UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.:N/A )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Cambridge Display Technology, Inc.

(Name of Registrant as Specified in Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Cambridge Display Technology, Inc.

c/o Cambridge Display Technology Limited

2020 Cambourne Business Park

Cambridge CB3 6DW, United Kingdom

011-44-1954-713-600

May 31, 2005

Dear Stockholder:

You are cordially invited to attend our 2005 Annual Meeting of Stockholders. The Annual Meeting will be held at 9:30 a.m., Eastern Daylight Time, on Wednesday, June 29, 2005, at the Grand Hyatt Hotel located at Park Avenue at Grand Central Station, New York, New York 10017.

The formal notice of the Annual Meeting and the Proxy Statement have been made a part of this invitation.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. After reading the Proxy Statement, please promptly vote and submit your proxy by dating, signing and returning the enclosed proxy card in the enclosed postage-prepaid envelope.Your shares cannot be voted unless you submit your proxy or attend the Annual Meeting in person.

The Board of Directors and management look forward to seeing you at the Annual Meeting.

|

Sincerely, |

|

|

David Fyfe |

Chief Executive Officer |

Cambridge Display Technology, Inc.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held June 29, 2005

To our Stockholders:

Cambridge Display Technology, Inc. will hold its Annual Meeting of Stockholders at 9:30 a.m., Eastern Daylight Time, on Wednesday, June 29, 2005, at the Grand Hyatt Hotel located at Park Avenue at Grand Central Station, New York, New York 10017.

We are holding the Annual Meeting:

| | • | | to elect five directors to serve until the 2006 Annual Meeting or until their successors are duly elected and qualified; |

| | • | | to ratify the appointment of Ernst & Young LLP as our independent registered public accountants; and |

| | • | | to transact such other business as may properly come before the Annual Meeting and any adjournments or postponements of the Annual Meeting. |

Only stockholders of record at the close of business on May 16, 2005 are entitled to notice of, and to vote at, the Annual Meeting and any adjournments or postponements of the Annual Meeting. For ten days prior to the Annual Meeting, a complete list of stockholders entitled to vote at the Annual Meeting will be available at the Corporate Secretary’s office, c/o Cambridge Display Technology Limited, 2020 Cambourne Business Park, Cambridge CB3 6DW, United Kingdom.

It is important that your shares are represented at the Annual Meeting. Even if you plan to attend the Annual Meeting, we hope that you will promptly vote and submit your proxy by dating, signing and returning the enclosed proxy card. This will not limit your rights to attend or vote at the Annual Meeting.

|

By Order of our Board of Directors, |

|

|

Stephen B. Chandler |

Corporate Secretary |

Cambridge, United Kingdom

May 31, 2005

Table of Contents

Cambridge Display Technology, Inc.

PROXY STATEMENT

INFORMATION CONCERNING VOTING AND SOLICITATION

This Proxy Statement is being furnished to you in connection with the solicitation by the Board of Directors of Cambridge Display Technology, Inc., a Delaware corporation, or CDT, of proxies to be used at the 2005 Annual Meeting of Stockholders to be held at the Grand Hyatt Hotel located at Park Avenue at Grand Central Station, New York, New York 10017, at 9:30 a.m., Eastern Daylight Time, on Wednesday, June 29, 2005 and any adjournments or postponements thereof. This Proxy Statement and the accompanying form of proxy card are being mailed to stockholders on or about May 31, 2005. In this Proxy Statement, the terms “we,” “us” and “our” refer to CDT, unless the context otherwise requires.

Appointment of Proxy Holders

Our Board of Directors asks you to appoint David Fyfe and Stephen Chandler as your proxy holders to vote your shares at the 2005 Annual Meeting of Stockholders. You make this appointment by voting the enclosed proxy card using one of the voting methods described below.

If appointed by you, the proxy holders will vote your shares as you direct on the matters described in this Proxy Statement. In the absence of your direction, they will vote your shares as recommended by our Board of Directors.

Unless you otherwise indicate on the proxy card, you also authorize your proxy holders to vote your shares on any matters that were not known by our Board of Directors at the time this Proxy Statement was printed and, under our By-Laws, may be properly presented for action at the Annual Meeting.

Who Can Vote

Only stockholders who owned shares of our common stock at the close of business on May 16, 2005, the record date for the Annual Meeting, can vote at the Annual Meeting. As of the close of business on the record date, we had 19,485,483 shares of our common stock outstanding and entitled to vote. Each holder of our common stock is entitled to one vote for each share held as of the record date. There is no cumulative voting in the election of directors.

How You Can Vote

You may vote your shares at the Annual Meeting either in person or by mail as described below. Stockholders holding shares through a bank or broker should follow the voting instructions on the form of proxy card received.

You may vote by dating, signing and returning your proxy card in the enclosed postage-prepaid return envelope. Voting by mail will not limit your right to vote at the Annual Meeting, if you decide to attend in person. Our Board of Directors recommends that you vote by mail, as it is not practical for most stockholders to attend the Annual Meeting. If you hold shares through a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the Annual Meeting.

If you submit your proxy, but do not mark your voting preference, the proxy holders will vote your shares FOR the election of the nominees for director and FOR the ratification of the appointment of independent registered public accountants.

1

Revocation of Proxies

Stockholders can revoke their proxies at any time in any of three ways before they are exercised:

| | • | | by voting in person at the Annual Meeting (if your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the meeting); |

| | • | | by submitting written notice of revocation to the Corporate Secretary prior to the Annual Meeting; or |

| | • | | by submitting another proxy of a later date prior to the Annual Meeting that is properly executed. |

Required Vote

Directors are elected by a plurality vote, which means that the five nominees receiving the most affirmative votes will be elected. All other matters submitted for stockholder approval require the affirmative vote of the majority of shares present in person or represented by proxy and entitled to vote.

A quorum, which is a majority of the outstanding shares as of May 16, 2005, must be present to hold the Annual Meeting. A quorum is calculated based on the number of shares represented by the stockholders attending in person and by their proxy holders. If you indicate an abstention as your voting preference, your shares will be counted toward a quorum. Abstentions on any matters are treated as shares present or represented and entitled to vote on that matter and have the same effect as a vote against such matter.

If a broker indicates on the enclosed proxy card or its substitute that such broker does not have discretionary authority to vote on a particular matter (broker non-votes), those shares will be considered as present for purposes of determining the presence of a quorum but will not be treated as shares entitled to vote on that matter.

Solicitation of Proxies

CDT will pay the cost of printing and mailing proxy materials. In addition to the solicitation of proxies by mail, solicitation may be made by our directors, officers and other employees by personal interview, telephone or facsimile. No additional compensation will be paid to these persons for solicitation. We will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation materials to beneficial owners of our common stock.

Important

Please promptly vote and submit your proxy by signing, dating and returning the enclosed proxy card in the postage-prepaid return envelope so that your shares can be voted. This will not limit your rights to attend or vote at the Annual Meeting.

2

PROPOSAL 1

ELECTION OF DIRECTORS

Directors and Nominees

Our By-Laws currently provide that the number of directors that shall constitute our entire Board of Directors shall be fixed from time to time by resolutions of our Board provided that such number shall not be less than three. We currently have authorized six directors and our Board has resolved that this number will be reduced to five immediately following the Annual Meeting. Therefore, at the Annual Meeting, five persons will be elected as members of our Board, each for a one-year term or until their successors are elected and qualified. The proxies given to the proxy holders will be voted or not voted as directed and, if no direction is given, will be voted FOR these five nominees. Our Board knows of no reason why any of these nominees should be unable or unwilling to serve. However, if for any reason any nominee should be unable or unwilling to serve, the proxies will be voted for any nominee designated by our Board to fill the vacancy.

General

Information with respect to our directors and all persons nominated or chosen to become directors is set forth below, including age, position (if any) with CDT, business experience during at least the past five years and directorships of other publicly owned corporations. Ages are as of April 15, 2005.

| | | | |

Name

| | Age

| | Position

|

Dr. David Fyfe | | 61 | | Chairman and Chief Executive Officer |

Philip E. Berney | | 41 | | Director |

Frank K. Bynum, Jr. | | 42 | | Director |

Joseph Carr | | 47 | | Director |

James V. Sandry | | 42 | | Director |

Business Experience of Nominees

Dr. David Fyfe has served as the Chairman of our Board and our Chief Executive Officer since September 2000. From 1996 to 1999, Dr. Fyfe was Chief Executive Officer of Harris Specialty Chemicals. Harris Specialty Chemicals was until March 1999 a privately held manufacturer and seller of construction products, operating principally in the United States and Western Europe. It sold products such as sealants, architectural coatings and expansion joints to construction distributors and contractors. Harris Specialty Chemicals was sold in 1999 to SKW GmbH of Germany, owned by E.ON AG, and has since become part of Degussa Construction Chemicals. Between 1999 and August 2000, Dr. Fyfe worked as an independent business consultant.

Philip E. Berney has served as a member of our Board since 1999. Mr. Berney is a Managing Director at Kelso & Company, a private equity firm, having joined Kelso in 1999. In addition, Mr. Berney is a director of Custom Building Products Inc., Del Laboratories, Inc., Eagle Bulk Shipping Inc. and Federal Information Technology Systems, LLC.

Frank K. Bynum, Jr.has served as a member of our Board since 1999. Mr. Bynum is a Managing Director at Kelso, having joined Kelso in 1987. In addition, Mr. Bynum is a director of Citation Corporation, Custom Building Products Inc., Endurance Business Media, Inc. and FairPoint Communications, Inc.

Joseph Carr has served as a member of our Board since March 2005. Mr. Carr was responsible for the Electronic Materials business of Dow Chemical from 1996 to 2001 when he was appointed Vice President at Osram Opto Semiconductors with global responsibility for Osram’s manufacture of Organic Light Emitting Diode (OLED) displays until March 2004. Since then he has been consulting at a strategic level for senior management clients in various high technology industries including electronics, consumer electronics and electronic materials.

3

James V. Sandry has served as a member of our Board since November 2004. From April 1996 to June 1999, Mr. Sandry was Chief Financial Officer and, subsequently, Executive Vice President—Finance of iXL Enterprises, an internet consulting company in which Kelso held a controlling interest. From January 2000 to November 2000, Mr. Sandry was the Chief Financial Officer of Online Insight Inc., a software development company. From November 2000 to May 2001, Mr. Sandry was the Chief Financial Officer of VCG, Inc., a software development company. From October 2001 to April 2002, Mr. Sandry was the Chief Financial Officer of Ted’s Montana Grill, a restaurant company. Since November 2002, Mr. Sandry has been the Chief Executive Officer of JVS Industries LLC, a privately held furniture rental company and a franchisee of Aaron Rents.

There are no family relationships among any of our directors or executive officers.

Vote Required

The five nominees for directors receiving the highest number of affirmative votes will be elected as directors. Unless marked to the contrary, proxies received will be voted “FOR” the nominees.

Our Board of Directors recommends a vote FOR the election of the nominees set forth above as directors of CDT.

Organization of our Board

Our Board of Directors held seven meetings during the fiscal year ended December 31, 2004 and each director, during the time that he was a director, attended at least 75% of the total regularly scheduled and special meetings of our Board and the committees on which he served. The rules and regulations of the National Association of Securities Dealers, the Nasdaq Stock Market and the Securities and Exchange Commission, or the SEC, require that, within one year from the date of our initial public offering on December 15, 2004, a majority of our board must be composed of members who meet the independence standards specified in these rules and regulations. Philip E. Berney and Frank K. Bynum, Jr., the two directors affiliated with our largest stockholder, Kelso & Company, and who do not meet these independence standards, have agreed that one of them will resign from our Board prior to December 15, 2005 if necessary in order for us to comply with these requirements.

Our Board has established an Audit Committee, in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, and a Compensation Committee. Our Board has determined that James V. Sandry is an “audit committee financial expert” under the rules of the SEC. We believe that Joseph Carr and Mr. Sandry, both of whom are members of the Audit Committee and the Compensation Committee of our Board, meet the independence standards of the National Association of Securities Dealers, the Nasdaq Stock Market and the rules and regulations of the SEC. We are relying on the exemption from the requirement that each member of the Audit Committee must be independent that is afforded to us for a period of one year from the date of our initial public offering, provided that a majority of the members of the Audit Committee meet the independence standards within 90 days of that date. We do not believe that reliance on this exemption materially adversely affects the ability of the Audit Committee to act independently and to satisfy the other requirements or Rule 10A-3 under the Securities Exchange Act of 1934. Our Board has approved a charter for each of these committees, which can be found in Appendices A and B and on our website atwww.cdtltd.co.uk.

Audit Committee

| | |

Number of Members: | | Three |

| |

Members: | | Frank K. Bynum, Jr. Joseph Carr James V. Sandry, Chairman and Financial Expert |

| |

Number of meetings in 2004: | | One |

4

| | |

Functions: | | The Audit Committee has responsibility for, among other things, selecting our independent auditors, reviewing and approving the scope of the independent auditors’ audit activity and extent of non-audit services, reviewing with management and the independent accountants the adequacy of our basic accounting systems and the effectiveness of our internal controls, reviewing with management and the independent accountants our financial statements and exercising general oversight of our financial reporting process, and reviewing litigation and other legal matters that may affect our financial condition and monitoring compliance with our business ethics and other policies. |

Compensation Committee

| | |

Number of Members: | | Three |

| |

Members: | | Philip E. Berney Joseph Carr, Chairman James V. Sandry |

| |

Number of meetings in 2004: | | One |

| |

Functions: | | The Compensation Committee reviews all compensation arrangements for executive officers. |

Director Nominations

Our Board of Directors has not established a standing committee to nominate candidates for election as directors. Instead, our independent directors recommend, and our Board selects, the candidates that will be nominated to stand for election as directors at our annual meetings of stockholders and to fill vacancies in our Board as they arise. Our Board believes that this process is appropriate given the relatively small size of our Board and because each independent director already serves on both the Audit Committee and the Compensation Committee of our Board.

Our Board of Directors has as an objective that its membership be comprised of individuals who have distinguished records of leadership and success in their arena of activity and who will make substantial contributions to our Board’s operations. The independent directors’ assessment of candidates for membership on our Board includes, but is not limited to, consideration of:

| | • | | the current composition of our Board; |

| | • | | the balance of management and non-management directors; |

| | • | | the need for particular financial expertise, including with respect to service on the audit committee and qualification as an “audit committee financial expert” as such term is defined under Item 401(h) of Regulation S-K, promulgated under the Securities Act of 1933 |

| | • | | the need for particular technical or strategic expertise; and |

| | • | | the evaluation of other prospective nominees. |

5

In addition, our procedures for nominating directors contain provisions that address the process by which a stockholder may nominate an individual to stand for election to our Board of Directors at our annual meeting of stockholders. In order to nominate a candidate for director, a stockholder must do so in writing to our Corporate Secretary. This written submission must be delivered to us not fewer than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting and in any event at least 45 days prior to the first anniversary of the date on which we first mailed our proxy materials for the preceding year’s annual meeting of stockholders, provided that if the date of the annual meeting is advanced by more than 30 days or delayed by more than 70 days from such anniversary date of the preceding year’s annual meeting, the written submission to be timely must be so delivered not earlier than 120 days prior to the annual meeting and not later than the close of business on the later of the 90th day prior to the annual meeting or the 10th day following the day on which public announcement of the date of the annual meeting is first made. Information required by these procedures to be in the notice include the name and contact information for the candidate and the person making the nomination and other information about the nominee that must be disclosed in proxy solicitations under Section 14 of the Securities Exchange Act of 1934 and the related rules and regulations thereunder.

Stockholder nominations must be made in accordance with the procedures outlined in, and include the information required by, our these procedures and must be addressed to:

Corporate Secretary

Cambridge Display Technology, Inc.

c/o Cambridge Display Technology Limited

2020 Cambourne Business Park, Cambridge CB3 6DW

United Kingdom.

Our Director Nominating Procedures are available on our website atwww.cdtltd.co.uk.

Communications with the Board

Our Board of Directors has a process for stockholders to send communications to directors. If you wish to communicate with our Board, you may send your communication in writing to: Stephen Chandler, Corporate Secretary, Cambridge Display Technology, Inc., c/o Cambridge Display Technology Limited, 2020 Cambourne Business Park, Cambridge CB3 6DW, United Kingdom. You must include your name and address in the written communication and indicate whether or not you are a stockholder of CDT. Stephen Chandler will review any communication received from a stockholder, and all material communications from stockholders will be forwarded to the appropriate director or directors or committee of the Board based on the subject matter.

Compensation of Directors

We reimburse directors for expenses incurred in attending meetings of our Board of Directors and committees thereof. Each of our independent non-executive directors also receives an annual fee of $50,000 for serving as a director and an additional fee of $3,000 for each day in which the director participates in meetings of our Board or any committee thereof. Each independent non-executive director also receives an annual fee of $10,000 for each committee of our Board on which such independent non-executive director serves and an annual fee of up to $25,000 for serving as the chairperson of a committee. On December 14, 2004, we granted to James V. Sandry options with respect to 5,000 shares of our common stock under our 2004 stock incentive plan. These options will vest in three equal annual installments, beginning on the first anniversary of their grant dates.

In addition, on March 3, 2005, we granted to Joseph Carr and James V. Sandry options with respect to 15,000 and 10,000, respectively, shares of our common stock under our 2004 stock incentive plan. These options will vest in three equal annual installments, beginning on the first anniversary of their grant dates.

Compensation Committee Interlocks and Insider Participation

No member of our Board of Directors serves as a member of the board of directors or compensation committee of any other entity that has one or more executive officers serving as a member of our Board or the

6

Compensation Committee thereof. From 1996 to 1999, James V. Sandry served as the Chief Financial Officer and, subsequently, Executive Vice President—Finance of iXL Enterprises, an internet consulting firm in which Kelso held a controlling interest.

Executive Officers

Our executive officers are set forth below, with ages as of April 15, 2005.

| | | | |

Name

| | Age

| | Position

|

Dr. David Fyfe | | 61 | | Chairman and Chief Executive Officer |

Dr. Jeremy Burroughes | | 44 | | Chief Technical Officer |

Dr. SB Cha | | 40 | | Vice President, Commercial |

Dr. Scott Brown | | 42 | | Vice President, Research & Technology |

Stephen Chandler | | 49 | | Vice President, Legal & Intellectual Property |

Set forth below is information concerning the business experience of those of our executive officers who are not also directors:

Dr. Jeremy Burroughes has served as our Chief Technical Officer since November 2001 and was one of the three original inventors of P-OLED technology. Dr. Burroughes joined us in 1997 to manage the new research group and held the positions of Technical Director from June 1998 to November 2000 and Product Business Unit Director from November 2000 to November 2001.

Dr. SB Cha has been our Vice President, Commercial since July 2002. Between 1998 and 2002, Dr. Cha was employed in the components division of Royal Philips Electronics, where he was Vice President of Strategic Marketing and Business Development from 1999 to 2002 and Vice President of Customer Development, North America Region from 1998 to 1999.

Dr. Scott Brown has served as our Vice President, Research & Technology since May 2002. Prior to joining us, Dr. Brown held a variety of management positions within the Research & Development division at Dow Corning between 1987 and 2002, ultimately serving as Global R&D Director of the electronics business.

Stephen Chandler has served as our Vice President, Legal & Intellectual Property since joining us in May 2003, responsible for all legal and intellectual property matters, and for developing our intellectual property strategy. Prior to joining us, Mr. Chandler was a partner at the law firm Pinsent Curtis Biddle between 1986 and 2003.

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of May 16, 2005, the record date for the Annual Meeting, as to shares of our common stock beneficially owned by:

| | • | | each person who is known by us to own beneficially more than 5% of our common stock; |

| | • | | each of our executive officers listed in the Summary Compensation Table; |

| | • | | each of our directors; and |

| | • | | all our directors and executive officers as a group. |

Unless otherwise stated below, the address of each beneficial owner listed on the table is c/o Cambridge Display Technology Limited, 2020 Cambourne Business Park, Cambridge CB3 6DW, United Kingdom.

We have determined beneficial ownership in accordance with the rules of the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons and entities named in the table below have sole voting and investment power with respect to all shares of our common stock that they beneficially own, subject to applicable community property laws.

The percentage of our common stock beneficially owned is based on 19,485,483 shares outstanding as of the record date. In computing the number of shares of our common stock beneficially owned by a person and the percentage ownership of that person, we deemed outstanding shares of our common stock subject to options held by that person that are currently exercisable or exercisable within 60 days after the record date. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person or of the directors and officers as a group.

| | | | | | | |

Name and Address of Beneficial Owner

| | Number of Shares of Common Stock Beneficially Owned

| | | Percentage of

Common Stock

Beneficially

Owned

| |

Kelso Investment Associates VI, L.P. (1)(2) | | | 8,657,833 | | | 44.4 | % |

KEP VI, LLC (1)(2) | | | 8,657,833 | | | 44.4 | % |

Frank T. Nickell (1) | | | | (3) | | | (3) |

Thomas R. Wall, IV (1) | | | | (3) | | | (3) |

George E. Matelich (1) | | | | (3) | | | (3) |

Michael B. Goldberg (1) | | | | (3) | | | (3) |

David I. Wahrhaftig (1) | | | | (3) | | | (3) |

Frank K. Bynum, Jr. (1)(4) | | | | (3) | | | (3) |

Philip E. Berney (1)(4) | | | | (3) | | | (3) |

Frank J. Loverro (1) | | | | (3) | | | (3) |

James J. Connors II (1) | | | | (3) | | | (3) |

Hillman CDT LLC (5)(6) | | | 4,235,978 | | | 21.7 | % |

Hillman CDT 2000 LLC (5)(6) | | | 4,235,978 | | | 21.7 | % |

Gerald Paul Hillman (4)(5) | | | | (7)(8) | | | (7)(8) |

James V. Sandry | | | — | | | — | |

Joseph Carr | | | — | | | — | |

David Fyfe (9) | | | 58,518 | | | * | |

Scott Brown (10) | | | 8,778 | | | * | |

Jeremy Burroughes (11) | | | 24,383 | | | * | |

SB Cha (12) | | | 4,681 | | | * | |

Stephen Chandler (13) | | | 11,704 | | | * | |

All directors and executive officers as a group (10 persons) (14) | | | 13,001,875 | | | 66.7 | % |

8

| (1) | Based on information contained in Schedule 13G, as filed on February 14, 2005, as amended by Schedule 13G/A, as filed on May 2, 2005. The business address for these persons is c/o Kelso & Company, 320 Park Avenue, 24th Floor, New York, New York 10022. |

| (2) | The shares owned by Kelso Investment Associates VI, L.P. and KEP VI, LLC represent the combined share ownership of Kelso Investment Associates VI, L.P. and KEP VI, LLC. Kelso Investment Associates VI, L.P. and KEP VI, LLC, due to their common control, could be deemed to beneficially own each of the other’s shares, but disclaim such beneficial ownership. |

| (3) | Messrs. Nickell, Wall, Matelich, Goldberg, Wahrhaftig, Bynum, Berney, Loverro and Connors may be deemed to share beneficial ownership of shares owned of record by Kelso Investment Associates VI, L.P. and KEP VI, LLC, by virtue of their status as managing members of KEP VI, LLC and the general partner of Kelso Investment Associates VI, L.P. Messrs. Nickell, Wall, Matelich, Goldberg, Wahrhaftig, Bynum, Berney, Loverro and Connors share investment and voting power with respect to the shares owned by Kelso Investment Associates VI, L.P. and KEP VI, LLC, but disclaim beneficial ownership of such shares. |

| (4) | Messrs. Berney, Bynum and Hillman are currently directors. Messrs. Berney and Bynum have been nominated for re-election to our Board, as described under “Proposal One: Election of Directors” above. |

| (5) | Based on information contained in Schedule 13G, as filed on February 14, 2005. The business address for these persons is c/o Hillman Capital Corporation, 900 Third Avenue, 5th Floor, New York, New York 10022. |

| (6) | The shares owned by Hillman CDT LLC and Hillman CDT 2000 LLC represent the combined share ownership of Hillman CDT LLC and Hillman CDT 2000 LLC. Hillman CDT LLC and Hillman CDT 2000 LLC, due to their common control, could be deemed to beneficially own each of the other’s shares, but disclaim such beneficial ownership. |

| (7) | Hillman Capital Management LLC (“Hillman Capital LLC”) is the sole managing member of Hillman CDT LLC (“Hillman CDT”) and has the power to direct Hillman CDT as to the voting and disposition of shares held by Hillman CDT. Hillman Capital Corporation is the sole managing member of Hillman Capital LLC, and has the sole voting and dispositive power of Hillman Capital LLC with respect to the shares owned by Hillman CDT. Mr. Hillman is the sole stockholder of Hillman Capital Corporation and has the sole voting and dispositive power of Hillman Capital Corporation with respect to the shares owned by Hillman CDT. Mr. Hillman expressly disclaims beneficial ownership of the shares owned by Hillman CDT. |

| (8) | Hillman Capital Management 2000 LLC (“Hillman Capital 2000 LLC”) is the sole managing member of Hillman CDT 2000 LLC (“Hillman CDT 2000”) and has the power to direct Hillman CDT 2000 as to the voting and disposition of shares held by Hillman CDT 2000. Hillman Capital Corporation is the sole managing member of Hillman Capital 2000 LLC, and has the sole voting and dispositive power of Hillman Capital 2000 LLC with respect to the shares owned by Hillman CDT 2000. Mr. Hillman is the sole stockholder of Hillman Capital Corporation and has the sole voting and dispositive power of Hillman Capital Corporation with respect to the shares owned by Hillman CDT 2000. Mr. Hillman expressly disclaims beneficial ownership of the shares owned by Hillman CDT 2000. |

| (9) | Consists of shares issuable to Dr. Fyfe upon exercise of options exercisable within 60 days. |

| (10) | Consists of shares issuable to Dr. Brown upon exercise of options exercisable within 60 days. |

| (11) | Consists of shares issuable to Dr. Burroughes upon exercise of options exercisable within 60 days. |

| (12) | Consists of shares issuable to Dr. Cha upon exercise of options exercisable within 60 days. |

| (13) | Consists of shares issuable to Mr. Chandler upon exercise of options exercisable within 60 days. |

| (14) | Includes shares held by Kelso Investment Associates VI, L.P. and KEP VI, LLC that may be deemed to be beneficially owned by Mr. Bynum and Mr. Berney and shares held by Hillman CDT LLC and Hillman CDT 2000 LLC that may be deemed to be beneficially owned by Mr. Hillman. |

9

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires our executive officers and directors, and persons who own more than 10% of a registered class of our equity securities, to file reports of ownership on Forms 3, 4 and 5 with the SEC. Officers, directors and greater than 10% stockholders are required to furnish us with copies of all Forms 3, 4 and 5 they file.

Based solely on our review of the copies of such forms we have received and written representations from certain reporting persons that they filed all required reports, we believe that all of our officers, directors and greater than 10% stockholders complied with all Section 16(a) filing requirements applicable to them with respect to transactions during fiscal year 2004.

REPORT OF THE AUDIT COMMITTEE

The following report of the Audit Committee does not constitute soliciting material and shall not be deemed filed or incorporated by reference into any other filing by CDT under the Securities Act of 1933 or the Securities Exchange Act of 1934.

The Audit Committee of CDT’s Board of Directors provides assistance to the Board in fulfilling its legal and fiduciary obligations in matters involving accounting, auditing, financial reporting, internal control and legal compliance functions by approving the services performed by CDT’s independent registered public accountants and reviewing their reports regarding CDT’s accounting practices and systems of internal accounting controls as set forth in a written charter adopted by the Board. CDT’s management is responsible for preparing the financial statements and the independent registered public accountants are responsible for auditing those financial statements. The Audit Committee is responsible for overseeing the conduct of these activities by management and the independent registered public accountants.

In this context, the Audit Committee of the Board of Directors has met and held discussions with management and the independent registered public accountants. Management represented to the Audit Committee that the consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accountants.

The Audit Committee of the Board of Directors has discussed with the independent registered public accountants matters required to be discussed by Statement on Auditing Standards No. 61 and No. 90 (Communication With Audit Committees), as amended. In addition, the independent registered public accountants provided to the Audit Committee the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee and the independent registered public accountants have discussed such accountants’ independence from CDT and from its management, including the matters in those written disclosures. In addition, the Audit Committee considered whether or not the provision of non-audit services was compatible with maintaining such accountants’ independence. The Audit Committee has discussed with management the procedures for selection of consultants and the related competitive bidding practices and fully considered whether or not those services provided by the independent registered public accountants are compatible with maintaining such accountant independence.

The Audit Committee of the Board of Directors has discussed with CDT’s independent registered public accounting firm, with and without management present, its evaluations of CDT’s internal accounting controls and the overall quality of its financial reporting. In reliance on the reviews and discussions with management and the independent registered public accountants referred to above, the Audit Committee recommended to the Board, and the Board has approved, the inclusion of the audited financial statements in CDT’s Annual Report on Form 10-K for the fiscal year ended December 31, 2004, for filing with the SEC.

Respectfully submitted on May 27, 2005, by the members of the Audit Committee of the Board:

James V. Sandry, Chairman

Frank K. Bynum, Jr.

Joseph Carr

10

EXECUTIVE COMPENSATION

Executive Compensation

The following table sets forth the compensation earned by our Chief Executive Officer and each of our other four most highly compensated executive officers (each, a named executive officer) for the last fiscal year.

Summary Compensation Table

| | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | Long-Term Compensation

| | |

Name and Principal Position

| | Year

| | Salary

($)(2)

| | Bonus

($)(3)

| | Other Annual Compensation ($)(4)

| | Restricted Stock

Award(s) ($)(5)

| | Securities Underlying Options/SARs (#)(6)

| | All Other Compensation ($)(7)

|

David Fyfe (1) Chief Executive Officer | | 2004 | | 428,114 | | 192,544 | | 280,194 | | 4,779,600 | | — | | 49,775 |

| | | | | | | |

Scott Brown (1) Vice-President, Research & Technology | | 2004 | | 266,022 | | 97,253 | | — | | 1,638,720 | | 2,341 | | 13,301 |

| | | | | | | |

Jeremy Burroughes (1) Chief Technical Officer | | 2004 | | 248,976 | | 81,890 | | — | | 1,638,720 | | — | | 12,449 |

| | | | | | | |

Stephen Chandler (1) Vice-President, Legal & Intellectual Property | | 2004 | | 330,124 | | 120,687 | | 444 | | 1,638,720 | | 4,389 | | 16,506 |

| | | | | | | |

SB Cha (1) Vice-President, Commercial | | 2004 | | 245,143 | | 80,621 | | — | | 1,638,720 | | 1,756 | | 12,257 |

| (1) | With the exception of the restricted stock awards, all payments to and for Dr. Brown, Dr. Burroughes, Mr. Chandler and Dr. Cha and certain payments to and for Dr. Fyfe were made in British pounds. These payments are converted to U.S. dollars at the exchange rate for the date on which each transaction was recorded in our financial statements as published by the Financial Times of London. |

| (2) | Amounts in this column include amounts contributed by the named executive to the executive’s 401(k) account, in the case of Dr. Fyfe, and to the executive’s defined contribution pension accounts, in the case of all other named executives. |

| (3) | Amounts in this column represent cash payments made pursuant to our Annual Incentive Plan. These bonus amounts were earned in 2004, but paid in January 2005. |

| (4) | Amounts in this column consist of (i) a $90,000 overseas allowance payment to Dr. Fyfe, (ii) $30,653 for personal tax advice for Dr. Fyfe, (iii) $9,207 for travel for Dr. Fyfe’s family members, (iv) $3,176 home rent subsidy for Dr. Fyfe, (v) $147,948 in tax equalization payments to U.K. Inland Revenue on Dr. Fyfe’s behalf pursuant to his Overseas Benefit Agreement and (vi) $444 paid to Mr. Chandler for local property taxes incurred by him in 2004. |

| (5) | An award of 420,000 restricted stock units was made to Dr. Fyfe and awards of 144,000 restricted stock units were made to Dr. Brown, Dr. Burroughes, Mr. Chandler and Dr. Cha pursuant to our Special Bonus Plan. The values of these restricted stock unit awards, based on the initial public offering price of $12.00 and based on our stock price of $11.38 per share at December 31, 2004, were $5,040,000 and $4,779,600, respectively, for the restricted stock units held by Dr. Fyfe and $1,728,000 and $1,638,720, respectively, for the restricted stock units held by each of Dr. Brown, Dr. Burroughes, Mr. Chandler and Dr. Cha. All restricted stock units will vest in three equal annual installments in December 2005, December 2006 and December 2007. However, if Kelso sells more than 25% of its stock in CDT, any unvested restricted stock units will vest immediately. Pursuant to the terms of our Special Bonus Plan, restrictions on the issuance of shares and the transferability of such shares issued in respect of the vested restricted stock units will remain in force until December 2009. No dividends will be paid on restricted stock units. The Special Bonus Plan is administered by the Compensation Committee of our Board. |

11

| (6) | Awards of 2,341 options to Dr. Brown, 4,389 options to Mr. Chandler and 1,756 options to Dr. Cha were granted under the CDT Acquisition Corp. Amended and Restated Stock Incentive Plan. This plan is administered by the Compensation Committee of our Board. |

| (7) | Amounts in this column consist of (i) a $10,250 matching contribution to Dr. Fyfe’s 401(k) plan and a $39,525 payment to Dr. Fyfe based on the difference between 5% of Dr. Fyfe’s salary and the aggregate caps on his employer contribution to his 401(k) plan for the years 2001 to 2004 and (ii) matching contributions to the defined contribution pension accounts of Dr. Brown, Dr. Burroughes, Mr. Chandler and Dr. Cha in the amounts of $13,301, $12,449, $16,506 and $12,257, respectively, in each case at the exchange rate as of December 31, 2004 as published by the Financial Times of London. |

Option Grants in the Fiscal Year Ended December 31, 2004

The following table sets forth information concerning individual grants of stock options made during the fiscal year ended December 31, 2004 to the executives named below.

Option Grants in Last Fiscal Year

| | | | | | | | | | | | | | |

| | | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(4)

|

Name

| | Number of

Securities

Underlying

Options

Granted

(#)(1)

| | Percent of

Total

Options

Granted to

Employees

in 2004(2)

| | | Exercise

Price

($/sh)(3)

| | Expiration

Date

| |

| | | | | | 5%($)

| | 10%($)

|

David Fyfe | | — | | | | | | | | | | | | |

Scott Brown (5) | | 2,341 | | 1.45 | % | | $ | 27.60 | | 1/1/2014 | | 40,629 | | 102,962 |

Jeremy Burroughes | | — | | | | | | | | | | | | |

Stephen Chandler (6) | | 4,389 | | 2.73 | % | | $ | 27.60 | | 1/1/2014 | | 76,180 | | 193,054 |

SB Cha (7) | | 1,756 | | 1.09 | % | | $ | 27.60 | | 1/1/2014 | | 30,472 | | 77,222 |

| (1) | All of the options were granted under our CDT Acquisition Corp. Amended and Restated Stock Incentive Plan administered by the Compensation Committee of our Board. |

| (2) | The total options granted to employees in the fiscal year include grants to our current and former employees and consultants under our CDT Acquisition Corp. Amended and Restated Stock Incentive Plan and our 2004 Stock Incentive Plan. |

| (3) | The exercise price is based on the fair market value of a share of our common stock on the date the option is granted. |

| (4) | Potential realizable value is based on the assumed annual growth for each of the grants, as disclosed over their 10-year option term. These amounts represent assumed rates of appreciation in the value of our common stock from the fair market value on the grant date. Actual gains, if any, on stock option exercises depend on the future performance of our common stock and overall stock market conditions. The amounts reflected in the table above may not necessarily be achieved. |

| (5) | Of the 2,341 options granted to Dr. Brown, 780 of these shares vest based upon continued service with us and 1,561 of these shares vest if and when Kelso Investment Associates VI, L.P., KEP VI, LLC, Hillman CDT LLC and Hillman CDT 2000 LLC receive an internal rate of return, compounded annually, on their investment in the aggregate number of shares of our common stock beneficially owned by them on the date of a change of control (as defined in the CDT Acquisition Corp. Amended and Restated Stock Incentive Plan), in an amount of at least 30%, calculated from the time of their initial investments in us. Of those options that vest based on continued service, 25% vested upon the grant date, and an additional 25% will vest on each of the first, second and third anniversaries of the grant date. |

| (6) | Of the 4,389 options granted to Mr. Chandler, 1,463 of these shares vest based upon continued service with us and 2,926 of these shares vest if and when Kelso Investment Associates VI, L.P., KEP VI, LLC, Hillman |

12

| | CDT LLC and Hillman CDT 2000 LLC receive an internal rate of return, compounded annually, on their investment in the aggregate number of shares of our common stock beneficially owned by them on the date of a change of control (as defined in the CDT Acquisition Corp. Amended and Restated Stock Incentive Plan), in an amount of at least 30%, calculated from the time of their initial investments in us. Of those options that vest based on continued service, 25% vested after the six-month anniversary of the grant date, and an additional 25% will vest on each of the first, second and third anniversaries of the grant date. |

| (7) | Of the 1,756 options granted to Dr. Cha, 585 of these shares vest based upon continued service with us and 1,171 of these shares vest if and when Kelso Investment Associates VI, L.P., KEP VI, LLC, Hillman CDT LLC and Hillman CDT 2000 LLC receive an internal rate of return, compounded annually, on their investment in the aggregate number of shares of our common stock beneficially owned by them on the date of a change of control (as defined in the CDT Acquisition Corp. Amended and Restated Stock Incentive Plan), in an amount of at least 30%, calculated from the time of their initial investments in us. Of those options that vest based on continued service, 25% vested after the six-month anniversary of the grant date, and an additional 25% will vest on each of the first, second and third anniversaries of the grant date. |

Stock Option Values as of December 31, 2004

The following table sets forth information for each named executive officer regarding the value of options to purchase shares of our common stock as of December 31, 2004. Such options were granted to the named executive officers pursuant to the CDT Acquisition Corp. Amended and Restated Stock Incentive Plan.

Stock Option Values as of Last Fiscal Year-End

| | | | | | | | | | |

| | | Number of Securities Underlying Unexercised Options at December 31, 2004

| | Value of Unexercised In-the-Money Options at December 31, 2004($)

|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

David Fyfe | | 58,518 | | 117,036 | | $ | 0 | | $ | 0 |

Stephen Chandler | | 7,681 | | 40,596 | | | 0 | | | 0 |

Scott Brown | | 6,437 | | 21,652 | | | 0 | | | 0 |

Jeremy Burroughes | | 24,383 | | 48,765 | | | 0 | | | 0 |

SB Cha | | 4,535 | | 14,776 | | | 0 | | | 0 |

Long-Term Incentive Plans-Awards in the Fiscal Year Ended December 31, 2004

The following table provides information regarding performance units granted during 2004 to the persons named in the Summary Compensation Table.

Long-Term Incentive Plans—Awards in Last Fiscal Year

| | | | |

Name

| | Number of Shares,

Units or Maximum

Other Rights(#)(1)

| | Performance or Other

Period Until Maturation

or Payout($)(2)

|

David Fyfe | | 420,000 | | 12/22/2004 to 12/21/2007 |

Scott Brown | | 144,000 | | 12/22/2004 to 12/21/2007 |

Jeremy Burroughes | | 144,000 | | 12/22/2004 to 12/21/2007 |

Stephen Chandler | | 144,000 | | 12/22/2004 to 12/21/2007 |

SB Cha | | 144,000 | | 12/22/2004 to 12/21/2007 |

| (1) | All awards are in the form of restricted stock units and were made under our Special Bonus Plan. Pursuant to the terms of the plan, certain restrictions on the issuance of shares underlying vested restricted stock units and the transferability of shares issued under such units apply and will remain in force until the plan terminates in December 2009. |

| (2) | All restricted stock units will vest in three equal annual installments in December 2005, December 2006 and December 2007. Any unvested restricted stock units will terminate when an executive’s employment |

13

| | terminates, except that (i) CDT may elect to allow a greater number of an executive’s restricted stock units to remain payable if the executive’s employment is terminated for cause, the executive resigns or the executive’s employment is terminated by reason of death, injury, ill health, disability or retirement, (ii) Dr. Fyfe’s restricted stock units will remain payable if his employment terminates for any reason other than his termination for cause, his resignation in circumstances that justify termination for cause or our failure to extend his employment agreement for cause and (iii) all unvested restricted stock units will vest immediately if Kelso sells more than 25% of its stock in CDT. |

Employment Agreements

We have entered into the following employment agreements with our executive officers, each of which is governed by the law of England and Wales, except for the agreement with Dr. David Fyfe, which is governed by U.S. law.

Dr. David Fyfe. In August 2002, we entered into an employment agreement with Dr. Fyfe, which was amended as of August 31, 2004 and modified by the Compensation Committee of our Board on February 11, 2005 and April 28, 2005. Pursuant to this agreement, Dr. Fyfe will serve as our Chief Executive Officer and a member of our Board of Directors for a term ending August 31, 2007 and Dr. Fyfe current contracted annual base salary is $441,000. Effective January 1, 2005, the compensation committee agreed that Dr. Fyfe’s monthly salary payments would be paid 50% in U.S. dollars and 50% in British pounds and that the British pound portion would be converted to U.S. dollars at an exchange rate of 1.82327, which was the average exchange rate for the period from January 2004 to November 2004. Therefore, Dr. Fyfe’s salary is comprised of $220,500 per year in U.S. dollars plus £120,937 in British pounds, or, in aggregate, $453,449 per year at an exchange rate of 1.9262 dollars to 1 pound sterling as published in the Financial Times of London for December 31, 2004. Dr. Fyfe receives an annual overseas allowance in the amount of $90,000 for periods during which he serves overseas and is considered a resident in the United Kingdom for tax purposes. Dr. Fyfe is also eligible to receive an annual bonus, which in his first year of employment was limited to 45% of his base salary.

We contribute to Dr. Fyfe’s 401(k) retirement plan to the maximum extent permitted and, in addition, make a cash payment to Dr. Fyfe equal to the difference between 5% of his contracted annual base salary and the aggregate amount that has been paid by us into his 401(k) plan during any calendar year.

Dr. Fyfe is also entitled to a benefit under the terms of our special bonus plan. Should Dr. Fyfe’s term not be extended upon expiration of his employment agreement or if his employment is terminated for any reason other than for cause (as defined in the employment agreement), his entitlement under the plan shall remain in place. In addition, Dr. Fyfe will be entitled to retain any options to purchase shares of our common stock for a period of seven years, after which, if a vesting event (as defined under our stock incentive plans) has not occurred, we will be required to liquidate the options at a value set by an independent third party.

Upon (1) expiration of his employment, (2) his death or disability or (3) termination of his employment either by us without cause or by him for good reason (including a change in control, each of which is defined in the employment agreement), Dr. Fyfe is entitled to a pension of $100,000 per year for a period of five years, contingent upon positive earnings before interest, taxes, depreciation, and amortization, or EBITDA, in each year that a given payment is to be made. In the event that EBITDA is not positive and thus a pension payment is withheld during a given year, the term of this provision shall be extended by a year, such that a cumulative sum of $500,000 is ultimately paid pursuant to this commitment. In the event we are acquired, the pension obligation must either be assumed by the acquirer without the EBITDA contingency, or the balance of such obligation paid in a lump sum, at Dr. Fyfe’s election.

Termination of Dr. Fyfe’s employment by either party, other than termination by us for cause, must be preceded by 12 months’ notice. Upon termination of Dr. Fyfe’s employment due to death or disability, by us without cause or by Dr. Fyfe for good reason, he will be entitled to (1) all accrued salary and vested benefits payable under the terms of the plan or policy under which they have accrued, (2) a pro-rata annual bonus payable in a lump sum within 30 days of termination and (3) his pension payments as described above. Upon termination

14

of Dr. Fyfe’s employment by us without cause or by Dr. Fyfe for good reason, he will also receive severance in the amount of his base salary through the end of his term, payable monthly, and benefit coverage through the end of his term. During his employment and any severance period and for a two-year period following termination by us with cause or by Dr. Fyfe without good reason, Dr. Fyfe will be subject to a customary non-compete provision. Upon termination for any reason, Dr. Fyfe will be subject to a customary one-year non-solicitation provision.

During periods in which he serves overseas, in addition to an annual allowance, we will reimburse Dr. Fyfe for certain reasonable transportation expenses incurred by himself and his family, and will make certain income and employment tax equalization payments pursuant to an overseas benefit agreement. We will also reimburse Dr. Fyfe for up to $10,000 in relocation expenses at the conclusion of his overseas service. Dr. Fyfe also participates in our benefits program, including private health insurance and life insurance.

Dr. Jeremy Burroughes. In July 2004, we entered into a new employment agreement with Dr. Burroughes as Chief Technical Officer. Pursuant to this employment agreement, Dr. Burroughes currently receives an annual salary of £149,350 or $287,678 at an exchange rate of 1.9262 dollars to 1 pound sterling as published in the Financial Times of London for December 31, 2004. Dr. Burroughes is also eligible to receive an annual bonus of up to 35% of his base salary and to participate in our stock incentive plans. Pursuant to this agreement, Dr. Burroughes also participates in our benefits program, including pension contributions, private health insurance and life insurance.

Dr. Burroughes’ employment agreement is for an indeterminate period of time, but may be terminated by either party with twelve months’ notice, or by us without notice for gross misconduct or upon his reaching mandatory retirement age. During any notice period, Dr. Burroughes may not work for any other employer without our permission and upon termination will be subject to customary six-month non-compete and non-solicitation provisions.

Stephen Chandler. In April 2003, we entered into an employment agreement with Mr. Chandler as Vice-President, Legal & Intellectual Property. Pursuant to this employment agreement, Mr. Chandler currently receives an annual base salary of £189,263 or $364,558 at an exchange rate of 1.9262 dollars to 1 pound sterling as published in the Financial Times of London for December 31, 2004. Mr. Chandler is also eligible to receive an annual bonus of up to 35% of his base salary and to participate in our stock incentive plans, pursuant to which he was awarded options to purchase up to 43,889 shares of our common stock under his employment agreement. Pursuant to this agreement, Mr. Chandler also participates in our benefits program, including pension contributions, private health insurance, life insurance and reasonable relocation expenses.

Mr. Chandler’s employment agreement is for an indeterminate period of time, but may be terminated by either party with twelve months’ notice, or by us without notice for gross misconduct or upon his reaching mandatory retirement age. During any notice period, Mr. Chandler may not work for any other employer without our permission and upon termination will be subject to customary six-month non-compete and non-solicitation provisions.

Dr. Scott Brown. In March 2002, we entered into an employment agreement with Dr. Brown as our Vice-President, Research & Technology. Pursuant to this employment agreement, Dr. Brown currently receives an annual base salary of £155,418 or $299,366 at an exchange rate of 1.9262 dollars to 1 pound sterling as published in the Financial Times of London for December 31, 2004. Dr. Brown is also eligible to receive an annual bonus of up to 35% of his base salary and to participate in our stock incentive plans, pursuant to which he was awarded options to purchase up to 23,407 shares of our common stock under his employment agreement. Pursuant to this agreement, Dr. Brown also participates in our benefits program, including pension contributions, private health insurance, life insurance and reasonable relocation expenses.

Dr. Brown’s employment agreement is for an indeterminate period of time, but may be terminated by either party with twelve months’ notice, or by us without notice for gross misconduct or upon his reaching mandatory retirement age. During any notice period, Dr. Brown may not work for any other employer without our permission and upon termination will be subject to customary six-month non-compete and non-solicitation provisions.

15

Dr. SB Cha. In June 2002, we entered into an employment agreement with Dr. Cha as our Vice-President, Commercial. Pursuant to this employment agreement, Dr. Cha currently receives an annual base salary of £149,350 or $287.678 at an exchange rate of 1.9262 dollars to 1 pound sterling as published in the Financial Times of London for December 31, 2004. Dr. Cha is also eligible to receive an annual bonus of up to 35% of his base salary, and to participate in our stock incentive plans, pursuant to which he was awarded 17,556 stock options under his employment agreement. Pursuant to this agreement, Dr. Cha also participates in our benefits program, including pension contributions, private health insurance, life insurance and reasonable relocation expenses.

Dr. Cha’s employment agreement has an indeterminate term, but may be terminated by either party with six months’ notice, or by us without notice for gross misconduct or upon his reaching mandatory retirement age. During any notice period, Dr. Cha may not work for any other employer without our permission and upon termination will be subject to customary six-month non-compete and non-solicitation provisions.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Consulting Agreements

Affiliates of Kelso and affiliates of Hillman Capital own, respectively, approximately 44% and 22% of our outstanding common stock. Each of Kelso and Hillman Capital is party to a separate consulting agreement with us pursuant to which they agree to provide such specific consulting services as we may request and we agree to indemnify them from and against any claims, losses and expenses they may incur in connection with their investment in us or their provision of services to us under these agreements or their being a controlling person of us, except as may be finally judicially determined to result from gross negligence or intentional misconduct on their part. Under the terms of each of these agreements, if Kelso or Hillman Capital provides consulting services specifically requested by us outside of the ordinary course of our business, we and Kelso or Hillman Capital, as applicable, will negotiate a mutually acceptable advisory fee. The term of our consulting agreements with Kelso and Hillman Capital ends on the date on which, respectively, Kelso (and its affiliates) and Hillman Capital (and its affiliates) cease to own any shares of our common stock. In connection with these agreements, Kelso and Hillman Capital may receive consulting fees from us and are entitled to receive reimbursement of certain out-of-pocket fees and expenses incurred in connection with their investments in us. No such consulting fees have been paid to Kelso or Hillman Capital. We paid Kelso expense reimbursements in the aggregate of $28,289, $67,420 and $20,200, respectively, for 2002, 2003 and 2004. We paid Hillman Capital expense reimbursements in the aggregate of $15,209 and $34,322, respectively, for 2002 and 2003. We did not pay Hillman Capital any expense reimbursements in 2004.

Registration Rights

Affiliates of Kelso and Hillman Capital are parties to a registration rights agreement with us that provides them certain demand and incidental registration rights. Various members of management who hold options exercisable for our common stock, including each of our executive officers, will be joined as parties to the registration rights agreement upon exercise of such holder’s options pursuant to which they will have certain incidental registration rights.

Director Fees and Relationships

No directors’ fees were paid in 2004. James V. Sandry was granted 5,000 stock options in December 2004. Mr. Sandry and Joseph Carr will be paid directors’ fees in 2005.

Mr. Carr, a current director, was the President and CEO of OSRAM Opto Semiconductors until March 2004. In May 2004, we received a royalty payment from Osram Optosemiconductors GmbH, an affiliate of OSRAM Opto Semiconductors, which represented approximately 8% of our 2004 revenue.

16

REPORT OF THE COMPENSATION COMMITTEE ON EXECUTIVE COMPENSATION

The following report of the Compensation Committee does not constitute soliciting material and shall not be deemed filed or incorporated by reference into any other filing by CDT under the Securities Act of 1933 or the Securities Exchange Act of 1934.

The Compensation Committee is comprised of three non-employee directors. The scope of duties and responsibilities of the Compensation Committee includes:

| | • | | oversight of CDT’s compensation structure, policies and programs; |

| | • | | review of individual performance of CDT’s officers and other senior executives; |

| | • | | adoption of recommendations to the Board regarding officer and senior executive compensation; and |

| | • | | review and approval of incentive compensation and equity-based plans. |

The Compensation Committee is responsible for setting and monitoring the compensation of executive officers. The Committee considers their performance and makes recommendations regarding their cash compensation and long-term incentive arrangements, including stock options, to the full Board of Directors. The Compensation Committee performs other activities and functions related to executive compensation as may be assigned from time to time by the Board of Directors.

The Compensation Committee expects to periodically review the approach to executive compensation and make changes as competitive conditions and other circumstances warrant and will seek to ensure CDT’s compensation philosophy is consistent with its best interests and is properly implemented.

The Compensation Committee makes recommendations for approval by the independent members of the Board of Directors regarding the compensation for the Chief Executive Officer and other executive officers of CDT.

Compensation Philosophy and Objectives

The Compensation Committee believes that compensation of CDT’s executive officers should encourage creation of stockholder value and the achievement of strategic corporate objectives, should attract and retain qualified, skilled and dedicated executives on a long-term basis, reward past performance and provide incentives for future performance.

It is the Compensation Committee’s philosophy to align the interests of CDT’s stockholders and management by integrating compensation with CDT’s annual and long-term corporate objectives.

In order to attract and retain the most qualified, skilled and dedicated employees, CDT intends to offer a total compensation package competitive with technology companies from broadly similar industry backgrounds, taking into account relative company size and complexity, performance and geographic location as well as individual responsibilities and performance.

The basic elements of CDT’s compensation program for its senior executives consist of base salary, annual incentive bonus opportunity and long-term equity-based incentive compensation.

In summary, CDT’s compensation philosophy is intended to reward the achievement of sustained, measurable results. CDT’s total compensation program must be competitive, support our overall strategy and objectives and provide significant rewards for outstanding performance while establishing clear consequences for under performance.

17

CDT generally intends to qualify compensation paid to executive officers for deductibility under section 162(m) of the Internal Revenue Code. Section 162(m) generally prohibits CDT from deducting the compensation of executive officers that exceeds $1 million per year unless that compensation is based on the satisfaction of objective performance goals. CDT does not expect that the non-exempt compensation paid to any of its executive officers for the fiscal year ended December 31, 2004 as calculated for purposes of section 162(m) will exceed the $1 million limit.

Executive Officer Base Salary

The Compensation Committee reviews salaries on an annual basis, considering the recommendations by the Chief Executive Officer for executive officers other than the Chief Executive Officer. The Compensation Committee sets the salary level of each executive officer on a case-by-case basis, taking into account the individual’s level of responsibilities and performance. The Compensation Committee also considers market information and the base salaries and other incentives paid to executive officers of similar and competitor companies.

The Chief Executive Officer is involved in final decisions on base salary adjustments for executives other than the Chief Executive Officer. The Compensation Committee may also recommend adjustments from time to time to recognize promotions, outstanding individual performance or changes to the role and responsibilities of each executive officer.

Executive Officer Bonus Payments

The Compensation Committee believes that a portion of executive officer compensation should be contingent upon individual performance and contribution to CDT’s success in meeting corporate objectives.

The annual incentive program is linked to key goals and closely ties annual incentive opportunities to individual performance. The program includes minimum performance thresholds required to earn any incentive compensation, as well as maximum payouts geared towards rewarding extraordinary performance.

Bonuses paid for the fiscal year ended December 31, 2004 were determined on a case-by-case basis, based upon individual performance and achievement against objectives. The Compensation Committee evaluated each executive officer individually to determine the bonus for the fiscal year. Actual bonus payouts are based on individual performance criteria, aligned to individual goals and objectives in line with CDT’s Annual Incentive Plan and CDT’s Performance Review Process. Bonus payouts are based on technical and commercial progress, including revenue growth, progress with key licensing, joint development and joint venture agreements, materials lifetime and other technical developments and effective financial management and cost control, while also taking into account the development of CDT’s strategic plan and economic and industry conditions.

The Compensation Committee compared the executive officer’s performance to the goals and objectives established for that executive officer for the year in relation to CDT’s overall strategic and business objectives. The Compensation Committee recommended the executive bonuses to the Board of Directors, and they were approved by the Board. Individual bonus payouts for executive officers for 2004 were in the range of 90% to 100% of the maximum target, dependent upon the individual performance of the executive officers against individual goals and objectives.

The Chief Executive Officer is involved in final decisions on bonus awards for executives other than the Chief Executive Officer.

Bonuses for 2004 were paid in January 2005.

18

Equity Compensation

The Compensation Committee believes that providing executive officers, who have responsibility for CDT’s management and growth, with an opportunity to increase their ownership of CDT stock, aligns the interests of the executive officers with those of the stockholders. Accordingly, the Compensation Committee, when reviewing executive officer compensation, also considers stock option grants as appropriate.

The Compensation Committee determines the number of shares underlying each stock option grant based upon the executive officer’s and CDT’s performance, the executive officer’s role and responsibilities, the executive officer’s base salary and comparison with comparable awards to individuals in similar positions in the industry.

In addition, CDT’s employees are eligible to participate in CDT’s stock incentive plans. The Compensation Committee determines the number of shares underlying each stock option grant based upon the individual’s performance, their role and responsibilities, their base salary and comparison with awards to individuals in similar positions in the industry.

The Compensation Committee administers CDT’s stock incentive plans for executive officers, employees, consultants and outside directors, under which it grants options to purchase CDT’s common stock with an exercise price equal to the fair market value of a share of the common stock on the date of grant.

The Chief Executive Officer is involved in final decisions on stock option awards for executives other than the Chief Executive Officer.

The Committee believes equity-based incentive compensation aligns executive and stockholder interests because (i) the use of a multi-year vesting schedule for equity awards encourages executive retention and emphasizes long-term growth and (ii) paying a significant portion of management’s compensation in CDT equity provides management with a powerful incentive to increase stockholder value over the long term.

Equity Compensation—CDT’s Special Bonus Plan

The Compensation Committee believes that compensation of CDT’s employees should encourage the achievement of strategic corporate objectives by attracting, and retaining on a long term basis, qualified, skilled and dedicated employees. The Compensation Committee also believes that past performance should be rewarded and incentives for future performance provided.

In November 2004, the Board of Directors approved CDT’s Special Bonus Plan. All employees were allocated shares under the terms of CDT’s Special Bonus Plan to recognize the accomplishments and achievements resulting in the successful completion of CDT’s initial offering of stock to the public.

Under the terms of the Plan, a bonus pool of $14.4 million was allocated to be distributed to the executive officers and employees by way of 1.2 million restricted stock units valued at the initial public offering price of $12 per share.

Other than awards made to the Chief Executive Officer as described below, awards vest in three equal installments on the first, second and third anniversary of grant, subject to the rules of the Plan. Prior to the fifth anniversary of the grant of awards, trading in all shares granted under the terms of this Plan is subject to the liquidity criteria outlined in the Plan.

CDT does not intend to make any further awards under the Plan. Awards forfeited prior to vesting will be available for reallocation.

19

Chief Executive Officer Compensation

The Compensation Committee reviewed the performance of the Chief Executive Officer using CDT’s performance review process. In addition to CDT’s performance, the performance review considered elements of personal performance such as overall leadership, commercial and financial acumen and selection and development of people.

During 2004, Dr. Fyfe’s employment agreement was extended for a further period of three years, terminating in August 2007. Dr. Fyfe received an increase to his annual salary of 5%. His resulting annualized salary is $441,000, effective August 2004. Based on individual and company performance, Dr. Fyfe earned a 2004 bonus of $192,544. This amount represents the maximum payout under CDT’s Annual Incentive Plan for exceeding stretch performance goals in the achievement of significant commercial and technical progress in a challenging business environment during 2004.

In 2004, CDT contributed $10,250 to the 401(k) plan on Dr. Fyfe’s behalf and paid Dr. Fyfe $39,525 in additional retirement allowances.

Dr. Fyfe also participated in CDT’s Special Bonus Plan. In December 2004, Dr. Fyfe was awarded 420,000 restricted stock units. Dr. Fyfe’s award under the Special Bonus Plan will continue to vest in line with the Plan’s rules, even in the event of him leaving CDT’s employment.

Dr. Fyfe received an annual Overseas Allowance in the amount of $90,000, due to the expatriate nature of his appointment to CDT. The Overseas Allowance is intended to cover temporary housing and automobile costs while he is based in the UK. In recognition of the expatriate nature of his appointment, Dr. Fyfe also received tax equalization support and reimbursement of certain travel costs between the UK and his home in Florida.

In reaching its decision regarding Dr. Fyfe’s compensation, the Compensation Committee considered many factors and focused on (a) CDT’s accomplishments and achievements under Dr. Fyfe’s leadership, including the successful completion of CDT’s initial offering of stock to the public, which was completed in December 2004, (b) the significant commercial and technical progress made during 2004, including strong revenue growth, significant progress made with regard to certain key joint venture and joint development agreements, materials lifetime development, effective financial management and cost control and (c) Dr. Fyfe’s expected contributions to CDT in the future.

The Committee considers Dr. Fyfe’s level of compensation appropriate for his outstanding leadership of CDT during 2004, culminating in the successful completion of CDT’s initial offering of stock to the public in December 2004.

Respectfully submitted on May 16, 2005, by the members of the Compensation Committee of the Board:

Joseph Carr, Chairman

Philip E. Berney

James V. Sandry

20

EQUITY COMPENSATION PLAN INFORMATION AT DECEMBER 31, 2004

| | | | | | | | | | |

Plan Category

| | Number of

securities to be

issued upon exercise

of outstanding

options and rights

(a)

| | | Weighted-average

exercise price

of outstanding

options and rights

(b)

| | | Number of securities

remaining available

for future issuance

under equity

compensation plans

(excluding securities

reflected in column (a))

(c)

| |

Equity compensation plans approved by CDT stockholders | | 2,168,807 | (1) | | $ | 9.04 | (2) | | 924,673 | (3) |

Equity compensation plans not approved by CDT stockholders | | — | | | $ | — | | | — | |

| | |

|

| |

|

|

| |

|

|

Total | | 2,168,807 | (1) | | $ | 9.04 | (2) | | 924,673 | (3) |

| (1) | Includes 1,198,816 restricted stock units issued pursuant to our Special Bonus Plan. |

| (2) | Calculated assuming an exercise price of zero for restricted stock units. |

| (3) | Includes 1,184 restricted stock units available for issue pursuant to our Special Bonus Plan. |

21

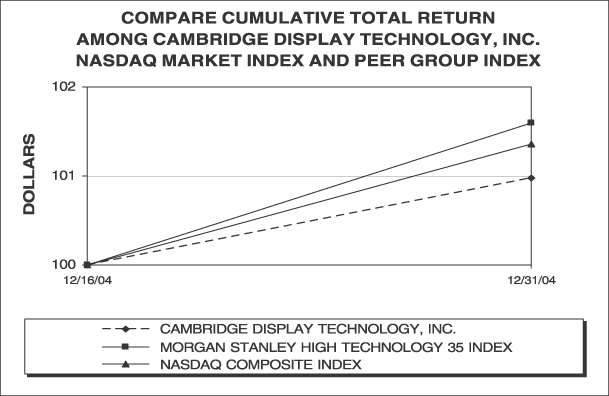

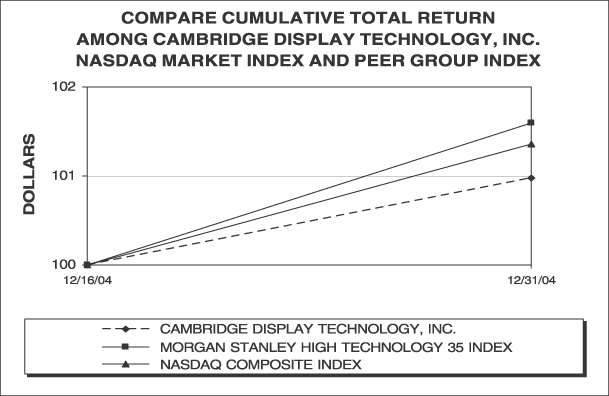

CDT STOCK PRICE PERFORMANCE

Stock Price Performance Graph