45

Reconciliation of Non-GAAP Financial Measures

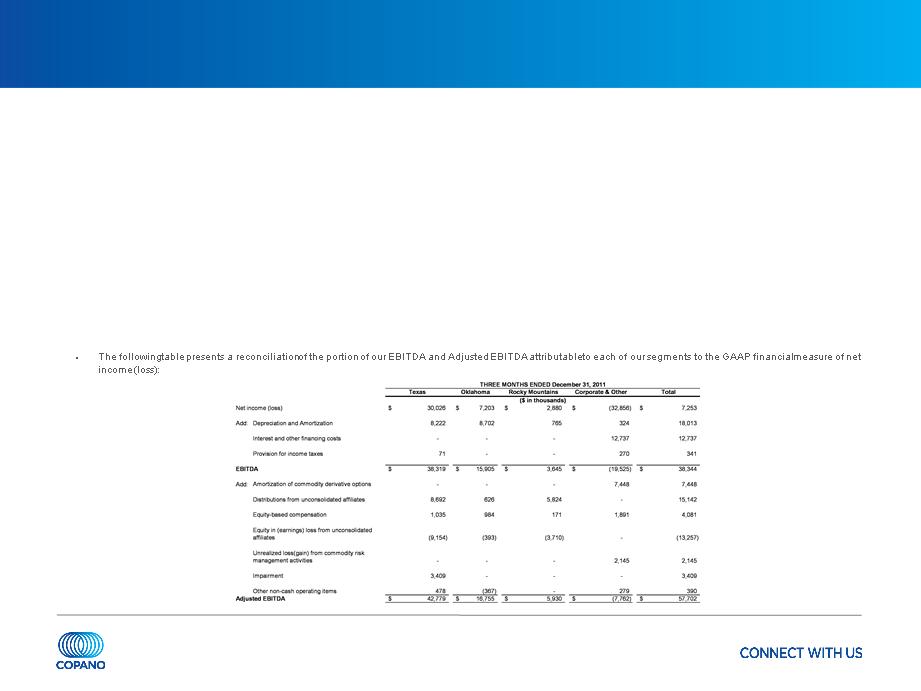

Adjusted EBITDA

• Commencing with the second quarter of 2011, we revised our calculation of adjusted EBITDA to more closely resemble that of many of our peers in terms of measuring

our ability to generate cash. Our adjusted EBITDA (as revised) equals:

- net income (loss);

- plus interest and other financing costs, provision for income taxes, depreciation, amortization and impairment expense, non-cash amortization expense associated with our commodity

derivative instruments, distributions from unconsolidated affiliates, loss on refinancing of unsecured debt and equity-based compensation expense;

- minus equity in earnings (loss) from unconsolidated affiliates and unrealized gains (losses) from commodity risk management activities; and

- plus or minus other miscellaneous non-cash amounts affecting net income (loss) for the period.

• In calculating adjusted EBITDA as revised, we no longer add to EBITDA (earnings before interest taxes depreciation and amortization our share of the depreciation,

amortization and impairment expense and interest and other financing costs embedded in our equity in earnings (loss) from unconsolidated affiliates; instead we now add

to EBITDA (i) our impairment expense, and other non-cash amounts affecting net income (loss) for the period, (ii) non-cash amortization expense associated with our

commodity derivative instruments, (iii) loss on refinancing of unsecured debt and (iv) distributions from unconsolidated affiliates.

• We believe that our revised calculation of adjusted EBITDA is a more effective tool for our management in evaluating our operating performance for several reasons.

Although our historical method for calculating adjusted EBITDA was useful in assessing the performance of our assets (including our unconsolidated affiliates) without

regard to financing methods, capital structure or historical cost basis, the prior calculation was not as useful in evaluating the core performance of our assets and their

ability to generate cash because adjustments for a number of non-cash expenses and other non-cash and non-operating items were not reflected in the calculation and

the impact of cash distributions from our unconsolidated affiliates was likewise not reflected. We believe that the revised calculation of adjusted EBITDA is more consistent

with the method and presentation used by many of our peers and will allow management and analysts to better evaluate our performance relative to our peer companies.

Also, we believe that the revised calculation more effectively represents what lenders and debt holders, as well as industry analysts and many of our unitholders, have

indicated is useful in assessing our core performance and outlook and comparing us to other companies in our industry.