1

The 6th Annual

Southwestern Showcase Conference

November 20, 2008

1

1

Forward Looking Statements

This presentation may contain forward-looking statements. These forward-looking statements are

subject to various risks and uncertainties, which could cause actual results and conditions to differ

materially from those projected, including the uncertainties associated with the timing of transaction

closings, changes in interest rates, availability of transactions, the future operating results of our

portfolio companies, changes in regional, national, or international economic conditions and their

impact on the industries in which we invest, or changes in the conditions of the industries in which we

invest, and other factors enumerated in our filings with the Securities and Exchange Commission.

Words such as “anticipates,” “believes,” “expects,” “intends,” “will,” “should,” “may” and similar

expressions may be used to identify forward-looking statements. Undue reliance should not be placed

on such forward-looking statements as such statements speak only as of the date on which they are

made. We do not undertake to update our forward-looking statements unless required by law.

Persons considering an investment in NGP Capital Resources Company should consider the investment

objectives, risks, and charges and expenses of the company carefully before investing. Such

information and other information about the company is available in our annual report on Form 10-K,

our quarterly reports on Form 10-Q and in prospectuses we issue from time to time in connection with

our offering of securities. Such materials are filed with the SEC and copies are available on the SEC's

website, www.sec.gov. Prospective investors should read such materials carefully before investing.

Past performance is not indicative of future results.

2

2

The NGPC Story

NGPC Business Rationale

The energy industry requires constant investment to maintain

and grow capacity

Our Company

A specialty finance company providing capital to small and mid-sized

energy companies

The Opportunity

Participation in a growing portfolio of attractive, energy investments

that meet our rigorous criteria and generate superior risk adjusted

returns

3

3

Agenda

NGPC overview

Business philosophy

Performance highlights

Profitability drivers

4

4

NGPC at a Glance

Equity market cap ~$315 million1

Number of portfolio companies: 181

Total Return Orientation

current yield plus

capital gains

Since 2004 IPO

investments of $604 million1; realizations and repayments of

$303 million1; current portfolio of $301 million1

Based in Houston

8 investment professionals1

Note 1: As of 09-30-08

5

5

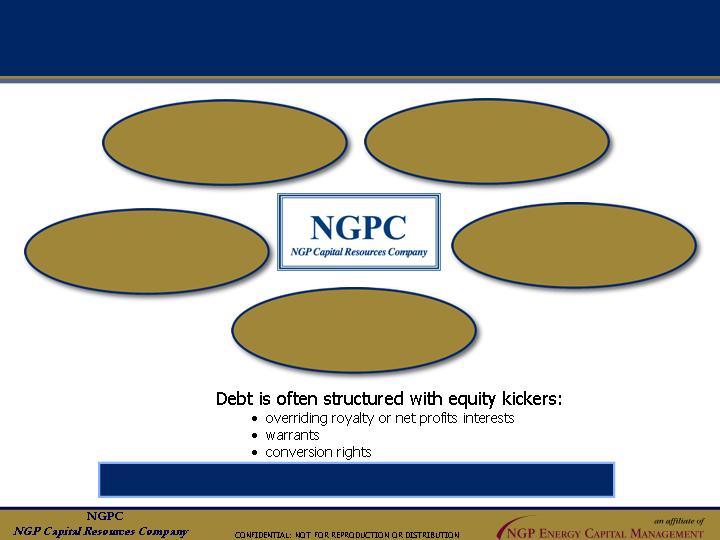

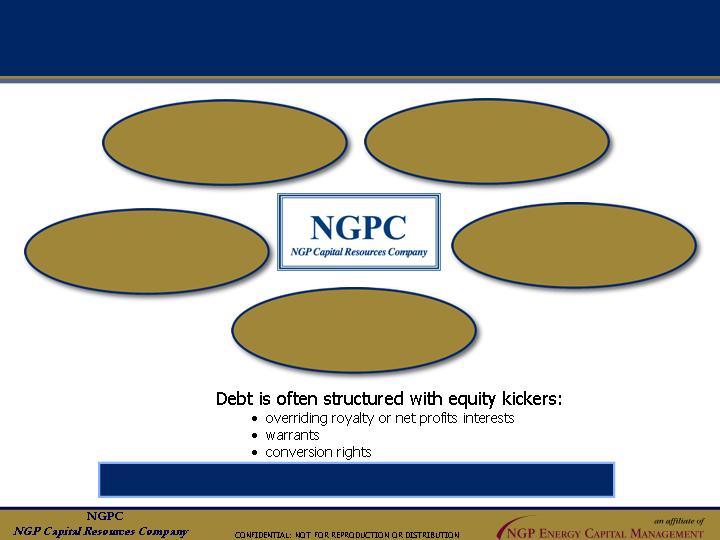

A Range of Financing Products

Combined senior &

subordinated debt

Subordinated debt

Preferred equity

Portfolio Total Return Target: 15%-25%

Convertible debt

Project equity

6

6

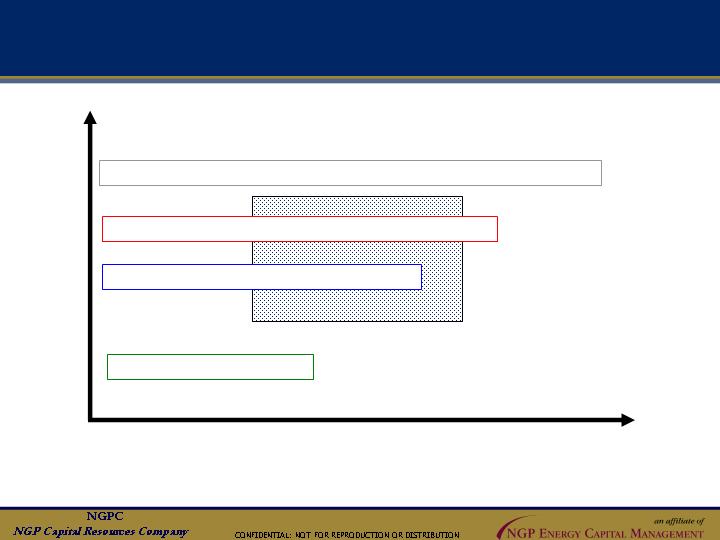

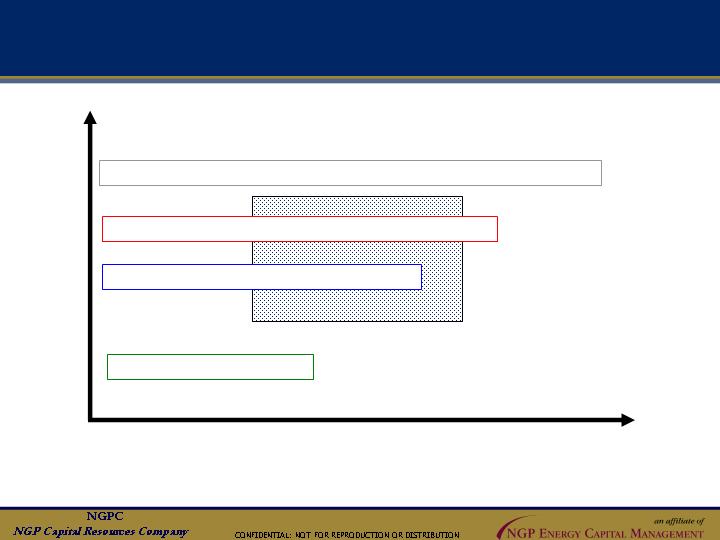

Positioned in the Mezzanine Investment Space

IRR

Equity

Cash Flow Producing Risk Developing Risk Finding/Buying Risk

30% +

20%

15%

10%

5%

Sr. Sub Loans

Senior Loans

Mezzanine

NGP Capital Resources

7

7

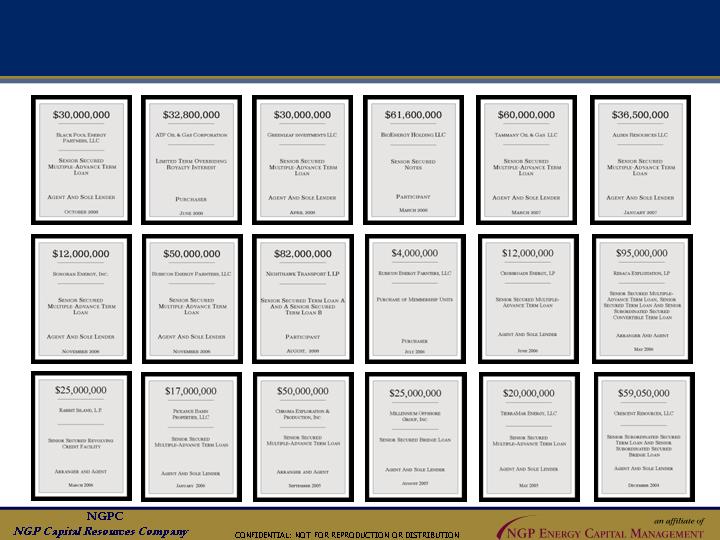

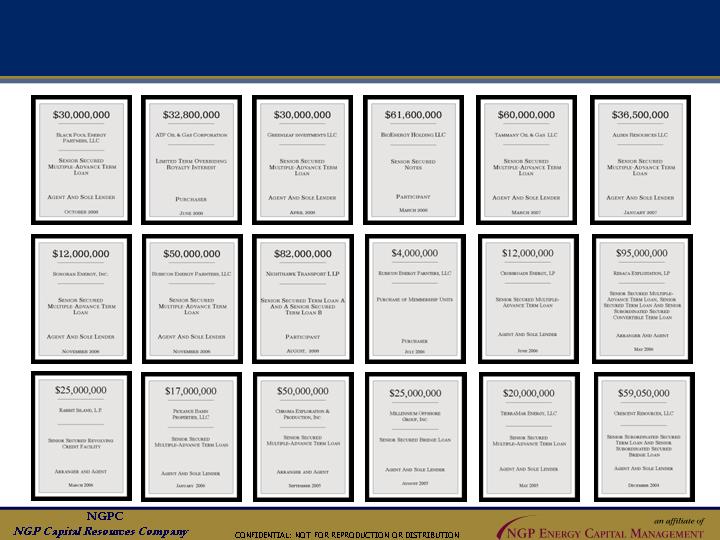

NGPC is an Active Participant

8

8

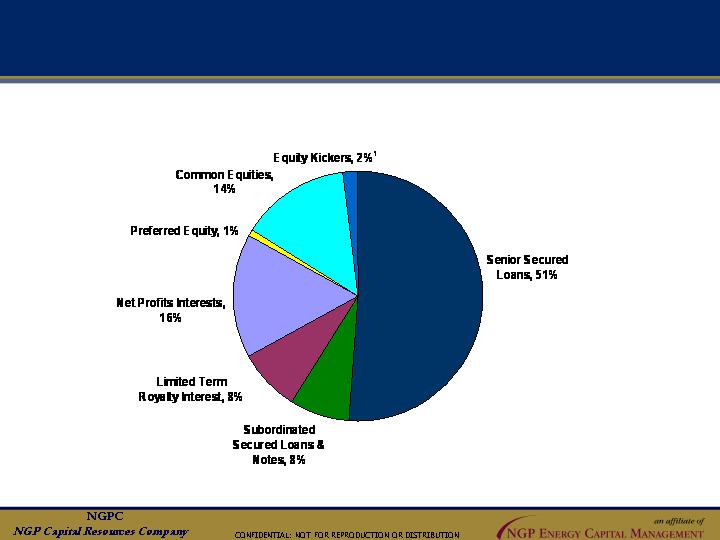

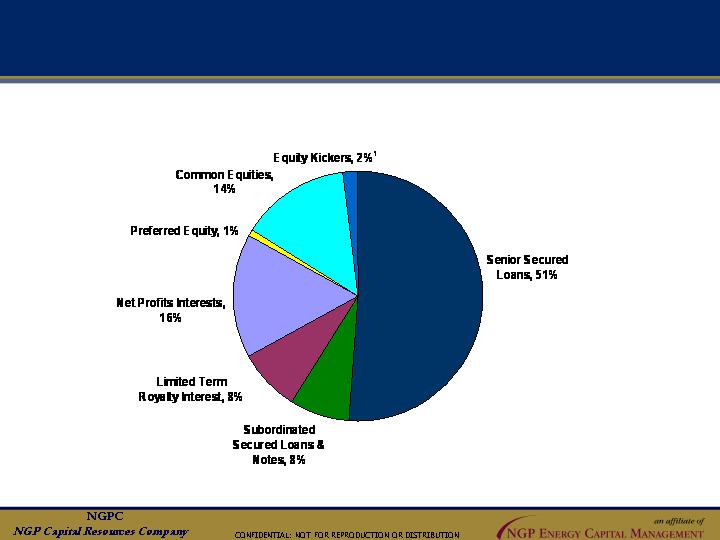

Composition of Investment Portfolio

As of September 30, 2008

Note 1: Overriding royalty interests, warrants, puts and similar assets

9

9

NGPC is a Business Development Company

Result: Compelling yield and tax attributes

No corporate Federal Income Tax

Distributes at least 90% of taxable income

1099 reporting

No unrelated business taxable income

Tax rules impose various asset diversification requirements

10

10

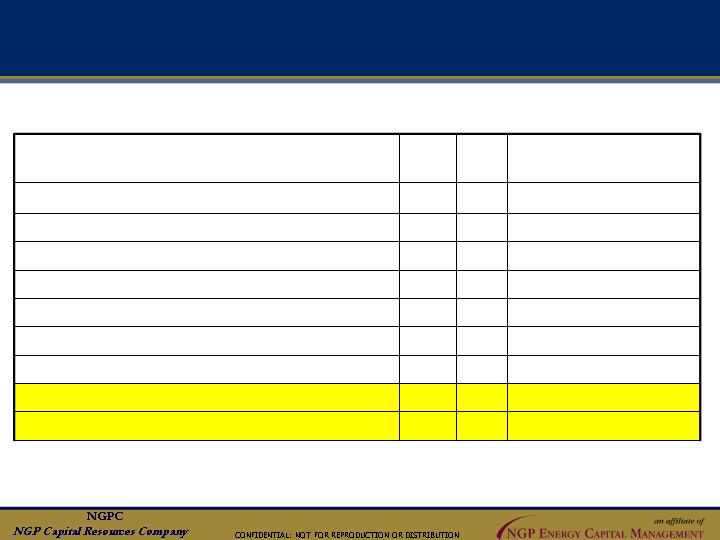

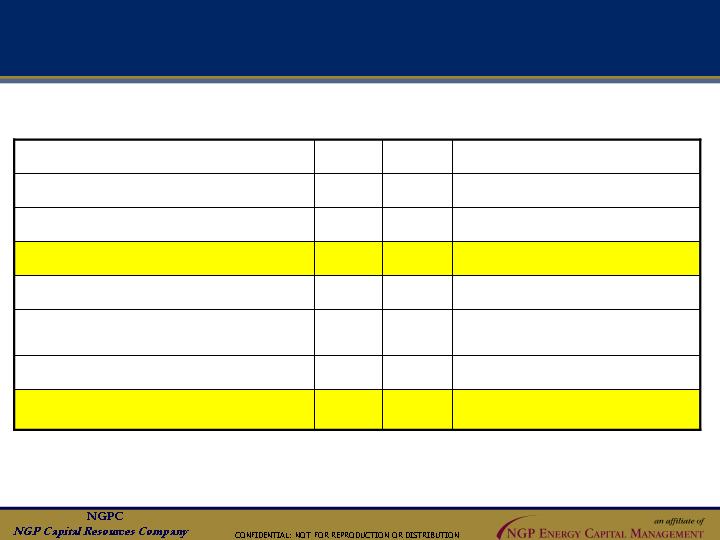

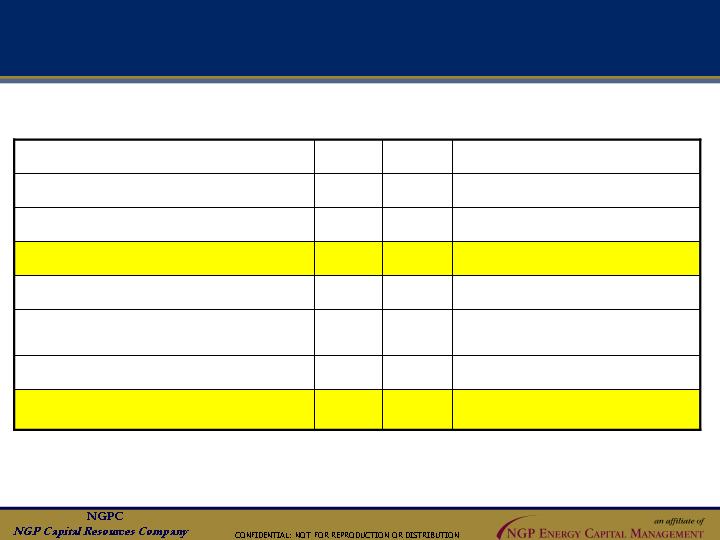

NGPC is Uniquely Positioned as a Mezzanine Provider

Company

Structure

Public

Private

Wide range of players

Mezzanine providers are

generally divisions of larger

companies/private funds

General

Energy

Capital Providers

25 Business Development

Companies of size

11

11

Ken Hersh (NGPECM)

Billy Quinn (NGPECM)

Dick Covington (NGPECM)

John Homier

NGPC is an Externally Managed BDC

Board of Directors

Ken Hersh (NGPECM)

Jim Latimer (Ind.)

David Albin (NGPECM)

Edward Blessing (Ind.)

Lon Kile (Ind.)

John Homier

President/CEO

Steve Gardner

CFO/Treasurer

Kelly Plato

Sr. VP & Managing Director

Executive Officers

NGP Investment

Advisor, LP

Investment

Advisory

Agreement

John Homier

Steve Gardner

Kelly Plato

&

14 Employees

Investment Committee

Executive Officers & Employees

12

12

Agenda

NGPC overview

Business philosophy

Performance highlights

Profitability drivers

13

13

Our Business Philosophy

2. Disciplined

investment

approach

3. Attractive

vehicle for

investors

4. Solid

results

1. Clear

industry

focus

14

14

1. Focus

A Clear Industry Focus

Small and mid-size companies in energy and related businesses

Private companies

Need capital for growth

Investments range from $5 to $100 million

Target investment size is $25 to $45 million

15

15

Est. 2008 is 43%

46%

27%

Percent Production from Unconventional Resources (Bcfpd)

Est. 2008 is 24.7 Bcfpd

24.3

13.8

Production from Unconventional Resources (Bcfpd)

Est. 2008 is 1.0 Bcfpd

2.1

0.1

Total U.S. LNG Imports (Bcfpd)

Est. 2008 is 8.1 Bcfpd

10.4

7.8

Total Net U.S. Natural Gas Imports (Bcfpd)

Est. 2008 is 56.7 Bcfpd

52.8

51.8

Total U.S. Natural Gas Production (Bcfpd)

Est. 2008 is 66.2 Bcfpd

63.2

62.3

Total U.S. Natural Gas Consumption (Bcfpd)

Est. 2008 Is 11.7 MMBopd

12.3

8.9

Total Net U.S. Crude Oil & Products Imports (MMBopd)

Est. 2008 is 7.2 MMBopd

7.3

8.6

Total U.S. Crude Oil & Products Production (MMBopd)

Est. 2008 is 19.7 MMBopd

20.7

18.6

Total U.S. Crude Oil & Products Consumption (MMBopd)

Comments

2007

1997

1. Focus

Energy Industry Dynamics

16

16

~400

~650

Average Reserve Adds per Well Drilled in

U.S.(MBoe)

Estimated 2008 is 1,873

1,763

941

Total U. S. Drilling Rig Count

$1,673 was the cost per well drilled

in 2004 (last data available)

$1,673

$604

Average Cost per Well in U. S. ($M)

Estimated 2008 is ~53,000 wells

48,501

27,586

Total U. S. Wells Drilled

$80,481

$25,078

E&P Capital Spent in U. S. ($MM)

FYE 08E $8.93, 4Q 08E $6.59

$ 7.12

$ 2.48

Average Henry Hub Natural Gas Price ($/Mcf)

FYE 08E $100.92, 4Q 08E $64.83

$72.34

$20.61

Average WTI Crude Oil Price ($/Bbl)

Comments

2007

1997

1. Focus

Energy Industry Dynamics

17

17

2. Disciplined Investment Approach

Conservative Underwriting and Investment Philosophy

We look at 30 deals to do 1

Rigorous Screening Process

30

1

Strong management

Engineering oriented

Collateral security

Appropriate return for the risk assumed

Exit strategy

Emphasis on total return with current yield

18

18

Producer with existing assets desired to purchase an asset package

having significant redevelopment potential (PDNP, PUD, operational

improvements)

Purchase price was approximately $120 million

Senior debt capacity was approximately $60 million

Solution: NGPC provided a $50 million subordinated debt facility and a

$10 million bridge loan

Conclusion: Our client completed the acquisition, successfully

developed its assets and ultimately refinanced our debt with

conventional senior debt

Subordinated Debt Solution

19

19

Producer desired to purchase producing properties with significant

development potential

The Company needed to approximately $105 million of capital to fund

the acquisition and to fund capital expenditures for development of

the properties

Senior debt capacity was approximately $25 million

Solution: In addition to $15 million of equity, NGPC arranged capital

for the acquisition and development through the issuance of three

securities: (i) $70 million Term Loan A, (ii) $15 million Term Loan B

and (iii) $10 million Convertible Sub-Debt

Conclusion: NGPC’s financing enabled our client to complete the

acquisition and begin development of the properties. In 3Q08, the

Company successfully completed an IPO on the London Stock

Exchange’s Alternative Investment Market and retired our investments

Combined Senior and Sub Debt Solution

20

20

Engineering and management team needed $30 million to acquire and

develop several producing oil and gas fields

The team needed additional equity to complete the transaction and

wanted a one-stop financing source

Senior debt capacity was approximately $17 million

Solution: In 3Q06, NGPC provided a $22 million combined senior and

subordinated facility and made a $4 million common equity investment in

the new company

Conclusion: Our client completed the acquisition, made follow-on

acquisitions, successfully developed its assets and ultimately refinanced

our debt facility with conventional senior debt. In 3Q08, the Company

sold its assets and distributed the proceeds to its members, resulting in a

4.5x return on equity

Integrated Balance Sheet Solution

21

21

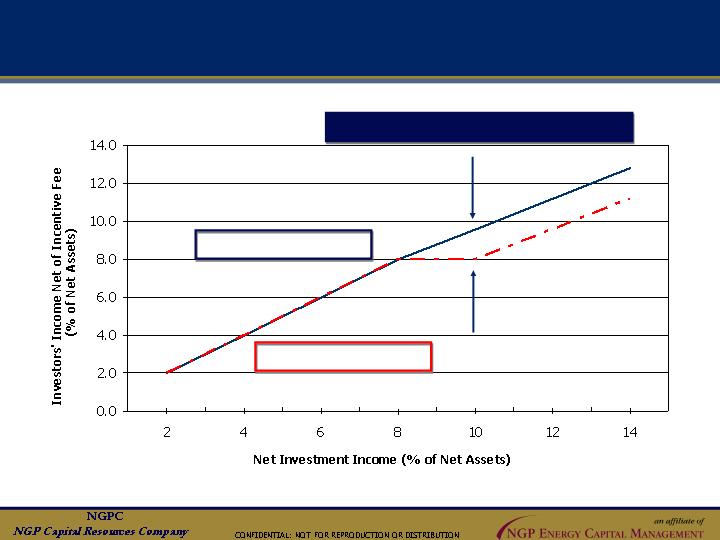

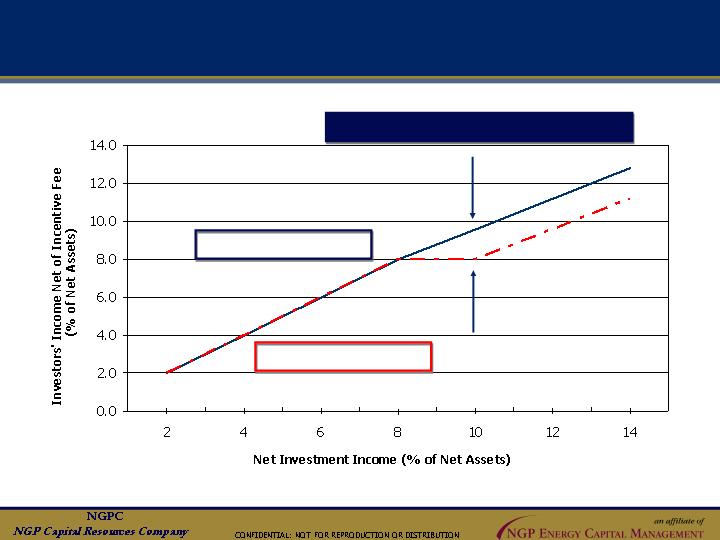

3. Attractive Vehicle

Many Advantages for Investors

Energy-specific focus

Attractive fee structure

20% over 8% hurdle and no catch-up provision

20% of realized capital gains net of realized and unrealized

capital losses

Liquid Investment

Total return investment with meaningful current yield

Efficient tax structure

regulated investment company no corporate federal

income tax

22

22

Without Catch-Up

With Catch-Up

1.6% Improvement in Total Yield w/o Catch-Up

3. Attractive Vehicle – A Closer Look

No “Catch Up” Provision Increases Yield

23

23

3. Attractive Vehicle – A Closer Look

Strong Management Team

Strong brand name, expertise and deal flow

An affiliate of NGP Energy Capital Management

Eight investment professionals

Energy, engineering, and financial experience and expertise

for this specialized investment focus

24

24

Agenda

NGPC overview

Business philosophy

Performance highlights

Profitability drivers

25

25

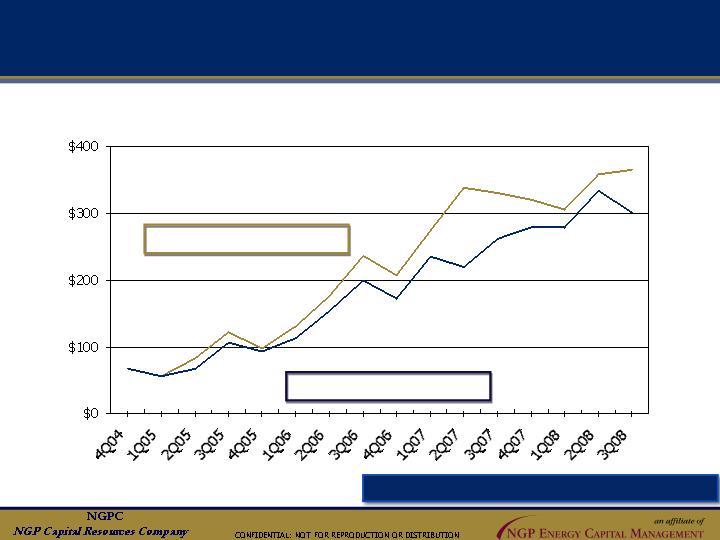

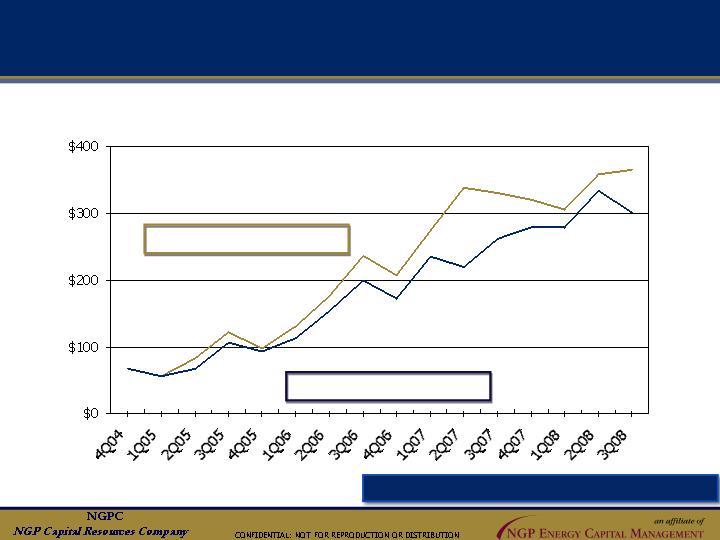

Strong Portfolio of Targeted Investments…

$M

Committed & Available

Outstanding

Excellent Credit Quality

26

26

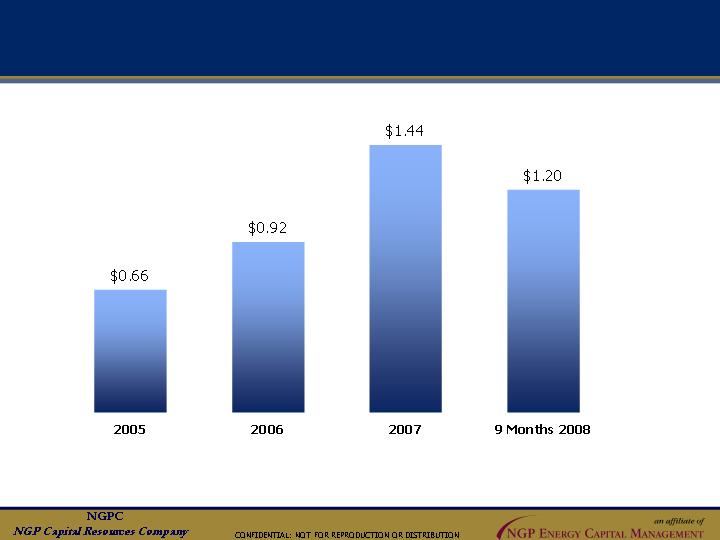

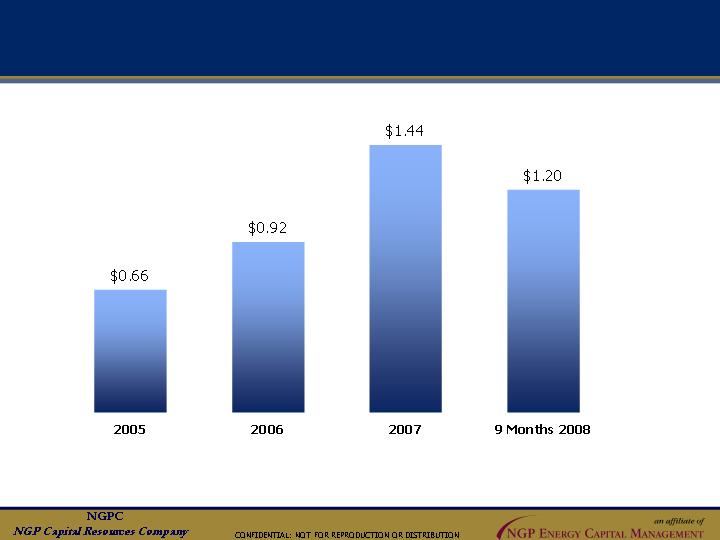

… Driving Profitability

Net income per share

Net Investment Income

Realized Capital Gain

Unrealized Capital Gain

Unrealized Capital Loss

Full Year 2005

Full Year 2007

Full Year 2006

Realized Capital Loss

9 Months 2008

27

27

… and Dividends

28

28

Agenda

NGPC overview

Business philosophy

Performance highlights

Profitability drivers

29

29

Robust need for capital

Strong deal pipeline

Portfolio momentum and realizations

Profitability Drivers

1

3

Realignment of mezzanine marketplace

2

4

4

5

Portfolio growth and diversification

30

30

NGPC – The Next Steps

$500 to $750 million portfolio

Originate $100 to $200 million per year

Continue investment discipline and diversification for

best risk adjusted returns

Continue focus on total return

Continue long term growth of earnings and dividends

31

31

Why Invest in NGPC

Uniquely positioned BDC in attractive energy market segment

continual financing needs, large market

Successful business model

clear focus, unique capabilities, disciplined approach,

proven results

Momentum building as company completes

fourth year of operations

well positioned, strong pipeline, maturing investments, portfolio

growth

32

32

33

www.ngpcrc.com

713-752-0062

John Homier Steve Gardner Kelly Plato

Dan Schockling Hans Hubbard Chris Ryals Robert Sheffey

33

33