UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission File No. 333-127405

CB RICHARD ELLIS REALTY TRUST

(Exact name of registrant as specified in its charter)

| | |

| Maryland | | 56-2466617 |

(State or other jurisdiction incorporation or organization) | | (I.R.S. Employer of Identification No.) |

515 South Flower Street, Suite 3100, Los Angeles, California 90071

(Address of principal executive offices—zip code)

(609) 683-4900

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| None | | Not Applicable |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small company filer. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated Filer ¨ Non-accelerated filer x Small reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x.

Since there was no established market for the voting and non-voting common shares as of June 30, 2007, there was no market value for the common shares held by non-affiliates of the registrant as of such date.

The number of shares outstanding of the registrant’s common shares, $0.01 par value, was 36,487,535 as of March 17, 2008.

CB RICHARD ELLIS REALTY TRUST

FORM 10-K

TABLE OF CONTENTS

PART I

Overview

CB Richard Ellis Realty Trust is a Maryland real estate investment trust that invests in real estate properties, focusing on office, retail, industrial and multi-family residential properties, as well as other real estate-related assets. As of December 31, 2007, we owned 44 office and industrial properties located in seven states (California, Georgia, Illinois, Massachusetts, North Carolina, South Carolina and Texas) and in the United Kingdom, as well as one undeveloped land parcel in Georgia. In addition, we have an ownership interest in an unconsolidated strategic partnership that, as of December 31, 2007, owned interests in six properties located in China and Japan.

We commenced operations in July 2004, following an initial private placement of our common shares of beneficial interest. We raised aggregate net proceeds (after commissions and expenses) of approximately $55,500,000 from July 2004 to October 2004 in private placements of our common shares. On October 24, 2006, we commenced an initial public offering of up to $2,000,000,000 in our common shares, 90% of which are offered at a price of $10.00 per share, and 10% of which are offered pursuant to our dividend reinvestment plan at a purchase price equal to the higher of $9.50 per share or 95% of the fair market value of a common share on the reinvestment date, as determined by CBRE Advisors LLC (“Investment Advisor”), or another firm we choose for that purpose. As of March 17, 2008, we had accepted subscriptions from 6,301 investors, issued 29,605,822 common shares and received $295,895,114 in gross proceeds.

We are an externally managed REIT. The Investment Advisor is responsible for managing our affairs on a day-to-day basis and for identifying and making acquisitions on our behalf. The Investment Advisor performs advisory services relating to real estate acquisitions, property management and communications with existing investors and, in addition, receives marketing and other operational services from CNL Fund Management Company, an affiliate of CNL Securities Corp (the “Dealer Manager”) pursuant to a sub-advisory agreement. We hold all of our real estate investments directly or indirectly through our operating partnership, CBRE Operating Partnership, L.P. (“CBRE OP”).

We benefit from the investment expertise and experience of the Investment Advisor, which is an affiliate of our sponsor CB Richard Ellis Investors, L.L.C. (“CBRE Investors”). CBRE Investors is a real estate investment management company and a registered investment advisor with the Securities and Exchange Commission, or the SEC. CBRE Investors is a wholly-owned subsidiary of CB Richard Ellis Group, Inc. (NYSE: CBG), or CB Richard Ellis. We have elected to be taxed as a real estate investment trust, or REIT, for U.S. federal income tax purposes. As a REIT, our company generally will not be subject to U.S. federal income tax on that portion of income that is distributed to shareholders if at least 90% of our company’s REIT taxable income is distributed to our shareholders.

Unless the context otherwise requires or indicates, references to “CBRE REIT,” “we,” “our” and “us” refer to the activities of and the assets and liabilities of the business and operations of CB Richard Ellis Realty Trust and its subsidiaries.

Investment Objectives

We invest in real estate properties, focusing on office, retail, industrial and multi-family residential properties, as well as certain other real estate-related assets. Our investment objectives are:

| | • | | to maximize cash dividends paid to you; |

| | • | | to preserve and protect your capital contributions; |

| | • | | to realize growth in the value of our assets upon our ultimate sale of such assets; and |

1

| | • | | to provide you with the potential for future liquidity by (i) listing our shares on a national securities exchange, the Nasdaq Global Select Market or the Nasdaq Global Market or (ii) if a listing has not occurred on or before December 31, 2011 our board of trustees must consider (but is not required to) commencing an orderly liquidation of our assets. |

We cannot assure you that we will attain these objectives or that our capital will not decrease. We may not change our investment objectives, except upon approval of shareholders holding a majority of our outstanding shares.

Acquisition and Investment Policies

We employ an enhanced income investment strategy designed to maximize risk-adjusted returns. To do so, we purchase, actively manage and sell properties located in the business districts and suburban markets of major metropolitan areas. Our primary focus is on office, industrial, retail and multi-family residential properties. The number and aggregate purchase price of properties we acquire in each asset class will depend upon real estate and market conditions and other circumstances existing at the time we acquire assets.

Our office portfolio may include properties such as multi-tenant, single-tenant and sale leasebacks, office parks and portfolios, newly constructed, corporate/user activity, medical office, technology/telecommunication, redevelopments and stabilized operations. Our retail portfolio may encompass regional malls, power centers, community centers, grocery-anchored strips, freestanding stores, urban properties, single assets and multiple property portfolios. Our industrial portfolio may consist of warehouse, office/showroom, research and development facilities, distribution, manufacturing, single tenant and sale leasebacks and corporate/user activity properties. Our multi-family residential portfolio may include garden complexes, townhouse developments, mid/high-rise towers, newly constructed and redevelopment properties, single assets and multi-property portfolios.

Our investment strategy is centered on CBRE Investors’ research-driven approach. We focus on the property types and markets identified as most compelling by CBRE Investors’ research. As a result, we believe that our opportunities will evolve over time as market conditions change.

All assets may be acquired, developed and operated by us on a stand-alone basis or jointly with another party. Development, if undertaken, will only be done with an experienced joint venture partner. We may enter into one or more joint ventures with an affiliate of the Investment Advisor or the acquisition of assets with an affiliate.

We hold all of our real estate investments directly or indirectly through our operating partnership, CBRE OP. We are the sole general partner of CBRE OP. Our ownership of properties in CBRE OP is referred to as an Umbrella Partnership REIT, or “UPREIT.” We believe the UPREIT structure is a competitive advantage for us when seeking to acquire assets, because it allows sellers of properties to defer gain recognition for U.S. federal income tax purposes by contributing properties to CBRE OP in return for an interest therein.

Although we are not limited as to the form our investments may take, our investments in real estate generally take the form of holding fee title or a long-term leasehold estate in the properties we acquire. We acquire such interests either directly in CBRE OP or indirectly by acquiring membership interests in, or acquisitions of property through, limited liability companies or through investments in joint ventures, partnerships, co-tenancies or other co-ownership arrangements with developers of properties, affiliates of the Investment Advisor or other persons. In addition, we may purchase properties and lease them back to the sellers of such properties.

We also may invest in or make mortgage loans, subject to the investment limitations contained in our declaration of trust and as limited by the Internal Revenue Code provisions applicable to REITs. The circumstances in which we believe we may invest in or make mortgage loans are limited to the following:

| | • | | the making of a mortgage loan required by a property owner as a condition to our purchase of a property; |

2

| | • | | the indirect acquisition of a mortgage by purchasing an entity, such as a REIT or other real estate company, that also owns a mortgage; and |

| | • | | the acquisition of a mortgage with the view of acquiring the underlying property through foreclosure. |

We are not limited as to the geographic area where we may conduct our operations and we seek to maintain a portfolio of geographically-diverse assets. We currently intend to invest primarily in properties located in the business districts and suburban markets of major metropolitan areas in the United States, but may, under appropriate circumstances, invest up to 30% of our total assets outside of the United States. Investments outside the United States are expected to be focused in locations in which CBRE Investors has existing operations or previous investment experience, which today consist of metropolitan markets in Western Europe (including London, Paris, Milan and Frankfurt), China (Shanghai and Beijing) and Japan. To the extent that we enter markets outside of the United States in which CBRE Investors does not already have existing operations or previous investment experience, we would expect to do so in partnership, utilizing joint venture or other structures, with entities that have significant existing local expertise in these markets. We expect that our international investments will focus on properties typically located in significant business districts and suburban markets.

We may purchase existing assets with an operating history, newly constructed properties or assets under construction. We will not invest more than 20% of our total assets in any single investment. Except for this limitation on our ability to invest in excess of 20% of our total assets in any single investment, after the initial startup activities, we are not specifically limited in the number or size of investments we may acquire or on the percentage of net proceeds of our initial public offering that we may invest in a single investment. It is our intent over time to build a diversified portfolio of assets. However, the number and mix of assets we acquire will depend upon real estate and market conditions and other circumstances existing at the time we acquire assets and the amount of proceeds we raise in our initial public offering. In making investment decisions for us, the Investment Advisor considers relevant risks and financial factors, including the creditworthiness of major tenants, the expected levels of rental and occupancy rates, current and projected cash flow of the property, the location, condition and use of the property, suitability for any development contemplated or in progress, income-producing capacity, the prospects for long-range appreciation, liquidity and income tax considerations. In addition to these factors, the Investment Advisor, when evaluating prospective mortgage loan investments, will consider the ratio of the amount of the investment to the value of the property by which it is selected and the quality, experience and creditworthiness of the borrower. The Investment Advisor also utilizes the resources and professionals of CBRE Investors and consults with its investment committee when evaluating potential investments. In this regard, the Investment Advisor has substantial discretion with respect to the selection of specific investments.

Our obligation to close the purchase of any property is generally conditioned upon the delivery and verification of certain documents from the seller or developer, including, where appropriate:

| | • | | plans and specifications; |

| | • | | evidence of marketable title subject to such liens and encumbrances as are acceptable to the Investment Advisor; |

| | • | | title and liability insurance policies; and |

| | • | | audited financial statements covering recent operations of properties having operating histories unless such statements would not be required to be filed with the SEC so long as we are a public company. |

We will not close the purchase of any property unless and until we obtain an environmental assessment for each property purchased and are generally satisfied with the environmental status of the property. A Phase I environmental site assessment basically consists of a visual survey of the building and the property in an attempt

3

to identify areas of potential environmental concern, visually observing neighboring properties to assess surface conditions or activities that may have an adverse environmental impact on the property, and contacting local governmental agency personnel and performing a regulatory agency file search in an attempt to determine any known environmental concerns in the immediate vicinity of the property. A Phase I environmental site assessment does not generally include any sampling or testing of soil, groundwater or building materials from the property. We may pursue additional assessments or reviews if the Phase I site assessment indicates that further environmental investigation is warranted.

We may also enter into arrangements with the seller or developer of a property whereby the seller or developer agrees that if during a stated period the property does not generate a specified cash flow, the seller or developer will pay in cash to us a sum necessary to reach the specified cash flow level, subject in some cases to negotiated dollar limitations.

In determining whether to purchase a particular property, we may, in accordance with customary practices, obtain an option on such property. The amount paid for an option, if any, is normally surrendered if the property is not purchased and is normally credited against the purchase price if the property is purchased.

Development and Construction of Properties

We may invest in properties on which improvements are to be constructed or completed. To help ensure performance by the builders of properties that are under construction, completion of properties under construction may be guaranteed at the price contracted either by an adequate completion bond or performance bond. We may rely, however, upon the substantial net worth of the contractor or developer or a personal guarantee accompanied by financial statements showing a substantial net worth provided by an affiliate of the person entering into the construction or development contract as an alternative to a completion bond or performance bond. Development of real estate properties is subject to risks relating to a builder’s ability to control construction costs or to build in conformity with plans, specifications and timetables.

We may make periodic progress payments or other cash advances to developers and builders of our properties prior to completion of construction only upon receipt of an architect’s certification as to the percentage of the project then-completed and as to the dollar amount of the construction then-completed. We intend to use such additional controls on disbursements to builders and developers as we deem necessary or prudent.

We may directly employ one or more project managers to plan, supervise and implement the development of any unimproved properties that we may acquire. In such event, such persons would be compensated directly by us. There currently is no affiliate of the Investment Advisor that performs development activities on our behalf and neither we nor the Investment Advisor currently intend to form an entity for such purpose.

Joint Venture Investments

We may enter into joint ventures, partnerships, co-tenancies and other co-ownership arrangements or participations with real estate developers, owners and other affiliated third-parties, including other programs sponsored by CBRE Investors, for the purpose of developing, owning and operating real properties. In determining whether to invest in a particular joint venture, the Investment Advisor will evaluate the real property that such joint venture owns or is being formed to own under the same criteria described elsewhere for the selection of our real estate property investments.

In the event that the co-venturer were to elect to sell property held in any such joint venture, however, we may not have sufficient funds to exercise our right of first refusal to buy the other co-venturer’s interest in the property held by the joint venture. In the event that any joint venture with an affiliated entity holds interests in more than one property, the interest in each such property may be specially allocated based upon the respective proportion of funds invested by each co-venturer in each such property. Our entering into joint ventures with other affiliates, including other programs sponsored by CBRE Investors, will result in certain conflicts of interest.

4

Borrowing Policies

While we strive for diversification, the number of different assets we can acquire will be affected by the amount of funds available to us.

Our ability to increase our diversification through borrowing could be adversely impacted by banks and other lending institutions reducing the amount of funds available for loans secured by real estate. When interest rates on mortgage loans are high or financing is otherwise unavailable on a timely basis, we may purchase certain properties for cash with the intention of obtaining a mortgage loan for a portion of the purchase price at a later time.

Although we have adopted a policy to limit our aggregate borrowing to no more than 65% of the value of the cost of our assets before non-cash reserves and depreciation, this policy may be altered at any time or suspended if necessary to pursue attractive investment opportunities. Our organizational documents contain a limitation on the amount of indebtedness that we may incur, so that unless our shares are listed on a national securities exchange, our aggregate borrowing may not exceed 300% of our net assets unless any excess borrowing is approved by a majority of our independent trustees and is disclosed to shareholders in our next quarterly report. Our board of trustees must review our aggregate borrowing from time to time, but at least quarterly.

By operating on a leveraged basis, we will have more funds available for investment in assets. This will allow us to make more investments than would otherwise be possible, resulting in a more diversified portfolio. Although our liability for the repayment of indebtedness is expected to be limited to the value of the asset securing the liability and the rents or profits derived therefrom, our use of leveraging may increase the risk of default on the mortgage payments and a resulting foreclosure of a particular property. To the extent that we do not obtain mortgage loans on our properties, our ability to acquire additional assets will be restricted. The Investment Advisor will use its best efforts to obtain financing on our behalf on the most favorable terms available. Lenders may have recourse to assets not securing the repayment of the indebtedness.

We may refinance properties during the term of a loan only in limited circumstances, such as when a decline in interest rates makes it beneficial to prepay an existing mortgage, when an existing mortgage matures or if an attractive investment becomes available and the proceeds from the refinancing can be used to purchase such investment. The benefits of the refinancing may include an increased cash flow resulting from reduced debt service requirements, an increase in dividend distributions from proceeds of the refinancing, if any, and an increase in property ownership if some refinancing proceeds are reinvested in real estate.

We may not borrow money from any of our trustees or from the Investment Advisor and its affiliates unless approved by a majority of our trustees, including a majority of any independent trustees not otherwise interested in the transaction, as fair, competitive and commercially reasonable and no less favorable to us than comparable loans between unaffiliated parties.

Disposition Policies

We intend to hold each asset we acquire for an extended period. However, circumstances might arise which could result in the early sale of some assets. We may sell a property before the end of the expected holding period if, among other reasons:

| | • | | in our judgment, the sale of the asset is in the best interests of our shareholders; |

| | • | | we can reinvest the proceeds in a higher-yielding investment; |

| | • | | we can increase cash flow through the disposition of the asset; or |

| | • | | in the judgment of the Investment Advisor, the value of an asset might decline substantially. |

5

The determination of whether a particular asset should be sold or otherwise disposed of will be made after consideration of relevant factors, including prevailing economic conditions, with a view to achieving maximum long-term capital appreciation. We cannot assure you that this objective will be realized.

If our shares are not listed for trading on a national securities exchange, the Nasdaq Global Select Market or the Nasdaq Global Market by December 31, 2011, our declaration of trust requires our board of trustees to consider commencing an orderly liquidation of our assets, which liquidation would require the approval of shareholders. In making the decision to apply for listing of our shares, our trustees will try to determine whether listing or quoting our shares or liquidating our assets will result in greater long-term value for our shareholders. We cannot determine at this time the circumstances, if any, under which our trustees will determine to list or quote our shares. Even if no shares are listed or included for quotation, we are under no obligation to actually sell our portfolio within this time period since the precise timing will depend on real estate and financial markets, economic conditions of the areas in which the properties are located and U.S. federal income tax effects on shareholders which may be applicable in the future. Furthermore, we cannot assure you that we will be able to liquidate our assets, and it should be noted that we will continue in existence until all of our assets are liquidated. In addition, we may consider other business strategies such as reorganizations or mergers with other entities if our board of trustees determines such strategies would be in the best interests of our shareholders. Any change in the investment objectives set forth in our declaration of trust would require the vote of shareholders holding a majority of our outstanding shares.

Investment Limitations

Our declaration of trust places numerous limitations on us with respect to the manner in which we may invest our funds, most of which are required by various provisions of the North American Securities Administrators Association Guidelines, or NASAA Guidelines. Our declaration of trust provides that until our shares are listed on a national securities exchange or included on the Nasdaq Global Select Market or the Nasdaq Global Market, we may not:

| | • | | invest in equity securities unless a majority of our trustees, including a majority of any independent trustees not otherwise interested in the transaction, approve such investment as being fair, competitive and commercially reasonable; |

| | • | | make investments in unimproved property or indebtedness secured by a deed of trust or mortgage loans on unimproved property in excess of 10% of our total assets; |

| | • | | invest in commodities or commodity futures contracts, except for futures contracts when used solely for the purpose of hedging in connection with our ordinary business of investing in real estate assets and mortgages; |

| | • | | make or invest in mortgage loans unless an appraisal is obtained concerning the underlying property, except for those mortgage loans insured or guaranteed by a government or government agency. In cases where a majority of our independent trustees determine, and in all cases in which the transaction is with any of our trustees or the Investment Advisor or its affiliates, such appraisal shall be obtained from an independent appraiser. We will maintain such appraisal in our records for at least five years and it will be available for your inspection and duplication. We will also obtain a mortgagee’s or owner’s title insurance policy as to the priority of the mortgage; |

| | • | | invest in real estate contracts of sale, otherwise known as land sale contracts, unless the contract is in recordable form and is appropriately recorded in the chain of title; |

| | • | | make or invest in mortgage loans, including construction loans, on any one property if the aggregate amount of all mortgage loans on such property would exceed an amount equal to 85% of the appraised value of such property as determined by appraisal unless substantial justification exists for exceeding such limit because of the presence of other underwriting criteria; |

6

| | • | | make or invest in mortgage loans that are subordinate to any mortgage or equity interest of any of our trustees, the Investment Advisor or its affiliates; |

| | • | | issue “redeemable securities,” as defined in Section 2(a)(32) of the Investment Company Act of 1940, as amended, or the 1940 Act; |

| | • | | issue debt securities unless the historical debt service coverage (in the most recently completed fiscal year) as adjusted for known changes is sufficient to properly service that higher level of debt; |

| | • | | grant warrants or options to purchase shares to the Investment Advisor or its affiliates or to officers or trustees affiliated with the Investment Advisor except on the same terms as such warrants or options are sold to the general public and in an amount not to exceed 10% of the outstanding shares on the date of grant of the warrants and options; |

| | • | | issue equity securities on a deferred payment basis or other similar arrangement; or |

| | • | | lend money to our trustees or to the Investment Advisor or its affiliates. |

The Investment Advisor continually reviews our investment activity to ensure that we do not come within the application of the 1940 Act. Among other things, the Investment Advisor monitors the proportion of our portfolio that is placed in various investments so that we do not come within the definition of an “investment company” under the 1940 Act. If at any time the character of our investments could cause us to be deemed an “investment company” for purposes of the 1940 Act, we will take the necessary actions to attempt to ensure that we are not deemed to be an “investment company.”

Change in Investment Objectives and Limitations

Until our shares are listed on a national securities exchange, our declaration of trust requires that the independent trustees review our investment policies at least annually to determine that the policies we are following are in the best interests of our shareholders. Each determination, and the basis therefore, are required to be set forth in our minutes. The methods of implementing our investment policies also may vary as new investment techniques are developed. The methods of implementing our investment objectives and policies, except as otherwise provided in the organizational documents, may be altered by a majority of our trustees, including a majority of the independent trustees, without the approval of the shareholders. Our investment objectives themselves, however, may only be amended by a vote of the shareholders holding a majority of our outstanding shares.

Policies With Respect to Certain Other Activities

If our board of trustees determines that additional funding is required, we may raise such funds through additional equity offerings or the retention of cash flow (subject to the REIT provisions of the Internal Revenue Code concerning distribution requirements and taxability of undistributed net taxable income) or a combination of these methods.

In the event that our board of trustees determines to raise additional equity capital, it has the authority, without shareholder approval, to issue additional common or preferred shares in any manner and on such terms and for such consideration it deems appro|iate, at any time.

We have authority to repurchase or otherwise reacquire our shares and may engage in such activities in the future. We may invest in the securities of other issuers for the purpose of exercising control. We currently have no intention to underwrite securities of other issuers.

Our board of trustees may change any of these policies without prior notice to you or a vote of our shareholders.

7

The Advisory Agreement

We entered into an advisory agreement with the Investment Advisor in July 2004, which was amended and restated in October 2006. Pursuant to this agreement, which was unanimously approved by our board of trustees, including our independent trustees, we appointed the Investment Advisor to manage, operate, direct and supervise our operations. The Investment Advisor performs its duties as a fiduciary of us and our shareholders. Many of the services to be performed by the Investment Advisor in managing our day-to-day activities are summarized below. This summary is provided to illustrate the material functions that the Investment Advisor performs for us as the Investment Advisor, and it is not intended to include all of the services that may be provided to us by the Investment Advisor or by third parties. The Investment Advisor may subcontract with third parties for the performance of certain duties on our behalf. The Investment Advisor will only subcontract with third parties that are believed to have the requisite experience to perform their duties. The Investment Advisor will supervise the activities of any such third parties consistent with its fiduciary duty to us. Under the terms of the advisory agreement, the Investment Advisor undertakes to use its best efforts to present to us investment opportunities consistent with our investment policies and objectives as adopted by our board of trustees. In its performance of this undertaking, the Investment Advisor shall, subject to the authority of the board:

| | • | | find, present and recommend to us real estate investment opportunities consistent with our investment policies and objectives; |

| | • | | structure the terms and conditions of transactions pursuant to which acquisitions of assets will be made; |

| | • | | acquire assets on our behalf in compliance with our investment objectives and policies; |

| | • | | arrange for financing and refinancing of properties; and |

| | • | | enter into leases and service contracts for the properties acquired. |

The initial term of the advisory agreement was for one year and the term may be renewed at the end of each year of the agreement for an additional one-year period. Prior to any such renewal, our trustees will evaluate the performance of the Investment Advisor and the criteria used in such evaluation will be reflected in the minutes of such meeting. In October 2007, the advisory agreement was renewed by our trustees (including our independent trustees) for one year. Additionally, the advisory agreement may be terminated:

| | • | | immediately by us (i) in the event the Investment Advisor commits fraud, criminal conduct, willful misconduct or willful or negligent breach of fiduciary duty by the Investment Advisor, (ii) upon the bankruptcy of the Investment Advisor or (iii) upon material breach of the Advisory Agreement by the Advisor, which remains uncured after 30 days’ written notice; |

| | • | | without cause or penalty by a majority of our independent trustees or by the Investment Advisor upon 60 days’ written notice; or |

| | • | | immediately by the Investment Advisor upon our bankruptcy or any material breach of the advisory agreement by us, which remains uncured after 10 days’ written notice. |

The Investment Advisor and its affiliates are paid fees, and can be reimbursed for all costs it incurs, in connection with services provided to us. In the event the advisory agreement is terminated, the Investment Advisor will be paid all accrued and unpaid fees and expense reimbursements. In addition, an affiliate of the Investment Advisor has received one class B limited partnership interest in CBRE OP (representing 100% of the class B interest outstanding) in exchange for the services provided to us relating to our formation and future services. The class B limited partnership interest is subject to redemption by CBRE OP in the event of termination of the advisory agreement.

A majority of the independent trustees, and a majority of trustees not otherwise interested in the transaction, must approve all transactions with the Investment Advisor or any of its affiliates. Until our shares are listed on a national securities exchange, the Nasdaq Global Select Market or the Nasdaq Global Market, our independent

8

trustees must determine from time to time, but at least annually, that our fees and expenses are reasonable in light of our performance, our net assets and net income and the fees and expenses of other comparable unaffiliated REITs. During this period, our independent trustees are also responsible for reviewing the performance of the Investment Advisor and determining that the compensation to be paid to the Investment Advisor is reasonable in relation to the nature and quality of services to be performed and that the provisions of the advisory agreement are being carried out.

Industry Segments

We view our operations as having two reportable segments, a Domestic segment and an International segment (which are each comprised of aggregated operating segments), which participate in the acquisition, development, ownership and operation of high quality real estate assets in their respective regions. Information regarding our reportable segments can be reviewed under footnote 11, “Segment Disclosure,” in the accompanying consolidated financial statements.

Geographic Areas of Properties

We currently operate in two geographic areas, the United States and the United Kingdom. We also have an ownership interest in CB Richard Ellis Strategic Partners Asia II-A, L.P. (“CBRE Asia Fund”), which, as of December 31, 2007, owned interests in properties in China and Japan. Information regarding the geographic diversification of our properties as of December 31, 2007 can be reviewed under footnote 10, “Concentrations—Geographic Concentrations,” in the accompanying consolidated financial statements.

Competition

When we invest in real estate properties, focusing on office, retail, industrial, multi-family residential properties and other investment assets, we compete with a variety of institutional investors, including other REITs, insurance companies, mutual funds, pension funds, investment banking firms, banks and other financial institutions that invest in the same types of assets. Many of these investors have greater financial resources and access to lower costs of capital than we do. The existence of these competitive entities, as well as the possibility of additional entities forming in the future, may increase the competition for the acquisition of the types of properties we are seeking to acquire, resulting in higher prices and lower yields on assets.

9

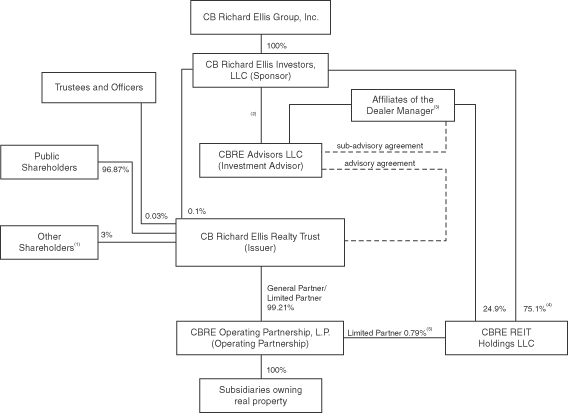

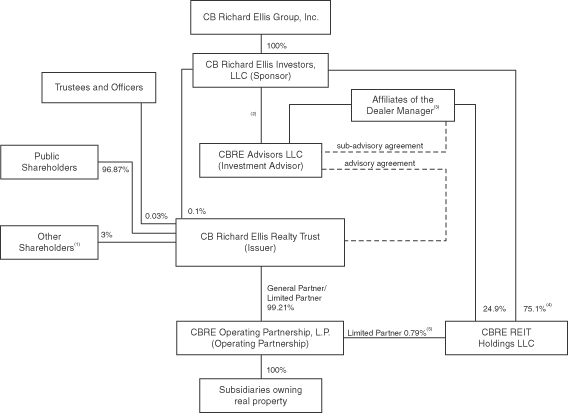

Organizational Structure

The following chart illustrates the structure and ownership of our company after our initial public offering (assuming all of the common shares are sold in the offering) and the management relationship between the Investment Advisor and us.

(1) | Includes shareholders who purchased common shares in our private offerings, excluding shares held by CBRE Investors, our trustees and officers. |

(2) | CBRE Investors owns all of the cash distribution interest and CBRE Investors (including certain of its executive officers and our executive officers) own an aggregate 77% distribution interest in the net proceeds upon a sale of the Investment Advisor. |

(3) | Fund Investors, LLC and CNL Fund Management Company, affiliates of the Dealer Manager, own (i) an aggregate 23% distribution interest in the net proceeds upon a sale of the Investment Advisor and (ii) an aggregate 24.9% voting and distribution interest (excluding distributions that CBRE Investors is entitled to with respect to 29,937 class A units) in CBRE REIT Holdings LLC. CNL Fund Management Company serves as the Sub-Advisor to the Investment Advisor. |

(4) | CBRE Investors owns a 75.1% voting interest and CBRE Investors (including certain of its executive officers) and our executive officers own an aggregate 75.1% distribution interest (excluding distributions that CBRE Investors is entitled to with respect to 29,937 class A units) in CBRE REIT Holdings LLC. |

(5) | CBRE REIT Holdings LLC owns 246,361 class A units, or limited partnership units, in the Operating Partnership and our Company owns 31,076,709 limited partnership units in the Operating Partnership as of December 31, 2007. CBRE REIT Holdings LLC also owns one class B limited partnership interest in the Operating Partnership (representing 100% of the class B interest outstanding). CBRE REIT Holdings LLC is controlled by CB Richard Ellis Investors, LLC, our sponsor. |

10

Employees

As of December 31, 2007, we had no full-time employees and do not anticipate any material changes in the number of our full-time employees. Our executive officers are employees of the Investment Advisor or one or more of its affiliates.

Facilities

Our principal offices are located at 515 South Flower Street, Suite 3100, Los Angeles, California 90071. We also have offices located at 17 Hulfish Street, Suite 280, Princeton, New Jersey 08542.

Available Information

Our internet address is www.cbrerealtytrust.com. We make available, free of charge, on or through the “SEC Filings” section of our website, annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. Also posted on our website is our Code of Business Conduct and Ethics, which governs our trustees, officers and employees. Within the time period required by the SEC, we will post on our website any amendment to our Code of Business Conduct and Ethics and any waiver applicable to our senior financial officers, and our executive officers or trustees. The information contained on our website is not incorporated into this report on Form 10-K. You can also read and copy any materials we file with the Securities and Exchange Commission at its Public Reference Room at 100 F Street, NE, Washington, DC 20549 (1-800-SEC-0330). The Securities and Exchange Commission maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Securities and Exchange Commission.

Recent Developments

From January 1, 2008 through March 17, 2008, we received gross proceeds of approximately $54,180,393 from the sale of 5,426,172 common shares in our initial public offering.

On January 23, 2008, we acquired a fee interest in land parcels located in the Spartanburg, South Carolina market for $820,000 exclusive of customary closing costs, which was funded using a purchase deposit of $41,000 and net proceeds from our initial public offering. Upon closing, we paid our Investment Advisor an acquisition fee of approximately $8,200.

On January 28, 2008, American La France LLC (“ALF”), the tenant in the Jedburg Commerce Park Building, filed for Chapter 11 bankruptcy protection. ALF occupies the entire Jedburg Commerce Park Building totaling 512,686 square feet under a lease that runs through July 31, 2027. The current annual rent is approximately $2,994,000 with 2% annual increases effective each year on August 1, through the end of the lease term. In connection with the lease, we have received an irrevocable stand-by letter of credit totaling $3,000,000 at December 31, 2007 as security for the lease. As of December 31, 2007, ALF owed us $515,000 in unpaid rent which it subsequently reduced to $131,000. In addition, as of December 31, 2007 and February 29, 2008 we had deferred rent receivables from ALF of $215,000 and $323,000, respectively. Since ALF has filed for Chapter 11 bankruptcy protection, we have received rent payments in the amount of $249,500 for each of January and February 2008.

On March 5, 2008, we acquired a fee interest in Lakeside Office Center (“Lakeside”) located at 2850 Lake Vista Drive, Lewisville, Texas, from an unrelated third party. We acquired Lakeside for approximately $17,700,000, exclusive of customary closing costs, which was funded using net proceeds from our initial public offering. Upon closing, we paid our Investment Advisor an acquisition fee of approximately $177,000. This

11

acquisition fee is not included in the $17,700,000 total acquisition cost of Lakeside. Lakeside consists of a 98,750 square foot, three-story office building and surface parking lot completed in August 2006. The building is 96% leased to several tenants, one of which is Teachers Insurance and Annuity Association of America (“TIAA”) who occupies 67,516 square feet under a lease that expires in May 2017.

On March 14, 2008, we acquired a fee interest in a warehouse distribution building, Kings Mountain III, totaling 541,910 rentable square feet located in the Charlotte, North Carolina market for $25,350,000, exclusive of customary closing costs, which was funded using a purchase deposit of $510,000 (as of December 31, 2007) and net proceeds from our initial public offering. Upon closing, we paid our Investment Advisor an acquisition fee of approximately $254,000.

On March 20, 2008, we acquired a fee interest in Thames Valley Five (“TVF”) located at 400 Thames Valley Park Drive, Reading, United Kingdom from an unrelated third-party. We acquired TVF for approximately £13,795,000 ($27,664,000), exclusive of customary closing costs, and stamp duty fees, which was funded using net proceeds from our initial public offering. Upon closing, we paid our Investment Advisor an acquisition fee of approximately $277,000. This acquisition fee is not included in the £13,795,000 ($27,664,000) acquisition cost of TVF. TVF consists of a four story office building and surface parking lot completed in 1998. The office building is 100% leased to Regus (United Kingdom) under a lease that expires in November 2013.

Risks Related To Our Business

We and the Investment Advisor commenced operations in July 2004 and have a limited operating history and may not be able to implement our operating policies and strategies successfully.

We began operations in July 2004 and, therefore, have a limited operating history and may not be able to implement our operating policies and strategies successfully. The Investment Advisor also has a limited operating history. The results of our operations depend on many factors, including, without limitation, the availability of office, retail, industrial and multi-family residential properties for acquisition, readily accessible short- and long-term funding alternatives in the financial markets and economic conditions. Moreover, delays in investing the net proceeds of our initial public offering may reduce our income. Our shareholders will not have the opportunity to evaluate the manner in which the net proceeds received by us from our initial public offering are to be invested or the economic merits of particular assets to be acquired. Furthermore, we cannot assure you that we will be able to operate our business successfully or implement our operating policies and strategies.

You must rely entirely upon the ability of the Investment Advisor with respect to the investment in and management of unspecified assets, and you will not have an opportunity to evaluate for yourself the relevant economic, financial and other information regarding the assets in which the proceeds of our initial public offering will be invested.

Our ability to achieve our investment objectives and to pay dividends is dependent upon the performance of the Investment Advisor, the real estate market and general economic conditions in the geographic regions where we invest. You must rely totally on the Investment Advisor in the selection of assets. We cannot be sure that the Investment Advisor will be successful in obtaining suitable investments on financially attractive terms or that, if investments are made, our objectives will be achieved. You should be aware that any appraisals we obtain are merely estimates of value and should not be relied upon as accurate measures of true worth or realizable value.

If the Investment Advisor loses or is unable to obtain key personnel, our ability to implement our investment strategies could be delayed or hindered.

Our success depends to a significant degree upon the continued contributions of certain key personnel of our Investment Advisor, including Robert H. Zerbst, Jack A. Cuneo, Laurie Romanak, Scott Stuckman, Doug

12

Herzbrun and Phil Kianka, each of whom would be difficult to replace. None of our key personnel are currently subject to employment agreements with us, nor do we maintain any key person life insurance on these key personnel. If the Investment Advisor were to lose the benefit of the experience, efforts and abilities of one or more of these individuals, our operating results could suffer. We also believe that our future success depends, in large part, upon the Investment Advisor’s ability to obtain highly skilled managerial, operational and marketing personnel. Competition for such personnel is intense, and we cannot assure you the Investment Advisor will be successful in attracting and retaining such skilled personnel.

We face risks related to accounting restatements.

On April 2, 2007, we filed an amendment to our quarterly report on Form 10-Q/A for the period ended September 30, 2006 in order to restate the related condensed consolidated balance sheet as of September 30, 2006 and the related condensed consolidated statements of operations, cash flows and shareholders’ equity. We have engaged in, a substantial effort and have remediated this material weakness in our internal control over financial reporting. In the future, we cannot be certain that any remedial measures we have taken or plan to take will ensure that we design, implement and maintain adequate controls over our financial processes and reporting. Also in the future, our inability to remedy every material weakness or any additional deficiencies or material weaknesses that may be identified, could, among other things, cause us to fail to file our periodic reports with the SEC in a timely manner or require us to incur additional costs or to divert management resources.

Conflict of Interest Risks

The Investment Advisor faces conflicts of interest relating to time management.

Although the Investment Advisor does not currently advise any other real estate investment programs, the Investment Advisor’s affiliates, including CBRE Investors, are sponsors of other real estate programs having investment objectives and legal and financial obligations similar to ours. In addition, certain members of the management team of the Investment Advisor may also work with or for other affiliates. As a result, they may have interests in other real estate programs and also engage in other business activities, and may have conflicts of interest in allocating their time between our business and these other activities. During times of intense activity in other programs and ventures, they may devote less time and resources to our business than are necessary or appropriate. If the Investment Advisor, for any reason, is not able to provide investment opportunities to us consistent with our investment objectives in a timely manner, we may have lower returns on our investments.

The Investment Advisor faces conflicts of interest relating to the purchase and leasing of assets.

We may be buying assets at the same time as other existing or future affiliates of the Investment Advisor are buying assets. There is a risk that the Investment Advisor will choose an asset that provides lower returns to us than an asset purchased by another affiliate. We may acquire assets in geographic areas where other affiliates own assets. If another affiliate attracts a tenant that we are competing for, we could suffer a loss of revenue due to delays in locating another suitable tenant.

The Investment Advisor and its affiliates may face conflicts of interest if they sell or lease properties they acquire to us.

We may acquire or lease properties from the Investment Advisor and its affiliates. We must follow certain procedures when purchasing or leasing assets from the Investment Advisor and its affiliates. The Investment Advisor may owe fiduciary and/or other duties to the selling entity in these transactions and conflicts of interest between the selling entities and us could exist in such transactions. Because we are relying on the Investment Advisor, these conflicts could result in transactions where we do not have the benefit of arm’s length negotiations of the type normally conducted with an unaffiliated third party.

13

We pay substantial fees and expenses to the Investment Advisor, its affiliates and the Dealer Manager, which payments increase the risk that you will not earn a profit on your investment.

The Investment Advisor and its affiliates perform services for us in connection with the selection and acquisition of our investments, the management and leasing of our properties and the administration of our other investments. We pay the Investment Advisor an acquisition fee based on the purchase price of our real estate assets and an investment management fee, a portion of which is based on the cost of our real estate assets, each of which is not tied to the performance of our portfolio. The Investment Advisor has entered into a sub-advisory agreement with an affiliate of the Dealer Manager, or the Sub-Advisor, and the Investment Advisor will compensate the Sub-Advisor through certain fees and reimbursable expenses the Investment Advisor receives from us. We pay fees and commissions to the Dealer Manager in connection with the offer and sale of the shares. We also have issued to CBRE REIT Holdings LLC, an affiliate of the Investment Advisor, one Class B limited partnership interest (representing 100% of the Class B interest outstanding) in CBRE OP in exchange for the services provided to us relating to our formation and future services. Our sponsor (including certain of its executive officers) and our executive officers own an aggregate 75.1% distribution interest and affiliates of the Dealer Manager own an aggregate 24.9% distribution interest (excluding distributions that CBRE Investors is entitled to with respect to 29,937 Class A units) in CBRE REIT Holdings LLC. The holder of the Class B limited partnership interest is entitled to receive distributions made by CBRE OP in an amount equal to 15% of all net proceeds of any disposition of properties to be distributed to the partners after subtracting (i) the costs of such disposition, (ii) the amount of equity capital invested in such property which has not been reinvested or returned to the partners, and (iii) an amount equal to a 7% annual, uncompounded return on such invested capital. These fees and partnership interest distributions reduce the amount of cash available for investment in properties or distribution to shareholders. These fees also increase the risk that the amount available for distribution to common shareholders upon a liquidation of our portfolio would be less than the purchase price of the shares in our offering and that you may not earn a profit on your investment.

Termination of the Advisory Agreement could be costly.

If the advisory agreement is terminated without cause, CBRE OP will redeem the Class B limited partnership interest for a newly created class of partnership interest, which we refer to as the advisor redemption interest, which shall initially have a capital account equal to the fair value of the Class B limited partnership interest as of such date, and if the advisory agreement is terminated for cause, CBRE OP will redeem the Class B limited partnership interest for $100. These provisions may increase the effective cost to us of terminating the advisory agreement, thereby adversely affecting our ability to terminate the Investment Advisor without cause.

Certain of our officers and trustees face conflicts of interest.

Our chairman and our chief financial officer each serve as managing directors of the Investment Advisor and also serve as president and executive managing director, respectively, of CBRE Investors, our sponsor. These individuals also are members of the investment committee of CBRE Asia Fund, an entity in which we are a limited partner. Our president and chief executive officer serves as the president and chief executive officer of the Investment Advisor and also serves as a managing director of CBRE Investors. Our president and chief executive officer and our chief financial officer directly hold an aggregate 12.9% economic interest in the Investment Advisor. These individuals owe fiduciary duties to these entities and their shareholders. Such fiduciary duties may from time to time conflict with the fiduciary duties owed to our shareholders and us. An affiliate of the Investment Advisor owns one class B limited partnership interest (representing 100% of the class B interest outstanding) in CBRE OP. This interest entitles such affiliate to receive distributions in an amount equal to a percentage of the net proceeds we receive from a sale of a property after certain amounts are paid or provided for. This interest may incentivize the Investment Advisor to recommend the sale of a property or properties that may not be in our best interest at the time. In addition, the premature sale of a property may add concentration risk to the portfolio or may be at a price lower than if we held on to the property and sold it at a later date.

14

We will be subject to additional risks as a result of any joint ventures.

We may in the future enter into joint ventures for the acquisition, development or improvement of properties. We may also purchase and develop properties in joint ventures or in partnerships, co-tenancies or other co-ownership arrangements with sellers of properties, affiliates of sellers, developers or other persons. Such investments may involve risks not otherwise present with an investment in real estate, including, for example:

| | • | | the possibility that our co-venturer, co-tenant or partner in an investment might become bankrupt; |

| | • | | that such co-venturer, co-tenant or partner may at any time have economic or business interests or goals which are or become inconsistent with our business interests or goals; or |

| | • | | that such co-venturer, co-tenant or partner may be in a position to take action contrary to our instructions or requests or contrary to our policies or objectives. |

Actions by such a co-venturer, co-tenant or partner might have the result of subjecting the property to liabilities in excess of those contemplated and may have the effect of reducing your returns.

General Investment Risks

No market currently exists for our common shares. If you are able to sell your shares, you would likely have to sell them at a substantial discount.

There is no current market for our shares and, therefore, it will be difficult for you to sell your shares promptly. We can not assure you that any trading market will develop or, if developed, that any such market will be sustained. Additionally, our declaration of trust contains restrictions on the ownership and transfer of our shares, and these restrictions may inhibit your ability to sell your shares. You may not sell your shares unless the buyer meets applicable suitability and minimum purchase standards. Therefore, it will be difficult for you to sell your shares promptly or at all. In addition, the price received for any shares sold is likely to be less than the proportionate value of the real estate we own. Therefore, you should purchase our shares only as a long-term investment.

We are conducting a “best efforts” offering and if we are unable to raise substantial funds, we may have substantial limitations on our ability to achieve a diversified portfolio of assets.

The Dealer Manager is selling our shares on a “best efforts” basis, whereby it and the other broker-dealers participating in our initial public offering are only required to use their best efforts to sell our common shares and have no firm commitment or obligation to purchase any of our common shares. As a result, the amount of proceeds we raise in our initial public offering may be substantially less than the amount we would need to achieve a broadly diversified portfolio. If we only sell a small number of shares offered in our initial public offering, we may purchase fewer properties resulting in less diversification of the number of assets we own, the types of assets in which we invest, the geographic regions of our properties and the industry types of our tenants. The likelihood of our profitability being affected by any one of our investments will also increase. Your investment in shares will be subject to greater risk to the extent that we lack a diversified asset portfolio.

We are conducting a blind pool offering and you will not have the opportunity to evaluate investments prior to purchasing our common shares.

You will not be able to evaluate the economic merits, transaction terms or other financial information concerning our future investments prior to purchasing our common shares. You must rely on the Investment Advisor and our board of trustees to implement our investment policies, to evaluate investment opportunities and to structure the terms of our investments.

15

Restrictions on ownership of a controlling percentage of our shares may limit your opportunity to receive a premium on your shares.

To assist us in complying with the share ownership requirements necessary for us to qualify as a REIT, our declaration of trust prohibits, with certain exceptions, direct or constructive ownership by any person of more than 3.0% by number or value, whichever is more restrictive, of our outstanding common shares or more than 3.0% by number or value, whichever is more restrictive, of our outstanding shares. Our board of trustees, in its sole discretion, may exempt a person from the share ownership limit. Our board of trustees has waived this limitation for CBRE Investors and the Stein Trusts. This waiver applies only to shares such persons already own, and not to further purchases unless approved by our board of trustees. Additionally, our declaration of trust prohibits direct or constructive ownership of our shares that would otherwise result in our failure to qualify as a REIT. The constructive ownership rules in our declaration of trust are complex and may cause the outstanding shares owned by a group of related individuals or entities to be deemed to be constructively owned by one individual or entity. As a result, the acquisition of less than any ownership limit by an individual or entity could cause that individual or entity to own constructively in excess of any ownership limit of our outstanding shares. Any attempt to own or transfer our shares in excess of the ownership limit without the consent of our board of trustees shall be void, and will result in the shares being transferred to a charitable trust. These provisions may inhibit market activity and the resulting opportunity for our shareholders to receive a premium for their shares that might otherwise exist if any person were to attempt to assemble a block of our shares in excess of the number of shares permitted under our declaration of trust and which may be in the best interests of our shareholders.

We have implemented certain provisions that could make any change in our board of trustees or in control of our company more difficult.

Maryland law, our declaration of trust and our bylaws contain provisions, such as provisions prohibiting, without the consent of our board of trustees, any single shareholder or group of affiliated shareholders, from beneficially owning in excess of an ownership limit, which could make it difficult or expensive for a third party to pursue a tender offer, change in control or takeover attempt that is opposed by our management and board of trustees. These and other anti-takeover provisions could substantially impede the ability of shareholders to change our management and board of trustees.

You are limited in your ability to sell your shares pursuant to our share redemption program.

Our share redemption program provides you with the opportunity, on a quarterly basis, to request us to redeem all or a portion of your shares after you have held them for one year, subject to certain restrictions and limitations. In the event that an eligible shareholder presents fewer than all of his or her shares to us for redemption, such shareholder must present at least 25% of his or her shares to us for redemption and must retain at least $5,000 of common shares if any shares are held after such redemption. Shares will be redeemed only to the extent of cash available after the payment of dividends necessary to maintain our qualification as a REIT and to avoid the payment of any U.S. federal income tax or excise tax on our net taxable income. This will significantly limit our ability to redeem your shares. To the extent our available cash flow is insufficient to fund all redemption requests, each shareholder’s request will be reduced on a pro rata basis, unless you withdraw your request for redemption or ask that we carry over your request to the next quarterly period, if any, when sufficient funds become available. Our board of trustees reserves the right to amend or terminate the share redemption program at any time. Our board of trustees has delegated to our officers the right to waive the one-year holding period and pro rata redemption requirements in the event of the death, disability (as such term is defined in the Internal Revenue Code) or bankruptcy of a shareholder. You will have no right to request redemption of your shares should our shares become listed on a national exchange, the Nasdaq Global Select Market or the Nasdaq Global Market. Therefore, in making a decision to purchase shares, you should not assume that you will be able to sell any of your shares back to us pursuant to our share redemption program.

16

We established the offering price on an arbitrary basis.

Our board of trustees has arbitrarily determined the selling price of the shares being offered in our initial public offering. Our offering price may not be indicative of the price at which our shares would trade if they were listed on an exchange or actively traded by brokers nor of the proceeds that a shareholder would receive if we were liquidated or dissolved.

Investors who purchased common shares in our offering incurred, as of December 31, 2007, an immediate dilution of up to approximately $(1.28), or (12.89)%, in the book value per share of our common shares from the price paid in our offering. Investors purchasing common shares in our offering may experience further dilution if we issue additional equity.

The initial offering price of our common shares is substantially higher than the book value per share of our outstanding common shares will be after our offering. Therefore, investors who purchased our common shares incurred, as of December 31, 2007, an immediate dilution of up to approximately $(1.28), or (12.89)%, in the book value per share of our common shares from the price paid in our offering. Existing shareholders and potential investors in our offering do not have preemptive rights to any common shares issued by us in the future. Therefore, investors purchasing shares in our offering may experience further dilution of their equity investment in the event that we sell additional common shares in the future, if we sell securities that are convertible into common shares or if we issue shares upon the exercise of options.

The amount and timing of cash dividends is uncertain.

Subject to certain limitations, we bear all expenses incurred in our operations, which reduces cash generated by operations and amounts available for distribution to our shareholders. In addition, our board of trustees, in its discretion, may retain any portion of such funds for working capital, subject to the REIT distribution requirements. We have not set any future dividend payment amount and cannot assure you that sufficient cash will be available to pay dividends to you.

We are uncertain of our sources for funding of future capital needs.

Substantially all of the net proceeds of the offering will be used for investment in assets and for payment of various fees and expenses. Accordingly, in the event that we develop a need for additional capital in the future for the improvement of our assets or for any other reason, we will need to identify sources for such funding, other than reserves we may establish, and we cannot assure you that such sources of funding will be available to us for capital needs in the future.

General Real Estate Risks

Real estate investments are long-term illiquid investments and may be difficult to sell in response to changing economic conditions.

Real estate investments are subject to certain inherent risks. Real estate investments are generally long-term investments that cannot be quickly converted to cash. Real estate investments are also subject to adverse changes in general economic conditions or local conditions that may reduce the demand for office, retail, industrial, multi-family residential or other types of properties. Other factors can also affect real estate values, including:

| | • | | possible international and U.S. federal, state or local regulations and controls affecting rents, prices of goods, fuel and energy consumption and prices, water and environmental restrictions; |

| | • | | increasing labor and material costs; |

| | • | | the attractiveness of the property to tenants; |

17

| | • | | rises in operating costs, taxes and insurance costs; and |

| | • | | changes in interest rates. |

Increases in interest rates could increase the amount of our debt payments and adversely affect our ability to pay dividends to our shareholders.

We expect that we will incur additional indebtedness in the future. Interest we pay could reduce cash available for distributions. Additionally, if we incur variable rate debt, increases in interest rates would increase our interest costs, which would reduce our cash flows and our ability to pay dividends to you. In addition, if we need to repay existing debt during periods of rising interest rates, we could be required to liquidate one or more of our investments in properties at times which may not permit realization of the maximum return on such investments.

Adverse economic conditions in the geographic regions in which we purchase properties may negatively impact your overall returns.

Adverse economic conditions in the geographic regions in which we buy our properties could affect real estate values in these regions and, to the extent that any of our tenants in these regions rely upon the local economy for their revenues, our tenants’ businesses could also be affected by such conditions. Therefore, changes in local economic conditions could reduce our ability to pay dividends and the amounts we could otherwise receive upon a sale of a property in a negatively affected region.

Adverse economic conditions affecting the particular industries of our tenants may negatively impact your overall returns.

Adverse economic conditions affecting a particular industry of one or more of our tenants could affect the financial ability of one or more of our tenants to make payments under their leases, which could cause delays in our receipt of rental revenues or a vacancy in one or more of our properties for a period of time. Therefore, changes in economic conditions of the particular industry of one or more of our tenants could reduce our ability to pay dividends and the value of one or more of our properties at the time of sale of such properties.

Because we are dependent on our tenants for substantially all of our revenue, our success is materially dependent on the financial stability of our tenants.

Lease payment defaults by tenants could cause us to reduce the amount of distributions to shareholders. A default of a tenant on its lease payments would cause us to lose the revenue from the property. In the event of such a default, we may experience delays in enforcing our rights as landlord and may incur substantial costs in protecting our investment and leasing our property. If a lease is terminated, we cannot assure you that we will be able to lease the property for the rent previously received or sell the property without incurring a loss.

If one or more of our tenants file for bankruptcy protection, we may be precluded from collecting all sums due.

If one or more of our tenants, or the guarantor of a tenant’s lease, commences, or has commenced against it, any proceeding under any provision of the U.S. federal bankruptcy code, as amended, or any other legal or equitable proceeding under any bankruptcy, insolvency, rehabilitation, receivership or debtor’s relief statute or law (bankruptcy proceeding), we may be unable to collect sums due under relevant leases. Any or all of the tenants, or a guarantor of a tenant’s lease obligations, could be subject to a bankruptcy proceeding.

Such a bankruptcy proceeding may bar our efforts to collect pre-bankruptcy debts from these entities or their properties, unless we are able to obtain an enabling order from the bankruptcy court. If a lease is rejected by a tenant in bankruptcy, we would only have a general unsecured claim against the tenant, and may not be entitled

18

to any further payments under the lease. A tenant’s or lease guarantor’s bankruptcy proceeding could hinder or delay efforts to collect past due balances under relevant leases, and could ultimately preclude collection of these sums. Such an event could cause a decrease or cessation of rental payments which would mean a reduction in our cash flow and the amount available for distribution to our shareholders. In the event of a bankruptcy proceeding, we cannot assure you that the tenant or its trustee will assume our lease. If a given lease, or guaranty of a lease, is not assumed, our cash flow and the amounts available for distribution to our shareholders may be adversely affected.

On January 28, 2008, American La France LLC, or ALF, the tenant in our Jedburg Commerce Park property, filed for Chapter 11 bankruptcy protection. Though the payment of rent from ALF is, in part, guaranteed by a letter of credit and ALF has continued to make timely rent payments, we may be unable to collect all future rent due to us if ALF fails to affirm its lease agreement with us.

We may not have funding for future tenant improvements, which may reduce your returns and make it difficult to attract one or more new tenants.

When a tenant at one of our properties does not renew its lease or otherwise vacates its space in one of our buildings, it is likely that, in order to attract one or more new tenants, we will be required to expend substantial funds for tenant improvements and tenant refurbishments to the vacated space and other lease-up costs. Substantially all of our net offering proceeds available for investment may be used for investment in real estate properties. We may maintain working capital reserves but cannot guarantee they will be adequate. We also have no identified funding source to provide funds that may be required in the future for tenant improvements, tenant refurbishments and other lease-up costs in order to attract new tenants. We cannot assure you that any such source of funding will be available to us for such purposes in the future and, to the extent we are required to use net cash from operations to fund such tenant improvements, tenant refurbishments and other lease-up costs, cash distributions to our shareholders will be reduced.

A property that incurs a significant vacancy could be difficult to sell or lease.

A property may incur a vacancy either by the continued default of a tenant under its lease or the expiration of one of our leases. Some of our properties may be specifically suited to the particular needs of the tenant based on the type of business the tenant operates. We may have difficulty obtaining a new tenant for any vacant space in our properties, particularly if the space limits the types of businesses that can use the space without major renovation. If a vacancy on any of our properties continues for a long period of time, we may suffer reduced revenues resulting in less cash to be distributed to shareholders. In addition, the resale value of the property could be diminished because the market value of a particular property may depend principally upon the value of the leases of such property.

Uninsured losses relating to real property may adversely affect your returns.

In the event that any of our properties incurs a casualty loss that is not fully covered by insurance, the value of our assets will be reduced by any such uninsured loss. In addition, we may have limited funding to repair or reconstruct the damaged property, and we cannot assure you that any such source of funding will be available to us for such purposes in the future. Furthermore, insurance may be unavailable or uneconomical. In particular, insurance coverage relating to flood or earthquake damage or terrorist acts may not be available or affordable.

Development and construction of our properties may result in delays and increased costs and risks.

We may invest some or all of the net proceeds available for investment in the acquisition and development of properties upon which we will develop and construct improvements. We will be subject to risks relating to the builder’s ability to control construction costs or to build in conformity with plans, specifications and timetables. The builder’s failure to perform may necessitate legal action by us to rescind the purchase or the construction contract or to compel performance. Performance may also be affected or delayed by conditions beyond the

19