchased 100% of its steel billet from the Longhai Steel Group until 2008. Since 2009, Longhai has purchased steel billet from third party vendors. Steel Billet is the principal raw material used in our production of steel wire. Longhai also purchases production utilities from the Longhai Steel Group.

On March 19, 2010, prior to the reverse acquisition transaction, Kalington Consulting and Longhai entered into a series of agreements known as variable interest agreements (the “VIE Agreements”) pursuant to which Longhai became Kalington Consulting’s contractually controlled affiliate. The use of VIE agreements is a common structure used to acquire PRC corporations, particularly in certain industries in which foreign investment is restricted or forbidden by the PRC government. The VIE Agreements included:

| | (1) | A Consulting Services Agreement through which Kalington Consulting has the right to advise, consult, manage and operate Longhai and collect and own all of the net profits of Longhai; |

| | (2) | an Operating Agreement through which Kalington Consulting has the right to recommend director candidates and appoint the senior executives of Longhai, approve any transactions that may materially affect the assets, liabilities, rights or operations of Longhai, and guarantee the contractual performance by Longhai of any agreements with third parties, in exchange for a pledge by Longhai of its accounts receivable and assets; |

| | (3) | a Proxy Agreement under which the three owners of Longhai have vested their collective voting control over Longhai to Kalington Consulting and will only transfer their respective equity interests in Longhai to Kalington Consulting or its designee(s); |

| | (4) | an Option Agreement under which the owners of Longhai have granted to Kalington Consulting the irrevocable right and option to acquire all of their equity interests in Longhai; and |

| | (5) | an Equity Pledge Agreement under which the owners of Longhai have pledged all of their rights, titles and interests in Longhai to Kalington Consulting to guarantee Longhai’s performance of its obligations under the Consulting Services Agreement. |

Because of the common control between Kalington, Kalington Consulting and Longhai, for accounting purposes, the acquisition of these entities has been treated as a recapitalization with no adjustment to the historical basis of their assets and liabilities. The restructuring has been accounted for using the “as if” pooling method of accounting and the operations were consolidated as if the restructuring had occurred as of the beginning of the earliest period presented in our consolidated financial statements and the current corporate structure had been in existence throughout the periods covered by our consolidated financial statements.

Our Corporate Structure

All of our business operations are conducted through our Hong Kong and Chinese subsidiaries and controlled affiliate. The chart below presents our corporate structure.

Our Growth Strategy

We believe that the market for high quality steel wire will continue to grow in the PRC. The PRC has placed a temporary moratorium on new steel wire plant construction in an effort to encourage consolidation, therefore our expansion plan is to build capacity through the acquisition of facilities at attractive prices from competitors who lack our management experience and efficient labor force. We plan to continue to improve margins through increased efficiencies in our production process.

We intend to pursue the following strategies to achieve our goal:

| 1) | Identify and acquire high quality producers at low valuations compared to earnings and assets to increase our market share. |

| 2) | Expand operations to greater capitalize on economies of scale to produce at higher margins and leverage suppliers and producers for greater cost control. |

| 3) | Expand downstream and capitalize on vertically integrated product synergies to capitalize on higher margins. |

Our Products:

Our products are steel wires of diameters ranging in diameter from 6.5mm to 10mm. All our wires are manufactured in accordance to ISO9001-2000 quality management system standards, and those of 6.5mm in diameter meet national standard GB/700-88. We ensure a low quantity of oxide in our wire to provide our downstream customers the highest quality wire for further processing. Our end customers process the wire into a variety of end products vital to construction and infrastructure, including but not limited to nails, screws, wire mesh, and fencing.

Longhai Steel Wire Products coming off production line and loading onto transport trucks

Raw Materials

The principal raw material used in our products is steel billet. In 2009, steel billet accounted for more than 95% of our production costs. We generally purchase billet only after a customer has made a wire order, and therefore avoid a large inventory of billet. This insulates us from commodity price fluctuation risk associated with holding large quantities of raw materials. We are generally able to pass higher costs due to fluctuations in raw material costs through directly to our customers.

Until 2008, we purchased 100% of our billet from the Longhai Steel Group. The Longhai Steel Group is controlled by our CEO Chaojun Wang. Since 2009, Longhai has purchased steel billet from third party vendors. Our purchasing team monitors and tracks movements in steel billet prices daily and provides regular guidance to management to respond quickly to market conditions and aid in long term business planning.

Sales Channels

We sell our products to a number of distribution companies. These companies are responsible for pickup and transport of our wire to nearby wire processors. Our products are manufactured on an on-demand basis and we usually collect payment in advance. This allows us to maintain a low inventory of both wire and billet, and protects us from exposure to commodity price volatility. During the year ended December 31, 2009, our top five distributers accounted for 39% of our revenues. In order to increase sales and be competitive in the market, we occasionally offer discounted wholesale prices to larger purchasers. Our sales efforts are directed toward developing long term relationships with customers who are able to purchase in large quantities. We pride ourselves on our ability to meet our customers’ demand for high quality products, fast turnaround and timely delivery, and customer support. We believe that our ability to consistently meet or exceed these standards is critical to our success and market share. Our sales department currently has 20 full time employees.

Sales prices are set at the market price for wire on a daily basis. Our customers generally prepay for their orders, and the final price may be adjusted to the market price on the day of manufacture and pick up. We sometimes provide discounts to newer or larger customers at our discretion to encourage higher sales volumes.

We sell 100% of our products in the PRC. Within China, the biggest market for our products is in Hebei Province, where approximately 80% of our products are sold. The industrial area in and around the nearby city of Hengshui contains one of the largest collective wire processing capacities in the world. Much our wire is distributed in this area for further processing. Domestic economic growth is a demand driver of our products. More specifically, fixed asset investment in construction and infrastructure projects is the major macroeconomic driver of our growth.

Employees

The table below contains a breakdown of our current employees by department as of December 31, 2009:

| Department | | Staff |

| Management | | 10 |

| Administrative | | 12 |

| Accounting | | 14 |

| Sales | | 20 |

| Production | | 402 |

| Total | | 458 |

We believe we are in material compliance with all applicable labor and safety laws and regulations in the PRC, including the PRC Labor Contract Law, the PRC Unemployment Insurance Law, the PRC Provisional Insurance Measures for Maternity of Employees, PRC Interim Provisions on Registration of Social Insurance, PRC Interim Regulation on the Collection and Payment of Social Insurance Premiums and other related regulations, rules and provisions issued by the relevant governmental authorities for our operations in the PRC. According to the PRC Labor Contract Law, we are required to enter into labor contracts with our employees and to pay them no less than local minimum wage.

Intellectual Property Rights

We protect our intellectual property primarily by maintaining strict control over the use of production processes. All our employees, including key employees and engineers, have signed our standard form of labor contracts, pursuant to which they are obligated to hold in confidence any of our trade secrets, know-how or other confidential information and not to compete with us. In addition, for each project, only the personnel associated with the project have access to the related intellectual property. Access to proprietary data is limited to authorized personnel to prevent unintended disclosure or otherwise using our intellectual property without proper authorization. We will continue to take steps to protect our intellectual property rights.

Our Facilities and Property

Our facilities are in located in Xingtai, Hebei. We lease a 5 story office space and the building which our production facilities occupy from the Longhai Steel Group. In total, the area covered by our facilities is more than 107,000 square meters. The production facilities include a fifth generation Morgan steel rolling mill. We utilize a double chamber heating furnace which feeds one coarse and one intermediate rolling mill, and then splits into two wire production lines arranged in a Y-shaped layout. We believe our rolling and drawing facilities are among the most advanced in the world. We have a capacity of approximately nine hundred thousand metric tons of wire per year.

Longhai Facilities:

Competition

Competition within the steel industry in the PRC is intense. There is an estimated capacity of 600MMT of steel capacity in China. Our competitors range from small private enterprises to extremely large state owned enterprises. Our operating subsidiary, Longhai, is located in Xingtai, Hebei. Hebei is the largest producer of steel by province in the PRC, therefore we are located near to numerous wire facilities. We are the largest non state owned steel wire manufacturer in Hebei.

The table below details our major competitors:

| Company | | Production Lines | | Est. Capacity | | Line Speed (m/s) | | Ownership |

| Xingtai Steel Company | | 2 | | 2MMT | | 90 | | State Owned |

| Hebei Xinjin Company | | 1 | | 0.5MMT | | 90 | | Private |

| Wuan Minglao Steel Company | | 1 | | 0.5MMT | | 75 | | Private |

| Yongnian Jianfa Company | | 1 | | 0.3MMT | | 49 | | Private |

In comparison, we operate two production lines with a combined yearly capacity of nine hundred thousand metric tons, line speed of 90 meters per second and the most advanced production equipment on the market.

Private steel product manufacturers in China generally focus on low-end products. Many of our competitors are significantly smaller than we are and use outdated equipment and production techniques . Due to our high quality equipment, economies of scale and management experience, we produce steel wire at higher efficiencies and lower prices than these competitors. The larger state owned enterprises with whom we compete often have oversized, unionized labor forces and associated pension and healthcare liabilities and cannot match our production efficiency. We distinguish ourselves in the market based on our extremely fast turnaround, high quality and low prices.

Regulation

Because our principal operating subsidiary, Longhai, is located in the PRC, our business is regulated by the national and local laws of the PRC. We believe our conduct of business complies with existing PRC laws, rules and regulations.

General Regulation of Businesses

We believe we are in material compliance with all applicable labor and safety laws and regulations in the PRC, including the PRC Labor Contract Law, the PRC Production Safety Law, the PRC Regulation for Insurance for Labor Injury, the PRC Unemployment Insurance Law, the PRC Provisional Insurance Measures for Maternity of Employees, PRC Interim Provisions on Registration of Social Insurance, PRC Interim Regulation on the Collection and Payment of Social Insurance Premiums and other related regulations, rules and provisions issued by the relevant governmental authorities from time to time, for our operations in the PRC.

According to the PRC Labor Contract Law, we are required to enter into labor contracts with our employees. We are required to pay no less than local minimum wages to our employees. We are also required to provide employees with labor safety and sanitation conditions meeting PRC government laws and regulations and carry out regular health examinations of our employees engaged in hazardous occupations.

Foreign Currency Exchange

The principal regulation governing foreign currency exchange in China is the Foreign Currency Administration Rules (1996), as amended (2008). Under these Rules, RMB is freely convertible for current account items, such as trade and service-related foreign exchange transactions, but not for capital account items, such as direct investment, loan or investment in securities outside China unless the prior approval of, and/or registration with, the State Administration of Foreign Exchange of the People’s Republic of China, or SAFE, or its local counterparts (as the case may be) is obtained.

Pursuant to the Foreign Currency Administration Rules, foreign invested enterprises, or FIEs, in China may purchase foreign currency without the approval of SAFE for trade and service-related foreign exchange transactions by providing commercial documents evidencing these transactions. They may also retain foreign exchange (subject to a cap approved by SAFE) to satisfy foreign exchange liabilities or to pay dividends. In addition, if a foreign company acquires a company in China, the acquired company will also become an FIE. However, the relevant PRC government authorities may limit or eliminate the ability of FIEs to purchase and retain foreign currencies in the future. In addition, foreign exchange transactions for direct investment, loan and investment in securities outside China are still subject to limitations and require approvals from, and/or registration with, SAFE.

Regulation of Income Taxes

On March 16, 2007, the National People’s Congress of China passed a new Enterprise Income Tax Law, or the New EIT Law, and its implementing rules, both of which became effective on January 1, 2008. Before the implementation of the New EIT Law, FIEs established in the PRC, unless granted preferential tax treatments by the PRC government, were generally subject to an earned income tax, or EIT, rate of 33.0%, which included a 30.0% state income tax and a 3.0% local income tax. The New EIT Law and its implementing rules impose a unified EIT rate of 25.0% on all domestic-invested enterprises and FIEs, unless they qualify under certain limited exceptions.

In addition to the changes to the current tax structure, under the New EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a resident enterprise and will normally be subject to an EIT of 25% on its global income. The implementing rules define the term “de facto management bodies” as “an establishment that exercises, in substance, overall management and control over the production, business, personnel, accounting, etc., of a Chinese enterprise.” If the PRC tax authorities subsequently determine that we should be classified as a resident enterprise, then our organization’s global income will be subject to PRC income tax of 25%.

Our future effective income tax rate depends on various factors, such as tax legislation, the geographic composition of our pre-tax income and non-tax deductible expenses incurred. Our management carefully monitors these legal developments and will timely adjust our effective income tax rate when necessary.

Dividend Distribution

Under applicable PRC regulations, FIEs in China may pay dividends only out of their accumulated profits, if any, determined in accordance with PRC accounting standards and regulations. In addition, a FIE in China is required to set aside at least 10.0% of its after-tax profit based on PRC accounting standards each year to its general reserves until the accumulative amount of such reserves reach 50.0% of its registered capital. These reserves are not distributable as cash dividends. The board of directors of a FIE has the discretion to allocate a portion of its after-tax profits to staff welfare and bonus funds, which may not be distributed to equity owners except in the event of liquidation.

The New EIT Law and its implementing rules generally provide that a 10% withholding tax applies to China-sourced income derived by non-resident enterprises for PRC enterprise income tax purposes unless the jurisdiction of incorporation of such enterprises’ shareholder has a tax treaty with China that provides for a different withholding arrangement. Kalington Consulting is considered an FIE and is directly held by our subsidiary Kalington in Hong Kong. According to a 2006 tax treaty between the Mainland and Hong Kong, dividends payable by an FIE in China to the company in Hong Kong who directly holds at least 25% of the equity interests in the FIE will be subject to a no more than 5% withholding tax. We expect that such 5% withholding tax will apply to dividends paid to Kalington by Kalington Consulting, but this treatment will depend on our status as a non-resident enterprise.

Environmental Matters

Our manufacturing facilities are subject to various pollution control regulations with respect to noise, water and air pollution and the disposal of waste and hazardous materials. We are also subject to periodic inspections by local environmental protection authorities. Our operating controlled affiliate Longhai has received certifications from the relevant PRC government agencies in charge of environmental protection indicating that their business operations are in material compliance with the relevant PRC environmental laws and regulations. We are not currently subject to any pending actions alleging any violations of applicable PRC environmental laws.

Insurance

Insurance companies in China offer limited business insurance products. While business interruption insurance is available to a limited extent in China, we have determined that the risks of interruption, cost of such insurance and the difficulties associated with acquiring such insurance on commercially reasonable terms make it impractical for us to have such insurance. As a result, we could face liability from the interruption of our business.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

Kalington

Overview

Longhai was established in 2008 and we began production of steel wire through our predecessor entity the Longhai Steel Group in 2008. We are a leading producer of steel wire products in northeastern China. Demand for our steel wire is driven primarily by spending in the construction and infrastructure industries. We have benefited from strong fixed asset investment and construction growth as the PRC has rapidly grown increasingly urbanized and invested in modernizing its infrastructure.

Our principal business is the production of steel wire ranging from 6mm to 10mm in diameter. We operate two wire production lines which have a combined annual capacity of approximately nine hundred thousand tons per year. Our products are sold to a number of distributors who transport the wire to nearby wire processing facilities. Our wire is then further processed by third party wire refiners into a variety of products such as nails, screws, and wire mesh for use in reinforced concrete and fencing. Our facilities and head offices are located in the town of Xingtai in southern Hebei.

Recent Developments

Acquisition of Kalington

On March 26, 2010, we completed a reverse acquisition transaction through a share exchange with Kalington and its shareholders (the Shareholders), whereby we acquired 100% of the issued and outstanding capital stock of Kalington in exchange for 10,000 shares of our Series A Preferred Stock, which constituted 98.5% of our issued and outstanding capital stock on an -as-converted basis as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Kalington became our wholly-owned subsidiary and the former shareholders of Longhai became our controlling stockholders. The share exchange transaction with Kalington and the Shareholders was treated as a reverse acquisition, with Kalington as the acquirer and Action Industries, Inc. as the acquired party. Unless the context suggests otherwise, when we refer in this Information Statement to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Kalington and its consolidated subsidiaries.

Immediately prior to the Share Exchange, the common stock of Kalington was owned by the following persons in the indicated percentages: William Hugh Luckman (3.51%); Wealth Index Capital Group LLC (a US company) (7.3%); K International Consulting Ltd. (a BVI company) (2.08%); Merrill King International Investment Consulting Ltd. (a BVI company) (0.31%); Shanchun Huang (3.12%); Xiucheng Yang (1.53%); Jianxin Wang (0.92%); Xingfang Zhang (29.45%); and Merry Success Limited (a BVI company) (51.78%). Jinhai Guo, a U.S. citizen, owns 100% of the capital stock of Merry Success Limited. Jinhai Guo and Chaojun Wang, our Chief Executive Officer, are the directors of Merry Success Limited. On March 18, 2010, Chaojun Wang, our Chief Executive Officer, entered into a call option agreement (the “Merry Success Option Agreement”) with Jinhai Guo, the sole shareholder of Merry Success Limited, our principal shareholder after the reverse acquisition. Under the Merry Success Option Agreement, Mr. Wang has the right to acquire up to 100% or the shares of Merry Success Limited for fixed consideration within the next three years. The Merry Success Option Agreement also provides that Mr. Guo shall not dispose any of the shares of Merry Success Limited without Mr. Wang’s consent. As a result of the Merry Success Option Agreement, Chaojun Wang, our Chief Executive Officer, beneficially owns a majority of the capital stock and voting power of Action Industries, Inc., as well as Longhai and the Longhai Steel Group.

Immediately following closing of the reverse acquisition of Kalington, certain Shareholder transferred 625 of the shares issued to them under the Share Exchange to certain persons who provided services to Kalington’s subsidiary and/or controlled affiliate.

Upon the closing of the reverse acquisition, Inna Sheveleva, our sole director and officer, submitted a resignation letter pursuant to which she resigned from all offices that she held effective immediately and from her position as our director that will become effective on April 19, 2010. In addition, our board of directors on March 25, 2010 increased the size of our board of directors to three directors and appointed Chaojun Wang, Jing Shen and Chaoshui Wang to fill the vacancies created by such increase, which appointments will become effective upon the effectiveness of the resignation of Inna Sheveleva. In addition, our executive officers were replaced by Longhai’s executive officers upon the closing of the reverse acquisition as indicated in more detail below.

As a result of our acquisition of Kalington, we now own all of the issued and outstanding capital stock of Kalington, which in turn owns all of the issued and outstanding capital stock of Kalington Consulting. In addition, we effectively and substantially control Longhai through a series of captive agreements with Kalington Consulting.

Kalington was established in Hong Kong on November 5, 2009 to serve as an intermediate holding company. Chaojun Wang and William Hugh Luckman currently serve as the directors of Kalington. Kalington Consulting was established in the PRC on March 18, 2010. Kalington currently owns 100% of Kalington Consulting. On March 5, 2010, the local government of the PRC issued a certificate of approval regarding the foreign ownership of Kalington Consulting by Kalington, a Hong Kong entity. Chaojun Wang serves as the executive director of Kalington Consulting.

Longhai, our operating affiliate, was established in the PRC on August 26, 2008 as a result of the division of the Longhai Steel Group for the purpose of engaging in the production of steel wire. Chaojun Wang serves as the Chairman of the Board of Directors and General Manager of Longhai and owns 80% of the capital stock in Longhai. Longhai’s additional shareholders are Wealth Index International (Beijing) Investment Co., Ltd. (15% owner) and Wenyi Chen (5% owner). Chaojun Wang also owns 80% of the capital stock of and is the chief executive officer of the Longhai Steel Group.

Longhai leases a five-story office space and the building which houses our production facilities from the Longhai Steel Group. Until 2008, Longhai purchased 100% of its steel billet from the Longhai Steel Group. Since 2009, Longhai has purchased steel billet from third party vendors. Steel Billet is the principal raw material used in our production of steel wire. Longhai also purchases production utilities from the Longhai Steel Group.

On March 19, 2010, prior to the reverse acquisition transaction, Kalington Consulting and Longhai entered into a series of agreements known as variable interest agreements (the “VIE Agreements”) pursuant to which Longhai became Kalington Consulting’s contractually controlled affiliate. The use of VIE agreements is a common structure used to acquire PRC corporations, particularly in certain industries in which foreign investment is restricted or forbidden by the PRC government. The VIE Agreements included:

| | (1) | A Consulting Services Agreement through which Kalington Consulting has the right to advise, consult, manage and operate Longhai and collect and own all of the net profits of Longhai; |

| | (2) | an Operating Agreement through which Kalington Consulting has the right to recommend director candidates and appoint the senior executives of Longhai, approve any transactions that may materially affect the assets, liabilities, rights or operations of Longhai, and guarantee the contractual performance by Longhai of any agreements with third parties, in exchange for a pledge by Longhai of its accounts receivable and assets; |

| | (3) | a Proxy Agreement under which the three owners of Longhai have vested their collective voting control over Longhai to Kalington Consulting and will only transfer their respective equity interests in Longhai to Kalington Consulting or its designee(s); |

| | (4) | an Option Agreement under which the owners of Longhai have granted to Kalington Consulting the irrevocable right and option to acquire all of their equity interests in Longhai; and |

| | (5) | an Equity Pledge Agreement under which the owners of Longhai have pledged all of their rights, titles and interests in Longhai to Kalington Consulting to guarantee Longhai’s performance of its obligations under the Consulting Services Agreement. |

Because of the common control between Kalington, Kalington Consulting and Longhai, for accounting purposes, the acquisitions of these entities has been treated as a recapitalization with no adjustment to the historical basis of their assets and liabilities. The restructuring has been accounted for using the “as if” pooling method of accounting and the operations were consolidated as if the restructuring had occurred as of the beginning of the earliest period presented in our consolidated financial statements and the current corporate structure had been in existence throughout the periods covered by our consolidated financial statements.

Principal Factors Affecting Our Financial Performance

Our operating results are primarily affected by the following factors:

| | · | Growth in the Chinese Economy - We operate our facilities in China and derive almost all of our revenues from sales to customers in China. Economic conditions in China, therefore, affect virtually all aspects of our operations, including the demand for our products, the availability and prices of our raw materials and our other expenses. China has experienced significant economic growth, achieving a compound annual growth rate of over 10% in gross domestic product from 1996 through 2008. China is expected to experience continued growth in all areas of investment and consumption, even in the face of a global economic recession. However, China has not been entirely immune to the global economic slowdown and is experiencing a slowing of its growth rate. |

| | · | Supply and Demand in the Steel Market – We are subject to macroeconomic factors dictating the supply and demand of steel and wire in the PRC. Steel commodity prices have been volatile in the past, and while they have stabilized since the first quarter of 2009, our revenues and earnings could be dramatically affected by increases and decreases in raw material and wire costs. |

| | · | Infrastructure and Construction Growth – We have in the past benefited from strong growth in fixed asset investment in roads, residential and commercial construction, bridges and other fundamental infrastructure and construction projects in the PRC. As the Chinese economy matures and develops, while we expect this growth to slow and fixed asset investment to fall as a percentage of GDP, we still believe demand for our products will remain strong. |

Taxation

United States and Hong Kong

We are subject to United States tax at a tax rate of 34%. No provision for income taxes in the United States has been made as we have no income taxable in the United States.

Kalington is incorporated in Hong Kong and is subject to Hong Kong profits tax.

People’s Republic of China

Income Taxes:

The Company accounts for income taxes in accordance with ASC 740 “Income Taxes”. ASC 740 requires an asset and liability approach for financial accounting and reporting for income taxes and allows recognition and measurement of deferred tax assets based upon the likelihood of realization of tax benefits in future years. Under the asset and liability approach, deferred taxes are provided for the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. A valuation allowance is provided for deferred tax assets if it is more likely than not these items will either expire before the Company is able to realize their benefits, or that future deductibility is uncertain. There was no deferred tax asset or liability for the years ended December 31, 2009 and 2008. The Company is governed by the Income Tax Law of the PRC concerning the private-run enterprises, which are generally subject to tax at a statutory rate of 25% and 33% on income reported in the statutory financial statements after appropriated tax adjustments in 2009 and 2008, respectively.

Value Added Taxes: