- ORA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ormat (ORA) DEF 14ADefinitive proxy

Filed: 28 Mar 23, 7:38am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant |  | Filed by a party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to §240.14a-12 |

ORMAT TECHNOLOGIES, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): | |

| No fee required |

| Fee paid previously with preliminary materials |

| Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

MESSAGE FROM

OUR CHAIRMAN OF THE BOARD

ISAAC ANGEL | March 28, 2023

TO OUR STOCKHOLDERS:

On behalf of the Board of Directors, I cordially invite you to attend the 2023 Annual Meeting of Stockholders of Ormat Technologies, Inc. to be held on May 9, 2023 at 10:00 a.m., Eastern Daylight Time (the “Annual Meeting”). The Annual Meeting will be a completely virtual meeting, conducted via live audio webcast. You will be able to attend the Annual Meeting online, vote your shares electronically and submit your questions during the Annual Meeting by visiting https://web.lumiagm.com/251938693 and following the instructions included in the enclosed Proxy Statement.

Only stockholders of record at the close of business on March 20, 2023 may vote at the Annual Meeting. Each stockholder of record is entitled to one vote for each share of common stock held at that time.

In accordance with the rules of the Securities and Exchange Commission, we sent a Notice of Internet Availability of Proxy Materials on or about March 28, 2023 to our stockholders of record as of the close of business on March 20, 2023. We also provided access to our proxy materials over the Internet beginning on that date. If you received a Notice of Internet Availability of Proxy Materials by mail and did not receive, but would like to receive, a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability of Proxy Materials.

Your vote is important to us. Whether or not you plan to attend the Annual Meeting, we strongly urge you to cast your vote promptly. You may vote over the Internet, as well as by telephone or by mail, or otherwise virtually at the Annual Meeting. Please review the instructions on the proxy card (or, if you hold your shares in “street name” through a broker, bank or other nominee, voting instruction form) regarding each of these voting options.

By order of the Board of Directors,

Isaac Angel

Chairman of the Board

| |  |

| NOTICE OF ANNUAL MEETING OF STOCKHOLDERS |

To Be Held May 9, 2023

10:00 a.m., Eastern Daylight Time

| |

ANNUAL MEETING ONLINE

https://web.lumiagm.com/251938693 | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 9, 2023:

The Proxy Statement and 2023 Annual Report to Stockholders, which includes the Annual Report on Form 10-K for the year ended December 31, 2022, are available at

https://www.astproxyportal.com/ast/13766. |

ITEMS OF BUSINESS:

The purpose of the Annual Meeting is to:

| 1. | elect the nine director nominees listed in the accompanying Proxy Statement; |

| 2. | ratify the appointment of Kesselman & Kesselman, a member firm of PricewaterhouseCoopers International Limited, as our independent registered public accounting firm for 2023; |

| 3. | approve, in a non-binding, advisory vote, the compensation paid to our named executive officers; |

| 4. | approve, in a non-binding, advisory vote, the frequency of the advisory stockholder vote on the compensation of our named executive officers; and |

| 5. | transact any other business that may properly come before the Annual Meeting and any adjournments or postponements thereof. |

These items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting.

WHO CAN VOTE: The record date for the Annual Meeting is March 20, 2023. Only stockholders of record at the close of business on that date may vote at the Annual Meeting or any adjournment thereof.

VOTING: Whether or not you plan to attend the Annual Meeting, we strongly urge you to cast your vote promptly. You may vote over the Internet, as well as by telephone or by mail, or otherwise virtually at the Annual Meeting. Please review the instructions on the proxy card (or, if you hold your shares in “street name” through a broker, bank or other nominee, voting instruction form) regarding each of these voting options.

By order of the Board of Directors,

JESSICA WOELFEL

General Counsel, Chief Compliance Officer and

Corporate Secretary

March 28, 2023

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 02

TABLE OF CONTENTS

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 03

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 04

A LETTER FROM OUR CEO

DORON BLACHAR | March 28, 2023 |

DEAR STOCKHOLDER,

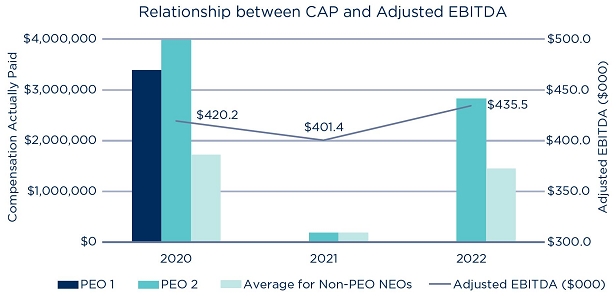

2022 was a very strong year for Ormat. The Company had solid growth in each operating segment, resulting in a 10.7% year-over-year increase in total revenues and an 8.3% year-over-year increase in operating income. We added 78MW of new generating capacity to our operating portfolio with the addition of our 35MW CD4 plant in Mammoth, California and some expansion projects and hybrid Solar facilities, and we signed long-term power purchase agreements of up to 365MW in our Geothermal and Energy Storage segments. The Company also saw a notable recovery in our Product segment, with higher revenues, improved margins, and new product contracts that considerably increased our backlog to pre-COVID-19 levels.

In 2023, we expect to deliver meaningful revenue expansion and continued profitable growth for our investors. Our growth plans are aggressive, and we are motivated to expand our portfolio significantly and continue providing clean sustainable energy to our customers. The passage of the Inflation Reduction Act of 2022 (the “IRA”) in the United States was a very positive development for renewable energy companies, and we expect to take advantage of the IRA to reduce our capital needs in the coming years. We are focusing our efforts on Indonesia and the United States, and see tremendous growth opportunities in both countries.

In 2022, we strengthened our already strong commitment to environmental, social and governance-related (“ESG”) issues. We issued a comprehensive sustainability report in accordance with the GRI Standards and the standards of the Sustainability Accounting Standards Board, and we successfully met our target of five percent annual average absolute reduction in Scope 1 and 2 greenhouse gas (“GHG”) emissions measured against 2019 base levels. Our Board of Directors also established an ESG Committee in February 2023.

We believe that we successfully weathered the labor challenges that have plagued most employers over the last year. Throughout these challenging times, we believe that we have continued to operate our power plants effectively and efficiently, have continued to build for ourselves and our clients operating power plants, and have engaged in significant drilling campaigns for projects all over the world. I am proud of our dedicated and talented workforce and their commitment to Ormat’s mission.

At Ormat, we take our job of providing clean, sustainable energy very seriously. As we look to the future, we will continue our aggressive development program and expect increased growth as we continue to lead in geothermal energy development and increase our solar and storage holdings. We see a bright future at Ormat and appreciate your trust and confidence in our company.

Thank you for your investment in Ormat.

Doron Blachar

Chief Executive Officer

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 05

The Board of Directors (the “Board”) of Ormat Technologies, Inc. (“Ormat” or the “Company”) is making this Proxy Statement available to you in connection with the solicitation of proxies on its behalf for the 2023 Annual Meeting of Stockholders (the “Annual Meeting”). The Annual Meeting will be held on May 9, 2023 at 10:00 a.m., Eastern Daylight Time. The Annual Meeting will be a completely virtual meeting, which will be conducted via live audio webcast.

This summary highlights information about the Company and certain information contained elsewhere in this Proxy Statement. You should read the entire Proxy Statement carefully before voting.

|  |  | |

| TIME AND DATE | ANNUAL MEETING | RECORD DATE | |

| Tuesday, May 9, 2023 | ONLINE | March 20, 2023 | |

| 10:00 a.m., Eastern Daylight Time | https://web.lumiagm.com/251938693 | ||

| Proposal | Board Vote Recommendation | Page | ||||

| Proposal 1 | Election to our Board of Directors of the nine director nominees | FOR each of the nominees | 13 | |||

| Proposal 2 | Ratification of the appointment of Kesselman & Kesselman, a member firm of PricewaterhouseCoopers International Limited, as our independent registered public accounting firm | FOR | 31 | |||

| Proposal 3 | Advisory vote on the compensation for our named executive officers | FOR | 36 | |||

| Proposal 4 | Advisory vote on the frequency of future advisory votes on the compensation for our named executive officers | ONE YEAR | 37 | |||

| Proposal 5 | Transaction of any other business that may properly come before the Annual Meeting |

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 06

| How to Vote | Stockholders of Record (Shares registered in your name with Ormat’s transfer agent) | Street Name Holders (Shares held through a broker, bank or other nominee) | |||

Internet | Visit the applicable voting website and follow the on-screen instructions. | www.voteproxy.com | Refer to voting instruction form. | ||

Telephone | Within the United States, U.S. Territories and Canada, call toll-free. | +1 (800) 776-9437 | Refer to voting instruction form. | ||

| Complete, sign and mail your proxy card (if a stockholder of record) or voting instruction form (if a street name holder) in the self-addressed envelope provided to you. | ||||

Virtually | Attend the Annual Meeting and cast your vote on the meeting website. | https://web.lumiagm.com/251938693, password ormat2023 | Refer to voting instruction form. | ||

If you own shares that are traded through the Tel Aviv Stock Exchange (“TASE”), you may vote your shares in one of the following ways:

| • | By Mail / E-Mail. Complete, sign and date the proxy card and attach to it an ownership certificate from the TASE Clearing House member through which your shares are registered (i.e., your broker, bank or other nominee), indicating that you were the beneficial owner of the shares as of the record date of March 20, 2023, (the “Record Date”), and return the proxy card, along with the ownership certificate, by mail, to the Company’s registered office, 1 Shidlovsky Street, Yavne 8122101, Israel, or by e-mail, to corporate_secretary@ormat.com, to be received no later than 11:00 a.m., Israel time, on Thursday, May 9, 2023. If the TASE member holding your shares is not a TASE Clearing House member, please make sure to include an ownership certificate from the TASE Clearing House member in which name your shares are registered. |

| • | By Voting Electronically. Vote your shares through the electronic voting system of the Israel Securities Authority (https://votes.isa.gov.il), subject to proof of ownership of the shares on the Record Date, as required by law. Voting through the electronic voting system will be allowed until 11:00 a.m., Israel time, on Thursday, May 9, 2023. You may receive guidance on the use of the electronic voting system from the TASE member through which you hold your shares. |

YOUR VOTE IS IMPORTANT TO US. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE CAST YOUR VOTE PROMPTLY. YOU MAY VOTE OVER THE INTERNET, BY PHONE OR BY SIGNING AND DATING A PROXY CARD AND RETURNING IT TO US BY MAIL.

By submitting your proxy using any of the methods specified in the Notice, you authorize each of Doron Blachar, our Chief Executive Officer, Assaf Ginzburg, our Chief Financial Officer, and Jessica Woelfel, our General Counsel, Chief Compliance Officer, and Corporate Secretary, to represent you and vote your shares at the Annual Meeting in accordance with your instructions. Any may also vote your shares to adjourn the Annual Meeting and will be authorized to vote your shares at any postponements or adjournments of the Annual Meeting.

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 07

You are being asked to vote on the following nine nominees for directors to serve on our Board for a one-year term expiring at the 2024 Annual Meeting of Stockholders. Information about each director’s experiences, qualifications, attributes and skills can be found in the sections below titled “Proposal 1 – Election of Directors” and “Our Board’s Skills, Experience and Backgrounds.”

| Committee Memberships | |||||||||||||

| Name | Age | Director Since | Independent | Audit | Compensation | Nominating & Corporate Governance | Investment | ESG | |||||

Isaac Angel  | 66 | 2020 | |||||||||||

| Karin Corfee | 62 | 2022 |  |  |  | ||||||||

| David Granot | 76 | 2012 |  |  |  |  | |||||||

| Michal Marom | 53 | 2022 |  |  |  | ||||||||

| Mike Nikkel | 58 | 2021 |  |  |  | ||||||||

| Dafna Sharir | 54 | 2018 |  |  |  | ||||||||

| Stanley B. Stern+ | 65 | 2015 |  |  |  |  | |||||||

| Hidetake Takahashi | 52 | 2020 |  |  | |||||||||

| Byron G. Wong | 71 | 2017 |  |  |  | ||||||||

| Chairman of the Board |

| Chair of committee |

| + | Lead Independent Director |

We are taking advantage of Securities and Exchange Commission (“SEC”) rules that permit companies to furnish proxy materials to stockholders via the Internet. As a result, we are mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”). If you received a Notice by mail, you will not receive a printed copy of our proxy materials unless you specifically request one by following the instructions contained in the Notice. The Notice instructs you on how to access our proxy materials, including this Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (“Fiscal 2022”), via the Internet, as well as how to vote online or by telephone. We are first making this Proxy Statement and the accompanying materials available to our stockholders on or about March 28, 2023.

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 08

At Ormat, we’re always on, delivering renewable power and energy solutions to our customers around the clock and around the world. Clean, reliable energy solutions provided from geothermal power, recovered energy, as well as energy storage solutions, is our expertise, commitment and focus.

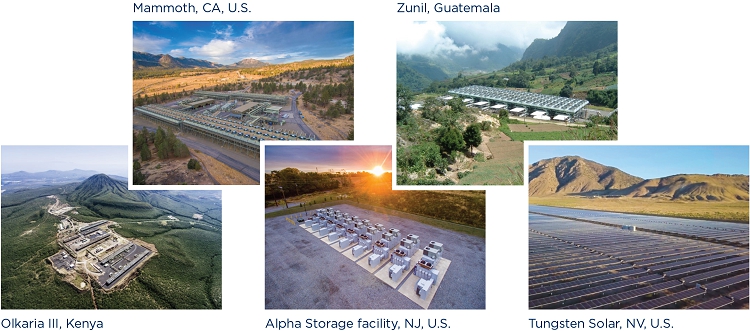

With over five decades of experience, Ormat is a leading geothermal company and the only vertically integrated company engaged in geothermal and recovered energy generation (“REG”), with robust plans to accelerate long-term growth in the energy storage market and to establish a leading position in the U.S. energy storage market. Ormat owns, operates, designs, manufactures and sells geothermal and REG power plants primarily based on the Ormat Energy Converter—a power generation unit that converts low-, medium- and high-temperature heat into electricity. Ormat has engineered, manufactured and constructed power plants, which it currently owns or has installed for utilities and developers worldwide, totaling approximately 3,200 MW of gross capacity. Ormat leveraged its core capabilities in the geothermal and REG industries and its global presence to expand its activity into energy storage services, solar Photovoltaic (PV) and energy storage plus Solar PV. Ormat’s current total generating portfolio is 1,158 MW with a 1,070 MW geothermal and solar generation portfolio that is spread globally in the U.S., Kenya, Guatemala, Indonesia, Honduras, and Guadeloupe, and an 88 MW energy storage portfolio that is located in the U.S. With the objective of leading the way in renewable energy, we are motivated to identify our opportunities and risks with respect to climate change and take efforts to reduce our GHG emissions and improve our energy efficiency. Our geothermal power plants have far lower emissions of carbon dioxide compared to fossil fuels and provide a sustainable source of baseload energy.

As a global company, we are proud of the impact we make in the communities we serve—not only through the delivery of clean, renewable energy, but through the social impacts we make around the world. We employ approximately 1,480 people and are committed to hiring from local communities. Wherever we work, our objectives are to build and retain an engaged, well-trained, diverse and equitable workforce.

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 09

We are committed to continuing our environmental, social and governance-related (“ESG”) efforts. As a renewable energy solution provider, we are motivated to identify our opportunities and risks with respect to climate change and take efforts to reduce our greenhouse gas emissions (“GHG”) and improve our energy efficiency. We have established a target of five percent annual average absolute reduction in Scope 1 (direct emissions) and Scope 2 (indirect emissions) GHG emissions measured against the 2019 base levels. In 2021, we exceeded our goal, and reduced our annual average by more than 11% in comparison to our 2019 baseline. Our progress towards this goal is reviewed annually and reported in our Sustainability Reports. Additionally, in 2021, we began to align our disclosures with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). As part of this effort, and guided by the TCFD’s recommendations, we are adding climate-related scenario analysis to our business development and strategy decision-making processes. Aligning to the TCFD standards further strengthens our awareness of the impact Ormat and its operations have on climate change. We have been sustainably generating power since 1965, and we remain committed to providing renewable energy safely, economically, and in an environmentally responsible manner. We aim to act as responsible stewards of the environment and to create and foster a corporate culture for our employees that encompasses the highest standards of fairness and equality. We have recently added updates on social activities such as diversity and inclusion training for employees and our recruiting efforts to attract, advance, and retain a more diverse talent pool. This work surrounding diversity and inclusion remains fundamental to our business as we look to drive both our short-term and long-term initiatives in a sustainable and socially responsible manner. These commitments are applied through our corporate governance, business activities, policies, and strategic objectives.

At the core of our business strategy, we strive to advance a number of goals and work toward accomplishing them in several ways:

| | 1 | | 2 | | 3 | | 4 | | 5 | | 6 |

Increasing clean energy production capacity

We work to better understand the specific properties of a geothermal reservoir and progressively add new energy generation capacities. As such, we strive to deliver more renewable energy while substantially maintaining the same developmental footprint. | Promoting innovation in all our activities

We strive to establish and operate our sites of operation in the most innovative way. Ormat’s R&D department regularly searches for innovations that can be implemented to improve the efficiency of our operations, including environmental performance. | Maintaining synergy with the communities in which we operate

This includes, both existing and new sites, where we work to understand the needs and concerns of the local stakeholder community and to build lasting relationships and specific community engagement programs designed to meet those needs and concerns. | Prioritizing and developing our people

We strive to provide a diverse and inclusive working environment, to ensure that employees can fulfill both their professional goals, and instill a safe workplace culture. As part of our strategy, we are focusing on hiring and promoting a diverse workforce across all areas of the organization. | Commitment to a fair supply chain

We see great importance in managing a fair supply chain and working with suppliers, subcontractors and business partners with good human rights practices. Ormat is committed to complying with applicable laws and human rights commitments, as reflected in our published policies and business activities. | Strong values for solid governance

Ormat is committed to conducting its business everywhere with honesty and integrity, and in a manner that avoids even the appearance of impropriety. We believe candor, openness and fairness must be demonstrated by every Ormat employee, manager or director, at all times. |

|  |  |  |  |  |

We report our progress on environmental goals and commitments annually in our Sustainability Reports, including, but not limited to, our climate change mitigation measures, biodiversity conservation, and water management efforts. A copy of our most recent Sustainability Report is accessible, free-of-charge, in the Sustainability section of our website at www.ormat.com.The contents of our website, including the Sustainability Reports, are not part of or otherwise incorporated by reference into this Proxy Statement.

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 10

Our executive officers are appointed by, and serve at the discretion of, our Board of Directors. The following sets forth certain information with respect to our executive officers as of March 28, 2023.

Age 55 Chief Executive Officer | DORON BLACHAR | |

| Doron Blachar has served as our Chief Executive Officer since July 1, 2020. Prior to that, Mr. Blachar served as the Company’s Chief Financial Officer from April 2013 to May 2020 and as President from November 2019 to July 2020. From 2011 to 2013, Mr. Blachar served as a member of the board of A.D.O. Group Ltd., a TASE-listed company. From 2009 to 2013, Mr. Blachar was the CFO of Shikun & Binui Ltd. From 2005 to 2009, Mr. Blachar served as Vice President—Finance of Teva Pharmaceutical Industries Ltd. From 1998 to 2005, Mr. Blachar served in a number of positions at Amdocs Limited, including as Vice President—Finance from 2002 to 2005. Mr. Blachar earned a BA in Accounting and Economics and an MBA from Tel Aviv University. He is also a Certified Public Accountant in Israel. | ||

Age 47 Chief Financial Officer | ASSAF GINZBURG | |

| Assaf Ginzburg has served as our Chief Financial Officer since May 10, 2020. Since October 2022, Mr. Ginzburg has served as a member of the board of Ithaca Energy plc, a company listed on the London Stock Exchange. Mr. Ginzburg also held several positions, including Executive Vice President and Chief Financial Officer of Delek US Holdings, Inc. (NYSE: DK) and Delek Logistics Partners, LP (NYSE: DKL) from 2013 to 2017 and from 2019 to May 2020, and has over 15 years of experience in the energy industry. Mr. Ginzburg earned a BA in Economics and Accounting from Tel Aviv University, and he has been a member of the Israeli Institute of Certified Public Accountants since 2001. | ||

Age 58 President and Head of Operations and Products | SHLOMI ARGAS | |

| Shlomi Argas has served as our President and Head of Operations and Products since January 1, 2021. Mr. Argas served as our Executive Vice President—Operations and Products from 2018 to 2021. From 2014 to 2017, Mr. Argas served as our Executive Vice President—Projects and was responsible for management of our drilling operations. From 2009 until 2014, Mr. Argas served as our Vice President responsible for management of geothermal projects and REG projects. From 2006 to 2009, Mr. Argas served as Manager of the REG Projects Department, responsible for the design and installation of REG power plants. From 1994 to 2006, Mr. Argas served in our Product Engineering Department as a Product Engineer. Mr. Argas earned a BS in Mechanical Engineering from Ben-Gurion University in 1992 and a Certificate from the Technology Institute of Management, Executive Management Program. As previously disclosed, Mr. Argas has decided to transition out of his role as President and Head of Operations and Products of the Company, effective July 1, 2023, and is expected to remain employed as a senior consultant to the Company’s management, where he will continue supporting various strategic, sales, business development and operational efforts. Mr. Argas’s decision is part of his longer-term personal plan to eventually retire. | ||

Age 61 Executive Vice President— Electricity Segment | SHIMON HATZIR | |

| Shimon Hatzir has served as Executive Vice President—Electricity Segment since April 1, 2021. Mr. Hatzir served in various roles at the Company for 32 years, most recently, beginning in October 2018 as General Manager of our Energy Storage segment. Previously, Mr. Hatzir has served as Executive Vice President, Engineering and Research and Development at the Company. Mr. Hatzir holds a Bachelor of Science in Mechanical Engineering from Tel Aviv University as well as a Certificate from the Executive Management Program at Technion Israel Institute of Management. |

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 11

Age 59 Executive Vice President— Energy Storage and Business Development | OFER BEN YOSEF | |

| Ofer Ben Yosef has served as our Executive Vice President—Energy Storage and Business Development since January 1, 2021. From April 2020 until January 2021, Mr. Ben Yosef served as our Executive Vice President—Business Development, Sales and Marketing. From 2008 to 2020, Mr. Ben Yosef served as a Division President at Amdocs Ltd. From 2000 to 2008, Mr. Ben Yosef served at other operational roles at Amdocs Ltd. From 1996 to 2000, Mr. Ben Yosef served as IT manager at AIG Israel. He earned a BA in Earth Science from Bar Ilan University, a BA in Software Development from Tel Aviv University and an MBA from Bar Ilan University. | ||

Age 46 General Counsel, Chief Compliance Officer, and Corporate Secretary | JESSICA WOELFEL | |

| Jessica Woelfel has served as our General Counsel and Chief Compliance Officer since January 25, 2022, and has served as our Corporate Secretary since November 2, 2022. Ms. Woelfel previously served as our Interim General Counsel and Chief Compliance Officer from March 2021 to January 2022, and as Vice President, U.S. Legal for the Company’s business in the United States from January 2019 to March 2021. Ms. Woelfel has more than 20 years of legal experience and, prior to joining the Company, was a partner at McDonald Carano LLP, in Reno, Nevada from 2010 to 2018 and an associate at Sonnenschein, Nath and Rosenthal LLP in San Francisco, California. Ms. Woelfel holds a Bachelor’s degree from the University of California, Berkeley and a J.D. from the University of California, Hastings College of Law. |

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 12

Our Board currently consists of nine members. Under its governance agreement with us, our stockholder ORIX is no longer entitled to a second director nominee due to the sell-down of its equity stake in an underwritten public offering in 2022. However, our Board has determined to re-nominate all of the directors previously nominated by ORIX. Upon the recommendation of the Nominating and Corporate Governance Committee, the Board has considered and nominated the following slate of nominees for a one-year term expiring in 2024: Isaac Angel, Karin Corfee, David Granot, Michal Marom, Mike Nikkel, Dafna Sharir, Stanley B. Stern, Hidetake Takahashi, and Byron G. Wong. Action will be taken at the Annual Meeting for the election of these nominees.

It is intended that the proxies delivered pursuant to this solicitation will be voted in favor of the election of Isaac Angel, Karin Corfee, David Granot, Michal Marom, Mike Nikkel, Dafna Sharir, Stanley B. Stern, Hidetake Takahashi, and Byron G. Wong, except in cases of proxies bearing contrary instructions. In the event that these nominees should become unavailable for election, the persons named in the proxy will have the right to use their discretion to vote for a substitute in accordance with SEC rules.

The following information describes the offices held and other business directorships of each nominee required to be disclosed by SEC rules. Beneficial ownership of equity securities of the nominees is shown under the section entitled “Security Ownership of Certain Beneficial Owners and Management” below.

| ISAAC ANGEL | |||

DIRECTOR QUALIFICATIONS: • Extensive experience with our Company, management experience and institutional and strategic knowledge about our energy market, industry and our business | ||||

Age 66 Member of our

Chairman of | BACKGROUND: Mr. Angel has served as Chairman of our Board since January 2021, and served as Executive Chairman of our Board from July 2020 to December 2020. Mr. Angel was also our CEO from 2014 to July 2020. Previously, Mr. Angel served as chairman of the board of directors of Gilat Satellite Networks Ltd. (Nasdaq: GILT), a U.S. public company, from March 2020 to March 2023, as a director of Frutarom Ltd. from 2008 until 2016 and Retalix Ltd. from 2012 until 2013, and as executive chairman of LeadCom Integrated Solutions Ltd. from 2008 to 2009. From 2006 to 2008, Mr. Angel served as Executive Vice President, Global Operations of VeriFone after it acquired Lipman Electronic Engineering Ltd. (“Lipman”), and from 1979 to 2006, he served in various positions at Lipman, including as its President and CEO. | |||

| KARIN CORFEE | |||

DIRECTOR QUALIFICATIONS: • Depth of experience in the energy sector and expertise with strategic planning, renewables, energy storage and ESG | EDUCATION: • BS, Political Economy of Natural Resources, University of California at Berkeley • MS, Civil Engineering, Stanford University | |||

Age 62 Member of our

Independent • Audit • ESG | BACKGROUND: Ms. Corfee has served on the board of directors of ClimeCo, a privately held global sustainability company, since September 2021 and the Center for Resource Solutions, a non-profit that creates policy and market solutions to advance sustainable energy, since March 2015. She is also the founder and CEO of KC Strategies LLC, a business consultancy firm specializing in energy, climate and sustainability services since its founding in April 2021. Ms. Corfee is an energy, ESG and management consultant with over three decades of experience assisting large corporations, utilities, government agencies, and investors with clean energy transition strategies. Previous work experience includes serving as Vice President of Professional & Advisory Services at Kevala, Inc., a power grid analytics company, from October 2021 to June 2022 where she built their professional advisory services team. From October 2019 through April 2021, Ms. Corfee served as a Partner at Guidehouse, a management consulting firm, where she oversaw the firm’s western energy practice. Ms. Corfee also served as Managing Director at Navigant Consulting, Inc., a management consulting firm from 2011 to its acquisition by Guidehouse in October 2019. Ms. Corfee also served as a Vice President at KEMA, Inc. (now DNV), a global energy consultancy company, from 1998 to 2011. Prior to consulting, Ms. Corfee worked for electric and gas utilities in North America, including Pacific Gas and Electric Company, City of Palo Alto Utilities, and Union Electric Company (now Ameren Corporation). | |||

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 13

| DAVID GRANOT | ||

DIRECTOR QUALIFICATIONS: • Extensive management, banking, and financial experience, and overall business knowledge | EDUCATION: • BA, Economics, Hebrew University • MBA, Hebrew University | ||

Age 76 Member of our

Independent • Nominating • Investment • ESG | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Bezeq The Israel Telecommunication Corp. Ltd. • M.L.R.N. Projects and Trading Ltd. (Chairman) • CLAL Insurance Enterprises Holdings Ltd. | ||

BACKGROUND: Mr. Granot currently serves on the boards of directors of Bezeq The Israel Telecommunication Corp. Ltd. (TASE: BEZQ), M.L.R.N. Projects and Trading Ltd. (where he is Chairman of the board) (TASE: MLRN), and CLAL Insurance Enterprises Holdings Ltd. (TASE: CLIS), which are all public companies in Israel. He also serves on the boards of directors of Sonol Israel Ltd. and Rav-Bariach (08) Industries Ltd., which are both private companies in Israel. During the past five years, Mr. Granot served as a member of the boards of directors of the following non-U.S. public and private companies, for which he no longer serves as a director: Akerstein Ltd., Fritz Companies Israel T. Ltd. (chairman), Alrov (Israel) Ltd., Geregu Power Plc, Harel Insurance, Investments and Financial Services Ltd. (chairman of the investments committee of the Nostro), Calcalit Jerusalem Ltd., Tempo Beverages Ltd., and Protalix BioTherapeutics, Inc. (NYSE: PLX, where he ceased to serve as a director on June 30, 2022). From 2001 through 2007, Mr. Granot was the Chief Executive Officer of the First International Bank of Israel Ltd. | |||

| MICHAL MAROM | ||

DIRECTOR QUALIFICATIONS: • Extensive corporate governance and financial experience | EDUCATION: • BA, Business, Israeli College of Management Academic Studies • MSF, Baruch College | ||

Age 53 Member of our

Independent • Audit • Compensation | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • OPC Energy Ltd. (resigning July 2023) • Partner Communications Ltd. • Paz Oil Company Ltd. • REE Automotive Ltd. | ||

BACKGROUND: Ms. Marom has served on the board of directors and the audit and compensation committees of REE Automotive Ltd. (Nasdaq: REE), a U.S. public company, since July 2021 and the board of directors and audit, finance, investment and compensation committees of Partner Communications Ltd. (TASE: PTNR), a public company in Israel, since January 2021. She is also a member of the boards of directors of two public companies in Israel, namely, Paz Oil Company Ltd. (TASE: PZOL), a leading energy company in Israel, and OPC Energy Ltd. (TASE: OPCE), the largest private electricity company in Israel, where she also serves on the audit and compensation committees. Ms. Marom has given notice of her intent to resign from the board of OPC Energy Ltd., effective July 2023. Additionally, she is on the board of directors of Dan Transportation Ltd., a private company in Israel. From 2011 to 2015, Ms. Marom served as the Chief Financial Officer of Linkury Ltd., an Israeli high-tech company she co-founded in 2011. She previously served on the boards of BiondVax Pharmaceuticals Ltd. (Nasdaq: BVXV) from 2015 to 2019, Panaxia Labs Israel Ltd. (TASE: PNAX) and Together Pharma Ltd. (TASE: TGTR). Ms. Marom is a certified public accountant in Israel and also acts as a consultant providing strategic advice on business models and financial transactions. | |||

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 14

| MIKE NIKKEL | ||

| DIRECTOR QUALIFICATIONS: • Extensive experience in the energy and infrastructure sectors, across development, finance, legal and management | EDUCATION: • JD, University of Minnesota School of Law | |

Age 58 Member of our

Independent • Compensation • Investment | BACKGROUND: Mr. Nikkel currently serves as Senior Managing Director and Deputy Head of the Energy and Eco-Services Business Headquarters of ORIX, where he assists with global business development and management. Mr. Nikkel joined ORIX in 2016. He has held senior management positions in the energy and infrastructure sectors across development, finance, legal and management for more than 25 years. Mr. Nikkel started his career in the sector at the AES Corporation in 1996, where he became Vice President and Head of Business Development as well as Chief Financial Officer of the firm’s Asian operations before departing the company in 2003. Since that time, he has been Managing Director and a regional head at CLP Holdings, the Chief Executive Officer of a joint venture between CLP and the Mitsubishi Corporation, an Asia-based partner at private equity firm Global Infrastructure Partners, as well as the internal infrastructure and energy advisor to the Jardine Matheson and Astra International group of companies. He has previously served on a number of boards of directors and various committees, including the board and executive committee of Electricity Generating PLC of Thailand, a public company. | ||

| DAFNA SHARIR | ||

DIRECTOR QUALIFICATIONS: • Extensive domestic and international financial and legal experience, specifically in mergers and acquisitions | EDUCATION: • BA, Economics, Tel Aviv University • LLB, Tel Aviv University School of Law • LLM, New York University School of Law • MBA, INSEAD | ||

Age 54 Member of our

Independent • Compensation • Nominating | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Cognyte Software Ltd. • Gilat Satellite Networks Ltd. | ||

BACKGROUND: Ms. Sharir has served on the board of directors of Gilat Satellite Networks Ltd. (Nasdaq: GILT), a U.S. public company, since 2016, on the board of directors and audit committee of Cognyte Software Ltd. (Nasdaq: CGNT), a U.S. public company, since 2022. She has also served on the board of directors of Minute Media Inc., a private company, since 2021. From 2013 to 2018, she served on the board of directors of Frutarom Industries Inc., and from 2012 to 2015, she served on the board of directors of Ormat Industries Inc., which was merged into Ormat Systems Ltd. (“Ormat Systems”) in February 2015. Since 2005, Ms. Sharir has served as a consultant, providing mergers and acquisitions advisory services, including with respect to due diligence, structuring, and negotiation, to public and private companies around the world. From 2002 to 2005, she served as Senior Vice President—Investments of AMPAL-American Israel Corporation, formerly a U.S. public company, and was responsible for all of its acquisitions and dispositions. From 1999 to 2002, she served as Business Development—Director of Mergers and Acquisitions at AMDOCS and was responsible for international acquisitions and equity investments. | |||

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 15

| STANLEY B. STERN | ||

DIRECTOR QUALIFICATIONS: • Extensive management, strategic analysis, banking and financial experience across a broad spectrum of industries | EDUCATION: • BA, Economics and Accounting, City University of New York, Queens College • MBA, Harvard University | ||

Age 65 Member of our

• Audit • Nominating • Investment | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Audiocodes, Inc. (Chairman) • Ekso Bionics Holdings, Inc. (Lead Independent Director) • Radware Ltd. | ||

BACKGROUND: Mr. Stern is the Managing Partner of Alnitak Capital, which he founded in 2013 to provide board level strategic advisory services and merchant banking services, primarily to companies in technology-related industries. From 1981 to 2000 and from 2004 to 2013, he was a Managing Director at Oppenheimer & Co, where, among other positions, he was head of the investment banking department and technology investment banking group. He also held positions at Salomon Brothers, STI Ventures and C.E. Unterberg. Mr. Stern has served as chairman of the board of directors of AudioCodes, Ltd. (Nasdaq: AUDC), a U.S. public company, since 2012, and serves as a member of the board of directors of the following U.S. public companies: Ekso Bionics Holdings, Inc. (Nasdaq: EKSO) since 2015, and Radware Ltd. (Nasdaq: RDWR) since September 2020. Mr. Stern previously served from 2015 to 2018 as the chairman of the board of directors of SodaStream International Ltd., a U.S. public company in until its sale to Pepsico in 2018, and previously as a member of the board of directors of the following public and private companies: Given Imaging Ltd., Fundtech Inc., Tucows, Inc. (Chairman), Polypid Ltd., and Odimo, Inc. | |||

| HIDETAKE TAKAHASHI | ||

DIRECTOR QUALIFICATIONS: • Extensive experience and knowledge related to the renewable energy sector | EDUCATION: • BA, Economics, Keio University (Japan) | ||

Age 52 Member of our

Independent • Investment | OTHER CURRENT PUBLIC COMPANY DIRECTORSHIPS: • Ubiteq, Inc. | ||

BACKGROUND: Mr. Takahashi currently serves as Managing Executive Officer and Head of Energy and Eco-Services Business Headquarters at ORIX, where he has been leading ORIX’s global energy and eco-services business and has been leading their global renewable energy initiative since 2011. Mr. Takahashi joined ORIX in 1993 and has held a variety of investment, management and business operations positions for the firm in multiple industry sectors, including energy, private equity, real estate and corporate finance. He currently serves as a member of the boards of directors of companies invested by ORIX, including Ubiteq Inc. (TYO: 6662), a technology services company which is public in Japan, and the following private companies: Elawn Energy S.L., a global renewable energy company in Spain, and Greenko Energy Holdings, a leading renewable energy company in India. | |||

| BYRON G. WONG | ||

DIRECTOR QUALIFICATIONS: • Extensive experience and proficiency in understanding, developing and managing energy and power projects globally | EDUCATION: • BA, Economics, University of California, Los Angeles • MBA, University of California, Los Angeles | ||

Age 71 Member of our

Independent • Audit • ESG | BACKGROUND: Mr. Wong has been a private energy consultant following his retirement from Chevron Corporation (“Chevron”) at the end of 2012 after more than 31 years with Chevron, its affiliates and predecessor companies. While at Chevron, from 2001 to 2012, Mr. Wong was Senior Vice President — Commercial Development (Asia) for Chevron Global Power Company, managing a team of professionals in identifying and developing opportunities for independent power projects to monetize Chevron’s gas in the region, and also participating as a member of a decision review board for overseeing Chevron’s geothermal development opportunities in Indonesia and the Philippines. Prior to the merger with Chevron in 2001, Mr. Wong established and staffed the initial Asian office location for Texaco Power and Gasification in Singapore in 1999. Before moving to Singapore, from 1995 to 1999. Mr. Wong was based in London with Texaco Europe: first as the Director of New Business Development (Downstream) for Central/Eastern Europe and Former Soviet Union, with primary responsibility for developing Texaco’s downstream entry into this region, and later, from 1998 to early 1999 as Vice President of Upstream Corporate Development for Europe, Eurasia, Middle East and North Africa, focusing on opportunities for upstream oil and gas mergers, divestments and acquisitions. | ||

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 16

Election of each director nominee requires the affirmative vote of the holders of a majority of votes cast for the election of each director at the Annual Meeting. Abstentions and “broker non-votes” will have no effect on the outcome of this proposal.

| OUR BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES NAMED ABOVE. |

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 17

Our commitment to good corporate governance is reflected in several practices of our Board of Directors and its committees, as described below.

| Board independence | All directors are independent, other than Mr. Angel, our former CEO, and all committees are made up of independent directors. |

| Executive sessions | Independent members of the Board and each of the committees meet regularly in executive session with no members of management present. |

| Board evaluation | Each of the Board and its committees evaluates and discusses its respective performance and effectiveness annually. |

| Engagement with stockholders | The Board and management value the perspectives of our stockholders and work to provide our stockholders with continuous and meaningful engagement. |

| Director accountability | All directors must be elected annually, by majority vote of the stockholders (except in contested elections, where they are elected by plurality). |

| Time commitment | We maintain stringent internal over-boarding standards for our directors, which reflect the standards of ISS and Glass Lewis. None of our directors is currently over-boarded under such standards. |

| Compensation review | The Compensation Committee reviews the appropriateness of our executive officer and director compensation. |

| Risk oversight | The Board and committees regularly review their oversight of risk and the allocation of risk oversight among the committees. |

| Board refreshment | Subject to certain exceptions, directors will not be nominated for re-election to the Board if they have served on the Board for more than 15 years at the time of such proposed nomination. |

The Board directs and oversees the management of the business and affairs of the Company in a manner consistent with the best interests of the Company and its stakeholders. The Board takes an active role in assisting management with the development of the Company’s strategy, strategic oversight of operations, and financial and investment activities. In accordance with our Corporate Governance Guidelines, at least one Board meeting annually is devoted to our long-term business strategy. During these meetings, the Board and management discuss the competitive landscape in our industry, emerging technologies, significant business risks and opportunities, and strategic priorities of the Company. Specific short- and long-term strategic plans are also discussed on an as-needed basis throughout the year, and our senior management team regularly reports to the Board on the execution of our long-term strategic plans, the status of important projects and initiatives, and the key opportunities and risks facing the Company. The Board regularly receives cyber risk and cybersecurity updates at its meetings. ESG and climate change considerations are factored into the business strategy through the recognition of risks and opportunities.

Our Board’s role in risk oversight at the Company is consistent with the Company’s leadership structure, with the CEO and other members of senior management having responsibility for assessing and managing the Company’s risk exposures, and our Board and its committees providing oversight in connection with those efforts and attempts to mitigate identified risks.

Our Board assesses on an ongoing basis the risks faced by the Company in executing its business plans, in part based on regular updates from management and its committees on such risks and the related risk mitigation measures. Updates from management include quarterly reports by our CEO and CFO outlining operational risks and financial risks, respectively.

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 18

While our full Board is ultimately responsible for oversight of risk management, its committees critically assist the Board in fulfilling its monitoring responsibilities in certain areas of risk, as shown below.

| Board/Committee | Key Areas of Risk Oversight | |

| Entire Board | • Strategic, financial, industrial, competitive and operational risks and exposures; • Technological risks, including cybersecurity and information technology risks and developments; • Litigation and regulatory exposures; • Climate change, social and other ESG related risks, strategies and approach; and • Other current matters that may present material risk to our operations, plans, prospects or reputation, both from a global perspective and on a power plant-by-power plant basis. | |

| Audit Committee | • Risks and exposures associated with financial matters, including financial reporting, tax, accounting, and disclosure; • Audit oversight; • Internal control over financial reporting (including the internal controls related to ESG disclosures and metrics); • Internal audit; and • Cybersecurity and information technology risks and developments, including authority to act on behalf of the Board in the event of a significant cybersecurity incident. | |

| Investment Committee | • Financial risk exposures, particularly risks and exposures associated with cash investment guidelines, financial risk policies and hedging activities. |

We believe succession planning, including succession in the event of an emergency or retirement of our CEO, is an important function of the Board. The Nominating and Corporate Governance Committee, with input from our CEO, is responsible for identifying possible successors to our CEO and developing a succession plan, which includes, among other things, an assessment of the experience, performance and skills for possible successors to the CEO. As provided by our Corporate Governance Guidelines, the plan is annually reviewed by the entire Board.

The Board regularly meets in executive session, chaired by the Lead Independent Director, with no members of management present. The independent directors of the Board also meet in executive session with no members of management present. Each of the committees of the Board also meets regularly in executive session.

We have adopted a Code of Business Conduct and Ethics that is applicable to all of our employees, executive officers and directors, as well as a Code of Ethics Applicable to Senior Executives that is applicable to our principal executive officers, principal financial officers, principal accounting officer and controller, and all persons performing similar functions, including our chief executive and senior financial officers. If we make any amendments to our Code of Business Conduct and Ethics or our Code of Ethics Applicable to Senior Executives or grant any waiver, including any implicit waiver, from a provision of either code applicable to our CEO, CFO, or principal accounting officer, we intend to disclose the nature of such amendment or waiver on our website within four business days to the extent required by SEC rules.

We have also adopted Corporate Governance Guidelines, which, together with our certificate of incorporation and bylaws, establish the governance framework for the management of the Company. Our Corporate Governance Guidelines are intended to align the interests of directors and management with those of our stockholders. The guidelines address, among other matters, the role of our Board, Board composition and committees, Board membership criteria, director independence, Board meetings, performance evaluation and succession planning.

Our Code of Business Conduct and Ethics, Code of Ethics Applicable to Senior Executives and Corporate Governance Guidelines are available in the Investor Relations section of our website at www.ormat.com.

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 19

Our Board manages or directs the business and affairs of the Company, as provided by Delaware law, and conducts its business and affairs through meetings of the Board and five standing committees: the Audit Committee, the Compensation Committee, the Nominating and Corporate Governance Committee, the Investment Committee, and the ESG Committee. The ESG Committee was formed in February 2023 and will be fully established following this Annual Meeting. In addition, from time to time, special committees may be established under the direction of the Board of Directors when necessary to address specific issues. The following shows an overview of the composition of our Board, as further detailed in the below sections of this Proxy Statement.

The Board maintains the flexibility to determine whether the roles of Chairman of the Board and CEO should be combined or separated, based on what it believes is in the best interests of the Company at a given point in time. The Board believes that this flexibility is in the best interest of the Company and its stockholders. The Board believes that one leadership structure is not more effective at creating long-term stockholder value, and the decision of whether to combine or separate the positions of CEO and Chairman should depend on a company’s particular circumstances at a given point in time. Specifically, an effective governance structure must balance the powers of the CEO and the independent directors and ensure that the independent directors are fully informed, are ready to discuss and debate the issues that they deem important, and are able to provide effective oversight of management. Our Board also believes that it should retain the flexibility to make this determination in the manner it feels will provide the most appropriate leadership for the Company from time to time. Our Chairman is appointed annually by the Board.

| Separation of CEO and Chairman | Currently, the CEO position is separate from the Chairman of the Board position; Mr. Angel serves as Chairman, while Mr. Blachar serves as our CEO and does not serve on our Board. We believe this structure is appropriate corporate governance for us at this time, as it best encourages the free and open dialogue of competing views and provides for strong checks and balances. Additionally, the Chairman’s attention to Board and committee matters allows the CEO to focus more specifically on overseeing the Company’s day-to-day operations as well as strategic opportunities and planning. | |

| Doron Blachar, CEO Isaac Angel, Chairman | ||

| Lead Independent Director | Under our bylaws, a Lead Independent Director must be appointed where the Chairman and CEO are the same individual. If one is required, the Lead Independent Director must be elected via secret ballot by a majority vote of the independent directors. The Lead Independent Director’s responsibilities (to the extent one is appointed) include but are not limited to the following: • coordinating the activities of the independent directors; • determining the schedule of Board and committee meetings and preparing meeting agendas; • assessing the flow of information from management to ensure independent directors can perform their duties responsibly; • ensuring the Compensation Committee’s oversight of the Company’s incentive-based compensation policies and procedures; • in conjunction with the Compensation Committee, evaluating the CEO’s performance; • coordinating, preparing the agendas for and moderating executive sessions; and • recommending the membership of Board committees and committee chairs. Currently, our Chairman and CEO are different individuals. However, because the Chairman of our Board, Mr. Angel, was determined by our Board not to be independent under our Corporate Governance Guidelines and the listing standards of the New York Stock Exchange (the “NYSE”), our Board determined it was appropriate to appoint a lead independent director to enhance the Board’s ability to carry out effectively its roles and responsibilities on behalf of our stockholders. Stanley Stern currently serves as Lead Independent Director. | |

| Stanley Stern |

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 20

The following table summarizes the current membership of each of the Board’s committees.

| Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Investment Committee | |||||||||

| Isaac Angel Chairman of the Board | ||||||||||||

| Stanley B. Stern* Lead Independent Director |  |  |  | |||||||||

| Karin Corfee* | ||||||||||||

| David Granot* |  |  |  |  | ||||||||

| Michal Marom* |  |  |  | |||||||||

| Mike Nikkel* |  | (1) | ||||||||||

| Dafna Sharir* |  |  |  | |||||||||

| Hidetake Takahashi* |  | (2) |  | (3) | ||||||||

| Byron G. Wong* |  | |||||||||||

| Chair |

| (1) | Appointed to serve on the Investment Committee in accordance with the terms of the Governance Agreement. For more information, see “ORIX Governance Agreement.” |

| (2) | Appointed to serve on the Compensation Committee in accordance with the terms of the Governance Agreement. For more information, see “ORIX Governance Agreement.” |

| (3) | Appointed to serve on the Nominating and Corporate Governance Committee in accordance with the terms of the Governance Agreement. For more information, see “ORIX Governance Agreement.” |

| * | Independent director for purposes of Board membership and membership on any committee on which the individual serves. For more information, see “How our Board Is Selected and Evaluated—Director Independence and Independence Determinations.” |

The following table summarizes the anticipated membership of the Board committees after the Annual Meeting, assuming each director’s election to the Board.

| Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Investment Committee | ESG Committee | |||||||||||

| Isaac Angel Chairman | |||||||||||||||

| Stanley B. Stern* Lead Independent Director |  |  |  |  | |||||||||||

| Karin Corfee* |  |  |  | ||||||||||||

| David Granot* |  |  |  |  | |||||||||||

| Michal Marom* |  |  |  | ||||||||||||

| Mike Nikkel* |  | (1) |  | (2) | |||||||||||

| Dafna Sharir* |  |  |  | ||||||||||||

| Hidetake Takahashi |  | ||||||||||||||

| Byron G. Wong* |  |  | |||||||||||||

| Chair |

| (1) | Appointed to serve on the Compensation Committee in accordance with the terms of the Governance Agreement. For more information, see “ORIX Governance Agreement.” |

| (2) | Appointed to serve on the Investment Committee in accordance with the terms of the Governance Agreement. For more information, see “ORIX Governance Agreement.” |

| * | Independent director for purposes of Board membership and membership on any committee on which the individual serves. For more information, see “How our Board Is Selected and Evaluated—Director Independence and Independence Determinations.” |

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 21

The Board of Directors has adopted written charters for each of the Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, and the Investment Committee. The charters of the Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, and Investment Committee are available on the Company’s website in the Investor Relations section of our website at www.ormat.com.

| AUDIT COMMITTEE | ||

INDEPENDENCE/ QUALIFICATIONS: • All members are “independent” under applicable standards. • All members are “financially literate” under NYSE listing standards. • Ms. Marom has “accounting or related financial management expertise” under NYSE listing standards and is an “audit committee financial expert” under applicable SEC rules. | KEY RESPONSIBILITIES: • Selects an independent registered public accounting firm to be engaged to audit our financial statements • Annually reviews and discusses with the independent registered public accounting firm its independence • Reviews and discusses the audited annual financial statements and unaudited quarterly financial statements with the independent registered public accounting firm • Discusses with management and the independent registered public accounting firm any significant financial reporting issues and judgments and the adequacy of internal controls • Annually prepares the Audit Committee report • Oversees our internal audit function • Oversees Sarbanes-Oxley Act compliance • Manages and reviews our compliance with legal and regulatory requirements with respect to accounting policies, internal controls and financial reporting and with our Code of Business Conduct and Ethics • Oversees the whistleblower ethics hotline and the procedures established by the Company for receiving and addressing anonymous complaints regarding financial or accounting irregularities • Reviews and approves or ratifies related person transactions | |

| COMPENSATION COMMITTEE | ||

INDEPENDENCE/ QUALIFICATIONS: • All members are “independent” under applicable standards.

| KEY RESPONSIBILITIES: • Annually reviews and approves corporate goals and objectives relevant to the compensation of our CEO and other executive officers • Annually evaluates the performance of our CEO and other executive officers in light of these goals and objectives and their individual achievements and recommends to our Board for approval the compensation of our CEO and other executive officers • Periodically reviews and approves of all other elements of our CEO’s and other executive officers’ compensation, including cash-based and equity- based awards, employment, severance or change in control agreements, and any special or supplemental compensation and benefits for our CEO and other executive officers • Makes recommendations to our Board with respect to the adoption, amendment, termination or replacement of incentive compensation, equity- based plans, revenue sharing plans or other compensation plans maintained by the Company • Makes recommendations to our Board as to the appropriate compensation for Board members • Annually reviews the “Compensation Discussion and Analysis,” recommends its inclusion in the proxy statement and prepares the Compensation Committee report • Makes recommendations to our Board as to changes in Ormat’s general compensation philosophy • Monitors Ormat’s compliance with SEC and NYSE rules and regulations regarding “say-on-pay” and binding stockholder approval of certain executive compensation |

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 22

| NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | ||

INDEPENDENCE/ QUALIFICATIONS: • All members are “independent” under applicable standards.

| KEY RESPONSIBILITIES: • Develops criteria and qualifications for Board membership • Identifies and approves individuals who meet Board membership criteria and are qualified to serve as members of our Board • Recommends director nominees for our annual meetings of stockholders • Recommends Board members for committee service • Develops and recommends to our Board corporate governance guidelines • Reviews the adequacy of our certificate of incorporation and bylaws • Reviews and monitors compliance with our Corporate Governance Guidelines • Oversees the evaluation of the Board and management • Makes independence determinations and periodically reviews independence standards | |

| INVESTMENT COMMITTEE | ||

INDEPENDENCE/ QUALIFICATIONS: • All members are “independent” under NYSE standards applicable to general Board service.

| KEY RESPONSIBILITIES: • Reviews and approves the investment policy adopted by our Board (the “Investment Policy”), which outlines general guidelines for investment, including the type and amount, the desired time period, and the authority to and procedures for making the investment • Considers and, as applicable, approves and authorizes hedging transactions we may enter into to hedge our exposure to certain risks and currencies in accordance with the Investment Policy • Makes recommendations and determinations as to the investment of our cash and cash-equivalents in accordance with the Investment Policy • Meets on an as-needed basis as instructed by our Board |

During 2022, (i) the Board met 12 times, (ii) the Audit Committee met six times, (iii) the Nominating and Corporate Governance Committee met three times, (iv) the Compensation Committee met seven times and (v) the Investment Committee met one time. The Board established the ESG Committee in 2023, so it did not meet during 2022. For information on our Board’s attendance record, see “–Expectations for Members of our Board—Attendance at Board and Committee Meetings.”

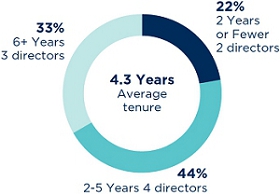

As part of its commitment to board refreshment, in 2023, the Nominating and Corporate Governance Committee recommended, and the Board approved, a 15-year term limit policy. Under this policy, directors will not be nominated for re-election to the Board if they have served on the Board for more than 15 years at the time of such proposed nomination. On the recommendation of the Nominating and Corporate Governance Committee, the Board, by majority vote and on an annual basis, may waive the term limit if the Board deems such waiver to be in the best interests of the Company. This does not impact the terms of the governance agreement with ORIX. We believe that maintaining an appropriate balance of tenure on the Board allows us to benefit from both the historical and institutional knowledge of longer-tenured directors as well as the additional, fresh perspectives contributed by newer directors.

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 23

On May 4, 2017, the Company entered into a governance agreement with ORIX (the “Governance Agreement”) in connection with an agreement between ORIX, certain former stockholders of the Company, Isaac Angel, the Company’s current Chairman of the Board and former CEO, and Doron Blachar, the Company’s CEO, pursuant to which ORIX agreed to purchase approximately 22.1% of our shares of common stock, par value $0.001 per share (“Common Stock”), for approximately $627 million (the “ORIX Transaction”). The Governance Agreement, which became effective on July 26, 2017 upon the closing of the ORIX Transaction, provides ORIX the right, for as long as ORIX and its affiliates collectively hold at least 18% of the voting power of all of the Company’s outstanding voting securities, to nominate three directors to our Board and jointly propose and nominate with the Company a director who is independent in accordance with the listing standards of the NYSE and SEC rules and regulations and who does not have, and within the three years prior to his or her becoming a director nominee of the Company has not had, any material relationship with ORIX or its affiliates (the “Independent ORIX Director”). If ORIX and its affiliates collectively hold less than 18% of the voting power of all of the Company’s outstanding voting securities but greater than or equal to 13% of the voting power of all of the Company’s outstanding voting securities, ORIX has the right to nominate two directors to our Board and jointly propose and nominate with the Company the Independent ORIX Director. If ORIX and its affiliates collectively hold less than 13% of the voting power of all of the Company’s outstanding voting securities but greater than or equal to 5% of the voting power of all of the Company’s outstanding voting securities, ORIX will have the right to nominate one director to our Board, but will no longer have the right to jointly propose and nominate with the Company the Independent ORIX Director. If ORIX holds less than 5% of the voting power of all of the Company’s outstanding voting securities, ORIX does not have the right to nominate any directors to our Board. Additionally, (i) the Compensation Committee, Nominating and Corporate Governance Committee and all other Board committees (other than the Audit Committee) must consist of two directors designated by the members of our Board that were not designated by ORIX and one director designated by ORIX and (ii) the Audit Committee must consist of two directors designated by the members of our Board that were not designated by ORIX and the Independent ORIX Director.

On April 13, 2020, the Company and ORIX entered into an amendment (the “Amendment”) to the Governance Agreement that facilitated the expansion of the Board of Directors in order to allow the addition of Mr. Angel as a director prior to his retirement as CEO of the Company on July 1, 2020. See “Transactions with Related Persons” below for further information concerning the ORIX Transaction, the Governance Agreement and the Amendment.

In November 2022, ORIX sold 4,312,500 shares pursuant to an underwritten secondary offering, resulting in it and its affiliates collectively owning 11.9% of the voting power of our outstanding voting securities. ORIX now has the right to nominate one director to our Board, but no longer has the right to jointly propose and nominate with the Company the Independent ORIX Director. Pursuant to the Governance Agreement, ORIX was required to use its reasonable best efforts to cause two of the directors nominated by it to tender their resignations, unless a majority of the directors other than the directors appointed by ORIX agreed in writing that such directors were not required to resign. A majority of the members of our Board agreed that none of the directors nominated by ORIX were required to resign following the offering and that such directors could continue to serve on our Board at least until the Annual Meeting.

Currently, ORIX has proposed the nomination of one director, Mr. Nikkel. Based on the recommendation of the Nominating and Corporate Governance Committee, our Board has determined to nominate for reelection at the Annual Meeting Ms. Corfee, who previously was nominated by ORIX as its Independent ORIX Director, and Mr. Takahashi, who was previously nominated by ORIX as one of its director nominees. Additionally, to reflect ORIX’s continued right to appoint one member of the Compensation Committee, Nominating and Corporate Governance Committee and Investment Committee, the Board has, upon the recommendation of the Nominating and Corporate Governance Committee determined to change the composition of certain of these committees following the Annual Meeting, assuming the election of all director nominees (specifically, with Mr. Nikkel to serve on the Compensation Committee and Investment Committee, and ORIX declining to use its right to appoint Mr. Nikkel to the Nominating and Corporate Governance Committee). For more information, see the second table under “Board Committees” above.

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 24

The NYSE listing standards require a majority of our directors and each member of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee to be independent. Under our Corporate Governance Guidelines and the NYSE rules, a director is not independent unless the Board affirmatively determines that he or she does not have a direct or indirect material relationship with the Company or any of its subsidiaries. The Board’s policy is to review and determine the independence of all incumbent directors annually, and to review and determine the independence of new director nominees and appointees when nominated or appointed.

The Board has established guidelines of director independence to assist it in making independence determinations, which conform to the independence requirements in the NYSE listing standards. In addition to applying these guidelines, which are set forth in our Corporate Governance Guidelines, the Board will consider all relevant facts and circumstances in making an independence determination. In the event a director has a relationship with the Company that is relevant to his or her independence and is not addressed by the independence guidelines, the Board will determine in its judgment whether such relationship is material.

The Nominating and Corporate Governance Committee undertook its annual review of director independence and made a recommendation to our Board regarding director independence. As a result of this review, our Board affirmatively determined that all of the current directors and directors serving during Fiscal 2022, other than Mr. Angel, are independent under the guidelines for director independence set forth in the Corporate Governance Guidelines and for purposes of applicable NYSE standards, including with respect to committee service. Our Board has also affirmatively determined that (i) each current member, each member who served during Fiscal 2022 and each nominee who will serve on our Audit Committee, assuming his or her election, is “independent” for purposes of audit committee membership under the applicable SEC rules and NYSE listing standards, and (ii) each current member, each member who served during Fiscal 2022 and each nominee who will serve on our Compensation Committee, assuming his or her election, is “independent” for purposes of compensation committee membership under the applicable SEC rules and NYSE listing standards.

Assessment of Board Composition

The Nominating and Corporate Governance Committee considers the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise.

|  | Candidate Identification

In the event that vacancies are anticipated, or otherwise arise, the Nominating and Corporate Governance Committee considers potential director candidates. Where stockholders nominate directors pursuant to our bylaws, the Nominating and Corporate Governance Committee also considers the qualifications of these directors.

|  | Candidate Evaluation

The Nominating and Corporate Governance Committee interviews and evaluates potential director candidates to determine their qualifications to serve on our Board as well as their compatibility with the culture of the Company, its philosophy and its Board and management.

|  | Recommendation to the Board

The Nominating and Corporate Governance Committee recommends director candidates to be presented to stockholders for election or, in the event of a vacancy, be appointed and subsequently presented to stockholders for election.

|

Candidates may come to the attention of the Nominating and Corporate Governance Committee through current Board members, management, stockholders or other persons. The Nominating and Corporate Governance Committee may also utilize the services of professional search firms to identify and recruit qualified candidates for the Board.

Director candidates identified by stockholders will be evaluated in the same manner in which the Nominating and Corporate Governance Committee evaluates any other director candidates, as described below.

ORMAT TECHNOLOGIES, INC. | 2023 PROXY STATEMENT 25

All recommendations for nomination received by the Corporate Secretary that satisfy our bylaw requirements relating to such director nominations will be presented to the Board for its consideration. Stockholders must, in particular, satisfy the notification, timeliness, consent and information requirements set forth in our bylaws. These requirements are also described under the section entitled “Stockholder Proposals for the 2024 Annual Meeting of Stockholders.”

The Nominating and Corporate Governance Committee is responsible for conducting appropriate inquiries into the backgrounds and qualifications of potential director candidates and their suitability for service on our Board. In evaluating each candidate, the Nominating and Corporate Governance Committee considers guidelines it has developed that set forth the criteria and qualifications for Board membership, including, but not limited to, relevant knowledge and individual qualifications (including professional experience, understanding of the Company’s business environment, and diversity of background and experience), personal qualities of leadership (including strength of character, wisdom, judgment, ability to make independent analytical inquiries, and the ability to work collegially with others), potential conflicts of interest, existing commitments to other businesses, and legal considerations such as antitrust issues, independence under applicable SEC rules and regulations and the NYSE listing standards, and overall fit with the composition and expertise of the existing Board.

In addition, the Nominating and Corporate Governance Committee seeks to achieve diversity within the Board and adheres to the Company’s philosophy of maintaining an environment free from discrimination based on race, color, religion, sex, sexual orientation, gender identity, age, national origin, disability, veteran status or any protected category under applicable law. This process is designed to provide that the Board includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to the business of the Company. Accordingly, in determining the pool from which Board nominees are chosen, the Nominating and Corporate Governance Committee is committed to seeking out highly qualified women and minority candidates, as well as candidates with diverse backgrounds, and experiences with the relevant mix of skills and other qualifying criteria as described above. For more information regarding the backgrounds and qualifications of our director nominees, see “Our Board’s Skills, Experience and Backgrounds” below.