PRELIMINARY—SUBJECT TO COMPLETION—DATED OCTOBER 15, 2019

OHA INVESTMENT CORPORATION

1114 Avenue of the Americas, 27th Floor

New York, New York 10036

MERGER PROPOSED—YOUR VOTE IS VERY IMPORTANT

[•], 2019

Dear Stockholder:

You are cordially invited to attend the Special Meeting of Stockholders (the “Special Meeting”) of OHA Investment Corporation (“OHAI”), to be held on [•], 2019 at [•] [p.m.][a.m.], Eastern Time, at the offices of Dechert LLP, located at 1095 Avenue of the Americas, 28th Floor, New York, NY 10036.

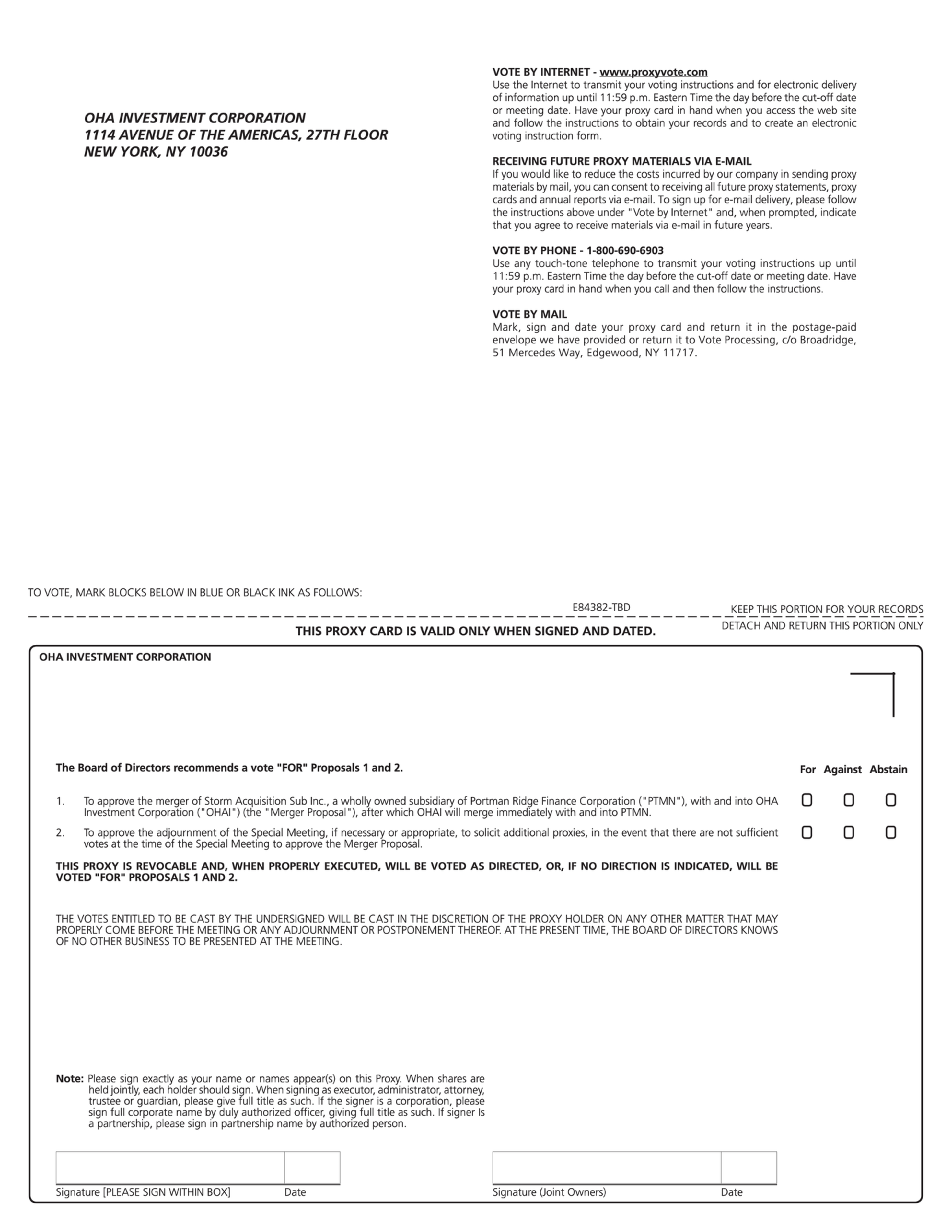

The notice of special meeting and the proxy statement/prospectus accompanying this letter provide an outline of the business to be conducted at the Special Meeting. At the Special Meeting, you will be asked to:

| (i) | approve the merger of Storm Acquisition Sub Inc. (“Acquisition Sub”), a wholly owned subsidiary of Portman Ridge Finance Corporation (“PTMN”), with and into OHAI (such proposal is referred to herein as the “Merger Proposal”), after which OHAI will merge immediately with and into PTMN; and |

| (ii) | approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies, in the event that there are not sufficient votes at the time of the Special Meeting to approve the Merger Proposal (such proposal is referred to herein as the “Adjournment Proposal”). |

OHAI and PTMN are proposing a combination of both companies by a merger and related transactions pursuant to the Agreement and Plan of Merger dated as of July 31, 2019 (as may be amended from time to time, the “Merger Agreement”) by and among OHAI, PTMN, Acquisition Sub and Sierra Crest Investment Management LLC (“Sierra Crest”) in which Acquisition Sub would merge with and into OHAI with OHAI surviving as a wholly-owned subsidiary of PTMN (the “First Merger”). Immediately following the First Merger, OHAI, as the surviving company, would merge with and into PTMN with PTMN continuing as the surviving company (the “Second Merger”, and together with the First Merger, the “Merger”).

Subject to the terms and conditions of the Merger Agreement, at the effective time of the First Merger (the “Effective Time”), each share of common stock, par value $0.001 per share, of OHAI (“OHAI Common Stock”) issued and outstanding immediately prior to the Effective Time (other than shares held by subsidiaries of OHAI or held, directly or indirectly, by PTMN or Acquisition Sub (“Canceled Shares”)) will be converted into the right to receive (i) an amount in cash equal to (A) $8,000,000 (the “Aggregate Cash Consideration”) divided by (B) the number of shares of OHAI Common Stock issued and outstanding as of the Determination Date (as defined below) (excluding any Canceled Shares) (such amount in cash, the “Cash Consideration”), and (ii) a number of shares of common stock, par value $0.01 per share, of PTMN (“PTMN Common Stock”) equal to the Exchange Ratio (as defined below) (the “Share Consideration” and, together with the Cash Consideration, the “Merger Consideration”). Furthermore, as additional consideration to the holders of shares of OHAI Common Stock that are issued and outstanding immediately prior to the Effective Time (excluding any Canceled Shares), Sierra Crest will cause to be paid directly to such holders an aggregate amount in cash equal to $3,000,000 (the “Additional Cash Consideration”).

Under the Merger Agreement, on the day prior to the closing date of the merger, each of OHAI and PTMN will deliver to the other a calculation as of three days prior to the closing of the Merger (such date, the “Determination Date”) of its net asset value as of 5:00 p.m. Eastern Time (such calculation with respect to OHAI, the “Closing OHAI Net Asset Value” and such calculation with respect to PTMN, the “Closing PTMN Net Asset Value”), in each case using a pre-agreed set of assumptions, methodologies and adjustments. Based on such calculations, the parties will calculate the “OHAI Per Share NAV”, which will be equal to (i) (A) the Closing OHAI Net Asset Value minus (B) the Aggregate Cash Consideration divided by (ii) the number of shares of OHAI Common Stock issued and outstanding as of the Determination Date (excluding any Canceled Shares), and the “PTMN Per Share NAV”, which will be equal to (I) the Closing PTMN Net Asset Value divided by (II) the number of shares of PTMN Common Stock issued and outstanding as of the Determination Date. For purposes of the Merger Agreement, the “Exchange Ratio” will be equal to (i) the OHAI Per Share NAV divided by (ii) the PTMN Per Share NAV.

If the aggregate number of shares of PTMN Common Stock to be issued in connection with the First Merger would exceed 19.9% of the number of issued and outstanding shares of PTMN Common Stock immediately prior to the Effective Time (the “Maximum Share Number”), the Aggregate Cash Consideration for all purposes of the Merger Agreement will be increased to the minimum extent necessary such that the aggregate number of shares of PTMN Common Stock to be issued in connection with the First Merger does not exceed the Maximum Share Number.

The market value of the Merger Consideration will fluctuate with changes in the market price of OHAI Common Stock and PTMN Common Stock. We urge you to obtain current market quotations of OHAI Common Stock and PTMN Common Stock. OHAI Common Stock and PTMN Common Stock trade on The Nasdaq Global Select Market (the “Nasdaq”) under the ticker symbol “OHAI” and “PTMN,” respectively. The following table shows the closing sale prices of OHAI Common Stock and PTMN Common Stock, as reported on the Nasdaq on July 30, 2019, the last trading day before the execution of the Merger Agreement, and on [•], 2019, the last full trading day before printing this document.

| OHAI

Common Stock | PTMN

Common Stock |

Closing Sales Price at July 30, 2019 | $ | 1.0833 | | $ | 2.345 | |

Closing Sales Price at [•], 2019 | $ | [•] | | $ | [•] | |

Your vote is extremely important. At the Special Meeting, you will be asked to vote on the Merger Proposal. The approval of the Merger Proposal requires the affirmative vote by the holders of at least a majority of the outstanding shares of OHAI Common Stock entitled to vote at the Special Meeting. You also may be asked to vote on a proposal to approve the Adjournment Proposal, if necessary or appropriate, to solicit additional proxies, in the event that there are not sufficient votes at the time of the Special Meeting to approve the Merger Proposal. The approval of the Adjournment Proposal requires the affirmative vote of the holders of at least a majority of votes cast by holders of shares of OHAI Common Stock present at the Special meeting, in person or represented by proxy.

Abstentions and broker non-votes (which occur when a beneficial owner does not instruct its broker, bank or other institution or nominee holding its shares of OHAI Common Stock on its behalf) will not count as affirmative votes cast and will therefore have the same effect as votes against each of the Merger Proposal.

After careful consideration, on the recommendation of a special committee (“Special Committee”) of the board of directors of OHAI (the “OHAI Board”), the OHAI Board (other than directors affiliated with Oak Hill Advisors, L.P., the external investment adviser to OHAI, who abstained from voting) has unanimously approved the Merger and the Merger Agreement and unanimously recommends that OHAI Stockholders vote “FOR” the Merger Proposal and “FOR” for the Adjournment Proposal, if necessary or appropriate, to solicit additional proxies, in the event that there are not sufficient votes at the time of the Special Meeting to approve the Merger Proposal.

It is very important that your shares be represented at the Special Meeting. Even if you plan to attend the meeting in person, we urge you to complete, date and sign the enclosed proxy card and promptly return it in the envelope provided. If you prefer, you can save time by voting through the Internet or by telephone as described in this proxy statement/prospectus and on the enclosed proxy card. We encourage you to vote via the Internet, if possible, as it saves us significant time and processing costs. Your vote and participation in the governance of OHAI are very important to us.

This proxy statement/prospectus describes the Special Meeting, the Merger, and the documents related to the Merger (including the Merger Agreement) that OHAI Stockholders should know before voting on the Merger Proposal and should be retained for future reference. Please carefully read this entire document, including “Risk Factors” beginning on page 15, for a discussion of the risks relating to the Merger. OHAI files annual, quarterly and current reports, proxy statements and other information about itself with the SEC. OHAI maintains a website at www.ohainvestmentcorporation.com and makes all of its annual, quarterly and current reports, proxy statements and other publicly filed information available on or through its website. You may also obtain such information, free of charge, and make shareholder inquiries by contacting OHAI at 1114 Avenue of the Americas, 27th floor, New York, New York 10036, Attention: Investor Relations, or by calling collect at (212) 852-1900. The SEC also maintains a website at http://www.sec.gov that contains such information.

| Sincerely yours, |

| |

| Steven T. Wayne

President and Chief Executive Officer |

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of the shares of PTMN Common Stock to be issued under this proxy statement/prospectus or determined if this proxy statement/prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus is dated [•], 2019 and it is first being mailed or otherwise delivered to OHAI Stockholders on or about [•], 2019.