UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

| | | |

o Preliminary Proxy Statement | | o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | |

þ Definitive Proxy Statement | | |

| | | |

o Definitive Additional Materials | | |

| | | |

o Soliciting Material Under Rule 14a-12 | | |

| REACHLOCAL, INC. |

| (Name of Registrant as Specified in Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if Other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| | þ | No fee required. |

| | o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | Title of each class of securities to which transaction applies: |

| | | (2) | Aggregate number of securities to which transaction applies: |

| | | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | (4) | Proposed maximum aggregate value of transaction: |

| | | (5) | Total fee paid: |

| | o | Fee paid previously with preliminary materials: |

| | o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | | (1) | Amount previously paid: |

| | | (2) | Form, Schedule or Registration Statement No.: |

| | | (3) | Filing Party: |

| | | (4) | Date Filed: |

April 5, 2013

Dear Stockholder:

You are cordially invited to join us at the 2013 Annual Meeting of Stockholders of ReachLocal, Inc., which will be held at 9:00 a.m. (PDT) on May 22, 2013 at The Westin Los Angeles Airport, 5400 West Century Boulevard, Los Angeles, California, 90045.

At the meeting, we will ask our stockholders to vote on proposals to elect Zorik Gordon, Robert Dykes and Alan Salzman to serve three-year terms as members of our board of directors and to approve our Amended and Restated 2008 Stock Incentive Plan. We will also ask our stockholders to ratify the audit committee’s appointment of our independent registered public accounting firm for the current fiscal year.

The board of directors unanimously believes that each of the proposals is in the best interests of ReachLocal and its stockholders, and, accordingly, recommends a vote “FOR” Zorik Gordon, Robert Dykes and Alan Salzman to serve as directors, a vote “FOR” the approval of our Amended and Restated 2008 Stock Incentive Plan, and a vote “FOR” the ratification of the selection of Grant Thornton LLP as our independent registered public accounting firm.

We hope that you will take this opportunity to participate in the affairs of the company. Whether or not you plan to attend the meeting, it is important that your shares be represented and voted. You may vote on the Internet, by telephone or by completing and mailing a proxy card. Voting over the Internet, by telephone or by written proxy will ensure your shares are represented at the annual meeting. Additional information about voting your shares is included in the proxy statement.

We look forward to seeing you at the Annual Meeting.

Sincerely,

David Carlick Chairman of the Board of Directors | | Zorik Gordon Chief Executive Officer |

REACHLOCAL, INC.

21700 Oxnard Street, Suite 1600

Woodland Hills, California 91367

Notice Of Annual Meeting Of Stockholders

To Be Held On Wednesday, May 22, 2013

To the Stockholders of ReachLocal, Inc.:

The Annual Meeting of Stockholders of ReachLocal, Inc., a Delaware corporation, will be held on May 22, 2013, at The Westin Los Angeles Airport, 5400 West Century Boulevard, Los Angeles, California, 90045, at 9:00 a.m. (PDT), for the purpose of considering and acting upon the following:

| | 1. | The election of Zorik Gordon, Robert Dykes and Alan Salzman to serve as members of our board of directors until the 2016 annual meeting of stockholders and until their respective successors have been duly elected and qualified; |

| | 2. | The approval of our Amended and Restated 2008 Stock Incentive Plan; |

| | 3. | Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013; and |

| | 4. | The transaction of any other business that may properly come before the meeting or any adjournments or postponements thereof. |

Only stockholders of record at the close of business on March 27, 2013 will be entitled to notice of and to vote at the meeting and any continuations, adjournments or postponements thereof. A list of stockholders eligible to vote at the Annual Meeting will be available for inspection at the meeting and at the executive offices of ReachLocal during regular business hours for at least ten days prior to the meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. Your vote is important to us, and we hope that you will take this opportunity to participate in the affairs of the company. Whether or not you plan to attend the Annual Meeting, we urge you to read the accompanying materials regarding matters to be voted on at the meeting and use the proxy card and instructions to submit your vote by proxy. You may vote by completing and mailing the proxy card enclosed with the proxy statement, or you may grant your proxy electronically via the Internet or by telephone by following the instructions on the proxy card. Submitting a proxy over the Internet, by telephone or by mailing a proxy card will ensure your shares are represented at the meeting. If you hold your shares in street name, which means your shares are held of record by a broker, bank or other nominee, you will receive instructions on how to vote your shares from such broker, bank or other nominee.

You may revoke your proxy delivered pursuant to this solicitation at any time prior to the Annual Meeting. If you attend the meeting and wish to change your proxy vote, you may do so automatically by voting in person at the meeting. If your shares are held in street name, you may change your vote by submitting new voting instructions to your broker, bank or other nominee. We look forward to your participation.

| | | By Order of the Board of Directors | |

| | | | |

| | | Adam F. Wergeles Secretary | |

| | | | |

Dated: April 5, 2013

TABLE OF CONTENTS

| Questions and Answers About the Proxy Materials and the Annual Meeting | 1 |

| | |

| Ownership of the Company | 5 |

| | |

| Corporate Governance | 7 |

| | |

| Report of the Audit Committee | 11 |

| | |

| Audit Matters | 12 |

| | |

| Executive Officers of the Company | 13 |

| | |

| Report of the Compensation Committee | 14 |

| | |

| Compensation Discussion and Analysis | 15 |

| | |

| Executive Compensation Tables | 25 |

| | |

| 2012 Director Compensation | 35 |

| | |

| Equity Compensation Plan Information | 37 |

| | |

| Proposal 1 — Election of Directors | 38 |

| | |

| Proposal 2 — Approval of Our Amended and Restated 2008 Stock Incentive Plan | 41 |

| | |

| Proposal 3 — Ratification of Appointment of Independent Registered Public Accounting Firm | 51 |

| | |

| Certain Relationships and Related Party Transactions | 51 |

| | |

| Other Matters | 52 |

| | |

| Appendix A: Amended and Restated 2008 Stock Incentive Plan | A-1 |

REACHLOCAL, INC.

21700 Oxnard Street, Suite 1600

Woodland Hills, California 91367

Your proxy is solicited on behalf of the board of directors (the “Board”) of ReachLocal, Inc., a Delaware corporation (“ReachLocal,” “we,” “us,” “our” or “the company”), for use at our 2013 Annual Meeting of Stockholders to be held on Wednesday, May 22, 2013, at 9:00 a.m. PDT, at The Westin Los Angeles Airport, 5400 West Century Boulevard, Los Angeles, California, 90045, or at any continuation, postponement or adjournment thereof, for the purposes discussed in this proxy statement and in the accompanying Notice of Annual Meeting and any business properly brought before the Annual Meeting. Proxies are solicited to give all stockholders of record an opportunity to vote on matters properly presented at the meeting. This proxy statement is first being released to stockholders on or about April 5, 2013.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE STOCKHOLDER MEETING TO BE HELD ON MAY 22, 2013

The following proxy materials are available for review at http://investors.reachlocal.com/annuals.cfm:

| | · | our 2013 proxy statement; |

| | · | our Annual Report on Form 10-K for the fiscal year ended December 31, 2012; and |

| | · | any amendments to the foregoing materials that are required to be furnished to stockholders. |

You are encouraged to access and review all of the important information contained in the proxy materials before voting.

Questions and Answers About the Proxy Materials and the Annual Meeting

Why am I receiving this Proxy Statement?

You have been sent this proxy statement because you were a stockholder, or held ReachLocal stock through a broker, bank or other nominee, at the close of business on March 27, 2013, which is the record date for stockholders entitled to vote at the Annual Meeting.

What proposals will be considered at the Annual Meeting?

At the Annual Meeting, stockholders will be asked to consider and act upon the following proposals:

| | 1. | The election of Zorik Gordon, Robert Dykes and Alan Salzman to serve as members of the Board until the 2016 annual meeting of stockholders and until their respective successors have been duly elected and qualified; |

| | 2. | The approval of our Amended and Restated 2008 Stock Incentive Plan (the “stock incentive plan proposal”); |

| | 3. | Ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013; and |

| | 4. | The transaction of any other business that may properly come before the meeting or any continuations, adjournments or postponements thereof. |

We are not aware of any other business to be brought before the meeting. If any additional business is properly brought before the meeting, the designated officers serving as proxies will vote in accordance with their best judgment.

The Board unanimously believes that each of the proposals is in the best interests of ReachLocal and its stockholders, and, accordingly, recommends a vote “FOR” Zorik Gordon, Robert Dykes and Alan Salzman to serve as directors, a vote “FOR” the approval of the stock incentive plan proposal, and a vote “FOR” the ratification of the selection of Grant Thornton LLP as our independent registered public accountants.

Who is entitled to vote at the Annual Meeting?

We have set March 27, 2013 as the record date for this year’s Annual Meeting. All stockholders who owned our stock at the close of business on the record date are entitled to this notice and to vote at the meeting and any adjournments or postponements thereof.

As of the record date, there were 28,266,215 shares of our common stock outstanding and entitled to vote at the Annual Meeting.

How many votes do I have?

Each outstanding share of our common stock is entitled to one vote at the Annual Meeting. You have one vote per share that you owned at the close of business on the record date.

How do I vote my shares?

You may vote by attending the Annual Meeting and voting in person, or you may vote by submitting a proxy. The method of voting by proxy differs for shares held as a record holder and shares held in “street name.” If you hold your shares of common stock as a record holder, you may vote your shares by completing, dating and signing the proxy card that was included with the proxy statement and promptly returning it in the preaddressed, postage paid envelope provided to you, or by submitting a proxy over the Internet or by telephone by following the instructions on the proxy card. If you hold your shares of common stock in street name, which means your shares are held of record by a broker, bank or other nominee, you will receive the proxy materials from your broker, bank or other nominee with instructions on how to vote your shares. Your broker, bank or other nominee may allow you to deliver your voting instructions over the Internet and may also permit you to vote by telephone.

The Internet and telephone voting facilities will close at 11:59 p.m. (EDT) on May 21, 2013. If you vote by Internet or telephone, then you need not return a written proxy card by mail.

YOUR VOTE IS VERY IMPORTANT. You should submit your proxy even if you plan to attend the Annual Meeting. If you properly give your proxy and submit it to us in time to vote, one of the individuals named as your proxy will vote your shares as you have directed.

What happens if I vote my shares by proxy?

If you properly fill in your proxy card and send it to us in time to vote, or vote your shares by telephone or Internet, you authorize our officers listed on the proxy card to vote your shares on your behalf as you direct.

If you sign and return a proxy card, but do not provide instructions on how to vote your shares, the designated officers will vote on each of the presented proposals on your behalf as follows:

| | · | “FOR” Zorik Gordon, Robert Dykes and Alan Salzman to serve as directors; |

| | · | “FOR” approval of the stock incentive plan proposal; and |

| | · | “FOR” ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013. |

Can I change or revoke my vote after I return my proxy card or voting instructions?

If you choose to vote your shares by giving a proxy pursuant to this solicitation, you may revoke or change your proxy instructions at any time prior to the casting of votes at the Annual Meeting if you take any of the following actions:

| | · | Execute and submit a new proxy card; |

| | · | Submit new voting instructions through telephonic or Internet voting, if available to you; |

| | · | Notify Adam F. Wergeles, Secretary of ReachLocal, in writing at the address provided on page 4, that you wish to revoke your proxy; or |

| | · | Attend the Annual Meeting and vote your shares in person. |

Attending the meeting in person will not automatically revoke your proxy. If your shares are held in street name, you may change your vote by submitting new voting instructions to your broker, bank or other nominee.

Who pays for the proxy solicitation and how will ReachLocal solicit votes?

We pay all costs associated with the solicitation of proxies represented by the enclosed proxy card. We will also pay any costs incurred by brokers and other fiduciaries to forward proxy solicitation materials to beneficial owners.

Proxies may be solicited by any of our directors, officers or employees on behalf of the Board by mail or in person, by telephone, via facsimile or e-mail. Additionally, we have retained the firm of MacKenzie Partners, Inc. to assist with the solicitation of proxies and will pay a fee of $5,000 for this service, plus reasonable costs and expenses.

How many votes must be present to hold the Annual Meeting?

In order to conduct business and have a valid vote at the Annual Meeting, a quorum must be present in person or represented by proxies. A quorum is defined as a majority of the shares outstanding on the record date and entitled to vote. In accordance with our Amended and Restated Bylaws (our “bylaws”) and Delaware law, proxies reflecting broker “non-votes” and abstentions will be counted for purposes of determining whether a quorum is present.

What are broker “non-votes”?

Brokers who hold shares for the accounts of their clients may vote such shares either as directed by their clients, or in the absence of such direction, in their own discretion if permitted by the stock exchange or other organization of which they are members. As members of the New York Stock Exchange, most banks, brokers or other nominees are permitted to vote their clients’ proxies in their own discretion as to certain “routine” proposals, such as the ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013. If a broker votes shares for which a client has not given voting instructions for or against a routine proposal, those shares are considered present and entitled to vote at the Annual Meeting. Those shares will be counted towards determining whether or not a quorum is present and will also be taken into account in determining the outcome of the routine proposals. However, where a proposal is not routine, a broker who has received no instructions from its client generally does not have discretion to vote its clients’ uninstructed shares on that proposal. When a broker indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, the missing votes are referred to as broker “non-votes.” Those shares will be considered present for the purpose of determining whether or not a quorum is present, but will not be considered entitled to vote on the non-routine proposals and, therefore, will not be taken into account in determining the outcome of the non-routine proposals. For this meeting, only Proposal 3 (ratifying the appointment of our independent registered public accounting firm) is considered a routine matter. Proposals 1 (election of directors) and 2 (stock incentive plan) are not considered routine matters, and without your instruction, your broker cannot vote your shares on those proposals.

How many votes are required to approve the proposals?

| | | | Broker Discretionary Voting Allowed |

| | | | | |

Proposal 1 — Election of Directors | | Plurality of Votes Cast | | NO |

Proposal 2 — Approval of Amended and Restated 2008 Stock Incentive Plan | | Majority of Votes Cast | | NO |

Proposal 3 — Ratification of Appointment of Independent Registered Public Accounting Firm | | Majority of Shares Present in Person or Represented by Proxy and Entitled to Vote Thereon | | YES |

Detailed information regarding each of the proposals to be presented at the 2013 Annual Meeting, and the means for stockholders to present proposals to be considered at the 2014 annual meeting, are presented on the following pages. Additional information about us, our Board and its committees, equity ownership, compensation of officers and directors and other matters can be found starting at page 5.

What does it mean if I receive more than one set of materials?

If you receive more than one set of materials, your shares are registered in more than one name or are registered in different accounts. In order to vote all the shares you own, you must either sign and return all of the proxy cards or follow the instructions for any alternative voting procedure on each of the proxy cards you receive.

How can I find out the results of the voting at the Annual Meeting?

Voting results will be announced by the filing of a Current Report on Form 8-K within four business days after the Annual Meeting. If final voting results are unavailable at that time, we will file an amended Current Report on Form 8-K within four business days of the day the final results are available.

Whom can I contact for assistance?

If you need assistance in voting over the Internet, by telephone or by completing your proxy card or have questions regarding the Annual Meeting, please contact Adam F. Wergeles at 818-274-0260 or write to Adam F. Wergeles, Secretary, ReachLocal, Inc., 21700 Oxnard Street, Suite 1600, Woodland Hills, California 91367.

Forward-Looking Statements

This proxy statement contains “forward-looking statements” (as defined in the Private Securities Litigation Reform Act of 1995). These statements are based on our current expectations and involve risks and uncertainties, which may cause results to differ materially from those set forth in the statements. The forward-looking statements may include statements regarding actions to be taken by us. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Forward-looking statements should be evaluated together with the many uncertainties that affect our business, particularly those mentioned in the risk factors in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2012 and in our periodic reports on Form 10-Q and Form 8-K.

Ownership of the Company

Security Ownership of Directors, Executive Officers and Certain Beneficial Owners

The following table shows the beneficial ownership of our common stock as of March 27, 2013 by:

| | · | each person who we believe beneficially owns more than 5% of our common stock based on our records and our review of Securities and Exchange (“SEC”) filings; |

| | · | our directors, director nominees and named executive officers; and |

| | · | all of our directors and executive officers as a group. |

Beneficial ownership, which is determined in accordance with the rules and regulations of the SEC, means the sole or shared power to vote or direct the voting or to dispose or direct the disposition of our common stock. The number of shares of our common stock beneficially owned by a person includes shares of common stock issuable with respect to options held by the person that are exercisable within 60 days. The percentage of our common stock beneficially owned by a person assumes that the person has exercised all options the person holds which are exercisable or exercisable within 60 days of March 27, 2013 and that no other persons exercised any of their options.

Except as otherwise indicated in the footnotes to the table or in cases where community property laws apply, we believe, based on the information furnished to us, that each person identified in the table possesses sole voting and investment power over all shares of common stock shown as beneficially owned by the person.

Except as otherwise indicated, the business address for each of the following persons is 21700 Oxnard Street, Suite 1600, Woodland Hills, California 91367.

| | | Common Stock Beneficially Owned as of March 27, 2013 | |

| | | | | | | |

| Greater Than 5% Stockholders: | | | | | | |

| Entities affiliated with VantagePoint Capital Partners (1) | | | 12,745,001 | | | | 44.78 | % |

| Entities affiliated with Rho Ventures (2) | | | 2,883,117 | | | | 10.16 | % |

| JPMorgan Chase & Co. (3) | | | 1,876,753 | | | | 6.64 | % |

| | | | | | | | | |

| Directors and Named Executive Officers: | | | | | | | | |

| Zorik Gordon (4) | | | 2,338,663 | | | | 8.09 | % |

| Nathan Hanks (5) | | | 1,107,473 | | | | 3.82 | % |

| Michael Kline (6) | | | 606,262 | | | | 2.12 | % |

| Ross G. Landsbaum (7) | | | 399,656 | | | | 1.40 | % |

| Joshua Claman (8) | | | 44,038 | | | | * | |

| John Mazur (9) | | | 38,657 | | | | * | |

| David Carlick (10) | | | 182,911 | | | | * | |

| Robert Dykes (11) | | | 208,889 | | | | * | |

| James Geiger (12) | | | 144,711 | | | | * | |

| Habib Kairouz (2) | | | 2,883,117 | | | | 10.16 | % |

| Alan Salzman (1) | | | 12,745,001 | | | | 44.78 | % |

Directors and Officers as a Group (13 persons) (13) | | | 20,937,525 | | | | 66.97 | % |

| * | Represents beneficial ownership of less than one percent (1%) of the outstanding common stock. |

| (1) | Includes 10,105 shares held by VantagePoint Management, Inc., 237,775 shares held by VantagePoint Venture Partners III, L.P., 1,952,995 shares held by VantagePoint Venture Partners III (Q), L.P., 846,099 shares held by VantagePoint Venture Partners IV, L.P., 8,451,641 shares held by VantagePoint Venture Partners IV(Q), L.P., 30,789 shares held by VantagePoint Venture Partners IV Principals Fund, L.P., 1,021,222 shares held by VantagePoint Venture Partners 2006(Q), L.P., 1,764 shares held by Mr. Salzman, 117,611 shares subject to options held by Mr. Salzman that are exercisable within 60 days of March 27, 2013, and 75,000 shares subject to options held by Jason Whitt, a former VantagePoint director nominee to the Board, that are exercisable within 60 days of March 27, 2013. Mr. Salzman, one of our directors, is the chief executive officer of VantagePoint Management, Inc. and also a managing member of the general partners of the limited partnerships listed above, and has voting and investment power with respect to such shares. Mr. Salzman disclaims beneficial ownership with respect to all shares beneficially owned by entities affiliated with VantagePoint Capital Partners, except to the extent of his pecuniary interests therein. The address of the entities and Mr. Salzman is 1001 Bayhill Drive, Suite 300, San Bruno, CA 94066. |

| (2) | Includes 2,534,443 shares held by Rho Ventures V, L.P., 222,523 shares held by Rho Ventures V Affiliates, L.L.C., 8,540 shares held by Mr. Kairouz and 117,611 shares subject to options held by Mr. Kairouz that are exercisable within 60 days of March 27, 2013. These stockholders are affiliated with Rho Capital Partners, Inc., the management company for Rho Ventures. Mr. Kairouz, one of our directors, Mark Leschly and Joshua Ruch are managing members of the general partner of Rho Ventures V, L.P. and Rho Ventures V Affiliates, L.L.C. and may be deemed to share voting and investment control over the shares held by these entities. Mr. Kairouz disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein. The address of Rho Capital Partners, Inc. is Carnegie Hall Tower, 152 West 57th Street, 23rd Floor, New York, NY 10019. |

| (3) | The 1,876,753 shares shown as beneficially owned are as reported by JPMorgan Chase & Co. (“JPM”) in a Schedule 13G filed with the SEC and dated February 1, 2013. JPM filed the Schedule 13G on behalf of itself and its wholly owned subsidiaries: JPMorgan Chase Bank, National Association, J.P. Morgan Investment Management Inc., JPMorgan Asset Management (UK) Ltd., and JPMorgan Asset Management (Canada) Inc. The address of JPM is 270 Park Ave., New York, NY 10017. |

| (4) | Consists of 1,620,879 shares held by the Gordon Family Revocable Trust, and 2,118 shares, 64,225 restricted shares subject to forfeiture and 651,441 shares subject to options that are exercisable within 60 days of March 27, 2013, each held by Mr. Gordon. |

| (5) | Consists of 240,000 shares held by the NJH GST Trust, of which Nathan Hanks’ spouse is the trustee and initial beneficiary, 47,527 shares held by Digital Media Distribution, LLC, of which Nathan Hanks is the Managing Director, and 46,963 shares, 60,475 restricted shares subject to forfeiture and 712,508 shares subject to options that are exercisable within 60 days of March 27, 2013, each held by Mr. Hanks. |

| (6) | Includes 6,000 restricted shares subject to forfeiture and 337,947 shares subject to options that are exercisable within 60 days of March 27, 2013. |

| (7) | Includes 28,913 restricted shares subject to forfeiture and 369,742 shares subject to options that are exercisable within 60 days of March 27, 2013. |

| (8) | Includes 44,038 restricted shares subject to forfeiture. |

| (9) | Includes 14,650 restricted shares subject to forfeiture and 24,007 shares subject to options that are exercisable within 60 days of March 27, 2013. |

| (10) | Includes 167,611 shares subject to options that are exercisable within 60 days of March 27, 2013. |

| (11) | Consists of 77,915 shares held by the Robert R.B. Dykes Trust, and 13,363 shares and 117,611 shares subject to options that are exercisable within 60 days of March 27, 2013, each held by Mr. Dykes. |

| (12) | Includes 117,611 shares subject to options that are exercisable within 60 days of March 27, 2013. |

| (13) | Includes an aggregate of 3,010,174 shares subject to options that are exercisable within 60 days of March 27, 2013 that are held by our directors and officers as a group. |

Corporate Governance

Composition of the Board

Our Board has adopted corporate governance guidelines to establish the company’s overall governance practices. These guidelines can be found in the corporate governance section of our website at http://investors.reachlocal.com. In addition, these guidelines are available in print to any stockholder who requests a copy. Please direct all requests to Adam F. Wergeles, Secretary, ReachLocal, Inc., 21700 Oxnard Street, Suite 1600, Woodland Hills, California 91367. The Board does not believe that its members should be prohibited from serving on boards of other organizations. In accordance with the corporate governance guidelines, however, a member of our Board may serve as a director of another company only to the extent such position does not conflict or interfere with such person’s service as our director, and the nominating and corporate governance committee takes into account the nature of and time involved in a director’s service on other boards and/or committees in evaluating the suitability of individual director candidates and current directors and making its recommendations to our company’s stockholders.

Messrs. Gordon and Hanks serve as our Chief Executive Officer and President, respectively, and each is compensated for his position as an executive. Neither executive receives additional compensation for his service on the Board. Directors who are not also employees, the non-employee directors, are compensated for their services as described under “2012 Director Compensation” below.

Board Leadership Structure and Risk Oversight

At present, the Chair position for the Board is separate from the Chief Executive Officer position. Mr. Salzman served as the non-executive Chairman of the Board from 2009 to April 2012. In April 2012, the Board, other than Mr. Carlick, unanimously appointed Mr. Carlick as non-executive Chairman. In making the determination to separate the roles of Chairman and CEO, our Board did not make a general determination that such separation is necessarily a better or more effective Board leadership structure for our company. Rather, based on the historical relationships among our directors, the contemplated make-up of our Board in the near-term, and Mr. Carlick’s substantial experience as a member of the Board and as a director at other companies, our Board determined that appointing Mr. Carlick as non-executive Chairman is the appropriate Board leadership structure for our company and our stockholders at this time.

Our Board currently has five independent members and two non-independent members, our Chief Executive Officer and our President.

A number of our independent Board members are currently serving or have served as members of senior management of other public companies and have served as directors of other public companies. We have three standing Board committees comprised solely of directors who are considered independent under The Nasdaq Global Select Market (“Nasdaq”) standards. We believe that the number of independent, experienced directors that make up our Board, along with the independent oversight of the Board by the non-executive Chairman, benefits our company and our stockholders.

Our Board is primarily responsible for overseeing our risk management processes. Our Board, as a whole, determines the appropriate level of risk for the company, assesses the specific risks that we face and reviews management’s strategies for adequately mitigating and managing the identified risks. Although our Board administers this risk management oversight function, each of our three standing Board committees supports our Board in discharging its oversight duties and addresses risks inherent in its respective area. We believe this division of responsibilities is an effective approach for addressing the risks we face and that our Board leadership structure supports this approach. In particular, the audit committee is responsible for considering and discussing our significant accounting and financial risk exposures and the actions management has taken to control and monitor these exposures, and the nominating and corporate governance committee is responsible for considering and discussing our significant corporate governance risk exposures and the actions management has taken to control and monitor these exposures. The audit committee has received periodic reports from management with regard to these types of risks and going forward, we expect that the nominating and corporate governance committee will receive periodic reports from management regarding our assessment of such risks. While the Board oversees our risk management, company management is responsible for day-to-day risk management processes. Our Board expects company management to consider risk and risk management in each business decision, to pro-actively develop and monitor risk management strategies and processes for day-to-day activities and to effectively implement risk management strategies adopted by the audit committee and the Board.

Our compensation committee, with input from our management, assists our Board in reviewing and assessing whether any of our compensation policies and programs could potentially encourage excessive risk-taking. In considering our employee compensation policies and practices, the compensation committee reviews, in depth, our policies related to payment of salaries and wages, commissions, benefits, bonuses, stock-based compensation and other compensation-related practices and considers the relationship between risk management policies and practices, corporate strategy and compensation. A primary focus of our compensation program is intended to incentivize and reward growth in revenue and adjusted EBITDA, among other metrics. See “Compensation Discussion and Analysis—Executive Summary—2012 Performance” for our definition of adjusted EBITDA. We believe these metrics are positive indicators of our long-term growth, operating results and increased stockholder value and therefore believe that our compensation program does not create risks that are reasonably likely to have a material adverse effect on the company.

Board Independence

In accordance with Nasdaq standards and ReachLocal’s corporate governance guidelines, our Board has determined that the nominees for election to the Board at the Annual Meeting and all continuing directors, other than Messrs. Gordon and Hanks, are independent under Nasdaq standards. In making this determination, the Board considered all relationships between ReachLocal and each director and each director’s family members.

Board Meetings

Our Board held nine meetings during 2012. During 2012, each Board member attended at least 75% of the meetings of the Board and 75% of the meetings of the committees on which he served. The Chairman of the Board, Mr. Carlick, or his designee, determines the order of business and the procedure at each meeting, including the regulation of the manner of voting and the conduct of business. The Board frequently meets in executive session without management or other employees present. The Chairman of the Board presides over these meetings. We encourage our directors and nominees for director to attend our annual meetings of stockholders, and all of our directors attended our 2012 Annual Meeting.

Board Committees

Our Board maintains a standing audit committee, nominating and corporate governance committee and compensation committee. Members serve on these committees until their resignation or until otherwise determined by our Board. To view the charter of each of these committees please visit the corporate governance section of our website at http://investors.reachlocal.com. The membership of all of our standing Board committees as of the record date is as follows:

| | | | Nominating and Corporate Governance Committee | | |

| Alan Salzman | | | | C | | ** |

| David Carlick | | ** | | | | C |

| Robert Dykes | | C | | ** | | |

| James Geiger | | ** | | | | ** |

| Habib Kairouz | | | | ** | | |

__________

** Member

“C” Chairperson

Audit Committee

We have an audit committee that has responsibility for, among other things:

| | · | overseeing management’s maintenance of the reliability and integrity of our accounting policies and financial reporting and our disclosure practices; |

| | · | overseeing management’s establishment and maintenance of processes to assure that an adequate system of internal control is functioning; |

| | · | reviewing our annual and quarterly financial statements; |

| | · | appointing and evaluating the independent accountants and considering and approving any non-audit services proposed to be performed by the independent accountants; and |

| | · | discussing with management and our Board our policies with respect to risk assessment and risk management, as well as our significant financial risk exposures and the actions management has taken to limit, monitor or control such exposures, if any. |

The current members of our audit committee are Messrs. Carlick, Dykes and Geiger, with Mr. Dykes serving as the committee’s chair. All members of our audit committee meet the requirements for financial literacy, and the requirements for independence, under Rule 10A-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the applicable rules and regulations of Nasdaq. Our Board has determined that Mr. Dykes is an audit committee “financial expert,” as that term is defined by the applicable rules of the SEC and has the requisite financial sophistication as defined under the applicable rules and regulations of Nasdaq. The audit committee met eleven times during 2012. Our audit committee operates under a written charter that satisfies the applicable standards of the SEC and Nasdaq. A copy of the audit committee charter is available in the corporate governance section of our website at http://investors.reachlocal.com.

Compensation Committee

We have a compensation committee that has responsibility for, among other things:

| | · | reviewing management and employee compensation policies, plans and programs; |

| | · | monitoring performance and compensation of our executive officers and other key employees; |

| | · | preparing recommendations and periodic reports to our Board concerning these matters; and |

| | · | administering our equity incentive plans. |

The Compensation Committee may delegate any or all of its responsibilities to a subcommittee of the Compensation Committee, but only to the extent consistent with our certificate of incorporation, bylaws, Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), Nasdaq rules and other applicable law.

The members of our compensation committee are Messrs. Carlick, Geiger and Salzman, with Mr. Carlick serving as the committee’s chair. All of the members of our compensation committee are “non-employee directors” as defined in Rule 16b-3 of the Exchange Act, “outside directors” as defined pursuant to Section 162(m) of the Code and satisfy the independence requirements of Nasdaq. The compensation committee met seven times during 2012. A copy of the compensation committee’s charter is available in the corporate governance section of our website at http://investors.reachlocal.com.

Nominating and Corporate Governance Committee

We have a nominating and corporate governance committee that has responsibility for, among other things:

| | · | recommending persons to be selected by our Board as nominees for election as directors and to fill any vacancies on our Board; |

| | · | considering and recommending to our Board qualifications for the position of director and policies concerning the term of office of directors and the composition of our Board; and |

| | · | considering and recommending to our Board other actions relating to corporate governance. |

The members of our nominating and corporate governance committee are Messrs. Salzman, Dykes and Kairouz, with Mr. Salzman serving as the committee’s chair. All members of our nominating and corporate governance committee meet the independence requirements of Nasdaq. When recommending persons to be selected by the Board as nominees for election as directors, the nominating and corporate governance committee considers such factors as the individual’s personal and professional integrity, ethics and values, experience in corporate management, experience in our company’s industry and with relevant social policy concerns, experience as a board member of another publicly held company, academic expertise in an area of our company’s operations and practical and mature business judgment. In addition, although the nominating and corporate governance committee does not have a formal policy with respect to diversity, the nominating and corporate governance committee considers diversity of relevant experience, expertise and background in identifying nominees for directors. A copy of the nominating and corporate governance committee charter is available in the corporate governance section of our website at http://investors.reachlocal.com.

The nominating and corporate governance committee will consider director candidates recommended by stockholders. For a stockholder to make any nomination for election to the Board at an annual meeting, the stockholder must provide notice, which notice must be delivered to, or mailed and received at, our principal executive offices not less than 90 days and not more than 120 days prior to the one-year anniversary of the preceding year’s annual meeting; provided, that if the date of the annual meeting is more than 30 days before or more than 60 days after such anniversary date, the stockholder’s notice must be delivered, or mailed and received, not earlier than the 120th and not later than the 90th day prior to the date of the annual meeting or, if later, the 10th day following the date on which public disclosure of the date of such annual meeting is made. Further updates and supplements to such notice may be required at the times and in the forms required under our bylaws. As set forth in our bylaws, submissions must include, among other things, the name and address of the proposed nominee; the class or series and number of shares of the company that are, directly or indirectly, owned of record or beneficially owned by such proposed nominee; information regarding the proposed nominee that is required to be disclosed in a proxy statement or other filings in a contested election pursuant to Section 14(a) under the Exchange Act; a description of all direct and indirect compensation and other material monetary agreements during the past three years between the nominating person and the proposed nominee; and a completed and signed questionnaire, representation and agreement of the proposed nominee. Our bylaws also specify further requirements as to the form and content of a stockholder’s notice. We recommend that any stockholder wishing to make a nomination for director review a copy of our bylaws, as amended and restated to date, which can be obtained, without charge, by contacting Adam F. Wergeles, Secretary, ReachLocal, Inc., 21700 Oxnard Street, Suite 1600 Woodland Hills, California 91367. The nominating and corporate governance committee did not receive any director recommendations from a stockholder for consideration at the Annual Meeting.

Communication with the Board

Interested persons, including stockholders, may communicate with our Board, including the non-employee directors, by sending a letter to Adam F. Wergeles, Secretary, ReachLocal, Inc., 21700 Oxnard Street, Suite 1600 Woodland Hills, California 91367. Our Secretary will submit all correspondence to the Chairman of our Board and to any specific director to whom the correspondence is directed.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee is currently, or has been at any time, one of our officers or employees. None of our executive officers currently serves, or has served during the last completed fiscal year, as a member of our Board or compensation committee of any entity that has one or more executive officers serving as a member of our Board or compensation committee.

Code of Business Conduct and Ethics

We have adopted a code of business conduct, anti-bribery and corruption, and ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. The code of business conduct, anti-bribery and corruption, and ethics is available in the corporate governance section of our website at http://investors.reachlocal.com. Any amendments to the code, or any waivers of its requirements, will be disclosed on our website.

Report of the Audit Committee

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of ReachLocal, Inc. under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act.

The primary purpose of the audit committee is to oversee our financial reporting processes on behalf of our Board. The audit committee’s functions are more fully described in its charter, which is available under the corporate governance section of our website at http://investors.reachlocal.com. Management has the primary responsibility for our financial statements and reporting processes, including our systems of internal controls. In fulfilling its oversight responsibilities, the audit committee reviewed and discussed with management ReachLocal’s audited financial statements as of and for the fiscal year ended December 31, 2012.

The audit committee has discussed with Grant Thornton LLP, our company’s independent registered public accounting firm, the matters required to be discussed by Public Company Accounting Oversight Board Statement on Auditing Standards No. 16. In addition, the audit committee has received and reviewed the written disclosures and the letter from Grant Thornton LLP required by the applicable requirements of the PCAOB regarding Grant Thornton LLP’s communications with the audit committee concerning independence, and has discussed with Grant Thornton LLP its independence from us. Finally, the audit committee discussed with Grant Thornton LLP, with and without management present, the scope and results of Grant Thornton LLP’s audit of such financial statements.

Based on these reviews and discussions, the audit committee has recommended to our Board that such audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 2012 for filing with the SEC. The audit committee also has engaged Grant Thornton LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2013 and is seeking ratification of such selection by the stockholders.

Audit Committee of the Board

Robert Dykes (Chair)

David Carlick

James Geiger

Audit Matters

Independent Public Accountants

The audit committee approved all audit and non-audit services provided by Grant Thornton LLP during the 2011 and 2012 fiscal years. The total fees paid or payable to Grant Thornton LLP for the last two fiscal years are as follows:

| | | | | | |

Audit Fees | | $ | 1,114,914 | | | $ | 1,089,112 | |

Audit-Related Fees | | | 17,340 | | | | 17,280 | |

Tax Fees | | | — | | | | — | |

| All Other Fees | | | — | | | | 48,507 | |

Total | | $ | 1,132,254 | | | $ | 1,154,899 | |

Audit Fees

This category includes fees billed for the 2012 and 2011 fiscal years for the audits of our annual consolidated financial statements and the reviews of each of the quarterly consolidated financial statements included in our Quarterly Reports on Form 10-Q, services rendered in connection with our Forms S-3 and S-8, audit of internal control over financial reporting related to requirements of the Sarbanes-Oxley Act of 2002, and other matters related to the SEC.

Audit-Related Fees

This category includes fees associated with agreed upon procedures related to the computation of our underclassmen expense.

Tax Fees

For the fiscal years ended December 31, 2012 and 2011, there were no fees billed by Grant Thornton LLP for professional services for tax compliance, tax advice or tax planning.

All Other Fees

Other fees include professional services related to due diligence services performed by Grant Thornton LLP in connection with acquisitions by our company.

Pre-Approval Policies and Procedures

The audit committee pre-approves all audit and non-audit services provided by its independent registered public accounting firm. This policy is set forth in our audit committee charter, which is available on our website.

The audit committee considered whether the non-audit services rendered by Grant Thornton LLP were compatible with maintaining Grant Thornton LLP’s independence as our independent registered public accounting firm and concluded that they were.

Executive Officers of the Company

Set forth below is information regarding our executive officers as of March 27, 2013:

| | | | |

| Zorik Gordon | | 41 | | Chief Executive Officer, Director |

| Nathan Hanks | | 38 | | President, Director |

| Michael Kline | | 46 | | Chief Strategy Officer and President of Local Commerce |

| Ross G. Landsbaum | | 50 | | Chief Financial Officer |

| Adam F. Wergeles | | 47 | | Chief Legal Officer, Secretary |

| Josh Claman | | 51 | | Chief Revenue Officer |

| Kris Barton | | 37 | | Chief Product Officer |

Zorik Gordon, one of our founders, has served as our Chief Executive Officer and as a member of our Board since 2003 and also served as our President from 2003 to 2011. For additional information regarding Mr. Gordon, see “Proposal 1—Election of Directors—Director Biographical Information—Nominees for Election at the Annual Meeting to Serve for a Three-Year Term Expiring at the 2016 Annual Meeting of Stockholders.”

Nathan Hanks, one of our founders, has served as our President since 2011 and as a member of our Board since October 2012. For additional information regarding Mr. Hanks, see “Proposal 1—Election of Directors—Director Biographical Information—Directors Continuing in Office until the 2014 Annual Meeting of Stockholders.”

Michael Kline, one of our founders, has served as our Chief Strategy Officer and President of Local Commerce since 2011. During the fourth quarter of 2012, Mr. Kline tendered his resignation, which will be effective June 30, 2013. Previously, Mr. Kline served as our Chief Operating Officer and Chief Product Officer from 2003 to 2011, and as our Co-Chief Operating Officer during 2011. Mr. Kline served as Vice President, Product Development at WorldWinner, a provider of prize-based tournaments in online games, from 2002 to 2003. From 2001 to 2002, Mr. Kline served as Senior Manager, Media & Entertainment, at Deloitte Consulting, and from 1999 to 2000 he served as Senior Vice President of Strategy & Product Development for AdStar.com, a provider of advertisement management solutions. Mr. Kline previously founded Recycler.com, a provider of online classified advertisements, and served as its General Manager from 1995 to 1998. Mr. Kline holds a Bachelor of Arts degree in literature from Harvard College.

Ross G. Landsbaum has served as our Chief Financial Officer since 2008. Prior to joining us, Mr. Landsbaum held various executive positions at MacAndrews and Forbes’ Panavision, a service provider to the motion picture and television industries, including Chief Financial Officer from 2005 to 2007 and Chief Operating Officer in 2007. Prior to Panavision, Mr. Landsbaum served as Executive Vice President, Finance and Operations and Chief Financial Officer for Miramax Films, the art-house and independent film division of The Walt Disney Company, from 2001 to 2005. Prior to that, he served in various capacities, including as the Chief Financial Officer at Spelling Entertainment Group, a diversified entertainment concern, and in various capacities at Arthur Andersen. Mr. Landsbaum holds a Master of Accounting and a Bachelor of Science in Accounting from the University of Southern California.

Adam F. Wergeles has served as our Chief Legal Officer since 2013 and currently serves as our Secretary. Previously, Mr. Wergeles served as our General Counsel from 2007 to 2013. From 2003 to 2007, Mr. Wergeles served as Chief Legal Officer for Connexus Corporation, an online media company. Before Connexus Corporation, Mr. Wergeles served as Vice President, Operations for Kaplan’s Concord Law School, a provider of online legal education, from 2001 to 2003. From 1999 to 2001, Mr. Wergeles served as General Counsel and Corporate Secretary for Quisic Corporation, an e-learning company. Mr. Wergeles holds a Juris Doctor degree from the University of Southern California Law School and a Bachelor of Arts from Hamilton College.

Josh Claman has served as our Chief Revenue Officer since August 2012. Prior to joining ReachLocal, he spent 10 years at Dell where he served in several executive sales and general management roles. From 2010 to 2012, Mr. Claman was Dell's Vice President and General Manager of Public and Large Enterprise Business in the Americas. Prior to Dell, he held several senior executive positions at NCR. Mr. Claman attended the Advanced Management Program at Oxford University, and received his Master of Business Administration from University of South Carolina and Bachelor of Arts from University of Illinois at Urbana-Champaign.

Kris Barton has served as ReachLocal’s Chief Product Officer since February 2012. Previously, he was Chief Operating Officer of multimedia software and platform company Nero AG from 2010 to 2012. Since starting at Nero in 2006, Barton also held the title of Executive Vice President of Global Products, overseeing all product development. Prior to Nero, Barton served in multiple management roles at Microsoft Corporation from 2001 to 2006, overseeing the product development efforts for the MSN online properties including MSN.com and MSN network channels. Barton has also held product positions at Omniture and Novell Corporation. He holds a Bachelor of Arts in business administration and marketing communications from Brigham Young University.

Report of the Compensation Committee

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of ReachLocal, Inc. under the Securities Act or the Exchange Act.

The compensation committee of the Board has reviewed and discussed the Compensation Discussion & Analysis with management. Based on this review and discussion, the compensation committee has recommended to the Board that the Compensation Discussion & Analysis be included in this proxy statement and incorporated by reference in our Annual Report on Form 10-K for the fiscal year ended December 31, 2012.

Compensation Committee of the Board

David Carlick (Chair)

James Geiger

Alan Salzman

Compensation Discussion and Analysis

This section discusses the principles underlying our policies and decisions with respect to the compensation of our executive officers who are named in the “Summary Compensation Table” and the most important factors relevant to an analysis of these policies and decisions. These “named executive officers” for 2012 include Zorik Gordon, Chief Executive Officer; Ross G. Landsbaum, Chief Financial Officer; Nathan Hanks, President; Michael Kline, Chief Strategy Officer and President of Local Commerce; Joshua Claman, Chief Revenue Officer; and John Mazur, Chief Executive Officer, ReachLocal Europe, who ceased being an executive officer as of November 2012 as part of a broader management reorganization.

Executive Summary

Our compensation strategy focuses on providing a total compensation package that will not only attract and retain high-caliber executive officers and employees, but will also be utilized as a tool to communicate and align employee contributions with our corporate objectives and stockholder interests. It is our philosophy to provide a competitive total compensation package that enables our named executive officers, as well as our other employees, to share our success when our objectives are met.

Pay for Performance

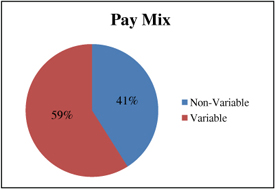

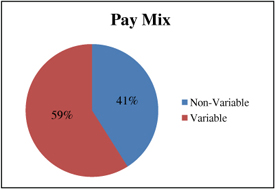

Pay for performance is an important component of our compensation philosophy. Consistent with this focus, our compensation program includes annual performance-based bonuses and long-term equity-based compensation, historically, primarily in the form of stock options. We have not adopted any formal or informal policies or guidelines for allocating compensation between long-term and short-term compensation, between cash and non-cash compensation or among different forms of cash and non-cash compensation. For 2012, on average, approximately 59% of our named executive officers’ compensation came from variable performance-based pay consisting of performance-based bonuses (both formulaic and discretionary), commissions and incentive stock option awards. Non-variable pay includes base salaries, non-performance based restricted stock awards and other perquisites and benefits. The chart below shows the mix between actual variable performance-based pay and non-variable pay for our named executive officers in 2012.

Annual Bonus Plan

For 2012, the compensation committee adopted the 2012 Executive Bonus Plan that included both a formulaic component and a discretionary component. This discretionary element gave the compensation committee greater flexibility to consider other performance aspects, such as individual performance, execution against strategic initiatives and overall performance of our company as compared to new and existing competitors in determining annual bonus payouts.

2012 Performance

As is more fully discussed below, the 2012 Executive Bonus Plan, or the bonus plan, established a target bonus pool, which was divided into three component target bonus pools: (i) 25% of the total bonus pool was tied to achievement of certain revenue objectives, (ii) 25% of the total bonus pool was tied to achievement of certain adjusted EBITDA (AEBITDA) objectives, and (iii) 50% of the total bonus pool was left to the discretion of the compensation committee (for information regarding our definition of adjusted EBITDA, see “Determination of Compensation—Compensation Philosophy” below). The actual size of the revenue and AEBITDA bonus pools were subject to adjustment upwards or downwards by multiplying the applicable bonus pool, determined based on the company’s actual achievement against the applicable targets, by the lower of the multiplier applied to the revenue pool and the multiplier applied to the AEBITDA pool. Although the revenue and AEBITDA bonus pools were determined independently, the compensation committee established this linkage to emphasize the importance of avoiding seeking either revenue growth or profitability at the expense of the other.

For 2012, we ended the year with revenue of $455.4 million (representing approximately 99.5% of target) and AEBITDA of $23.6 million (representing approximately 112% of target). Due to the linkage of the two pools as described above, 96.4% of each of the revenue pool and the AEBITDA pool were funded and paid by reference to the Revenue Pool target. In addition, the compensation committee awarded all executives the full 50% they were eligible to receive under the discretionary portion of the bonus.

Mr. Mazur was not eligible to participate in the bonus plan but, as described below, was eligible to receive commission compensation.

Alignment with Stockholder Interests

We believe that our equity compensation program supports a long-term performance orientation by aligning interests between our executives and our stockholders. In addition, equity compensation awards with multi-year vesting requirements are intended to serve as a retention tool. We therefore view equity compensation as an important component of our executive compensation program. We provide long-term incentive awards to executives primarily through grants of stock options and restricted stock awards. Equity-based awards represented between 30% and 67% of our named executive officers’ compensation opportunity for 2012.

Stock Option Exchange

As more fully described below, on May 22, 2012, our stockholders approved a one-time stock option exchange for eligible employees that permitted such employees, including our executive officers, to surrender certain underwater stock options for cancellation in exchange for the grant of new replacement options to purchase a lesser number of shares having an exercise price equal to the fair market value of our common stock on the replacement grant date, or for our executive officers, $13.00 per share, which was 23% above the fair market value of our common stock on the replacement grant date. The stock option exchange was implemented to provide a reasonable, balanced and meaningful incentive for our employees, while minimizing accounting costs and reducing our equity award overhang.

Good Governance and Best Practices

In furtherance of our objective of implementing policies and practices that are mindful of the concerns of our stockholders, (i) our compensation committee is comprised solely of independent directors, (ii) our compensation committee retained an independent compensation consultant to provide it with advice on matters related to executive compensation, non-employee director remuneration and assistance with preparing compensation disclosure for inclusion in our SEC filings, and (iii) our compensation committee meets frequently so as to be certain that it remains current with the performance of our senior team and addresses compensation matters in a timely manner.

We also endeavor to structure our executive compensation program in a manner that reflects best practices, including the following:

| | · | Our compensation programs limit cash severance payments to not more than twelve months’ base salary upon a termination of employment without cause or for good reason; |

| | · | We do not provide for the payment of excise tax gross-ups on severance or other change in control payments; and |

| | · | We maintain compensation arrangements that provide only for “double trigger” cash severance provisions in connection with a change in control of the company. |

We provide our stockholders with the opportunity to cast a triennial advisory vote on the compensation of our named executive officers (a “say-on-pay proposal”). A substantial majority of the votes cast at our 2011 annual meeting, our most recent annual meeting at which a say-on-pay proposal was presented to our stockholders, voted in favor of our say-on-pay proposal. In evaluating our executive compensation program, the compensation committee considered the results of the say-on-pay proposal and other factors as discussed in this Compensation Discussion and Analysis. While each of these factors informed the compensation committee’s decisions regarding the compensation of our named executive officers, the compensation committee did not implement significant changes to our executive compensation program in 2012. The compensation committee will continue to consider the outcome of the company’s say-on-pay proposals when making future compensation decisions for our named executive officers. We will provide our stockholders with the opportunity to cast a say-on-pay vote at our 2014 annual meeting.

Determination of Compensation

Roles of Our Board of Directors, Compensation Committee and Chief Executive Officer in Compensation Decisions

Our compensation committee oversees our executive compensation program. Our Chief Executive Officer provides recommendations to our compensation committee with respect to salary adjustments, annual cash incentive bonus targets (if applicable) and awards and equity incentive awards for the named executive officers, excluding himself, and the other executive officers that report to him. Our compensation committee meets with our Chief Executive Officer at least annually to discuss and review his recommendations, together with the market data provided by its independent compensation consultant regarding executive compensation for our executive officers, excluding himself. Our policy has been that our compensation committee considers these recommendations in determining the compensation of the Chief Executive Officer and our other senior officers, and has the ability to increase or decrease amounts of compensation payable to our executive officers pursuant to those recommendations.

Competitive Market Data and Use of Compensation Consultants

Commencing in 2010, our compensation committee retained Frederic W. Cook & Co., or Cook, to advise on executive compensation matters. For 2012, the compensation committee again retained Cook, who compiled a peer group of companies against which to assess the three key components comprising our named executive officers’ compensation: base salary, cash bonus and equity incentives. The peer group consisted of the following 15 publicly-traded Internet and distribution companies:

| comScore | Kenexa | OpenTable | Taleo |

| Concur Technologies | Liquidity Services | QuinStreet | ValueClick |

| Constant Contact | Marchex | Shutterfly | Vistaprint |

| DealerTrack | NetSuite | Success Factors | |

This peer group represented a fairly substantial change in the peer group used in 2011 as the compensation committee worked closely with management and Cook to ensure that our peer group most closely reflected our business operations and financial profile. Dice Holdings, Digital River, GSI Commerce, InfoSpace, Internet Brands, MDC Partners, MercadoLibre, Monster Worldwide, National CineMedia, Web.com and Websense were removed for the 2012 peer group due to differences in business model and/or financial profile. Concur Technologies, DealerTrack, Kenexa, Liquidity Services, OpenTable, QuinStreet, Shutterfly, Success Factors, and Taleo were added because they more closely reflect our business model and/or financial profile. The company’s revenues were between the median and 75th percentile of the 2012 peer group and the company’s market capitalization was below the 25th percentile of the 2012 peer group.

Our compensation committee considered peer group data, but only as one element of the compensation committee’s overall consideration of the appropriate compensation levels. Our compensation committee does not aim to set total compensation, or any compensation element, at a specified level as compared to the companies in this peer group. Although our compensation committee considered Cook’s advice in considering our executive compensation program in 2012, our compensation committee ultimately made their own decisions about these matters, based on the peer group analysis and their own business experience and judgment.

For 2013, the compensation committee further refined our peer group by removing the following five companies: Concur Technologies, Liquidity Services, and NetSuite due to differences in business model, and SuccessFactors and Taleo due to acquisition in 2012 (meaning that compensation data was no longer publicly available). The compensation committee added the following seven companies that have business models which are more similar to the company’s business model: Active Network, Angie’s List, Boingo Wireless, Cbeyond, Web.com Group, WebMD Group and Yelp. The company’s revenues are between the median and 75th percentile of the 2013 peer group and the company’s market capitalization is at approximately the 25th percentile of the 2013 peer group.

Cook performs services solely on behalf of the compensation committee and, except as it may relate to the performance of such services, did not provide any other services to the company or company management in 2012. Services that Cook provided to the compensation committee in 2012 included development of an applicable peer group, providing comparative data regarding compensation levels and practice and assistance with the design of our incentive programs and with structure our 2012 stock option exchange program. Our compensation committee has assessed the independence of Cook pursuant to SEC rules and concluded that no conflict of interest exists that would prevent Cook from independently representing the compensation committee.

Compensation Philosophy

Our compensation philosophy has been driven by a number of factors that are closely linked with our broader strategic objectives. Our ability to excel depends on the skill, creativity, integrity and teamwork of our employees. To this end, we strive to create an environment of mutual respect, encouragement and teamwork that rewards commitment and performance while ensuring that the interests of the management team are aligned both internally, and with our strategic plan and the interests of our stockholders. Our executive compensation philosophy also recognizes that key and core to our success is our ability to rapidly expand the size and breadth of our direct sales force throughout the United States and overseas to create competitive barriers to entry. In that regard, a primary focus of our compensation program has been to incentivize and reward growth in revenue and adjusted EBITDA. We define adjusted EBITDA, or AEBITDA as net income (loss) from continuing operations before interest, income taxes, depreciation and amortization expenses, excluding, when applicable, stock-based compensation, the effects of accounting for business combinations (including any impairment of acquired intangibles and, in the case of the acquisition of SMB:LIVE, the deferred cash consideration), and amounts included in other non-operating income or expense.

Compensation for our named executive officers in 2012 consisted of the elements identified in the following table:

| Compensation Element | | Primary Objective |

| Base salary | | To recognize ongoing performance of job responsibilities and as a necessary tool in attracting and retaining employees |

| | |

| Annual incentive cash compensation (bonuses) | | To focus employees on corporate and individual objectives and link compensation opportunities for our named executive officers (and employees generally) to achievement of key business and individual objectives |

| | |

| Equity incentive compensation | | To incentivize and reward increases in stockholder value and to emphasize and reinforce our focus on team success and to assist with the attraction and retention of key employees |

| | |

| Severance and change of control benefits | | To provide income protection in the event of involuntary loss of employment and to focus named executive officers on stockholder interests when considering strategic alternatives |

| | |

| Retirement savings (401(k)) plan | | To provide retirement savings in a tax-efficient manner |

| | |

| Health and welfare benefits | | To provide a basic level of protection from health, dental, life and disability risks |

Each of the primary elements of our executive compensation program is discussed in more detail below. While we have identified particular compensation objectives that each element of executive compensation serves, our compensation programs are designed to be flexible and complementary and to collectively serve all of the executive compensation objectives described above. Accordingly, whether or not specifically mentioned below, we believe that, as a part of our overall executive compensation policy, each individual element, to a greater or lesser extent, serves each of our objectives. The compensation levels of our named executive officers reflect to a significant degree the varying roles and responsibilities of such executives, as well as the length of time those executives have served our company.

Elements of Compensation

The following is a discussion of the primary elements of the compensation for each of our named executive officers.

Base Salaries

Messrs. Gordon, Hanks and Kline were among the original five founders of our company. Accordingly, their compensation was initially established to reflect their positions as founding executives of a start-up company and has evolved as we have grown and new investors have joined us. In contrast, Messrs. Landsbaum, Mazur and Claman joined us in June 2008, December 2007, and July 2012 respectively, and their initial compensation was the result of an arms-length negotiation at that time. Base salaries of our named executive officers (other than our Chief Executive Officer) are recommended and reviewed periodically by our Chief Executive Officer, and the base salary for each named executive officer is approved by our compensation committee. Adjustments to base salaries are based on the scope of an executive’s responsibilities, individual contribution, experience and sustained performance. Decisions regarding salary increases may take into account the named executive officer’s current salary, equity ownership and the amounts paid to individuals in comparable positions at our peer companies. No formulaic base salary increases are provided to our named executive officers. This strategy is consistent with our intent of offering compensation that is cost-effective, competitive and contingent on the achievement of performance objectives.

None of our named executive officers received an increase in base salary for 2012. The actual base salaries paid to all of our named executive officers during 2012 are set forth in the “Summary Compensation Table” below.

Cash Bonuses

2012 Executive Bonus Plan. In addition to base salaries, in 2012 the compensation committee recommended, and the board of directors adopted, our 2012 Executive Bonus Plan, or the bonus plan, in which Messrs. Gordon, Landsbaum, Hanks, Kline and Claman participated. Mr. Mazur was not eligible to participate in the bonus plan, and did not receive a bonus in 2012. Mr. Mazur did, however, receive commission compensation in addition to his 2012 base salary (for additional information see “Commission Compensation” below).

The bonus plan consisted of both a formulaic component and a discretionary component. The formulaic part of the plan was comprised of two target bonus pools, one of which was based on achievement of an annual consolidated revenue objective, or Revenue Target, and the other of which was based on achievement of an annual AEBITDA objective, or AEBITDA Target. Each of the Revenue Target and the AEBITDA Target was derived from the 2012 operating plan adopted by our board of directors and we developed this component of our bonus plan, in cooperation with our compensation committee, to motivate achievement of the Revenue Target and the AEBITDA Target. Finally, the compensation committee also determined that it was beneficial for there to be a purely discretionary element to enable focus and motivate outstanding individual performance and achievement of strategic and/or non-financial goals that may not be directly reflected through achievement of revenue or AEBITDA targets.

The aggregate 2012 target bonus pool for all our senior executives was set at approximately $2.3 million, with achievement of the Revenue Target comprising 25% of the target amount, or the Revenue Pool, achievement of the AEBITDA Target comprising 25% of the target amount, or the AEBITDA Pool, and the discretionary component comprising the remaining 50% of the target amount, or the Discretionary Pool. Our compensation committee determined that this allocation was consistent with the corporate objectives of rewarding revenue and AEBITDA growth, while at the same time encouraging focus on individual performance.

The Revenue Targets for 2012 were set as follows:

| % of Revenue Pool Payable | | 2012 Revenue Target |

| 0 | | Below $442,500,000 |

| 75% | | $442,500,000 |

| 100% | | $457,500,000 |

| 125% | | At or above $468,750,000 |

For amounts between $442,500,000 and $468,750,000 the percentage of the Revenue Pool payable was prorated between 75% and 125% depending on actual achievement in 2012.

The AEBITDA Targets for 2012 were set as follows:

| % of AEBITDA Pool Payable | | 2012 AEBITDA Target |

| 0 | | Below $17,000,000 |

| 75% | | $17,000,000 |

| 100% | | $21,000,000 |

| 125% | | At or above $25,000,000 |

For amounts between $17,000,000 and $25,000,000 the percentage of the AEBITDA Pool payable was prorated between 75% and 125% depending on actual achievement in 2012.

Our compensation committee also determined that the percentage payable for both pools would be the lower of the two (as determined based on actual 2012 performance). For instance, if the percentage payable for the Revenue Pool was 100% and the percentage payable for the AEBITDA Pool was 110%, the percentage payable for both pools would be 100%. The committee established this linkage to emphasize the importance of not seeking either revenue growth or profitability at the expense of the other. The Discretionary Pool was set aside to reflect individual performance of our management.