Copano Energy

59

Reconciliation of Non-GAAP

Financial Measures

Adjusted EBITDA

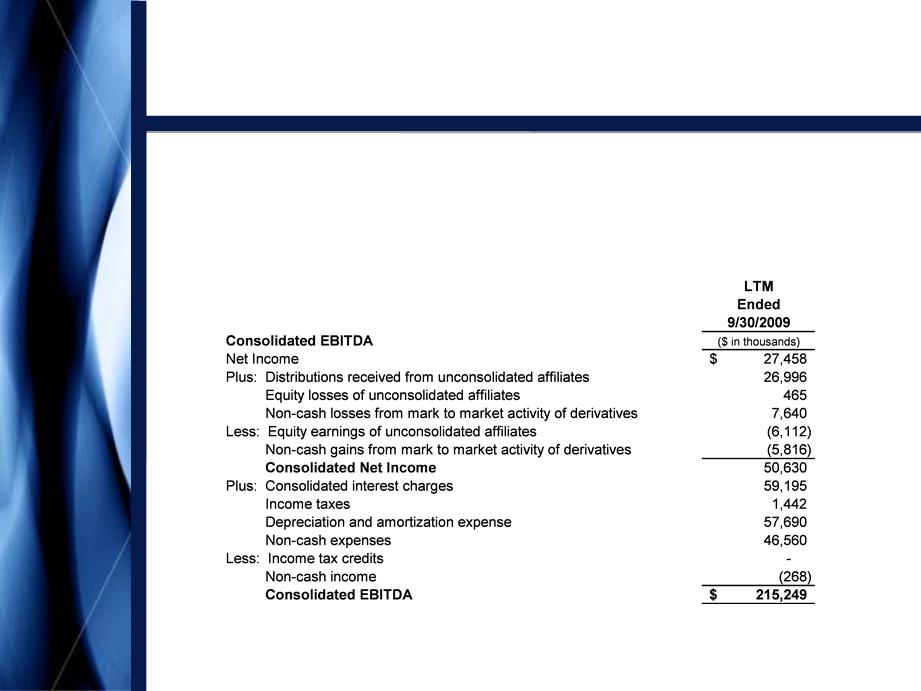

• We define EBITDA as net income (loss) plus interest expense, provision for income taxes and depreciation and amortization expense. Because a portion of

our net income (loss) is attributable to equity in earnings (loss) from our equity investees (which include Bighorn, Fort Union, Webb Duval and Southern

Dome), our management also calculates Adjusted EBITDA to reflect the depreciation and amortization expense embedded in equity in earnings (loss) from

unconsolidated affiliates. Specifically, our management determines Adjusted EBITDA by adding to EBITDA (i) the amortization expense attributable to the

difference between our carried investment in each unconsolidated affiliate and the underlying equity in its net assets, (ii) the portion of each unconsolidated

affiliate’s depreciation and amortization expense, which is proportional to our ownership interest in that unconsolidated affiliate and (iii) the portion of each

unconsolidated affiliate’s interest and other financing costs, which is proportional to our ownership interest in that unconsolidated affiliate.

• External users of our financial statements such as investors, commercial banks and research analysts use EBITDA or Adjusted EBITDA, and our

management uses Adjusted EBITDA, as a supplemental financial measure to assess:

– The financial performance of our assets without regard to financing methods, capital structure or historical cost basis;

– The ability of our assets to generate cash sufficient to pay interest costs and support our indebtedness;

– Our operating performance and return on capital as compared to those of other companies in the midstream energy sector, without regard to

financing or capital structure; and

– The viability of acquisitions and capital expenditure projects and the overall rates of return on alternative investment opportunities.

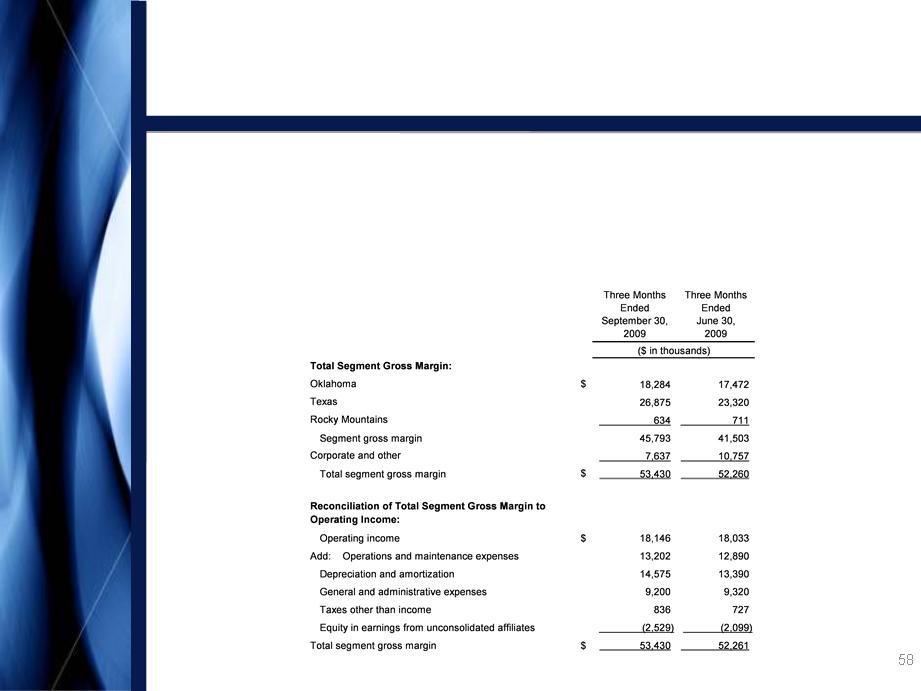

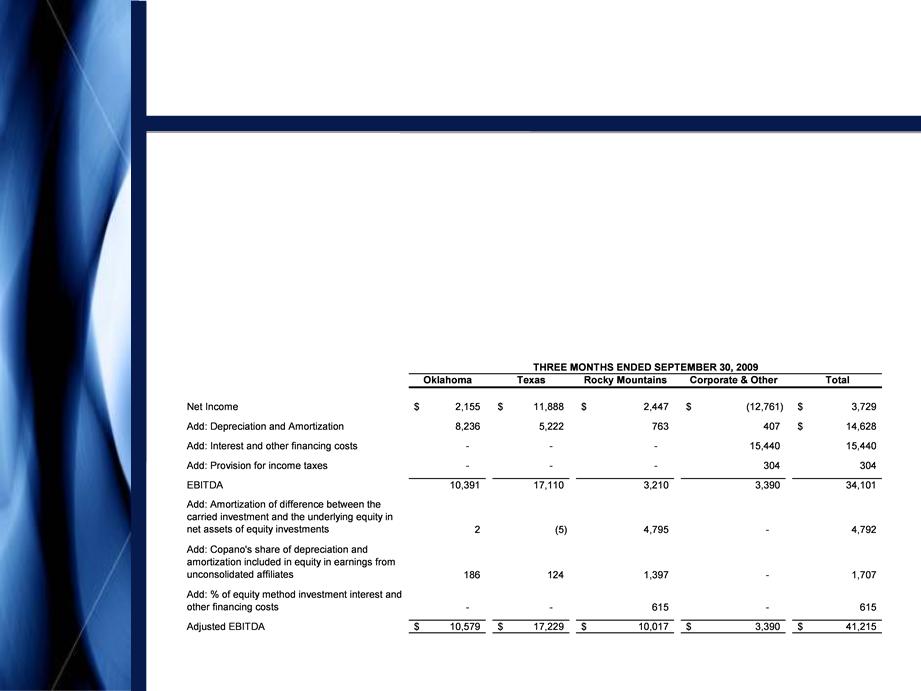

• The following table presents a reconciliation of the portion of our EBITDA and Adjusted EBITDA attributable to each of our segments to the GAAP financial

measure of net income (loss):

Appendix