UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: August 31, 2006

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-51099

FCStone Group, Inc.

(Exact name of Registrant as specified in its charter)

| | |

| Iowa | | 42-1091210 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 2829 Westown Parkway, Suite 100, West Des Moines, Iowa | | 50266 |

| (Address of principal executive office) | | (Zip Code) |

Registrant’s telephone number, including area code: (515) 223-3756

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to 12(g) of the Act: Common Stock, no par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer (as defined in Exchange Act Rule 12b-2).

| | | | |

| Large accelerated filer ¨ | | Accelerated filer ¨ | | Non-accelerated filer x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

There is currently no public market for the Registrant’s securities. As of November 28, 2006, the Registrant had 4,845,736 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement for its Annual Meeting of Stockholders to be held on January 11, 2007, are incorporated by reference into Part III of this Report on Form 10-K.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report includes forward-looking statements regarding, among other things, our plans, strategies and prospects, both business and financial. All statements other than statements of current or historical fact contained in this annual report on Form 10-K are forward-looking statements. The words “believe,” “expect,” “anticipate,” “should,” “could,” “plan,” “will,” “may,” “intend,” “estimate,” “potential,” “continue” or the negative of these terms and similar expressions, as they relate to us, are intended to identify forward-looking statements.

We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. They can be affected by inaccurate assumptions, including the risks, uncertainties and assumptions described in “Risk Factors.” In light of these risks, uncertainties and assumptions, the forward-looking statements in this report may not occur and actual results could differ materially from those anticipated or implied in the forward-looking statements. When you consider these forward-looking statements, you should keep in mind these risk factors and other cautionary statements in this report.

Our forward-looking statements speak only as of the date of this report. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

PART I

Item 1. Business

General

FCStone Group, Inc. is an integrated commodity risk management company providing risk management consulting and transaction execution services to commercial commodity intermediaries, end-users and producers. We assist primarily middle market customers in optimizing their profit margins and mitigating their exposure to commodity price risk. In addition to our risk management consulting services, we operate one of the leading independent clearing and execution platforms for exchange-traded futures and options contracts. We serve more than 7,500 customers and in fiscal 2006, executed more than 47.8 million derivative contracts in the exchange-traded and OTC markets. As a natural complement to our commodity risk management consulting and execution services, we also assist our customers with the financing, transportation and merchandising of their physical commodity requirements and inventories.

We began offering commodity risk management consulting services to grain elevators in 1968. Since that time, our business has evolved to meet the changing needs of our customers. In response to these changing needs, we expanded our risk management products to include derivatives on agricultural commodities, energy commodities, forest products and food products. We originally operated as a member-owned cooperative that was governed by a mission to deliver professional marketing and risk management programs to enhance the profitability of our members and other customers. In 2000, we acquired the assets of another futures commission merchant (FCM), Saul Stone & Company, which enhanced our execution and clearing capabilities and gave us the ability to clear all U.S. exchange-traded commodity futures and options contracts. In 2005, we converted to a stock corporation to improve our access to financial capital and to facilitate continued growth in our operations.

We provide our customers with various levels of commodity risk management services, ranging from value-added consulting services delivered through our Integrated Risk Management Program (“IRMP”) to lower-margin clearing and execution services for exchange-traded derivative contracts. Our consultative focus is demonstrated by our IRMP, which involves providing our customers with commodity risk management consulting services that are designed to help them mitigate their exposure to commodity price risk and maximize the amount and certainty of their operating profits. In performing consulting services, we educate our customers

1

as to the commodity risks that they may encounter and how they can use the derivative markets to mitigate those risks. The IRMP forms the basis of our value-added approach, and serves as a competitive advantage in customer

acquisition and retention. We offer our customers access to both exchange-traded and OTC derivative markets, integrating the two platforms into a seamless product offering delivered by our approximately 100 commodity risk management consultants.

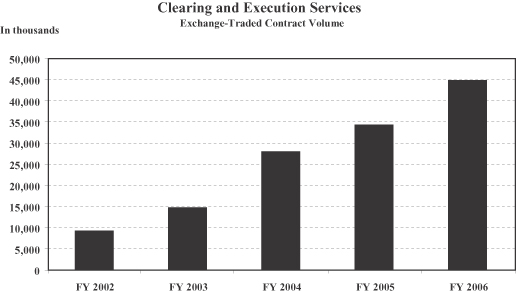

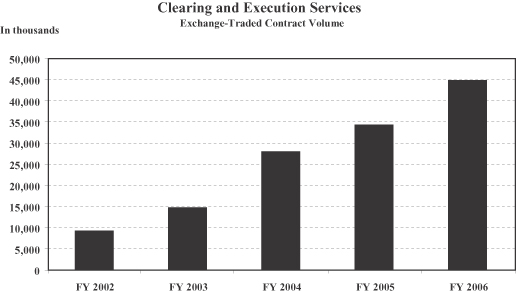

We also offer clearing and execution services to a broad array of participants in exchange-traded futures and options markets including commercial accounts, professional traders, managed futures funds, introducing brokers and retail customers. We are an FCM with clearing-member status at all of the major U.S. commodity futures and options exchanges. As of August 31, 2006, we were the third largest FCM in the U.S., as measured by required customer segregated assets, not affiliated with a major financial institution or commodity producer, intermediary or end-user. Our exchange-traded futures and options transaction volumes have grown from 10.6 million contracts in fiscal year 2002 to 47.5 million contracts in fiscal 2006. As of August 31, 2006, we had $764.8 million in customer segregated assets.

In addition to our Commodity and Risk Management and Clearing and Execution Services segments discussed above, we also operate in two other related business segments. In our Financial Services segment, through FCStone Financial, Inc. and FCStone Merchant Services, LLC, we offer financing and facilitation for our customers with respect to their inventories of physical commodities. FCStone Financial, Inc. offers financing services that help our customers finance physical grain inventories, while FCStone Merchant Services, LLC provides the same services for other commodities. FCStone Merchant Services, LLC also provides financing in transactions where it shares in profits with customers in commodity or commodity-related projects in exchange for financial support.

In the Grain Merchandising segment, we operate through our majority interest in FGDI, LLC. FGDI acts as a grain dealer in the United States and international markets, primarily Asia, Latin America and Canada. It also manages a pool of grain originated by a group of grain elevators in Texas. The primary role of FGDI is to link merchandisers of grain products through our network of industry contacts, serving as an intermediary to facilitate the purchase and sale of grain.

Operating Segments

We operate through a number of wholly-owned and majority-owned subsidiaries with offices and facilities in twelve states, China, Brazil, Canada and Ireland. See Note 18 to our consolidated financial statements for a description of segment financial information. Our principal business activities consist of four operating segments as follows: commodity and risk management services, clearing and execution services, grain merchandising, and financial services.

Commodity and Risk Management Services

The Commodity and Risk Management (“C&RM”) segment is the foundation of our company. Consistent with our original mandate as a cooperative to serve our grain elevator members, we approach middle-market intermediaries, end-users and producers of commodities with the objective of serving as their commodity risk manager. Some of these customers are sophisticated and knowledgeable of the derivative markets and how they operate, understanding the inherent commodity risk of their business and pursuing their own risk management policies. At the same time, many of our customers look for guidance and consulting with regard to their commodity risk exposure and the use of the derivative markets to mitigate that risk.

Within the C&RM segment, we serve customers through a force of approximately 100 risk management consultants with a level of service that maximizes our abilities and the opportunity to retain the customer. Among more sophisticated customers, we provide less in the way of consulting services and focus more on providing a breadth of products and competitive pricing, while among our customers with less experience in the derivative markets, we provide a broad range of consulting services that are demonstrated most clearly in our IRMP. The

2

IRMP is a fee-based commodity risk management consulting service that is based upon a review of our customers’ commodity inputs and outputs in their products and services, with exposures identified and quantified. We use the information obtained in this review to determine commodity exposures and design strategies intended to optimize their profit margins and mitigate our customers’ risks to changing commodity prices. We advise the client through monthly account reviews and an evaluation of existing hedge positions, as well as by review of year-to-date performance of the program.

We believe that our consulting services, including the IRMP, serve as a value-added competitive advantage in the acquisition and development of new customers. We provide our IRMP customers and other risk management consulting customers with assistance in the execution of their hedging strategies through our exchange-traded futures and options clearing and execution operations as well as access to more customized alternatives provided by our OTC trading desk. As our clients increase their knowledge and acceptance of risk management practices, they become more independent in their hedging decision-making and, in some cases, will transition to fully self-directed trading over a three- to five-year period. However, we often continue to provide transactional advice and consulting services to fully self-directed trading customers. Generally, our customers direct their own trading activity and we do not have discretionary authority to transact trades on behalf of our customers.

We maintain an extensive proprietary database of historical price information for each local market in which our customers operate. Local prices tend to react to similar fundamentals each year relative to the benchmark futures prices. Accordingly, these local characteristics can be analyzed and factored into a customer-specific risk analysis. A commodity price hedging program must recognize and account for these local differences because physical commodity prices are often driven by local supply and demand dynamics such as weather, transportation costs and availability, storage and insurance costs. While exchange–traded futures and options prices reflect the world market, local markets are considered to be more relevant to mid-sized commodity users. Therefore, we provide our customers with a tailored program reflective of the market characteristics within which they operate.

Reflective of the local nature of our product, we service our customers through 13 U.S. offices and five international offices. We currently serve approximately 460 customers through our IRMP.

We deliver our consulting services through an experienced force of approximately 100 risk management consultants. The average tenure of our consultants is eight years, while the annual turnover rate has averaged approximately 9% over the past four fiscal years. We maintain a formal training program for our incoming consultant trainees which provides a foundation in the basics of our business, including risk management, futures and options markets, OTC markets, financial statement analysis and derivative accounting. As part of the training process, new consultants apprentice with an experienced risk management consultant for up to two years before independently managing customer relationships.

We organize our marketing efforts into customer industry segments. We currently serve customers in the following areas:

| | • | | Commercial Grain—The commercial grain customer segment represents the foundation of our C&RM Segment, as the roots of our company can be traced back to this business. Within this sector we provide services to grain elevators, traders, processors, manufacturers and end-users. |

| | • | | Energy—The energy customer segment targets companies where energy represents a significant input cost into the production of their product or service. Such customers include producers, refiners, wholesalers, transportation companies, convenience store chains, auto and truck fleet operators, industrial companies, railroads and municipalities. |

| | • | | Introducing Brokers—Introducing Brokers within our C&RM segment include individuals or organizations that maintain relationships with customers and intermediate transactions between the customer and ourselves. The customers within this segment are primarily agricultural producers. |

3

| | • | | Latin America/Brazil—The customers within this customer segment are located predominantly in Mexico and Brazil. Our customers are involved in all sectors of agribusiness, including livestock production and feeding, flour milling and bakery, oilseed crushing and refining, grain merchandising, meat processing and sugar/ethanol production. We believe there are significant opportunities to deepen the penetration of risk management practices within this customer segment in this region. |

| | • | | China—The China customer segment represents both Chinese FCMs as well as commercial companies seeking to hedge their commodity risk exposures. The Chinese FCMs are similar to introducing brokers, facilitating the transactions of their clients in the U.S. commodities markets. The commercial accounts, generally, represent significant processors of grain or other commodities. |

| | • | | Renewable Fuels—The renewable fuels customer segment targets producers of ethanol and biodiesel products, capitalizing on the rapid growth occurring in the alternative fuels industry. |

| | • | | Other—We maintain a number of developing customer segments where the adoption of risk management practices is increasing and our consultative approach is serving as a catalyst to customer adoption. These customer segments currently include customers with risk management needs in the areas of forest products, food services, transportation and weather-related products. In addition, we believe that we are positioned to participate in the development of markets for carbon and emission credits. We have entered into agreements that would, depending on further developments, enable us to market carbon and emission credits generated by third parties and share in the proceeds from sales of such credits. |

Our integrated platform allows our customers, aided by our risk management consultants, to execute and clear commodity futures and options contracts for the purpose of establishing and maintaining their hedge positions through our C&RM segment. Alternatively, we are able to meet more customized hedging needs through our OTC trading desk. Our OTC trading desk, through broad access to commodity market participants as well as major financial institutions, is able to design hedge arrangements that may contain features with respect to contract performance, time period, commodity types, and transaction size that are not achievable in the highly-standardized exchange-traded commodity futures and options markets. Further, our OTC capability has provided an ability to create products that assist our customers, in turn, to offer value-added services to their clients. We believe that we are unique in offering both exchange-traded and OTC products to our middle-market target customers.

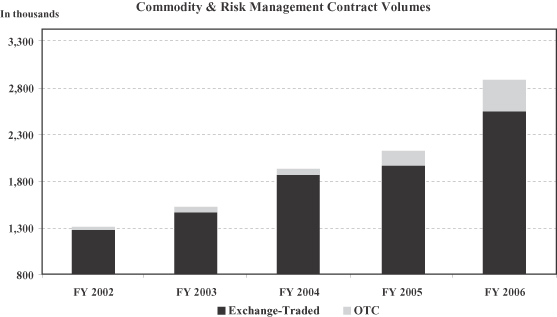

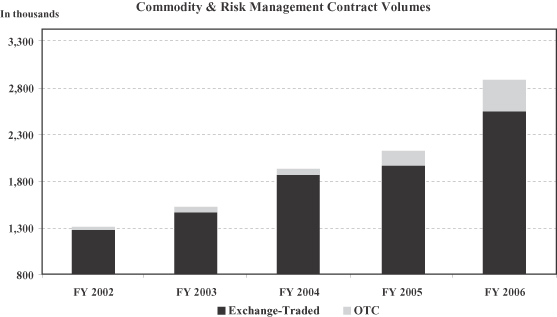

Source: Company Information

4

Within our C&RM business, we have experienced strong growth in contract trading volumes. Since 2002, growth in exchange-traded contract trading and OTC contract trading have both been robust.

In fiscal 2006, the C&RM segment had consolidated income before minority interest and income tax of $21.9 million, an increase of $10.7 million, or 95.5%, from $11.2 million in fiscal 2005. In fiscal 2006, the C&RM segment represented approximately 68% of our consolidated income before minority interest, income tax and corporate overhead.

See Note 18 of the notes to consolidated financial statements for a table showing a summary of the Company’s consolidated revenues by geographic area.

Clearing and Execution Services

We seek to provide economical clearing and execution of exchange-traded futures and options for the institutional and professional trader market segments through the Stone division of our subsidiary, FCStone LLC. Through our platform, we accept customer orders and direct those orders to the appropriate exchange for execution. We then facilitate the clearing of our customers’ transactions. Clearing involves the matching of our customers’ trades with the exchange, the collection and management of margin deposits to support the transactions, and the accounting and reporting of the transactions to our customers. We seek to leverage our capabilities and capacity by offering facilities management or outsourcing solutions to other FCMs.

FCStone LLC is a registered FCM and a clearing member of all major U.S. commodity futures exchanges including the CME, CBOT, NYMEX, COMEX Division of NYMEX, New York Board of Trade (“NYBOT”), Kansas City Board of Trade and the Minneapolis Grain Exchange. We are one of the largest clearing members on the NYBOT and NYMEX as measured by contracts cleared.

We service our customers though a Wholesale Division and a Professional Trading Division:

Wholesale Division. Wholesale division customers generally consist of non-clearing FCMs, introducing brokers and clearing FCMs for which we provide back-office services such as trade processing and accounting. These customers serve as intermediaries to the ultimate customer transacting the futures or options contract.

Professional Trading Division. The professional trading customers consist of retail-oriented introducing brokers, professional traders and floor traders. In this division, we target high-volume users of the futures and options markets. We hold the largest share of the professional floor trader market at the NYBOT and the COMEX Division of NYMEX. Through our retail division, we also target managed futures funds, hedge funds and commodity trading advisors. We believe that this segment of our customer base will benefit from the increasing significance of electronic trading, providing them a greater opportunity to trade across markets and commodities.

5

Source: Company Information

In fiscal 2006, the Clearing and Execution segment had consolidated income before minority interest and income tax of $11.0 million, an increase of $5.8 million, or 111.5%, from $5.2 million in fiscal 2005. In fiscal 2006, the Clearing and Execution Services segment represented approximately 34% of our consolidated income before minority interest, income tax and corporate overhead.

Financial Services

Our Financial Services segment is comprised of FCStone Financial, Inc. and FCStone Merchant Services, LLC. FCStone Financial, Inc. serves as a grain financing and facilitation business through which we lend to commercial grain-related companies against physical grain inventories. We use sale/repurchase agreements to purchase grain evidenced by warehouse receipts at local grain elevators subject to a simultaneous agreement to sell such grain back to the original seller at a later date.

Our activity in FCStone Financial, Inc. led us to develop FCStone Merchant Services, LLC. FCStone Merchant Services serves as a financing vehicle for a number of different commodities, including grain, energy products and renewable fuels. These arrangements can take the form of repurchase agreements or traditional lending arrangements, backed by letters of credit, depending on the risk, underlying commodity and borrower involved in the transaction.

We believe that our commodity risk management, merchandising and transportation expertise, along with our experience in the renewable fuels area, can be applied to the rapidly growing alternative fuels industry. Our presence in these markets and our interest in renewable fuels created an opportunity for us to provide financing to a startup biodiesel company. In fiscal 2006, we loaned $1.5 million to Green Diesel LLC as part of its financing to build a biodiesel production facility to be located in Houston, Texas. The loan included the issuance of warrants exercisable for up to 48% of the equity of Green Diesel. FCStone Merchants Services has discounted the note receivable relative to the value assigned to the warrants, which has been reported in other assets on the consolidated statement of financial condition. The discount is being amortized over the term of the loan agreement as an adjustment of the loan yield through interest income on the consolidated statement of operations. We have also committed to make available, or assist in arranging, a $15 million line of credit to Green Diesel to

6

be secured by all of its assets. The principal use of this line of credit will be to finance raw materials required for production of biodiesel and the storage, blending and sale of the final product. Our commitment is subject to satisfaction of certain conditions, the completion of due diligence and the negotiation of definitive terms acceptable to the parties. Subsequently, Green Diesel decided to raise additional equity in order to build a larger production facility with an annual production capacity of approximately 46 million gallons. In order for us to prevent the dilution of our potential 48% interest in Green Diesel, we invested an additional $2.4 million. Subsequent to August 31, 2006, we loaned an additional $600,000 to Green Diesel to finance the expanded facility. We are not contractually bound to invest additional equity in Green Diesel. We believe the Green Diesel production facility will begin commercial production in early calendar 2007. We continue to explore other avenues to increase our presence in the renewable fuels area.

Grain Merchandising

As a complement to our commodity risk management consulting services, through our majority interest in FGDI we assist our customers and utilize our market contacts to link merchandisers of grain products, serving as an intermediary to facilitate the purchase and sale of physical grain. We maintain a 70% equity interest in FGDI, and AGREX, Inc., a subsidiary of Mitsubishi Corporation, holds the remaining 30% interest.

FGDI’s services help elevators and grain marketers maximize the value of their grain by locating domestic and international buyers and assisting the originator in retaining ownership and margins as far into the marketing pipeline as possible. We consistently offer value-added opportunities for our customers to merchandise their inventories beyond their traditional channels.

In the grain merchandising segment, FGDI earns revenue primarily through the sale of grain which is driven by the volume and price of grain we merchandise.

For the end-users, processors and exporters, FGDI provides a dedicated and efficient method of sourcing the specific type and quality of grain, and assures consistent delivery to match a buyer’s needs. Because FGDI works closely with a wide range of customers, we are able to regularly link customers in mutually beneficial transactions. We manage and operate approximately 1,000 grain rail cars in conjunction with our merchandising program. In fiscal 2006, we merchandised 235.9 million bushels of grain, of which approximately 34.3 million were shipped through our leased facilities located at the port in Mobile, Alabama, primarily to the Asia market.

Regulatory Matters

We are regulated by several governmental agencies and self-regulatory organizations in connection with various aspects of our business. Compliance with these laws and regulations is material to our operations. The following discussion describes the material licenses and registrations that we maintain.

FCStone, LLC is a registered FCM with the CFTC and a member of the NFA, both of which have regulatory authority over our company. FCStone, LLC is also a clearing member of all major U.S. futures exchanges. The CME is its Designated Self-Regulatory Organization for regulatory purposes and performs an annual examination of FCStone, LLC’s activities.

FCStone Investments, Inc., is registered as a commodity pool operator with the NFA and acts as the general partner or managing member of commodity pools. FCStone Advisory, Inc. is registered with the NFA as a commodity trading advisor and provides market commentary.

FCC Futures, Inc., and Westown Commodities, LLC, are guaranteed introducing brokers of FCStone, LLC registered with the NFA.

FCC Investments, Inc. is a registered broker-dealer with the Securities and Exchange Commission (“SEC”) and the National Association of Securities Dealers (“NASD”). FCC Investments, Inc. must file annual Financial and Operational Combined Uniform Single reports with the SEC and is subject to the various rules and regulations of the NASD.

7

FGDI is licensed as a grain dealer in Missouri, North Dakota, South Dakota, Nebraska, Minnesota, Indiana, Michigan, Ohio, Kentucky, Georgia, Alabama and Ontario, Canada. FGDI also has a Canadian Federal License for grain dealing. FGDI is registered as an exporter of grain with the United States Department of Agriculture.

In addition, we are subject to other general legal and regulatory provisions applicable to trading services and commodities dealing.

Sales and Marketing

We have a comprehensive sales and marketing program that is primarily implemented by our staff of risk management consultants. Our risk management consultants are compensated on a commission basis and are responsible for developing new customers and providing services to new and existing customers. Our executive management team also engages in significant sales and marketing activities.

Sales efforts are primarily centered on consulting services and on presenting our ability to obtain and utilize commodity intelligence information to support customer needs and improve customer profitability. Specifically, we emphasize our IRMP, which provides the most comprehensive level of service offered by the Company. Sales efforts are supported by systems, staff and resources, including current commodity information and intelligence systems, communications systems, archives of commodity basis and pricing information and related presentation and analytical tools, marketing materials, an internet web site, advertising, and educational materials.

We engage in direct sales efforts to seek new customers with a strategy of extending our services from our existing customer base to similar customers not yet served and to different kinds of customers that have risk management needs similar to those of our existing customer base. We seek to serve not only those customers that currently use risk management methods, but also those customers that we believe should use risk management methods. We are expanding our services into new business segments and are expanding our services geographically into foreign markets, particularly in Asia, Latin America and Canada.

We stay in regular contact with existing customers to provide commodity information and services, usually on a daily basis, by direct personal contact and by issuing current market commentary by fax or e-mail. We also offer educational programs on risk management methods and regular outlook meetings for our customers as well as the customers of our customers.

Competition

The commodity and risk management industry can generally be classified into four basic types of companies: (1) pure consultants, (2) clearing FCMs providing trade execution but not broad-based consulting services, (3) captive businesses providing consulting and trade execution as divisions of financial institutions or larger commodity-oriented companies, and (4) integrated FCMs providing both consulting and trade execution from an independent platform. As a result, we compete with a large number of smaller firms that focus on personalized service, and a smaller number of large, better capitalized companies that focus less on personalized service but have significant execution capabilities and market presence. We believe that our C&RM segment, which operates as an integrated FCM, serves the needs of middle market companies that require both the personalized consulting services provided by our risk management consultants and the trade execution services that we offer as an FCM.

We compete with a large number of firms in the exchange-traded futures and options execution sector and in the OTC derivatives sector. We compete primarily on the basis of price and value of service. Our competitors in the exchange-traded futures and options sector include international brokerage firms, national brokerage firms, regional brokerage firms (both cooperatives and non-cooperatives) as well as local introducing brokers, with competition driven by price level and quality of service. Many of these competitors offer OTC trading programs as well. In addition, there are a number of financial firms and physical commodities firms that participate in the

8

OTC markets, both directly in competition with us and indirectly through firms like us. We compete in the OTC market by making specialized OTC transactions available to our customers in contract sizes smaller than those usually available from major counter-parties.

In the Financial Services segment we compete with traditional lenders, including banks and asset-based lenders. In addition, we also compete with specialized investment groups that seek to earn an investment return based on commodities transactions. We compete on price and service and by managing commodity risks that traditional lenders may seek to avoid. We are an extremely small participant in the financial services industry, which consists of a very large number of large and small firms. We do not attempt to compete generally in this industry. Rather, we focus our energies on filling a specific niche of supporting commodities transactions.

The grain merchandising segment competes for both the purchase and sale of grain. Competition is intense and profit margins are low. Our major competitors have substantially greater financial resources than those available to us, but we believe that our relationships, primarily with cooperative customers, give us a broad origination capability. Competition for grain sales is based on price, services and ability to provide the desired quantity and quality of grains. Our grain merchandising operations compete with numerous larger grain merchandisers, including major grain merchandising companies such as Archer-Daniels-Midland Co., Cargill, Incorporated, CHS Inc., ConAgra Foods, Inc., Bunge Ltd., and Louis Dreyfus Group, each of which handles grain volumes of more than one billion bushels annually.

Technology

We utilize front-end electronic trading, mid office, back office and accounting systems that process transactions on a daily basis. These systems are integrated to provide recordkeeping, trade reporting to exchange clearing, internal risk controls, and reporting to government entities, corporate managers, risk managers and customers. Our futures back office system is maintained by a service bureau which is located in Chicago with a disaster recovery site in New York. All other systems are maintained in our West Des Moines headquarters data center and system backups are stored off-site.

All of these systems are accessed through a wide area network. All systems are protected by a firewall and require proper security authorization for access. Our wide area network is managed by a service bureau which has redundant data facilities in Kansas City. We are currently building a disaster recovery plan to utilize the West Des Moines and Kansas City data centers to house redundant systems.

Our risk managers access market information from network-based software systems. Market information includes real-time quotes, market history (futures/cash), news and commentaries. Market information also includes our historic database of market pricing and trend information used in the IRMP. This information is used to analyze the markets to help risk managers determine the best strategy for a customer to minimize risk and maximize profit margins, especially when used in conjunction with the IRMP.

We use the RISC back office trade system to process exchange-traded futures and options trades. We also commenced use of the KIODEX and a proprietary back office trade system to process OTC/derivative trades beginning in fiscal 2007. We use Globex, Clearport, eAcess, CQ, Transact, TT, RANorder and PATS electronic trading/order routing platforms.

Employees

As of August 31, 2006, we employed 424 people. This total is broken down by business segment as follows: C&RM had 194 employees; Clearing and Execution Services had 114 employees; Financial Services had 2 employees; Grain Merchandising had 82 employees; and Corporate had 32 employees. We believe our relationship with our employees is good, and we have not suffered any work stoppages or labor disputes. None of our employees operate under a collective bargaining agreement. Many of our employees are subject to employment agreements. It is our current policy to obtain an employment agreement containing noncompetition provisions from each risk management consultant.

9

Item 1A. Risk Factors

Our business depends on commodity market and general economic conditions. We generate significant revenues from commissions and clearing fees we earn from executing and clearing customer orders, fees for providing commodity risk management consulting services and interest income we earn on cash balances in our customers’ accounts. These revenue sources are substantially dependent on customer trading volumes, interest rates and related services and activities. The volume of transactions our customers conduct with us, interest rates and demand for our related services and activities are directly affected by domestic and international commodity market and economic conditions that are beyond our control, including:

| | • | | commodity market conditions, such as price levels and volatility, |

| | • | | concerns about terrorism and war, |

| | • | | the level and volatility of interest rates, |

| | • | | availability and cost of funding and capital, |

| | • | | credit capacity or perceived creditworthiness of the futures industry in the marketplace, |

| | • | | legislative and regulatory changes, and |

| | • | | currency values and changes in government monetary policies. |

Declines in the volume of trading in the markets in which we operate generally result in lower revenue from our most profitable segments, which would adversely affect our profitability.

Our revenue depends on trading volume which depends in large part on commodity prices and commodity price volatility. Trading volume is driven largely by the degree of volatility—the magnitude and frequency of fluctuations—in prices of commodities. Higher volatility increases the need to hedge contractual price risk and creates opportunities for arbitrage trading. Energy commodities markets historically, and agricultural commodities markets periodically, have experienced significant price volatility. In addition to price volatility, increases in commodity prices lead to increased trading volume. As prices of commodities have risen, especially energy prices, new participants have entered the markets to address their growing risk-management needs or to take advantage of greater trading opportunities. Sustained periods of stability in the prices of commodities or generally lower prices could result in lower trading volumes and, potentially, lower revenues.

Factors that are particularly likely to affect price volatility and price levels of commodities include:

| | • | | supply and demand of commodities; |

| | • | | weather conditions affecting certain commodities; |

| | • | | national and international economic and political conditions; |

| | • | | perceived stability of commodities and financial markets; |

| | • | | the level and volatility of interest rates and inflation; and |

| | • | | financial strength of market participants. |

Any one or more of these factors may reduce price volatility or price levels in the markets for commodities trading, which in turn could reduce trading activity in those markets. Moreover, any reduction in trading activity could reduce liquidity which in turn could further discourage existing and potential market participants and thus accelerate any decline in the level of trading activity in these markets.

Decreases in short-term interest rates would negatively impact our profitability.The level of prevailing short-term interest rates affects our profitability because a portion of our revenue is derived from interest earned

10

from the investment of funds deposited with us by our customers. Our financial performance generally benefits from rising interest rates. Rising interest rates increase the amount of interest income earned from these customer deposits. If short-term interest rates fall, our revenues derived from interest will decline which would negatively impact our profitability.

Short-term interest rates are highly sensitive to factors that are beyond our control, including general economic conditions and the policies of various governmental and regulatory authorities. In particular, decreases in the federal funds rate by the Board of Governors of the Federal Reserve System usually lead to decreasing interest rates in the U.S., which generally lead to a decrease in short-term interest rates.

Our customers are concentrated in the agricultural sector and related industries and we are therefore particularly subject to government policies and regulations affecting those industries.We do a substantial amount of business with companies in the agricultural sector and related industries. Economic forces, including agricultural commodity, energy and financial markets, as well as government policies and regulations affecting the agricultural sector and related industries could adversely affect our operations and profitability. Agricultural production and trade flows are significantly affected by government policies and regulations. Governmental policies affecting the agricultural industry, such as taxes, tariffs, duties, subsidies and import and export restrictions on agricultural commodities and commodity products, can influence industry profitability, the planting of certain crops versus other uses of agricultural resources, the location and size of crop production, whether unprocessed or processed commodity products are traded and the volume and types of imports and exports.

Many of our customers and much of our expected growth are in the energy and related renewable fuels industries and our revenues could decline as a result of adverse developments in these industries.Many of our current customers and much of our expected growth are in the energy and related renewable fuels industries. Energy prices and energy price volatility are affected by local, regional and global events and conditions that affect supply and demand for the relevant energy-related commodity. Adverse developments in the energy markets could adversely affect the operations and profitability of our customers in these industries, which could adversely affect demand for our commodity risk management services in this area and our revenues. The renewable fuels industry is a developing industry that involves a high degree of risk. Generally, renewable fuel production is profitable as long as energy prices remain at relatively high levels and feed stocks are readily available at acceptable price and volume levels. In addition, government subsidies of the renewable fuel industry and favorable environmental regulations are critical to the industry’s profitability at this time. The renewable fuels industry is currently in a period of rapid expansion, and there can be no assurance that such expansion will continue or that such expansion will not result in reduced prices and profit margins in the industry. We enter into long-term supply contracts with renewable fuel producers, which creates potential credit risk with respect to the obligations of those producers, particularly if the producers become less profitable.

We are exposed to the credit risk of our customers and counterparties and their failure to meet their financial obligations could adversely affect our business.Each segment of our business is subject to credit risk. Over-the-counter derivative transactions are subject to credit risks, which is the risk that a counterparty will fail to perform its obligations when due. Customers and counterparties that owe us money, securities or other assets may default on their obligations to us due to bankruptcy, lack of liquidity, operational failure or other reasons.

As a clearing broker, we act on behalf of our customers for all trades consummated on exchanges. Accordingly, we are responsible for our customers’ obligations with respect to these transactions, which exposes us to significant credit risk. A substantial part of our working capital is at risk if customers default on their obligations to us and their account balances and security deposits are insufficient to meet all of their obligations.

Our grain merchandising business is also subject to credit risk for the failure of counterparties to meet their financial obligations. These counterparties may, in some instances, be in international markets, which may complicate collection efforts.

11

Our financial service activities, which primarily relate to financial accommodations to customers used to acquire and carry commodities, expose us to substantial credit risks due to possible defaults or nonperformance of our customers.

Although we have procedures for reviewing credit exposures to specific customers and counterparties to address present credit concerns, default risk may arise from events or circumstances that are difficult to detect or foresee including rapid changes in commodity price levels. Some of our risk management methods depend upon the evaluation of information regarding markets, clients or other matters that are publicly available or otherwise accessible by us. That information may not, in all cases, be accurate, complete, up-to-date or properly evaluated. In addition, concerns about, or a default by, one institution could lead to significant liquidity problems, losses or defaults by other institutions, which in turn could adversely affect us. We may be materially and adversely affected in the event of a significant default by our customers and counterparties.

We face substantial competition that could negatively impact our revenues and our profitability.The commodity risk management industry and the broader financial services industry are very competitive and we expect competition to continue to intensify in the future. Many of the companies with which we compete are better capitalized than we are and have greater financial, technical, marketing and other resources than we have. Our primary competitors include both large, diversified financial institutions and commodity-oriented businesses, smaller firms that focus on specific products or regional markets and independent futures commission merchants (“FCMs”). As a result, we compete with a large number of smaller firms that focus on personalized service, and a smaller number of larger, better capitalized companies that focus less on personalized service but have significant execution capabilities and market presence.

Some of our competitors offer a wider range of services, have broader name recognition and have larger customer bases than we do. Some of them may be able to respond more quickly to new or evolving opportunities, technologies and customer requirements than we can, and may be able to undertake more extensive marketing activities. If we are not able to compete successfully in the future, our business, financial condition and results of operations would be adversely affected.

We have experienced intense price competition in our clearing and execution business in recent years. Some competitors may offer clearing and execution services to customers at lower prices than we are offering, which may force us to reduce our prices or to lose market share and revenue. In addition, we focus on developing and marketing complex strategies to our clients that are specifically designed to address their commodity risk management or merchandising needs, or the needs of their customers. As the market adopts these strategies, competitors may have the ability to replicate our services. As a result, the need for our services in relation to these strategies could be significantly reduced.

Until recently we operated as a member-owned cooperative and have a limited operating history as a business corporation. Accordingly, our historical and recent financial and business results may not be representative of what they may be in the future.Prior to 2005, we operated as a member-owned cooperative operating for the benefit of our members and our business strategy was focused on providing services to our members at a reasonable cost. Since 2005, we have operated our business for the long-term benefit of our stockholders and our business strategy is designed to maximize revenue and profitability. We have a limited operating history as a business corporation on which you can evaluate our management decisions, business strategy and financial results. As a result, our historical financial and business results may not be representative of what they may be in the future. We are subject to risks, uncertainties, expenses and difficulties associated with changing and implementing our business strategy.

Future growth could strain our personnel and infrastructure resources.We anticipate a period of significant growth, which we expect to place a strain on our administrative, financial and operational resources. Our ability to manage growth effectively will require us to improve existing, and implement additional, operational, financial and management controls and reporting systems and procedures. We will also be required to identify, hire and train additional risk management consultants as well as administrative staff. We cannot

12

assure you that we will be able to improve or implement such controls, systems and procedures in an efficient and timely manner or that they will be adequate to support our future operations. Furthermore, we may not be able to identify, hire and train sufficient personnel to accommodate our growth. If we are unable to manage growth effectively, maintain our service or if new personnel are unable to achieve performance levels, our business, operating results, prospects and financial condition could be materially adversely affected.

Our business could be adversely affected if we are unable to retain our existing customers or attract new customers.The success of our business depends, in part, on our ability to maintain and increase our customer base. Customers in our market are sensitive to, among other things, the costs of using our services, the quality of the services we offer, the speed and reliability of order execution and the breadth of our service offerings and the products and markets to which we offer access. We may not be able to continue to offer the pricing, service, speed and reliability of order execution or the service, product and market breadth that customers desire. In addition, once our commodity risk management consulting customers have become better educated with regard to sources of commodity risk and the tools available to facilitate the management of this risk and we have provided them with recommended hedging strategies, they may no longer continue paying monthly fees for these services. Furthermore, our existing customers, including Integrated Risk Management Program (“IRMP”) customers, generally are not obligated to use our services and can switch providers of clearing and execution services or decrease their trading activity conducted through us at any time. As a result, we may fail to retain existing customers or be unable to attract new customers. Our failure to maintain or attract customers could have a material adverse effect on our business, financial condition and operating results.

We rely on relationships with introducing brokers for obtaining some of our customers. The failure to maintain these relationships could adversely affect our business.We have relationships with introducing brokers who assist us in establishing new customer relationships and provide marketing and customer service functions for some of our customers. These introducing brokers receive compensation for introducing customers to us. Many of our relationships with introducing brokers are non-exclusive or may be cancelled on relatively short notice. In addition, our introducing brokers have no obligation to provide new customer relationships or minimum levels of transaction volume. Our failure to maintain these relationships with these introducing brokers or the failure of these introducing brokers to establish and maintain customer relationships would result in a loss of revenues, which could adversely affect our business.

We are dependent on our management team, and the loss of any key member of our team may prevent us from executing our business strategy effectively.Our future success depends, in large part, upon our management team who possess extensive knowledge and management skills with respect to commodity risk management. The unexpected loss of services of any of our executive officers could adversely affect our ability to manage our business effectively or execute our business strategy. Although these officers have employment contracts with us, they are generally not required to remain with us for a specified period of time. In addition, we do not maintain key-man life insurance policies on any of our executive officers.

Competition for risk management consultants could result in our being unable to attract and retain the highly skilled risk management consultants that we need to support our business or we may be required to incur additional expense to do so.We strive to provide high-quality risk management consulting and execution services that allow us to establish and maintain long-term relationships with our clients. Our ability to continue to provide these services, maintain these relationships and expand our business depends, in large part, upon our risk management consultants. As a result, we must attract and retain highly qualified personnel. Competition for the services of consultants is intense, especially for people with extensive experience in the specialized markets in which we participate or may seek to enter. If we are unable to hire highly qualified people, we may not be able to enter new markets or develop new products. If we lose one or more of our risk management consultants in a particular market in which we participate, our revenues may decrease and we may lose market share in that particular market.

In addition, recruitment and retention of qualified personnel could require us to pay sign-on or guaranteed bonuses or otherwise increase our employee costs. These additional costs could adversely affect our profitability.

13

We operate in a highly regulated industry and we may face restrictions with respect to the way we conduct certain of our operations.Our businesses, and the commodity brokerage industry generally, are subject to extensive regulation at the federal level. These regulations are designed to protect the interests of the investing public generally rather than our stockholders. Self-regulatory organizations, including the National Futures Association (the “NFA”) and the Chicago Mercantile Exchange (the “CME”) (our designated self-regulatory organization), require compliance with their extensive rules and regulations. The Commodity Futures Trading Commission (the “CFTC”) and other federal agencies extensively regulate the U.S. futures and commodities industry. Our grain merchandising business is also subject to state regulation of grain dealers and federal regulation by the U.S. Department of Agriculture and the Food and Drug Administration.

Some aspects of our business are subject to extensive regulation, including:

| | • | | the way we deal with and solicit clients, |

| | • | | financial and reporting practices, |

| | • | | required record keeping and record retention procedures, |

| | • | | the licensing of our operating subsidiaries and our employees, |

| | • | | the conduct of directors, officers, employees and affiliates, |

| | • | | systems and control requirements, |

| | • | | restrictions on marketing, and |

| | • | | client identification and anti-money laundering requirements. |

Failure to comply with any of the laws, rules or regulations of any federal, state or self-regulatory authority could result in a fine, injunction, suspension or expulsion from the industry, which could materially and adversely impact us.

We and our employees, including our officers, may be subject to censure, fines, suspensions or other sanctions which may have a material and adverse impact on our business. Even if any sanction does not materially affect our financial position or results of operations, our reputation could be harmed.

The government agencies that regulate us have broad powers to investigate and enforce compliance and punish noncompliance with their rules, regulations and industry standards of practice. We or our directors, officers and employees may not comply with the rules and regulations of, and may be subject to claims or actions by, these agencies. In addition, because our industry is heavily regulated, regulatory approval may be required prior to expansion of business activities. We may not be able to obtain the necessary regulatory approvals for any desired expansion. Even if approvals are obtained, they may impose restrictions on our business or we may not be able to continue to comply with the terms of the approvals or applicable regulations. The implementation of unfavorable regulations or unfavorable interpretations of existing regulations by courts or regulatory bodies could require us to incur significant compliance costs or cause the development or continuation of business activities in affected markets to become impractical.

Changes in legislation or regulations may affect our ability to conduct our business or reduce our profitability.The legislative and regulatory environment in which we operate has undergone significant change in the past and may undergo significant change again in the future. The federal government, the CFTC, the Securities and Exchange Commission (the “SEC”), the CME, the NFA and other U.S. or foreign governmental authorities continuously review legislative and regulatory initiatives and may adopt new or revised laws and regulations. These legislative and regulatory initiatives may affect the way in which we conduct our business and may make our business less profitable. Changes in the interpretation or enforcement of existing laws and regulations by those entities may also adversely affect our business.

14

We are subject to a risk of legal proceedings, which may result in significant losses to us that we cannot recover.Many aspects of our business subject us to substantial risk of potential liability to customers and to regulatory enforcement proceedings by federal and other regulators. These risks include, among others, potential civil litigation triggered by regulatory investigations, potential liability from disputes over terms of a trade, the claim that a system failure or delay caused monetary losses to a customer, that we entered into an unauthorized transaction or that we provided materially false or misleading statements in connection with a transaction. Dissatisfied clients can make claims against us, including claims for negligence, fraud, unauthorized trading, failure to supervise, breach of fiduciary duty, employee errors, intentional misconduct, unauthorized transactions by associated persons and failures in the processing of transactions. These risks also include potential liability from disputes over the exercise of our rights with respect to customer accounts and collateral. Although our customer agreements generally provide that we may exercise such rights with respect to customer accounts and collateral as we deem reasonably necessary for our protection, our exercise of these rights could lead to claims by customers that we have exercised these rights improperly.

Additionally, employee misconduct could subject us to financial losses and regulatory sanctions and could seriously harm our reputation and negatively affect our business. It is not always possible to deter employee misconduct and the precautions taken to prevent and detect employee misconduct may not always be effective. Misconduct by employees could include engaging in unauthorized transactions or activities, failure to properly supervise other employees, engaging in improper or unauthorized activities on behalf of clients or improperly using confidential information. We cannot assure you that these types of proceedings will not materially and adversely affect us.

Employee errors, including mistakes in executing, recording or reporting transactions for clients, could cause us to enter into transactions that clients may disavow and refuse to settle, which could expose us to the risk of material losses until the errors are detected and the transactions are unwound or reversed. If our clients are not able to settle their transactions on a timely basis, the time in which employee errors are detected may be increased and our risk of material loss can be increased. The risk of employee error or miscommunication may be greater for products that are new or have non-standardized terms.

Misconduct by employees of our customers in dealing with us can also expose us to claims for financial losses or regulatory proceedings when it is alleged we or our employees knew or should have known that the employee of the customer was not authorized to undertake certain transactions.

In addition to the foregoing financial costs and risks associated with potential liability, the defense of litigation includes increased costs associated with attorneys’ fees. The amount of outside attorneys’ fees incurred in connection with the defense of litigation could be substantial and might materially and adversely affect our results of operations for any reporting period.

Our compliance and risk management methods might not be effective, which could increase the risk that we are subject to regulatory action or litigation or otherwise negatively impact our business.Our ability to comply with applicable laws, rules and regulations is largely dependent on our establishment and maintenance of compliance, audit and reporting systems, as well as our ability to attract and retain qualified compliance and other risk management personnel. If we fail to effectively establish and maintain such compliance and reporting systems or fail to attract and retain personnel who are capable of designing and operating such systems, it will increase the likelihood that we will become subject to legal and regulatory infractions, including civil litigation and investigations by regulatory agencies.

For us to avoid a number of risks inherent in our business, it is necessary for us to have polices and procedures that identify, monitor and manage our risk exposure. Management of operational, legal and regulatory risk requires, among other things, policies and procedures to record properly and verify a large number of transactions and events. Such policies may not be fully effective. Some of our risk management policies and procedures depend upon evaluation of information regarding markets, customers or other matters that are publicly available or otherwise accessible by us. That information may not in all cases be accurate, complete,

15

up-to-date or properly evaluated. Further, our risk management policies and procedures rely on a combination of technical and human controls and supervision, which are subject to error and failure. Some of our risk management policies and procedures are based on internally developed controls and observed historical market behavior and also involve reliance on industry standard practices. These policies and procedures may not adequately prevent future losses, particularly as they relate to extreme market movements, which may be significantly greater than comparable historical movements. We may not always be successful in monitoring or evaluating the risks to which we are or may be exposed. If our risk management efforts are ineffective, we could suffer losses that could have a material adverse effect on our financial condition or operating results.

We operate as a principal in the OTC derivatives markets which involves the risks associated with commodity derivative instruments.We offer OTC derivatives to our customers in which we act as a principal counterparty. We endeavor to simultaneously offset the commodity price risk of the instruments by establishing corresponding offsetting positions with commodity counterparties. To the extent that we are unable to simultaneously offset an open position or the offsetting transaction is not fully effective to eliminate the commodity derivative risk, we have market risk exposure on these unmatched transactions. Our exposure varies based on the size of the overall positions, the terms and liquidity of the instruments brokered, and the amount of time the positions remain open.

To the extent an unhedged position is not disposed of intra-day, adverse movements in the commodities underlying these positions or a downturn or disruption in the markets for these positions could result in a substantial loss. In addition, any principal gains and losses resulting from these positions could on occasion have a disproportionate effect, positive or negative, on our financial condition and results of operations for any particular reporting period.

Transactions involving OTC derivative contracts may be adversely affected by fluctuations in the level, volatility, correlation or relationship between market prices, rates, indices and/or other factors. These types of instruments may also suffer from illiquidity in the market or in a related market.

OTC derivative transactions are subject to unique risks.OTC derivative transactions are subject to the risk that, as a result of mismatches or delays in the timing of cash flows due from or to counterparties in OTC derivative transactions or related hedging, trading, collateral or other transactions, we or our counterparty may not have adequate cash available to fund its current obligations.

We could incur material losses pursuant to OTC derivative transactions because of inadequacies in or failures of our internal systems and controls for monitoring and quantifying the risk and contractual obligations associated with OTC derivative transactions and related transactions or for detecting human error, systems failure or management failure.

OTC derivative transactions may be modified or terminated only by mutual consent of the original parties and subject to agreement on individually negotiated terms. Accordingly it may not be possible to modify, terminate or offset obligations or exposure to the risk associated with a transaction prior to its scheduled termination date.

We are subject to regulatory capital requirements and failure to comply with these rules would significantly harm our business.The CFTC and various other self-regulatory organizations have stringent rules with respect to the maintenance of specific levels of net capital by our FCM subsidiary. Failure to maintain the required net capital may subject a firm to limitations on its activities, including suspension or revocation of its registration by the CFTC and suspension or expulsion by the NFA, various exchanges of which our FCM subsidiary is a member and ultimately may require its liquidation. Failure to comply with the net capital rules could have material and adverse consequences such as limiting our operations, or restricting us from withdrawing capital from our FCM subsidiary.

If these net capital rules are changed or expanded, or if there is an unusually large charge against net capital, operations that require the intensive use of capital would be limited. Also, our ability to withdraw capital from

16

our regulated subsidiaries is subject to restrictions, which in turn could limit our ability to pay dividends, repay debt and redeem or purchase shares of our common stock. A large operating loss or charge against net capital could adversely affect our ability to expand or even maintain our present levels of business, which could have a material adverse effect on our business. We cannot predict our future capital needs or our ability to obtain additional financing.

We are subject to margin funding requirements on short notice; failure to meet such requirements would significantly harm our business.Our business involves establishment and carrying of substantial open positions for customers on futures exchanges and in the OTC derivatives markets. We are required to post and maintain margin or credit support for these positions. Although we collect margin or other deposits from our customers for these positions, significant adverse price movements can occur which will require us to post margin or other deposits on short notice, whether or not we are able to collect additional margin or credit support from our customers. Although we maintain borrowing facilities for the purpose of funding margin and credit support and have systems to endeavor to collect margin and other deposits from customers on a same-day basis, there can be no assurance that these facilities and systems will be adequate to eliminate the risk of margin calls in the event of severe adverse price movements affecting open positions of our customers.

We must obtain and maintain credit facilities to operate; failure to maintain such facilities would require curtailment of our operations and result in losses.We are substantially dependent on credit facilities for liquidity and operational funding as well as to insure the availability of sufficient regulatory capital at our subsidiaries. These credit facilities are necessary in order to meet immediate margin funding requirements, to fund and carry ownership in cash commodities, and to maintain positions required for our own risk management position in futures and OTC markets. If our credit facilities are unavailable or insufficient to support our level of business activities, we may need to raise additional funds externally, either in the form of debt or equity. If we cannot raise additional funds on acceptable terms, we may not be able to develop or enhance our business, take advantage of future opportunities or respond to competitive pressure or unanticipated requirements.

Our international operations involve special challenges that we may not be able to meet, which could adversely affect our financial results.We engage in a significant amount of business with customers in Asia, Latin America and Canada, as well as other international markets. Certain additional risks are inherent in doing business in international markets, particularly in a regulated industry. These risks include:

| | • | | the inability to manage and coordinate the various regulatory requirements of multiple jurisdictions that are constantly evolving and subject to unexpected change, |

| | • | | tariffs and other trade barriers, |

| | • | | difficulties in recruiting and retaining personnel, and managing international operations, |

| | • | | difficulties of debt collection in foreign jurisdictions, |

| | • | | potentially adverse tax consequences, and |

| | • | | reduced protection for intellectual property rights. |

Our operations are also subject to the political, legal and economic risks associated with politically unstable and less developed regions of the world, including the risk of war and other international conflicts and actions by governmental authorities, insurgent groups, terrorists and others. Specifically, we conduct business in countries whose currencies may be unstable. Future instability in such currencies or the imposition of governmental or regulatory restrictions on such currencies could impede our foreign exchange business and our ability to collect on collateral held in such currencies.

In addition, we are required to comply with the laws and regulations of foreign governmental and regulatory authorities of each country in which we conduct business. These may include laws, rules and regulations, including registration requirements. Our compliance with these laws and regulations may be difficult and time consuming and may require significant expenditures and personnel requirements, and our failure to be in

17

compliance would subject us to legal and regulatory liabilities. We have customers in numerous countries around the world in which we are not registered. As a result, we may become subject to the regulatory requirements of those countries. We may also experience difficulty in managing our international operations because of, among other things, competitive conditions overseas, established domestic markets, language and cultural differences and economic or political instability. Any of these factors could have a material adverse effect on the success of our international operations or limit our ability to grow our international operations and, consequently, on our business, financial condition and operating results.

Although most of our international business is settled in U.S. dollars, our international operations also expose us to the risk of fluctuations in currency exchange rates. Our risk management strategies relating to exchange rates may not prevent us from suffering losses that would adversely affect our financial condition or results of operations.

If we are unable to manage any of these risks effectively, our business could be adversely affected.

We buy and sell agricultural commodities and agricultural commodity products in our business, the demand for which can be affected by weather, disease and other factors beyond our control.Weather conditions, disease and other factors have historically caused volatility in the agricultural commodities industry and consequently in our operating results by causing crop failures or significantly reduced or increased harvests, which can affect the supply and pricing of the agricultural commodities that we buy and sell in our business, reduce the demand for our fertilizer products and negatively affect the creditworthiness of our customers and suppliers. Reduced supply of agricultural commodities due to weather-related factors could adversely affect our profitability in the future.

Our grain merchandising activities involve numerous business risks.Our grain merchandising activities depend on our ability to earn a margin on bushels of grain purchased and sold. We can incur losses if the sale price, after taking into account hedge gains and losses, is less than the purchase price, if the purchase price cannot be collected or if there are uncovered losses relating to physical quality or uncovered risk of casualty losses. We attempt to mitigate the losses by appropriate policies and practices, but there can be no assurance that such efforts will be sufficient to avoid losses.

Our financial services activities involve substantial operational risk.We are exposed to various kinds of operational risks relating to the underlying commodities that form the basis of our financial services transactions. Losses in and to these commodities, which could be caused by fraud, misappropriation or other uninsured loss, could cause loss to us. Many of our financial services transactions depend on documents of title issued to, or held by, us. If such documents were invalid or not fully enforceable, it could cause a material loss. There are government programs that back grain warehouse receipts, but these could be inadequate to fully reimburse us for the value of grain evidenced by our warehouse receipts in the event of the business failure of the issuer of the receipt.

Computer systems failures, capacity constraints and breaches of security could increase our operating costs and cause us to lose clients.We are heavily dependent on the capacity and reliability of the computer and communications systems supporting our operations, whether owned and operated internally or by third parties. We receive and process a large portion of our trade orders through electronic means, such as through public and private communications networks. These computer and communications systems and networks are subject to performance degradation or failure from any number of reasons, including loss of power, acts of war or terrorism, human error, natural disasters, fire, sabotage, hardware or software malfunctions or defects, computer viruses, intentional acts of vandalism, customer error or misuse, lack of proper maintenance or monitoring and similar events. Our systems, or those of our third party providers, may fail or operate slowly, causing one or more of the following:

| | • | | unanticipated disruptions in service to our clients, |

18

| | • | | delays in our clients’ trade execution, |

| | • | | failed settlement of trades, |

| | • | | decreased client satisfaction with our services, |

| | • | | incomplete, untimely or inaccurate accounting, recording, reporting or processing of trades, |

| | • | | litigation or other client claims, and |

The occurrence of degradation or failure of the communications and computer systems on which we rely may lead to financial losses, litigation or arbitration claims filed by or on behalf of our customers and regulatory investigations and sanctions, including by the CFTC, which require that our trade execution and communications systems be able to handle anticipated present and future peak trading volumes. Any such degradation or failure could also have a negative effect on our reputation, which in turn could cause us to lose existing customers to our competitors or make it more difficult for us to attract new customers in the future. Further, any financial loss that we suffer as a result of such degradations or failures could be magnified by price movements of contracts involved in transactions impacted by the degradation or failure, and we may be unable to take corrective action to mitigate any losses we suffer.