Exhibit 99.1

Company Presentation

September 2013

Forward Looking Statements

This presentation may contain various “forward-looking statements.” You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “would,” “could,” “should,” “seeks,” “approximately,” “intends,” “plans,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Statements regarding the following subjects may be impacted by a number of risks and uncertainties such as our business strategy; our ability to obtain future financing arrangements; estimates relating to our future distributions; our understanding of our competition; market trends; projected capital expenditures; the impact of technology on our products, operations and business; and the use of the proceeds of any offerings of securities.

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations are subject to risks and uncertainties and can change as a result of many possible events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. You should carefully consider these risks before you make an investment decision with respect to our common shares, along with the following factors that could cause actual results to vary from our forward-looking statements such as: general volatility of the securities markets in which we participate; national, regional and local economic climates; changes in supply and demand for office and industrial properties; adverse changes in the real estate markets, including increasing vacancy, decreasing rental revenue and increasing insurance costs; availability and credit worthiness of prospective tenants; our ability to maintain rental rates and maximize occupancy; our ability to identify and secure acquisitions; our failure to successfully manage growth or operate acquired properties; our pace of acquisitions and/or dispositions of properties; risks related to development projects (including construction delay, cost overruns or our inability to obtain necessary permits); payment of distributions from sources other than cash flows and operating activities; receiving corporate debt ratings and changes in the general interest rate environment; availability of capital (debt and equity); our ability to refinance existing indebtedness or incur additional indebtedness; failure to comply with our debt covenants; unanticipated increases in financing and other costs, including a rise in interest rates; the actual outcome of the resolution of any conflict; material adverse actions or omissions by any of our joint venture partners; our ability to operate as a self-managed company; availability of and ability to retain our executive officers and other qualified personnel; future terrorist attacks in the United States or abroad; the ability of our operating partnership to continue to qualify as a partnership for U.S. federal income tax purposes; our ability to continue to qualify as a REIT for U.S. federal income tax purposes; foreign currency fluctuations; changes to accounting principles, policies and guidelines applicable to REITs; legislative or regulatory changes adversely affecting REITs and the real estate business; and environmental, regulatory and/or safety requirements. The foregoing review of important factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included herein and elsewhere, including the risk factors included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012, the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2013 and other documents of the Company on file with or furnished to the SEC; except to the extent that the risk factors therein are inconsistent with the fact that (i) we listed our shares on the NYSE on May 21, 2013 and (ii) we have amended and restated our bylaws and our declaration of trust. Any forward looking statements made in this press release are qualified by these cautionary statements, and there can be no assurance that the actual results or developments anticipated by the Company will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, the Company or its business or operations.

Except as required by law, the Company undertakes no obligation to update publicly or revise any forward looking statement, whether as a result of new information, future developments or otherwise. We caution you that actual outcomes and results may differ materially from what is expressed, implied or forecast by our forward looking statements.

Unless otherwise noted, the information in this presentation represents our portfolio as of June 30, 2013 and includes our consolidated and unconsolidated properties at our pro rata share of ownership.

Investment Highlights

Ingenuity Drive

Orlando, Florida

Graben Distribution Center I

Munich, Germany

?High Quality, Triple Net Lease Focused Portfolio

?Diversified Tenant Base With Strong Credit Profile and Stable Occupancy

?Demonstrated Investment Track Record

?Conservative Balance Sheet With Growth-Oriented Capital Structure

?Experienced Management Team and Shareholder-Aligned Corporate Governance

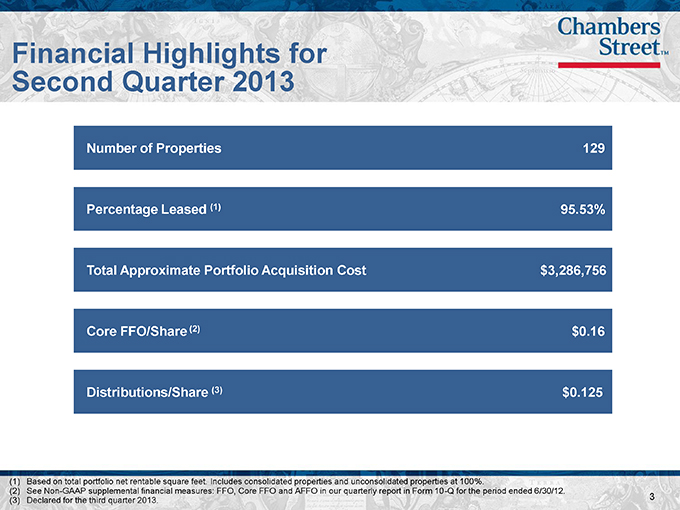

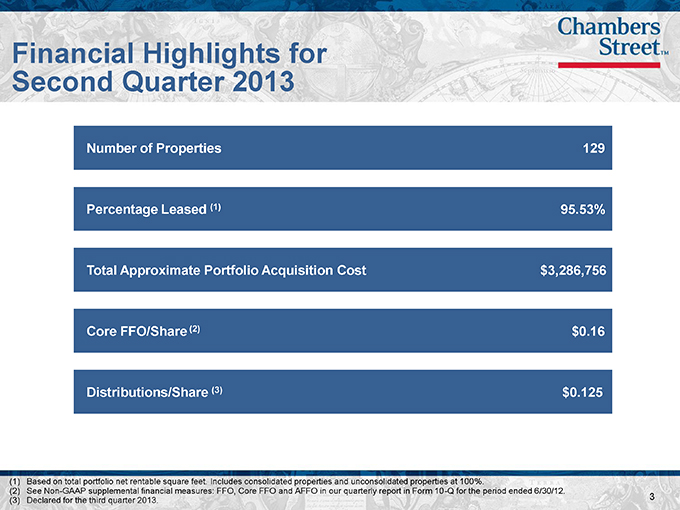

Financial Highlights for Second Quarter 2013

Number of Properties 129

Percentage Leased (1) 95.53%

Total Approximate Portfolio Acquisition Cost $3,286,756

Core FFO/Share (2) $0.16

Distributions/Share (3) $0.125

(1) Based on total portfolio net rentable square feet. Includes consolidated properties and unconsolidated properties at 100%.

(2) See Non-GAAP supplemental financial measures: FFO, Core FFO and AFFO in our quarterly report in Form 10-Q for the period ended 6/30/12.

(3) | | Declared for the third quarter 2013. |

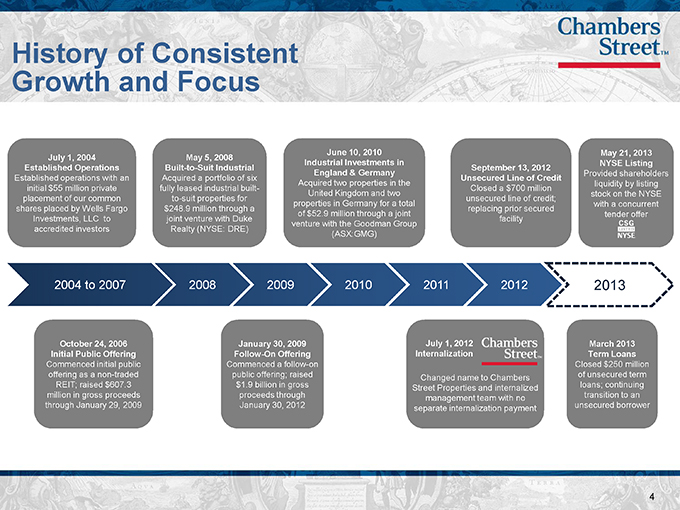

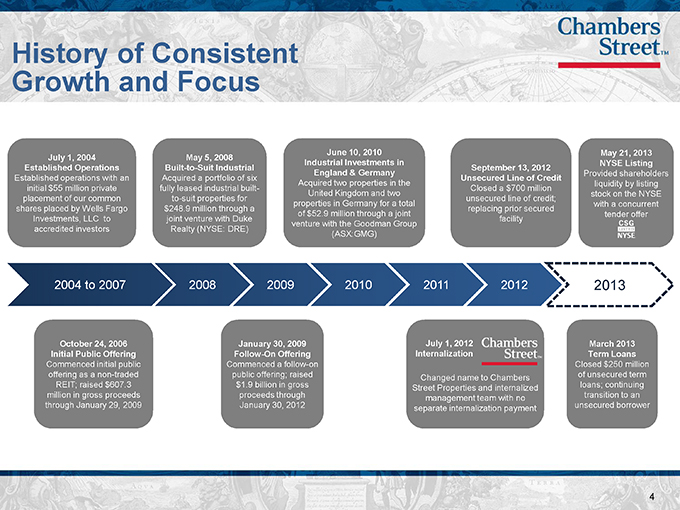

History of Consistent

Growth and Focus

July 1, 2004

Established Operations

Established operations with an

initial $55 million private

placement of our common

shares placed by Wells Fargo

Investments, LLC to

accredited investors

May 5, 2008

Built-to-Suit Industrial

Acquired a portfolio of six

fully leased industrial built-

to-suit properties for

$248.9 million through a

joint venture with Duke

Realty (NYSE: DRE)

June 10, 2010

Industrial Investments in

England & Germany

Acquired two properties in the

United Kingdom and two

properties in Germany for a total

of $52.9 million through a joint

venture with the Goodman Group

(ASX:GMG)

September 13, 2012

Unsecured Line of Credit

Closed a $700 million

unsecured line of credit;

replacing prior secured

facility

May 21, 2013

NYSE Listing

Provided shareholders

liquidity by listing

stock on the NYSE

with a concurrent

tender offer

2004 to 2007

2008

2009

2010

2011

2012

2013

October 24, 2006

Initial Public Offering

Commenced initial public

offering as a non-traded

REIT; raised $607.3

million in gross proceeds

through January 29, 2009

January 30, 2009

Follow-On Offering

Commenced a follow-on

public offering; raised

$1.9 billion in gross

proceeds through

January 30, 2012

July 1, 2012

Internalization

Changed name to Chambers

Street Properties and internalized

management team with no

separate internalization payment

March 2013

Term Loans

Closed $250 million

of unsecured term

loans; continuing

transition to an

unsecured borrower

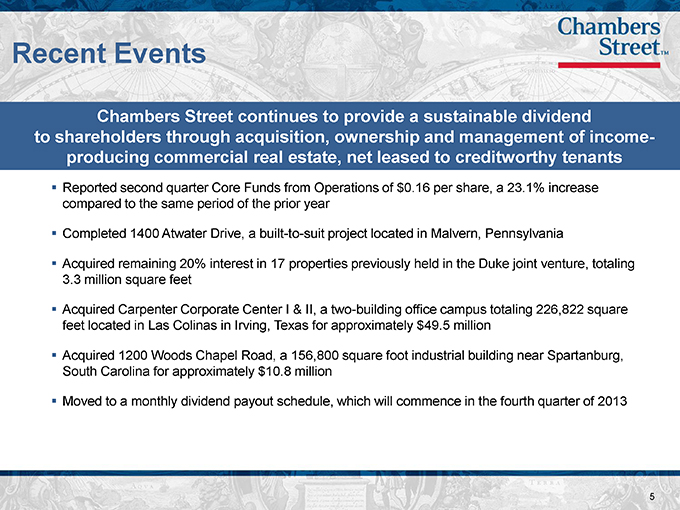

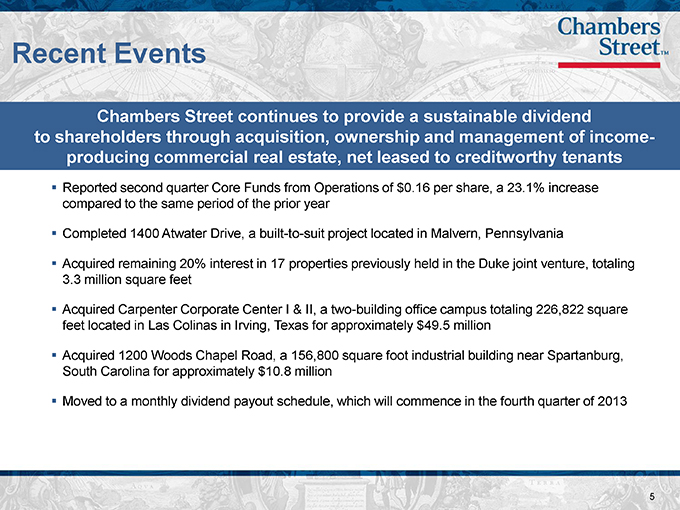

Recent Events

Chambers Street continues to provide a sustainable dividend to shareholders through acquisition, ownership and management of income producing commercial real estate, net leased to creditworthy tenants

Reported second quarter Core Funds from Operations of $0.16 per share, a 23.1% increase compared to the same period of the prior year

Completed 1400 Atwater Drive, a built-to-suit project located in Malvern, Pennsylvania

Acquired remaining 20% interest in 17 properties previously held in the Duke joint venture, totaling 3.3 million square feet

Acquired Carpenter Corporate Center I & II, a two-building office campus totaling 226,822 square feet located in Las Colinas in Irving, Texas for approximately $49.5 million

Acquired 1200 Woods Chapel Road, a 156,800 square foot industrial building near Spartanburg, South Carolina for approximately $10.8 million

Moved to a monthly dividend payout schedule, which will commence in the fourth quarter of 2013

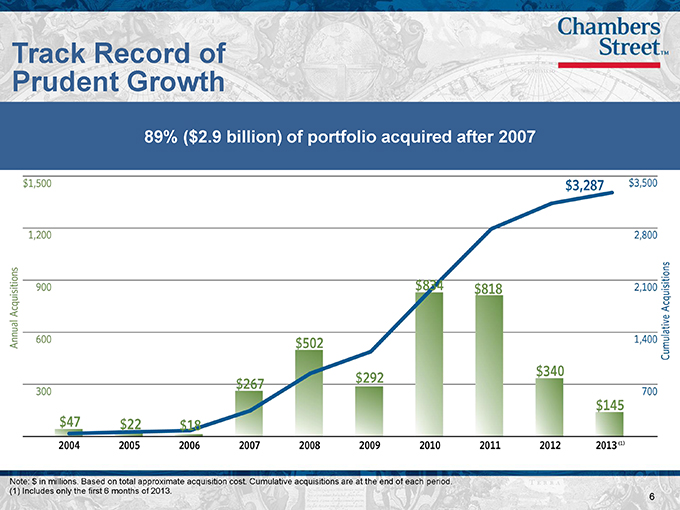

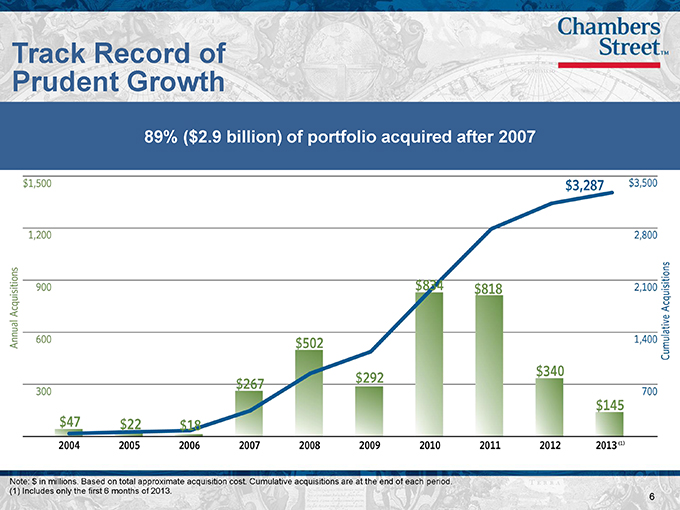

Track Record of Prudent Growth

89% ($2.9 billion) of portfolio acquired after 2007

Note: $ in millions. Based on total approximate acquisition cost. Cumulative acquisitions are at the end of each period.

(1) | | Includes only the first 6 months of 2013. |

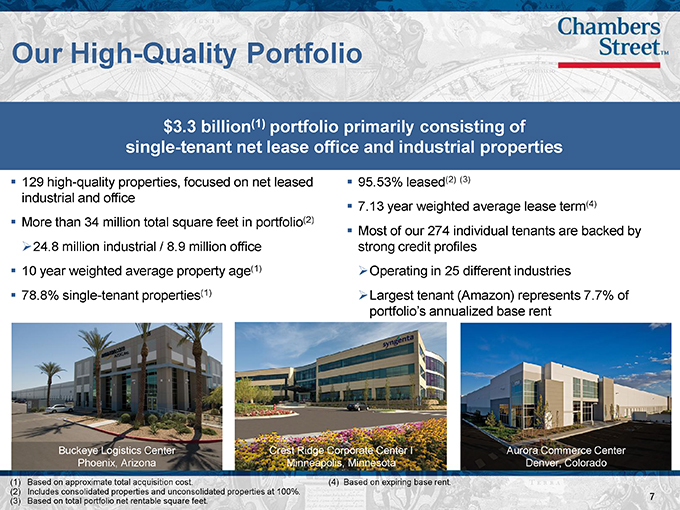

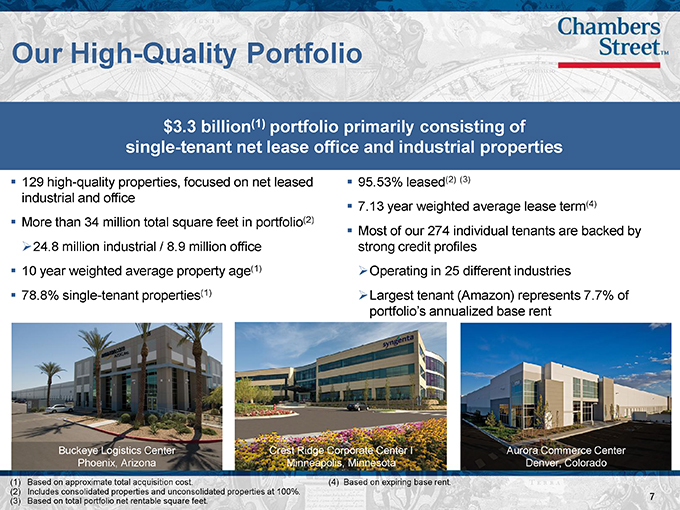

Our High-Quality Portfolio

$3.3 billion(1) portfolio primarily consisting of single-tenant net lease office and industrial properties

129 high-quality properties, focused on net leased

industrial and office

More than 34 million total square feet in portfolio(2)

24.8 million industrial / 8.9 million office

10 year weighted average property age(1)

78.8% single-tenant properties(1)

95.53% leased(2) (3)

7.13 year weighted average lease term(4)

Most of our 274 individual tenants are backed by

strong credit profiles

Operating in 25 different industries

Largest tenant (Amazon) represents 7.7% of

portfolio’s annualized base rent

Buckeye Logistics Center

Phoenix, Arizona

Crest Ridge Corporate Center I

Minneapolis, Minnesota

Aurora Commerce Center

Denver, Colorado

(1) | | Based on approximate total acquisition cost. |

(2) | | Includes consolidated properties and unconsolidated properties at 100%. |

(3) | | Based on total portfolio net rentable square feet. |

(4) | | Based on expiring base rent. |

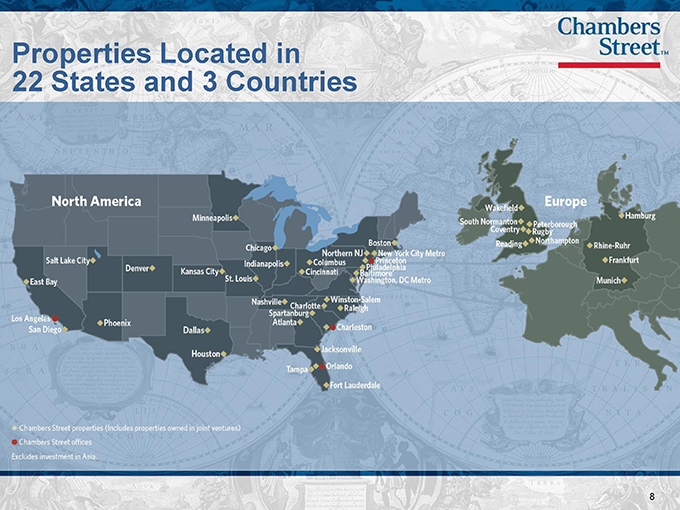

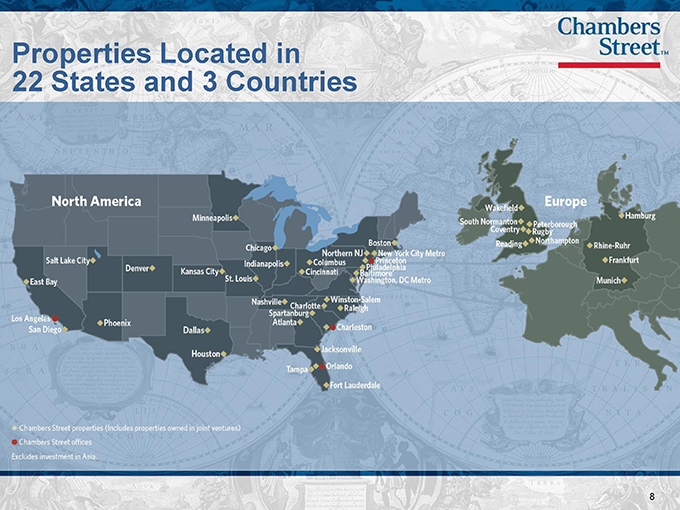

Properties Located in

22 States and 3 Countries

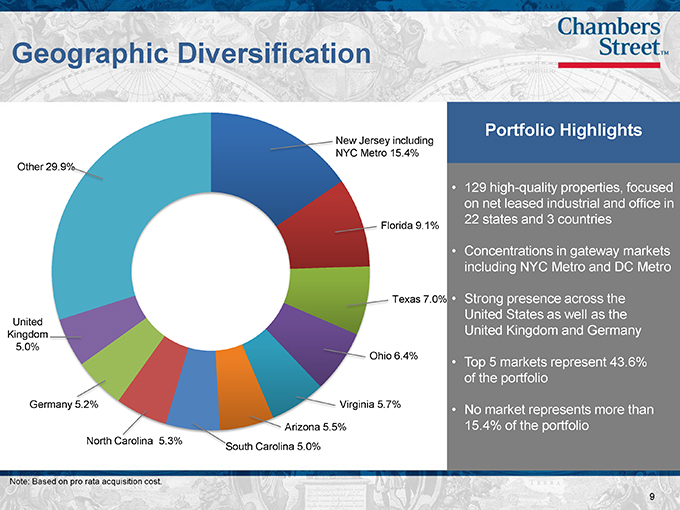

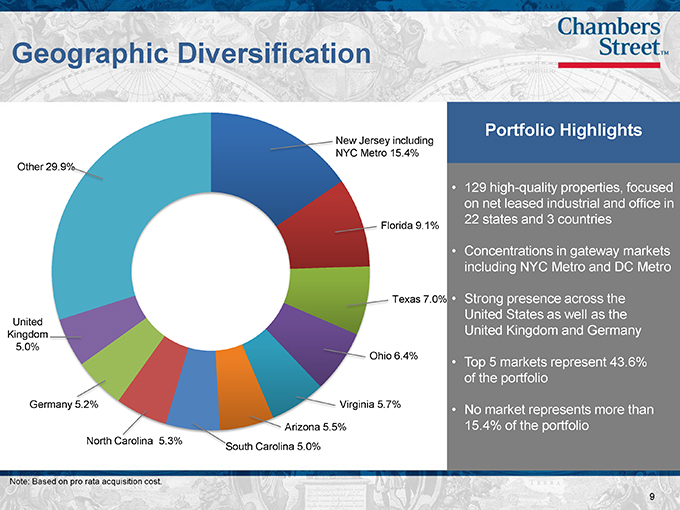

Geographic Diversification

Portfolio Highlights

129 high-quality properties, focused on net leased industrial and office in 22 states and 3 countries

Concentrations in gateway markets including NYC Metro and DC Metro

Strong presence across the United States as well as the United Kingdom and Germany

Top 5 markets represent 43.6% of the portfolio

No market represents more than 15.4% of the portfolio

Note: Based on pro rata acquisition cost.

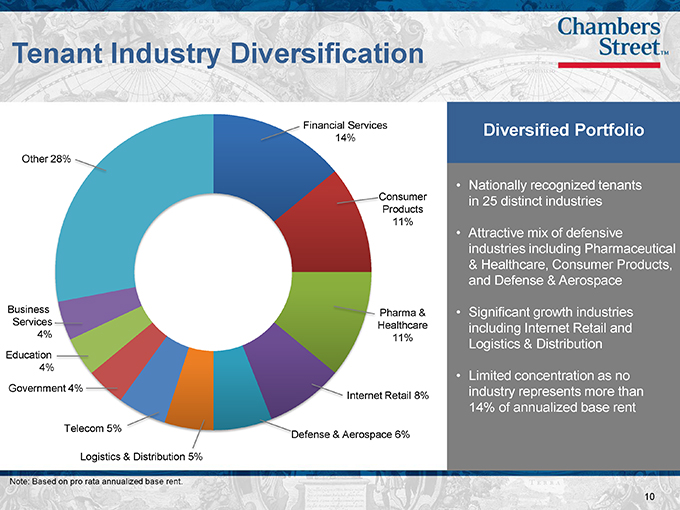

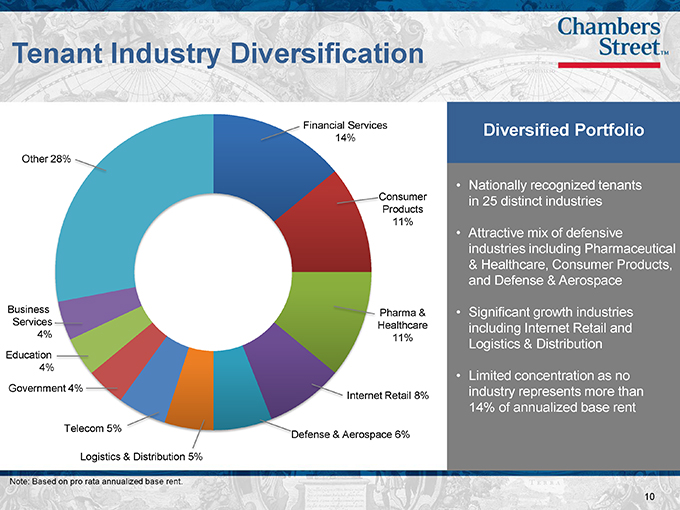

Tenant Industry Diversification

Diversified Portfolio

Nationally recognized tenants in 25 distinct industries

Attractive mix of defensive industries including Pharmaceutical & Healthcare, Consumer Products, and Defense & Aerospace

Significant growth industries including Internet Retail and Logistics & Distribution

Limited concentration as no industry represents more than 14% of annualized base rent

Note: Based on pro rata acquisition cost.

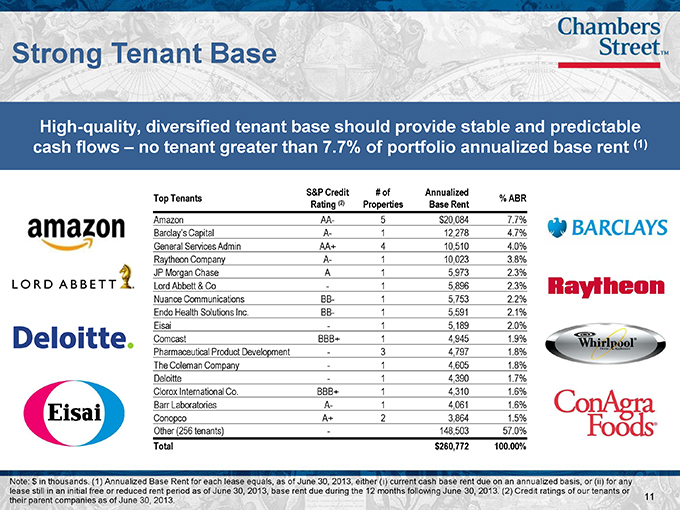

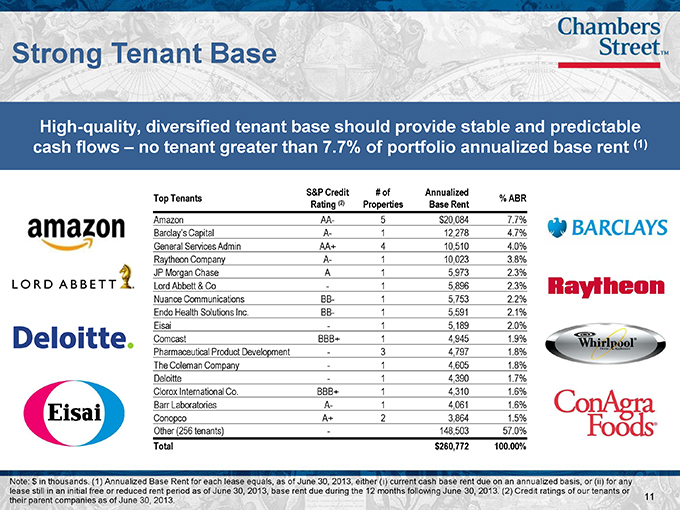

Strong Tenant Base

High-quality, diversified tenant base should provide stable and predictable cash flows – no tenant greater than 7.7% of portfolio annualized base rent (1)

S&P Credit # of Annualized

Top Tenants Rating (2) Properties Base Rent % ABR

Amazon AA- 5 $20,084 7.7%

Barclay’s Capital A- 1 12,278 4.7%

General Services Admin AA+ 4 10,510 4.0%

Raytheon Company A- 1 10,023 3.8%

JP Morgan Chase A 1 5,973 2.3%

Lord Abbett & Co—1 5,896 2.3%

Nuance Communications BB- 1 5,753 2.2%

Endo Health Solutions Inc. BB- 1 5,591 2.1%

Eisai—1 5,189 2.0%

Comcast BBB+ 1 4,945 1.9%

Pharmaceutical Product Development—3 4,797 1.8%

The Coleman Company—1 4,605 1.8%

Deloitte—1 4,390 1.7%

Clorox International Co. BBB+ 1 4,310 1.6%

Barr Laboratories A- 1 4,061 1.6%

Conopco A+ 2 3,864 1.5%

Other (256 tenants)—148,503 57.0%

Total $260,772 100.00%

Note: $ in thousands. (1) Annualized Base Rent for each lease equals, as of June 30, 2013, either (i) current cash base rent due on an annualized basis, or (ii) for any lease still in an initial free or reduced rent period as of June 30, 2013, base rent due during the 12 months following June 30, 2013. (2) Credit ratings of our tenants or their parent companies as of June 30, 2013.

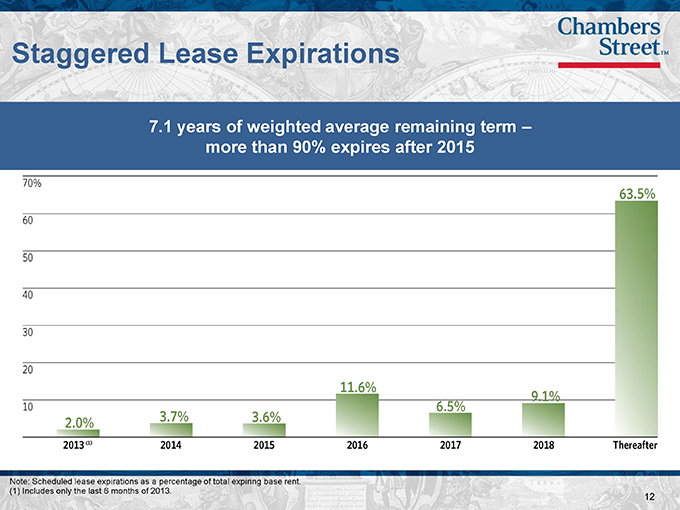

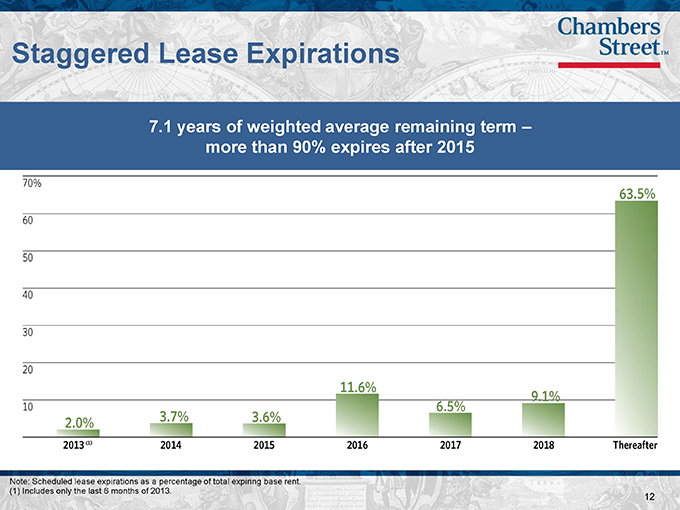

Staggered Lease Expirations

7.1 years of weighted average remaining term – more than 90% expires after 2015

Note: Scheduled lease expirations as a percentage of total expiring base rent.

(1) | | Includes only the last 6 months of 2013. |

Representative Industrial Investments

125 Enterprise Parkway; Columbus, OH

Langenbach; Munich, Germany

Koblenz; Frankfurt, Germany

Acquisition Cost

(Date)

SF / Leased

Tenant

$38.1 MM (Dec. 2008)

1,142,000 / 100%

Kellogg’s

Acquisition Cost

(Date)

SF / Leased

Tenant

$18.5 MM (October 2010)

225,000/ 100%

DSV

Acquisition Cost

(Date)

SF / Leased

Tenant

$63.0 MM (Dec. 2012)

1,070,000 / 100%

Amazon

West Point Trade Ctr; Jacksonville, FL

Goodyear Crossing; Phoenix, AZ

AllPoints Midwest; Indianapolis, IN

(Date) Acquisition Cost

SF / Leased

Tenant

$29.0 MM (Dec. 2009)

602,000 / 100%

Dr. Pepper

(Date) Acquisition Cost

SF / Leased

Tenant

$64.9 MM (Jan. 2013)

820,000 / 100%

Amazon

(Date) Acquisition Cost

SF / Leased

Tenant

$41.4 MM (Dec. 2008)

1,200,000 / 100%

Prime Distribution

Services

Note: Acquisition cost shown at pro rata share, square footage shown at 100%.

Representative Office Investments

1400 Atwater Drive; Malvern, PA

100 Tice Blvd.; Northern New Jersey, NJ

Pacific Corp. Park; Washington, DC

Development Cost

(Date)

SF / Leased

Tenant

$65.0 MM (January 2013)

300,000 / 100%

Endo Health Solutions

Acquisition Cost

(Date)

SF / Leased

Tenant

$67.6 MM (Sept. 2010)

209,000 / 100%

Eisai Pharmaceutical

Acquisition Cost

(Date)

SF / Leased

Tenant

$144.5 MM (Nov. 2010)

696,000 / 100%

Raytheon

Aspen Corporate Ctr;

Nashville, TN

Enclave on the Lake; Houston, TX

Sky Harbor; Phoenix, AZ

Acquisition Cost

(Date)

SF / Leased

Tenant

$29.9 MM (Sept. 2008)

180,000 / 100%

Verizon

Acquisition Cost

(Date)

SF / Leased

Tenant

$37.8 MM (July 2008)

171,000 / 100%

SBM

Acquisition Cost

(Date)

SF / Leased

Tenant

$53.5 MM (Sept. 2011)

396,000 / 100%

J.P. Morgan Chase

Note: Acquisition cost shown at pro rata share, square footage shown at 100%.

Growth Strategies

Execute multiple strategies to continue growth

Acquisitions

Management maintains an extensive network of relationships to source acquisitions

Acquisitions will continue to focus on high-quality credit tenants with long-term leases

A respected buyer with a proven track record

Expansions

Strong relationships with existing tenants allow the Company to capitalize on expansion

opportunities

Produce attractive returns with incremental capital investment

Creating value through active management

Build-to-Suits

Will continue to selectively pursue development opportunities, especially built-to-suit projects

Projects will focus on opportunities with attractive initial yields and long-term triple net

leases to credit tenants

Ability to source built-to-suit projects from large tenant base and developer relationships

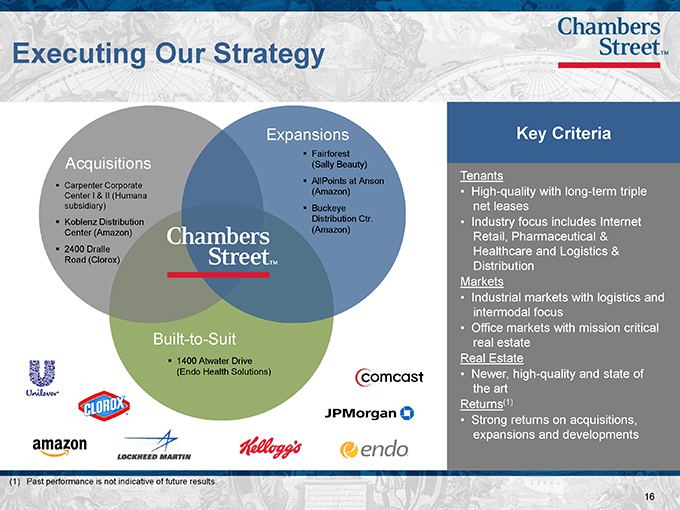

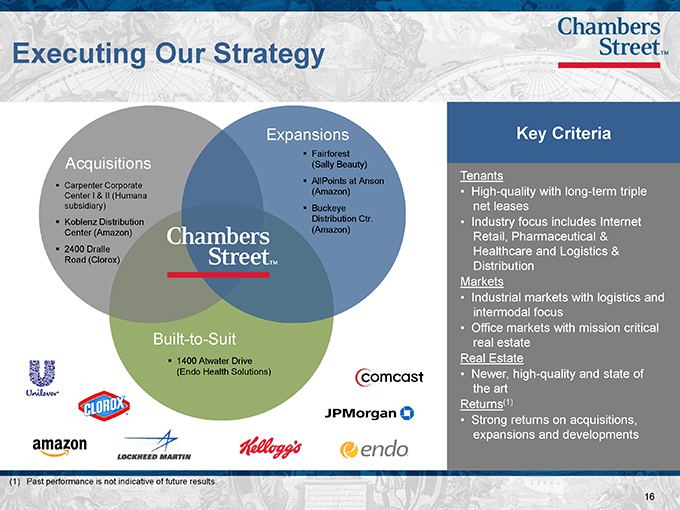

Executing Our Strategy

Acquisitions

Carpenter Corporate Center I & II (Humana subsidiary)

Koblenz Distribution Center (Amazon)

2400 Dralle Road (Clorox)

Expansions

Fairforest (Sally Beauty)

AllPoints at Anson (Amazon)

Buckeye Distribution Ctr. (Amazon)

Built-to-Suit

1400 Atwater Drive (Endo Health Solutions)

Key Criteria

Tenants

High-quality with long-term triple net leases

Industry focus includes Internet

Retail, Pharmaceutical & Healthcare and Logistics & Distribution Markets

Industrial markets with logistics and intermodal focus

Office markets with mission critical real estate Real Estate

Newer, high-quality and state of the art Returns(1)

Strong returns on acquisitions, expansions and developments

(1) | | Past performance is not indicative of future results. |

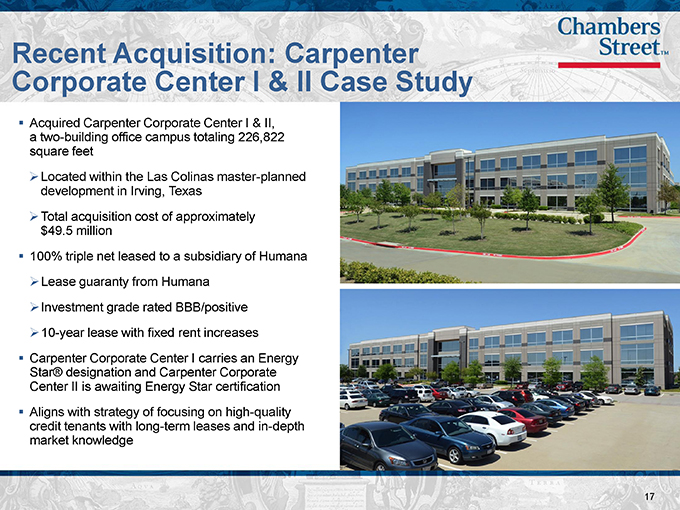

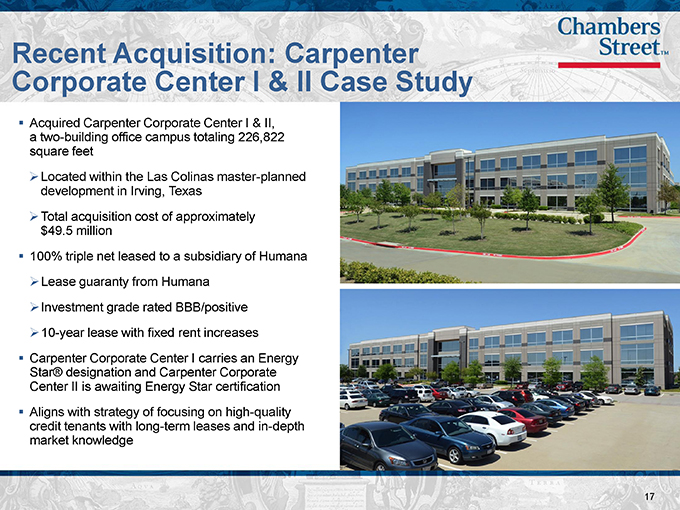

Recent Acquisition: Carpenter Corporate Center I & II Case Study

Acquired Carpenter Corporate Center I & II, a two-building office campus totaling 226,822 square feet

Located within the Las Colinas master-planned development in Irving, Texas

Total acquisition cost of approximately $49.5 million

100% triple net leased to a subsidiary of Humana

Lease guaranty from Humana

Investment grade rated BBB/positive

10-year lease with fixed rent increases

Carpenter Corporate Center I carries an Energy Star® designation and Carpenter Corporate Center II is awaiting Energy Star certification

Aligns with strategy of focusing on high-quality credit tenants with long-term leases and in-depth market knowledge

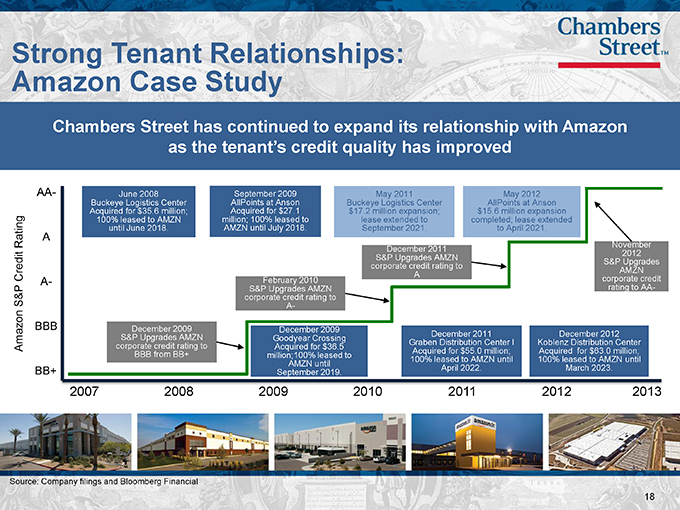

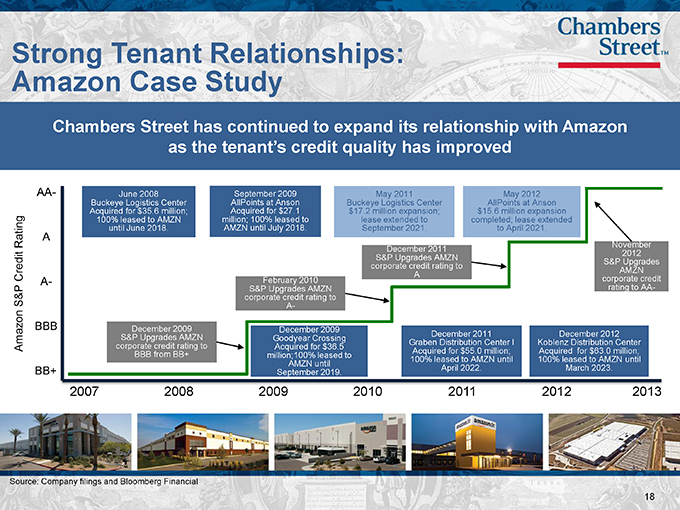

Strong Tenant Relationships: Amazon Case Study

Chambers Street has continued to expand its relationship with Amazon as the tenant’s credit quality has improved

June 2008

Buckeye Logistics Center Acquired for $35.6 million; 100% leased to AMZN until June 2018.

September 2009 AllPoints at Anson Acquired for $27.1 million; 100% leased to AMZN until July 2018.

May 2011

Buckeye Logistics Center

$17.2 million expansion; lease extended to September 2021.

May 2012 AllPoints at Anson

$15.6 million expansion completed; lease extended to April 2021.

December 2011 S&P Upgrades AMZN corporate credit rating to A

November 2012 S&P Upgrades AMZN corporate credit rating to AA-

February 2010 S&P Upgrades AMZN corporate credit rating to A-

December 2009 S&P Upgrades AMZN corporate credit rating to BBB from BB+

December 2009 Goodyear Crossing Acquired for $36.5 million;100% leased to AMZN until September 2019.

December 2011

Graben Distribution Center I Acquired for $55.0 million; 100% leased to AMZN until April 2022.

December 2012 Koblenz Distribution Center Acquired for $63.0 million; 100% leased to AMZN until March 2023.

Source: Company filings and Bloomberg Financial

Proactive Asset Management: Sally Beauty Expansion Case Study

Existing 100,606 SF industrial facility expanded to 190,606 SF

Located in Spartanburg, SC

100% triple net leased to a subsidiary of Sally Beauty Holdings, Inc. (NYSE:SBH)

BB+ / Baa3 credit rating (1)

New 10-year lease expiring May 31, 2023

Fixed scheduled rent increases

Total expansion cost of $3.4 million

12% yield on expansion cost

Demonstrates our proactive asset management strategy and ability to meet our existing tenants needs

(1) | | Credit rating as of June 30, 2013. |

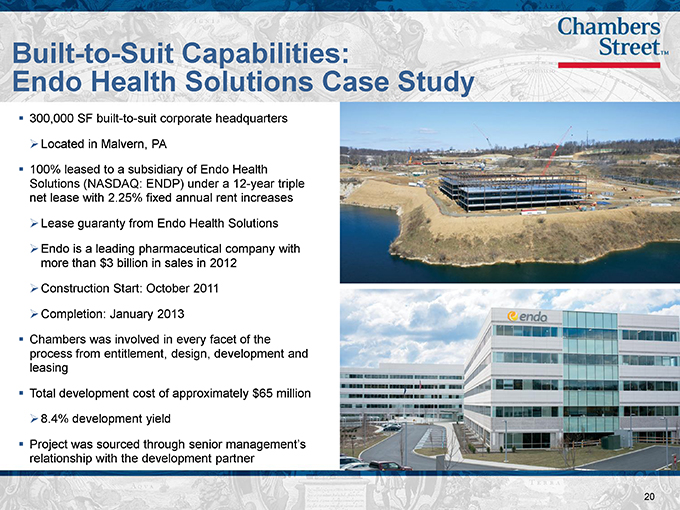

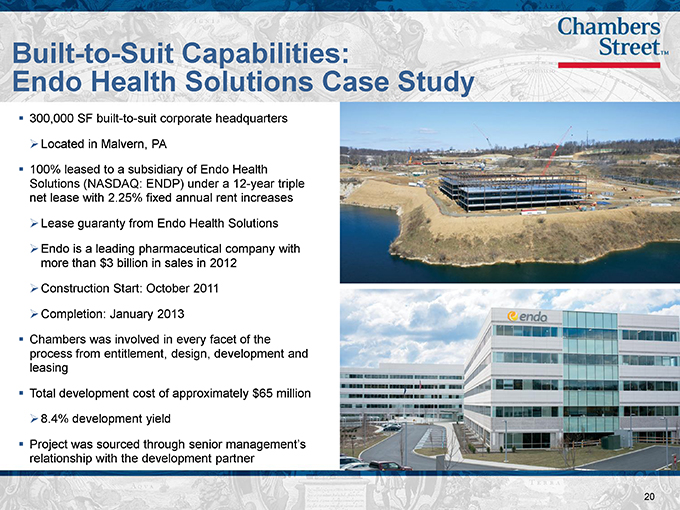

Built-to-Suit Capabilities:

Endo Health Solutions Case Study

300,000 SF built-to-suit corporate headquarters

Located in Malvern, PA

100% leased to a subsidiary of Endo Health Solutions (NASDAQ: ENDP) under a 12-year triple net lease with 2.25% fixed annual rent increases

Lease guaranty from Endo Health Solutions

Endo is a leading pharmaceutical company with more than $3 billion in sales in 2012

Construction Start: October 2011

Completion: January 2013

Chambers was involved in every facet of the process from entitlement, design, development and leasing

Total development cost of approximately $65 million

8.4% development yield

Project was sourced through senior management’s relationship with the development partner

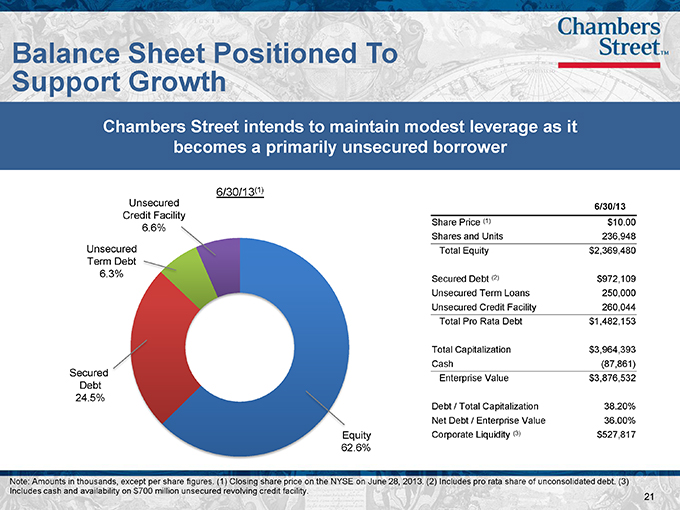

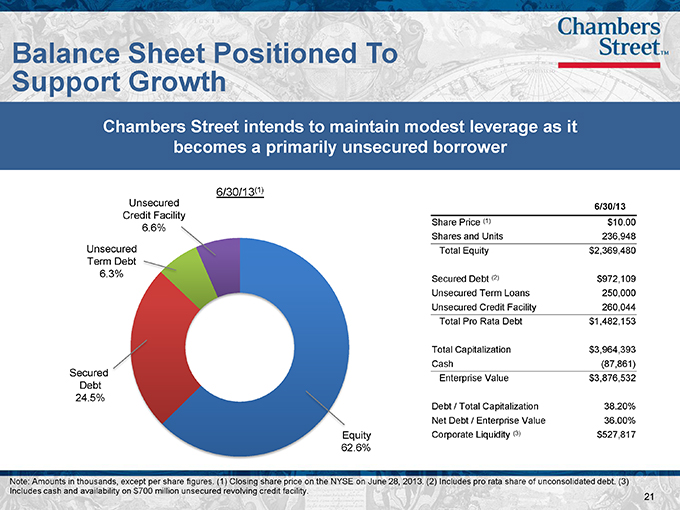

Balance Sheet Positioned To Support Growth

Chambers Street intends to maintain modest leverage as it becomes a primarily unsecured borrower

6/30/13

Share Price (1) $10.00

Shares and Units 236,948

Total Equity $2,369,480

Secured Debt (2) $972,109

Unsecured Term Loans 250,000

Unsecured Credit Facility 260,044

Total Pro Rata Debt $1,482,153

Total Capitalization $3,964,393

Cash (87,861)

Enterprise Value $3,876,532

Debt / Total Capitalization 38.20%

Net Debt / Enterprise Value 36.00%

Corporate Liquidity (3) $527,817

Note: Amounts in thousands, except per share figures. (1) Closing share price on the NYSE on June 28, 2013. (2) Includes pro rata share of unconsolidated debt. (3) Includes cash and availability on $700 million unsecured revolving credit facility.

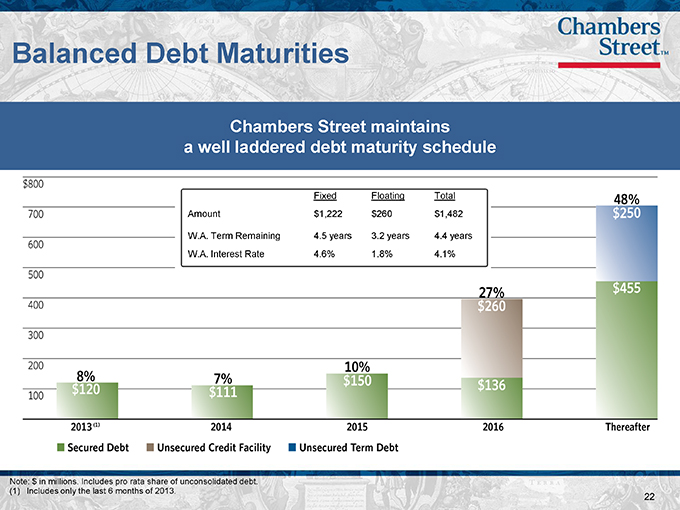

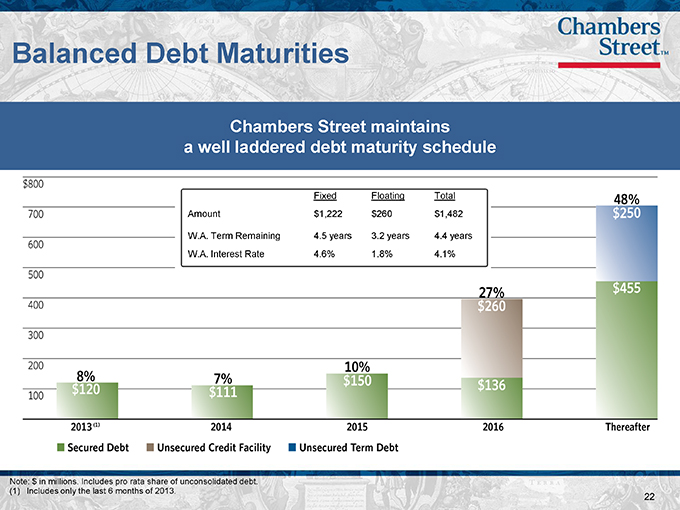

Balanced Debt Maturities

Chambers Street maintains a well laddered debt maturity schedule

Fixed Floating Total

Amount $1,222 $260 $1,482

W.A. Term Remaining 4.5 years 3.2 years 4.4 years

W.A. Interest Rate 4.6% 1.8% 4.1%

Note: $ in millions. Includes pro rata share of unconsolidated debt.

(1) | | Includes only the last 6 months of 2013. |

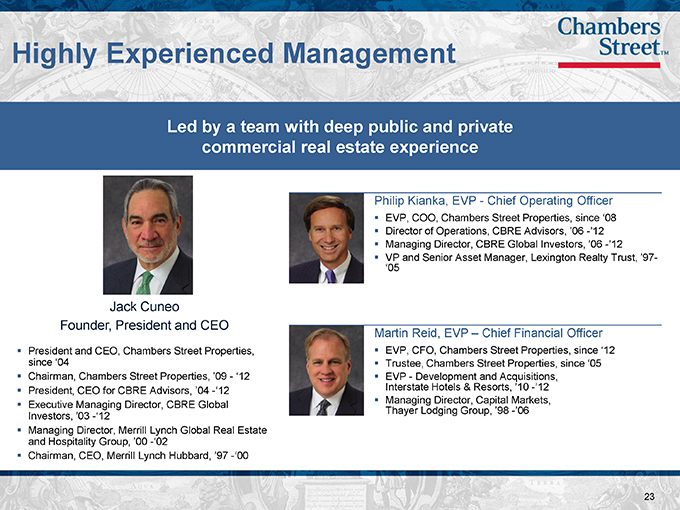

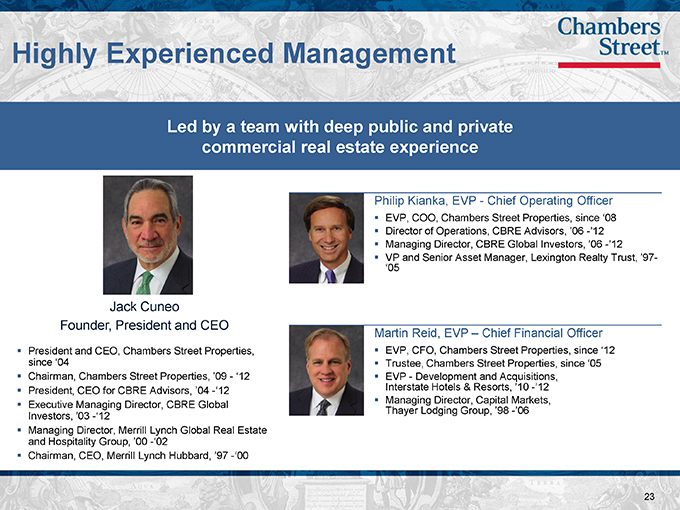

Highly Experienced Management

Led by a team with deep public and private commercial real estate experience

Philip Kianka, EVP—Chief Operating Officer

EVP, COO, Chambers Street Properties, since ‘08

Director of Operations, CBRE Advisors, ’06 -’12

Managing Director, CBRE Global Investors, ’06 -’12

VP and Senior Asset Manager, Lexington Realty Trust, ’97-

‘05

Jack Cuneo

Founder, President and CEO

President and CEO, Chambers Street Properties,

since ‘04

Chairman, Chambers Street Properties, ’09—‘12

President, CEO for CBRE Advisors, ’04 -‘12

Executive Managing Director, CBRE Global

Investors, ’03 -‘12

Managing Director, Merrill Lynch Global Real Estate

and Hospitality Group, ’00 -‘02

Chairman, CEO, Merrill Lynch Hubbard, ’97 -‘00

Martin Reid, EVP – Chief Financial Officer

EVP, CFO, Chambers Street Properties, since ‘12

Trustee, Chambers Street Properties, since ‘05

EVP—Development and Acquisitions,

Interstate Hotels & Resorts, ’10 -’12

Managing Director, Capital Markets,

Thayer Lodging Group, ’98 -’06

Corporate Officers

Chambers Street has a deep management team with 23 full-time employees

Conclusion

Ingenuity Drive

Orlando, Florida

Graben Distribution Center I

Munich, Germany

High Quality, Triple Net Lease Focused Portfolio

Diversified Tenant Base With Strong Credit Profile and

Stable Occupancy

Demonstrated Investment Track Record

Conservative Balance Sheet With Growth-Oriented

Capital Structure

Experienced Management Team and Shareholder-

Aligned Corporate Governance

Appendix

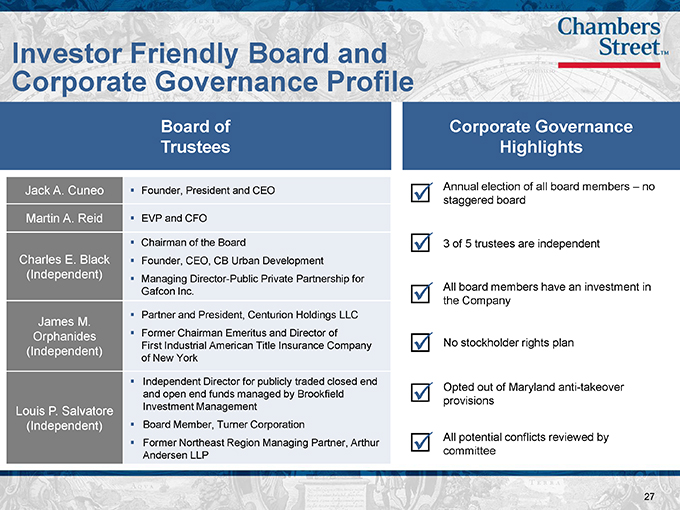

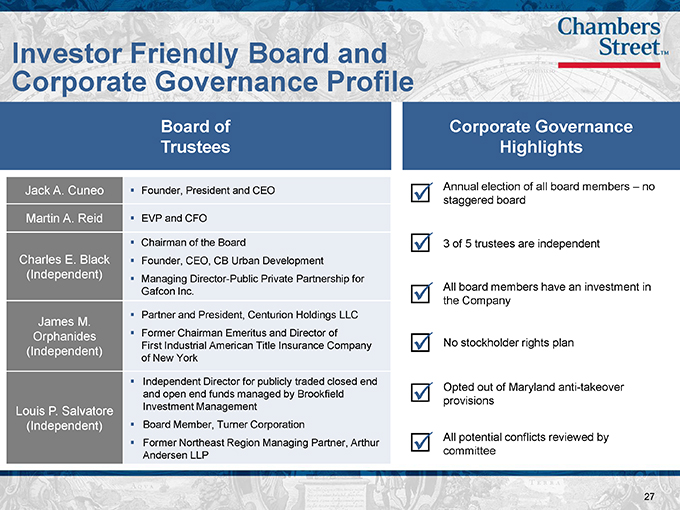

Investor Friendly Board and Corporate Governance Profile

Board of Corporate Governance

Trustees Highlights

Jack A. CuneoFounder, President and CEO Annual election of all board members – no

staggered board

Martin A. ReidEVP and CFO

Chairman of the Board3 of 5 trustees are independent

Charles E. BlackFounder, CEO, CB Urban Development

(Independent)Managing Director-Public Private Partnership for

Gafcon Inc.All board members have an investment in

the Company

James M.Partner and President, Centurion Holdings LLC

OrphanidesFormer Chairman Emeritus and Director of

(Independent) First Industrial American Title Insurance CompanyNo stockholder rights plan

of New York

Independent Director for publicly traded closed end Opted out of Maryland anti-takeover

and open end funds managed by Brookfield ?

Louis P. Salvatore Investment Management provisions

(Independent)Board Member, Turner Corporation

Former Northeast Region Managing Partner, ArthurAll potential conflicts reviewed by

Andersen LLP committee

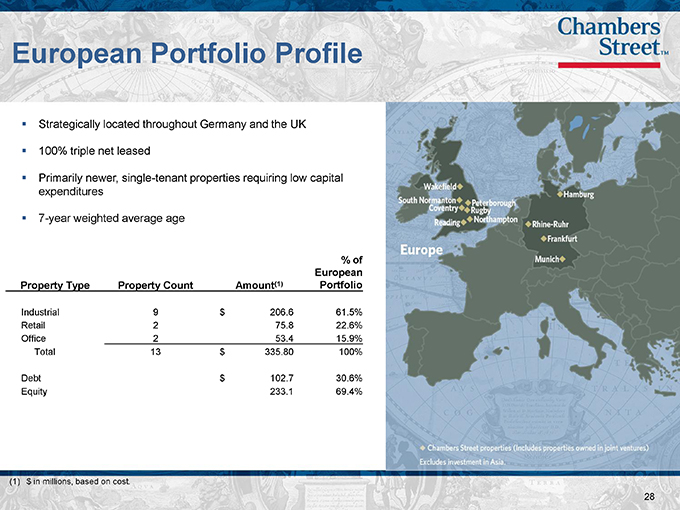

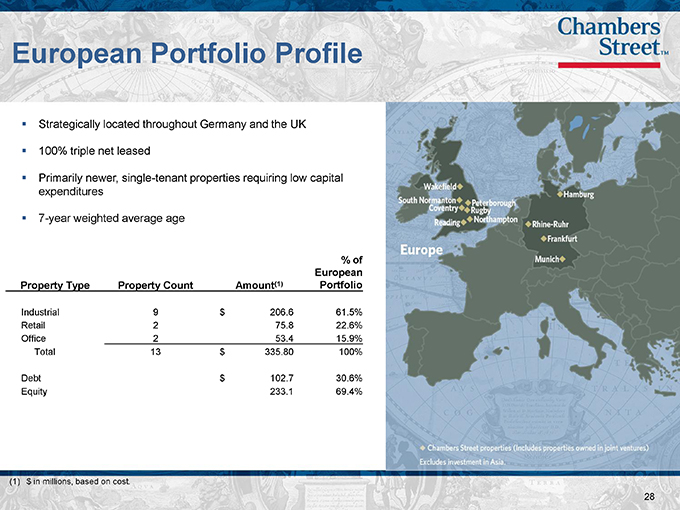

European Portfolio Profile

Strategically located throughout Germany and the UK

? 100% triple net leased

Primarily newer, single-tenant properties requiring low capital expenditures

7-year weighted average age

% of

European

Property Type Property Count Amount(1) Portfolio

Industrial 9 $ 206.6 61.5%

Retail 2 75.8 22.6%

Office 2 53.4 15.9%

Total 13 $ 335.80 100%

Debt $ 102.7 30.6%

Equity 233.1 69.4%

(1) | | $ in millions, based on cost. |