UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantþ

Filed by a Party other than the Registranto

Check the appropriate box:

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

Copano Energy, L.L.C.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| |

| | | | |

| | | | |

| |

| | (2) | | Aggregate number of securities to which transaction applies: |

| |

| | | | |

| | | | |

| |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| | | | |

| | | | |

| |

| | (4) | | Proposed maximum aggregate value of transaction: |

| |

| | | | |

| | | | |

| |

| | (5) | | Total fee paid: |

| |

| | | | |

| | | | |

| o | | Fee paid previously with preliminary materials. |

| |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| |

| | | | |

| | | | |

| |

| | (2) | | Form, Schedule or Registration Statement No.: |

| |

| | | | |

| | | | |

| |

| | (3) | | Filing Party: |

| |

| | | | |

| | | | |

| |

| | (4) | | Date Filed: |

| |

| | | | |

| | | | |

COPANO ENERGY, L.L.C.

2727 Allen Parkway, Suite 1200

Houston, Texas 77019

NOTICE OF ANNUAL MEETING OF UNITHOLDERS

TO BE HELD ON MAY 14, 2009

Dear Unitholder:

You are cordially invited to attend the 2009 Annual Meeting of Unitholders of Copano Energy, L.L.C., a Delaware limited liability company (“Copano”), which will be held on Thursday, May 14, 2009, at 9:30 a.m., Central Daylight Time, at 2727 Allen Parkway, Ground Level, Meeting Room 1, Houston, Texas 77019. The 2009 Annual Meeting will be held for the following purposes:

| | |

| | 1. | To elect seven directors to Copano’s Board of Directors to serve until the 2010 Annual Meeting of Unitholders; |

| |

| | 2. | To approve an amendment to Copano’s Amended and Restated Long-Term Incentive Plan; |

| |

| | 3. | To ratify the appointment of Deloitte & Touche LLP as Copano’s independent registered public accounting firm for the fiscal year ending December 31, 2009; and |

| |

| | 4. | To transact such other business as may properly come before the annual meeting and any adjournments or postponements of the meeting. |

Additional information regarding the annual meeting is set forth in the attached proxy statement.

Only holders of record of our common, Class C and Class D units at the close of business on March 16, 2009 are entitled to receive notice of and to vote at the annual meeting or any adjournment or postponement thereof. A list of our unitholders will be available for examination at the annual meeting and at Copano’s Houston office at least ten days prior to the annual meeting.

By Order of the Board of Directors,

Douglas L. Lawing

Senior Vice President, General Counsel and Secretary

Houston, Texas

April 3, 2009

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE CAST YOUR VOTE PROMPTLY. YOU MAY SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE POSTAGE-PAID RETURN ENVELOPE PROVIDED, OR YOU MAY VOTE BY USING THE TELEPHONE OR INTERNET VOTING PROCEDURES DESCRIBED ON THE PROXY CARD. IF YOU ATTEND THE MEETING AND SO DESIRE, YOU MAY WITHDRAW YOUR PROXY AND VOTE IN PERSON.

PROXY STATEMENT

TABLE OF CONTENTS

| | | | | |

| | | 1 | |

| | | 1 | |

| | | 1 | |

| | | 1 | |

| | | 1 | |

| | | 2 | |

| | | 2 | |

| | | 2 | |

| | | 2 | |

| | | 3 | |

| | | 3 | |

| | | 4 | |

| | | 5 | |

| | | 5 | |

| | | 5 | |

| | | 6 | |

| | | 6 | |

| | | 6 | |

| | | 8 | |

| | | 8 | |

| | | 9 | |

| | | 10 | |

| | | 12 | |

| | | 12 | |

| | | 12 | |

| | | 14 | |

| | | 23 | |

| | | 23 | |

| | | 23 | |

| | | 24 | |

| | | 24 | |

| | | 25 | |

| | | 26 | |

| | | 27 | |

| | | 28 | |

| | | 28 | |

| | | 29 | |

| | | 32 | |

| | | 35 | |

| | | 36 | |

| | | 37 | |

| | | 40 | |

| | | 40 | |

| | | 40 | |

| | | 40 | |

i

| | | | | |

| | | 41 | |

| | | 41 | |

| | | 41 | |

| | | 42 | |

| | | 43 | |

| | | 45 | |

| | | 45 | |

| | | 45 | |

| | | 45 | |

| | | 45 | |

| | | 46 | |

| | | 46 | |

| | | 46 | |

| | | 46 | |

| | | 46 | |

| | | 47 | |

| | | 47 | |

| | | 48 | |

| | | 48 | |

| | | A-1 | |

| | | B-1 | |

| | | C-1 | |

| | | D-1 | |

ii

COPANO ENERGY, L.L.C.

2727 Allen Parkway, Suite 1200

Houston, Texas 77019

Annual Meeting of Unitholders

To Be Held on Thursday, May 14, 2009

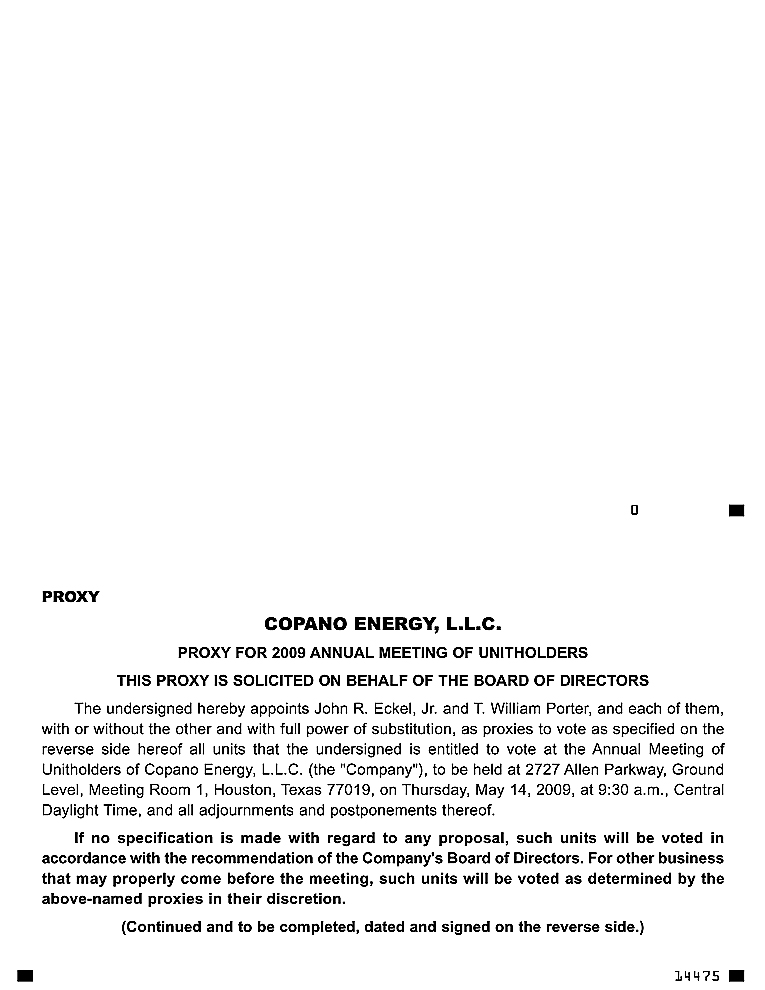

This proxy statement, which was first mailed to our unitholders on April 3, 2009, is being furnished to you in connection with the solicitation of proxies by and on behalf of the Board of Directors of Copano Energy, L.L.C., for use at our 2009 Annual Meeting of Unitholders, or the annual meeting, or at any adjournments or postponements thereof. The annual meeting will be held on Thursday, May 14, 2009, at 9:30 a.m., Central Daylight Time, at 2727 Allen Parkway, Ground Level, Meeting Room 1, Houston, Texas 77019. Only holders of record of our common, Class C and Class D units at the close of business on March 16, 2009, or the record date, were entitled to notice of, and are entitled to vote at, the annual meeting and any adjournment or postponement thereof, unless such adjournment or postponement is for more than 45 days, in which event we will set a new record date. Unless the context requires otherwise, the terms “our,” “our company” “we,” “us” and similar terms refer to Copano Energy, L.L.C., together with its consolidated subsidiaries.

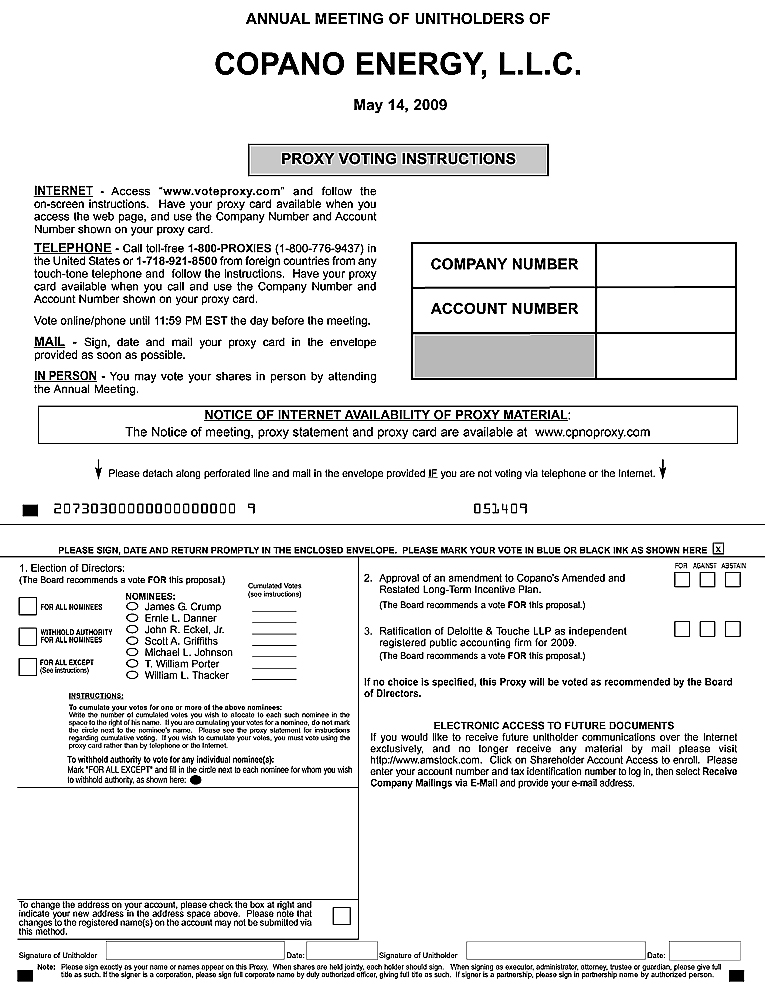

Proposals

At the annual meeting, we will ask unitholders to consider and act upon proposals to: (i) elect seven directors to serve until our 2010 Annual Meeting of Unitholders, (ii) approve an amendment to our Amended and Restated Long-Term Incentive Plan, or “LTIP,” that increases the percentage of authorized common units that may be used for awards other than options and unit appreciation rights and (iii) ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2009.

Quorum Required

The holders of a majority, or 28,937,676, of the units outstanding as of the record date must be present in person or represented by proxy at the meeting to constitute a quorum. A properly executed proxy submitted without instructions will be voted “FOR” each of the proposals, unless it has been properly revoked. A properly executed proxy marked “ABSTAIN” or “WITHHELD” will not be voted, although it will be counted for purposes of determining the presence of a quorum. Abstentions and broker non-votes will count as present for purposes of establishing a quorum, but will not be counted in the total votes cast on the proposals.

How to Vote

You may vote by completing, dating and signing the enclosed proxy card and returning it promptly in the envelope provided, or by using the telephone or internet voting procedures described on the enclosed proxy card. You may also attend the annual meeting and vote in person. Even if you plan to attend the annual meeting, we urge you to cast your vote by promptly returning your completed proxy or by using the telephone or internet voting procedures.

If you plan to attend the annual meeting and wish to vote in person, we will give you a ballot at the meeting. However, if your units are held in the name of a broker and you wish to vote in person, you must obtain from the brokerage firm an account statement, letter or other evidence satisfactory to us of your beneficial ownership of the units. Whichever method of voting you choose, please do so as soon as possible to ensure that your vote is represented at the annual meeting.

Revoking Your Proxy

You may revoke your proxy before it is voted at the annual meeting: (i) by delivering, before or at the annual meeting, a new proxy with a later date, (ii) by delivering, on or before the business day prior to the annual meeting, a

notice of revocation to our Secretary at the address set forth in the notice of the annual meeting, (iii) by attending the annual meeting in person and voting (although your attendance at the annual meeting, without actually voting, will not by itself revoke a previously granted proxy) or (iv) if you have instructed a broker to vote your units, by following the directions your broker provides you regarding changes to your instructions.

Outstanding Units Held on Record Date

As of the record date, 57,875,350 units were outstanding and entitled to vote at the annual meeting, consisting of 54,234,680 common units, 394,853 Class C units (all of which will convert to common units on May 1, 2009) and 3,245,817 Class D units.

Copano/Operations, Inc.

When we refer to our employees in this proxy statement, we are referring to individuals (i) that we employ or (ii) that are employed by Copano/Operations, Inc., or Copano Operations, and who perform services for our benefit pursuant to our administrative and operating services agreement with Copano Operations. For additional information with respect to our business relationship with Copano Operations, please read “Certain Relationships and Related Transactions — Copano/Operations, Inc.”

Internet Availability of Proxy Materials

Unitholders can access electronic copies of the proxy materials for our 2009 annual meeting by visitingwww.cpnoproxy.com.

Questions About Annual Meeting

If you have any questions about the annual meeting, please contact D.F. King & Co., Inc., our proxy solicitor, at 48 Wall Street, New York, New York 10005. Banks and brokerage firms, please call(212) 269-5550. Unitholders, please call(800) 714-3313.

2

PROPOSAL ONE — ELECTION OF DIRECTORS

At the annual meeting, unitholders will consider and act upon a proposal to elect seven directors to our Board of Directors to serve until our 2010 Annual Meeting of Unitholders. All seven of our current board members have been nominated to stand for re-election. We encourage our director nominees to attend our annual meetings to provide an opportunity for unitholders to communicate with them directly about issues affecting our company. We anticipate that all director nominees will attend.

Each of the nominees has consented to serve as a director if so elected. Each nominee who is elected to our Board will serve until his term expires and his successor has been duly elected and qualified or until his earlier death, resignation or removal. The persons named as proxies in the accompanying proxy card, who have been designated by our Board, intend to vote FOR the election of the director nominees unless otherwise instructed by a unitholder in a proxy card. If any of the director nominees becomes unable for any reason to stand for election, the persons named as proxies in the accompanying proxy card will vote for the election of such other person or persons as our Board may recommend and propose to replace such nominee or nominees.

Information concerning the seven director nominees is set forth below.

Director Nominees

| | | | | | | | | | | |

| | | | | | | Director

|

| Name | | Age | | Position with Our Company | | Since |

| |

| John R. Eckel, Jr. | | | 57 | | | Chairman of the Board and Chief Executive Officer | | | 1992 | |

| James G. Crump | | | 68 | | | Director | | | 2004 | |

| Ernie L. Danner | | | 54 | | | Director | | | 2004 | |

| Scott A. Griffiths | | | 54 | | | Director | | | 2004 | |

| Michael L. Johnson | | | 58 | | | Director | | | 2004 | |

| T. William Porter | | | 67 | | | Director | | | 2004 | |

| William L. Thacker | | | 63 | | | Director | | | 2004 | |

John R. Eckel, Jr., Chairman of the Board and Chief Executive Officer, founded our business in 1992 and served as our President and Chief Executive Officer until April 2003, when he was elected to his current position. Mr. Eckel serves on the board of directors and the executive committee of the Texas Pipeline Association. Mr. Eckel also serves as President and Chief Executive Officer of Live Oak Reserves, Inc., which he founded in 1986, and which, with its affiliates, is engaged in oil and gas exploration and production in South Texas. Mr. Eckel received a Bachelor of Arts degree from Columbia University and was employed in various corporate finance positions in New York prior to entering the energy industry in 1979.

James G. Crumpjoined our Board of Directors upon completion of our initial public offering in November 2004. Mr. Crump is Chairman of the Audit Committee and a member of the Conflicts Committee. He is also a member of the board of directors of Exterran GP, LLC, the general partner of the general partner of Exterran Partners, L.P. (formerly UCO GP, LLC and Universal Compression Partners, L.P., respectively). Mr. Crump began his career at Price Waterhouse in 1962 and became a partner in 1974. From 1977 until the merger of Price Waterhouse and Coopers & Lybrand in 1998, Mr. Crump held numerous management and leadership roles. From 1998 until his retirement in 2001, Mr. Crump served as Global Energy and Mining Cluster Leader, a member of the U.S. Management Committee and the Global Management Committee and as Houston Office Managing Partner of PricewaterhouseCoopers. Mr. Crump holds a B.A. in Accounting from Lamar University.

Ernie L. Dannerjoined our Board of Directors upon completion of our initial public offering in November 2004. Mr. Danner is Chairman of the Conflicts Committee and a member of the Audit Committee. Mr. Danner serves as President and Chief Operating Officer and a director of Exterran Holdings, Inc. and as a director of Exterran GP, LLC. Mr. Danner joined Universal Compression Holdings, Inc. in 1998 as its Chief Financial Officer and served in various positions of increasing responsibility, including Chief Operating Officer, beginning in July 2006 through August 2007 when Universal Compression Holdings, Inc. merged with Hanover Compressor Company to form Exterran Holdings, Inc. He also serves as a director of Anchor Drilling Fluids, LLC, a private company that provides drilling fluids services. Mr. Danner holds a B.A. and an M.A. in Accounting from Rice University.

3

Scott A. Griffithsjoined our Board of Directors in December 2004. Mr. Griffiths is a member of the Nominating and Governance Committee and the Compensation Committee. Mr. Griffiths served as Senior Vice President and Chief Operating Officer of Hydro Gulf of Mexico, L.L.C. from December 2005 to December 2006. From 2003 through December 2005, Mr. Griffiths served as Executive Vice President and Chief Operating Officer of Spinnaker Exploration Company. From 2002 to 2003, Mr. Griffiths served as Senior Vice President, Worldwide Exploration for Ocean Energy, Inc. Mr. Griffiths joined Ocean following the 1999 merger of Ocean and Seagull Energy Corporation, where he served as Vice President, Domestic Exploration. He holds a B.S. in Geology from the University of New Mexico and an M.A. in Geology from Indiana University.

Michael L. Johnsonjoined our Board of Directors in December 2004. Mr. Johnson is a member of the Audit Committee and the Conflicts Committee. Mr. Johnson began his career in 1975 with Conoco Inc. and most recently served as Chairman and Chief Executive Officer of Conoco Gas and Power from 1997 until his retirement in 2002. Mr. Johnson holds a B.S. in Geology from New Mexico State University, an M.A. in Geochemistry from Rice University and an M.S. in Management, Sloan Fellow, from the Alfred P. Sloan School of Business, Massachusetts Institute of Technology.

T. William Porterjoined our Board of Directors upon completion of our initial public offering in November 2004. Mr. Porter is Chairman of the Nominating and Governance Committee and a member of the Compensation Committee. Mr. Porter is Chairman and a founding partner of Porter & Hedges, L.L.P., a Houston law firm formed in 1981. He also serves on the boards of directors of Helix Energy Solutions, Inc. and U.S. Concrete, Inc. Mr. Porter holds a Bachelor of Business Administration degree in Finance from Southern Methodist University and Bachelor of Law degree from Duke University.

William L. Thackerjoined our Board of Directors upon completion of our initial public offering in November 2004. Mr. Thacker is Chairman of the Compensation Committee and a member of the Nominating and Governance Committee. Mr. Thacker serves on the boards of directors of Kayne Anderson Energy Development Company and Mirant Corporation. Mr. Thacker joined Texas Eastern Products Pipeline Company (the general partner of TEPPCO Partners, L.P.) in September 1992 as President, Chief Operating Officer and director. He was elected Chief Executive Officer in January 1994. In March 1997, he was named to the additional position of Chairman of the Board, which he held until his retirement in May 2002. Prior to joining Texas Eastern Products Pipeline Company, Mr. Thacker was President of Unocal Pipeline Company from 1986 until 1992. Mr. Thacker is past Chairman of the Executive Committee of the Association of Oil Pipelines, has served as a member of the board of directors of the American Petroleum Institute, and has actively participated in many energy-related organizations during his35-year career in the energy industry. Mr. Thacker holds a Bachelor of Mechanical Engineering degree from the Georgia Institute of Technology and a Masters of Business Administration degree from Lamar University.

Cumulative Voting

Our limited liability company agreement provides for “cumulative voting” in the election of directors. This means that a unitholder will be entitled to a number of votes equal to the number of units that such unitholder is entitled to vote at the annual meeting multiplied by the number of directors to be elected at the annual meeting. A unitholder may (i) cast all such votes for a single director, (ii) distribute them evenly among the number of directors to be voted for at the annual meeting, or (iii) distribute them among any two or more directors to be voted for at the annual meeting. For example, because there are seven director nominees, if you own 100 units you will be entitled to cast 700 votes in the manner set forth in the preceding sentence. Cumulative voting permits a unitholder to concentrate his or her votes on fewer nominees, thereby allowing the unitholder potentially to have a greater impact on the outcome of the election with respect to one or more nominees. A unitholder holding a sufficient number of units may have the ability to elect one or more nominees to the Board of Directors without the support of other unitholders.

With respect to the annual meeting, we have seven nominees and seven available board seats. Each properly executed proxy received in time for the annual meeting will be voted as specified therein. The seven nominees receiving the most votes cast at the annual meeting will be elected to the Board of Directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT UNITHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE SEVEN NOMINEES FOR DIRECTOR.

4

THE BOARD OF DIRECTORS AND ITS COMMITTEES

Director Independence

To qualify as “independent” under the listing standards of the NASDAQ Stock Market LLC, or NASDAQ, a director must meet objective criteria set forth in the NASDAQ rules, and the Nominating and Governance Committee of the Board must also make a subjective determination that the director has no material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us) that would interfere with his exercise of independent judgment in carrying out his responsibilities as a director. In conducting its review of director independence, our Nominating and Governance Committee reviewed the direct or indirect business relationships between each non-employee director (including his or her immediate family) and our company, as well as each non-employee director’s relationships with charitable organizations.

The Nominating and Governance Committee has determined that Messrs. Crump, Danner, Griffiths, Johnson, Porter and Thacker qualify as “independent” in accordance with NASDAQ listing standards. Mr. Eckel is not independent by virtue of his role as Chief Executive Officer of our company. During the Nominating and Governance Committee’s most recent review of independence, the committee considered the following relationships and determined that these relationships would not interfere with the independent judgment of the Copano Board members involved:

| | |

| | • | Mr. Thacker is a member of the board of directors of Kayne Anderson Energy Development Company (“KED”), an investment company that invests in private and publicly traded energy companies. The main functions of KED’s board are to approve valuations of its investments in private companies, its distribution policy and its SEC reports. KED’s investment decisions are made by its investment advisor, KA Fund Advisors, LLC (“KA Fund Advisors”). |

KED and KA Fund Advisors are subsidiaries of Kayne Anderson Capital Advisors, L.P. (“Kayne Anderson”), a registered investment advisor. Kayne Anderson beneficially owns approximately 9.65% of our common units (according to its most recent Schedule 13G filing) and 26.2% of our Class D units through various investment partnerships, a registered investment company and institutional accounts.

| | |

| | • | Mr. Danner and Mr. Crump are members of the board of directors of Exterran GP, LLC (“Exterran GP”), the general partner of the general partner of Exterran Partners, L.P., and Mr. Crump serves on Exterran GP’s audit, conflicts and compensation committees. Mr. Danner is also President and Chief Operating Officer and a member of the board of directors of Exterran Holdings, Inc. (“Exterran Holdings”) the parent company of Exterran GP and Exterran Energy Solutions, L.P. (“Exterran Solutions”), and was party to a consulting agreement, dated August 20, 2007, with Exterran Holdings, which ended February 20, 2008. |

Exterran Solutions and one of its subsidiaries provided goods and services relating to natural gas compression to our operating subsidiaries or affiliates during 2008. Total payments for these goods and services equaled less than 1% of Exterran’s consolidated revenue for 2008.

In addition, the Nominating and Governance Committee has determined that each member of the Audit Committee qualifies as “independent” under enhanced independence standards established by the SEC for members of audit committees. The Board has also designated Mr. Crump as the “audit committee financial expert” based on its finding that Mr. Crump’s experience and understanding with respect to certain accounting and auditing matters meet the SEC criteria for an “audit committee financial expert.” Designation of one member of our audit committee as an “audit committee financial expert” is a disclosure requirement of the SEC; it does not impose on Mr. Crump any duties, obligations or liability that are greater than are generally imposed on him as a member of the Audit Committee and the Board of Directors, nor does it affect the duties, obligations or liability of any other member of the Audit Committee or the Board.

Corporate Governance

Our Board of Directors has adopted Corporate Governance Guidelines to assist in the exercise of its responsibility to provide effective governance over our affairs for the benefit of our unitholders. In addition, our Board has adopted a Code of Business Conduct and Ethics, which sets forth legal and ethical standards of

5

conduct for all our employees and other personnel, and an additional code of ethics applicable to our Chief Executive Officer and principal financial officers. All of these documents are available on our website atwww.copanoenergy.com, and paper copies will be provided free of charge to any unitholder requesting a copy by writing to our Corporate Secretary, Copano Energy, L.L.C., 2727 Allen Parkway, Suite 1200, Houston, Texas 77019. The information on our website is not a part of this proxy statement or incorporated into any other filing we make with the SEC.

Communications to Our Board of Directors

Our Board is receptive to direct communication from unitholders and recommends that unitholders initiate any communications in writing and send them to our Boardc/o Douglas L. Lawing, Senior Vice President, General Counsel and Secretary, Copano Energy, L.L.C., 2727 Allen Parkway, Suite 1200, Houston, Texas 77019. The name of any specific Board recipient should be noted in the communication. All such communications will be forwarded without review to the appropriate director. This centralized process will assist our Board in reviewing and responding to unitholder communications in an appropriate manner. Communications to our Board must include the number of units owned by the unitholder as well as the unitholder’s name, address, telephone number and email address, if any.

Meetings of Our Board of Directors; Executive Sessions

Our Board of Directors holds regular meetings, and special meetings from time to time as may be necessary. During the period from January 1 through December 31, 2008, our Board of Directors held 14 meetings. The standing committees of our Board of Directors held an aggregate of 28 meetings during this period. Each director attended at least 75% of the aggregate number of meetings of the Board and committees on which he served.

Our Corporate Governance Guidelines provide that our independent directors will meet in executive session at least quarterly, or more frequently if necessary. The Chairman of our Nominating and Governance Committee develops the agendas for executive sessions of the independent directors.

Committees of Our Board of Directors

Our Board of Directors currently has, and appoints the members of, standing audit, compensation, conflicts, and nominating and governance committees. These committees are composed solely of independent directors in accordance with applicable NASDAQ listing standards and SEC rules. The Board has adopted a written charter for each committee, which sets forth the committee’s purposes, responsibilities and authority. Each committee reviews and assesses on an annual basis the adequacy of its charter and recommends any proposed modifications to the Board for its approval. These committee charters are available on our website atwww.copanoenergy.com.You may also contact Douglas L. Lawing, our Senior Vice President, General Counsel and Secretary, at Copano Energy, L.L.C., 2727 Allen Parkway, Suite 1200, Houston, Texas 77019, to request paper copies free of charge. The following are brief descriptions of the functions and operations of our Board committees.

Audit Committee. The Audit Committee assists our Board of Directors in its general oversight of our financial reporting, internal controls and audit functions, and is directly responsible for the appointment, retention, compensation and oversight of the work of our independent registered public accounting firm. During the period from January 1 through December 31, 2008, the Audit Committee held eight meetings. The Audit Committee is composed of three independent directors: Mr. Crump (Chairman), Mr. Danner and Mr. Johnson. The Audit Committee’s Charter is included as Appendix A to this proxy statement.

Compensation Committee. The Compensation Committee’s primary responsibilities are to (i) approve compensation arrangements for officers of our company and for our Board members, including salaries and bonuses and other compensation for executive officers of our company, (ii) approve any compensation plans in which officers and directors of our company are eligible to participate, and to administer such plans, including the granting of equity awards or other benefits under any such plans and (iii) review and discuss with our management the Compensation Discussion and Analysis and related disclosure to be included in our annual proxy statement. For a discussion of the roles of executive officers and compensation consultants in determining or recommending compensation, please read “Compensation Discussion and Analysis — The Compensation-Setting Process.”

6

During the period from January 1 to December 31, 2008, the Compensation Committee held nine meetings. The Compensation Committee consists of three independent directors: William L. Thacker (Chairman), Scott A. Griffiths and T. William Porter. All Compensation Committee members are “non-employee directors” as defined byRule 16b-3 under the Securities Exchange Act of 1934, or the “Exchange Act.”

Conflicts Committee. Upon the request of the Board of Directors, the Conflicts Committee reviews specific matters that the Board believes may involve conflicts of interest between our Board members or their affiliates and our company. Any matters approved by the Conflicts Committee will be permitted and deemed approved by all unitholders and will not constitute a breach of our limited liability company agreement or of any duty stated or implied by law or equity, including any fiduciary duty. During the period from January 1, 2008 through December 31, 2008, the Conflicts Committee held five meetings. The Conflicts Committee consists of three independent directors: Mr. Danner (Chairman), Mr. Crump and Mr. Johnson.

In addition to conflicts involving Board members, the Conflicts Committee is responsible for investigating, reviewing and acting on other matters where a conflict of interest arises. The committee’s charter sets forth the Conflicts Committee’s policy and procedures for review, approval and ratification of transactions involving our company and “related persons” (directors, director nominees, executive officers or their immediate family members, or unitholders owning five percent or greater of our company’s outstanding common units). The charter covers any related person transaction that meets the minimum threshold for disclosure in the proxy statement under the relevant SEC rules (generally, transactions with our company involving amounts exceeding $120,000 in which a related person has a direct or indirect material interest). The charter states that, in determining whether to approve or ratify aconflict-of-interest transaction, including a related person transaction, the Conflicts Committee shall consider whether the transaction is (i) on terms no less favorable to us than those generally being provided to or available from unrelated third parties, or (ii) fair and reasonable to us, taking into account the totality of the relationships between the parties involved (including other transactions that may be particularly favorable or advantageous to us).

Currently, our only transactions with related persons (other than in their capacity as our employees) are those described under “Certain Relationships and Related Transactions.” The agreements underlying these transactions were entered into prior to the time of our initial public offering in November 2004. The Conflicts Committee did not review and approve the agreements underlying these transactions because we entered into the agreements before or simultaneously with the closing of our initial public offering. However, we determined that each of the agreements was on terms no less favorable than could be obtained with a third party, and at the closing of our initial public offering, our unitholders approved the conflicts of interest involved. In addition, the Conflicts Committee, or in some cases the Audit Committee, monitors transactions occurring under the agreements as described in “Certain Relationships and Related Transactions,” and the Conflicts Committee must review and approve any modifications to the agreements in accordance with the procedures described above.

Nominating and Governance Committee. The Nominating and Governance Committee’s primary responsibilities are (i) to recruit and recommend candidates for election to the Board and for committee appointments, (ii) to review the qualifications of officer candidates for our company and recommend officer nominees for such positions to the Board, (iii) to develop and recommend corporate governance guidelines to the Board of Directors, and to assist the Board in implementing such guidelines, (iv) to lead the Board in its annual review of the performance of our Board and its committees, (v) to make annual determinations as to the independence of director nominees under applicable NASDAQ and SEC rules and (vi) to develop and monitor our succession plan.

Although the Nominating and Governance Committee has no set of specific minimum qualifications for director nominees, the Committee will evaluate each nominee based upon consideration of a nominee’s independence, diversity, age, skills and experience in the context of the needs of the Board as described in our Corporate Governance Guidelines. The Nominating and Governance Committee may rely on various sources to identify director nominees. These include input from directors, management, professional search firms and others that the committee feels are reliable. During the period from January 1 through December 31, 2008, the Nominating and Governance Committee held six meetings. The Nominating and Governance Committee consists of three independent directors: Mr. Porter (Chairman), Mr. Thacker and Mr. Griffiths.

7

The Nominating and Governance Committee will consider director nominations by unitholders in the same manner as other director candidates. Any such nominations, together with appropriate biographical information, should be submitted to the Chairman of the Nominating and Governance Committee,c/o Douglas L. Lawing, Senior Vice President, General Counsel and Secretary, Copano Energy, L.L.C., 2727 Allen Parkway, Suite 1200, Houston, Texas 77019. For a description of the procedures required of unitholders seeking to nominate director candidates, please read “Unitholder Proposals and Director Nominations — Recommendation of Director Candidates to the Nominating and Governance Committee.”

Compensation Committee Interlocks and Insider Participation

Messrs. Thacker, Porter and Griffiths served as members of the Compensation Committee during all of 2008. No member of the Compensation Committee is or has been an executive officer of our company, and no member of the committee had a relationship with us in 2008 requiring “related-person” transaction disclosure under Item 404 ofRegulation S-K. None of our executive officers serves as a director or member of a compensation committee of any entity whose executive officers includes a member of our Board or Compensation Committee.

Director Compensation

Annual Retainer and Fees. Each independent member of our Board of Directors receives an annual retainer of $30,000. We also pay directors serving as Chairman of each of the Compensation, Conflicts and Nominating and Governance Committee an additional $4,000 per year. The director serving as Chairman of the Audit Committee is paid $8,000 per year, and each additional member of the Audit Committee is paid $4,000 per year. Directors are not paid a fee for attendance at meetings of our Board of Directors. Members of committees other than the Audit Committee are paid a fee of $1,000 for attendance at each committee meeting, and directors serving on the Audit Committee are paid a fee of $1,500 for attendance at each Audit Committee meeting. In addition, Messrs. Crump and Danner were each paid a fee of $1,000 for service on a committee that met once last year in connection with the pricing of our 2008 offering of 7.75% senior notes due 2018. Each of our independent directors is also reimbursed forout-of-pocket expenses incurred in connection with attending Board or committee meetings. Under individual indemnity agreements with us, each director is fully indemnified by us to the extent permitted under Delaware law for actions associated with being a member of our Board.

Restricted Unit Awards. Under our current director compensation program, we award independent directors 6,000 restricted common units upon initial election and 3,000 restricted common units annually thereafter. Each restricted common unit award (and its associated distributions) vests in three equal annual installments or upon a change in control, death, disability, in some cases upon retirement, and for post-2005 awards, failure to be nominated for re-election to our Board.

Director Compensation Table. The following table summarizes the compensation we paid to our independent directors for the fiscal year ended December 31, 2008.

Director Compensation for 2008

| | | | | | | | | | | | | |

| | | Fees Earned or

| | | Restricted Unit

| | | | |

| Name(1) | | Paid in Cash | | | Awards(2)(3)(4) | | | Total | |

| |

| James G. Crump | | $ | 53,500 | | | $ | 94,718 | | | $ | 148,218 | |

| Ernie L. Danner | | $ | 53,500 | | | $ | 94,718 | | | $ | 148,218 | |

| Scott A. Griffiths | | $ | 44,000 | | | $ | 94,718 | | | $ | 138,718 | |

| Michael L. Johnson | | $ | 48,500 | | | $ | 94,718 | | | $ | 143,218 | |

| T. William Porter | | $ | 46,000 | | | $ | 94,718 | | | $ | 140,718 | |

| William L. Thacker | | $ | 46,000 | | | $ | 94,718 | | | $ | 140,718 | |

| | |

| (1) | | Mr. Eckel is not included in the Director Compensation table because he receives no compensation for his services as a director. |

| |

| (2) | | The amounts in the “Restricted Unit Awards” column reflect the dollar amount of compensation expense we recognized in accordance with SFAS No. 123(R) for the year ended December 31, 2008 and include compensation expense attributable to |

8

| | |

| | awards granted in and prior to 2008. Assumptions used in the calculation of these amounts are discussed in Note 8 to our Consolidated Financial Statements, “Members’ Capital — Accounting for Equity-Based Compensation,” included in our annual report onForm 10-K for the year ended December 31, 2008. These amounts reflect our accounting expense for these awards, and do not correspond to the actual value that will be recognized by the independent directors. |

| |

| (3) | | At the end of 2008, the aggregate number of restricted unit awards held by each director was 18,000 (12,000 of which had vested). |

| |

| (4) | | In 2008, each director received an award of 3,000 restricted units. The fair value of each director’s award as computed in accordance with SFAS No. 123(R) was $37,830. |

Report of the Audit Committee

The Audit Committee oversees Copano’s financial reporting process on behalf of its Board of Directors. Management has the primary responsibility for the preparation of the financial statements and the reporting process, including the systems of internal control.

The Audit Committee hereby reports as follows:

| | |

| | • | The Audit Committee has reviewed and discussed with management the audited consolidated financial statements of Copano as of and for the year ending December 31, 2008, and the unaudited financial statements of Bighorn Gas Gathering, L.L.C., an unconsolidated affiliate of Copano, as of and for the year ending December 31, 2008. |

| |

| | • | The Audit Committee has discussed with the independent auditor the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. |

The Audit Committee has received from the independent auditor the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as adopted by the Public Company Accounting Oversight Board in Rule 3600T, and has discussed with the independent auditor its independence. The Audit Committee has determined that the non-audit services provided to Copano and its affiliates by the independent auditor (discussed below under “Proposal Three — Ratification of Independent Registered Public Accounting Firm”) are compatible with such firm maintaining its independence.

Based on the reviews and discussions described above, the Audit Committee recommended to the Board of Directors that the financial statements of Copano and Bighorn Gas Gathering, L.L.C. be included in the Annual Report onForm 10-K for the year ended December 31, 2008, for filing with the Securities and Exchange Commission.

Submitted By:

Audit Committee

James G. Crump, Chairman

Ernie L. Danner

Michael L. Johnson

Notwithstanding anything to the contrary set forth in any of our previous or future filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate this proxy statement or future filings with the SEC, in whole or in part, the preceding report shall not be deemed to be “soliciting material” or to be “filed” with the SEC or incorporated by reference into any filing except to the extent the foregoing report is specifically incorporated by reference therein.

9

EXECUTIVE OFFICERS

Certain information concerning Copano’s executive officers as of the date of this proxy statement is set forth below.

| | | | | | | |

| Name | | Age | | Position with Our Company |

| |

| John R. Eckel, Jr. | | | 57 | | | Chairman of the Board and Chief Executive Officer |

| R. Bruce Northcutt | | | 49 | | | President and Chief Operating Officer |

| John A. Raber | | | 55 | | | Executive Vice President; President and Chief

Operating Officer, Rocky Mountains |

| Matthew J. Assiff | | | 42 | | | Senior Vice President and Chief Financial Officer |

| Douglas L. Lawing | | | 48 | | | Senior Vice President, General Counsel and Secretary |

| Lari Paradee | | | 46 | | | Vice President and Controller |

| Carl A. Luna | | | 39 | | | Vice President, Finance |

| Sharon J. Robinson | | | 49 | | | President and Chief Operating Officer, Oklahoma |

| | | | | | | |

John R. Eckel, Jr., Chairman of the Board and Chief Executive Officer, founded our business in 1992 and served as our President and Chief Executive Officer until April 2003, when he was elected to his current position. Mr. Eckel serves on the board of directors and as Chairman of the Texas Pipeline Association. Mr. Eckel also serves as President and Chief Executive Officer of Live Oak Reserves, Inc., which he founded in 1986, and which, with its affiliates, is engaged in oil and gas exploration and production in South Texas. Mr. Eckel received a Bachelor of Arts degree from Columbia University and was employed in various corporate finance positions in New York prior to entering the energy industry in 1979.

R. Bruce Northcutt, President and Chief Operating Officer, has served in his current capacity since April 2003. Mr. Northcutt served as President of El Paso Global Networks Company (a provider of wholesale bandwidth transport services) from November 2001 until April 2003; Managing Director of El Paso Global Networks Company from April 1999 until December 2001 and Vice President, Business Development, of El Paso Gas Services Company (a marketer of strategic interstate pipeline capacity) from January 1998 until April 1999. Mr. Northcutt began his career with Tenneco Oil Exploration and Production in 1982 working in the areas of drilling and production engineering. From 1988 until 1998, Mr. Northcutt held various levels of responsibility within several business units of El Paso Energy and its predecessor, Tenneco Energy, including supervision of pipeline supply and marketing as well as regulatory functions. Mr. Northcutt holds a Bachelor of Science degree in Petroleum Engineering from Texas Tech University. Mr. Northcutt is a Registered Professional Engineer in Texas.

John A. Raber, Executive Vice President of Copano and President and Chief Operating Officer, Rocky Mountains, has served in his current capacity since August 2007. Mr. Raber’s responsibilities include assisting us with the development of corporate strategy and major initiatives, acquisitions and capital projects, including opportunities in the Rocky Mountains region. Mr. Raber served as President and Chief Operating Officer of ScissorTail Energy, LLC, from its formation on July 1, 2000 until August 2007. He also served as President and Chief Operating Officer of Copano Energy/Mid-Continent, L.L.C., our wholly-owned subsidiary, from August 1, 2005, the date we acquired ScissorTail, until August 2007. Mr. Raber served as Vice President of Marketing and Business Development of Wyoming Refining Company (a Rocky Mountains refiner) from July 1999 to August 2005, Senior Vice President of Processing and other executive positions with Tejas Gas Corporation (a public midstream company) from February 1995 to July 1999 and as Vice President and other positions with LEDCO, Inc. (a private midstream and gas distribution company in Louisiana) from July 1982 to February 1995. Mr. Raber began his career as a Field and Operations Engineer with J. Ray McDermott, Inc. (a marine oil and gas construction company) working mainly in overseas locations from May 1976 to July 1982. Mr. Raber holds a Bachelor of Science degree in Civil Engineering from Tulane University and has also attended the Stanford Business School of Executive Education.

Matthew J. Assiff, Senior Vice President and Chief Financial Officer, has served in his current capacity since October 2004 and previously served as our Senior Vice President, Finance and Administration, from January 2002. Mr. Assiff serves on the board of directors and as Treasurer of the National Association of Publicly Traded

10

Partnerships. Prior to joining our company, Mr. Assiff was a Vice President within the Global Energy Group of Credit Suisse and was with Donaldson, Lufkin and Jenrette from 1998 (prior to its purchase by Credit Suisse in 2000) initially as an Associate and subsequently as a Vice President. Mr. Assiff began his career in 1989 with Goldman, Sachs & Co. in the Mergers & Acquisitions group focusing on energy transactions and has worked in the corporate finance and Mergers & Acquisitions groups of Bear Stearns and Chemical Securities (now J.P. Morgan Chase). Mr. Assiff has also worked with Landmark Graphics Company and Compaq Computer in the areas of finance, planning, mergers and acquisitions and corporate venture investing. Mr. Assiff graduated from Columbia University with a Bachelor of Arts degree and holds a Masters of Business Administration degree from Harvard Business School.

Douglas L. Lawing,Senior Vice President, General Counsel and Secretary, has served in his current capacity since November 2007. From October 2004 until November 2007, Mr. Lawing served as our Vice President, General Counsel and Secretary and previously served as our General Counsel since November 2003. From January 2002 until November 2003, Mr. Lawing served as our Corporate Counsel. Mr. Lawing has served as Corporate Secretary of our company and its predecessors since February 1994. Additionally, from March 1998 until January 2002, Mr. Lawing served as an Associate Counsel of Nabors Industries, Inc. (now Nabors Industries Ltd.), a land drilling contractor. Mr. Lawing holds a Bachelor of Science degree in Business Administration from the University of North Carolina at Chapel Hill and a J.D. from Washington and Lee University.

Lari Paradee,Vice President and Controller, has served in her current capacity since joining us in July 2003. As Vice President and Controller, Ms. Paradee is primarily responsible for our accounting and reporting functions. From September 2000 until March 2003, Ms. Paradee served as Accounting and Consolidations Manager for Intergen, a global power generation company jointly owned by Shell Generating (Holdings) B.V. and Bechtel Enterprises Energy B.V. Ms. Paradee served as Vice President and Controller of DeepTech International, Inc. (an offshore pipeline and exploration and production company) from May 1991 until August 1998, when DeepTech was merged into El Paso Energy Corporation. Ms. Paradee then served as Manager, Finance and Administration of El Paso Energy until March 2000. Ms. Paradee has served as Senior Auditor and Staff Auditor for Price Waterhouse. Ms. Paradee graduated magna cum laude from Texas Tech University with a B.B.A. in Accounting. Ms. Paradee is also a Certified Public Accountant.

Carl A. Luna,Vice President, Finance, has served in his current capacity since May 2006 and previously served as a financial consultant to us from August 2005 to May 2006. Mr. Luna is primarily responsible for our finance and treasury functions. From 1997 until 2005, Mr. Luna served as a Vice President in the Syndicated and Leveraged Finance Group of J.P. Morgan Securities Inc. and as an Associate in that area from 1995 until 1997. Mr. Luna began his career at Texas Commerce Bank (now J.P. Morgan Chase Bank) in 1992 as an Analyst and subsequently worked as an Assistant Vice President in the Commercial Banking Division until 1995. Mr. Luna holds a Bachelor of Business Administration degree in Finance from Texas A&M University and a Master of Business Administration degree from Rice University.

Sharon J. Robinson, President and Chief Operating Officer, Oklahoma, has served as President of our Oklahoma subsidiaries since August 2007 and was also elected Chief Operating Officer in June 2008. From June 2003 until August 2007, Ms. Robinson served as Vice President, Commercial Activities — ScissorTail Energy, LLC where she was responsible for overseeing the commercial operations, budgeting and business development activities for ScissorTail. Ms. Robinson joined ScissorTail when it was formed on July 1, 2000 and served as General Manager, Commercial from September 2001 to June 2003. Ms. Robinson worked for Transok from July 1993 through December 1999 in both commercial and engineering positions. Ms. Robinson began her career as a Project Engineer with Cities Service Oil Company, which later became Occidental Petroleum, in December 1981 and continued through March 1992. Ms. Robinson holds a Bachelor of Science in Chemical Engineering from Oklahoma State University and is a Registered Professional Engineer in the State of Oklahoma. Ms. Robinson also serves on the board of directors of the Gas Processors Association.

11

COMPENSATION DISCUSSION AND ANALYSIS

We provide what we believe is a competitive total compensation package to our executive management team through a combination of base salary, a short-term incentive compensation plan, a long-term equity incentive compensation plan and broad-based benefits programs. This Compensation Discussion and Analysis addresses the following topics:

| | |

| | • | the role of our Compensation Committee in establishing executive compensation; |

| |

| | • | our process for setting executive compensation; |

| |

| | • | our compensation objectives; |

| |

| | • | the components of our compensation program; and |

| |

| | • | our executive compensation decisions for fiscal year 2008, as well as any compensation decisions made in and for fiscal year 2009 prior to the date of the filing of this proxy statement. |

Our named executive officers for 2008 were:

| | |

| | • | John R. Eckel, Jr., Chairman of the Board and Chief Executive Officer; |

| |

| | • | R. Bruce Northcutt, President and Chief Operating Officer; |

| |

| | • | John A. Raber, Executive Vice President; President and Chief Operating Officer, Rocky Mountains; |

| |

| | • | Matthew J. Assiff, Senior Vice President and Chief Financial Officer; |

| |

| | • | Sharon J. Robinson, President and Chief Operating Officer, Oklahoma; and |

| |

| | • | Ronald W. Bopp, former Senior Vice President, Corporate Development, who retired from the company on May 31, 2008, after which he has provided consulting services to us in his capacity as Senior Advisor. |

The Compensation Committee

The Compensation Committee of our Board assists the Board in fulfilling its duties relating to executive officer and director compensation and has overall responsibility for the approval, evaluation and oversight of all our compensation plans, policies and programs. The fundamental responsibilities of the Compensation Committee are to (i) establish the objectives of our executive compensation program, (ii) approve and administer our incentive compensation plans, (iii) monitor the performance and compensation of executive officers and (iv) set compensation levels and make awards under incentive compensation plans that are consistent with our compensation objectives and the performance of our company and its executive officers. The Compensation Committee also has responsibility for evaluating and making a recommendation to our Board regarding compensation for service on our Board. For additional information with respect to our Compensation Committee, please read “The Board of Directors and its Committees — Committees of Our Board of Directors — Compensation Committee.”

The Compensation-Setting Process

Compensation Committee Meetings. Our Compensation Committee holds regular quarterly meetings each year that coincide with our quarterly Board meetings and additional meetings as required to carry out its duties. The Chairman of the Compensation Committee works with our Chief Executive Officer and our General Counsel to establish each meeting agenda.

The Compensation Committee’s annual process for establishing executive compensation begins each year at its regular fourth quarter meeting, with the consideration of base salaries for the succeeding calendar year. At the following regular first quarter meeting, the Compensation Committee (i) considers annual incentive awards under our Management Incentive Compensation Plan, or MICP, for the previous year based upon the achievement of previously established objectives and (ii) approves annual guidelines that provide for the administration of the MICP and include target awards for each participant and financialand/or operational objectives for the current year. These objectives are subject to further approval by our Board at its regular first quarter meeting. The guidelines also may provide for the establishment of individual objectives for plan participants, including our named executive

12

officers for a particular year, which would be subject to approval of the Compensation Committee. Annual awards of equity incentive compensation under our Long-Term Incentive Plan, or LTIP, are considered at the Compensation Committee’s regular second quarter meeting each year.

The Compensation Committee meets outside the presence of management to consider appropriate compensation for our Chief Executive Officer and meets with the Chief Executive Officer to consider compensation for all other executive officers. When compensation decisions are not being considered, the Compensation Committee typically meets in the presence of the Chief Executive Officer and our General Counsel or his representative. Depending upon the agenda for a particular meeting, the Compensation Committee may invite our Director, Human Resources and a representative of BDO Seidman, LLP, or BDO, an independent compensation consultant, to participate in committee meetings. The Compensation Committee also regularly meets in executive session without management. The Compensation Committee Chairman works with our Chief Executive Officer, our General Counsel, our Director, Human Resources and BDO to assemble meeting materials, which are distributed to committee members for review in advance of each meeting.

Role of Compensation Consultant. The Compensation Committee Charter grants the Compensation Committee the sole and direct authority to hire and fire advisors and to approve their compensation, which we are obligated to pay. Any advisors so hired report directly to the Compensation Committee. Shortly after its creation in connection with our 2004 initial public offering, the Compensation Committee engaged an independent compensation consultant to assess the then-existing compensation of our executive officers, including base salaries, bonus arrangements and long-term incentive compensation, and to assist the Compensation Committee in developing compensation principles and a compensation program for executive officers. Since that time, our independent compensation consultant, currently BDO, has assisted the Compensation Committee in assessing and determining competitive compensation packages for our executive officers that are consistent with our compensation philosophy of offering rewards that align the interests of our management with those of our unitholders.

BDO has, from time to time at the Compensation Committee’s request, assembled information regarding (i) compensation trends in the midstream natural gas industry and for master limited partnerships, and (ii) relative compensation for similarly-situated executive officers of companies within these groups as well as of other companies with revenues comparable to ours. BDO employs data compiled from surveys and the public filings of a peer group of master limited partnerships.1 We believe that compensation levels of executive officers in a master limited partnership peer group are relevant to our compensation decisions because we compete with these companies for executive management talent.

Role of Executive Officers. Except with respect to his own compensation, our Chief Executive Officer plays a significant role in the Compensation Committee’s decisions regarding compensation for our executive officers. In fulfilling his role, the Chief Executive Officer relies in part on advice from other executive officers and market information provided by BDO. The most significant aspects of our Chief Executive Officer’s role are:

| | |

| | • | evaluating and advising the Compensation Committee regarding individual performance, both generally and with respect to the achievement of individual objectives under our MICP; |

| |

| | • | recommending target awards and financial, operationaland/or individual objectives under our MICP; and |

| |

| | • | recommending base salary levels, MICP awards and LTIP awards. |

1 In 2008, this peer group included Enterprise Products Partners L.P., Buckeye Partners, L.P., Regency Energy Partners LP, Boardwalk Pipeline Partners, LP, Crosstex Energy, L.P., Magellan Midstream Partners, L.P., MarkWest Energy Partners, L.P., Plains All American Pipeline, L.P., Sunoco Logistics Partners L.P., NuStar Energy L.P., Energy Transfer Partners, L.P., TEPPCO Partners, L.P., Williams Partners L.P., Spectra Energy Partners, LP, Targa Resources Partners LP, DCP Midstream Partners, LP and Hiland Partners, LP.

13

Our Executive Compensation Program

Overview

Compensation Objectives

Our executive compensation program is intended to align the interests of management with those of our unitholders by motivating executive officers to achieve strong financial and operating results, which we believe closely correlate to long-term unitholder value. This alignment of interests is primarily reflected through executive officers’ participation in our MICP and our LTIP. In addition, our program is designed to achieve the following objectives:

| | |

| | • | attract and retain talented executive officers by providing reasonable total compensation levels competitive with that of executives holding comparable positions in similarly-situated organizations; |

| |

| | • | provide total target compensation for each named executive officer that, when gauged against the market median, is appropriate considering the executive’s performance, experience and overall value to the company; |

| |

| | • | provide a performance-based compensation component that balances rewards for short-term and long-term results and is tied to both individual and company performance; and |

| |

| | • | encourage the long-term commitment of our executive officers to us and to our unitholders’ long-term interests through grants of equity under the terms of our LTIP. |

Compensation Strategy

To accomplish our objectives, we seek to offer a total compensation program to our executive officers that, when valued in its entirety, approximates the median value of programs sponsored by companies of similar size, line of business, performance and operational complexity. Our executive compensation program consists of three principal elements: (i) base salary, (ii) potential for annual incentive compensation awards under our MICP based upon the achievement of performance goals, (iii) opportunities to earn unit-based awards under our LTIP, which provide long-term incentives that are intended to encourage the achievement of superior results over time and to align the interests of executive officers with those of our unitholders and (iv) other benefits designed primarily to provide competitive health and welfare and retirement savings opportunities. We believe that if the overall value of our total compensation opportunities for executive officers is consistent with market practice, we will be able to continue to attract qualified executives, retain them and provide appropriate rewards consistent with their efforts on behalf of our unitholders.

In order to ensure that the total compensation package we offer our executive officers is competitive, our compensation consultant develops an assessment of market levels of compensation through an analysis of survey data regarding companies in the midstream gas gathering and processing industry, companies of comparable size in terms of revenues and information disclosed in peer companies’ public filings. While the Compensation Committee relies upon this data to assess the reasonableness of total compensation, it also considers a number of other factors including (i) historical compensation levels, (ii) the specific role the executive plays within our company, (iii) the performance of the executive and (iv) the relative compensation levels among our executive officers. The Compensation Committee’s allocation of total compensation between long-term compensation in the form of LTIP awards and currently-paid compensation in the form of base salary and MICP awards, generally is based upon an analysis of how our peer companies use long-term and currently-paid compensation to pay their executive officers and the Compensation Committee’s judgment regarding how each individual officer’s compensation should be allocated.

14

Compensation Elements

2008 Target Compensation

For 2008, target compensation for our named executive officers was allocated as reflected below:

| | | | | | | | | | | | | | | | | |

| | | | | | | | | Total Target

|

| Name and Principal Position | | Base Salary | | MICP | | LTIP | | Compensation |

| |

John R. Eckel, Jr. | | | 61 | % | | | 39 | % | | | 0 | % | | | 100 | % |

Chairman of the Board and

Chief Executive Officer | | | | | | | | | | | | | | | | |

R. Bruce Northcutt | | | 43 | % | | | 24 | % | | | 33 | % | | | 100 | % |

President and

Chief Operating Officer | | | | | | | | | | | | | | | | |

John A. Raber | | | 45 | % | | | 22 | % | | | 33 | % | | | 100 | % |

Executive Vice President;

President and Chief Operating Officer,

Rocky Mountains | | | | | | | | | | | | | | | | |

Matthew J. Assiff | | | 47 | % | | | 24 | % | | | 29 | % | | | 100 | % |

Senior Vice President and

Chief Financial Officer | | | | | | | | | | | | | | | | |

Sharon J. Robinson | | | 49 | % | | | 24 | % | | | 27 | % | | | 100 | % |

President and Chief Operating Officer,

Oklahoma | | | | | | | | | | | | | | | | |

Ronald W. Bopp | | | 49 | % | | | 24 | % | | | 27 | % | | | 100 | % |

Senior Advisor, (formerly

Senior Vice President, Corporate Development)(1) | | | | | | | | | | | | | | | | |

| | |

| (1) | | On May 31, 2008, Mr. Bopp retired and entered into a retirement, release and services agreement with the company, pursuant to which, as Senior Advisor, he provides consulting services to us. |

Because our Chief Executive Officer has a 4.27% indirect equity interest in our company (as of the record date), he and the Compensation Committee have agreed that opportunities to earn additional compensation through long-term incentive awards are not required to align his interests with those of our unitholders. Accordingly, no LTIP awards have been made to our Chief Executive Officer, although he remains eligible to receive future awards. Equity ownership is not otherwise a factor in the determination of equity awards, as we want to encourage our executives to hold significant amounts of our equity.

Base Salary

Base salary is a critical element of executive compensation because it provides executives with a base level of fixed annual cash compensation. The Compensation Committee reviews base salaries of our executive officers annually, and makes any adjustment after considering economic conditions, increases in the cost of living, job performance of the executive officer over time, any expansion of the executive officer’s responsibilities and market salary levels, including those in effect in the midstream natural gas industry. No specific weight or emphasis is assigned to any one of these factors. By reviewing the salary data of other companies from time to time, we intend to ensure that the base salaries established by the Compensation Committee are generally within the median range of base salaries paid by similarly-situated companies.

The Compensation Committee conducted its annual review of base salaries of all executive officers in November 2007 and as a result, approved base salary increases for executive officers effective January 1, 2008. In approving the increases for 2008, the Compensation Committee primarily considered: (i) an analysis of market information provided by BDO, (ii) individual performance, (iii) the salary levels among our executive officers and (iv) the effect of our company’s growth on the responsibilities of each executive officer.

15

The following base salary increases for our named executive officers for 2008 represented an average increase of approximately 12% over 2007 base salaries. Our named executive officers’ 2008 base salaries were within the median range of base salary for similarly situated executive officers in our peer group.

Base Salaries for 2008

| | | | | | | | | |

| Name | | Increase | | | 2008 Base Salary | |

| |

| John R. Eckel, Jr. | | $ | 55,000 | | | $ | 430,000 | |

| R. Bruce Northcutt | | $ | 25,000 | | | $ | 305,000 | |

| John A. Raber | | $ | 15,000 | | | $ | 295,000 | |

| Matthew J. Assiff | | $ | 15,000 | | | $ | 255,000 | |

| Sharon J. Robinson | | $ | 65,000 | (1) | | $ | 245,000 | |

| Ronald W. Bopp | | $ | 9,000 | | | $ | 244,000 | |

| | |

| (1) | | Ms. Robinson received an approximately 27% increase in base salary in connection with her promotion to President of our Oklahoma subsidiaries in August 2007. |

In December 2008, in response to the national economic downturn and upon recommendation of management, the Compensation Committee decided that salaries for all executive officers for 2009 would remain at 2008 levels. In addition, as discussed in greater detail below in “Deferred Compensation Plan,” the Compensation Committee approved a Deferred Compensation Plan, or DCP, pursuant to which 10% of the Chief Executive Officer’s 2009 base salary and 5% of the 2009 base salaries for the other named executive officers will be deferred and not paid unless and until a stated company performance target is achieved, or under certain other conditions as described below under “Deferred Compensation Plan.”

Short-Term Incentive Compensation

MICP. The MICP provides for annual bonus opportunities for executive officers, including the Chief Executive Officer, and certain key employees based upon the achievement of company financial or operational objectives, or both, and, if applicable, individual performance goals. In November 2008, the MICP was amended to provide for settlement of MICP bonuses with either cash or equity awards under the company’s LTIP, at the discretion of the Committee. The MICP is intended to focus our executive officers’ efforts by linking officers’ compensation to the achievement of goals that promote the interests of the company and its unitholders. Target incentive opportunities under the MICP are established each year by the Compensation Committee as a percentage of base salary in effect as of July 1 of that year. Targets are intended to be competitive with short-term incentive compensation opportunities available for comparable positions in comparable companies. In addition to annual awards, the MICP also provides the Compensation Committee with the ability to make special incentive awards in recognition of exemplary performance by an executive officer with respect to a specified project or issue. Under the MICP, no participant may receive an annual award that exceeds 200% of his or her annual base salary during any calendar year, or a special incentive award that exceeds 50% of his or her annual base salary during any calendar year.

MICP Guidelines. The Compensation Committee adopts annual guidelines for the administration of the MICP, which include annual target awards, annual objectives and the percentage of each target award that will be contingent on applicable financial, operational and individual objectives. Because the financial and operational objectives are intended to be consistent with our company performance goals, they are approved by the Compensation Committee subject to further approval by our Board of Directors. The guidelines also may provide for the establishment of individual objectives for each plan participant for a particular year. Depending upon the participant’s role in our company, a participant’s individual objectives may include a combination of financial, strategic and operational objectives, each of which are assigned a percentage weight, the sum of which comprises the portion of the target award attributable to the achievement of individual objectives. Based upon the level of achievement of the applicable objectives and a subjective assessment of the level of achievement of applicable individual objectives, the Chief Executive Officer recommends to the Compensation Committee the amount of award for each participant (other than his own award). The Compensation Committee then determines the final

16

amount of any award under the plan for all participants. In determining awards, the Compensation Committee has discretion with respect to subjective factors, such as assessment of a participant’s level of achievement of his or her individual objectives.

Non-GAAP Financial Measures. Our discussion of MICP financial objectives includes references to the non-GAAP financial measures of distributable cash flow per unit and total distributable cash flow per unit. For a discussion of how we calculate these measures and reconciliations of distributable cash flow and total distributable cash flow to net income, their most directly comparable GAAP measure, please see Appendix B to this proxy statement.

2008 MICP Awards. In February 2008, the Compensation Committee adopted guidelines for the MICP for calendar year 2008, which provided that 75% of each plan participant’s 2008 target award was contingent on the company’s achievement of a single financial objective, which was approved by our Board upon the committee’s recommendation, and 25% of the target award was contingent on the achievement of individual objectives. The 2008 financial objective consisted of our attainment, on an annual basis, of one of three levels (threshold, target or maximum) of cash available for distribution to our unitholders on a per unit basis, which we refer to as distributable cash flow per unit. Distributable cash flow per unit is a non-GAAP financial measure. Upon the achievement of the threshold, target or maximum level of distributable cash flow per unit, a plan participant was entitled to 50%, 100% or 150%, respectively, of the portion of his or her target award attributable to the achievement of the financial objective. If performance fell between the threshold and target levels or between the target and maximum levels, the amount of the bonus was determined by straight-line interpolation.

The Compensation Committee and the Board designated distributable cash flow per unit as the financial objective under our MICP because distributable cash flow is an important non-GAAP performance measure of our success in providing a cash return on investment. Specifically, this financial measure indicates to investors whether or not we are generating cash flow at a level that can sustain or support an increase in our quarterly distribution.

The 2008 MICP guidelines further provided that the Compensation Committee and the Chief Executive Officer would approve individual objectives for the named executive officers. The 2008 individual objectives for the named executive officers generally included the following, depending on the officer’s role in our company:

| | |

| | • | strategic objectives — develop succession plans, pursue expansion and acquisition opportunities and initiate a process for implementation of a new accounting system; and |

| |

| | • | operational objectives — meet budget targets, successfully integrate acquired systems, assets and operations and meet environmental, health and safety goals. |

Based on the Compensation Committee’s evaluation of individual performance and our company’s achievement of the financial objective for 2008, incentive compensation awards under our MICP for 2008 were approved for each of our named executive officers as shown in the following table:

Named Executive Officer MICP Awards for 2008

| | | | | | | | | | | | | | | | | | | | | |

| | | % of Financial

| | | % of Individual

| | | | | | | | | | |

| | | Performance

| | | Performance

| | | 2008

| | | 2008

| | | Payout as a

| |

| | | Target

| | | Target

| | | Target

| | | Approved

| | | % of

| |

| Name | | Achieved | | | Achieved | | | Payment | | | Award | | | Target | |

| |

| John R. Eckel, Jr. | | | 93.0 | % | | | 92.0 | % | | $ | 279,500 | | | $ | 260,000 | (1) | | | 93.02 | % |

| R. Bruce Northcutt | | | 93.0 | % | | | 95.0 | % | | $ | 167,750 | | | $ | 156,900 | (2) | | | 93.50 | % |

| John A. Raber | | | 93.0 | % | | | 100.0 | % | | $ | 147,500 | | | $ | 139,800 | (2) | | | 94.77 | % |

| Matthew J. Assiff | | | 93.0 | % | | | 95.0 | % | | $ | 127,500 | | | $ | 120,200 | (2) | | | 94.27 | % |

| Sharon J. Robinson | | | 93.0 | % | | | 98.5 | % | | $ | 122,500 | | | $ | 115,600 | (2) | | | 94.36 | % |

| Ronald W. Bopp | | | — | | | | — | | | $ | 122,000 | | | | — | | | | — | |

| | |

| (1) | | Payment deferred pursuant to DCP. |

| |

| (2) | | Settled with unit awards under our LTIP. |

17

In response to the downturn in the national economy, payment of Mr. Eckel’s 2008 MICP award was deferred pursuant to our DCP and will not be paid unless and until a specified company performance target is achieved, or certain other conditions are met as described under “Deferred Compensation Plan.” Additionally, the Compensation Committee settled all 2008 MICP awards, including awards to our named executive officers, with common unit awards under our LTIP. These units are not subject to vesting or forfeiture. The number of units granted in settlement of 2008 MICP bonuses was determined by dividing (a) the amount of each participant’s bonus approved by the Compensation Committee by (b) $16.0322, which was the volume weighted average price of a common unit during the ten consecutive trading days before the Compensation Committee approved MICP awards for 2008. The awards were settled net of taxes.

Determinations of MICP Target Levels. In making the annual determination of the threshold, target and maximum levels for performance objectives, the Compensation Committee and the Board consider the specific circumstances facing us during the relevant year. Generally, the committee seeks to set the threshold, target and maximum levels such that the relative challenge of achieving the target level is consistent from year to year. The expectation that management will achieve the threshold level is relatively high, while meaningful additional effort would be required to achieve the target level.