Airbee Wireless, Inc.

No 1A First Lane, Shanti Ram Center

Nungambakkam High Road

Nungambakkam, Chennai 600034

India

May 6, 2009

U.S. Securities & Exchange Commission

Division of Corporation Finance

100 F Street, NE

Washington, DC 20549

Attn: Stephen Krikorian and Morgan Youngwood

| | | |

| | Re: | Response to Comments on Airbee Wireless, Inc. |

| | | Forms 10-Q/A filed on November 19, 2008 |

| | | Form 10-Q filed on November 19, 2008 |

| | | Form 8-K/A filed on March 10, 2008 |

| | | File No. 000-50918 |

| | | |

Dear Messrs. Krikorian and Youngwood:

Airbee Wireless, Inc. (the “Company”), hereby submits responses to the comment letter issued by the staff of the Securities and Exchange Commission dated December 11, 2008. Staff’s comments from its letter are shown below in bold type followed immediately by our responses.

Forms 10-Q/A for the quarterly periods ended March 31, 2008 and June 30, 2008

Condensed Consolidated Financial Statements

Notes to Condensed Consolidated Financial Statements

Note 15, Restatements, page 20

| 1. | We note that in response to prior comments No. 2 and 3, you have amended your quarterly filings for the periods ended March 31, 2008 and June 30, 2008. Tell us your consideration of providing all of the disclosures required by paragraph 26 of SFAS 154. In this respect, your disclosures do not disclose the effect of the restatement on each balance sheet line item. In addition, tell us your consideration of providing disclosures that show the effect of your restatements in a format similar to that in paragraph A7 of SFAS 154. |

| | Please see the revisions to Note 15 for the quarterly periods ended March 31, 2008 and June 30, 2008 attached as Exhibits 1 and 2 below. |

| 2. | We note your response to prior comment No. 5 that indicates you proposed adding additional disclosures to discuss the cumulative impact of the restatements. Explain why you have not disclosed the cumulative impact of the restatement for the six months ended June 30, 2007. In this respect, your disclsures only appear to show the impact of the restatement on the three month period ended June 30, 2007. Your disclosures also do not describe the cumulative impact of the restatements relating to the write-off of intangible assets and any related amortization expenses during the quarter ended June 30, 2008. |

Please see the revisions to Note 15 for the quarterly period ended June 30, 2008 attached as Exhibit 2 below.

Form 10-Q for the quarterly period ended September 30, 2008

Condensed Consolidated Financial Statements

Notes to Condensed Consolidated Financial Statements

Stock-based compensation, page 46

| 3. | We note that you continue to disclose a “pro forma” table required by SFAS 148. Since each reporting period included in your financial statements presents results subsequent to the adoption of SFAS 123(R), this table is no longer required. This comment also applies to a similar table included in Note 9 Stockholders Equity. |

The subject pro forma presentations will not be included in future filings.

| 4. | We note that you entered into a Note and Settlement Agreement with the Zimmers on April 15, 2008. Please further clarify the nature of this transaction and cite the accounting guidance that you relied upon in deciding to record $1.4 millino of penalties returned and forgiveness of debt as other income in your condensed consolidated statements of operations. |

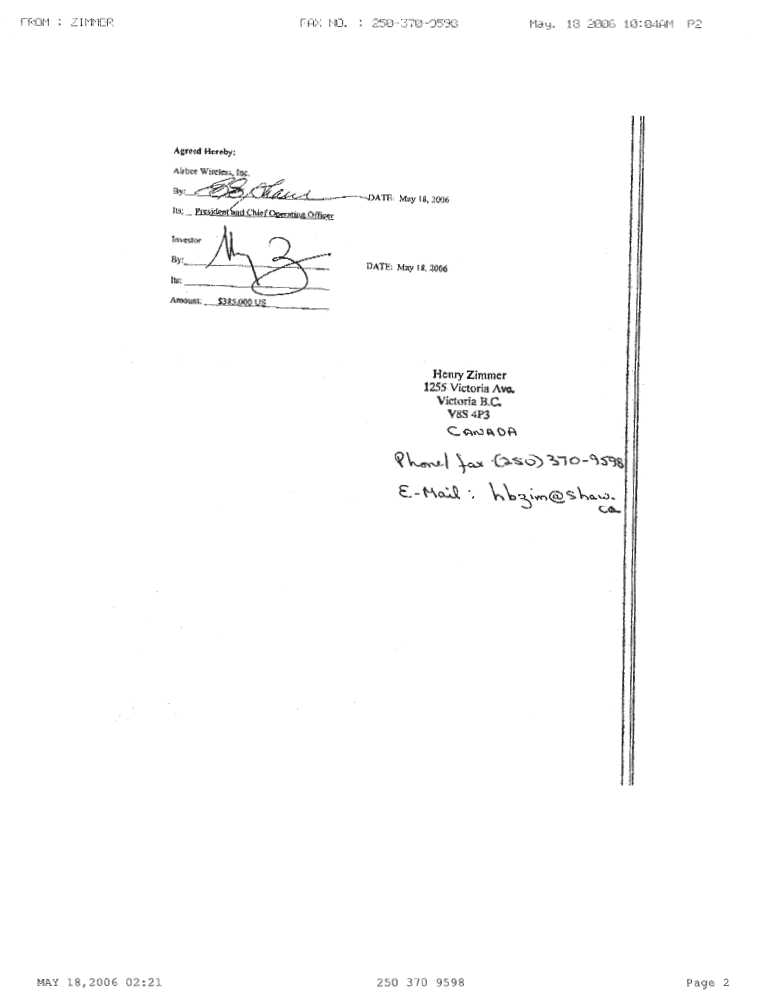

The Note and Settlement Agreement (the “Agreement”) between the Company and the Zimmers was attached as an exhibit to our Current Report on Form 8-K filed on April 21, 2008. The terms of the Agreement speak for themselves. The Agreement was negotiated to restructure the Company’s indebtedness to the Zimmers resulting from their participation in bridge loans to the Company beginning in May 2006.

Initially, the Zimmers loaned $385,000 to the Company pursuant to a Bridge Loan Term Sheet, a copy of which is attached as Exhibit 3 (the “Bridge Loan”). This was envisioned as short-term financing (an initial term of 90 days with an additional 30 days allowed if the Company agreed to pay a fee of equal to 8% of the amount loaned). The Bridge Loan also contained a penalty provision whereby the Company agreed to pay an additional 10% interest penalty for each calendar quarter the Bridge Loan remained outstanding beyond the due date. Between October 2006 and February 28, 2007, the Zimmers advanced a total of $215,000 in additional funds to the Company. Each advance was memorialized by a writing which in each case added the advance to the existing Bridge Loan and in one instance included a provision which required the Company to issue 3.2 million common shares to the Zimmers if the Company did not repay the Bridge Loan by the next due date. The total principal amount due the Zimmers under the Bridge Loan was eventually $600,000. The Company failed to make the required payment and issued the penalty shares to the Zimmers in 2007. All of the foregoing has been disclosed in our previous public filings. Specifically, the Company charged all interest accrued to expense and the shares issued to financing costs in the periods in which each was incurred.

On April 15, 2008, the Company owed the Zimmers a total of $1,418,328 in principal, interest and penalties. As a result of the restructuring negotiations, the Zimmers agreed to a new promissory note in the principal amount of $700,000 due two years after date bearing simple interest at 8.5% per annum. Please note Sections 5 and 7 of the Agreement. Section 5 states that the Note supersedes, cancels, replaces and marks “PAID” all prior loans denoted as Bridge Notes between the Company and the Zimmers. The Zimmers further agreed to return the 3.2 million shares issued to them, which have indeed been returned and canceled by the transfer agent. Section 7 is a mutual release.

The Company accounted for this transaction by debiting the Bridge Loan and accrued interest and crediting Other Income. It accounted for the new promissory note by debiting Other Income and crediting Notes Payable. The Company accounted for the cancelled stock by debiting Common Stock and Additional Paid-in Capital and crediting Other Income. The total gain attributed to this transaction was $1,398,425.

In selecting this accounting treatment, the Company reviewed FASB 145 and APB Opinion No. 30. Prior to the effective date of FASB 145 significantly limited the list of extraordinary items by repealing the requirement in SFAS 4, Reporting Gains and Losses From Extinguishment of Debt, that early extinguishment of debt be treated as an extraordinary item. Our analysis focused on APB Opinion No. 30, Reporting the Results of Operations – Reporting the Effects of Disposal of a Segment of a Business, and Extraordinary, Unusual and Infrequently Occurring Events and Transactions, which requires that an event or transaction be both “unusual” and “infrequent” before it can be classified as an extraordinary item. These standards are subjective. The determination that an event is unusual depends on the environment in which the entity operates, taking into account factors such as the characteristics of its industry, the geographical location of its operations, and the nature and extent of government regulation. Past occurrence of an event or transaction provides some evidence of the probability of recurrence in the foreseeable future in determining if the occurrence is sufficiently infrequent. The bias, if any, seems to be against finding items to be both unusual and infrequent. We note that EITF 01-10 specified that costs and losses associated with the terror events of September 11, 2001 should be classified as part of income from continuing operations. If the attacks on the United States that day were not unusual, one wonders what event meets the definition.

The analysis applied by the Company finds that the gain occasioned by this transaction, while material, is not both “unusual” and “infrequent.” The Company has a history of converting debt to equity, which has been reported from time to time in our public filings. During the first quarter of 2008 we reached settlements with two other creditors to resolve outstanding liabilities and certain of the Company’s officers reached contingent settlements of outstanding salary obligations which have yet to take effect. Indeed, management believes it will be necessary to restructure other material liabilities in the future if the Company is to survive. The Company argues that such actions are not unusual for development stage companies (even though the Company removed the development stage designation from its financial statements in 2006, its revenues are more in keeping with development stage companies than going concerns). The Company’s practice of restructuring and compromising debt goes to refute the “infrequent” requirement as well. We therefore believe that the restructuring to the Zimmer Bridge Loan was neither “unusual” nor “infrequent” and thus it is not reportable as an extraordinary item.

The Company further believes it is not possible to divorce the stock transaction from the overall debt. The Company’s obligation to issue the stock to the Zimmers initially arose from the underlying Bridge Loan transaction and the Company’s inability to repay the indebtedness in a timely manner. Further, the cancellation of previously issued stock is not without precedent since as part of the now-rescinded Restricted Equity Purchase Agreement with Mercatus in 2007-08 certain officers of the Company returned previously issued common stock purchased under stock option grants. The “infrequent” requirement for this portion of the transaction has therefore not been met.

As a result of the foregoing, the Company believes it correctly presented the material gain from this transaction with the Zimmers as other income because the requirements for treatment as an extraordinary item were not met.

Note 13. Fair Value Measurements, page 17

| 5. | Tell us the type of liabilities that are subjected to the fair value measurements being displayed in the table. Disclose, in future files, the type of input assumptions utilized to measure fair value. |

The liabilities subjected to the fair value measurements displayed in the table are as follows:

| | |

| Level II Inputs for Fair Value Measurements as of September 30, 2008 | |

| | | | |

| Notes payable - other | | $ | 506,713 | |

| Fair value of derivatives | | | 444,942 | |

| Convertible debentures, net of discount | | | 2,047,955 | |

| Warrants liability | | | 897,328 | |

| Long-term convertible debenutres, net of discount | | | 733,591 | |

| | | $ | 4,630,529 | |

The foregoing items were valued using the Black-Scholes option pricing model since conversion features attached to some or all of the transactions.

Note 15. Restatements, page 18

| 6. | Please explain why your disclosures do not discuss the impact of the restatement for the quarter ended September 30, 2007. |

Please see the revisions to Note 15 for the quarterly period ended September 30, 2008 attached as Exhibit 4 below.

| | Form 8-K/A filed on March 10, 2008 |

| 7. | We note your response to prior comment No. 6 that indicates you believe it is appropriate to account for the debit side of this transaction as a prepaid consulting contra-equity account in your balance sheet. Explain your consideration of paragraph 13 of EITF 00-18, which indicates that an asset acquired in exchange for the issuance of fully vested, non-forfeitable equity instruments should not be displayed as contra-equity by the grantor of the equity instrument. |

Since it appears that the Company acquired a prepaid asset in exchange for the equity instruments, the Company will reclassify the prepaid consulting contra-equity account as a prepaid asset on its March 31, 2007, June 30, 2007 and September 30, 2007 balance sheets and will make the appropriate reclassification to its December 31, 2007 balance sheet when it files its Form 10-K for the year ended December 31, 2008. We note that the amount to be reclassified at December 31, 2007 ($83,333) is not material and suggest this would be a more cost-effective way to handle the reclassification as of December 31, 2007. We further note that the required accounting greatly distorts our total assets on the balance sheet dates at issue in this comment and we continue to believe that our original presentation more accurately presents our financial position to financial statement users.

We note the staff’s closing comments and appreciate the cooperation and courtesies extended to us by the staff. If you require additional assistance, please let us know.

Sincerely,

/s/ E. Eugene Sharer

E. Eugene Sharer

Interim Chief Financial Officer

Airbee Wireless, Inc.

No 1A First Lane, Shanti Ram Center

Nungambakkam High Road

Nungambakkam, Chennai 600034

India

May 6, 2009

U.S. Securities & Exchange Commission

Division of Corporate Finance

100 F Street, NE

Washington, DC 20549

Attn: Stephen Krikorian and Morgan Youngwood

| | | |

| | Re: | Response to Comments on Airbee Wireless, Inc. |

| | | Forms 10-Q/A filed on November 19, 2008 |

| | | Form 10-Q filed on November 19, 2008 |

| | | Form 8-K/A filed on March 10, 2008 |

| | | File No. 000-50918 |

Dear Messrs. Krikorian and Youngwood:

In connection with our responses to the SEC comment letter dated December 11, 2008, the Company acknowledges the following regarding our above-captioned reports:

| · | The Company is responsible for the adequacy and accuracy of the disclosure in the filings; |

| · | Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filings; and |

| · | The Company may not assert staff comments and the declaration of effectiveness as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Sincerely,

/s/ E. Eugene Sharer

E. Eugene Sharer

Interim Chief Financial Officer

Exhibit 1 to May 6, 2009 Comment Letter Response

| 15. | Restatement |

| | |

| | The Company amended its previously issued condensed consolidated financial statements for the three months ended March 31, 2008 to recognize additional amortization expense of $203,038, the net amount of changes occasioned by the write-off of intellectual property and capitalized research and development in the amount of $227,201 and the recalculation of the discount on debt associated with the Bartfam and Empire Financial convertible debentures which resulted in a decrease of $24,163. In addition, the Company reclassified certain elements of deferred financing costs to warrant liability and convertible debenture discount on debt. The effect of these changes resulted in an increase of the loss for the three month period ended March 31, 2008 of $203,038 to a net loss of $1,315,799 and an increase in the accumulated deficit to $18,474,956. At March 31, 2008, total assets decreased by $805,306, of which $578,105 is attributable to the reclassification of deferred financing costs. There was no change in net loss per share for the three months ended March 31, 2008. The tables below reflect the application of these corrections. |

| Statement of Operations | |

| For the Three Months Ended March 31, 2008 | |

| | | | | | | | | | |

| | | As Originally Reported | | | As Adjusted | | | Effect of Change | |

| Sales | | $ | - | | | $ | - | | | $ | - | |

| Cost of Goods Sold | | | - | | | | - | | | | - | |

| Gross Profit | | | - | | | | - | | | | - | |

| Operating Expenses | | | | | | | | | | | | |

| Compensation & professional fees | | | 814,789 | | | | 814,789 | | | | - | |

| Stock option compensation expense | | | - | | | | - | | | | - | |

| Research and development | | | 25,000 | | | | 25,000 | | | | - | |

| Selling, general and administrative expenses | | | 158,770 | | | | 158,770 | | | | - | |

| Depreciation and amortization | | | 120,041 | | | | 323,079 | | | | 203,038 | |

| Total Operating Expenses | | | 1,118,600 | | | | 1,321,638 | | | | 203,038 | |

| Loss before Other Income (Expense) | | | (1,118,600 | ) | | | (1,321,638 | ) | | | (203,038 | ) |

| Other Income (Expense) | | | 5,839 | | | | 5,839 | | | | - | |

| Net Loss Applicable to Common Shares | | $ | (1,112,761 | ) | | $ | (1,315,799 | ) | | $ | (203,038 | ) |

Exhibit 1 to May 6, 2009 Comment Letter Response

| | |

| Balance Sheet | |

| March 31, 2008 | |

| | | | | | | | | | |

| ASSETS | |

| | | | | | | | | | |

| | | As Originally Reported | | | As Adjusted | | | Effect of Change | |

| Current Assets | | | | | | | | | |

| Cash and cash equivalents | | $ | 80,157 | | | $ | 80,157 | | | $ | - | |

| Accounts receivable, net | | | - | | | | - | | | | - | |

| Deferred financing costs - current | | | 344,154 | | | | 28,824 | | | | (315,330 | ) |

| Prepaid expenses and other current assets | | | 31,459 | | | | 31,459 | | | | - | |

| Total Current Assets | | | 455,770 | | | | 140,440 | | | | (315,330 | ) |

| | | | | | | | | | | | | |

| Fixed assets | | | 211,086 | | | | 211,086 | | | | - | |

| | | | | | | | | | | | | |

| Intangible assets | | | 227,666 | | | | 465 | | | | (227,201 | ) |

| Deferred financing costs | | | 306,010 | | | | 43,235 | | | | (262,775 | ) |

| Other assets | | | 75,451 | | | | 75,451 | | | | - | |

| | | | 609,127 | | | | 119,151 | | | | (489,976 | ) |

| | | | | | | | | | | | | |

| TOTAL ASSETS | | $ | 1,275,983 | | | $ | 470,677 | | | $ | (805,306 | ) |

| | | | | | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | |

| | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | |

| Current Liabilities | | | | | | | | | | | | |

| Notes payable - related parties | | $ | 59,483 | | | $ | 59,483 | | | $ | - | |

| Notes payable - other | | | 1,903,817 | | | | 1,903,817 | | | | - | |

| Litigation liability | | | 735,863 | | | | 735,863 | | | | - | |

| Fair value of derivatives | | | 374,304 | | | | 374,304 | | | | - | |

| Convertible debentures, net of discount | | | 105,798 | | | | 105,798 | | | | - | |

| Warrants liability | | | 709,940 | | | | 419,983 | | | | (289,957 | ) |

| Liability for stock to be issued | | | - | | | | - | | | | - | |

| Accounts payables and accrued expenses | | | 2,899,546 | | | | 2,899,546 | | | | - | |

| Total Current Liabilities | | | 6,788,751 | | | | 6,498,794 | | | | (289,957 | ) |

| | | | | | | | | | | | | |

| Long-term Liabilities | | | | | | | | | | | | |

| Convertible debentures, net of discount | | | 780,010 | | | | 467,699 | | | | (312,311 | ) |

| | | | | | | | | | | | | |

| TOTAL LIABILITIES | | | 7,568,761 | | | | 6,966,493 | | | | (602,268 | ) |

| | | | | | | | | | | | | |

| STOCKHOLDERS' DEFICIT | | | | | | | | | | | | |

| Common stock | | | 4,400 | | | | 4,400 | | | | - | |

| Additional paid-in capital | | | 12,175,179 | | | | 12,175,179 | | | | - | |

| Unearned compensation | | | (6,105 | ) | | | (6,105 | ) | | | - | |

| Other accumulated comprehensive income | | | 103,205 | | | | 103,205 | | | | - | |

| Accumulated deficit | | | (18,271,918 | ) | | | (18,474,956 | ) | | | (203,038 | ) |

| Treasury stock | | | (297,539 | ) | | | (297,539 | ) | | | - | |

| Total Stockholders' Deficit | | | (6,292,778 | ) | | | (6,495,816 | ) | | | (203,038 | ) |

| | | | | | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS DEFICIT | | $ | 1,275,983 | | | $ | 470,677 | | | $ | (805,306 | ) |

Exhibit 1 to May 6, 2009 Comment Letter Response

The Company amended its previously issued condensed consolidated financial statements for the three months ended March 31, 2007 to recognize additional compensation and professional fees of $51,667 and to record a liability for stock to be issued in the amount of $510,000 offset by a contra-equity prepaid consulting account totaling $458,333. The effect of these changes resulted in an increase of the loss for the three month period ended March 31, 2007 of $51,667 to a net loss of $1,247,652 and an increase in the accumulated deficit to $12,640,293. The tables below reflect these corrections.

| Statement of Operations | |

| For the Three Months Ended March 31, 2007 | |

| | | | | | | | | | |

| | | As Originally Reported | | | As Adjusted | | | Effect of Change | |

| Sales | | $ | 20,790 | | | $ | 20,790 | | | $ | - | |

| Cost of Goods Sold | | | - | | | | - | | | | - | |

| Gross Profit | | | 20,790 | | | | 20,790 | | | | - | |

| Operating Expenses | | | | | | | | | | | | |

| Compensation & professional fees | | | 475,448 | | | | 527,115 | | | | 51,667 | |

| Stock option compensation expense | | | 469 | | | | 469 | | | | - | |

| Research and development | | | 4,842 | | | | 4,842 | | | | - | |

| Selling, general and administrative expenses | | | 202,094 | | | | 202,094 | | | | - | |

| Depreciation and amortization | | | 55,685 | | | | 55,685 | | | | - | |

| Total Operating Expenses | | | 738,538 | | | | 790,205 | | | | 51,667 | |

| Loss before Other Income (Expense) | | | (717,748 | ) | | | (769,415 | ) | | | (51,667 | ) |

| Other Income (Expense) | | | (478,237 | ) | | | (478,237 | ) | | | - | |

| Net Loss Applicable to Common Shares | | $ | (1,195,985 | ) | | $ | (1,247,652 | ) | | $ | (51,667 | ) |

Exhibit 1 to May 6, 2009 Comment Letter Response

| Balance Sheet | |

| March 31, 2007 | |

| | | | | | | | | | |

| ASSETS | |

| | | | | | | | | | |

| | | As Originally Reported | | | As Adjusted | | | Effect of Change | |

| Current Assets | | | | | | | | | |

| Cash and cash equivalents | | $ | - | | | $ | - | | | $ | - | |

| Accounts receivable, net | | | 10,395 | | | | 10,395 | | | | - | |

| Deferred financing costs - current | | | - | | | | - | | | | - | |

| Prepaid expenses and other current assets | | | 3,455 | | | | 3,455 | | | | - | |

| Total Current Assets | | | 13,850 | | | | 13,850 | | | | - | |

| | | | | | | | | | | | | |

| Fixed assets | | | 231,575 | | | | 231,575 | | | | - | |

| | | | | | | | | | | | | |

| Intangible assets | | | 392,650 | | | | 392,650 | | | | - | |

| Deferred financing costs | | | 11,595 | | | | 11,595 | | | | - | |

| Other assets | | | 55,266 | | | | 55,266 | | | | - | |

| | | | 459,511 | | | | 459,511 | | | | - | |

| | | | | | | | | | | | | |

| TOTAL ASSETS | | $ | 704,936 | | | $ | 704,936 | | | $ | - | |

| | | | | | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | |

| | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | |

| Current Liabilities | | | | | | | | | | | | |

| Notes payable - related parties | | $ | 120,109 | | | $ | 120,109 | | | $ | - | |

| Notes payable - other | | | 1,016,714 | | | | 1,016,714 | | | | - | |

| Litigation liability | | | 217,268 | | | | 217,268 | | | | - | |

| Fair value of derivatives | | | 689,517 | | | | 689,517 | | | | - | |

| Convertible debentures, net of discount | | | 218,750 | | | | 218,750 | | | | - | |

| Warrants liability | | | 987,804 | | | | 987,804 | | | | - | |

| Liability for stock to be issued | | | - | | | | 510,000 | | | | 510,000 | |

| Accounts payables and accrued expenses | | | 1,962,597 | | | | 1,962,597 | | | | - | |

| Total Current Liabilities | | | 5,212,759 | | | | 5,722,759 | | | | 510,000 | |

| | | | | | | | | | | | | |

| TOTAL LIABILITIES | | | 5,212,759 | | | | 5,722,759 | | | | 510,000 | |

| | | | | | | | | | | | | |

| STOCKHOLDERS' DEFICIT | | | | | | | | | | | | |

| Common stock | | | 3,257 | | | | 3,257 | | | | - | |

| Additional paid-in capital | | | 8,372,747 | | | | 8,372,747 | | | | - | |

| Unearned compensation | | | (18,562 | ) | | | (18,562 | ) | | | - | |

| Prepaid consulting | | | - | | | | (458,333 | ) | | | (458,333 | ) |

| Other accumulated comprehensive income | | | 20,404 | | | | 20,404 | | | | - | |

| Accumulated deficit | | | (12,588,626 | ) | | | (12,640,293 | ) | | | (51,667 | ) |

| Treasury stock | | | (297,043 | ) | | | (297,043 | ) | | | - | |

| Total Stockholders' Deficit | | | (4,507,823 | ) | | | (5,017,823 | ) | | | (510,000 | ) |

| | | | | | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS DEFICIT | | $ | 704,936 | | | $ | 704,936 | | | $ | - | |

Exhibit 2 to May 6, 2009 Comment Letter Response

15. Restatement

The Company amended its previously issued condensed consolidated financial statements for the six months ended June 30, 2008 to recognize additional amortization expense of $122,249, the net amount of changes occasioned by the write-off of intellectual property and capitalized research and development in the amount of $227,201 and the recalculation of the discount on debt associated with the Bartfam and Empire Financial convertible debentures which resulted in a decrease in the amount recognized of $104,952. In addition, the Company reclassified certain elements of deferred financing costs to warrant liability and convertible debenture discount on debt. The effect of these changes resulted in an increase in the loss for the six month period ended June 30, 2008 of $122.249 to a net loss of $1,239,709 and an decrease in the accumulated deficit to $18,398,866. There was no change in net loss per share for the six months ended June 30, 2008.

The Company amended its previously issued condensed consolidated financial statements for the three months ended June 30, 2008 to reduce the amortization of discount on debt resulting from the recalculation of the discount on debt associated with the Bartfam and Empire Financial convertible debentures. In addition, the Company reclassified certain elements of deferred financing costs to warrant liability and convertible debenture discount on debt. The effect of these changes resulted in a decrease in the loss for the three month period ended June 30, 2008 of $80,789 to a net income of $76,091 and a decrease in the accumulated deficit to $18,398,866. There was no change in net loss per share for the three months ended June 30, 2008.

| Statement of Operations | |

| For the Six Months Ended June 30, 2008 | |

| | | | | | | | | | |

| | | As Originally Reported | | | As Adjusted | | | Effect of Change | |

| Sales | | $ | 40,000 | | | $ | 40,000 | | | $ | - | |

| Cost of Goods Sold | | | - | | | | - | | | | - | |

| Gross Profit | | | 40,000 | | | | 40,000 | | | | - | |

| Operating Expenses | | | | | | | | | | | | |

| Compensation & professional fees | | | 1,666,246 | | | | 1,666,246 | | | | - | |

| Stock option compensation expense | | | 1,521 | | | | 1,521 | | | | - | |

| Research and development | | | 60,000 | | | | 60,000 | | | | - | |

| Selling, general and administrative expenses | | | 444,503 | | | | 444,503 | | | | - | |

| Depreciation and amortization | | | 282,173 | | | | 404,422 | | | | 122,249 | |

| Total Operating Expenses | | | 2,454,443 | | | | 2,576,692 | | | | 122,249 | |

| Loss before Other Income (Expense) | | | (2,414,443 | ) | | | (2,536,692 | ) | | | (122,249 | ) |

| Other Income (Expense) | | | 1,296,983 | | | | 1,296,983 | | | | - | |

| Net Loss Applicable to Common Shares | | $ | (1,117,460 | ) | | $ | (1,239,709 | ) | | $ | (122,249 | ) |

| Statement of Operations | |

| For the Three Months Ended June 30, 2008 | |

| | | | | | | | | | |

| | | As Originally Reported | | | As Adjusted | | | Effect of Change | |

| Sales | | $ | 40,000 | | | $ | 40,000 | | | $ | - | |

| Cost of Goods Sold | | | - | | | | - | | | | - | |

| Gross Profit | | | 40,000 | | | | 40,000 | | | | - | |

| Operating Expenses | | | | | | | | | | | | |

| Compensation & professional fees | | | 851,456 | | | | 851,456 | | | | - | |

| Stock option compensation expense | | | 1,521 | | | | 1,521 | | | | - | |

| Research and development | | | 35,000 | | | | 35,000 | | | | - | |

| Selling, general and administrative expenses | | | 285,733 | | | | 285,733 | | | | - | |

| Depreciation and amortization | | | 162,132 | | | | 81,343 | | | | (80,789 | ) |

| Total Operating Expenses | | | 1,335,842 | | | | 1,255,053 | | | | (80,789 | ) |

| Loss before Other Income (Expense) | | | (1,295,842 | ) | | | (1,215,053 | ) | | | 80,789 | |

| Other Income (Expense) | | | 1,291,144 | | | | 1,291,144 | | | | - | |

| Net Loss Applicable to Common Shares | | $ | (4,698 | ) | | $ | 76,091 | | | $ | 80,789 | |

Exhibit 2 to May 6, 2009 Comment Letter Response

| Balance Sheet | |

| June 30, 2008 | |

| | | | | | | | | | |

| ASSETS | |

| | | | | | | | | | |

| | | As Originally Reported | | | As Adjusted | | | Effect of Change | |

| Current Assets | | | | | | | | | |

| Cash and cash equivalents | | $ | 87,481 | | | $ | 87,481 | | | $ | - | |

| Accounts receivable, net | | | 40,000 | | | | 40,000 | | | | - | |

| Deferred financing costs - current | | | 482,045 | | | | 28,824 | | | | (453,221 | ) |

| Prepaid expenses and other current assets | | | 31,525 | | | | 31,525 | | | | - | |

| Total Current Assets | | | 641,051 | | | | 187,830 | | | | (453,221 | ) |

| | | | | | | | | | | | | |

| Fixed assets | | | 206,060 | | | | 206,060 | | | | - | |

| | | | | | | | | | | | | |

| Intangible assets | | | 196,405 | | | | 10,450 | | | | (185,955 | ) |

| Deferred financing costs | | | 341,146 | | | | 36,029 | | | | (305,117 | ) |

| Other assets | | | 70,397 | | | | 70,397 | | | | - | |

| | | | 607,948 | | | | 116,876 | | | | (491,072 | ) |

| | | | | | | | | | | | | |

| TOTAL ASSETS | | $ | 1,455,059 | | | $ | 510,766 | | | $ | (944,293 | ) |

| | | | | | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | |

| | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | |

| Current Liabilities | | | | | | | | | | | | |

| Notes payable - related parties | | $ | 55,389 | | | $ | 55,389 | | | $ | - | |

| Notes payable - other | | | 456,100 | | | | 456,100 | | | | - | |

| Litigation liability | | | - | | | | - | | | | - | |

| Fair value of derivatives | | | 392,485 | | | | 392,485 | | | | - | |

| Convertible debentures, net of discount | | | 1,751,004 | | | | 31,798 | | | | (1,719,206 | ) |

| Warrants liability | | | 1,193,532 | | | | 843,485 | | | | (350,047 | ) |

| Liability for stock to be issued | | | - | | | | - | | | | - | |

| Accounts payables and accrued expenses | | | 3,067,848 | | | | 3,067,848 | | | | - | |

| Total Current Liabilities | | | 6,916,358 | | | | 4,847,105 | | | | (2,069,253 | ) |

| | | | | | | | | | | | | |

| Long-term Liabilities | | | | | | | | | | | | |

| Convertible debentures, net of discount | | | 1,326,962 | | | | 2,574,171 | | | | 1,247,209 | |

| | | | | | | | | | | | | |

| TOTAL LIABILITIES | | | 8,243,320 | | | | 7,421,276 | | | | (822,044 | ) |

| | | | | | | | | | | | | |

| STOCKHOLDERS' DEFICIT | | | | | | | | | | | | |

| Common stock | | | 4,953 | | | | 4,953 | | | | - | |

| Additional paid-in capital | | | 11,756,295 | | | | 11,756,295 | | | | - | |

| Unearned compensation | | | (5,555 | ) | | | (5,555 | ) | | | - | |

| Other accumulated comprehensive income | | | 30,202 | | | | 30,202 | | | | - | |

| Accumulated deficit | | | (18,276,617 | ) | | | (18,398,866 | ) | | | (122,249 | ) |

| Treasury stock | | | (297,539 | ) | | | (297,539 | ) | | | - | |

| Total Stockholders' Deficit | | | (6,788,261 | ) | | | (6,910,510 | ) | | | (122,249 | ) |

| | | | | | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS DEFICIT | | $ | 1,455,059 | | | $ | 510,766 | | | $ | (944,293 | ) |

Exhibit 2 to May 6, 2009 Comment Letter Response

The Company amended its previously issued condensed consolidated financial statements for the six months ended June 30, 2007 to recognize additional compensation and professional fees of $206,667 and to record a liability for stock to be issued in the amount of $540,000 offset by a contra-equity prepaid consulting account totaling $333,333. There was no change in net loss per share for the six months ended June 30, 2007. The effect of these changes resulted in an increase of the loss for the six month period ended June 30, 2007 of $206,667 to a net loss of $2,970,917 and an increase in the accumulated deficit to $14,363,558.

The Company amended its previously issued condensed consolidated financial statements for the three months ended June 30, 2007 to recognize additional compensation and professional fees of $155,000 and to record a liability for stock to be issued in the amount of $30,000 offset by a contra-equity prepaid consulting account totaling $333,333. There was no change in net loss per share for the six months ended June 30, 2007. The effect of these changes resulted in an increase of the loss for the three month period ended June 30, 2007 of $155,000 to a net loss of $1,723,265 and an increase in the accumulated deficit to $14,363,558.

| |

| For the Six Months Ended June 30, 2007 | |

| | | | | | | | | | |

| | | As Originally Reported | | | As Adjusted | | | Effect of Change | |

| Sales | | $ | 23,238 | | | $ | 23,238 | | | $ | - | |

| Cost of Goods Sold | | | - | | | | - | | | | - | |

| Gross Profit | | | 23,238 | | | | 23,238 | | | | - | |

| Operating Expenses | | | | | | | | | | | | |

| Compensation & professional fees | | | 1,580,013 | | | | 1,786,680 | | | | 206,667 | |

| Stock option compensation expense | | | 27,965 | | | | 27,965 | | | | - | |

| Research and development | | | 10,432 | | | | 10,432 | | | | - | |

| Selling, general and administrative expenses | | | 684,767 | | | | 684,767 | | | | - | |

| Depreciation and amortization | | | 98,989 | | | | 98,989 | | | | - | |

| Total Operating Expenses | | | 2,402,166 | | | | 2,608,833 | | | | 206,667 | |

| Loss before Other Income (Expense) | | | (2,378,928 | ) | | | (2,585,595 | ) | | | (206,667 | ) |

| Other Income (Expense) | | | (385,322 | ) | | | (385,322 | ) | | | - | |

| Net Loss Applicable to Common Shares | | $ | (2,764,250 | ) | | $ | (2,970,917 | ) | | $ | (206,667 | ) |

| Statement of Operations | |

| For the Three Months Ended June 30, 2007 | |

| | | | | | | | | | |

| | | As Originally Reported | | | As Adjusted | | | Effect of Change | |

| Sales | | $ | 2,448 | | | $ | 2,448 | | | $ | - | |

| Cost of Goods Sold | | | - | | | | - | | | | - | |

| Gross Profit | | | 2,448 | | | | 2,448 | | | | - | |

| Operating Expenses | | | | | | | | | | | | |

| Compensation & professional fees | | | 1,104,565 | | | | 1,259,565 | | | | 155,000 | |

| Stock option compensation expense | | | 27,496 | | | | 27,496 | | | | - | |

| Research and development | | | 5,590 | | | | 5,590 | | | | - | |

| Selling, general and administrative expenses | | | 482,673 | | | | 482,673 | | | | - | |

| Depreciation and amortization | | | 43,304 | | | | 43,304 | | | | - | |

| Total Operating Expenses | | | 1,663,628 | | | | 1,818,628 | | | | 155,000 | |

| Loss before Other Income (Expense) | | | (1,661,180 | ) | | | (1,816,180 | ) | | | (155,000 | ) |

| Other Income (Expense) | | | 92,915 | | | | 92,915 | | | | - | |

| Net Loss Applicable to Common Shares | | $ | (1,568,265 | ) | | $ | (1,723,265 | ) | | $ | (155,000 | ) |

Exhibit 2 to May 6, 2009 Comment Letter Response

| Balance Sheet | |

| June 30, 2007 | |

| | | | | | | | | | |

| ASSETS | |

| | | | | | | | | | |

| | | As Originally Reported | | | As Adjusted | | | Effect of Change | |

| Current Assets | | | | | | | | | |

| Cash and cash equivalents | | $ | 14,953 | | | $ | 14,953 | | | $ | - | |

| Accounts receivable, net | | | 2,448 | | | | 2,448 | | | | - | |

| Deferred financing costs - current | | | - | | | | - | | | | - | |

| Prepaid expenses and other current assets | | | 6,092 | | | | 6,092 | | | | - | |

| Total Current Assets | | | 23,493 | | | | 23,493 | | | | - | |

| | | | | | | | | | | | | |

| Fixed assets | | | 236,555 | | | | 236,555 | | | | - | |

| | | | | | | | | | | | | |

| Intangible assets | | | 351,403 | | | | 351,403 | | | | - | |

| Deferred financing costs | | | 7,731 | | | | 7,731 | | | | - | |

| Other assets | | | 62,280 | | | | 62,280 | | | | - | |

| | | | 421,414 | | | | 421,414 | | | | - | |

| | | | | | | | | | | | | |

| TOTAL ASSETS | | $ | 681,462 | | | $ | 681,462 | | | $ | - | |

| | | | | | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | |

| | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | |

| Current Liabilities | | | | | | | | | | | | |

| Notes payable - related parties | | $ | 128,090 | | | $ | 128,090 | | | $ | - | |

| Notes payable - other | | | 1,625,444 | | | | 1,625,444 | | | | - | |

| Montgomery settlement liability | | | 203,737 | | | | 203,737 | | | | - | |

| Litigation liability | | | 500,000 | | | | 500,000 | | | | - | |

| Fair value of derivatives | | | 663,830 | | | | 663,830 | | | | - | |

| Convertible debentures, net of discount | | | 412,500 | | | | 412,500 | | | | - | |

| Warrants liability | | | 616,202 | | | | 616,202 | | | | - | |

| Liability for stock to be issued | | | - | | | | 540,000 | | | | 540,000 | |

| Accounts payables and accrued expenses | | | 2,055,121 | | | | 2,055,121 | | | | - | |

| Total Current Liabilities | | | 6,204,924 | | | | 6,744,924 | | | | 540,000 | |

| | | | | | | | | | | | | |

| Long-term Liabilities | | | | | | | | | | | | |

| Convertible debentures, net of discount | | | 0 | | | | 0 | | | | - | |

| | | | | | | | | | | | | |

| TOTAL LIABILITIES | | | 6,204,924 | | | | 6,744,924 | | | | 540,000 | |

| | | | | | | | | | | | | |

| STOCKHOLDERS' DEFICIT | | | | | | | | | | | | |

| Common stock | | | 4,669 | | | | 4,669 | | | | - | |

| Additional paid-in capital | | | 13,146,321 | | | | 13,146,321 | | | | - | |

| Unearned compensation | | | (14,570 | ) | | | (14,570 | ) | | | - | |

| Prepaid consulting | | | - | | | | (333,333 | ) | | | (333,333 | ) |

| Other accumulated comprehensive income | | | 10,803 | | | | 10,803 | | | | - | |

| Share issued for deferred financing, net of discount | | | (4,216,751 | ) | | | (4,216,751 | ) | | | | |

| Accumulated deficit | | | (14,156,891 | ) | | | (14,363,558 | ) | | | (206,667 | ) |

| Treasury stock | | | (297,043 | ) | | | (297,043 | ) | | | - | |

| Total Stockholders' Deficit | | | (5,523,462 | ) | | | (6,063,462 | ) | | | (540,000 | ) |

| | | | | | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS DEFICIT | | $ | 681,462 | | | $ | 681,462 | | | $ | - | |

Exhibit 3 to May 6, 2009 Comment Letter Response

Exhibit 3 to May 6, 2009 Comment Letter Response

Exhibit 4 to May 6, 2009 Comment Letter Response

15. Restatement

The Company amended its previously issued condensed consolidated financial statement for the nine months ended September 30, 2007 to recognize additional compensation and professional fees of $181,031 and additional selling, general and administrative expense of $455. The effect of these changes resulted in an increase of the loss for the nine month period ended September 30, 2007 of $181,486 to a net loss of $4,372,043 and an increase in the accumulated deficit to $15,764,684. There was no change in net loss per share for the nine months ended September 30, 2007.

The Company amended its previously issued condensed consolidated financial statement for the three months ended September 30, 2007 to recognize additional compensation and professional fees of $125,000 and to reclassify items among research and development, selling, general and administrative, depreciation and amortization and other income (expense). The effect of these changes resulted in an increase of the loss for the three month period ended September 30, 2007 of $125,000 to a net loss of $1,401,125 and an increase in the accumulated deficit to $15,764,684. There was no change in net loss per share for the three months ended September 30, 2007. The tables below show the effects of these changes on the financial statement items.

| Statement of Operations | |

| For the Nine Months Ended September 30, 2007 | |

| | | | | | | | | | |

| | | As Originally Reported | | | As Adjusted | | | Effect of Change | |

| Sales | | $ | 29,163 | | | $ | 29,163 | | | $ | - | |

| Cost of Goods Sold | | | - | | | | - | | | | - | |

| Gross Profit | | | 29,163 | | | | 29,163 | | | | - | |

| Operating Expenses | | | | | | | | | | | | |

| Compensation & professional fees | | | 2,892,780 | | | | 2,711,749 | | | | (181,031 | ) |

| Stock option compensation expense | | | 27,965 | | | | 27,965 | | | | - | |

| Research and development | | | 10,556 | | | | 10,556 | | | | - | |

| Selling, general and administrative expenses | | | 1,136,809 | | | | 1,136,354 | | | | (455 | ) |

| Depreciation and amortization | | | 146,955 | | | | 146,955 | | | | - | |

| Total Operating Expenses | | | 4,215,065 | | | | 4,033,579 | | | | (181,486 | ) |

| Loss before Other Income (Expense) | | | (4,185,902 | ) | | | (4,004,416 | ) | | | 181,486 | |

| Other Income (Expense) | | | (367,627 | ) | | | (367,627 | ) | | | - | |

| Net Loss Applicable to Common Shares | | $ | (4,553,529 | ) | | $ | (4,372,043 | ) | | $ | 181,486 | |

| Statement of Operations | |

| For the Three Months Ended September 30, 2007 | |

| | | | | | | | | | |

| | | As Originally Reported | | | As Adjusted | | | Effect of Change | |

| Sales | | $ | 5,925 | | | $ | 5,925 | | | $ | - | |

| Cost of Goods Sold | | | - | | | | - | | | | - | |

| Gross Profit | | | 5,925 | | | | 5,925 | | | | - | |

| Operating Expenses | | | | | | | | | | | | |

| Compensation & professional fees | | | 800,068 | | | | 925,068 | | | | 125,000 | |

| Stock option compensation expense | | | - | | | | - | | | | - | |

| Research and development | | | 34 | | | | 124 | | | | 90 | |

| Selling, general and administrative expenses | | | 423,728 | | | | 451,587 | | | | 27,859 | |

| Depreciation and amortization | | | 75,378 | | | | 47,966 | | | | (27,412 | ) |

| Total Operating Expenses | | | 1,299,208 | | | | 1,424,745 | | | | 125,537 | |

| Loss before Other Income (Expense) | | | (1,293,283 | ) | | | (1,418,820 | ) | | | (125,537 | ) |

| Other Income (Expense) | | | 17,158 | | | | 17,695 | | | | 537 | |

| Net Loss Applicable to Common Shares | | $ | (1,276,125 | ) | | $ | (1,401,125 | ) | | $ | (125,000 | ) |

Exhibit 4 to May 6, 2009 Comment Letter Response

| Balance Sheet | |

| September 30, 2007 | |

| | | | | | | | | | |

| ASSETS | |

| | | | | | | | | | |

| | | As Originally Reported | | | As Adjusted | | | Effect of Change | |

| Current Assets | | | | | | | | | |

| Cash and cash equivalents | | $ | 8,205 | | | $ | 8,205 | | | $ | - | |

| Accounts receivable, net | | | - | | | | - | | | | - | |

| Prepaid expenses and other current assets | | | 5,181 | | | | 213,514 | | | | 208,333 | |

| Total Current Assets | | | 13,386 | | | | 221,719 | | | | 208,333 | |

| | | | | | | | | | | | | |

| Fixed assets | | | 228,579 | | | | 228,579 | | | | - | |

| | | | | | | | | | | | | |

| Intangible assets | | | 310,157 | | | | 310,157 | | | | - | |

| Deferred financing costs | | | 3,867 | | | | 3,867 | | | | - | |

| Other assets | | | 63,727 | | | | 63,727 | | | | - | |

| | | | 377,751 | | | | 377,751 | | | | - | |

| | | | | | | | | | | | | |

| TOTAL ASSETS | | $ | 619,716 | | | $ | 828,049 | | | $ | 208,333 | |

| | | | | | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' DEFICIT | |

| | | | | | | | | | | | | |

| LIABILITIES | | | | | | | | | | | | |

| Current Liabilities | | | | | | | | | | | | |

| Notes payable - related parties | | $ | 137,974 | | | $ | 137,974 | | | $ | - | |

| Notes payable - other | | | 1,852,130 | | | | 1,852,130 | | | | - | |

| Litigation liability | | | 700,000 | | | | 700,000 | | | | - | |

| Fair value of derivatives | | | 421,415 | | | | 421,415 | | | | - | |

| Convertible debentures, net of discount | | | 156,250 | | | | 156,250 | | | | - | |

| Warrants liability | | | 185,540 | | | | 185,540 | | | | - | |

| Liability for stock to be issued | | | 70,000 | | | | 70,000 | | | | - | |

| Accounts payables and accrued expenses | | | 2,586,942 | | | | 2,613,789 | | | | 26,847 | |

| Total Current Liabilities | | | 6,110,251 | | | | 6,137,098 | | | | 26,847 | |

| | | | | | | | | | | | | |

| Long-term Liabilities | | | | | | | | | | | | |

| Convertible debentures, net of discount | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | |

| TOTAL LIABILITIES | | | 6,110,251 | | | | 6,137,098 | | | | 26,847 | |

| | | | | | | | | | | | | |

| STOCKHOLDERS' DEFICIT | | | | | | | | | | | | |

| Common stock | | | 4,211 | | | | 4,211 | | | | - | |

| Additional paid-in capital | | | 14,920,231 | | | | 14,920,231 | | | | - | |

| Unearned compensation | | | (10,578 | ) | | | (10,578 | ) | | | - | |

| Other accumulated comprehensive income | | | 56,061 | | | | 56,061 | | | | - | |

| Share issued for deferred financing, net of discount | | | (4,216,751 | ) | | | (4,216,751 | ) | | | | |

| Accumulated deficit | | | (15,946,170 | ) | | | (15,764,684 | ) | | | 181,486 | |

| Treasury stock | | | (297,539 | ) | | | (297,539 | ) | | | - | |

| Total Stockholders' Deficit | | | (5,490,535 | ) | | | (5,309,049 | ) | | | 181,486 | |

| | | | | | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS DEFICIT | | $ | 619,716 | | | $ | 828,049 | | | $ | 208,333 | |