4

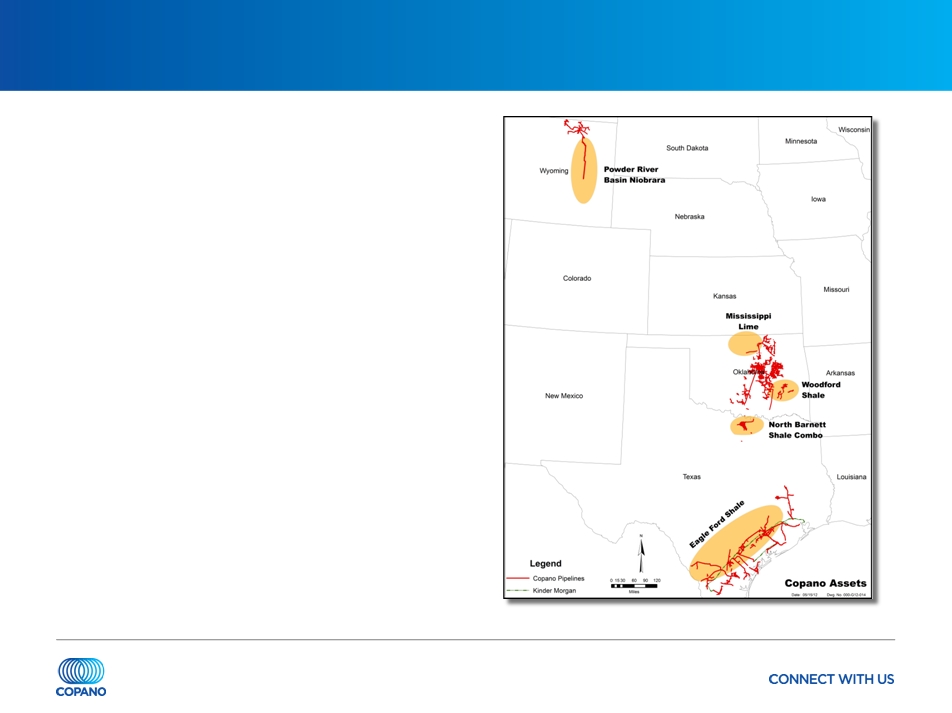

Long-term Value of Eagle Ford Strategy Unchanged

Eagle Ford Shale play considered one of the best in North America

• Size, quality and proximity to markets

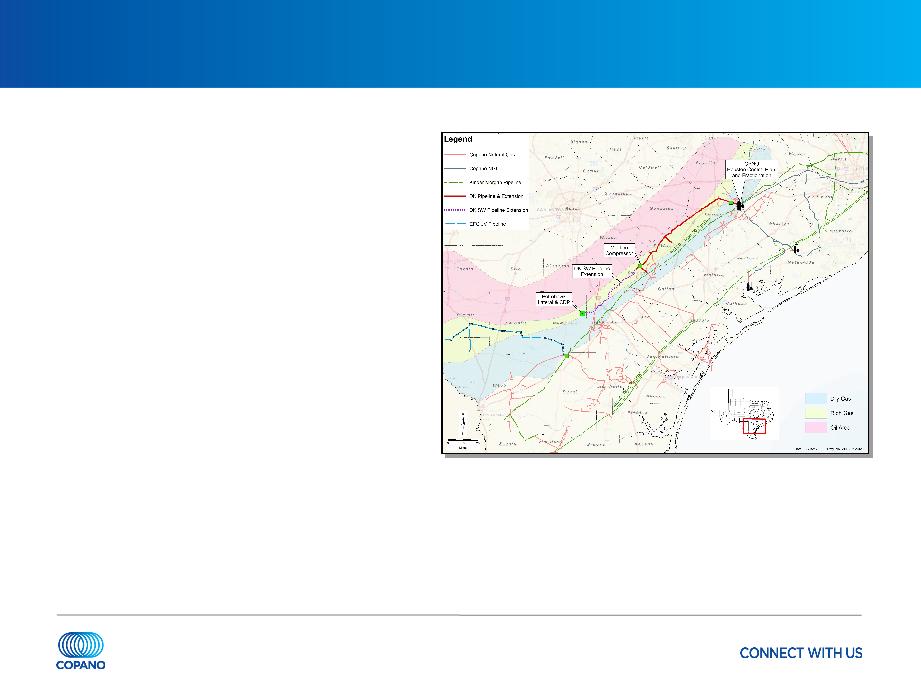

Copano assets well positioned

• Existing pipes and processing capacity with significant tailgate market access

• New, large-diameter pipelines in service

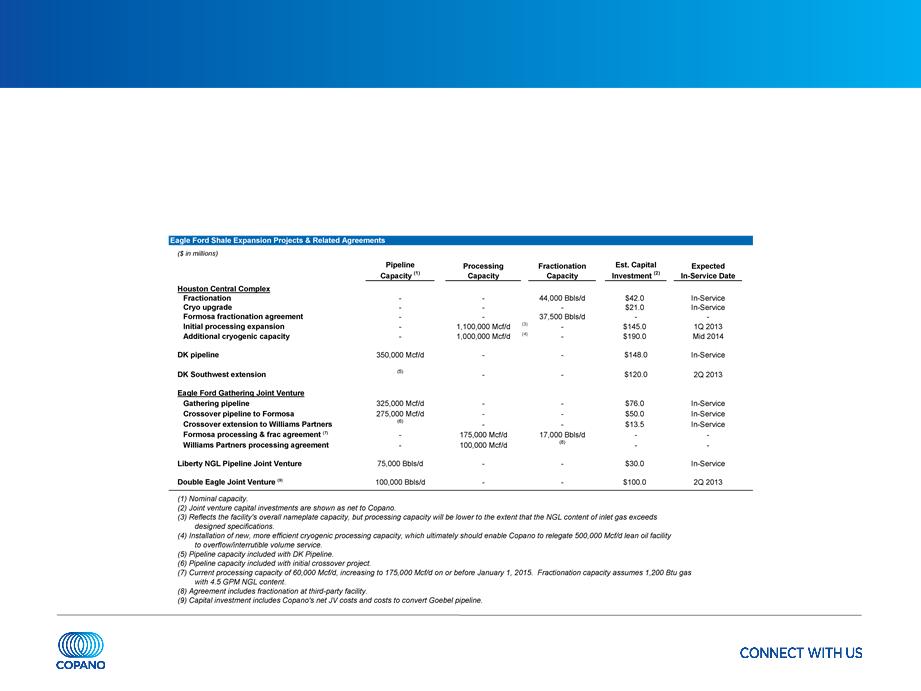

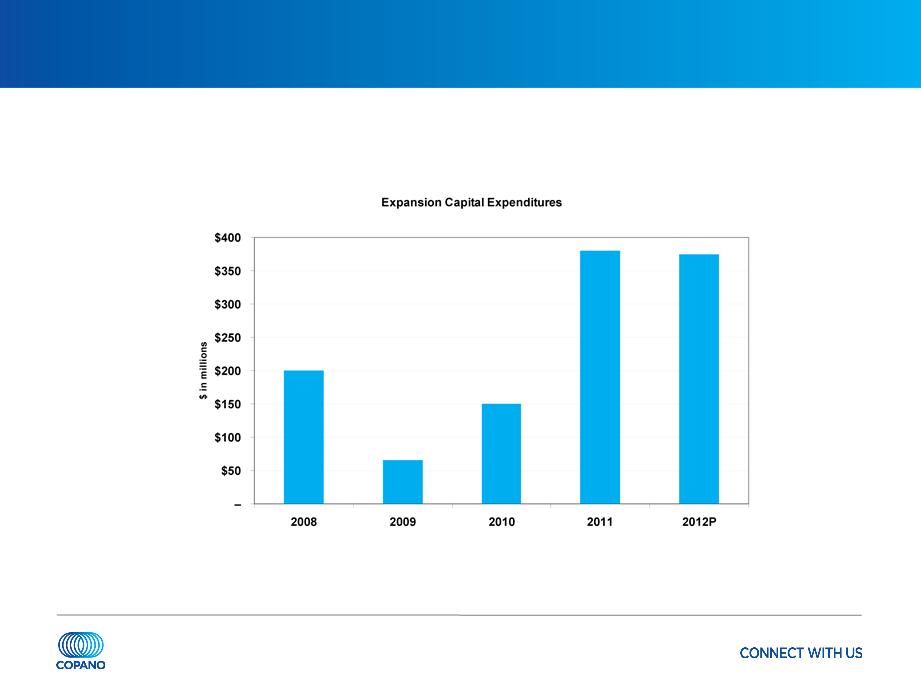

Created and investing $1 billion in organic projects

• Capital invested at 5x multiple

Executed producer contracts totaling up to 1,000,000 MMBtu/d of committed

volumes

• Weighted average term of approximately 10 years

• Committed volumes over the terms of the agreements total approximately 3.3 Tcf of rich

Eagle Ford Shale gas

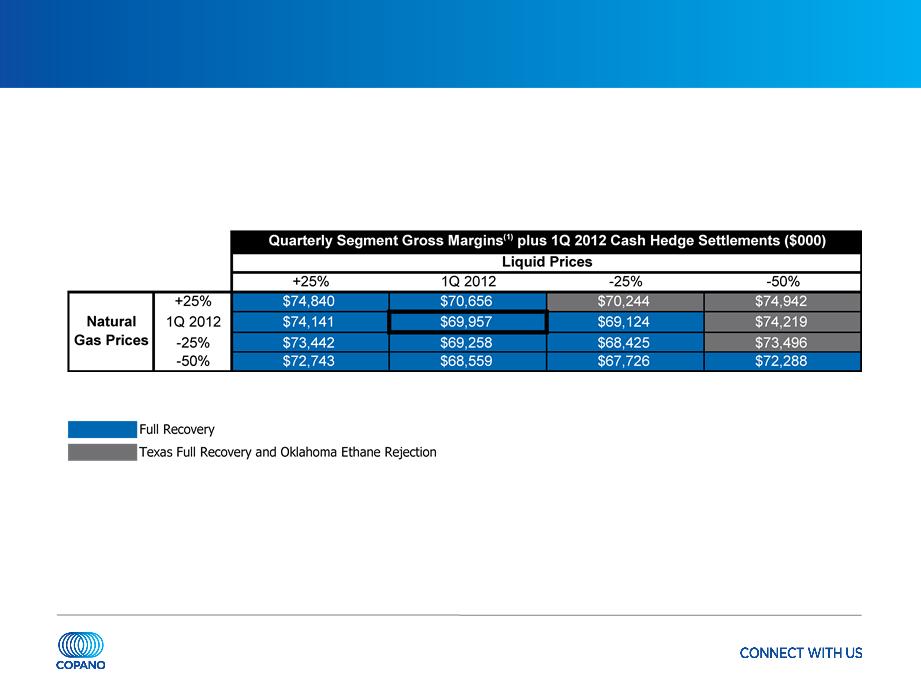

Increasing contribution from fee-based cash flows

• Vast majority of our Eagle Ford shale contracts include fixed fees for gathering,

processing, transportation and fractionation services, and producer volume commitments

with deficiency payments

Based on today’s operating environment, we expect to maintain current

distribution level in the near-term, and our long-term view of distribution

growth is unchanged