Exhibit 99.1

NGP Capital Resources Company (NASDAQ: NGPC) Investor Presentation – June 2013 NGPC P ROVIDING G ROWTH C APITAL FOR D IVERSE I NDUSTRIES

Forward Looking Statements NGPC NGP Capital Resources Company Page 2 This presentation may contain forward - looking statements . These forward - looking statements are subject to various risks and uncertainties, which could cause actual results and conditions to differ materially from those projected, including the uncertainties associated with the timing of transaction closings, changes in interest rates, availability of transactions, the future operating results of our portfolio companies, changes in regional, national, or international economic conditions and their impact on the industries in which we invest, or changes in the conditions of the industries in which we invest, and other factors enumerated in our filings with the Securities and Exchange Commission . Words such as “anticipates,” “believes,” “expects,” “intends,” “will,” “should,” “may” and similar expressions may be used to identify forward - looking statements . Undue reliance should not be placed on such forward - looking statements as such statements speak only as of the date on which they are made . We assume no obligation to update our forward - looking statements or any other information in this presentation . Persons considering an investment in NGP Capital Resources Company should consider the investment objectives, risks, and charges and expenses of the company carefully before investing . Such information and other information about the company is available in our annual report on Form 10 - K, our quarterly reports on Form 10 - Q and in prospectuses we issue from time to time in connection with our offering of securities . Such materials are filed with the SEC and copies are available on the SEC's website, www . sec . gov . Prospective investors should read such materials carefully before investing . Past performance is not indicative of future results .

Agenda NGPC NGP Capital Resources Company Page 3 Company Overview Investment Criteria Financial Update Partnering with NGPC

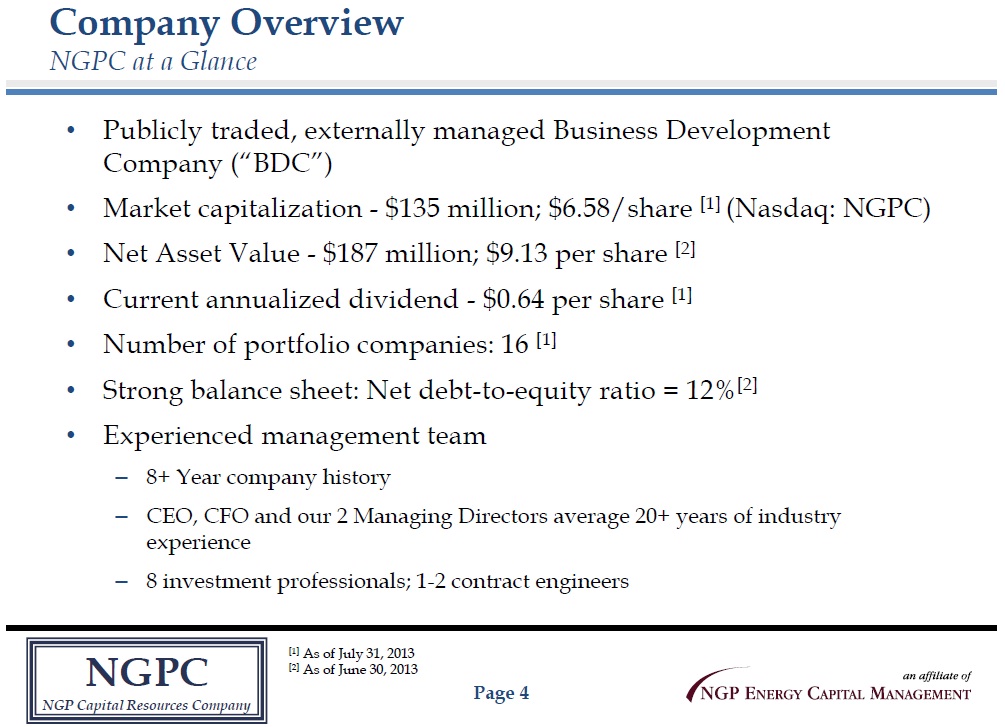

NGPC NGP Capital Resources Company Page 4 • Publicly traded, externally managed Business Development Company (“BDC”) • Market capitalization - $135 million; $6.58/share [1] ( Nasdaq : NGPC) • Net Asset Value - $187 million; $9.13 per share [2] • Current annualized dividend - $0.64 per share [1] • Number of portfolio companies: 16 [1] • Strong balance sheet: Net debt - to - equity ratio = 12% [2] • Experienced management team – 8+ Year company history – CEO , CFO and our 2 Managing Directors average 20+ years of industry experience – 8 investment professionals ; 1 - 2 contract engineers [1] As of July 31, 2013 [2] As of June 30, 2013 Company Overview NGPC at a Glance

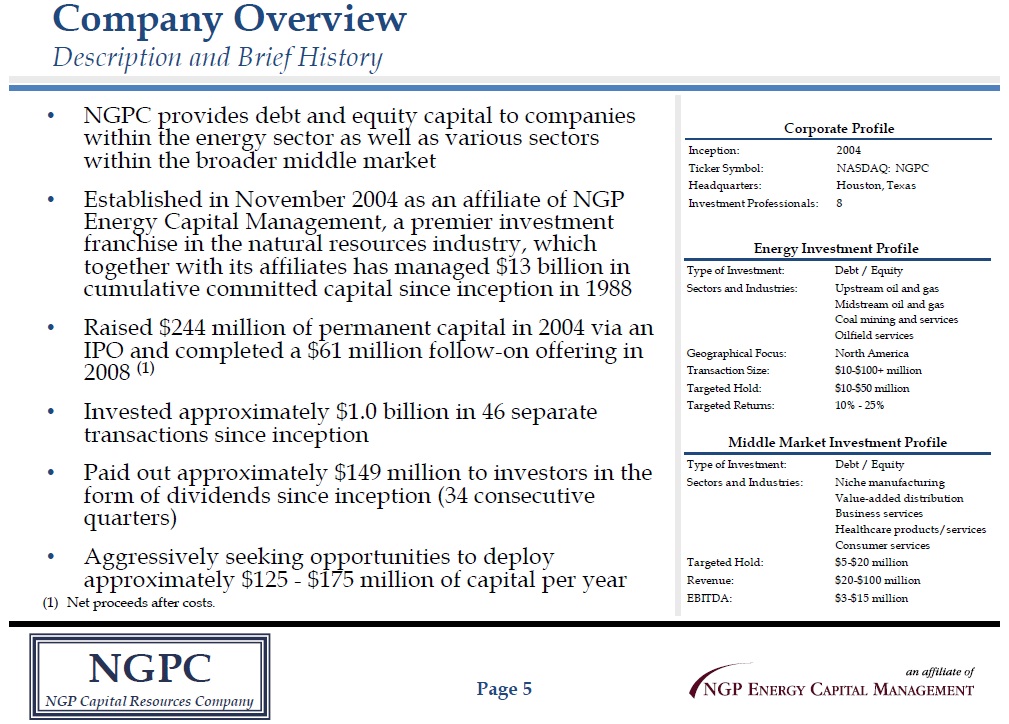

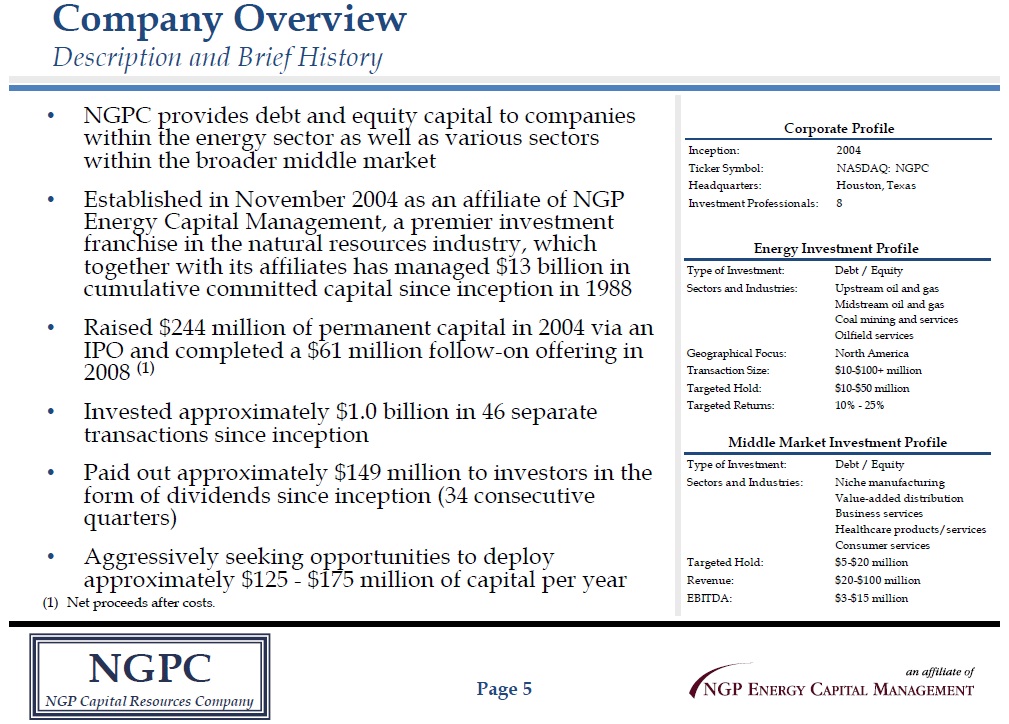

Company Overview NGPC NGP Capital Resources Company Page 5 Description and Brief History • NGPC provides debt and equity capital to companies within the energy sector as well as various sectors within the broader middle market • Established in November 2004 as an affiliate of NGP Energy Capital Management, a premier investment franchise in the natural resources industry, which together with its affiliates has managed $13 billion in cumulative committed capital since inception in 1988 • Raised $244 million of permanent capital in 2004 via an IPO and completed a $61 million follow - on offering in 2008 (1) • Invested approximately $1.0 billion in 46 separate transactions since inception • Paid out approximately $149 million to investors in the form of dividends since inception (34 consecutive quarters) • Aggressively seeking opportunities to deploy approximately $125 - $175 million of capital per year (1) Net proceeds after costs . Middle Market Investment Profile Type of Investment: Debt / Equity Sectors and Industries: Niche manufacturing Value-added distribution Business services Healthcare products/services Consumer services Targeted Hold: $5-$20 million Revenue: $20-$100 million EBITDA: $3-$15 million Energy Investment Profile Type of Investment: Debt / Equity Sectors and Industries: Upstream oil and gas Midstream oil and gas Coal mining and services Oilfield services Geographical Focus: North America Transaction Size: $10 - $100+ million Targeted Hold: $10 - $50 million Targeted Returns: 10% - 25% Corporate Profile Inception: 2004 Ticker Symbol: NASDAQ: NGPC Headquarters: Houston, Texas Investment Professionals: 8

Company Overview NGPC NGP Capital Resources Company Page 6 Why Invest in a BDC? • Business Development Companies (“BDC’s”) were created by Congress in 1980 as lenders to small and mid - sized private companies • Access to private equity / mezzanine markets with liquidity through a publicly traded vehicle • High dividend income - As a Regulated Investment Company (“RIC”), BDC’s distribute substantially all earnings as dividends and pay no federal income taxes • Regulated under the Investment Company Act of 1940 – Asset diversification tests – Limited to 1:1 debt - to - equity leverage • Full transparency – Schedule of investments – Fair value accounting – SEC disclosure requirements • BDC’s, generally, withstood the financial crisis better than other financial service companies • Currently 42 publicly traded BDC’s with aggregate market capital of approximately $28.0 billion

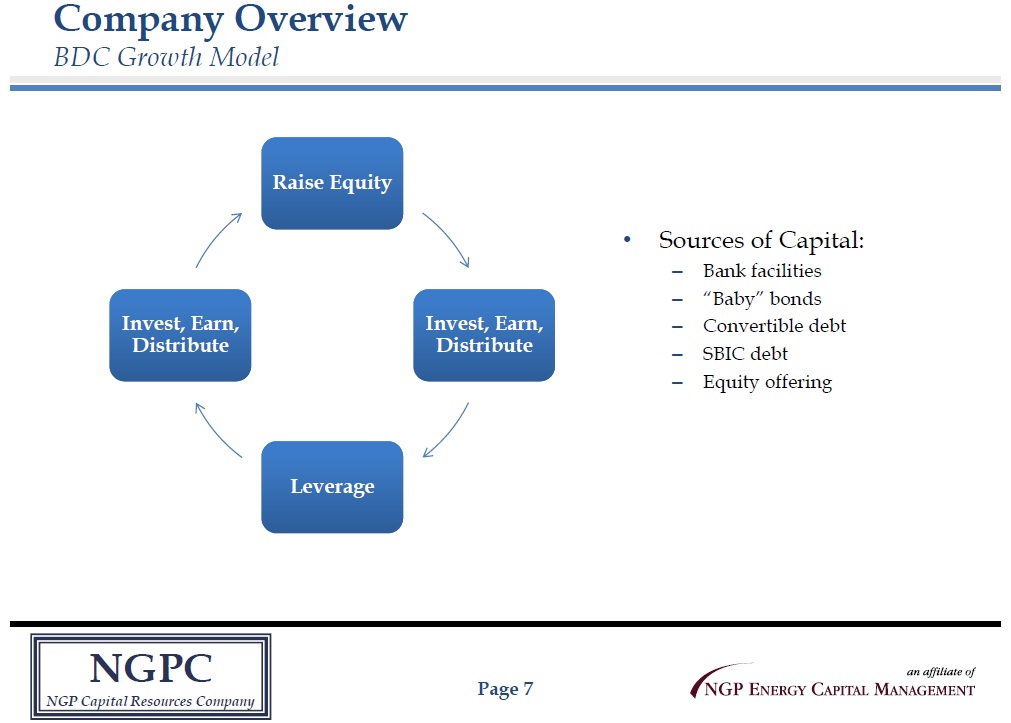

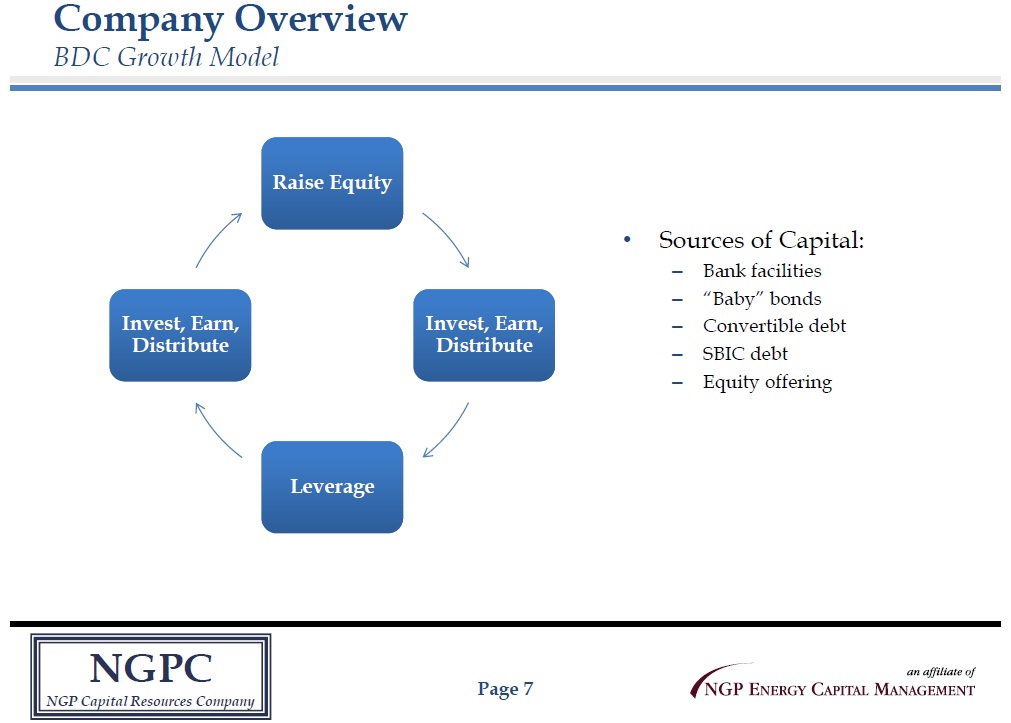

Company Overview NGPC NGP Capital Resources Company Page 7 BDC Growth Model • Sources of Capital: – Bank facilities – “Baby” bonds – Convertible debt – SBIC debt – Equity offering Raise Equity Invest, Earn, Distribute Leverage Invest, Earn, Distribute

Company Overview NGPC NGP Capital Resources Company Page 8 Why Invest in NGPC? • Only BDC with energy industry focus (75% of the portfolio) • 8+ year track record of energy investing • Affiliation with NGP Energy Capital Management • Recent addition of middle market non - energy investments increases asset and sector diversification and enhances portfolio yield • 34 consecutive quarterly dividend payments (since inception) • Stock Repurchase Plan – NGPC has repurchased 1.1 million shares (5.2% of shares outstanding) since May 2012 • Diversified $210 million investment portfolio, trading at a >25% discount to NAV with an attractive dividend yield

NGPC NGP Capital Resources Company Page 9 Peer Group / Other BDC Comps Company Market Cap ($MM’s) Price / NAV (a) Current Dividend Yield NGP Capital (NGPC) $136 73% 9.6% Gladstone Capital (GLAD) $179 99% 9.8% Gladstone Investment (GAIN) $192 83% 8.3% Hercules (HTGC) $895 144% 7.4% KCAP Financial (KCAP) $348 126% 10.7% MCG Capital (MCGC) $385 104% 9.3% THL Credit (TCRD) $528 116% 8.7% TICC Capital (TICC) $529 100% 11.5% Ares (ARCC) $4,857 113% 8.4% Prospect (PSEC) $2,664 102% 12.1% Apollo (AINV) $1,841 100% 9.8% Main Street (MAIN) $1,076 167% 6.0% Triangle Capital (TCAP) $810 192% 7.3% Pennant Park (PNNT) $774 111% 9.6% (a) 8/2/13 price; most recently available NAV. Source: Keefe, Bruyette & Woods weekly BDC report. Company Overview

Company Overview NGPC NGP Capital Resources Company Page 10 Portfolio Growth and Turnover • Rebuilding portfolio in wake of 2008 financial crisis • Entered middle market in 2012 (closed first middle - market deals in 2013 ) to diversify the portfolio — natural complement to NGPC’s energy - based portfolio • Strategy to continue to grow the portfolio with quality investments and reasonable returns (1) Through 6/30/13. $49.8 $64.2 $106.6 $125.2 $82.8 $79.3 $42.4 $151.5 $66.6 $76.8 $200.1 $216.1 $145.1 $213.6 $209.3 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 2009 2010 2011 2012 2013(1) Capital Invested Repayments Portfolio Balance

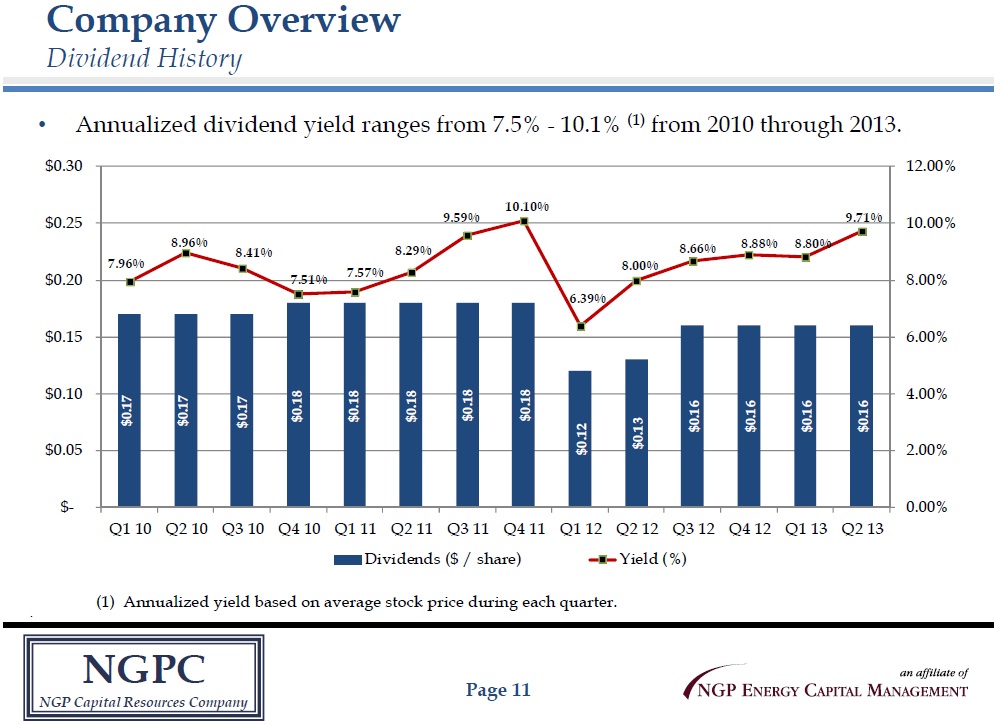

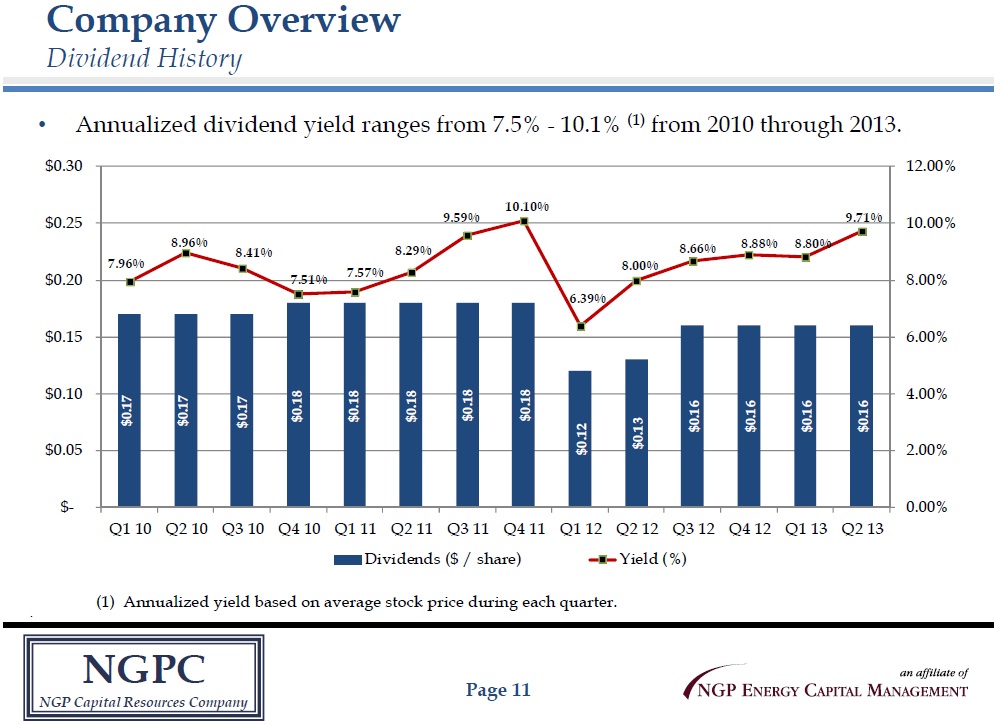

Company Overview NGPC NGP Capital Resources Company Page 11 Dividend History • Annualized dividend yield ranges from 7 . 5 % - 10 . 1 % ( 1 ) from 2010 through 2013 . . (1) Annualized yield based on average stock price during each quarter. $0.17 $0.17 $0.17 $0.18 $0.18 $0.18 $0.18 $0.18 $0.12 $0.13 $0.16 $0.16 $0.16 $0.16 7.96% 8.96% 8.41% 7.51% 7.57% 8.29% 9.59% 10.10% 6.39% 8.00% 8.66% 8.88% 8.80% 9.71% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% $- $0.05 $0.10 $0.15 $0.20 $0.25 $0.30 Q1 10 Q2 10 Q3 10 Q4 10 Q1 11 Q2 11 Q3 11 Q4 11 Q1 12 Q2 12 Q3 12 Q4 12 Q1 13 Q2 13 Dividends ($ / share) Yield (%)

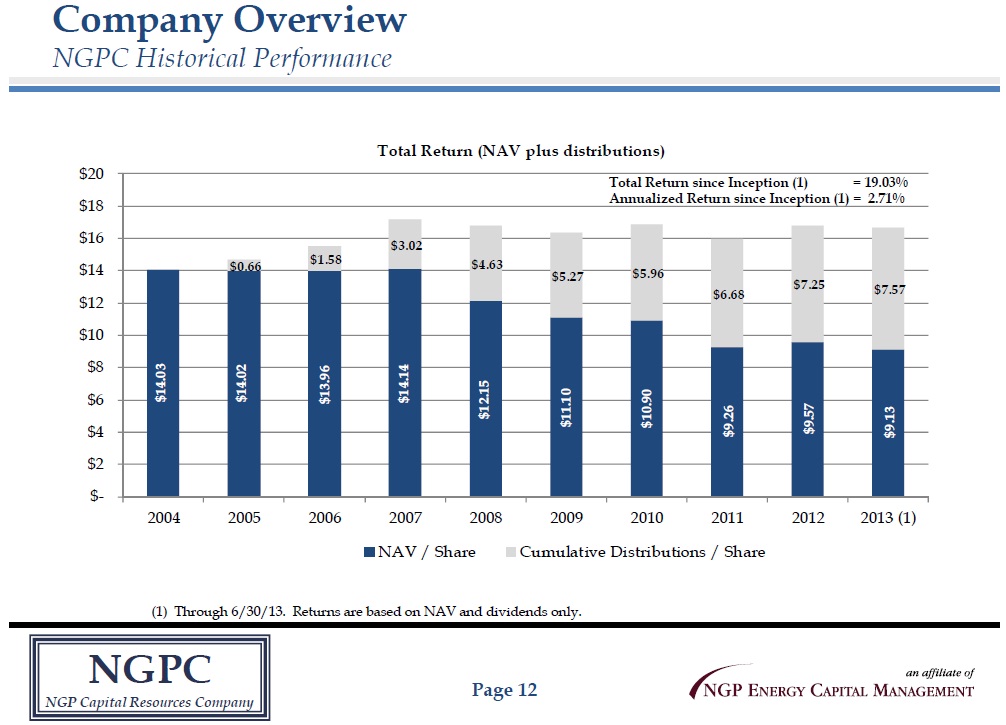

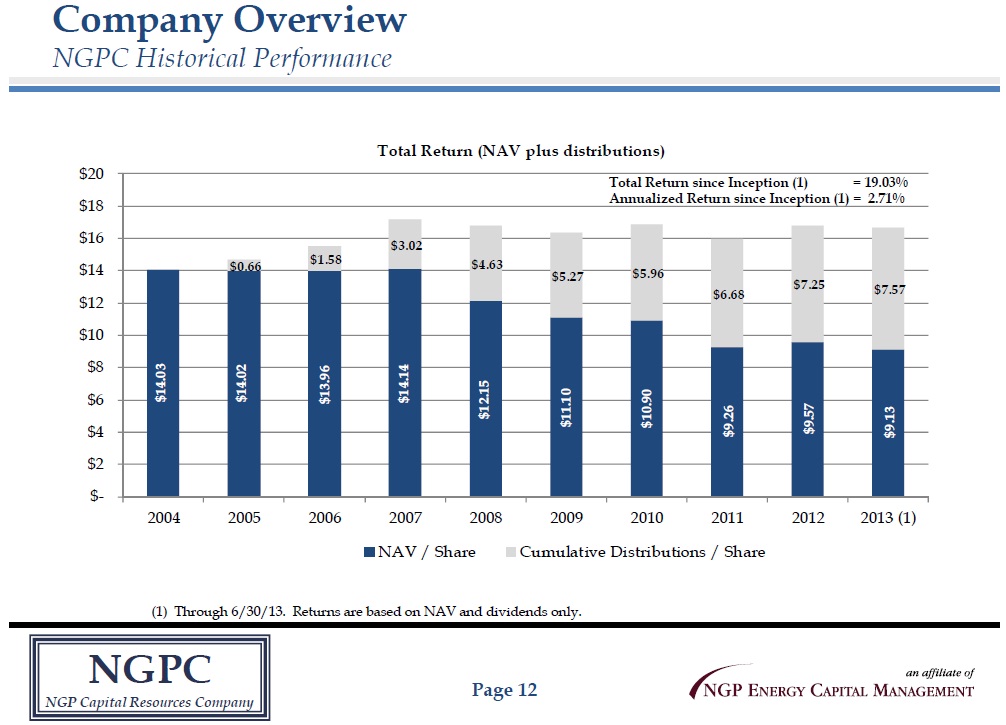

$14.03 $14.02 $13.96 $14.14 $12.15 $11.10 $10.90 $9.26 $9.57 $9.13 $0.66 $1.58 $3.02 $4.63 $5.27 $5.96 $6.68 $7.25 $7.57 $- $2 $4 $6 $8 $10 $12 $14 $16 $18 $20 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 (1) Total Return (NAV plus distributions) NAV / Share Cumulative Distributions / Share NGPC NGP Capital Resources Company Page 12 NGPC Historical Performance (1) Through 6/30/13. Returns are based on NAV and dividends only. Total Return since Inception (1) = 19.03% Annualized Return since Inception (1) = 2.71% Company Overview

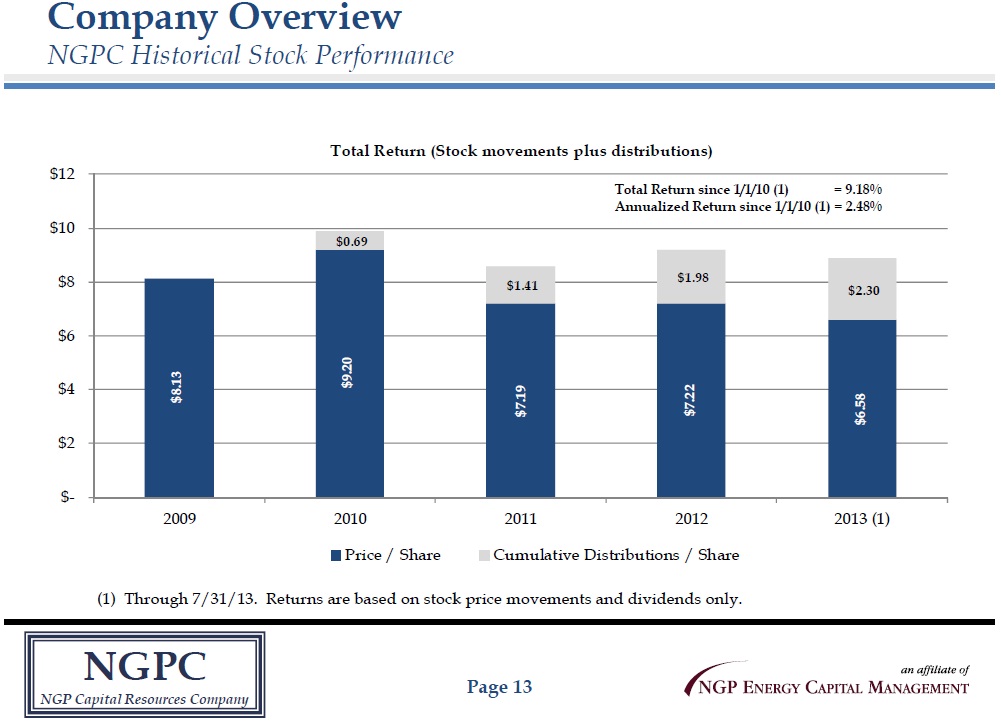

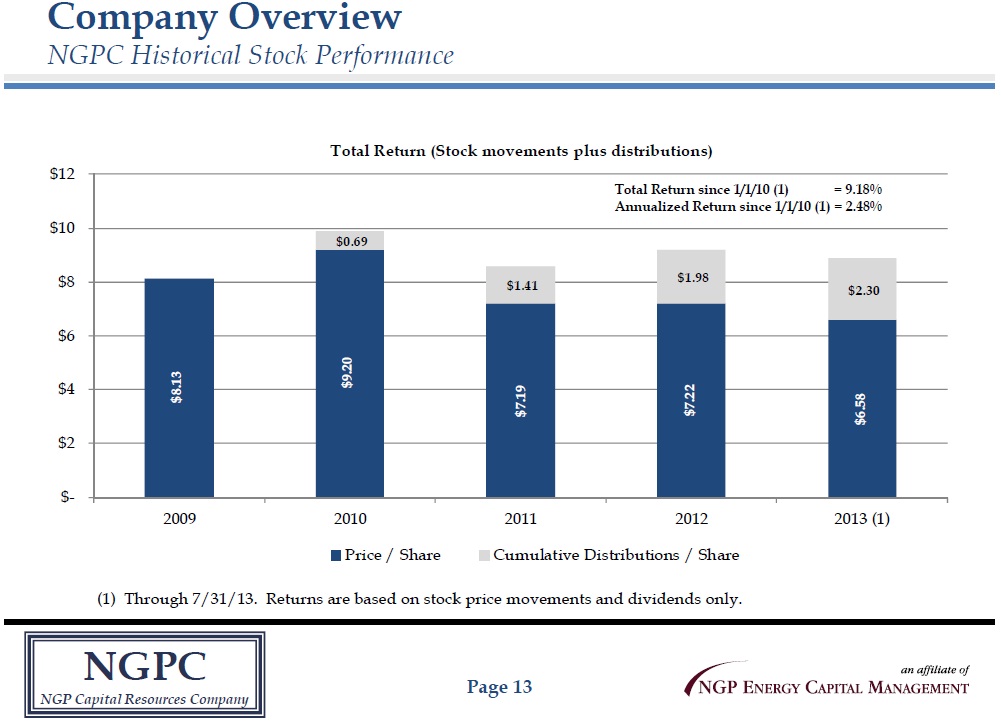

$8.13 $9.20 $7.19 $7.22 $6.58 $0.69 $1.41 $1.98 $2.30 $- $2 $4 $6 $8 $10 $12 2009 2010 2011 2012 2013 (1) Total Return (Stock movements plus distributions) Price / Share Cumulative Distributions / Share NGPC NGP Capital Resources Company Page 13 NGPC Historical Stock Performance (1) Through 7/31/13. Returns are based on stock price movements and dividends only. Total Return since 1/1/10 (1) = 9.18% Annualized Return since 1/1/10 (1) = 2.48% Company Overview

Agenda NGPC NGP Capital Resources Company Page 14 Company Overview Investment Criteria Financial Update Partnering with NGPC

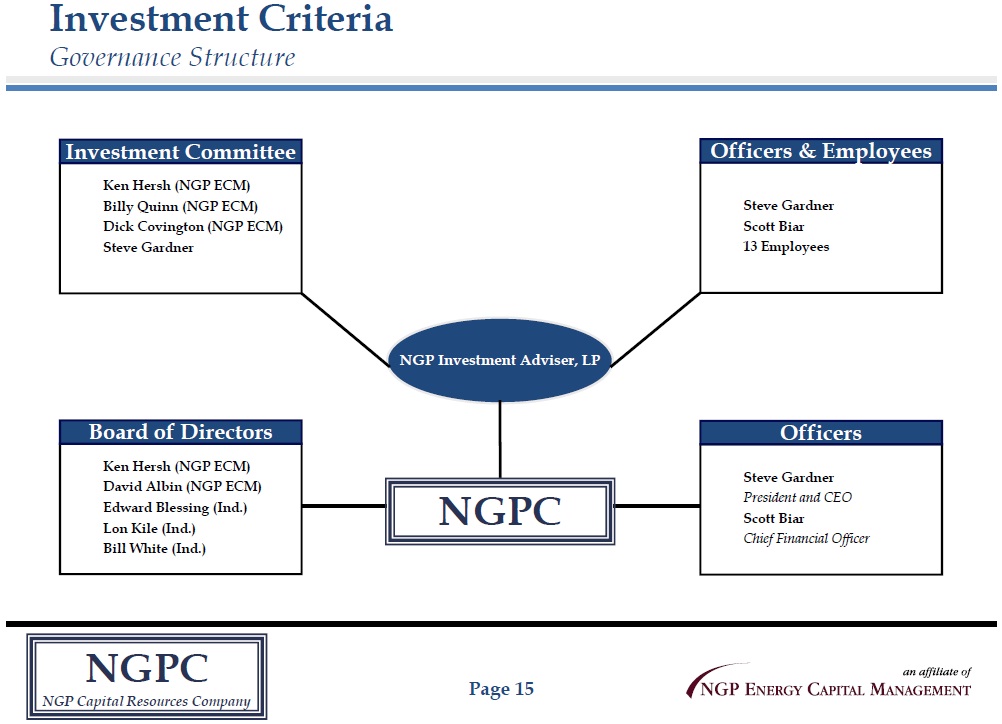

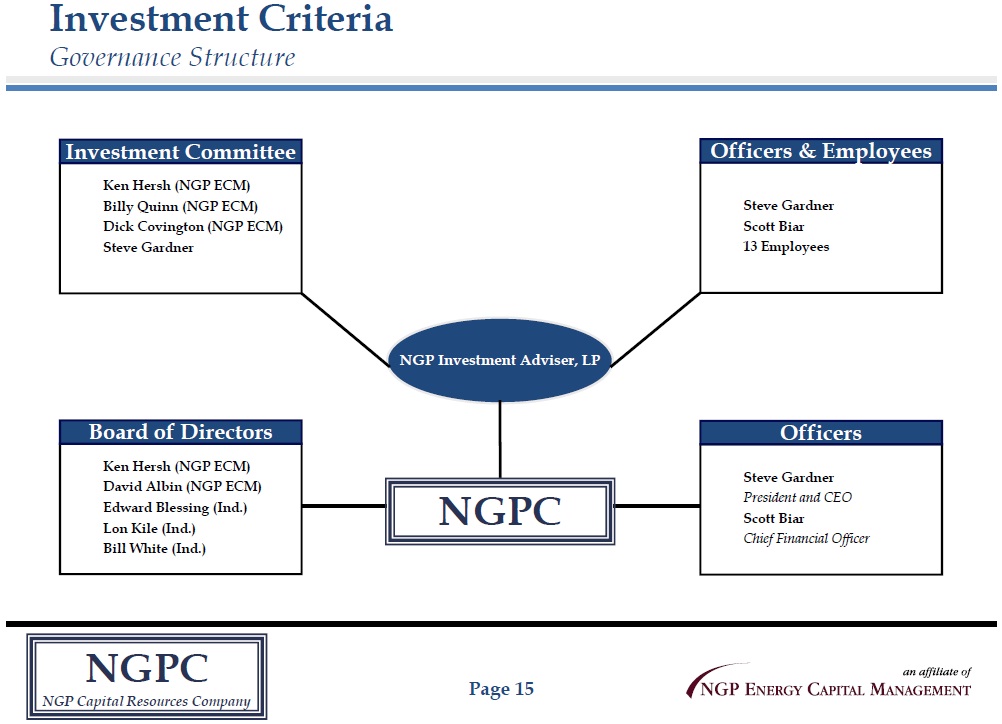

Investment Criteria NGPC NGP Capital Resources Company Page 15 Governance Structure NGP Investment Adviser, LP Ken Hersh ( NGP ECM ) David Albin ( NGP ECM ) Edward Blessing ( Ind.) Lon Kile (Ind .) Bill White (Ind .) Board of Directors NGPC Ken Hersh ( NGP ECM ) Billy Quinn (NGP ECM ) Dick Covington (NGP ECM) Steve Gardner Investment Committee Steve Gardner President and CEO Scott Biar Chief Financial Officer Officers Steve Gardner Scott Biar 13 Employees Officers & Employees

Investment Criteria NGPC NGP Capital Resources Company Page 16 Investment Thesis • NGPC offers investors the opportunity to participate in the energy and middle market sectors via a liquid investment with an efficient tax structure that provides yield and total return Risk Reward Spectrum 30%+ 20% 15% 10% NGPC 5% Sr. Sub Loans Senior Loans Mezzanine Equity Risk Return

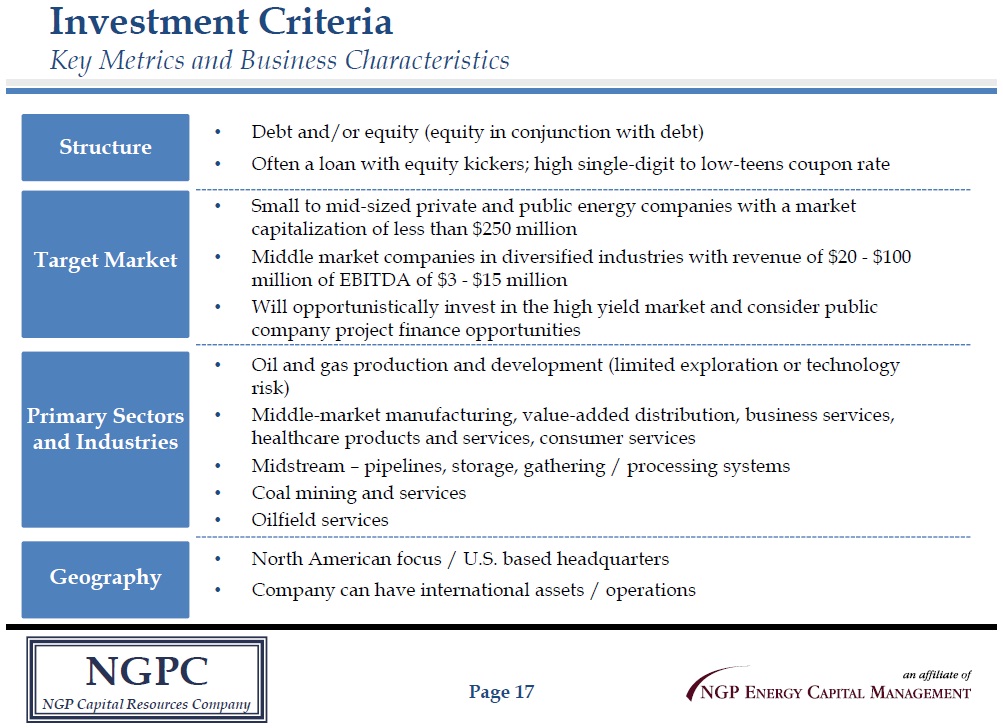

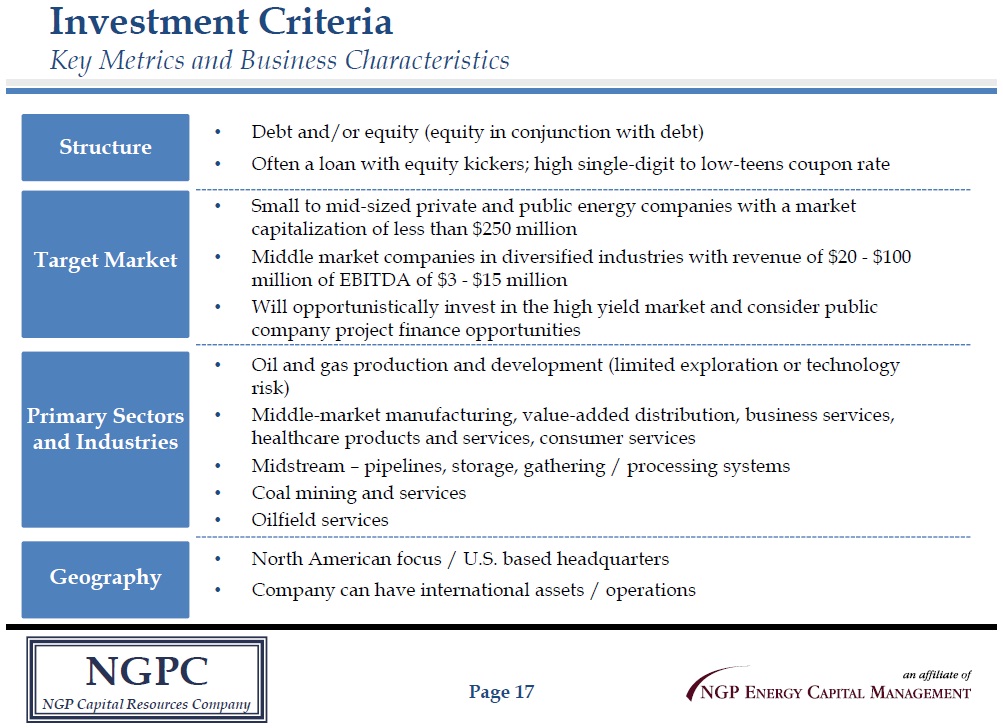

NGPC NGP Capital Resources Company Page 17 Key Metrics and Business Characteristics • Debt and/or equity (equity in conjunction with debt) • Often a loan with equity kickers; high single - digit to low - teens coupon rate Investment Criteria Structure Target Market Primary Sectors and Industries • Small to mid - sized private and public energy companies with a market capitalization of less than $250 million • Middle market companies in diversified industries with revenue of $20 - $100 million of EBITDA of $3 - $15 million • Will opportunistically invest in the high yield market and consider public company project finance opportunities • Oil and gas production and development (limited exploration or technology risk ) • Middle - market manufacturing, value - added distribution, business services, healthcare products and services, consumer services • Midstream – pipelines, storage, gathering / processing systems • Coal mining and services • Oilfield services Geography • North American focus / U.S. based headquarters • Company can have international assets / operations

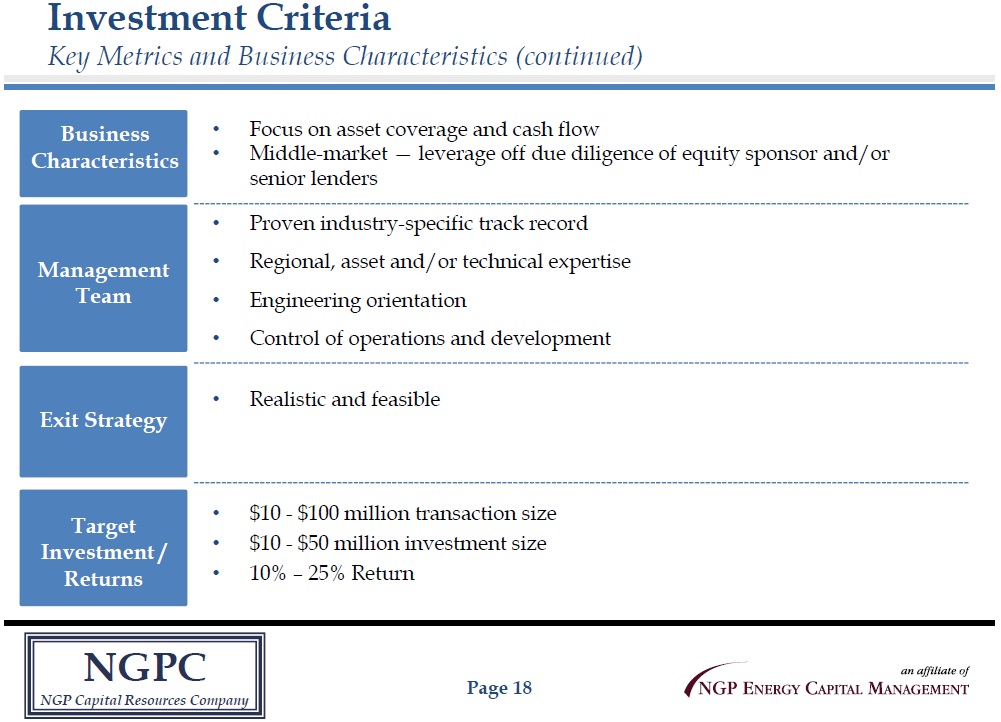

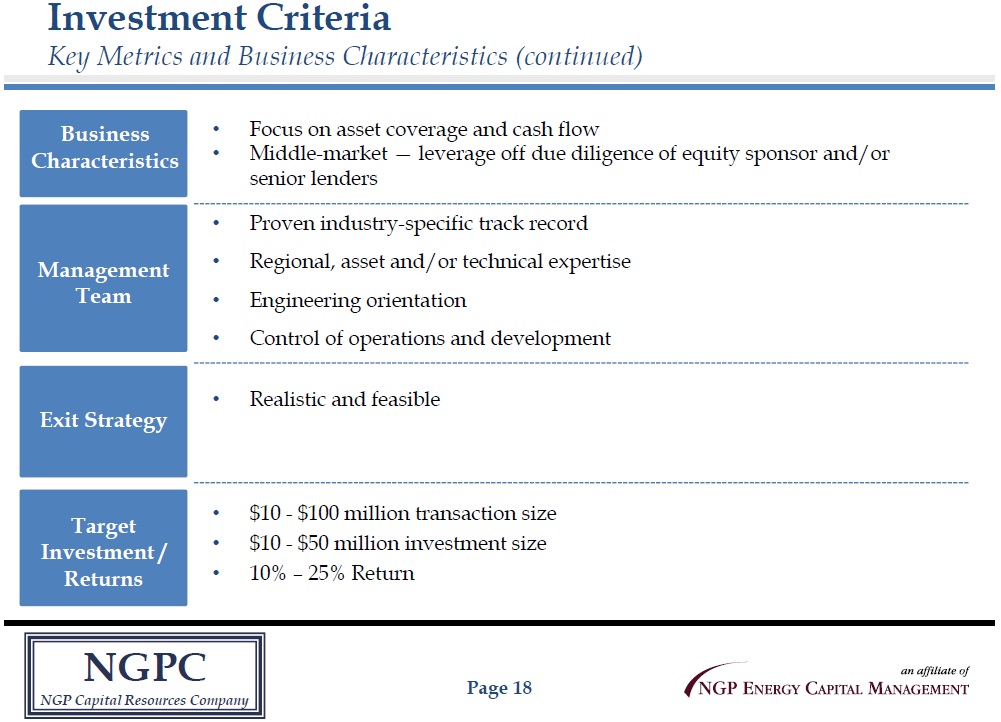

NGPC NGP Capital Resources Company Page 18 Key Metrics and Business Characteristics (continued) • Focus on asset coverage and cash flow • Middle - market — leverage off due diligence of equity sponsor and/or senior lenders Investment Criteria Business Characteristics Management Team Exit Strategy • Proven industry - specific track record • Regional, asset and/or technical expertise • Engineering orientation • Control of operations and development Geography • Realistic and feasible Target Investment / Returns • $10 - $100 million transaction size • $10 - $50 million investment size • 10% – 25% Return

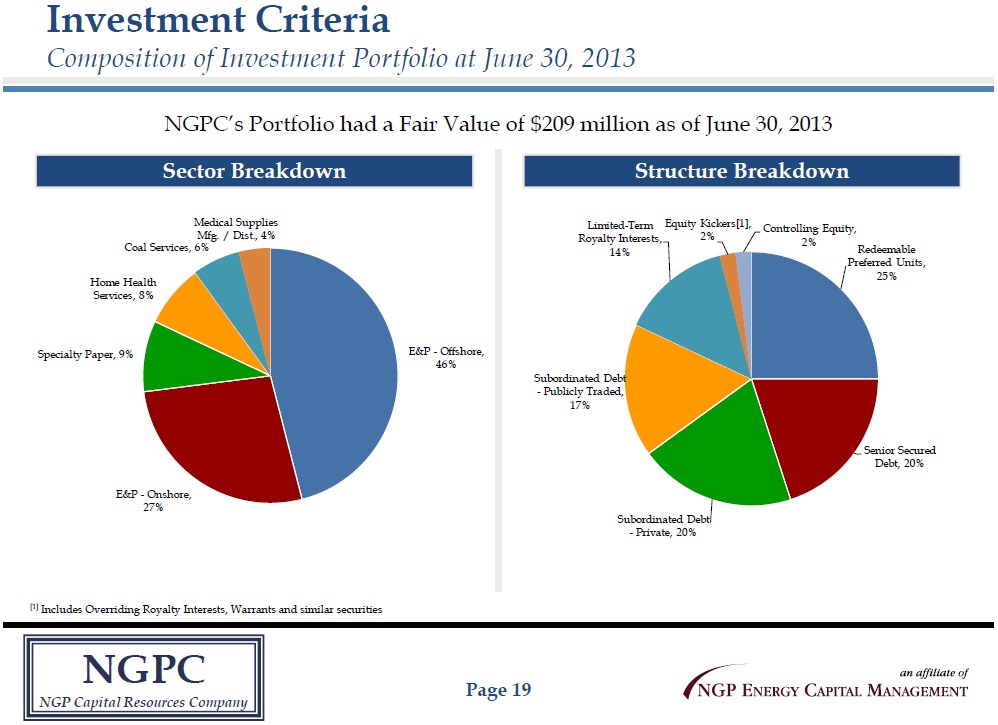

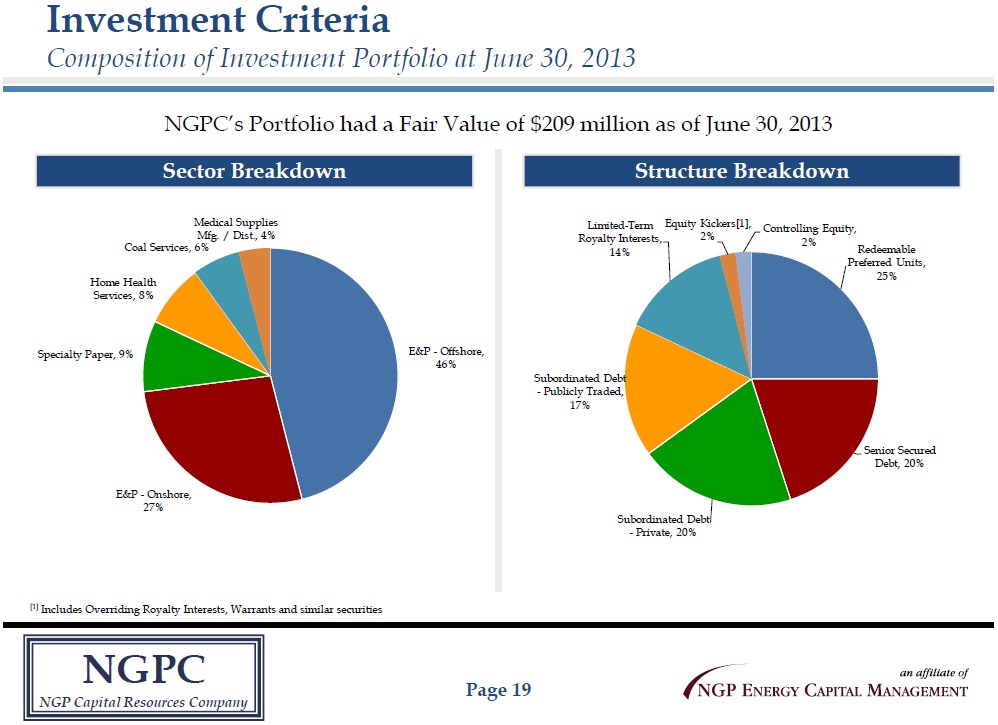

Redeemable Preferred Units, 25% Senior Secured Debt, 20% Subordinated Debt - Private, 20% Subordinated Debt - Publicly Traded, 17% Limited - Term Royalty Interests, 14% Equity Kickers[1], 2% Controlling Equity, 2% E&P - Offshore, 46% E&P - Onshore, 27% Specialty Paper, 9% Home Health Services, 8% Coal Services, 6% Medical Supplies Mfg. / Dist., 4% Investment Criteria NGPC NGP Capital Resources Company Page 19 Composition of Investment Portfolio at June 30, 2013 [1] Includes Overriding Royalty Interests, Warrants and similar securities Sector Breakdown Structure Breakdown NGPC’s Portfolio had a Fair Value of $209 million as of June 30, 2013

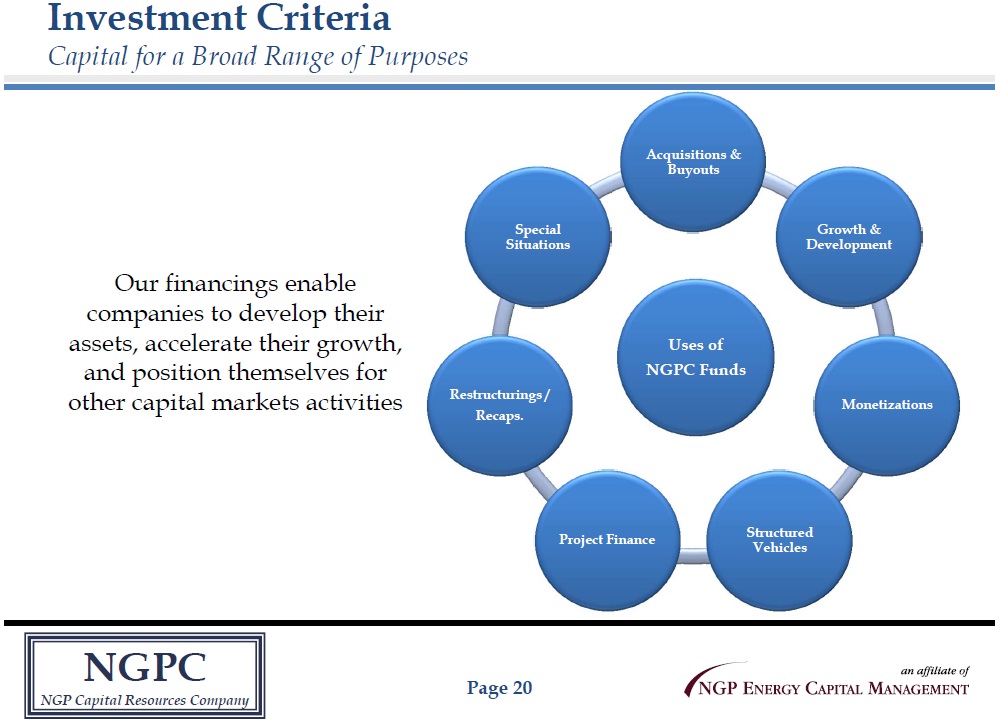

Investment Criteria NGPC NGP Capital Resources Company Page 20 Capital for a Broad Range of Purposes Uses of NGPC Funds Acquisitions & Buyouts Growth & Development Monetizations Structured Vehicles Project Finance Restructurings / Recaps. Special Situations Our financings enable companies to develop their assets, accelerate their growth, and position themselves for other capital markets activities

Agenda NGPC NGP Capital Resources Company Page 21 Company Overview Investment Criteria Financial Update Partnering with NGPC

NGPC NGP Capital Resources Company Page 22 Financial Update Statement of Operations – Q2 2013 vs. Q1 2013 (in $000’s) Q2 Q1 Variance Investment income $ 9,613 $5,803 $ 3,810 Interest expense 998 815 (183) Management fees 1,830 1,367 (463) Other G&A 1,299 1,286 (13) Income taxes 22 16 (6) Net investment income 5,464 2,319 3,145 Net investment income per share $0.26 $0.11 $ 0.15 Realized capital gains (losses) 1,064 (228) 1,292 Unrealized gains (losses) (3,015) (9,698) 6,683 Net increase (decrease) in net assets from ops / per share $ 3,513 $ 0.16 $ (7,607) $ (0.36) $ 11,120 $ 0.52

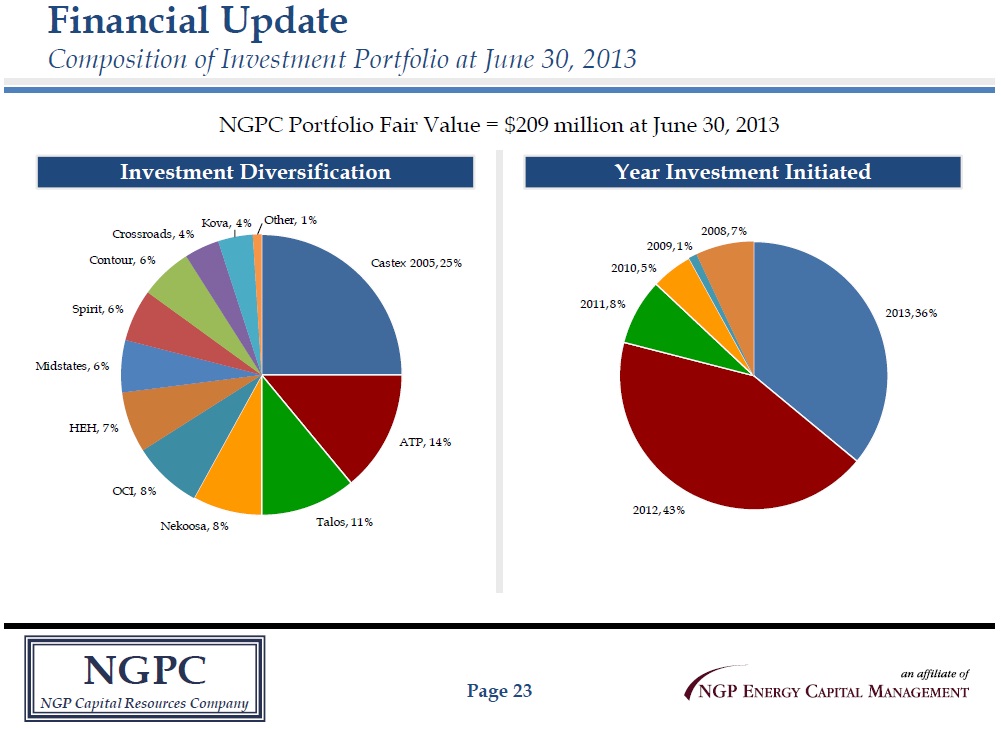

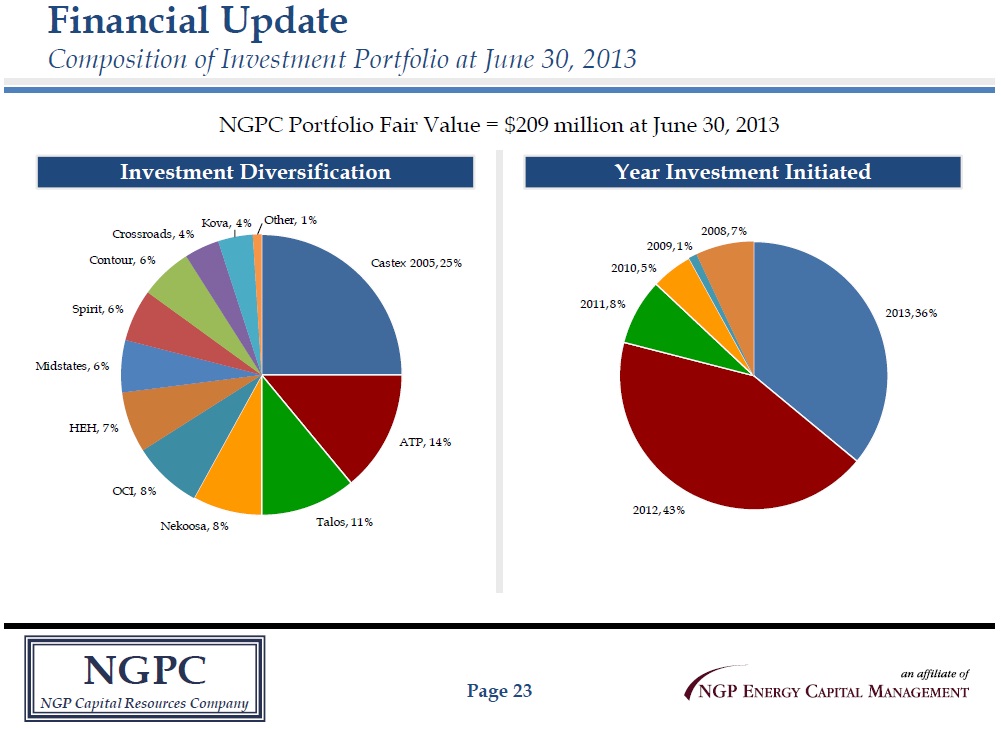

Financial Update NGPC NGP Capital Resources Company Page 23 Composition of Investment Portfolio at June 30, 2013 Investment Diversification Year Investment Initiated NGPC Portfolio Fair Value = $209 million at June 30, 2013 Castex 2005, 25% ATP, 14% Talos, 11% Nekoosa, 8% OCI, 8% HEH, 7% Midstates, 6% Spirit, 6% Contour, 6% Crossroads, 4% Kova, 4% Other, 1% 2013, 36% 2012, 43% 2011, 8% 2010, 5% 2009, 1% 2008, 7%

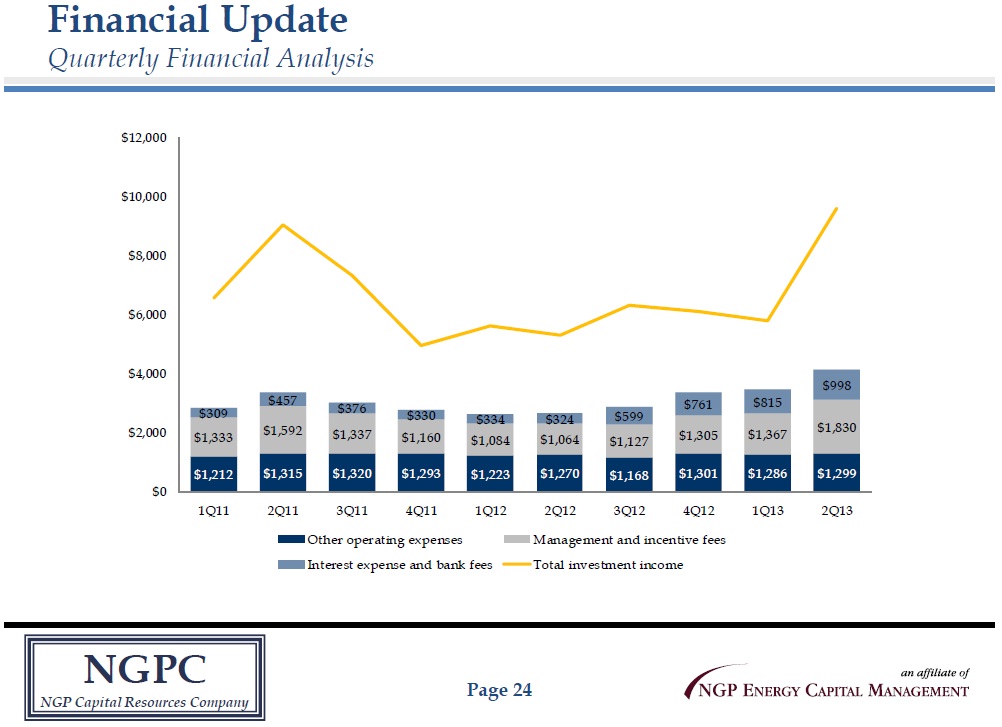

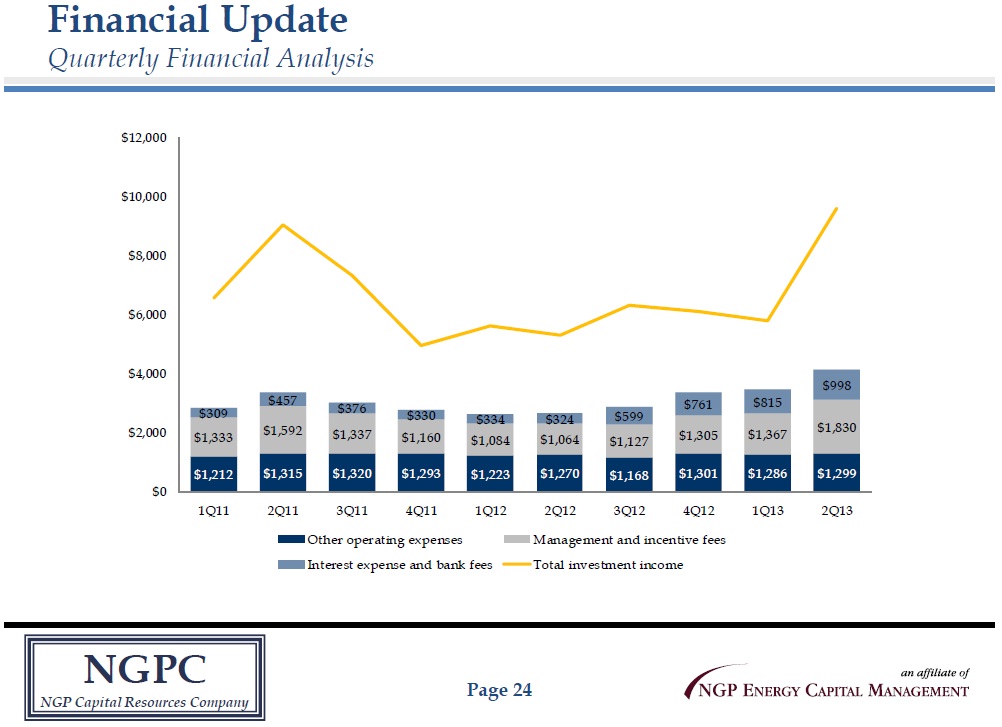

Financial Update NGPC NGP Capital Resources Company Page 24 Quarterly Financial Analysis $1,212 $1,315 $1,320 $1,293 $1,223 $1,270 $1,168 $1,301 $1,286 $1,299 $1,333 $1,592 $1,337 $1,160 $1,084 $1,064 $1,127 $1,305 $1,367 $1,830 $309 $457 $376 $330 $334 $324 $599 $761 $815 $998 $0 $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13 2Q13 Other operating expenses Management and incentive fees Interest expense and bank fees Total investment income

NGPC NGP Capital Resources Company Page 25 Financial Update Balance Sheet – Q2 2013 vs. Q4 2012 (in $000’s) 6/30/13 12/31/12 Variance P ortfolio investments $209,286 $213,614 $ (4,328) U.S. Treasury Bills 46,000 45,996 4 Cash and cash equivalents 49,155 47,655 1,500 Prepaids and other 6,181 5,057 1,124 Tota l assets $ 310,622 $ 312,322 $ (1,700) Current liabilities $ 6,474 $ 6,555 $ 81 Short - term debt 45,000 45,000 -- Long - term debt 72,000 59,500 (12,500) Total liabilities 123,474 111,056 $ (12,418) Total net asset value $187,148 $201,266 $ (14,118) Net asset value per share $ 9.13 $ 9.57 $ (0.44)

($000’s, except per share data ) 2010 2011 2012 LTM 6/30/13 Investment income $23,585 $27,903 $23,369 $27,855 Interest expense/bank fees 1,261 1,473 2,018 3,173 Management fees 5,548 5,422 4,580 5,629 Other G&A 5,282 5,139 4,962 5,054 Income taxes 54 60 46 61 Net investment income $ 11,440 $ 15,809 $ 11,763 $ 13,938 Net investment income per share $ 0.53 $ 0.73 $ 0.55 $ 0.63 Net investment income margin 48.5% 56.7% 50.3% 50.0% Dividends declared per share $ 0.69 $ 0.72 $ 0.57 $ 0.64 Market value return (1) 22.4% (14.6)% 8.4% (4.2)% NGPC NGP Capital Resources Company Page 26 (1) Assumes reinvestment of dividends. Financial Update Historical Financial Highlights

Agenda NGPC NGP Capital Resources Company Page 27 Company Overview Investment Criteria Financial Update Partnering with NGPC

Partnering with NGPC NGPC NGP Capital Resources Company Page 28 Why Partner with NGPC? • Actively seeking to deploy permanent and established capital • Long - term capital partner • Depth of energy, engineering, and financial experience and expertise • Customized financing solutions – “One - Stop Shop” • Pricing and structure tailored to the risk assumed • Management assistance • Speed of commitment and closing • Underwriting capability • Ability to leverage resources from NGP Energy Capital Management

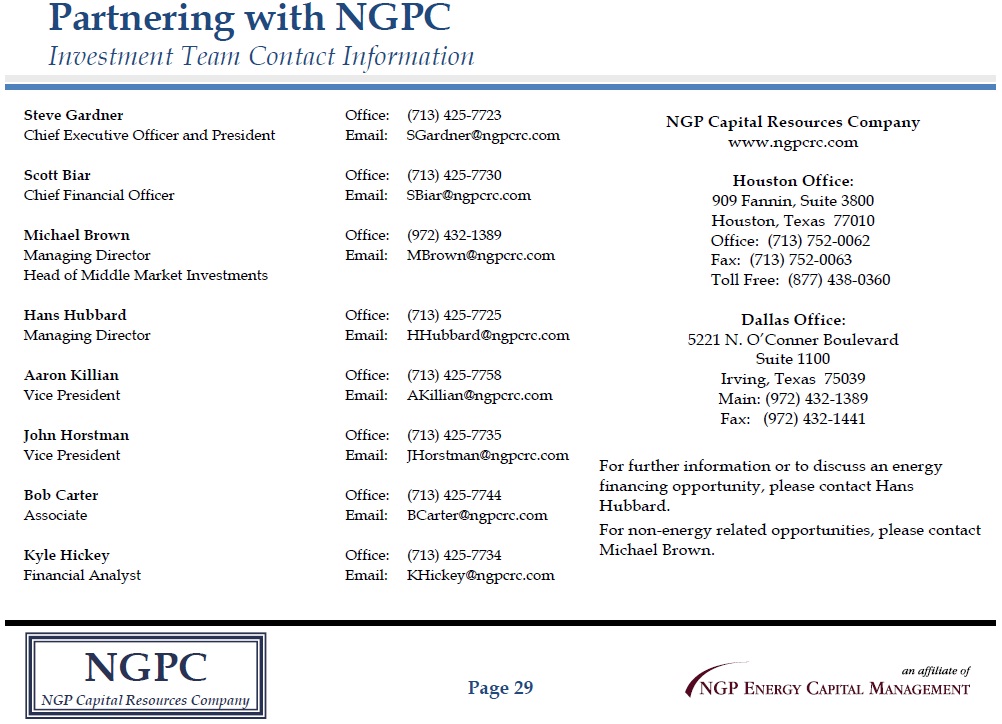

Partnering with NGPC NGPC NGP Capital Resources Company Page 29 Investment Team Contact Information Steve Gardner Office: (713) 425 - 7723 Chief Executive Officer and President Email: SGardner@ngpcrc.com Scott Biar Office: (713) 425 - 7730 Chief Financial Officer Email: SBiar@ngpcrc.com Michael Brown Office: (972) 432 - 1389 Managing Director Email: MBrown@ngpcrc.com Head of Middle Market Investments Hans Hubbard Office: (713) 425 - 7725 Managing Director Email: HHubbard@ngpcrc.com Aaron Killian Office: (713) 425 - 7758 Vice President Email: AKillian@ngpcrc.com John Horstman Office: (713) 425 - 7735 Vice President Email: JHorstman@ngpcrc.com Bob Carter Office: (713) 425 - 7744 Associate Email: BCarter@ngpcrc.com Kyle Hickey Office: (713) 425 - 7734 Financial Analyst Email : KHickey@ngpcrc.com NGP Capital Resources Company www.ngpcrc.com Houston Office: 909 Fannin , Suite 3800 Houston, Texas 77010 Office: (713) 752 - 0062 Fax: (713) 752 - 0063 Toll Free: (877) 438 - 0360 Dallas Office : 5221 N. O’Conner Boulevard Suite 1100 Irving, Texas 75039 Main: (972) 432 - 1389 Fax: (972) 432 - 1441 For further information or to discuss an energy financing opportunity, please contact Hans Hubbard. For non - energy related opportunities, please contact Michael Brown.

NGPC NGP Capital Resources Company Page 30 Questions & Answers