UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

FCStone Group, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

December 7, 2007

Dear Stockholder:

You are invited to attend the annual meeting of stockholders of FCStone Group, Inc. to be held on Thursday, January 10, 2008, at 9:00 a.m. local time, in the Kansas City Airport Hilton located at 8801 N.W. 112th Street, Kansas City, Missouri.

The business to be conducted at the meeting is described in the accompanying notice of annual meeting and proxy statement. At this year’s meeting, the agenda includes the election of four Class II directors and a proposal to ratify the selection of our independent registered public accounting firm. In addition, there will be an opportunity to meet with members of senior management and review the business and operations of our company.

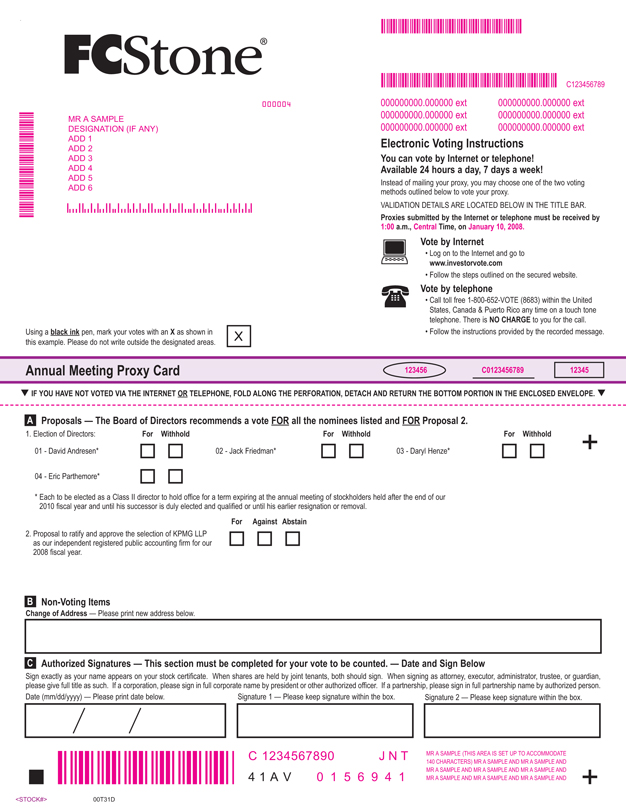

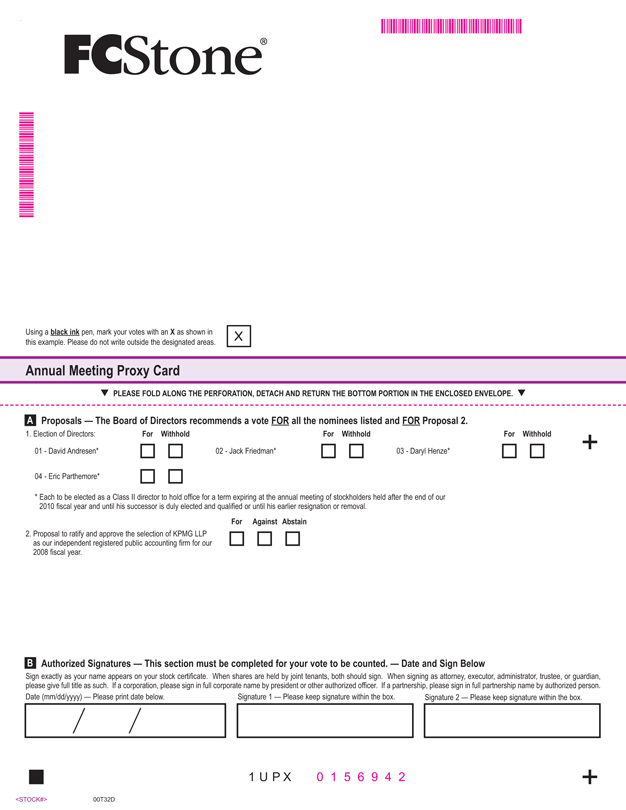

Your vote is important. Whether or not you plan to attend the meeting, please cast your vote as soon as possible. Generally, you may vote by telephone, by Internet, or by completing, signing and returning the enclosed proxy card or voting instruction form. Specific voting instructions appear on the enclosed proxy card or voting instruction form.

I appreciate your continued interest in and support of our company.

Very truly yours,

FCSTONE GROUP, INC.

Paul G. Anderson

Chief Executive Officer

FCSTONE GROUP, INC.

10330 N.W. Prairie View Road

Kansas City, Missouri 64153

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JANUARY 10, 2008

You hereby are notified that the annual meeting of stockholders of FCStone Group, Inc., a Delaware corporation, will be held on Thursday, January 10, 2008, at 9:00 a.m. local time, in the Kansas City Airport Hilton located at 8801 N.W. 112th Street, Kansas City, Missouri, for the following purposes:

| | 1. | To elect four Class II directors to hold office for a term expiring at the annual meeting of stockholders held after the end of our 2010 fiscal year and until their respective successors are duly elected and qualified or until their respective earlier resignation or removal; |

| | 2. | To consider and act upon ratification and approval of the selection of KPMG LLP as our independent registered public accounting firm for our 2008 fiscal year; and |

| | 3. | To consider and act upon any other matters which may properly come before the annual meeting of stockholders or any adjournment thereof. |

The proposals referred to above are more fully described in the accompanying proxy statement. Our board of directors has approved the proposals and recommends that you vote “FOR” the election of each nominee for director named in the accompanying proxy statement and “FOR” the ratification and approval of KPMG LLP as our independent registered public accounting firm. Before voting, you should carefully review all of the information contained in the accompanying proxy statement.

Our board of directors has fixed the close of business on November 21, 2007 as the record date for the determination of the holders of our common stock entitled to notice of, and to vote at, the annual meeting of stockholders or any adjournment thereof. Our board of directors solicits you to give your proxy to vote at the annual meeting by following the specific voting instructions appearing on the enclosed proxy card or voting instruction form, regardless of whether you intend to attend the meeting.

BY ORDER OF THE BOARD OF DIRECTORS,

David A. Bolte

Secretary

December 7, 2007

Kansas City, Missouri

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE FOLLOW THE SPECIFIC VOTING INSTRUCTIONS APPEARING ON THE ENCLOSED PROXY CARD OR VOTING INSTRUCTION FORM AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING.

FCSTONE GROUP, INC.

10330 N.W. Prairie View Road

Kansas City, Missouri 64153

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

Although we encourage you to read this proxy statement in its entirety, we include this question and answer section to provide some background information and brief answers to several questions you might have about the annual meeting.

Why am I receiving these materials?

The board of directors of FCStone Group, Inc. is providing these materials to you in connection with our annual meeting of stockholders. This proxy statement, the notice of annual meeting of stockholders and the accompanying form of proxy or voting instruction form were first sent to our stockholders on or about December 7, 2007. As a stockholder of our company, you are entitled and encouraged to vote on the items of business described in these proxy materials. Your vote is very important. For this reason, our board is requesting that you allow your shares to be represented at the annual meeting by the persons named as proxies on the enclosed proxy card or voting instruction form.

What information is contained in these materials?

The information included in this proxy statement relates to the proposals to be voted on at the annual meeting, the voting process, the compensation of directors and our most highly paid executive officers, and certain other required information. Our annual report on Form 10-K for our 2007 fiscal year, which contains our audited financial statements, a proxy card or voting instruction form, and a return envelope accompany this proxy statement.

When and where will the annual meeting be held?

The annual meeting of stockholders will be held on Thursday, January 10, 2008, at 9:00 a.m., local time, in the Kansas City Airport Hilton located at 8801 N.W. 112th Street, Kansas City, Missouri. You do not have to attend the annual meeting to be able to vote.

What matters will be voted on at the annual meeting?

Stockholders will consider and vote upon the following business items at the annual meeting:

| | • | | The election of four Class II directors to hold office for a term expiring at the annual meeting of stockholders held after the end of our 2010 fiscal year and until their respective successors are duly elected and qualified or until their respective earlier resignation or removal; |

| | • | | The ratification and approval of the selection of the accounting firm of KPMG LLP as our independent registered public accounting firm for our 2008 fiscal year; and |

| | • | | Any other matters that may properly come before the annual meeting. |

How does our board of directors recommend that I vote?

Our board of directors recommends that you vote:

| | • | | “FOR” the election of each nominee for director named in this proxy statement; and |

| | • | | “FOR” the ratification and approval of KPMG LLP as our independent registered public accounting firm. |

1

What shares can I vote?

The only outstanding voting securities of our company are the shares of our common stock, $0.0001 par value, our Series 2 common stock, $0.0001 par value, and our Series 3 common stock, $0.0001 par value. Each share of each class or series of our common stock issued and outstanding as of the close of business on the November 21, 2007 record date for the annual meeting, including each share of our Series 2 and Series 3 common stock, is entitled to one vote on each matter submitted to a vote at the annual meeting. As of the record date, we had 27,434,243 shares of common stock issued and outstanding, of which 17,617,636 shares were common stock, 4,768,355 shares were Series 2 common stock, and 5,048,252 shares were Series 3 common stock. The common stock and the two series of our common stock – Series 2 and Series 3 common stock – collectively are referred to in this proxy statement simply as “shares” or “common stock.”

You may vote all shares of our common stock that you held as of the record date. This includes (1) shares held directly in your name as the stockholder of record, (2) shares held for you in our company benefit plans, and (3) shares held for you as the beneficial owner through a broker, trustee or other nominee, sometimes referred to as shares held in “street name.”

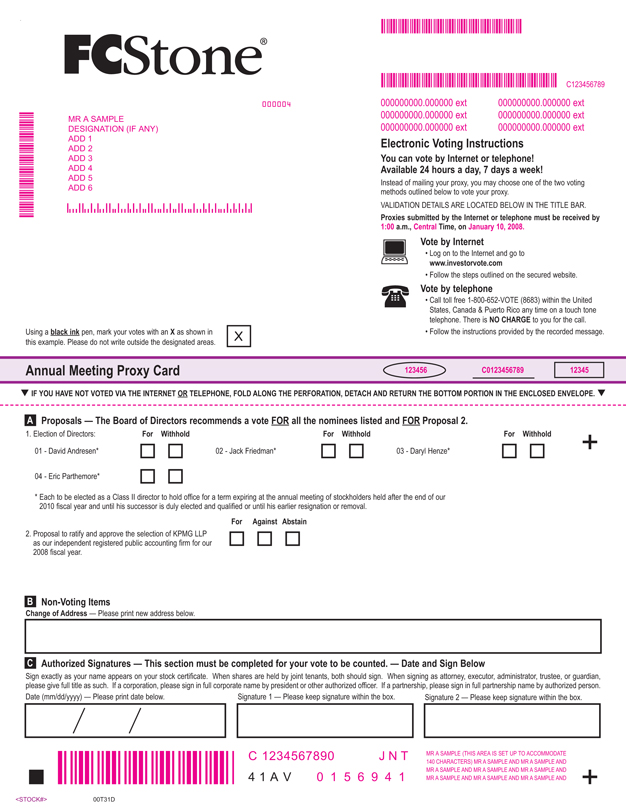

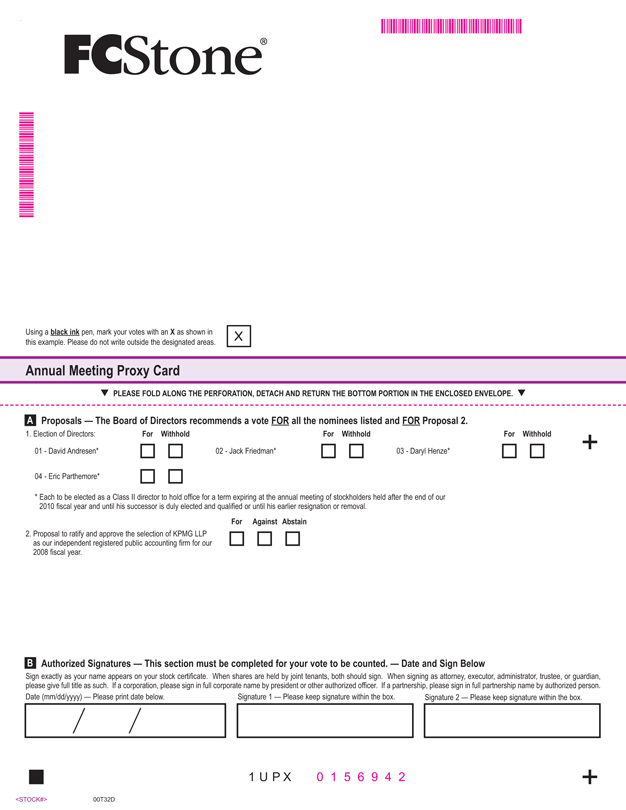

How do I submit my vote?

Shares held by the stockholder of record. If you are the stockholder of record of your shares, you may vote them at the annual meeting in one of two ways. You may attend the annual meeting and vote your shares in person. Alternatively, you may vote your shares by following the specific voting instructions appearing on the enclosed proxy card. Generally, you may vote by telephone, by Internet, or by completing, signing and returning the proxy card in the enclosed postage prepaid envelope. If you vote by telephone or by Internet, you do not need to return the proxy card. The persons designated as proxies were selected by our board of directors and are officers and directors of our company.

Shares held in our company benefit plans. If your shares are held for you in our company benefit plans, such as our employee stock ownership plan or “ESOP,” you are receiving a voting instruction form from the plan trustee or administrator. To vote these shares, you will need to follow the specific voting instructions appearing on the enclosed voting instruction form. To the extent that you do not provide voting instructions prior to the deadline specified in such form, it is anticipated that our company, as the plan administrator, will direct the plan trustee to vote the shares credited to your account in accordance with the recommendation of our board of directors. You may attend the annual meeting, however, you may not vote these shares in person at the meeting unless you obtain a “legal proxy” from the plan trustee.

Shares held in street name. If you hold shares in street name, you are receiving a voting instruction card from your broker, trustee or other nominee. As the beneficial owner, you have the right to direct your broker, trustee or nominee how to vote your shares by following the instructions on the voting instruction card. Although you may attend the annual meeting, you may not vote these shares in person at the meeting unless you obtain a “legal proxy” from your broker, trustee or nominee.

Can I change my proxy vote?

If you are a stockholder of record, you may change your vote or revoke your proxy any time before your vote is used at the annual meeting by:

| | • | | submitting a valid later-dated proxy; |

| | • | | notifying our company’s general counsel and corporate secretary in writing that you have revoked your proxy; or |

| | • | | completing a written ballot at the annual meeting. |

Attendance at the annual meeting will not in and of itself constitute a revocation of your proxy.

2

You may revoke your voting instructions with respect to any shares of common stock you hold in our benefit plans by delivering a valid, later-dated voting instruction form prior to the deadline specified in the voting instructions furnished by the plan trustee or administrator.

If you hold shares as the beneficial owner in street name, you may change your vote by submitting new voting instructions to your broker, trustee or other nominee or, if you have obtained a legal proxy from your broker, trustee or nominee, by voting in person at the annual meeting.

How many votes are needed to conduct business at the annual meeting?

A majority of all outstanding shares of our common stock entitled to vote at the annual meeting must be present or represented by proxy in order to satisfy the quorum requirement for the transaction of business at the annual meeting. Both abstentions and broker non-votes (described below under “What is the effect of a broker non-vote?”) are counted as present and entitled to vote for purposes of determining a quorum. If a quorum should not be present, the annual meeting may be adjourned from time to time until a quorum is obtained.

How are votes counted?

If you are a stockholder of record and you give your proxy, the shares represented by the proxy will be voted in accordance with your instructions. However, if you are a stockholder of record and you give your proxy without providing voting instructions on one or more proposals, your proxy will be voted for those proposals in accordance with the recommendation of our board of directors (which recommendation is identified above under “How does our board of directors recommend that I vote?”).

If your shares are held in our company benefit plans, they will be voted in accordance with your voting instructions. If we do not receive voting instructions for shares held in our company benefit plans, it is anticipated that our company, as the plan administrator, will direct the plan trustee to vote those shares in accordance with the recommendation of our board of directors.

If your shares are held in street name through a broker or other nominee, they will be voted in accordance with the voting instructions that you provide. If you do not provide voting instructions, your broker or other nominee is permitted to vote your shares on proposals that are considered routine, including the election of directors and ratification of the appointment of KPMG LLP as our independent registered public accounting firm.

What vote is required to approve the proposals at the annual meeting?

Election of Directors. Directors are elected by a plurality of the votes cast, in person or by proxy, by stockholders entitled to vote at the annual meeting for that purpose. This means that the four nominees receiving the highest number of votes at the annual meeting will be elected. Stockholders can withhold authority to vote for one or more nominees for director. Shares not voted, whether by specifically withholding authority to vote on your proxy card or voting instruction form or otherwise, will have no impact on the election of directors except to the extent the failure to vote for an individual results in another individual receiving a larger proportion of the total votes. No shares may be voted for more than four nominees at the annual meeting. Stockholders do not have cumulative voting rights in the election of directors.

Selection of Accounting Firm and Other Matters. Approval of the proposal to ratify and approve the selection of KPMG LLP as our independent registered public accounting firm and all other proposals that properly may come before the annual meeting require the affirmative vote of a majority of the shares represented at the meeting and entitled to vote on the particular proposal. Stockholders may abstain from voting on any proposal at the meeting. If you abstain from voting on any proposal, it has the same effect as a vote against the proposal.

3

What is the effect of a broker non-vote?

A “broker non-vote” occurs when a broker or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker or other nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner. Broker non-votes are counted as present or represented for purposes of determining the presence or absence of a quorum for the annual meeting, if such shares are otherwise properly represented at the meeting in person or by proxy. Broker non-votes are not counted for purposes of determining the number of shares entitled to vote on any proposal for which the broker or other nominee lacks discretionary authority, and therefore would reduce the number of affirmative votes that are necessary to approve that proposal.

Are there any other matters that will be considered at the annual meeting?

The only items of business that may be properly brought before the annual meeting are the matters set forth herein or those brought before the meeting by or at the direction of our board of directors. We are not aware of any business to be acted upon at the annual meeting other than the items described in this proxy statement. Your signed proxy, however, will entitle the persons named as proxy holders to vote in their discretion for any other matter that is properly presented at the meeting unless you specifically withhold authority to do so.

Who pays the cost of soliciting votes at the annual meeting?

This proxy solicitation is being made by our board of directors. All costs of this solicitation will be borne by our company. In addition to the use of the mails, proxies may be solicited personally or by telephone by some of the regular employees of our company. Our company may reimburse brokers, banks and other persons holding stock in their names, or in the names of nominees, for their expenses incurred in sending proxy materials to their principals and obtaining their proxies. Our company requests that brokerage houses and other custodians, nominees and fiduciaries forward the soliciting materials to the beneficial owners of the shares of common stock held of record by such persons.

Where can I find the voting results of the annual meeting?

We will announce preliminary voting tabulations at the annual meeting and publish the final results in our quarterly report on Form 10-Q for the quarter ending February 29, 2008.

What should I do if I receive more than one set of proxy materials?

Each stockholder at a given address will receive a separate proxy card or voting instruction form. You may receive multiple sets of proxy materials if you hold shares in more than one brokerage account or if you are a stockholder of record and have shares registered in more than one name. Please vote the shares on each proxy card or voting instruction form you receive.

The Securities and Exchange Commission or SEC has adopted rules that permit companies and intermediaries (including brokers) to satisfy the delivery requirements for proxy statements and annual reports with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, which is commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

We have adopted a “householding” procedure that you may wish to follow. If you are receiving multiple sets of proxy materials and wish to have your accounts householded, contact our corporate secretary, David A. Bolte, at (515) 223-3797, or send written instructions to our corporate secretary at FCStone Group, Inc., 10330 N.W. Prairie View Road, Kansas City, MO 64153. If you no longer wish to participate in householding, you must provide written notification to our corporate secretary to withhold your consent for householding.

Many brokerage firms participate in householding as well. If you have a householding request for your brokerage account, please contact your broker.

4

MATTERS TO BE CONSIDERED AT THE ANNUAL MEETING

ITEM 1: ELECTION OF DIRECTORS

What am I voting on?

One of the purposes of this annual meeting is to elect four directors in Class II to serve for a three-year term expiring at the annual meeting of stockholders held after the end of our 2010 fiscal year and until their respective successors are duly elected and qualified or until their respective earlier resignation or removal.

What is the structure of our board and how often are directors elected?

Our board of directors currently consists of 12 persons. With the exception of Paul G. Anderson, each of our directors satisfies the independence requirements of the SEC, and the NASDAQ Global Select Market. Our certificate of incorporation divides the board into three classes of directors, with directors serving staggered terms of three years and until their respective successors are duly elected and qualified or until their respective earlier resignation or removal. The present terms of David Andresen, Jack Friedman, Daryl Henze and Eric Parthemore, the four directors in Class II, expire at this annual meeting. Directors in Class I (Paul G. Anderson, Kenneth Hahn, Dave Reinders and Rolland Svoboda) and Class III (Brent Bunte, Doug Derscheid, Bruce Krehbiel and Tom Leiting) have terms expiring at the time of the annual meeting of stockholders after the end of our 2009 fiscal year and 2008 fiscal year, respectively.

Who are this year’s nominees?

The nominating and corporate governance committee of our board of directors has designated David Andresen, Jack Friedman, Daryl Henze and Eric Parthemore as the four nominees proposed for election at the annual meeting. Each of these nominees currently serves on our board. Unless authority to vote for the nominees or a particular nominee is withheld, it is intended that the shares represented by properly executed proxies in the form enclosed will be voted for the election as directors of these four nominees. The following table sets forth certain information with respect to each person nominated for election as a Class II director at the annual meeting and each director whose term of office will continue after the annual meeting.

| | | | | | |

Name | | Age | | Position With our Company | | Director

Since |

NOMINEES | | | | | | |

Class II: Term to expire in 2008 | | | | | | |

David Andresen | | 53 | | Director | | 2005 |

Jack Friedman | | 50 | | Vice Chairman, Director | | 1996 |

Daryl Henze | | 64 | | Director | | 2006 |

Eric Parthemore | | 58 | | Vice Chairman, Director | | 1996 |

| | | |

DIRECTORS CONTINUING IN OFFICE | | | | | | |

Class I: Term to expire in 2010 | | | | | | |

Paul G. (Pete) Anderson | | 55 | | President, CEO, Director | | 2006 |

Kenneth Hahn | | 55 | | Director | | 2002 |

David Reinders | | 51 | | Director | | 2001 |

Rolland Svoboda | | 48 | | Director | | 2004 |

| | | |

Class III: Term to expire in 2009 | | | | | | |

Brent Bunte | | 51 | | Director | | 2000 |

Douglas Derscheid | | 58 | | Director | | 2003 |

Bruce Krehbiel | | 54 | | Chairman of the Board, Director | | 1988 |

Tom Leiting | | 53 | | Director | | 1997 |

5

There is no arrangement or understanding between any director and any other person pursuant to which such director was selected as a director.

What is the business experience of the nominees and of our continuing board members?

The business experience during the last five years of each person nominated for election as a director at the annual meeting and each director whose term of office will continue after the annual meeting is as follows:

Paul G. (Pete) Andersonhas served as a director of our company since November 9, 2006. He has been employed by our company since 1987 and has served as president and chief executive officer since 1999. Prior to becoming president, Mr. Anderson was the vice president of operations. Mr. Anderson is the past president of the Kansas Cooperative Council and past founding chairman of the Arthur Capper Cooperative Center at Kansas State University. Mr. Anderson sits on the board of directors of Associated Benefits Corporation and is a member of National Council of Farmer Cooperatives, the National Feed and Grain Association and several other state associations.

David Andresen has served as a director of our company since January 6, 2005. Mr. Andresen is the general manager of 4 Seasons Cooperative and Petroleum Partners LLC in Britton, South Dakota and has served in that capacity for nine years. Mr. Andresen has served as the president of the South Dakota Managers Association, South Dakota Association of Cooperatives, Britton Area Chamber of Commerce and currently is the mayor of Britton, South Dakota.

Brent Bunte has served as a director of our company since 2000 and is the former chairman of our audit committee. Mr. Bunte is the manager of the NEW Cooperative in Fort Dodge, Iowa, and has been with NEW Cooperative for 22 years. Mr. Bunte has held directorships with First American Bank and Associated Benefits Corporation.

Douglas Derscheid has served as a director of our company since 2003. Mr. Derscheid is the president and chief executive officer of the Central Valley Ag Cooperative in O’Neill, Nebraska and has been with Central Valley, and one of its predecessors, Central Farmers Cooperative, for the past 15 years. Prior to his work with Central Farmers, Mr. Derscheid was the general manager of Farmers Cooperative Elevator in Plymouth, Nebraska for seven years. Mr. Derscheid is currently chairman of the board of Cooperative Mutual Insurance Company and is the treasurer for the O’Neill Airport Authority. Mr. Derscheid previously served as a board member of the Nebraska Propane Gas Association and a Trustee for the Nebraska Managers Association.

Jack Friedman has served as a director of our company since 1996 and is a vice chairman. Mr. Friedman is the chief executive officer of Innovative Ag Services in Monticello, Iowa and has been with that firm or its predecessor company for 31 years. For the past 15 years, Mr. Friedman had served as manager of Swiss Valley Ag Center in Monticello, Iowa. Mr. Friedman serves as a director of Western Dubuque Biodiesel LLC.

Kenneth Hahn has served as a director of our company since 2002. Mr. Hahn is the general manager of Planters Cooperative in Lone Wolf, Oklahoma and has been with Planters Cooperative for a total of 32 years, 24 years as manager and eight years as assistant manager. Mr. Hahn has held director positions with the Coop Retirement Board and Oklahoma Grain and Feed Association.

Daryl Henze has served as a director of our company since November 9, 2006. On that date he also was appointed to serve as the chairman of our audit committee. Mr. Henze is a consultant in the area of finance and accounting. He spent 36 years with the accounting firm KPMG LLP before his retirement in 2001, including 28 years as an audit partner. Mr. Henze serves on the board of directors of Wellmark, Inc., as well as the boards of two other private companies. He is a former president of the Minnesota State Mankato Alumni Association and on the Iowa State University Accounting Advisory Board. He is the past president of the Iowa Society of Certified Public Accountants and served on the Iowa Accountancy Examining Board for nine years.

6

Bruce Krehbiel has served as a director of our company since 1988 and is our chairman. Mr. Krehbiel is the manager of Kanza Cooperative Association in Iuka, Kansas, and has worked for Kanza Cooperative Association since 1986. Mr. Krehbiel has held director positions on the boards of the Midwest Chapter of the National Society of Accountants for Cooperatives, CenKan, LLC, and Agri-Business Benefit Group.

Tom Leiting has served as a director of our company since 1997. Mr. Leiting is the manager of the River Valley Cooperative in Clarence, Iowa. He has been employed by River Valley or one of its parent companies for the past 19 years. Prior to his position with River Valley, Mr. Leiting was employed by Swiss Valley Farms Services for eight years. Mr. Leiting is currently a member of the Associated Benefits Corporation board of directors.

Eric Parthemore has served as a director of our company since 1996 and as a vice chairman of our company since January, 2007. He served as our secretary and treasurer until January, 2007. Mr. Parthemore is the president and chief executive officer of the Farmers Commission Company in Upper Sandusky, Ohio and has held that position since 1996. For the previous five years, he was the general manager of U.S. Commission Company. Mr. Parthemore was appointed in January 2004 to serve on the Ohio Agricultural Commodity Advisory Commission by the Secretary of Agriculture in the State of Ohio. Mr. Parthemore is a director on the Ohio AgriBusiness Association and serves as a trustee of the OABA Education Trust.

David Reinders has served as a director of our company since 2001. Mr. Reinders is the general manager of Sunray Co-op in Sunray, Texas and has held that position since January 2004. Prior to his service at Sunray Co-op, Mr. Reinders was general manager of United Farmers Coop in George, Iowa, for ten years. Mr. Reinders formerly was a director of the Iowa Institute of Coops, the Agribusiness Association of Iowa and Land O’Lakes.

Rolland Svoboda previously served as a director of our company from January 1999 to January 2002 and currently is serving a term as director that commenced in January 2004. Mr. Svoboda is the general manager of Pro Cooperative in Gilmore City, Iowa. He has been with Pro Cooperative since 1999. Prior to his current position, Mr. Svoboda served for five years as the general manager of Farmers Coop in Hemingford, Nebraska.

What if a nominee is unwilling or unable to serve?

Each of the nominees listed in this proxy statement has indicated his willingness to serve as a director if elected, and the board of directors has no reason to believe that any nominee will be unavailable for election. If, for some unforeseen reason, a nominee becomes unwilling or unable to serve, it is intended that shares represented by the proxies will be voted for the election of such substitute nominee as may be designated by our nominating and corporate governance committee, unless the authority to vote for all nominees or for the particular nominee who has ceased to be a candidate has been withheld.

How does our board of directors recommend that I vote?

Our board of directors recommends that you vote “FOR” the election of David Andresen, Jack Friedman, Daryl Henze and Eric Parthemore as Class II directors.

7

ITEM 2: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

What am I voting on?

Stockholders are being asked to ratify and approve the selection of KPMG LLP as our independent registered public accounting firm for our 2008 fiscal year. The selection of KPMG LLP was made by the audit committee of our board of directors. KPMG LLP has served as our independent auditors since 1980. In connection with the audit of our 2008 fiscal year financial statements, our company entered into an engagement agreement with KPMG LLP which sets forth the terms by which KPMG LLP will perform audit services for our company. That agreement is subject to alternative dispute resolution procedures. The ratification and approval by stockholders of the selection of KPMG LLP effectively would also be a ratification of that agreement.

What services do the independent registered public accountants provide?

Audit services provided by KPMG LLP for our 2007 fiscal year included the examination of the consolidated financial statements of our company and services related to our periodic filings with the SEC. Audit-related services provided by KPMG LLP included services related to our registration statements for the initial public offering of our common stock and subsequent selling stockholder resale of common stock. KPMG LLP also provided corporate income tax compliance services related to the preparation of our federal and state income tax returns. The services provided by KPMG LLP are more fully described in this proxy statement under the captions “Audit Committee Report” and “Independent Auditor Fees and Services.”

Will a representative of KPMG LLP be present at the meeting?

One or more representatives of KPMG LLP are expected to be present at the annual meeting. Any such representative will have an opportunity to make a statement if he or she desires to do so and is expected to be available to respond to appropriate questions from stockholders.

What if this proposal is not approved?

Stockholder ratification and approval of the audit committee’s selection of KPMG LLP as our independent registered public accounting firm is not required by any statute or regulation or by our bylaws. Nevertheless, if the stockholders do not ratify and approve the selection of KPMG LLP at the annual meeting, the audit committee will reconsider the appointment. Submission of our selection of KPMG LLP to the stockholders for ratification and approval will not limit the authority of the audit committee to appoint another independent certified public accounting firm to serve as independent auditors if the present auditors resign or their engagement otherwise is terminated.

How does our board of directors recommend that I vote?

Our board of directors recommends that you vote “FOR” approval of the selection of KPMG LLP.

8

CORPORATE GOVERNANCE AND BOARD MATTERS

Communication with the Board

Our board of directors has established a process for stockholders to follow in sending communications to our board or its members. Stockholders who wish to communicate with our board or any of our directors may do so. Such communications must be addressed to our board or any such director in care of our corporate secretary at FCStone Group, Inc., 10330 N.W. Prairie View Road, Kansas City, MO 64153. Alternatively, such communications may be sent by e-mail to Board@fcstone.com. All such communications will be compiled by our corporate secretary and submitted to our board or the individual director, as applicable, on a periodic basis.

Neither our board of directors nor a specific director is required to respond to a stockholder communication. To avoid selective disclosure, our board or the individual director may respond to a stockholder’s communication only if the communication involves information which is not material or which is already public. In such case, our board of directors, as a whole, or the individual director may respond, if at all:

| | • | | Directly, following consultation with our corporate secretary or other advisors or without additional consultation, as our board determines appropriate; |

| | • | | Indirectly through our corporate secretary or other designated officer, following consultation with our corporate secretary or other advisors or without additional consultation, as our board determines appropriate; or |

| | • | | Pursuant to such other means as our board determines appropriate from time to time. |

If the communication involves material non-public information, our board of directors or the individual director will not provide a response to the stockholder concerning such information. Our company may, however, publicly provide information responsive to such communication if (following consultation with our advisors, as our board determines appropriate) our board determines disclosure is appropriate. In that case, the responsive information will be provided in compliance with SEC Regulation FD and other applicable laws and regulations.

Consideration of Director Nominees

In identifying and evaluating director nominees, the nominating and corporate governance committee of our board of directors may receive recommendations from management, from other directors and from stockholders. The committee reviews and considers information on each candidate and evaluates it in light of the needs and requirements of our company. The committee believes that our board and its committees should be comprised of persons who are of high character and integrity, who have a personal and professional reputation that is consistent with the image and reputation of our company, and who have expertise that may be useful to our company. The committee also considers various factors, including the independence of the candidate, as well as his or her education or special skills, areas of expertise, experience, age, business associations, reputation and other characteristics and qualities that the committee believes are likely to enhance the effectiveness of our board and its committees. In determining whether a director should be retained and stand for re-election, the committee also considers the director’s past attendance at meetings and participation in and contributions to the activities of our board and each committee on which such director serves.

Stockholders who wish the nominating and corporate governance committee to consider their recommendations for nominees for the position of director should submit their recommendations in writing to the nominating and corporate governance committee in care of our corporate secretary at FCStone Group, Inc., 10330 N.W. Prairie View Road, Kansas City, MO 64153. All nominees, including those submitted by stockholders in accordance with these procedures, will be evaluated using generally the same methods and criteria described above, although those methods and criteria are not standardized and may vary from time to time. Stockholders also may submit director nominations to our company in accordance with the procedures described below under “Advance Notice of Stockholder Proposals.”

9

Committees of the Board

Our board of directors has established an executive committee, an audit committee, a compensation committee and a nominating and corporate governance committee. There currently are no other standing audit, compensation, nominating or other committees of our board of directors, or committees performing similar functions of our board. Members of the executive committee, audit committee, compensation committee and nominating and corporate governance committee serve at the pleasure of our board of directors.

Executive Committee. The executive committee of our board of directors consists of the chairman of the board and the two vice chairmen of the board – Bruce Krehbiel, Jack Friedman and Eric Parthemore, respectively. Currently, Bruce Krehbiel serves as chairman of the executive committee. With certain exceptions specified in our bylaws, the executive committee is empowered to exercise all powers of our board of directors between regular board meetings. The executive committee met four times during our 2007 fiscal year.

Audit Committee. The audit committee of our board of directors currently is comprised of Daryl Henze, its chairman, Brent Bunte, Bruce Krehbiel and Eric Parthemore. Each member of the audit committee is independent as defined by NASDAQ’s independence standards. In addition, our board of directors has determined that Daryl Henze meets the SEC’s definition of an “audit committee financial expert.” The audit committee is responsible for reviewing our financial statements, audit reports, internal financial controls and the services performed by the independent registered public accounting firm, and for making recommendations with respect to those matters to our board of directors. A more complete description of the audit committee’s functions is provided in its charter, a copy of which is available on our internet website (www.fcstone.com) under “Investor Relations.” The audit committee met 12 times during our 2007 fiscal year.

Compensation Committee. The compensation committee of our board of directors currently is comprised of Bruce Krehbiel, its chairman, Jack Friedman and Eric Parthemore. Each member of the compensation committee is independent as defined by NASDAQ’s independence standards. The committee is responsible for reviewing and making recommendations to our board of directors with respect to compensation of executive officers and other compensation matters and awards. Our chief executive officer assists the committee from time to time on a variety of compensation matters, including making recommendations for the appropriate salaries and bonuses of our executive officers (other than our chief executive officer). The committee has the authority to consult with management and to engage the services of outside advisors, experts and others to assist it in its efforts. For our 2007 fiscal year, the committee retained Riley, Dettmann & Kelsey LLC as compensation consultant to the committee with respect to compensation for our executive officers, including our chief executive officer. In September, 2007, the committee retained Hay Group, Inc. as compensation consultant to the committee with respect to the compensation for our chief executive officer and other executive officers for our 2008 fiscal year. The compensation consultant reports directly to the committee. All projects performed by the compensation consultant are reviewed, discussed and approved by the committee. A more complete description of the committee’s functions is provided in its charter, a copy of which is available on our internet website (www.fcstone.com) under “Investor Relations.” The compensation committee met four times during our 2007 fiscal year.

Nominating Committee. The nominating and corporate governance committee of our board of directors is responsible for the director nomination process, including evaluating and recommending director nominees and committee appointments. It also is responsible for various other governance related matters, including an annual board assessment. A more complete description of the committee’s functions is provided in its charter, a copy of which is available on our internet website (www.fcstone.com) under “Investor Relations.” The members of the nominating and corporate governance committee are Jack Friedman, its chairman, Doug Derscheid and Kenneth Hahn, each of whom is independent, as defined by NASDAQ’s independence standards. The committee met twice during our 2007 fiscal year.

10

Meetings of the Board

During our 2007 fiscal year, our board of directors held ten meetings. Each director attended at least 75% of the total meetings of the board of directors and of the committees of the board on which he served during the fiscal year. Our company’s directors discharge their responsibilities throughout the year, not only at such board of directors and committee meetings, but through personal meetings and other communications with members of management and others regarding matters of interest and concern to our company.

Directors are encouraged by our company to attend our annual meeting of stockholders if their schedules permit, but our company does not otherwise have a policy regarding such attendance. With the exception of Doug Derscheid, all directors were present at the annual meeting of the stockholders held on January 11, 2007.

Code of Ethics

Our board of directors has adopted a code of business conduct and ethics applicable to all employees, officers and directors. A copy of the code of business conduct and ethics is available to any stockholder who requests it by writing to our corporate secretary at FCStone Group, Inc., 10330 N.W. Prairie View Road, Kansas City, MO 64153. It also is available on our internet website (www.fcstone.com) under “Investor Relations.”

Director Compensation

Only outside (non-employee) members of our board of directors receive compensation for their service to our company as a director. Prior to November 8, 2007, members of our board of directors received a quarterly retainer, a per diem board meeting payment and a per diem committee meeting payment of $3,750, $1,000 and $1,000, respectively. Per diem committee meeting payments are not made if the committee meeting is held on the same day as a board meeting and only one per diem committee meeting payment will be payable if more than one committee meeting is held on the same day. For our 2007 fiscal year, our board chairman received an additional $2,500 per quarter retainer, and the two other members of our executive committee as well as the audit committee chairman each received an additional $1,250 per quarter retainer. In addition, on March 15, 2007, our company granted stock options for a total of 236,250 shares of our common stock to our non-employee directors. On November 8, 2007, the quarterly retainer, per diem board meeting payment and per diem committee meeting payment were increased to $12,500, $1,500 and $1,500, respectively. In addition, the board chairman’s quarterly retainer, the audit committee chairman’s quarterly retainer and the vice chairmen’s quarterly retainer were increased to $8,750, $3,750 and $2,500, respectively, and an annual grant of restricted stock having a fair value of $50,000 will be made to each director on the date of our annual meeting of stockholders. Compensation earned in our 2007 fiscal year by our directors (other than those who are named executive officers in the summary compensation table under “Executive Compensation and Related Matters”) for service on the board and its committees is presented in the table below.

| | | | | | | | | | | | | | |

Name | | Fees Earned

or Paid in

Cash ($)(1) | | Stock

Awards ($) | | Option

Awards ($)(2) | | Non-Equity

Incentive Plan

Compensation ($) | | Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings ($) | | All Other

Compensation ($) | | Total ($) |

David Andresen | | 21,194 | | — | | 6,199 | | — | | — | | — | | 27,393 |

Brent Bunte | | 25,000 | | — | | 12,399 | | — | | — | | — | | 37,399 |

Doug Derscheid | | 20,194 | | — | | 6,199 | | — | | — | | — | | 26,393 |

Jack Friedman | | 32,694 | | — | | 16,738 | | — | | — | | — | | 49,432 |

Kenneth Hahn | | 23,194 | | — | | 6,199 | | — | | — | | — | | 29,393 |

Daryl Henze | | 20,278 | | — | | 6,199 | | — | | — | | — | | 26,477 |

Bruce Krehbiel | | 34,694 | | — | | 22,318 | | — | | — | | — | | 57,012 |

Tom Leiting | | 23,194 | | — | | 12,399 | | — | | — | | — | | 35,593 |

Eric Parthemore | | 27,194 | | — | | 16,738 | | — | | — | | — | | 43,932 |

Dave Reinders | | 23,194 | | — | | 12,399 | | — | | — | | — | | 35,593 |

Rolland Svoboda | | 23,194 | | — | | 12,399 | | — | | — | | — | | 35,593 |

11

| (1) | The amounts in this column include quarterly retainer fees, meeting and activity fees and chairman and executive committee retainer fees received for service as a director, as follows: |

| | | | | | | | |

Name | | Quarterly

Retainers ($) | | Meeting and

Activity Fees ($) | | Chair/Executive

Committee

Retainers ($) | | Total Fees

Paid in Cash ($) |

David Andresen | | 13,194 | | 8,000 | | — | | 21,194 |

Brent Bunte | | 13,194 | | 10,000 | | 1,806 | | 25,000 |

Doug Derscheid | | 13,194 | | 7,000 | | — | | 20,194 |

Jack Friedman | | 13,194 | | 14,500 | | 5,000 | | 32,694 |

Kenneth Hahn | | 13,194 | | 10,000 | | — | | 23,194 |

Daryl Henze | | 9,584 | | 7,500 | | 3,194 | | 20,278 |

Bruce Krehbiel | | 13,194 | | 11,500 | | 10,000 | | 34,694 |

Tom Leiting | | 13,194 | | 10,000 | | — | | 23,194 |

Eric Parthemore | | 13,194 | | 9,000 | | 5,000 | | 27,194 |

Dave Reinders | | 13,194 | | 10,000 | | — | | 23,194 |

Rolland Svoboda | | 13,194 | | 10,000 | | — | | 23,194 |

| (2) | The amounts in this column reflect the dollar amount recognized for financial statement reporting purposes for the fiscal year ended August 31, 2007, in accordance with SFAS No. 123R, of option awards granted in our 2007 fiscal year. Assumptions used in the calculation of this amount are included in footnote 11 to our consolidated financial statements for the fiscal year ended August 31, 2007 included in our Annual Report on Form 10-K for that fiscal year. The options were granted pursuant to our 2006 equity incentive plan. As of August 31, 2007, the aggregate number of vested and unvested stock options held by each named director was as follows: Mr. Andresen (29,250); Mr. Bunte (58,500); Mr. Derscheid (29,250); Mr. Friedman (78,975); Mr. Hahn (29,250); Mr. Henze (11,250); Mr. Krehbiel (105,300); Mr. Leiting (58,500); Mr. Parthemore (78,975); Mr. Reinders (58,500); and Mr. Svoboda (58,500). |

Compensation Committee Interlocks and Insider Participation

During our 2007 fiscal year, Messrs. Krehbiel, Parthemore and Friedman served on the compensation committee of our board of directors. None of the members of our compensation committee is currently or was formerly a company officer or employee. There are no compensation committee interlocks and no insider participation in compensation decisions that are required to be reported under the SEC’s rules and regulations. Each member of our compensation committee, Jack Friedman, Bruce Krehbiel and Eric Parthemore, has an interest in reportable transactions as set forth under “Related Party Transactions” below.

12

EXECUTIVE COMPENSATION AND RELATED MATTERS

Compensation Discussion and Analysis

Overview

This compensation discussion and analysis or “CD&A” describes the material elements of compensation of our president and chief executive officer, our chief financial officer and each of our next three most highly compensated executive officers for our 2007 fiscal year, collectively referred to as our “named executive officers.” It also provides information on our compensation philosophy, our compensation policies and programs designed to achieve our compensation objectives and the compensation for the members of our board of directors. This discussion and analysis should be read in conjunction with the Summary Compensation Table, its accompanying footnotes and the additional tabular and narrative disclosure that follows the Summary Compensation Table.

Objectives and Philosophy of our Executive Compensation Program

The overall goal of our compensation programs is to attract and retain the talented executives and employees needed to achieve our business objectives at an appropriate cost to our stockholders, as well as to ensure that an appropriate relationship exists between pay, our financial performance and the creation of long-term stockholder value. Our compensation program has four principal components:

| | |

| Base salary: | | Designed to compensate employees competitively relative to the market; |

| |

| Performance bonus: | | Designed to reward short-term performance, particularly the achievement of annual performance objectives; |

| |

| Long-term incentives: | | Designed to encourage creation of long-term stockholder value and reward long-term performance; and |

| |

| Benefits: | | Designed to provide competitive benefits. |

Our company has a longstanding guiding philosophy that executive compensation should be based on the principle of “pay-for-performance.” Accordingly, a significant portion of executive compensation is directly related to our company’s performance, as measured by pretax return on equity, during the applicable fiscal year. Our company does not focus on the short-term performance of our common stock, whether favorable or unfavorable, based on our view that the price of our common stock will, in the long-term, reflect our operating performance and, ultimately, the management of our company by our executives. In pursuit of these objectives, our executive compensation program consists of two main elements, broadly categorized as “short-term compensation” and “long-term compensation.” The general elements of each, both of which are more thoroughly described in this CD&A, are as follows:

| | • | | Short-Term Compensation: Our company attempts to pay our executives annual base salary and bonus compensation at competitive levels. Certain perquisites that have been judged to be reasonable and appropriate to provide competitive compensation for our senior executives. |

| | • | | Long-Term Compensation: Long-term compensation is provided primarily through grants under our 2006 equity incentive plan, which provides for grants of: incentive stock options, non-qualified stock options, stock appreciation rights, restricted stock, restricted stock units, and performance and annual incentive awards. By granting equity awards in long-term compensation, executives are rewarded in relation to the increased share value resulting from long-term improved financial performance. |

Our equity incentive plan was implemented in 2006. The compensation committee of our board of directors is in the process of formulating a program to systematized long-term incentive awards, but has not concluded that determination as of the date of this proxy statement. It is the intention of our compensation committee that once a process has been finalized, our board of directors will make award determinations beginning in 2008 and thereafter, at the board meeting held shortly after the conclusion of each fiscal year. There are 3,375,000 shares

13

of our common stock reserved for grants under our equity incentive plan, of which 2,925,000 shares have been allocated with respect to previously awarded equity grants, including those made in connection with our company’s initial public offering of common stock.

We have established an employee stock ownership plan or “ESOP.” An ESOP is a special type of qualified retirement plan described in and subject to requirements contained in the Internal Revenue Code of 1986, referred to as the “Code”, and the Employee Retirement Income Security Act of 1974 or “ERISA.” By definition, an ESOP must be designed to invest primarily in the capital stock of the sponsoring employer. Participants in our 401(k) retirement plan are eligible to participate in the ESOP. When the ESOP was established, each participant was given a one-time opportunity to transfer up to 33% of the assets in the participant’s 401(k) plan account to the ESOP. Following the establishment of the ESOP, our company matching contributions under the 401(k) plan for all eligible ESOP participants were made to the ESOP, where they are invested in our common stock.

To ensure that our programs are reasonable and competitive, we target our total compensation and benefit opportunities at the median of our selected peer group. For more information on our benchmarking practices, we refer you to the discussion below under the caption “Benchmarking.” Compensation or amounts realized by executives from prior compensation, such as gains from previously granted equity awards, generally are not taken into account in setting other elements of compensation, such as annual base salary and bonus.

Our compensation philosophy specifically does not permit:

| | • | | repricing of stock options; |

| | • | | backdating of stock options; or |

| | • | | granting of personal loans to executives officers and board members. |

Description of Each Element of Compensation

We target our overall compensation of executives at the median of the competitive market relative to each position’s duties and level of responsibility. However, we weight the various elements differently in order to conform our overall compensation program to our principal philosophy of paying for performance. As a result, each of our compensation element targets will compare differently with our selected peer group members, but overall our compensation targets are designed to compensate our executives at levels that approximate the median of total compensation of our selected peer group. Upon review of competitive market data with our compensation consultant, Hay Group, Inc., it was determined that our existing executive compensation overall was significantly below the median of the competitive market as reflected by our selected peer group. At the same time, our company expects its executives to perform at levels that significantly exceed median performance. Many of the developments with respect to our company’s executive compensation program discussed below reflect an intention to move executive compensation to median levels.

Base Salary.Our compensation philosophy has lead us to the practice of establishing base salary levels below the median of the competitive market relative to each position’s duties and level of responsibility. By doing so, we can emphasize the performance-based aspects of our compensation program with performance-based bonuses and long-term incentive compensation. Following our 2007 fiscal year, we established a practice for annual reviews of the range of our base salaries based upon similar job duties and levels of responsibility in comparison with those of similar positions in the market. From this analysis, we establish a competitive range for each position that guides our analysis. Individual base salaries are based upon an evaluation of individual factors, such as past and current performance, experience in the position, potential for growth and development with our company, level and scope of responsibility, and internal fairness – how a position compares in scope and responsibility to other positions within our company.

Our compensation committee annually evaluates base salaries for the named executive officers. Following our 2007 fiscal year, the committee recommended to our board of directors, and our board approved, a base salary increase for our chief executive officer from $400,000 in fiscal 2007 to $550,000 in fiscal 2008, as well as

14

increases for each of the other named executive officers. The base salary earned by each of our named executive officers for our 2007 fiscal year is set forth in the Summary Compensation Table below.

Performance Bonus.Our executive short-term incentive plan is tied to our pre-established objective performance metric of our company’s pretax return on equity. We believe compensating our management based on our company’s overall achievement of return on equity supports our philosophy of pay-for-performance and the achievement of long-term stockholder value creation. Our board utilizes this metric (as well as others) in evaluating our company’s performance.

For our 2007 fiscal year, our board utilized a 15% pretax return on equity target, but adjusted this metric to use after-tax return on equity in subsequent years. Pretax return on equity is defined as a percentage, calculated as the sum of pretax operating income plus interest expense on subordinated debt, divided by the sum of average combined monthly equity (including common stock held by the ESOP) plus average monthly subordinated debt. In prior years, our annual pretax return on equity target was established by our compensation committee, in consultation with a compensation consulting firm, as the performance metric for our executive short-term incentive plan. The attainment of payment for performance at target or above is intended to require significant effort on the part of our executives. For our 2007 fiscal year, our actual pretax return on equity was 45.4%, which exceeded our 15% pretax return on equity target by 30.4 percentage points.

To further align bonus compensation with company performance, a minimum target under our annual incentive plan was established. For our 2007 fiscal year, if our company’s actual pretax return on equity fell below 10%, no bonuses would be payable to our named executive officers. Our company does not place a cap on the level of performance bonus that may be earned by a named executive officer. Our company determined early in its development that placing caps on performance-based compensation created retention issues and disincentives for top-performing executives. This philosophy is generally applied to all employees of our company.

Bonus opportunities are expressed as a percent of base salary for our named executive officers and depend on the pretax return on equity achieved. For our 2007 fiscal year, the performance bonus for our chief executive officer, chief operating officer and chief financial officer (referred to in the plan as “Tier I”) was 50% of base salary if the 15% target level of pretax return on equity was realized. For all other participating officers of our company, including the remaining named executive officers other than the senior vice president – FCStone Trading (referred to in the plan as “Tier II”), the performance bonus was 40% of base salary if the target level was realized. The senior vice president – FCStone Trading does not participate in the performance bonus program and receives incentive compensation based upon commissions. The following table illustrates the percentage of base salary payouts in Tier I and Tier II for various pretax return on equity targets under the performance bonus program for our 2007 fiscal year:

| | | | | | |

Pretax Return on

Equity Levels | | Tier I Base Salary Percentages | | | Tier II Base Salary Percentages | |

Under 10% | | 0 | % | | 0 | % |

10% | | 25 | % | | 20 | % |

15% | | 50 | % | | 40 | % |

20% | | 75 | % | | 60 | % |

25% | | 100 | % | | 80 | % |

30% | | 126 | % | | 101 | % |

35% | | 151 | % | | 121 | % |

40% | | 176 | % | | 141 | % |

45% | | 201 | % | | 161 | % |

After our 2007 fiscal year, our compensation committee approved the bonuses for the participating named executive officers and for the other participating members of our management team for fiscal 2007 based on our company’s achievement of pretax return on equity of 45.4%. The bonus awarded to each named executive officer for our 2007 fiscal year is set forth in the Summary Compensation Table under the heading Non-Equity Incentive Plan Compensation.

15

For our 2008 fiscal year, our compensation committee approved a formula for calculating performance bonuses under the short-term incentive plan based upon advice from Hay Group, Inc. In their approval process, the committee considered competitive market data of performance bonuses for comparable positions with comparable scope and responsibilities. The committee also considered competitive market data to establish the target. Based upon the selected peer group, the committee determined that the median level of after-tax return on equity realized by peers in the group was approximately 17% for 2006, with a median short-term incentive for chief executive officers of approximately 169% of base salary. Having established our chief executive officer’s annual base salary at 85% of the median annual base salary of the peer group, in order to approximate an overall median compensation level, the committee determined that the targeted performance bonus should be approximately 120% of the median. This equated to a performance bonus of approximately 200% of base salary payable if median performance of 17% after-tax return on equity is met. For performance above or below target, the bonus percentage would increase or decrease by 11.8% of base salary for each percentage point increase or decrease in after-tax return on equity. The committee decided to set the after-tax return on equity threshold at 10%. The committee believes that this approach will cause total compensation (base salary, performance bonus and long term incentive compensation) to approximate median total compensation levels in the competitive market. However, if our company exceeds median performance, as compared to the peer group, executives will receive significant short-term incentive bonuses. This is consistent with our company’s philosophy to pay superior compensation for superior performance.

For our 2008 fiscal year, the performance bonus for our chief executive officer, chief operating officer and chief financial officer (referred to in the plan as “Tier I”) was established at 200% of base salary if the 17% target level of after-tax return on equity is realized. For all other participating officers of our company, including the remaining named executive officers, other than the senior vice president – FCStone Trading (referred to in the plan as “Tier II”), the performance bonus will be 160% of base salary if the target level is realized. There is no cap on the level of performance bonus that may be earned by a named executive officer. The following table illustrates the percentage of base salary payouts in Tier I and Tier II for various after-tax return on equity targets under the performance bonus program for our 2008 fiscal year:

| | | | | | |

After-Tax Return on

Equity Levels | | Tier I Base Salary Percentages | | | Tier II Base Salary Percentages | |

Under 10% | | 0 | % | | 0 | % |

10% | | 118 | % | | 94 | % |

17% | | 200 | % | | 160 | % |

20% | | 236 | % | | 188 | % |

25% | | 295 | % | | 235 | % |

30% | | 354 | % | | 282 | % |

Our compensation committee has discretion to make adjustments to the annual cash earnings performance target to reflect positive or negative effects of external events outside the control of our senior management, such as litigation or regulatory changes in accounting or taxation standards. Such adjustments may also reflect positive or negative effects of unusual or significant strategic events that are within the control of our senior management that were not contemplated at the time the metric was established and that were undertaken with an expectation of improving our long-term financial performance, such as acquisitions or strategic relationships. Our compensation committee has not utilized its discretion to modify our pre-established annual cash earnings performance target.

Long Term Incentive.Long-term incentive grants of equity are important to reflect an alignment with stockholder value creation and a competitive mix of long- and short-term incentives. Our program is designed to reward and encourage the success and contributions of our employees, which leads to value creation for our company and our stockholders. Under our equity incentive plan, all officers are eligible for annual stock option and restricted stock grants. All non-officers are eligible for one-time grants based on length of service and annual discretionary grants based on individual performance. Grants are subject to a five-year vesting schedule with 20% vesting upon each one-year anniversary of the grant. There are 3,375,000 shares of our common stock

16

reserved for grants under our equity incentive plan, of which 2,925,000 shares have been allocated with respect to previously awarded equity grants, including those made in connection with our company’s initial public offering of common stock.

Our compensation committee is in the process of developing a formal long-term incentive plan utilizing equity grants, but has not concluded that determination as of the date of this proxy statement. It is the intention of the committee that once a process has been finalized, our board of directors will make equity award determinations beginning in 2008 and thereafter, in a meeting of our board held shortly after the conclusion of each fiscal year.

Benefits. All eligible employees, including the named executive officers, participate in our benefit programs. We provide health and welfare benefits, including medical and dental coverage, disability insurance benefits based on two-thirds of base pay and life insurance benefits based on three times base pay. In addition our named executive officers are eligible to participate in our 401(k) retirement plan, the ESOP and our deferred compensation plans. Qualified and non-qualified retirement benefits provided to the named executive officers for our 2007 fiscal year are set forth in the Pension Benefits Table and the Non-Qualified Deferred Compensation Table.

Benchmarking

We target total compensation opportunities at the median level of peer companies. To ensure that our compensation programs are properly benchmarked, we review a number of sources of competitive compensation data and have established a peer group against which we benchmark compensation. We analyze compensation relative to market median levels, making adjustments for market conditions and special considerations as appropriate. In reviewing competitive published survey compensation data obtained from Hay Group, Inc., we most recently developed a list of 19 companies included in their proprietary database, consisting of three asset managers, one banking firm, 11 investment services companies, two life insurance companies, one property and casualty insurance company and one specialty finance company. This group of companies consists of:

| | |

• AG Edwards | | • MF Global Ltd. |

| |

• The Blackstone Group | | • National Financial Partners Corp. |

| |

• CME Group, Inc. | | • Penson Worldwide Inc. |

| |

• Corus Bancshares Inc. | | • Philadelphia Consolidated Holding Corp. |

| |

• GFI Group Inc. | | • Raymond James Financial Inc. |

| |

• Interactive Brokers Group, Inc. | | • SEI Investments Co. |

| |

• Jefferies Group Inc. | | • StanCorp Financial Group Inc. |

| |

• KBW Inc. | | • Universal American Financial Corp. |

| |

• Knight Capital Group Inc. | | • Waddell & Reed Financial Inc. |

| |

• LaBranche & Co. Inc. | | |

Our compensation committee selected this peer group, after consultation with management and its consultant, in an effort to establish a group that could be comparable in many aspects with our company, when considering such factors as the type of services provided and the relative size of the organization as measured by number of employees, comparable market capitalization and revenues. However, we were unable to identify any company for inclusion in our peer group that is substantially identical to our company in terms of the size, scope and nature of operations.

Role of Executive Officers in Compensation Decisions

Our compensation committee approves base pay adjustments and annual bonus awards for each named executive officer based on individual performance reviews. Our chief executive officer discusses the

17

performance reviews and make recommendations to the committee on annual base salary and performance bonus awards. The committee approves all equity grants made to the members of management and other employees in accordance with the terms of our equity incentive plan. The committee works with our chief executive officer and other senior management members in a collaborative nature with respect to substantially all compensation and benefit decisions.

Hedging and Speculative Stock Transactions

We prohibit our executive officers and members of our board of directors from engaging in hedging transactions relative to their ownership of our common stock. We believe this policy serves to further align the interests of our executive officers and directors with those of our company and its stockholders and ensures that such individuals share in the risks and rewards of the ownership of our common stock.

Other Benefits and Perquisites

We provide limited perquisites and other personal benefits to our executive officers that we believe are moderate and consistent with our overall compensation program.

Compensation Committee and Board Review of Total Compensation

Our compensation committee and board of directors annually review aggregate compensation for our chief executive officer and all other named executive officers. The components of aggregate compensation reviewed include, but are not limited to, annual base salary, annual performance bonus, long-term equity compensation, including the in-the-money value of all equity grants and monetized gains, and the value of all qualified and non-qualified retirement contributions.

Employment Contracts and Retention Agreements

Our company has entered into employment agreements with our chief executive officer and each of the other named executive officers. These agreements are discussed in more detail below under the caption “Employment Agreement.” Our compensation committee currently is considering entering into a new employment agreement with our chief executive officer, whose current employment agreement will expire on August 31, 2008. The terms of the new agreement have not been finalized.

Severance Benefits

A description of our severance policies and practices and the estimated amounts that would be payable to our named executive officers under certain circumstances are set forth below under the caption “Change in Control Severance Plan.”

Board of Directors Compensation

Similar to our philosophy on executive compensation, we target the median of the competitive market for compensation of our board of directors. The primary components of our director compensation package consist of an annual retainer, committee and board meeting fees, annual retainers for the chairman, the vice chairmen and audit committee chairman, and annual equity grants.

The compensation of our board members is set forth below in the table entitled “Director Summary Compensation Table.”

Compensation Committee Responsibilities

Our compensation committee currently consists of three directors, each of whom is independent, as defined by NASDAQ’s independence standards, and each of whom is a non-employee director, as defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934. The primary responsibilities of our compensation

18

committee are to review and approve compensation arrangements for senior management, review and recommend compensation arrangements for our board of directors, adopt compensation plans in which senior management is eligible to participate and oversee matters relating to employee compensation, employee benefit plans and employee incentive programs. A more complete description of the committee’s responsibilities is presented above under the caption “Corporate Governance and Board Matters – Committees of the Board – Compensation Committee.” The committee typically meets in executive session without management present for a portion of each meeting.

Use of Outside Consultants

Our compensation committee retains Hay Group, Inc., an outside compensation and benefits consulting firm, from time to time to respond directly to the committee and its inquiries regarding management pay, compensation design and other related matters. The committee may ask that management participate in these engagements. Management has retained Vedder, Price, Kaufman & Kammholz, P.C. to provide legal advice and consultation with respect to management pay, compensation design and other related matters. The committee has approved the reimbursement of management for the cost of these services.

Tax and Accounting Implications

Limit on Tax-Deductible Compensation.Section 162(m) of the Internal Revenue Code or the “Code” imposes a $1 million limit on the deduction that we may claim in any tax year with respect to compensation paid to any of the Named Executive Officers. However, the Internal Revenue Service or “IRS” allows for certain types of performance-based exemptions to this $1 million limit, provided that the compensation plan meets certain IRS requirements. Compensation payable solely on account of attainment of one or more performance goals is not subject to the deduction limit if: (i) the performance goals are objective, pre-established and determined by a committee comprised solely of two or more outside directors; (ii) the material terms of the performance goals under which the compensation is to be paid are disclosed to the stockholders and approved by a majority vote; and (iii) the committee certifies that the performance goals and other material terms were in fact satisfied before the compensation is paid.

Non-Qualified Deferred Compensation.Our company claims tax deductions on company contributions made on behalf of plan participants, including the named executive officers, under our non-qualified plans at the time of benefit payment.

Accounting for Share-Based Compensation.Effective September 1, 2006, our company adopted Statement of Financial Accounting Standard No. 123R, “Share-Based Payment” using the modified prospective transition method, which requires the measurement and recognition of compensation expense based on estimated fair values beginning September 1, 2006 for all share-based payment awards made to employees and directors.

Compensation Committee Report

The compensation committee of our board of directors has reviewed and discussed with management the above Compensation Discussion and Analysis required by Item 402(b) of the SEC’s Regulation S-K. Based on such review and discussions, our compensation committee recommended to our board of directors that the Compensation Discussion and Analysis be included in this proxy statement.

Compensation Committee

| | | | |

| Bruce Krehbiel | | Jack Friedman | | Eric Parthemore |

19

Summary Compensation Table

The following summary compensation table summarizes the compensation paid or accrued by our company in our 2007 fiscal year with respect to our chief executive officer, our principal financial officer and our three other most highly compensated executive officers. In this proxy statement, these individuals are referred to as our “named executive officers.”

| | | | | | | | | | | | | | | | |

Name and Principal Position | | Fiscal

Year | | Salary ($) | | Bonus ($) | | Option

Awards ($)(1) | | Non-Equity

Incentive Plan

Compensation ($)(2) | | Change in

Pension

Value and

Nonquali-

fied

Deferred

Compensa-

tion

Earnings ($) (3) | | All other

Compensa-

tion ($)(4) | | Total ($) |

Paul G. (Pete) Anderson, President & Chief Executive Officer | | 2007 | | 400,000 | | — | | 136,385 | | 942,771 | | 375,768 | | 24,526 | | 1,879,450 |