Exhibit 99.1

NGP CAPITAL RESOURCES

COMPANY

EnerCom Oil & Gas Conference

August 7 – 11, 2005

Forward-Looking Statements

This presentation contains forward-looking statements. These forward-looking statements are subject to various risks and uncertainties, which could cause actual results and conditions to differ materially from those projected, including the uncertainties associated with the timing of transaction closings, changes in interest rates, availability of transactions, the future operating results of our portfolio companies, changes in regional, national, or international economic conditions and their impact on the industries in which we invest, or changes in the conditions of the industries in which we invest, and other factors enumerated in our filings with the Securities and Exchange Commission.

Words such as “anticipates,” “believes,” “expects,” “intends,” “will,” “should,” “may” and similar expressions may be used to identify forward-looking statements. Undue reliance should not be placed on such forward-looking statements as such statements speak only as of the date on which they are made. We do not undertake to update our forward-looking statements unless required by law.

Persons considering an investment in NGP Capital Resources Company should consider the investment objectives, risks, and charges and expenses of the company carefully before investing. Such information and other information about the company is available in our annual report on Form 10-K, our quarterly reports on Form 10-Q and in prospectuses we issue from time to time in connection with our offering of securities. Such materials are filed with the SEC and copies are available on the

SEC’s website, www.sec.gov. Prospective investors should read such materials carefully before investing.

NGPC

1

NGP Capital Resources Company

NGP Capital Resources Company (Nasdaq: NGPC) is a publicly held financial services company that invests primarily in securities of small and midsized energy companies.

NGPC offers yield and total return investors the opportunity to participate in investments that target the capital needs of these small and midsized companies.

Our primary focus is in the domestic upstream and midstream businesses.

NGPC leverages Natural Gas Partners’ highly successful franchise that focuses on private equity investments in the energy industry.

Our current investment availability is approximately $300 million with capacity of approximately $450 million utilizing leverage with our equity base.

Our public equity capital makes NGPC a permanent source of capital for the energy markets.

NGPC

2

NGPC — a business development company

Regulated by the SEC under the Investment Company Act of 1940 and the Securities and Exchange Act of 1934.

Seventy percent of investments must be in the securities of private companies and public companies not listed on a national exchange.

Leverage is restricted to a maximum debt to capitalization of 50%.

The majority of our Board of Directors are independent.

We offer management assistance to our portfolio companies.

NGPC

3

NGPC — also a regulated investment company

Income must be generated primarily from investments in securities of portfolio companies.

Mandatory asset diversification.

Annual distribution of at least 90% of taxable income.

No corporate federal income tax.

NGPC

4

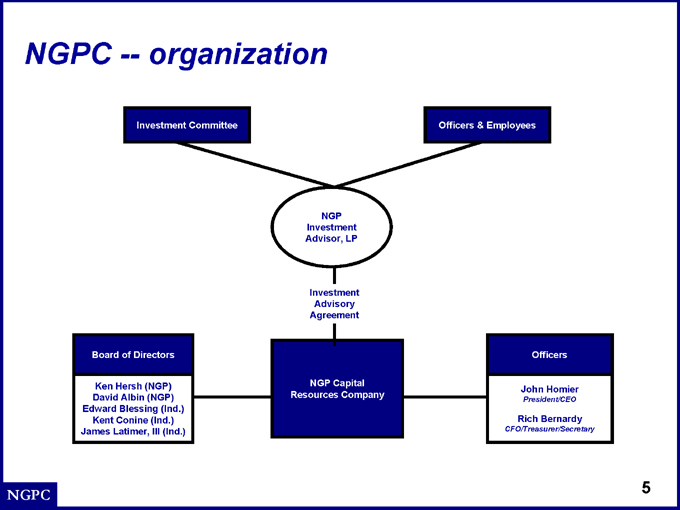

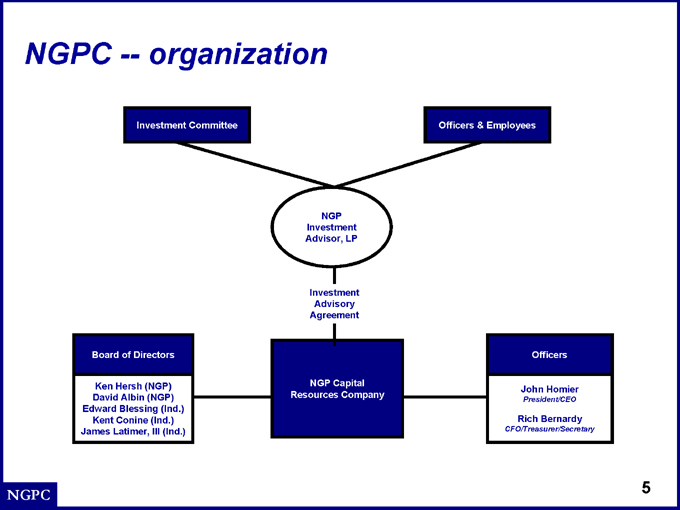

NGPC — organization

Investment Committee

Officers & Employees

NGP Investment Advisor, LP

Investment Advisory Agreement

Board of Directors

Ken Hersh (NGP) David Albin (NGP) Edward Blessing (Ind.) Kent Conine (Ind.) James Latimer, III (Ind.)

NGP Capital Resources Company

Officers

John Homier

President/CEO

Rich Bernardy

CFO/Treasurer/Secretary

NGPC

5

NGPC — our business

NGPC is a flexible source of capital, providing customized financing solutions. We can invest at multiple levels of the balance sheet:

Senior Debt Subordinated Debt Mezzanine Capital Project Equity

Our investments can range from $5 million to over $100 million.

NGPC

6

NGPC — our business

Our capital serves a broad range of purposes, including:

Acquisitions and Buyouts Growth & Development Monetizations Structured Vehicles Recapitalizations Restructuring Special Situations

NGPC

7

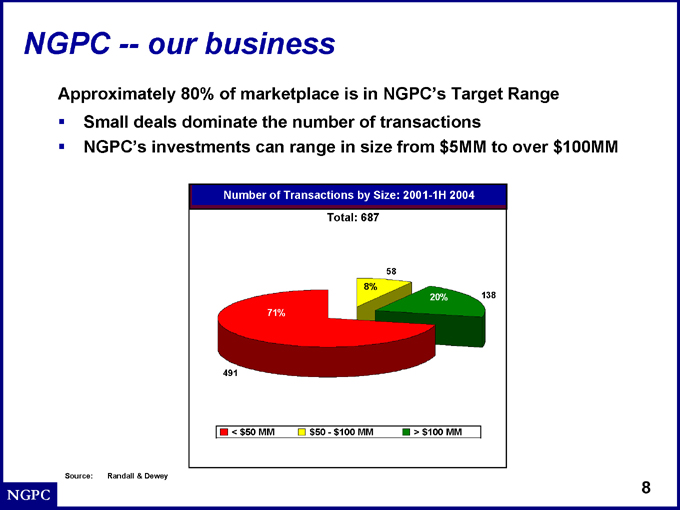

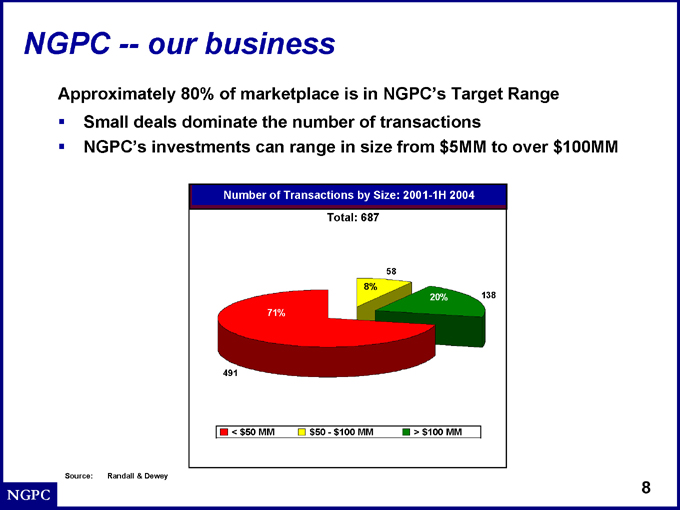

NGPC — our business

Approximately 80% of marketplace is in NGPC’s Target Range

Small deals dominate the number of transactions

NGPC’s investments can range in size from $5MM to over $100MM

Number of Transactions by Size: 2001-1H 2004

Total: 687

58

8%

71%

20%

138

491

< $50 MM $50—$100 MM

> $100 MM

Source: Randall & Dewey

8

NGPC — investment criteria

Good management

Proven energy track record

Regional, asset and/or technical expertise

Management controls the pace of development and operations.

Reserves development and engineering play — not a pure exploration or price play.

Acquisition and development projects for oil and gas production and other related investments, such as gas plants, pipelines and gas storage. NGPC can also invest in coal, power, and alternative energy. Target rate of return is dependent on overall risk of the transaction being financed and can range from high single digit to high teens.

NGPC

9

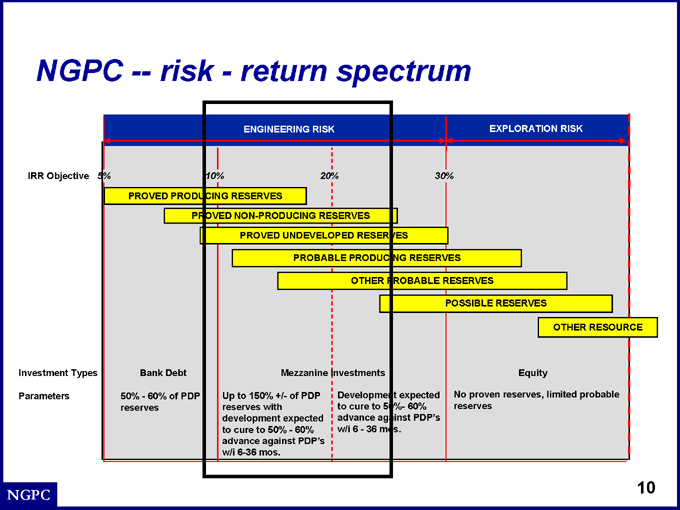

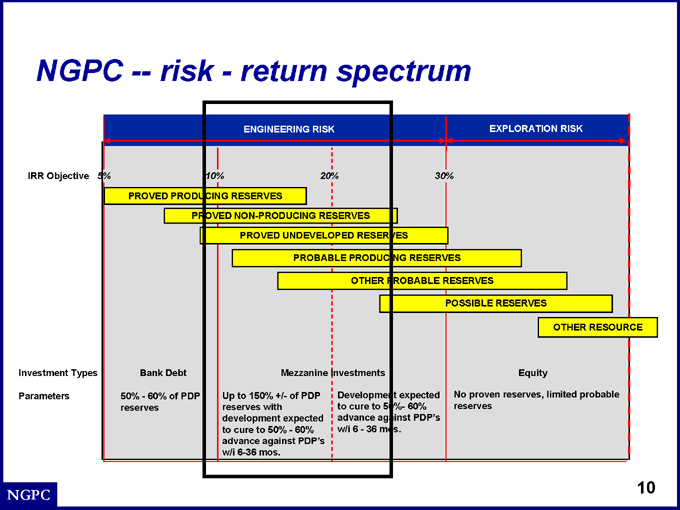

NGPC — risk—return spectrum

ENGINEERING RISK

EXPLORATION RISK

IRR Objective

5%

10%

20%

30%

PROVED PRODUCING RESERVES

PROVED NON-PRODUCING RESERVES

PROVED UNDEVELOPED RESERVES

PROBABLE PRODUCING RESERVES

OTHER PROBABLE RESERVES

POSSIBLE RESERVES

OTHER RESOURCE

Investment Types

Bank Debt

Mezzanine Investments

Equity

Parameters

50%—60% of PDP reserves

Up to 150% +/- of PDP reserves with development expected to cure to 50%—60% advance against PDP’s w/i 6-36 mos.

Development expected to cure to 50%- 60% advance against PDP’s w/i 6—36 mos.

No proven reserves, limited probable reserves

10

NGPC — financing advantages

Energy Focused and Experienced

Permanent Capital

Speed of Commitment and Closing

One-Stop Shop

Pricing and Structure tailored to the risk assumed

Underwriting Capability

11

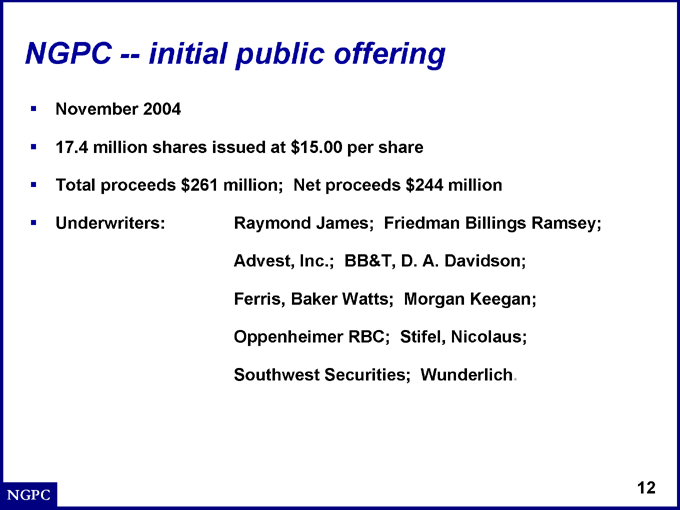

NGPC — initial public offering

November 2004

17.4 million shares issued at $15.00 per share

Total proceeds $261 million; Net proceeds $244 million

Underwriters: Raymond James; Friedman Billings Ramsey;

Advest, Inc.; BB&T, D. A. Davidson;

Ferris, Baker Watts; Morgan Keegan;

Oppenheimer RBC; Stifel, Nicolaus;

Southwest Securities; Wunderlich.

12

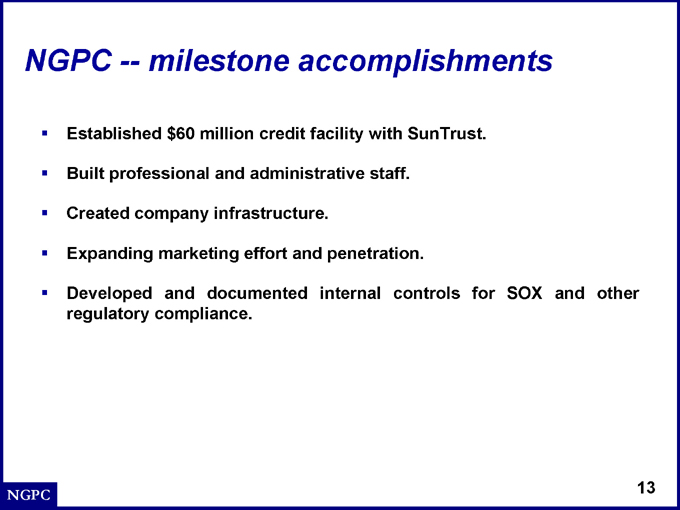

NGPC — milestone accomplishments

Established $60 million credit facility with SunTrust.

Built professional and administrative staff.

Created company infrastructure.

Expanding marketing effort and penetration.

Developed and documented internal controls for SOX and other regulatory compliance.

13

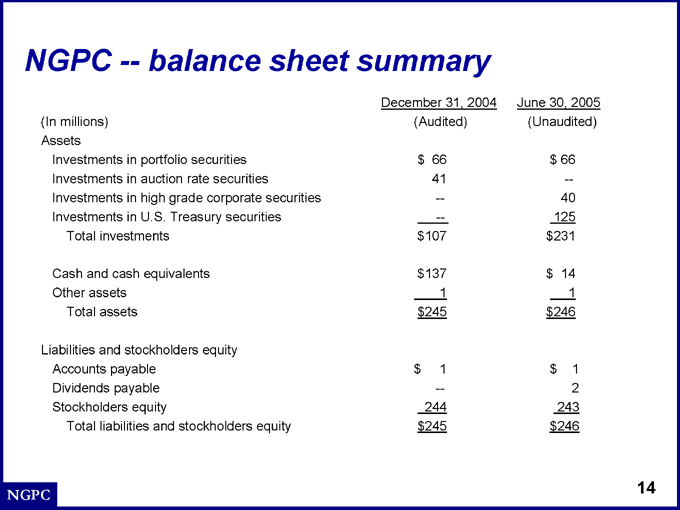

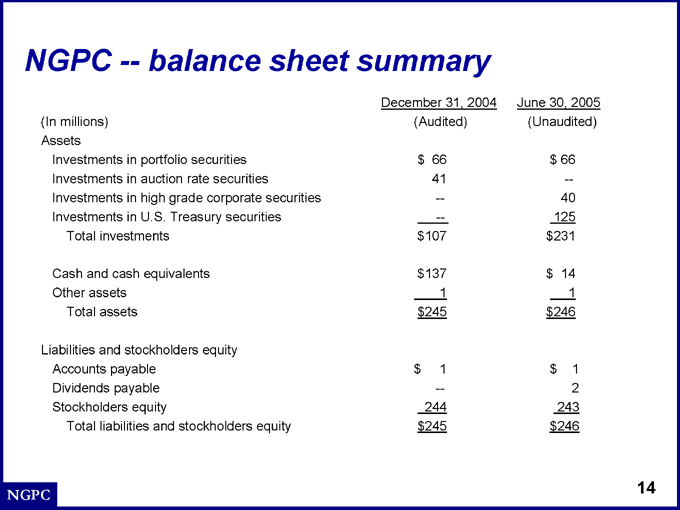

NGPC — balance sheet summary

December 31, 2004 June 30, 2005

(In millions) (Audited) (Unaudited)

Assets

Investments in portfolio securities $66 $66

Investments in auction rate securities 41 —

Investments in high grade corporate securities — 40

Investments in U.S. Treasury securities — 125

Total investments $107 $231

Cash and cash equivalents $137 $14

Other assets 1 1

Total assets $245 $246

Liabilities and stockholders equity

Accounts payable $1 $1

Dividends payable — 2

Stockholders equity 244 243

Total liabilities and stockholders equity $245 $246

14

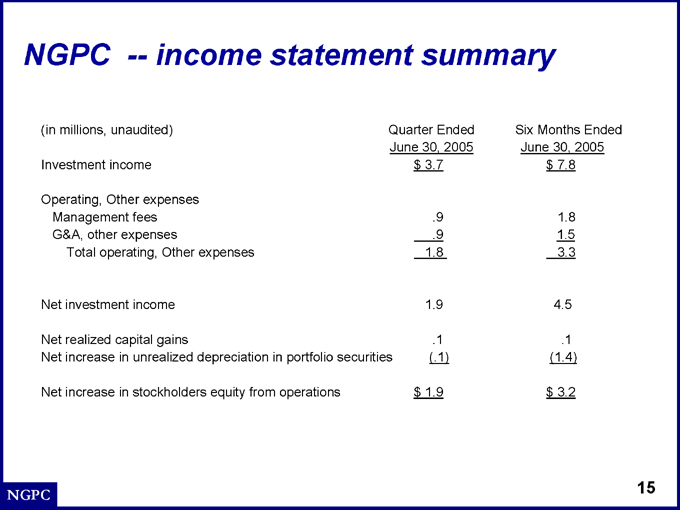

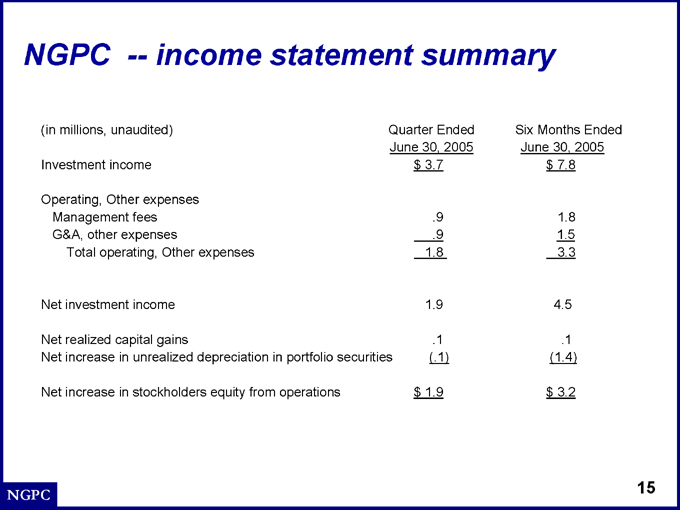

NGPC — income statement summary

(in millions, unaudited) Quarter Ended June 30, 2005 Six Months Ended June 30, 2005

Investment income $3.7 $7.8

Operating, Other expenses

Management fees .9 1.8

G&A, other expenses .9 1.5

Total operating, Other expenses 1.8 3.3

Net investment income 1.9 4.5

Net realized capital gains .1 .1

Net increase in unrealized depreciation in portfolio securities (.1) (1.4)

Net increase in stockholders equity from operations $1.9 $3.2

15

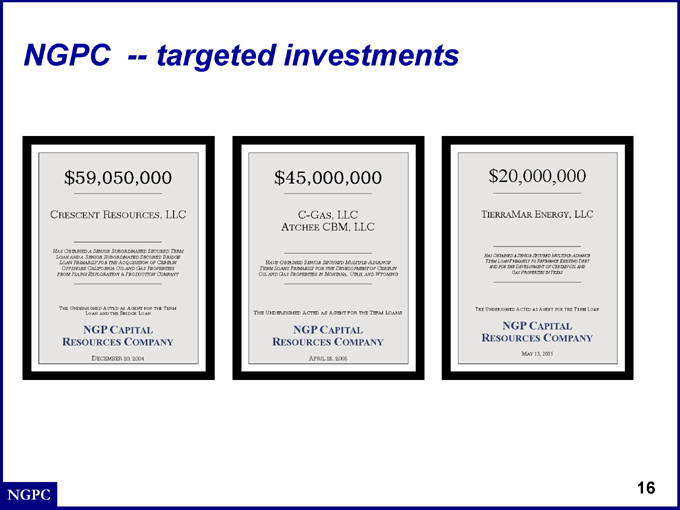

NGPC — targeted investments

16

NGPC — summary and conclusion

NGPC is a vehicle that offers investors the opportunity to participate in investments that target the capital needs of small and midsized energy companies.

Our primary focus is to provide financing for domestic upstream and midstream businesses.

Our investments in portfolio companies are in the range of $5 million to over $100 million.

NGPC is a permanent and flexible source of capital for multiple levels of a portfolio company’s balance sheet.

Our financings enable companies to develop their assets, accelerate their growth, and position themselves for other capital markets activities.

17

NGP CAPITAL RESOURCES

COMPANY

www.ngpcrc.com

713-752-0062

John Homier Rich Bernardy Kelly Plato

Larry Tharp Steve Gardner Dan Schockling