UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| | | | | | |

¨ | | Preliminary Proxy Statement | | ¨ | | Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2)) |

x | | Definitive Proxy Statement | | |

¨ | | Definitive Additional Materials | | |

¨ | | Soliciting Material Pursuant to §240.14a-12 | | |

DREAMWORKS ANIMATION SKG, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on April 21, 2011

To the Stockholders:

Notice is hereby given that the Annual Meeting of Stockholders (the “Annual Meeting”) of DreamWorks Animation SKG, Inc., a Delaware corporation (“DreamWorks Animation” or the “Company”), will be held on April 21, 2011 at 8:00 a.m., local time, at the InterContinental Hotel, 2151 Avenue of the Stars, Los Angeles, California 90067 for the following purposes:

| | 1. | To elect 10 directors, all of such directors to serve for the ensuing year or until their successors are duly elected and qualified. |

| | 2. | To ratify the appointment of PricewaterhouseCoopers LLP as DreamWorks Animation’s independent registered public accounting firm for the year ending December 31, 2011. |

| | 3. | To approve the adoption of the Company’s Amended and Restated 2008 Omnibus Incentive Compensation Plan. |

| | 4. | To conduct an advisory vote on executive compensation. |

| | 5. | To conduct an advisory vote on the frequency of holding future advisory votes on executive compensation. |

| | 6. | To transact such other business as may properly come before the meeting and any adjournments or postponements thereof. |

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

Only holders of record of DreamWorks Animation’s common stock at the close of business on March 1, 2011 are entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof. For 10 days prior to the Annual Meeting, a complete list of stockholders entitled to vote at the Annual Meeting will be available at the Corporate Secretary’s office, Campanile Building, 1000 Flower Street, Glendale, California 91201.

All stockholders are cordially invited to attend the Annual Meeting in person. An admission ticket as well as a form of personal identification are needed to enter the Annual Meeting. Stockholders whose shares are held in street name (the name of a bank, broker or other nominee) should bring with them a legal proxy or recent brokerage statement or letter from the street name holder confirming their beneficial ownership of shares. Any stockholder attending the Annual Meeting may vote in person even if he or she has returned a proxy card.

DreamWorks Animation’s Proxy Statement is attached hereto. Financial and other information concerning DreamWorks Animation is contained in its Annual Report to Stockholders for the year ended December 31, 2010.

By Order of the Board of Directors,

Andrew Chang

General Counsel and Corporate Secretary

Glendale, California

March 1, 2011

IMPORTANT: WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, YOU ARE REQUESTED TO COMPLETE AND PROMPTLY RETURN THE ENCLOSED PROXY CARD IN THE ENVELOPE PROVIDED.

TABLE OF CONTENTS

DREAMWORKS ANIMATION SKG, INC.

PROXY STATEMENT

FOR

2011 ANNUAL MEETING OF STOCKHOLDERS

PROCEDURAL MATTERS

General

DreamWorks Animation SKG, Inc., a Delaware corporation (“DreamWorks Animation”), is providing these proxy materials in connection with the solicitation by its board of directors (the “Board of Directors”) of proxies to be voted at its Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Thursday, April 21, 2011 at 8:00 a.m., local time, and at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. The Annual Meeting will be held at the InterContinental Hotel, 2151 Avenue of the Stars, Los Angeles, California 90067. DreamWorks Animation’s headquarters is located at 1000 Flower Street, Glendale, California 91201 and the telephone number at that location is (818) 695-5000.

This Proxy Statement and the enclosed proxy card, together with DreamWorks Animation’s Annual Report on Form 10-K for the year ended December 31, 2010, are being mailed to stockholders beginning on or about March 21, 2011. References in this Proxy Statement to the “Company,” “we,” “us” and “our” refer to DreamWorks Animation.

Stockholders are cordially invited to attend DreamWorks Animation’s Annual Meeting. An admission ticket as well as a form of personal identification are needed to enter the Annual Meeting. Stockholders whose shares are held in street name (the name of a bank, broker or other nominee) should bring with them a legal proxy or recent brokerage statement or letter from the street name holder confirming their beneficial ownership of shares.

DreamWorks Animation will offer a live audio webcast of the Annual Meeting. Stockholders choosing to listen to the audio webcast may do so at the time of the meeting through the link on www.DreamWorksAnimation.com/webcast.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on April 21, 2011

This proxy statement and our 2010 Annual Report to Stockholders are available at www.proxyvoting.com/dwa.

Record Date; Stockholders Entitled to Vote

Only holders of record of DreamWorks Animation’s Class A common stock, par value $0.01 per share (the “Class A Stock”), and Class B common stock, par value $0.01 per share the (“Class B Stock” and, together with the Class A Stock, the “Common Stock”), at the close of business on March 1, 2011 are entitled to notice of and to vote at the Annual Meeting. Each share of Class A Stock entitles the holder to one vote and each share of Class B Stock entitles the holder to 15 votes, in each case with respect to each matter presented to stockholders on which the holders of Common Stock are entitled to vote. The holders of Class A Stock and Class B Stock are not entitled to cumulate their votes in the election of directors. Except as otherwise provided in DreamWorks Animation’s restated certificate of incorporation or required by law, all matters to be voted on by DreamWorks

1

Animation’s stockholders must be approved by a majority, or in the case of election of directors, by a plurality, of the votes entitled to be cast by all shares of Common Stock present in person or represented by proxy, voting together as a single class.

As of March 1, 2011, there were approximately 73,599,939 shares of Class A Stock and 10,838,731 shares of Class B Stock outstanding. For information regarding security ownership by management and by the beneficial owners of more than 5% of DreamWorks Animation’s Common Stock, see “Security Ownership of Certain Beneficial Owners and Management.”

Proxies; Revocation of Proxies

All shares entitled to vote and represented by properly executed proxies received prior to the Annual Meeting, and not revoked, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxies. If no instructions are indicated on a properly executed proxy, the shares represented by that proxy will be voted as recommended by the Board of Directors. If any other matters are properly presented for consideration at the Annual Meeting, the persons named in the enclosed proxy and acting thereunder will vote on those matters in their discretion. DreamWorks Animation does not currently anticipate that any other matters will be raised at the Annual Meeting.

A stockholder may revoke any proxy given pursuant to this solicitation at any time before it is voted by delivering to DreamWorks Animation’s Corporate Secretary a written notice of revocation or a duly executed proxy bearing a date later than that of the previously submitted proxy, or by attending the Annual Meeting and voting in person.

Quorum; Abstentions; Broker Non-Votes

The presence, in person or by proxy, of the holders of a majority of the votes entitled to be cast by all shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Such stockholders are counted as present at the meeting if they are present at the Annual Meeting or have properly submitted a proxy card.

With respect to Proposal Number 1 (the election of directors), stockholders may vote in favor of or withhold their votes for each nominee. While stockholders cannot choose to “abstain” when voting on this proposal, a withhold vote for a nominee is the equivalent of abstaining. The 10 nominees receiving the greatest number of votes cast for the election of directors by shares of Class A and Class B Stock, voting together as a single class, entitled to vote and present in person or by proxy at the Annual Meeting will be elected directors. With respect to Proposal Numbers 2, 3 and 4, stockholders may vote in favor of or against the proposal, or abstain from voting. Abstentions will be treated as the equivalent of a vote against the proposal for the purpose of determining whether a proposal has been adopted or approved on an advisory basis, as applicable. The affirmative vote of the majority of votes cast by holders of Class A and Class B Stock, voting together as a single class, is required for the adoption of Proposal Numbers 2 and 3 and advisory approval of Proposal Number 4. With respect to Proposal Number 5, the Company will treat the option (i.e., every one, two or three years) receiving the support of the greatest number of shares as the option approved by the stockholders. Abstentions will have no effect on Proposal Number 5. Although our Board of Directors intends to carefully consider the stockholder votes on Proposal Numbers 4 and 5, those votes will not be binding on the Board of Directors and are advisory in nature.

If your shares are held in “street name” (the name of a bank, broker or other nominee), the nominee may require your instructions in order to vote your shares. If you give your nominee instructions, your shares will be voted as directed. If you do not give your nominee instructions and the proposal is considered “routine,” brokers are generally permitted to vote your shares in their discretion. Proposal Number 2 in this Proxy Statement (ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accountants) will be considered routine. For all other proposals, brokers are not permitted to vote your shares in their discretion. Proposal Numbers 1, 3, 4 and 5 will not be considered routine and therefore brokers will not have

2

discretionary authority to vote on them. A “broker non-vote” occurs when a broker holding shares for a beneficial owner has not received voting instructions from the beneficial owner and does not have discretionary authority to vote those shares. Shares that constitute broker non-votes will be counted as present at the Annual Meeting for the purpose of determining a quorum, but will not be considered entitled to vote on the proposal in question.

Solicitation of Proxies

The expense of preparing, printing and mailing the Proxy Statement and the proxies solicited hereby will be borne by DreamWorks Animation. DreamWorks Animation may reimburse brokerage firms and other persons representing beneficial owners of shares for their reasonable expenses in forwarding solicitation materials to such beneficial owners. Proxies may also be solicited by certain of DreamWorks Animation’s directors, officers and regular employees, without additional compensation, personally or by telephone, telegram, letter or facsimile.

Proxies and ballots will be received and tabulated by BNY Mellon Shareholder Services, DreamWorks Animation’s inspector of elections for the Annual Meeting.

Deadline for Receipt of Stockholder Proposals

Proposals Pursuant to Rule 14a-8. Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), stockholders may present proper proposals for inclusion in our Proxy Statement and for consideration at our next annual meeting of stockholders. To be eligible for inclusion in our 2012 Proxy Statement, your proposal must be received by us no later than November 2, 2011, and must otherwise comply with Rule 14a-8. While the Board of Directors will consider stockholder proposals, we reserve the right to omit from our Proxy Statement stockholder proposals that we are not required to include under the Exchange Act, including Rule 14a-8.

Proposals and Nominations Pursuant to our Bylaws. Under our Bylaws, in order to nominate a director or bring any other business before the stockholders at the 2012 Annual Meeting of Stockholders that will not be included in our Proxy Statement, you must comply with the procedures described below. In addition, you must notify us in writing and such notice must be delivered to our Secretary no earlier than December 23, 2011, and no later than January 22, 2012. The Company’s management may exercise discretionary voting authority with respect to any stockholder proposal that is not submitted pursuant to Rule 14a-8 for inclusion in the Proxy Statement for the 2012 Annual Meeting of Stockholders if such proposal is not received by the Company within such time period.

Our Bylaws provide that a stockholder’s nomination must contain the following information about the nominee: (1) all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required pursuant to Regulation 14A under the Exchange Act; and (2) such person’s written consent to being named in the Proxy Statement as a nominee and to serving as a director if elected. We may require any proposed nominee to furnish additional information as we may reasonably require in order to determine such person’s eligibility to serve as a director, including appropriate biographical information to permit the Board of Directors to determine whether such nominee meets the qualification and independence standards adopted by the Board of Directors. Any candidates recommended by stockholders for nomination by the Board of Directors will be evaluated in the same manner that nominees suggested by Board members, management or other parties are evaluated.

Our Bylaws provide that a stockholder’s notice of a proposed business item must include: (1) a brief description of the business desired to be brought before the meeting; (2) the text of the proposal or business (including the text of any resolutions proposed for consideration and, in the event that such business includes a proposal to amend our Bylaws, the language of the proposed amendments); (3) the reasons for conducting such business at the meeting; and (4) any material interest of the stockholder making the proposal in such business.

3

In addition, our Bylaws provide that a stockholder giving notice of a nomination or a proposed business item must include the following information in the notice: (1) the name and address of the stockholder; (2) the class and number of shares of our capital stock which are owned beneficially and of record by the stockholder; (3) a representation that the stockholder is a holder of record of our stock entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to propose such nomination or business item; and (4) a representation whether the stockholder intends to solicit proxies from stockholders in support of such nomination or proposed business item.

You may write to our Secretary at our principal executive offices, 1000 Flower Street, Glendale, California 91201, to deliver the notices discussed above and for a copy of the relevant Bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates pursuant to the Bylaws.

Electronic Access

In addition to the website address listed in the section entitled “Important Notice Regarding Internet Availability of Proxy Materials for the Stockholder Meeting to Be Held on April 21, 2011,” this Proxy Statement and DreamWorks Animation’s 2010 Annual Report may be viewed online at www.DreamWorksAnimation.com. Stockholders of record may elect to receive future annual reports and Proxy Statements electronically by following the instructions provided in the enclosed proxy if such stockholder is voting by Internet. Such stockholders’ choice will remain in effect until they notify DreamWorks Animation by mail that they wish to resume mail delivery of these documents. Stockholders holding their Common Stock through a bank, broker or another holder of record should refer to the information provided by that entity for instructions on how to elect this option.

4

PROPOSAL NO. 1

ELECTION OF 10 DIRECTORS

Nominees

DreamWorks Animation’s restated certificate of incorporation currently authorizes a range of three to 15 directors, currently set at 12, to serve on the Board of Directors. At the Annual Meeting, 10 persons will be elected as members of the Board of Directors, each to serve until the next Annual Meeting of Stockholders or until his or her successor is elected and qualified. The Nominating and Governance Committee has nominated, and the Board of Directors has designated, the 10 persons listed below for election at the Annual Meeting. Although the maximum number of directors is currently set at 12, the Board of Directors believes that the current number of 10 directors allows for easier coordination while still allowing the Company to benefit from the various directors’ different expertise and experience. The proxyholders will not be able to vote for a greater number of nominees at the Annual Meeting than 10 nominees.

In the event that any nominee of DreamWorks Animation is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the present Board of Directors to fill the vacancy. It is not expected that any nominee will be unable or will decline to serve as a director.

The name and certain information regarding each nominee are set forth below. There are no family relationships among directors or executive officers of DreamWorks Animation. Ages are as of March 1, 2011.

| | | | | | |

Name | | Age | | | Position |

Jeffrey Katzenberg | | | 60 | | | Chief Executive Officer and Director |

Roger A. Enrico | | | 66 | | | Chairman of the Board of Directors |

Lewis Coleman | | | 69 | | | President, Chief Financial Officer and Director |

Harry “Skip” Brittenham | | | 69 | | | Director |

Thomas E. Freston | | | 65 | | | Director |

Judson C. Green | | | 58 | | | Director |

Mellody Hobson | | | 41 | | | Director |

Michael Montgomery | | | 56 | | | Director |

Nathan Myhrvold | | | 51 | | | Director |

Richard Sherman | | | 58 | | | Director |

Jeffrey Katzenberg—Chief Executive Officer and Director. Mr. Katzenberg has served as our Chief Executive Officer and member of our Board of Directors since October 2004. DreamWorks Animation is the largest animation studio in the world and has released a total of 21 animated feature films, which have enjoyed a number of critical and commercial theatrical successes. These include the franchise propertiesShrek,Madagascar,Kung Fu Panda andHow to Train Your Dragon. Under Mr. Katzenberg’s leadership, DreamWorks Animation became the first studio to produce all of its feature films in 3D and in 2010 became the first Company to release three CG feature films in 3D in a single year. Mr. Katzenberg co-founded and was a principal member of DreamWorks L.L.C. (“DreamWorks Studios”) from its founding in October 1994 until its sale to Paramount in January 2006. Prior to founding DreamWorks Studios, Mr. Katzenberg served as chairman of The Walt Disney Studios from 1984 to 1994. As chairman, he was responsible for the worldwide production, marketing and distribution of all Disney filmed entertainment, including motion pictures, television, cable, syndication, home entertainment and interactive entertainment. During his tenure, the studio produced a number of live-action and animated box office hits, includingWho Framed Roger Rabbit, The Little Mermaid, Beauty and the Beast, Aladdin and The Lion King. Prior to joining Disney, Mr. Katzenberg was president of Paramount Studios. Mr. Katzenberg is Chairman of the Board of The Motion Picture & Television Fund Foundation. He serves on the Boards of AIDS Project Los Angeles, American Museum of the Moving Image, Cedars-Sinai Medical Center, California Institute of the Arts, Geffen Playhouse, Michael J. Fox Foundation for Parkinson’s Research and The Simon Wiesenthal Center. He is co-chairman of the Creative Rights Committee of the Directors Guild of

5

America and the Committee on the Professional Status of Writers of the Writers Guild of America. With over 30 years of experience in the entertainment industry, Mr. Katzenberg brings an unparalleled level of expertise and knowledge of the Company’s core business to the Board. Among the many accomplishments of his lengthy career, he has been responsible for the production of many of the most successful animated films of all time.

Roger A. Enrico—Chairman of the Board. Mr. Enrico has served as the Chairman of our Board of Directors since October 2004. Mr. Enrico is the former chairman and chief executive officer of PepsiCo, Inc. Mr. Enrico was chief executive officer of PepsiCo, Inc. from April 1996 to April 2001, chairman of PepsiCo, Inc.’s board from November 1996 to April 2001, and vice chairman from April 2001 to April 2002. He joined PepsiCo, Inc. in 1971, became president and chief executive officer of Pepsi-Cola USA in 1983, president and chief executive officer of PepsiCo Worldwide Beverages in 1986, chairman and chief executive officer of Frito-Lay, Inc. in 1991, and chairman and chief executive officer of PepsiCo Worldwide Foods in 1992. Mr. Enrico was chairman and chief executive officer, PepsiCo Worldwide Restaurants, from 1994 to 1997. He is also on the boards of directors of The National Geographic Society, the Environmental Defense Fund and the American Film Institute. Previously, Mr. Enrico served on the boards of directors of Belo Corporation (until May 2007) and Electronic Data Systems (until April 2007). Mr. Enrico’s knowledge and experience in leading large, complex organization are valuable attributes for his service as a director. In addition, Mr. Enrico has significant expertise in the areas of consumer products and marketing.

Lewis Coleman—President, Chief Financial Officer and Director. Mr. Coleman has served as our President since December 2005, as Chief Financial Officer since February 2007 and as a member of our Board of Directors since December 2006. He served as Chief Accounting Officer from May 2007 until September 2007. He also previously served as a member of our Board of Directors from October 2004 until his resignation from our Board of Directors in December 2005 to assume his new role as President. Previously, he was the president of the Gordon and Betty Moore Foundation from its founding in November 2000 to December 2004. Prior to that, Mr. Coleman was employed by Banc of America Securities, formerly known as Montgomery Securities, where he was a senior managing director from 1995 to 1998 and chairman from 1998 to 2000. Before he joined Montgomery Securities, Mr. Coleman spent 10 years at the Bank of America and Bank of America Corporation, where he was head of capital markets, head of the world banking group and vice chairman of the board and chief financial officer. He spent the previous 13 years at Wells Fargo Bank, where his positions included head of international banking, chief personnel officer and chairman of the credit policy committee. He serves as the Chairman of the Board of Northrop Grumman Corporation. Previously, Mr. Coleman served on the board of directors of Chiron Corporation (until April 2006). Mr. Coleman has vast financial and accounting knowledge and experience gained through his position as the chief financial officer of a large financial services company. Mr. Coleman also possesses extensive knowledge regarding corporate governance matters and other items applicable to public companies through his service on the boards of directors of several other public companies.

Harry “Skip” Brittenham—Director. Mr. Brittenham has served as a member of the Board of Directors since May 2008. He is a senior partner with the entertainment law firm of Ziffren, Brittenham LLP, which was founded in 1978. Mr. Brittenham currently serves on the board of, or is a trustee of numerous charitable organizations, including Conservation International, KCET, the Environmental Media Association and the Alternative Medical AIDS Foundation. Mr. Brittenham received a B.S. from the United States Air Force Academy and a J.D. from the University of California, Los Angeles. Previously, Mr. Brittenham served on the board of directors of Pixar (until May 2006). Mr. Brittenham possesses unique insight and expertise regarding the entertainment industry gained from his over 30 years of experience representing many of the entertainment industry’s leading talent.

Thomas E. Freston—Director. Mr. Freston has served as a member of the Board of Directors since September 2007. Since December 2006, Mr. Freston has been a principal with firefly3, a consulting and investment company. Mr. Freston served as the President and Chief Executive Officer of Viacom Inc. from January 1, 2006 until his resignation in September 2006. At Viacom, he oversaw Viacom’s cable network properties (which include MTV, Nickelodeon, BET, Comedy Central and many other networks), Paramount Pictures and Famous Music (publishing). He also served on the Board of Viacom from September 2005 until

6

September 2006. Previously, he was Co-President and Co-Chief Operating Officer of Viacom’s predecessor entity since June 2004. Prior to that, Mr. Freston served as Chairman and Chief Executive Officer of MTV Networks since 1987. Mr. Freston joined MTV Networks in 1980 and was one of the founding members of the team that launched MTV: Music Television. Among other things, he created MTV’s classic “I want my MTV” ad campaign. Mr. Freston is on the board of the American Museum of Natural History and Emerson College. Previously, Mr. Freston served on the board of directors of Viacom, Inc. (until September 2006). Mr. Freston possesses significant knowledge regarding the entertainment industry as a result of more than 25 years of experience with several media and entertainment companies. His experience includes broad operational responsibilities as the president of a large, diversified media and entertainment business.

Judson C. Green—Director. Mr. Green joined the board of directors in March 2006. Mr. Green is Vice Chairman of NAVTEQ, a subsidiary of Nokia Corporation and a leading provider of comprehensive digital map information for automotive navigation systems, mobile navigation devices and Internet-based mapping applications. Previously, he served as President and Chief Executive Officer of NAVTEQ from 2008 to 2009 and of NAVTEQ Corporation from 2000 until its acquisition by Nokia Corporation in 2008. Previously, Mr. Green was the President of Walt Disney Attractions, the theme park and resort segment of The Walt Disney Company, from August 1991 until December 1998, and Chairman from December 1998 until April 2000. Prior to his positions at Walt Disney Attractions, he served as Chief Financial Officer of The Walt Disney Company from December 1989 until August 1991. Mr. Green is also currently a director of Harley-Davidson, Inc. Mr. Green holds a M.B.A. from the University of Chicago Booth School of Business and a bachelor’s degree in economics from DePauw University. Mr. Green brings extensive business knowledge and financial and accounting experience to the Board from having served as President and Chief Executive Officer of NAVTEQ Corporation and on the boards of directors of several other public companies. Additionally, his previous experience in the entertainment industry, in particular with the operations of theme parks, provides unique insight and expertise to the Board.

Mellody Hobson—Director. Ms. Hobson has served as a director since October 2004. Ms. Hobson has served as the president of Ariel Investments, LLC, a Chicago-based investment management firm, since 2004. She also has served as president and a director of its sole managing member, Ariel Capital Management Holdings, Inc. since 2000. She is also the president of Ariel Investment Trust, an open-end management investment company, and has served as a trustee since 1993 and as chairman of the board of trustees since 2006. She previously served as senior vice president and director of marketing at Ariel Capital Management, Inc. from 1994 to 2000, and as vice president of marketing at Ariel Capital Management, Inc. from 1991 to 1994. Ms. Hobson is a graduate of Princeton University where she received a Bachelor of Arts from the Woodrow Wilson School of International Relations and Public Policy. Ms. Hobson works with a variety of civil and professional institutions, including serving as a director of the Chicago Public Library as well as its foundation and as a board member of the Field Museum and the Chicago Public Education Fund. She has also served as a director of Estee Lauder and Starbucks since 2004 and 2005, respectively. In 2002, Esquire Magazine named Ms. Hobson as one of “America’s Best and Brightest” emerging leaders. Ms. Hobson possesses valuable knowledge of corporate governance and similar issues from her service on several public companies’ boards of directors. She has also has significant operational and financial expertise as the president of a large investment company.

Michael J. Montgomery—Director. Mr. Montgomery has served as a director since July 2006. Mr. Montgomery serves as president of Montgomery & Co., a media and entertainment investment banking firm, and heads up the firm’s media and entertainment practice. Prior to joining the predecessor company to Montgomery & Co. in 1999, Mr. Montgomery was the chief executive officer at Sega GameWorks, a joint venture between Sega, Universal Studios and DreamWorks Studios. Before that, Mr. Montgomery was a senior executive at DreamWorks Studios from 1995 until 1999. Before joining DreamWorks Studios, Mr. Montgomery spent approximately eight years with The Walt Disney Company and its affiliates, where he held a number of senior positions including managing director and chief financial officer of EuroDisney and treasurer of Walt Disney Company. He has previously served on the board of directors of Corus Pharma and Pathogenesis, a public pharmaceutical company that was acquired by Chiron Corporation in 2000. Mr. Montgomery received his

7

M.B.A. from the Amos Tuck School at Dartmouth College, where he also received a B.A. degree as Rufus Choate Scholar withmagna cum laude honors. Mr. Montgomery’s qualifications for Board service include his experience overseeing a media and entertainment investment banking business. In that position, among other things, Mr. Montgomery has also gained unique experience and valuable insight regarding the Internet and other emerging media businesses. Mr. Montgomery also has prior operational experience with a large media and entertainment business.

Nathan Myhrvold—Director. Dr. Myhrvold has served as a director since October 2004. Dr. Myhrvold is the chief executive officer of Intellectual Ventures, an invention investment company based in Bellevue, Washington. Before Intellectual Ventures, Dr. Myhrvold spent 14 years at Microsoft Corporation. At Microsoft, he was a top technical and business strategist for the company and was involved with founding the company’s scalable operating systems efforts which lead to the Windows NT and Windows CE product lines. During his tenure, Dr. Myhrvold held several executive positions, eventually retiring as chief technology officer in May 2000. Before assuming his role as chief technology officer at Microsoft, Dr. Myhrvold was group vice president of applications and content, which comprised a number of company divisions, including desktop applications, consumer software and Microsoft’s online systems. Prior to that, he was senior vice president of Microsoft’s advanced technology division, responsible for advanced product development in areas such as interactive television, advanced graphics and identifying new forms of consumer computing. Before joining Microsoft in 1986, Dr. Myhrvold was founder and president of Dynamical Systems. Prior to that he was a postdoctoral fellow in the department of applied mathematics and theoretical physics at Cambridge University and worked with Professor Stephen Hawking on research in cosmology, quantum field theory in curved space time and quantum theories of gravitation. Dr. Myhrvold holds a doctorate in theoretical and mathematical physics and a master’s degree in mathematical economics from Princeton University. He also has a master’s degree in geophysics and space physics and a bachelor’s degree in mathematics, all from the University of California, Los Angeles. Mr. Myhrvold’s qualifications for Board service include his broad knowledge of intellectual property from his service as the chief executive officer of an invention investment firm. In addition, as the former Chief Technology Officer of Microsoft Corporation, Mr. Myhrvold possesses lengthy experience in all facets of technology.

Richard Sherman—Director. Mr. Sherman has served as a director since November 2008. Mr. Sherman has served as the Chief Executive Officer of The David Geffen Company (“DGC”), an investment management firm, since 1992. DGC is owned and controlled by David Geffen, a significant stockholder of the Company. From 1977 until 1992, Mr. Sherman was a partner with Breslauer, Jacobson, Rutman and Sherman, which provided business management services. Mr. Sherman was a staff accountant with Peat, Marwick and Mitchell from 1973 until 1977. Mr. Sherman is a certified public accountant. Mr. Sherman serves on the boards of directors of Aviva Family and Children’s Services, the Geffen Playhouse and The David Geffen Foundation. Mr. Sherman also previously served as an adjunct professor of finance with the Graduate School of Architecture and Engineering of the University of Southern California. As a certified public accountant, Mr. Sherman brings a wealth of financial expertise to the Board. He also possesses practical business experience as the current chief executive officer of a diversified investment management firm.

Director Independence

The Board of Directors has adopted Director Independence Standards to assist in its determination of director independence. To be considered “independent” for purposes of these standards, the Board of Directors must determine that the director has no material relationship with DreamWorks Animation other than as a director. In each case, the Board of Directors broadly considers all relevant facts and circumstances and applies the following standards. In addition, the Board of Directors applies the independence standards set by the NASDAQ, which are included in the standards set forth below.

A director will not be considered “independent” if, within the preceding three years:

| | • | | The director was or is an employee, or an immediate family member of the director was or is an executive officer, of DreamWorks Animation; or |

8

| | • | | The director, or an immediate family member of the director, received more than $120,000 per year in direct compensation from DreamWorks Animation, other than director fees and committee fees and pension or other forms of deferred compensation for prior service (provided that such compensation is not contingent in any way on continued service with DreamWorks Animation); except that compensation received by an immediate family member of the director for services as a non-executive employee of DreamWorks Animation need not be considered in determining independence under this test; or |

| | • | | The director was affiliated with or employed by, or an immediate family member of the director was affiliated with or employed in a professional capacity by, a present or former internal or external auditor of DreamWorks Animation; or |

| | • | | The director, or an immediate family member of the director, was or is employed as an executive officer of another company where any of DreamWorks Animation’s present executives at the same time serves or served on that company’s compensation committee; or |

| | • | | The director is employed by another company (other than a charitable organization), or an immediate family member of the director is a current executive officer of any such company, that makes payments to, or receives payments from, DreamWorks Animation for property or services in an amount which, in any single fiscal year, exceeds the greater of $200,000 or 5% of such other company’s consolidated gross revenues. In applying this test, both the payments and the consolidated gross revenues to be measured will be those reported in the last completed fiscal year. This test applies solely to the financial relationship between DreamWorks Animation and the director’s (or immediate family member’s) current employer; the former employment of the director or immediate family member need not be considered. |

The following relationships will not, by themselves, be considered to be material relationships that would impair a director’s independence:

| | • | | Commercial Relationship: If a director of DreamWorks Animation is an executive officer or an employee, or an immediate family member of the director is an executive officer, of another company that makes payments to, or receives payments from, DreamWorks Animation for property or services in an amount which, in any single fiscal year, does not exceed the greater of $200,000 or 5% of such other company’s consolidated gross revenues; or |

| | • | | Indebtedness Relationship: If a director of DreamWorks Animation is an executive officer of another company that is indebted to DreamWorks Animation, or to which DreamWorks Animation is indebted, and the total amount of either company’s indebtedness to the other is less than 5% of the consolidated assets of the company where the director serves as an executive officer; or |

| | • | | Equity Relationship: If a director is an executive officer of another company in which DreamWorks Animation owns a common stock interest and the amount of the common stock interest is less than 5% of the total shareholders’ equity of the company where the director serves as an executive officer; or |

| | • | | Charitable Relationship: If a director, or an immediate family member of the director, serves as a director, officer or trustee of a charitable organization and DreamWorks Animation’s contributions to the organization in any single fiscal year are less than the greater of $200,000 or 5% of that organization’s gross revenues. |

For relationships not covered above as to which the Board of Directors believes a director may nevertheless be independent, the determination of whether the relationship is material or not, and therefore whether the director would be independent, is made by the directors who satisfy the independence tests set forth above.

For the purposes of these standards, an “immediate family member” includes a person’s spouse, parents, children, siblings, mothers- and fathers-in-law, sons- and daughters-in-law, brothers- and sisters-in-law and

9

anyone (other than domestic employees) who shares such person’s home. However, when applying the independence tests described above, the Board of Directors need not consider individuals who are no longer immediate family members as a result of legal separation or divorce, or those who have died or have become incapacitated.

The Board of Directors has determined that each of Harry Brittenham, Thomas Freston, Judson C. Green, Mellody Hobson, Michael Montgomery and Nathan Myhrvold is an independent director. Each of these directors meets the independence requirements adopted by the Board of Directors as set forth above and has no other material relationships with DreamWorks Animation that the Board of Directors, after considering all relevant facts and circumstances, believes would interfere with the exercise of independent judgment in carrying out such director’s responsibilities.

In making its determination that Ms. Hobson is an independent director, the Board of Directors noted that the investment management firm of which Ms. Hobson is the president and director was previously deemed to be the beneficial owner (as of December 31, 2009) of approximately 6% of the outstanding securities of Hewitt Associates, which served as the Compensation Committee’s independent compensation consultant until February 2010. However, given that Ms. Hobson has no involvement in the investment decisions made by her firm and that the Company’s payments to such compensation consultant during 2010 represented a small amount of such consultant’s overall revenues, the Board of Directors also concluded that this relationship does not affect her status as an independent director.

In making its determination that Mr. Green is an independent director, the Board of Directors noted that Mr. Green was a director of Hewitt Associates during a portion of the time that Hewitt served as the Compensation Commitee’s independent compensation consultant. However, given that the Company’s payments to Hewitt during 2010 represented a small amount of Hewitt’s overall revenues and that Hewitt ceased providing services to the Company in early 2010, the Board of Directors concluded that this relationship does not affect his status as an independent director. The Board of Directors also noted that, by virtue of the acquisition of NAVTEQ by Nokia Corporation in 2008, Mr. Green has become an employee of Nokia Corporation. In 2008, Nokia also acquired another company with which DreamWorks Animation has had various business dealings. During 2010, the Company paid a total of approximately $158,000 to this subsidiary of Nokia for software maintenance and support fees. However, given that Mr. Green is not an officer or director of Nokia and had no involvement in the Company’s relationship with Nokia’s subsidiary, the Board of Directors concluded that this relationship does not affect his status as an independent director.

Because Jeffrey Katzenberg and David Geffen, acting together, control approximately 70% of the total voting power of DreamWorks Animation’s outstanding Common Stock, DreamWorks Animation is able to take advantage of, and does take advantage of, the “controlled company” exemption to the NASDAQ’s director independence requirements with respect to its Nominating and Governance Committee. See “—Meetings and Committees—Nominating and Governance Committee” for a further discussion.

Meetings and Committees

During 2010, the Board of Directors held a total of five meetings (including regularly scheduled and special meetings). DreamWorks Animation’s Bylaws provide that, unless otherwise determined by the Board of Directors, no director is eligible for re-election unless he or she has attended at least 75% of the total number of meetings of the Board of Directors and any committees of which he or she is a member that are held during such directors then-current term. Based upon attendance as of the date of this Proxy Statement, the Company currently expects that every incumbent director will have attended at least 75% of the total number of meetings of the Board of Directors and any committees of which he or she is a member during the term that began on May 12, 2010, other than Thomas Freston, who attended approximately 70% of such meetings. During the calendar year 2010, no incumbent director attended fewer than 75% of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees on which he or she served.

10

The Board of Directors has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Governance Committee. The Board of Directors has approved a charter for each of these committees. Copies of the charters for each committee and DreamWorks Animation’s Corporate Governance Guidelines and Director Independence Standards can be found on DreamWorks Animation’s website at

http://www.DreamWorksAnimation.com. These materials are also available in print to any stockholder upon request.

DreamWorks Animation’s Corporate Governance Guidelines provide that independent directors must regularly meet without the Chairman of the Board and the Chief Executive Officer and may select a director to facilitate the meeting. The chairs of the Audit and Compensation Committees may chair executive sessions of the independent directors at which the principal items to be considered are within the scope of the committee chair’s authority.

DreamWorks Animation invites, but does not require, its directors to attend the Annual Meeting. In 2010, four directors attended the Annual Meeting.

Audit Committee

| | |

Number of Members: | | 3 |

| |

Members: | | Judson Green, Chairman Harry “Skip” Brittenham Michael Montgomery |

| |

Number of Meetings in 2010: | | 5 |

| |

Functions: | | The Audit Committee is responsible for, among other things: • overseeing management’s maintenance of the reliability and integrity of DreamWorks Animation’s accounting policies and financial reporting and disclosure practices; • overseeing management’s establishment and maintenance of processes to assure that an adequate system of internal control is functioning; • overseeing management’s establishment and maintenance of processes to assure DreamWorks Animation’s compliance with all applicable laws, regulations and corporate policy; • reviewing DreamWorks Animation’s annual and quarterly financial statements prior to their filing and prior to the release of earnings; and • reviewing the performance and qualifications of DreamWorks Animation’s independent accountants and making recommendations to the Board of Directors regarding the appointment or termination of its independent accountants and considering and approving any non-audit services proposed to be performed by the independent accountants. |

The Board of Directors has determined that each of Mr. Green, Mr. Brittenham and Mr. Montgomery qualifies as an audit committee financial expert, as such term is defined by the Securities and Exchange Commission (“SEC”) in Item 407 of Regulation S-K. Each of these directors has extensive financial and accounting expertise and currently serves, or has previously served, on the board of directors (and, in the case of Mr. Green and Mr. Montgomery, the audit committee) of one or more public companies. The Board of Directors has determined that such simultaneous service would not impair such director’s ability to effectively serve on DreamWorks Animation’s Audit Committee. As mentioned above, the Company has also determined that each of the Audit Committee members is independent under the Company’s Director Independence Standards and under the independence standards set by the NASDAQ. For a further description of the experience and qualifications of our Audit Committee members, see “—Nominees.”

11

Compensation Committee

| | |

Number of Members: | | 3 |

| |

Members: | | Mellody Hobson, Chair Thomas Freston Nathan Myhrvold |

| |

Number of Meetings in 2010: | | 6 |

| |

Functions: | | The Compensation Committee is responsible for, among other things: • reviewing and approving the compensation of our executive officers; • reviewing key employee compensation policies, plans and programs; • monitoring performance and compensation of DreamWorks Animation’s employee-directors, officers and other key employees; • preparing recommendations and periodic reports to the Board of Directors concerning these matters; and • functioning as a committee of the Board of Directors that administers DreamWorks Animation’s incentive compensation programs. |

In the section entitled “Compensation Discussion and Analysis,” we provide an additional discussion of the Compensation Committee’s role and responsibilities.

Nominating and Governance Committee

| | |

Number of Members | | 2 |

| |

Members: | | Jeffrey Katzenberg, Chairman Mellody Hobson |

| |

Number of Meetings in 2010: | | 1 |

| |

Functions: | | The Nominating and Governance Committee is responsible for, among other things: • recommending persons to be selected by the Board of Directors as nominees for election as directors and Chief Executive Officer; • assessing the performance of the Board of Directors and the performance of the members of the Board of Directors; • recommending director compensation and benefits policies; and • considering and recommending to the Board of Directors other actions relating to corporate governance. |

DreamWorks Animation’s amended and restated certificate of incorporation provides that until the earlier of the date that, in the opinion of its counsel, it is required by law or the applicable rules of a securities exchange to have a nominating and corporate governance committee comprised solely of “independent directors” and the date that no shares of Class B Stock remain outstanding, the Nominating and Governance Committee will be composed solely of Jeffrey Katzenberg (or, if he is not DreamWorks Animation’s chief executive officer, then his designee), David Geffen (or his designee) and a director duly appointed by the Board of Directors.

Because Jeffrey Katzenberg and David Geffen, acting together, currently control approximately 70% of the total voting power of DreamWorks Animation’s Common Stock, DreamWorks Animation relies on the “controlled company” exemption to the NASDAQ rule requiring that director nominees be selected, or recommended for the Board of Directors’ selection, by the independent directors.

12

Executive Committee

DreamWorks Animation does not currently have an executive committee. In the event DreamWorks Animation forms an executive committee, Jeffrey Katzenberg (or, if he is not DreamWorks Animation’s chief executive officer, his designee) and David Geffen (or his designee) will be included on the executive committee for so long as the committee exists and such person is entitled to remain on the Board of Directors in accordance with the Vulcan Stockholder Agreement described in“Certain Relationships and Related Party Transactions—Vulcan Stockholder Agreement.”

Board Leadership Structure

Our Corporate Governance Guidelines provide that the Board has the authority to decide whether the offices of the Chairman of the Board (“Chairman”) and Chief Executive Officer (“CEO”) shall be held by the same or different persons. The Board currently believes that separate individuals should hold the positions of Chairman and CEO, which has been the case since our initial public offering (“IPO”) in October 2004.

We believe the current structure described above provides strong leadership for our Board (especially given Mr. Enrico’s extensive corporate board experience), while also positioning our CEO as the leader of the Company for our employees, business partners and investors and the media. We believe that our current structure, which includes a nonexecutive Chairman, helps ensure independent oversight over the Company. Our current structure further allows the CEO to focus his energies on management of the Company.

Our Board currently has six independent members. A number of our independent Board members are currently serving or have served as directors or as members of senior management of other public companies. Our Audit and Compensation Committees are comprised solely of independent directors, each with a different independent director serving as chairperson of the committee. We believe that the number of independent experienced directors that make up our Board, along with the independent oversight of the Board by the non-executive Chairman, benefit our Company and our stockholders.

Pursuant to our bylaws and our Corporate Governance Guidelines, our Board determines the best leadership structure for the Company. As part of our annual Board self-evaluation process, the Board evaluates issues such as independence of the Board, communication between directors and management and other matters that may be relevant to our leadership structure.

Board of Directors’ Oversight of Risk

Our management bears responsibility for the management and assessment of risk at the Company on a daily basis. Management is also responsible for communicating the most material risks to the Board and its committees, who provide oversight over the risk management practices implemented by management. Our full Board provides oversight for risk management, except for the oversight of risks that have been specifically delegated to a committee. Even when the oversight of a specific area of risk has been delegated to a committee, the full Board may maintain oversight over such risks through the receipt of reports from the committee to the full Board. In addition, if a particular risk is material, or where otherwise appropriate, the full Board may assume oversight over a particular risk, even if the risk was initially overseen by a committee. The Board and committee reviews occur principally through the receipt of regular reports from Company management on these areas of risk and discussions with management regarding risk assessment and risk management. Our Board believes that the leadership structure described above under“Board Leadership Structure” facilitates the Board’s oversight of risk management because it allows the Board, working through its committees, to appropriately participate in the oversight of management’s actions.

Full Board. At its regularly scheduled meetings, the Board generally receives a number of reports which include information relating to specific risks faced by the Company. As appropriate, the Company’s Chief Executive Officer or other members of senior management provide operational reports, which include risks

13

relating to the Company’s core theatrical film and home entertainment business as well as the Company’s new business ventures. The Company’s Chief Financial Officer and Treasurer provide regular reports on the Company’s various investments, including its liquid assets, and an analysis of prospective capital sources and uses. The Company’s President and Head of Human Resources also provide periodic reports regarding, and lead the full Board in a discussion of, succession-planning issues. At its regularly scheduled Board meetings, the full Board also receives reports from individual committee chairpersons, which may include a discussion of risks initially overseen by the committees for discussion and input from the full Board. As noted above, in addition to these regular reports, the Board receives reports on specific areas of risk from time to time, such as cyclical or other risks that are not covered in the regular reports given to the Board and described above.

Committees. The Audit Committee maintains initial oversight over risks related to the integrity of the Company’s financial statements, internal controls over financial reporting and disclosure controls and procedures (including the performance of the Company’s internal audit function), the performance of the Company’s independent auditor and the operation of the Company’s ethics program. The Company’s General Counsel provides privileged reports to the Audit Committee, which reports include information regarding the status of the Company’s litigation and related matters. Under the direction of the Company’s Head of Internal Audit, the Company conducts an annual risk assessment regarding the primary risks facing the Company and the Company’s associated risk-mitigation measures. Following completion of this assessment, the Head of Internal Audit presents a report to the Audit Committee. The Company’s Compensation Committee maintains initial oversight of risks related to the Company’s compensation practices, including practices related to equity programs, other executive or companywide incentive programs and hiring and retention. The Compensation Committee also reviews the Company’s compensation programs periodically for consistency and overall alignment with corporate goals and strategies.

Director Nominations

The Board of Directors nominates directors for election at each annual meeting of stockholders and elects new directors to fill vacancies when they arise. The Nominating and Governance Committee has the responsibility to identify, evaluate, recruit and recommend qualified candidates to the Board of Directors for nomination or election.

The Nominating and Governance Committee has a policy regarding consideration of director candidates, including director candidates recommended by stockholders. The Nominating and Governance Committee’s assessment of potential candidates for election to the Board of Directors includes, but is not limited to, consideration of (i) roles and contributions valuable to the business community; (ii) personal qualities of leadership, character, judgment and whether the candidate possesses and maintains throughout service on the Board of Directors a reputation in the community at large of integrity, trust, respect, competence and adherence to the highest ethical standards; (iii) relevant knowledge and diversity of background and experience in such things as business, technology, finance and accounting, marketing, international business, government and the like; and (iv) whether the candidate is free of conflicts and has the time required for preparation, participation and attendance at all meetings.

The Nominating and Governance Committee assesses the Board of Directors’ current and anticipated strengths and needs based upon the Board of Directors’ then-current profile and DreamWorks Animation’s current and future needs and screens the slate of candidates to identify the individuals who best fit the criteria listed above and the Board of Directors’ needs. Although the Company does not maintain a separate policy regarding the diversity of the Board, during the director selection process the Nominating and Governance Committee seeks inclusion and diversity within the Board of Directors. Consistent with these principles, both the Nominating and Governance Committee and the full Board look for director nominees with diverse and distinct professional backgrounds, experience and perspectives so that the Board as a whole has the range of skills and viewpoints necessary to fulfill its responsibilities.

14

Stockholder nominations of candidates for election to the Board of Directors must be made in accordance with the procedures outlined in, and include the information required by, DreamWorks Animation’s Bylaws and must be addressed to: Corporate Secretary, DreamWorks Animation SKG, Inc., Campanile Building, 1000 Flower Street, Glendale, California 91201. Stockholders can obtain a copy of DreamWorks Animation’s Bylaws by writing to the Corporate Secretary at this address. See “Procedural Matters—Deadline for Receipt of Stockholder Proposals—Proposals and Nominations Pursuant to Our Bylaws.”

Communications with the Board of Directors

DreamWorks Animation does not have formal procedures for communications with the Board of Directors by stockholders or any other interested parties. Any matter intended for the Board of Directors, any committees of the Board of Directors, the non-employee directors as a group or any individual member or members of the Board of Directors should be directed to DreamWorks Animation’s Corporate Secretary, 1000 Flower Street, Glendale, California 91201, with a request to forward the same to the intended recipient. In general, all communications delivered to the Corporate Secretary for forwarding to the Board of Directors or specified directors will be forwarded in accordance with the sender’s instructions. However, the Corporate Secretary reserves the right not to forward to directors any abusive, threatening or otherwise inappropriate materials.

Code of Business Conduct and Ethics

DreamWorks Animation has adopted a Code of Business Conduct and Ethics applicable to its Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer, as well as persons performing similar functions. A copy of the Code of Business Conduct and Ethics has been filed as an exhibit to our Annual Report on Form 10-K and is also available at http://www.DreamWorksAnimation.com. A copy of the Code of Business Conduct and Ethics is also available in print to any stockholder upon request. Any amendments to and waivers from any provision of the Company’s Code of Business Conduct and Ethics applicable to the Company’s principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions and relating to any element of the code of ethics definition enumerated in Item 406(b) of Regulation S-K will be posted on the Company’s website.

Director Compensation

The compensation of the Board of Directors is subject to the approval of the Compensation Committee. Directors who are employees of DreamWorks Animation receive no compensation for service as members of either the Board of Directors or board committees. Other than Mr. Enrico, directors who are not employees of DreamWorks Animation receive approximately $200,000 ($225,000 in the case of the chairpersons of the Audit and Compensation Committees) worth of equity awards annually. In recognition of his greater duties as Chairman of the Board, Mr. Enrico receives an annual equity grant having a grant-date fair value of $400,000. All annual equity awards are paid 100% in the form of restricted stock units. The restricted stock units are fully vested at the time of grant and will be settled by the delivery of shares of Class A Stock only at the time the director leaves the Board of Directors. Directors do not receive annual cash retainers or meeting fees.

In accordance with the Company’s outside director compensation policy, the Company currently anticipates that all of its outside directors will receive annual equity grants on the date of the Annual Meeting. We currently expect that any future directors elected other than at an Annual Meeting of Stockholders will receive a pro-rated grant upon joining the Board and will thereafter receive annual grants on the same schedule as other directors.

15

The table below details the compensation of our directors during 2010.

2010 Director Compensation(1)

| | | | | | | | | | | | |

Name | | Stock Awards ($)(2) | | | Option Awards ($)(2) | | | Total ($) | |

Roger Enrico(3) | | $ | 399,963 | | | $ | — | | | $ | 399,963 | |

Mellody Hobson (4) | | $ | 224,967 | | | $ | — | | | $ | 224,967 | |

Judson C. Green(5) | | $ | 224,967 | | | $ | — | | | $ | 224,967 | |

Nathan Myhrvold(6) | | $ | 199,962 | | | $ | — | | | $ | 199,962 | |

Michael Montgomery(7) | | $ | 199,962 | | | $ | — | | | $ | 199,962 | |

Thomas Freston(8) | | $ | 199,962 | | | $ | — | | | $ | 199,962 | |

Harry M. (“Skip”) Brittenham (9) | | $ | 199,962 | | | $ | — | | | $ | 199,962 | |

Richard Sherman(10) | | $ | 199,962 | | | $ | — | | | $ | 199,962 | |

| (1) | Compensation information for those members of the Company’s Board of Directors who are also considered named executive officers of DreamWorks Animation is disclosed in the section “Executive Compensation Information—Summary Compensation Table.” |

| (2) | The amounts reflected in each respective column represent the aggregate grant date fair value of the award made during the year ended December 31, 2010 as computed in accordance with Accounting Standards Codification 718 “Compensation-Stock Compensation” (“ASC 718”). For a further discussion of the assumptions used in the calculation of the 2010 grant date fair value (for all applicable grants of equity awards) pursuant to ASC 718, please see“Financial Statements and Supplementary Data—Notes to Financial Statements—Footnote No. 14 Stock-Based Compensation” of the Company’s Annual Report on Form 10-K for the year ended December 31, 2010. |

| (3) | Represents the grant date fair value of the award made to Mr. Enrico on May 12, 2010. As of December 31, 2010, Mr. Enrico had 31,614 restricted stock units that will be settled only upon his departure from the Board of Directors. |

| (4) | Represents the grant date fair value of the award made to Ms. Hobson on May 12, 2010. As of December 31, 2010, Ms Hobson had 23,161 restricted stock units that will be settled only upon her departure from the Board of Directors. |

| (5) | Represents the grant date fair value of the award made to Mr. Green on May 12, 2010. As of December 31, 2010, Mr. Green had 32,241 restricted stock units that will be settled only upon his departure from the Board of Directors. |

| (6) | Represents the grant date fair value of the award made to Mr. Myhrvold on May 12, 2010. In addition, as of December 31, 2010, Mr. Myhrvold had 20,587 restricted stock units that will be settled only upon his departure from the Board of Directors. |

| (7) | Represents the grant date fair value of the award made to Mr. Montgomery on May 12, 2010. As of December 31, 2010, Mr. Montgomery had 28,416 restricted stock units that will be settled only upon his departure from the Board of Directors. |

| (8) | Represents the grant date fair value of the award made to Mr. Freston on May 12, 2010. As of December 31, 2010, Mr. Freston had 20,587 restricted stock units that will be settled only upon his departure from the Board of Directors. |

| (9) | Represents the grant date fair value of the award made to Mr. Brittenham on May 12, 2010. As of December 31, 2010, Mr. Brittenham had 12,248 restricted stock units that will be settled only upon his departure from the Board of Directors. |

| (10) | Represents the grant date fair value of the award made to Mr. Sherman on May 12, 2010. As of December 31, 2010, Mr. Sherman had 15,769 restricted stock units that will be settled only upon his departure from the Board of Directors. |

Pursuant to its policies, the Company reimburses its directors for expenses incurred in the performance of their duties, including reimbursement for air travel and hotel expenses. The Company’s outside director travel policy, among other things, authorizes the Company to enter into an aircraft timesharing agreement in instances where a director uses a private aircraft to attend Board meetings and other Company functions. The Company has

16

entered into an aircraft timesharing agreement with an entity controlled by Nathan Myhrvold, one of the Company’s independent directors. Pursuant to Federal Aviation Administration regulations, beginning in October 2010 the Company began reimbursing the entity controlled by Mr. Myhrvold that operates such aircraft for the costs of Mr. Myhrvold’s use of the aircraft to attend Board meetings. During 2010, the Company incurred a total of $34,000 in connection with Mr. Myhrvold’s use of private aircraft to attend Board meetings.

Agreements with Roger Enrico

At the time of the Company’s IPO in October 2004, we entered into a multi-year employment agreement with Roger Enrico, the Company’s Chairman. This employment agreement provided for an annual base salary of $1 in return for which he was granted certain performance-based equity compensation awards. Under Mr. Enrico’s employment agreement, in addition to the customary duties of the Chairman, he also agreed to perform certain additional functions (such as corporate strategic planning, marketing strategy and management of promotional partnerships) not typically associated with the role of the Chairman of the Board. In July 2008, the Company and Mr. Enrico jointly agreed that he would relinquish his employee duties, although he would remain as the non-executive Chairman of the Board. In connection with Mr. Enrico’s transition to non-executive Chairman status, his employment agreement was terminated. In addition, Mr. Enrico and the Company entered into a letter agreement covering, among other things, the treatment of his then-outstanding equity awards. Among other things, given that a portion of Mr. Enrico’s prior awards reflected compensation for his services as an employee, the Compensation Committee believed it would not be equitable if his transition to non-executive Chairman status caused him to forfeit previously granted awards related to his employee status. The letter agreement generally provided that any then-unvested equity awards would continue to vest in accordance with their terms provided that Mr. Enrico remained a director until October 23, 2009 (the original expiration date of his employment agreement). Because Mr. Enrico remained a director through October 23, 2009, these awards automatically vested as of that date and, with respect to SARs, will remain exercisable for the remainder of the term of the grant.

Compensation Committee Interlocks and Insider Participation

During the year ended December 31, 2010, the Compensation Committee was composed of Ms. Hobson, Mr. Freston and Mr. Myhrvold. None of these persons has at any time been an officer or employee of the Company or any of our subsidiaries. In addition, no member of the Compensation Committee had any relationship with us requiring disclosure under Item 404 of Regulation S-K adopted by the SEC. During the year ended December 31, 2010, none of the executive officers of the Company served on the board of directors or on the compensation committee of any other entity that has or had executive officers serving as a member of the Board of Directors or Compensation Committee of the Company.

Required Vote

The 10 nominees receiving the highest number of affirmative votes cast at the Annual Meeting by holders of Class A and Class B Stock entitled to vote on the election of directors, voting together as a single class, shall be elected as directors.

Recommendation

The Board of Directors recommends that stockholders vote “FOR” the election of the nominees listed above.

17

PROPOSAL NO. 2

RATIFICATION AND APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has selected PricewaterhouseCoopers LLP (“PwC”), independent registered public accounting firm, to audit the financial statements of DreamWorks Animation for the year ending December 31, 2011. A representative of PwC is expected to be present at the Annual Meeting, will have the opportunity to make a statement and is expected to be available to respond to appropriate questions. PwC has served as our independent registered public accounting firm since February 24, 2011. Prior to such time, Ernst & Young LLP (“E&Y”) served as our independent registered public accounting firm. See “—Changes in Independent Registered Public Accounting Firm” below. The Company does not expect that a representative of E&Y will be present at the Annual Meeting.

Required Vote

The Audit Committee has conditioned its appointment of DreamWorks Animation’s independent registered public accounting firm upon the receipt of a majority of the votes entitled to be cast by all shares of Common Stock present in person or represented by proxy at the Annual Meeting, voting together as a single class. In the event that the stockholders do not approve the selection of PwC, the appointment of the independent registered public accounting firm will be reconsidered by the Audit Committee.

Recommendation

The Board of Directors recommends that stockholders vote “FOR” the ratification of the appointment of PwC as DreamWorks Animation’s independent registered public accounting firm for the year ending December 31, 2011.

Independent Registered Public Accounting Firm Fees

The Company previously entered into an engagement agreement with E&Y which set forth the terms by which E&Y would perform audit services for the Company. In the Company’s engagement letter with E&Y, the Company and E&Y each agreed to alternative dispute resolution procedures.

The following is a summary of the fees and expenses billed to DreamWorks Animation by E&Y for the years ended December 31, 2009 and 2010.

| | | | | | | | |

| | | 2009 | | | 2010 | |

Audit Fees | | $ | 1,870,000 | | | $ | 1,527,500 | |

Audit-Related Fees | | | 41,500 | | | | 41,500 | |

Tax Fees | | | 22,488 | | | | 55,000 | |

All Other Fees | | | 2,500 | | | | 92,500 | |

| | | | | | | | |

Total | | $ | 1,936,488 | | | $ | 1,716,500 | |

| | | | | | | | |

Audit Fees

Audit fees in 2009 and 2010 consisted of fees and expenses billed for professional services rendered for the audit of DreamWorks Animation’s annual consolidated financial statements for the years ended December 31, 2009 and 2010 and the effectiveness of its internal control over financial reporting as required under Section 404 of the Sarbanes-Oxley Act of 2002 and review of the interim consolidated financial statements included in quarterly reports.

18

Audit fees in 2009 and 2010 also consisted of fees billed for services normally provided in connection with statutory and regulatory filings or engagements (including audits of the Company’s Indian and Irish subsidiaries).

Audit-Related Fees

Audit-related fees consist of fees and expenses billed for assurance and related services that are reasonably related to the performance of the audit or review of DreamWorks Animation’s consolidated financial statements and are not reported under “Audit Fees.” These services include attest services that are not required by statute or regulation.

Tax Fees

Tax fees consist of fees and expenses billed for professional services for tax compliance and tax advice (primarily Federal and state income tax returns).

All Other Fees

In 2009 and 2010, other fees represent fees paid for the use of an on-line accounting research tool. In 2010, other fees also included fees for professional services rendered with respect to a royalty audit of one of the Company’s consumer products licensees.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

The Audit Committee’s policy is to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm, including fees. These services may include audit services, audit-related services, tax services and other services. Pre-approval is detailed as to the particular service or category of services and is generally subject to a specific budget. Since the IPO in October 2004, each new engagement of E&Y was approved in advance by the Audit Committee, and none of such engagements made use of thede minimis exception to pre-approval contained in the SEC’s rules.

Change in Independent Registered Public Accounting Firm

On October 21, 2010, the Audit Committee approved the engagement of PwC as the Company’s independent registered public accounting firm for the year ending December 31, 2011. PwC’s engagement as the Company’s independent registered public accounting firm commenced on February 24, 2011. The decision to change auditors was the result of a competitive process that was launched in conjunction with the rotation of the lead E&Y audit partner for the Company’s account pursuant to Rule 2-01(c)(6) of Regulation S-X.

On February 24, 2011 the Audit Committee dismissed E&Y as the Company’s independent registered public accounting firm.

During the years ended December 31, 2009 and December 31, 2010 and through February 24, 2011, neither the Company nor anyone on its behalf has consulted with PwC with respect to either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and neither a written report nor oral advice was provided to the Company that PwC concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K) or a reportable event (as defined in Item 304(a)(1)(v) of Regulation S-K).

The reports of E&Y on the Company’s consolidated financial statements for the years ended December 31, 2009 and December 31, 2010 did not contain an adverse opinion or a disclaimer of an opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles.

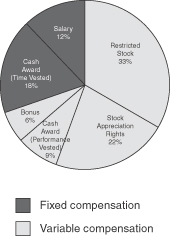

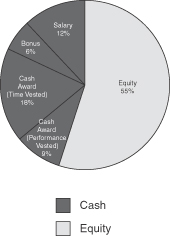

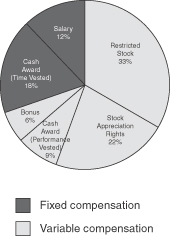

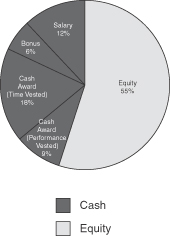

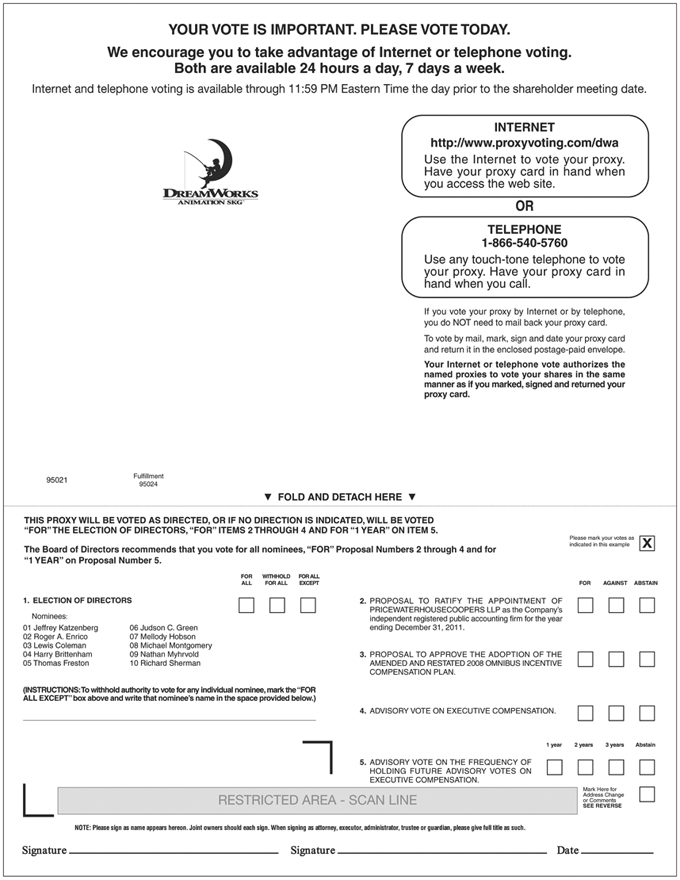

19