Exhibit 99.2

DIGITAL REALTY TRUST, INC.

Second Quarter 2013

| | | | |

| | | PAGE | |

Corporate Data | | | | |

| |

Corporate Information | | | 4 | |

| |

Ownership Structure | | | 6 | |

| |

Consolidated Financial Information | | | | |

| |

Key Quarterly Financial Data | | | 7 | |

| |

Consolidated Balance Sheets | | | 8 | |

| |

Consolidated Quarterly Statements of Operations | | | 9 | |

| |

Funds From Operations and Adjusted Funds From Operations | | | 10 | |

| |

Reconciliation of Earnings Before Interest, Taxes, Depreciation and Amortization and Financial Ratios | | | 11 | |

| |

Same Store and New Properties Consolidated Quarterly Statements of Operations | | | 12 | |

| |

Same Store Operating Trend Summary | | | 13 | |

| |

Consolidated Debt Analysis and Global Revolving Credit Facility | | | 14 | |

| |

Debt Maturities | | | 15 | |

| |

Debt Analysis & Covenant Compliance | | | 16 | |

| |

Portfolio Data | | | | |

| |

Portfolio Summary | | | 17 | |

| |

Properties Acquired | | | 18 | |

| |

Occupancy Analysis | | | 19 | |

| |

Top 20 Tenants by Annualized Rent | | | 23 | |

| |

Lease Expirations and Lease Distribution | | | 24 | |

| |

Lease Expirations - By Product Type | | | 25 | |

| |

Portfolio Overview by Product Type | | | 26 | |

| |

Summary of Leasing Activity - Signed | | | 27 | |

| |

Summary of Leasing Activity - Commenced | | | 28 | |

| |

Historical Capital Expenditures | | | 29 | |

| |

Construction Activity Report | | | 30 | |

| |

Construction Projects in Progress and Total Estimated Direct Cost | | | 31 | |

| |

Definitions | | | | |

| |

Management Statements on Non-GAAP Supplemental Measures | | | 32 | |

Page 2

DIGITAL REALTY TRUST, INC.

Second Quarter 2013

Statement Regarding Forward-Looking Statements

This supplemental package contains forward-looking statements within the meaning of the federal securities laws, including information related to trends, leasing expectations, weighted average lease terms, the exercise of lease extensions, lease expirations, debt maturities, annualized rent at expiration of leases, the effect new leases and increases in rental rates will have on our rental revenue, our credit ratings, construction and development activity, projected construction costs and other forward-looking financial data. Such statements are based on management’s beliefs and assumptions made based on information currently available to management. Such statements are subject to risks, uncertainties and assumptions and are not guarantees of future performance and may be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. Some of the risks and uncertainties that may cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include, among others, the following:

| | • | | the impact of the recent deterioration in global economic, credit and market conditions, including the downgrade of the U.S. government’s credit rating; |

| | • | | current local economic conditions in our geographic markets; |

| | • | | decreases in information technology spending, including as a result of economic slowdowns or recession; |

| | • | | adverse economic or real estate developments in our industry or the industry sectors that we sell to (including risks relating to decreasing real estate valuations and impairment charges); |

| | • | | our dependence upon significant tenants; |

| | • | | bankruptcy or insolvency of a major tenant or a significant number of smaller tenants; |

| | • | | defaults on or non-renewal of leases by tenants; |

| | • | | our failure to obtain necessary debt and equity financing; |

| | • | | increased interest rates and operating costs; |

| | • | | risks associated with using debt to fund our business activities, including re-financing and interest rate risks, our failure to repay debt when due, adverse changes in our credit ratings or our breach of covenants or other terms contained in our loan facilities and agreements; |

| | • | | financial market fluctuations; |

| | • | | changes in foreign currency exchange rates; |

| | • | | our inability to manage our growth effectively; |

| | • | | difficulty acquiring or operating properties in foreign jurisdictions; |

| | • | | our failure to successfully integrate and operate acquired or developed properties or businesses; |

| | • | | the suitability of our properties and data center infrastructure, delays or disruptions in connectivity, failure of our physical infrastructure or services or availability of power; |

| | • | | risks related to joint venture investments, including as a result of our lack of control of such investments; |

| | • | | delays or unexpected costs in development of properties; |

| | • | | decreased rental rates or increased vacancy rates; |

| | • | | increased competition or available supply of data center space; |

| | • | | our inability to successfully develop and lease new properties and space held for development; |

| | • | | difficulties in identifying properties to acquire and completing acquisitions; |

| | • | | our inability to acquire off-market properties; |

| | • | | our inability to comply with the rules and regulations applicable to reporting companies; |

| | • | | our failure to maintain our status as a REIT; |

| | • | | possible adverse changes to tax laws; |

| | • | | restrictions on our ability to engage in certain business activities; |

| | • | | environmental uncertainties and risks related to natural disasters; |

| | • | | losses in excess of our insurance coverage; |

| | • | | changes in foreign laws and regulations, including those related to taxation and real estate ownership and operation; and |

| | • | | changes in local, state and federal regulatory requirements, including changes in real estate and zoning laws and increases in real property tax rates. |

The risks included here are not exhaustive, and additional factors could adversely affect our business and financial performance. We discussed a number of additional material risks in our annual report on Form 10-K for the year ended December 31, 2012, and other filings with the Securities and Exchange Commission. Those risks continue to be relevant to our performance and financial condition. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and it is not possible for management to predict all such risk factors, nor can it assess the impact of all such risk factors on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We expressly disclaim any responsibility to update forward-looking statements, whether as a result of new information, future events or otherwise.

Page 3

DIGITAL REALTY TRUST, INC.

Second Quarter 2013

Corporate Information

Corporate Profile

Digital Realty Trust, Inc. owns, acquires, develops and manages technology-related real estate. The Company is focused on providing datacenter solutions for domestic and international tenants across a variety of industry verticals ranging from information technology and Internet enterprises, to manufacturing and financial services. As of June 30, 2013, the Company’s 127 properties, including three properties held as investments in unconsolidated joint ventures, contain applications and operations critical to the day-to-day operations of technology industry tenants and corporate enterprise datacenter tenants. Comprising approximately 23.7 million net rentable square feet, including approximately 2.8 million square feet of space held for development, Digital Realty’s portfolio is located throughout North America, Europe, Asia and Australia. For additional information, please visit the Company’s website at www.digitalrealty.com.

Corporate Headquarters

Four Embarcadero Center, Suite 3200

San Francisco, California 94111

Telephone: (415) 738-6500

Facsimile: (415) 738-6501

Web site: www.digitalrealty.com

Senior Management

Michael F. Foust: Chief Executive Officer

A. William Stein: Chief Financial Officer and Chief Investment Officer

Scott E. Peterson: Chief Acquisitions Officer

David J. Caron: Senior Vice President, Portfolio Management

Matthew Miszewski: Senior Vice President, Sales

Investor Relations

To request an Investor Relations package or be added to our e-mail distribution list, please visit our website:

www.digitalrealty.com (Proceed to Information Request in the Investor Relations section)

| | | | | | | | | | | | |

| Analyst Coverage | | | | | | | | | | | | |

| | | | | | |

| Baird | | Bank of America Merrill Lynch | | Barclays Capital | | Canaccord Genuity | | Cantor Fitzgerald | | Citigroup | | Deutsche Bank |

Dave Rodgers (216) 737-7341 | | James Feldman (646) 855-5808 Stephen Douglas (646) 855-2615 | | Ross Smotrich (212) 526-2306 | | Greg Miller (212) 389-8128 Eric Z. Chu (212) 389-8129 | | David Toti (212) 915-1219 Evan Smith (212) 915-1220 | | Michael Bilerman (212) 816-1685 Emmanuel Korchman (212) 816-1382 | | Vincent Chao (212) 250-6799 |

| | | | | | |

| Evercore | | Green Street | | ISI | | Jefferies | | JMP Securities | | KeyBanc Capital Markets | | Macquarie |

Johnathan Schildkraut (212) 497-0864 Robert Gutman (212) 497-0877 | | John Stewart (949) 640-8780 Eric Frankel (949) 640-8780 | | Steve Sakwa (212) 446-9462 George Auerbach (212) 446-9459 | | Omotayo Okusanya (212) 336-7076 | | William C. Marks (415) 835-8944 Mitch Germain (212) 906-3546 | | Jordan Sadler (917) 368-2280 Craig Mailman (917) 368-2316 | | Rob Stevenson (212) 231-8068 |

| | | | | | |

| MLV & Co. | | Morgan Stanley | | Raymond James | | RBC Capital Markets | | Stifel Nicolaus | | UBS | | |

Jonathan M. Petersen (646) 556-9185 | | Paul Morgan (415) 576-2627 Vance Edelson (212) 761-0078 | | Paul D. Puryear (727) 567-2253 William A. Crow (727) 567-2594 | | Jonathan Atkin (415) 633-8589 | | Todd Weller (443) 224-1305 Ben Lowe (443) 224-1264 | | Ross Nussbaum (212) 713-2484 Gabriel Hilmoe (212) 713-3876 | | |

This Supplemental Operating and Financial Data package supplements the information provided in our quarterly and annual reports filed with the Securities and Exchange Commission. Additional information about us and our properties is also available at our website www.digitalrealty.com.

Page 4

DIGITAL REALTY TRUST, INC.

Second Quarter 2013

Corporate Information

Stock Listing Information

The stock of Digital Realty Trust, Inc. is traded primarily on the New York Stock Exchange under the following symbols:

| | |

| Common Stock: | | DLR |

| Series E Preferred Stock: | | DLRPRE |

| Series F Preferred Stock: | | DLRPRF |

| Series G Preferred Stock: | | DLRPRG |

Note that symbols may vary by stock quote provider.

| | | | |

| Credit Ratings | | | | |

| | |

| Standard & Poors | | | | |

| Corporate Credit Rating | | BBB | | (Stable Outlook) |

| Preferred Stock | | BB+ | | |

| | |

| Moody’s | | | | |

| Issuer Rating | | Baa2 | | (Stable Outlook) |

| Preferred Stock | | Baa3 | | |

| | |

| Fitch | | | | |

| Issuer Default Rating | | BBB | | (Stable Outlook) |

| Preferred Stock | | BB+ | | |

These credit ratings may not reflect the potential impact of risks relating to the structure or trading of the Company’s securities and are provided solely for informational purposes. Credit ratings are not recommendations to buy, sell or hold any security, and may be revised or withdrawn at any time by the issuing organization in its sole discretion. The Company does not undertake any obligation to maintain the ratings or to advise of any change in ratings. Each agency’s rating should be evaluated independently of any other agency’s rating. An explanation of the significance of the ratings may be obtained from each of the rating agencies.

Common Stock Price Performance

The following summarizes recent activity of Digital Realty’s common stock (DLR):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2nd Quarter

2013 | | | 1st Quarter

2013 | | | 4th Quarter

2012 | | | 3rd Quarter

2012 | | | 2nd Quarter

2012 | | | 1st Quarter

2012 | |

High Price * | | $ | 74.00 | | | $ | 72.92 | | | $ | 70.16 | | | $ | 80.59 | | | $ | 76.04 | | | $ | 74.04 | |

Low Price * | | $ | 56.02 | | | $ | 62.75 | | | $ | 59.25 | | | $ | 66.70 | | | $ | 67.84 | | | $ | 65.00 | |

Closing Price, end of quarter * | | $ | 61.00 | | | $ | 66.91 | | | $ | 67.89 | | | $ | 69.85 | | | $ | 75.07 | | | $ | 73.97 | |

Average daily trading volume * | | | 1,680,636 | | | | 1,420,527 | | | | 1,389,261 | | | | 1,215,760 | | | | 1,073,521 | | | | 1,026,947 | |

Indicated dividend per common share ** | | $ | 3.12 | | | $ | 3.12 | | | $ | 2.92 | | | $ | 2.92 | | | $ | 2.92 | | | $ | 2.92 | |

Closing annual dividend yield, end of quarter | | | 5.1 | % | | | 4.7 | % | | | 4.3 | % | | | 4.2 | % | | | 3.9 | % | | | 3.9 | % |

Closing shares and units outstanding, end of quarter *** | | | 131,418,758 | | | | 131,410,505 | | | | 127,992,183 | | | | 127,887,458 | | | | 115,050,528 | | | | 112,215,683 | |

Closing market value of shares and units outstanding (thousands), end of quarter | | $ | 8,016,544 | | | $ | 8,792,677 | | | $ | 8,689,389 | | | $ | 8,932,939 | | | $ | 8,636,843 | | | $ | 8,300,594 | |

| * | New York Stock Exchange trades only. |

| ** | On an annualized basis. |

| *** | As of June 30, 2013, the total number of shares and units includes 128,421,888 common stock, 1,505,814 common units held by third parties and 1,491,056 common units, vested and unvested long-term incentive units and vested class C units held by officers and directors, and excludes all unexercised common stock options and all shares potentially issuable upon exchange of our 5.50% exchangeable senior debentures due 2029 or upon conversion of our series E, series F and series G cumulative redeemable preferred stock upon certain change of control transactions. |

This Supplemental Operating and Financial Data package supplements the information provided in our quarterly and annual reports filed with the Securities and Exchange Commission. Additional information about us and our properties is also available at our website www.digitalrealty.com.

Page 5

DIGITAL REALTY TRUST, INC.

Second Quarter 2013

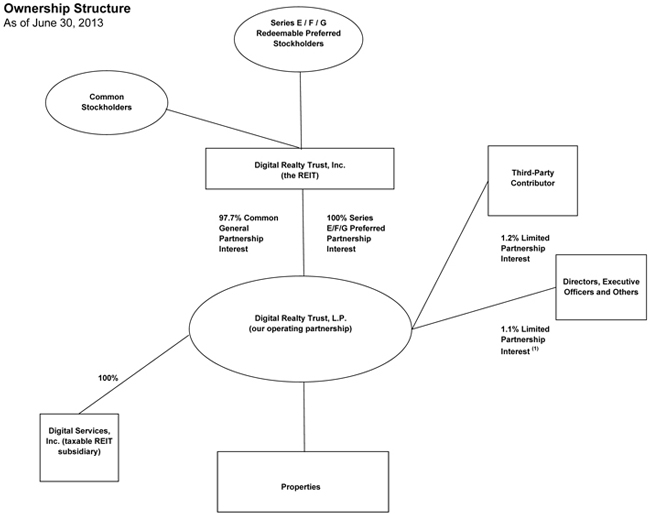

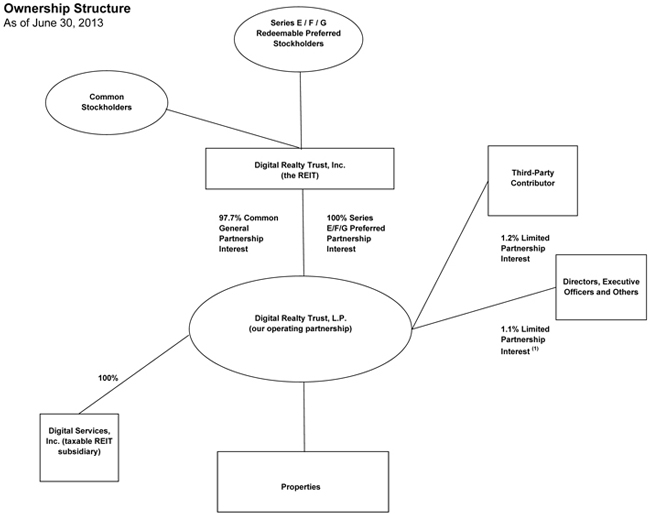

| | | | | | | | |

Partner | | # of Units(2) | | | % Ownership | |

| | |

Digital Realty Trust, Inc. | | | 128,421,888 | | | | 97.7 | % |

Cambay Tele.com, LLC(3) | | | 1,505,814 | | | | 1.2 | % |

Directors, Executive Officers and Others | | | 1,491,056 | | | | 1.1 | % |

| | | | | | | | |

| | |

Total | | | 131,418,758 | | | | 100.0 | % |

| | | | | | | | |

| (1) | Reflects limited partnership interests held by our officers and directors in the form of common units, vested and unvested long-term incentive units and vested class C units and excludes all unexercised common stock options. |

| (2) | The total number of units includes 128,421,888 common units, 1,505,814 common units held by third parties and 1,491,056 common units, vested and unvested long-term incentive units and vested class C units held by officers and directors, and excludes all unexercised common stock options and all shares potentially issuable upon exchange of our 5.50% exchangeable senior debentures due 2029 or upon conversion of our series E, series F and series G cumulative redeemable preferred stock upon certain change of control transactions. |

| (3) | This third-party contributor received the common units (along with cash and our operating partnership’s assumption of debt) in exchange for their interests in 200 Paul Avenue 1-4, 1100 Space Park Drive, the eXchange colocation business and other specified assets and liabilities. Includes 409,913 common units held by the members of Cambay Tele.com, LLC. |

Page 6

DIGITAL REALTY TRUST, INC.

Second Quarter 2013

Key Quarterly Financial Data

(Unaudited and dollars in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 30-Jun-13 | | | 31-Mar-13 | | | 31-Dec-12 | | | 30-Sep-12 | | | 30-Jun-12 | | | 31-Mar-12 | |

Shares and Units at End of Quarter | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Common shares outstanding | | | 128,421,888 | | | | 128,413,791 | | | | 125,140,783 | | | | 123,261,390 | | | | 110,268,388 | | | | 107,342,049 | |

Common units outstanding | | | 2,996,870 | | | | 2,996,714 | | | | 2,851,400 | | | | 4,626,068 | | | | 4,782,140 | | | | 4,873,634 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total shares and operating partnership units | | | 131,418,758 | | | | 131,410,505 | | | | 127,992,183 | | | | 127,887,458 | | | | 115,050,528 | | | | 112,215,683 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Enterprise Value | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Market value of common equity (1) | | $ | 8,016,544 | | | $ | 8,792,677 | | | $ | 8,689,389 | | | $ | 8,932,939 | | | $ | 8,636,843 | | | $ | 8,300,594 | |

Liquidation value of preferred equity | | | 720,000 | | | | 470,000 | | | | 593,413 | | | | 597,447 | | | | 644,096 | | | | 590,081 | |

Total debt at balance sheet carrying value | | | 4,698,248 | | | | 4,682,124 | | | | 4,278,565 | | | | 4,080,073 | | | | 3,400,212 | | | | 3,271,848 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total enterprise value | | $ | 13,434,792 | | | $ | 13,944,801 | | | $ | 13,561,367 | | | $ | 13,610,459 | | | $ | 12,681,151 | | | $ | 12,162,523 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total debt/Total enterprise value | | | 35.0 | % | | | 33.6 | % | | | 31.5 | % | | | 30.0 | % | | | 26.8 | % | | | 26.9 | % |

| | | | | | |

Selected Balance Sheet Data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Investments in real estate (before depreciation) | | $ | 9,335,886 | | | $ | 9,011,433 | | | $ | 8,809,153 | | | $ | 8,430,710 | | | $ | 6,828,926 | | | $ | 6,511,710 | |

Total assets | | | 9,184,859 | | | | 8,971,492 | | | | 8,819,214 | | | | 8,512,598 | | | | 6,717,113 | | | | 6,418,061 | |

Total liabilities | | | 5,601,589 | | | | 5,589,544 | | | | 5,320,830 | | | | 4,985,042 | | | | 3,978,929 | | | | 3,785,077 | |

| | | | | | |

Selected Operating Data | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total operating revenues | | $ | 363,502 | | | $ | 358,370 | | | $ | 349,736 | | | $ | 342,479 | | | $ | 303,704 | | | $ | 283,148 | |

Total operating expenses | | | 263,508 | | | | 259,784 | | | | 255,098 | | | | 245,404 | | | | 215,255 | | | | 197,232 | |

Interest expense | | | 47,583 | | | | 48,078 | | | | 40,350 | | | | 41,047 | | | | 37,681 | | | | 38,030 | |

Net income | | | 59,621 | | | | 51,681 | | | | 55,895 | | | | 56,921 | | | | 53,968 | | | | 49,263 | |

Net income available to common stockholders | | | 47,077 | | | | 42,657 | | | | 44,815 | | | | 45,615 | | | | 42,021 | | | | 39,211 | |

| | | | | | |

Financial Ratios | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

EBITDA (2) | | $ | 211,238 | | | $ | 203,561 | | | $ | 192,893 | | | $ | 189,212 | | | $ | 170,211 | | | $ | 161,957 | |

Adjusted EBITDA (3) | | $ | 223,782 | | | $ | 212,585 | | | $ | 203,973 | | | $ | 200,518 | | | $ | 182,158 | | | $ | 172,009 | |

Cash interest expense (4) | | $ | 35,563 | | | $ | 56,163 | | | $ | 30,311 | | | $ | 54,517 | | | $ | 27,447 | | | $ | 53,876 | |

Fixed charges (5) | | $ | 50,735 | | | $ | 68,113 | | | $ | 43,829 | | | $ | 67,919 | | | $ | 42,646 | | | $ | 66,477 | |

Debt service coverage ratio (6) | | | 6.3x | | | | 3.8x | | | | 6.7x | | | | 3.7x | | | | 6.6x | | | | 3.2x | |

Fixed charge coverage ratio (7) | | | 4.4x | | | | 3.1x | | | | 4.7x | | | | 3.0x | | | | 4.3x | | | | 2.6x | |

| | | | | | |

Profitability Measures | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net income per common share - basic | | $ | 0.37 | | | $ | 0.34 | | | $ | 0.36 | | | $ | 0.37 | | | $ | 0.38 | | | $ | 0.37 | |

Net income per common share - diluted | | $ | 0.37 | | | $ | 0.34 | | | $ | 0.36 | | | $ | 0.37 | | | $ | 0.38 | | | $ | 0.36 | |

Funds From Operations (FFO) per diluted share and unit (8) | | $ | 1.22 | | | $ | 1.16 | | | $ | 1.16 | | | $ | 1.13 | | | $ | 1.09 | | | $ | 1.06 | |

Adjusted Funds From Operations (AFFO) per diluted share and unit (9) | | $ | 0.95 | | | $ | 0.92 | | | $ | 0.88 | | | $ | 0.88 | | | $ | 0.86 | | | $ | 0.86 | |

Dividends per share and common unit | | $ | 0.78 | | | $ | 0.78 | | | $ | 0.73 | | | $ | 0.73 | | | $ | 0.73 | | | $ | 0.73 | |

Diluted FFO payout ratio (10) | | | 64.1 | % | | | 67.5 | % | | | 63.0 | % | | | 64.8 | % | | | 67.1 | % | | | 69.1 | % |

Diluted AFFO payout ratio (9) (11) | | | 82.1 | % | | | 85.2 | % | | | 82.6 | % | | | 82.6 | % | | | 85.4 | % | | | 84.6 | % |

| | | | | | |

Portfolio Statistics | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Buildings (12) | | | 187 | | | | 178 | | | | 171 | | | | 164 | | | | 158 | | | | 152 | |

Properties (12) | | | 127 | | | | 125 | | | | 120 | | | | 113 | | | | 108 | | | | 105 | |

Net rentable square feet, excluding development space (12) | | | 20,948,042 | | | | 20,606,509 | | | | 19,889,396 | | | | 19,322,704 | | | | 18,282,226 | | | | 17,629,567 | |

Square feet held for development (13) | | | 2,798,241 | | | | 2,588,034 | | | | 2,427,257 | | | | 2,242,204 | | | | 2,177,144 | | | | 2,189,203 | |

Occupancy at end of quarter (14) | | | 93.1 | % | | | 94.0 | % | | | 94.4 | % | | | 94.2 | % | | | 93.5 | % | | | 94.8 | % |

Weighted average remaining lease term (years) (15) | | | 7.1 | | | | 6.9 | | | | 6.9 | | | | 7.0 | | | | 7.0 | | | | 7.0 | |

Same store occupancy at end of quarter (14) (16) | | | 92.3 | % | | | 93.1 | % | | | 93.7 | % | | | 94.2 | % | | | 93.2 | % | | | 94.6 | % |

| (1) | The market value of common equity is based on the closing stock price at the end of the quarter and assumes 100% redemption of the limited partnership units in our operating partnership, including common units and vested and unvested long-term incentive units (including vested class C units), for shares of our common stock. Excludes shares issuable with respect to stock options that have been granted but have not yet been exercised, and also excludes all shares potentially issuable upon exchange of our 5.50% exchangeable senior debentures due 2029 or upon conversion of our series E, series F and series G cumulative redeemable preferred stock upon certain change of control transactions. |

| (2) | EBITDA is calculated as earnings before interest, taxes, depreciation and amortization. For a discussion of EBITDA, see page 32. For a reconciliation of net income available to common stockholders to EBITDA, see page 11. |

| (3) | Adjusted EBITDA is EBITDA adjusted for preferred dividends and non-controlling interests. For a discussion of Adjusted EBITDA, see page 32. For a reconciliation of net income available to common stockholders to Adjusted EBITDA, see page 11. |

| (4) | Cash interest expense is interest expense per our statement of operations less amortization of debt discount and deferred financing fees and includes interest that we capitalized. For a reconciliation of GAAP interest expense to cash interest expense, see page 11. |

| (5) | Fixed charges consist of cash interest expense, scheduled debt principal payments and preferred dividends. |

| (6) | Debt service coverage ratio is Adjusted EBITDA divided by cash interest expense. |

| (7) | Fixed charge coverage ratio is Adjusted EBITDA divided by fixed charges. |

| (8) | For a definition and discussion of FFO, see page 32. For a reconciliation of net income available to common stockholders to FFO, see page 10. |

| (9) | All periods presented include internal leasing commissions, the amounts of which have historically been included in capitalized leasing commissions and were previously excluded from recurring capital expenditures. For a definition and discussion of AFFO, see page 32. For a reconciliation of FFO to AFFO, see page 10. |

| (10) | Diluted FFO payout ratio is dividends declared per common share and unit divided by diluted FFO per share and unit. |

| (11) | Diluted AFFO payout ratio is dividends declared per common share and unit divided by diluted AFFO per share and unit. |

| (12) | Includes properties held as investments in unconsolidated joint ventures. |

| (13) | Development space requires significant capital investment in order to develop data center facilities that are ready for use. Most often this is shell space. However, in certain circumstances this may include partially built datacenter space that was not completed by previous ownership and requires a large capital investment in order to build out the space. |

| (14) | Occupancy and same store occupancy exclude space held for development and properties held as investments in unconsolidated joint ventures. For some of our properties, we calculate occupancy based on factors in addition to contractually leased square feet, including available power, required support space and common area. |

| (15) | Weighted average remaining lease term excludes renewal options and is weighted by net rentable square feet. |

| (16) | Same store properties were acquired before December 31, 2011. |

Page 7

DIGITAL REALTY TRUST, INC.

Second Quarter 2013

Consolidated Balance Sheets

(Dollars in thousands, except per share data)

| | | | | | | | |

| | | June 30, 2013 | | | December 31, 2012 | |

ASSETS | | (unaudited) | | | | |

| | |

Investments in real estate | | | | | | | | |

Land | | $ | 690,356 | | | $ | 661,058 | |

Acquired ground leases | | | 13,216 | | | | 13,658 | |

Buildings and improvements | | | 8,125,636 | | | | 7,662,973 | |

Tenant improvements | | | 432,631 | | | | 404,830 | |

| | | | | | | | |

| | |

Investments in real estate | | | 9,261,839 | | | | 8,742,519 | |

Accumulated depreciation and amortization | | | (1,377,375 | ) | | | (1,206,017 | ) |

| | | | | | | | |

Net investments in properties | | | 7,884,464 | | | | 7,536,502 | |

Investment in unconsolidated joint ventures | | | 74,047 | | | | 66,634 | |

| | | | | | | | |

Net investments in real estate | | | 7,958,511 | | | | 7,603,136 | |

| | |

Cash and cash equivalents | | | 24,260 | | | | 56,281 | |

| | |

Accounts and other receivables, net of allowance for doubtful accounts of $3,603 and $3,609 as of June 30, 2013 and December 31, 2012, respectively | | | 159,847 | | | | 168,286 | |

Deferred rent | | | 360,588 | | | | 321,715 | |

Acquired above market leases, net | | | 56,310 | | | | 65,055 | |

Acquired in place lease value and deferred leasing costs, net | | | 492,884 | | | | 495,205 | |

Deferred financing costs, net | | | 31,881 | | | | 30,621 | |

Restricted cash | | | 38,977 | | | | 44,050 | |

Other assets | | | 61,601 | | | | 34,865 | |

| | | | | | | | |

| | |

Total Assets | | $ | 9,184,859 | | | $ | 8,819,214 | |

| | | | | | | | |

| | |

LIABILITIES AND EQUITY | | | | | | |

| | |

Global revolving credit facility | | $ | 610,328 | | | $ | 723,729 | |

Unsecured term loan | | | 741,178 | | | | 757,839 | |

Unsecured senior notes, net of discount | | | 2,342,990 | | | | 1,738,221 | |

Exchangeable senior debentures | | | 266,400 | | | | 266,400 | |

Mortgage loans, net of premiums | | | 737,352 | | | | 792,376 | |

Accounts payable and other accrued liabilities | | | 617,766 | | | | 646,427 | |

Accrued dividends and distributions | | | — | | | | 93,434 | |

Acquired below market leases, net | | | 137,297 | | | | 148,233 | |

Security deposits and prepaid rents | | | 148,278 | | | | 154,171 | |

| | | | | | | | |

Total Liabilities | | | 5,601,589 | | | | 5,320,830 | |

| | | | | | | | |

| | |

Commitments and contingencies | | | — | | | | — | |

| | |

EQUITY: | | | | | | | | |

Stockholders’ equity: | | | | | | | | |

Preferred Stock: $0.01 par value per share, 70,000,000 shares authorized: | | | | | | | | |

Series D Cumulative Convertible Preferred Stock, 5.500%, $0 and $123,413 liquidation preference, respectively ($25.00 per share), 0 and 4,936,505 shares issued and outstanding as of June 30, 2013 and December 31, 2012, respectively | | | — | | | | 119,348 | |

Series E Cumulative Redeemable Preferred Stock, 7.000%, $287,500 and $287,500 liquidation preference, respectively ($25.00 per share), 11,500,000 and 11,500,000 shares issued and outstanding as of June 30, 2013 and December 31, 2012, respectively | | | 277,172 | | | | 277,172 | |

Series F Cumulative Redeemable Preferred Stock, 6.625%, $182,500 and $182,500 liquidation preference, respectively ($25.00 per share), 7,300,000 and 7,300,000 shares issued and outstanding as of June 30, 2013 and December 31, 2012, respectively | | | 176,191 | | | | 176,191 | |

Series G Cumulative Redeemable Preferred Stock, 5.875%, $250,000 and $0 liquidation preference, respectively ($25.00 per share), 10,000,000 and 0 shares issued and outstanding as of June 30, 2013 and December 31, 2012, respectively | | | 241,565 | | | | — | |

Common Stock: $0.01 par value per share, 215,000,000 shares authorized, 128,421,888 and 125,140,783 shares issued and outstanding as of June 30, 2013 and December 31, 2012, respectively | | | 1,279 | | | | 1,247 | |

Additional paid-in capital | | | 3,681,618 | | | | 3,562,642 | |

Dividends in excess of earnings | | | (766,704 | ) | | | (656,104 | ) |

Accumulated other comprehensive income, net | | | (64,010 | ) | | | (12,191 | ) |

| | | | | | | | |

Total stockholders’ equity | | | 3,547,111 | | | | 3,468,305 | |

| | | | | | | | |

| | |

Noncontrolling interests: | | | | | | | | |

Noncontrolling interest in operating partnership | | | 28,935 | | | | 24,135 | |

Noncontrolling interest in consolidated joint ventures | | | 7,224 | | | | 5,944 | |

| | | | | | | | |

Total noncontrolling interests | | | 36,159 | | | | 30,079 | |

| | | | | | | | |

Total Equity | | | 3,583,270 | | | | 3,498,384 | |

| | | | | | | | |

| | |

Total Liabilities and Equity | | $ | 9,184,859 | | | $ | 8,819,214 | �� |

| | | | | | | | |

Page 8

DIGITAL REALTY TRUST, INC.

Second Quarter 2013

Consolidated Quarterly Statements of Operations

(unaudited and in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | 30-Jun-13 | | | 31-Mar-13 | | | 31-Dec-12 | | | 30-Sep-12 | | | 30-Jun-12 | | | 31-Mar-12 | |

| | | | | | |

Rental | | $ | 285,953 | | | $ | 281,399 | | | $ | 272,906 | | | $ | 260,052 | | | $ | 234,923 | | | $ | 222,834 | |

Tenant reimbursements - Utilities | | | 54,397 | | | | 51,245 | | | | 50,085 | | | | 56,126 | | | | 41,931 | | | | 37,378 | |

Tenant reimbursements - Other | | | 22,284 | | | | 24,672 | | | | 25,062 | | | | 22,752 | | | | 18,491 | | | | 20,484 | |

Construction management | | | 728 | | | | 806 | | | | 1,525 | | | | 2,497 | | | | 1,954 | | | | 2,452 | |

Other | | | 140 | | | | 248 | | | | 158 | | | | 1,052 | | | | 6,405 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total operating revenues | | | 363,502 | | | | 358,370 | | | | 349,736 | | | | 342,479 | | | | 303,704 | | | | 283,148 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Utilities | | | 57,142 | | | | 53,972 | | | | 53,040 | | | | 58,866 | | | | 43,622 | | | | 39,352 | |

Rental property operating | | | 26,911 | | | | 29,180 | | | | 25,044 | | | | 25,914 | | | | 24,065 | | | | 19,768 | |

Repairs and maintenance | | | 22,283 | | | | 23,628 | | | | 28,011 | | | | 21,880 | | | | 19,889 | | | | 20,725 | |

Property taxes | | | 19,374 | | | | 21,042 | | | | 19,682 | | | | 17,982 | | | | 15,769 | | | | 16,042 | |

Insurance | | | 2,238 | | | | 2,205 | | | | 2,647 | | | | 2,463 | | | | 2,260 | | | | 2,230 | |

Construction management | | | 294 | | | | 384 | | | | 184 | | | | 623 | | | | 596 | | | | 193 | |

Depreciation and amortization | | | 115,867 | | | | 111,623 | | | | 107,718 | | | | 101,840 | | | | 89,000 | | | | 83,995 | |

General and administrative | | | 17,891 | | | | 15,951 | | | | 13,441 | | | | 14,409 | | | | 15,109 | | | | 14,250 | |

Transactions | | | 1,491 | | | | 1,763 | | | | 5,331 | | | | 504 | | | | 4,608 | | | | 677 | |

Other | | | 17 | | | | 36 | | | | — | | | | 923 | | | | 337 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 263,508 | | | | 259,784 | | | | 255,098 | | | | 245,404 | | | | 215,255 | | | | 197,232 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Operating income | | | 99,994 | | | | 98,586 | | | | 94,638 | | | | 97,075 | | | | 88,449 | | | | 85,916 | |

| | | | | | |

Equity in earnings of unconsolidated joint ventures | | | 2,330 | | | | 2,335 | | | | 1,733 | | | | 1,520 | | | | 3,493 | | | | 1,389 | |

Gain on insurance settlement | | | 5,597 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Interest and other income | | | (6 | ) | | | 41 | | | | (116 | ) | | | 83 | | | | 1,216 | | | | 709 | |

Interest expense | | | (47,583 | ) | | | (48,078 | ) | | | (40,350 | ) | | | (41,047 | ) | | | (37,681 | ) | | | (38,030 | ) |

Tax expense | | | (210 | ) | | | (1,203 | ) | | | (10 | ) | | | (710 | ) | | | (1,206 | ) | | | (721 | ) |

Loss from early extinguishment of debt | | | (501 | ) | | | — | | | | — | | | | — | | | | (303 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | 59,621 | | | | 51,681 | | | | 55,895 | | | | 56,921 | | | | 53,968 | | | | 49,263 | |

Net income attributable to noncontrolling interests | | | (1,145 | ) | | | (970 | ) | | | (1,329 | ) | | | (1,529 | ) | | | (1,634 | ) | | | (1,221 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income attributable to Digital Realty Trust, Inc. | | | 58,476 | | | | 50,711 | | | | 54,566 | | | | 55,392 | | | | 52,334 | | | | 48,042 | |

Preferred stock dividends | | | (11,399 | ) | | | (8,054 | ) | | | (9,751 | ) | | | (9,777 | ) | | | (10,313 | ) | | | (8,831 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income available to common stockholders | | $ | 47,077 | | | $ | 42,657 | | | $ | 44,815 | | | $ | 45,615 | | | $ | 42,021 | | | $ | 39,211 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net income per share available to common stockholders - basic | | $ | 0.37 | | | $ | 0.34 | | | $ | 0.36 | | | $ | 0.37 | | | $ | 0.38 | | | $ | 0.37 | |

Net income per share available to common stockholders - diluted | | $ | 0.37 | | | $ | 0.34 | | | $ | 0.36 | | | $ | 0.37 | | | $ | 0.38 | | | $ | 0.36 | |

Weighted-average shares outstanding - basic | | | 128,419,745 | | | | 126,445,285 | | | | 123,824,957 | | | | 122,026,421 | | | | 109,761,017 | | | | 107,099,856 | |

Weighted-average shares outstanding - diluted | | | 128,623,076 | | | | 126,738,339 | | | | 124,145,590 | | | | 122,353,511 | | | | 110,166,082 | | | | 107,584,856 | |

Weighted-average fully diluted shares and units | | | 131,177,283 | | | | 129,181,095 | | | | 127,835,847 | | | | 126,569,841 | | | | 114,505,563 | | | | 111,917,822 | |

Page 9

DIGITAL REALTY TRUST, INC.

Second Quarter 2013

Funds From Operations (FFO)

(unaudited and in thousands, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | 30-Jun-13 | | | 31-Mar-13 | | | 31-Dec-12 | | | 30-Sep-12 | | | 30-Jun-12 | | | 31-Mar-12 | |

Reconciliation of net income available to common stockholders to FFO (Note): | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Net income available to common stockholders | | $ | 47,077 | | | $ | 42,657 | | | $ | 44,815 | | | $ | 45,615 | | | $ | 42,021 | | | $ | 39,211 | |

| | | | | | |

Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Noncontrolling interests in operating partnership | | | 936 | | | | 824 | | | | 1,336 | | | | 1,574 | | | | 1,661 | | | | 1,586 | |

Real estate related depreciation and amortization (1) | | | 114,913 | | | | 110,690 | | | | 106,797 | | | | 100,994 | | | | 88,186 | | | | 82,993 | |

Real estate related depreciation and amortization related to investment in unconsolidated joint ventures | | | 797 | | | | 833 | | | | 727 | | | | 710 | | | | 866 | | | | 905 | |

Gain on sale of assets held in unconsolidated joint venture | | | — | | | | — | | | | — | | | | — | | | | (2,325 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

FFO available to common stockholders and unitholders | | $ | 163,723 | | | $ | 155,004 | | | $ | 153,675 | | | $ | 148,893 | | | $ | 130,409 | | | $ | 124,695 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

FFO per share and unit: | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | 1.25 | | | $ | 1.20 | | | $ | 1.21 | | | $ | 1.18 | | | $ | 1.14 | | | $ | 1.12 | |

Diluted(2) | | $ | 1.22 | | | $ | 1.16 | | | $ | 1.16 | | | $ | 1.13 | | | $ | 1.09 | | | $ | 1.06 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Weighted-average shares and units outstanding - basic | | | 130,974 | | | | 128,888 | | | | 127,515 | | | | 126,243 | | | | 114,100 | | | | 111,433 | |

Weighted-average shares and units outstanding - diluted (2) | | | 137,787 | | | | 137,680 | | | | 137,510 | | | | 137,304 | | | | 125,824 | | | | 125,482 | |

| | | | | | |

(1) Real estate related depreciation and amortization was computed as follows: | | | | | | | | | | | | | | | | | | | | | | | | |

Depreciation and amortization per income statement | | $ | 115,867 | | | $ | 111,623 | | | $ | 107,718 | | | $ | 101,840 | | | $ | 89,000 | | | $ | 83,995 | |

Non-real estate depreciation | | | (954 | ) | | | (933 | ) | | | (921 | ) | | | (846 | ) | | | (814 | ) | | | (1,002 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | $ | 114,913 | | | $ | 110,690 | | | $ | 106,797 | | | $ | 100,994 | | | $ | 88,186 | | | $ | 82,993 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (2) | For the three months ended June 30, 2013, we have excluded the effect of dilutive series E, series F and series G preferred stock, as applicable, that may be converted upon the occurrence of specified change in control transactions as described in the articles supplementary governing the series E, series F and series G preferred stock, as applicable, which we consider highly improbable; if included, the dilutive effect for the three months ended June 30, 2013 would be 11,949. In addition, we had a balance of $266,400 of 5.50% exchangeable senior debentures due 2029 that were exchangeable for 6,610 common shares on a weighted average basis for the three months ended June 30, 2013. See below for calculations of diluted FFO available to common stockholders and unitholders and weighted average common stock and units outstanding. |

| | | | | | | | | | | | | | | | | | | | | | | | |

FFO available to common stockholders and unitholders | | $ | 163,723 | | | $ | 155,004 | | | $ | 153,675 | | | $ | 148,893 | | | $ | 130,409 | | | $ | 124,695 | |

Add: Series C convertible preferred dividends | | | — | | | | — | | | | — | | | | — | | | | — | | | | 1,402 | |

Add: Series D convertible preferred dividends | | | — | | | | — | | | | 1,697 | | | | 1,723 | | | | 2,394 | | | | 2,398 | |

Add: 5.50% exchangeable senior debentures interest expense | | | 4,050 | | | | 4,050 | | | | 4,050 | | | | 4,050 | | | | 4,050 | | | | 4,050 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

FFO available to common stockholders and unitholders - diluted | | $ | 167,773 | | | $ | 159,054 | | | $ | 159,422 | | | $ | 154,666 | | | $ | 136,853 | | | $ | 132,545 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Weighted average common stock and units outstanding | | | 130,974 | | | | 128,888 | | | | 127,515 | | | | 126,243 | | | | 114,100 | | | | 111,433 | |

Add: Effect of dilutive securities (excl. series C & D convert. preferred stock & 5.50% debentures) | | | 203 | | | | 293 | | | | 321 | | | | 327 | | | | 405 | | | | 485 | |

Add: Effect of dilutive series C convertible preferred stock | | | — | | | | — | | | | — | | | | — | | | | 489 | | | | 2,785 | |

Add: Effect of dilutive series D convertible preferred stock | | | — | | | | 1,909 | | | | 3,143 | | | | 4,219 | | | | 4,374 | | | | 4,337 | |

Add: Effect of dilutive 5.50% exchangeable senior debentures | | | 6,610 | | | | 6,590 | | | | 6,531 | | | | 6,515 | | | | 6,456 | | | | 6,442 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Weighted average common stock and units outstanding - diluted | | | 137,787 | | | | 137,680 | | | | 137,510 | | | | 137,304 | | | | 125,824 | | | | 125,482 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Note: For a definition and discussion of FFO, see page 32.

Adjusted Funds From Operations (AFFO)

(unaudited and in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | 30-Jun-13 | | | 31-Mar-13 | | | 31-Dec-12 | | | 30-Sep-12 | | | 30-Jun-12 | | | 31-Mar-12 | |

Reconciliation of FFO to AFFO (Note): | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

FFO available to common stockholders and unitholders | | $ | 163,723 | | | $ | 155,004 | | | $ | 153,675 | | | $ | 148,893 | | | $ | 130,409 | | | $ | 124,695 | |

| | | | | | |

Adjustments: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Non-real estate depreciation | | | 954 | | | | 933 | | | | 921 | | | | 846 | | | | 814 | | | | 1,002 | |

Amortization of deferred financing costs | | | 2,471 | | | | 2,431 | | | | 2,359 | | | | 2,328 | | | | 1,799 | | | | 2,214 | |

Amortization of debt discount | | | 418 | | | | 605 | | | | 340 | | | | 260 | | | | 250 | | | | 247 | |

Non-cash compensation | | | 3,580 | | | | 2,888 | | | | 2,709 | | | | 2,741 | | | | 3,775 | | | | 3,407 | |

Loss from early extinguishment of debt | | | 501 | | | | — | | | | — | | | | — | | | | 303 | | | | — | |

Straight line rents | | | (19,892 | ) | | | (21,169 | ) | | | (20,004 | ) | | | (20,221 | ) | | | (19,649 | ) | | | (15,902 | ) |

Above and below market rent amortization | | | (3,041 | ) | | | (3,045 | ) | | | (2,819 | ) | | | (2,333 | ) | | | (2,871 | ) | | | (2,239 | ) |

Change in fair value of contingent consideration (3) | | | (370 | ) | | | 1,300 | | | | (1,051 | ) | | | — | | | | — | | | | — | |

Capitalized leasing compensation | | | (4,786 | ) | | | (5,053 | ) (5) | | | (4,008 | ) | | | (3,847 | ) | | | (3,334 | ) | | | (3,913 | ) |

Recurring capital expenditures (4) | | | (13,429 | ) | | | (9,860 | ) | | | (14,432 | ) | | | (11,015 | ) | | | (9,229 | ) | | | (6,754 | ) |

Capitalized internal leasing commissions | | | (3,331 | ) | | | (2,025 | ) | | | (1,877 | ) | | | (2,040 | ) | | | (1,100 | ) | | | (2,284 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

AFFO available to common stockholders and unitholders | | $ | 126,799 | | | $ | 122,009 | | | $ | 115,813 | | | $ | 115,612 | | | $ | 101,167 | | | $ | 100,473 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (3) | Relates to earn-out contingency in connection with Sentrum Portfolio acquisition. |

| (4) | For a definition, see page 29. |

| (5) | Corrects understated amount in previously reported capitalized leasing compensation. |

Note: For a definition and discussion of AFFO, see page 32. For a reconciliation of net income available to common stockholders to FFO, see above table.

Page 10

DIGITAL REALTY TRUST, INC.

Second Quarter 2013

Reconciliation of Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA)(1)

(unaudited and in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

| | | 30-Jun-13 | | | 31-Mar-13 | | | 31-Dec-12 | | | 30-Sep-12 | | | 30-Jun-12 | | | 31-Mar-12 | |

| | | | | | |

Net income available to common stockholders | | $ | 47,077 | | | $ | 42,657 | | | $ | 44,815 | | | $ | 45,615 | | | $ | 42,021 | | | $ | 39,211 | |

| | | | | | |

Interest | | | 47,583 | | | | 48,078 | | | | 40,350 | | | | 41,047 | | | | 37,681 | | | | 38,030 | |

Loss from early extinguishment of debt | | | 501 | | | | — | | | | — | | | | — | | | | 303 | | | | — | |

Taxes | | | 210 | | | | 1,203 | | | | 10 | | | | 710 | | | | 1,206 | | | | 721 | |

Depreciation and amortization | | | 115,867 | | | | 111,623 | | | | 107,718 | | | | 101,840 | | | | 89,000 | | | | 83,995 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

EBITDA | | | 211,238 | | | | 203,561 | | | | 192,893 | | | | 189,212 | | | | 170,211 | | | | 161,957 | |

| | | | | | |

Noncontrolling interests | | | 1,145 | | | | 970 | | | | 1,329 | | | | 1,529 | | | | 1,634 | | | | 1,221 | |

Preferred stock dividends | | | 11,399 | | | | 8,054 | | | | 9,751 | | | | 9,777 | | | | 10,313 | | | | 8,831 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Adjusted EBITDA | | $ | 223,782 | | | $ | 212,585 | | | $ | 203,973 | | | $ | 200,518 | | | $ | 182,158 | | | $ | 172,009 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | For the definition and discussion of EBITDA and Adjusted EBITDA, see page 32. EBITDA and Adjusted EBITDA for the three months ended June 30, 2012 include a gain on sale of 700 / 750 Central Expressway, held through an unconsolidated joint venture, of approximately $2.3 million. Excluding this gain, EBITDA and Adjusted EBITDA would have been $167.9 million and $179.9 million, respectively, for three months ended June 30, 2012. |

Financial Ratios

(unaudited and in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | 30-Jun-13 | | | 31-Mar-13 | | | 31-Dec-12 | | | 30-Sep-12 | | | 30-Jun-12 | | | 31-Mar-12 | |

| | | | | | |

Total GAAP interest expense | | $ | 47,583 | | | $ | 48,078 | | | $ | 40,350 | | | $ | 41,047 | | | $ | 37,681 | | | $ | 38,030 | |

Capitalized interest | | | 6,617 | | | | 5,343 | | | | 7,833 | | | | 4,496 | | | | 4,602 | | | | 4,526 | |

Change in accrued interest and other non-cash amounts | | | (18,637 | ) | | | 2,742 | | | | (17,872 | ) | | | 8,974 | | | | (14,836 | ) | | | 11,320 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Cash interest expense (a) | | | 35,563 | | | | 56,163 | | | | 30,311 | | | | 54,517 | | | | 27,447 | | | | 53,876 | |

Scheduled debt principal payments and preferred dividends | | | 15,172 | | | | 11,950 | | | | 13,518 | | | | 13,402 | | | | 15,199 | | | | 12,601 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total fixed charges (b) | | $ | 50,735 | | | $ | 68,113 | | | $ | 43,829 | | | $ | 67,919 | | | $ | 42,646 | | | $ | 66,477 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Debt service coverage ratio based on GAAP interest expense (c) | | | 4.7x | | | | 4.4x | | | | 5.1x | | | | 4.9x | | | | 4.8x | | | | 4.5x | |

Debt service coverage ratio based on cash interest expense (d) | | | 6.3x | | | | 3.8x | | | | 6.7x | | | | 3.7x | | | | 6.6x | | | | 3.2x | |

Fixed charge coverage ratio based on GAAP interest expense (e) | | | 3.6x | | | | 3.5x | | | | 3.8x | | | | 3.7x | | | | 3.4x | | | | 3.4x | |

Fixed charge coverage ratio based on cash interest expense (f) | | | 4.4x | | | | 3.1x | | | | 4.7x | | | | 3.0x | | | | 4.3x | | | | 2.6x | |

Debt to total enterprise value including debt and preferred equity (g) | | | 35.0 | % | | | 33.6 | % | | | 31.5 | % | | | 30.0 | % | | | 26.8 | % | | | 26.9 | % |

Debt plus preferred stock to total enterprise value including debt and preferred equity (h) | | | 40.3 | % | | | 36.9 | % | | | 35.9 | % | | | 34.4 | % | | | 31.9 | % | | | 31.8 | % |

Pretax income to interest expense (i) | | | 2.3x | | | | 2.1x | | | | 2.4x | | | | 2.4x | | | | 2.4x | | | | 2.3x | |

Net Debt to Adjusted EBITDA (j) | | | 5.2x | | | | 5.5x | | | | 5.2x | | | | 5.0x | | | | 4.6x | | | | 4.7x | |

| (a) | Cash interest expense is interest expense less amortization of debt discount and deferred financing fees and includes interest that we capitalized. We consider cash interest expense to be a useful measure of interest as it excludes non-cash based interest expense. |

| (b) | Fixed charges consist of cash interest expense, scheduled debt principal payments and preferred dividends. |

| (c) | Adjusted EBITDA divided by GAAP interest expense. |

| (d) | Adjusted EBITDA divided by cash interest expense. |

| (e) | Adjusted EBITDA divided by the sum of GAAP interest expense, scheduled debt principal payments and preferred dividends. |

| (f) | Adjusted EBITDA divided by fixed charges. |

| (g) | Mortgage debt and other loans divided by mortgage debt and other loans plus the liquidation value of preferred stock and the market value of outstanding common stock and operating partnership units, assuming the redemption of operating partnership units for shares of our common stock. |

| (h) | Same as (e), except numerator includes preferred stock. |

| (i) | Calculated as net income, adding back interest expense and divided by GAAP interest expense. |

| (j) | Calculated as total debt at balance sheet carrying value (see page 7) less unrestricted cash and cash equivalents divided by the product of Adjusted EBITDA multiplied by four. |

Page 11

DIGITAL REALTY TRUST, INC.

Second Quarter 2013

Same Store and New Properties Consolidated Quarterly Statements of Operations

(unaudited and in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

Same store(1) | | 30-Jun-13 | | | 31-Mar-13 | | | 31-Dec-12 | | | 30-Sep-12 | | | 30-Jun-12 | | | 31-Mar-12 | |

Operating Revenues: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Rental | | $ | 248,299 | | | $ | 245,678 | | | $ | 237,932 | | | $ | 233,341 | | | $ | 229,875 | | | $ | 221,067 | |

Tenant reimbursements - Utilities | | | 44,600 | | | | 42,525 | | | | 41,736 | | | | 47,127 | | | | 40,726 | | | | 36,879 | |

Tenant reimbursements - Other | | | 18,112 | | | | 20,124 | | | | 19,941 | | | | 19,408 | | | | 18,561 | | | | 20,053 | |

Construction management (2) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Other | | | — | | | | 248 | | | | 158 | | | | 1,052 | | | | 6,405 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total operating revenues | | | 311,011 | | | | 308,575 | | | | 299,767 | | | | 300,928 | | | | 295,567 | | | | 277,999 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Operating Expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Utilities | | | 47,186 | | | | 45,032 | | | | 44,633 | | | | 50,080 | | | | 42,468 | | | | 38,854 | |

Rental property operating | | | 24,633 | | | | 25,559 | | | | 23,602 | | | | 24,040 | | | | 23,614 | | | | 19,664 | |

Repairs and maintenance | | | 20,214 | | | | 21,524 | | | | 25,742 | | | | 20,574 | | | | 19,632 | | | | 20,671 | |

Property taxes | | | 16,796 | | | | 18,695 | | | | 17,249 | | | | 16,589 | | | | 15,428 | | | | 15,925 | |

Insurance | | | 2,028 | | | | 2,111 | | | | 2,299 | | | | 2,151 | | | | 2,218 | | | | 2,193 | |

Construction management(2) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Depreciation and amortization | | | 98,953 | | | | 96,177 | | | | 91,993 | | | | 89,279 | | | | 86,886 | | | | 82,956 | |

General and administrative(3) | | | 17,891 | | | | 15,951 | | | | 13,441 | | | | 14,409 | | | | 15,109 | | | | 14,250 | |

Transactions(4) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Other | | | 17 | | | | 36 | | | | — | | | | 923 | | | | 337 | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 227,718 | | | | 225,085 | | | | 218,959 | | | | 218,045 | | | | 205,692 | | | | 194,513 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Operating income | | | 83,293 | | | | 83,490 | | | | 80,808 | | | | 82,883 | | | | 89,875 | | | | 83,486 | |

| | | | | | |

Other Income (Expenses): | | | | | | | | | | | | | | | | | | | | | | | | |

Equity in earnings of unconsolidated joint ventures | | | 2,346 | | | | 2,346 | | | | 1,743 | | | | 1,531 | | | | 3,493 | | | | 1,389 | |

Gain on insurance settlement | | | 5,597 | | | | — | | | | — | | | | — | | | | — | | | | — | |

Interest and other income | | | (21 | ) | | | 39 | | | | (118 | ) | | | (53 | ) | | | 1,263 | | | | 774 | |

Interest expense | | | (40,486 | ) | | | (42,007 | ) | | | (38,383 | ) | | | (39,208 | ) | | | (37,643 | ) | | | (38,030 | ) |

Tax expense | | | 158 | | | | (831 | ) | | | 310 | | | | (587 | ) | | | (1,083 | ) | | | (598 | ) |

Loss from early extinguishment of debt | | | (501 | ) | | | — | | | | — | | | | — | | | | (303 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 50,386 | | | $ | 43,037 | | | $ | 44,360 | | | $ | 44,566 | | | $ | 55,602 | | | $ | 47,021 | |

| | | | | | |

New properties(1) | | | | | | | | | | | | | | | | | | |

Operating Revenues: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Rental | | $ | 37,654 | | | $ | 35,721 | | | $ | 34,974 | | | $ | 26,711 | | | $ | 5,048 | | | $ | 1,767 | |

Tenant reimbursements - Utilities | | | 9,797 | | | | 8,720 | | | | 8,349 | | | | 8,999 | | | | 1,205 | | | | 499 | |

Tenant reimbursements - Other | | | 4,172 | | | | 4,548 | | | | 5,121 | | | | 3,344 | | | | (70 | ) | | | 431 | |

Construction management(2) | | | 728 | | | | 806 | | | | 1,525 | | | | 2,497 | | | | 1,954 | | | | 2,452 | |

Other | | | 140 | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total operating revenues | | | 52,491 | | | | 49,795 | | | | 49,969 | | | | 41,551 | | | | 8,137 | | | | 5,149 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Operating Expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Utilities | | | 9,956 | | | | 8,940 | | | | 8,407 | | | | 8,786 | | | | 1,154 | | | | 498 | |

Rental property operating | | | 2,278 | | | | 3,621 | | | | 1,442 | | | | 1,874 | | | | 451 | | | | 104 | |

Repairs and maintenance | | | 2,069 | | | | 2,104 | | | | 2,269 | | | | 1,306 | | | | 257 | | | | 54 | |

Property taxes | | | 2,578 | | | | 2,347 | | | | 2,433 | | | | 1,393 | | | | 341 | | | | 117 | |

Insurance | | | 210 | | | | 94 | | | | 348 | | | | 312 | | | | 42 | | | | 37 | |

Construction management(2) | | | 294 | | | | 384 | | | | 184 | | | | 623 | | | | 596 | | | | 193 | |

Depreciation and amortization | | | 16,914 | | | | 15,446 | | | | 15,725 | | | | 12,561 | | | | 2,114 | | | | 1,039 | |

General and administrative(3) | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Transactions(4) | | | 1,491 | | | | 1,763 | | | | 5,331 | | | | 504 | | | | 4,608 | | | | 677 | |

Other | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 35,790 | | | | 34,699 | | | | 36,139 | | | | 27,359 | | | | 9,563 | | | | 2,719 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Operating income | | | 16,701 | | | | 15,096 | | | | 13,830 | | | | 14,192 | | | | (1,426 | ) | | | 2,430 | |

| | | | | | |

Other Income (Expenses): | | | | | | | | | | | | | | | | | | | | | | | | |

Equity in earnings of unconsolidated joint ventures | | | (16 | ) | | | (11 | ) | | | (10 | ) | | | (11 | ) | | | — | | | | — | |

Gain on insurance settlement | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

Interest and other income | | | 15 | | | | 2 | | | | 2 | | | | 136 | | | | (47 | ) | | | (65 | ) |

Interest expense | | | (7,097 | ) | | | (6,071 | ) | | | (1,967 | ) | | | (1,839 | ) | | | (38 | ) | | | — | |

Tax expense | | | (368 | ) | | | (372 | ) | | | (320 | ) | | | (123 | ) | | | (123 | ) | | | (123 | ) |

Loss from early extinguishment of debt | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Income | | $ | 9,235 | | | $ | 8,644 | | | $ | 11,535 | | | $ | 12,355 | | | $ | (1,634 | ) | | $ | 2,242 | |

| (1) | Same store properties are properties that were acquired on or before December 31, 2011 and new properties are properties acquired after December 31, 2011. |

| (2) | Construction management revenues and expenses are included entirely in new properties as they are not allocable to specific properties. |

| (3) | General and administrative expenses are included entirely in same store properties as they are not allocable to specific properties. |

| (4) | Transaction expenses are included entirely in new properties as they are not allocable to specific properties. |

Page 12

DIGITAL REALTY TRUST, INC.

Second Quarter 2013

Same Store Operating Trend Summary

(unaudited and in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended | |

Same store(1) | | 30-Jun-13 | | | 31-Mar-13 | | | Percentage

Change | | | 30-Jun-12 | | | Percentage

Change | |

| | | | | |

Rental(2) | | $ | 248,299 | | | $ | 245,678 | | | | 1.1 | % | | $ | 229,875 | | | | 8.0 | % |

Tenant reimbursements - Utilities | | | 44,600 | | | | 42,525 | | | | 4.9 | % | | | 40,726 | | | | 9.5 | % |

Tenant reimbursements - Other | | | 18,112 | | | | 20,124 | | | | (10.0 | %) | | | 18,561 | | | | (2.4 | %) |

| | | | | | | | | | | | | | | | | | | | |

| | | 311,011 | | | | 308,327 | | | | 0.9 | % | | | 289,162 | | | | 7.6 | % |

| | | | | |

Utilities | | | 47,186 | | | | 45,032 | | | | 4.8 | % | | | 42,468 | | | | 11.1 | % |

Rental property operating | | | 24,633 | | | | 25,559 | | | | (3.6 | %) | | | 23,614 | | | | 4.3 | % |

Repairs and maintenance | | | 20,214 | | | | 21,524 | | | | (6.1 | %) | | | 19,632 | | | | 3.0 | % |

Property taxes | | | 16,796 | | | | 18,695 | | | | (10.2 | %) | | | 15,428 | | | | 8.9 | % |

Insurance | | | 2,028 | | | | 2,111 | | | | (3.9 | %) | | | 2,218 | | | | (8.6 | %) |

| | | | | | | | | | | | | | | | | | | | |

| | | 110,857 | | | | 112,921 | | | | (1.8 | %) | | | 103,360 | | | | 7.3 | % |

| | | | | | | | | | | | | | | | | | | | |

Net Operating Income(3) | | $ | 200,154 | | | $ | 195,406 | | | | 2.4 | % | | $ | 185,802 | | | | 7.7 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | |

Same store occupancy at end of quarter(4) | | | 92.3 | % | | | 93.1 | % | | | (0.8 | %) | | | 93.2 | % | | | (0.9 | %) |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Same store properties were acquired on or before December 31, 2011. |

| (2) | For the periods presented, same store straight-line rent was $17,061, $18,528 and $19,246, respectively, and non-cash purchase accounting adjustments were $2,114, $2,215, and $1,857, respectively. |

| (3) | For a definition and discussion of Net Operating Income, see page 32. |

| (4) | Occupancy excludes space held for development. For some of our properties, we calculate occupancy based on factors in addition to contractually leased square feet, including available power, required support space and common area. |

Page 13

DIGITAL REALTY TRUST, INC.

Second Quarter 2013

Consolidated Debt Analysis

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | |

| | | Maturity Date | | | | Principal Balance as of

June 30, 2013 | | | % of Debt | | | Interest Rate as of

June 30, 2013 | | | Interest Rate as of

June 30, 2013

including swaps | |

Global Revolving Credit Facility: | | | | | | | | | | | | | | | | | | | | |

Global revolving credit facility | | November 2, 2016 | | (1) | | | 610,328 | | | | 13.0 | % | | | 1.94 | % | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | $ | 610,328 | | | | 13.0 | % | | | | | | | | |

| | | | | | |

Unsecured term loan: | | | | | | | | | | | | | | | | | | | | |

Unsecured term loan | | April 16, 2017 | | | | | 741,178 | | | | 15.8 | % | | | 1.79 | % | | | 2.22 | % |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | $ | 741,178 | | | | 15.8 | % | | | | | | | | |

| | | | | | |

Unsecured senior notes: | | | | | | | | | | | | | | | | | | | | |

Prudential Shelf Facility: | | | | | | | | | | | | | | | | | | | | |

Series B | | November 5, 2013 | | | | | 33,000 | | | | 0.7 | % | | | 9.32 | % | | | | |

Series C | | January 6, 2016 | | | | | 25,000 | | | | 0.5 | % | | | 9.68 | % | | | | |

Series D | | January 20, 2015 | | | | | 50,000 | | | | 1.1 | % | | | 4.57 | % | | | | |

Series E | | January 20, 2017 | | | | | 50,000 | | | | 1.1 | % | | | 5.73 | % | | | | |

Series F | | February 3, 2015 | | | | | 17,000 | | | | 0.4 | % | | | 4.50 | % | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total Prudential Shelf Facility | | | | | | $ | 175,000 | | | | 3.8 | % | | | | | | | | |

| | | | | | |

Senior Notes: | | | | | | | | | | | | | | | | | | | | |

4.50% notes due 2015 | | July 15, 2015 | | | | | 375,000 | | | | 8.0 | % | | | 4.50 | % | | | | |

5.875% notes due 2020 | | February 1, 2020 | | | | | 500,000 | | | | 10.6 | % | | | 5.88 | % | | | | |

5.25% notes due 2021 | | March 15, 2021 | | | | | 400,000 | | | | 8.5 | % | | | 5.25 | % | | | | |

3.625% notes due 2022 | | October 1, 2022 | | | | | 300,000 | | | | 6.4 | % | | | 3.63 | % | | | | |

4.25% notes due 2025 | | January 17, 2025 | | | | | 608,520 | | | | 12.9 | % | | | 4.25 | % | | | | |

Unamortized discounts | | | | | | | (15,530 | ) | | | -0.3 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total senior notes | | | | | | $ | 2,167,990 | | | | 46.1 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total unsecured senior notes | | | | | | $ | 2,342,990 | | | | 49.9 | % | | | | | | | | |

| | | | | | |

Exchangeable senior debentures: | | | | | | | | | | | | | | | | | | | | |

5.50% exchangeable senior debentures due 2029 | | April 15, 2029 | | | | | 266,400 | | | | 5.7 | % | | | 5.50 | %�� | | | | |

| | | | | | | | | | | | | | | | | | | | |

Total exchangeable senior debentures | | | | | | $ | 266,400 | | | | 5.7 | % | | | | | | | | |

| | | | | | |

Mortgage loans: | | | | | | | | | | | | | | | | | | | | |

Paul van Vlissingenstraat 16 | | July 18, 2013 | | (2) | | | 13,041 | | | | 0.3 | % | | | 1.78 | % | | | 5.58 | % |

Chemin de l’Epinglier 2 | | July 18, 2013 | | (2) | | | 9,436 | | | | 0.2 | % | | | 1.68 | % | | | 5.57 | % |

1500 Space Park Drive | | October 5, 2013 | | (2) | | | 34,528 | | | | 0.7 | % | | | 6.15 | % | | | | |

Gyroscoopweg 2E-2F | | October 18, 2013 | | | | | 8,305 | | | | 0.2 | % | | | 1.68 | % | | | 5.49 | % |

360 Spear Street | | November 8, 2013 | | | | | 46,103 | | | | 1.0 | % | | | 6.32 | % | | | | |

Mundells Roundabout | | November 30, 2013 | | | | | 65,150 | | | | 1.4 | % | | | 1.71 | % | | | 4.18 | % |

Cressex 1 | | October 16, 2014 | | | | | 26,496 | | | | 0.5 | % | | | 5.68 | % | | | | |

Manchester Technopark | | October 16, 2014 | | | | | 8,060 | | | | 0.2 | % | | | 5.68 | % | | | | |

Secured Term Debt | | November 11, 2014 | | | | | 134,490 | | | | 2.9 | % | | | 5.65 | % | | | | |

200 Paul Avenue 1-4 | | October 8, 2015 | | | | | 71,688 | | | | 1.5 | % | | | 5.74 | % | | | | |

8025 North Interstate 35 | | March 6, 2016 | | | | | 6,439 | | | | 0.1 | % | | | 4.09 | % | | | | |

600 West Seventh Street | | March 15, 2016 | | | | | 50,373 | | | | 1.1 | % | | | 5.80 | % | | | | |

34551 Ardenwood Boulevard 1-4 | | November 11, 2016 | | | | | 52,535 | | | | 1.1 | % | | | 5.95 | % | | | | |

2334 Lundy Place | | November 11, 2016 | | | | | 38,209 | | | | 0.8 | % | | | 5.96 | % | | | | |

1100 Space Park Drive | | December 11, 2016 | | | | | 52,504 | | | | 1.1 | % | | | 5.89 | % | | | | |

2045 & 2055 LaFayette Street | | February 6, 2017 | | | | | 64,124 | | | | 1.3 | % | | | 5.93 | % | | | | |

150 South First Street | | February 6, 2017 | | | | | 50,465 | | | | 1.1 | % | | | 6.30 | % | | | | |

731 East Trade Street | | July 1, 2020 | | | | | 4,351 | | | | 0.1 | % | | | 8.22 | % | | | | |

Unamortized net premiums | | | | | | | 1,055 | | | | 0.0 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | $ | 737,352 | | | | 15.6 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Total Consolidated Debt | | | | | | $ | 4,698,248 | | | | 100.0 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Weighted average cost of debt (including interest rate swaps) | | | | | | | | | | | | | | | | | | | 4.25 | % |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Assumes all extensions will be exercised. |

| (2) | Mortgage loans paid in full in July 2013. |

Global Revolving Credit Facility

(in thousands)

| | | | | | | | | | | | |

| | | Maximum Available as of

June 30, 2013 | | | Available as of

June 30, 2013 (3) | | | Drawn as of

June 30, 2013 | |

Global Revolving Credit Facility | | $ | 1,800,000 | | | $ | 1,154,281 | | | $ | 610,328 | |

| (3) | Net of letters of credit issued. |

Page 14

DIGITAL REALTY TRUST, INC.

Second Quarter 2013

Debt Maturities

(unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | 2013 | | | 2014 | | | 2015 | | | 2016 | | | 2017 | | | Thereafter | | | Total | |

Unsecured term loan | | | | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 741,178 | | | $ | — | | | $ | 741,178 | |

Global revolving credit facility | | | (1 | ) | | | — | | | | — | | | | — | | | | 610,328 | | | | — | | | | — | | | | 610,328 | |

4.25% notes due 2025 | | | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 608,520 | | | | 608,520 | |

5.875% notes due 2020 | | | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 500,000 | | | | 500,000 | |

5.25% notes due 2021 | | | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 400,000 | | | | 400,000 | |

4.50% notes due 2015 | | | | | | | — | | | | — | | | | 375,000 | | | | — | | | | — | | | | — | | | | 375,000 | |

3.625% notes due 2022 | | | | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 300,000 | | | | 300,000 | |

5.50% exchangeable senior debentures due 2029 | | | (2 | ) | | | — | | | | 266,400 | | | | — | | | | — | | | | — | | | | — | | | | 266,400 | |

Prudential shelf facility senior notes | | | | | | | 33,000 | | | | — | | | | 67,000 | | | | 25,000 | | | | 50,000 | | | | — | | | | 175,000 | |

Secured Term Debt | | | (3 | ) | | | 1,524 | | | | 132,966 | | | | — | | | | — | | | | — | | | | — | | | | 134,490 | |

200 Paul Avenue 1-4 | | | | | | | 974 | | | | 2,048 | | | | 68,666 | | | | — | | | | — | | | | — | | | | 71,688 | |

Mundells Roundabout | | | | | | | 65,150 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 65,150 | |

2045 & 2055 LaFayette Street | | | | | | | 501 | | | | 1,060 | | | | 1,125 | | | | 1,195 | | | | 60,243 | | | | — | | | | 64,124 | |

34551 Ardenwood Boulevard 1-4 | | | | | | | 384 | | | | 812 | | | | 862 | | | | 50,477 | | | | — | | | | — | | | | 52,535 | |

1100 Space Park Drive | | | | | | | 389 | | | | 821 | | | | 871 | | | | 50,423 | | | | — | | | | — | | | | 52,504 | |

150 South First Street | | | | | | | 368 | | | | 781 | | | | 832 | | | | 878 | | | | 47,606 | | | | — | | | | 50,465 | |

600 West Seventh Street | | | | | | | 825 | | | | 1,723 | | | | 1,825 | | | | 46,000 | | | | — | | | | — | | | | 50,373 | |

360 Spear Street | | | | | | | 46,103 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 46,103 | |

2334 Lundy Place | | | | | | | 279 | | | | 590 | | | | 626 | | | | 36,714 | | | | — | | | | — | | | | 38,209 | |

1500 Space Park Drive | | | (4 | ) | | | 34,528 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 34,528 | |

Cressex 1 | | | | | | | 233 | | | | 26,263 | | | | — | | | | — | | | | — | | | | — | | | | 26,496 | |

Paul van Vlissingenstraat 16 | | | (4 | ) | | | 13,041 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 13,041 | |

Chemin de l’Epinglier 2 | | | (4 | ) | | | 9,436 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 9,436 | |

Gyroscoopweg 2E-2F | | | | | | | 8,305 | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 8,305 | |

Manchester Technopark | | | | | | | 71 | | | | 7,989 | | | | — | | | | — | | | | — | | | | — | | | | 8,060 | |

8025 North Interstate 35 | | | | | | | 125 | | | | 257 | | | | 268 | | | | 5,789 | | | | — | | | | — | | | | 6,439 | |

731 East Trade Street | | | | | | | 164 | | | | 350 | | | | 418 | | | | 503 | | | | 546 | | | | 2,370 | | | | 4,351 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Total | | | | | | $ | 215,400 | | | $ | 442,060 | | | $ | 517,493 | | | $ | 827,307 | | | $ | 899,573 | | | $ | 1,810,890 | | | $ | 4,712,723 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Weighted Average Term to Initial Maturity | | | (2 | ) | | | | | | | 4.9 Years | | | | | | | | | | | | | | | | | | | | | |

Weighted Average Term to Initial Maturity (assuming exercise of extension options) | | | (2 | ) | | | | | | | 5.1 Years | | | | | | | | | | | | | | | | | | | | | |

| (1) | Assumes all extensions will be exercised. |

| (2) | Assumes maturity of 5.50% exchangeable senior debentures due 2029 at first redemption date in April 2014. |

| (3) | This amount represents six mortgage loans secured by our interests in 36 NE 2nd Street, 3300 East Birch Street, 100 & 200 Quannapowitt Parkway, 300 Boulevard East, 4849 Alpha Road, and 11830 Webb Chapel Road. Each of these loans is cross-collateralized by the six properties. |

| (4) | Mortgage loans paid in full in July 2013. |

Note:Total excludes $1,055 of loan premiums, net and ($4,442), ($6,166), ($494), ($732), and ($3,696) of debt discount on 4.25% unsecured senior notes due 2025, 5.875% unsecured senior notes due 2020, 4.50% unsecured senior notes due 2015, 5.25% unsecured senior notes due 2021, and 3.625% unsecured senior notes due 2022, respectively.

Page 15

DIGITAL REALTY TRUST, INC.

Second Quarter 2013

Debt Analysis & Covenant Compliance

(unaudited)

| | | | | | | | | | | | | | | | |

Debt Covenant Ratios(1): | | As of June 30, 2013 | |

| | | 4.50% Notes due 2015,

5.875% Notes due 2020 & 5.25% Notes due 2021 | | | 3.625% Notes

due 2022 &

4.250% Notes

due 2025 | | | Global Revolving Credit Facility | |

| | | Required | | Actual | | | Actual | | | Required | | Actual | |

| | | | | |

Total Outstanding Debt / Total Assets (2) | | Less than 60% | | | 45 | % | | | 41 | % | | Less than 60%(3) | | | 38 | % |

| | | | | |

Secured Debt / Total Assets(4) | | Less than 40% | | | 7 | % | | | 6 | % | | Less than 40% | | | 6 | % |

| | | | | |

Total Unencumbered Assets / Unsecured Debt | | Greater than 150% | | | 237 | % | | | 255 | % | | | | | N/A | |

| | | | | |

Consolidated EBITDA / Interest Expense (5) | | Greater than 1.50x | | | 3.7x | | | | 3.7x | | | | | | N/A | |

| | | | | |

Fixed Charge Coverage | | | | | N/A | | | | N/A | | | Greater than 1.50x | | | 3.9x | |

| | | | | |

Unsecured Debt / Total Unencumbered Asset Value (6) | | | | | N/A | | | | N/A | | | Less than 60% | | | 43 | % |

| | | | | |

Unencumbered Assets Debt Service Coverage Ratio | | | | | N/A | | | | N/A | | | Greater than 1.50x | | | 4.9x | |

| (1) | For a definition of the capitalized terms used in the table above and related footnotes, please refer to: the Indenture dated January 28, 2010, which governs the 5.875% Notes due 2020; the Indenture dated July 8, 2010, which governs the 4.50% Notes due 2015; the Indenture and Supplemental Indenture No. 1 dated March 8, 2011, which governs the 5.25% Notes due 2021; the Indenture and Supplemental Indenture No. 1 dated September 24, 2012, which governs the 3.625% Notes due 2022; the Indenture dated January 18, 2013, which governs the 4.250% Guaranteed Notes due 2025; and the Global Senior Credit Agreement dated as of November 3, 2011, which are filed as exhibits to our reports filed with the Securities and Exchange Commission. |

| (2) | This ratio is referred to as the Leverage Ratio, defined as Consolidated Debt / Total Asset Value, under the Global Revolving Credit Facility. Under the 4.50% Notes due 2015, 5.875% Notes due 2020, and 5.25% Notes due 2021, Total Assets is calculated using Consolidated EBITDA capped at 9.0%. Under the 3.625% Notes due 2022 and 4.250% Guaranteed Notes due 2025, Total Assets is calculated using Consolidated EBITDA capped at 8.25%. Under the Global Revolving Credit Facility, Total Asset Value is calculated using Adjusted Net Operating Income capped at 8.25% for Data Center Assets and 7.50% for Other Assets. |

| (3) | The Company has the right to maintain a Leverage Ratio of greater than 60.0% but less than or equal to 65.0% for up to four consecutive fiscal quarters during the term of the Facility following an acquisition of one or more Assets for a purchase price and other consideration in an amount not less than 5% of Total Asset Value. |

| (4) | This ratio is referred to as the Secured Debt Leverage Ratio, defined as Consolidated Secured Debt / Total Asset Value, under the Global Revolving Credit Facility. |

| (5) | Calculated as current quarter annualized Consolidated EBITDA to current quarter annualized Interest Expense (including capitalized interest and debt discounts). |

| (6) | Assets must satisfy certain conditions to qualify for inclusion as an Unencumbered Asset under the Global Revolving Credit Facility. |

Page 16

DIGITAL REALTY TRUST, INC.

Second Quarter 2013

Portfolio Summary(1)

As of June 30, 2013

| | | | | | | | |

| | | 6/30/2013 | | | 3/31/2013 | |

Number of Properties: | | | | | | | | |

Domestic | | | 96 | | | | 95 | |

International | | | 28 | | | | 27 | |

Unconsolidated Joint Ventures | | | 3 | | | | 3 | |

| | | | | | | | |

| | | 127 | | | | 125 | |

| | |

Number of Buildings: | | | | | | | | |

Domestic | | | 152 | | | | 144 | |

International | | | 32 | | | | 31 | |

Unconsolidated Joint Ventures | | | 3 | | | | 3 | |

| | | | | | | | |

| | | 187 | | | | 178 | |

| | |

Number of Markets: | | | | | | | | |

Domestic | | | 20 | | | | 20 | |

International | | | 10 | | | | 10 | |

Unconsolidated Joint Ventures | | | 2 | | | | 2 | |

| | | | | | | | |

| | | 32 | | | | 32 | |

| | |

Net Rentable Square Feet:(2) | | | | | | | | |

Domestic | | | 17,685,861 | | | | 17,371,366 | |

International | | | 2,814,782 | | | | 2,787,474 | |

Unconsolidated Joint Ventures | | | 447,399 | | | | 447,669 | |

| | | | | | | | |

| | | 20,948,042 | | | | 20,606,509 | |

| | |

Space Held for Development Square Feet: | | | | | | | | |

Domestic | | | 2,404,288 | | | | 2,182,779 | |

International | | | 393,953 | | | | 405,255 | |

Unconsolidated Joint Ventures | | | — | | | | — | |

| | | | | | | | |

| | | 2,798,241 | | | | 2,588,034 | |

| | |

Portfolio Occupancy(3) | | | 93.1 | % | | | 94.0 | % |

Same Store Pool Occupancy(3) | | | 92.3 | % | | | 93.1 | % |

| (1) | Includes properties held through three unconsolidated joint ventures: 2001 Sixth Avenue, Seattle; 2020 Fifth Avenue, Seattle; and 33 Chun Choi Street, Hong Kong. |

| (2) | We estimate the total net rentable square feet available for lease based on a number of factors in addition to contractually leased square feet, including available power, required support space and common area. |