Global. Connected. Sustainable. 4Q18 FINANCIAL RESULTS FEBURARY 2019 Digital Realty the trusted foundation | powering your digital ambitions

Navigating the Future Sustainable Growth for Customers, Shareholders & Employees GLOBAL CONNECTED SUSTAINABLE DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 2

Navigating the Future Sustainable Growth for Customers, Shareholders & Employees Leading Position in Unparalleled Expertise Rapidly Growing to Execute in Latin American Region Latin America Leading data center provider in Latin America, providing a full spectrum of offerings, including colocation and th connectivity to hyperscale deployments 8 Leading global provider of data center, colocation 214 LARGEST ECONOMY and interconnection GLOBAL DATA BY 2018E GDP PER solutions for customers CENTERS 16 108 INTERNATIONAL MONETARY FUND across a variety of verticals STATE-OF-THE-ART TOTAL PLANNED DATA CENTERS CAPACITY (MW) th 5 Leading global asset LARGEST POPULATION IN manager with 115 years of $42+ Bn 2018 experience owning and AUM operating real assets IN BRAZIL ~75% #1 Market Share 95% USD DENOMINATED ASCENTY HAS THE LEADING MARKET SHARE (1) LEASED CONTRACTS (2) IN BRAZIL AMONG MULTI-TENANT DATA CENTER PROVIDERS (3) Highly experienced management team with a 100+ Years proven track record in OF COMBINED Latin America EXPERIENCE Source: Ascenty management, International Monetary Fund and 451 Research (April 2018). Note: Data as of December 31, 2018. Includes signed but not yet commenced leases and leases pending execution that are subject to closing or other conditions under the Share Purchase Agreement. 1) Based on net rentable square feet currently in-service. 2) Figures based on remaining contractual cash rent, including signed but not yet commenced leases and leases pending execution that are subject to closing or other conditions under the Share Purchase Agreement. 3) Market share based on megawatts. Ascenty includes additional capacity expected to be built at data centers under construction. DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 3

Industry-Leading Sustainability Track Record and Commitment to Energy Efficiency Received Nareit’s Earned EPA ENERGY Enrolled in new Issued first data 2018 data center STAR® certification solar energy center green “Leader in the for superior energy program to source Euro bond (1) Light” award performance in 24 renewable energy data centers in 2018 in Arizona 1) Issued January 2019 DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 4

Firm Fundamentals Robust Demand, Rational Supply NORTH AMERICA EMEA APAC 2,410 1,128 882 2,043 990 772 4Q17 4Q18 4Q17 4Q18 4Q17 4Q18 MEGAWATTS COMMISSIONED(1)(2) MEGAWATTS COMMISSIONED(1)(2) MEGAWATTS COMMISSIONED(1)(2) 91% 89% 90% 88% 90% 92% DIGITAL DIGITAL DIGITAL REGION REALTY REGION REALTY REGION REALTY OCCUPANCY RATE (4Q18)(1) OCCUPANCY RATE (4Q18)(1) OCCUPANCY RATE (4Q18)(1) 2.1x 1.6x 1.3x Market Absorption-to-Available Market Absorption-to-Available Market Absorption-to-Available Current Construction(3) Current Construction(3) Current Construction(3) 1) Management estimates, based on a sub-set of Digital Realty metros (North America: Northern Virginia, Chicago, Dallas, Silicon Valley, New Jersey, Phoenix and Toronto; EMEA: Amsterdam, Dublin, Frankfurt, and London; APAC: Melbourne, Osaka, Singapore and Sydney). 2) Prior periods may be adjusted to reflect updated information. 3) Trailing 12-month market absorption divided by available data center construction. DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 5

Supportive Economic Growth Outlook Levered to Long-Term Secular Demand Drivers 3Q18 CALL CURRENT Better/ October 15, 2018 February 4, 2019 Worse 2019E 2020E Global GDP Growth Forecast (1) 2019E: 3.7% 2019E: 3.5% q 3.5% 3.6% U.S. GDP Growth Forecast (1) 2019E: 2.5% 2019E: 2.5% tu 2.5% 1.8% U.S. Unemployment Rate (2) 3.7% 4.0% p 3.6% 3.7% Inflation Rate – U.S. Annual CPI Index (2) 2.3% 1.9% q 2.0% 2.2% Crude Oil ($/barrel) (3) $72 $54 q $61 $63 MACROECONOMIC Control of White House, Senate and HoR (4) R,R,R R,R,D tu R,R,D R,R,D Three-Month Libor (USD) (2) 2.4% 2.7% p 3.1% 3.1% (2) q RATES 10-Yr U.S. Treasury Yield 3.2% 2.7% 3.1% 3.2% GBP-USD (2) 1.32 1.30 q 1.37 1.44 (2) INTEREST EUR-USD 1.16 1.14 q 1.20 1.27 S&P 500 (2) 2,751 (YTD 2.9%); P/E: 19.8x 2,713 (YTD 8.3%); P/E: 18.1x q 16.1x 14.5x NASDAQ 100 (2) 7,069 (YTD 10.5%); P/E: 24.6x 6,942 (YTD 9.7%); P/E: 22.2x q 19.0x 16.7x EQUITIES (2)(5) RMZ 1,086 (YTD -6.1%); P/AFFO 17.1x 1,175 (YTD 11.1%); P/AFFO 18.0x p 18.0x N/A IT Spending Growth Worldwide (6) 2019E: 3.0% 2019E: 3.1% p 3.1% 2.8% Server Shipment Worldwide (7) 2019E: 4.2% 2019E: 4.1% q 4.1% 2.1% Global Data Center IP Traffic (8) CAGR 2016 - 2021E: 25% CAGR 2016 - 2021E: 25% tu CAGR 2016 - 2021E: 25% INDUSTRY Global Cloud IP Traffic (8) CAGR 2016 - 2021E: 27% CAGR 2016 - 2021E: 27% tu CAGR 2016 - 2021E: 27% 1) IMF World Economic Outlook October 2018 and January 2019 5) Citi Investment Research - October 2018 and January 2019 2) Bloomberg 6) Gartner: IT Spending, Worldwide (constant currency), August 2018 and December 2018 3) Bloomberg, NY Mercantile Exchange WTI Crude Oil (Front Month) 7) Gartner: Servers Forecast Worldwide, October 2018 and January 2019 4) FiveThirtyEight- October 2018 and January 2019 8) Cisco Global Cloud Index: Forecast and Methodology, 2016-2021 - February 2018 and November 2018 DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 6

Financial Results DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 7

Lumpy But Healthy Comprehensive Solutions Support Diverse Customer Base HISTORICAL BOOKINGS ANNUALIZED GAAP BASE RENT(1)(2) $ in millions Space & Power Interconnection $100 $75 $50 $25 $0 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 4Q18 BOOKINGS BY PRODUCT(1)(2) $22.0 mm $4.6 mm $10.0 mm $0.5 mm $6.6 mm $43.8 mm TURN-KEY POWERED BASE COLOCATION NON-TECHNICAL INTERCONNECTION TOTAL BOOKINGS FLEX® BUILDING® Note: Darker shading represents interconnection bookings. Fourth quarter bookings are highlighted in lighter blue. 1) GAAP rental revenues include total rent for new leases and expansions. The timing between lease signing and lease commencement (and receipt of rents) may be significant. 2) Includes signings for new and re-leased space. DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 8

Top-Line Step Function Healthy Backlog Sets a Solid Foundation BACKLOG ROLL-FORWARD COMMENCEMENT TIMING $ in millions $ in millions 3Q18 Backlog Signings Commencements 4Q18 Backlog Current Period Backlog Total Backlog $37 $88 $5 $4 $148 $97 $97 $88 3Q18 Backlog Sign Commence 4Q18 Backlog 2019 2020 2021 Total Backlog Note: Totals may not add up due to rounding. Amounts shown represent GAAP annualized base rent from leases signed, but not yet commenced, and are based on current estimates of future lease commencement timing. Actual results may vary from current estimates. The lag between lease signing and lease commencement (and receipt of rents) may be significant. Reflects expected commencement date at time of signing. DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 9

Cycling Through Peak Vintage Renewals Gradually Improving Mark-to-Market RE-LEASING SPREADS FOURTH QUARTER 2018 FULL YEAR 2018 Rental Rate Change Rental Rate Change -2.6% +0.3% CASH CASH +3.2% +4.5% GAAP GAAP Signed renewal leases Signed renewal leases representing representing $138 million $330 million of annualized GAAP of annualized GAAP rental revenue rental revenue Note: Represents Turn-Key Flex®, Powered Base Building®, Colocation, and Non-Tech leases signed during the quarter ended December 31, 2018 and full year 2018. DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 10

Putting Exposure in Perspective Benefits of Scale and Diversification on Display EXPOSURE BY REVENUE 2019 CORE FFO/SHARE EXPOSURE USD CAD GBP EURO JPY HKD SGD AUD 1.0% BENCHMARK 1% 9% RATES 4% +/- 100 bps 82% 0% Midpoint of 0.5% 0.4% Guidance 0% $6.60 – $6.70(1) GBP EUR +/- 10% +/- 10% 3% 1% EXCHANGE RATES(2) U.S. DOLLAR INDEX 4Q17 4Q18 U.S. DOLLAR / U.S. DOLLAR / BRITISH POUND EURO 3.0% 3.4% INCREASE INCREASE Source: FactSet 1) Based on the midpoint of 2019 core FFO per share guidance of $6.60 – $6.70. Core FFO is a non-GAAP financial measure. For a definition of core FFO and a reconciliation to its nearest GAAP equivalent, see the Appendix. 2) Based on average exchange rates for the quarter ending December 31, 2018 compared to average exchange rates for the quarter ending December 31, 2017. DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 11

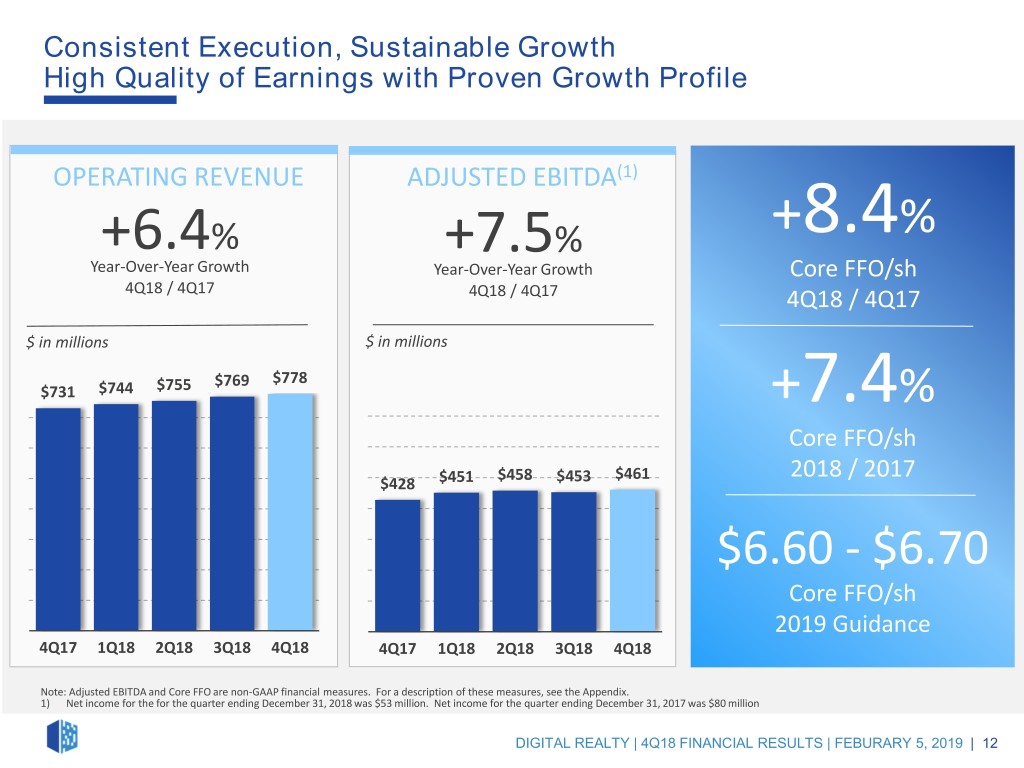

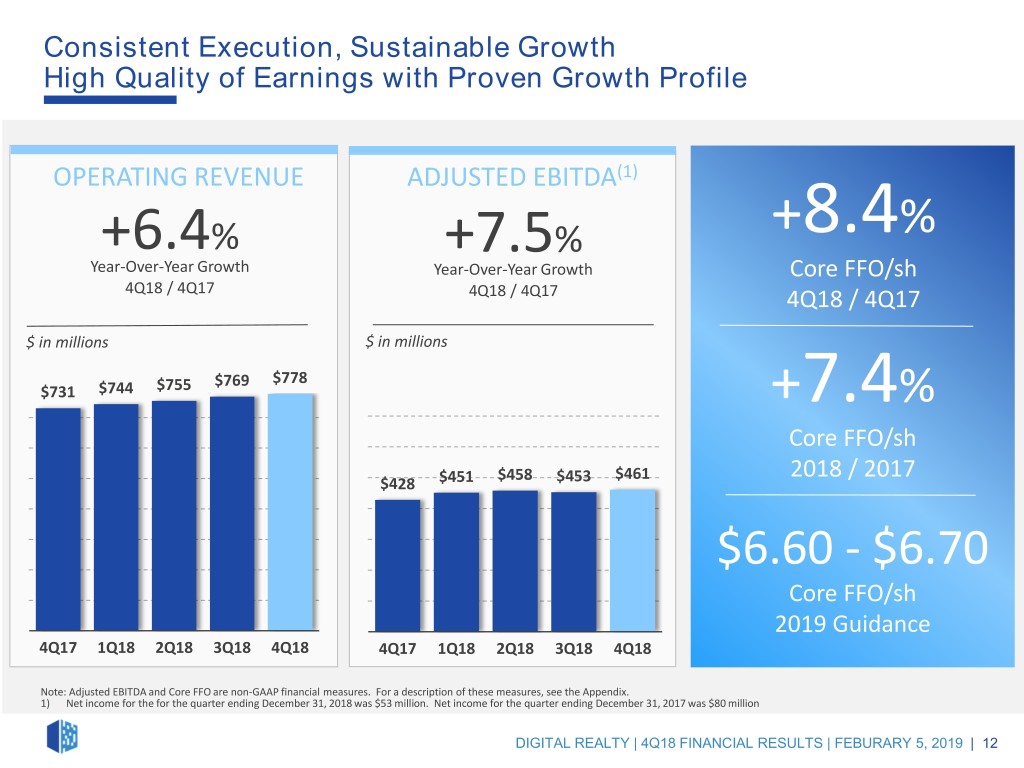

Consistent Execution, Sustainable Growth High Quality of Earnings with Proven Growth Profile OPERATING REVENUE ADJUSTED EBITDA(1) +6.4% +7.5% +8.4% Year-Over-Year Growth Year-Over-Year Growth Core FFO/sh 4Q18 / 4Q17 4Q18 / 4Q17 4Q18 / 4Q17 $ in millions $ in millions $769 $778 $731 $744 $755 +7.4% Core FFO/sh $458 $461 2018 / 2017 $428 $451 $453 $6.60 - $6.70 Core FFO/sh 2019 Guidance 4Q17 1Q18 2Q18 3Q18 4Q18 4Q17 1Q18 2Q18 3Q18 4Q18 Note: Adjusted EBITDA and Core FFO are non-GAAP financial measures. For a description of these measures, see the Appendix. 1) Net income for the for the quarter ending December 31, 2018 was $53 million. Net income for the quarter ending December 31, 2017 was $80 million DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 12

Prudently Financed Transaction Enhances Credit Stats Reflecting a Full-Quarter Contribution (1) (2) Net Debt to Adjusted EBITDA Fixed Charge Coverage Ratio 6.2x 4.8x 1.2x 5.0x 4.0x 0.8x 26% 9% Floating Rate Floating Rate Debt Debt(4)(5) 4Q18 Pro Forma for 4Q18 (4)(5) 4Q18 Pro Forma for 4Q18 Reported Ascenty JV and As Adjusted Reported Ascenty JV and As Adjusted (4)(5) Forward Equity(3) Forward Equity (3) 1) Calculated as total debt at balance sheet carrying value, plus capital lease obligations, plus our share of unconsolidated JV debt, less unrestricted cash and cash equivalents divided by the product of Adjusted EBITDA (inclusive of our share of JV EBITDA) multiplied by four. Adjusted EBITDA is a non-GAAP financial measure. For a description of Adjusted EBITDA and the calculation of these ratios, see the Appendix. 2) Fixed charge coverage ratio is Adjusted EBITDA divided by total fixed charges. Total fixed charges include interest expenses, capitalized interest, scheduled debt principal payments and preferred dividends, excluding bridge facility fees for the quarter ended December 31, 2018. Adjusted EBITDA is a non-GAAP financial measure. For a description of Adjusted EBITDA and the calculation of these ratios , see the Appendix. 3) Pro Forma for planned Ascenty JV and assumed forward equity closing. 4) Adjusted to include a full quarter of Ascenty’s adjusted EBITDA, assuming DLR’s share at 49%, and Brookfield’s expected investment in the joint venture. 5) Adjusted to reflect pro forma September 24, 2018 full settlement of the $1.1 billion forward equity offering executed on September 24, 2018. Assumes proceeds are used to repay borrowings under the global unsecured revolving credit facility. DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 13

Matching the Duration of Assets and Liabilities Clear Runway on the Left, No Bar Too Tall on the Right DEBT PROFILE DEBT MATURITY SCHEDULE AS OF DECEMBER 31, 2018(1)(2) (USD in billions) 94% Unsecured Unsecured Secured 6 YEARS 3.7% Weighted Avg. Weighted Avg. Maturity(1)(2) $3.2 Coupon(1) 74% Fixed Fixed Floating $1.9 $1.4 $1.0 $1.1 $0.8 £ $0.7 USD $0.5 $0.4 € $0.4 $0.1 GBP £ £ $0.0 £ £ € ¥ 62% Euro 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 USD Other Pro Rata Share of JV Debt Secured Mortgage Debt Unsecured Senior Notes Unsecured Term Loan Unsecured Credit Facilities(3) Unsecured Green Bonds Note: As of December 31, 2018. 1) Includes Digital Realty’s pro rata share of four unconsolidated joint venture loans. 2) Assumes exercise of extension options. 3) Includes Yen Facility. DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 14

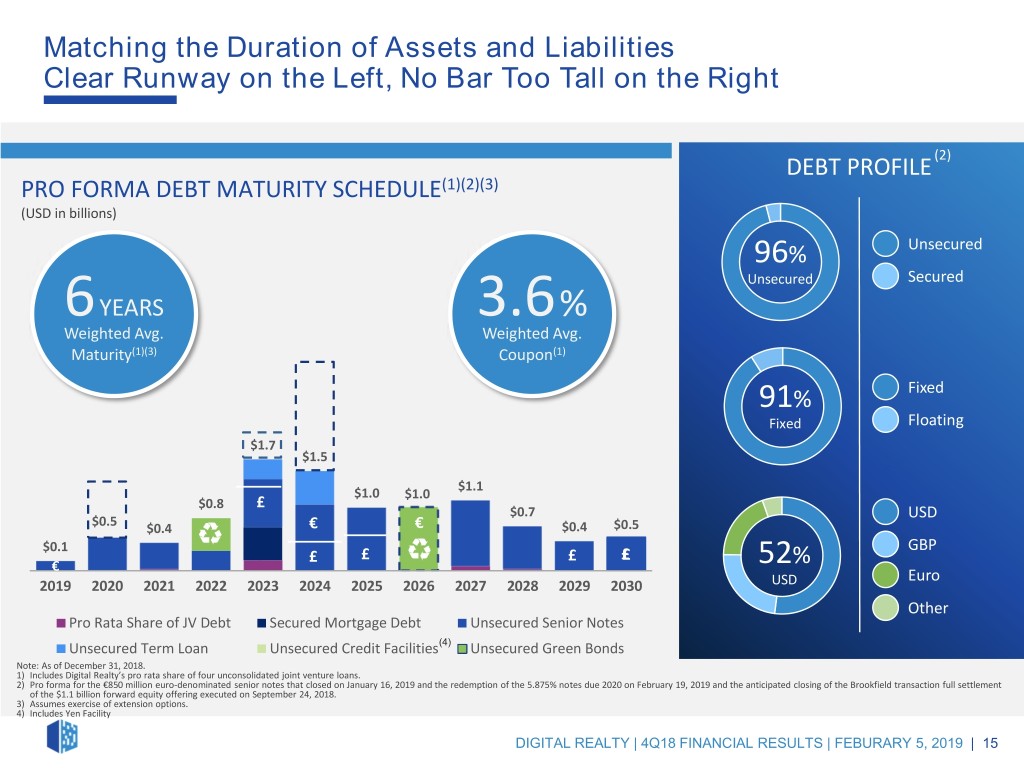

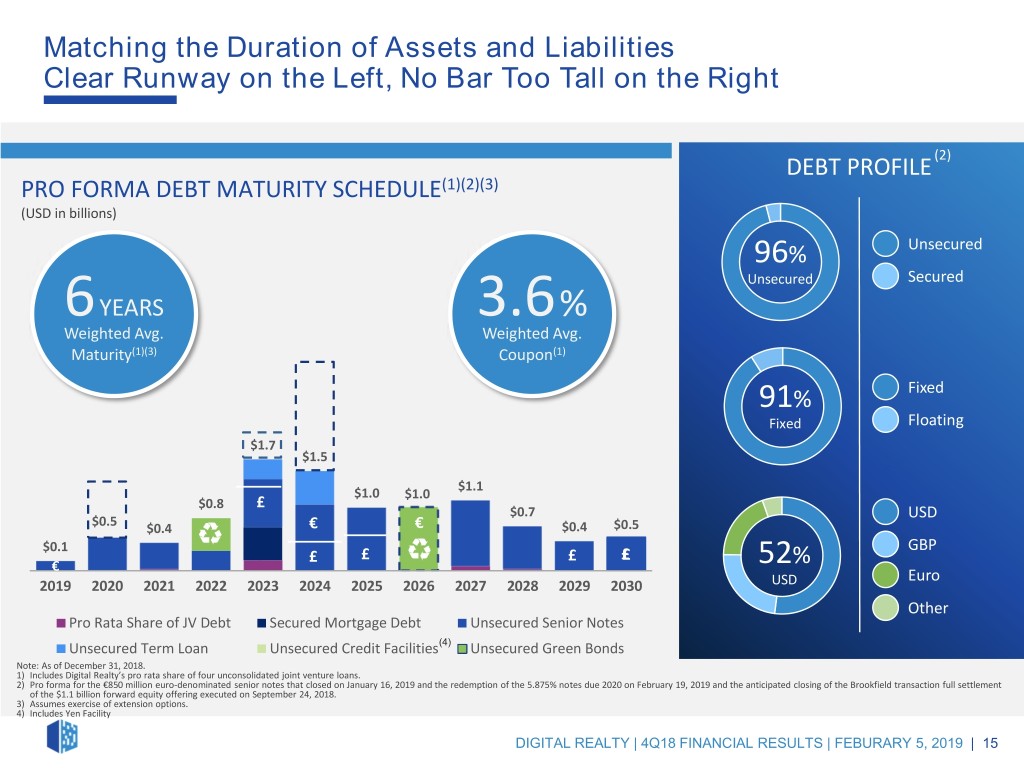

Matching the Duration of Assets and Liabilities Clear Runway on the Left, No Bar Too Tall on the Right DEBT PROFILE (2) PRO FORMA DEBT MATURITY SCHEDULE(1)(2)(3) (USD in billions) 96% Unsecured Unsecured Secured 6 YEARS 3.6% Weighted Avg. Weighted Avg. Maturity(1)(3) Coupon(1) 91% Fixed Fixed Floating $1.7 $1.5 £ $1.1 $1.0 $1.0 $0.8 £ $0.7 USD $0.5 $0.4 € € $0.4 $0.5 $0.1 GBP £ £ £ £ € 52% Euro 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 USD Other Pro Rata Share of JV Debt Secured Mortgage Debt Unsecured Senior Notes Unsecured Term Loan Unsecured Credit Facilities(4) Unsecured Green Bonds Note: As of December 31, 2018. 1) Includes Digital Realty’s pro rata share of four unconsolidated joint venture loans. 2) Pro forma for the €850 million euro-denominated senior notes that closed on January 16, 2019 and the redemption of the 5.875% notes due 2020 on February 19, 2019 and the anticipated closing of the Brookfield transaction full settlement of the $1.1 billion forward equity offering executed on September 24, 2018. 3) Assumes exercise of extension options. 4) Includes Yen Facility DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 15

Consistent Execution on Strategic Vision Delivering Current Results, Seeding Future Growth SUCCESSFUL 2018 INITIATIVES $268 mm 1. Deepening Connections with Customers 2018 Total Bookings Delivered record bookings in 2018, a 35% year-over-year increase 2. Extending Sustainability Leadership +90 MW Expanded renewable energy capacity Incremental Renewable Capacity 3. Exceeding Expectations +10% Delivered double-digit AFFO/sh growth 2018 / 2017 AFFO/sh (1) 4. Strengthening the Balance Sheet +1year Raised common equity, recast credit facility, locked in long-term debt Weighted Average Debt Maturity 1) For a definition and reconciliation of AFFO, please see the appendix. DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 16

Appendix DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 17

Robust Long-Term Demand, Lumpy Near-Term Signings Diverse Customer Base + Product Offerings HISTORICAL BOOKINGS TRAILING FOUR-QUARTER AVERAGE ANNUALIZED GAAP BASE RENT(1)(2) $ in millions Space & Power Interconnection $80 $60 $40 $20 $0 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 4Q18 TRAILING FOUR-QUARTER AVERAGE BOOKINGS BY PRODUCT(1)(2) $48.2 mm $2.4 mm $8.5 mm $0.6 mm $7.2 mm $66.9 mm TURN-KEY POWERED BASE COLOCATION NON-TECHNICAL INTERCONNECTION TOTAL BOOKINGS FLEX® BUILDING® Note: Darker shading represents interconnection bookings. 1) GAAP rental revenues include total rent for new leases and expansions. The timing between lease signing and lease commencement (and receipt of rents) may be significant. 2) Includes signings for new and re-leased space. DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 18

Appendix Management Statements on Non-GAAP Measures The information included in this presentation contains certain non-GAAP financial measures that management believes are helpful in understanding our business, as further described below. Our definition and calculation of non-GAAP financial measures may differ from those of other REITs, and, therefore, may not be comparable. The non-GAAP financial measures should not be considered an alternative to net income or any other GAAP measurement of performance and should not be considered an alternative to cash flows from operating, investing or financing activities as a measure of liquidity. Funds from Operations (FFO): We calculate funds from operations, or FFO, in accordance with the standards established by the National Association of Real Estate Investment Trusts, or NAREIT. FFO represents net income (loss) (computed in accordance with GAAP), excluding gains (or losses) from real estate transactions, non-controlling interests share of gain on sale of property, impairment of investment in real estate, real estate related depreciation and amortization (excluding amortization of deferred financing costs), unconsolidated JV real estate related depreciation & amortization, non-controlling interests in operating partnership and after adjustments for unconsolidated partnerships and joint ventures. Management uses FFO as a supplemental performance measure because, in excluding real estate related depreciation and amortization and gains and losses from property dispositions and after adjustments for unconsolidated partnerships and joint ventures, it provides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We also believe that, as a widely recognized measure of the performance of REITs, FFO will be used by investors as a basis to compare our operating performance with that of other REITs. However, because FFO excludes depreciation and amortization and captures neither the changes in the value of our data centers that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our data centers, all of which have real economic effect and could materially impact our financial condition and results from operations, the utility of FFO as a measure of our performance is limited. Other REITs may not calculate FFO in accordance with the NAREIT definition and, accordingly, our FFO may not be comparable to other REITs’ FFO. FFO should be considered only as a supplement to net income computed in accordance with GAAP as a measure of our performance. Core Funds from Operations (Core FFO): We present core funds from operations, or core FFO, as a supplemental operating measure because, in excluding certain items that do not reflect core revenue or expense streams, it provides a performance measure that, when compared year over year, captures trends in our core business operating performance. We calculate core FFO by adding to or subtracting from FFO (i) termination fees and other non-core revenues, (ii) transaction and integration expenses, (iii) gain from early extinguishment of debt, (iv) issuance costs associated with redeemed preferred stock, (v) equity in earnings adjustment for non-core items, (vi) severance, equity acceleration, and legal expenses, (vii) bridge facility fees and (viii) other non-core expense adjustments. Because certain of these adjustments have a real economic impact on our financial condition and results from operations, the utility of core FFO as a measure of our performance is limited. Other REITs may calculate core FFO differently than we do and accordingly, our core FFO may not be comparable to other REITs' core FFO. Core FFO should be considered only as a supplement to net income computed in accordance with GAAP as a measure of our performance. Adjusted Funds from Operations (AFFO): We present adjusted funds from operations, or AFFO, as a supplemental operating measure because, when compared year over year, it assesses our ability to fund dividend and distribution requirements from our operating activities. We also believe that, as a widely recognized measure of the operations of REITs, AFFO will be used by investors as a basis to assess our ability to fund dividend payments in comparison to other REITs, including on a per share and unit basis. We calculate AFFO by adding to or subtracting from core FFO (i) non-real estate depreciation, (ii) amortization of deferred financing costs, (iii) amortization of debt discount/premium, (iv) non-cash stock-based compensation expense, (v) straight-line rental revenue, (vi) straight-line rental expense, (vii) above- and below-market rent amortization, (viii) deferred non-cash tax expense, (ix) capitalized leasing compensation, (x) recurring capital expenditures and (xi) capitalized internal leasing commissions. Other REITs may calculate AFFO differently than we do and accordingly, our AFFO may not be comparable to other REITs’ AFFO. AFFO should be considered only as a supplement to net income computed in accordance with GAAP as a measure of our performance. DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 19

Appendix Management Statements on Non-GAAP Measures EBITDA and Adjusted EBITDA: We believe that earnings before interest, loss from early extinguishment of debt, income taxes, depreciation and amortization, and impairment of investments in real estate, or EBITDA, and Adjusted EBITDA (as defined below), are useful supplemental performance measures because they allow investors to view our performance without the impact of non-cash depreciation and amortization or the cost of debt and, with respect to Adjusted EBITDA, severance, equity acceleration, and legal expenses, transaction and integration expenses, (gain) loss on real estate transactions, equity in earnings adjustment for non-core items, other non-core adjustments, net, noncontrolling interests, preferred stock dividends, including undeclared dividends, and issuance costs associated with redeemed preferred stock. Adjusted EBITDA is EBITDA excluding severance, equity acceleration, and legal expenses, transaction and integration expenses, (gain) loss on real estate transactions, equity in earnings adjustment for non-core items, other non-core adjustments, net, non-controlling interests, preferred stock dividends, including undeclared dividends, and issuance costs associated with redeemed preferred stock. In addition, we believe EBITDA and Adjusted EBITDA are frequently used by securities analysts, investors and other interested parties in the evaluation of REITs. Because EBITDA and Adjusted EBITDA are calculated before recurring cash charges including interest expense and income taxes, exclude capitalized costs, such as leasing commissions, and are not adjusted for capital expenditures or other recurring cash requirements of our business, their utility as a measure of our performance is limited. Other REITs may calculate EBITDA and Adjusted EBITDA differently than we do and accordingly, our EBITDA and Adjusted EBITDA may not be comparable to other REITs’ EBITDA and Adjusted EBITDA. Accordingly, EBITDA and Adjusted EBITDA should be considered only as supplements to net income computed in accordance with GAAP as a measure of our financial performance. Net Operating Income (NOI) and Cash NOI: Net operating income, or NOI, represents rental revenue, tenant reimbursement revenue and interconnection revenue less utilities expense, rental property operating expenses, property taxes and insurance expenses (as reflected in the statement of operations). NOI is commonly used by stockholders, company management and industry analysts as a measurement of operating performance of the company’s rental portfolio. Cash NOI is NOI less straight-line rents and above- and below-market rent amortization. Cash NOI is commonly used by stockholders, company management and industry analysts as a measure of property operating performance on a cash basis. However, because NOI and cash NOI exclude depreciation and amortization and capture neither the changes in the value of our data centers that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our data centers, all of which have real economic effect and could materially impact our results from operations, the utility of NOI and cash NOI as measures of our performance is limited. Other REITs may calculate NOI and cash NOI differently than we do and, accordingly, our NOI and cash NOI may not be comparable to other REITs’ NOI and cash NOI. NOI and cash NOI should be considered only as supplements to net income computed in accordance with GAAP as measures of our performance. DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 20

Appendix Management Statements on Non-GAAP Measures The information included in this presentation contains forward-looking statements. Such statements are based on management’s beliefs and assumptions made based on information currently available to management. Such forward-looking statements include statements relating to: our economic outlook; public cloud services spending; the expected timing, locations, benefits and product offerings for IBM Cloud and Service Exchange; our acquisition of Ascenty; our sustainability initiatives; the expected effect of foreign currency translation adjustments on our financials; demand drivers and economic growth outlook; business drivers; sources and uses; our expected development plans and completions, including timing, total square footage, IT capacity and raised floor space upon completion; expected availability for leasing efforts and colocation initiatives; organizational initiatives; our expected product offerings; our expected Go-to-Market strategy; joint venture opportunities; occupancy and total investment; our expected investment in our properties; our estimated time to stabilization and targeted returns at stabilization of our properties; our expected future acquisitions; acquisitions strategy; available inventory and development strategy; the signing and commencement of leases, and related rental revenue; lag between signing and commencement of leases; future rents; our expected same store portfolio growth; our expected growth and stabilization of development completions and acquisitions; our expected mark-to-market rates on lease expirations, lease rollovers and expected rental rate changes; our expected yields on investments; our expectations with respect to capital investments at lease expiration on existing data center or colocation space; barriers to entry; competition; debt maturities; lease maturities; our expected returns on invested capital; estimated absorption rates; our other expected future financial and other results, and the assumptions underlying such results; our top investment geographies and market opportunities; our expected colocation expansions; our ability to access the capital markets; expected time and cost savings to our customers; our customers’ capital investments; our plans and intentions; future data center utilization, utilization rates, growth rates, trends, supply and demand, and demand drivers; datacenter outsourcing trends; datacenter expansion plans; estimated kW/MW requirements; growth in the overall Internet infrastructure sector and segments thereof; the replacement cost of our assets; the development costs of our buildings, and lead times; estimated costs for customers to deploy or migrate to a new data center; capital expenditures; the effect new leases and increases in rental rates will have on our rental revenues and results of operations; lease expiration rates; our ability to borrow funds under our credit facilities; estimates of the value of our development portfolio; our ability to meet our liquidity needs, including the ability to raise additional capital; the settlement of our forward sales agreements; credit ratings; capitalization rates, or cap rates; market forecasts; potential new locations; the expected impact of our global expansion; dividend payments and our dividend policy; projected financial information and covenant metrics; annualized; core FFO run-rate and NOI Growth; other forward-looking financial data; leasing expectations; our exposure to tenants in certain industries; our expectations and underlying assumptions regarding our sensitivity to fluctuations in foreign exchange rates and energy prices; and the sufficiency of our capital to fund future requirements. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “approximately,” “intends,” “plans,” “pro forma,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and discussions which do not relate solely to historical matters. Such statements are subject to risks, uncertainties and assumptions, are not guarantees of future performance and may be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control that may cause actual results to vary materially. Some of the risks and uncertainties include, among others, the following: reduced demand for data centers or decreases in information technology spending; decreased rental rates, increased operating costs or increased vacancy rates; increased competition or available supply of data center space; the suitability of our data centers and data center infrastructure, delays or disruptions in connectivity or availability of power, or failures or breaches of our physical and information security infrastructure or services; our dependence upon significant customers, bankruptcy or insolvency of a major customer or a significant number of smaller customers, or defaults on or non-renewal of leases by customers; breaches of our obligations or restrictions under our contracts with our customers; our inability to successfully develop and lease new properties and development space, and delays or unexpected costs in development of properties; the impact of current global and local economic, credit and market conditions; our inability to retain data center space that we lease or sublease from third parties; difficulty acquiring or operating properties in foreign jurisdictions; our failure to realize the intended benefits from, or disruptions to our plans and operations or unknown or contingent liabilities related to, our recent acquisitions; our failure to successfully integrate and operate acquired or developed properties or businesses; difficulties in identifying properties to acquire and completing acquisitions; risks related to joint venture investments, including as a result of our lack of control of such investments; risks associated with using debt to fund our business activities, including re-financing and interest rate risks, our failure to repay debt when due, adverse changes in our credit ratings or our breach of covenants or other terms contained in our loan facilities and agreements; our failure to obtain necessary debt and equity financing, and our dependence on external sources of capital; financial market fluctuations and changes in foreign currency exchange rates; adverse economic or real estate developments in our industry or the industry sectors that we sell to, including risks relating to decreasing real estate valuations and impairment charges and goodwill and other intangible asset impairment charges; our inability to manage our growth effectively; losses in excess of our insurance coverage; environmental liabilities and risks related to natural disasters; our inability to comply with rules and regulations applicable to our company; our failure to maintain our status as a REIT for federal income tax purposes; our operating partnership’s failure to qualify as a partnership for federal income tax purposes; restrictions on our ability to engage in certain business activities; and changes in local, state, federal and international laws and regulations, including related to taxation, real estate and zoning laws, and increases in real property tax rates. The risks included here are not exhaustive, and additional factors could adversely affect our business and financial performance. We discussed a number of additional material risks in our annual report on Form 10-K for the year ended December 31, 2017 and other filings with the Securities and Exchange Commission, including our Current Report on Form 8-K filed on September 24, 2018. Those risks continue to be relevant to our performance and financial condition. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time and it is not possible for management to predict all such risk factors, nor can it assess the impact of all such risk factors on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We expressly disclaim any responsibility to update forward-looking statements, whether as a result of new information, future events or otherwise. Digital Realty, Digital Realty Trust, the Digital Realty logo, Turn-Key Flex and Powered Base Building are registered trademarks and service marks of Digital Realty Trust, Inc. in the United States and/or other countries. DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 21

Reconciliation of Non-GAAP Items To Their Closest GAAP Equivalent Funds from operations (1) Q418 Q318 Q218 Q118 FY 2018 Q417 FY 2017 Net income (loss) available to common stockholders $ 31,230 $ 67,268 $ 65,134 $ 86,298 $ 249,930 $ 53,306 $ 173,149 Noncontrolling interests in operating partership 1,300 2,700 2,700 3,480 10,180 2,138 3,770 Real estate related depreciation and amortization (2) 295,724 290,757 295,750 291,686 1,173,917 284,924 830,252 Real estate related depreciation and amortization related to investment in unconsolidated joint venture 3,615 3,775 3,722 3,476 14,588 3,323 11,566 (Gain) loss on sale of property (7) (26,577) (14,192) (39,273) (80,049) (30,746) (40,355) Non-controlling interests share of gain on sale of property - - - - - 3,900 3,900 Impairment of investments in real estate - - - - - - 28,992 Funds from operations (FFO) $ 331,862 $ 337,923 $ 353,114 $ 345,667 $ 1,368,566 $ 316,845 $ 1,011,274 Funds from operations (FFO) per diluted share $ 1.54 $ 1.57 $ 1.64 $ 1.61 $ 3.25 $ 1.48 $ 4.16 Net income (loss) per diluted share available to common stockholders $ 0.15 $ 0.33 $ 0.32 $ 0.42 $ 0.73 $ 0.26 $ 0.73 FFO available to common stockholders and unitholders 331,862 337,923 353,114 345,667 1,368,566 316,845 1,011,274 FFO available to common stockholders and unitholders -- diluted $ 331,862 $ 337,923 $ 353,114 $ 345,667 $ 1,368,566 $ 316,845 $ 1,011,274 Termination fees and other non-core revenues (21) (518) (3,663) (858) (5,060) (447) (1,031) Transaction expenses 25,917 9,626 5,606 4,178 45,327 15,681 76,048 (Gain) loss from early extinguishment of debt 1,568 - - - 1,568 - (1,990) Issuance costs associated with redeemed preferred stock - - - - - - 6,309 Equity in earnings adjustment for non-core items - - - - - - (3,285) Severance related accrual, equity acceleration, and legal expenses 602 645 1,822 234 3,303 1,209 4,731 Bridge facility fees - - - - - - 3,182 Other non-core expense adjustments 1,471 2,269 152 431 4,323 2 3,077 Core Funds from operations (FFO) $ 361,399 $ 349,945 $ 357,031 $ 349,652 $ 1,418,027 $ 333,290 $ 1,098,315 Non real estate depreciation 3,638 3,200 3,038 3,103 12,979 3,049 12,212 Amortization of deferred financing costs 3,128 3,066 2,953 3,060 12,207 3,092 10,664 Amortization of debt discount 971 902 882 875 3,630 858 3,084 Non cash compensation 5,609 5,823 8,419 5,497 25,348 3,923 17,900 Straight-line rent revenue (11,157) (10,511) (8,489) (10,266) (40,423) (8,705) (16,565) Straight-line rent expense 2,052 2,482 2,669 2,547 9,750 (635) 12,107 Above and below market rent amortization 6,521 6,552 6,794 6,666 26,533 6,562 1,770 Non-cash tax expense/(benefit) (only disclosed for 2014 - 2018) (8,835) (1,783) (1,137) (216) (11,971) (1,100) (2,912) Capitalized leasing compensation (2,501) (2,606) (2,825) (2,998) (10,930) (3,567) (11,886) Recurring capital expenditures (only disclosed for 2012 - 2018) (47,951) (22,500) (34,447) (27,328) (132,226) (45,298) (136,290) Internal leasing commissions (only disclosed for 2012 - 2018) (2,659) (2,547) (2,822) (2,049) (10,077) (1,217) (5,290) Adjusted funds from operations (1) $ 310,215 $ 332,023 $ 332,066 $ 328,543 $ 1,302,847 $ 290,252 $ 983,109 (1) Funds from operations and Adjusted funds from operations for all periods presented above include the results of properties sold (2) Real estate related depreciation and amortization was computed as follows: Q418Q318Q218Q118 FY 2018 Q417 FY 2017 Depreciation and amortization per income statement 299,362$ 293,957$ 298,788$ 294,789$ 1,186,896$ 287,973$ 842,464$ Non real estate depreciation (3,638) (3,200) (3,038) (3,103) (12,979) (3,049) (12,212) 295,724$ 290,757$ 295,750$ 291,686$ 1,173,917$ 284,924$ 830,252$ Weighted-average shares and units outstanding - diluted 215,417214,937 214,895 214,803 214,951 214,424 166,938 DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 22

Reconciliation of Non-GAAP Items To Their Closest GAAP Equivalent Cash interest expense and fixed charges Q418 Q318 Q218 Q118 FY 2018 Q417 FY 2017 Total GAAP interest expense (including discontinued operations) $ 84,883 $ 80,851 $ 78,810 $ 76,985 $ 321,529 $ 73,989 $ 258,642 Bridge facility fees - - - - - - (3,182) Capitalized interest 9,462 9,725 8,164 7,385 34,736 8,045 21,714 Change in accrued interest and other noncash amounts (43,892) 20,151 (10,888) 1,743 (32,886) (29,588) (43,911) Cash interest expense 50,453 110,727 76,086 86,113 323,379 52,446 233,263 Scheduled debt principal payments and preferred dividends $ 153 $ 150 $ 98 $ 193 $ 594 $ 141 $ 546 Total fixed charges (includes GAAP interest expense, capitalized interest, and scheduled debt principal payments and preferred dividends) $ 20,329 $ 20,329 $ 20,329 $ 20,329 $ 81,316 $ 20,329 $ 68,802 Reconciliation of EBITDA Q418 Q318 Q218 Q118 FY 2018 Q417 FY 2017 Net income (loss) available to common stockholders $ 31,230 $ 67,268 $ 65,134 $ 86,298 $ 249,930 $ 53,306 $ 173,149 Interest 84,883 80,851 78,810 76,985 321,529 73,989 258,642 Loss from early extinguishment of debt 1,568 - - - 1,568 - (1,990) Taxes (5,843) 2,432 2,121 3,374 2,084 545 7,901 Depreciation and amortization 299,362 293,957 298,788 294,789 1,186,896 287,973 842,464 Impairment of investments in real estate - - - - - - 28,992 EBITDA 411,200 444,508 444,853 461,446 1,762,007 415,813 1,309,158 EBITDA, less effect of gain on sale of assets $ 411,200 $ 444,508 $ 444,853 $ 461,446 $ 1,762,007 $ 415,813 $ 1,309,158 Reconciliation of Adjusted EBITDA Q418 Q318 Q218 Q118 FY 2018 Q417 FY 2017 EBITDA $ 411,200 $ 444,508 $ 444,853 $ 461,446 $ 1,762,007 $ 415,813 $ 1,309,158 Severance accrual and equity acceleration 602 645 1,822 234 3,303 1,209 4,731 Transaction and integration expenses 25,917 9,626 5,606 4,178 45,327 15,681 76,048 (Gain) loss on sale of properties (7) (26,577) (14,192) (39,273) (80,049) (30,746) (40,355) Equity in earnings adjustment for non-core items - - - - - - (3,285) Other non-core expense adjustments 1,471 2,269 (2,984) 431 1,187 2 3,077 Noncontrolling interests 1,038 2,667 2,696 3,468 9,869 6,023 8,008 Preferred stock dividends 20,329 20,329 20,329 20,329 81,316 20,329 68,802 Costs on redemption of preferred stock - - - - - - 6,309 Adjusted EBITDA 460,550 453,467 458,130 450,813 1,822,960 428,311 1,432,493 Adjusted EBITDA, less effect of gain on sale of assets $ 460,550 $ 453,467 $ 458,130 $ 450,813 $ 1,822,960 $ 428,311 $ 1,432,493 Reconciliation of Net Operating Income (NOI) Q418 Q318 Q218 Q118 FY 2018 Q417 FY 2017 Operating income 122,847$ 139,065$ 144,062$ 143,813$ $ 549,787 117,198$ $ 451,295 Less: Fee income (only disclosed for 2008 through 2018) (2,896) (1,469) (2,343) (1,133) (7,841) (1,386) (6,372) Other revenue (21) (518) (527) (858) (1,924) (447) (1,031) Add: Depreciation and amortization 299,362 293,957 298,788 294,789 1,186,896 287,973 842,464 General and administrative 38,801 40,997 44,277 36,289 160,364 44,311 156,710 Severance accrual and equity acceleration 602 645 1,822 234 3,303 1,209 4,731 Transactions 25,917 9,626 5,606 4,178 45,327 15,681 76,048 Impairment of investments in real estate - - - - - - 28,992 Other expenses 1,096 1,139 152 431 2,818 2 3,077 Net Operating Income 485,708$ 483,442$ 491,837$ 477,743$ $ 1,938,730 464,541$ $ 1,555,914 DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 23

Reconciliation of Non-GAAP Items To Their Closest GAAP Equivalent Net Debt/LQA Adjusted EBTDA Net Debt/LQA Adjusted EBTDA – As Adjusted QE 12/31/2018 QE 12/31/2018 Net Debt as of December 31, 2018 $ 11,517,315 Total debt at balance sheet carrying value $ 11,101,479 Less: Expected Brookfield equity investment in joint venture (675,000) Add: DLR share of unconsolidated joint venture debt 268,692 Less: Ascenty Loan (100% share) (600,000) Add: Capital lease obligations 263,844 Plus: Ascenty Loan (49% share) 294,000 Plus: Unrestricted cash at Ascenty (100% share) 106,000 Less: Unrestricted cash (116,700) Less: Unrestricted cash at Ascenty (49% share) (51,940) Net Debt as of December 31, 2018 $ 11,517,315 Less: Gross Proceeds from Forward Equity (1,104,575) Net Debt as of December 31, 2018 (As Adjusted) $ 9,485,800 (i) Net Debt / LQA Adjusted EBITDA 6.2x (ii) Net Debt / LQA Adjusted EBITDA (As Adjusted) 5.0x (i) Adjusted EBITDA (ii) Adjusted EBITDA (As Adjusted) Adjusted EBITDA (a) $ 466,266 Net Income (loss) available to common stockholders $ 31,230 Less: Ascenty EBITDA (100% share) (3,302) Interest 84,883 Plus: Ascenty EBITDA (49% share, adjusted for full-quarter activity) 7,293 Adjusted EBITDA (As Adjusted for Ascenty) $ 470,257 DLR share of unconsolidated joint venture interest expense 2,101 (Gain) loss from early extinguishment of debt 1,568 LQA Adjusted EBITDA (Adjusted EBITDA x 4) $ 1,881,026 Taxes (income) expense (5,843) Fixed Charge Coverage Ratio (LQA Adjusted EBITDA/Total Fixed Charges) Depreciation & amortization 299,362 QE 12/31/2018 DLR share of unconsolidated joint venture depreciation 3,615 GAAP interest expense plus capitalized interest, less bridge facility fees $ 94,345 EBITDA $ 416,916 Scheduled debt principal payments 153 Preferred dividends 20,329 Total fixed charges $ 114,827 Severance accrual, equity acceleration and legal expenses 602 Transaction and integration expense 25,917 Fixed charge coverage ratio 4.0x (Gain) on real estate transactions (7) Fixed Charge Coverage Ratio (LQA Adjusted EBITDA/Total Fixed Charges) - As Adjusted Other non-core adjustments, net 1,471 QE 12/31/2018 Non-controlling interests 1,038 Total fixed charges $ 114,827 Preferred stock dividends, including undeclared dividends 20,329 Less: Adjustment to Interest on 49% Share of Ascenty Loan (5,387) Adjusted EBITDA (a) $ 466,266 Less: Lower Global Credit Facility Interest from Brookfield Investment and Forward Equity (12,295) Total fixed charges $ 97,145 LQA Adjusted EBITDA (Adjusted EBITDA x 4) $ 1,865,062 Fixed charge coverage ratio 4.8x (a) Includes certain financial information from unconsolidated joint ventures. DIGITAL REALTY | 4Q18 FINANCIAL RESULTS | FEBURARY 5, 2019 | 24