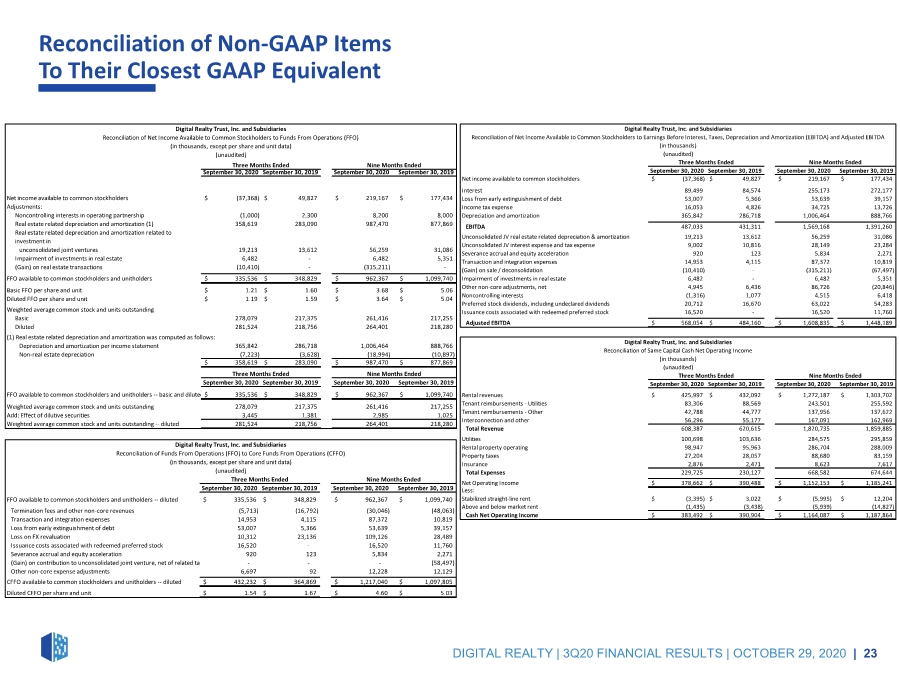

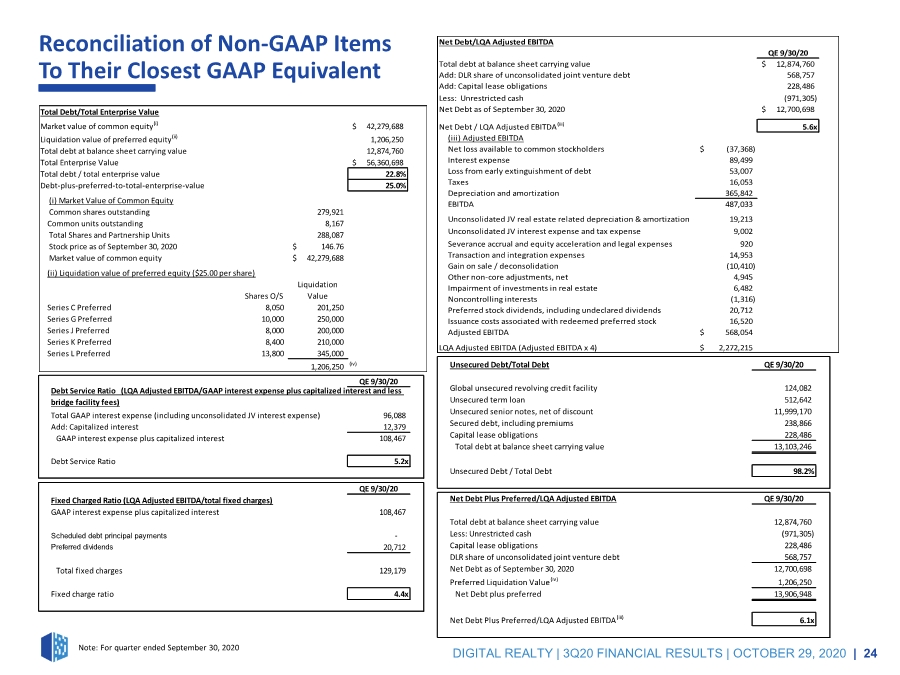

| Reconciliation of Non-GAAP Items To Their Closest GAAP Equivalent DIGITAL REALTY | 3Q20 FINANCIAL RESULTS | OCTOBER 29, 2020 | 23 September 30, 2020 September 30, 2019 September 30, 2020 September 30, 2019 Net income available to common stockholders (37,368) $ 49,827 $ 219,167 $ 177,434 $ Adjustments: Noncontrolling interests in operating partnership (1,000) 2,300 8,200 8,000 Real estate related depreciation and amortization (1) 358,619 283,090 987,470 877,869 Real estate related depreciation and amortization related to investment in unconsolidated joint ventures 19,213 13,612 56,259 31,086 Impairment of investments in real estate 6,482 - 6,482 5,351 (Gain) on real estate transactions (10,410) - (315,211) - FFO available to common stockholders and unitholders 335,536 $ 348,829 $ 962,367 $ 1,099,740 $ Basic FFO per share and unit 1.21 $ 1.60 $ 3.68 $ 5.06 $ Diluted FFO per share and unit 1.19 $ 1.59 $ 3.64 $ 5.04 $ Weighted average common stock and units outstanding Basic 278,079 217,375 261,416 217,255 Diluted 281,524 218,756 264,401 218,280 (1) Real estate related depreciation and amortization was computed as follows: Depreciation and amortization per income statement 365,842 286,718 1,006,464 888,766 Non-real estate depreciation (7,223) (3,628) (18,994) (10,897) 358,619 $ 283,090 $ 987,470 $ 877,869 $ September 30, 2020 September 30, 2019 September 30, 2020 September 30, 2019 FFO available to common stockholders and unitholders -- basic and diluted 335,536 $ 348,829 $ 962,367 $ 1,099,740 $ Weighted average common stock and units outstanding 278,079 217,375 261,416 217,255 Add: Effect of dilutive securities 3,445 1,381 2,985 1,025 Weighted average common stock and units outstanding -- diluted 281,524 218,756 264,401 218,280 Nine Months Ended Digital Realty Trust, Inc. and Subsidiaries Reconciliation of Net Income Available to Common Stockholders to Funds From Operations (FFO) (in thousands, except per share and unit data) (unaudited) Three Months Ended Three Months Ended Nine Months Ended September 30, 2020 September 30, 2019 September 30, 2020 September 30, 2019 FFO available to common stockholders and unitholders -- diluted 335,536 $ 348,829 $ 962,367 $ 1,099,740 $ Termination fees and other non-core revenues (5,713) (16,792) (30,046) (48,063) Transaction and integration expenses 14,953 4,115 87,372 10,819 Loss from early extinguishment of debt 53,007 5,366 53,639 39,157 Loss on FX revaluation 10,312 23,136 109,126 28,489 Issuance costs associated with redeemed preferred stock 16,520 - 16,520 11,760 Severance accrual and equity acceleration 920 123 5,834 2,271 (Gain) on contribution to unconsolidated joint venture, net of related tax - - - (58,497) Other non-core expense adjustments 6,697 92 12,228 12,129 CFFO available to common stockholders and unitholders -- diluted 432,232 $ 364,869 $ 1,217,040 $ 1,097,805 $ Diluted CFFO per share and unit 1.54 $ 1.67 $ 4.60 $ 5.03 $ Digital Realty Trust, Inc. and Subsidiaries Reconciliation of Funds From Operations (FFO) to Core Funds From Operations (CFFO) (in thousands, except per share and unit data) (unaudited) Three Months Ended Nine Months Ended September 30, 2020 September 30, 2019 September 30, 2020 September 30, 2019 Net income available to common stockholders (37,368) $ 49,827 $ 219,167 $ 177,434 $ Interest 89,499 84,574 255,173 272,177 Loss from early extinguishment of debt 53,007 5,366 53,639 39,157 Income tax expense 16,053 4,826 34,725 13,726 Depreciation and amortization 365,842 286,718 1,006,464 888,766 EBITDA 487,033 431,311 1,569,168 1,391,260 Unconsolidated JV real estate related depreciation & amortization 19,213 13,612 56,259 31,086 Unconsolidated JV interest expense and tax expense 9,002 10,816 28,149 23,284 Severance accrual and equity acceleration 920 123 5,834 2,271 Transaction and integration expenses 14,953 4,115 87,372 10,819 (Gain) on sale / deconsolidation (10,410) - (315,211) (67,497) Impairment of investments in real estate 6,482 - 6,482 5,351 Other non-core adjustments, net 4,945 6,436 86,726 (20,846) Noncontrolling interests (1,316) 1,077 4,515 6,418 Preferred stock dividends, including undeclared dividends 20,712 16,670 63,022 54,283 Issuance costs associated with redeemed preferred stock 16,520 - 16,520 11,760 . Adjusted EBITDA 568,054 $ 484,160 $ 1,608,835 $ 1,448,189 $ Nine Months Ended Three Months Ended Digital Realty Trust, Inc. and Subsidiaries Reconciliation of Net Income Available to Common Stockholders to Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) and Adjusted EBITDA (in thousands) (unaudited) September 30, 2020 September 30, 2019 September 30, 2020 September 30, 2019 Rental revenues 425,997 $ 432,092 $ 1,272,187 $ 1,303,702 $ Tenant reimbursements - Utilities 83,306 88,569 243,501 255,592 Tenant reimbursements - Other 42,788 44,777 137,956 137,622 Interconnection and other 56,296 55,177 167,091 162,969 Total Revenue 608,387 620,615 1,820,735 1,859,885 Utilities 100,698 103,636 284,575 295,859 Rental property operating 98,947 95,963 286,704 288,009 Property taxes 27,204 28,057 88,680 83,159 Insurance 2,876 2,471 8,623 7,617 Total Expenses 229,725 230,127 668,582 674,644 Net Operating Income 378,662 $ 390,488 $ 1,152,153 $ 1,185,241 $ Less: Stabilized straight-line rent (3,395) $ 3,022 $ (5,995) $ 12,204 $ Above and below market rent (1,435) (3,438) (5,939) (14,827) Cash Net Operating Income 383,492 $ 390,904 $ 1,164,087 $ 1,187,864 $ Three Months Ended Nine Months Ended Digital Realty Trust, Inc. and Subsidiaries Reconciliation of Same Capital Cash Net Operating Income (in thousands) (unaudited) |