Copano’s Key Strengths

Founded in 1992 as an independent midstream company

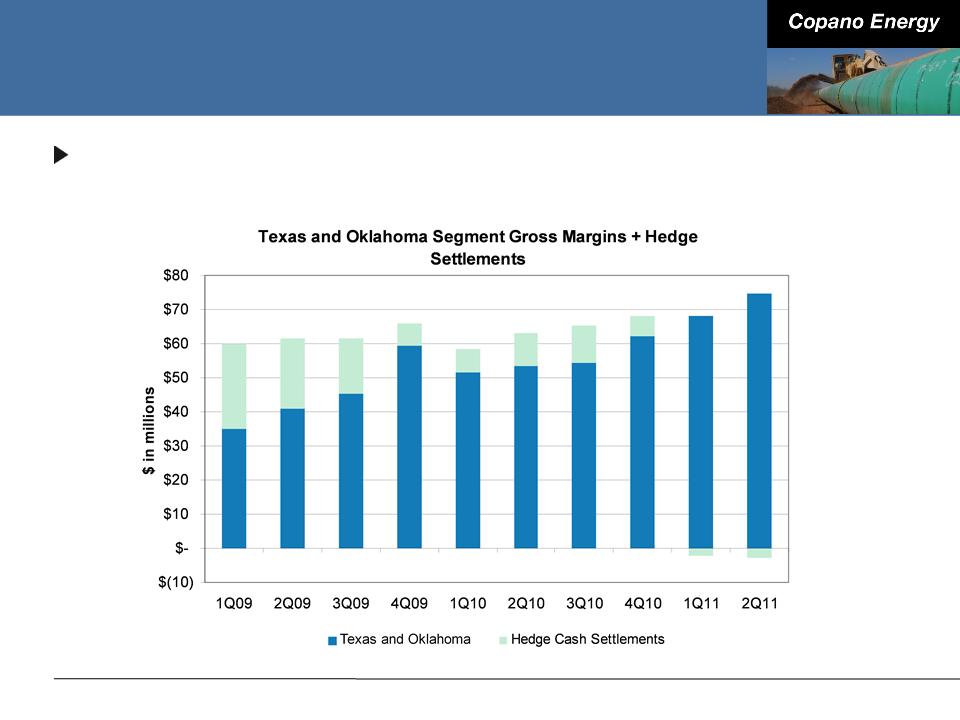

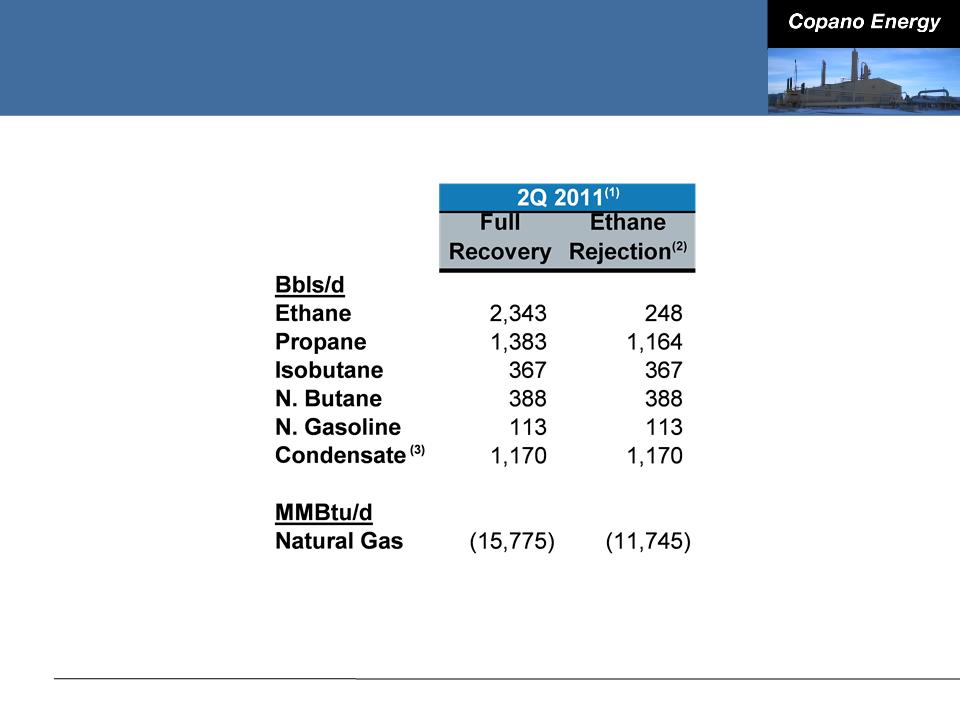

Experienced operator in liquids-rich natural gas plays

Six executive management members with 166 combined years of industry experience

28

Experienced

Operator /

Seasoned Team

Strong Balance

Sheet with

Access to

Liquidity

Strategic and

Diverse Asset

Base

Significant

Organic Growth

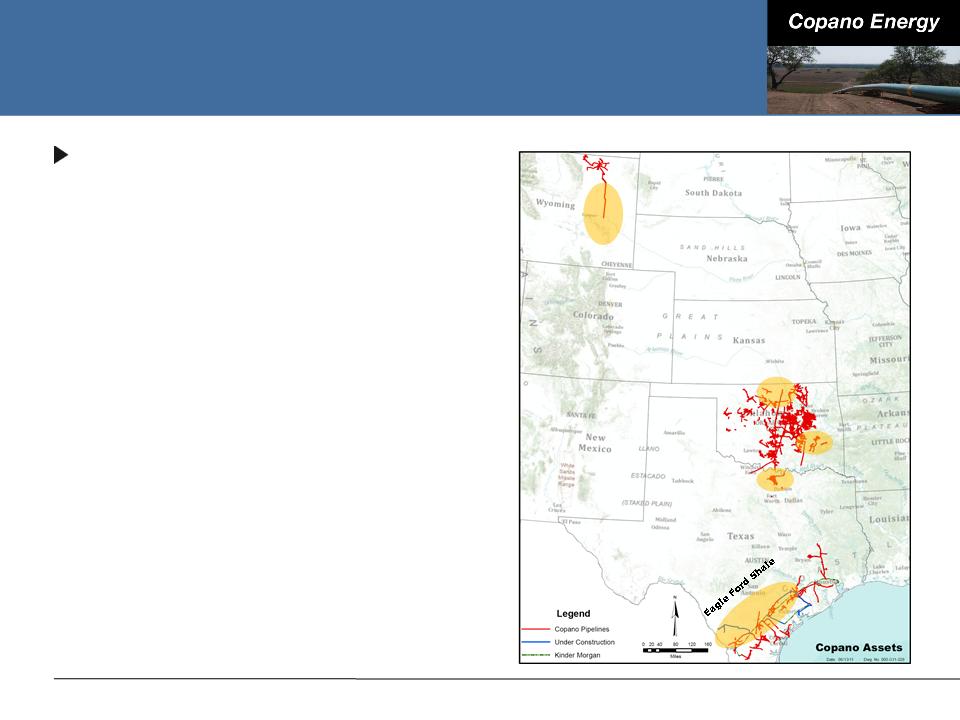

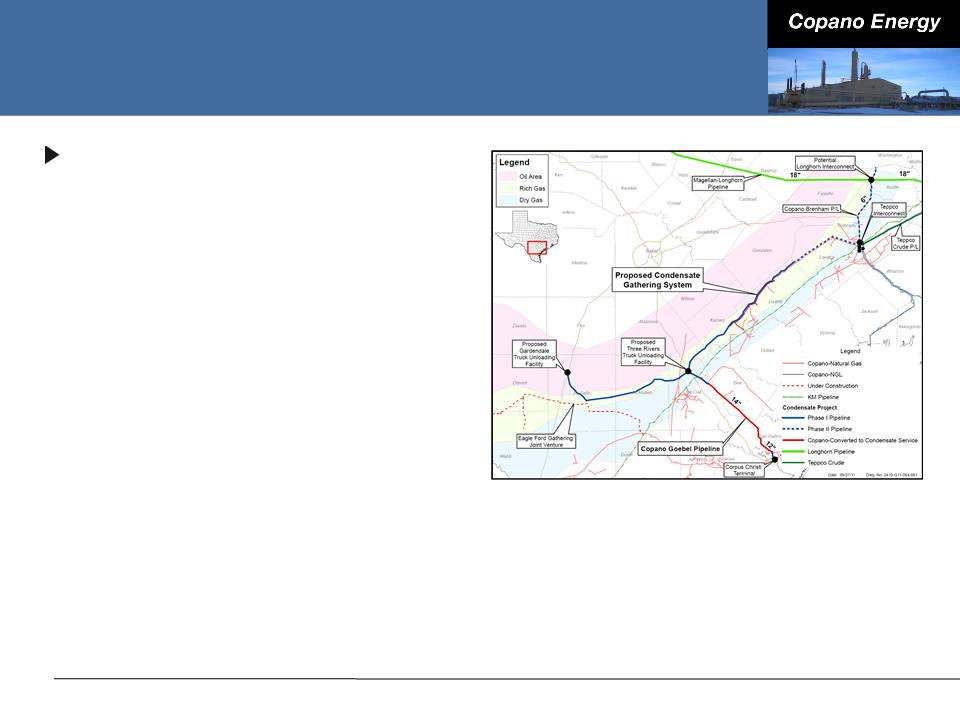

Significant position in Eagle Ford Shale and North Barnett Shale Combo

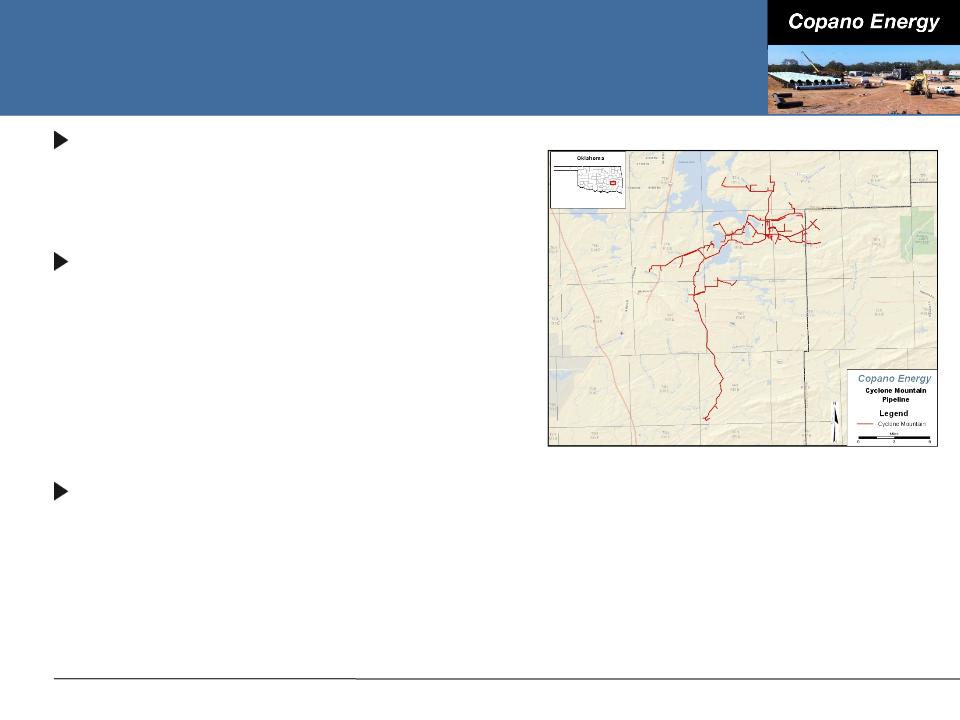

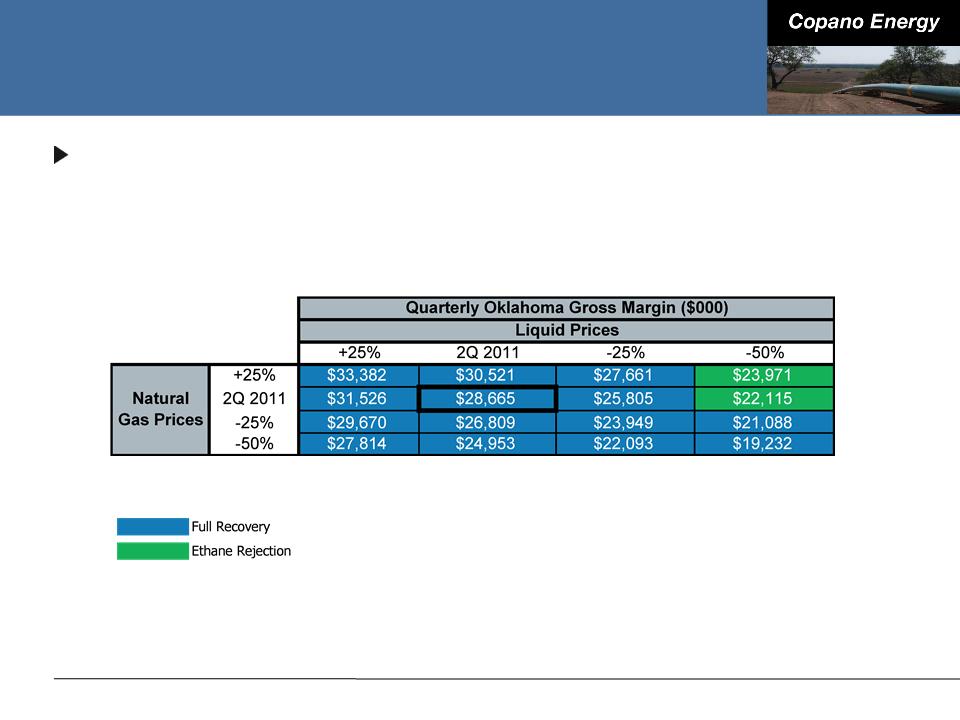

One of the largest gatherers of associated gas in Eastern Oklahoma

Large gatherer of Powder River Basin gas with access to Niobrara and Frontier gas

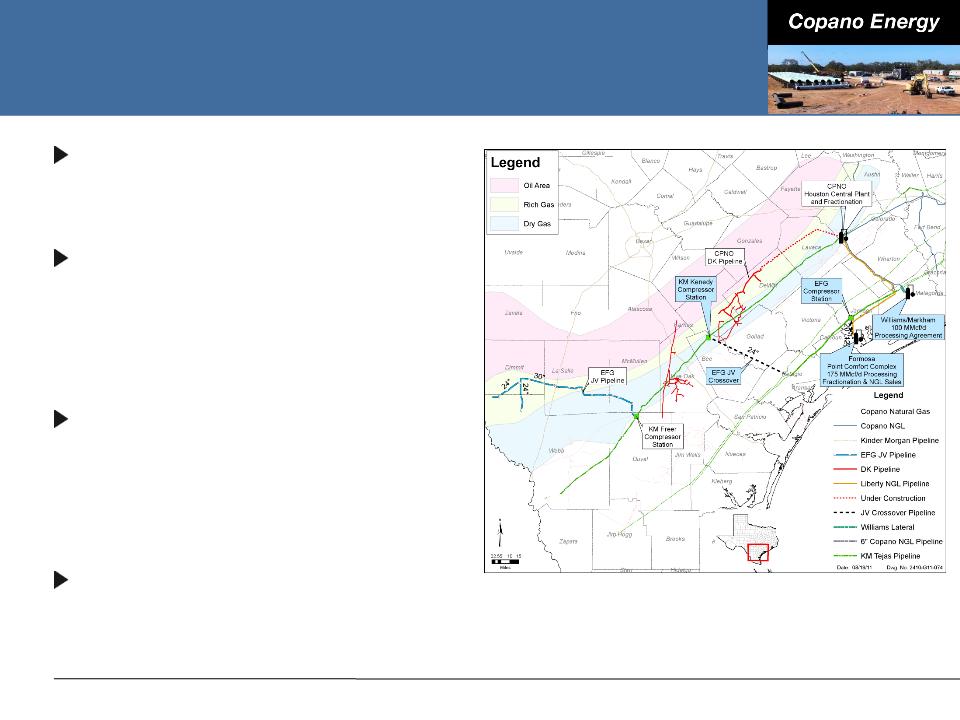

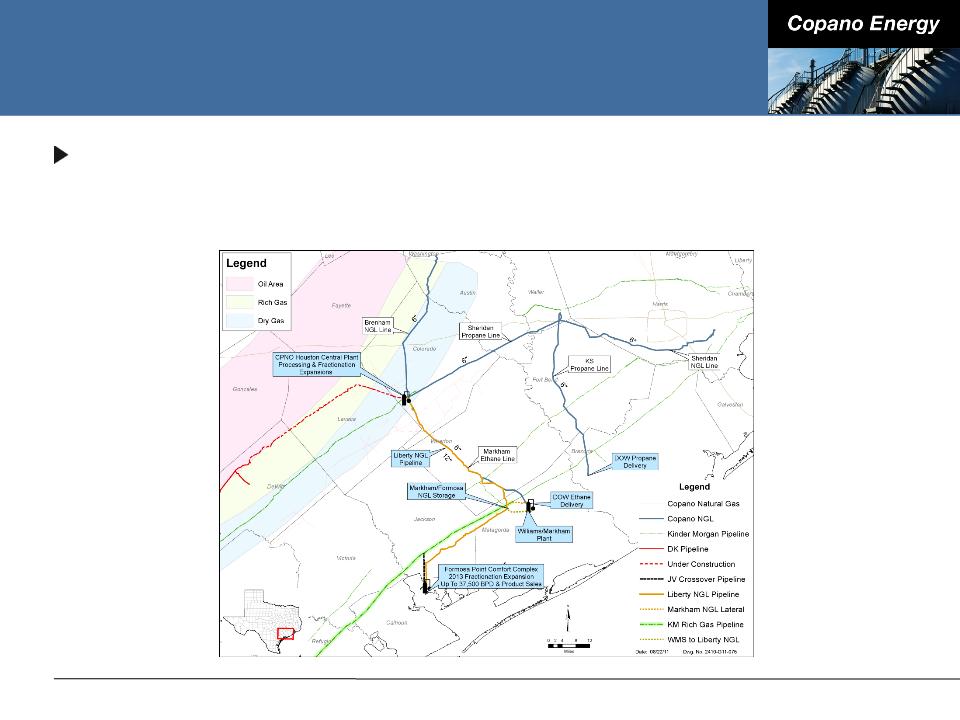

Upon completion of processing expansion, Houston Central complex will be largest

plant in Texas

Approximately $440 million in 2011 growth projects (1) - majority in Eagle Ford Shale

Investments in announced growth projects target 5x multiple

Opportunities beyond traditional gathering and processing

New $700 million revolver in place

$300 million TPG Capital preferred equity

Cash flow growth expected from projects due to be completed this year

Long-term

Contracts and

Improving

Contract Mix

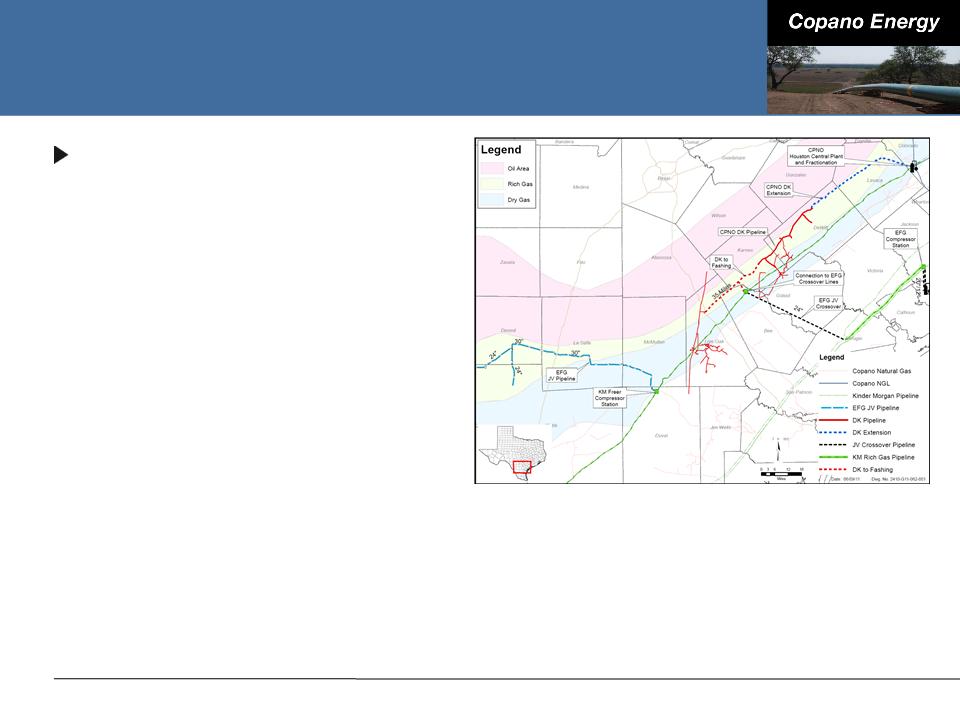

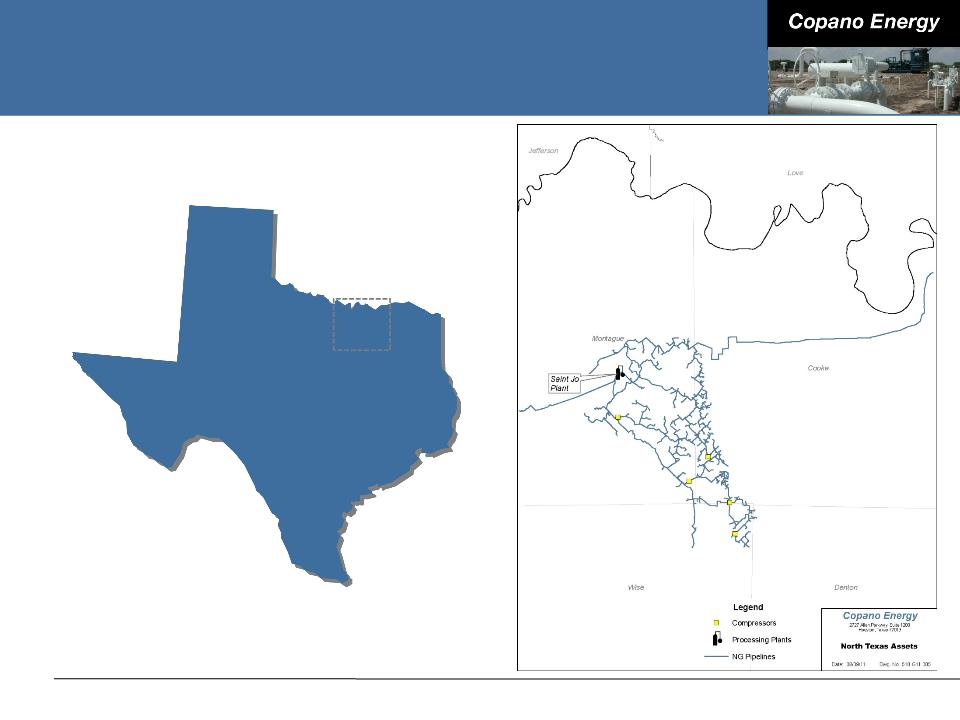

DK pipeline, Eagle Ford Gathering JV and Saint Jo system approximately 80%

contracted on a combined basis

Average contract length for Eagle Ford Shale and North Texas Barnett Combo

approaching 9 years

Contract mix expected to be two-thirds fee-based by end of 2012

(1) Includes Copano’s net share for unconsolidated affiliates.