| Financial Supplement | |

| Table of Contents | First Quarter 2019 | |

| Overview | PAGE | ||||

| Corporate Information | |||||

| Ownership Structure | |||||

| Key Quarterly Financial Data | |||||

| Consolidated Statements of Operations | |||||

| Earnings Release | |||||

| 2019 Outlook | |||||

| Consolidated Quarterly Statements of Operations | |||||

| Funds From Operations and Core Funds From Operations | |||||

| Adjusted Funds From Operations | |||||

| Balance Sheet Information | |||||

| Consolidated Balance Sheets | |||||

| Components of Net Asset Value | |||||

Consolidated Debt Analysis and Global Unsecured Revolving Credit Facility | |||||

| Debt Maturities | |||||

| Debt Analysis & Covenant Compliance | |||||

| Internal Growth | |||||

| Same-Capital Operating Trend Summary | |||||

| Summary of Leasing Activity - Signed | |||||

| Summary of Leasing Activity - Commenced | |||||

| Lease Expirations and Lease Distribution | |||||

| Lease Expirations - By Product Type | |||||

| Top 20 Customers by Annualized Rent | |||||

| Portfolio Summary | |||||

| Portfolio Overview by Product Type | |||||

| Product Overview by Metropolitan Area | |||||

| Occupancy Analysis | |||||

| External Growth | |||||

| Development Lifecycle - Committed Active Development | |||||

| Development Lifecycle - In Service | |||||

| Construction Projects in Progress | |||||

| Historical Capital Expenditures and Investments in Real Estate | |||||

| Development Lifecycle - Held for Development | |||||

| Acquisitions / Dispositions / Joint Ventures | |||||

| Unconsolidated Joint Ventures | |||||

| Additional Information | |||||

Reconciliation of Earnings Before Interest, Taxes, Depreciation & Amortization and Financial Ratios | |||||

| Management Statements on Non-GAAP Measures | 38 | ||||

| Forward-Looking Statements | |||||

| Financial Supplement | |

| Corporate Information | First Quarter 2019 | |

Corporate Profile

Digital Realty owns, acquires, develops and operates data centers. The company is focused on providing data center, colocation and interconnection solutions for domestic and international customers across a variety of industry verticals ranging from cloud and information technology services, communications and social networking to financial services, manufacturing, energy, healthcare, and consumer products. As of March 31, 2019, the company's 215 data centers, including 35 data centers held as investments in unconsolidated joint ventures, contain applications and operations critical to the day-to-day operations of technology industry and corporate enterprise data center customers. Digital Realty's portfolio is comprised of approximately 29.6 million square feet, excluding approximately 3.2 million square feet of space under active development and 2.1 million square feet of space held for future development, located throughout North America, Europe, Latin America, Asia and Australia. For additional information, please visit the company's website at www.digitalrealty.com.

Corporate Headquarters

Four Embarcadero Center, Suite 3200

San Francisco, California 94111

Telephone: (415) 738-6500

Website: www.digitalrealty.com

Senior Management

A. William Stein: Chief Executive Officer

Andrew P. Power: Chief Financial Officer

Gregory S. Wright: Chief Investment Officer

Christopher L. Sharp: Chief Technology Officer

Corey J. Dyer: Executive Vice President, Global Sales & Marketing

Erich J. Sanchack: Executive Vice President, Operations

Investor Relations

To request more information or to be added to our e-mail distribution list, please visit our website: www.digitalrealty.com

(Please proceed to the Investor Relations section)

Analyst Coverage

| Bank of America | ||||||||

| BMO Capital Markets | Merrill Lynch | Barclays Capital | Berenberg | Citigroup | ||||

| Ari Klein | Michael Funk | Ross Smotrich | Nate Crossett | Michael Rollins | ||||

| (212) 885-4103 | (646) 855-5664 | (212) 526-2306 | (646) 949-9030 | (212) 816-1116 | ||||

| Cowen & Company | Credit Suisse | Deutsche Bank | Green Street Advisors | Guggenheim Securities | ||||

| Colby Synesael | Sami Badri | Matthew Niknam | Lukas Hartwich | Robert Gutman | ||||

| (646) 562-1355 | (212) 538-1727 | (212) 250-4711 | (949) 640-8780 | (212) 518-9148 | ||||

| J.P. Morgan | Jefferies | KeyBanc Capital | MoffettNathanson | Morgan Stanley | ||||

| Richard Choe | Jonathan Petersen | Jordan Sadler | Nick Del Deo | Simon Flannery | ||||

| (212) 662-6708 | (212) 284-1705 | (917) 368-2280 | (212) 519-0025 | (212) 761-6432 | ||||

| Morningstar | New Street Research | RBC Capital Markets | Raymond James | Robert W. Baird | ||||

| Matthew Dolgin | Spencer Kurn | Jonathan Atkin | Frank Louthan | David Rodgers | ||||

| (312) 696-6783 | (212) 921-2067 | (415) 633-8589 | (404) 442-5867 | (216) 737-7341 | ||||

| Stifel | SunTrust | UBS | Wells Fargo | William Blair | ||||

| Erik Rasmussen | Gregory Miller | John Hodulik | Jennifer Fritzsche | James Breen | ||||

| (212) 271-3461 | (212) 303-4169 | (212) 713-4226 | (312) 920-3548 | (617) 235-7513 | ||||

This Earnings Press Release and Supplemental Information package supplements the information provided in our quarterly and annual reports filed with the Securities and Exchange Commission. Additional information about us and our data centers is also available on our website at www.digitalrealty.com.

3

| Financial Supplement | |

Corporate Information (Continued) | First Quarter 2019 | |

Stock Listing Information

The stock of Digital Realty Trust, Inc. is traded primarily on the New York Stock Exchange under the following symbols:

| Common Stock: | DLR | |

| Series C Preferred Stock: | DLRPRC | |

| Series G Preferred Stock: | DLRPRG | |

| Series H Preferred Stock: | DLRPRH (1) | |

| Series I Preferred Stock: | DLRPRI | |

| Series J Preferred Stock: | DLRPRJ | |

| Series K Preferred Stock: | DLRPRK | |

Symbols may vary by stock quote provider.

Credit Ratings

| Standard & Poors | |||

| Corporate Credit Rating: | BBB | (Positive Outlook) | |

| Preferred Stock: | BB+ | ||

| Moody's | |||

| Issuer Rating: | Baa2 | (Stable Outlook) | |

| Preferred Stock: | Baa3 | ||

| Fitch | |||

| Issuer Default Rating: | BBB | (Stable Outlook) | |

| Preferred Stock: | BB+ | ||

These credit ratings may not reflect the potential impact of risks relating to the structure or trading of the company’s securities and are provided solely for informational purposes. Credit ratings are not recommendations to buy, hold or sell any security, and may be revised or withdrawn at any time by the issuing rating agency at its sole discretion. The company does not undertake any obligation to maintain the ratings or to advise of any change in ratings. Each agency’s rating should be evaluated independently of any other agency’s rating. An explanation of the significance of the ratings may be obtained from each of the rating agencies.

Common Stock Price Performance

The following summarizes recent activity of Digital Realty's common stock (DLR):

| Three Months Ended | |||||||||||||||

| 31-Mar-19 | 31-Dec-18 | 30-Sep-18 | 30-Jun-18 | 31-Mar-18 | |||||||||||

| High price | $120.93 | $117.87 | $125.10 | $112.07 | $115.08 | ||||||||||

| Low price | $100.05 | $100.57 | $110.80 | $100.50 | $96.56 | ||||||||||

| Closing price, end of quarter | $119.00 | $106.55 | $112.48 | $111.58 | $105.38 | ||||||||||

| Average daily trading volume | 1,472,260 | 1,543,927 | 1,192,244 | 1,121,334 | 1,565,456 | ||||||||||

Indicated dividend per common share (2) | $4.32 | $4.04 | $4.04 | $4.04 | $4.04 | ||||||||||

| Closing annual dividend yield, end of quarter | 3.6 | % | 3.8 | % | 3.6 | % | 3.6 | % | 3.8 | % | |||||

Shares and units outstanding, end of quarter (3) | 217,687,598 | 217,006,540 | 214,607,642 | 214,553,149 | 214,611,402 | ||||||||||

| Closing market value of shares and units outstanding (4) | $25,904,824 | $23,122,047 | $24,139,068 | $23,939,840 | $22,615,749 | ||||||||||

| (1) | Redeemed April 1, 2019. |

| (2) | On an annualized basis. |

| (3) | As of March 31, 2019, the total number of shares and units includes 208,214,139 shares of common stock, 7,083,623 common units held by third parties and 2,389,836 common units and vested and unvested long-term incentive units held by directors, officers and others and excludes all shares of common stock potentially issuable upon conversion of our series C, series G, series H (redeemed on April 1, 2019), series I, series J, and series K cumulative redeemable preferred stock upon certain change of control transactions. Also excludes 9,775,000 shares of common stock that may be issued upon full physical settlement of the September 2018 forward sales agreements. |

| (4) | Dollars in thousands as of the end of the quarter. |

This Earnings Press Release and Supplemental Information package supplements the information provided in our quarterly and annual reports filed with the Securities and Exchange Commission. Additional information about us and our data centers is also available on our website at www.digitalrealty.com.

4

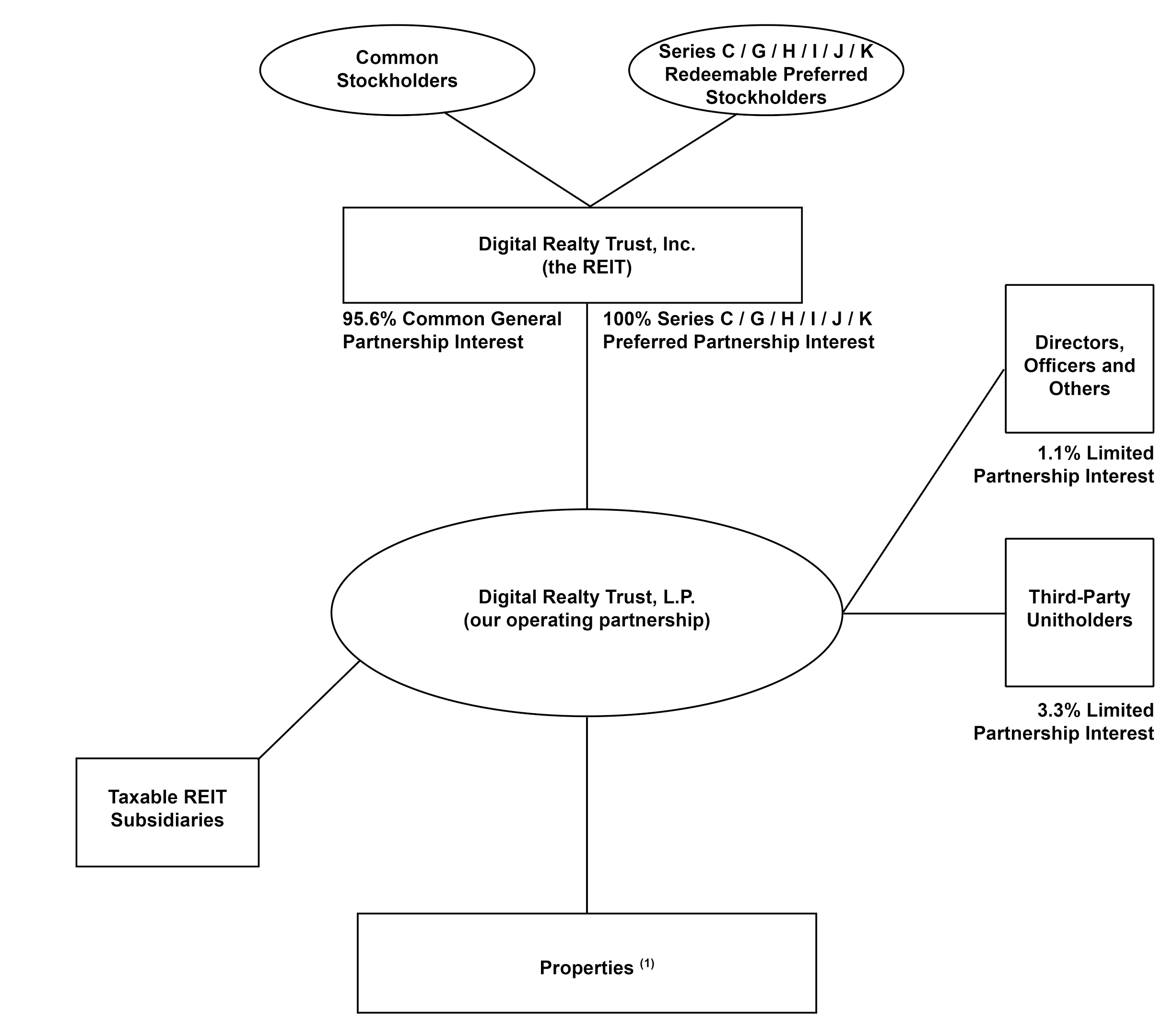

| Ownership Structure |  | Financial Supplement |

| As of March 31, 2019 | First Quarter 2019 | |

| Partner | # of Units (2) | % Ownership | ||||

| Digital Realty Trust, Inc. | 208,214,139 | 95.6 | % | |||

| Third-Party Unitholders | 7,083,623 | 3.3 | % | |||

| Directors, Officers and Others (3) | 2,389,836 | 1.1 | % | |||

| Total | 217,687,598 | 100.0 | % | |||

| (1) | Includes properties owned by joint ventures. |

| (2) | The total number of units includes 208,214,139 general partnership common units, 7,083,623 common units held by third parties and 2,389,836 common units and vested and unvested long-term incentive units held by directors, officers and others, and excludes all shares of common stock potentially issuable upon conversion of our series C, series G, series H (redeemed on April 1, 2019), series I, series J, and series K cumulative redeemable preferred stock upon certain change of control transactions. Also excludes 9,775,000 shares of common stock that may be issued upon full physical settlement of the September 2018 forward sales agreements. |

| (3) | Reflects limited partnership interests held by our directors, officers and others in the form of common units, and vested and unvested long-term incentive units. |

5

| Key Quarterly Financial Data |  | Financial Supplement |

| Unaudited and Dollars in Thousands, Except Per Share Data | First Quarter 2019 | |

| Shares and Units at End of Quarter | 31-Mar-19 | 31-Dec-18 | 30-Sep-18 | 30-Jun-18 | 31-Mar-18 | |||||

| Common shares outstanding | 208,214,139 | 206,425,656 | 206,267,055 | 206,055,117 | 205,874,914 | |||||

| Common units outstanding | 9,473,459 | 10,580,884 | 8,340,587 | 8,498,032 | 8,736,488 | |||||

| Total Shares and Partnership Units | 217,687,598 | 217,006,540 | 214,607,642 | 214,553,149 | 214,611,402 | |||||

| Enterprise Value | ||||||||||

| Market value of common equity (1) | $25,904,824 | $23,122,047 | $24,139,068 | $23,939,840 | $22,615,749 | |||||

| Liquidation value of preferred equity | 1,476,250 | 1,266,250 | 1,266,250 | 1,266,250 | 1,266,250 | |||||

| Total debt at balance sheet carrying value | 10,279,656 | 11,101,479 | 9,179,871 | 9,106,084 | 9,147,712 | |||||

| Total Enterprise Value | $37,660,730 | $35,489,776 | $34,585,189 | $34,312,174 | $33,029,711 | |||||

| Total debt / total enterprise value | 27.3 | % | 31.3 | % | 26.5 | % | 26.5 | % | 27.7 | % |

| Selected Balance Sheet Data | ||||||||||

| Investments in real estate (before depreciation) | $19,666,056 | $19,014,993 | $17,981,293 | $17,722,610 | $17,528,976 | |||||

| Total Assets | 23,342,067 | 23,766,695 | 21,462,110 | 21,411,423 | 21,581,917 | |||||

| Total Liabilities | 12,341,890 | 12,892,653 | 10,681,095 | 10,561,690 | 10,595,502 | |||||

| Selected Operating Data | ||||||||||

| Total operating revenues | $814,515 | $778,267 | $768,924 | $754,919 | $744,368 | |||||

| Total operating expenses | 672,972 | 655,420 | 629,859 | 610,857 | 600,555 | |||||

| Interest expense | 101,552 | 84,883 | 80,851 | 78,810 | 76,985 | |||||

| Net income | 120,997 | 52,597 | 90,264 | 88,159 | 110,095 | |||||

| Net income available to common stockholders | 95,869 | 31,230 | 67,268 | 65,134 | 86,298 | |||||

| Financial Ratios | ||||||||||

| EBITDA (2) | $526,059 | $411,200 | $444,508 | $444,853 | $461,446 | |||||

| Adjusted EBITDA (3) | 483,063 | 464,165 | 457,242 | 461,852 | 454,289 | |||||

| Net Debt to Adjusted EBITDA (4) | 5.5x | 6.2x | 5.2x | 5.2x | 5.3x | |||||

| GAAP interest expense | 101,552 | 84,883 | 80,851 | 78,810 | 76,985 | |||||

| Fixed charges (5) | 133,545 | 114,827 | 111,055 | 107,401 | 104,892 | |||||

| Interest coverage ratio (6) | 4.3x | 4.9x | 5.0x | 5.3x | 5.4x | |||||

| Fixed charge coverage ratio (7) | 3.6x | 4.0x | 4.1x | 4.3x | 4.3x | |||||

| Profitability Measures | ||||||||||

| Net income per common share - basic | $0.46 | $0.15 | $0.33 | $0.32 | $0.42 | |||||

| Net income per common share - diluted | $0.46 | $0.15 | $0.33 | $0.32 | $0.42 | |||||

| Funds from operations (FFO) / diluted share and unit (8) | $1.92 | $1.54 | $1.57 | $1.64 | $1.61 | |||||

| Core funds from operations (Core FFO) / diluted share and unit (8) | $1.73 | $1.68 | $1.63 | $1.66 | $1.63 | |||||

| Adjusted funds from operations (AFFO) / diluted share and unit (9) | $1.53 | $1.44 | $1.54 | $1.55 | $1.53 | |||||

| Dividends per share and common unit | $1.08 | $1.01 | $1.01 | $1.01 | $1.01 | |||||

| Diluted FFO payout ratio (8) (10) | 56.4 | % | 65.6 | % | 64.2 | % | 61.5 | % | 62.8 | % |

| Diluted Core FFO payout ratio (8) (11) | 62.4 | % | 60.1 | % | 62.0 | % | 60.8 | % | 62.0 | % |

| Diluted AFFO payout ratio (9) (12) | 70.5 | % | 70.1 | % | 65.4 | % | 65.4 | % | 66.0 | % |

| Portfolio Statistics | ||||||||||

| Data Centers (13) | 215 | 214 | 198 | 198 | 199 | |||||

| Cross-connects | 79,000 | 78,000 | 77,000 | 76,000 | 75,000 | |||||

| Net rentable square feet, excluding development space (13) | 29,551,498 | 29,134,633 | 27,918,778 | 27,847,819 | 27,115,634 | |||||

| Occupancy at end of quarter (14) | 88.6 | % | 89.0 | % | 89.5 | % | 89.4 | % | 89.2 | % |

| Occupied square footage | 26,181,004 | 25,935,668 | 25,001,127 | 24,906,210 | 24,195,848 | |||||

| Space under active development (15) | 3,227,275 | 3,350,848 | 3,634,830 | 3,325,092 | 3,629,821 | |||||

| Space held for development (16) | 2,095,868 | 2,056,799 | 1,816,366 | 1,455,841 | 1,532,682 | |||||

| Weighted average remaining lease term (years) (17) | 5.3 | 4.6 | 4.5 | 4.7 | 4.9 | |||||

| Same-capital occupancy at end of quarter (14) (18) | 89.8 | % | 90.2 | % | 90.8 | % | 91.3 | % | 91.3 | % |

6

| Key Quarterly Financial Data |  | Financial Supplement |

| Unaudited and Dollars in Thousands, Except Per Share Data | First Quarter 2019 | |

| (1) | The market value of common equity is based on the closing stock price at the end of the quarter and assumes 100% redemption of the limited partnership units in our operating partnership, including common units and vested and unvested long-term incentive units, for shares of our common stock. Excludes shares of common stock potentially issuable upon conversion of our series C, series G, series H, series I, series J, and series K cumulative redeemable preferred stock upon certain change of control transactions, as applicable. |

| (2) | EBITDA is calculated as earnings before interest expense, loss from early extinguishment of debt, tax expense, and depreciation and amortization. For a discussion of EBITDA, see page 39. For a reconciliation of net income available to common stockholders to EBITDA, see page 38. |

| (3) | Adjusted EBITDA is EBITDA excluding unconsolidated joint venture real estate related depreciation & amortization, severance, equity acceleration, and legal expenses, transaction and integration expenses, gain on sale / deconsolidation, impairment of investments in real estate, other non-core adjustments, net, non-controlling interests, and preferred stock dividends, including undeclared dividends. For a discussion of Adjusted EBITDA, see page 39. For a reconciliation of net income available to common stockholders to Adjusted EBITDA, see page 38. |

| (4) | Net Debt to Adjusted EBITDA is calculated as total debt at balance sheet carrying value (see page 6), plus capital lease obligations, plus our share of joint venture debt, less unrestricted cash and cash equivalents, divided by the product of Adjusted EBITDA (inclusive of our share of joint venture EBITDA), multiplied by four. |

| (5) | Fixed charges consist of GAAP interest expense, capitalized interest, scheduled debt principal payments and preferred dividends. |

| (6) | Interest coverage ratio is Adjusted EBITDA divided by GAAP interest expense plus capitalized interest. |

| (7) | Fixed charge coverage ratio is Adjusted EBITDA divided by fixed charges. |

| (8) | For definitions and discussion of FFO and core FFO, see page 39. For reconciliations of net income available to common stockholders to FFO and core FFO, see page 14. |

| (9) | For a definition and discussion of AFFO, see page 39. For a reconciliation of core FFO to AFFO, see page 15. |

| (10) | Diluted FFO payout ratio is dividends declared per common share and unit divided by diluted FFO per share and unit. |

| (11) | Diluted core FFO payout ratio is dividends declared per common share and unit divided by diluted core FFO per share and unit. |

| (12) | Diluted AFFO payout ratio is dividends declared per common share and unit divided by diluted AFFO per share and unit. |

| (13) | Includes buildings held as investments in unconsolidated joint ventures. Excludes buildings held-for-sale. |

| (14) | Occupancy and same-capital occupancy exclude space under active development and space held for development. Occupancy represents our consolidated portfolio in addition to our managed portfolio of unconsolidated joint ventures and non-managed unconsolidated joint ventures. For some of our buildings, we calculate occupancy based on factors in addition to contractually leased square feet, including available power, required support space and common area. Excludes buildings held-for-sale. |

| (15) | Space under active development includes current Base Building and Data Centers projects in progress (see page 31). Excludes buildings held-for-sale. |

| (16) | Space held for development includes space held for future Data Center development, and excludes space under active development (see page 35). Excludes buildings held-for-sale. |

| (17) | Weighted average remaining lease term excludes renewal options and is weighted by net rentable square feet. |

| (18) | Represents buildings owned as of December 31, 2017 with less than 5% of total rentable square feet under development. Excludes buildings that were undergoing, or were expected to undergo, development activities in 2018-2019, buildings classified as held-for-sale, and buildings sold or contributed to joint ventures for all periods presented. Prior period results have been adjusted to reflect current same-capital pool. |

7

| Digital Realty Trust |  | |

| Earnings Release | First Quarter 2019 | |

DIGITAL REALTY REPORTS FIRST QUARTER 2019 RESULTS

San Francisco, CA — April 25, 2019 — Digital Realty (NYSE: DLR), a leading global provider of data center, colocation and interconnection solutions, announced today financial results for the first quarter of 2019. All per-share results are presented on a fully-diluted share and unit basis.

Highlights

| • | Reported net income available to common stockholders of $0.46 per share in 1Q19, compared to $0.42 in 1Q18 |

| • | Reported FFO per share of $1.92 in 1Q19, compared to $1.61 in 1Q18 |

| • | Reported core FFO per share of $1.73 in 1Q19, compared to $1.63 in 1Q18 |

| • | Signed total bookings during 1Q19 expected to generate $50 million of annualized GAAP rental revenue, including $9 million from Ascenty (at 100% share) and a $7 million contribution from interconnection |

| • | Reiterated 2019 core FFO per share outlook of $6.60 - $6.70 |

Financial Results

Digital Realty reported revenues for the first quarter of 2019 of $815 million, a 5% increase from the previous quarter and a 9% increase from the same quarter last year.

The company delivered first quarter of 2019 net income of $121 million, and net income available to common stockholders of $96 million, or $0.46 per diluted share, compared to $0.15 per diluted share in the previous quarter and $0.42 per diluted share in the same quarter last year.

Digital Realty generated first quarter of 2019 adjusted EBITDA of $483 million, a 4% increase from the previous quarter and a 6% increase over the same quarter last year.

The company reported first quarter of 2019 funds from operations of $417 million, or $1.92 per share, compared to $1.54 per share in the previous quarter and $1.61 per share in the same quarter last year.

Excluding certain items that do not represent core expenses or revenue streams, Digital Realty delivered first quarter of 2019 core FFO per share of $1.73, a 3% increase from $1.68 per share in the previous quarter, and a 6% increase from $1.63 per share in the same quarter last year.

Leasing Activity

“In the first quarter, we signed total bookings expected to generate $50 million of annualized GAAP rental revenue, including $9 million from Ascenty along with a $7 million contribution from interconnection,” said Chief Executive Officer A. William Stein. “We delivered solid execution against our strategic plan, extending our global platform, strengthening our balance sheet and capitalizing on our competitive advantages to capture robust and diverse enterprise demand across geographic regions. Given the resiliency of our business and our balance sheet, we believe we are well positioned to continue to deliver sustainable growth for customers, shareholders and employees, into the second half of 2019 and beyond.”

The weighted-average lag between leases signed during the first quarter of 2019 and the contractual commencement date was two months.

In addition to new leases signed, Digital Realty also signed renewal leases representing $116 million of annualized GAAP rental revenue during the quarter. Rental rates on renewal leases signed during the first quarter of 2019 rolled down 6.9% on a cash basis and up 7.1% on a GAAP basis.

8

| Digital Realty Trust |  | |

| Earnings Release | First Quarter 2019 | |

New leases signed during the first quarter of 2019 are summarized by region and product type as follows:

| Annualized GAAP | |||||||||||||||||||

| Base Rent | GAAP Base Rent | GAAP Base Rent | |||||||||||||||||

| North America | (in thousands) | Square Feet | per Square Foot | Megawatts | per Kilowatt | ||||||||||||||

| Turn-Key Flex | $13,578 | 109,551 | $124 | 11.3 | $100 | ||||||||||||||

| Powered Base Building | 4,854 | 51,615 | 94 | — | — | ||||||||||||||

| Colocation | 5,322 | 22,743 | 234 | 1.7 | 261 | ||||||||||||||

| Non-Technical | 206 | 69,486 | 3 | — | — | ||||||||||||||

| Total | $23,960 | 253,395 | $95 | 13.0 | $121 | ||||||||||||||

| Europe (1) | |||||||||||||||||||

| Turn-Key Flex | $5,168 | 34,461 | $150 | 3.2 | $136 | ||||||||||||||

| Colocation | 1,264 | 2,261 | 559 | 0.3 | 314 | ||||||||||||||

| Non-Technical | 32 | 369 | 86 | — | — | ||||||||||||||

| Total | $6,464 | 37,091 | $174 | 3.5 | $153 | ||||||||||||||

| Asia Pacific (1) | |||||||||||||||||||

| Turn-Key Flex | $3,196 | 15,716 | $203 | 1.5 | $178 | ||||||||||||||

| Non-Technical | 83 | 1,646 | 50 | — | — | ||||||||||||||

| Total | $3,279 | 17,362 | $189 | 1.5 | $178 | ||||||||||||||

| South America (1) | $8,622 | N/A | N/A | N/A | N/A | ||||||||||||||

| Interconnection | $7,460 | N/A | N/A | N/A | N/A | ||||||||||||||

| Grand Total | $49,785 | 307,848 | $109 | 18.0 | $132 | ||||||||||||||

Note: Totals may not foot due to rounding differences.

| (1) | Based on quarterly average exchange rates during the three months ended March 31, 2019. |

Investment Activity

During the first quarter of 2019, Digital Realty closed the previously announced joint venture with Brookfield Infrastructure, an affiliate of Brookfield Asset Management, one of the largest owners and operators of infrastructure assets globally. Brookfield invested approximately $700 million in exchange for approximately 49% of the total equity interests in the joint venture which owns and operates Ascenty, the leading data center provider in Brazil.

During the first quarter of 2019, Digital Realty closed the previously announced 30-year ground lease with Jurong Town Council for two adjacent land parcels in Singapore totaling three acres for an upfront payment of approximately $6 million. These parcels are located less than one block from the company's existing Loyang Way data center, and are expected to support the development of up to 40 megawatts of critical power. Commencement of development will be subject to market demand and delivery will be phased to meet future growth requirements upon build-out and lease-up of the company's existing Loyang Way data center.

As previously disclosed, MC Digital Realty, a 50/50 joint venture between Mitsubishi Corporation and Digital Realty, reached an agreement during the first quarter of 2019 to acquire a five-acre land parcel in Tokyo. The site is located at the center of the Inzai data center cluster, one of the highest-density areas in Japan with a well-established utility and connectivity infrastructure, and home to leading global cloud providers and financial institutions. Demolition of the existing structure on the site will begin immediately after closing and data center development is expected to commence in 2020, subject to planning approvals. The initial facility is expected to deliver up to 35.6 megawatts of total IT capacity. The Tokyo land parcel acquisition is expected to close later this year and is subject to customary closing conditions.

Digital Realty participated in Megaport's March 2019 equity offering, investing approximately $2.6 million to maintain a 7.3% ownership stake.

9

| Digital Realty Trust |  | |

| Earnings Release | First Quarter 2019 | |

Balance Sheet

Digital Realty had approximately $10.3 billion of total debt outstanding as of March 31, 2019, comprised of $10.2 billion of unsecured debt and approximately $0.1 billion of secured debt. At the end of the first quarter of 2019, net debt-to-adjusted EBITDA was 5.5x, debt-plus-preferred-to-total enterprise value was 31.2% and fixed charge coverage was 3.6x. Pro forma for de-consolidation of the Ascenty joint venture with Brookfield and settlement of the $1.1 billion forward equity offering, net debt-to-adjusted EBITDA was 5.1x and fixed charge coverage was 4.1x.

During the first quarter of 2019, Digital Realty closed an €850 million (approximately $970 million) Euro-denominated green bond offering of seven-year senior unsecured notes at 2.500%. In February 2019, Digital Realty raised an additional €225 million (approximately $256 million) of Euro-denominated green bonds due 2026.

During the first quarter of 2019, Digital Realty redeemed all of its outstanding 5.875% senior notes due 2020. Approximately 70% of the notes were purchased through a tender offer at a tender price of $1,022.81 per $1,000 principal amount, while the remaining 30% were redeemed through a call notice delivered in accordance with the terms of the indenture governing the notes.

During the first quarter of 2019, Digital Realty also issued £150 million (approximately $200 million) of pounds sterling-denominated 3.750% guaranteed notes due 2030 as additional notes under the indenture dated October 17, 2018, under which Digital Realty previously issued £400,000,000 (approximately $530 million) of its 3.750% guaranteed notes due 2030.

Separately, Digital Realty closed an offering of 8,400,000 shares of 5.850% Series K Cumulative Redeemable Preferred Stock (including 400,000 shares from the partial exercise of the underwriters' over-allotment option) at a price of $25.00 per share, generating gross proceeds of approximately $210 million.

Subsequent to quarter-end, Digital Realty redeemed all 14.6 million shares of its 7.375% Series H Cumulative Redeemable Preferred Stock.

10

| Digital Realty Trust |  | |

| Earnings Release | First Quarter 2019 | |

2019 Outlook

Digital Realty reiterated its 2019 core FFO per share outlook of $6.60 - $6.70. The assumptions underlying this guidance are summarized in the following table.

| As of | As of | As of | |

| Top-Line and Cost Structure | January 8, 2019 | February 5, 2019 | April 25, 2019 |

| Total revenue | $3.2 - $3.3 billion | $3.2 - $3.3 billion | $3.2 - $3.3 billion |

| Net non-cash rent adjustments (1) | ($5 - $15 million) | ($5 - $15 million) | ($5 - $15 million) |

| Adjusted EBITDA margin | 57.0% - 59.0% | 57.0% - 59.0% | 57.0% - 59.0% |

| G&A margin | 6.0% - 7.0% | 6.0% - 7.0% | 6.0% - 7.0% |

| Internal Growth | |||

| Rental rates on renewal leases | |||

| Cash basis | Down high-single-digits | Down high-single-digits | Down high-single-digits |

| GAAP basis | Slightly positive | Slightly positive | Slightly positive |

| Year-end portfolio occupancy | +/- 50 bps | +/- 50 bps | +/- 50 bps |

| "Same-capital" cash NOI growth (2) | +/- 2.0% | +/- 2.0% | -2.0% to -4.0% |

| Foreign Exchange Rates | |||

| U.S. Dollar / Pound Sterling | $1.20 - $1.30 | $1.20 - $1.30 | $1.20 - $1.30 |

| U.S. Dollar / Euro | $1.10 - $1.20 | $1.10 - $1.20 | $1.10 - $1.20 |

| External Growth | |||

| Development | |||

| CapEx | $1.2 - $1.4 billion | $1.2 - $1.4 billion | $1.2 - $1.4 billion |

| Average stabilized yields | 9.0% - 12.0% | 9.0% - 12.0% | 9.0% - 12.0% |

| Enhancements and other non-recurring CapEx (3) | $30 - $40 million | $30 - $40 million | $30 - $40 million |

| Recurring CapEx + capitalized leasing costs (4) | $145 - $155 million | $145 - $155 million | $145 - $155 million |

| Balance Sheet | |||

| Long-term debt issuance | |||

| Dollar amount | $0.5 - $1.0 billion | $1.0 - $1.5 billion | $1.5 - $2.0 billion |

| Pricing | 3.50% - 5.00% | 2.50% - 5.00% | 2.75% - 3.75% |

| Timing | Early-to-mid 2019 | Early-to-mid 2019 | Early-to-mid 2019 |

| Net income per diluted share | $1.40 - $1.45 | $1.40 - $1.45 | $1.65 - $1.70 |

| Real estate depreciation and (gain) / loss on sale | $5.15 - $5.15 | $5.15 - $5.15 | $5.00 - $5.10 |

| Funds From Operations / share (NAREIT-Defined) | $6.55 - $6.60 | $6.55 - $6.60 | $6.65 - $6.80 |

| Non-core expenses and revenue streams | $0.05 - $0.10 | $0.05 - $0.10 | ($0.05 - $0.10) |

| Core Funds From Operations / share | $6.60 - $6.70 | $6.60 - $6.70 | $6.60 - $6.70 |

| Foreign currency translation adjustments | $0.05 - $0.15 | $0.05 - $0.15 | $0.05 - $0.15 |

| Constant-Currency Core FFO / share | $6.65 - $6.85 | $6.65 - $6.85 | $6.65 - $6.85 |

| (1) | Net non-cash rent adjustments represent the sum of straight-line rental revenue and straight-line rent expense, as well as the amortization of above- and below-market leases (i.e., FAS 141 adjustments). |

| (2) | The "same-capital" pool includes properties owned as of December 31, 2017 with less than 5% of total rentable square feet under development. It also excludes properties that were undergoing, or were expected to undergo, development activities in 2018-2019, properties classified as held for sale, and properties sold or contributed to joint ventures for all periods presented. |

| (3) | Other non-recurring CapEx represents costs incurred to enhance the capacity or marketability of operating properties, such as network fiber initiatives and software development costs. |

| (4) | Recurring CapEx represents non-incremental improvements required to maintain current revenues, including second-generation tenant improvements and leasing commissions. |

11

| Digital Realty Trust |  | |

| Earnings Release | First Quarter 2019 | |

Non-GAAP Financial Measures

This press release contains non-GAAP financial measures, including FFO, core FFO, and Adjusted EBITDA. A reconciliation from U.S. GAAP net income available to common stockholders to FFO, a reconciliation from FFO to core FFO, and definitions of FFO, and core FFO are included as an attachment to this document. A reconciliation from U.S. GAAP net income available to common stockholders to Adjusted EBITDA, a definition of Adjusted EBITDA and definitions of net debt-to-Adjusted EBITDA, debt-plus-preferred-to-total enterprise value, cash NOI, and fixed charge coverage ratio are included as an attachment to this document.

Investor Conference Call

Prior to Digital Realty’s investor conference call at 5:30 p.m. EDT / 2:30 p.m. PDT on April 25, 2019, a presentation will be posted to the Investors section of the company’s website at http://investor.digitalrealty.com. The presentation is designed to accompany the discussion of the company's first quarter of 2019 financial results and operating performance. The conference call will feature Chief Executive Officer A. William Stein and Chief Financial Officer Andrew P. Power.

To participate in the live call, investors are invited to dial (888) 317-6003 (for domestic callers) or (412) 317-6061 (for international callers) and reference the conference ID# 3463240 at least five minutes prior to start time. A live webcast of the call will be available via the Investors section of Digital Realty’s website at http://investor.digitalrealty.com.

Telephone and webcast replays will be available after the call until May 31, 2019. The telephone replay can be accessed by dialing (877) 344-7529 (for domestic callers) or (412) 317-0088 (for international callers) and providing the conference ID# 10129308. The webcast replay can be accessed on Digital Realty’s website.

About Digital Realty

Digital Realty supports the data center, colocation and interconnection strategies of more than 2,300 firms across its secure, network-rich portfolio of data centers located throughout North America, Europe, Latin America, Asia and Australia. Digital Realty's clients include domestic and international companies of all sizes, ranging from cloud and information technology services, communications and social networking to financial services, manufacturing, energy, healthcare, and consumer products.

Contact Information

Andrew P. Power

Chief Financial Officer

Digital Realty

(415) 738-6500

John J. Stewart / Nina Bari

Investor Relations

Digital Realty

(415) 738-6500

12

| Consolidated Quarterly Statements of Operations |  | Financial Supplement |

| Unaudited and in Thousands, Except Share and Per Share Data | First Quarter 2019 | |

| Three Months Ended | |||||||||||||||

| 31-Mar-19 | 31-Dec-18 | 30-Sep-18 | 30-Jun-18 | 31-Mar-18 | |||||||||||

| Rental revenues | $585,425 | $555,816 | $541,073 | $534,556 | $530,925 | ||||||||||

| Tenant reimbursements - Utilities | 102,569 | 102,641 | 105,822 | 100,084 | 98,576 | ||||||||||

| Tenant reimbursements - Other | 55,868 | 53,090 | 57,282 | 55,639 | 51,503 | ||||||||||

| Interconnection & other | 68,168 | 63,803 | 62,760 | 61,770 | 61,373 | ||||||||||

| Fee income | 1,921 | 2,896 | 1,469 | 2,343 | 1,133 | ||||||||||

| Other | 564 | 21 | 518 | 527 | 858 | ||||||||||

| Total Operating Revenues | $814,515 | $778,267 | $768,924 | $754,919 | $744,368 | ||||||||||

| Utilities | $124,334 | $122,108 | $127,239 | $115,470 | $112,230 | ||||||||||

| Rental property operating | 130,620 | 133,024 | 118,732 | 114,852 | 113,410 | ||||||||||

| Property taxes | 37,315 | 32,098 | 34,871 | 27,284 | 35,263 | ||||||||||

| Insurance | 2,991 | 2,412 | 2,653 | 2,606 | 3,731 | ||||||||||

| Depreciation & amortization | 311,486 | 299,362 | 293,957 | 298,788 | 294,789 | ||||||||||

| General & administration | 51,976 | 38,801 | 40,997 | 44,277 | 36,289 | ||||||||||

| Severance, equity acceleration, and legal expenses | 1,483 | 602 | 645 | 1,822 | 234 | ||||||||||

| Transaction and integration expenses | 2,494 | 25,917 | 9,626 | 5,606 | 4,178 | ||||||||||

| Impairment of investments in real estate | 5,351 | — | — | — | — | ||||||||||

| Other expenses | 4,922 | 1,096 | 1,139 | 152 | 431 | ||||||||||

| Total Operating Expenses | $672,972 | $655,420 | $629,859 | $610,857 | $600,555 | ||||||||||

| Operating Income | $141,543 | $122,847 | $139,065 | $144,062 | $143,813 | ||||||||||

| Equity in earnings of unconsolidated joint venture | $9,217 | $9,245 | $8,886 | $7,438 | $7,410 | ||||||||||

| Gain on sale / deconsolidation | 67,497 | 7 | 26,577 | 14,192 | 39,273 | ||||||||||

| Interest and other income | 21,444 | 1,106 | (981 | ) | 3,398 | (42 | ) | ||||||||

| Interest (expense) | (101,552 | ) | (84,883 | ) | (80,851 | ) | (78,810 | ) | (76,985 | ) | |||||

| Tax benefit (expense) | (4,266 | ) | 5,843 | (2,432 | ) | (2,121 | ) | (3,374 | ) | ||||||

| Loss from early extinguishment of debt | (12,886 | ) | (1,568 | ) | — | — | — | ||||||||

| Net Income | $120,997 | $52,597 | $90,264 | $88,159 | $110,095 | ||||||||||

| Net income attributable to noncontrolling interests | (4,185 | ) | (1,038 | ) | (2,667 | ) | (2,696 | ) | (3,468 | ) | |||||

| Net Income Attributable to Digital Realty Trust, Inc. | $116,812 | $51,559 | $87,597 | $85,463 | $106,627 | ||||||||||

| Preferred stock dividends, including undeclared dividends | (20,943 | ) | (20,329 | ) | (20,329 | ) | (20,329 | ) | (20,329 | ) | |||||

| Net Income Available to Common Stockholders | $95,869 | $31,230 | $67,268 | $65,134 | $86,298 | ||||||||||

| Weighted-average shares outstanding - basic | 207,809,383 | 206,345,138 | 206,118,472 | 205,956,005 | 205,714,173 | ||||||||||

| Weighted-average shares outstanding - diluted | 208,526,249 | 207,113,100 | 206,766,256 | 206,563,079 | 206,507,476 | ||||||||||

| Weighted-average fully diluted shares and units | 217,756,161 | 215,417,085 | 214,937,168 | 214,895,273 | 214,802,763 | ||||||||||

| Net income per share - basic | $0.46 | $0.15 | $0.33 | $0.32 | $0.42 | ||||||||||

| Net income per share - diluted | $0.46 | $0.15 | $0.33 | $0.32 | $0.42 | ||||||||||

13

| Funds From Operations and Core Funds From Operations |  | Financial Supplement |

| Unaudited and in Thousands, Except Per Share Data | First Quarter 2019 | |

| Reconciliation of Net Income to Funds From Operations (FFO) | Three Months Ended | ||||||||||||||

| 31-Mar-19 | 31-Dec-18 | 30-Sep-18 | 30-Jun-18 | 31-Mar-18 | |||||||||||

| Net Income Available to Common Stockholders | $95,869 | $31,230 | $67,268 | $65,134 | $86,298 | ||||||||||

| Adjustments: | |||||||||||||||

| Non-controlling interests in operating partnership | 4,300 | 1,300 | 2,700 | 2,700 | 3,480 | ||||||||||

| Real estate related depreciation & amortization (1) | 307,864 | 295,724 | 290,757 | 295,750 | 291,686 | ||||||||||

| Unconsolidated JV real estate related depreciation & amortization | 3,851 | 3,615 | 3,775 | 3,722 | 3,476 | ||||||||||

| (Gain) on real estate transactions | — | (7 | ) | (26,577 | ) | (14,192 | ) | (39,273 | ) | ||||||

| Impairment of investments in real estate | 5,351 | — | — | — | — | ||||||||||

| Funds From Operations | $417,235 | $331,862 | $337,923 | $353,114 | $345,667 | ||||||||||

| Funds From Operations - diluted | $417,235 | $331,862 | $337,923 | $353,114 | $345,667 | ||||||||||

| Weighted-average shares and units outstanding - basic | 217,039 | 214,649 | 214,289 | 214,288 | 214,009 | ||||||||||

| Weighted-average shares and units outstanding - diluted (2) | 217,756 | 215,417 | 214,937 | 214,895 | 214,803 | ||||||||||

| Funds From Operations per share - basic | $1.92 | $1.55 | $1.58 | $1.65 | $1.62 | ||||||||||

| Funds From Operations per share - diluted (2) | $1.92 | $1.54 | $1.57 | $1.64 | $1.61 | ||||||||||

| Three Months Ended | |||||||||||||||

| Reconciliation of FFO to Core FFO | 31-Mar-19 | 31-Dec-18 | 30-Sep-18 | 30-Jun-18 | 31-Mar-18 | ||||||||||

| Funds From Operations - diluted | $417,235 | $331,862 | $337,923 | $353,114 | $345,667 | ||||||||||

| Adjustments: | |||||||||||||||

| Termination fees and other non-core revenues (3) | (14,445 | ) | (21 | ) | (518 | ) | (3,663 | ) | (858 | ) | |||||

| Transaction and integration expenses | 2,494 | 25,917 | 9,626 | 5,606 | 4,178 | ||||||||||

| Loss from early extinguishment of debt | 12,886 | 1,568 | — | — | — | ||||||||||

| Severance, equity acceleration, and legal expenses (4) | 1,483 | 602 | 645 | 1,822 | 234 | ||||||||||

| Loss on FX revaluation | 9,604 | — | — | — | — | ||||||||||

| Gain on contribution to unconsolidated joint venture, net of related tax | (58,497 | ) | — | — | — | — | |||||||||

| Other non-core expense adjustments | 4,922 | 1,471 | 2,269 | 152 | 431 | ||||||||||

| Core Funds From Operations - diluted | $375,682 | $361,399 | $349,945 | $357,031 | $349,652 | ||||||||||

| Weighted-average shares and units outstanding - diluted (2) | 217,756 | 215,417 | 214,937 | 214,895 | 214,803 | ||||||||||

| Core Funds From Operations per share - diluted (2) | $1.73 | $1.68 | $1.63 | $1.66 | $1.63 | ||||||||||

| (1) Real Estate Related Depreciation & Amortization: | Three Months Ended | ||||||||||||||

| 31-Mar-19 | 31-Dec-18 | 30-Sep-18 | 30-Jun-18 | 31-Mar-18 | |||||||||||

| Depreciation & amortization per income statement | $311,486 | $299,362 | $293,957 | $298,788 | $294,789 | ||||||||||

| Non-real estate depreciation | (3,622 | ) | (3,638 | ) | (3,200 | ) | (3,038 | ) | (3,103 | ) | |||||

| Real Estate Related Depreciation & Amortization | $307,864 | $295,724 | $290,757 | $295,750 | $291,686 | ||||||||||

| (2) | For all periods presented, we have excluded the effect of dilutive series C, series G, series H, series I, series J, and series K preferred stock, as applicable, that may be converted into common stock upon the occurrence of specified change in control transactions as described in the articles supplementary governing the series C, series G, series H, series I, series J, and series K preferred stock, as applicable, which we consider highly improbable. See above for calculations of diluted FFO available to common stockholders and unitholders and the share count detail section of the reconciliation of core FFO to AFFO for calculations of weighted average common stock and units outstanding. |

| (3) | Includes lease termination fees and certain other adjustments that are not core to our business. |

| (4) | Relates to severance and other charges related to the departure of company executives and integration-related severance. |

14

| Adjusted Funds From Operations (AFFO) |  | Financial Supplement |

| Unaudited and in Thousands, Except Per Share Data | First Quarter 2019 | |

| Three Months Ended | |||||||||||||||

| Reconciliation of Core FFO to AFFO | 31-Mar-19 | 31-Dec-18 | 30-Sep-18 | 30-Jun-18 | 31-Mar-18 | ||||||||||

| Core FFO available to common stockholders and unitholders | $375,682 | $361,399 | $349,945 | $357,031 | $349,652 | ||||||||||

| Adjustments: | |||||||||||||||

| Non-real estate depreciation | 3,622 | 3,638 | 3,200 | 3,038 | 3,103 | ||||||||||

| Amortization of deferred financing costs | 4,493 | 3,128 | 3,066 | 2,953 | 3,060 | ||||||||||

| Amortization of debt discount/premium | 760 | 971 | 902 | 882 | 875 | ||||||||||

| Non-cash stock-based compensation expense | 7,592 | 5,609 | 5,823 | 8,419 | 5,497 | ||||||||||

| Straight-line rental revenue | (15,979 | ) | (11,157 | ) | (10,511 | ) | (8,489 | ) | (10,266 | ) | |||||

| Straight-line rental expense | 1,235 | 2,052 | 2,482 | 2,669 | 2,547 | ||||||||||

| Above- and below-market rent amortization | 6,210 | 6,521 | 6,552 | 6,794 | 6,666 | ||||||||||

| Deferred tax expense | (15,397 | ) | (8,835 | ) | (1,783 | ) | (1,137 | ) | (216 | ) | |||||

| Leasing compensation & internal lease commissions (1) | 3,581 | (5,160 | ) | (5,153 | ) | (5,647 | ) | (5,047 | ) | ||||||

| Recurring capital expenditures (2) | (38,059 | ) | (47,951 | ) | (22,500 | ) | (34,447 | ) | (27,328 | ) | |||||

| AFFO available to common stockholders and unitholders (3) | $333,740 | $310,215 | $332,023 | $332,066 | $328,543 | ||||||||||

| Weighted-average shares and units outstanding - basic | 217,039 | 214,649 | 214,289 | 214,288 | 214,009 | ||||||||||

| Weighted-average shares and units outstanding - diluted (4) | 217,756 | 215,417 | 214,937 | 214,895 | 214,803 | ||||||||||

| AFFO per share - diluted (4) | $1.53 | $1.44 | $1.54 | $1.55 | $1.53 | ||||||||||

| Dividends per share and common unit | $1.08 | $1.01 | $1.01 | $1.01 | $1.01 | ||||||||||

| Diluted AFFO Payout Ratio | 70.5 | % | 70.1 | % | 65.4 | % | 65.4 | % | 66.0 | % | |||||

| Three Months Ended | ||||||||||

| Share Count Detail | 31-Mar-19 | 31-Dec-18 | 30-Sep-18 | 30-Jun-18 | 31-Mar-18 | |||||

| Weighted Average Common Stock and Units Outstanding | 217,039 | 214,649 | 214,289 | 214,288 | 214,009 | |||||

| Add: Effect of dilutive securities | 717 | 768 | 648 | 607 | 794 | |||||

| Weighted Avg. Common Stock and Units Outstanding - diluted | 217,756 | 215,417 | 214,937 | 214,895 | 214,803 | |||||

| (1) | The company adopted ASC 842 in the first quarter of 2019. |

| (2) | Recurring capital expenditures represent non-incremental building improvements required to maintain current revenues, including second-generation tenant improvements and external leasing commissions. Recurring capital expenditures do not include acquisition costs contemplated when underwriting the purchase of a building, costs which are incurred to bring a building up to Digital Realty's operating standards, or internal leasing commissions. |

| (3) | For a definition and discussion of AFFO, see the definitions section. For a reconciliation of net income available to common stockholders to FFO and core FFO, see above. |

| (4) | For all periods presented, we have excluded the effect of dilutive series C, series G, series H, series I, series J, and series K preferred stock, as applicable, that may be converted into common stock upon the occurrence of specified change in control transactions as described in the articles supplementary governing the series C, series G, series H, series I, series J, and series K preferred stock, as applicable, which we consider highly improbable. See above for calculations of diluted FFO available to common stockholders and unitholders and for calculations of weighted average common stock and units outstanding. |

15

| Consolidated Balance Sheets |  | Financial Supplement |

| Unaudited and in Thousands, Except Share and Per Share Data | First Quarter 2019 | |

| 31-Mar-19 | 31-Dec-18 | 30-Sep-18 | 30-Jun-18 | 31-Mar-18 | |||||||||||

| Assets | |||||||||||||||

| Investments in real estate: | |||||||||||||||

| Real estate | $16,988,322 | $17,055,017 | $16,062,402 | $15,969,938 | $15,654,932 | ||||||||||

| Construction in progress | 1,584,327 | 1,621,927 | 1,464,010 | 1,323,998 | 1,470,065 | ||||||||||

| Land held for future development | 163,081 | 162,941 | 284,962 | 261,368 | 236,415 | ||||||||||

| Investments in real estate | $18,735,730 | $18,839,885 | $17,811,374 | $17,555,304 | $17,361,412 | ||||||||||

| Accumulated depreciation and amortization | (4,124,002 | ) | (3,935,267 | ) | (3,755,596 | ) | (3,588,124 | ) | (3,439,050 | ) | |||||

| Net Investments in Properties | $14,611,728 | $14,904,618 | $14,055,778 | $13,967,180 | $13,922,362 | ||||||||||

| Investment in unconsolidated joint ventures | 930,326 | 175,108 | 169,919 | 167,306 | 167,564 | ||||||||||

| Net Investments in Real Estate | $15,542,054 | $15,079,726 | $14,225,697 | $14,134,486 | $14,089,926 | ||||||||||

| Cash and cash equivalents | $123,879 | $126,700 | $46,242 | $17,589 | $22,370 | ||||||||||

| Accounts and other receivables (1) | 328,009 | 299,621 | 308,709 | 282,287 | 309,328 | ||||||||||

| Deferred rent | 479,640 | 463,248 | 454,412 | 445,766 | 442,887 | ||||||||||

| Acquired in-place lease value, deferred leasing costs and other real estate intangibles, net | 2,580,624 | 3,144,395 | 2,734,158 | 2,823,275 | 2,928,566 | ||||||||||

| Acquired above-market leases, net | 106,044 | 119,759 | 135,127 | 150,084 | 165,568 | ||||||||||

| Goodwill | 3,358,463 | 4,348,007 | 3,373,342 | 3,378,325 | 3,405,110 | ||||||||||

| Restricted cash | 10,130 | 8,522 | 8,068 | 9,443 | 7,330 | ||||||||||

| Assets associated with real estate held for sale | — | — | — | — | 41,707 | ||||||||||

| Operating lease right-of-use assets (2) | 660,586 | — | — | — | — | ||||||||||

| Other assets | 152,638 | 176,717 | 176,355 | 170,168 | 169,125 | ||||||||||

| Total Assets | $23,342,067 | $23,766,695 | $21,462,110 | $21,411,423 | $21,581,917 | ||||||||||

| Liabilities and Equity | |||||||||||||||

| Global unsecured revolving credit facility | $842,975 | $1,647,735 | $590,289 | $466,971 | $952,121 | ||||||||||

| Unsecured term loans | 807,726 | 1,178,904 | 1,352,969 | 1,376,784 | 1,428,498 | ||||||||||

| Unsecured senior notes, net of discount | 8,523,462 | 7,589,126 | 7,130,541 | 7,156,084 | 6,660,727 | ||||||||||

| Secured debt, net of premiums | 105,493 | 685,714 | 106,072 | 106,245 | 106,366 | ||||||||||

| Operating lease liabilities (2) | 725,470 | — | — | — | — | ||||||||||

| Accounts payable and other accrued liabilities | 922,571 | 1,164,509 | 1,059,355 | 1,031,794 | 1,012,490 | ||||||||||

| Accrued dividends and distributions | — | 217,241 | — | — | — | ||||||||||

| Acquired below-market leases | 192,667 | 200,113 | 208,202 | 216,520 | 225,674 | ||||||||||

| Security deposits and prepaid rent | 221,526 | 209,311 | 233,667 | 207,292 | 207,859 | ||||||||||

| Liabilities associated with assets held for sale | — | — | — | — | 1,767 | ||||||||||

| Total Liabilities | $12,341,890 | $12,892,653 | $10,681,095 | $10,561,690 | $10,595,502 | ||||||||||

| Redeemable non-controlling interests - operating partnership | 17,678 | 15,832 | 17,553 | 52,805 | 49,871 | ||||||||||

| Equity | |||||||||||||||

| Preferred Stock: $0.01 par value per share, 110,000,000 shares authorized: | |||||||||||||||

| Series C Cumulative Redeemable Preferred Stock (3) | $219,250 | $219,250 | $219,250 | $219,250 | $219,250 | ||||||||||

| Series G Cumulative Redeemable Preferred Stock (4) | 241,468 | 241,468 | 241,468 | 241,468 | 241,468 | ||||||||||

| Series H Cumulative Redeemable Preferred Stock (5) | 353,290 | 353,290 | 353,290 | 353,290 | 353,290 | ||||||||||

| Series I Cumulative Redeemable Preferred Stock (6) | 242,012 | 242,012 | 242,012 | 242,012 | 242,012 | ||||||||||

| Series J Cumulative Redeemable Preferred Stock (7) | 193,540 | 193,540 | 193,540 | 193,540 | 193,540 | ||||||||||

| Series K Cumulative Redeemable Preferred Stock (8) | 203,423 | — | — | — | — | ||||||||||

| Common Stock: $0.01 par value per share, 310,000,000 shares authorized (9) | 2,066 | 2,051 | 2,049 | 2,047 | 2,045 | ||||||||||

| Additional paid-in capital | 11,492,766 | 11,355,751 | 11,333,035 | 11,310,132 | 11,285,611 | ||||||||||

| Dividends in excess of earnings | (2,767,708 | ) | (2,633,071 | ) | (2,455,189 | ) | (2,314,291 | ) | (2,177,269 | ) | |||||

| Accumulated other comprehensive (loss), net | (91,699 | ) | (115,647 | ) | (103,201 | ) | (107,070 | ) | (106,096 | ) | |||||

| Total Stockholders' Equity | $10,088,408 | $9,858,644 | $10,026,254 | $10,140,378 | $10,253,851 | ||||||||||

| Noncontrolling Interests | |||||||||||||||

| Noncontrolling interest in operating partnership | $772,931 | $906,510 | $671,269 | $654,261 | $680,400 | ||||||||||

| Noncontrolling interest in consolidated joint ventures | 121,160 | 93,056 | 65,939 | 2,289 | 2,293 | ||||||||||

| Total Noncontrolling Interests | $894,091 | $999,566 | $737,208 | $656,550 | $682,693 | ||||||||||

| Total Equity | $10,982,499 | $10,858,210 | $10,763,462 | $10,796,928 | $10,936,544 | ||||||||||

| Total Liabilities and Equity | $23,342,067 | $23,766,695 | $21,462,110 | $21,411,423 | $21,581,917 | ||||||||||

| (1) | Net of allowance for doubtful accounts of $16,910 and $11,554, as of March 31, 2019 and December 31, 2018, respectively. |

| (2) | Adoption of the new lease accounting standard required that we adjust the consolidated balance sheet as of March 31, 2019, to include the recognition of additional right-of-use assets and lease liabilities for operating leases. See the filed Form 10-Q for additional information. |

| (3) | Series C Cumulative Redeemable Perpetual Preferred Stock, 6.625%, $201,250 and $201,250 liquidation preference, respectively ($25.00 per share), 8,050,000 and 8,050,000 shares issued and outstanding as of March 31, 2019 and December 31, 2018, respectively. |

| (4) | Series G Cumulative Redeemable Preferred Stock, 5.875%, $250,000 and $250,000 liquidation preference, respectively ($25.00 per share), 10,000,000 and 10,000,000 shares issued and outstanding as of March 31, 2019 and December 31, 2018, respectively. |

| (5) | Series H Cumulative Redeemable Preferred Stock, 7.375%, $365,000 and $365,000 liquidation preference, respectively ($25.00 per share), 14,600,000 and 14,600,000 shares issued and outstanding as of March 31, 2019 and December 31, 2018, respectively. Redeemed April 1, 2019. |

| (6) | Series I Cumulative Redeemable Preferred Stock, 6.350%, $250,000 and $250,000 liquidation preference, respectively ($25.00 per share), 10,000,000 and 10,000,000 shares issued and outstanding as of March 31, 2019 and December 31, 2018, respectively. |

| (7) | Series J Cumulative Redeemable Preferred Stock, 5.250%, $200,000 and $200,000 liquidation preference, respectively ($25.00 per share), 8,000,000 and 8,000,000 shares issued and outstanding as of March 31, 2019 and December 31, 2018, respectively. |

| (8) | Series K Cumulative Redeemable Preferred Stock, 5.850%, $210,000 and $0 liquidation preference, respectively ($25.00 per share), 8,400,000 and 0 shares issued and outstanding as of March 31, 2019 and December 31, 2018, respectively. |

| (9) | Common Stock: 208,214,139 and 206,425,656 shares issued and outstanding as of March 31, 2019 and December 31, 2018, respectively. |

16

| Components of Net Asset Value (NAV) (1) |  | Financial Supplement |

| Unaudited and in Thousands | First Quarter 2019 | |

| Consolidated Data Centers Cash Net Operating Income (NOI) (2), Annualized (3) | |||

| Internet Gateway (4) | $358,727 | ||

| Turn-Key Flex® (4) | 1,232,738 | ||

| Powered Base Building® (4) | 220,480 | ||

| Colo & Non-tech (4) | 123,617 | ||

| Internet Gateway Leaseholds (4) | 97,164 | ||

| Total Cash NOI, Annualized | $2,032,726 | ||

| less: Partners' share of consolidated JVs | 83 | ||

| Acquisitions / dispositions / expirations | (56,979 | ) | |

| 1Q19 carry-over & remaining FY19 backlog cash NOI (stabilized) (5) | 61,947 | ||

| Total Consolidated Cash NOI, Annualized | $2,037,777 | ||

| Digital Realty's Pro Rata Share of Unconsolidated JV Cash NOI (3)(6) | |||

| Turn-Key Flex® | $52,732 | ||

| Powered Base Building® | 9,540 | ||

| Total Unconsolidated Cash NOI, Annualized | $62,272 | ||

| Other Income | |||

| Development and Management Fees (net), Annualized | $7,684 | ||

| Other Assets | |||

| Pre-stabilized inventory, at cost (7) | $491,936 | ||

| Land held for development | 163,081 | ||

| Development CIP (8) | 1,584,327 | ||

| less: Investment associated with FY19 Backlog NOI | (227,422 | ) | |

| Cash and cash equivalents | 123,879 | ||

| Restricted cash | 10,130 | ||

| Accounts and other receivables, net | 328,009 | ||

| Other assets | 152,638 | ||

| less: Partners' share of consolidated JV assets | (26 | ) | |

| Total Other Assets | $2,626,552 | ||

| Liabilities | |||

| Global unsecured revolving credit facilities | $857,211 | ||

| Unsecured term loans | 811,654 | ||

| Unsecured senior notes | 8,580,715 | ||

| Secured debt, excluding premiums | 105,621 | ||

| Accounts payable and other accrued liabilities (9) | 922,571 | ||

| Security deposits and prepaid rents | 221,526 | ||

| Backlog NOI cost to complete (10) | 95,042 | ||

| Preferred stock, at liquidation value | 1,476,250 | ||

| Digital Realty's share of unconsolidated JV debt | 561,402 | ||

| Total Liabilities | $13,631,992 | ||

| Diluted Shares and Units Outstanding | 218,405 | ||

| (1) | Includes Digital Realty's share of backlog leasing at unconsolidated joint venture buildings. Excludes Ascenty. |

| (2) | For definitions and discussion of NOI and cash NOI and a reconciliation of operating income to NOI and cash NOI, see page 40. |

| (3) | Annualized cash NOI is calculated by multiplying results for the most recent quarter by four. Annualized results may not be indicative of any four-quarter period and do not take into account scheduled lease expirations, among other things. Annualized data is presented for illustrative purposes only. |

| (4) | Reflects annualized 1Q19 Cash NOI of $2,032.7 million. NOI is allocated based on management’s best estimates derived using contractual ABR and stabilized margins. |

| (5) | Estimated cash NOI related to signed leasing expected to commence through December 31, 2019. Includes Digital Realty's share of signed leases at unconsolidated joint venture buildings. Excludes Ascenty. |

| (6) | For a reconciliation of Digital Realty's pro rata share of unconsolidated joint venture operating income to cash NOI, see page 37. |

| (7) | Includes Digital Realty's share of cost at unconsolidated joint venture buildings. Excludes Ascenty. |

| (8) | See page 33 for further details on the breakdown of the construction in progress balance. |

| (9) | Includes net deferred tax liability of approximately $139.0 million. |

| (10) | Includes Digital Realty's share of expected cost to complete at unconsolidated joint venture buildings. Excludes Ascenty. |

17

| Consolidated Debt Analysis and Global Unsecured Revolving Credit Facility |  | Financial Supplement |

| Unaudited and in Thousands | First Quarter 2019 | |

| As of March 31, 2019 | ||||||||||

| Maturity Date | Principal Balance | % of Total Debt | Interest Rate | Interest Rate Including Swaps | ||||||

| Global Unsecured Revolving Credit Facilities (1) | ||||||||||

| Global unsecured revolving credit facility - Unhedged | January 24, 2024 | $394,278 | 1.795 | % | ||||||

| Global unsecured revolving credit facility - Hedged | January 24, 2024 | 290,000 | 3.391 | % | 2.240 | % | ||||

| Yen revolving credit facility | January 24, 2024 | 172,933 | 0.500 | % | ||||||

| Deferred financing costs, net | (14,236 | ) | ||||||||

| Total Global Unsecured Revolving Credit Facilities | $842,975 | 8 | % | 2.074 | % | 1.684 | % | |||

| Unsecured Term Loan (1) | ||||||||||

| Hedged variable rate portion of seven-year term loan | January 15, 2023 | $300,000 | 3.484 | % | 2.435 | % | ||||

| Unhedged variable rate portion of five-year term loan | January 24, 2024 | 437,868 | 2.772 | % | ||||||

| Hedged variable rate portion of five-year term loan | January 24, 2024 | 73,786 | 2.977 | % | 1.779 | % | ||||

| Deferred financing costs, net | (3,928 | ) | ||||||||

| Total Unsecured Term Loan | $807,726 | 8 | % | 3.054 | % | 2.557 | % | |||

| Senior Notes | ||||||||||

| Floating rate guaranteed notes due 2019 | May 22, 2019 | $140,225 | 0.192 | % | ||||||

| 3.400% notes due 2020 | October 1, 2020 | 500,000 | 3.400 | % | ||||||

| 5.250% notes due 2021 | March 15, 2021 | 400,000 | 5.250 | % | ||||||

| 3.950% notes due 2022 | July 1, 2022 | 500,000 | 3.950 | % | ||||||

| 3.625% notes due 2022 | October 1, 2022 | 300,000 | 3.625 | % | ||||||

| 2.750% notes due 2023 | February 1, 2023 | 350,000 | 2.750 | % | ||||||

| 4.750% notes due 2023 | October 13, 2023 | 391,050 | 4.750 | % | ||||||

| 2.625% notes due 2024 | April 15, 2024 | 673,080 | 2.625 | % | ||||||

| 2.750% notes due 2024 | July 19, 2024 | 325,875 | 2.750 | % | ||||||

| 4.250% notes due 2025 | January 17, 2025 | 521,400 | 4.250 | % | ||||||

| 4.750% notes due 2025 | October 1, 2025 | 450,000 | 4.750 | % | ||||||

| 2.500% notes due 2026 | January 16, 2026 | 1,205,935 | 2.500 | % | ||||||

| 3.700% notes due 2027 | August 15, 2027 | 1,000,000 | 3.700 | % | ||||||

| 4.450% notes due 2028 | July 15, 2028 | 650,000 | 4.450 | % | ||||||

| 3.300% notes due 2029 | July 19, 2029 | 456,225 | 3.300 | % | ||||||

| 3.750% notes due 2030 | October 17, 2030 | 716,925 | 3.750 | % | ||||||

| Unamortized discounts | (11,520 | ) | ||||||||

| Deferred financing costs, net | (45,733 | ) | ||||||||

| Total Senior Notes | $8,523,462 | 83 | % | 3.558 | % | |||||

| Total Unsecured Senior Notes | $8,523,462 | 83 | % | 3.558 | % | |||||

| Secured Debt | ||||||||||

| 731 East Trade Street | July 1, 2020 | $1,621 | 8.220 | % | ||||||

| Secured note due 2023 | March 1, 2023 | 104,000 | 3.484 | % | 2.611 | % | ||||

| Unamortized net premiums | 124 | |||||||||

| Deferred financing costs, net | (252 | ) | ||||||||

| Total Secured Debt | $105,493 | 1 | % | 3.556 | % | 2.697 | % | |||

| Total Indebtedness | $10,279,656 | 100 | % | 3.395 | % | 3.315 | % | |||

| Debt Summary | ||||||||||

| Total unhedged variable rate debt | $1,145,304 | 11 | % | |||||||

| Total fixed rate / hedged variable rate debt | 9,209,897 | 89 | % | |||||||

| Total Consolidated Debt | $10,355,201 | 100 | % | 3.395 | % | 3.315% (2) | ||||

| Global Unsecured Revolving Credit Facilities Detail as of March 31, 2019 | |||||||||

| Maximum Available | Existing Capacity (3) | Currently Drawn | |||||||

| Global Unsecured Revolving Credit Facilities | $2,656,077 | $1,753,854 | $857,211 | ||||||

| (1) | Maturity date assumes that all extensions will be exercised. |

| (2) | Debt instruments shown at coupon rates. |

| (3) | Net of letters of credit issued of $45.0 million. |

18

| Debt Maturities |  | Financial Supplement |

| Unaudited and in Thousands | First Quarter 2019 | |

| As of March 31, 2019 | ||||||||||||||||||||||

| Interest Rate | 2019 | 2020 | 2021 | 2022 | 2023 | Thereafter | Total | |||||||||||||||

| Global Unsecured Revolving Credit Facilities (1) | ||||||||||||||||||||||

| Global unsecured revolving credit facility - Unhedged | 1.795% | — | — | — | — | — | $394,278 | $394,278 | ||||||||||||||

| Global unsecured revolving credit facility - Hedged | 2.240% (2) | — | — | — | — | — | 290,000 | 290,000 | ||||||||||||||

| Yen revolving credit facility | 0.500% | — | — | — | — | — | 172,933 | 172,933 | ||||||||||||||

| Total Global Unsecured Revolving Credit Facilities | 1.684% (2) | — | — | — | — | — | $857,211 | $857,211 | ||||||||||||||

| Unsecured Term Loan (1) | ||||||||||||||||||||||

| Hedged variable rate portion of seven-year term loan | 2.435% (2) | — | — | — | — | $300,000 | — | $300,000 | ||||||||||||||

| Unhedged variable rate portion of five-year term loan | 2.772% | — | — | — | — | — | $437,868 | 437,868 | ||||||||||||||

| Hedged variable rate portion of five-year term loan | 1.779% (2) | — | — | — | — | — | 73,786 | 73,786 | ||||||||||||||

| Total Unsecured Term Loan | 2.557% (2) | — | — | — | — | $300,000 | $511,654 | $811,654 | ||||||||||||||

| Senior Notes | ||||||||||||||||||||||

| Floating rate guaranteed notes due 2019 | 0.192% | $140,225 | — | — | — | — | — | $140,225 | ||||||||||||||

| 3.400% notes due 2020 | 3.400% | — | $500,000 | — | — | — | — | 500,000 | ||||||||||||||

| 5.250% notes due 2021 | 5.250% | — | — | $400,000 | — | — | — | 400,000 | ||||||||||||||

| 3.950% notes due 2022 | 3.950% | — | — | — | $500,000 | — | — | 500,000 | ||||||||||||||

| 3.625% notes due 2022 | 3.625% | — | — | — | 300,000 | — | — | 300,000 | ||||||||||||||

| 2.750% notes due 2023 | 2.750% | — | — | — | — | $350,000 | — | 350,000 | ||||||||||||||

| 4.750% notes due 2023 | 4.750% | — | — | — | — | 391,050 | — | 391,050 | ||||||||||||||

| 2.625% notes due 2024 | 2.625% | — | — | — | — | — | $673,080 | 673,080 | ||||||||||||||

| 2.750% notes due 2024 | 2.750% | — | — | — | — | — | 325,875 | 325,875 | ||||||||||||||

| 4.250% notes due 2025 | 4.250% | — | — | — | — | — | 521,400 | 521,400 | ||||||||||||||

| 4.750% notes due 2025 | 4.750% | — | — | — | — | — | 450,000 | 450,000 | ||||||||||||||

| 2.500% notes due 2026 | 2.500% | — | — | — | — | — | 1,205,935 | 1,205,935 | ||||||||||||||

| 3.700% notes due 2027 | 3.700% | — | — | — | — | — | 1,000,000 | 1,000,000 | ||||||||||||||

| 4.450% notes due 2028 | 4.450% | — | — | — | — | — | 650,000 | 650,000 | ||||||||||||||

| 3.300% notes due 2029 | 3.300% | — | — | — | — | — | 456,225 | 456,225 | ||||||||||||||

| 3.750% notes due 2030 | 3.750% | — | — | — | — | — | 716,925 | 716,925 | ||||||||||||||

| Total Senior Notes | 3.558% | $140,225 | $500,000 | $400,000 | $800,000 | $741,050 | $5,999,440 | $8,580,715 | ||||||||||||||

| Secured Debt | ||||||||||||||||||||||

| Secured note due 2023 | 2.611% (2) | — | — | — | — | $104,000 | — | $104,000 | ||||||||||||||

| 731 East Trade Street | 8.220% | $488 | $1,133 | — | — | — | — | 1,621 | ||||||||||||||

| Total Secured Debt | 2.697% (2) | $488 | $1,133 | — | — | $104,000 | — | $105,621 | ||||||||||||||

| Total unhedged variable rate debt | $140,225 | — | — | — | — | $1,005,079 | $1,145,304 | |||||||||||||||

| Total fixed rate / hedged variable rate debt | 488 | $501,133 | $400,000 | $800,000 | $1,145,050 | 6,363,226 | 9,209,897 | |||||||||||||||

| Total Debt | 3.315% | $140,713 | $501,133 | $400,000 | $800,000 | $1,145,050 | $7,368,305 | $10,355,201 | ||||||||||||||

| Weighted Average Interest Rate | 0.220 | % | 3.411 | % | 5.250 | % | 3.828 | % | 3.338 | % | 3.204 | % | 3.315 | % | ||||||||

| Summary | ||||||||||||||||||||||

| Weighted Average Term to Initial Maturity | 5.9 Years | |||||||||||||||||||||

| Weighted Average Maturity (assuming exercise of extension options) | 6.0 Years | |||||||||||||||||||||

| (1) | Assumes all extensions will be exercised. |

| (2) | Interest rate including swaps. |

Note: Totals exclude net premiums/(discounts) and deferred financing costs.

19

| Debt Analysis & Covenant Compliance |  | Financial Supplement |

| Unaudited | First Quarter 2019 | |

| As of March 31, 2019 | ||||||||||||

5.250% Notes due 2021 | Floating Rate Notes due 2019 3.400% Notes due 2020 3.950% Notes due 2022 3.625% Notes due 2022 4.750% Notes due 2023 2.750% Notes due 2023 2.625% Notes due 2024 2.750% Notes due 2024 4.250% Notes due 2025 4.750% Notes due 2025 2.500% Notes due 2026 3.700% Notes due 2027 4.450% Notes due 2028 3.300% Notes due 2029 3.750% Notes due 2030 | Global Unsecured Revolving Credit Facilities | ||||||||||

| Debt Covenant Ratios (1) | Required | Actual | Actual | Required | Actual | |||||||

| Total outstanding debt / total assets (2) | Less than 60% | 46 | % | 43 | % | Less than 60% (3) | 36 | % | ||||

| Secured debt / total assets (4) | Less than 40% | < 1% | < 1% | Less than 40% | 2 | % | ||||||

| Total unencumbered assets / unsecured debt | Greater than 150% | 221 | % | 238 | % | N/A | N/A | |||||

| Consolidated EBITDA / interest expense (5) | Greater than 1.5x | 4.2x | 4.2x | N/A | N/A | |||||||

| Fixed charge coverage | N/A | N/A | Greater than 1.5x | 3.9x | ||||||||

| Unsecured debt / total unencumbered asset value (6) | N/A | N/A | Less than 60% | 38 | % | |||||||

| Unencumbered assets debt service coverage ratio | N/A | N/A | Greater than 1.5x | 5.6 | ||||||||

| (1) | For a definition of the terms used in the table above and related footnotes, please refer to the indentures which govern the notes and the Amended and Restated Global Senior Credit Agreement dated as of October 24, 2018, which are filed as exhibits to our reports filed with the Securities and Exchange Commission. |

| (2) | This ratio is referred to as the Leverage Ratio, defined as Consolidated Debt / Total Asset Value, under the Global Unsecured Revolving Credit Facility. For the calculation of Total Assets, please refer to the indentures which govern the notes and the Amended and Restated Global Senior Credit Agreement dated as of October 24, 2018, which are filed as exhibits to our reports filed with the Securities and Exchange Commission. |

| (3) | The company has the right to maintain a Leverage Ratio of greater than 60.0% but less than or equal to 65.0% for up to four consecutive fiscal quarters during the term of the facility following an acquisition of one or more Assets for a purchase price and other consideration in an amount not less than 5% of Total Asset Value. |

| (4) | This ratio is referred to as the Secured Debt Leverage Ratio, defined as Secured Debt / Total Asset Value, under the Global Unsecured Revolving Credit Facility. |

| (5) | Calculated as current quarter annualized consolidated EBITDA to current quarter annualized Interest Expense (including capitalized interest and debt discounts). |

| (6) | Assets must satisfy certain conditions to qualify for inclusion as an Unencumbered Asset under the Global Unsecured Revolving Credit Facility. |

20

| Same-Capital Operating Trend Summary |  | Financial Supplement |

| Unaudited and in Thousands | First Quarter 2019 | |

Stabilized ("Same-Capital") Portfolio (1)

| Three Months Ended | |||||||||||

| 31-Mar-19 | 31-Mar-18 | % Change | 31-Dec-18 | % Change | |||||||

| Rental revenues | $455,668 | $463,419 | (1.7 | %) | $459,178 | (0.8 | %) | ||||

| Tenant reimbursements - Utilities | 85,962 | 86,222 | (0.3 | %) | 89,073 | (3.5 | %) | ||||

| Tenant reimbursements - Other | 47,661 | 45,383 | 5.0 | % | 48,159 | (1.0 | %) | ||||

| Interconnection & other | 57,405 | 55,833 | 2.8 | % | 57,665 | (0.5 | %) | ||||

| Total Revenue | $646,696 | $650,857 | (0.6 | %) | $654,075 | (1.1 | %) | ||||

| Utilities | $99,955 | $97,779 | 2.2 | % | $102,774 | (2.7 | %) | ||||

| Rental property operating | 98,397 | 93,417 | 5.3 | % | 106,156 | (7.3 | %) | ||||

| Property taxes | 27,533 | 27,659 | (0.5 | %) | 26,408 | 4.3 | % | ||||

| Insurance | 2,673 | 3,325 | (19.6 | %) | 2,697 | (0.9 | %) | ||||

| Total Expenses | $228,558 | $222,180 | 2.9 | % | $238,035 | (4.0 | %) | ||||

| Net Operating Income (2) | $418,138 | $428,677 | (2.5 | %) | $416,040 | 0.5 | % | ||||

| Less: | |||||||||||

| Stabilized straight-line rent | $2,796 | $3,337 | (16.2 | %) | ($3,785) | (173.9 | %) | ||||

| Above- and below-market rent | (5,400) | (6,127) | (11.9 | %) | (5,604) | (3.6 | %) | ||||

| Cash Net Operating Income (3) | $420,742 | $431,467 | (2.5 | %) | $425,429 | (1.1 | %) | ||||

| Stabilized Portfolio occupancy at period end (4) | 89.8 | % | 91.3 | % | (1.6 | %) | 90.2 | % | (0.4 | %) | |

| (1) | Represents buildings owned as of December 31, 2017 with less than 5% of total rentable square feet under development. Excludes buildings that were undergoing, or were expected to undergo, development activities in 2018-2019, buildings classified as held for sale, and buildings sold or contributed to joint ventures for all periods presented. Prior period numbers adjusted to reflect current same-capital pool. |

| (2) | For a definition and discussion of net operating income and a reconciliation of operating income to NOI, see page 40. |

| (3) | For a definition and discussion of cash net operating income and a reconciliation of operating income to cash NOI, see page 40. |

| (4) | Occupancy excludes space under active development and space held for development. For some of our buildings, we calculate occupancy based on factors in addition to contractually leased square feet, including available power, required support space and common areas. |

21

| Summary of Leasing Activity |  | Financial Supplement |

| Leases Signed in the Quarter Ended March 31, 2019 | First Quarter 2019 | |

| Turn-Key Flex® | Powered Base Building® | Colocation | Non-Tech | Total | ||||||||||||||||||||||||||||||

| Leasing Activity - New (1) (2) | 1Q19 | LTM | 1Q19 | LTM | 1Q19 | LTM | 1Q19 | LTM | 1Q19 | LTM | ||||||||||||||||||||||||

| Number of leases (3) | 18 | 127 | 1 | 4 | 153 | 698 | 8 | 31 | 180 | 860 | ||||||||||||||||||||||||

| Rentable Square Feet Leased (4) | 159,728 | 1,312,643 | 51,615 | 144,035 | 25,004 | 147,118 | 71,501 | 178,299 | 307,848 | 1,782,095 | ||||||||||||||||||||||||

| Initial stabilized cash rent per square foot | $127 | $130 | $84 | $62 | $269 | $236 | $5 | $14 | $103 | $121 | ||||||||||||||||||||||||

| GAAP base rent per square foot (5) | $137 | $131 | $94 | $66 | $263 | $234 | $4 | $14 | $109 | $123 | ||||||||||||||||||||||||

| Leasing cost per square foot | $65 | $25 | $51 | $43 | $25 | $24 | $1 | $9 | $44 | $25 | ||||||||||||||||||||||||

| Weighted Average Lease Term (years) | 12.0 | 8.9 | 15.0 | 15.0 | 2.1 | 2.3 | 3.1 | 7.1 | 9.6 | 8.7 | ||||||||||||||||||||||||

| Net Effective Leasing Economics (6) | ||||||||||||||||||||||||||||||||||

| Base rent | $139 | $136 | $97 | $71 | $263 | $234 | $5 | $14 | $111 | $127 | ||||||||||||||||||||||||

| Rental concessions | $2 | $5 | $3 | $5 | — | $1 | — | $1 | $1 | $4 | ||||||||||||||||||||||||

| Estimated operating expense | $26 | $31 | — | — | $93 | $96 | $3 | $4 | $21 | $31 | ||||||||||||||||||||||||

| Net Rent | $112 | $101 | $94 | $66 | $170 | $137 | $2 | $10 | $88 | $92 | ||||||||||||||||||||||||

| Tenant improvements | $3 | $2 | — | — | — | — | — | $1 | $2 | $1 | ||||||||||||||||||||||||

| Leasing commissions | $2 | $2 | $3 | $3 | $20 | $17 | — | $1 | $3 | $3 | ||||||||||||||||||||||||

| Net Effective Rent | $107 | $97 | $91 | $63 | $150 | $120 | $2 | $9 | $83 | $88 | ||||||||||||||||||||||||

| Turn-Key Flex® | Powered Base Building® | Colocation | Non-Tech | Total | ||||||||||||||||||||

| Leasing Activity - Renewals (1) | 1Q19 | LTM | 1Q19 | LTM | 1Q19 | LTM | 1Q19 | LTM | 1Q19 | LTM | ||||||||||||||

| Number of leases (3) | 33 | 155 | 23 | 35 | 387 | 1,708 | 11 | 37 | 454 | 1,935 | ||||||||||||||

| Rentable square feet renewed (4) | 205,006 | 892,390 | 1,564,333 | 1,824,776 | 105,760 | 644,681 | 122,957 | 354,367 | 1,998,056 | 3,716,214 | ||||||||||||||

| Expiring cash rent per square foot | $148 | $177 | $36 | $38 | $282 | $255 | $9 | $13 | $59 | $106 | ||||||||||||||

| Renewed cash rent per square foot | $139 | $173 | $32 | $35 | $289 | $255 | $10 | $14 | $55 | $104 | ||||||||||||||

| Cash Rental Rate Change | (5.9 | %) | (2.2 | %) | (12.6 | %) | (8.9 | %) | 2.5 | % | 0.1 | % | 11.8 | % | 7.6 | % | (6.9 | %) | (2.3 | %) | ||||

| Expiring GAAP base rent per square foot (5) | $136 | $162 | $32 | $33 | $282 | $255 | $9 | $12 | $54 | $100 | ||||||||||||||

| Renewed GAAP base rent per square foot (5) | $142 | $170 | $35 | $38 | $289 | $255 | $11 | $14 | $58 | $105 | ||||||||||||||

| GAAP Base Rental Rate Change | 4.3 | % | 5.3 | % | 11.0 | % | 13.6 | % | 2.5 | % | 0.3 | % | 22.5 | % | 15.8 | % | 7.1 | % | 4.6 | % | ||||

| Leasing cost per square foot | $18 | $7 | $14 | $13 | $0 | $0 | $2 | $3 | $13 | $8 | ||||||||||||||

| Weighted Average Lease Term (years) | 8.6 | 6.6 | 14.6 | 13.2 | 1.4 | 1.8 | 4.2 | 5.4 | 12.6 | 8.9 | ||||||||||||||

| Retention Ratio (7) | 74.0 | % | 76.1 | % | 99.3 | % | 94.6 | % | 86.1 | % | 89.1 | % | 89.1 | % | 64.9 | % | 94.5 | % | 85.0 | % | ||||

| (1) | Excludes short-term, roof and garage leases. |

| (2) | Includes leases for new and re-leased space. |

| (3) | The number of leases represents the leased-unit count; a lease may include multiple units. |

| (4) | For some of our buildings, we calculate square footage based on factors in addition to contractually leased square feet, including power, required support space and common area. |

| (5) | Rental rates represent annual estimated cash rent per rentable square foot, adjusted for straight-line rents in accordance with GAAP. |

| (6) | All dollar amounts are per square foot averaged over lease term. |

| (7) | Based on square feet. |

Note: LTM is last twelve months, including current quarter.

22

| Summary of Leasing Activity |  | Financial Supplement |

| Leases Commenced in the Quarter Ended March 31, 2019 | First Quarter 2019 | |

| Turn-Key Flex® | Powered Base Building® | Colocation | Non-Tech | Total | |||||||||||||||||||||||||||||

| Leasing Activity - New (1) (2) | 1Q19 | LTM | 1Q19 | LTM | 1Q19 | LTM | 1Q19 | LTM | 1Q19 | LTM | |||||||||||||||||||||||