Exhibit 99.1

NGP CAPITAL RESOURCES

COMPANY

Annual Shareholder Meeting

May 18, 2005

Forward-Looking Statements

This presentation contains forward-looking statements. These forward-looking statements are subject to various risks and uncertainties, which could cause actual results and conditions to differ materially from those projected, including the uncertainties associated with the timing of transaction closings, changes in interest rates, availability of transactions, the future operating results of our portfolio companies, changes in regional, national, or international economic conditions and their impact on the industries in which we invest, or changes in the conditions of the industries in which we invest, and other factors enumerated in our filings with the Securities and Exchange Commission.

Words such as “anticipates,” “believes,” “expects,” “intends”, “will”, “should,” “may” and similar expressions may be used to identify forward-looking statements. Undue reliance should not be placed on such forward-looking statements as such statements speak only as of the date on which they are made. We do not undertake to update our forward-looking statements unless required by law.

Persons considering an investment in NGP Capital Resources Company should consider the investment objectives, risks, and charges and expenses of the company carefully before investing. Such information and other information about the company is available in our annual report on Form 10-K and in prospectuses we issue from time to time in connection with our offering of securities. Such materials are filed with the SEC and copies are available on the SEC’s website, www.sec.gov. Prospective investors should read such materials carefully before investing.

NGPC

NGPC – Status Update

Recent deals closed.

Status of deal pipeline:

Substantially unchanged from Conference Call on May 10, 2005.

New bank facility.

NGPC

NGPC – Our Business

NGPC is a flexible source of capital, providing customized financing solutions. We can invest at multiple levels of the balance sheet:

Senior Debt

Subordinated Debt

Mezzanine Capital

These investments can range from $5 million to $100 + million.

Our capital serves a broad range of purposes, including:

Acquisitions and Buyouts

Growth & Development

Monetizations

Structured Vehicles

Recapitalizations

Restructuring

Special Situations

NGPC

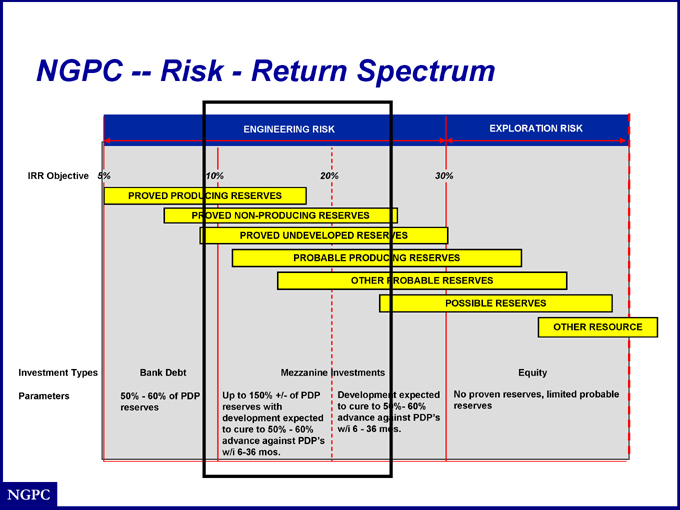

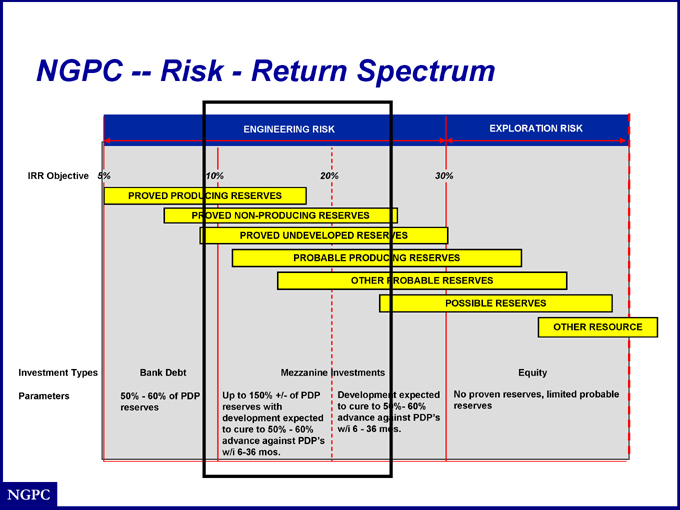

NGPC — Risk — Return Spectrum

ENGINEERING RISK

EXPLORATION RISK

IRR Objective

5%

10%

20%

30%

PROVED PRODUCING RESERVES

PROVED NON-PRODUCING RESERVES

PROVED UNDEVELOPED RESERVES

PROBABLE PRODUCING RESERVES

OTHER PROBABLE RESERVES

POSSIBLE RESERVES

OTHER RESOURCE

Investment Types

Bank Debt

Mezzanine Investments

Equity

Parameters

50%—60% of PDP reserves

Up to 150% +/- of PDP reserves with development expected to cure to 50%—60% advance against PDP’s w/i 6-36 mos.

Development expected to cure to 50%- 60% advance against PDP’s w/i 6—36 mos.

No proven reserves, limited probable reserves

NGPC

NGPC – Deal Particulars

Structure: Typically a Loan, often with Equity Kickers.

Coupon: High single digit to low teens, depending on position in the risk spectrum.

Equity Kickers: Property based and/or warrant based; sized along with coupon to achieve target return commensurate with risk of financing.

Important Things to Start:

Clear description of engineering development opportunity.

Engineering Report (internally generated report is good to start, with a third party report completed prior to close).

Development Plan (projects, properties, timing, funds required, schedule, forecast of outcomes) – should tie to engineering report.

A custom tailored facility for the assets and management team being financed.

Timing: 30 to 60 days start to close.

NGPC

NGPC — Investment Criteria

Good management

Proven energy track record

Regional, asset and/or technical expertise

Reserves development and engineering play — not a pure exploration or price play.

Acquisition and development projects for oil and gas production and other related investments, such as gas plants, pipelines and gas storage. Also, on a limited basis, coal, power, and alternative energy.

Management controls the pace of development and operations.

Target investment size in the range of $5 million to $50 million, although NGPC can underwrite and syndicate transactions of $100 + million dollars.

NGPC

NGP CAPITAL RESOURCES

COMPANY

www.ngpcrc.com 713-752-0062