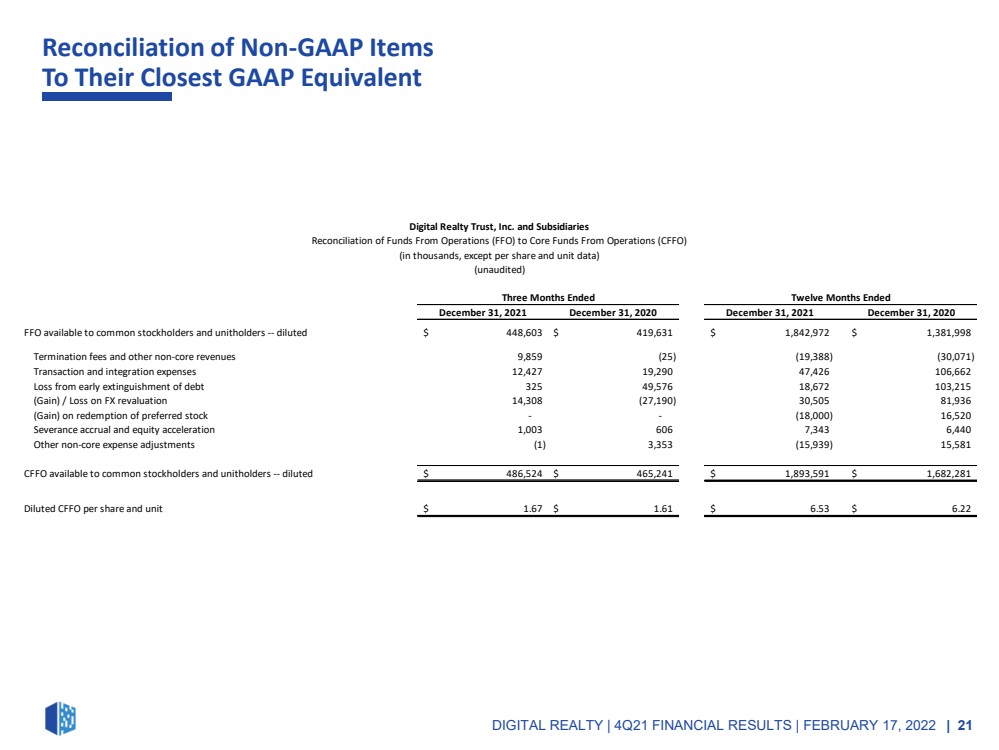

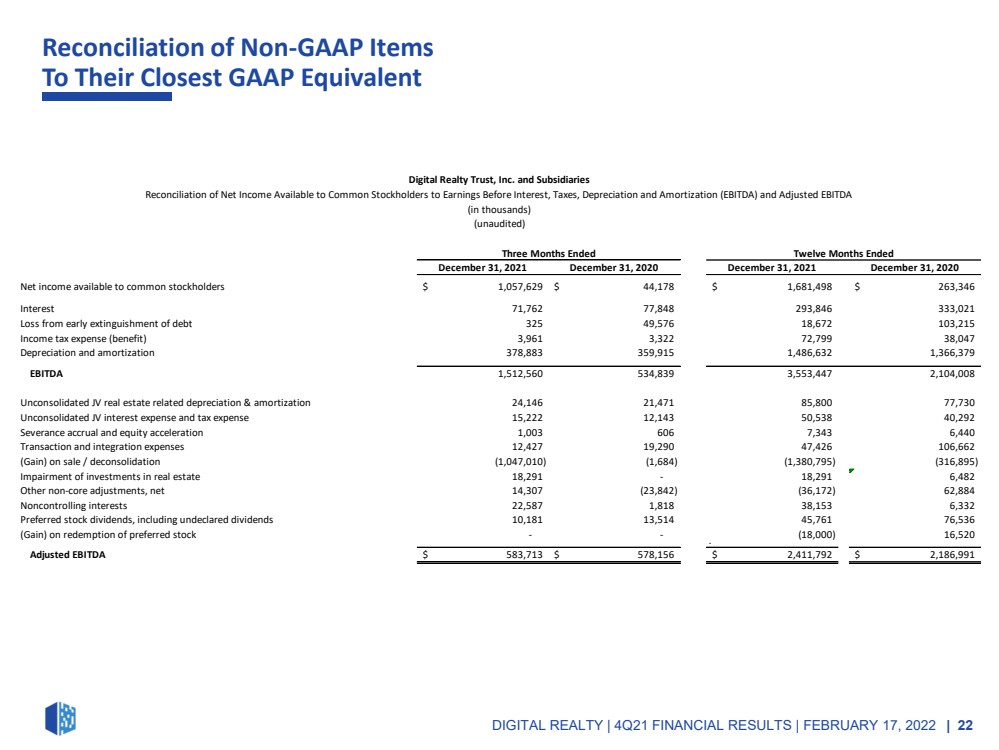

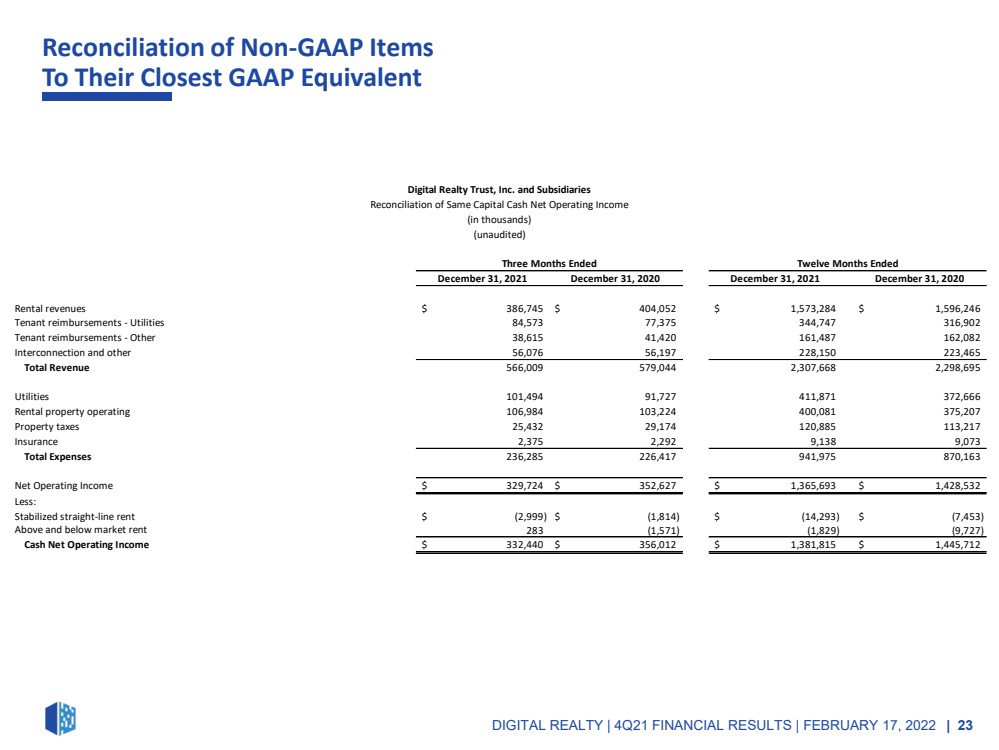

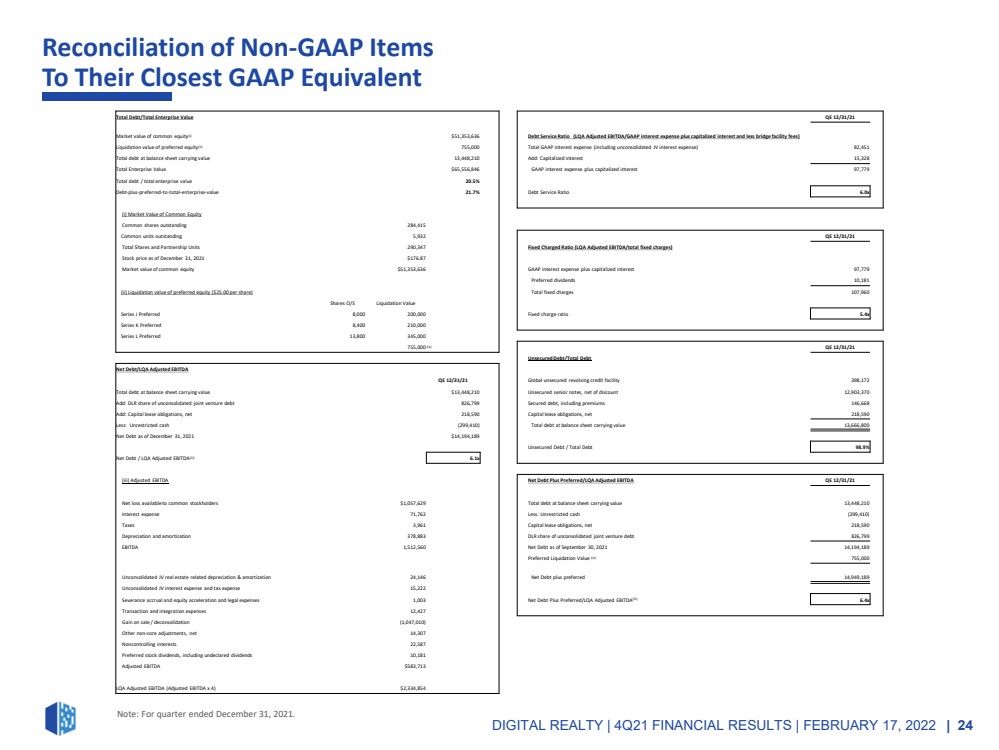

| Appendix Management Statements on Non - GAAP Measures | 18 The information included in this presentation contains certain non - GAAP financial measures that management believes are helpful in understanding our business, as further described below. Our definition and calculation of non - GAAP financial measures may differ from those of other REITs, and, therefore, may not be comparable. The non - GAAP financial measures should not be considered alternatives to net income or any other GAAP measurement of performance and should not be considered an alternative to cash flows from operating, investing or financing activities as a measure of liquidity. Funds From Operations (FFO): We calculate funds from operations, or FFO, in accordance with the standards established by the National Association of Real Est ate Investment Trusts, or NAREIT, in the NAREIT Funds From Operations White Paper - 2018 Restatement. FFO represents net income (loss) (computed in accordance with GAAP), excluding gains (or losses) from real estate transactions, impairment of investment in real estate, real estate related depreciation and amortization (excluding amortization of deferred financing costs), unconsolidated JV real estate rel ate d depreciation & amortization, non - controlling interests in operating partnership and after adjustments for unconsolidated partnerships and joint ventures. Management uses FFO as a supplemental performance mea sure because, in excluding real estate related depreciation and amortization and gains and losses from property dispositions and after adjustments for unconsolidated partnerships and joint ventures, it pro vides a performance measure that, when compared year over year, captures trends in occupancy rates, rental rates and operating costs. We also believe that, as a widely recognized measure of the performanc e o f REITs, FFO will be used by investors as a basis to compare our operating performance with that of other REITs. However, because FFO excludes depreciation and amortization and captures neither the c han ges in the value of our data centers that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the operating performance of our data centers, all of which have real economic effect and could materially impact our financial condition and results from operations, the utility of FFO as a measure of our performance is limited. Other RE ITs may not calculate FFO in accordance with the NAREIT definition and, accordingly, our FFO may not be comparable to other REITs’ FFO. FFO should be considered only as a supplement to net income computed in accord anc e with GAAP as a measure of our performance. Core Funds from Operations (Core FFO) : We present core funds from operations, or core FFO, as a supplemental operating measure because, in excluding certain items t hat do not reflect core revenue or expense streams, it provides a performance measure that, when compared year over year, captures trends in our core business operating performance. We calculate core FFO by adding to or subtracting from FFO (i) termination fees and other non - core revenues, (ii) transaction and integration expenses, (iii) loss from early extinguishment of debt, (iv) gain on / issuance costs associated with redeemed preferred stock, (v) severance, equity acceleration, and legal expenses, (vi) gain/loss on FX revaluation, and (vii) other non - core expense adjustments. Because certain of these adjustments h ave a real economic impact on our financial condition and results from operations, the utility of core FFO as a measure of our performance is limited. Other REITs may calculate core FFO differently than we do an d accordingly, our core FFO may not be comparable to other REITs’ core FFO. Core FFO should be considered only as a supplement to net income computed in accordance with GAAP as a measure of our performance. EBITDA and Adjusted EBITDA : We believe that earnings before interest, loss from early extinguishment of debt, income taxes, and depreciation and amortiza tio n, or EBITDA, and Adjusted EBITDA (as defined below), are useful supplemental performance measures because they allow investors to view our performance without the impact of non - cash depreciation and amorti zation or the cost of debt and, with respect to Adjusted EBITDA, unconsolidated joint venture real estate related depreciation & amortization, unconsolidated joint venture interest expense and tax, severance, equity acceleration, and legal expenses, transaction and integration expenses, gain on sale / deconsolidation, impairment of investments in real estate, other non - core adjustments, net, non - control ling interests, preferred stock dividends, including undeclared dividends, and issuance costs associated with redeemed preferred stock. Adjusted EBITDA is EBITDA excluding unconsolidated joint venture rea l e state related depreciation & amortization, unconsolidated joint venture interest expense and tax, severance, equity acceleration, and legal expenses, transaction and integration expenses, gain on sale / dec ons olidation, impairment of investments in real estate, other non - core adjustments, net, non - controlling interests, preferred stock dividends, including undeclared dividends, and gain on / issuance costs associat ed with redeemed preferred stock. In addition, we believe EBITDA and Adjusted EBITDA are frequently used by securities analysts, investors and other interested parties in the evaluation of REITs. Because EB ITDA and Adjusted EBITDA are calculated before recurring cash charges including interest expense and income taxes, exclude capitalized costs, such as leasing commissions, and are not adjusted for capital e xpe nditures or other recurring cash requirements of our business, their utility as a measure of our performance is limited. Other REITs may calculate EBITDA and Adjusted EBITDA differently than we do and, accor din gly, our EBITDA and Adjusted EBITDA may not be comparable to other REITs’ EBITDA and Adjusted EBITDA. Accordingly, EBITDA and Adjusted EBITDA should be considered only as supplements to net income co mpu ted in accordance with GAAP as a measure of our financial performance. Net Operating Income (NOI) and Cash NOI: Net operating income, or NOI, represents rental revenue, tenant reimbursement revenue and interconnection revenue less utilit ies expense, rental property operating expenses, property taxes and insurance expenses (as reflected in the statement of operations). NOI is commonly used by stockholders, company management and industry an alysts as a measurement of operating performance of the company’s rental portfolio. Cash NOI is NOI less straight - line rents and above - and below - market rent amortization. Cash NOI is commonly used by stockholders, company management and industry analysts as a measure of property operating performance on a cash basis. However, because NOI and cash NOI exclude depreciation and amortization and c apt ure neither the changes in the value of our data centers that result from use or market conditions, nor the level of capital expenditures and capitalized leasing commissions necessary to maintain the ope rat ing performance of our data centers, all of which have real economic effect and could materially impact our results from operations, the utility of NOI and cash NOI as measures of our performance is limite d. Other REITs may calculate NOI and cash NOI differently than we do and, accordingly, our NOI and cash NOI may not be comparable to other REITs’ NOI and cash NOI. NOI and cash NOI should be considered only as su ppl ements to net income computed in accordance with GAAP as measures of our performance. DIGITAL REALTY | 4Q21 FINANCIAL RESULTS | FEBRUARY 17, 2022 |