UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 000-53200

CB RICHARD ELLIS REALTY TRUST

(Exact name of registrant as specified in its charter)

| | |

| Maryland | | 56-2466617 |

(State or other jurisdiction incorporation or organization) | | (I.R.S. Employer Identification No.) |

47 Hulfish Street, Suite 210, Princeton, New Jersey 08542

(Address of principal executive offices—zip code)

(609) 683-4900

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

| None | | Not Applicable |

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

Common Shares of Beneficial Interest, Par Value $0.01 Per Share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x .

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x .

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

Large accelerated filer ¨ | | Accelerated Filer ¨ | | Non-accelerated filer x | | Smaller reporting company ¨ |

| | (do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Since there was no established market for the voting and non-voting common shares as of June 30, 2010, there was no market value for the common shares held by non-affiliates of the registrant as of such date.

The number of shares outstanding of the registrant’s common shares, $0.01 par value, was 172,025,430 as of March 17, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for its 2011 Annual Shareholders’ Meeting expected to be filed on or prior to April 30, 2011 are incorporated by reference into Part III of this Annual Report on Form 10-K.

CB RICHARD ELLIS REALTY TRUST

FORM 10-K

TABLE OF CONTENTS

PART I

Overview

CB Richard Ellis Realty Trust is a Maryland real estate investment trust that invests in real estate, focusing on office, industrial (primarily warehouse/distribution), retail and potentially multi-family residential properties. As of December 31, 2010, we owned, on a consolidated basis, 73 office, industrial (primarily warehouse/distribution) and retail properties located in 15 states (Arizona, California, Florida, Georgia, Illinois, Massachusetts, Minnesota, New Jersey, North Carolina, Ohio, South Carolina, Texas, Utah and Virginia) and in the United Kingdom encompassing approximately 12,800,000 rentable square feet in the aggregate. In addition, we have ownership interests in five unconsolidated entities that, as of December 31, 2010, owned interests in 38 properties. Excluding those properties owned through our investment in CB Richard Ellis Strategic Partners Asia II, L.P. (“CBRE Strategic Partners Asia”), we owned, on an unconsolidated basis, 30 industrial, office and retail properties located in eight states (Arizona, Florida, Indiana, Missouri, North Carolina, Ohio, Tennessee and Texas) and in the United Kingdom and Europe encompassing approximately 9,901,000 rentable square feet in the aggregate.

We commenced operations in July 2004, following an initial private placement of our common shares of beneficial interest. We raised aggregate net proceeds (after commissions and expenses) of approximately $55,500,000 from July 2004 to October 2004 in private placements of our common shares. On October 24, 2006, we commenced an initial public offering of up to $2,000,000,000 in our common shares. In connection with that offering, as of January 30, 2009, we had accepted subscriptions from 13,270 investors, issued 60,808,967 common shares including 1,487,943 common shares issued pursuant to our dividend reinvestment plan, and received $607,345,702 in gross proceeds. Our initial public offering was terminated effective as of the close of business on January 29, 2009. We withdrew from registration a total of 140,243,665 common shares that were registered but not sold in connection with the initial public offering.

The registration statement relating to our follow-on public offering was declared effective by the Securities and Exchange Commission (the “SEC”) on January 30, 2009. CNL Securities Corp. is the dealer manager of our offering (the “Dealer Manager”). The registration statement covers up to $3,000,000,000 in common shares of beneficial interest, 90% of which will be offered at a price of $10.00 per share, and 10% of which will be offered pursuant to our dividend reinvestment plan at a purchase price equal to the higher of $9.50 per share or 95% of the fair market value of a common share on the reinvestment date, as determined by the Investment Advisor, or another firm we choose for that purpose. We reserve the right to reallocate the shares between the primary offering and our dividend reinvestment plan. From January 30, 2009 (effective date) through December 31, 2010, we had accepted subscriptions from 26,244 investors and we had received gross offering proceeds of approximately $1,010,076,294 from the sale of 101,245,478 common shares including 4,756,981 common shares issued pursuant to our dividend reinvestment plan.

From October 24, 2006 through December 31, 2010, we had accepted subscriptions from 39,514 investors, issued 162,054,446 common shares, including 6,244,924 common shares issued pursuant to our dividend reinvestment plan, and received $1,617,421,996 in gross proceeds. As of December 31, 2010, 164,511,252 common shares were issued and outstanding.

We are an externally managed REIT, and have retained CBRE Advisors LLC as our investment advisor (the “Investment Advisor”). The Investment Advisor is responsible for managing our affairs on a day-to-day basis and for identifying and making acquisitions on our behalf. The Investment Advisor receives advisory services relating to real estate acquisitions, property management and communications with existing investors and, in addition, receives marketing and other operational services from CNL Fund Management Company, an affiliate of CNL Securities Corp pursuant to a sub-advisory agreement. We hold all of our real estate investments directly or indirectly through our operating partnership, CBRE Operating Partnership, L.P. (“CBRE OP”).

We benefit from the investment expertise and experience of the Investment Advisor, which is an affiliate of our sponsor CB Richard Ellis Investors, L.L.C. (“CBRE Investors”). CBRE Investors is a real estate investment management company and a registered investment advisor with the SEC. CBRE Investors is a wholly-owned subsidiary of CB Richard Ellis Group, Inc. (NYSE: CBG), or CB Richard Ellis. We have elected to be taxed as a real estate investment trust, or REIT, for U.S. federal income tax purposes. As a REIT, we generally will not be subject to U.S. federal income tax on that portion of our income that we distribute to our shareholders if, in general, at least 90% of our net taxable income (excluding net capital gain) is distributed to our shareholders.

Unless the context otherwise requires or indicates, references to “CBRE REIT,” “we,” “our” and “us” refer to the activities of and the assets and liabilities of the business and operations of CB Richard Ellis Realty Trust and its subsidiaries.

1

Investment Objectives and Acquisition Policies

When we invest in real estate properties, focusing on office, industrial (primarily warehouse/distribution), retail and potentially multi-family residential properties and other investment assets, we compete with a variety of institutional investors, including other REITs, insurance companies, mutual funds, pension funds, investment banking firms, banks and other financial institutions that invest in the same types of assets. Many of these investors have greater financial resources and access to lower costs of capital than we do. The existence of these competitive entities, as well as the possibility of additional entities forming in the future, may increase the competition for the acquisition of the types of properties we are seeking to acquire, resulting in higher prices and lower yields on assets. The consideration we agree to pay for real property shall ordinarily be based on the fair market value of the property as determined by a majority of our trustees.

We invest in real estate properties, focusing on office, retail, industrial (primarily warehouse/distribution), and multi-family residential properties, as well as certain other real estate-related assets. Our investment objectives are:

| | ¡ | | to maximize cash dividends paid to you; |

| | ¡ | | to preserve and protect your capital contributions; |

| | ¡ | | to realize growth in the value of our assets upon our ultimate sale of such assets; and |

| | ¡ | | to provide you with the potential for future liquidity by (i) listing our shares on a national securities exchange, the Nasdaq Global Select Market or the Nasdaq Global Market or (ii) if a listing has not occurred on or before December 31, 2011 our Board of Trustees must consider (but is not required to commence) an orderly liquidation of our assets. |

In 2010, our Board of Trustees established a Special Committee of the Board (the “Special Committee”) consisting of all of the Board’s independent trustees, Messrs. Black (Chairman) Reid and Orphanides, to explore and review our strategic alternatives and liquidity events in accordance with our investment objectives. There can be no assurance that the exploration of strategic alternatives will result in any particular outcome. We do not anticipate any further public comment on this matter unless and until the Special Committee deems it necessary.

We cannot assure you that we will attain these objectives or that our capital will not decrease. We may not change our investment objectives, except upon approval of shareholders holding a majority of our outstanding shares; however, our Board of Trustees may change any of our investment policies without prior notice to you or a vote of our shareholders.

We employ an enhanced income investment strategy designed to maximize risk-adjusted returns. To do so, we purchase, actively and passively manage and sell properties located in the business districts and suburban markets of major metropolitan areas. Our primary focus is on office, industrial (primarily warehouse/distribution), retail and potentially multi-family residential properties. The number and aggregate purchase price of properties we acquire in each asset class will depend upon real estate and market conditions and other circumstances existing at the time we acquire assets.

Our office portfolio may include properties such as multi-tenant, single-tenant and sale leasebacks, office parks and portfolios, newly constructed, corporate/user activity, medical office, technology/telecommunication, redevelopments and stabilized operations. Our retail portfolio may encompass regional malls, power centers, community centers, grocery-anchored strips, freestanding stores, urban properties, single assets and multiple property portfolios. Our industrial portfolio will consist primarily of warehouse/distribution properties, but may also include office/showroom, research and development facilities, manufacturing, single-tenant and sale leasebacks and corporate/user activity properties. Our multi-family residential portfolio may include garden complexes, townhouse developments, mid/high-rise towers, newly constructed and redevelopment properties, single assets and multi-property portfolios.

Our investment strategy is centered on CBRE Investors’ research-driven approach. We focus on the property types and markets identified as most compelling by CBRE Investors’ research. As a result, we believe that our opportunities will evolve over time as market conditions change.

We hold all of our real estate investments directly or indirectly through our operating partnership, CBRE OP. We are the sole general partner of CBRE OP. Our ownership of properties in CBRE OP is referred to as an Umbrella Partnership REIT, or “UPREIT.” We believe the UPREIT structure is a competitive advantage for us when seeking to acquire assets, because it allows potential sellers of properties to defer gain recognition for U.S. federal income tax purposes by contributing properties to CBRE OP in return for an interest therein. Although we are not limited as to the form our investments may take, our investments in real estate generally take the form of holding fee title or a long-term leasehold estate in the properties we acquire. We acquire such interests either directly in CBRE OP or indirectly by acquiring membership interests in, or acquisitions of property through, limited liability companies or through investments in joint ventures, partnerships, co-tenancies or other co-ownership arrangements with developers of properties, affiliates of the Investment Advisor or other persons. In addition, we may purchase properties and lease them back to the sellers of such properties.

2

We may, from time to time, invest in or make mortgage or other real estate-related loans, which may include first or second mortgages, mezzanine loans or other real estate-related investments that do not conflict with the maintenance of our REIT qualification. Although we do not have a formal policy, our criteria for investing in mortgage loans will be substantially the same as those involved in our investment in properties and will be subject to the investment limitations contained in our declaration of trust.

We are not limited as to the geographic area where we may conduct our operations. We intend to invest primarily in properties located in geographically-diverse major metropolitan areas in the United States. In addition, we currently intend to invest up to 30% of our total assets in properties outside of the United States. Our international investments may be in markets in which CBRE Investors has existing operations or previous investment experience, or may be in partnership with other entities that have significant local-market expertise. We expect that our international investments will focus on properties typically located in significant business districts and suburban markets.

We may purchase existing assets with an operating history, newly constructed properties or assets under construction. We will not invest more than 20% of our total assets in any single investment. Except for this limitation on our ability to invest in excess of 20% of our total assets in any single investment, after the initial startup activities, we are not specifically limited in the number or size of investments we may acquire or on the percentage of net proceeds of our offerings that we may invest in a single investment. It is our intent over time to build a diversified portfolio of assets. However, the number and mix of assets we acquire will depend upon real estate and market conditions and other circumstances existing at the time we acquire assets and the amount of proceeds we raise in our current public offering. In making investment decisions for us, the Investment Advisor considers relevant risks and financial factors, including the creditworthiness of major tenants, the expected levels of rental and occupancy rates, current and projected cash flow of the property, the location, condition and use of the property, suitability for any development contemplated or in progress, income-producing capacity, the prospects for long-range appreciation, liquidity and income tax considerations. In addition to these factors, the Investment Advisor, when evaluating prospective mortgage loan investments, will consider the ratio of the amount of the investment to the value of the property by which it is selected and the quality, experience and creditworthiness of the borrower. The Investment Advisor also utilizes the resources and professionals of CBRE Investors and consults with its investment committee when evaluating potential investments. In this regard, the Investment Advisor has substantial discretion with respect to the selection of specific investments.

Our obligation to close the purchase of any property is generally conditioned upon the delivery and verification of certain documents from the seller or developer, including, where appropriate:

| | ¡ | | plans and specifications; |

| | ¡ | | evidence of marketable title subject to such liens and encumbrances as are acceptable to the Investment Advisor; |

| | ¡ | | title and liability insurance policies; and |

| | ¡ | | audited financial statements covering recent operations of properties having operating histories, unless such statements would not be required to be filed with the SEC, so long as we are a public company. |

We will not close the purchase of any property unless and until we obtain an environmental assessment for each property purchased and are generally satisfied with the environmental status of the property. A Phase I environmental site assessment basically consists of a visual survey of the building and the property in an attempt to identify areas of potential environmental concern, visually observing neighboring properties to assess surface conditions or activities that may have an adverse environmental impact on the property, and contacting local governmental agency personnel and performing a regulatory agency file search in an attempt to determine any known environmental concerns in the immediate vicinity of the property. A Phase I environmental site assessment does not generally include any sampling or testing of soil, groundwater or building materials from the property. We may pursue additional assessments or reviews if the Phase I site assessment indicates that further environmental investigation is warranted.

In connection with our assessment and selection of investment partners, property managers, development managers and other service providers, we will consider their experience and reputation in the areas of environmental sustainability, including experience in the development and operation of buildings certified under the LEED (Leadership in Energy and Environmental Design) Green Building Rating System promulgated by the US Green Building Counsel. The Investment Advisor will evaluate the sustainability of a prospective investment property by assessing its Energy Star score, its preliminary LEED score, and sustainability measures that have been or can be implemented, such as recycling, water conservation and green cleaning methods. We will consider operational, maintenance and capital improvement practices for existing properties designed to increase energy efficiency, reduce waste and otherwise lessen environmental impacts while remaining conscious of economic performance. We will engage in dialog with our property managers and tenants to determine and implement sustainability initiatives appropriate for particular properties. We will also consider utilizing and recommending to our tenants the environmental sustainability consulting services of CB Richard Ellis or unaffiliated parties.

3

We may also enter into arrangements with the seller or developer of a property whereby the seller or developer agrees that if during a stated period the property does not generate a specified cash flow, the seller or developer will pay in cash to us a sum necessary to reach the specified cash flow level, subject in some cases to negotiated dollar limitations.

In determining whether to purchase a particular property, we may, in accordance with customary practices, obtain an option on such property. The amount paid for an option, if any, is normally surrendered if the property is not purchased and is normally credited against the purchase price if the property is purchased.

Development and Construction of Properties

We have invested in, and may in the future invest in properties on which improvements are to be constructed or completed. We are not restricted in our ability to invest in such properties. To help ensure performance by the builders of properties that are under construction, completion of properties under construction may be guaranteed at the price contracted either by an adequate completion bond or performance bond. We may rely, however, upon the substantial net worth of the contractor or developer or a personal guarantee accompanied by financial statements showing a substantial net worth provided by an affiliate of the person entering into the construction or development contract as an alternative to a completion bond or performance bond. Development of real estate properties is subject to risks relating to a builder’s ability to control construction costs or to build in conformity with plans, specifications and timetables.

We may make periodic progress payments or other cash advances to developers and builders of our properties prior to completion of construction only upon receipt of an architect’s certification as to the percentage of the project then-completed and as to the dollar amount of the construction then-completed. We intend to use such additional controls on disbursements to builders and developers as we deem necessary or prudent.

We may directly employ one or more project managers to plan, supervise and implement the development of any unimproved properties that we may acquire. In such event, such persons would be compensated directly by us. There currently is no affiliate of the Investment Advisor that performs development activities on our behalf and neither we nor the Investment Advisor currently intend to form an entity for such purpose.

Joint Venture Investments

We have entered into, and may in the future enter into, joint ventures, partnerships, co-tenancies and other co-ownership arrangements or participations with real estate developers, owners and other affiliated third-parties, including other programs sponsored by CBRE Investors, for the purpose of developing, owning and operating real properties. In determining whether to invest in a particular joint venture, the Investment Advisor will evaluate the real property that such joint venture owns or is being formed to own under the same criteria employed for the selection of our real estate property investments.

In the event that the co-venturer were to elect to sell property held in any such joint venture, however, we may not have sufficient funds to exercise our right of first refusal to buy the other co-venturer’s interest in the property held by the joint venture. In the event that any joint venture with an affiliated entity holds interests in more than one property, the interest in each such property may be specially allocated based upon the respective proportion of funds invested by each co-venturer in each such property. Our entering into joint ventures with other affiliates, including other programs sponsored by CBRE Investors, will result in certain conflicts of interest.

Borrowing Policies

While we strive for diversification, the number of different assets we can acquire will be affected by the amount of funds available to us.

Our ability to increase our diversification through borrowing could be adversely impacted by banks and other lending institutions reducing the amount of funds available for loans secured by real estate. When interest rates on mortgage loans are high or financing is otherwise unavailable on a timely basis, we may purchase certain properties for cash with the intention of obtaining a mortgage loan for a portion of the purchase price at a later time.

Although we have adopted a policy to limit our aggregate borrowing to no more than 65% of the cost of our assets before non-cash reserves and depreciation, subject to the 300% of net assets borrowing restriction described below, this policy may be altered at any time or suspended by our Board of Trustees if necessary to pursue attractive investment opportunities. Our organizational documents contain a limitation on the amount of indebtedness that we may incur, so that until our shares are listed on a national securities exchange, our aggregate borrowing may not exceed 300% of our net assets unless any excess borrowing is approved by a majority of our independent trustees and is disclosed to shareholders in our next quarterly report. Our Board of Trustees must review our aggregate borrowing from time to time, but at least quarterly.

4

By operating on a leveraged basis, we will have more funds available for investment in assets. This will allow us to make more investments than would otherwise be possible, resulting in a more diversified portfolio. Although our liability for the repayment of indebtedness is expected to be limited to the value of the asset securing the liability and the rents or profits derived therefrom, our use of leveraging may increase the risk of default on the mortgage payments and a resulting foreclosure of a particular property. To the extent that we do not obtain mortgage loans on our properties, our ability to acquire additional assets will be restricted. The Investment Advisor will use its best efforts to obtain financing on our behalf on the most favorable terms available. Lenders may have recourse to assets not securing the repayment of the indebtedness.

We may refinance properties during the term of a loan only in limited circumstances, such as when a decline in interest rates makes it beneficial to prepay an existing mortgage, when an existing mortgage matures or if an attractive investment becomes available and the proceeds from the refinancing can be used to purchase such investment. The benefits of the refinancing may include an increased cash flow resulting from reduced debt service requirements, an increase in dividend distributions from proceeds of the refinancing, if any, and/or an increase in property ownership if some refinancing proceeds are reinvested in real estate.

We may not borrow money from any of our trustees or from the Investment Advisor and its affiliates unless approved by a majority of our trustees, including a majority of any independent trustees not otherwise interested in the transaction, as fair, competitive and commercially reasonable and no less favorable to us than comparable loans between unaffiliated parties.

Disposition Policies

We intend to hold each asset we acquire for an extended period. However, circumstances might arise which could result in the early sale of some assets. We may sell a property before the end of the expected holding period if, among other reasons:

| | ¡ | | in our judgment, the sale of the asset is in the best interests of our shareholders; |

| | ¡ | | we can reinvest the proceeds in a higher-yielding investment; |

| | ¡ | | we can increase cash flow through the disposition of the asset; or |

| | ¡ | | in the judgment of the Investment Advisor, the value of an asset might decline substantially. |

The determination of whether a particular asset should be sold or otherwise disposed of will be made after consideration of relevant factors, including prevailing economic conditions, with a view to achieving maximum long-term capital appreciation. We cannot assure you that this objective will be realized.

If our shares are not listed for trading on a national securities exchange, the Nasdaq Global Select Market or the Nasdaq Global Market by December 31, 2011, our declaration of trust requires our Board of Trustees to consider (but is not required to commence) an orderly liquidation of our assets, which liquidation would require the approval of shareholders. In making the decision to apply for listing of our shares, our trustees will try to determine whether listing our shares or liquidating our assets will result in greater long-term value for our shareholders. We cannot determine at this time the circumstances, if any, under which our trustees will determine to list our shares. Even if no shares are listed, we are under no obligation to actually sell our portfolio within this time period since the precise timing will depend on real estate and financial markets, economic conditions of the areas in which the properties are located and U.S. federal income tax effects on shareholders which may be applicable in the future. Furthermore, we cannot assure you that we will be able to liquidate our assets. In addition, we may consider other business strategies such as reorganizations or mergers with other entities if our Board of Trustees determines such strategies would be in the best interests of our shareholders. Any change in the investment objectives set forth in our declaration of trust would require the vote of shareholders holding a majority of our outstanding shares.

Investment Limitations

Our declaration of trust places numerous limitations on us with respect to the manner in which we may invest our funds, most of which are required by various provisions of the North American Securities Administrators Association Guidelines, or NASAA Guidelines. Our declaration of trust provides that until our shares are listed on a national securities exchange or included on the Nasdaq Global Select Market or the Nasdaq Global Market, we may not:

| | ¡ | | invest in equity securities unless a majority of our trustees, including a majority of any independent trustees not otherwise interested in the transaction, approve such investment as being fair, competitive and commercially reasonable; |

| | ¡ | | make investments in unimproved property or indebtedness secured by a deed of trust or mortgage loans on unimproved property in excess of 10% of our total assets; |

5

| | ¡ | | invest in commodities or commodity futures contracts, except for futures contracts when used solely for the purpose of hedging in connection with our ordinary business of investing in real estate assets and mortgages; |

| | ¡ | | make or invest in mortgage loans unless an appraisal is obtained concerning the underlying property, except for those mortgage loans insured or guaranteed by a government or government agency. In cases where a majority of our independent trustees determine, and in all cases in which the transaction is with any of our trustees or the Investment Advisor or its affiliates, such appraisal shall be obtained from an independent appraiser. We will maintain such appraisal in our records for at least five years and it will be available for your inspection and duplication. We will also obtain a mortgagee’s or owner’s title insurance policy as to the priority of the mortgage; |

| | ¡ | | invest in real estate contracts of sale, otherwise known as land sale contracts, unless the contract is in recordable form and is appropriately recorded in the chain of title; |

| | ¡ | | make or invest in mortgage loans, including construction loans, on any one property if the aggregate amount of all mortgage loans on such property would exceed an amount equal to 85% of the appraised value of such property as determined by appraisal unless substantial justification exists for exceeding such limit because of the presence of other underwriting criteria; |

| | ¡ | | make or invest in mortgage loans that are subordinate to any mortgage or equity interest of any of our trustees, the Investment Advisor or its affiliates; |

| | ¡ | | issue “redeemable securities,” as defined in Section 2(a)(32) of the Investment Company Act of 1940, as amended, or the Investment Company Act; |

| | ¡ | | issue debt securities unless the historical debt service coverage (in the most recently completed fiscal year) as adjusted for known changes is sufficient to properly service that higher level of debt; |

| | ¡ | | grant warrants or options to purchase shares to the Investment Advisor or its affiliates or to officers or trustees affiliated with the Investment Advisor except on the same terms as such warrants or options are sold to the general public and in an amount not to exceed 10% of the outstanding shares on the date of grant of the warrants and options; |

| | ¡ | | issue equity securities on a deferred payment basis or other similar arrangement; or |

| | ¡ | | lend money to our trustees or to the Investment Advisor or its affiliates. |

The Investment Advisor continually reviews our investment activity to ensure that we do not come within the application of the Investment Company Act. Among other things, the Investment Advisor monitors the proportion of our portfolio that is placed in various investments so that we do not come within the definition of an “investment company” under the Investment Company Act. If at any time the character of our investments could cause us to be deemed an “investment company” for purposes of the Investment Company Act, we will take the necessary actions to attempt to ensure that we are not deemed to be an “investment company.”

Change in Investment Objectives and Limitations

Until our shares are listed on a national securities exchange, our declaration of trust requires that the independent trustees review our investment policies at least annually to determine that the policies we are following are in the best interests of our shareholders. Each determination, and the basis therefore, is required to be set forth in our minutes. The methods of implementing our investment policies also may vary as new investment techniques are developed. The methods of implementing our investment objectives and policies, except as otherwise provided in the organizational documents, may be altered by a majority of our trustees, including a majority of the independent trustees, without the approval of the shareholders. Our investment objectives themselves, however, may only be amended by a vote of the shareholders holding a majority of our outstanding shares.

Restrictions on Roll-up Transactions

Until our shares are listed on a national securities exchange, our declaration of trust requires that we follow the policy set forth below with respect to any “Roll-up Transaction.” In connection with any proposed transaction considered a “Roll-up Transaction” involving us and the issuance of securities of an entity, or a Roll-up Entity, that would be created or would survive after the successful completion of the Roll-up Transaction, an appraisal of all properties must be obtained from a competent independent appraiser. The properties must be appraised on a consistent basis, and the appraisal shall be based on the evaluation of all relevant information and shall indicate the value of the properties as of the date immediately prior to the announcement of the proposed Roll-up Transaction. The appraisal shall assume an orderly liquidation of properties over a 12-month period. The terms of the engagement of the independent appraiser must clearly state that the engagement is for our benefit and our shareholders’ benefit. A summary of the appraisal, indicating all material assumptions underlying the appraisal, shall be included in a report to our shareholders in connection with any proposed Roll-up Transaction. If the appraisal will be included in a document used to offer the securities of a Roll-up Entity, the appraisal shall be filed with the SEC and the states as an exhibit to the registration statement for the offering.

6

A “Roll-up Transaction” is a transaction involving the acquisition, merger, conversion or consolidation, directly or indirectly, of us and the issuance of securities of a Roll-up Entity. This term does not include:

| | ¡ | | a transaction involving our securities that have been listed on a national securities exchange for at least 12 months; or |

| | ¡ | | a transaction involving our conversion into corporate or association form if, as a consequence of the transaction, there will be no significant adverse change in any of the following: our shareholder voting rights; the term of our existence; compensation to the Investment Advisor or its affiliates; or our investment objectives. |

In connection with a proposed Roll-up Transaction, the person sponsoring the Roll-up Transaction must offer to our shareholders who vote “no” on the proposal a choice of:

| | ¡ | | accepting the securities of the Roll-up Entity offered in the proposed Roll-up Transaction; or |

| | ¡ | | remaining as shareholders and preserving their interests on the same terms and conditions as existed previously; or |

| | ¡ | | receiving cash in an amount equal to the shareholders’pro rata share of the appraised value of our net assets. |

We are prohibited from participating in any proposed Roll-up Transaction:

| | ¡ | | that would result in our shareholders having voting rights in a Roll-up Entity that are less than those provided in our bylaws and described elsewhere in this document including rights with respect to the election and removal of trustees, annual reports, annual and special meetings, amendment of our declaration of trust and our dissolution; |

| | ¡ | | that includes provisions that would operate to materially impede or frustrate the accumulation of shares by any purchaser of the securities of the Roll-up Entity, except to the minimum extent necessary to preserve the tax status of the Roll-up Entity, or which would limit the ability of an investor to exercise voting rights of its securities of the Roll-up Entity on the basis of the number of shares held by that investor; |

| | ¡ | | in which investors’ right to access of records of the Roll-up Entity will be less than those provided in the section of our prospectus entitled “Description of Shares”; or |

| | ¡ | | in which any of the costs of the Roll-up Transaction would be borne by us if the Roll-up Transaction is not approved by our shareholders. |

Policies With Respect to Certain Other Activities

If our Board of Trustees determines that additional funding is required, we may raise such funds through additional equity offerings or the retention of cash flow (subject to the REIT provisions of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”) concerning distribution requirements and taxability of undistributed net taxable income) or a combination of these methods.

In the event that our Board of Trustees determines to raise additional equity capital, it has the authority, without shareholder approval, to issue additional common or preferred shares in any manner and on such terms and for such consideration it deems appropriate, at any time.

We have authority to repurchase or otherwise reacquire our shares and may engage in such activities in the future. We may invest in the securities of other issuers for the purpose of exercising control. We currently have no intention to underwrite securities of other issuers.

Our Board of Trustees may change any of these policies without prior notice to you or a vote of our shareholders.

The Advisory Agreement

We entered into an advisory agreement with the Investment Advisor in July 2004, which was amended and restated in October 2006, January 2009 and December 2010. Pursuant to this agreement, which was unanimously approved by our Board of Trustees, including our independent trustees, we appointed the Investment Advisor to manage, operate, direct and supervise our operations. The Investment Advisor performs its duties as a fiduciary of us and our shareholders. Many of the services to be performed by the Investment Advisor in managing our day-to-day activities are summarized below.

7

This summary is provided to illustrate the material functions that the Investment Advisor performs for us as the Investment Advisor, and it is not intended to include all of the services that may be provided to us by the Investment Advisor or by third parties. The Investment Advisor may subcontract with third parties for the performance of certain duties on our behalf. The Investment Advisor will only subcontract with third parties that are believed to have the requisite experience to perform their duties. The Investment Advisor will supervise the activities of any such third parties consistent with its fiduciary duty to us. Under the terms of the advisory agreement, the Investment Advisor undertakes to use its best efforts to present to us investment opportunities consistent with our investment policies and objectives as adopted by our Board of Trustees. In its performance of this undertaking, the Investment Advisor shall, subject to the authority of the board:

| | ¡ | | find, present and recommend to us real estate investment opportunities consistent with our investment policies and objectives; |

| | ¡ | | structure the terms and conditions of transactions pursuant to which acquisitions of properties will be made; |

| | ¡ | | acquire assets on our behalf in compliance with our investment objectives and policies; |

| | ¡ | | arrange for financing and refinancing of properties; and |

| | ¡ | | enter into leases and service contracts for the properties acquired. |

The initial term of the advisory agreement was for one year and the term may be renewed at the end of each year of the agreement for an additional one-year period. The current term of the advisory agreement expires on April 30, 2011. Prior to any renewal, our trustees will evaluate the performance of the Investment Advisor and the criteria used in such evaluation will be reflected in the minutes of such meeting. Additionally, the advisory agreement may be terminated:

| | ¡ | | immediately by us (i) in the event the Investment Advisor commits fraud, criminal conduct, willful misconduct or willful or negligent breach of fiduciary duty by the Investment Advisor, (ii) upon the bankruptcy or insolvency of the Investment Advisor, CBRE Investors or CB Richard Ellis or (iii) upon material breach of the Advisory Agreement by the Investment Advisor, which remains uncured after 30 days’ written notice or (iv) if there is a dissolution of any of the Investment Advisor, CBRE Investors or CB Richard Ellis; |

| | ¡ | | without cause or penalty by a majority of our independent trustees or by the Investment Advisor upon 60 days’ written notice; or |

| | ¡ | | immediately by the Investment Advisor upon our bankruptcy or any material breach of the advisory agreement by us, which remains uncured after 10 days’ written notice. |

Affiliates of the Investment Advisor may engage in other business ventures and, as a result, their resources may not be dedicated exclusively to our business. However, pursuant to the advisory agreement, the Investment Advisor must devote sufficient resources to the administration of our company to discharge our obligations. The Investment Advisor does not currently intend to advise REITs other than us. The Investment Advisor may assign the advisory agreement to an affiliate upon approval of a majority of the trustees, including the independent trustees. Until our shares are listed on a national securities exchange, the Nasdaq Global Select Market or the Nasdaq Global Market, the trustees shall determine that any successor advisor possesses sufficient qualifications to (i) perform the advisory function for us and (ii) justify the compensation provided for in its contract with us. We may assign or transfer the advisory agreement to a successor entity of ours.

The Investment Advisor may not complete an acquisition or disposition of property or financing of such acquisition on our behalf without the prior approval of a majority of our Board of Trustees. The Investment Advisor also utilizes the resources and professionals of CBRE Investors and consults with its investment committee when evaluating potential investments. However, the actual terms and conditions of transactions involving investments in properties shall be determined in the sole discretion of the Investment Advisor, subject at all times to such board approval.

We reimburse the Investment Advisor for all of the costs it incurs in connection with the services it provides to us, including, but not limited to:

| | ¡ | | cumulative organization and offering expenses estimated to be 0.8%, but in no event shall such organizational and offering expenses exceed 15.0% of our aggregate gross offering proceeds from the sale of shares in the primary offering, which include actual legal, accounting, printing and other expenses attributable to conducting our offering or other offerings, any organizational documents, qualification of the shares for sale in the states and filing fees incurred by the Investment Advisor, as well as reimbursements for marketing, direct expenses of its employees while engaged in registering and marketing the shares and other marketing and organization costs; |

8

| | ¡ | | the annual cost of goods and materials used by us, including brokerage fees paid in connection with the purchase and sale of securities; |

| | ¡ | | administrative services including personnel costs; |

| | ¡ | | acquisition expenses, which are defined to include expenses related to the selection and acquisition of properties; |

| | ¡ | | financing expenses; and |

| | ¡ | | operating expenses, subject to certain limitations set forth in the advisory agreement, which includes all expenses paid or incurred by the Investment Advisor or its affiliates as determined by generally accepted accounting principles, such as real estate operating costs, net of reimbursements, management and leasing fees, general and administrative expenses, and legal and accounting expenses. |

The Investment Advisor and its affiliates are paid fees in connection with services provided to us. In the event the advisory agreement is terminated, the Investment Advisor will be paid all accrued and unpaid fees and expense reimbursements. In addition, an affiliate of the Investment Advisor has received one class B limited partnership interest in CBRE OP (representing 100% of the class B interest outstanding) in exchange for the services provided to us relating to our formation and future services. The class B limited partnership interest is subject to redemption by CBRE OP in the event of termination of the advisory agreement.

A majority of the independent trustees, and a majority of trustees not otherwise interested in the transaction, must approve all transactions with the Investment Advisor or any of its affiliates. Until our shares are listed on a national securities exchange, the Nasdaq Global Select Market or the Nasdaq Global Market, our independent trustees must determine from time to time, but at least annually, that our fees and expenses are reasonable in light of our performance, our net assets and net income and the fees and expenses of other comparable unaffiliated REITs. During this period, our independent trustees are also responsible for reviewing the performance of the Investment Advisor and determining that the compensation to be paid to the Investment Advisor is reasonable in relation to the nature and quality of services to be performed and that the provisions of the advisory agreement are being carried out. Specifically, our independent trustees consider factors such as:

| | ¡ | | the amount of the fee paid to the Investment Advisor in relation to the size, composition and performance of our investments; |

| | ¡ | | the success of the Investment Advisor in generating appropriate investment opportunities; |

| | ¡ | | rates charged to other REITs and other investors by advisors performing similar services; |

| | ¡ | | additional revenues realized by the Investment Advisor and any of its Affiliates through their relationship with us, whether we pay them or they are paid by others with whom we do business; |

| | ¡ | | the quality and extent of service and advice furnished by the Investment Advisor and the performance of our investment portfolio; |

| | ¡ | | the performance of our investments, including income generation, conservation or appreciation of capital, frequency of problem investments and competence in dealing with distress situations; and |

| | ¡ | | the quality of our portfolio relative to the investments generated by the Investment Advisor for its other clients. |

Until our shares are listed on a national securities exchange, the Nasdaq Global Select Market or the Nasdaq Global Market, neither our trustees, the Investment Advisor nor their affiliates may vote or consent to the voting of shares they now own or hereafter acquire on matters submitted to the shareholders regarding either (1) the removal of the Investment Advisor, any trustee or any affiliate, or (2) any transaction between us and the Investment Advisor, any trustee or any affiliate.

The Sub-Advisory Agreement

The Investment Advisor has entered into a sub-advisory agreement with CNL Fund Management Company, or the Sub-Advisor. The Sub-Advisor, which is a wholly-owned subsidiary of CNL Financial Group, Inc., is an affiliate of the Dealer Manager, which is a wholly-owned subsidiary of CNL Capital Markets Corp. Pursuant to this agreement, the Sub-Advisor acts only as an advisor to the Investment Advisor, upon request, and may provide advisory services relating to real estate acquisitions, property management and communications with existing investors and, in addition, provides marketing and other operational services. The term of this agreement will continue so long as the Investment Advisor remains our advisor pursuant to the advisory agreement and it may automatically be extended concurrently with the advisory agreement. The sub-advisory agreement may be terminated by (i) the Investment Advisor for “cause” on 60 days’ written notice or if the managing dealer agreement is terminated pursuant to its terms, or (ii) the Sub-Advisor for

9

a material breach of the agreement which remains uncured after 15 days’ written notice or the bankruptcy of the Investment Advisor. For advisory services relating to real estate acquisitions, property management and communications with existing investors, the Investment Advisor compensates the Sub-Advisor through certain investment management and acquisition fees, which are in an amount equal to approximately 14% to 19%, respectively, of such fees the Investment Advisor receives from us. The Sub-Advisor may also provide certain marketing and operational services to the Investment Advisor, for which it is entitled to receive fees, and the Sub-Advisor is also entitled to reimbursement by the Investment Advisor for certain expenses it incurs. In the event the sub-advisory agreement is terminated, the Sub-Advisor will be paid all accrued and unpaid fees and expense reimbursements. The Investment Advisor retains ultimate responsibility for the performance of all of the matters entrusted to it under the advisory agreement.

Industry Segments

We view our operations as having three reportable segments, two Domestic segments, consisting of Domestic Office Properties and Domestic Industrial Properties and an International Office/Retail Properties segment, which participate in the acquisition, development, ownership and operation of high quality real estate assets in their respective regions. Information regarding our reportable segments can be reviewed under Note 11, “Segment Disclosure,” in the accompanying consolidated financial statements.

Geographic Areas of Properties

We currently operate in two geographic areas, the United States and the United Kingdom. Information regarding the geographic diversification of our consolidated properties as of December 31, 2010 can be reviewed under Note 10, “Concentrations—Geographic Concentrations,” in the accompanying consolidated financial statements. As of December 31, 2010, we also have ownership interests in (i) CBRE Strategic Partners Asia, which, owned interests in properties in China and Japan, (ii) the UK JV, which owned interests in properties in the United Kingdom and (iii) the European JV, which owned interests in properties in Germany. Information relative to CBRE Strategic Partners Asia, the UK JV and the European JV can be reviewed under Note 5, “Investments in Unconsolidated Entities” in the accompanying consolidated financial statements.

Competition

As we purchase properties to build our portfolio, we are in competition with other potential buyers for the same properties, which may result in an increase in the amount we must pay to acquire a property or may require us to locate another property that meets our investment criteria. Leasing of real estate is also highly competitive in the current market, and we will experience competition for tenants from owners and managers of competing projects. As a result, we may have to provide rent concessions, incur charges for tenant improvements or offer other inducements to enable us to timely lease vacant space, all of which may have an adverse impact on our results of operations. At the time we elect to dispose of our properties, we will also be in competition with sellers of similar properties to locate suitable purchasers.

10

Organizational Structure

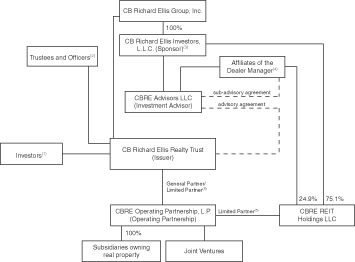

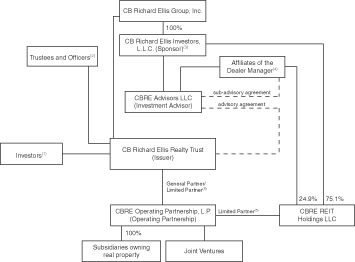

The following chart illustrates our general structure and ownership and the management relationship between the Investment Advisor and us.

| (1) | Includes investors in our current public offering, our initial public offering and our private offerings, excluding shares held by CBRE Investors, our trustees and officers. As of December 31, 2010, 164,511,252 common shares were issued and outstanding. |

| (2) | Our trustees and officers own an aggregate 105,642 of our common shares. |

| (3) | CBRE Investors owns 243,229 of our common shares. CBRE Investors also owns all of the cash distribution interest and CBRE Investors (including certain of its current and former executive officers and our executive officers) own an aggregate 77% distribution interest in the net proceeds upon a sale of the Investment Advisor. |

| (4) | Fund Investors, LLC and CNL Fund Management Company, affiliates of the Dealer Manager, own (i) an aggregate 23% distribution interest in the net proceeds upon a sale of the Investment Advisor and (ii) an aggregate 24.9% voting and distribution interest (excluding distributions that CBRE Investors is entitled to with respect to 29,937 class A units) in CBRE REIT Holdings LLC. CNL Fund Management Company serves as the Sub-Advisor to the Investment Advisor. |

| (5) | CBRE Investors owns a 75.1% voting interest and CBRE Investors (including certain of its current and former executive officers) and our executive officers own an aggregate 75.1% distribution interest (excluding distributions that CBRE Investors is entitled to with respect to 29,937 class A units) in CBRE REIT Holdings LLC. |

| (6) | As of December 31, 2010, we owned a 99.85% general/limited partnership interest in CBRE OP and CBRE REIT Holdings LLC owned a 0.15% (or 246,361 class A units) limited partnership interest in CBRE OP. CBRE REIT Holdings LLC also owns one class B limited partnership interest in CBRE OP (representing 100% of the class B interest outstanding). CBRE REIT Holdings LLC is controlled by CBRE Investors. |

Employees

As of December 31, 2010, we had no full-time employees and do not anticipate any material changes in the number of our full-time employees. Our executive officers are employees of the Investment Advisor or one or more of its affiliates.

Facilities

Our principal offices are located at 47 Hulfish Street, Suite 210, Princeton, New Jersey 08542. We also have offices located at 515 South Flower Street, Suite 3100, Los Angeles, California 90071. Our telephone number is (609) 683-4900.

Available Information

Our website ishttp://www.cbrerealtytrust.com. The information found on, or otherwise accessible through, our website is not incorporated information and does not form a part of this Annual Report on Form 10-K or any other report or document we file with or furnish to the SEC. We make available, free of charge, on or through the “SEC Filings” section of our website, annual reports on

11

Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. We have also posted on our website the Audit Committee Charter, Compensation Committee Charter, Conflicts Committee Charter and Code of Business Conduct and Ethics, which govern our trustees, officers and employees. Within the time period required by the SEC, we will post on our website any amendment to our Code of Business Conduct and Ethics and any waiver applicable to our senior financial officers, and our executive officers or trustees. The information contained on our website is not incorporated into this report on Form 10-K. You can also read and copy any materials we file with the Securities and Exchange Commission at its Public Reference Room at 100 F Street, NE, Washington, DC 20549 (1-800-SEC-0330). The Securities and Exchange Commission maintains an Internet site(http://www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Securities and Exchange Commission.

Recent Developments

From January 1, 2011 through March 17, 2011, we received gross proceeds from our public offering of approximately $80,515,423 from the sale of 8,105,529 common shares.

On January 20, 2011 and February 14, 2011, we paid down the Amended Wells Fargo Credit Facility loan payable by $20,000,000 and $15,000,000, respectively. On March 30, 2011, an additional $30,000,000 was drawn down on the Amended Wells Fargo Credit Facility.

On January 31, 2011, we were notified that the investment commitment period of CBRE Strategic Partners Asia was extended for one year from January 31, 2011 to January 31, 2012.

On February 8, 2011, we entered into five secured term loans totaling $37,000,000 with ING USA Annuity and Life Insurance Company secured by the following properties: 4701 Gold Spike Road, $10,650,000, Summit Distribution Center, $6,700,000, Tolleson Commerce Park II, $4,600,000, 3660 Deerpark Blvd., $7,650,000 and 1985 International Way, $7,400,000. The loans bear interest at a fixed rate of 4.45% and mature on February 8, 2018.

On February 22, 2011, we entered into a lease for the Kings Mountain III property, a 541,910 square foot warehouse/distribution building located in Charlotte, North Carolina for a 10 year term.

On February 28, 2011, we entered into a $33,000,000 secured term loan with TD Bank secured by the 100 Kimball Drive property. Upon closing the 100 Kimball Drive loan, we simultaneously entered into an interest rate swap agreement with TD Bank to effectively fix the interest rate on the entire outstanding loan amount to 5.25% for its 10 year term.

12

On March 24, 2011, the Duke joint venture acquired fee interests in the second and third tranches of properties (the “Remaining Properties”), thus completing the acquisition of the Office Portfolio, as described further below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Property and Market | | Address | | Year

Built | | | Tenant(1) | | Net

Rentable

Square

Feet | | | Lease

Expiration | | | Approximate

Purchase

Price(2) | | | Pro Rata

Share of

Approximate

Purchase

Price(3) | | | Percentage

Leased | | | Acquisition

Fee(4) | |

Norman Pointe I /

Minneapolis, MN | | 5601 Green Valley Drive Bloomington, MN | | | 2000 | | | NCS Pearson, Inc.(5) | | | 212,722 | | | | 02/2017 | | | $ | 42,600,000 | | | $ | 34,080,000 | | | | 100 | % | | $ | 511,200 | |

| | | | | | | | | |

Norman Pointe II /

Minneapolis, MN | | 5600 West American Boulevard, Bloomington, MN | | | 2007 | | | General Services Administration(6); Hartford Fire Insurance Company(7) | | | 324,296 | | |

| 02/2016;

06/2013 |

| | $ | 46,900,000 | | | $ | 37,520,000 | | | | 100 | % | | $ | 562,800 | |

| | | | | | | | | |

The Landings I /

Cincinnati, Ohio | | 9997 Carver Road, Blue Ash, OH | | | 2006 | | | Citicorp North America(8) | | | 175,695 | | | | 01/2022 | | | $ | 29,659,500 | | | $ | 23,727,600 | | | | 100 | % | | $ | 355,914 | |

| | | | | | | | | |

The Landings II /

Cincinnati, Ohio | | 9987 Carver Road, Blue Ash, OH | | | 2007 | | | — | | | 175,076 | | | | — | | | $ | 26,160,500 | | | $ | 20,928,400 | | | | 96.1 | % | | $ | 313,926 | |

| | | | | | | | | |

One Easton Oval /

Columbus, Ohio | | One Easton Oval, Columbus, Ohio | | | 1997 | | | — | | | 125,031 | | | | — | | | $ | 11,911,000 | | | $ | 9,528,800 | | | | 89.4 | % | | $ | 142,932 | |

| | | | | | | | | |

Two Easton Oval /

Columbus, Ohio | | Two Easton Oval, Columbus, Ohio | | | 1995 | | | — | | | 128,674 | | | | — | | | $ | 12,744,000 | | | $ | 10,195,200 | | | | 74.6 | % | | $ | 152,928 | |

| | | | | | | | | |

Weston Pointe I /

Ft. Lauderdale, Florida | | 2400 North Commerce Parkway, Weston, FL | | | 1999 | | | — | | | 97,579 | | | | — | | | $ | 19,384,250 | | | $ | 15,507,400 | | | | 87.1 | % | | $ | 232,611 | |

| | | | | | | | | |

Weston Pointe II /

Ft. Lauderdale, Florida | | 2200 North Commerce Parkway, Weston, FL | | | 2000 | | | — | | | 97,180 | | | | — | | | $ | 23,375,950 | | | $ | 18,700,760 | | | | 100 | % | | $ | 280,511 | |

| | | | | | | | | |

Weston Pointe III /

Ft. Lauderdale, Florida | | 2250 North Commerce Parkway, Weston, FL | | | 2003 | | | American Intercontinental University(9) | | | 97,178 | | | | 09/2015 | | | $ | 23,583,550 | | | $ | 18,866,840 | | | | 100 | % | | $ | 283,003 | |

| | | | | | | | | |

Weston Pointe IV /

Ft. Lauderdale, Florida | | 2100 North Commerce Parkway, Weston, FL | | | 2006 | | | General Services Administration(6) | | | 96,175 | | | | 04/2019 | | | $ | 28,256,250 | | | $ | 22,605,000 | | | | 100 | % | | $ | 339,075 | |

| | | | | | | | | |

One Conway Park /Chicago, Illinois | | 100 Field Drive, Lake Forest, IL | | | 1989 | | | — | | | 105,000 | | | | — | | | $ | 15,400,000 | | | $ | 12,320,000 | | | | 86.5 | % | | $ | 184,800 | |

| | | | | | | | | |

West Lake at Conway /

Chicago, Illinois | | 1925 West Field Ct., Lake Forest, IL | | | 2008 | | | — | | | 99,538 | | | | — | | | $ | 17,575,000 | | | $ | 14,060,000 | | | | 90.1 | % | | $ | 210,900 | |

| | | | | | | | | |

Atrium I /Columbus, Ohio | | 5525 Parkcenter Circle, Dublin, OH | | | 1996 | | | Nationwide Mutual Insurance Company(10) | | | 315,102 | | |

| 05/2018;

05/2019 |

(11) | | $ | 45,250,000 | | | $ | 36,200,000 | | | | 100 | % | | $ | 543,000 | |

| (1) | This column represents tenants that currently occupy more than 50,000 net rentable square feet of each property. Properties which do not list a tenant are multi-tenant properties that do not currently have a tenant that occupies more than 50,000 net rentable square feet. |

| (2) | Approximate total purchase price, exclusive of customary closing costs, paid by the Duke Joint Venture for each property. |

| (3) | Pro rata share of approximate purchase price is at the Company’s pro rata share of effective ownership for each of these properties, which was funded using net proceeds of the Company’s current public offering. |

| (4) | Acquisition fees payable to the Investment Advisor are not included in the total acquisition cost for the properties. |

| (5) | NCS Pearson, Inc. provides services, software, systems, and Internet-based technologies for the collection, management, and interpretation of data. |

| (6) | The General Services Administration is an independent agency of the Federal Government of the United States of America, which supplies products and communications for U.S. government offices, provides transportation and office space to federal employees and develops government-wide cost-minimizing policies and other management tasks. |

| (7) | Hartford Fire Insurance Company is a subsidiary of The Hartford Financial Services Group and one of the world’s leading providers of fire, marine and casualty insurance. |

| (8) | Citicorp North America, Inc., provides regional banking services and is a subsidiary of Citigroup, Inc. (NYSE: C). |

| (9) | American Intercontinental University is an international for-profit university with both physical and online campuses. |

| (10) | Nationwide Mutual Insurance Company is one of the nation’s largest insurance and financial services companies. |

| (11) | This tenant has two separate leases within this property, as they rent two separate spaces. |

13

On March 24, 2011, in connection with the acquisition of the Remaining Properties as described above, the Duke joint venture entered into a $275,000,000 unsecured term loan (the “Term Loan Agreement”) with Wells Fargo Bank, National Association. While the term loan is non-recourse to us, the pro rata share of the term loan obligation attributable to us is $220,000,000 in accordance with our ownership interest in the Duke joint venture. The loan proceeds were used to accelerate the acquisition of the Remaining Properties. The loan has a six-month term and two six-month extension options. The term loan has an interest rate of LIBOR plus 2.50% and is fully pre-payable at any time, subject to any customary costs. An origination fee of $1,650,000 was paid to Wells Fargo Bank, National Association at the closing of the term loan. The Term Loan Agreement contains customary representations and warrants and covenants. During the term of the loan, the Duke Joint Venture has agreed to comply with certain financial covenants related to its leverage ratio, net asset value, unencumbered leverage ratio and the inability to enter into certain types of investments.

14

Risks Related To Our Business

The Investment Advisor has limited experience operating a REIT and we cannot assure you that the past experience of its management will be sufficient to successfully manage our business as a REIT.

The Investment Advisor has limited experience operating a REIT, and the Investment Advisor has limited direct experience in complying with the income, asset and other limitations imposed by the REIT provisions of the Internal Revenue Code. Those provisions are complex and the failure to comply with those provisions in a timely manner could cause us to fail to qualify as a REIT or could force us to pay unexpected taxes and penalties. The Investment Advisor’s limited experience in managing a portfolio of assets under such constraints may hinder its ability to achieve our investment objectives. We can offer no assurance that the Investment Advisor will replicate CBRE Investors’ historical success or our management team’s success in its previous endeavors.

You must rely entirely upon the ability of the Investment Advisor with respect to the selection and timing of investments in and the management of unspecified assets, and you will not have an opportunity to evaluate for yourself the relevant economic, financial and other information regarding the assets in which the proceeds of our public offerings will be invested.

Our ability to achieve our investment objectives and to pay dividends is dependent upon the performance of the Investment Advisor, the real estate market and general economic conditions in the geographic regions where we invest. You must rely totally on the Investment Advisor in the selection of assets. We cannot be sure that the Investment Advisor will be successful in obtaining suitable investments on financially attractive terms or that, if investments are made, our objectives will be achieved. Furthermore, you should be aware that any appraisals we obtain are merely estimates of value and should not be relied upon as accurate measures of true worth or realizable value. Moreover, delays in investing the net proceeds of our public offerings may reduce our income. Our shareholders will not have the opportunity to evaluate the manner in which the net proceeds received by us from our public offerings are to be invested or the economic merits of particular assets to be acquired.

We are dependent on the Investment Advisor and may not find a suitable replacement if the advisory agreement is terminated, in which case we may not be able to operate our business.

We have no employees and are completely reliant on the Investment Advisor, which has significant discretion as to the implementation and execution of our operating policies and strategies. We depend on the diligence, skill and network of business contacts of the management of our Investment Advisor, and, through our sponsor, CBRE Investors. We can offer no assurance that the Investment Advisor will remain our investment advisor or that we will continue to have access to the Investment Advisor’s professionals, and, through the Investment Advisor, the resources and experience of CBRE Investors. We are subject to the risk that the advisory agreement may be terminated by either party. If the advisory agreement is terminated and no suitable replacement is found to manage us or key personnel leave our Investment Advisor, we may not be able to execute our business plan.

If the Investment Advisor loses or is unable to obtain key personnel, our ability to implement our investment strategies could be delayed or hindered.

Our success depends to a significant degree upon the continued contributions of certain key personnel of the Investment Advisor who would be difficult to replace. None of our key personnel are currently subject to employment agreements with us, nor do we maintain any key person life insurance on these key personnel. If the Investment Advisor were to lose the benefit of the experience, efforts and abilities of one or more of these individuals, our operating results could suffer. We also believe that our future success depends, in large part, upon the Investment Advisor’s ability to obtain and retain highly skilled managerial, operational and marketing personnel. Competition for such personnel is intense, and we cannot assure you the Investment Advisor will be successful in attracting and retaining such skilled personnel.

Your investment return may be reduced if we are required to register as an investment company under the Investment Company Act of 1940, as amended.

We do not intend to invest in marketable securities and we do not intend to register as an investment company under the Investment Company Act of 1940, as amended, (“the Investment Company Act”). If we were obligated to register as an investment company, we would have to comply with a variety of substantive requirements under the Investment Company Act that impose, among other things:

| | ¡ | | limitations on capital structure; |

15

| | ¡ | | restrictions on specified investments; |

| | ¡ | | prohibitions on transactions with affiliates; and |

| | ¡ | | compliance with reporting, record keeping, voting, proxy disclosure and other rules and regulations that would significantly increase our operating expenses. |

In general, we expect to be able to rely on the exemption from registration provided by Section 3(c)(5)(C) of the Investment Company Act. In order to qualify for this exemption, at least 55% of our portfolio must be comprised of real property and mortgages and other liens on an interest in real estate (collectively, “qualifying assets”) and at least 80% of our portfolio must be comprised of real estate-related assets. Qualifying assets include mortgage loans, mortgage-backed securities that represent the entire ownership in a pool of mortgage loans and other interests in real estate. In order to maintain our exemption from regulation under the Investment Company Act, we must continue to engage primarily in the business of buying real estate, and these investments must be made within a year after our offering ends. If we are unable to invest a significant portion of the proceeds of our offering in properties within one year of the termination of our offering, we may be able to avoid being required to register as an investment company by temporarily investing any unused proceeds in government securities with low returns. This would reduce the cash available for distribution to shareholders and possibly lower your returns.

To maintain compliance with the Investment Company Act exemption, we may be unable to sell assets we would otherwise want to sell and may need to sell assets we would otherwise wish to retain. In addition, we may have to acquire additional income or loss generating assets that we might not otherwise have acquired or may have to forego opportunities to acquire interests in companies that we would otherwise want to acquire and would be important to our investment strategy. If we were required to register as an investment company we would be prohibited from engaging in our business as currently contemplated because the Investment Company Act imposes significant limitations on leverage. In addition, we would have to seek to restructure the advisory agreement because the compensation that it contemplates would not comply with the Investment Company Act. Criminal and civil actions could also be brought against us if we failed to comply with the Investment Company Act. In addition, our contracts would be unenforceable unless a court was to require enforcement, and a court could appoint a receiver to take control of us and liquidate our business.

Conflicts of Interest Risks

The Investment Advisor faces conflicts of interest relating to time management.

Although the Investment Advisor does not currently advise any other real estate investment programs, the Investment Advisor’s affiliates, including CBRE Investors, are sponsors of other real estate programs having investment objectives and legal and financial obligations similar to ours. In addition, certain members of the management team of the Investment Advisor may also work with or for other affiliates. As a result, they may have interests in other real estate programs and also engage in other business activities, and may have conflicts of interest in allocating their time between our business and these other activities. During times of intense activity in other programs and ventures, they may devote less time and resources to our business than is necessary or appropriate. If the Investment Advisor, for any reason, is not able to provide investment opportunities to us consistent with our investment objectives in a timely manner, we may have lower returns on our investments.

The Investment Advisor faces conflicts of interest relating to the purchase and leasing of assets.

We may be buying assets at the same time as other existing or future affiliates of the Investment Advisor are buying assets. There is a risk that the Investment Advisor will choose an asset that provides lower returns to us than an asset purchased by an affiliate of the Investment Advisor. We may acquire assets in geographic areas where other affiliates own assets. If another affiliate attracts a tenant that we are competing for, we could suffer a loss of revenue due to delays in locating another suitable tenant.

The Investment Advisor may have conflicting fiduciary obligations if we acquire properties with its affiliates or other related entities; as a result, in any such transaction we may not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties.

The Investment Advisor may cause us to acquire an interest in a property from its affiliates or through a joint venture with its affiliates or to dispose of an interest in a property to its affiliates. In these circumstances, the Investment Advisor will have a conflict of interest when fulfilling its fiduciary obligation to us. In any such transaction we may not have the benefit of arm’s length negotiations of the type normally conducted between unrelated parties.

16

We pay substantial fees and expenses to the Investment Advisor, its affiliates and the Dealer Manager, which payments increase the risk that you will not earn a profit on your investment.