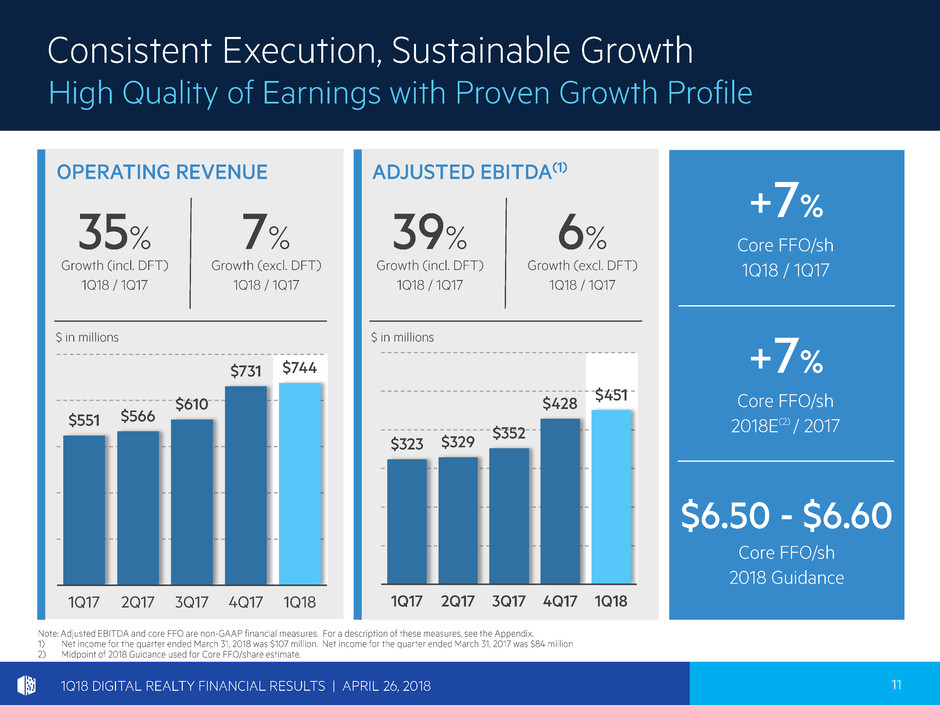

Funds from operations Q118 Q117 FY 2017 Net income (loss) available to common stockholders $ 86,298 $ 66,145 $ 173,149 Noncontrolling interests in operating partnership 3,480 904 3,770 Real estate related depreciation and amortization (2) 291,686 173,447 830,252 Real estate related depreciation and amortization related to investment in unconsolidated joint venture 3,476 2,757 11,566 (Gain) loss on sale of property (39,273) 522 (40,355) Non-controlling interests share of gain on sale of property - 3,900 Impairment of investments in real estate - - 28,992 Funds from operations (FFO) $345,667 $243,775 $1,011,274 Funds from operations (FFO) per diluted share $ 1.61 $ 1.50 $ 4.16 Net income (loss) per diluted share available to common stockholders $ 0.42 $ 0.41 $ 0.73 FFO available to common stockholders and unitholders 345,667 243,775 1,011,274 FFO available to common stockholders and unitholders -- diluted $345,667 $243,775 $1,011,274 Termination fees and other non-core revenues (858) (35) (1,031) Transaction expenses 4,178 3,323 76,048 Loss from early extinguishment of debt - - (1,990) Issuance costs associated with redeemed preferred stock - - 6,309 Equity in earnings adjustment for non-core items - - (3,285) Severance related accrual, equity acceleration, and legal expenses 234 869 4,731 Bridge facility fees - - 3,182 Other non-core expense adjustments 431 - 3,077 Core Funds from operations (FFO) $349,652 $247,932 $1,098,315 Non real estate depreciation 3,103 3,019 12,212 Amortization of deferred financing costs 3,060 2,443 10,664 Amortization of debt discount 875 697 3,084 Non cash compensation 5,497 3,704 17,900 Straight-line rent revenue (10,266) (4,058) (16,565) Straight-line rent expense 2,547 4,187 12,107 Above and below market rent amortization 6,666 (1,973) 1,770 Non-cash tax expense/(benefit) (only disclosed for 2014 - 2018) (216) (653) (2,912) Capitalized leasing compensation (2,998) (2,634) (11,886) Recurring capital expenditures (only disclosed for 2012 - 2018) (27,328) (29,588) (136,290) Internal leasing commissions (only disclosed for 2012 - 2018) (2,049) (1,493) (5,290) Adjusted funds from operations (1) $328,543 $221,583 $ 983,109 (1) Funds from operations and Adjusted funds from operations for all periods presented above include the results of properties sold in 2006 and 2007 — 7979 East Tufts Avenue (July 2006), 100 Technology Center Drive (March 2007) and 4055 Valley View Lane (March 2007). (2) Real estate related depreciation and amortization was computed as follows: Q118 Q117 FY 2017 Depreciation and amortization per income statement $294,789 $176,466 $ 842,464 Non real estate depreciation (3,103) (3,019) (12,212) $291,686 $173,447 $ 830,252 Weighted-average shares and units outstanding - diluted 214,803 162,600 166,938 Reconciliation of Adjusted EBITDA Q118 Q117 EBITDA 461,446$ 300,284$ Severance accrual and equity acceleration (including associated legal expenses for 2015 only) 234 869 Transaction and integration expenses 4,178 3,323 (Gain) loss on sale of properties (39,273) 522 Other non-core expense adjustments 431 - Noncontrolling interests 3,468 1,025 Preferred stock dividends 20,329 17,393 Adjusted EBITDA 450,813 323,416 Adjusted EBITDA, less effect of gain on sale of assets 450,813$ 323,416$ Reconciliati n of Net Operating Income (NOI) Q118 FY 2017 Operating income 143,813$ 451,295$ Less: Fee income (only disclosed for 2008 through 2017) (1 13 ) (6 372) Other revenue (858) (1,031) Depreciation and amortiza i n 294,789 842, 64 General and administrative 36,289 156,710 Severance accrual and equity acceleration 234 4,731 Transactions 4,178 76,048 Other expenses 431 3,077 Net Operating Income 477,743$ 1,555,914$ 1Q18 1Q17 % change Operating Revenue $744,368 $550,569 35% (Less DFT) (157,031) - Operating Revenue (excl DFT) $587,337 $550,569 7% Adjusted EBITDA $450,813 $323,416 39% (Less DFT) (107,317) - Adjusted EBTIDA (excl DFT) $343,496 $323,416 6%