QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12

|

Copano Energy, L.L.C. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

COPANO ENERGY, L.L.C.

2727 Allen Parkway, Suite 1200

Houston, Texas 77019

NOTICE OF ANNUAL MEETING OF UNITHOLDERS

TO BE HELD ON JUNE 7, 2005

Dear Unitholders:

You are cordially invited to attend the 2005 Annual Meeting of Unitholders (the "Annual Meeting") of Copano Energy, L.L.C., a Delaware limited liability company ("Copano"), which will be held on Tuesday, June 7, 2005, at 9:00 a.m., Central Standard Time, at 2727 Allen Parkway, Ground Level, Meeting Room 1, Houston, Texas 77019. The Annual Meeting will be held for the following purposes:

- 1.

- To elect eight directors to Copano's Board of Directors to serve until the 2006 Annual Meeting of Unitholders;

- 2.

- To ratify the appointment of Deloitte & Touche LLP as independent auditors of Copano for the fiscal year ending December 31, 2005; and

- 3.

- To transact such other business as may properly come before the Annual Meeting and at any adjournments or postponements of the meeting.

Only unitholders of record at the close of business on April 18, 2005 are entitled to receive notice of and to vote at the Annual Meeting or any adjournments or postponement thereof. A list of our holders will be available for examination at the Annual Meeting and at Copano's office at least ten days prior to the Annual Meeting.

By Order of the Board of Directors,

Douglas L. Lawing

Vice President, General Counsel and Secretary

Houston, Texas

April 27, 2005

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE-PAID RETURN ENVELOPE AS PROMPTLY AS POSSIBLE. IF YOU ATTEND THE MEETING AND SO DESIRE, YOU MAY WITHDRAW YOUR PROXY AND VOTE IN PERSON.

COPANO ENERGY, L.L.C.

2727 Allen Parkway, Suite 1200

Houston, Texas 77019

PROXY STATEMENT

Annual Meeting of Unitholders

To Be Held on Tuesday, June 7, 2005

This Proxy Statement, which was first mailed to our unitholders on April 27, 2005, is being furnished to you in connection with the solicitation of proxies by and on behalf of the Board of Directors of Copano Energy, L.L.C., for use at our 2005 Annual Meeting of Unitholders (the "Annual Meeting") or at any adjournments or postponements thereof. The Annual Meeting will be held on Tuesday, June 7, 2005, at 9:00 a.m., Central Standard Time, at 2727 Allen Parkway, Ground Level, Meeting Room 1, Houston, Texas 77019. Only holders of record of common units and subordinated units at the close of business on April 18, 2005 (the "Record Date") were entitled to notice of, and are entitled to vote at, the Annual Meeting and any adjournments or postponement thereof, unless such adjournment or postponement is for more than 45 days, in which event we will set a new record date. Unless the context requires otherwise, the terms "our," "we," "us" and similar terms refer to Copano Energy, L.L.C., together with its consolidated subsidiaries.

Proposals

At our 2005 Annual Meeting of Unitholders, we are asking our common unitholders and subordinated unitholders, voting together as a single class, to consider and act upon proposals to: (1) elect eight directors to serve until our 2006 Annual Meeting and (2) ratify the appointment of Deloitte & Touche LLP as our independent auditors for the fiscal year ending December 31, 2005.

Quorum Required

The presence, in person or by proxy, of the holders as of the Record Date of a majority of our outstanding common units and subordinated units is necessary to constitute a quorum for purposes of voting on the proposals at the Annual Meeting. Withheld votes will count as present for purposes of establishing a quorum on the proposals.

How to Vote

You may vote in person at the Annual Meeting or by proxy. Even if you plan to attend the Annual Meeting, we encourage you to complete, sign and return your proxy card in advance of the Annual Meeting. If you plan to attend the Annual Meeting and wish to vote in person, we will give you a ballot at the meeting. However, if your units are held in the name of a broker, you must obtain from the brokerage firm an account statement, letter or other evidence satisfactory to us of your beneficial ownership of the units. Please mail your completed, signed and dated proxy card in the enclosed postage-paid return envelope as soon as possible so that your units may be represented at the Annual Meeting.

Revoking Your Proxy

You may revoke your proxy before it is voted at the Annual Meeting as follows: (i) by delivering, before or at the Annual Meeting, a new proxy with a later date; (ii) by delivering, on or before the business day prior to the Annual Meeting, a notice of revocation to our Secretary at the address set forth in the notice of the Annual Meeting; (iii) by attending the Annual Meeting in person and voting, although your

1

attendance at the Annual Meeting, without actually voting, will not by itself revoke a previously granted proxy; or (iv) if you have instructed a broker to vote your units, you must follow the directions received from your broker to change those instructions.

Outstanding Common and Subordinated Units Held on Record Date

As of the Record Date, there were 7,076,192 outstanding common units and 3,519,126 outstanding subordinated units entitled to vote at the Annual Meeting.

Common and Subordinated Units Owned by Our Affiliates as of the Record Date

As of the Record Date: (i) Copano Partners Trust held 763,221 common units and 1,317,733 subordinated units; (ii) DLJ Merchant Banking Partners III, L.P. and affiliated funds, which are affiliates of Credit Suisse First Boston Private Equity, held 230,560 common units and 874,924 subordinated units; (iii) EnCap Energy Capital Fund III, L.P. and affiliated funds, which are affiliated funds of EnCap Investments L.P., held 230,560 common units and 874,924 subordinated units; and (iv) our directors and executive officers collectively held 96,211 common units and 110,345 subordinated units, excluding units held by Copano Partners Trust. Please read "Security Ownership of Certain Beneficial Owners and Management."

2

PROPOSAL ONE—ELECTION OF DIRECTORS

The total number of directors on our Board of Directors is currently set at eight, and the eight current board members are our Board's nominees for the upcoming election of directors. Members of our Board of Directors are elected on an annual basis at the Annual Meeting.

At the Annual Meeting, our common unitholders and subordinated unitholders, voting together as a single class, will consider and act upon a proposal to elect eight directors to our Board of Directors to serve until the 2006 Annual Meeting of Unitholders. Each of the nominees has consented to serve as a director if so elected. The persons named as proxies in the accompanying proxy card, who have been designated by our Board of Directors, intend to vote for the election of the director nominees unless otherwise instructed by a unitholder in a proxy card. If these nominees become unable for any reason to stand for election as a director, the persons named as proxies in the accompanying proxy card will vote for the election of such other person or persons as our Board of Directors may recommend and propose to replace such nominee or nominees.

Information concerning the eight director nominees is set forth below.

Director Nominees

Name

| | Age

| | Position with Our Company

| | Director

Since

|

|---|

| John R. Eckel, Jr. | | 53 | | Chairman of the Board and Chief Executive Officer | | 1992 |

| Robert L. Cabes, Jr. | | 35 | | Director | | 2001 |

| James G. Crump | | 64 | | Director | | 2004 |

| Ernie L. Danner | | 50 | | Director | | 2004 |

| Scott A. Griffiths | | 50 | | Director | | 2004 |

| Michael L. Johnson | | 54 | | Director | | 2004 |

| T. William Porter III | | 63 | | Director | | 2004 |

| William L. Thacker | | 59 | | Director | | 2004 |

John R. Eckel, Jr. founded our business in 1992 and served as our President and Chief Executive Officer until April 2003, when he was elected to his current position of Chairman of the Board and Chief Executive Officer. Mr. Eckel serves on the Board of Directors of the Texas Pipeline Association. Mr. Eckel also serves as President and Chief Executive Officer of Live Oak Reserves, Inc., which he founded in 1986, and which, with its affiliates, is engaged in oil and gas exploration and production in South Texas. Mr. Eckel received a Bachelor of Arts degree from Columbia University and was employed in various corporate finance positions in New York prior to entering the energy industry in 1979.

Robert L. Cabes, Jr. joined our Board of Directors in 2001. Mr Cabes is a Principal of Global Energy Partners, a specialty group within Credit Suisse First Boston's Alternative Capital Division that makes investments in energy companies. Prior to joining Global Energy Partners in 2001, Mr. Cabes was with Credit Suisse First Boston's and Donaldson, Lufkin and Jenrette's Investment Banking Division (prior to its acquisition by Credit Suisse First Boston in 2000). Before joining Donaldson, Lufkin and Jenrette, Mr. Cabes spent six years with Prudential Securities in its energy corporate finance group in Houston and New York. Mr. Cabes serves as a director of CEH Holdco, Inc., Laramie Energy, LLC, Medicine Bow Energy Corporation and Pinnacle Gas Resources, Inc. Mr. Cabes holds a B.B.A. from Southern Methodist University and is a CFA charterholder.

James G. Crump joined our Board of Directors upon completion of our initial public offering in November 2004. Mr. Crump is the Chairman of the Audit Committee and a member of the Conflicts Committee. He began his career at Price Waterhouse in 1962 and became a partner in 1974. From 1977 until the merger of Price Waterhouse and Coopers & Lybrand in 1998, Mr. Crump held numerous management and leadership roles. From 1998 until his retirement in 2001, Mr. Crump served as Global

3

Energy and Mining Cluster Leader, a member of the U.S. Management Committee and the Global Management Committee and as Houston Office Managing Partner of PricewaterhouseCoopers. Mr. Crump holds a B.A. in Accounting from Lamar University.

Ernie L. Danner joined our Board of Directors upon completion of our initial public offering in November 2004. Mr. Danner is the Chairman of the Conflicts Committee and a member of the Audit Committee. Mr. Danner currently serves as Executive Vice President and as a director of Universal Compression Holdings Inc. as well as President of the Latin America Division of a natural gas compression service company subsidiary of Universal Compression. Mr. Danner joined Universal Compression in 1998 as its Chief Financial Officer. Mr. Danner holds a B.A. and an M.A. in Accounting from Rice University.

Scott A. Griffiths joined our Board of Directors in December 2004. Mr. Griffiths is a member of the Nominating and Governance Committee and the Compensation Committee. Mr. Griffiths has served as Executive Vice President and Chief Operating Officer of Spinnaker Exploration Company since 2003. From 2002 to 2003, Mr. Griffiths served as Senior Vice President, Worldwide Exploration for Ocean Energy, Inc. Mr. Griffiths joined Ocean following the 1999 merger of Ocean and Seagull Energy Corporation, where he served as Vice President, Domestic Exploration. He holds a B.S. in Geology from the University of New Mexico and an M.A. in Geology from Indiana University.

Michael L. Johnson joined our Board of Directors in December 2004. Mr. Johnson is a member of the Audit Committee and the Conflicts Committee. Mr. Johnson began his career in 1975 with Conoco Inc. and most recently served as Chairman and Chief Executive Officer of Conoco Gas and Power from 1997 until his retirement in 2002. Mr. Johnson holds a B.S. in Geology from New Mexico State University, an M.A. in Geochemistry from Rice University and an M.S. in Management, Sloan Fellow from Alfred P. Sloan School of Business, M.I.T.

T. William Porter III joined our Board of Directors upon completion of our initial public offering in November 2004. Mr. Porter is the Chairman of the Nominating and Governance Committee and a member of the Compensation Committee. Mr. Porter is Chairman and a founding partner of Porter & Hedges, L.L.P., a Houston law firm formed in 1981. He also serves as a director of Cal Dive International, Inc. and as a director of U.S. Concrete, Inc. Mr. Porter holds a Bachelor of Business Administration degree in Finance from Southern Methodist University and Bachelor of Law degree from Duke University.

William L. Thacker joined our Board of Directors upon completion of our initial public offering in November 2004. Mr. Thacker is a member of the board of directors of Pacific Energy Management, LLC, the general partner of Pacific Energy GP, LP, which is in turn the general partner of Pacific Energy Partners, L.P. Mr. Thacker joined Texas Eastern Products Pipeline Company (the general partner of TEPPCO Partners, L.P.) in September 1992 as President, Chief Operating Officer and director. He was elected Chief Executive Officer in January 1994. In March 1997, he was named to the additional position of Chairman of the Board, which he held until his retirement in May 2002. Prior to joining Texas Eastern Products Pipeline Company, Mr. Thacker was President of Unocal Pipeline Company from 1986 until 1992. Mr. Thacker is past Chairman of the Executive Committee of the Association of Oil Pipelines, has served as a member of the board of directors of the American Petroleum Institute, and has actively participated in many energy-related organizations during his 35-year career in the energy industry. Mr. Thacker holds a Bachelor of Mechanical Engineering degree from the Georgia Institute of Technology and a Masters of Business Administration degree from Lamar University.

Required Vote

Our limited liability company agreement provides for "cumulative voting" in the election of directors. This means that a unitholder will be entitled to a number of votes equal to (i) the number of units that such unitholder is entitled to vote at the Annual Meeting (ii) multiplied by the number of directors to be elected at the Annual Meeting. A unitholder may (i) cast all such votes for a single director, (ii) distribute

4

them evenly among the number of directors to be voted for at the Annual Meeting, or (iii) distribute them among any two or more directors to be voted for at the Annual Meeting. For example, because there are eight director nominees, if you own 100 units you will be entitled to cast 800 votes in the manner set forth in the preceding sentence. Cumulative voting permits a unitholder to concentrate his or her votes on fewer nominees, thereby allowing the unitholder potentially to have a greater impact on the outcome of the election with respect to one or more nominees. A unitholder holding a sufficient number of units may have the ability to elect one or more nominees to the Board of Directors without the support of other unitholders.

The eight nominees receiving the most votes cast at the Annual Meeting will be elected to the Board of Directors. With respect to the Annual Meeting, we have eight nominees and eight available board seats. Each nominee who is elected to the Board of Directors will serve in such capacity until his successor has been duly elected and qualified or until such director dies, resigns or is removed. Each properly executed proxy received in time for the Annual Meeting will be voted as specified therein.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT UNITHOLDERS VOTE "FOR" THE ELECTION OF EACH OF THE EIGHT NOMINEES FOR DIRECTOR.

THE BOARD OF DIRECTORS AND ITS COMMITTEES

The Board of Directors has determined that Messrs. Crump, Danner, Griffiths, Johnson, Porter and Thacker qualify as "independent" in accordance with the published listing requirements of The NASDAQ National Market ("NASDAQ"). The NASDAQ independence definition includes a series of objective tests, such as that the director is not an employee of the company and has not engaged in various types of business dealings with the company. In addition, as further required by the NASDAQ rules, the Board of Directors has made a subjective determination as to each independent director that no relationships exist which, in the opinion of the Board of Directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

In addition, the members of the Audit Committee of the Board of Directors also each qualify as "independent" under special standards established by the Securities and Exchange Commission ("SEC") for members of audit committees, and the Audit Committee includes at least one member who is determined by the Board of Directors to meet the qualifications of an "audit committee financial expert" in accordance with SEC rules, including that the person meets the relevant definition of an "independent" director. Mr. Crump is the independent director who has been determined to be an audit committee financial expert. Unitholders should understand that this designation is a disclosure requirement of the SEC related to Mr. Crump's experience and understanding with respect to certain accounting and auditing matters. The designation does not impose on Mr. Crump any duties, obligations or liability that are greater than are generally imposed on him as a member of the Audit Committee and Board of Directors, and his designation as an audit committee financial expert pursuant to this SEC requirement does not affect the duties, obligations or liability of any other member of the Audit Committee or Board of Directors.

The Board of Directors is receptive to direct communication with unitholders and recommends that unitholders initiate any communications with our Board in writing and send them to our Board of Directors c/o Douglas L. Lawing, Vice President, General Counsel and Secretary, Copano Energy, L.L.C., 2727 Allen Parkway, Suite 1200, Houston, Texas 77019. This centralized process will assist our Board in reviewing and responding to unitholder communications in an appropriate manner. The name of any specific intended board recipient should be noted in the communication. Communications to our Board of Directors must include the number of units owned by the unitholder as well as the unitholder's name,

5

address, telephone number and email address, if any. All such communications will be forwarded without review to the appropriate directors.

Our Board of Directors will hold regular and special meetings at any time as may be necessary. Regular meetings may be held without notice on dates set by the Board of Directors from time to time. Special meetings of the Board of Directors may be called with reasonable notice to each member upon request of the Chairman of the Board of Directors or upon the written request of any three board members. A quorum for a regular or special meeting will exist when a majority of the members are participating in the meeting either in person or by conference telephone. Any action required or permitted to be taken at a board meeting may be taken without a meeting, without prior notice and without a vote if all of the members sign a written consent authorizing the action.

During the period from the closing of our initial public offering in November 2004 through December 2004, our Board of Directors held one special meeting. Additionally, during this period, our Board of Directors took action by unanimous written consent on three occasions. During this period, no director attended fewer than 75% of the aggregate of: (1) the total number of meetings of the Board of Directors held during the period for which he was a director, and (2) the total number of meetings held by all committees of the Board of Directors on which he served following his appointment to such committee. The Annual Meeting of Unitholders will be our first annual meeting as a public company. We anticipate that all director nominees will attend the Annual Meeting.

Our Board of Directors has adopted a policy providing that the independent directors will meet in executive session at least quarterly, or more frequently if necessary. The chairman of our Nominating and Governance Committee will chair the executive sessions of the independent directors.

The Board of Directors currently has, and appoints the members of, standing Audit, Compensation, Conflicts, and Nominating and Governance Committees. Each member of the Audit, Compensation, Conflicts, and Nominating and Governance Committees is an independent director in accordance with the NASDAQ listing standards described above. Our Board of Directors has adopted a written charter for each of these committees, which sets forth each committee's purposes, responsibilities and authority. Our Board of Directors has also adopted Corporate Governance Guidelines, a Code of Business Conduct and Ethics (including complaint procedures for financial, accounting and audit matters) and a Code of Ethics for Chief Executive Officer and Senior Financial Officers. These committee charters, guidelines, codes and procedures are available on our website at www.copanoenergy.com. You may also contact Douglas L. Lawing, our Vice President, General Counsel and Secretary, to request paper copies free of charge. If any substantive amendments are made to the Code of Ethics for Chief Executive Officer and Senior Financial Officers or if we grant any waiver, including any implicit waiver, from a provision of the code, we will disclose the nature of such amendment or waiver within four business days on our internet website at www.copanoenergy.com. The following is a brief description of the functions and operations of the standing committees of our Board of Directors:

Audit Committee. The Audit Committee assists the Board of Directors in its general oversight of our financial reporting, internal controls and audit functions, and is directly responsible for the appointment, retention, compensation and oversight of the work of our independent auditors. During the period from the closing of our initial public offering in November 2004 through December 2004, the Audit Committee held one meeting. The Audit Committee is currently comprised of three directors: Mr. Crump (Chairman), Mr. Danner and Mr. Johnson. Each member of the Audit Committee is "independent" as defined by the NASDAQ listing standards. Mr. Crump has been designated the "audit committee financial expert" as prescribed by the SEC. A copy of the Audit Committee charter is included asAppendix A to this Proxy Statement.

6

Compensation Committee. The Compensation Committee's primary responsibilities are to approve the compensation arrangements for senior management of our company and for our Board members, including establishment of salaries and bonuses and other compensation for executive officers of our company; to approve any compensation plans in which officers and directors of our company are eligible to participate and to administer such plans, including the granting of unit options or other benefits under any such plans; and to review significant issues that relate to changes in benefit plans. The Compensation Committee did not meet during the period from the closing of our initial public offering in November 2004 through December 2004. The Compensation Committee is currently comprised of three directors: Mr. Thacker (Chairman), Mr. Griffiths and Mr. Porter. All of the members of the Compensation Committee are "independent" as defined by the NASDAQ listing standards.

Conflicts Committee. Upon the request of the Board of Directors, the Conflicts Committee reviews specific matters that the Board of Directors believes may involve conflicts of interest between our board members or their affiliates and our company. Any matters approved by the Conflicts Committee will be permitted and deemed approved by all unitholders and will not constitute a breach of our limited liability company agreement or of any duty stated or implied by law or equity, including any fiduciary duty. In addition to conflicts involving board members, the Conflicts Committee is responsible for investigating, reviewing and acting on other matters where a conflict of interest arises. The Conflicts Committee did not meet during the period from the closing of our initial public offering in November 2004 through December 2004. The Conflicts Committee is currently comprised of three directors: Mr. Danner (Chairman), Mr. Crump and Mr. Johnson. All of the members of the Conflicts Committee are "independent" as defined by the NASDAQ listing standards.

Nominating and Governance Committee. The Nominating and Governance Committee's primary responsibilities are to recruit and recommend candidates for election to the Board of Directors and for committee appointments, to develop and recommend corporate governance guidelines to the Board of Directors, to assist the Board in implementing such guidelines, to lead the Board in its annual review of the performance of our Board and its committees and to develop and monitor our succession plan. Although the Nominating and Governance Committee has no set of specific minimum qualifications for director nominees, the committee will evaluate each nominee based upon a consideration of a nominee's qualification as independent and consideration of diversity, age, skills and experience in the context of the needs of the Board as described in our Corporate Governance Guidelines. The Nominating and Governance Committee may rely on various sources to identify director nominees. These include input from directors, management, others that the committee feels are reliable and professional search firms. In connection with the selection of our current independent directors in 2004, we paid a professional search firm to assist with the identification and evaluation of potential director nominees.

The Nominating and Governance Committee will consider director candidate suggestions made by unitholders in the same manner as other candidates. Any such nominations, together with appropriate biographical information, should be submitted to the Chairman of the Nominating and Governance Committee, c/o Douglas L. Lawing, Vice President, General Counsel and Secretary, Copano Energy, L.L.C., 2727 Allen Parkway, Suite 1200, Houston, Texas 77019. For other procedures that must be followed in order for the committee to consider recommendations from unitholders, please read "Unitholder Proposals and Director Nominations—Recommendation of Director Candidates to the Nominating and Governance Committee." The Nominating and Governance Committee did not meet during the period from the closing of our initial public offering in November 2004 through December 2004. The Nominating and Governance Committee is currently comprised of three directors: Mr. Porter (Chairman), Mr. Thacker and Mr. Griffiths. Each member of the Nominating and Governance Committee is "independent" as defined by the NASDAQ listing standards.

7

Upon the closing of our initial public offering in November 2004, Messrs. Thacker, Porter and Crump were appointed to serve as members of the Compensation Committee. In December 2004, Mr. Crump resigned as a member of the Compensation Committee and was replaced with Mr. Griffiths. Only "independent" directors as defined by the NASDAQ listing standards serve on the Compensation Committee. Additionally, no member of the Compensation Committee has any relationship with our company that is required to be disclosed in any of the reports that we file with the SEC. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Board of Directors or Compensation Committee.

Annual Retainer and Fees. Each independent member of our Board of Directors receives an annual retainer of $30,000. We also pay each director serving as Chairman of the Compensation, Conflicts or Nominating and Governance Committee an additional $4,000 per year. A director serving as Chairman of the Audit Committee is paid $8,000 per year and each additional member of the Audit Committee is paid $4,000 per year. Directors are not paid a fee for attendance at individual meetings of our Board of Directors. Directors serving on the Compensation, Conflicts or Nominating and Governance Committees are paid a fee of $1,000 for attendance at each meeting and directors serving on the Audit Committee are paid a fee of $1,500 per meeting. In addition, each independent member of our Board of Directors is reimbursed for out-of-pocket expenses in connection with attending meetings of our Board of Directors or committees. Each director is fully indemnified by us for actions associated with being a member of our Board of Directors to the extent permitted under Delaware law.

Unit Awards. Upon the initial election of each of our independent directors, we award each independent director 3,000 restricted common units under our Long-Term Incentive Plan and upon each annual anniversary date of grant, we plan to award each independent director an additional 1,500 restricted common units. Each restricted common unit award (and the associated distributions) vests in equal one-third annual installments commencing on the first anniversary of the grant date or upon a change of control, death, disability or, in certain circumstances, retirement.

Report of the Audit Committee

The Audit Committee oversees the financial reporting process of Copano Energy, L.L.C. on behalf of its Board of Directors. Management has the primary responsibility for the preparation of the financial statements and the reporting process, including the systems of internal controls.

With respect to the financial statements for the calendar year ended December 31, 2004, the Audit Committee reviewed and discussed the audited financial statements of Copano Energy, L.L.C. and Webb/Duval Gatherers, an unconsolidated affiliate, and the quality of financial reporting with management and the independent auditors. It also discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61 (Codification of Statements on Auditing Standards, AU § 380), as modified or supplemented, and received from the independent auditors the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), as modified or supplemented. Additionally, the Audit Committee has discussed with the independent auditors the independent auditors' independence with respect to Copano Energy, L.L.C. and Webb/Duval Gatherers.

8

Based on the reviews and discussions described above, the Audit Committee recommended to the Board of Directors that the audited financial statements of Copano Energy, L.L.C. and Webb/Duval Gatherers be included in the Annual Report on Form 10-K for the year ended December 31, 2004 for filing with the Securities and Exchange Commission.

Notwithstanding anything to the contrary set forth in any of our previous or future filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate this Proxy Statement or future filings with the SEC, in whole or in part, the preceding information shall not be deemed to be "soliciting material" or to be "filed" with the SEC or incorporated by reference into any filing except to the extent the foregoing report is specifically incorporated by reference therein.

9

PROPOSAL TWO: RATIFICATION OF INDEPENDENT PUBLIC ACCOUNTANTS

The Audit Committee of our Board of Directors has selected Deloitte & Touche LLP to continue as our independent public accountants for 2005. Deloitte & Touche LLP has served as Copano's independent auditors since 2002. The Audit Committee has determined to submit Deloitte & Touche LLP's selection to unitholders for ratification. If this selection of auditors is not ratified by a majority of the units entitled to vote at the Annual Meeting, the Audit Committee will reconsider its selection of auditors. We are advised that no member of Deloitte & Touche LLP has any direct or material indirect financial interest in our company or, during the past three years, has had any connection with us in the capacity of promoter, underwriter, voting trustee, director, officer or employee. A representative of Deloitte & Touche LLP will attend the Annual Meeting. The representative will have the opportunity to make a statement if he desires to do so and to respond to appropriate questions.

Audit Fees

The fees for professional services rendered by Deloitte & Touche LLP for the audit of our annual consolidated financial statements and subsidiary financial statements for each of the fiscal years ended December 31, 2004 and 2003 and the reviews of the financial statements included in any of our Quarterly Reports on Forms 10-Q for each of those fiscal years were $747,000 and $582,000, respectively.

Audit-Related Fees

Deloitte & Touche LLP also received fees for services that are normally provided by Deloitte & Touche LLP in connection with statutory or regulatory filings. These fees, which were associated with comfort letters and consents related to our initial public offering, totaled $523,000 and $15,000 for the years ended December 31, 2004 and 2003, respectively.

Tax Fees

We incurred aggregate fees of $538,000 and $134,000 for each of the fiscal years ended December 31, 2004 and 2003, respectively, for tax-related services provided by Deloitte & Touche LLP. These fees included fees relating to reviews of tax compliance and to tax advice and planning.

All Other Fees

Deloitte & Touche LLP did not render services to us, other than those services covered in the sections captioned "Audit Fees," "Audit-Related Fees" and "Tax Fees" for the fiscal years ended December 31, 2004 and 2003.

Audit Committee Approval of Audit and Non-Audit Services

In 2004, the Audit Committee had not formally adopted any pre-approval polices and procedures relating to the provision of audit and non-audit services by our independent auditors, Deloitte & Touche LLP. Prior to our initial public offering in November 2004, each type of audit and non-audit service provided by Deloitte & Touche LLP was approved on an individual basis by management in advance of the rendering of such services. Subsequent to the initial public offering, the Audit Committee approved any significant audit and non-audit services on an individual basis, including the engagement of Deloitte & Touche LLP to perform our 2004 audit. In February 2005, the Audit Committee adopted a Pre-Approval of Audit and Non-Audit Services Policy, which requires specific pre-approval of audit and non-audit services performed by the independent auditor, unless pre-approval of the type of service is reflected in the pre-approval policy. The pre-approval policy provides specific pre-approval for (i) certain categories of audit services, including audits of our subsidiaries and services associated with SEC filings, (ii) audit-related services, including transaction integration assistance and attestation services required by statute or regulation, (iii) tax-related services and (iv) services relating to business acquisitions or dispositions.

10

Management is required to report to the Audit Committee its engagement of the independent auditor to perform any of the services specifically pre-approved in the policy. The engagement terms and fees related to our annual audit remain subject to the specific approval of the Audit Committee. Additionally, the pre-approval policy specifically prohibits certain non-audit services, including bookkeeping, appraisal or valuation services, and legal services.

Vote Required

Although unitholder ratification of the selection of independent auditors in not required, the Audit Committee and the Board of Directors consider it desirable for the unitholders to vote upon this selection. Under our limited liability company agreement, approval of the ratification of the selection of Deloitte & Touche LLP as our independent accountants for 2005 requires the affirmative vote of the holders of a majority of the outstanding units present in person or represented by proxy at the Annual Meeting and entitled to vote on the proposal. Abstentions and broker non-votes are counted for purposes of determining the presence or absence of a quorum for the transaction of business and will have the same effect as a vote against the proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT UNITHOLDERS VOTE "FOR" APPROVAL OF THE RATIFICATION OF THE SELECTION OF DELOITTE & TOUCHE LLP AS OUR INDEPENDENT ACCOUNTANTS FOR 2005.

In the event of a negative vote on such ratification, the Audit Committee will reconsider its selection. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent auditing firm at any time during the year if the Audit Committee believes that such a change would be in the best interest of our company and our unitholders.

11

EXECUTIVE OFFICERS

Certain information concerning Copano's executive officers as of the date of this Proxy Statement is set forth below.

Name

| | Age

| | Position with Our Company

|

|---|

| John R. Eckel, Jr. | | 53 | | Chairman of the Board and Chief Executive Officer |

| R. Bruce Northcutt | | 45 | | President and Chief Operating Officer |

| Matthew J. Assiff | | 38 | | Senior Vice President and Chief Financial Officer |

| Brian D. Eckhart | | 49 | | Senior Vice President, Transportation and Supply |

| Ron W. Bopp | | 58 | | Senior Vice President, Corporate Development |

| J. Terrell White | | 41 | | Vice President, Operations |

| James J. Gibson, III | | 58 | | Vice President, Processing |

| Lari Paradee | | 42 | | Vice President and Controller |

| Douglas L. Lawing | | 44 | | Vice President, General Counsel and Secretary |

| Kathryn S. De Young | | 44 | | Vice President, Government and Regulatory Affairs |

John R. Eckel, Jr., Chairman of the Board and Chief Executive Officer, founded our business in 1992 and served as our President and Chief Executive Officer until April 2003, when he was elected to his current position. Mr. Eckel serves on the Board of Directors of the Texas Pipeline Association. Mr. Eckel also serves as President and Chief Executive Officer of Live Oak Reserves, Inc., which he founded in 1986, and which, with its affiliates, is engaged in oil and gas exploration and production in South Texas. Mr. Eckel received a Bachelor of Arts degree from Columbia University and was employed in various corporate finance positions in New York prior to entering the energy industry in 1979.

R. Bruce Northcutt, President and Chief Operating Officer, has served in his current capacity since April 2003. Mr. Northcutt served as President of El Paso Global Networks Company (a provider of wholesale bandwidth transport services) from November 2001 until April 2003, Managing Director of El Paso Global Networks Company from April 1999 until December 2001 and Vice President, Business Development, of El Paso Gas Services Company (a marketer of strategic interstate pipeline capacity) from January 1998 until April 1999. Mr. Northcutt began his career with Tenneco Oil Exploration and Production in 1982 working in the areas of drilling and production engineering. From 1988 until 1998, Mr. Northcutt held various levels of responsibility within several business units of El Paso Energy and its predecessor, Tenneco Energy, including supervision of pipeline supply and marketing as well as regulatory functions. Mr. Northcutt holds a Bachelor of Science degree in Petroleum Engineering from Texas Tech University. Mr. Northcutt is a Registered Professional Engineer in Texas.

Matthew J. Assiff, Senior Vice President and Chief Financial Officer, has served in his current capacity since October 2004 and previously served as our Senior Vice President, Finance and Administration, since January 2002. Prior thereto, Mr. Assiff was a Vice President within the Global Energy Group of Credit Suisse First Boston and was with Donaldson, Lufkin and Jenrette (prior to its purchase by Credit Suisse First Boston in 2000) initially as an Associate and subsequently as a Vice President from 1998. Mr. Assiff began his career in 1989 with Goldman, Sachs & Co. in the Merger & Acquisitions group focusing on energy transactions and has worked in the corporate finance and Merger & Acquisition groups of Bear Stearns and Chemical Securities (now J. P. Morgan Chase). Mr. Assiff has also worked with Landmark Graphics Company and Compaq Computer in the areas of finance, planning, mergers and acquisitions and corporate venture investing. Mr. Assiff graduated from Columbia University with a Bachelor of Arts degree and holds a Masters of Business Administration degree from Harvard Business School.

Brian D. Eckhart, Senior Vice President, Transportation and Supply, has served in his current capacity since March 2002. From January 1998 until March 2002, Mr. Eckhart served as our Vice President, Business Development. From February 1997 to January 1998, Mr. Eckhart served as Vice President, Operations. From 1979 until 1997, Mr. Eckhart held various engineering and management positions at

12

Natural Gas Pipeline Company of America and other subsidiaries of MidCon Corporation, a predecessor of Kinder Morgan, Inc. Mr. Eckhart graduated from Texas A&M University with a Bachelor of Science degree in Ocean Engineering.

Ron W. Bopp, Senior Vice President, Corporate Development, was elected to his current position in April 2005 to coordinate and oversee the development and management of our acquisition opportunities. Mr. Bopp served as Vice President—Onshore Assets of Shell US Gas & Power LLC, an affiliate of Shell Oil Company, from February 1998 until February 2005. From 1994 until February 1998, Mr. Bopp was Vice President and Chief Financial Officer of Corpus Christi Natural Gas Company, a midstream gas gathering, processing, and transportation company that was acquired by affiliates of Shell Oil Company in October 1997. Mr. Bopp graduated from the University of Houston with a Bachelor of Business Administration and a Master of Science in Accounting degree and is a Certified Public Accountant.

J. Terrell White, Vice President, Operations, has served in his current capacity since joining us in January 1998. Mr. White oversees pipeline operations, including new well connects, dehydration, compression, measurement, and construction activities. From 1990 until 1997, Mr. White served in increasingly responsible engineering, project management and business development roles with Enron Liquid Services Corp., and from February 1997 until January 1998 with TransCanada Energy USA, Inc., following its acquisition of certain Enron midstream assets. From 1985 until 1990, Mr. White was an engineer with Mobil E&P SE, Inc. and Mobil Chemical, involved primarily in gas processing, fractionation, gathering and NGL transportation. Mr. White is a registered professional engineer in the State of Oklahoma. Mr. White graduated from the University of Alabama with a Bachelor of Science degree in Mechanical Engineering.

James J. Gibson, III, Vice President, Processing, has served in his current capacity since joining us in October 2001. Mr. Gibson oversees operations for our processing segment. From 1998 until September 2001, Mr. Gibson served as Manager, Business Development—Texas Gas Plants of Coral Energy, LLC, an affiliate of Shell Oil Company. From 1997 until 1998, Mr. Gibson served as Director, Gas Processing and Treating Services of Corpus Christi Natural Gas, Inc. From 1992 until 1997, Mr. Gibson was self-employed as a consultant to several midstream energy companies operating in Texas. From 1980 until 1992, Mr. Gibson served as Vice President—Plant Operations of Seagull Energy Corporation. From 1977 until 1980, Mr. Gibson served as project engineer for Houston Oil & Minerals Corporation. Mr. Gibson began his career in 1969 as an engineer with Sun Oil Company. Mr. Gibson is a registered professional engineer in the State of Texas. Mr. Gibson graduated from Texas A&I University with a Bachelor of Science degree in Natural Gas Engineering.

Lari Paradee, Vice President and Controller, has served in her current capacity since joining us in July 2003. As Vice President and Controller, Ms. Paradee is primarily responsible for our accounting and reporting functions. From September 2000 until March 2003, Ms. Paradee served as Accounting and Consolidations Manager for Intergen, a global power generation company jointly owned by Shell Generating (Holdings) B.V. and Bechtel Enterprises Energy B.V. Ms. Paradee served as Vice President and Controller of DeepTech International, Inc. (an offshore pipeline and exploration and production company) from May 1991 until August 1998, when DeepTech was merged into El Paso Energy Corporation. Ms. Paradee then served as Manager, Finance and Administration of El Paso Energy until March 2000. Ms. Paradee has served as Senior Auditor and Staff Auditor for Price Waterhouse. Ms. Paradee graduated magna cum laude from Texas Tech University with a B.B.A. in Accounting. Ms. Paradee is also a Certified Public Accountant.

Douglas L. Lawing, Vice President, General Counsel and Secretary, has served in his current capacity since October 2004 and previously served as our General Counsel since November 2003. From January 2002 until November 2003, Mr. Lawing served as our Corporate Counsel. Since February 1994, Mr. Lawing has served as corporate secretary of our company and its predecessors. Additionally, from March 1998 until January 2002, Mr. Lawing served as an Associate Counsel of Nabors Industries, Inc.

13

(now Nabors Industries, Ltd.). Mr. Lawing holds a Bachelor of Science degree in Business Administration from the University of North Carolina at Chapel Hill and a J.D. from Washington and Lee University.

Kathryn S. De Young, Vice President, Government and Regulatory Affairs, has served in her current capacity since March 1, 2005. Ms. De Young is responsible for coordinating government affairs activities and compliance with state and federal regulations, including compliance with environmental, health and safety standards. Ms. De Young has been associated with us since our inception in 1992 and from August 2001 through February 2005, Ms. De Young served as our Senior Director, Operations Services and from June 1992 until August 2001, she served as our Director of Operations Services where her duties included regulatory compliance and risk management. Ms. De Young attended the University of St. Thomas and the University of Houston.

14

EXECUTIVE COMPENSATION

The following table sets forth certain information with respect to the compensation paid to our Chief Executive Officer and our four other most highly compensated executive officers for the years ended December 31, 2004 and 2003.

Summary Compensation Table

| | Annual Compensation

| | Long-Term

Compensation

| |

|

|---|

Name and Principal Position

| | Year

| | Salary

| | Bonus

| | Other Annual

Compensation

| | Securities

Underlying

Options

| | All Other

Compensation

|

|---|

John R. Eckel, Jr.

Chairman of the Board and

Chief Executive Officer | | 2004

2003 | | $

$ | 208,626

202,267 | | $

| 125,000

— | | $

$ | 23,595

13,749 | | —

— | | —

— |

R. Bruce Northcutt

President and Chief

Operating Officer |

|

2004

2003 |

|

$

$ |

202,000

135,641 |

|

$

|

225,000

— |

(1)

|

$

$ |

61,062

7,320 |

(2)

|

15,000

— |

|

—

— |

Matthew J. Assiff

Senior Vice President and

Chief Financial Officer |

|

2004

2003 |

|

$

$ |

142,500

133,750 |

|

$

$ |

91,800

11,000 |

|

$

$ |

29,337

14,721 |

|

10,000

— |

|

—

— |

Douglas L. Lawing

Vice President, General

Counsel and Secretary |

|

2004

2003 |

|

$

|

113,000

— |

|

$

|

62,000

— |

|

$

|

18,722

— |

|

7,600

— |

|

—

— |

Lari Paradee

Vice President and

Controller |

|

2004

2003 |

|

$

|

113,625

— |

|

$

|

60,000

— |

|

$

|

19,335

— |

|

7,600

— |

|

—

— |

- (1)

- Includes a one-time bonus of $125,000 to which Mr. Northcutt was entitled upon completion of our initial public offering pursuant to the terms of his employment agreement.

- (2)

- In accordance with rules of the SEC, the dollar value of the prerequisites and other personal benefits of named executives are only shown to the extent that they exceed the lesser of $50,000 or 10% of the total of annual salary and bonus for the named executive. The amount shown for Mr. Northcutt in 2004 included $41,184 related to debt forgiveness, a $9,600 automobile allowance, an $8,000 payment for unused sick time, and $2,278 in insurance-related benefits.

The following table reflects the options that were granted in 2004 under our Long-Term Incentive Plan to the named executive officers. Each option has an exercise price equal to the fair market value of our common units on the date of grant, has a ten-year term and vests in five equal annual installments commencing on November 15, 2005 or earlier, upon a change of control, death or disability. The rates of unit appreciation presented in this table for the units underlying the options are not predictions of future unit prices.

Option Grants in Last Fiscal Year

| |

| |

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Unit Price Appreciation for Option Term(1)

|

|---|

| | Individual Grants

|

|---|

| | Number of

Securities

Underlying Options

Granted (#)

| | Percent of Total

Options Granted

to Employees in

Fiscal Year

| |

| |

|

|---|

Name

| | Exercise or

Base Price

($/Unit)

| | Expiration

Date

| | 5%

($)

| | 10%

($)

|

|---|

| John R. Eckel, Jr. | | — | | — | | | — | | — | | | — | | | — |

| R. Bruce Northcutt | | 15,000 | | 7.5 | % | $ | 20.00 | | 11/14/2014 | | $ | 188,700 | | $ | 478,050 |

| Matthew J. Assiff | | 10,000 | | 5.0 | % | $ | 20.00 | | 11/14/2014 | | $ | 125,800 | | $ | 318,700 |

| Douglas L. Lawing | | 7,600 | | 3.8 | % | $ | 20.00 | | 11/14/2014 | | $ | 95,608 | | $ | 242,212 |

| Lari Paradee | | 7,600 | | 3.8 | % | $ | 20.00 | | 11/14/2014 | | $ | 95,608 | | $ | 242,212 |

- (1)

- All options granted in 2004 have a ten-year term.

15

The following table reflects exercises of options by the named executive officers during 2004 and unexercised options held by them at the end of 2004.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| |

| |

| | Number of Securities

Underlying Unexercised

Options at

Fiscal Year-End (#)

| | Value of Unexercised

In-the-Money

Options at Fiscal

Year-End ($)(1)

|

|---|

Name

| | Units Acquired on

Exercise (#)

| | Value

Realized

($)

| | Exercisable/

Unexercisable

| | Exercisable/

Unexercisable

|

|---|

| John R. Eckel, Jr. | | — | | — | | —/— | | —/— |

| R. Bruce Northcutt | | — | | — | | —/15,000 | | —/$127,500 |

| Matthew J. Assiff | | — | | — | | —/10,000 | | —/$85,000 |

| Douglas L. Lawing | | — | | — | | —/7,600 | | —/$64,600 |

| Lari Paradee | | — | | — | | —/7,600 | | —/$64,600 |

- (1)

- These values are calculated based upon the difference between the last reported sale price of our common units as reported on NASDAQ on December 31, 2004 ($28.50) and the exercise price of the options ($20.00).

Securities Authorized for Issuance under Equity Compensation Plans

The following table provides information, as of December 31, 2004, relating to equity compensation plans pursuant to which unit options, restricted units or other rights to acquire units may be granted from time to time.

Equity Compensation Plan Information

Plan Category

| | Number of Securities

to be Issued upon

Exercise/Vesting of

Outstanding Options,

Warrants and Rights

| | Weighted-

Average Exercise

Price of

Outstanding

Options,

Warrants and

Rights

| | Number of Units

Remaining Available for

Future Issuance Under

Equity Compensation

Plans (Excluding Units

Reflected in the First

Column of this Table)

|

|---|

| Equity Compensation Plans Approved by Unitholders(1) | | 218,000 | (2) | $ | 20.000 | (3) | 582,000 |

| Equity Compensation Plan Not Approved by Unitholders | | — | | | — | | — |

| | Total | | 218,000 | (2) | $ | 20.000 | (3) | 582,000 |

- (1)

- Our sole equity compensation plan is our Long-Term Incentive Plan, which was approved by our members prior to our initial public offering.

- (2)

- Includes 18,000 issued and outstanding restricted common units and options to purchase 200,000 common units awarded under our Long-Term Incentive Plan.

- (3)

- Weighted average exercise price of outstanding options; excludes restricted common units.

Employment Agreements

R. Bruce Northcutt, our President and Chief Operating Officer, entered into an employment agreement with Copano/Operations, Inc. ("Copano Operations") and certain of our subsidiaries effective April 28, 2003, pursuant to which he agreed to serve us in those capacities. Effective January 1, 2005, Copano Operations assigned its rights and obligations under Mr. Northcutt's employment agreement to us. For additional information with respect to our relationship with Copano Operations, please read "Certain

16

Relationships and Related Transactions—Copano/Operations, Inc." Mr. Northcutt's employment agreement has an initial term that expires on April 28, 2005, but will automatically continue from year to year thereafter until terminated by Mr. Northcutt or by us. Mr. Northcutt's employment agreement also provides for a non-competition period that will continue for one year after the termination of his employment by us for cause or by Mr. Northcutt other than for a good reason.

Mr. Northcutt's employment agreement initially provided for an annual base salary of $200,000 subject to annual review. Mr. Northcutt's employment agreement also provides for an annual incentive bonus targeted at 50% of his base salary, which is payable within the discretion of our Board of Directors, taking into account his individual performance and our financial performance during the preceding year. On March 1, 2005, Mr. Northcutt's employment agreement was amended to reflect his current annual base salary of $226,000 and to provide that, effective April 28, 2005, his right with respect to an annual incentive bonus will be governed by the terms of our Management Incentive Compensation Plan rather than the existing provisions of his employment agreement for so long as the Management Incentive Compensation Plan, or successor plan, remains in effect. Additionally, Mr. Northcutt is eligible to participate in all other benefit programs for which employees and/or senior executives are generally eligible. Except in the event of termination for cause, termination upon Mr. Northcutt's death or disability or termination by Mr. Northcutt other than for good reason, the employment agreement provides for a severance payment equal to one year of Mr. Northcutt's then base salary plus one year of continued benefits following termination of employment. If a change in control or an initial public offering occurs prior to April 28, 2005, and, as a result, we terminate Mr. Northcutt's employment other than for cause or Mr. Northcutt terminates his employment for good reason, he will be entitled to receive a severance payment equal to two years of his then base salary plus one year of continued benefits.

James J. Gibson, III, our Vice President, Processing, entered into an employment agreement with Copano Operations effective October 1, 2004. Effective January 1, 2005, Copano Operations assigned its rights and obligations under Mr. Gibson's employment agreement to us. Mr. Gibson's employment agreement has an initial term that expires on October 1, 2005, but will automatically continue from month to month thereafter until terminated by Mr. Gibson or by us. Mr. Gibson's employment agreement also provides for a non-competition period that will continue for one year after the termination of his employment.

Mr. Gibson's employment agreement initially provided for an annual base salary of $122,713 subject to cost of living adjustments. Mr. Gibson's employment agreement also provides for a quarterly incentive bonus, which is payable within the discretion of our Board of Directors, taking into account his individual performance during the preceding year and other relevant circumstances. On March 1, 2005, Mr. Gibson's employment agreement was amended to reflect his current annual base salary of $135,000 and to provide that effective January 1, 2005, his right with respect to an annual incentive cash bonus will be governed by the terms of our Management Incentive Compensation Plan rather than the existing provisions of his employment agreement for so long as the Management Incentive Compensation Plan, or successor plan, remains in effect. Additionally, Mr. Gibson is eligible to participate in all other benefit programs for which employees and/or senior executives are generally eligible. In the event of termination by us of Mr. Gibson's employment other than for cause or upon Mr. Gibson's death or disability, the employment agreement provides for the payment of the greater of (i) any severance amount provided for in any company-sponsored severance plan, if applicable, or (ii) severance amounts provided for in his employment agreement. In the event of termination by us prior to October 1, 2006, the employment agreement provides for a severance payment equal to 20% of the aggregate of Mr. Gibson's base salary from the termination date through September 30, 2006. In the event of termination of employment by us after September 30, 2006, Mr. Gibson shall be entitled under the employment agreement to receive a severance payment equal to 20% of the aggregate of his base salary from the termination date through September 30, 2011.

17

Change of Control and Severance Arrangements

In February 2005, our Board of Directors adopted a Management Incentive Compensation Plan to be effective beginning in 2005, which provides for annual cash bonus opportunities for executive officers and certain key employees based upon the achievement of a combination of individual performance goals and of company operational and financial objectives. In the event of the termination of a plan participant's employment without "cause" or termination of employment by a plan participant for "good reason," in either case within one year of a change of control of our company, the participant is entitled to a pro rata portion of his or her annual target award under the plan. Other than these provisions and certain provisions in Mr. Northcutt's employment agreement, there are no other arrangements that could result in payments by us to any of our executive officers as a result of a change of control.

In April 2005, Ron W. Bopp was elected our Senior Vice President, Corporate Development. In connection with his employment, we agreed that if we terminate Mr. Bopp's employment without cause, then he would be entitled to continued payment of his base salary for twelve months following such termination unless we adopt a severance plan that would provide for a higher amount. As consideration for this severance benefit, Mr. Bopp agreed not to compete with us for one year following: (i) our termination of his employment for cause or (ii) Mr. Bopp's voluntarily termination of his employment.

Report of the Compensation Committee

The Compensation Committee of the Board of Directors of Copano Energy, L.L.C., or Copano Energy, administers executive compensation and was created in November 2004 in connection with the completion of Copano Energy's initial public offering. With respect to executive compensation, the Compensation Committee's responsibility is (i) to establish the compensation principles for executive officers, (ii) to approve and administer Copano Energy's incentive compensation plans, (iii) to monitor the performance and compensation of executive officers and (iv) to set compensation levels and make awards under incentive compensation plans that are consistent with our compensation principles and the performance of Copano Energy and its executive officers.

Because our fiscal year ending December 31, 2004 was substantially complete at the time of the Compensation Committee's formation, we did not adopt compensation principles applicable to Copano Energy's Chief Executive Officer and other executive officers for the 2004 fiscal year. Furthermore, we did not take any action with respect to executive compensation for 2004 other than the approval of bonuses to certain executive officers for the fourth quarter of 2004 pursuant to Copano Energy's existing quarterly bonus program. During 2004, the Board of Directors did not modify or reject in any material way any decision, action or recommendation by the Compensation Committee.

Shortly after the Compensation Committee's creation, an independent compensation consultant was engaged to assess the existing compensation of Copano Energy's executive officers, including base salaries, bonus arrangements and long-term incentive compensation, and to assist us in developing compensation principles and a compensation program for implementation in 2005. As a result, in February 2005, the Compensation Committee established a compensation program for Copano Energy's executive officers, including the Chief Executive Officer, with respect to 2005 compensation. This compensation program is intended to:

- •

- Attract and retain talented executive officers by providing total compensation competitive with that of executives who hold comparable positions in other similarly situated organizations;

- •

- Motivate executives to achieve strong financial and operational results;

- •

- Provide a performance-based compensation component that balances rewards for short-term and long-term results and that is tied to both individual performance as well as company performance; and

- •

- Encourage long-term commitment to Copano Energy.

18

Our executive compensation program consists of three principal elements: (i) base salary, (ii) potential for annual cash incentive compensation awards based on the achievement of specific measures of company and individual performance goals and (iii) opportunities to earn long-term unit-based awards, which provide long-term incentives that are intended to encourage the achievement of superior results over time and to align the interests of executive officers with those of Copano Energy's unitholders. The annual incentive compensation awards and long-term unit-based awards constitute the performance-based portion of Copano Energy's executive compensation program.

Base Salary. The Compensation Committee has established base salary levels of the Chief Executive Officer and other executive officers for 2005 after review of salary survey data of other midstream natural gas companies and of "general industry" companies with revenues comparable to those of Copano Energy. The base salary established for each executive officer, including the Chief Executive Officer, also takes into account the executive's particular experience and level of responsibility. Base salaries of the executive officers will be reviewed annually by the Compensation Committee, with adjustments made based on consideration of any increases in the cost of living, job performance of the executive officer over time, the expansion of duties and responsibilities, if any, of the executive officer and market salary levels, including those in effect in the midstream natural gas industry. No specific weight or emphasis will be placed on any one of these factors. By reviewing the salary data of other companies from time to time, we intend to ensure that the base salaries established by the Compensation Committee are generally within the range of base salaries paid by other similarly-situated companies.

Short-Term Incentive Compensation. In February 2005, Copano Energy adopted a management incentive compensation plan to be effective beginning in 2005, which provides for annual cash bonus opportunities for executive officers, including the Chief Executive Officer, and certain key employees based upon the achievement of a combination of individual performance goals and of company operational and financial objectives. Target incentive opportunities under the plan are established each year by the Compensation Committee as a percentage of base salary. When target performance is achieved, incentive amounts are intended to be competitive with incentive compensation available to comparable positions in comparable companies. In addition to target bonus awards, the plan also provides for the ability to make special incentive awards in recognition of exemplary performance with respect to a specified project or issue. Under the plan, no participant may receive a cash bonus award exceeding 200% of his or her annual base salary during any calendar year, or a special incentive award exceeding 50% of his or her annual base salary during any calendar year. Additionally, participants in the incentive compensation plan are not eligible to participate in Copano Energy's quarterly bonus program for non-executive employees.

Long-Term Incentive Compensation. The long-term incentive portion of our executive compensation program is administered through Copano Energy's Long-Term Incentive Plan, which was established in November 2004 in anticipation of the company's initial public offering. The plan provides a means by which Copano Energy's employees, including executive officers, may develop an economic interest in the company's future financial success in order to enhance the recipients' desire to remain with the company, to devote their best efforts to its business and to more closely align executives' and unitholders' long-term interests. Upon the closing of its initial public offering in November 2004, Copano Energy granted then executive officers, excluding the Chief Executive Officer, options to acquire an aggregate of 63,000 common units. No other awards were made to executive officers pursuant to the Long-Term Incentive Plan during 2004. During 2005, the Compensation Committee intends to develop guidelines with respect to the future grant of long-term incentive awards, which will be based upon benchmarking of market compensation and Copano Energy's overall compensation principles.

Section 162(m). Section 162(m) of the Internal Revenue Code, enacted in 1993, imposes a limit of $1 million, with certain exceptions, on the amount that a publicly held corporation may deduct in any year for the compensation paid or accrued with respect to each of its chief executive officer and four other most highly compensated executive officers. None of Copano Energy's executive officers currently receives

19

compensation exceeding the limits imposed by Section 162(m). While the Compensation Committee cannot predict with certainty how our executive compensation might be affected in the future by Section 162(m) or applicable tax regulations issued thereunder, the Compensation Committee intends to attempt to preserve the tax deductibility of all executive compensation while pursuing the objectives of our executive compensation program as described in this report.

Notwithstanding anything to the contrary set forth in any of our previous or future filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate this Proxy Statement or future filings with the SEC, in whole or in part, the preceding performance information shall not be deemed to be "soliciting material" or to be "filed" with the SEC or incorporated by reference into any filing except to the extent the foregoing report is specifically incorporated by reference therein.

20

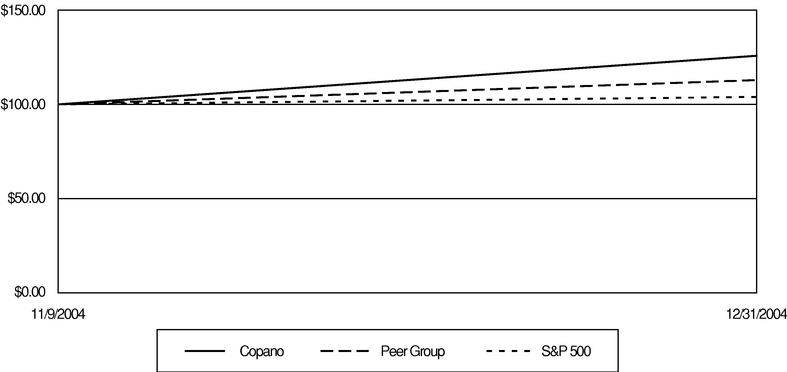

UNITHOLDER RETURN PERFORMANCE PRESENTATION

The Performance Graph below compares the cumulative total unitholder return on our common units, based on the market price of our common units, with the cumulative total return of the Standard & Poor's 500 Index (the "S&P 500 Index") and a weighted index peer group of four companies (the "Peer Group"). The Peer Group is comprised of Atlas Pipeline Partners, L.P., Crosstex Energy, L.P., Energy Transfer Partners, L.P. and MarkWest Energy Partners, L.P. Cumulative total return is based on annual total return, which assumes reinvested dividends or distributions for the period shown in the Performance Graph and assumes that $100 was invested in our company at the last reported sale price of our common units as reported on the NASDAQ ($22.70) on November 9, 2004 (the day trading of our common units commenced), and in the S&P 500 Index and the Peer Group on the same date. The Peer Group investment is weighted at the beginning of each period based on the market capitalization of each individual company within the group. The results shown in the graph below are not necessarily indicative of future performance.

| | 11/9/2004

| | 12/31/2004

|

|---|

| Copano | | $ | 100 | | $ | 126(1) |

| Peer Group | | $ | 100 | | $ | 113 |

| S&P 500 | | $ | 100 | | $ | 104 |

- (1)

- Based on the last reported sale price of our common units as reported on the NASDAQ on December 31, 2004 ($28.50).

Notwithstanding anything to the contrary set forth in any of our previous or future filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate this Proxy Statement or future filings with the SEC, in whole or in part, the preceding performance information shall not be deemed to be "soliciting material" or to be "filed" with the SEC or incorporated by reference into any filing except to the extent this performance presentation is specifically incorporated by reference therein.

21

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth as of the Record Date the number of units beneficially owned by: (i) each person who is known to us to beneficially own more than 5% of a class of units; (ii) the current directors and nominees of our Board of Directors; (iii) each executive officer named in the Summary Compensation Table included under "Executive Compensation"; and (iv) all current directors and executive officers as a group. We obtained certain information in the table from filings made with the SEC. Unless otherwise noted, each beneficial owner has sole voting power and sole investment power.

Name of Beneficial Owner, Director,

Nominee or Named Executive Officer

| | Common

Units

| | Percentage

of

Common

Units

| | Subordinated

Units

| | Percentage of

Subordinated

Units

| | Percentage

of Total

Units

Beneficially

Owned

| |

|---|

| Copano Partners, L.P.(1) | | 763,221 | | 10.8 | % | 1,317,733 | | 37.4 | % | 19.6 | % |

| DLJ Merchant Banking Partners III, L.P. and related owners(2) | | 230,560 | | 3.3 | % | 874,924 | | 24.9 | % | 10.4 | % |

| EnCap Energy Capital Fund III, L.P. and related owners(3) | | 230,560 | | 3.3 | % | 874,924 | | 24.9 | % | 10.4 | % |

| John R. Eckel, Jr.(1)(4)(5) | | 763,221 | | 10.8 | % | 1,317,733 | | 37.4 | % | 19.6 | % |

| R. Bruce Northcutt(5) | | 42,330 | | 0.6 | % | 73,084 | | 2.1 | % | 1.1 | % |

| Matthew J. Assiff(5)(6) | | 21,581 | | 0.3 | % | 37,261 | | 1.1 | % | 0.6 | % |

| Douglas L. Lawing(5) | | * | | * | | * | | * | | | |

| Lari Paradee(5) | | * | | * | | * | | * | | * | |

| Robert L. Cabes, Jr.(7) | | * | | * | | * | | * | | * | |

| James G. Crump(8) | | * | | * | | * | | * | | * | |

| Ernie L. Danner(8) | | * | | * | | * | | * | | * | |

| Scott A. Griffiths(8) | | * | | * | | * | | * | | * | |

| Michael L. Johnson(8) | | * | | * | | * | | * | | * | |

| T. William Porter III(8) | | * | | * | | * | | * | | * | |

| William L. Thacker(8) | | * | | * | | * | | * | | * | |

| All directors and executive officers as a group (17 persons) | | 859,432 | | 12.1 | % | 1,428,078 | | 40.6 | % | 21.6 | % |

- *

- Less than 1% of total outstanding units of class.

- (1)

- All units are held by Copano Partners Trust, a Delaware statutory trust, the sole beneficiary of which is Copano Partners, L.P., which retains sole voting and dispositive power with respect to the common units and subordinated units held by Copano Partners Trust. Ten grantor trusts own indirectly all of the outstanding general partner interests in Copano Partners, L.P. and, together with 19 additional grantor trusts, own, directly or indirectly, all of its outstanding limited partner interests. The direct or indirect beneficiaries of the grantor trusts are members of our management team, certain of our employees and certain current and former employees of Copano Operations and consultants. 27 of the 29 grantor trusts have three trustees, John R. Eckel, Jr., Charles R. Noll, Jr. and Charles R. Barker, Jr., and Mr. Eckel has the power to appoint additional trustees for 23 of the 29 grantor trusts, including each of the grantor trusts holding indirect interests in the general partner of Copano Partners, L.P. Mr. Eckel, Jeffrey A. Casey and Douglas L. Lawing serve as the trustees of one of the remaining grantor trusts and Messrs. Eckel, Noll, Barker and Matthew J. Assiff serve as the trustees of the other remaining grantor trust.

- (2)

- Based solely on information furnished in the Schedule 13D filed with the SEC by such person on November 24, 2004 and subsequent transactions known to us. Includes common units and subordinated units owned by MBP III AIV, L.P., and MBP III Onapoc Holdings LLC, which are merchant banking funds managed by affiliates of CSFB Private Equity that are indirect subsidiaries of Credit Suisse First Boston (USA), Inc. (formerly Donaldson, Lufkin & Jenrette, Inc.) ("CSFB-USA").

Credit Suisse First Boston, a Swiss bank, owns the majority of the voting stock of Credit Suisse First Boston, Inc., which owns all of the stock of CSFB-USA. The ultimate parent company of Credit Suisse First Boston is Credit Suisse Group ("CSG"). CSG disclaims beneficial ownership of the reported common units that are beneficially

22

owned by its direct and indirect subsidiaries. Robert L. Cabes, Jr. is a Principal of Global Energy Partners, a specialty group within CSFB Private Equity.

DLJ Merchant Banking Partners III, L.P. and related owners can be contacted at the following address: Eleven Madison Avenue, New York, New York 10010-3629.

- (3)