As filed with the Securities and Exchange Commission on September 10, 2004

Registration No. 333-117218

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

FORM S-4

REGISTRATION STATEMENT

Under

The Securities Act of 1933

Global Cash Access, Inc.

Global Cash Access Finance Corporation

(Exact names of registrants as specified in their charters)

| | |

Global Cash Access, Inc. Delaware | | Global Cash Access Finance Corporation Delaware |

| (State or Other Jurisdiction of Incorporation or Organization) | | (State or Other Jurisdiction of Incorporation or Organization) |

| |

| 94-3309549 | | 20-0723255 |

| (I.R.S. Employer Identification No.) | | (I.R.S. Employer Identification No.) |

| |

| 6199 | | 9995 |

| (Primary Standard Industrial Classification Code Number) | | (Primary Standard Industrial Classification Code Number) |

The following subsidiaries of Global Cash Access, Inc. are guarantors of the 8 3/4% Senior Subordinated Notes due 2012 and are co-registrants:

| | | | | | |

Name of Additional Registrant

| | State of Incorporation or Organization

| | I.R.S. Employer Identification Number

| | Primary Standard Industrial

Classification Code Number

|

| CCI Acquisition, LLC | | Delaware | | 94-3309549 | | 9995 |

| Central Credit, LLC | | Delaware | | 88-0431550 | | 7320 |

3525 East Post Road, Suite 120

Las Vegas, Nevada 89120

(800) 833-7110

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Kirk Sanford

Chief Executive Officer

Global Cash Access, Inc.

3525 East Post Road, Suite 120

Las Vegas, Nevada 89120

(702) 855-3006

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Paul “Chip” L. Lion III

Timothy J. Harris

Morrison & Foerster LLP

755 Page Mill Road

Palo Alto, California 94304-1018

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨ ____________

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨ ___________

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities or consummate the exchange offer until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell or exchange these securities and it is not soliciting an offer to acquire or exchange these securities in any jurisdiction where the offer, sale or exchange is not permitted.

SUBJECT TO COMPLETION, DATED �� , 2004

PROSPECTUS

$235,000,000

Offer to Exchange

8 3/4% Senior Subordinated Notes Due 2012,

Which Have Been Registered Under the Securities Act of 1933,

for any and all Outstanding 8 3/4% Senior Subordinated Notes Due 2012

The Exchange Notes

We are offering to exchange $235 million aggregate principal amount of our 8 3/4% senior subordinated notes due 2012 that we have registered under the Securities Act, or the exchange notes, for any and all outstanding 8 3/4% senior subordinated notes due 2012 that we issued on March 10, 2004, or the old notes. The terms of the exchange notes will be identical to the material terms of our old notes, except for the elimination of some transfer restrictions, registration rights and certain liquidated damage provisions relating to the registration rights of the holders of the old notes.

The exchange notes will mature on March 15, 2012. Interest on the exchange notes will accrue at 8 3/4% per year, and the interest will be payable semi-annually in arrears on March 15 and September 15, beginning September 15, 2004. The exchange notes will be subject to full and unconditional guarantees on a senior subordinated basis by all of our existing and future domestic wholly-owned subsidiaries other than Global Cash Access Finance Corporation. The exchange notes will not be senior to any of our current obligations and will be subordinate to up to $276,750,000 of indebtedness under our senior secured credit facilities. We may redeem the exchange notes at any time on or after March 15, 2008. In addition, at any time prior to March 15, 2008, we may redeem up to 35% of the exchange notes with the net proceeds of one or more public equity offerings.

If we undergo a change of control or sell certain of our assets, we may be required to offer to purchase exchange notes from holders. The exchange notes and the guarantees will be our general unsecured senior subordinated obligations. Accordingly, they will rank:

| | • | | behind all of our and the guarantors’ existing and future senior debt, whether or not secured; as of June 30, 2004, we and the guarantors had $256.8 million of senior debt (excluding four letters of credit for a total of $3.4 million), all of which was secured; |

| | • | | effectively behind the liabilities of those of our subsidiaries that are not guaranteeing the exchange notes by virtue of the fact that such subsidiaries may pay their liabilities without regard to the exchange notes; |

| | • | | effectively behind all of our and the guarantors’ existing and future secured debt by virtue of the fact that the secured creditors may seek recourse to collateral without regard to the exchange notes; |

| | • | | equally with all of our and the guarantors’ existing and future unsecured senior subordinated obligations that do not expressly provide that they are subordinated to the exchange notes; and |

| | • | | ahead of any of our and the guarantors’ future debt that expressly provides that it is subordinated to the exchange notes. |

Material Terms of The Exchange Offer

The exchange offer expires at 5:00 p.m., New York City time, on , 2004, unless extended. We do not currently intend to extend the expiration date.

Our completion of the exchange offer is subject to customary conditions which we may waive. Any such waiver will apply evenly to all holders of old notes.

Upon our completion of the exchange offer, all old notes that are validly tendered and not withdrawn will be exchanged for an equal principal amount of exchange notes that are registered under the Securities Act. Tenders of old notes may be withdrawn at any time prior to the expiration of the exchange offer.

The exchange of the exchange notes for old notes pursuant to the exchange offer will not be a taxable exchange for U.S. Federal income tax purposes.

We will not receive any proceeds from the exchange offer.

Resales of Exchange Notes

The exchange notes may be sold in the over-the-counter market, in negotiated transactions or through a combination of such methods. There has been no public market for the old notes and we cannot assure you that any public market for the exchange notes will develop. We do not intend to list the exchange notes on any national securities exchange or any automated quotation system. As a result, holders of exchange notes may have difficulty selling the exchange notes.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for old notes where such old notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 180 days after the expiration of the exchange offer or until any broker-dealer has sold all exchange notes held by it, we will make this prospectus available to such broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

Please see “Risk Factors” beginning on page 12 of this prospectus for a discussion of certain factors that you should consider before participating in this exchange offer.

Neither the Securities and Exchange Commission, any gaming authority, any state securities commission nor any other regulatory agency has approved or disapproved of the notes offered hereby or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2004

TABLE OF CONTENTS

NOTICE TO NEW HAMPSHIRE RESIDENTS

Neither the fact that a registration statement or an application for a license has been filed with the State of New Hampshire nor the fact that a security is effectively registered or a person is licensed in the State of New Hampshire constitutes a finding by the Secretary of State of New Hampshire that any document filed under RSA 421-B is true, complete and not misleading. Neither any such fact nor the fact that an exemption or exception is available for a security or a transaction means that the Secretary of State of New Hampshire has passed in any way upon the merits or qualifications of, or recommended or given approval to, any person, security or transaction. It is unlawful to make, or cause to be made, to any prospective investor, customer or client any representation inconsistent with the provisions of this paragraph.

i

PROSPECTUS SUMMARY

This summary contains basic information about us and this offering and is qualified in its entirety by the more detailed information and financial statements and related notes appearing elsewhere in this prospectus. This summary does not contain all of the information that is important to you. We urge you to carefully read and review the entire prospectus, including the Risk Factors and our financial statements and related notes before you decide whether or not to participate in the exchange offer.

The Company

We are a provider of cash access products and services to the gaming industry in the United States, Canada, the Caribbean and the United Kingdom. We provide a suite of cash access products and services to the gaming industry. Our cash access products and services allow gaming patrons to access funds through a variety of methods, including credit card cash advances, point-of-sale, or POS, debit card transactions, automated teller machine, or ATM, withdrawals, check cashing transactions and money transfers. We also own a gaming patron credit bureau database, which is used in the industry as a resource for underwriting patron credit decisions, or markers. In 2003, we processed over 60 million transactions, representing approximately $12 billion in face value. For the year ended December 31, 2003, we generated $356.4 million in revenues, $63.8 million in operating income and $58.4 million in net income.

We provide our cash access services to patrons at approximately 920 gaming establishments. We have contracts with eight of the top ten gaming operators in the United States, including Harrah’s Entertainment, Inc., Caesars Entertainment, Inc., Mandalay Resort Group, Boyd Gaming Corporation, Foxwoods Resort Casino, Mohegan Tribal Gaming Authority, Trump Hotels & Casino Resorts, Inc. and Penn National Gaming, Inc., and three of the top four gaming operators in the United Kingdom. Our contracts are generally exclusive for terms ranging from three to five years.

We generate revenues by charging patrons and gaming establishments service fees for the use of our cash access services. We typically share a portion of our service fees with gaming establishments in the form of commissions.

Global Cash Access, Inc.’s principal executive offices are located at 3525 East Post Road, Suite 120, Las Vegas, Nevada 89120. Our telephone number is (800) 833-7110. Our web site address is www.globalcashaccess.com. The information on our web site is not deemed to be part of this prospectus.

You should rely only on the information contained in this prospectus. We have not authorized any person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell or exchange these securities (1) in any jurisdiction where the offer, sale or exchange is not permitted, (2) where the person making the offer is not qualified to do so, or (3) to any person who cannot legally be offered the securities. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

You should not consider any information in this prospectus to be legal, business or tax advice. You should consult your own attorney, business advisor and tax advisor for legal, business and tax advice regarding an investment in the exchange notes.

This prospectus contains trademarks and service marks owned by us and our subsidiaries, such as ACM®, Global Cash Access®, QuikPlay®, and QuikCash®, and also contains trademarks and service marks owned by third parties.

1

The Private Equity Restructuring

The transactions summarized below, pursuant to which we and GCA Holdings, L.L.C. were converted into Delaware corporations, and pursuant to which GCA Holdings, Inc. became 55% owned by a number of private equity investors (who obtained, in the aggregate, only 49.96% of the voting interests), approximately 40% owned by M&C International and approximately 5% owned by Bank of America Corporation, occurred subsequent to the recapitalization and prior to the date of this prospectus. We refer to these transactions in this prospectus as the private equity restructuring. While an understanding of the transactions summarized below is important to your understanding of our corporate structure, future cost structure, results of operations, financial position and cash flows, we do not believe that the transactions described below directly impact either the exchange offer or your decision as to whether or not to participate in the exchange offer.

Our parent company, formerly known as GCA Holdings, L.L.C., entered into a Securities Purchase and Exchange Agreement, dated April 21, 2004, as amended on May 13, 2004, with certain entities affiliated with Summit Partners, L.P., certain entities affiliated with Tudor Investment Corporation, certain entities directly or indirectly administered or managed by HarbourVest Partners, LLC and certain entities directly or indirectly administered or managed by General Motors Investment Management Corporation or JPMorgan Chase Bank. We refer to these entities in this prospectus as the private equity investors. Pursuant to the private equity restructuring, (i) GCA Holdings, L.L.C. agreed to exchange with M&C International its Common Units in GCA Holdings, L.L.C. for Class A Common Units, Class A Preferred Units and Class B Preferred Units in GCA Holdings, L.L.C., (ii) GCA Holdings, L.L.C. agreed to exchange with Bank of America Corporation its Common Units in GCA Holdings, L.L.C. for Class A Common Units and Class B Common Units in Holdings, (iii) M&C International agreed to sell to the private equity investors 244.000 Class A Preferred Units and 58.5 Class B Preferred Units (which constituted all of the Class A Preferred Units and Class B Preferred Units acquired by M&C International in connection with the exchange described in clause (i) above) for an aggregate purchase price of $316,400,000, (iv) GCA Holdings, L.L.C. agreed to convert from a limited liability company to a corporation organized under the laws of Delaware and named GCA Holdings, Inc., (v) GCA Holdings, L.L.C. agreed to cause GCA to be converted from a limited liability company to a corporation organized under the laws of Delaware named Global Cash Access, Inc., and (vi) in connection with the conversion of GCA Holdings, L.L.C., all outstanding Class A Common Units, Class B Common Units, Class A Preferred Units and Class B Preferred Units in GCA Holdings, L.L.C. were automatically converted into shares of Class A Common Stock, Class B Common Stock, Class A Preferred Stock and Class B Preferred Stock of GCA Holdings, Inc. respectively.

The sale of equity interests to the private equity investors was consummated on May 13, 2004, the conversion of GCA Holdings, L.L.C. to a Delaware corporation was consummated on May 14, 2004, and the conversion of GCA to a Delaware corporation was consummated on June 7, 2004. Upon the consummation of the private equity restructuring, we became a Delaware corporation and wholly-owned subsidiary of GCA Holdings, Inc., and GCA Holdings, Inc. became 55% owned by the private equity investors (who obtained, in the aggregate, only 49.96% of the voting interests), approximately 40% owned by M&C International and approximately 5% owned by Bank of America Corporation. See “The Private Equity Restructuring” for more details of these transactions.

We did not receive any of the proceeds of the investments in the private equity restructuring, but we became obligated to pay costs and expenses associated with the private equity restructuring in the aggregate amount of approximately $1.5 million. These transactions are referred to herein as the private equity restructuring.

2

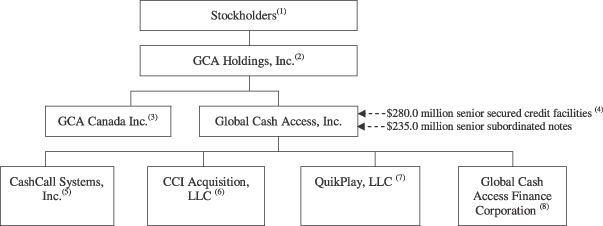

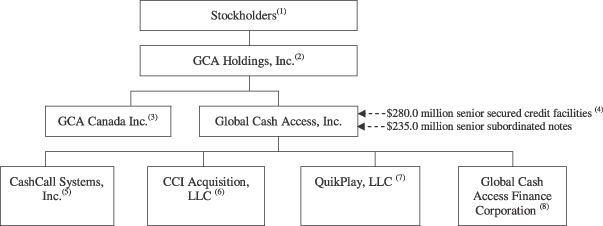

Corporate Structure Following the Private Equity Restructuring

The chart below illustrates our corporate structure upon completion of the private equity restructuring.

| (1) | | After the private equity restructuring, GCA Holdings, Inc. became 55% owned by the private equity investors (who obtained, in the aggregate, only 49.96% of the voting interests), approximately 40% owned by M&C International and approximately 5% owned by Bank of America Corporation. |

| (2) | | After the private equity restructuring, GCA Holdings, Inc. directly owned 100% of the outstanding capital stock of GCA and pledged such membership interests to the lenders under GCA’s senior secured credit facilities. GCA Holdings, Inc. is also a guarantor under the senior secured credit facilities. |

| (3) | | GCA Canada Inc. is a wholly-owned Canadian subsidiary of GCA Holdings, Inc. GCA Canada Inc. has no operations and is not a guarantor under either the senior secured credit facilities or the old notes and will not guarantee the exchange notes. |

| (4) | | The senior secured credit facilities consist of a $20.0 million revolving credit facility and a $260.0 million term loan. |

| (5) | | CashCall Systems, Inc. is a wholly-owned Canadian subsidiary. CashCall Systems, Inc. is not a guarantor under either the senior secured credit facilities or the old notes and will not guarantee the exchange notes. |

| (6) | | CCI Acquisition, LLC owns Central Credit, LLC. CCI Acquisition, LLC and Central Credit, LLC have guaranteed the senior secured credit facilities and the old notes and will guarantee the exchange notes. |

| (7) | | QuikPlay, LLC is a joint venture that is owned 60% by GCA and 40% by International Game Technology. QuikPlay, LLC is not a guarantor under the senior secured credit facilities or the old notes and will not guarantee the exchange notes. |

| (8) | | Global Cash Access Finance Corporation is a co-issuer of the old notes and will be a co-issuer of the exchange notes and has guaranteed all amounts outstanding under the senior secured credit facilities. |

3

Summary of the Exchange Offer

The Exchange Offer | We are offering to exchange an aggregate of $235 million principal amount of our exchange notes for $235 million of our old notes. Old notes may be exchanged in integral multiples of $1,000 principal amount. To be exchanged, an old note must be properly tendered and accepted. All outstanding old notes that are validly tendered and not validly withdrawn will be exchanged for exchange notes issued on or promptly after the expiration date of the exchange offer. Currently, there is $235 million aggregate principal amount of old notes outstanding and no exchange notes outstanding. |

| | The form and terms of the exchange notes will be identical to the material terms of the old notes except that the exchange notes will have been registered under the Securities Act. Therefore, the exchange notes will not be subject to certain contractual transfer restrictions, registration rights and certain liquidated damage provisions applicable to the old notes prior to consummation of the exchange offer. |

| | The obligations under the exchange notes will be subject to the full and unconditional guarantees on a senior subordinated basis of all of our existing and future domestic wholly-owned subsidiaries other than Global Cash Access Finance Corporation. |

Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time on , 2004, unless extended, in which case the term “expiration date” shall mean the latest date and time to which the exchange offer is extended. |

Withdrawal | You may withdraw the tender of your old notes at any time prior to the expiration date of the exchange offer. See “The Exchange Offer—Withdrawal Rights.” |

Conditions to the Exchange Offer | The exchange offer is subject to customary conditions which we may waive. The exchange offer is not conditioned upon any minimum principal amount of old notes being tendered for exchange. See “The Exchange Offer—Conditions to the Exchange Offer.” |

Procedures for Tendering Old Notes | If you are a holder of old notes who wishes to accept the exchange offer, you must: |

| | • | | properly complete, sign and date the accompanying letter of transmittal (including any documents required by the letter of transmittal), or a facsimile of the letter of transmittal, according to the instructions contained in this prospectus and the letter of transmittal, and mail or otherwise deliver the letter of transmittal, together with your old notes, to the exchange agent at the address set forth under “The Exchange Offer—Exchange Agent;” or |

| | • | | arrange for The Depository Trust Company to transmit certain required information, including an agent’s message forming part of |

4

| | a book-entry transfer in which you agree to be bound by the terms of the letter of transmittal, to the exchange agent in connection with a book-entry transfer. |

By tendering your old notes in either manner, you will be representing, among other things, that:

| | • | | you are acquiring the exchange notes issued to you in the exchange offer in the ordinary course of your business; |

| | • | | you are not engaged in, and do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes issued to you in the exchange offer; and |

| | • | | you are not an “affiliate” of ours within the meaning of Rule 144 under the Securities Act. |

See “The Exchange Offer—Procedures for Tendering Old Notes.”

Special Procedures for Beneficial Owners | If you beneficially own old notes registered in the name of a broker, dealer, commercial bank, trust company or other nominee and wish to tender your beneficially owned old notes in the exchange offer, you should contact the registered holder promptly and instruct it to tender the old notes on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your outstanding notes, either make appropriate arrangements to register ownership of the outstanding notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the expiration date. See “The Exchange Offer—Procedures for Tendering Old Notes.” |

Guaranteed Delivery Procedures | If you wish to tender your old notes, but: |

| | • | | your old notes are not immediately available; or |

| | • | | you cannot deliver your old notes, the letter of transmittal or any other documents required by the letter of transmittal to the exchange agent prior to the expiration date; or |

| | • | | the procedures for book-entry transfer of your old notes cannot be completed prior to the expiration date, |

you may tender your old notes pursuant to the guaranteed delivery procedures set forth in this prospectus and the letter of transmittal. See “The Exchange Offer—Guaranteed Delivery Procedures.”

Acceptance of Old Notes for Exchange and Delivery of Exchange Notes | Upon effectiveness of the registration statement of which this prospectus is a part and commencement of the exchange offer, we will accept any and all old notes that are properly tendered in the exchange offer prior to 5:00 p.m., New York City time, on the expiration date. The exchange notes issued pursuant to the exchange |

5

| | offer will be delivered promptly following the expiration date. See “The Exchange Offer—Acceptance of Old Notes For Exchange and Delivery of Exchange Notes.” |

Material Federal Income Tax Considerations | The exchange of exchange notes for old notes in the exchange offer will not be a taxable exchange for U.S. federal income tax purposes. See “Material Federal Income Tax Considerations.” |

Use of Proceeds | We will not receive any proceeds from the issuance of exchange notes pursuant to the exchange offer. |

Fees and Expenses | We will pay all expenses incident to the consummation of the exchange offer and compliance with the registration rights agreement. We will also pay certain transfer taxes applicable to the exchange offer. See “The Exchange Offer—Fees and Expenses.” |

Termination of Certain Rights | The old notes were issued and sold in a private offering to Banc of America Securities LLC as the initial purchaser, on March 10, 2004. In connection with that sale, we executed and delivered a registration rights agreement for the benefit of the noteholders. |

Pursuant to the registration rights agreement, holders of old notes: (i) have rights to receive liquidated damages in certain instances; and (ii) have certain rights intended for the holders of unregistered securities. Holders of exchange notes will not be, and upon consummation of the exchange offer, holders of old notes will no longer be, entitled to the right to receive liquidated damages in certain instances, as well as certain other rights under the registration rights agreement for holders of unregistered securities. See “The Exchange Offer.”

Resale of Exchange Notes | We believe, based on an interpretation by the staff of the SEC contained in no-action letters issued to third parties in other transactions, that you may offer to sell, sell or otherwise transfer the exchange notes issued to you in this exchange offer without complying with the registration and prospectus delivery requirements of the Securities Act, provided that: |

| | • | | you are acquiring the exchange notes issued to you in the exchange offer in the ordinary course of your business; |

| | • | | you are not engaged in, and do not intend to engage in, and have no arrangement or understanding with any person to participate in, a distribution of the exchange notes issued to you in the exchange offer; and |

| | • | | you are not an “affiliate” of ours within the meaning of Rule 144 under the Securities Act. |

If you are a broker-dealer and you receive exchange notes for your own account in exchange for old notes that you acquired for your own account as a result of market-making activities or other trading activities, you must acknowledge that you will deliver a prospectus if you decide to resell your exchange notes. See “Plan of Distribution.”

6

Consequences of Failure to Exchange | If you do not tender your old notes or if you tender your old notes improperly, you will continue to be subject to the restrictions on transfer of your old notes as contained in the legend on the old notes. In general, you may not sell or offer to sell the old notes, except pursuant to a registration statement under the Securities Act or any exemption from registration thereunder and in compliance with all applicable state securities laws. See “The Exchange Offer—Consequences of Failure to Exchange.” |

Exchange Agent | The Bank of New York, the trustee under the indenture, is the exchange agent for the exchange offer. |

7

Summary of the Exchange Notes

The form and terms of the exchange notes will be substantially identical to those of the old notes except that the exchange notes will have been registered under the Securities Act. Therefore, the exchange notes will not be subject to certain transfer restrictions, registration rights and certain liquidated damage provisions applicable to the old notes prior to the consummation of the exchange offer.

Issuers | Global Cash Access, Inc. and Global Cash Access Finance Corporation. |

Securities | $235.0 million in aggregate principal amount of exchange notes. |

Interest | Annual Rate: 8 3/4%. |

Payment Frequency: every six months on March 15 and September 15. First Payment: September 15, 2004.

Guarantees | The exchange notes will be fully and unconditionally guaranteed on a senior subordinated basis by all of our domestic wholly-owned subsidiaries other than Global Cash Access Finance Corporation. |

Ranking | The exchange notes and the guarantees will be unsecured senior subordinated obligations. Accordingly, they will rank: |

| | • | | behind all of our and the guarantors’ existing and future senior debt, whether or not secured; |

| | • | | equally with all of our and the guarantors’ existing and future unsecured senior subordinated obligations that do not expressly provide that they are subordinated to the exchange notes; and |

| | • | | ahead of any of our and the guarantors’ future debt that expressly provides that it is subordinated to the exchange notes. |

As of June 30, 2004, after the completion of the offering of the old notes and the application of the net proceeds therefrom, we and the guarantors had $256.8 million of senior debt (excluding 4 letters of credit for a total of $3.4 million), all of which would have been secured. In addition, approximately $16.6 million would have been available to borrow under our senior secured credit facilities. In addition, our non-guarantor subsidiaries had $0.6 million of intercompany and related party liabilities.

Use of Proceeds | We will not receive any cash proceeds from the issuance of the exchange notes. |

Optional Redemption | On or after March 15, 2008, we may redeem some or all of the exchange notes at any time at the redemption prices listed under “Description of Exchange Notes—Optional Redemption,” plus accrued interest. At any time prior to March 15, 2008, we may |

8

| | redeem some or all of the exchange notes at any time at a price equal to 100% of their outstanding principal amount plus the make-whole premium described under “Description of Exchange Notes—Optional Redemption.” |

At any time before March 15, 2007, we may redeem up to 35% of the exchange notes with the proceeds from certain equity offerings at the redemption price listed under “Description of Exchange Notes—Optional Redemption.”

Special Redemption | The exchange notes are subject to redemption requirements imposed by gaming laws and regulations of gaming authorities in jurisdictions in which we conduct gaming operations. See “Description of Exchange Notes—Special Redemption.” |

Change of Control | If we experience certain types of change of control, we must offer to repurchase the exchange notes at 101% of the aggregate principal amount of the exchange notes repurchased plus accrued and unpaid interest. |

Certain Covenants | The indenture governing the exchange notes, among other things, restricts our and our subsidiaries’ ability to: |

| | • | | make distributions on, redeem or repurchase membership interests; |

| | • | | make specified types of investments; |

| | • | | apply net proceeds from certain asset sales; |

| | • | | engage in transactions with our affiliates; |

| | • | | restrict dividends or other payments from subsidiaries; |

| | • | | sell preferred equity interests of subsidiaries; and |

| | • | | sell, assign, transfer, lease, convey or dispose of assets. |

These covenants are subject to a number of important exceptions, limitations and qualifications that are described under “Description of Exchange Notes—Certain Covenants.”

Trustee and Paying Agent | The Bank of New York. |

You should carefully consider all of the information contained in this prospectus, including the discussion in the section entitled “Risk Factors,” for an explanation of certain risks of participating in the exchange offer.

9

Summary Consolidated Financial Data

The following summary consolidated financial data should be read in conjunction with our audited consolidated financial statements and related notes and our unaudited condensed consolidated financial statements and related notes appearing elsewhere in this prospectus. The summary consolidated financial data for the fiscal years ended December 31, 2003, 2002, 2001, 2000 and 1999 have been derived from our audited consolidated financial statements. The unaudited summary condensed consolidated financial data for the six months ended June 30, 2004 and 2003 has been derived from our unaudited condensed consolidated financial statements. Our summary historical consolidated financial data may not be indicative of our future financial condition or results of operations. See “Consolidated Financial Statements” and “Unaudited Condensed Consolidated Financial Statements.” The pro forma income tax amounts below are unaudited and have been calculated to reflect the taxes that would have been reported had we been subject to federal and state income taxes as a C Corporation during the periods presented.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Years Ended December 31,

| | | For the Six Months

Ended June 30,

| |

| | | 2003

| | | 2002

| | | 2001 (1)

| | | 2000

| | | 1999

| | | 2004

| | | 2003

| |

| | | (dollars in thousands) | |

Income Statement Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Revenues: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash advance | | $ | 186,547 | | | $ | 182,754 | | | $ | 174,787 | | | $ | 170,792 | | | $ | 172,154 | | | $ | 100,806 | | | $ | 92,376 | |

ATM | | | 132,341 | | | | 119,424 | | | | 110,074 | | | | 33,611 | | | | 12,847 | | | | 77,382 | | | | 62,660 | |

Check cashing | | | 26,326 | | | | 29,412 | | | | 26,614 | | | | 26,997 | | | | 23,761 | | | | 11,520 | | | | 14,211 | |

Central Credit and other | | | 11,176 | | | | 10,825 | | | | 10,758 | | | | 10,537 | | | | 3,546 | | | | 5,928 | | | | 5,494 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total revenues | | | 356,390 | | | | 342,415 | | | | 322,233 | | | | 241,937 | | | | 212,308 | | | | 195,636 | | | | 174,741 | |

Costs and Expenses: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Commissions | | | 154,889 | | | | 146,824 | | | | 140,640 | | | | 87,409 | | | | 74,868 | | | | 88,433 | | | | 74,320 | |

Interchange and processing | | | 67,245 | | | | 59,574 | | | | 54,251 | | | | 52,594 | | | | 56,469 | | | | 37,221 | | | | 34,146 | |

Check cashing warranties | | | 9,848 | | | | 9,827 | | | | 8,532 | | | | 7,582 | | | | 6,294 | | | | 5,129 | | | | 4,902 | |

Central Credit and other costs of revenues | | | 414 | | | | 511 | | | | 492 | | | | 620 | | | | 182 | | | | 155 | | | | 213 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Total costs and expenses | | | 232,396 | | | | 216,736 | | | | 203,915 | | | | 148,205 | | | | 137,813 | | | | 130,938 | | | | 113,581 | |

Gross profit | | | 123,994 | | | | 125,679 | | | | 118,318 | | | | 93,732 | | | | 74,495 | | | | 64,698 | | | | 61,160 | |

Operating expenses | | | (45,494 | ) | | | (55,527 | ) | | | (52,867 | ) | | | (38,243 | ) | | | (33,193 | ) | | | (24,872 | ) | | | (25,765 | ) |

Depreciation and amortization | | | (14,061 | ) | | | (11,820 | ) | | | (16,838 | ) | | | (11,084 | ) | | | (8,361 | ) | | | (6,813 | ) | | | (7,000 | ) |

Other operating expenses | | | (679 | ) | | | (2,566 | ) | | | (1,368 | ) | | | — | | | | — | | | | — | | | | (564 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Operating income | | | 63,760 | | | | 55,766 | | | | 47,245 | | | | 44,405 | | | | 32,941 | | | | 33,013 | | | | 27,831 | |

Interest expense, net (2) | | | (5,450 | ) | | | (4,933 | ) | | | (5,082 | ) | | | (1,177 | ) | | | 206 | | | | (12,652 | ) | | | (2,441 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income before income tax (provision) benefit and minority ownership loss | | | 58,310 | | | | 50,833 | | | | 42,163 | | | | 43,228 | | | | 33,147 | | | | 20,361 | | | | 25,390 | |

Income tax (provision) benefit | | | (321 | ) | | | (1,451 | ) | | | (442 | ) | | | (637 | ) | | | (1,133 | ) | | | 208,082 | | | | (233 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Income before minority ownership loss | | | 57,989 | | | | 49,382 | | | | 41,721 | | | | 42,591 | | | | 32,014 | | | | 228,443 | | | | 25,157 | |

Minority ownership loss (3) | | | 400 | | | | 1,040 | | | | 420 | | | | — | | | | — | | | | 122 | | | | 400 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net income | | $ | 58,389 | | | $ | 50,422 | | | $ | 42,141 | | | $ | 42,591 | | | $ | 32,014 | | | $ | 228,565 | | | $ | 25,557 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Pro forma computation related to conversion to C corporation for tax purposes | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income before provision for income taxes and minority ownership loss—historical | | $ | 58,310 | | | $ | 50,833 | | | $ | 42,163 | | | $ | 43,228 | | | $ | 33,147 | | | $ | 20,361 | | | $ | 25,390 | |

Income tax provision—historical, exclusive of one-time tax benefit (8) | | | (321 | ) | | | (1,451 | ) | | | (442 | ) | | | (637 | ) | | | (1,133 | ) | | | (2,542 | ) | | | (233 | ) |

Pro forma income tax provision (7) | | | (20,741 | ) | | | (16,940 | ) | | | (16,154 | ) | | | (17,951 | ) | | | (10,857 | ) | | | (4,788 | ) | | | (8,938 | ) |

Minority ownership loss—historical | | | 400 | | | | 1,040 | | | | 420 | | | | — | | | | — | | | | 122 | | | | 400 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Pro forma net income | | $ | 37,648 | | | $ | 33,482 | | | $ | 25,987 | | | $ | 24,640 | | | $ | 21,157 | | | $ | 13,153 | | | $ | 16,619 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| | | | | | | |

Other Financial Data: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash flows provided by (used in): | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Operating activities (4) | | $ | 33,508 | | | $ | 81,964 | | | $ | 73,610 | | | $ | 51,110 | | | $ | 65,061 | | | $ | 23,559 | | | $ | (10,459 | ) |

Investing activities | | | (7,047 | ) | | | (9,750 | ) | | | (6,295 | ) | | | (14,348 | ) | | | (4,288 | ) | | | (2,794 | ) | | | (5,916 | ) |

Financing activities (5) | | | (63,067 | ) | | | (52,333 | ) | | | (56,812 | ) | | | (45,475 | ) | | | (36,203 | ) | | | (30,457 | ) | | | (24,580 | ) |

Capital expenditures | | | 7,047 | | | | 9,750 | | | | 6,295 | | | | 14,348 | | | | 4,288 | | | | 2,794 | | | | 5,916 | |

Ratio of earnings to fixed charges (6) | | | 9.1 | x | | | 8.5 | x | | | 6.6 | x | | | 13.6 | x | | | 19.3 | x | | | 18.1 | x | | | 5.6 | x |

10

| | | | | | |

| | | December 31, 2003

| | June 30, 2004

|

| | | (dollars in thousands) |

Balance Sheet Data: | | | | | | |

Cash and cash equivalents | | $ | 23,423 | | $ | 13,536 |

Total assets | | | 239,257 | | | 443,218 |

Total borrowings | | | — | | | 491,750 |

| (1) | | The increase in revenues and operating expenses during fiscal 2001, as compared to fiscal 2000, is primarily attributable to our acquisitions of the gaming ATM portfolios of Bank of America, N.A. and InnoVentry Corporation. |

| (2) | | Interest expense, net, includes interest income. |

| (3) | | Minority ownership loss represents the portion of the loss from operations of QuikPlay, LLC that is attributable to the 40% ownership interest in QuikPlay, LLC that is not owned by us. |

| (4) | | Our cash flows from operating activities depend upon changes in settlement receivables and the timing of payments related to settlement liabilities. As such, our cash flows from operating activities can change substantially based upon the timing of our settlement liability payments. We calculate our net cash position as cash and cash equivalents plus settlement receivables less settlement liabilities. As a result, the following table reflects our relatively constant net cash position. |

| | | | | | | | | | | | | | | | |

| | | December 31,

| | | June 30, 2004

| |

| | | 2003

| | | 2002

| | | 2001

| | |

| | | (dollars in thousands) | |

Cash and cash equivalents | | $ | 23,423 | | | $ | 57,584 | | | $ | 37,500 | | | $ | 13,536 | |

Settlement receivables | | | 15,937 | | | | 20,828 | | | | 33,378 | | | | 13,844 | |

Settlement liabilities | | | (17,624 | ) | | | (56,962 | ) | | | (47,859 | ) | | | (3,444 | ) |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Net cash position | | $ | 21,736 | | | $ | 21,450 | | | $ | 23,019 | | | $ | 23,936 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| (5) | | Cash used in financing activities primarily reflect distributions to our owners for all periods presented, except for the six months ended June 30, 2004. In this period, in addition to distributions to our owners we also received proceeds from our credit facility and note offering that were utilized to redeem a portion of the membership interests of our owners. |

| (6) | | For purposes of calculating the ratio of earnings to fixed charges, (i) earnings is defined as income before minority ownership loss plus fixed charges, and (ii) fixed charges is defined as interest expense (including capitalized interest and amortization of debt issuance costs) and the estimated portion (1/3) of operating lease expense deemed by management to represent the interest component of rent expense. |

| (7) | | The pro forma unaudited income tax adjustments represent the tax effects that would have been reported had the Company been subject to U.S. federal and state income taxes as a corporation. Pro forma expenses are based upon the statutory income tax rates and adjustments to income for estimated permanent differences occurring during the period. Actual rates and expenses could have differed had the Company been subject to U.S. federal and state income taxes for all periods presented. Therefore, the unaudited pro forma amounts are for informational purposes only and are intended to be indicative of the results of operations had the Company been subject to U.S. federal and state income taxes for all periods presented. |

| | | The following table presents the computation of the pro forma income tax expense for all the periods presented (amounts in thousands): |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the Years Ended December 31,

| | | For the Six

Months Ended

June 30,

| |

| | | 2003

| | | 2002

| | | 2001

| | | 2000

| | | 1999

| | | 2004

| | | 2003

| |

Income before income taxes, as reported | | $ | 58,310 | | | $ | 50,833 | | | $ | 42,163 | | | $ | 43,228 | | | $ | 33,147 | | | $ | 20,361 | | | $ | 25,390 | |

Effective pro forma income tax rate | | | 36.12 | % | | | 36.18 | % | | | 39.36 | % | | | 43.00 | % | | | 36.17 | % | | | 36.00 | % | | | 36.12 | % |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

Pro forma income tax expense | | $ | 21,062 | | | $ | 18,391 | | | $ | 16,596 | | | $ | 18,588 | | | $ | 11,990 | | | $ | 7,330 | | | $ | 9,171 | |

| | |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

| (8) | | In connection with our conversion to a taxable corporate entity for U.S. income tax purposes, we recognized a net tax asset created by a step up in the tax basis of our net assets due to the Restructuring of Ownership and the Securities Purchase and Exchange Agreement. For purposes of determining the pro forma net income, the recognition of this one-time step up in basis has been excluded from our pro forma tax computation. |

11

RISK FACTORS

Our business faces significant risks. The following is a description of what we consider to be all material risks to our business known to us. The risks described below may not be the only risks we face. Additional risks that we do not yet know of or that we currently think are immaterial may also impair our business operations. If any of the events or circumstances described in the following risks actually occur, our business, financial condition or results of operations could suffer, our ability to make payments under the notes could be impaired and the market value of the notes could decline. As used herein, the term “notes” means both the old notes and the exchange notes, unless otherwise indicated.

Risk Factors Related to Our Business

Competition in the market for cash access products and services is intense, and if we are unable to compete effectively, we could face price reductions and decreased demand for our services.

Some of our current and potential competitors have a number of significant advantages over us, including:

| | • | | commission structures that are more beneficial to gaming establishments than ours; |

| | • | | longer operating histories; |

| | • | | pre-existing relationships with potential customers; and |

| | • | | significantly greater financial, marketing and other resources, which allow them to respond more quickly to new or changing opportunities. |

In addition, some of our potential competitors have greater name recognition and marketing power.

Furthermore, some of our current competitors have established, and in the future potential competitors may establish, cooperative relationships with each other or with third parties or adopt aggressive pricing policies to gain market share.

As a result of the intense competition in this industry, we could encounter significant pricing pressures and lose customers. These pricing pressures could result in significantly lower average service charges for our cash access services or higher commissions payable to gaming establishments. We may not be able to offset the effects of any service charge reductions with an increase in the number of customers, cost reductions or otherwise. In addition, the gaming industry is always subject to market consolidation, which could result in increased pricing pressure and additional competition. We believe that the breadth of our offerings, our differentiating technology and the ease of use of our services allow us to provide greater overall value to our customers and therefore to command higher prices for our cash access services than other providers without making our pricing uncompetitive. To the extent that competitive pressures in the future force us to reduce our pricing to establish or maintain relationships with gaming establishments, our revenues could decline.

First Data Corporation’s resources and its familiarity with our business and the markets that we serve may help it compete with us, and such competition may have a material adverse effect on our business, results of operations and financial condition.

From our inception and up until the closing of the recapitalization, First Data Corporation indirectly held an ownership interest in us. As a result, First Data Corporation has had detailed access to and knowledge of our operations, including but not limited to our technology, our strategy, our results of operations, our marketing plan and our pricing practices. First Data Corporation also has greater financial resources than us. We continue to have contractual business relationships with affiliates of First Data Corporation following the consummation of the recapitalization of our membership. The definitive agreement that effected our recapitalization contains a

12

covenant by First Data Corporation, on behalf of itself and affiliates under its control, not to compete with us during the three-year period following the consummation of the recapitalization. This covenant not to compete is subject to limited qualifications and exceptions that permit First Data Corporation to, among other things: (i) own up to 5% of any publicly-traded corporation that competes with us, (ii) acquire a business that competes with us and continue the operation of such business for a specified period of time, (iii) provide competitive services in areas of gaming establishments outside of the areas where minors are prohibited from entering, (iv) provide gaming patron credit bureau services, and (v) provide certain back-end processing services, such as authorization, capture, submission to interchange, settlement, chargeback, clearing, reporting or customer support services. Upon the expiration of this covenant not to compete, First Data Corporation or affiliates under its control may compete with us.

The cash access industry is subject to change, and we must keep pace with the changes to successfully compete.

The demand for our products and services is affected by changing technology, evolving industry standards and the introduction of new products and services. Cash access services are based on existing financial services and payment methods, which are also continually evolving. Our future success will depend, in part, upon our ability to successfully develop and introduce new cash access services based on emerging financial services and payment methods, which may, for example, be based on stored value cards, Internet-based payment methods or the use of portable consumer devices such as personal digital assistants and cellular telephones, and to enhance our existing products and services on a timely basis to respond to changes in patron preferences and industry standards. We cannot be sure that the products, services or technologies that we choose to develop will achieve market acceptance or obtain any necessary regulatory approval or that products, services or technologies that we choose not to develop will not threaten our market position. If we are unable, for technological or other reasons, to develop new products or services, enhance or sell existing products or services in a timely and cost-effective manner in response to technological or market changes, our business, financial condition and results of operations may be materially adversely affected.

If we are unable to protect our intellectual property, we may lose a valuable competitive advantage or be forced to incur costly litigation to protect our rights.

We utilize technology in operating our business, and our success depends on developing and protecting our intellectual property. We rely on copyright, patent, trademark and trade secret laws, as well as the terms of license agreements with third parties, to protect our intellectual property. We also rely on other confidentiality and contractual agreements and arrangements with our employees, affiliates, business partners and customers to establish and protect our intellectual property and similar proprietary rights. We do not hold any issued patents, but we have three patent applications pending. At the same time, our products may not be patentable in their entirety or at all. For example, although we currently have three inventions that are the subject of patent applications pending in the United States Patent and Trademark Office, we can provide no assurance that these applications will become issued patents. If they do not become issued patents, our competitors would not be prevented from using these inventions.

We also license various technology and intellectual property rights from third parties as an exclusive licensee in the gaming industry, such as our 10-year license to use the “3-in-1 rollover” feature from USA Payments, which is under common control with M&C International, and our license for at least 10 years to certain portions of the software infrastructure upon which our systems operate from Infonox on the Web, which is under common control with M&C International. The licenses expire in 2014. We rely heavily on the maintenance and protection of these technology and intellectual property rights. If our licensors or business partners fail to protect their intellectual property rights in material that we license, the value of our licenses may diminish significantly. It is possible that third parties may copy or otherwise obtain and use our information and proprietary technology without authorization or otherwise infringe on our intellectual property rights. In addition, we may not be able to deter current and former employees, consultants, and other parties from breaching

13

confidentiality agreements and misappropriating proprietary information. If we are unable to adequately protect our technology or our exclusively licensed rights, or if we are unable to continue to obtain or maintain licenses for technology from third parties including in particular from USA Payments and Infonox on the Web, it could have a material adverse effect on the value of our intellectual property, similar proprietary rights, our reputation, or our results of operations.

In the future, we may have to rely on litigation to enforce our intellectual property rights and contractual rights. In addition, although we do not believe that our products or services infringe upon the intellectual property rights of third parties, we may face claims of infringement that could interfere with our ability to use technology or other intellectual property rights that are material to our business operations. If litigation that we initiate is unsuccessful, we may not be able to protect the value of some of our intellectual property. In the event a claim of infringement against us is successful, we may be required to pay royalties or license fees to continue to use technology or other intellectual property rights that we had been using or we may be unable to obtain necessary licenses from third parties at a reasonable cost or within a reasonable time. Any litigation of this type, whether successful or unsuccessful, could result in substantial costs to us and diversions of our resources. Although we believe that our intellectual property rights are sufficient to allow us to conduct our business without incurring liability to third parties, our products and services may infringe on the intellectual property rights of third parties and our intellectual property rights may not have the value we believe them to have.

We have formed relationships with and rely heavily on the services and technology of a number of third-party and affiliated companies and consultants to operate our systems and ensure the integrity of our technology. Although we do not anticipate severing relations with any of these parties, any of these providers may cease providing these services or technology in an efficient, cost-effective manner, or altogether, or be unable to adequately expand their services to meet our needs. In the event of an interruption in, or the cessation of, services or technology by an existing third-party or affiliated provider, we may not be able to make alternative arrangements for the supply of the services or technology that are critical to the operation of our business and this could have a material adverse effect on our business.

Our products and services are complex, depend on a myriad of complex networks and technologies and may be subject to software or hardware errors or failures that could lead to an increase in our costs, reduce our net revenues or damage our reputation.

Our products and services, and the networks and third-party services upon which our products and services are based, are complex and may contain undetected errors or may suffer unexpected failures. The computer networks that we rely upon in providing our products and services are vulnerable to computer viruses, physical or electronic break-ins and similar disruptions, which could lead to interruptions, delays, loss of data, public release of confidential data or the inability to complete patron transactions. The occurrence of these errors or failures, disruptions or unauthorized access could adversely affect our sales to customers, diminish the use of our cash access products and services by patrons, cause us to incur significant repair costs, result in our liability, divert the attention of our development personnel from product development efforts, and cause us to lose credibility with current or prospective customers or patrons.

Because of our dependence on a few providers, or in some cases one provider, for some of the financial services we offer to patrons, the loss of a provider could have a material adverse effect on our business or our financial performance.

We depend on a few providers, or in some cases one provider, for some of the financial services that we offer to patrons. For example, we exclusively use the TeleCheck check verification, processing and guarantee service of TeleCheck for our check cashing services. We also exclusively use Integrated Payment Systems, Inc. to issue negotiable instruments to complete certain cash access transactions. We also exclusively use USA Payments and USA Payment Systems to obtain authorizations for credit card cash advances, POS debit transactions and ATM withdrawal transactions under a 10-year contract. USA Payments is under common

14

control with M&C International and USA Payment Systems is 50% owned by the principals of M&C International. In addition, we depend on Bank of America Merchant Services, formerly known as BA Merchant Services, Inc. for sponsorship into the Visa U.S.A. and MasterCard International associations. We depend on Bank of America, N.A. to supply cash for our ATMs. We depend on Western Union Financial Services, Inc. for money transfers. We have shorter-term (in some cases as short as one year) contracts with TeleCheck, Bank of America Merchant Services and Western Union Financial Services, Inc. that provide us with certain rights to continue our business relationships for specified terms, subject to certain early termination rights in the event of a breach. Some of these contracts are also terminable by the third party after the occurrence of specified events of default described in the contract. We also rely heavily on Infonox on the Web for the research, design, development, testing, deployment, operation, monitoring and support of our systems and the software that runs our systems. We have a 10-year contract with Infonox on the Web, which is under common control with M&C International. This contract expires in 2014. We could replace any of these providers with an alternate provider of similar services, but doing so could be materially disruptive to our operations, and there can be no assurance that we would be able to enter into contracts or arrangements with alternate providers on terms and conditions as beneficial to us as contracts or arrangements with our current providers or at all. A change in our business relationships with any of these third-party providers or the loss of their services or failed execution on their part could adversely affect our business, financial condition and results of operation.

We may experience difficulties in transitioning our supply of cash for our ATMs and ACMs.

We recently transitioned our supply of cash for our ATMs and ACMs from Wells Fargo Bank, N.A. to Bank of America, N.A. The transition of our supply of currency has involved discontinuing operational procedures that we had previously developed and refined with Wells Fargo Bank, N.A. and establishing new operational procedures with Bank of America, N.A. We may also have to modify other existing operational procedures in order to accommodate the requirements of our new supplier of currency. If, in the course of this transition, we are unable to establish operational procedures that allow us to access our new supply of currency as readily as our former supply of currency, if we are required to modify our other operational procedures, or if we experience unanticipated difficulties, we may suffer a disruption in our ATM and ACM or other operations.

The loss of our sponsorship by Bank of America Merchant Services into the Visa U.S.A. and MasterCard International card associations could have a material adverse effect on our business.

We cannot provide cash access services involving Visa cards and MasterCard cards without sponsorship into the Visa U.S.A. and MasterCard International card associations. Our sponsorship into these card associations by Bank of America Merchant Services is conditioned upon First Data Corporation’s continued indemnification of Bank of America Merchant Services for any losses it may suffer as a result of such sponsorship. Bank of America Merchant Services has never made a claim under this indemnity. First Data Corporation will have the right to terminate its indemnification obligations, and therefore our sponsorship into the card associations, in the event that we breach certain indemnification obligations that we owe to First Data Corporation, in the event that we incur chargebacks in excess of certain levels, in the event that we are fined in excess of certain amounts for violating card association operating rules, or in the event that we amend the sponsorship agreement without First Data Corporation’s consent.

In the event that First Data Corporation terminates its indemnification obligations and as a result we lose our sponsorship into the card associations, we would need to obtain sponsorship into the card associations through another member of the card associations that is capable of supporting our transaction volume. We do not believe that we would be able to obtain such alternate sponsorship on terms as favorable to us as the terms of our current sponsorship by Bank of America Merchant Services. We cannot assure you that we would be able to obtain alternate sponsorship at all. Our inability to obtain alternate sponsorship on favorable terms or at all would have a material adverse effect on our business, financial condition and results of operations.

15

Because of our dependence on certain customers, the loss of a top customer could have a material adverse effect on our revenues and profitability.

For the six months ended June 30, 2004, our five largest customers, which accounted for approximately 36.6% of our cash advance and ATM revenues, were: Harrah’s Entertainment, Inc., Caesars Entertainment, Inc., Mandalay Resort Group, Station Casinos, Inc. and Foxwoods Resort Casino.For the six months ended June 30, 2004, cash advance and ATM revenues attributable to Harrah’s Entertainment, Inc. were approximately 12.1% of our cash advance and ATM revenues. We believe that revenues attributable to these customers will continue to be a substantial percentage of our revenues throughout 2004. The loss or financial hardship experienced by, or a substantial decrease in revenues from, any one of our top customers could have a material adverse effect on our business, financial condition and results of operations. Consolidation among operators of gaming establishments, such as the proposed acquisition of the Mandalay Resort Group by MGM Mirage, may also result in the loss of a top customer to the extent that customers of ours are acquired by our competitors’ customers. In addition, our contracts are generally exclusive contracts with three to five year terms. Any failure to renew our significant contracts, or a large number of our contracts, could have a material adverse effect on our business, financial condition and results of operations.

Economic downturns, a decline in the popularity of gaming or changes in the demographic profile of gaming patrons could reduce the number of patrons that use our services or the amounts of cash that they access using our services.

The strength and profitability of our business depends on consumer demand for gaming. During periods of economic contraction, our revenues may decrease while some of our costs remain fixed, resulting in decreased earnings. This is because the gaming activities in connection with which we provide our cash access services are discretionary leisure activity expenditures and participation in leisure activities may decline during economic downturns because consumers have less disposable income. Even an uncertain economic outlook may adversely affect consumer spending in gaming operations, as consumers spend less in anticipation of a potential economic downturn. Reductions in tourism could also have a material adverse effect on our business, financial condition and results of operations.

Changes in consumer preferences or discretionary consumer spending could harm our business. Gaming competes with other leisure activities as a form of consumer entertainment, and may lose relative popularity as new leisure activities arise or as other existing leisure activities become more popular. The popularity of gaming is also influenced by the social acceptance of gaming, which is dictated by prevailing social mores. To the extent that the popularity of gaming declines as a result of either of these factors, the demand for our cash access services may decline and our business may be harmed.

Aside from the general popularity of gaming, the demographic profile of gaming patrons changes over time. The gaming habits and use of cash access services varies with the demographic profile of gaming patrons. To the extent that the demographic profile of gaming patrons either narrows or migrates towards patrons who use cash access services less frequently or for lesser amounts of cash, the demand for our cash access services may decline and our business may be harmed.

An unexpectedly high level of chargebacks could adversely affect our business.

When patrons use our cash access services, we either dispense cash or produce a negotiable instrument that can be endorsed and exchanged for cash. If a completed cash access transaction is subsequently disputed by a cardholder or accountholder and if we are unsuccessful in establishing the validity of the transaction, the transaction becomes a chargeback and we may not be able to collect payment for such transaction. We are always subject to the risk of chargebacks, which we manage by employing detailed transaction completion procedures designed to detect and prevent fraudulent transactions. During the years ending December 31, 2003, 2002 and 2001, our chargeback expenses represented approximately 0.008%, 0.049% and (0.089)%, respectively, of our

16

total revenues during such years. If, in the future, we incur an unexpectedly high level of chargebacks, we may suffer a material adverse effect to our business, financial condition or results of operation.

Following the recapitalization of our ownership, we must make alternate arrangements to receive certain services that we have historically received from First Data Corporation.

We have historically obtained certain services from or through First Data Corporation or its affiliates as a result of its indirect ownership interest in us. For example, as a majority-owned subsidiary of First Data Corporation, we received tax and regulatory compliance services and procured insurance coverage and telecommunications services through First Data Corporation’s enterprise-wide procurement arrangements. For these services we incurred expenses of $0.2 million during fiscal 2003. As a result of the recapitalization of our ownership, we must perform these services ourselves or make alternate arrangements to receive these services from third parties. We cannot assure you that we will be able to provide these services ourselves or procure them from third parties on terms as favorable as those upon which we received them from First Data Corporation and its affiliates. In addition, we may lose certain other benefits of being associated with a large, well-known, publicly-traded company.

We are subject to extensive rules and regulations of MasterCard International and Visa U.S.A., which may harm our business.

A significant portion of our cash access services are processed as transactions subject to the extensive rules and regulations of the two leading card associations, MasterCard International and Visa U.S.A. From time to time, we receive correspondence from the card associations regarding our compliance with their rules and regulations. In the ordinary course of our business, we engage in discussions with our sponsoring bank and/or the card associations regarding our compliance with their rules and regulations. The rules and regulations do not expressly address some of the contexts and settings in which we process cash access transactions, or do so in a manner subject to varying interpretations. For example, when we first launched our ACM, the card associations had difficulty determining whether our ability to process credit card cash advance transactions at an unmanned machine, without cashier involvement, complied with card association regulations. As another example, in 2003, one of the card associations informed our sponsoring bank that authorization requests originating from our systems needed to be encoded to identify our transactions as gambling transactions, even though our services do not directly involve any gambling activity. We resolved the issue by encoding the authorization requests with an indicator that the card association agreed was applicable. From time to time we also face technical compliance issues, e.g. the format of data submission files. We expect to continue to face and resolve issues such as these in the ordinary course of business, which we do not believe will result in a material adverse impact on our operations. The card associations modify their rules and regulations from time to time. In the event that the card associations or our sponsoring bank determine that the manner in which we process certain card transactions is not in compliance with existing rules and regulations, or if the card associations adopt new rules or regulations that prohibit or restrict the manner in which we process certain card transactions, we may be forced to modify the manner in which we operate which may increase our costs, or cease processing certain types of cash access transactions altogether which could have a material negative impact on our business.

Changes in interchange rates may affect our costs of revenues.

We pay credit card associations interchange fees for services they provide in settling transactions routed through their networks. In addition, we pay fees to participate in various ATM or debit networks. The amounts of these interchange fees are fixed by the card associations and networks in their sole discretion, and are subject to increase in their discretion from time to time. Visa U.S.A. increased certain interchange fees in February 2004 and MasterCard International increased certain interchange fees in April 2004. Visa U.S.A.’s Interlink network, through which we processes approximately 30% of the dollar volume of our PIN-based debit transactions, recently increased the interchange rates applicable to our PIN-based debit transactions by an amount that will effectively increase our interchange expenses for PIN-based debit transactions processed through Interlink by a

17

factor of ten times. Many of our contracts enable us to pass through to our customers the amount of any increase in interchange or processing fees, but competitive pressures might prevent us from doing so. To the extent that we are unable to pass through to our customers the amount of any increase in interchange or processing fees, our costs of revenues would increase and our net income would decrease, assuming no change in transaction volumes. Any such decrease in net income could have a material adverse effect on our financial condition and results of operations.

We are subject to extensive governmental gaming regulation, which may harm our business.

We are subject to a variety of regulations in the jurisdictions in which we operate. Regulatory authorities at the federal, state and local levels have broad powers with respect to the licensing of gaming-related activities and may revoke, suspend, condition or limit our licenses, impose substantial fines and take other actions, any one of which could have a material adverse effect on our business, financial condition and results of operations. We cannot assure you that any new gaming license or related approval that may be required in the future will be granted, or that our existing licenses will not be revoked, suspended or limited or will be renewed. If additional gaming-related regulations are adopted in a jurisdiction in which we operate, such regulations could impose restrictions or costs that could have a material adverse effect on our business. From time to time, various proposals are introduced in the legislatures of some of the jurisdictions in which we have existing or planned operations that, if enacted, could adversely affect the tax, regulatory, operational or other aspects of the gaming industry and our company. Legislation of this type may be enacted in the future.

Members of our management team and the beneficial owners of equity interests in our company must also be approved by certain state regulatory authorities. If state regulatory authorities were to find a person occupying any such position unsuitable, we would be required to sever our relationship with that person. Certain public issuances of securities and certain other transactions by us also require the approval of certain regulatory authorities.

In addition, certain new products and services that we may develop cannot be offered in the absence of regulatory approval of the product or licensing of us, or both. For example, the QuikPlay cashless gaming product has to date only been approved for use at one casino and cannot be used at any other location until we receive approval from the appropriate authority in such additional location. These approvals could require that we and our officers, directors or ultimate beneficial owners obtain a license or be found suitable and that the product be approved after testing and review. We cannot assure you that we will obtain any such approvals in the future.