UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2010

Commission file number 001-32337

DREAMWORKS ANIMATION SKG, INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 68-0589190 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. employer identification no.) |

1000 Flower Street

Glendale, California 91201

(Address of principal executive offices) (Zip code)

(818) 695-5000

(Registrants’ telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

(Do not check if a smaller reporting company)

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock: As of March 31, 2010, there were 76,484,926 shares of Class A common stock and 10,838,731 shares of Class B common stock of the registrant outstanding.

TABLE OF CONTENTS

Unless the context otherwise requires, the terms “DreamWorks Animation,” the “Company,” “we,” “us” and “our” refer to DreamWorks Animation SKG, Inc., its consolidated subsidiaries, predecessors in interest, and the subsidiaries and assets and liabilities contributed to it by the entity then known as DreamWorks L.L.C. (“Old DreamWorks Studios”) on October 27, 2004 in connection with our separation from Old DreamWorks Studios, including Pacific Data Images, Inc. and its subsidiary, Pacific Data Images, LLC.

1

PART I—FINANCIAL INFORMATION

| Item 1. | Financial Statements |

DREAMWORKS ANIMATION SKG, INC.

CONSOLIDATED BALANCE SHEETS

| | | | | | | | |

| | | March 31,

2010 | | | December 31,

2009 | |

| | | (unaudited) | | | | |

| | | (in thousands, except par value and share amounts) | |

Assets | | | | | | | | |

Cash and cash equivalents | | $ | 218,387 | | | $ | 231,245 | |

Trade accounts receivable, net of allowance for doubtful accounts | | | 53,647 | | | | 42,175 | |

Income taxes receivable | | | 4,632 | | | | 9,016 | |

Receivable from Paramount, net of reserve for returns and allowance for doubtful accounts | | | 134,519 | | | | 171,292 | |

Film costs, net | | | 723,686 | | | | 695,963 | |

Prepaid expenses and other assets | | | 49,989 | | | | 41,463 | |

Property, plant and equipment, net of accumulated depreciation and amortization | | | 168,767 | | | | 161,558 | |

Deferred taxes, net | | | 8,207 | | | | 7,669 | |

Goodwill | | | 34,216 | | | | 34,216 | |

| | | | | | | | |

Total assets | | $ | 1,396,050 | | | $ | 1,394,597 | |

| | | | | | | | |

Liabilities and Equity | | | | | | | | |

Liabilities: | | | | | | | | |

Accounts payable | | $ | 2,105 | | | $ | 2,400 | |

Accrued liabilities | | | 100,840 | | | | 111,281 | |

Payable to former stockholder | | | 53,945 | | | | 67,456 | |

Deferred revenue and other advances | | | 49,377 | | | | 60,870 | |

| | | | | | | | |

Total liabilities | | | 206,267 | | | | 242,007 | |

Commitments and contingencies | | | | | | | | |

Stockholders’ equity: | | | | | | | | |

Class A common stock, par value $.01 per share, 350,000,000 shares authorized, 96,975,381 and 95,967,515 shares issued, as of March 31, 2010 and December 31, 2009, respectively | | | 970 | | | | 960 | |

Class B common stock, par value $.01 per share, 150,000,000 shares authorized, 10,838,731 and 11,419,461 shares issued and outstanding, as of March 31, 2010 and December 31, 2009, respectively | | | 108 | | | | 114 | |

Additional paid-in capital | | | 940,471 | | | | 922,681 | |

Retained earnings | | | 817,965 | | | | 796,296 | |

Less: Class A Treasury common stock, at cost, 20,490,455 and 20,430,031 shares, as of March 31, 2010 and December 31, 2009, respectively | | | (569,731 | ) | | | (567,461 | ) |

| | | | | | | | |

Total stockholders’ equity | | | 1,189,783 | | | | 1,152,590 | |

| | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 1,396,050 | | | $ | 1,394,597 | |

| | | | | | | | |

See accompanying notes.

2

DREAMWORKS ANIMATION SKG, INC.

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

| | | | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2010 | | | 2009 | |

| | | (in thousands, except

per share amounts) | |

Revenues | | $ | 162,143 | | | $ | 263,524 | |

Costs of revenues | | | 106,183 | | | | 156,406 | |

| | | | | | | | |

Gross profit | | | 55,960 | | | | 107,118 | |

Product development | | | 185 | | | | 2,368 | |

Selling, general and administrative expenses | | | 23,510 | | | | 20,691 | |

| | | | | | | | |

Operating income | | | 32,265 | | | | 84,059 | |

Interest income, net | | | 59 | | | | 539 | |

Other income, net | | | 2,093 | | | | 1,452 | |

Increase in income tax benefit payable to former stockholder | | | (8,188 | ) | | | (16,010 | ) |

| | | | | | | | |

Income before income taxes | | | 26,229 | | | | 70,040 | |

Provision for income taxes | | | 4,560 | | | | 7,730 | |

| | | | | | | | |

Net income | | $ | 21,669 | | | $ | 62,310 | |

| | | | | | | | |

Basic net income per share | | $ | 0.25 | | | $ | 0.71 | |

Diluted net income per share | | $ | 0.24 | | | $ | 0.71 | |

Shares used in computing net income per share | | | | | | | | |

Basic | | | 86,838 | | | | 87,465 | |

Diluted | | | 88,709 | | | | 88,102 | |

See accompanying notes.

3

DREAMWORKS ANIMATION SKG, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2010 | | | 2009 | |

| | | (in thousands) | |

Operating activities | | | | | | | | |

Net income | | $ | 21,669 | | | $ | 62,310 | |

Adjustments to reconcile net income to net cash (used in) provided by operating activities: | | | | | | | | |

Amortization and write off of film costs | | | 96,875 | | | | 135,237 | |

Stock compensation expense | | | 6,674 | | | | 5,854 | |

Depreciation and amortization | | | 629 | | | | 726 | |

Revenue earned against deferred revenue and other advances | | | (29,898 | ) | | | (10,831 | ) |

Deferred taxes, net | | | (538 | ) | | | 13,548 | |

Change in operating assets and liabilities: | | | | | | | | |

Trade accounts receivable | | | (11,472 | ) | | | (448 | ) |

Receivable from Paramount | | | 36,773 | | | | (46,762 | ) |

Film costs | | | (116,670 | ) | | | (101,657 | ) |

Prepaid expenses and other assets | | | (8,963 | ) | | | (9,664 | ) |

Accounts payable and accrued liabilities | | | (10,597 | ) | | | (29,431 | ) |

Payable to former stockholder | | | (13,511 | ) | | | (9,686 | ) |

Income taxes payable/receivable, net | | | 4,345 | | | | (5,022 | ) |

Deferred revenue and other advances | | | 19,889 | | | | 38,496 | |

| | | | | | | | |

Net cash (used in) provided by operating activities | | | (4,795 | ) | | | 42,670 | |

| | | | | | | | |

Investing activities | | | | | | | | |

Purchases of property, plant and equipment | | | (13,928 | ) | | | (13,411 | ) |

| | | | | | | | |

Net cash used in investing activities | | | (13,928 | ) | | | (13,411 | ) |

| | | | | | | | |

Financing Activities | | | | | | | | |

Receipts from exercise of stock options | | | 7,964 | | | | 21 | |

Excess tax benefits from employee equity awards | | | 171 | | | | — | |

Purchase of treasury stock | | | (2,270 | ) | | | (31,294 | ) |

| | | | | | | | |

Net cash provided by (used in) financing activities | | | 5,865 | | | | (31,273 | ) |

| | | | | | | | |

Decrease in cash and cash equivalents | | | (12,858 | ) | | | (2,014 | ) |

Cash and cash equivalents at beginning of period | | | 231,245 | | | | 262,644 | |

| | | | | | | | |

Cash and cash equivalents at end of period | | $ | 218,387 | | | $ | 260,630 | |

| | | | | | | | |

Supplemental disclosure of cash flow information: | | | | | | | | |

Cash paid (refunded) during the period for income taxes, net | | $ | 563 | | | $ | (878 | ) |

| | | | | | | | |

Cash paid during the period for interest, net of amounts capitalized | | $ | 149 | | | $ | 218 | |

| | | | | | | | |

See accompanying notes.

4

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS

1. Business and Basis of Presentation

Business

The businesses and activities of the DreamWorks Animation SKG, Inc. (“DreamWorks Animation” or the “Company”) primarily include the development, production and exploitation of animated films and characters in the worldwide theatrical, home entertainment, television, merchandising and licensing and other markets. The Company’s films are distributed in theatrical, home entertainment and television markets on a worldwide basis by Paramount Pictures Corporation, a subsidiary of Viacom Inc. (“Viacom”), and its affiliates (collectively, “Paramount”) pursuant to a distribution agreement and a fulfillment services agreement (collectively, the “Paramount Agreements”). The Company generally retains all other rights to exploit its films, including commercial tie-in and promotional rights with respect to each film, as well as merchandising, interactive, literary publishing, music publishing and soundtrack rights. In addition, the Company continues to expand its business of creating high-quality entertainment through the development and production of non-theatrical special content such as television specials and series, live theatrical stage performances and online virtual world games based on characters from its feature films.

Basis of Presentation and Use of Estimates

The consolidated financial statements of the Company present the financial position, results of operations and cash flows of DreamWorks Animation and its wholly owned subsidiaries. All significant intercompany accounts and transactions have been eliminated. The accompanying unaudited financial data as of March 31, 2010 and for the three months ended March 31, 2010 and 2009 has been prepared by the Company pursuant to the rules and regulations of the Securities and Exchange Commission (the “SEC”) and in accordance with United States generally accepted accounting principles (“GAAP”) for interim financial information. Accordingly, certain information and footnote disclosures normally included in comprehensive financial statements have been condensed or omitted pursuant to such rules and regulations. The consolidated balance sheet as of December 31, 2009, was derived from audited financial statements.

These financial statements should be read in conjunction with the consolidated financial statements and related notes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2009 (the “2009 Form 10-K”).

The accompanying unaudited consolidated financial statements reflect all adjustments, consisting of only normal recurring items, which in the opinion of management, are necessary for a fair statement of the results of operations for the periods shown. The results of operations for such periods are not necessarily indicative of the results expected for the full year or for any future period.

The preparation of financial statements in conformity with United States GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes, including estimates of ultimate revenues and ultimate costs of film and television product, estimates of product sales that will be returned and the amount of receivables that ultimately will be collected, the potential outcome of future tax consequences of events that have been recognized in the Company’s financial statements, loss contingencies, and estimates used in the determination of the fair value of stock options and other equity awards for stock-based compensation. Actual results could differ from those estimates. To the extent that there are material differences between these estimates and actual results, the Company’s financial condition or results of operations will be affected. Estimates are based on past experience and other assumptions that management believes are reasonable under the circumstances, and management evaluates these estimates on an ongoing basis.

5

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Recent Accounting Pronouncements

In October 2009, the Financial Accounting Standards Board (“FASB”) issued guidance on revenue arrangements with multiple deliverables which is effective for the Company as of January 1, 2010. The guidance revises the criteria for separating, measuring, and allocating consideration received for deliverables under multiple element arrangements. The guidance requires companies to allocate revenue using the relative selling price of each deliverable, which must be estimated if the Company does not have a history of selling the deliverable on a stand-alone basis or third-party evidence of selling price. The implementation of the new accounting guidance did not have an impact on the Company’s consolidated financial statements.

In February 2010, the FASB issued an amendment to previously issued guidance on subsequent events. The amended guidance removed the requirement for SEC filers to disclose the date through which subsequent events were evaluated in both originally issued and reissued financial statements.

2. Financial Instruments

The fair value of cash and cash equivalents, accounts receivable, accounts payable and advances approximates carrying value due to the short-term maturity of such instruments. The Company has short-term money market investments which are classified as cash and cash equivalents on the balance sheet. The fair value of these investments was measured based on quoted prices in active markets.

3. Film Costs

Film costs consist of the following (in thousands):

| | | | | | |

| | | March 31,

2010 | | December 31,

2009 |

| | | (unaudited) | | |

In release, net of amortization(1) | | $ | 300,872 | | $ | 233,109 |

In production | | | 399,574 | | | 441,489 |

In development | | | 23,240 | | | 21,365 |

| | | | | | |

Total film costs | | $ | 723,686 | | $ | 695,963 |

| | | | | | |

| (1) | Includes $14.3 million and $13.3 million of stage musical costs at March 31, 2010 and December 31, 2009, respectively. |

The Company anticipates that 51.4% and 86.4% of “in release” film costs as of March 31, 2010 will be amortized over the next 12 months and three years, respectively.

4. Accrued Liabilities

Accrued liabilities consist of the following (in thousands):

| | | | | | |

| | | March 31,

2010 | | December 31,

2009 |

| | | (unaudited) | | |

Employee compensation | | $ | 30,329 | | $ | 39,087 |

Participations and residuals | | | 43,376 | | | 38,592 |

Deferred rent | | | 3,666 | | | 4,023 |

Other accrued liabilities | | | 23,469 | | | 29,579 |

| | | | | | |

Total accrued liabilities | | $ | 100,840 | | $ | 111,281 |

| | | | | | |

6

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

As of March 31, 2010, the Company estimates that over the next 12 months it will pay approximately $26.4 million of its accrued participation and residual costs.

5. Deferred Revenue and Other Advances

The following is a summary of deferred revenue and other advances included in the consolidated balance sheets as of March 31, 2010 and December 31, 2009 and the related amounts earned and recorded either as revenue in the consolidated statements of income or capitalized as an offset to film costs for the three-month periods ended March 31, 2010 and 2009 (in thousands):

| | | | | | | | | | | | |

| | | | | | | Amounts Earned |

| | | March 31,

2010 | | December 31,

2009 | | Three Months

Ended

March 31, |

| | | | | 2010 | | 2009 |

| | | (unaudited) | | | | (unaudited) |

Home Box Office Inc. Advance | | $ | — | | $ | — | | $ | 13,333 | | $ | — |

Licensing Advances | | | 35,017 | | | 44,045 | | | 9,028 | | | 3,097 |

Deferred Revenue | | | 6,141 | | | 5,542 | | | 1,707 | | | 1,767 |

Strategic Alliance/Development Advances(1) | | | 1,275 | | | 1,767 | | | 2,993 | | | 3,810 |

Other Advances | | | 6,944 | | | 9,516 | | | 4,321 | | | 4,657 |

| | | | | | | | | | | | |

Total deferred revenue and other advances | | $ | 49,377 | | $ | 60,870 | | | | | | |

| | | | | | | | | | | | |

| (1) | During the three months ended March 31, 2010 and 2009, of the total amounts earned against the “Strategic Alliance/Development Advances,” $1.5 million and $2.5 million, respectively, were capitalized as an offset to film costs or property, plant and equipment. |

6. Financing Arrangements

Revolving Credit Facility.The Company has a $125.0 million revolving credit facility with a number of banks which terminates in June 2013. There was no debt outstanding for the respective periods. The Company is required to pay a commitment fee on undrawn amounts at an annual rate of 0.375%. Interest on borrowed amounts is determined by reference to i) either the lending banks’ base rate plus 0.50% per annum or ii) LIBOR plus 1.50% per annum. Borrowings are secured by substantially all the Company’s assets. Interest costs incurred as a result of the commitment fee was $0.1 million for each of the three-month periods ended March 31, 2010 and 2009.

Animation Campus Financing. In accordance with the terms of the financing arrangement, the entire amount of the obligation, $73.0 million, was repaid upon maturity in October 2009. Accordingly, during the three months ended March 31, 2010, the Company did not incur any interest expense related to this financing. During the three months ended March 31, 2009, the Company incurred $0.3 million of related interest expense.

As of March 31, 2010, the Company was in compliance with all applicable financial debt covenants.

Interest Capitalized to Film Costs. There was no interest capitalized to film costs during the three months ended March 31, 2010. Interest capitalized to film costs during the three months ended March 31, 2009 totaled $0.3 million.

7

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

7. Income Taxes

Set forth below is a reconciliation of the components that caused the Company’s provision for income taxes (including the income statement line item “Income tax benefit payable to former stockholder”) to differ from amounts computed by applying the U.S. Federal statutory rate of 35% for the three months ended March 31, 2010 and 2009.

| | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2010 | | | 2009 | |

| | | (unaudited) | |

Provision for income taxes (combined with Increase in Income tax benefit payable to former stockholder)(1) | | | | | | |

U.S. Federal statutory rate | | 35.0 | % | | 35.0 | % |

U.S. state taxes, net of Federal benefit | | 1.4 | | | 1.7 | |

Revaluation of deferred tax assets, net | | 3.0 | | | (7.4 | ) |

Other | | (2.4 | ) | | (1.7 | ) |

| | | | | | |

Total provision for income taxes (combined with Increase in income tax benefit payable to former stockholder)(1)(2) | | 37.0 | % | | 27.6 | % |

| | | | | | |

Less: Increase in income tax benefit payable to former stockholder(1) | | | | | | |

U.S. state taxes, net of Federal benefit | | (1.1 | ) | | (1.4 | ) |

Revaluation of deferred tax assets, net | | (22.3 | ) | | (17.3 | ) |

Other | | (0.3 | ) | | 0.1 | |

| | | | | | |

Total increase in income tax benefit payable to former stockholder(1) | | (23.7 | )% | | (18.6 | )% |

| | | | | | |

Total provision for income taxes | | 13.3 | % | | 9.0 | % |

| | | | | | |

| (1) | Income tax benefit payable to former stockholder: The Company is obligated to remit to an affiliate of a former significant stockholder 85% of any cash savings in U.S. Federal income tax and California franchise tax and certain other related tax benefits. Refer to the Company’s 2009 Form 10-K for a more detailed description. |

| (2) | For the three months ended March 31, 2010, includes an adjustment primarily related to deferred tax assets (net of valuation allowance) of approximately $2.1 million associated with prior year taxes. |

The Company’s California Franchise tax returns for the years ended December 31, 2004 through 2007 are currently under examination by the Franchise Tax Board (“FTB”). The Internal Revenue Service (“IRS”) concluded its audits of the Company’s federal income tax return for the periods through December 31, 2006. The Company’s federal income tax returns for the tax years ended December 31, 2007 and 2008 are currently under examination by the IRS. All tax years since the Company’s separation from Old DreamWorks Studios remain open to audit by all state and local taxing jurisdictions.

8. Stockholders’ Equity

Class A Common Stock

Stock Repurchase Program. In July 2008, the Company’s Board of Directors approved a stock repurchase program pursuant to which the Company may repurchase up to an aggregate of $150 million of its outstanding stock. For the period January 1, 2009 through April 21, 2009, the Company repurchased approximately 2.3 million shares of its outstanding Class A common stock for $45.7 million pursuant to this program. On April 22, 2009, the Company’s Board of Directors terminated the July 2008 stock repurchase program and

8

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

authorized a new stock repurchase program pursuant to which the Company may repurchase up to an aggregate of $150 million of its outstanding stock. The Company repurchased 0.7 million shares of its outstanding Class A Common Stock for $27.6 million during the month of March 2010, which did not settle until subsequent to March 31, 2010. As of April 27, 2010, the Company had repurchased an aggregate of 0.9 million shares of its outstanding Class A Common Stock for approximately $36.6 million pursuant to the 2009 stock repurchase program and has remaining authorization to purchase approximately $113.3 million of its outstanding stock.

Class B Common Stock

In March 2010, 580,730 shares of the Company’s Class B common stock were converted into an equal amount of shares of the Company’s Class A common stock at the request of David Geffen, a significant stockholder, who owned such shares. Mr. Geffen, in turn, donated these shares to a charitable foundation that was established by him. These transactions had no impact on the total amount of the Company’s shares outstanding.

9. Equity-Based Compensation

The Company recognizes stock-based compensation by measuring the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award.

Most of the Company’s equity awards contain vesting conditions dependent upon the completion of specified service periods. The Company has awarded some equity awards to senior management that are dependent upon the achievement of established sets of market-based criteria. Compensation cost for service-based equity awards is recognized ratably over the vesting period. In addition, the Company has granted equity awards of stock appreciation rights and restricted shares subject to market-based conditions. Compensation costs related to awards with a market-based condition will be recognized regardless of whether the market condition is satisfied, provided that the requisite service has been provided. The Company currently satisfies exercises of stock options and stock appreciation rights, the vesting of restricted stock and the delivery of shares upon the vesting of restricted stock units with the issuance of new shares.

The impact of stock options (including stock appreciation rights) and restricted stock awards on net income (excluding amounts capitalized) for the three-month periods ended March 31, 2010 and 2009, respectively, was as follows (in thousands):

| | | | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2010 | | | 2009 | |

| | | (unaudited) | |

Total equity-based compensation | | $ | 6,674 | | | $ | 5,854 | |

Tax impact(1) | | | (2,469 | ) | | | (1,616 | ) |

| | | | | | | | |

Reduction in net income, net of tax | | $ | 4,205 | | | $ | 4,238 | |

| | | | | | | | |

| (1) | Tax impact is determined at the Company’s annual blended effective tax rate, which includes the income statement line item “Income tax benefit payable to former stockholder” (see Note 7). |

Compensation cost capitalized as a part of film costs was $3.0 million and $2.1 million for the three-month periods ended March 31, 2010 and 2009, respectively.

9

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The following tables set forth the number and weighted average grant-date fair value of equity awards granted during the three-month periods ended March 31, 2010 and 2009:

| | | | | |

| | | Three Months Ended

March 31, |

| | | Number

Granted | | Weighted

Average

Grant-Date

Fair Value |

| | | (unaudited) |

| | | (in thousands) | | |

2010 | | | | | |

Stock appreciation rights | | 14 | | $ | 17.62 |

Restricted stock and restricted stock units | | 51 | | $ | 43.46 |

2009 | | | | | |

Stock appreciation rights | | 15 | | $ | 8.41 |

Restricted stock and restricted stock units | | 20 | | $ | 19.29 |

As of March 31, 2010, the total compensation cost related to unvested equity awards granted to employees but not yet recognized was approximately $85.1 million and will be amortized on a straight-line basis over a weighted average remaining life of 1.7 years.

10. Significant Customer

Significant Customer. A substantial portion of the Company’s revenue is derived directly from Paramount.Paramount represented 58.5% and 93.6% of total revenue for the three-month periods ended March 31, 2010 and 2009, respectively.

11. Related Party Transactions

In June 2008, the Company entered into an aircraft sublease (the“Sublease”) agreement with an entity controlled by Jeffrey Katzenberg, the Company’s Chief Executive Officer and a significant stockholder, for use of an aircraft that such entity leases from the aircraft owner, a company jointly owned indirectly by Mr. Katzenberg and Mr. Spielberg (who is also a stockholder in the Company). Under the Sublease, the Company pays all the aircraft operating expenses on Mr. Katzenberg’s Company-related flights. In addition, in the event that Mr. Katzenberg uses the aircraft for Company-related travel more than 34 hours in any calendar year, the Company pays the subleasing entity a specified hourly rate for those hours. The Company did not incur significant costs during the three months ended March 31, 2010 and 2009.

12. Commitments and Contingencies

Legal Proceedings. From time to time, the Company is involved in legal proceedings arising in the ordinary course of its business, typically intellectual property litigation and infringement claims related to the Company’s feature films, which could cause the Company to incur significant expenses or prevent the Company from releasing a film. The Company also has been the subject of patent and copyright claims relating to technology and ideas that it may use or feature in connection with the production, marketing or exploitation of the Company’s feature films, which may affect the Company’s ability to continue to do so. While the resolution of these matters cannot be predicted with certainty, the Company does not believe, based on current knowledge, that any existing legal proceedings or claims are likely to have a material adverse effect on its financial position, results of operations or liquidity.

10

DREAMWORKS ANIMATION SKG, INC.

NOTES TO UNAUDITED CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

13. Net Income Per Share

The following table sets forth the computation of basic and diluted net income per share (in thousands, except per share amounts):

| | | | | | | | |

| | | Three Months Ended

March 31, | |

| | | 2010 | | | 2009 | |

| | | (unaudited) | |

Numerator: | | | | | | | | |

Net income | | $ | 21,669 | | | $ | 62,310 | |

Denominator: | | | | | | | | |

Weighted average common shares and denominator for basic calculation: | | | | | | | | |

Weighted average common shares outstanding | | | 87,271 | | | | 88,340 | |

Less: Unvested restricted stock | | | (433 | ) | | | (875 | ) |

| | | | | | | | |

Denominator for basic calculation | | | 86,838 | | | | 87,465 | |

| | | | | | | | |

Weighted average effects of dilutive equity-based compensation awards: | | | | | | | | |

Employee stock options and stock appreciation rights | | | 963 | | | | 53 | |

Restricted stock awards | | | 908 | | | | 584 | |

| | | | | | | | |

Denominator for diluted calculation | | | 88,709 | | | | 88,102 | |

| | | | | | | | |

Net income per share—basic | | $ | 0.25 | | | $ | 0.71 | |

Net income per share—diluted | | $ | 0.24 | | | $ | 0.71 | |

The following table sets forth (in thousands) the weighted average number of options to purchase shares of common stock, stock appreciation rights and equity awards subject to performance or market conditions which were not included in the calculation of diluted per share amounts because the effects would be anti-dilutive.

| | | | |

| | | Three Months Ended

March 31, |

| | | 2010 | | 2009 |

| | | (unaudited) |

Options to purchase shares of common stock and restricted stock awards | | — | | 1,887 |

Stock appreciations rights | | 972 | | 3,613 |

| | | | |

Total | | 972 | | 5,500 |

| | | | |

In addition, 2.8 million (which is comprised of 1.2 million restricted stock awards and 1.6 million stock appreciation rights) and 0.6 million shares of equity awards that are contingently issuable were not included in the calculation of diluted shares as the required market and/or performance conditions had not been met as of March 31, 2010 and 2009, respectively.

11

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

This section and other parts of this Quarterly Report on Form 10-Q (the “Quarterly Report”) contain forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from the results discussed in the forward-looking statements. You should read the following discussion and analysis in conjunction with our unaudited consolidated financial statements and the related notes thereto contained elsewhere in this Quarterly Report, and our audited consolidated financial statements and related notes thereto, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the “Risk Factors” section included in our Annual Report on Form 10-K for the year ended December 31, 2009 (the “2009 Form 10-K”). We urge you to carefully review and consider the various disclosures made by us in this Quarterly Report and in our other reports filed with the Securities and Exchange Commission (the “SEC”), including our 2009 Form 10-K and Current Reports on Form 8-K, before deciding to purchase, hold or sell our common stock.

Overview

Our Business and Distribution and Servicing Arrangements

Our business is currently devoted to developing and producing animated feature films. Our films are distributed in the worldwide theatrical, home entertainment and television markets by Paramount Pictures Corporation, a subsidiary of Viacom Inc., and its affiliates (collectively, “Paramount”) pursuant to a distribution agreement and a fulfillment services agreement (collectively, the “Paramount Agreements”). We generally retain all other rights to exploit our films, including commercial tie-in and promotional rights with respect to each film, as well as merchandising, interactive, literary publishing, music publishing and soundtrack rights. Please see Part I, Item 1 “Business—Distribution and Servicing Arrangements” in our 2009 Form 10-K for a discussion of our distribution and servicing arrangements with Paramount. In addition, we continue to expand our business of creating high-quality entertainment through the development and production of non-theatrical special content such as television specials and series, live theatrical stage performances and online virtual world games based on our films.

Our Revenues and Costs

Our feature films are currently the source of a significant percentage of our revenues. We derive revenue from our distributor’s worldwide exploitation of our feature films in theaters and in markets such as home entertainment, pay and free broadcast television and other ancillary markets. Pursuant to the Paramount Agreements, prior to reporting any revenue for one of our feature films to us, Paramount is entitled to (i) retain a fee of 8.0% of gross revenue (without deduction for distribution and marketing costs and third-party distribution fees and sales agent fees), and (ii) recoup all of its distribution and marketing costs with respect to the exploitation of our films on a film-by-film basis. As such, under the Paramount Agreements, each film’s total expenses and fees are offset against that film’s revenues on a worldwide basis across all markets, and Paramount reports no revenue to the Company until the first period in which an individual film’s cumulative worldwide gross revenues exceed its cumulative worldwide gross distribution fee and costs, which may be several quarters after a film’s initial theatrical release. Additionally, as the cumulative revenues and cumulative costs for each individual film are commingled between all markets and geographical territories and Paramount only reports additional revenue to the Company for a film in those reporting periods in which that film’s cumulative worldwide gross revenues continue to exceed its cumulative worldwide gross costs, the Company’s reported revenues in any period are often a result of gross revenues generated in one or several territories being offset by the gross costs of both related and unrelated territories.

In addition, we generate royalty-based revenues from the licensing of our character and film elements to consumer product and home entertainment companies worldwide and we recently have begun to expand our business beyond our core feature film business, including the development, production and licensing of animated television specials and live theatrical stage performances. For certain properties, we have entered into exclusive licensing and promotional arrangements. Additionally, in late March 2010, our online virtual world game, based

12

on our filmKung Fu Panda,was made commercially available primarily on a promotional basis. Revenue and costs generated by the virtual world during the three months ended March 31, 2010 were not material. These activities are not typically subject to the Paramount Agreements and, accordingly, we receive payment and record revenues directly from third parties.

Our primary operating expenses include:

| | • | | Costs of Revenues—Our costs of revenues primarily include the amortization of capitalized production, overhead and interest costs, participation and residual costs for our feature films and television specials and write-offs of amounts previously capitalized for titles not expected to be released or released titles not expected to recoup their capitalized costs. Generally, given the structure of our distribution arrangements, our costs of revenues do not include distribution and marketing costs or third-party distribution and fulfillment services fees associated with our feature films. Distribution and marketing costs for feature films would only be included in our costs of revenues to the extent that we caused Paramount to make additional expenditures in excess of agreed amounts. Our costs of revenues also include direct costs for sales commissions to outside third parties for the licensing and merchandising of our characters and marketing and promotion costs and other product costs associated with our live theatrical stage performances and certain television specials as these activities are not typically subject to the Paramount Agreements. |

| | • | | Selling, General and Administrative Expenses—Our selling, general and administrative expenses consist primarily of employee compensation (including salaries, bonuses, stock compensation and employee benefits), rent, insurance and fees for professional services. |

For a detailed description of our revenues and operating expenses, please see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Our Revenues and Costs” in our 2009 Form 10-K.

Our films are distributed in foreign countries and, in recent years, we have derived approximately 40% of our revenue from foreign countries. A significant amount of our transactions in foreign countries are conducted in the local currencies and, as a result, fluctuations in foreign currency exchange rates can affect our business, results of operations and cash flow. For a detailed discussion of our foreign currency risk, please see Item 7A “Quantitative and Qualitative Disclosures About Market Risk” of our 2009 Form 10-K.

Seasonality

The timing of revenue reporting and receipt of cash remittances to us from our distributor fluctuate based upon the timing of our films’ theatrical and home entertainment releases and the recoupment position of our distributor on a film-by-film basis, which varies depending upon a film’s overall performance. Furthermore, revenues related to our television specials fluctuate based upon the timing of their broadcast and the licensing of our character and film elements are influenced by seasonal consumer purchasing behavior and the timing of our animated feature film theatrical releases and television special broadcasts. As a result, our annual or quarterly operating results for any period are not necessarily indicative of results to be expected for future periods.

13

Results of Operations

Overview of Financial Results

The following table sets forth, for the periods presented, certain data from our unaudited consolidated statements of income. This information should be read in conjunction with our unaudited consolidated financial statements and the notes thereto included elsewhere in this Quarterly Report.

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, | |

| | | 2010 | | | 2009 | | | $ Change | | | % Change | |

| | | (unaudited) | |

| | | (in millions, except percentages and per share data) | |

Revenues | | $ | 162.1 | | | $ | 263.5 | | | $ | (101.4 | ) | | (38.5 | )% |

Costs of revenues | | | 106.2 | | | | 156.4 | | | | (50.2 | ) | | (32.1 | )% |

Product development | | | 0.2 | | | | 2.4 | | | | (2.2 | ) | | (91.7 | )% |

Selling, general and administrative expenses | | | 23.5 | | | | 20.7 | | | | 2.8 | | | 13.5 | % |

| | | | | | | | | | | | | | | |

Operating income | | | 32.2 | | | | 84.0 | | | | (51.8 | ) | | (61.7 | )% |

Interest income, net | | | 0.1 | | | | 0.5 | | | | (0.4 | ) | | (80.0 | )% |

Other income, net | | | 2.1 | | | | 1.5 | | | | 0.6 | | | 40.0 | % |

Increase in income tax benefit payable to former stockholder | | | (8.2 | ) | | | (16.0 | ) | | | (7.8 | ) | | (48.8 | )% |

| | | | | | | | | | | | | | | |

Income before income taxes | | | 26.2 | | | | 70.0 | | | | (43.8 | ) | | (62.6 | )% |

Provision for income taxes | | | 4.5 | | | | 7.7 | | | | (3.2 | ) | | (41.6 | )% |

| | | | | | | | | | | | | | | |

Net income | | $ | 21.7 | | | $ | 62.3 | | | $ | (40.6 | ) | | (65.2 | )% |

| | | | | | | | | | | | | | | |

Diluted net income per share | | $ | 0.24 | | | $ | 0.71 | | | $ | (0.47 | ) | | (66.2 | )% |

| | | | | | | | | | | | | | | |

Diluted shares used in computing diluted net income per share | | | 88.7 | | | | 88.1 | | | | | | | 0.68 | % |

| | | | | | | | | | | | | | | |

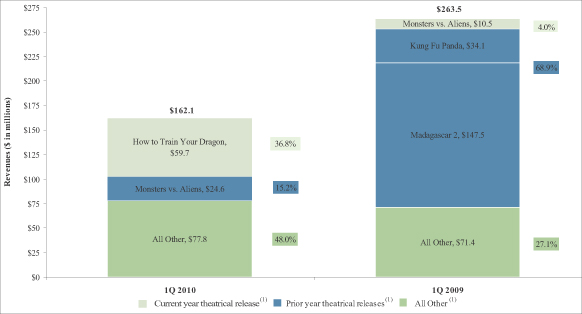

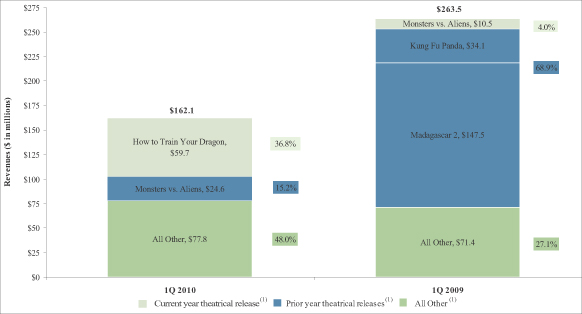

The following table sets forth (in millions), for the periods presented, our revenues by film. This information should be read in conjunction with our unaudited consolidated financial statements and the notes thereto included elsewhere in this Quarterly Report.

| (1) | For each period shown, “Current year theatrical release” consists of revenues attributable to films released in the current year, “Prior year theatrical releases” consists of revenues attributable to films released during the immediately prior year, and “All Other” consists of revenues attributable to films released during all previous periods, including our library titles, as well as revenues from any other sources. |

14

Three Months Ended March 31, 2010 Compared to Three Months Ended March 31, 2009

Revenues. For the three months ended March 31, 2010, our revenue was $162.1 million, a decrease of $101.4 million, or 38.5%, as compared to $263.5 million for the three months ended March 31, 2009. Without a theatrical release in the fourth quarter of 2009 or home entertainment release in the first quarter of 2010,How to Train Your Dragon (released in the first quarter of 2010) was the largest single contributor of revenues during the three months ended March 31, 2010, generating $59.7 million, or 36.8%, attributable primarily to licensing and merchandising activities. In the first quarter of 2010, our distributor reported no theatrical revenue forHow to Train Your Dragon as our distributor is entitled to recover its marketing and distribution costs before it is required to report to us any revenue generated from the exploitation of this film. Additionally, the first quarter 2009 release ofMonsters vs. Aliens contributed $24.6 million of revenues in the first quarter of 2010, earned primarily in the domestic television market. In the first quarter of 2009,Madagascar: Escape 2 Africa(our 2008 fourth quarter release) contributed revenues totaling $147.5 million from the home entertainment market, and to a lesser extent, from the worldwide theatrical market. Revenues earned in the “All Other” category for the first quarter of 2010 remained relatively unchanged from those of the first quarter of 2009.

Revenue for the quarter ended March 31, 2009 was primarily driven byMadagascar: Escape 2 Africa,which contributed $147.5 million, and was earned in the worldwide theatrical and domestic home entertainment markets.Kung Fu Panda contributed $34.1 million which was earned in the worldwide home entertainment and television markets. Additionally,Monsters vs. Aliens contributed $10.5 million of ancillary revenue, including merchandising and licensing revenue. Lastly, our library of titles contributed $71.4 million earned across several markets, includingShrek the Musical which contributed $9.8 million of revenues.

Costs of Revenues. Costs of revenues for the three months ended March 31, 2010 totaled $106.2 million, a decrease of $50.2 million, compared to $156.4 million for the three months ended March 31, 2009.

Cost of revenues, the primary component of which is film amortization costs, as a percentage of revenues was 65.5% for the three months ended March 31, 2010 and was 59.4% for the three months ended March 31, 2009. The increase in amortization of film costs as a percentage of film revenue for the three months ended March 31, 2010 was primarily due to the overall stronger performance ofMadagascar: Escape 2 Africa(2009’s “Prior year theatrical release”) in the first quarter of 2009 as compared to the combined performance ofHow to Train Your Dragonand Monsters vs. Aliens (2010’s “Current year theatrical release” and “Prior year theatrical release,” respectively) in the first quarter of 2010.The higher current period amortization rate was partially offset by the lower rate of amortization for the “All Other” category during the three months ended March 31, 2010 (which for the first quarter of 2010 includesMadagascar: Escape 2 Africa).

Product Development. Product development costs totaled $0.2 million for the three-month period ended March 31, 2010 and $2.4 million for the three-month period ended March 31, 2009. Product development costs represent research and development costs that are incurred in connection with our online virtual worlds or that are not related to an individual film. Subsequent to March 31, 2009, the Company made the determination that the online virtual world based on our filmKung Fu Panda had demonstrated technological feasibility, which allowed the Company to capitalize direct costs incurred until completion of the virtual world (which occurred in March 2010). Accordingly, the Company’s product development costs during the quarter ended March 31, 2010 were significantly lower than during the quarter ended March 31, 2009.

Selling, General and Administrative Expenses. Total selling, general and administrative expenses increased $2.8 million to $23.5 million (including $6.1 million of stock compensation expense) for the quarter ended March 31, 2010 from $20.7 million (including $5.4 million of stock compensation expense) for the quarter ended March 31, 2009. The increase in selling, general and administrative expenses was primarily attributable to stock compensation expense associated with certain senior executive performance awards that were granted in 2009, an increase in expense related to our annual incentive compensation plan and other higher selling, general and administrative expenses, none of which were individually material.

15

Operating Income. Operating income for the three months ended March 31, 2010 was $32.2 million, a decrease of $51.8 million, compared to $84.0 million for the comparable period of 2009. The decrease in operating income between the periods was primarily because we did not release a film in the fourth quarter of 2009 (historically, films released in the fourth quarter contribute meaningful revenue to the first quarter of the following year). Operating income was higher for the comparable quarter of the prior year as it benefited from revenue generated by our 2008 fourth quarter release,Madagascar: Escape 2 Africa.

Interest Income, Net. For the three months ended March 31, 2010, total interest income was $0.1 million, a decrease of $0.4 million or 80.0% from $0.5 million for the same period of 2009. The decrease in interest income was due to lower rates of interest earned on investments and lower average cash balances during the first quarter of 2010 as compared to the first quarter of 2009.

There was no interest capitalized to film costs during the three months ended March 31, 2010 due to the payoff of outstanding loans which resulted in no interest expense in the first quarter of 2010. Interest capitalized to production film costs during the three months ended March 31, 2009 totaled $0.3 million.

Other Income, Net. For the three months ended March 31, 2010 and 2009, total other income was $2.1 million and $1.5 million respectively. Other income in both years consisted primarily of income recognized in connection with preferred vendor arrangements with certain of our strategic alliance partners.

Increase in Income Tax Benefit Payable to Former Stockholder. As a result of a partial increase in the tax basis of our tangible and intangible assets attributable to transactions entered into by affiliates controlled by a former significant stockholder (“Tax Basis Increase”), we may pay reduced tax amounts to the extent we generate sufficient taxable income in the future. As discussed below in “—Critical Accounting Policies and Estimates—Provision for Income Taxes,” we are obligated to remit to such affiliates 85% of any cash savings in U.S. Federal income tax and California franchise tax and certain other related tax benefits, subject to repayment if it is determined that these savings should not have been available to us.

For the quarters ended March 31, 2010 and 2009, we recorded $9.6 million and $18.8 million, respectively, in net tax benefits associated with the Tax Basis Increase as a reduction in the provision for income taxes and recorded an expense of $8.2 million and $16.0 million, respectively, representing 85% of these recognized benefits, as an increase in income tax benefit payable to former stockholder.

Provision for Income Taxes. For the three months ended March 31, 2010 and 2009, we recorded a provision for income taxes of $4.6 million and $7.7 million, respectively, or an effective tax rate of 13.3% and 9.0%, respectively. When our provision for income taxes is combined with the amounts associated with the Increase in Income Tax Benefit Payable to Former Stockholder (see above), the combined effective percentages for the three months ended March 31, 2010 and March 31, 2009 were 37.0% and 27.6%, respectively. The increase in the combined effective tax rate between periods is related to projected higher annual operating income for 2010 and an adjustment related to prior year taxes recorded as a discrete item in the first quarter of 2010. Our effective tax rate for both periods was lower than the 35% statutory federal rate because of the decrease in our valuation allowance, primarily resulting from the increase in the net tax benefits recognized from the Tax Basis Increase as described above.

Net Income. Net income for the three months ended March 31, 2010 was $21.7 million, or $0.24 per diluted share, as compared to net income of $62.3 million, or $0.71 net income per diluted share, in the corresponding period in 2009.

Financing Arrangements

There were no material changes during the three months ended March 31, 2010, outside of the ordinary course of business, to the financing arrangements specified in the section “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our 2009 Form 10-K.

As of March 31, 2010, we were in compliance with all applicable financial debt covenants.

16

For a more detailed description of our various financing arrangements, please see Note 6 to the unaudited consolidated financial statements contained in Part I, Item 1 of this Quarterly Report and the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section of our 2009 Form 10-K.

Liquidity and Capital Resources

Current Financial Condition

Our primary operating capital needs are to fund the production and development costs of our films and new lines of business, including television specials and live theatrical stage performances, make participation and residual payments, and fund selling, general and administrative costs and capital expenditures. Our operating activities for the three months ended March 31, 2010 generated adequate cash to meet our operating needs. For the next 12 months, we expect that cash on hand and cash from operations will be sufficient to satisfy our anticipated cash needs for working capital and capital expenditures. In the event that these cash flows are insufficient, we expect to be able to draw funds from our revolving credit facility to meet these needs.

As of March 31, 2010, we had cash and cash equivalents totaling $218.4 million. Our cash and cash equivalents consist of cash on deposit and short-term money market investments, principally commercial paper and commercial paper mutual funds, that are rated AAA and with maturities of three months of less when purchased. Our cash and cash equivalents balance at March 31, 2010 decreased by $12.8 million from that of $231.2 million at December 31, 2009. Components of this change in cash for the three months ended March 31, 2010, as well as for the three months ended March 31, 2009, are provided below in more detail.

Operating Activities

Net cash (used in) provided by operating activities for the three months ended March 31, 2010 and 2009 was as follows (in thousands):

| | | | | | | |

| | | 2010 | | | 2009 |

Net cash (used in) provided by operating activities | | $ | (4,795 | ) | | $ | 42,670 |

During the three months ended March 31, 2010, our main source of cash from operating activities was attributable to collections of revenues from Paramount related toMonsters vs. Aliens’ worldwide home entertainment and domestic television releases,Kung Fu Panda’s worldwide home entertainment and television releases,Madagascar: Escape 2 Africa’s worldwide home entertainment and domestic television releases and, to a lesser extent, the collection of worldwide television and home entertainment revenues from our other films. Net cash used in operating activities for the first three months of 2010 was primarily attributable to $23.5 million paid related to annual incentive compensation payments, as well as $21.7 million paid to an affiliate of a former significant stockholder related to tax benefits realized in 2010 from the Tax Basis Increase. The operating cash provided by revenues was also partially offset by film production spending and participation and residual payments.

Net cash provided by operating activities for the first three months of 2009 was primarily attributable to the collection of revenue fromMadagascar: Escape 2 Africa’s worldwide theatrical release,Kung Fu Panda’s worldwide home entertainment release and, to a lesser extent, the collection of worldwide television and home entertainment revenues for our other films, includingShrek the Third, Bee Movie, MadagascarandOver the Hedge. The operating cash provided by the collection of revenues during the first quarter of 2009 was offset by $30.0 million paid to an affiliate of a former significant stockholder related to tax benefits realized in 2008 from the Tax Basis Increase and $37.6 million paid related to annual incentive compensation payments. The operating cash provided by revenues was also partially offset by film production spending and participation and residual payments.

17

Investing Activities

Net cash used in investing activities for the three months ended March 31, 2010 and 2009 was as follows (in thousands):

| | | | | | | | |

| | | 2010 | | | 2009 | |

Net cash used in investing activities | | $ | (13,928 | ) | | $ | (13,411 | ) |

Net cash used in investing activities for the three months ended March 31, 2010 and 2009 was primarily related to the investment in property, plant and equipment.

Financing Activities

Net cash provided by (used in) financing activities for the three months ended March 31, 2010 and 2009 was as follows (in thousands):

| | | | | | | |

| | | 2010 | | 2009 | |

Net cash provided by (used in) financing activities | | $ | 5,865 | | $ | (31,273 | ) |

Net cash provided by financing activities for the three-month period ended March 31, 2010 was primarily due to proceeds received upon employee exercise of stock options. Net cash used in financing activities for the three-month period ended March 31, 2009 was primarily comprised of repurchases of our Class A common stock.

Contractual Obligations

There have been no material changes during the period covered by this Quarterly Report, outside of the ordinary course of business, to the contractual obligations specified in the table of contractual obligations included in the section “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our 2009 Form 10-K.

As of March 31, 2010 we had non-cancelable talent commitments totaling approximately $35.1 million that are payable over the next five years.

Critical Accounting Policies and Estimates

Our significant accounting policies are outlined in Note 2 to the audited consolidated financial statements contained in our 2009 Form 10-K. We prepare our consolidated financial statements in accordance with United States generally accepted accounting principles (“GAAP”). In doing so, we have to make estimates and assumptions that affect our reported amounts of assets, liabilities, revenues and expenses, as well as related disclosure of contingent assets and liabilities including estimates of ultimate revenues and costs of film and television product, estimates of product sales that will be returned, the potential outcome of future tax consequences of events that have been recognized in our financial statements and estimates used in the determination of the fair value of stock options and other equity awards for the determination of stock-based compensation. In some cases, changes in the accounting estimates are reasonably likely to occur from period to period. Accordingly, actual results could differ materially from our estimates. To the extent that there are material differences between these estimates and actual results, our financial condition or results of operations will be affected. We base our estimates on past experience and other assumptions that we believe are reasonable under the circumstances, and we evaluate these estimates on an ongoing basis. We believe that the application of the following accounting policies, which are important to our financial position and results of operations, requires significant judgments and estimates on the part of management.

Revenue Recognition

We recognize revenue from the distribution of our animated feature films when earned and reported to us by our distributor.

18

Pursuant to our distribution and servicing arrangements, we recognize our feature film revenue net of reserves for returns, rebates and other incentives after our distributor has (i) retained a distribution fee of 8.0% of revenue (without deduction for any distribution and marketing costs or third-party distribution and fulfillment services fees) and (ii) recovered all of its distribution and marketing costs with respect to our films on a title-by-title basis. Paramount generally reports our international home entertainment results on a 30-day lag. We do not believe that this has a material impact on our consolidated financial statements for the three months ended March 31, 2010 and 2009. Because a third party is the principal distributor of our films, the amount of revenue that we recognize from our films in any given period is dependent on the timing, accuracy and sufficiency of the information we receive from our distributor. As typical in the film industry, our distributor may make adjustments in future periods to information previously provided to us that could have a material impact on our operating results in later periods. Furthermore, management may, in its judgment, make material adjustments to the information reported by our distributor in future periods to ensure that revenues are accurately reflected in our financial statements. To date, our distributor has not made subsequent, nor has management made, material adjustments to information provided by our distributor and used in the preparation of our historical financial statements.

Revenue from the theatrical exhibition of films is recognized at the later of when a film is exhibited in theaters or when revenue is reported by our distributor.

Revenue from the sale of our feature film home video units is recognized at the later of when product is made available for retail sale and when video sales to customers are reported to us by third parties, such as fulfillment service providers or distributors. In addition, we and our distributor provide for future returns of home video product and for customer programs and sales incentives. We and our distributor calculate these estimates by analyzing a combination of historical returns, current economic trends, projections of consumer demand for our product and point-of-sale data available from certain retailers. Based on this information, a percentage of each sale is reserved, and in the case of product returns, provided that the customer has the right of return. Customers are typically given varying rights of return, from 15% up to 100%. However, although we and our distributor allow various rights of return for our customers, we do not believe that these rights are critical in establishing return estimates, because other factors, such as our historical experience with similar types of sales, information we receive from retailers and our assessment of the product’s appeal based on domestic box office success and other research, are more important to the estimation process.

Revenue from both free and pay television licensing agreements is recognized at the later of the time the production is made available for exhibition in those markets or it is reported to us by our distributor.

Revenue from licensing and merchandising is recognized when the associated feature film or television specials has been released and the criteria for revenue recognition have been met. Licensing and merchandising related minimum guarantees are generally recognized as revenue upon the theatrical release of a film and royalty-based revenues (revenues based upon a percentage of net sales of the products) are generally recognized as revenue in periods when royalties are reported by licensees or cash is received.

Film Costs Amortization

Capitalized film and television special production costs, contingent compensation and residuals are amortized and included in costs of revenues in the proportion that a title’s revenue during the period (“Current Revenue”) bears to its estimated remaining total revenue to be received from all sources (“Ultimate Revenue”) as of the beginning of the current fiscal period under the individual-film-forecast-computation method. The amount of capitalized production costs that is amortized each period will therefore depend on the ratio of Current Revenue to Ultimate Revenue for each film or television special for such period. We make certain estimates and judgments of Ultimate Revenue to be received for each film or television special based on information received from our distributor and our knowledge of the industry. Ultimate Revenue includes estimates of revenue that will be earned over a period not to exceed 10 years from the date of initial release. Historically, there has been a close correlation between the success of a film in the domestic box office market and the film’s success in the

19

international theatrical and worldwide home entertainment markets. In general, films that achieve domestic box office success also tend to experience success in the home entertainment and international theatrical markets. While we continue to believe that domestic box office performance is a key indicator of a film’s potential performance in these subsequent markets, we do not believe that it is the only factor influencing the film’s success in these markets and recognize that a range of other market and film-specific factors can have a significant impact.

Estimates of Ultimate Revenue and anticipated participation and residual costs are reviewed periodically and are revised if necessary. A change in any given period to the Ultimate Revenue for an individual title will result in an increase or decrease to the percentage of amortization of capitalized production costs relative to a previous period. An increase in estimate of Ultimate Revenues will lower the percentage rate of amortization while, conversely, a decrease in the estimate of Ultimate Revenue will raise the percentage rate of amortization. In addition, we evaluate capitalized production costs for impairment each reporting period on a title-by-title basis. If estimated remaining revenue is not sufficient to recover the unamortized capitalized production costs for that title, the unamortized capitalized production costs will be written down to fair value determined using a net present value calculation. The cost of any such write downs are reflected in costs of revenues.

Stock-Based Compensation

We record employee stock-based compensation by measuring the cost of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award. As of March 31, 2010, the total compensation cost related to unvested equity awards granted to employees (excluding equity awards with performance objectives deemed not probable of achievement) but not yet recognized was approximately $85.1 million. This cost will be amortized on a straight-line basis over a weighted average remaining life of 1.7 years.

The fair value of stock option grants with either service-based or performance-based vesting criteria is estimated on the date of grant using the Black-Scholes option-pricing model. Some of the primary input assumptions of the Black-Scholes option-pricing model are volatility, dividend yield, the weighted average expected option term and the risk-free interest rate. We apply the “simplified” method of calculating the weighted average expected term. The simplified method defines the weighted average expected term as being the average of the weighted average of the vesting period and contractual term of each stock option granted. Given our lack of sufficient historical exercise data for stock option grants, we continue to expect to use the simplified method for calculating the expected term. Once sufficient information regarding exercise behavior, such as historical exercise data or exercise information from external sources becomes available, we will be required to utilize another method to determine the weighted average expected term. In addition, the estimated volatility incorporates both historical volatility and the implied volatility of publicly traded options. Additionally, management makes an estimate of expected forfeitures and is recognizing compensation costs only for those equity awards expected to vest.

For equity awards of stock options to purchase and restricted shares of our common stock that contain certain performance-based measures, compensation costs are adjusted to reflect the estimated probability of vesting. For equity awards of stock appreciation rights to purchase and restricted shares of our common stock which contain a market-based condition (such as vesting based upon stock-price appreciation), we use a Monte-Carlo simulation option-pricing model to determine the award’s grant-date fair value. The Monte-Carlo simulation option-pricing model takes into account the same input assumptions as the Black-Scholes model as outlined above, however, it also further incorporates into the fair-value determination the possibility that the market condition may not be satisfied and impact of the possible differing stock price paths. Compensation costs related to awards with a market-based condition will be recognized regardless of whether the market condition is satisfied, provided that the requisite service has been provided.

Estimates of the fair value of stock options are not intended to predict actual future events or the value ultimately realized by employees who receive stock option awards, and subsequent events are not indicative of

20

the reasonableness of the original estimates of fair value made by us. Changes to our underlying stock price or satisfaction of performance criteria for performance-based awards granted to employees could significantly affect compensation expense to be recognized in future periods.

Provision for Income Taxes

We account for income taxes pursuant tothe asset and liability method, and, accordingly, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax basis and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates or a change in tax status is recognized in income in the period that includes the enactment date. We record a valuation allowance to reduce our deferred income tax assets to the amount that is more likely than not to be realized. In evaluating our ability to recover our deferred income tax assets, management considers all available positive and negative evidence, including our operating results, ongoing prudent and feasible tax-planning strategies and forecasts of future taxable income.

At the time of our separation from Old DreamWorks Studios, affiliates controlled by a former significant stockholder entered into a series of transactions that resulted in a partial increase in the tax basis of the Company’s tangible and intangible assets (previously defined above as the Tax Basis Increase). The Tax Basis increase was $1.61 billion, resulting in a potential tax benefit to us of approximately $595.0 million that is expected to be realized over 15 years if we generate sufficient taxable income. The Tax Basis Increase is expected to reduce the amount of tax that we may pay in the future to the extent we generate taxable income in sufficient amounts in the future. We are obligated to remit to the affiliate of our former significant stockholder 85% of any such cash savings in U.S. Federal income tax and California franchise tax and certain other related tax benefits, subject to repayment if it is determined that these savings should not have been available to us.

Additionally, we use a single comprehensive model to address uncertainty in tax positions and apply a minimum recognition threshold and a measurement attribute for tax positions taken or expected to be taken in a tax return in order to be recognized in the financial statements. We continue to follow the practice of recognizing interest and penalties related to income tax matters as part of the provision for income taxes.

Recent Accounting Pronouncements

For a discussion of recent accounting pronouncements please see Note 1 to the unaudited consolidated financial statements contained in Part I, Item 1 of this Quarterly Report.

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk |

Market and Exchange Rate Risk

For quantitative and qualitative disclosures about our interest rate, foreign currency, and credit risks, please see Part II, Item 7A “Quantitative and Qualitative Disclosures About Market Risk,” of our 2009 Form 10-K. Exposure to our interest rate, foreign currency and credit risks have not changed materially since December 31, 2009.

| Item 4. | Controls and Procedures |

(a) Evaluation of disclosure controls and procedures.

Our management, with the participation of our chief executive officer and chief financial officer, evaluated the effectiveness of our disclosure controls and procedures pursuant to Rule 13a-15 under the Securities Exchange Act of 1934, as amended, as of the end of the period covered by this Quarterly Report. In designing and evaluating the disclosure controls and procedures, management recognized that any controls and procedures,

21

no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives, and management is required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures.

Based on that evaluation, our chief executive officer and chief financial officer concluded that our disclosure controls and procedures were effective as of the end of the first quarter to provide reasonable assurance that information we are required to disclose in reports that we file or submit under the Securities Exchange Act of 1934, as amended, is accurately recorded, processed, summarized and reported within the time periods specified in SEC rules and forms, and that such information is accumulated and communicated to our management, including our chief executive officer and chief financial officer, as appropriate, to allow timely decisions regarding required disclosure.

(b) Changes in internal controls over financial reporting.

There were no changes in our internal control over financial reporting that occurred during the period covered by this Quarterly Report that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

22

PART II—OTHER INFORMATION

See discussion of Legal Proceedings in Note 12 to the unaudited consolidated financial statements contained in Part I, Item 1 of this Quarterly Report.

Information concerning certain risks and uncertainties appears in Part I, Item 1A “Risk Factors” of the Company’s 2009 Form 10-K. You should carefully consider these risks and uncertainties before making an investment decision with respect to shares of our Class A common stock. Such risks and uncertainties could materially adversely affect our business, financial condition or operating results.

During the period covered by this Quarterly Report, there have been no material changes from the risk factors previously disclosed in the Company’s 2009 Form 10-K or filings subsequently made with the SEC.

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds |

The following table shows Company repurchases of its Class A common stock for the three months ended March 31, 2010.

| | | | | | | | | | |

| | | Total Number of

Shares

Purchased(1) | | Average

Price Paid

per Share | | Total Number of

Shares Purchased

as Part of Publicly

Announced Plan

or Program(2) | | Maximum Number

(or Approximate

Dollar Value)

of Shares That May

Yet Be Purchased

Under the Plan or

Program(2) |

January 1–January 31, 2010 | | — | | $ | — | | — | | $ | 150,000,000 |

February 1–February 28, 2010 | | — | | $ | — | | — | | $ | 150,000,000 |

March 1–March 31, 2010 | | — | | $ | — | | — | | $ | 150,000,000 |

| | | | | | | | | | |

Total | | — | | $ | — | | — | | | |

| (1) | Does not include shares forfeited to the Company upon the expiration or cancellation of unvested restricted stock awards. |

| (2) | In April 2009, the Company’s Board of Directors approved a stock repurchase program pursuant to which the Company may repurchase up to an aggregate of $150 million of its outstanding stock. The Company repurchased 0.7 million shares of its outstanding Class A Common Stock for $27.6 million during the month of March 2010, which did not settle until subsequent to March 31, 2010. As of April 27, 2010, the Company had repurchased an aggregate of 0.9 million shares of its outstanding Class A Common Stock for approximately $36.6 million under its existing stock repurchase program and has remaining authorization to purchase approximately $113.3 million of its outstanding stock. |

Item 3 is not applicable and has been omitted.

None.

| | |

| |

| Exhibit 10.1 | | DreamWorks Animation SKG, Inc. 2010 Employee Stock Purchase Plan. |

| |

| Exhibit 31.1 | | Certification of Chief Executive Officer Pursuant to Exchange Act Rule 13a-14(a) or 15d-14(a), as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| |

| Exhibit 31.2 | | Certification of Chief Financial Officer Pursuant to Exchange Act Rule 13a-14(a) or 15d-14(a),

as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| |

| Exhibit 32.1 | | Certifications of Chief Executive Officer and Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

23

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | |

| | | | DREAMWORKS ANIMATION SKG, INC. |

| | | |

Date: April 27, 2010 | | | | By: | | /S/ LEWIS W. COLEMAN |

| | | | Name: | | Lewis W. Coleman |

| | | | Title: | | President and Chief Financial Officer |

24

EXHIBIT INDEX

| | |

Exhibit

Number | | Description |

| |

| Exhibit 10.1 | | DreamWorks Animation SKG, Inc. 2010 Employee Stock Purchase Plan. |

| |

| Exhibit 31.1 | | Certification of Chief Executive Officer Pursuant to Exchange Act Rule 13a-14(a) or 15d-14(a),

as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| |

| Exhibit 31.2 | | Certification of Chief Financial Officer Pursuant to Exchange Act Rule 13a-14(a) or 15d-14(a), as Adopted Pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| |