UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

|

| | |

Filed by the Registrant x | | Filed by a Party other than the Registrant o |

Check the appropriate box:

|

| |

| o | Preliminary Proxy Statement |

| o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

CHAMBERS STREET PROPERTIES

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

| | |

| | (4) | Proposed maximum aggregate value of the transaction: |

| | (5) | Total fee paid: |

|

| | |

| o | Fee paid previously with preliminary materials: |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid:

|

| | (2) | Form, Schedule or Registration Statement No.: |

| | (3) | Filing Party: |

| | (4) | Date Filed:

|

April 22, 2014

Dear Shareholder:

You are invited to attend the annual meeting of shareholders of Chambers Street Properties. This year's meeting will be held on Thursday, June 12, 2014, at 9:30 a.m., Eastern Time, at the Nassau Inn Princeton, 10 Palmer Square, Princeton, New Jersey 08542.

The attached proxy statement, with the accompanying notice of the meeting, describes the matters expected to be acted upon at the meeting. We urge you to review these materials carefully and to take part in the affairs of our company by voting on the matters described in the proxy statement. We hope that you will be able to attend the meeting. Our trustees and management team will be available to answer questions. Afterwards, there will be a vote on the proposals presented in the proxy statement.

Your vote is important. Whether you plan to attend the meeting or not, please submit your proxy or voting instructions on the Internet or by telephone promptly by following the instructions about how to view the proxy materials on your Notice Regarding the Internet Availability of Proxy Materials so that your shares can be voted, regardless of whether you expect to attend the annual meeting. If you received your proxy materials by mail, you may submit your proxy or voting instructions on the Internet or by telephone, or you may submit your proxy by marking, dating, signing and returning the enclosed proxy card/voting instruction form. If you attend the annual meeting, you may continue to have your shares voted as you have previously instructed or you may withdraw your proxy at the annual meeting and vote your shares in person. We look forward to seeing you at the meeting.

Sincerely,

Jack A. Cuneo

President and Chief Executive Officer

Chambers Street Properties

47 Hulfish Street, Suite 210

Princeton, New Jersey 08542

_________________________________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held on June 12, 2014

_________________________________________

The 2014 annual meeting of shareholders of Chambers Street Properties, a Maryland real estate investment trust, or REIT, will be held on Thursday, June 12, 2014 at 9:30 a.m., Eastern Time, at the Nassau Inn Princeton, 10 Palmer Square, Princeton, New Jersey 08542. At the annual meeting, shareholders will be asked to consider and vote upon the following proposals set forth in the accompanying proxy statement:

| |

| (1) | A proposal to elect seven trustees; |

| |

| (2) | A proposal to approve, on a non-binding, advisory basis, the compensation of our named executive officers; |

| |

| (3) | A proposal to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

| |

| (4) | A proposal to act upon any other matters that may properly be brought before the annual meeting or at any adjournments or postponements thereof. |

Any action may be taken on the foregoing matters at the annual meeting on the date specified above, or on any date or dates to which, by original or later adjournment, the annual meeting may be adjourned, or to which the annual meeting may be postponed.

Our Board of Trustees has fixed the close of business on April 10, 2014, as the record date for determining the shareholders entitled to notice of, and to vote at, the annual meeting, and at any adjournments or postponements thereof. Only holders of record of our common shares at the close of business on that date will be entitled to notice of, and to vote at, the annual meeting and at any adjournments or postponements thereof.

Admittance to the annual meeting will be limited to shareholders as of the record date, or their duly appointed proxies. In the interest of safety, all boxes, handbags and briefcases are subject to inspection. Cameras (including cell phones with photographic capability), recording devices and other electronic devices are not permitted at the meeting.

We are furnishing proxy materials primarily by taking advantage of the Securities and Exchange Commission rule that allows issuers to furnish proxy materials to their shareholders on the Internet. We believe that the rule allows us to provide you with the information you need while lowering costs and reducing the environmental impact of our annual meeting.

Please submit your proxy or voting instructions on the Internet or by telephone promptly by following the instructions about how to view the proxy materials on your Notice Regarding the Internet Availability of Proxy Materials so that your shares can be voted, regardless of whether you expect to attend the annual meeting. If you received your proxy materials by mail, you may submit your proxy or voting instructions on the Internet or by telephone, or you may submit your proxy by marking, dating, signing and returning the enclosed proxy card/voting instruction form. If you attend the annual meeting, you may withdraw your proxy and vote in person.

By Order of our Board of Trustees,

Martin A. Reid

Secretary

April 22, 2014

TABLE OF CONTENTS

|

| | | |

| | Page |

| QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING | | | |

| Who is entitled to vote at the meeting? | | | |

| Who may attend the meeting? | | | |

| What is the purpose of the meeting? | | | |

| What constitutes a quorum? | | | |

| What is the difference between holding shares as a shareholder of record and as a beneficial holder? | | | |

| What vote is needed to approve each proposal? | | | |

| How do I vote? | | | |

| Can I change my vote after I submit my proxy card? | | | |

| Who counts the votes cast at our annual meeting? | | | |

| How is my vote counted? | | | |

| Can other matters be presented at the annual meeting? | | | |

| What other information should I review before voting? | | | |

| What is "householding" and how does it affect me? | | | |

| Cautionary Note Regarding Forward-Looking Statements | | | |

| PROPOSAL 1: ELECTION OF TRUSTEES | | | |

| Information Regarding the Nominees | | | |

| Biographical Information Regarding Executive Officers Who Are Not Trustees | | | |

| Our Board of Trustees and its Committees | | | |

| Compensation of Trustees | | | |

| PROPOSAL 2: NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION | | | |

| PROPOSAL 3: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | |

| Fee Disclosure | | | |

| Pre-Approval Policies and Procedures of our Audit Committee | | | |

| AUDIT COMMITTEE REPORT | | | |

| CORPORATE GOVERNANCE MATTERS | | | |

| Amended and Restated Code of Business Conduct and Ethics | | | |

| Trustee Independence | | | |

| Audit Committee Financial Expert | | | |

| Communications with our Board of Trustees | | | |

| Amended and Restated Whistleblowing and Whistleblower Protection Policy | | | |

| Trustee Attendance at Annual Meetings | | | |

| Executive Sessions of Independent Trustees | | | |

| Leadership Structure of our Board of Trustees | | | |

| Our Board of Trustees' Role in Risk Oversight | | | |

| EXECUTIVE COMPENSATION | | | |

| Compensation Discussion and Analysis | | | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | | |

| Policies and Procedures With Respect to Related Party Transactions | | | |

|

| | | |

| | Page |

| Related Party Transactions | | | |

| OTHER MATTERS | | | |

| Solicitation of Proxies | | | |

| Confidentially of Voting | | | |

| Voting Results | | | |

| Shareholder Proposals | | | |

| Other Matters | | | |

Chambers Street Properties

47 Hulfish Street, Suite 210

Princeton, New Jersey 08542

_________________________________________

PROXY STATEMENT

_________________________________________

2014 ANNUAL MEETING OF SHAREHOLDERS

to be held on June 12, 2014

_________________________________________

This proxy statement contains information related to the solicitation of proxies by the Board of Trustees of Chambers Street Properties, a Maryland real estate investment trust, for use at the 2014 annual meeting of shareholders to be held on Thursday, June 12, 2014, at 9:30 a.m., Eastern Time, at the Nassau Inn Princeton, 10 Palmer Square, Princeton, New Jersey 08542 or at any postponement(s) or adjournment(s) of the annual meeting.

Electronic Delivery of Proxy Materials

Pursuant to the rules and regulations of the Securities and Exchange Commission ("SEC"), we are primarily furnishing proxy materials to our shareholders via the Internet, rather than mailing paper copies of the materials.

On or about April 22, 2014, we mailed a Notice Regarding the Internet Availability of Proxy Materials (the "Notice") to many of our shareholders of record, which contained instructions on how to access and review proxy materials, including our proxy statement and our 2013 annual report to shareholders, on the Internet. The Notice also instructs shareholders on how to access their proxy card to be able to submit their proxies on the Internet. Brokerage firms, banks and other nominees who hold shares on behalf of beneficial owners will be sending their own similar notice. Other shareholders, in accordance with their prior requests, have received e-mail notification of how to access the proxy materials and submit their proxies on the Internet. On or about April 22, 2014, we also began mailing a full set of proxy materials to certain shareholders, including shareholders who have previously requested a paper copy of the proxy materials.

Internet distribution of the proxy materials is designed to expedite receipt by shareholders, lower costs and reduce the environmental impact of our annual meeting. If you have previously elected to receive proxy materials electronically, you will continue to receive the materials via e-mail unless you elect otherwise.

How do I access the proxy materials if I received a Notice of Internet Availability of Proxy Materials?

The Notice you received from us or your brokerage firm, bank or other nominee provides instructions regarding how to view the proxy materials for the 2014 annual meeting on the Internet. As explained in greater detail in the Notice, to view the proxy materials and submit your proxy, you will need to visit www.proxyvote.com and have available your 12-digit control number(s) contained in your notice.

How do I request a paper or e-mail copy of the proxy materials?

Whether you hold Chambers Street Properties common shares through a brokerage firm, bank or other nominees (in "street name") as a beneficial owner, or hold our common shares directly in your name through our transfer agent, DST Systems, Inc. ("DST"), as a shareholder of record, you may request a paper or e-mail copy of the 2014 annual meeting proxy materials by following the instructions listed at www.proxyvote.com, by telephoning 1-800-579-1639 or by sending an e-mail to sendmaterial@proxyvote.com. There is NO charge for requesting a paper or e-mail copy of the 2014 annual meeting proxy materials.

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS

This proxy statement and our 2013 Annual Report to Shareholders are available at www.proxyvote.com.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Who is entitled to vote at the meeting?

If our records show that you were a holder of our common shares at the close of business on April 10, 2014, which is referred to in this proxy statement as the record date, you are entitled to receive notice of the meeting and to vote the common shares that you held on the record date. Each outstanding common share entitles its holder to cast one vote for each matter to be voted upon. If you were a shareholder on the record date, you will be entitled to vote all of the shares that you held on that date at the annual meeting or any adjournment(s) or postponement(s) of the annual meeting.

Who may attend the meeting?

Subject to space availability, shareholders, or their duly appointed proxies, are entitled to attend the annual meeting only if they were shareholders at the close of business on the record date, April 10, 2014. Since seating is limited, admission to the meeting will be on a first-come, first-served basis. Registration and seating will begin at 9:00 a.m., Eastern Time. In order to be admitted to the annual meeting of shareholders you must present a valid government-issued photo identification (such as a driver's license or passport) and proof of ownership of our common shares on the record date. Proof of ownership can be accomplished through the following:

| |

| • | a brokerage statement or letter from your broker or custodian with respect to your ownership of common shares on April 10, 2014; |

| |

| • | the Notice Regarding the Internet Availability of Proxy Materials; |

| |

| • | a printout of the proxy distribution email (if you receive your materials electronically); |

| |

| • | a voting instruction form; |

| |

| • | a "legal proxy" provided by your broker or custodian. |

We reserve the right to determine the validity of any purported proof of ownership. For the safety and security of our shareholders, we will be unable to admit you to the annual meeting of shareholders if you do not present photo identification and proof of ownership of our common shares or if you otherwise refuse to comply with our security procedures. Cameras, recording devices and other electronic devices will not be permitted, and attendees may be subject to security inspections and other security precautions.

What is the purpose of the meeting?

At the annual meeting, you will be asked:

| |

• | to elect the seven trustee nominees specified in this proxy statement; |

| |

| • | to approve, on a non-binding, advisory basis, the compensation of our named executive officers disclosed in this proxy statement; |

| |

| • | to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014; and |

| |

| • | to act upon any other matters that may properly be brought before the annual meeting or at any adjournment(s) or postponement(s) thereof. |

What constitutes a quorum?

The presence at our annual meeting, in person or by proxy, of holders of a majority of the total number of outstanding common shares entitled to vote at this meeting is necessary to constitute a quorum for the transaction of business at the meeting. As of the record date, there were 237,010,447 common shares outstanding and entitled to vote at the meeting.

In determining the presence of a quorum at the annual meeting, abstentions in person, proxies received but marked as abstentions as to any or all matters to be voted on that permit abstentions, and proxies received with broker non-votes on some but not all matters to be voted on, will be counted as present.

A broker "non-vote" occurs when a broker, bank or other holder of record that holds shares for a beneficial owner (collectively, "broker") does not vote on a particular proposal because the broker has not received voting instructions from the beneficial owner and does not have discretionary voting power for that particular proposal. Brokers may vote on ratification of the appointment of our independent registered public accounting firm (Proposal 3) even if they have not received instructions from the beneficial owners whose shares they hold. However, brokers may not vote on any of the other matters submitted to shareholders at the 2014 annual meeting unless they have received voting instructions from the beneficial owner. See the response to "What vote is needed to approve each proposal?" for a discussion of the effect of broker non-votes.

What is the difference between holding shares as a shareholder of record and as a beneficial holder?

If your shares are registered directly in your name with Chamber Street Properties' transfer agent, DST Systems, Inc., you are considered, with respect to those shares, the "shareholder of record." The Notice or, for some shareholders of record, a full set of proxy materials in paper form, has been sent directly to you by or on our behalf.

If your shares are held in "street name," you are considered the "beneficial owner" of the shares. The Notice or, for some beneficial owners, a full set of the proxy materials, was sent to you by or on behalf of your broker, who is considered, with respect to those shares, the shareholder of record.

What vote is needed to approve each proposal?

The affirmative vote of a plurality of all votes cast at the meeting at which a quorum is present is necessary for election of the nominees for the trustees named in this proxy statement (Proposal 1). A majority of all the votes cast at the meeting at which a quorum is present is necessary for (i) approval, on a non-binding, advisory basis, of the compensation of our named executive officers (Proposal 2); (ii) ratification of the selection of Deloitte Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014 (Proposal 3); and (iii) approval of any other matters properly presented at the annual meeting for shareholder approval. We will treat abstentions as shares that are present and entitled to vote for purposes of determining the presence or absence of a quorum. Abstentions do not constitute a vote "for" or "against" any matter being voted on at the annual meeting and will not be counted as "votes cast." Therefore, abstentions will have no effect on proposals 1 through 3 (or any other matters presented at the annual meeting for shareholder approval), assuming a quorum is present. Broker "non-votes," or proxies from brokers indicating that such broker has not received instructions from the beneficial owner or other entity entitled to vote such shares on a particular matter with respect to which such broker does not have discretionary voting power, will be treated in the same manner as abstentions for purposes of the annual meeting. There will not be any broker non-votes with respect to Proposal 3, because Proposal 3 is a routine matter on which brokers are permitted to vote without instructions from the beneficial owner. If you are a beneficial owner whose common shares are held of record by a broker, your broker has discretionary voting authority under the NYSE rules to vote your shares on Proposal 3, even if the broker does not receive voting instructions from you. However, under the NYSE rules, your broker does not have discretionary authority to vote on the election of the nominees for the trustees named in this proxy statement (Proposal 1), on the approval, on a non-binding, advisory basis, of the compensation of our named executive officers (Proposal 2), or any other matters presented at the annual meeting for shareholder approval without instructions from you, in which case a broker "non-vote" will occur and your common shares will not be voted on these matters at the annual meeting. None of the proposals, if approved, entitle any of our shareholders to appraisal rights under Maryland law or our declaration of trust.

How do I vote?

In Person at the Meeting. If you are a shareholder of record and attend the annual meeting, you may vote in person at the meeting. If you are a beneficial owner and you wish to vote in person at the meeting, you will need to obtain a "legal proxy" from the broker that holds your common shares of record.

By Internet or telephone, and if you received the proxy materials by mail, also by mail:

| |

| • | By Internet. You may authorize a proxy to vote your shares via the Internet by going to the website address found on your proxy card (www.proxyvote.com) and following the instructions provided. Internet proxy authorization is available 24 hours |

per day until 11:59 p.m., Eastern Time, on Wednesday, June 11, 2014. Please have your proxy card/voting instruction form available when you access www.proxyvote.com. You will be given the opportunity to confirm that your voting instructions have been properly submitted. If you are a beneficial owner, your broker may provide additional instructions to you regarding voting your shares through the Internet. IF YOU AUTHORIZE A PROXY VOTE VIA THE INTERNET, YOU DO NOT NEED TO RETURN YOUR PROXY CARD.

| |

| • | By Telephone. You also have the option to authorize a proxy to vote your shares by telephone by calling the toll-free number listed on your proxy (1-800-690-6903). Telephone proxy authorization is available 24 hours per day until 11:59 p.m., Eastern Time, on Wednesday, June 11, 2014. When you call, please have your proxy card/voting instruction form in hand, and you will receive a series of voice instructions which will allow you to authorize a proxy to vote your common shares. You will be given the opportunity to confirm that your instructions have been properly recorded. If you are a beneficial owner, your broker may provide additional instructions to you regarding voting your shares by telephone. IF YOU AUTHORIZE A PROXY TO VOTE BY TELEPHONE, YOU DO NOT NEED TO RETURN YOUR PROXY CARD. |

| |

| • | By Mail. If you would like to authorize a proxy to vote your shares by mail, then please mark, sign and date your proxy card and return it promptly to our proxy tabulator Broadridge Financial Solutions, Inc., in the postage-paid envelope provided, to Chambers Street Properties Vote Processing, c/o Broadridge Financial Solutions, Inc. 51 Mercedes Way Edgewood, NY 11717. Your proxy card must be received by Wednesday, June 11, 2014. If you are a beneficial owner, your broker may provide additional instructions to you regarding voting your shares by mail. |

Can I change my vote after I submit my proxy card?

Yes.

If you cast a vote by proxy, you may revoke it at any time before it is voted by:

| |

| • | providing a written notice revoking the proxy to Chambers Street Properties, 47 Hulfish Street, Suite 210, Princeton, NJ 08542, Attn: Secretary; |

| |

| • | making timely delivery of later-dated voting instructions on the Internet or by telephone or, if you received the proxy materials by mail, also by making timely delivery of a valid, later-dated proxy card; or |

| |

| • | appearing in person and voting by ballot at the meeting. |

If you attend the meeting, you may vote in person whether or not you have previously given a proxy, but your presence (without further action) at the meeting will not constitute revocation of a previously given proxy.

If you are a beneficial owner, you may submit new voting instructions by contacting your broker, bank or other nominee. You may also vote in person at the annual meeting if you obtain a legal proxy as described in the answer to the above question.

All shares for which proxies have been properly submitted and not revoked will be voted at the annual meeting.

Who counts the votes cast at our annual meeting?

Representatives of Broadridge Financial Solutions, Inc., American Election Services, LLC, will tabulate the votes cast at our 2014 annual meeting, and will act as the independent inspector of election.

How is my vote counted?

If you properly execute a proxy in the accompanying form, and if we receive it prior to voting at the meeting, or authorize your proxy to vote your shares electronically through the Internet or by telephone, the common shares that the proxy represents will be voted in the manner specified on the proxy. If no specification is made, the common shares will be voted in accordance with the recommendations of our Board of Trustees. Our Board of Trustees recommendations are set forth together with the description of each proposal in this proxy statement. In summary, our Board of Trustees recommends a vote:

| |

| • | For election of each of the nominees for the trustees named in this proxy statement (Proposal 1); |

| |

| • | For approval, on a non-binding, advisory basis, the compensation of our named executive officers disclosed in this proxy statement (Proposal 2); |

| |

| • | For ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2014 (Proposal 3); and |

| |

| • | as recommended by our Board of Trustees with regard to all other matters in its discretion. |

Can other matters be presented at the annual meeting?

At the date of the printing of this proxy statement, our Board of Trustees is unaware of any matters to be submitted for action at the annual meeting other than the proposals described in this proxy statement, and it is not anticipated that any matters other than those set forth in the proxy statement will be presented at the meeting. If, however, other matters are properly presented, your proxies include discretionary authority on the part of the individuals appointed as proxies to vote your shares or act on those matters according to their discretion with respect to any proposal or for any other reason. In addition, no shareholder proposals or nominations were received on a timely basis, so no such matters may be brought to a vote at the annual meeting.

What other information should I review before voting?

For your review, our 2013 annual report, together with our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, is being provided to you concurrently with the delivery of this proxy statement. You may also obtain, free of charge, a copy of our 2013 annual report on our website at http://www.chambersstreet.com. The information found on, or accessible through, our website is not incorporated into, and does not form a part of, this proxy statement or any other report or document we file with or furnish to the SEC. You may also obtain a copy of our Annual Report on Form 10-K, free of charge, by directing your request in writing to Chambers Street Properties, 47 Hulfish Street, Suite 210, Princeton, New Jersey 08542, Attention: Secretary. The 2013 annual report, however, is not part of the proxy solicitation material.

What is "householding" and how does it affect me?

We have adopted a procedure approved by the SEC called "householding." Under this procedure, shareholders of record who have the same address and last name, and do not participate in electronic delivery of proxy materials, will be mailed only one package that contains the individual paper copies of the Notice or proxy materials, including individual proxy cards, for each shareholder of record at the address. Householding allows us to reduce postage costs and help conserve natural resources.

If your household receives only a single package containing a copy of the Notice or proxy materials, and you wish to receive a separate copy for each shareholder of record, please contact Broadridge Financial Solutions, Inc., toll free at 1-800-542-1061, or write to Broadridge Financial Solutions, Inc., 51 Mercedes Way, Edgewood, NY 11717, Attn: Householding Department, and separate copies will be provided promptly.

If you are a beneficial owner, you can request information about householding from your broker, bank or other holders of record.

Cautionary Note Regarding Forward-Looking Statements

This proxy statement contains various "forward-looking statements." You can identify forward-looking statements by the use of forward-looking terminology such as "believes," "expects," "may," "will," "would," "could," "should," "seeks," "approximately," "intends," "plans," "projects," "estimates" or "anticipates" or the negative of these words and phrases or similar words or phrases.

You can also identify forward-looking statements by discussions of strategy, plans or intentions, including statements about the timing and likelihood of providing a liquidity event to our shareholders. Statements regarding the following subjects may be impacted by a number of risks and uncertainties:

| |

| • | our ability to obtain future financing arrangements; |

| |

| • | estimates relating to our future distributions; |

| |

| • | our understanding of our competition; |

| |

| • | projected capital expenditures; |

| |

| • | the impact of technology on our products, operations and business; and |

| |

| • | the use of the proceeds of any offerings of securities. |

The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. These beliefs, assumptions and expectations are subject to risks and uncertainties and can change as a result of many possible events or factors, not all of which are known to us. If a change occurs, our business, financial condition, liquidity and results of operations may vary materially from those expressed in our forward-looking statements. You should carefully consider these risks before you make an investment decision with respect to our common shares, along with the following factors that could cause actual results to vary from our forward-looking statements:

| |

| • | general volatility of the securities markets in which we participate; |

| |

| • | national, regional and local economic climates; |

| |

| • | changes in supply and demand for industrial and office properties; |

| |

| • | adverse changes in the real estate markets, including increasing vacancy, increasing competition and decreasing rental; |

| |

| • | availability and credit worthiness of prospective tenants; |

| |

| • | our ability to maintain rental rates and maximize occupancy; |

| |

| • | our ability to identify and secure acquisitions; |

| |

| • | our failure to successfully manage growth or operate acquired properties; |

| |

| • | our pace of acquisitions and/or dispositions of properties; |

| |

| • | risks related to development projects (including construction delay, cost overruns or our inability to obtain necessary permits); |

| |

| • | receiving and maintaining corporate debt ratings and changes in the general interest rate environment; |

| |

| • | availability of capital (debt and equity); |

| |

| • | our ability to refinance existing indebtedness or incur additional indebtedness; |

| |

| • | failure to comply with our debt covenants; |

| |

| • | unanticipated increases in financing and other costs, including a rise in interest rates; |

| |

| • | the actual outcome of the resolution of any conflict; |

| |

| • | material adverse actions or omissions by any of our joint venture partners; |

| |

| • | our ability to operate as a self-managed company; |

| |

| • | availability of and ability to retain our executive officers and other qualified personnel; |

| |

| • | future terrorist attacks in the United States or abroad; |

| |

| • | the ability of our operating partnership to continue to qualify as a partnership for U.S. federal income tax purposes; |

| |

| • | our ability to continue to qualify as a REIT for U.S. federal income tax purposes; |

| |

| • | foreign currency fluctuations; |

| |

| • | changes to accounting principles, policies and guidelines applicable to REITs; |

| |

| • | legislative or regulatory changes adversely affecting REITs and the real estate business; |

| |

| • | environmental, regulatory and/or safety requirements; and |

| |

| • | other factors discussed under Item 1A Risk Factors of our Annual Report on Form 10-K for the year ended December 31, 2013 and those factors that may be contained in any filing we make with the SEC, including Part II, Item 1A of our Form 10-Qs. |

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of future events, new information or otherwise.

No person is authorized on our behalf to give any information or to make any representations with respect to the proposals other than the information and representations contained in this proxy statement, and, if given or made, such information and/or representations must not be relied upon as having been authorized. The delivery of this proxy statement shall not, under any circumstances, create any implication that there has been no change in our affairs since the date hereof.

PROPOSAL 1: ELECTION OF TRUSTEES

Our Board of Trustees currently consists of seven members each serving for a term of one year and until their successors are duly elected and qualify, which term expires at each annual meeting of shareholders. Our declaration of trust and bylaws provide that a majority of the entire Board of Trustees may at any time increase or decrease the number of trustees. However, unless our declaration of trust and bylaws are amended, the number of trustees may never be less than the minimum number required by the Maryland REIT law.

At the annual meeting, all of the trustees will be elected to serve until the 2015 annual meeting and until their successors are duly elected and qualify. Our Board of Trustees, upon recommendation of the Nominating and Corporate Governance Committee, has nominated Charles E. Black, Mark W. Brugger, Jack A. Cuneo, James L. Francis, James M. Orphanides, Martin A. Reid and Louis P. Salvatore to serve as trustees. Our Board of Trustees anticipates that each nominee will serve, if elected, as a trustee. However, if any nominee is unable to accept election, proxies voted in favor of such nominee will be voted for the election of such other person or persons as our Board of Trustees may select.

The election of each nominee requires the affirmative vote of a plurality of all votes cast at the meeting at which a quorum is present in person or by proxy.

Our Board of Trustees unanimously recommends a vote "FOR" each nominee.

Information Regarding the Nominees

The following table and biographical descriptions set forth certain information with respect to each nominee for election as a trustee at the 2014 annual meeting, based upon information furnished by each trustee. The biographical descriptions for each nominee includes the specific experience, qualifications, attributes and skills that led to the conclusion by our Board of Trustees that such person should serve as a trustee.

|

| | | | |

| Name | | Age | | Position |

| Charles E. Black | | 65 | | Chairman of the Board of Trustees(1) |

| Mark W. Brugger | | 44 | | Trustee(1) |

| Jack A. Cuneo | | 66 | | President and Chief Executive Officer and Trustee |

| James L. Francis | | 52 | | Trustee(1) |

| James M. Orphanides | | 63 | | Trustee(1) |

| Martin A. Reid | | 58 | | Executive Vice President, Chief Financial Officer, Treasurer, Secretary and Trustee |

| Louis P. Salvatore | | 67 | | Trustee(1) |

__________

Charles E. Black. Mr. Black has been one of Chambers Street Properties' (NYSE: CSG) trustees since June 2004 and has been the Chambers Street's Chairman of the Board of Trustees since June 2012. Mr. Black is the Chief Executive Officer of CB Urban Development, a development company he founded in 2007 which specializes in mixed-use urban development projects. Mr. Black is also an attorney in private practice who represents developers, land owners and businesses in the development, entitlement, financing and implementation of politically sensitive, public and private real estate projects. In addition, Mr. Black is Managing Director-Public Private Partnership for Gafcon Inc., of San Diego, California. Mr. Black's area of special focus in the real estate industry relates to structuring the entitlement and financing of large public/private mixed-use developments anchored by sports venues, convention centers and other public facilities. Before founding CB Urban Development, Mr. Black was the Regional Senior Vice President (San Diego region) of The Irvine Company. Prior to joining The Irvine Company in March 2006, Mr. Black was the Executive Vice President of JMI Realty, where he had overall management responsibility for the development of Petco Park, the $450 million San Diego Padres baseball park that was completed in February 2004. Prior to joining JMI Realty in 2002, Mr. Black was the President and Chief Operating Officer of the San Diego Padres Baseball Club. From 1991 to 2002, Mr. Black was a partner in the law firm of Gray, Cary, Ware & Freidenrich LLP, where his areas of expertise included real estate acquisition and development, urban planning and development law and development financing. Mr. Black is a member of the Urban Land Institute (ULI) and the

land economics society Lambda Alpha International. Mr. Black received a B.S. from the United States Air Force Academy and a J.D. from the University of California at Davis.

Mark W. Brugger. Mr. Brugger has been one of Chambers Street Properties' (NYSE: CSG) trustees since September 2013. Mr. Brugger is a founder of DiamondRock Hospitality Company ("DiamondRock") where he has served as Chief Executive Officer and a member of the Board of Directors since September 1, 2008. Until he was promoted to his current role, Mr. Brugger served as DiamondRock's Executive Vice President, Chief Financial Officer and Treasurer since its formation in 2004. Previously, Mr. Brugger served Marriott International in a number of roles, including as the Chief Executive Officer of Marriott International's synthetic fuels company from 2001 to 2004 and as Vice President of Project Finance from 2000 to 2004. From 1997 to 2000, Mr. Brugger served as Vice President of Investment Sales at Transwestern Commercial Services. From 1995 to 1997, Mr. Brugger was the Land Development Director for Brookfield Residential, formerly Coscan Washington, Inc. Mr. Brugger received a Juris Doctor cum laude from the American University Washington College of Law in 1995 and a B.A. from the University of Maryland at College Park in 1992.

Jack A. Cuneo. Mr. Cuneo is founder, president, CEO and a trustee of Chambers Street Properties (NYSE: CSG). Mr. Cuneo served as Chairman of Chambers Street's Board of Trustees from January 2009 until June 2012 and was President and CEO of our former investment advisor, from March 2004 through June 2012. Mr. Cuneo was also Executive Managing Director of CBRE Global Investors from July 2008 until June 2012. Mr. Cuneo has over 43 years of experience in the real estate industry and had been involved in a wide range of real estate investment activity including acquisitions, development, joint venture structuring, property sales, work outs and private equity financing for REITs and real estate operating companies. Prior to joining CBRE Global Investors in June 2003, Mr. Cuneo served as President of Cuneo Capital Group which engaged in advisory and private equity investment activities from 2002 to 2003. Mr. Cuneo also spent 26 years at Merrill Lynch where he served from 1997 to 2000 as the Chairman and Chief Executive Officer of Merrill Lynch Hubbard, a real estate investment subsidiary which acquired, operated and sold over 100 properties valued at $1.8 billion on behalf of over 240,000 individual investors. Mr. Cuneo was a Managing Director of the Global Real Estate and Hospitality Group at Merrill Lynch from 2000 to 2002 where he led private equity, advisory and asset sales activities. He is a member of the Urban Land Institute (ULI), the Policy Advisory Board at the Haas School of Business, University of California at Berkeley and the Real Estate Board of New York. Mr. Cuneo received a B.A. from City College of New York and pursued graduate studies at the University of Massachusetts at Amherst.

James L. Francis. Mr. Francis has been one of Chambers Street Properties' (NYSE: CSG) trustees since September 2013. Mr. Francis is President and Chief Executive Officer and a Trustee of Chesapeake Lodging Trust, a lodging REIT ("Chesapeake"), positions he has held since Chesapeake's formation. Prior to co-founding Chesapeake, Mr. Francis served as the President and Chief Executive Officer and a director of Highland Hospitality Corporation ("Highland"), positions that he held from Highland's IPO in December 2003 to its sale in July 2007. Following the sale of Highland, Mr. Francis served as a consultant to the affiliate of JER Partners that acquired Highland until September 2008. Since September 2008, until Chesapeake's formation, Mr. Francis was a private investor. From June 2002 until joining Highland in December 2003, Mr. Francis served as the Chief Operating Officer, Chief Financial Officer and Treasurer of Barceló Crestline Corporation ("Barceló"), and served as Executive Vice President and Chief Financial Officer of Crestline Capital Corporation ("Crestline Capital"), prior to its acquisition by Barceló, from December 1998 to June 2002. Prior to the spin-off of Crestline Capital from Host Hotels & Resorts, Inc. (formerly Host Marriott Corporation, "Host Marriott"), Mr. Francis held various finance and strategic planning positions with Host Marriott and Marriott International, Inc. ("Marriott International"). From June 1997 to December 1998, Mr. Francis held the position of Assistant Treasurer and Vice President Corporate Finance for Host Marriott, where he was responsible for Host Marriott's corporate finance function, business strategy and investor relations. Over a period of ten years, Mr. Francis served in various capacities with Marriott International's lodging business, including Vice President of Finance for Marriott Lodging from 1995 to 1997; Brand Executive, Courtyard by Marriott from 1994 to 1995; Controller for Courtyard by Marriott and Fairfield Inn from 1993 to 1994; Director of Finance and Strategic Planning for Courtyard by Marriott and Fairfield Inn from 1991 to 1993; and Director of Hotel Development Finance from 1987 to 1991. Mr. Francis received his B.A. in Economics and Business from Western Maryland College and earned an M.B.A. in Finance and Accounting from Vanderbilt University.

James M. Orphanides. Mr. Orphanides has been one of Chambers Street Properties' (NYSE: CSG) trustees since October 2005. Since January 2010, Mr. Orphanides has been a Partner and the President of Centurion Holdings LLC. Mr. Orphanides has been retired from First Industrial American Title Insurance Company of New York since 2008 where he served as Chairman Emeritus and as a director until the company merged with its parent, First American Title Insurance Company in November 2010. Mr. Orphanides worked for First American from 1992 through 2008 in key executive positions including, from 1996 through 2007, as President, Chief Executive Officer and Chairman of the Board. Prior to joining First American, Mr. Orphanides was a Principal and President of

Preferred Land Title Services, Inc. from 1982 to 1992. Mr. Orphanides was an executive at Commonwealth Land Title Insurance Company from 1979 to 1982 and an executive at Chicago Title Insurance Company from 1972 to 1979. Mr. Orphanides was a trustee of Wilshire Enterprises, Inc. from January 2009 through January 2010 where he was a member of the Audit committee and chaired strategic planning. Mr. Orphanides has been actively involved in many non-for profit organizations. Until January 2012, Mr. Orphanides sat on the Board of the American Ballet Theatre. Currently, Mr. Orphanides sits on the Boards of: the Foundation for Medical Evaluation and Early Detection, Citizen Budget Commission and CUNY TV Foundation. Mr. Orphanides is also a member of the Hellenic American Bankers Association (HABA); the Economic Club of New York; TPC Golf Club at Jasna Polana in Princeton, New Jersey; the Nassau Club in Princeton, New Jersey, the Union League Club in New York City and the Metropolitan Club in New York City. Mr. Orphanides received a B.A. from Heidelberg College and an M.A. from Queens College of New York.

Martin A. Reid. Mr. Reid has been one of Chambers Street Properties' (NYSE: CSG) trustees since March 2005, and its Executive Vice President and Chief Financial Officer since June 2012 and its Treasurer and Secretary since September 2012. Mr. Reid has over 33 years of experience in the real estate and capital markets industry and has been involved in a wide range of real estate investment and capital markets activity including acquisitions, development, structuring, dispositions, and debt and equity financings. From September 2010 to June 2012, Mr. Reid was the Executive Vice President, Development and Acquisitions at Interstate Hotels & Resorts where he was responsible for real estate holdings, sourcing and acquiring hotels, and identifying management contract opportunities. Prior to joining Interstate, Mr. Reid was a partner in Cheswold Real Estate Investment Management. Prior to joining Cheswold, Mr. Reid was the Chief Executive Officer of the General Partner of Redstone Hotel Partners, advising on hotel transactions and fund raising activities. From 1998 until 2006, Mr. Reid was a Managing Director of Thayer Lodging Group where he was responsible for acquisitions, dispositions, capital raising and financial matters of Thayer Lodging Group. Mr. Reid has a broad professional background in real estate investment, capital markets and finance, including experience in public accounting and financial reporting. Prior to joining Thayer Lodging Group in 1998, Mr. Reid spent four years as a Principal at LaSalle Advisors in Baltimore, Maryland, successor through merger to Alex. Brown Kleinwort Benson, where he originated and closed real estate transactions for pension fund clients. Prior to his tenure with LaSalle, Mr. Reid spent several years in acquisitions and dispositions with real estate investment and advisory affiliates of Merrill Lynch & Co. and Chase Manhattan Bank, where he was involved in the acquisition of several office, retail and residential properties and portfolios. Mr. Reid received a B.S. in Accounting from the State University of New York at Albany and an M.B.A. in Financial Management from Pace University. Mr. Reid is a Member of the American Institute of Certified Public Accountants and is a Full Member of the Urban Land Institute (ULI).

Louis P. Salvatore. Mr. Salvatore has been one of Chambers Street Properties' (NYSE: CSG) trustees since July 2012. Mr. Salvatore has been employed by Arthur Andersen LLP since 1967, where he currently works part-time focusing on the wind down of the public accounting practice. Mr. Salvatore was a partner at Arthur Andersen LLP from 1977 until 2002 and held a number of management positions with Arthur Andersen LLP including Office Managing Partner for Metro New York, Northeast Region Managing Partner, Member of the Worldwide Board of Partners and Interim Managing Partner of Andersen Worldwide. He also currently serves as an independent director and Chairman of the Audit Committee for public traded closed end and open end funds managed by Brookfield Asset Management and serves as a Board Member and Chairman of the Audit Committee for Turner Corporation and for SP Fiber Technologies Inc. Mr. Salvatore previously served as a Board Member and Chairman of the Audit Committee for Jackson Hewitt Tax Service Inc. from 2004 through 2011 and for Crystal River Capital Inc., a mortgage REIT sponsored by Brookfield Asset Management, from 2005 through 2010. In addition, Mr. Salvatore has served on the board of many of New York area civic and community organizations, including New York Partnership, United Way of New York City and Catholic Charities Dioceses of Brooklyn. Mr. Salvatore also holds a Masters Professional Director Certification from the American College of Corporate Directors. Mr. Salvatore received a B.S. in Accounting from Fordham University.

Biographical Information Regarding Executive Officers Who Are Not Trustees

Philip L. Kianka. Mr. Kianka has been Chambers Street Properties' (NYSE: CSG) Executive Vice President and Chief Operating Officer since October 2008. Mr. Kianka has also been the Director of Operations of our former Investment Advisor since January 2006. Mr. Kianka was a Managing Director of CBRE Global Investors from January 2009 to June 2012. Mr. Kianka has over 29 year of experience in the real estate industry and has been involved in a wide range of activities including acquisitions, asset and portfolio management, development, dispositions, finance and joint venture structuring. Prior to joining CBRE Global Investors in January 2006, Mr. Kianka served as Vice President and senior asset manager for Lexington Properties Trust from 1997 to December 2005. Mr. Kianka also spent 13 years as Vice President at Merrill Lynch Hubbard, a real estate subsidiary of Merrill Lynch which acquired, operated and sold more than 100 properties valued at over $1.8 billion on behalf of over 240,000 individual investors. Mr. Kianka is a sustaining member of the Samuel Zell and Robert Lurie Real Estate Center at The Wharton School of the University of Pennsylvania, a member of The Greater Philadelphia Chapter of the National Association of Industrial and Office Properties and a

full member of the Urban Land Institute. Mr. Kianka received a B.A. and a Masters of Architecture from Clemson University in Clemson, South Carolina and is a licensed architect in the State of New Jersey. Mr. Kianka is 57 years old.

Our Board of Trustees and its Committees

Our Board of Trustees presently consists of seven members. Our Board of Trustees has affirmatively determined that Messrs. Charles E. Black, Mark W. Brugger, James L. Francis, James M. Orphanides and Louis P. Salvatore representing a majority of its members, are "independent trustees," as such term is defined by the applicable rules of the SEC and the NYSE. Our Board of Trustees held 21 meetings during fiscal year 2013. Each of the current trustees attended at least 90% of the total number of meetings of our Board of Trustees held during 2013 during which he was a member of our Board of Trustees. For a discussion of our Board of Trustees leadership structure and role in risk oversight, see "Corporate Governance Matters" in this proxy statement.

The Board has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee, the current charters of which are available on our corporate website at http://www.chambersstreet.com under the Investor Relations—Corporate Overview "Governance Documents" section. Further, we will provide a copy of these charters without charge to each shareholder upon written request. Requests for copies should be addressed to Chambers Street Properties, 47 Hulfish Street, Suite 210, Princeton, New Jersey 08542, Attn: Secretary. From time to time, our Board of Trustees also may create additional committees for such purposes as it may determine.

Audit Committee. We have a standing Audit Committee, consisting of Messrs. Salvatore (Chairman), Black, Brugger and Francis, each of whom is "independent" as such term is defined by the applicable rules of the SEC and the NYSE. Our Board of Trustees has determined that Mr. Louis P. Salvatore is an "audit committee financial expert," as defined in the rules promulgated by the SEC under the Sarbanes-Oxley Act of 2002, as amended. Our Audit Committee's primary functions are to select and appoint our independent registered public accounting firm (including overseeing the auditor's qualifications and independence) and to assist our Board of Trustees in fulfilling its oversight responsibilities by reviewing (i) the financial information to be provided to the shareholders and others, (ii) the system of internal controls that management has established, (iii) the performance of our internal audit function and independent auditor, and (iv) the audit and financial reporting process. Our Audit Committee also prepares the report that the rules of the SEC requires to be included in this proxy statement and provides an open avenue of communication among the our independent registered public accounting firm, our internal auditors, our management and our Board of Trustees. Our Board of Trustees has approved a written charter for our Audit Committee, a copy of which is available on our website at http:// www.chambersstreet.com under the Investor Relations—Corporate Overview "Governance Documents" section. Additional information regarding the functions performed by our Audit Committee is set forth in the "Audit Committee Report" included in this annual proxy statement. Our Audit Committee held nine meetings during fiscal year 2013. Each of the committee members attended 89% of the total number of meetings of our Audit Committee held during 2013 during the time in which he was a member of our Audit Committee.

Compensation Committee. We have a standing Compensation Committee, consisting of Messrs. Black (Chairman), Brugger, Orphanides and Salvatore, each of whom is "independent" as such term is defined by the applicable rules of the SEC and the NYSE. Our Compensation Committee's primary purposes are (i) to determine how our executive officers and certain other senior managers should be compensated; (ii) to administer our employee benefit plans and executive compensation programs; (iii) to set policies and review management decisions regarding compensation of our senior managers other than our executive officers and certain other senior managers; and (iv) to produce the report on executive compensation required to be included in this proxy statement. Our Compensation Committee has retained Towers Watson & Co., or Towers Watson, as its independent outside compensation consulting firm and has engaged Towers Watson to provide the Compensation Committee with relevant data concerning the marketplace, our peer group and its own independent analysis and recommendations concerning executive compensation. Towers Watson regularly participates in Compensation Committee meetings. See "Executive Compensation—Compensation Discussion and Analysis." Our Board of Trustees has approved a written charter for our Compensation Committee, a copy of which is available on our website at http://www.chambersstreet.com under the Investor Relations—Corporate Overview "Governance Documents" section. Our Compensation Committee held eight meetings during fiscal year 2012. Each of the committee members attended 100% of the total number of meetings of our Compensation Committee held during 2013 during the time in which he was a member of our Compensation Committee.

Nominating and Corporate Governance Committee. We have a standing Nominating and Corporate Governance Committee consisting of Messrs. Orphanides (Chairman), Black and Francis, each of whom is "independent" as such term is defined by the applicable rules of the SEC and the NYSE. Our Nominating and Corporate Governance Committee is primarily responsible for

(i) assisting our Board of Trustees by identifying individuals qualified to become board members and to serve on board committees, (ii) reviewing and approving specific matters that our Board of Trustees believes may involve conflicts of interest and determining whether the resolution of the conflict of interest is fair and reasonable to us and our shareholders and (iii) developing and recommending to our Board of Trustees, a set of corporate governance guidelines applicable to us and reviewing those guidelines periodically and, if appropriate, recommending to our Board of Trustees changes to our corporate governance policies and procedures. Our Nominating and Corporate Governance Committee does not have any minimum qualifications with respect to board nominees. However, our Nominating and Corporate Governance Committee considers many factors with regard to each candidate, including judgment, integrity, diversity, prior experience, the interplay of the candidate's experience with the experience of other board members and the candidate's willingness to devote substantial time and effort to board responsibilities. Our Nominating and Corporate Governance Committee does not have a formal written policy with regard to the consideration of diversity in identifying trustee nominees, although it may consider diversity when identifying and evaluating proposed trustee candidates. Our Board of Trustees has approved a written charter for our Nominating and Corporate Governance Committee, a copy of which is available on our website at http:// www.chambersstreet.com under the Investor Relations—Corporate Overview "Governance Documents" section. Our Nominating and Corporate Governance Committee held four meetings during fiscal year 2013. Each of the committee members attended 100% of the total number of meetings of our Nominating and Corporate Governance Committee held during 2013 during the time in which he was a member of our Nominating and Corporate Governance Committee.

Compensation of Trustees

Trustees who are not independent do not receive additional compensation for their services as trustees. The following table sets forth the compensation earned by our independent trustees for the year ended December 31, 2013:

|

| | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($) | | Share Awards(1) | | All Other Compensation | | Total ($) |

| Charles E. Black | | $ | 330,000 |

| | $ | 157,400 |

| | $ | — |

| | $ | 487,400 |

|

Mark W. Brugger(2) | | $ | 41,139 |

| | $ | 12,199 |

| | — |

| | $ | 53,338 |

|

James L. Francis(2) | | $ | 39,139 |

| | $ | 12,199 |

| | — |

| | $ | 51,338 |

|

| James M. Orphanides | | $ | 179,195 |

| | $ | 39,350 |

| | — |

| | $ | 218,545 |

|

| Louis P. Salvatore | | $ | 186,472 |

| | $ | 39,350 |

| | — |

| | $ | 225,822 |

|

| |

| • | The columns "Option Awards," "Non-Equity Incentive Plan Compensation," and "Change in Pension Value and Nonqualified Deferred Compensation Earnings" were omitted from this table as no such compensation was earned by our independent trustees for the 2013 fiscal year. |

| |

| (1) | On January 29, 2014, we awarded each of our independent trustees equity grants under our 2013 equity incentive plan with respect to their service during fiscal year 2013 on the following terms: (i) (a) Mr. Black's award was for 20,000 common shares, (b) Messrs. Orphanides' and Salvatore's award was for 5,000 common shares and (c) Messrs. Brugger's and Francis' award was for 1,550 common shares; and (ii) each award vested in its entirety, upon issuance. |

| |

| (2) | Appointed as a trustee in September 2013. Beginning with this proxy statement, we will report equity grants in the year granted. |

For the fiscal year 2013, each of our independent trustees (except for our Chairman of the Board) was entitled to receive $100,000 per year and $2,000 per regularly scheduled committee meeting attended, $2,000 per special board meeting attended whether held in person or by telephone conference and an equity grant of 5,000 shares. Messrs. Brugger and Francis were appointed in September 2013 and therefore were compensated for the period in which they served. Our Chairman of the Board was entitled to receive $300,000 per year and an equity grant of 20,000 shares. Our Chairman of the Board received additional compensation for board committee chair positions and participation but did not receive compensation for meeting attendance. The chairperson of the Audit Committee was entitled to an additional annual fee of $20,000 and each member of the Audit Committee was entitled to receive an annual fee of $10,000. The chairperson of the Compensation Committee was entitled to an additional annual fee of $15,000 and each member of the Compensation Committee was entitled to receive an annual fee of $5,000. The chairperson of the Nominating and Corporate Governance Committee was entitled to an additional annual fee of $15,000 and each member of the Nominating and Corporate Governance Committee was entitled to receive an annual fee of $5,000.

All trustees received reimbursement of reasonable out-of-pocket expenses incurred in connection with their service as trustees for the fiscal year ended 2013. If a trustee was also an officer of ours, we did not pay separate compensation for those services rendered as a trustee for the fiscal year ended 2013.

PROPOSAL 2: NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION

We seek your advisory vote on our executive compensation as described in the "Compensation Discussion and Analysis" and the tabular (and accompanying narrative disclosure) beginning on page 20 of this proxy statement to contribute to our commitment to high standards of governance and pursuant to regulations under Section 14A of the Exchange Act. The following proposal, commonly known as a "Say on Pay" proposal, gives shareholders the opportunity to approve, reject or abstain from voting with respect to our fiscal 2013 executive compensation programs and policies and the compensation paid to our named executive officers. Your non-binding advisory vote will serve as an additional tool to guide our Board of Trustees and our Compensation Committee in aligning our executive compensation programs with the interests of our company and our shareholders.

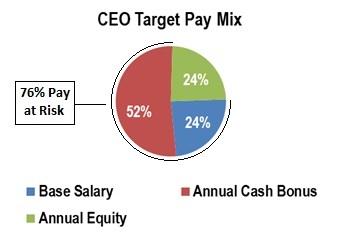

As discussed in the "Compensation Discussion and Analysis" section of this proxy statement and the accompanying tables and related narrative disclosure, the primary objectives of our executive compensation program are to attract and retain qualified and talented individuals who possess the skills and expertise necessary to lead, manage and grow our company, and are accountable for the performance of our company. We also seek to promote an ownership mentality amongst our named executive officers by issuing equity grants to them that not only align their interests with the interests of our shareholders, but also enhance the executives' focus on our long-term performance. The compensation of our named executive officers for 2013 reflects the accomplishments of our management team in attaining certain operational goals and strategic milestones described in "Measuring 2013 Compensation." We believe this strong tie between compensation and performance leads to our success and serves the best interests of our shareholders. Our Compensation Committee regularly reviews all elements of the compensation paid to our named executive officers to align the interests of our named executive officers with our shareholders, and incentivize our executives to focus on the achievement of our long-term business objectives.

Approval of this non-binding advisory "Say on Pay" resolution requires the affirmative vote of the holders of a majority of the votes cast at the shareholder meeting at which a quorum is present.

The vote on this proposal is non-binding and advisory in nature. Because of this, it will not affect any compensation already paid or awarded to any named executive officer, it will not be binding on or overrule any decisions by our Board of Trustees, and it will not restrict or limit the ability of our shareholders to make proposals for inclusion in proxy materials related to executive compensation. Nevertheless, our Board of Trustees values input from our shareholders highly and will carefully consider the results of this vote when making future decisions about executive compensation. In addition, even if a majority of our shareholders approves this proposal, if there is a significant vote against the compensation of our named executive officers, our Compensation Committee will evaluate whether any actions are appropriate to address the concerns of our shareholders. The vote on this resolution is not intended to address any specific element of compensation; rather, the vote relates to the overall compensation of our named executive officers, as described in this proxy statement in accordance with the compensation disclosure rules of the SEC.

Our Board of Trustees unanimously recommends that you vote "FOR" the following non-binding advisory resolution:

"RESOLVED, that the compensation paid to our named executive officers, as disclosed in this proxy statement pursuant to the Securities and Exchange Commission's executive compensation disclosure rules, including the "Compensation Discussion and Analysis," the compensation tables and narrative discussion, is hereby approved."

PROPOSAL 3: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit Committee has selected the accounting firm of Deloitte & Touche LLP to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2014, subject to ratification of this appointment by our shareholders. Action by shareholders is not required by law in the appointment of an independent registered public accounting firm, but its appointment is submitted by our Board of Trustees in order to give the shareholders a voice in the designation of auditors. If the appointment is not ratified by the shareholders, our Board of Trustees will reconsider its choice of Deloitte & Touche LLP as our independent registered public accounting firm. Deloitte & Touche LLP has advised us that neither it nor any member thereof has any financial interest, direct or indirect, in our company or any of our subsidiaries in any capacity. Deloitte & Touche LLP has served as our independent registered public accounting firm since July 1, 2004 and audited our consolidated financial statements for the seven years ended December 31, 2013.

We expect that a representative of Deloitte & Touche LLP will be present at the annual meeting, will be given an opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Fee Disclosure

The following table lists the fees for services rendered by our independent registered public accounting firm for the years ended December 31, 2013 and 2012:

|

| | | | | | | | |

| Services | | 2013 | | 2012 |

| Audit Fees | | | | |

| Recurring Audit, Quarterly Reviews and Accounting Assistance for New Accounting Standards and Potential Transactions | | $ | 1,161,500 |

| | $ | 918,000 |

|

| Comfort Letters, Consents and Assistance with Documents Filed with the SEC and Securities Offerings | | 130,000 |

| | — |

|

| Total Audit Fees | | 1,291,500 |

| | 918,000 |

|

Audit Related Fees(1) | | 85,500 |

| | — |

|

Tax Fees(2) | | 390,500 |

| | 313,000 |

|

| Total | | $ | 1,767,500 |

| | $ | 1,231,000 |

|

__________

| |

| (1) | Audit-related fees consist of a property audit required by a city taxing authority. |

| |

| (2) | Tax services consist of federal and state tax return preparation, and quarterly and annual REIT tax compliance. |

Pre-Approval Policies and Procedures of our Audit Committee

Our Audit Committee must pre-approve, to the extent required by applicable law, all audit services and permissible non-audit services provided by our independent registered public accounting firm, except for any de minimis non-audit services. Non-audit services are considered de minimis if (i) the aggregate amount of all such non-audit services constitutes less than 5% of the total amount of revenues we paid to our independent registered public accounting firm during the fiscal year in which they are provided; (ii) we did not recognize such services at the time of the engagement to be non-audit services; and (iii) such services are promptly brought to our Audit Committee's attention and approved prior to the completion of the audit by our Audit Committee or any of its member(s) who has authority to give such approval. None of the fees reflected above were approved by our Audit Committee pursuant to this de minimis exception. Our Audit Committee may delegate to one or more of its members the authority to grant pre-approvals. All services provided by Deloitte & Touche LLP in 2013 were pre-approved by our Audit Committee.

The proposal to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm requires the affirmative vote of the holders of a majority of the votes cast at the shareholder meeting at which a quorum is present.

Our Board of Trustees unanimously recommends a vote "FOR" the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm.

AUDIT COMMITTEE REPORT

The following is a report by the Audit Committee of the Board of Trustees of Chambers Street Properties regarding the responsibilities and functions of our Audit Committee. This report shall not be deemed to be incorporated by reference in any previous or future documents filed by us with the Securities and Exchange Commission, or SEC, under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that we specifically incorporate this report by reference in any such document.

Our Audit Committee oversees our financial reporting process. Management has the primary responsibility for the preparation, presentation and integrity of our financial statements, accounting and financial reporting principles, internal controls and procedures designed to ensure compliance with accounting standards, applicable laws and regulations. In fulfilling its oversight responsibilities, our Audit Committee reviewed the audited financial statements in the Annual Report on Form 10-K for the year ended December 31, 2013 with management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements.

Our Audit Committee reviewed with the independent registered public accounting firm, who are responsible for auditing our financial statements and for expressing an opinion on the conformity of those audited financial statements with accounting principles generally accepted in the United States, their judgments as to the quality, not just the acceptability, of our accounting principles and such other matters as are required to be discussed with the Audit Committee under Statement on Auditing Standards No. 61, as currently in effect. Our Audit Committee received the written disclosure and the letter from our independent registered public accounting firm required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant's communications with the Audit Committee concerning independence, as currently in effect, discussed with our independent registered public accounting firm the auditors' independence from both management and our company and considered the compatibility of our independent registered public accounting firm's provision of non-audit services to our company with their independence.

Our Audit Committee discussed with our independent registered public accounting firm the overall scope and plans for their audit. Our Audit Committee met with our independent registered public accounting firm, with and without management present, to discuss the results of their examinations, their evaluations of our internal controls and the overall quality of our financial reporting, including unconsolidated sheet investments.

In reliance on the reviews and discussions referred to above, our Audit Committee recommended to our Board of Trustees (and our Board of Trustees has approved) that the audited financial statements be included in the Annual Report on Form 10-K for the year ended December 31, 2013 for filing with the SEC.

The members of our Audit Committee are not professionally engaged in the practice of auditing or accounting. Committee members rely, without independent investigation or verification, on the information provided to them and on the representations made by management and our independent registered public accounting firm. Accordingly, our Audit Committee's oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, our Audit Committee's considerations and discussions referred to above do not assure that the audit of our financial statements has been carried out in accordance with the standards of the Public Company Accounting Oversight Board (United States), that the financial statements are presented in accordance with accounting principles generally accepted in the United States or that Deloitte & Touche LLP is in fact "independent."

Our Board of Trustees has determined that each member of the Audit Committee is financially literate and has accounting or related financial management expertise, as such qualifications are defined under the rules of the NYSE. It also has determined that the Audit Committee has at least one "audit committee financial expert," as defined in Item 407(d)(5) of SEC Regulation S-K, such expert being Mr. Salvatore, and that he is "independent," as that term is used in Item 7(d)(3)(iv) of Schedule 14A under the Exchange Act.

Submitted by our Audit Committee

Louis P. Salvatore (Chairman)

Charles E. Black

Mark W. Brugger

James L. Francis

CORPORATE GOVERNANCE MATTERS

We emphasize the importance of professional business conduct and ethics through our corporate governance initiatives. Our Board of Trustees consists of a majority of independent trustees. You are encouraged to visit our website at http://www.chambersstreet.com under the Investor Relations—Corporate Overview "Governance Documents" section to view or to obtain copies of our committee charters, amended and restated code of business conduct and ethics, our corporate governance guidelines, and our amended and restated whistleblowing and whistleblower protection policy. The information found on, or accessible through, our website is not incorporated into, and does not form a part of, this proxy statement or any other report or document we file with or furnish to the SEC. You may also obtain, free of charge, a copy of our committee charters, amended and restated code of business conduct and ethics, our corporate governance guidelines and our amended and restated whistleblowing and whistleblower protection policy by directing your request in writing to Chambers Street Properties, 47 Hulfish Street, Suite 210, Princeton, New Jersey 08542, Attn: Secretary. Additional information relating to the corporate governance of our company is also included in other sections of this proxy statement.

Amended and Restated Code of Business Conduct and Ethics

Our Board of Trustees has adopted an amended and restated code of business conduct and ethics that applies to our trustees, executive officers and employees. Among other matters, our amended and restated code of business conduct and ethics was designed to deter wrongdoing and to assist our trustees, executive officers and employees in promoting honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; full, fair, accurate, timely and understandable disclosure in our SEC reports and other public communications; compliance with applicable governmental laws, rules and regulations; prompt and anonymous internal reporting of violations of the code to appropriate persons identified in the code; and accountability for adherence to the code.

Any amendment to, or waiver of, this amended and restated code of business conduct and ethics may be made only by our Board of Trustees or one of our board committees specifically authorized for this purpose and we intend to disclose any changes in or waivers from our code of ethics by posting such information on our website or by filing a Form 8-K.

Trustee Independence

Background. Our corporate governance guidelines provide that a majority of our trustees serving on the Board of Trustees must be independent as required by the listing standards of the NYSE and the rules promulgated by the SEC.