|

| | |

| | | Financial Supplement |

Table of Contents

| Third Quarter 2016 |

|

| | | | | | |

| Overview | PAGE |

|

| | | | | | |

| 3 |

|

| | | | | | |

| 5 |

|

| | | | | | |

| 6 |

|

| | | | | | |

| Consolidated Statements of Operations | |

| | | | | | |

| Earnings Release | 8 |

|

| | | | | | |

| 2016 Guidance | 11 |

|

| | | | | | |

| 13 |

|

| | | | | | |

| 14 |

|

| | | | | | |

| 15 |

|

| | | | | | |

| Balance Sheet Information | |

| | | | | | |

| 16 |

|

| | | | | | |

| 17 |

|

| | | | | | |

| 18 |

|

| | | | | | |

| 19 |

|

| | | | | | |

| 20 |

|

| | | | | | |

| Internal Growth | |

| | | | | | |

| Same-Capital Operating Trend Summary | 21 |

|

| | | | | | |

| 22 |

|

| | | | | | |

| 23 |

|

| | | | | | |

| 24 |

|

| | | | | | |

| 25 |

|

| | | | | | |

| 26 |

|

| | | | | | |

| 27 |

|

| | | | | | |

| 28 |

|

| | | | | | |

| 29 |

|

| | | | | | |

| 30 |

|

| | | | | | |

| External Growth | |

| | | | | | |

| 35 |

|

| | | | | | |

| 36 |

|

| | | | | | |

| 37 |

|

| | | | | | |

| 38 |

|

| | | | | | |

| 39 |

|

| | | | | | |

| 40 |

|

| | | | | | |

| 41 |

|

| | | | | | |

| 42 |

|

| | | | | | |

| Definitions | |

| | | | | | |

| 46 |

|

| | | | | | |

| Management Statements on Non-GAAP Measures | 47 |

|

|

| | |

| | | Financial Supplement |

| Corporate Information | Third Quarter 2016 |

Corporate Profile

Digital Realty Trust, Inc. owns, acquires, develops and operates data centers. The company is focused on providing data center, colocation and interconnection solutions for domestic and international customers across a variety of industry verticals ranging from financial services, cloud and information technology services, to manufacturing, energy, healthcare, and consumer products. As of September 30, 2016, the company's 144 properties, including 14 properties held as investments in unconsolidated joint ventures, contain applications and operations critical to the day-to-day operations of technology industry and corporate enterprise data center customers. Digital Realty's portfolio is comprised of approximately 22.8 million square feet, excluding approximately 1.3 million square feet of space under active development and 1.1 million square feet of space held for future development, located throughout North America, Europe, Asia and Australia. For additional information, please visit the company's website at www.digitalrealty.com.

Corporate Headquarters

Four Embarcadero Center, Suite 3200

San Francisco, California 94111

Telephone: (415) 738-6500

Website: www.digitalrealty.com

Senior Management

A. William Stein: Chief Executive Officer

Andrew P. Power: Chief Financial Officer

Scott E. Peterson: Chief Investment Officer

Jarrett Appleby: Chief Operating Officer

Michael Henry: Chief Information Officer

Chris Sharp: Chief Technology Officer

Investor Relations

To request more information or to be added to our e-mail distribution list, please visit our website:

www.digitalrealty.com (Proceed to the Investor Relations section)

Analyst Coverage |

| | | | | | | | |

| Bank of America | | | | | | | | |

| Merrill Lynch | | Barclays Capital | | Canaccord Genuity | | Citigroup | | Cowen |

| Michael J. Funk | | Ross Smotrich | | Paul Morgan | | Michael Bilerman | | Colby Synesael |

| (646) 855-5664 | | (212) 526-2306 | | (212) 389-8128 | | (212) 816-1383 | | (646) 562-1355 |

| | | | | | | | | |

| Jeffrey Spector | | Dan Occhionero | | Joseph Ng | | Emmanuel Korchman | | Jonathan Charbonneau |

| (646) 855-1363 | | (212) 526-7164 | | (212) 389-8096 | | (212) 816-1382 | | (646) 562-1356 |

| | | | | | | | | |

| Deutsche Bank | | Green Street Advisors | | Jefferies | | JP Morgan | | KeyBanc |

| Vincent Chao | | Lukas Hartwich | | Jonathan Petersen | | Richard Choe | | Jordan Sadler |

| (212) 250-6799 | | (949) 640-8780 | | (212) 284-1705 | | (212) 662-6708 | | (917) 368-2280 |

| | | | | | | | | |

| Michael Husseini | | David Guarino | | Omotayo Okusanya | | | | Austin Wurschmidt |

| (212) 250-7703 | | (949) 640-8780 | | (212) 336-7076 | | | | (917) 368-2311 |

| | | | | | | | | |

| Morgan Stanley | | Raymond James | | RBC Capital Markets | | RW Baird | | Stifel |

| Sumit Sharma | | Frank Louthan | | Jonathan Atkin | | David Rodgers | | Matthew Heinz |

| (212) 761-0078 | | (404) 442-5867 | | (415) 633-8589 | | (216) 737-7341 | | (443) 224-1382 |

| | | | | | | | | |

| | | | | Bora Lee | | Richard Schiller | | |

| | | | | (212) 618-7823 | | (312) 609-5485 | | |

| | | | | | | | | |

| Sun Trust | | UBS | | Wells Fargo | | | | |

| Greg Miller | | John Hodulik | | Jennifer Fritzsche | | | | |

| (212) 303-4169 | | (212) 713-4226 | | (312) 920-3548 | | | | |

| | | | | | | | | |

| Matthew Kahn | | Lisa Friedman | | Eric Luebchow | | | | |

| (212) 319-2644 | | (212) 713-2589 | | (312) 630-2386 | | | | |

This Earnings Press Release and Supplemental Information package supplements the information provided in our quarterly and annual reports filed with the Securities and Exchange Commission. Additional information about us and our properties is also available on our website www.digitalrealty.com.

|

| | |

| | | Financial Supplement |

Corporate Information (Continued)

| Third Quarter 2016 |

Stock Listing Information

The stock of Digital Realty Trust, Inc. is traded primarily on the New York Stock Exchange under the following symbols:

|

| | |

| Common Stock: | | DLR |

| Series F Preferred Stock: | | DLRPRF |

| Series G Preferred Stock: | | DLRPRG |

| Series H Preferred Stock: | | DLRPRH |

| Series I Preferred Stock: | | DLRPRI |

Note that symbols may vary by stock quote provider.

Credit Ratings

|

| | | |

| Standard & Poors | | | |

| Corporate Credit Rating: | | BBB | (Stable Outlook) |

| Preferred Stock: | | BB+ | |

| | | | |

| Moody's | | | |

| Issuer Rating: | | Baa2 | (Stable Outlook) |

| Preferred Stock: | | Baa3 | |

| | | | |

| Fitch | | | |

| Issuer Default Rating: | | BBB | (Stable Outlook) |

| Preferred Stock: | | BB+ | |

These credit ratings may not reflect the potential impact of risks relating to the structure or trading of the company’s securities and are provided solely for informational purposes. Credit ratings are not recommendations to buy, hold or sell any security, and may be revised or withdrawn at any time by the issuing organization at its sole discretion. The company does not undertake any obligation to maintain the ratings or to advise of any change in ratings. Each agency’s rating should be evaluated independently of any other agency’s rating. An explanation of the significance of the ratings may be obtained from each of the rating agencies.

Common Stock Price Performance

The following summarizes recent activity of Digital Realty's common stock (DLR):

|

| | | | | | | | | | | | | | | |

| | Three Months Ended |

| | 30-Sep-16 |

| 30-Jun-16 |

| 31-Mar-16 |

| 31-Dec-15 |

| 30-Sep-15 |

|

| High price (1) |

| $113.21 |

|

| $109.08 |

|

| $89.34 |

|

| $77.26 |

|

| $69.83 |

|

Low price (1) |

| $91.27 |

|

| $85.50 |

|

| $69.89 |

|

| $64.11 |

|

| $60.66 |

|

Closing price, end of quarter (1) |

| $97.12 |

|

| $108.99 |

|

| $88.49 |

|

| $75.62 |

|

| $65.32 |

|

Average daily trading volume (1) | 1,821,628 |

| 2,005,969 |

| 1,499,369 |

| 1,164,119 |

| 1,365,945 |

|

Indicated dividend per common share (2) |

| $3.52 |

|

| $3.52 |

|

| $3.52 |

|

| $3.40 |

|

| $3.40 |

|

| Closing annual dividend yield, end of quarter | 3.6 | % | 3.2 | % | 4.0 | % | 4.5 | % | 5.2 | % |

Shares and units outstanding, end of quarter (3) | 161,447,802 |

| 149,396,223 |

| 149,394,198 |

| 149,217,573 |

| 138,679,297 |

|

| Closing market value of shares and units outstanding (4) |

| $15,679,811 |

|

| $16,282,694 |

|

| $13,219,892 |

|

| $11,283,763 |

|

| $9,058,532 |

|

| |

| (1) | New York Stock Exchange trades only. |

| |

| (2) | On an annualized basis. |

| |

| (3) | As of September 30, 2016, the total number of shares and units includes 158,926,811 shares of common stock, 1,218,814 common units held by third parties and 1,302,177 common units, vested and unvested long-term incentive units and vested class C units held by directors, officers and others and excludes all unexercised common stock options and all shares potentially issuable upon conversion of our series F, series G, series H and series I cumulative redeemable preferred stock upon certain change of control transactions. Also excludes 2,375,000 additional shares of common stock that may be issued upon full physical settlement of the May 2016 forward sales agreements. |

| |

| (4) | Dollars in thousands as of the end of the quarter. |

This Earnings Press Release and Supplemental Information package supplements the information provided in our quarterly and annual reports filed with the Securities and Exchange Commission. Additional information about us and our properties is also available on our website www.digitalrealty.com.

|

| | |

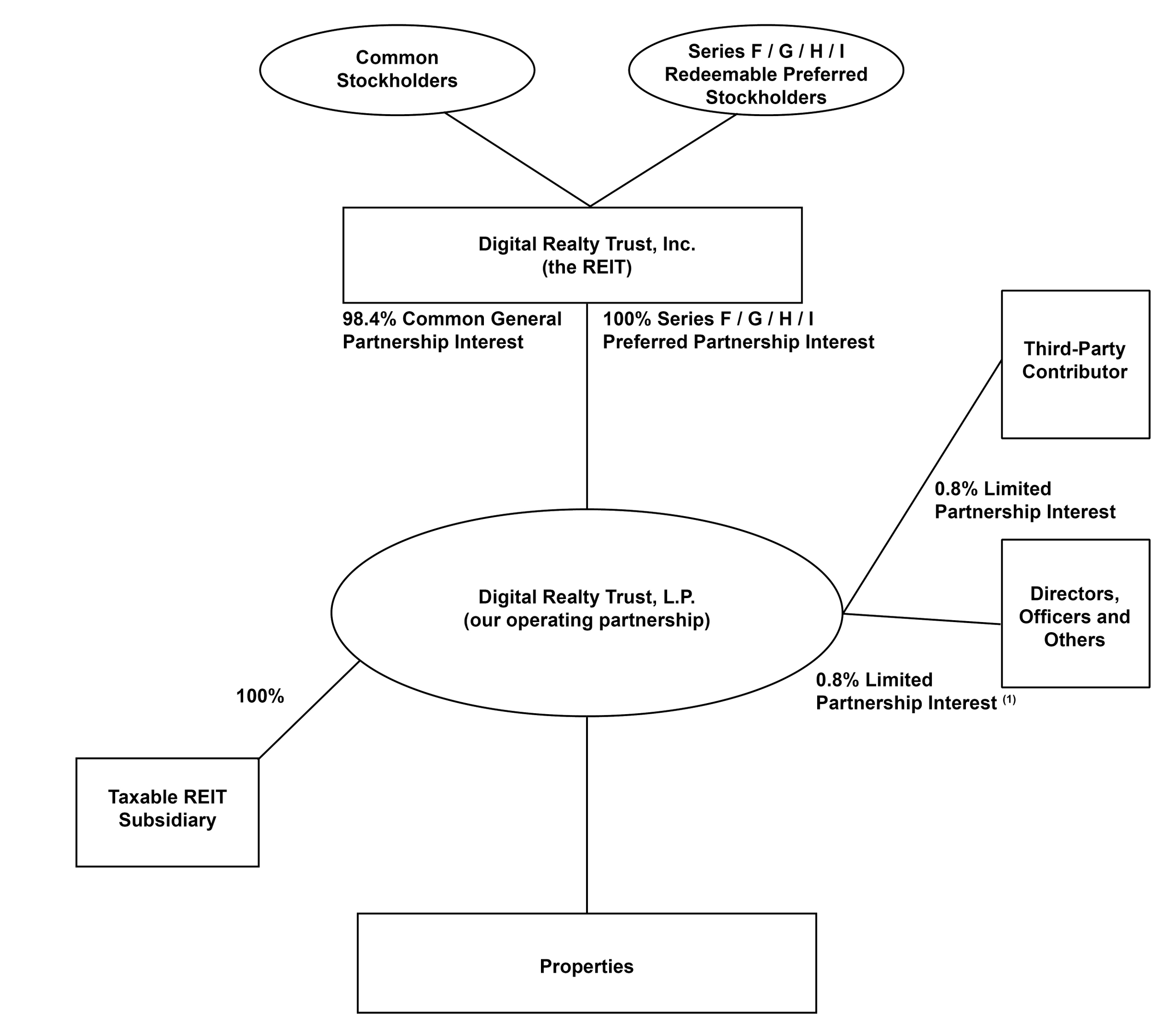

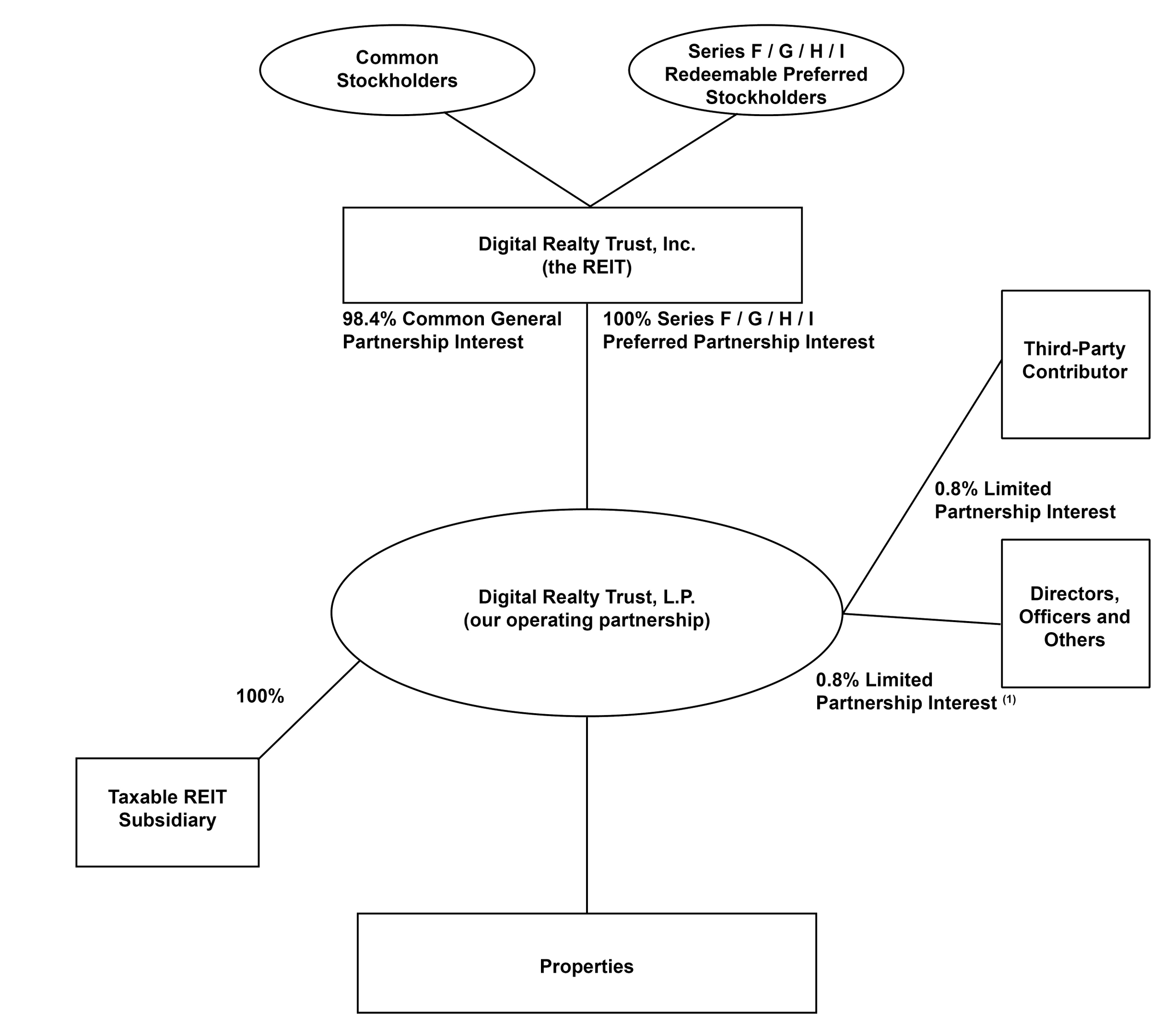

| Ownership Structure | | Financial Supplement |

| As of September 30, 2016 | Third Quarter 2016 |

|

| | | | | | |

| Partner |

| # of Units (2) | | % Ownership |

| Digital Realty Trust, Inc. |

| 158,926,811 |

| | 98.4 | % |

| Cambay Tele.com, LLC (3) |

| 1,218,814 |

| | 0.8 | % |

| Directors, Executive Officers and Others |

| 1,302,177 |

| | 0.8 | % |

| Total |

| 161,447,802 |

| | 100.0 | % |

| |

| (1) | Reflects limited partnership interests held by our directors, officers and others in the form of common units, vested and unvested long-term incentive units and vested class C units and excludes all unexercised common stock options. |

| |

| (2) | The total number of units includes 158,926,811 general partnership common units, 1,218,814 common units held by third parties and 1,302,177 common units, vested and unvested long-term incentive units and vested class C units held by directors, officers and others, and excludes all unexercised common stock options and all shares potentially issuable upon conversion of our series F, series G, series H and series I cumulative redeemable preferred stock upon certain change of control transactions. Also excludes 2,375,000 additional shares of common stock that may be issued upon full physical settlement of the May 2016 forward sales agreements. |

| |

| (3) | This third-party contributor received the common units (along with cash and our operating partnership's assumption of debt) in exchange for their interests in 200 Paul Avenue, 1100 Space Park Drive, the eXchange colocation business and other specified assets and liabilities. Includes 397,413 common units held by the members of Cambay Tele.com, LLC. |

|

| | |

| Key Quarterly Financial Data | | Financial Supplement |

| Unaudited and Dollars in Thousands, Except Per Share Data | Third Quarter 2016 |

|

| | | | | | | | | | |

| Shares and Units at End of Quarter | 30-Sep-16 | 30-Jun-16 | 31-Mar-16 | 31-Dec-15 | 30-Sep-15 |

| Common shares outstanding | 158,926,811 |

| 146,859,067 |

| 146,797,648 |

| 146,384,247 |

| 135,843,684 |

|

| Common units outstanding | 2,520,991 |

| 2,537,156 |

| 2,596,550 |

| 2,833,326 |

| 2,835,613 |

|

| Total Shares and Partnership Units | 161,447,802 |

| 149,396,223 |

| 149,394,198 |

| 149,217,573 |

| 138,679,297 |

|

| | | | | | |

| Enterprise Value | | | | | |

| Market value of common equity (1) | $15,679,811 | $16,282,694 | $13,219,892 | $11,283,833 | $9,058,532 |

| Liquidation value of preferred equity | 1,047,500 |

| 1,335,000 |

| 1,335,000 |

| 1,335,000 |

| 1,335,000 |

|

| Total debt at balance sheet carrying value | 6,024,987 |

| 6,135,406 |

| 6,156,729 |

| 5,934,241 |

| 4,748,579 |

|

| Total Enterprise Value | $22,752,298 | $23,753,100 | $20,711,621 | $18,553,074 | $15,142,111 |

| Total debt / total enterprise value | 26.5 | % | 25.8 | % | 29.7 | % | 32.0 | % | 31.4 | % |

| | | | | | |

| Selected Balance Sheet Data | | | | | |

| Investments in real estate (before depreciation) | $11,617,684 | $11,086,319 | $11,208,920 | $11,021,480 | $10,280,897 |

| Total Assets | 12,299,035 |

| 11,292,375 |

| 11,421,975 |

| 11,416,063 |

| 9,471,840 |

|

| Total Liabilities | 7,102,388 |

| 6,966,733 |

| 6,976,765 |

| 6,879,561 |

| 5,436,189 |

|

| | | | | | |

| Selected Operating Data | | | | | |

| Total operating revenues | $546,293 | $514,934 | $504,199 | $500,443 | $435,989 |

| Total operating expenses (2) | 430,543 |

| 402,636 |

| 386,083 |

| 398,258 |

| 333,357 |

|

| Interest expense | 63,084 |

| 59,909 |

| 57,261 |

| 61,717 |

| 48,138 |

|

| Net income (loss) | 222,435 |

| 50,944 |

| 62,333 |

| (16,573) |

| 57,842 |

|

| Net income (loss) available to common stockholders | 187,330 |

| 27,951 |

| 39,125 |

| (40,039) |

| 38,522 |

|

| | | | | | |

| Financial Ratios | | | | | |

| EBITDA (3) | $432,285 | $265,706 | $268,475 | $194,902 | $225,484 |

| Adjusted EBITDA (4) | 306,963 |

| 296,904 |

| 293,933 |

| 288,184 |

| 250,834 |

|

| Net Debt to Adjusted EBITDA (5) | 5.1x |

| 5.2x |

| 5.3x |

| 5.2x |

| 4.8x |

|

| GAAP interest expense | 63,084 |

| 59,909 |

| 57,261 |

| 61,717 |

| 48,138 |

|

| Fixed charges (6) | 89,291 |

| 87,457 |

| 85,286 |

| 90,496 |

| 70,682 |

|

| Interest coverage ratio (7) | 4.6x |

| 4.7x |

| 4.8x |

| 4.7x |

| 5.0x |

|

| Fixed charge coverage ratio (8) | 3.4x |

| 3.4x |

| 3.4x |

| 3.3x |

| 3.5x |

|

| | | | | | |

| Profitability Measures | | | | | |

| Net income (loss) per common share - basic | $1.27 | $0.19 | $0.27 | ($0.28) | $0.28 |

| Net income (loss) per common share - diluted | $1.25 | $0.19 | $0.27 | ($0.28) | $0.28 |

| Funds from operations (FFO) / diluted share and unit (9) | $1.31 |

| $1.36 |

| $1.39 |

| $0.79 |

| $1.28 |

|

| Core funds from operations (Core FFO) / diluted share and unit (9) | $1.44 |

| $1.42 |

| $1.42 |

| $1.38 |

| $1.32 |

|

| Adjusted funds from operations (AFFO) / diluted share and unit (10) | $1.36 |

| $1.33 |

| $1.28 |

| $1.11 |

| $1.13 |

|

| Dividends per share and common unit | $0.88 |

| $0.88 |

| $0.88 |

| $0.85 |

| $0.85 |

|

| Diluted FFO payout ratio (9) (11) | 66.9 | % | 64.7 | % | 63.3 | % | 107.8 | % | 66.5 | % |

| Diluted Core FFO payout ratio (9) (12) | 61.1 | % | 62.0 | % | 62.0 | % | 61.6 | % | 64.4 | % |

| Diluted AFFO payout ratio (10) (13) | 64.6 | % | 66.1 | % | 68.8 | % | 76.5 | % | 75.0 | % |

| | | | | | |

| Portfolio Statistics | | | | | |

| Buildings (14) | 199 |

| 199 |

| 199 |

| 198 |

| 191 |

|

| Properties (14) | 141 |

| 140 |

| 140 |

| 139 |

| 132 |

|

| Cross-connects | 69,000 |

| 62,145 |

| 61,478 |

| 60,551 |

| N/A |

|

| Net rentable square feet, excluding development space (14) | 22,614,180 |

| 23,131,694 |

| 22,840,703 |

| 22,894,255 |

| 21,907,913 |

|

| Occupancy at end of quarter (15) | 89.9 | % | 90.4 | % | 90.9 | % | 91.4 | % | 93.0 | % |

| Occupied square footage | 20,319,073 |

| 20,919,133 |

| 20,766,756 |

| 20,915,293 |

| 20,365,597 |

|

| Space under active development (16) | 1,336,590 |

| 1,468,437 |

| 1,761,995 |

| 1,342,660 |

| 1,385,315 |

|

| Space held for development (17) | 1,011,382 |

| 1,172,087 |

| 1,174,143 |

| 1,347,741 |

| 1,325,282 |

|

| Weighted average remaining lease term (years) (18) | 5.3 |

| 5.4 |

| 5.6 |

| 5.8 |

| 6.2 |

|

| Same-capital occupancy at end of quarter (15) (19) | 92.6 | % | 93.0 | % | 93.0 | % | 93.1 | % | 93.5 | % |

|

| | |

| Key Quarterly Financial Data | | Financial Supplement |

| Unaudited and Dollars in Thousands, Except Per Share Data | Third Quarter 2016 |

| |

| (1) | The market value of common equity is based on the closing stock price at the end of the quarter and assumes 100% redemption of the limited partnership units in our operating partnership, including common units and vested and unvested long-term incentive units (including vested class C units), for shares of our common stock. Excludes shares issuable with respect to stock options that have been granted but have not yet been exercised, and also excludes all shares potentially issuable upon conversion of our series E, series F, series G, series H and series I cumulative redeemable preferred stock, as applicable, upon certain change of control transactions. Also excludes 2,375,000 additional shares of common stock that may be issued upon full physical settlement of the May 2016 forward sales agreements. |

| |

| (2) | All periods presented exclude change in fair value of contingent consideration and purchase accounting adjustments related to the acquisition of Telx Holdings, Inc. (the "Telx Acquisition") in order to provide a more comparable operating expense trend. For total operating expenses, see page 13. |

| |

| (3) | EBITDA is calculated as earnings before interest expense, loss from early extinguishment of debt, tax expense and depreciation and amortization. For a discussion of EBITDA, see page 47. For a reconciliation of net income available to common stockholders to EBITDA, see page 46. |

| |

| (4) | Adjusted EBITDA is EBITDA excluding: change in fair value of contingent consideration; severance-related accrual, equity acceleration, legal expenses; transaction expenses; (gain) loss on sale of property; (gain) on settlement of pre-existing relationship with Telx; loss on currency forwards; other non-core adjustment expenses; non-controlling interests; preferred stock dividends; and costs on redemption of preferred stock. For a discussion of Adjusted EBITDA, see page 47. For a reconciliation of net income available to common stockholders to Adjusted EBITDA, see page 46. |

| |

| (5) | Net Debt to Adjusted EBITDA is calculated as total debt at balance sheet carrying value (see page 6), plus capital lease obligations, plus our share of joint venture debt, less unrestricted cash and cash equivalents, divided by the product of Adjusted EBITDA (inclusive of our share of joint venture EBITDA), multiplied by four. |

| |

| (6) | Fixed charges consist of GAAP interest expense, capitalized interest, scheduled debt principal payments and preferred dividends. |

| |

| (7) | Interest coverage ratio is Adjusted EBITDA divided by GAAP interest expense plus capitalized interest and excluding bridge facility fees for the quarter ended December 31, 2015. |

| |

| (8) | Fixed charge coverage ratio is Adjusted EBITDA divided by fixed charges excluding bridge facility fees for the quarter ended December 31, 2015. |

| |

| (9) | For a definition and discussion of FFO and core FFO, see page 47. For a reconciliation of net income available to common stockholders to FFO and core FFO, see page 14. |

| |

| (10) | For a definition and discussion of AFFO, see page 47. For a reconciliation of FFO to AFFO, see page 15. |

| |

| (11) | Diluted FFO payout ratio is dividends declared per common share and unit divided by diluted FFO per share and unit. |

| |

| (12) | Diluted Core FFO payout ratio is dividends declared per common share and unit, divided by diluted core FFO per share and unit. |

| |

| (13) | Diluted AFFO payout ratio is dividends declared per common share and unit, divided by diluted AFFO per share and unit. |

| |

| (14) | Includes properties held as investments in unconsolidated joint ventures. Excludes properties held-for-sale. |

| |

| (15) | Occupancy and same-capital occupancy exclude space under active development and space held for development. Occupancy represents our consolidated portfolio in addition to our managed portfolio of unconsolidated joint ventures and non-managed unconsolidated joint ventures. For some of our properties, we calculate occupancy based on factors in addition to contractually leased square feet, including available power, required support space and common area. |

| |

| (16) | Space under active development includes current Base Building and Data Centers projects in progress (see page 39). |

| |

| (17) | Space held for development includes space held for future Data Center development, and excludes space under active development (see page 39). Excludes properties held-for-sale. |

| |

| (18) | Weighted average remaining lease term excludes renewal options and is weighted by net rentable square feet. |

| |

| (19) | Represents properties owned as of December 31, 2014 with less than 5% of total rentable square feet under development. Excludes properties that were undergoing, or were expected to undergo, development activities in 2015-2016, properties classified as held for sale, and properties sold or contributed to joint ventures for all periods presented. Prior period results have been adjusted to reflect current same-capital pool. |

|

| | |

| Digital Realty Trust | | |

| Press Release | Third Quarter 2016 |

DIGITAL REALTY REPORTS THIRD QUARTER 2016 RESULTS

San Francisco, CA -- October 27, 2016 -- Digital Realty Trust, Inc. (NYSE: DLR), a leading global provider of data center, colocation and interconnection solutions, announced today financial results for the third quarter of 2016. All per share results are presented on a fully-diluted share and unit basis.

Highlights

| |

| • | Reported net income available to common stockholders per share of $1.25 in 3Q16, compared to $0.28 in 3Q15 |

| |

| • | Reported FFO per share of $1.31 in 3Q16, compared to $1.28 in 3Q15 |

| |

| • | Reported core FFO per share of $1.44 in 3Q16, compared to $1.32 in 3Q15 |

| |

| • | Signed total bookings during 3Q16 expected to generate $55 million of annualized revenue, including a $9 million contribution from interconnection |

| |

| • | Reiterated 2016 core FFO per share outlook of $5.65 - $5.75 and "constant-currency" core FFO per share outlook of $5.70 - $5.90 |

Financial Results

Revenues were $546 million for the third quarter of 2016, a 6% increase from the previous quarter and a 25% increase over the same quarter last year.

Net income for the third quarter of 2016 was $222 million, and net income available to common stockholders was $187 million, or $1.25 per diluted share, compared to $0.19 per diluted share in the second quarter of 2016 and $0.28 per diluted share in the third quarter of 2015.

Adjusted EBITDA was $307 million for the third quarter of 2016, a 3% increase from the previous quarter and a 22% increase over the same quarter last year.

Funds from operations (“FFO”) on a fully diluted basis was $199 million in the third quarter of 2016, or $1.31 per share, compared to $1.36 per share in the second quarter of 2016 and $1.28 per share in the third quarter of 2015.

Excluding certain items that do not represent core expenses or revenue streams, third quarter of 2016 core FFO was $1.44 per share, a 1% increase from $1.42 per share in the second quarter of 2016, and a 9% increase from $1.32 per share in the third quarter of 2015.

Leasing Activity

“During the third quarter, we signed total bookings representing $55 million of annualized GAAP rental revenue, including a $9 million contribution from interconnection,” said Chief Executive Officer A. William Stein.

The weighted-average lag between leases signed during the third quarter of 2016 and the contractual commencement date was 4 months.

In addition to new leases signed, Digital Realty also signed renewal leases representing $44 million of annualized GAAP rental revenue during the quarter. Rental rates on renewal leases signed during the third quarter of 2016 rolled up 2.5% on a cash basis and up 3.9% on a GAAP basis.

|

| | |

| Digital Realty Trust | | |

| Press Release | Third Quarter 2016 |

New leases signed during the third quarter of 2016 by region and product type are summarized as follows: |

| | | | | | | | | | | | | | | | | | |

| | | Annualized GAAP | | | | | | | | |

| | | Base Rent | | | | GAAP Base Rent | | | | GAAP Base Rent |

| North America | | (in thousands) | | Square Feet | | per Square Foot | | Megawatts | | per Kilowatt |

| Turn-Key Flex | |

| $28,777 |

| | 205,121 |

| |

| $140 |

| | 20 |

| |

| $120 |

|

| Powered Base Building | | 445 |

| | 10,230 |

| | 44 |

| | — |

| | — |

|

| Colocation | | 6,933 |

| | 22,808 |

| | 304 |

| | 2 |

| | 295 |

|

| Non-Technical | | 999 |

| | 56,312 |

| | 18 |

| | — |

| | — |

|

| Total | |

| $37,154 |

| | 294,471 |

| |

| $126 |

| | 22 |

| |

| $135 |

|

| | | | | | | | | | | |

| Europe (1) | | | | | | | | | | |

| Turn-Key Flex | |

| $6,601 |

| | 43,116 |

| |

| $153 |

| | 4 |

| |

| $145 |

|

| Colocation | | 755 |

| | 2,829 |

| | 267 |

| | — |

| | 419 |

|

| Non-Technical | | 17 |

| | 398 |

| | 42 |

| | — |

| | — |

|

| Total | |

| $7,373 |

| | 46,343 |

| |

| $159 |

| | 4 |

| |

| $155 |

|

| | | | | | | | | | | |

| Asia Pacific (1) | | | | | | | | | | |

| Turn-Key Flex (2) | |

| $1,839 |

| | 2,167 |

| |

| $849 |

| | — |

| |

| $578 |

|

| Colocation | | — |

| | — |

| | — |

| | — |

| | — |

|

| Non-Technical | | — |

| | — |

| | — |

| | — |

| | — |

|

| Total | |

| $1,839 |

| | 2,167 |

| |

| $849 |

| | — |

| |

| $578 |

|

| | | | | | | | | | | |

| Interconnection | |

| $9,086 |

| | — |

| | — |

| | — |

| | — |

|

| | | | | | | | | | | |

| Grand Total | |

| $55,452 |

| | 342,981 |

| |

| $135 |

| | 26 |

| |

| $143 |

|

Note: Totals may not foot due to rounding differences.

| |

| (1) | Based on quarterly average exchange rates during the three months ended September 30, 2016. |

| |

| (2) | Includes one transaction representing incremental revenue only with no additional footprint or kW. |

Investment Activity

During the third quarter of 2016, Digital Realty completed the previously announced acquisition of a portfolio of eight high-quality, carrier-neutral data centers in Europe from Equinix in a transaction valued at $874 million.

Digital Realty also closed on the sale of 114 rue Ambroise Croizat in Paris to Equinix for €190 million (or approximately $212 million). The property was 96% leased and was expected to generate cash net operating income of €14.7 million (or approximately $16.2 million) in 2016, representing a cap rate of 7.7%. The sale generated net proceeds of approximately $211 million, and Digital Realty recognized a gain on the sale of $144 million in the third quarter of 2016.

During the third quarter of 2016, Digital Realty also closed on the previously announced sale of a four-property data center portfolio totaling approximately 454,000 square feet for $115 million, or $252 per square foot. The properties were expected to generate cash net operating income of approximately $9 million in 2016. The sale generated net proceeds of $112 million, and Digital Realty recognized a gain on the sale of approximately $25 million in the third quarter of 2016.

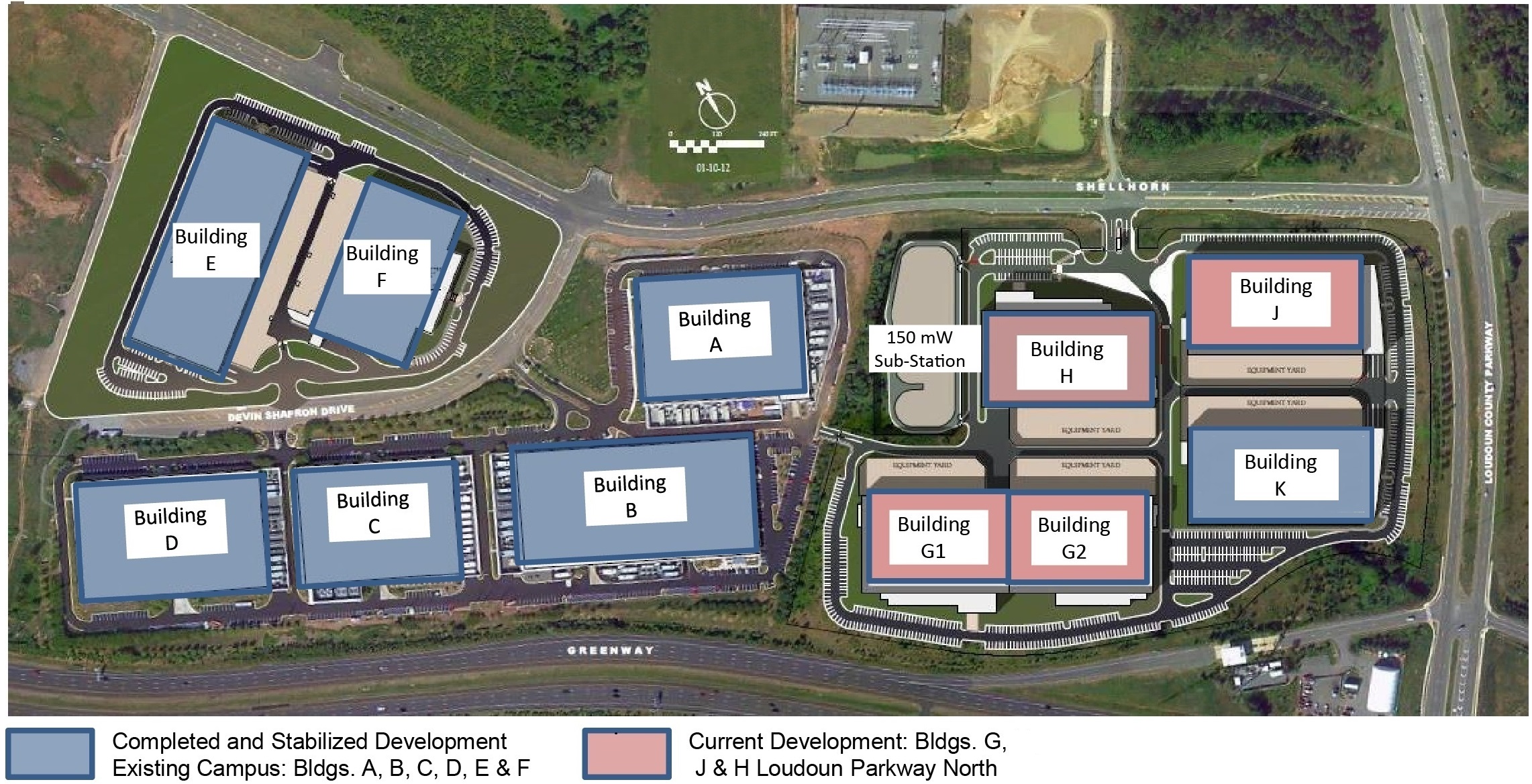

During the third quarter of 2016, Digital Realty acquired two land parcels totaling approximately 30 acres of developable land adjacent to its existing campus in Ashburn, Virginia for a total purchase price of $19 million. The combined 290-acre site is expected to support the development of an additional 3.2 million square feet and 270 megawatts of critical power. Commencement of development will be subject to market demand and delivery will be phased to facilitate customer expansion requirements upon completion of the existing campus in Ashburn.

Digital Realty also acquired a 48-acre land parcel in Garland, Texas during the third quarter of 2016 for a total purchase price of $17 million. The site is expected to support the development of 960,000 square feet and the build-out of approximately 72 megawatts of critical power. Commencement of development will be subject to market demand and delivery will be phased to facilitate customer expansion requirements upon completion of the existing campus in Richardson.

|

| | |

| Digital Realty Trust | | |

| Press Release | Third Quarter 2016 |

Likewise, during the third quarter of 2016, Digital Realty acquired a 19-acre land parcel adjacent to its existing campus in Franklin Park, Illinois for a total purchase price of $13 million. The site is expected to support the development of a 469,000 square foot building and the build-out of approximately 36 megawatts of critical power. Commencement of development will be subject to market demand and delivery will be phased to facilitate customer expansion requirements upon completion of the existing campus in Franklin Park.

Balance Sheet

Digital Realty had approximately $6.0 billion of total debt outstanding as of September 30, 2016, comprised of $5.9 billion of unsecured debt and approximately $0.1 billion of secured debt. At the end of the third quarter of 2016, net debt-to-adjusted EBITDA was 5.1x, debt-plus-preferred-to-total enterprise value was 31.1% and fixed charge coverage was 3.4x.

On September 15, 2016, Digital Realty redeemed all 11.5 million outstanding shares of its 7.000% Series E Cumulative Redeemable Preferred Stock, at a redemption price of $25 per share, plus accrued and unpaid dividends for a total payment of $25.35972 per share, or $291.6 million in aggregate.

On September 27, 2016, Digital Realty settled a portion of the forward sale agreements originally entered into in May 2016 with the issuance of 12 million shares of its common stock, generating net proceeds of $1.1 billion. Following the settlement, 2.375 million shares remain subject to the forward sale agreements.

|

| | |

| Digital Realty Trust | | |

| Press Release | Third Quarter 2016 |

2016 Outlook

Digital Realty reiterated its 2016 core FFO per share outlook of $5.65 - $5.75. The assumptions underlying this guidance are summarized in the following table.

|

| | | | | | | | | | |

| | | Jan. 4, 2016 | | Feb. 25, 2016 | | Apr. 28, 2016 | | Jul. 28, 2016 | | Oct. 27, 2016 |

| Top-Line and Cost Structure | | | | | | | | | | |

| 2016 total revenue | | $2.0 - $2.2 billion | | $2.0 - $2.2 billion | | $2.0 - $2.2 billion | | $2.0 - $2.2 billion | | $2.0 - $2.2 billion |

| 2016 net non-cash rent adjustments (1) | | $10 - $20 million | | $10 - $20 million | | $10 - $20 million | | $10 - $20 million | | $10 - $15 million |

| 2016 adjusted EBITDA margin | | 55.0% - 57.0% | | 55.0% - 57.0% | | 55.5% - 57.5% | | 56.0% - 58.0% | | 56.5% - 58.0% |

| 2016 G&A margin | | 7.0% - 7.5% | | 7.0% - 7.5% | | 6.5% - 7.0% | | 6.5% - 7.0% | | 6.8% - 7.0% |

| | | | | | | | | | | |

| Internal Growth | | | | | | | | | | |

| Rental rates on renewal leases | | | | | | | | | | |

| Cash basis | | N/A | | Flat | | Flat | | Slightly positive | | Slightly positive |

| GAAP basis | | N/A | | Up high single-digits | | Up high single-digits | | Up high single-digits | | Up high single-digits |

| Year-end portfolio occupancy | | N/A | | +/- 50 bps | | +/- 50 bps | | +/- 50 bps | | Down 150-200 bps |

| "Same-capital" cash NOI growth (2) | | N/A | | 0.0% - 3.0% | | 1.0% - 4.0% | | 2.5% - 4.0% | | 2.5% - 4.0% |

| | | | | | | | | | | |

| Foreign Exchange Rates | | | | | | | | | | |

| U.S. Dollar / Pound Sterling | | N/A | | $1.40 - $1.48 | | $1.38 - $1.45 | | $1.27 - $1.32 | | $1.18 - $1.22 |

| U.S. Dollar / Euro | | N/A | | $1.02 - $1.07 | | $1.05 - $1.10 | | $1.05 - $1.10 | | $1.05 - $1.10 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| External Growth | | | | | | | | | | |

| Dispositions | | | | | | | | | | |

| Dollar volume | | $0 - $200 million | | $38 - $200 million | | $38 - $200 million | | $150 - $360 million | | $326.5 million |

| Cap rate | | 0.0% - 10.0% | | 0.0% - 10.0% | | 0.0% - 10.0% | | 7.0% - 8.0% | | 7.1% |

| Development | | | | | | | | | | |

| CapEx | | $750 - $900 million | | $750 - $900 million | | $750 - $900 million | | $750 - $900 million | | $750 - $900 million |

| Average stabilized yields | | 10.5% - 12.5% | | 10.5% - 12.5% | | 10.5% - 12.5% | | 10.5% - 12.5% | | 10.5% - 12.5% |

| Enhancements and other non-recurring CapEx (3) | | $20 - $25 million | | $20 - $25 million | | $20 - $25 million | | $5 - $10 million | | $5 - $10 million |

| Recurring CapEx + capitalized leasing costs (4) | | $145 - $155 million | | $145 - $155 million | | $145 - $155 million | | $120 - $130 million | | $95 - $105 million |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Balance Sheet | | | | | | | | | | |

| Long-term debt issuance | | | | | | | | | | |

| Dollar amount | | $1.25 - $1.75 billion | | $1.25 - $1.75 billion | | $1.25 - $1.75 billion | | $1.25 - $1.75 billion | | $1.25 - $1.75 billion |

| Pricing | | 3.00% - 5.00% | | 3.00% - 5.00% | | 2.50% - 3.50% | | 2.50% - 3.50% | | 2.50% - 3.50% |

| Timing | | Mid 2016 | | Mid 2016 | | Early-to-mid 2016 | | Early-to-mid 2016 | | Early-to-mid 2016 |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net income per diluted share | | $0.35 - $0.45 | | $0.35 - $0.45 | | $0.45 - $0.50 | | $1.95 - $2.00 | | $1.95 - $2.00 |

| Real estate depreciation and (gain)/loss on sale | | $5.00 - $5.00 | | $5.00 - $5.00 | | $5.00 - $5.00 | | $3.55 - $3.55 | | $3.55 - $3.55 |

| Funds From Operations / share (NAREIT-Defined) | | $5.35 - $5.45 | | $5.35 - $5.45 | | $5.45 - $5.50 | | $5.50 - $5.55 | | $5.45 - $5.50 |

| Non-core expense and revenue streams | | $0.10 - $0.15 | | $0.10 - $0.15 | | $0.10 - $0.15 | | $0.15 - $0.20 | | $0.20 - $0.25 |

| Core Funds From Operations / share | | $5.45 - $5.60 | | $5.45 - $5.60 | | $5.55 - $5.65 | | $5.65 - $5.75 | | $5.65 - $5.75 |

| Foreign currency translation adjustments | | $0.05 - $0.10 | | $0.05 - $0.10 | | $0.05 - $0.10 | | $0.05 - $0.15 | | $0.05 - $0.15 |

| Constant-Currency Core FFO / share | | $5.50 - $5.70 | | $5.50 - $5.70 | | $5.60 - $5.75 | | $5.70 - $5.90 | | $5.70 - $5.90 |

| |

| (1) | Net non-cash rent adjustments represents the sum of straight-line rental revenue, straight-line rent expense as well as the amortization of above- and below-market leases (i.e., FAS 141 adjustments). |

| |

| (2) | The "same-capital" pool includes properties owned as of December 31, 2014 with less than 5% of the total rentable square feet under development. It also excludes properties that were undergoing, or were expected to undergo, development activities in 2015-2016, properties classified as held for sale, and properties sold or contributed to joint ventures for all periods presented. |

Note: In an effort to present 2016 same-capital results on a basis comparable to 2015, projected Net Operating Income (NOI) is shown prior to Telx-related eliminations at properties owned as of December 31, 2014 that meet the same-capital definition.

| |

| (3) | Other non-recurring CapEx represents costs incurred to enhance the capacity or marketability of operating properties, such as network fiber initiatives and software development costs. |

| |

| (4) | Recurring CapEx represents non-incremental improvements required to maintain current revenues, including second-generation tenant improvements and leasing commissions. Capitalized leasing costs include capitalized leasing compensation as well as capitalized internal leasing commissions. |

|

| | |

| Digital Realty Trust | | |

| Press Release | Third Quarter 2016 |

Non-GAAP Financial Measures

This press release contains non-GAAP financial measures, including FFO, core FFO, constant-currency core FFO, and adjusted EBITDA. A reconciliation from U.S. GAAP net income available to common stockholders to FFO, a reconciliation from FFO to core FFO and constant-currency core FFO, and definitions of FFO, core FFO and constant-currency core FFO are included as an attachment to this press release. A reconciliation from U.S. GAAP net income available to common stockholders to Adjusted EBITDA, a definition of Adjusted EBITDA and definitions of net debt-to-Adjusted EBITDA, debt-plus-preferred-to-total enterprise value, cash NOI, and fixed charge coverage ratio are included as an attachment to this press release.

Investor Conference Call

Prior to Digital Realty’s investor conference call at 5:30 p.m. EDT / 2:30 p.m. PDT on October 27, 2016, a presentation will be posted to the Investors section of the company’s website at http://investor.digitalrealty.com. The presentation is designed to accompany the discussion of the company's third quarter 2016 financial results and operating performance. The conference call will feature Chief Executive Officer A. William Stein and Chief Financial Officer Andrew P. Power.

To participate in the live call, investors are invited to dial +1 (888) 317-6003 (for domestic callers) or +1 (412) 317-6061 (for international callers) and reference the conference ID# 9116034 at least five minutes prior to start time. A live webcast of the call will be available via the Investors section of Digital Realty’s website at http://investor.digitalrealty.com.

Telephone and webcast replays will be available one hour after the call until November 24, 2016. The telephone replay can be accessed by dialing +1 (877) 344-7529 (for domestic callers) or +1 (412) 317-0088 (for international callers) and providing the conference ID# 10093425. The webcast replay can be accessed on Digital Realty’s website.

About Digital Realty

Digital Realty Trust, Inc. supports the data center, colocation and interconnection strategies of more than 2,000 firms across its secure, network-rich portfolio of data centers located throughout North America, Europe, Asia and Australia. Digital Realty's clients include domestic and international companies of all sizes, ranging from financial services, cloud and information technology services, to manufacturing, energy, gaming, life sciences and consumer products.

Additional information about Digital Realty is included in the Company Overview, available on the Investors page of Digital Realty’s website at www.digitalrealty.com. The Company Overview is updated periodically, and may contain material information and updates. To receive e-mail alerts when the Company Overview is updated, please visit the Investors page of Digital Realty’s website.

Contact Information

Andrew P. Power

Chief Financial Officer

Digital Realty Trust, Inc.

+1 (415) 738-6500

John J. Stewart / Maria S. Lukens

Investor Relations

Digital Realty Trust, Inc.

+1 (415) 738-6500

|

| | |

| Consolidated Quarterly Statements of Operations | | Financial Supplement |

| Unaudited & in Thousands, Except Share and Per Share Data | Third Quarter 2016 |

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | 30-Sep-16 | 30-Jun-16 | 31-Mar-16 | 31-Dec-15 | 30-Sep-15 | | 30-Sep-16 | 30-Sep-15 |

| Rental revenues |

| $395,212 |

|

| $377,109 |

|

| $371,128 |

|

| $365,827 |

|

| $336,679 |

| |

| $1,143,449 |

|

| $988,172 |

|

| Tenant reimbursements - Utilities | 68,168 |

| 62,363 |

| 58,955 |

| 60,800 |

| 70,148 |

| | 189,486 |

| 192,217 |

|

| Tenant reimbursements - Other | 27,497 |

| 25,848 |

| 25,263 |

| 30,190 |

| 25,336 |

| | 78,608 |

| 76,668 |

|

| Interconnection & other | 53,897 |

| 48,363 |

| 46,963 |

| 41,746 |

| 1,651 |

| | 149,223 |

| — |

|

| Fee income | 1,517 |

| 1,251 |

| 1,799 |

| 1,880 |

| 1,595 |

| | 4,567 |

| 4,758 |

|

| Other | 2 |

| — |

| 91 |

| — |

| 580 |

| | 93 |

| 1,078 |

|

| Total Operating Revenues | $546,293 | $514,934 | $504,199 | $500,443 | $435,989 | | $1,565,426 | $1,262,893 |

| | | | | | | | | |

| Utilities |

| $85,052 |

|

| $74,396 |

|

| $69,917 |

|

| $70,758 |

|

| $73,887 |

| |

| $229,365 |

|

| $201,526 |

|

| Rental property operating | 58,685 |

| 54,731 |

| 54,109 |

| 52,563 |

| 35,254 |

| | 167,525 |

| 107,087 |

|

| Repairs & maintenance | 33,455 |

| 30,421 |

| 30,143 |

| 32,063 |

| 31,301 |

| | 94,019 |

| 86,027 |

|

| Property taxes | 20,620 |

| 27,449 |

| 27,331 |

| 28,472 |

| 19,953 |

| | 75,400 |

| 64,116 |

|

| Insurance | 2,470 |

| 2,241 |

| 2,412 |

| 2,360 |

| 2,140 |

| | 7,123 |

| 6,449 |

|

| Change in fair value of contingent consideration | — |

| — |

| — |

| — |

| (1,594 | ) | | — |

| (44,276 | ) |

| Depreciation & amortization | 178,133 |

| 175,594 |

| 169,016 |

| 172,956 |

| 136,974 |

| | 522,743 |

| 397,571 |

|

| General & administrative | 43,555 |

| 32,681 |

| 29,808 |

| 29,862 |

| 26,431 |

| | 106,044 |

| 70,541 |

|

| Severance, equity acceleration, and legal expenses | 2,580 |

| 1,508 |

| 1,448 |

| 6,125 |

| (3,676 | ) | | 5,536 |

| (979 | ) |

| Transaction expenses | 6,015 |

| 3,615 |

| 1,900 |

| 3,099 |

| 11,042 |

| | 11,530 |

| 14,301 |

|

| Other expenses | (22 | ) | — |

| (1 | ) | 60,914 |

| 51 |

| | (23 | ) | 29 |

|

| Total Operating Expenses | $430,543 | $402,636 | $386,083 | $459,172 | $331,763 | | $1,219,262 | $902,392 |

| | | | | | | | | |

| Operating Income | $115,750 | $112,298 | $118,116 | $41,271 | $104,226 | | $346,164 | $360,501 |

| | | | | | | | | |

| Equity in earnings of unconsolidated joint ventures |

| $4,152 |

|

| $4,132 |

|

| $4,078 |

|

| $3,321 |

|

| $4,169 |

| |

| $12,362 |

|

| $12,170 |

|

| Gain (loss) on sale of property | 169,000 |

| — |

| 1,097 |

| 322 |

| (207 | ) | | 170,097 |

| 94,282 |

|

| Interest and other income | 355 |

| (3,325 | ) | (624 | ) | 498 |

| (358 | ) | | (3,594 | ) | (2,879 | ) |

| Interest (expense) | (63,084 | ) | (59,909 | ) | (57,261 | ) | (61,717 | ) | (48,138 | ) | | (180,254 | ) | (139,718 | ) |

| Tax (expense) | (3,720 | ) | (2,252 | ) | (2,109 | ) | (268 | ) | (1,850 | ) | | (8,081 | ) | (6,044 | ) |

| Loss from early extinguishment of debt | (18 | ) | — |

| (964 | ) | — |

| — |

| | (982 | ) | (148 | ) |

| Net Income (Loss) | $222,435 | $50,944 | $62,333 | ($16,573) | $57,842 | | $335,712 | $318,164 |

| | | | | | | | | |

| Net (income) loss attributable to non-controlling interests | (3,247 | ) | (569 | ) | (784 | ) | 590 |

| (864 | ) | | (4,600 | ) | (5,492 | ) |

| Net Income (Loss) Attributable to Digital Realty Trust, Inc. | $219,188 | $50,375 | $61,549 | ($15,983) | $56,978 | | $331,112 | $312,672 |

| | | | | | | | | |

| Preferred stock dividends | (21,530 | ) | (22,424 | ) | (22,424 | ) | (24,056 | ) | (18,456 | ) | | (66,378 | ) | (55,367 | ) |

| Issuance costs associated with redeemed preferred stock | (10,328 | ) | — |

| — |

| — |

| — |

| | (10,328 | ) | — |

|

| | | | | | | | | |

| Net Income (Loss) Available to Common Stockholders | $187,330 | $27,951 | $39,125 | ($40,039) | $38,522 | | $254,406 | $257,305 |

| | | | | | | | | |

| Weighted-average shares outstanding - basic | 147,397,853 |

| 146,824,268 |

| 146,565,564 |

| 145,561,559 |

| 135,832,503 |

| | 146,930,939 |

| 135,782,831 |

|

| Weighted-average shares outstanding - diluted | 149,384,871 |

| 147,808,268 |

| 147,433,194 |

| 145,561,559 |

| 138,259,936 |

| | 147,655,184 |

| 136,920,477 |

|

| Weighted-average fully diluted shares and units | 151,764,542 |

| 150,210,714 |

| 149,915,428 |

| 149,100,083 |

| 139,192,198 |

| | 150,076,482 |

| 139,050,965 |

|

| | | | | | | | | |

| Net income (loss) per share - basic | $1.27 | $0.19 | $0.27 | ($0.28) | $0.28 | | $1.73 | $1.89 |

| Net income (loss) per share - diluted | $1.25 | $0.19 | $0.27 | ($0.28) | $0.28 | | $1.72 | $1.88 |

|

| | |

| Funds From Operations and Core Funds From Operations | | Financial Supplement |

| Unaudited and in Thousands, Except Per Share Data | Third Quarter 2016 |

|

| | | | | | | | | | | | | | | | | | | | | | |

| Reconciliation of Net Income to Funds From Operations (FFO) | Three Months Ended | | Nine Months Ended |

| 30-Sep-16 | 30-Jun-16 | 31-Mar-16 | 31-Dec-15 | 30-Sep-15 | | 30-Sep-16 | 30-Sep-15 |

| | | | | | | | | |

| Net Income (Loss) Available to Common Stockholders |

| $187,330 |

|

| $27,951 |

|

| $39,125 |

|

| ($40,039 | ) |

| $38,522 |

| |

| $254,406 |

|

| $257,305 |

|

| Adjustments: | | | | | | | | |

| Non-controlling interests in operating partnership | 3,024 |

| 457 |

| 663 |

| (708 | ) | 747 |

| | 4,144 |

| 5,150 |

|

| Real estate related depreciation & amortization (1) | 175,332 |

| 167,043 |

| 166,912 |

| 170,095 |

| 135,613 |

| | 509,287 |

| 393,634 |

|

| Impairment charge related to Telx trade name | — |

| 6,122 |

| — |

| — |

| — |

| | 6,122 |

| — |

|

| Unconsolidated JV real estate related depreciation & amortization | 2,810 |

| 2,810 |

| 2,803 |

| 2,867 |

| 2,761 |

| | 8,424 |

| 8,551 |

|

| (Gain) loss on sale of property | (169,000 | ) | — |

| (1,097 | ) | (322 | ) | 207 |

| | (170,097 | ) | (94,282 | ) |

| (Gain) on settlement of pre-existing relationship with Telx (2) | — |

| — |

| — |

| (14,355 | ) | — |

| | — |

| — |

|

| Funds From Operations |

| $199,496 |

|

| $204,383 |

|

| $208,406 |

|

| $117,538 |

|

| $177,850 |

| |

| $612,286 |

|

| $570,358 |

|

| | | | | | | | | |

| Funds From Operations - diluted |

| $199,496 |

|

| $204,383 |

|

| $208,406 |

|

| $117,538 |

|

| $177,850 |

| |

| $612,286 |

|

| $570,358 |

|

| | | | | | | | | |

| Weighted-average shares and units outstanding - basic | 149,778 |

| 149,227 |

| 149,048 |

| 148,388 |

| 138,468 |

| | 149,352 |

| 138,481 |

|

| Weighted-average shares and units outstanding - diluted (3) | 151,765 |

| 150,211 |

| 149,915 |

| 149,100 |

| 139,192 |

| | 150,076 |

| 139,051 |

|

| | | | | | | | | |

| Funds From Operations per share - basic | $1.33 | $1.37 | $1.40 | $0.79 | $1.28 | | $4.10 | $4.12 |

| | | | | | | | | |

| Funds From Operations per share - diluted (3) | $1.31 | $1.36 | $1.39 | $0.79 | $1.28 | | $4.08 | $4.10 |

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| Reconciliation of FFO to Core FFO | 30-Sep-16 | 30-Jun-16 | 31-Mar-16 | 31-Dec-15 | 30-Sep-15 | | 30-Sep-16 | 30-Sep-15 |

| | | | | | | | | |

| Funds From Operations - diluted |

| $199,496 |

|

| $204,383 |

|

| $208,406 |

|

| $117,538 |

|

| $177,850 |

| |

| $612,286 |

|

| $570,358 |

|

| Adjustments: | | | | | | | | |

| Termination fees and other non-core revenues (4) | (2 | ) | — |

| (91 | ) | — |

| (580 | ) | | (93 | ) | 680 |

| Transaction expenses | 6,015 |

| 3,615 |

| 1,900 |

| 3,099 |

| 11,042 |

| | 11,530 |

| 14,301 |

|

| Loss from early extinguishment of debt | 18 |

| — |

| 964 |

| — |

| — |

| | 982 |

| 148 |

|

| Issuance costs associated with redeemed preferred stock | 10,328 |

| — |

| — |

| — |

| — |

| | 10,328 |

| — |

|

| Change in fair value of contingent consideration (5) | — |

| — |

| — |

| — |

| (1,594 | ) | | — |

| (44,276 | ) |

| Severance, equity acceleration, and legal expenses (6) | 2,580 |

| 1,508 |

| 1,448 |

| 6,125 |

| (3,676 | ) | | 5,536 |

| (979 | ) |

| Bridge facility fees (7) | — |

| — |

| — |

| 3,903 |

| — |

| | — |

| — |

|

| Loss on currency forwards | — |

| 3,082 |

| — |

| — |

| — |

| | 3,082 |

| — |

|

| Other non-core expense adjustments (8) | (22 | ) | — |

| (1 | ) | 75,269 |

| 51 |

| | (23 | ) | (8 | ) |

| Core Funds From Operations - diluted |

| $218,413 |

|

| $212,587 |

|

| $212,626 |

|

| $205,934 |

|

| $183,093 |

| |

| $643,627 |

|

| $540,224 |

|

| | | | | | | | | |

| Weighted-average shares and units outstanding - diluted (3) | 151,765 |

| 150,211 |

| 149,915 |

| 149,100 |

| 139,192 |

| | 150,076 |

| 139,051 |

|

| | | | | | | | | |

Core Funds From Operations per share - diluted (3) | $1.44 | $1.42 | $1.42 | $1.38 | $1.32 | | $4.29 | $3.89 |

| | | | | | | | | |

|

| | | | | | | | | | | | | | | | | | | | | | |

| (1) Real Estate Related Depreciation & Amortization: | Three Months Ended | | Nine Months Ended |

| | 30-Sep-16 | 30-Jun-16 | 31-Mar-16 | 31-Dec-15 | 30-Sep-15 | | 30-Sep-16 | 30-Sep-15 |

| | | | | | | | | |

| Depreciation & amortization per income statement |

| $178,133 |

|

| $175,594 |

|

| $169,016 |

|

| $172,956 |

|

| $136,974 |

| |

| $522,743 |

|

| $397,571 |

|

| Non-real estate depreciation | (2,801 | ) | (2,429 | ) | (2,104 | ) | (2,861 | ) | (1,361 | ) | | (7,334 | ) | (3,937 | ) |

| Impairment charge related to Telx trade name | — |

| (6,122 | ) | — |

| — |

| — |

| | (6,122 | ) | — |

|

| | | | | | | | | |

| Real Estate Related Depreciation & Amortization |

| $175,332 |

|

| $167,043 |

|

| $166,912 |

|

| $170,095 |

|

| $135,613 |

| |

| $509,287 |

|

| $393,634 |

|

| |

| (2) | Included in Other expenses on the Income Statement, offset by the write off of straight-line rent receivables related to the Telx Acquisition of $75.3 million. |

| |

| (3) | For all periods presented, we have excluded the effect of dilutive series E, series F, series G, series H and series I preferred stock, as applicable, that may be converted upon the occurrence of specified change in control transactions as described in the articles supplementary governing the series E, series F, series G, series H and series I preferred stock, as applicable, which we consider highly improbable. See above for calculations of diluted FFO available to common stockholders and unitholders and page 15 for calculations of weighted average common stock and units outstanding. |

| |

| (4) | Includes lease termination fees and certain other adjustments that are not core to our business. |

| |

| (5) | Relates to earn-out contingencies in connection with the Sentrum and Singapore (29A International Business Park) acquisitions. The Sentrum earn-out contingency expired in July 2015 and the Singapore earn-out contingency will expire in November 2020 and will be reassessed on a quarterly basis. During the first quarter of 2015, we reduced the fair value of the earnout related to Sentrum by approximately $44.8 million. The adjustment was the result of an evaluation by management that no additional leases would be executed for vacant space by the contingency expiration date. |

| |

| (6) | Relates to severance and other charges related to the departure of company executives and integration related severance. |

| |

| (7) | Bridge facility fees included in interest expense. |

| |

| (8) | For the quarter ended December 31, 2015, includes write off of straight-line rent receivables related to the Telx Acquisition of $75.3 million. Includes reversal of accruals and certain other adjustments that are not core to our business. Construction management expenses are included in Other expenses on the income statement but are not added back to core FFO. |

|

| | |

| Adjusted Funds From Operations (AFFO) | | Financial Supplement |

| Unaudited and in Thousands, Except Per Share Data | Third Quarter 2016 |

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| Reconciliation of Core FFO to AFFO | 30-Sep-16 | 30-Jun-16 | 31-Mar-16 | 31-Dec-15 | 30-Sep-15 | | 30-Sep-16 | 30-Sep-15 |

| | | | | | | | | |

| Core FFO available to common stockholders and unitholders |

| $218,413 |

|

| $212,587 |

|

| $212,626 |

|

| $205,934 |

|

| $183,093 |

| |

| $643,627 |

|

| $540,224 |

|

| Adjustments: | | | | | | | | |

| Non-real estate depreciation | 2,801 |

| 2,429 |

| 2,104 |

| 2,861 |

| 1,361 |

| | 7,334 |

| 3,936 |

|

| Amortization of deferred financing costs | 2,550 |

| 2,643 |

| 2,260 |

| 2,121 |

| 2,076 |

| | 7,454 |

| 6,360 |

|

| Amortization of debt discount/premium | 693 |

| 689 |

| 647 |

| 611 |

| 557 |

| | 2,029 |

| 1,685 |

|

| Non-cash stock-based compensation expense | 4,041 |

| 4,630 |

| 3,420 |

| 604 |

| 3,831 |

| | 12,091 |

| 11,144 |

|

| Straight-line rental revenue | (6,032 | ) | (5,554 | ) | (7,456 | ) | (9,530 | ) | (13,579 | ) | | (19,043 | ) | (41,447 | ) |

| Straight-line rental expense | 6,402 |

| 5,933 |

| 5,655 |

| 5,698 |

| 80 |

| | 17,990 |

| 247 |

|

| Above- and below-market rent amortization | (2,002 | ) | (1,997 | ) | (2,266 | ) | (2,479 | ) | (2,174 | ) | | (6,265 | ) | (6,856 | ) |

| Deferred non-cash tax expense | (189 | ) | 669 |

| 637 |

| (757 | ) | 680 |

| | 1,117 |

| 2,303 |

|

| Capitalized leasing compensation (1) | (2,795 | ) | (2,455 | ) | (2,695 | ) | (2,563 | ) | (2,581 | ) | | (7,945 | ) | (7,653 | ) |

| Recurring capital expenditures (2) | (15,252 | ) | (17,914 | ) | (21,064 | ) | (35,386 | ) | (14,716 | ) | | (54,230 | ) | (56,490 | ) |

| Capitalized internal leasing commissions | (1,786 | ) | (1,677 | ) | (2,024 | ) | (1,460 | ) | (907 | ) | | (5,487 | ) | (2,621 | ) |

| | | | | | | | | |

| AFFO available to common stockholders and unitholders (3) |

| $206,843 |

|

| $199,984 |

|

| $191,844 |

|

| $165,654 |

|

| $157,721 |

| |

| $598,672 |

|

| $450,832 |

|

| | | | | | | | | |

| Weighted-average shares and units outstanding - basic | 149,778 |

| 149,227 |

| 149,048 |

| 148,388 |

| 138,468 |

| | 149,352 |

| 138,481 |

|

| Weighted-average shares and units outstanding - diluted (4) | 151,765 |

| 150,211 |

| 149,915 |

| 149,100 |

| 139,192 |

| | 150,076 |

| 139,051 |

|

| | | | | | | | | |

| AFFO per share - diluted (4) |

| $1.36 |

|

| $1.33 |

|

| $1.28 |

|

| $1.11 |

|

| $1.13 |

| |

| $3.99 |

|

| $3.24 |

|

| | | | | | | | | |

| Dividends per share and common unit |

| $0.88 |

|

| $0.88 |

|

| $0.88 |

|

| $0.85 |

|

| $0.85 |

| |

| $2.64 |

|

| $2.55 |

|

| | | | | | | | | |

| Diluted AFFO Payout Ratio | 64.6 | % | 66.1 | % | 68.8 | % | 76.5 | % | 75.0 | % | | 66.2 | % | 78.7 | % |

|

| | | | | | | | | | | | | | | |

| | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| Share Count Detail | 30-Sep-16 | 30-Jun-16 | 31-Mar-16 | 31-Dec-15 | 30-Sep-15 | | 30-Sep-16 | 30-Sep-15 |

| | | | | | | | | |

| Weighted Average Common Stock and Units Outstanding | 149,778 |

| 149,227 |

| 149,048 |

| 148,388 |

| 138,468 |

| | 149,352 |

| 138,481 |

|

| Add: Effect of dilutive securities | 1,987 |

| 984 |

| 867 |

| 712 |

| 724 |

| | 724 |

| 570 |

|

| | | | | | | | | |

| Weighted Avg. Common Stock and Units Outstanding - diluted | 151,765 |

| 150,211 |

| 149,915 |

| 149,100 |

| 139,192 |

| | 150,076 |

| 139,051 |

|

| |

| (1) | Beginning in the first quarter of 2015, we changed the presentation of certain capital expenditures. Infrequent expenditures for capitalized replacements and upgrades are now categorized as Recurring capital expenditures (categorized as Enhancements and Other Non-Recurring capital expenditures in 2014). First-generation leasing costs are now classified as Development capital expenditures (categorized as recurring capital expenditures in 2014). Capitalized leasing compensation for 2015 and 2016 includes only second generation leasing costs. |

| |

| (2) | For a definition of recurring capital expenditures, see page 38. |

| |

| (3) | For a definition and discussion of AFFO, see page 47. For a reconciliation of net income available to common stockholders to FFO, see page 14. |

| |

| (4) | For all periods presented, we have excluded the effect of dilutive series E, series F, series G, series H and series I preferred stock, as applicable, that may be converted upon the occurrence of specified change in control transactions as described in the articles supplementary governing the series F, series G, series H and series I preferred stock, as applicable, which we consider highly improbable. See page 13 for calculations of diluted FFO available to common stockholders and unitholders and above for calculations of weighted average common stock and units outstanding. |

|

| | |

| Consolidated Balance Sheets | | Financial Supplement |

| Unaudited and in Thousands, Except Share and Per Share Data | Third Quarter 2016 |

|

| | | | | | | | | | | | | | | |

| | 30-Sep-16 | 30-Jun-16 | 31-Mar-16 | 31-Dec-15 | 30-Sep-15 |

| Assets | | | | | |

| Investments in real estate: | | | | | |

| Real estate |

| $10,607,440 |

|

| $10,223,946 |

|

| $10,226,549 |

|

| $10,066,936 |

|

| $9,473,253 |

|

| Construction in progress | 681,189 |

| 594,986 |

| 720,363 |

| 664,992 |

| 570,598 |

|

| Land held for future development | 223,236 |

| 161,714 |

| 156,000 |

| 183,445 |

| 133,343 |

|

| Investments in Real Estate |

| $11,511,865 |

|

| $10,980,646 |

|

| $11,102,912 |

|

| $10,915,373 |

|

| $10,177,194 |

|

| Accumulated depreciation & amortization | (2,565,368 | ) | (2,441,150 | ) | (2,380,400 | ) | (2,251,268 | ) | (2,137,631 | ) |

| Net Investments in Properties |

| $8,946,497 |

|

| $8,539,496 |

|

| $8,722,512 |

|

| $8,664,105 |

|

| $8,039,563 |

|

| Investment in unconsolidated joint ventures | 105,819 |

| 105,673 |

| 106,008 |

| 106,107 |

| 103,703 |

|

| Net Investments in Real Estate |

| $9,052,316 |

|

| $8,645,169 |

|

| $8,828,520 |

|

| $8,770,212 |

|

| $8,143,266 |

|

| | | | | | |

| Cash and cash equivalents |

| $36,445 |

|

| $33,241 |

|

| $31,134 |

|

| $57,053 |

|

| $22,998 |

|

| Accounts and other receivables (1) | 208,097 |

| 165,867 |

| 180,456 |

| 177,398 |

| 157,994 |

|

| Deferred rent | 412,977 |

| 408,193 |

| 412,579 |

| 403,327 |

| 475,796 |

|

| Acquired in-place lease value, deferred leasing costs and other real estate intangibles, net | 1,526,563 |

| 1,331,275 |

| 1,368,340 |

| 1,391,659 |

| 405,824 |

|

| Acquired above-market leases, net | 24,554 |

| 26,785 |

| 30,107 |

| 32,698 |

| 30,617 |

|

| Goodwill | 780,099 |

| 330,664 |

| 330,664 |

| 330,664 |

| — |

|

| Restricted cash | 11,685 |

| 18,297 |

| 19,599 |

| 18,009 |

| 12,500 |

|

| Assets associated with real estate held for sale | 55,915 |

| 222,304 |

| 145,087 |

| 180,139 |

| 173,461 |

|

| Other assets | 190,384 |

| 110,580 |

| 75,489 |

| 54,904 |

| 49,384 |

|

| | | | | | |

| Total Assets |

| $12,299,036 |

|

| $11,292,375 |

|

| $11,421,975 |

|

| $11,416,063 |

|

| $9,471,840 |

|

| | | | | | |

| Liabilities and Equity | | | | | |

| Global unsecured revolving credit facility |

| $153,189 |

|

| $88,535 |

|

| $677,868 |

|

| $960,271 |

|

| $682,648 |

|

| Unsecured term loan | 1,521,613 |

| 1,545,590 |

| 1,566,185 |

| 923,267 |

| 937,198 |

|

| Unsecured senior notes, net of discount | 4,238,435 |

| 4,252,570 |

| 3,662,753 |

| 3,712,569 |

| 2,794,783 |

|

| Mortgage loans, net of premiums | 111,750 |

| 248,711 |

| 249,923 |

| 302,930 |

| 304,777 |

|

| Accounts payable and other accrued liabilities | 823,906 |

| 598,610 |

| 570,653 |

| 608,343 |

| 513,555 |

|

| Accrued dividends and distributions | — |

| — |

| — |

| 126,925 |

| — |

|

| Acquired below-market leases | 86,888 |

| 90,823 |

| 96,475 |

| 101,114 |

| 88,632 |

|

| Security deposits and prepaid rent | 163,787 |

| 128,802 |

| 147,934 |

| 138,347 |

| 107,704 |

|

| Liabilities associated with assets held for sale | 2,820 |

| 13,092 |

| 4,974 |

| 5,795 |

| 6,892 |

|

| Total Liabilities |

| $7,102,388 |

|

| $6,966,733 |

|

| $6,976,765 |

|

| $6,879,561 |

|

| $5,436,189 |

|

| | | | | | |

| Equity | | | | | |

| Preferred Stock: $0.01 par value per share, 110,000,000 shares authorized: | | | | | |

| Series E Cumulative Redeemable Preferred Stock (2) | — |

|

| $277,172 |

|

| $277,172 |

|

| $277,172 |

|

| $277,172 |

|

| Series F Cumulative Redeemable Preferred Stock (3) |

| $176,191 |

| 176,191 |

| 176,191 |

| 176,191 |

| 176,191 |

|

| Series G Cumulative Redeemable Preferred Stock (4) | 241,468 |

| 241,468 |

| 241,468 |

| 241,468 |

| 241,468 |

|

| Series H Cumulative Redeemable Preferred Stock (5) | 353,290 |

| 353,290 |

| 353,290 |

| 353,290 |

| 353,290 |

|

| Series I Cumulative Redeemable Preferred Stock (6) | 242,012 |

| 242,012 |

| 242,014 |

| 242,014 |

| 241,683 |

|

| Common Stock: $0.01 par value per share, 265,000,000 shares authorized (7) | 1,581 |

| 1,460 |

| 1,459 |

| 1,456 |

| 1,351 |

|

| Additional paid-in capital | 5,759,338 |

| 4,669,149 |

| 4,659,484 |

| 4,655,220 |

| 3,977,945 |

|

| Dividends in excess of earnings | (1,483,223 | ) | (1,541,265 | ) | (1,440,028 | ) | (1,350,089 | ) | (1,185,633 | ) |

| Accumulated other comprehensive (loss) income, net | (131,936 | ) | (129,657 | ) | (104,252 | ) | (96,590 | ) | (87,988 | ) |

| Total Stockholders' Equity |

| $5,158,721 |

|

| $4,289,820 |

|

| $4,406,798 |

|

| $4,500,132 |

|

| $3,995,479 |

|

| | | | | | |

| Non-controlling Interests | | | | | |

| Non-controlling interest in operating partnership |

| $31,088 |

|

| $29,095 |

|

| $31,648 |

|

| $29,612 |

|

| $33,411 |

|

| Non-controlling interest in consolidated joint ventures | 6,839 |

| 6,727 |

| 6,764 |

| 6,758 |

| 6,761 |

|

| | | | | | |

| Total Non-controlling Interests |

| $37,927 |

|

| $35,822 |

|

| $38,412 |

|

| $36,370 |

|

| $40,172 |

|

| | | | | | |

| Total Equity |

| $5,196,648 |

|

| $4,325,642 |

|

| $4,445,210 |

|

| $4,536,502 |

|

| $4,035,651 |

|

| | | | | | |

| Total Liabilities and Equity |

| $12,299,036 |

|

| $11,292,375 |

|

| $11,421,975 |

|

| $11,416,063 |

|

| $9,471,840 |

|

| |

| (1) | Net of allowance for doubtful accounts of $10,052 and $5,844 as of September 30, 2016 and December 31, 2015, respectively. |

| |

| (2) | Series E Cumulative Redeemable Preferred Stock, 7.000%, $0 and $287,500 liquidation preference, respectively ($25.00 per share), 0 and 11,500,000 shares issued and outstanding as of September 30, 2016 and December 31, 2015, respectively. |

| |

| (3) | Series F Cumulative Redeemable Preferred Stock, 6.625%, $182,500 and $182,500 liquidation preference, respectively ($25.00 per share), 7,300,000 and 7,300,000 shares issued and outstanding as of September 30, 2016 and December 31, 2015, respectively. |

| |

| (4) | Series G Cumulative Redeemable Preferred Stock, 5.875%, $250,000 and $250,000 liquidation preference, respectively ($25.00 per share), 10,000,000 and 10,000,000 shares issued and outstanding as of September 30, 2016 and December 31, 2015, respectively. |

| |

| (5) | Series H Cumulative Redeemable Preferred Stock, 7.375%, $365,000 and $365,000 liquidation preference, respectively ($25.00 per share), 14,600,000 and 14,600,000 shares issued and outstanding as of September 30, 2016 and December 31, 2015, respectively. |

| |

| (6) | Series I Cumulative Redeemable Preferred Stock, 6.350%, $250,000 and $250,000 liquidation preference, respectively ($25.00 per share), 10,000,000 and 10,000,000 shares issued and outstanding as of September 30, 2016 and December 31, 2015, respectively. |

| |

| (7) | Common Stock: 158,926,811 and 146,384,247 shares issued and outstanding as of September 30, 2016 and December 31, 2015, respectively. |

|

| | |

| Components of Net Asset Value (NAV) (1) | | Financial Supplement |

| Unaudited and in Thousands | Third Quarter 2016 |

|

| | | |

| Consolidated Properties Cash Net Operating Income (NOI) (2), Annualized (3) | |

| Internet Gateway (4) |

| $286,981 |

|

| Turn-Key Flex® (4) | 647,700 |

|

| Powered Base Building® (4) | 193,950 |

|

| Colo & Non-tech (4) | 109,112 |

|

| Internet Gateway Leaseholds (4) | 133,032 |

|

| Total Cash NOI, Annualized |

| $1,370,775 |

|

| less: Partners' share of consolidated JVs | (559 | ) |

| Dispositions & expirations | (8,500 | ) |

| 3Q16 carry-over & remaining FY16 backlog cash NOI (stabilized) (5) | 33,542 |

|

| Total Consolidated Cash NOI, Annualized |

| $1,395,258 |

|

| | |

| Digital Realty's Pro Rata Share of Unconsolidated JV Cash NOI | |

| Turn-Key Flex® |

| $23,850 |

|

| Powered Base Building® | 9,190 |

|

| Total Unconsolidated Cash NOI, Annualized |

| $33,040 |

|

| | |

| Other Income | |

| Development and Management Fees (net), Annualized |

| $6,068 |

|

| | |

| Other Assets | |

| Pre-stabilized inventory, at cost (6) |

| $203,964 |

|

| Land held for development | 223,236 |

|

| Development CIP (7) | 681,198 |

|

| less: Investment associated with FY16 Backlog NOI | (123,105 | ) |

| Cash and cash equivalents | 36,445 |

|

| Restricted cash | 11,685 |

|

| Accounts and other receivables, net | 208,097 |

|

| Other assets | 190,384 |

|

| less: Partners' share of consolidated JV assets | (123 | ) |

| Total Other Assets |

| $1,431,781 |

|

| | |

| Liabilities | |

| Global unsecured revolving credit facility |

| $164,786 |

|

| Unsecured term loan | 1,528,099 |

|

| Unsecured senior notes | 4,282,140 |

|

| Mortgage loans, excluding premiums | 111,442 |

|

| Accounts payable and other accrued liabilities (8) | 823,906 |

|

| Security deposits and prepaid rents | 163,787 |

|

| Liabilities associated with assets held for sale | 2,820 |

|

| Backlog NOI cost to complete (9) | 26,545 |

|

| Preferred stock, at liquidation value | 1,047,500 |

|

| Digital Realty's share of unconsolidated JV debt | 136,411 |

|

| Total Liabilities |

| $8,287,436 |

|

| | |

| Diluted Shares and Units Outstanding (10) | 162,335 |

|

| |

| (1) | Includes Digital Realty's share of backlog leasing at unconsolidated joint venture properties. |

| |

| (2) | For a definition and discussion of NOI and cash NOI and a reconciliation of operating income to NOI and cash NOI, see page 48. |

| |

| (3) | Annualized cash NOI is calculated by multiplying results for the most recent quarter by four. Annualized results may not be indicative of any four-quarter period and do not take into account scheduled lease expirations, among other things. Annualized data is presented for illustrative purposes only. |

| |

| (4) | Reflects annualized 3Q16 Cash NOI of $1,370.8 million. NOI is allocated based on management’s best estimate derived using contractual ABR and stabilized margins. |

| |

| (5) | Estimated Cash NOI related to signed leasing expected to commence through FY16. Includes Digital Realty's share of signed leases at unconsolidated joint venture properties. |

| |

| (6) | Includes Digital Realty's share of cost at unconsolidated joint venture properties. |

| |

| (7) | See page 36 for further details on the breakdown of the construction in progress balance. |

| |

| (8) | Includes net deferred tax liability of approximately $168.8 million. |

| |

| (9) | Includes Digital Realty's share of expected cost to complete at unconsolidated joint venture properties. |

| |

| (10) | Includes 161,448 shares and units outstanding at quarter-end plus 887 dilutive shares. Dilutive shares used for NAV purposes exclude 1,100 shares associated with the equity forward settled during the period. |

|

| | |

| Consolidated Debt Analysis | | Financial Supplement |

| Unaudited and in Thousands | Third Quarter 2016 |

|

| | | | | | | | | | |

| | As of September 30, 2016 |

| | Maturity Date | Principal Balance | % of Total Debt | Interest Rate | Interest Rate

Including Swaps |

| Global Unsecured Revolving Credit Facility (1) | | | | | |

| Global unsecured revolving credit facility | January 15, 2021 |

| $164,786 |

| | | |

| Deferred financing costs, net | | (11,597 | ) | | | |

| Total Global Unsecured Revolving Credit Facility | |

| $153,189 |

| 3 | % | 1.392 | % | |

| | | | | | |

| Unsecured Term Loan | | | | | |

| Hedged variable rate portion of five-year term loan | January 15, 2021 |

| $844,808 |

| | 1.629 | % | 1.946 | % |

| Unhedged variable rate portion of five-year term loan | January 15, 2021 | 383,291 |

| | 1.983 | % |

|

|

| Hedged variable rate portion of seven-year term loan | January 15, 2023 | 300,000 |

| | 2.074 | % | 2.985 | % |

| Deferred financing costs, net | | (6,486 | ) | | | |

| Total Unsecured Term Loan | |

| $1,521,613 |

| 25 | % | 1.805 | % | 2.159 | % |

| | | | | | |

| Prudential Unsecured Senior Notes | | | | | |

| Series E | January 20, 2017 |

| $50,000 |

| | 5.730 | % | |

| Total Prudential Unsecured Senior Notes | |

| $50,000 |

| 1 | % | 5.730 | % | |

| | | | | | |

| Senior Notes | | | | | |

| 5.875% notes due 2020 | February 1, 2020 |

| $500,000 |

| | 5.875 | % | |

| 3.400% notes due 2020 | October 1, 2020 | 500,000 |

| | 3.400 | % | |

| 5.250% notes due 2021 | March 15, 2021 | 400,000 |

| | 5.250 | % | |

| 3.950% notes due 2022 | July 1, 2022 | 500,000 |

| | 3.950 | % | |

| 3.625% notes due 2022 | October 1, 2022 | 300,000 |

| | 3.625 | % | |

| 4.750% notes due 2023 | October 13, 2023 | 389,160 |

| | 4.750 | % | |

| 2.625% notes due 2024 | April 15, 2024 | 674,100 |

| | 2.625 | % | |

| 4.250% notes due 2025 | January 17, 2025 | 518,880 |

| | 4.250 | % | |

| 4.750% notes due 2025 | October 1, 2025 | 450,000 |

| | 4.750 | % | |

| Unamortized discounts | | (16,658 | ) | | | |

| Deferred financing costs, net | | (27,047 | ) | | | |

| Total Senior Notes | |

| $4,188,435 |

| 69 | % | 4.197 | % | |

| | | | | | |

| Total Unsecured Senior Notes | |