Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on July 29, 2004

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

THE KENAN ADVANTAGE GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | | 4213 | | 34-1950439 |

(State or other jurisdiction of

incorporation or organization) | | (Primary Standard Industrial

Classification Code Number) | | (I.R.S. Employer

Identification Number) |

4895 Dressler Road, Canton, Ohio 44718, (330) 491-0474

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Dennis A. Nash, President and Chief Executive Officer

The Kenan Advantage Group, Inc.

4895 Dressler Road, Canton, Ohio 44718

(330) 491-0474

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Paul Jacobs, Esq.

Roy L. Goldman, Esq.

Fulbright & Jaworski L.L.P.

666 Fifth Avenue

New York, New York 10103

Telephone (212) 318-3000

Fax (212) 318-3400 | | Kris F. Heinzelman, Esq.

George A. Stephanakis, Esq.

Cravath, Swaine & Moore LLP

Worldwide Plaza

825 Eighth Avenue

New York, New York 10019

Telephone (212) 474-1000

Fax (212) 474-3700 |

Approximate date of commencement of proposed sale to public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the "Securities Act"), check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

| | Proposed Maximum

Aggregate Offering Price(1)

| | Amount of

Registration Fee

|

|---|

|

| Common stock, $0.0001 par value per share | | $92,000,000 | | $11,657 |

|

- (1)

- Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act. The proposed maximum aggregate offering price includes amounts attributed to shares of common stock that the underwriters may purchase to cover over-allotments, if any.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED JULY 29, 2004

The information in this prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Shares

Common Stock

We are selling shares of our common stock.

Prior to this offering, there has been no public market for our common stock. The initial public offering price of the common stock is expected to be between $ and $ per share. We will apply to have the shares of our common stock approved for quotation on The Nasdaq National Market under the symbol "TKAG."

The underwriters have an option to purchase from the selling stockholders identified in this prospectus up to an additional shares of common stock to cover over-allotments of shares. We will not receive any of the proceeds from any shares of common stock sold by the selling stockholders.

Investing in our common stock involves risks. See "Risk Factors" beginning on page 10.

| | Price to

Public

| | Underwriting Discounts and

Commissions

| | Proceeds to

KAG

|

|---|

| Per Share | | | $ | | | $ | | | $ |

| Total | | $ | | | $ | | | $ | |

Delivery of the shares of common stock will be made on or about , 2004.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Credit Suisse First Boston |

UBS Investment Bank |

| KeyBanc Capital Markets | |

Legg Mason Wood Walker

Incorporated |

| | | Stephens Inc.

|

The date of this prospectus is , 2004.

2003 STATISTICS*

- •

- 21 billion gallons of refined petroleum products delivered

- •

- 57.5 million gallons per day

- •

- 2.4 million gallons per hour

- •

- 40,000 gallons per minute

- •

- 1 load (9,000 gallons) every 12 seconds

- •

- 700 gallons per second

- *

- On a pro forma basis after giving effect to the acquisition of the fuels delivery operations of Beneto, Inc. and Carl Klemm, Inc. in 2003.

TABLE OF CONTENTS

You should rely only on the information contained in this document or to which we have referred you. We have not authorized anyone to provide you with information that is different from that contained in this prospectus. This document may only be used where it is legal to sell these securities. The information in this prospectus may only be accurate on the date of this prospectus regardless of the time of delivery of this prospectus.

Market and industry data and other statistical information used throughout this prospectus are based on independent industry publications, government publications and other published independent sources. The most recent government data available regarding the petroleum industry is for 2002. Some data are also based on our good faith estimates, which are derived from management's knowledge of the industry and independent sources. Although we believe that these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and/or completeness. Similarly, we believe our internal research is reliable, but it has not been verified by any independent sources.

Dealer Prospectus Delivery Obligation

Until , 2004 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

i

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus but might not contain all of the information that is important to you. Before investing in our common stock, you should read the entire prospectus carefully, including the "Risk Factors" section and our historical and pro forma consolidated financial statements and the notes thereto included elsewhere in this prospectus.

We conduct our business primarily through our operating subsidiaries, each of which is a direct or indirect wholly owned subsidiary of The Kenan Advantage Group, Inc. For purposes of this prospectus, unless the context otherwise requires, all references herein to "our company," "Kenan Advantage," "KAG," "we," "us" and "our" refer to The Kenan Advantage Group, Inc. and its consolidated subsidiaries and their predecessors. Whenever we refer to information being provided as pro forma or on a pro forma basis, we are presenting the information assuming that our acquisitions of the fuels delivery operations of Beneto, Inc. and Carl Klemm, Inc., which we completed in May 2003 and June 2003, respectively, had occurred on January 1, 2003. Unless otherwise indicated, the information contained in this prospectus assumes that the underwriters' over-allotment option is not exercised.

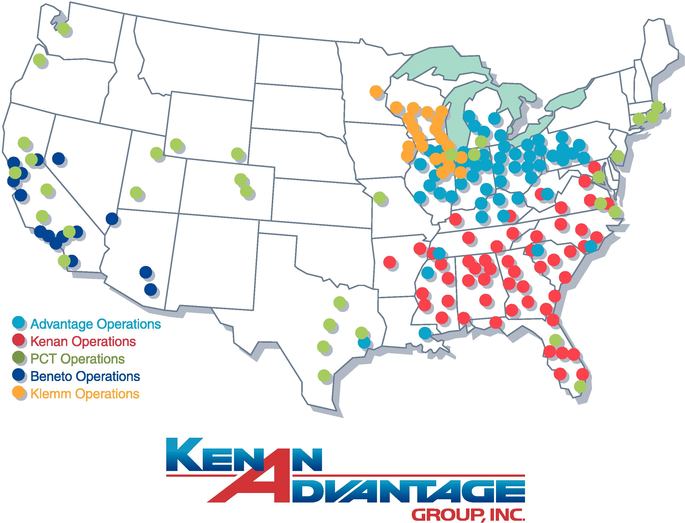

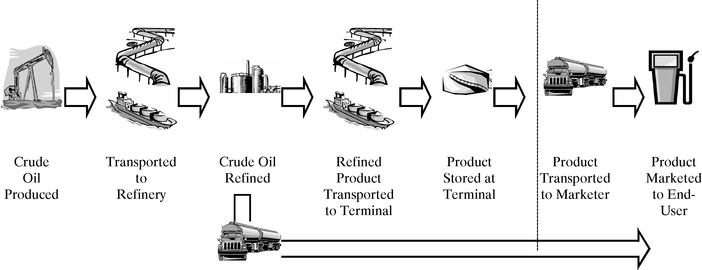

Our Company

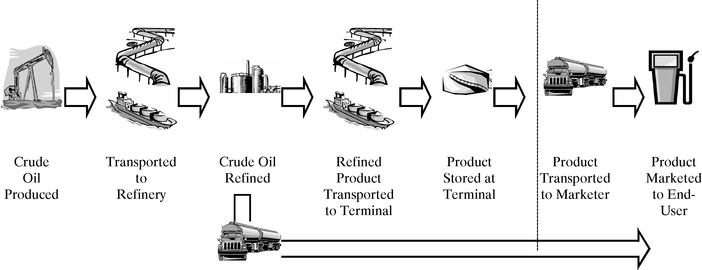

We are the largest independent fuels delivery carrier in North America. We make regular, local deliveries of refined petroleum products, such as gasoline, diesel and aviation fuels, to our customers. We believe our short-haul, "last mile" delivery of refined petroleum products from pipelines and refineries to gasoline stations, fuel marketers and other end users is a vital link in the country's energy distribution network. In 2002, this network distributed approximately 260 billion gallons of refined petroleum products that were consumed in the United States during that year. On a pro forma basis, we delivered approximately 21 billion gallons of refined petroleum products in 2003 to our customers using our network of 77 terminals and 93 satellite operations. With approximately $365 million in revenue and approximately $416 million in pro forma revenue for 2003, and approximately $104 million in revenue for the three months ended March 31, 2004, we are approximately six times larger than our next largest competitor.

Our customer base includes most of the major oil companies, as well as truck stop chains, convenience stores, hypermarkets, aviation fuel marketers and other national and regional petroleum marketers. For most of our customers, we operate under contracts that have specified minimum levels of business. Each of our ten largest customers for 2003 has been a customer of ours for more than ten years. We are the only independent fuels delivery carrier with a nationwide network, with operations in 32 states and the ability to deliver within all 48 states of the continental United States, as well as Canada. Our nationwide network allows us to offer our national and regional customers broad distribution capabilities that are difficult for our smaller competitors to replicate. In addition, we seek to expand the services we offer our customers by providing value-added logistics solutions such as real-time delivery monitoring, inventory and supply source management, fleet scheduling and integrated billing and payment. These services, together with our nationwide footprint, make us a nationwide single source provider of supply chain solutions for petroleum and petrochemical products. We believe that with our size, capabilities, scope of services and geographic reach, we are well-positioned to capitalize on both our customers' continued outsourcing of their fuels delivery operations and our industry's trend towards consolidation.

We have grown substantially through strategic acquisitions and internal growth. Prior to 1992, we provided fuels delivery services primarily in northeastern Ohio. By 1998, we had expanded throughout Ohio and into Michigan, Kentucky, West Virginia and western Pennsylvania. Since 2000, we have expanded from 14 to 32 states and expanded our infrastructure with six acquisitions and 17 private fleet conversions, through which we have taken ownership of our customers' private fleets and service the business they previously had serviced on their own. This expansion has allowed us to build the only independent national fuels delivery carrier in our industry. Between 1992 and 2003, we grew our revenue, organically and through acquisitions, from approximately $7 million to approximately

1

$416 million on a pro forma basis, representing a compound annual growth rate of approximately 45%. We believe our size, capabilities and geographic scope will allow us to increase operating efficiencies for ourselves and our customers and improve driver productivity, as well as enable us to increase our revenue by expanding the services we provide to our customers and by capitalizing on industry trends.

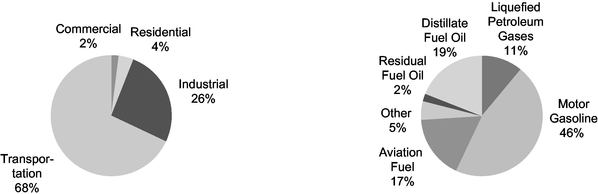

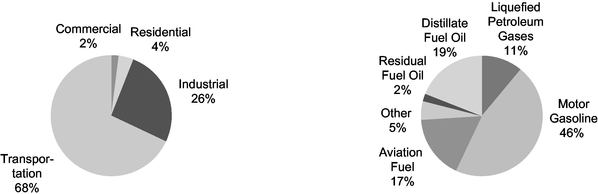

Our Industry

The nationwide consumption of refined petroleum products, such as gasoline, diesel and aviation fuels, drives the underlying demand for delivery of these products from refiners to fuel marketers and other end users. Historically, consumption of gasoline and other refined petroleum products has been very stable, exhibiting compounded annual growth of approximately 1.4% from 1980 through 2002. The Energy Information Administration of the U.S. Department of Energy estimates that retail demand for refined petroleum products will increase between 2002 and 2025 at a compounded annual growth rate of 1.6%, a 44% increase over the total period. Unlike trucking companies that service the more cyclical retail and manufacturing sectors, demand for fuels delivery service is non-cyclical, although the industry experiences increased seasonal demand in periods of heightened driving activity in certain areas of the country.

We estimate, based on industry sources, that approximately 264 billion gallons of refined petroleum products were consumed during 2003. We believe that substantially all of these 264 billion gallons were transported by truck at some point in the distribution process and, based on our revenue per gallon, represent a market in excess of $6 billion. Of this market, we estimate that 60% to 70%, or approximately 158 billion to 185 billion gallons, is still handled by the in-house private fleets of the major oil companies and other petroleum marketers. As major oil companies have renewed their focus on their core operations of oil and gas exploration, production, refining and marketing over the past few years, several have made the decision to outsource a number of their non-core functions, including their fuels delivery and logistics needs, in order to reduce costs and lower overhead. We are seeing this outsourcing trend take several forms. For example, some major oil companies and other petroleum marketers may choose to outsource a portion, or all, of their fuels delivery and logistics operations, while others may choose to outsource the logistics function only and retain control over their own private fleets. We believe an independent carrier with the infrastructure and technology capable of reliably serving the major petroleum marketers on a national and regional basis will be well-positioned to benefit from both of these outsourcing trends.

The remaining 30% to 40% of the market is highly fragmented, served by more than 1,000 small regional or local carriers. Because our industry is characterized by stringent customer requirements relating to safety, significant insurance requirements and substantial federal and state regulatory requirements relating to safety, driver training, equipment and product handling, many of these companies are facing increased pressure from escalating insurance and operating costs, which has created a difficult environment for smaller carriers with lesser financial resources. As a result, many of these small regional and local carriers are being forced to exit the industry or partner with a larger company better equipped to meet these strict customer, insurance and regulatory requirements. In addition to the recent consolidation among the major oil companies, hypermarkets and super regional and national chains have emerged to replace many of the independent convenience stores and service stations served by many of our competitors. As our customers consolidate, we believe they will increasingly seek a delivery services provider with the size, infrastructure, capabilities, scope of services and geographic reach to service their entire operation, and, as a result, smaller carriers will face increasing pressure to consolidate.

Our industry is characterized by high barriers to entry, such as the time and cost required to develop the capabilities necessary to handle hazardous material, the resources required to recruit and train drivers, substantial industry regulatory and insurance requirements and the significant capital investments required to build a fleet of equipment and establish a network of terminals.

2

In addition, unlike most trucking companies, our core fuels delivery business has an average one-way trip length of approximately 35 miles. This shorter length of haul minimizes our exposure to the difficulties of recruiting and retaining a high quality workforce, because we are able to offer our drivers scheduled shifts that allow them to return home each day and allow them regularly scheduled days off. Furthermore, the new hours-of-service regulations that may reduce the productivity of other trucking companies are not expected to have an impact on our operations, because our scheduled shifts and scheduled time off already comply with these new regulations. Finally, unlike most other trucking companies, we service most of our customers under contracts that specify minimum levels of business.

Our Strengths

Leading Market Position. We are the largest independent fuels delivery carrier in North America and the only carrier with a nationwide network. With approximately $416 million in pro forma revenue for 2003 and approximately $104 million in revenue for the three months ended March 31, 2004, we are approximately six times larger than our next largest competitor. Our national footprint, with locations in 32 states that allows us to operate in all 48 states in the continental United States, enables us to serve customers with both national and regional shipping requirements and provides us with a significant network of operations. Our extensive network of 77 terminals and 93 satellite operations provides us with the flexibility to successfully handle volume fluctuations, which benefits our customers by helping to eliminate service disruptions and the need to use backup carriers at higher rates during peak periods. We believe that our geographic diversity, capabilities, industry reputation, broad offering of value-added logistics services and proprietary technology will increase our leading market position as our industry consolidates and our customers continue to outsource their fuels delivery operations.

Commitment to Safety and Quality Leads to Strong Industry Reputation. We believe our customers' satisfaction and the success of our company is largely a result of our commitment to safety and quality. Our drivers, as the interface with the customer, play a critical role in helping us build and enhance our customer relationships. We dedicate significant time and resources to ensure our drivers have the proper experience and training, are supported by qualified field and terminal staff, have access to well-maintained equipment, operate in a safe and secure environment and are satisfied with their jobs. Our driver training exceeds federal and state requirements. Our commitment to safety and quality service has resulted in strong relationships with our customers. We provide delivery and logistics services to all of the ten largest petroleum marketers in the United States, including Amerada Hess, BP, ChevronTexaco, Citgo, ExxonMobil, Marathon Ashland, Shell, Sunoco and 7-Eleven. The strength of our reputation and our high rate of overall customer retention is evidenced by the fact that each of our ten largest customers for 2003 has been a customer of ours for more than ten years. We believe our industry reputation has made us the preferred partner of major oil companies and petroleum marketers, as well as the preferred employer of drivers and independent owner-operators.

Industry-Leading Technology. We have developed and are currently implementing proprietary technology aimed at enhancing the efficiency of our operations and lowering our customers' costs. Our technology consists of hardware and software designed specifically for the petroleum transport sector, including the same fleet scheduling software package used by the major oil companies. Our technology enables us to provide customers with a seamless interface throughout their supply chains. For example, we have developed real-time analysis tools that allow us to continuously track our customers' inventory levels in order to minimize their inventory costs and optimize our delivery schedule and truck utilization. Our customers value this technology because it provides them with real-time data to help them lower their inventory costs. We are also developing tools to transmit delivery information to internal billing systems to ensure accuracy and timeliness of billing.

Partner of Choice in a Consolidating Industry. As a result of our size and scope of operations relative to our competitors, as well as our strong industry reputation and our industry-leading technology, we believe we are the carrier of choice to acquire and integrate smaller carriers, as well as

3

to execute private fleet conversions for major oil companies and other petroleum marketers. Because our size allows us to benefit from economies of scale in purchasing items such as fuel, tires and insurance coverage, as well as in training drivers, we believe we are well-positioned to continue strategically acquiring and integrating smaller carriers who find the current operating environment difficult. In addition, we are the only carrier in the industry providing full-service fuels delivery and logistics services to customers on a regional and national basis, and we believe we are the partner of choice for large petroleum marketers, such as the major oil companies, that are considering outsourcing their petroleum delivery and logistics needs.

Experienced Management Team. We have an experienced management team with an average of over 24 years in the industry. In 1991, our chief executive officer and chief financial officer founded the company that is now known as The Kenan Advantage Group. Our management team has extensive experience and a proven track record of growing our company organically, integrating strategic acquisitions, establishing the foundation necessary to service significant new customers and developing new business with existing customers. We believe our management team's experience in identifying, consummating and integrating acquisitions, as well as obtaining outsource contracts and converting private transportation fleets, affords us a competitive advantage in a consolidating industry.

Our Strategy

Capitalize on the Current Trend of Private Fleet Conversion. We believe there will continue to be significant revenue growth opportunities as major oil companies and other petroleum marketers increase their focus on core businesses and consider outsourcing non-core operations, such as fuels delivery and logistics. Because the delivery and logistics infrastructure maintained by our customers is difficult to manage and requires substantial internal expertise and resources, including capital spending and management focus, we believe an increasing number of petroleum marketers will choose to sell their internal truck fleets and outsource the delivery services currently provided by those fleets. With our ability to implement industry-leading safety and security programs, hiring and training programs, and key technology and other enhanced value-added systems such as inventory tracking and supply source management, we believe our outsourced delivery and logistics services offer an attractive opportunity to petroleum marketers seeking a viable, cost-effective option for reliable delivery across a large number of locations.

Make Selective Acquisitions. We intend to continue growing through the acquisition of high-quality regional and local petroleum carriers. Overall, the fuels delivery and logistics services market is highly fragmented, consisting of over 1,000 regional and local carriers smaller than us. Many of these smaller or regional players are facing increased pressure from escalating insurance and operating costs, increasing customer demands for additional services and a stricter regulatory environment, and we believe this has created a very favorable environment for strategic acquirors. We have developed a defined process to effectively integrate new acquisitions without adversely affecting operations. Since 2000, we have completed six acquisitions, and we believe there are additional strategically attractive targets that would both complement our existing operations in high fuels consumption markets such as Texas, California and New England as well as expand our geographic reach.

Deliver Value-Added Services to Our Customers. We offer a wide array of value-added services and features that complement the core delivery services we provide to our customers. Our advanced technology will enable us to extend our service offerings into areas we believe are critical to our customers through a variety of technology-based solutions, including web-based access to information in our fully integrated transportation management system. These solutions allow us to market value-added services to our customers, such as real-time delivery monitoring, inventory and supply source management, fleet scheduling, driver performance monitoring and integrated billing and payment. We believe we are the only provider in our industry capable of supplying all of these solutions to our customers.

4

Provide Logistics Outsourcing Solutions. As our customers continue to focus on their core businesses, we believe they will increasingly rely on their primary carriers to provide comprehensive supply chain solutions. We intend to offer bulk transportation solutions to our customers by providing products and services such as scheduling services, best buy or optimal sourcing, fuel capital management, quality assurance and carrier settlement, brokerage services and real-time data. As a logistics provider, we will be able to purchase transportation services from both our company and other carriers, then package that transportation with other value-added services we provide. By managing the logistics function of our customers, we will be able to deliver a high-value solution to our customers while allowing our company to complement our core operations with a more flexible, non asset-based business model.

Opportunistically Serve Existing Customers in Other Product Categories. Many of our existing customers also have delivery needs for other petroleum and non-petroleum based products, such as chemicals, lubricants, plastics and cement. We intend to expand into delivery of those products exhibiting similar characteristics to our core fuels delivery business, primarily those characterized by dedicated short-haul routes with no backhaul or requirement for the driver to make an overnight trip. In addition to refined petroleum products, approximately 7.0% of our pro forma revenue for 2003 and 7.6% of our revenue for the three months ended March 31, 2004 was derived from delivery services for the petrochemical industry, which we estimate has a total market size of approximately $5.7 billion. We believe continued growth in the petrochemical industry, along with expansion into delivery or logistics services for other related products, will provide additional growth opportunities for our company.

Corporate Information

We are a Delaware corporation formed in 2001. Our principal executive offices are located at 4895 Dressler Road, Canton, Ohio 44718, and our telephone number is (330) 491-0474. We are a holding company with no significant assets or operations other than direct or indirect ownership of 100% of the stock of our subsidiaries. Our website is located at www.thekag.com. Information contained on our website does not constitute a part of this prospectus.

5

The Offering

Common stock offered |

|

shares |

Common stock to be outstanding after the offering |

|

shares (1) |

Over-allotment option granted |

|

shares, to be sold by the selling stockholders |

Use of proceeds |

|

We expect to use approximately $40.0 million of the net proceeds of this offering to repay our outstanding subordinated indebtedness, including accrued interest and a prepayment penalty, and the remaining approximately $33.4 million for general corporate purposes, including working capital, capital expenditures, repayment of debt and possible future acquisitions. |

Proposed Nasdaq National Market symbol |

|

"TKAG" |

Risk Factors |

|

An investment in our common stock involves a high degree of risk. You should carefully consider the risk factors set forth under "Risk Factors" beginning on page 10 and the other information contained in this prospectus prior to making an investment decision regarding our common stock. |

- (1)

- The number of shares of common stock to be outstanding after this offering gives effect to (i) the issuance of shares of common stock as a dividend to effect a for 1 stock split of our common stock (assuming an initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus), effective immediately prior to the date set forth on the cover page of this prospectus and (ii) the automatic conversion to common stock of all outstanding shares of our preferred stock upon the closing of this offering, assuming an initial public offering price of $ per share, the midpoint of the range set forth on the cover page of this prospectus.

The number of shares to be outstanding after the offering excludes:

- •

- shares of common stock issuable upon the exercise of options outstanding under our equity compensation plans, having a weighted average exercise price of $ per share;

- •

- shares of common stock reserved for future grant under our equity compensation plans;

- •

- shares of common stock issuable upon the exercise of outstanding warrants, at an exercise price of $ per share;

- •

- shares of common stock issuable upon the exercise of outstanding options at an exercise price of $ per share, which options will only become exercisable if (i) our stock price is equal to or greater than $ (assuming an initial public offering price of $ , the midpoint of the range set forth on the cover page of this prospectus) 180 days after the date of this prospectus or (ii) prior to that date we are sold for a price per share that would result in certain of our current stockholders achieving an internal rate of return of 30% or more (the "Contingent Options"); and

- •

- shares of common stock issuable upon the exercise of outstanding warrants, at an exercise price of $ per share, which warrants will only become exercisable if and to the extent the Contingent Options become exercisable.

See "Description of Capital Stock."

6

Summary Financial Information and Other Data

The following table sets forth our summary financial information and other data. The historical statement of operations data for the years ended December 31, 2001, 2002 and 2003 are derived from, and should be read in conjunction with, our audited financial statements and related notes appearing elsewhere in this prospectus. The pro forma statement of operations and other data for 2003 show what our results of operations and other data might have been had we acquired the petroleum delivery operations of Beneto, Inc. and Carl Klemm, Inc. on January 1, 2003. The historical statement of operations data for the three months ended March 31, 2003 and March 31, 2004 and the historical balance sheet data as of March 31, 2004 are derived from our unaudited financial statements. In management's opinion, these unaudited financial statements have been prepared on substantially the same basis as the audited financial statements and include all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the financial data for the periods presented. The results of operations for the interim period are not necessarily indicative of the operating results for the entire year or any future period. The unaudited pro forma financial data is presented for informational purposes only and does not purport to be indicative of our operating results that would have occurred had the acquisition of the fuels delivery operations of Beneto and Klemm actually occurred as of January 1, 2003, nor does it purport to be indicative of our future operating results following the acquisitions.

The information contained in this table should also be read in conjunction with "Use of Proceeds," "Capitalization," "Selected Historical Financial Information," "Unaudited Pro Forma Financial Data," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the consolidated financial statements and accompanying notes thereto, all included elsewhere in this prospectus.

| | Year Ended December 31,(1)

| | Three Months

Ended

March 31,(1)

| |

|---|

| | 2001(2)

| | Historical

2002

| | 2003(3)

| | Pro Forma

2003(4)

| | 2003

| | 2004(5)

| |

|---|

| |

| |

| |

| |

| | (Unaudited)

| |

|---|

| | (Dollars in thousands, except per share data)

| |

|---|

| Statement of Operations Data: | | | | | | | | | | | | | | | | | | | |

Net Revenues |

|

$ |

201,619 |

|

$ |

269,254 |

|

$ |

364,910 |

|

$ |

415,621 |

|

$ |

72,097 |

|

$ |

103,624 |

|

| Operating Costs: | | | | | | | | | | | | | | | | | | | |

| | Wages and employee benefits | | | 113,086 | | | 147,155 | | | 211,542 | | | 243,992 | | | 40,619 | | | 60,744 | |

| | Fuel and other operating costs | | | 37,084 | | | 53,260 | | | 72,672 | | | 81,759 | | | 14,943 | | | 20,768 | |

| | Insurance and claims | | | 7,531 | | | 14,775 | | | 19,495 | | | 21,318 | | | 3,884 | | | 5,354 | |

| | Taxes and licenses | | | 2,509 | | | 3,263 | | | 4,268 | | | 4,848 | | | 823 | | | 1,216 | |

| | General and administrative | | | 12,522 | | | 15,972 | | | 20,082 | | | 22,137 | | | 4,088 | | | 5,527 | |

| | Depreciation and amortization | | | 11,674 | | | 13,514 | | | 19,074 | | | 22,146 | | | 3,732 | | | 5,623 | |

| | |

| |

| |

| |

| |

| |

| |

| | | Total operating costs | | | 184,406 | | | 247,939 | | | 347,133 | | | 396,200 | | | 68,089 | | | 99,232 | |

| | |

| |

| |

| |

| |

| |

| |

| Income from operations | | | 17,213 | | | 21,315 | | | 17,777 | | | 19,421 | | | 4,008 | | | 4,392 | |

| Other income (expenses): | | | | | | | | | | | | | | | | | | | |

| | Interest expense | | | (10,657 | ) | | (11,648 | ) | | (12,841 | ) | | (14,149 | ) | | (3,035 | ) | | (3,270 | ) |

| | Change in fair value of detachable stock warrants(6) | | | — | | | — | | | (13,687 | ) | | (13,687 | ) | | — | | | — | |

| | Management fee to related party(7) | | | (402 | ) | | (511 | ) | | (550 | ) | | (550 | ) | | (138 | ) | | (138 | ) |

| | Interest income and other expenses, net | | | (240 | ) | | 16 | | | (765 | ) | | (699 | ) | | 247 | | | (256 | ) |

| | |

| |

| |

| |

| |

| |

| |

| Income (loss) before income taxes | | | 5,914 | | | 9,172 | | | (10,066 | ) | | (9,664 | ) | | 1,082 | | | 728 | |

| Income taxes | | | 2,673 | | | 3,589 | | | 1,533 | | | 1,609 | | | 432 | | | 288 | |

| | |

| |

| |

| |

| |

| |

| |

| Net income (loss) | | $ | 3,241 | | $ | 5,583 | | $ | (11,599 | ) | $ | (11,273 | ) | $ | 650 | | $ | 440 | |

| | |

| |

| |

| |

| |

| |

| |

| Net income (loss) per share | | | | | | | | | | | | | | | | | | | |

| | Basic | | | | | | | | | | | | | | | | | | | |

| | Diluted | | | | | | | | | | | | | | | | | | | |

7

| | Year Ended December 31,(1)

| | Three Months

Ended

March 31,(1)

| |

|---|

| | 2001(2)

| | Historical

2002

| | 2003(3)

| | Pro Forma

2003(4)

| | 2003

| | 2004(5)

| |

|---|

| |

| |

| |

| |

| | (Unaudited)

| |

|---|

| | (Dollars in thousands, except per mile data)

| |

|---|

Other Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income(8) |

|

$ |

3,241 |

|

$ |

5,583 |

|

$ |

2,088 |

|

$ |

2,414 |

|

$ |

650 |

|

$ |

440 |

|

| Adjusted EBITDA(9) | | $ | 28,578 | | $ | 34,492 | | $ | 36,382 | | $ | 41,164 | | $ | 7,851 | | $ | 9,908 | |

| Net cash provided by operating activities | | $ | 18,440 | | $ | 14,213 | | $ | 22,249 | | $ | 26,955 | | $ | 6,677 | | $ | 13,701 | |

| Net cash (used in) investing activities | | $ | (95,769 | ) | $ | (11,459 | ) | $ | (61,845 | ) | $ | (61,845 | ) | $ | (4,305 | ) | $ | (4,486 | ) |

| Net cash provided by (used in) financing activities | | $ | 81,892 | | $ | (4,706 | ) | $ | 41,963 | | $ | 41,963 | | $ | (2,297 | ) | $ | (6,475 | ) |

Number of Loads |

|

|

1,206,273 |

|

|

1,475,174 |

|

|

2,003,366 |

|

|

2,277,224 |

|

|

386,848 |

|

|

569,515 |

|

| Miles Driven | | | 106,676,722 | | | 138,064,494 | | | 183,926,450 | | | 207,024,158 | | | 36,801,466 | | | 51,045,818 | |

| Revenue Per Mile | | $ | 1.89 | | $ | 1.95 | | $ | 1.98 | | $ | 2.01 | | $ | 1.96 | | $ | 2.03 | |

| Number of Tractors (10)(11) | | | 1,117 | | | 1,292 | | | 1,595 | | | 1,595 | | | 1,231 | | | 1,594 | |

| Number of Trailers (10) | | | 1,812 | | | 1,818 | | | 2,579 | | | 2,579 | | | 1,865 | | | 2,638 | |

| Number of Company Drivers (10) | | | 1,535 | | | 2,101 | | | 2,953 | | | 2,953 | | | 2,213 | | | 2,823 | |

| Number of Owner-Operators (10) | | | 277 | | | 278 | | | 472 | | | 472 | | | 322 | | | 520 | |

|

|

As of March 31, 2004

|

|---|

| | Actual

| | Pro Forma(12)

| | Pro Forma

As Adjusted(13)

|

|---|

| | (Dollars in thousands)

|

|---|

| Balance Sheet Data: | | | | | | | | |

| Working capital | | $ | 2,559 | | $ | 14,261 | | |

| Total assets | | | 296,312 | | | 302,003 | | |

| Total indebtedness, including current maturities(14) | | | 156,930 | | | 166,667 | | |

| Total stockholders' equity(15) | | | 46,001 | | | 43,747 | | |

- (1)

- Effective May 1, 2001, we completed the acquisition of Kenan Transport Company, a publicly-traded company founded in 1949 that had become the largest independent fuels delivery carrier in the industry (based on revenues), with operations focused in the southeast United States. Effective May 31, 2003, we acquired the fuels delivery operations of Beneto, Inc. ("Beneto"), which operates primarily in California, and effective June 30, 2003, we acquired substantially all the assets of Carl Klemm, Inc. ("Klemm"), which operates primarily in Wisconsin and Illinois. Because the results of operations of these entities are included in our financial results from the respective dates of acquisition, a comparison of our period-to-period financial results may not necessarily be meaningful. See "Unaudited Pro Forma Financial Data," which shows what our results of operations might have been had we acquired the Beneto and Klemm operations on January 1, 2003, and Note 2 to our consolidated financial statements included elsewhere in this prospectus.

- (2)

- Includes the results of operations of Kenan Transport Company from May 1, 2001. See "Certain Relationships and Related Transactions—The Kenan Acquisition" and Note 2 to our consolidated financial statements included elsewhere in this prospectus.

- (3)

- Includes the results of operations of the fuels delivery operations of Beneto from May 31, 2003 and Klemm from June 30, 2003. See "Unaudited Pro Forma Financial Data" and Note 2 to our consolidated financial statements included elsewhere in this prospectus.

- (4)

- Gives effect to the acquisition of the fuels delivery operations of Beneto and Klemm, including the incurrence of $50.0 million of indebtedness to finance the acquisitions (including the transaction costs), as if the acquisitions had occurred on January 1, 2003. See "Unaudited Pro Forma Financial Data" and Note 2 to our consolidated financial statements included elsewhere in this prospectus.

- (5)

- Includes the actual results of operations of the fuels delivery operations of Beneto and Klemm described in note 1 above for the entire period.

- (6)

- Represents the non-cash charge related to the change in fair value of warrants issued to holders of our subordinated debt. The holders of these warrants have the right, which will terminate upon the closing of this offering, to require us to repurchase these warrants for an amount in cash based upon the fair market value of the underlying shares at any time beginning April 30, 2006 and earlier upon the occurrence of certain events. See "Description of Capital Stock—Warrants" and Note 3 to our consolidated financial statements included elsewhere in this prospectus.

- (7)

- For a description of the management fees paid to Sterling Investment Partners Advisors, LLC, RFE Management Corporation and Sterling Ventures Limited, all of which are affiliates of two of our principal stockholders, see "Certain Relationships and Related Transactions."

- (8)

- Represents net income excluding, in the year ended December 31, 2003 (actual and pro forma), the non-cash charge of $13,687,000 related to the change in fair value of warrants issued to holders of our subordinated debt. This non-cash charge is not deductible for income tax purposes and therefore did not affect our tax provision. We believe this figure is useful in allowing management and our investors to compare our annual operating results without the accounting effect attributable to put rights attached to our warrants that will terminate following the closing of this offering. See note 6 above. However,

8

adjusted net income is not a measure of financial performance under U.S. generally accepted accounting principles ("GAAP") and should be considered in addition to, but not as a substitute for, other measures of financial performance reported in accordance with GAAP, such as net income.

- Adjusted net income is calculated in the following manner for each of the periods presented:

|

| | Year Ended December 31,(1)

| | Three Months

Ended

March 31,(1)

|

|---|

|

| | 2001

| | 2002

| | 2003

| | Pro Forma

2003(4)

| | 2003

| | 2004(5)

|

|---|

|

| | (Dollars in thousands)

|

|---|

| | Net income (loss) | | $ | 3,241 | | $ | 5,583 | | $ | (11,599 | ) | $ | (11,273 | ) | $ | 650 | | $ | 440 |

| | Change in fair value of detachable stock warrants | | | — | | | — | | | 13,687 | | | 13,687 | | | — | | | — |

| | | |

| |

| |

| |

| |

| |

|

| | Adjusted net income | | $ | 3,241 | | $ | 5,583 | | $ | 2,088 | | $ | 2,414 | | $ | 650 | | $ | 440 |

| | | |

| |

| |

| |

| |

| |

|

- (9)

- Adjusted EBITDA represents net income (loss) plus income taxes, interest expense and depreciation and amortization and non-operating non-cash charges. Adjusted EBITDA is presented herein because we believe it to be relevant and useful information to our investors because it is used by our management to evaluate our operating performance compared to that of other companies in our industry, as the calculation of Adjusted EBITDA eliminates the effects of financing, income taxes, the accounting effects of capital spending and other non-operating non-cash charges, which items may vary for different companies for reasons unrelated to overall operating performance. Adjusted EBITDA is also used by our lenders in evaluating our financial performance. When analyzing our operating performance, however, investors should use Adjusted EBITDA in addition to, not as an alternative for, operating income, net income and cash flow from operating activities, as those terms are defined by GAAP. Investors should also note that our presentation of Adjusted EBITDA may not be comparable to similarly titled measures used by other companies.

- Adjusted EBITDA is calculated in the following manner for each of the periods presented:

|

| | Year Ended December 31,(1)

| | Three Months

Ended

March 31,(1)

|

|---|

|

| | 2001(2)

| | 2002

| | 2003(3)

| | Pro Forma

2003(4)

| | 2003

| | 2004(5)

|

|---|

|

| | (Dollars in thousands)

|

|---|

| | Net income (loss) | | $ | 3,241 | | $ | 5,583 | | $ | (11,599 | ) | $ | (11,273 | ) | $ | 650 | | $ | 440 |

| | Income taxes | | | 2,673 | | | 3,589 | | | 1,533 | | | 1,609 | | | 432 | | | 288 |

| | Change in fair value of detachable stock warrants | | | — | | | — | | | 13,687 | | | 13,687 | | | — | | | — |

| | Interest expense | | | 10,657 | | | 11,648 | | | 12,841 | | | 14,149 | | | 3,035 | | | 3,270 |

| | Depreciation and amortization | | | 11,674 | | | 13,514 | | | 19,074 | | | 22,146 | | | 3,733 | | | 5,623 |

| | (Gain) loss on disposal of equipment | | | 333 | | | 158 | | | 846 | | | 846 | | | 1 | | | 287 |

| | | |

| |

| |

| |

| |

| |

|

| | Adjusted EBITDA | | $ | 28,578 | | $ | 34,492 | | $ | 36,382 | | $ | 41,164 | | $ | 7,851 | | $ | 9,908 |

| | | |

| |

| |

| |

| |

| |

|

- (10)

- As of last day of period.

- (11)

- Excludes tractors owned by owner-operators.

- (12)

- As adjusted to reflect the amendment and restatement of our credit facility on July 13, 2004, including the effect of a charge of $2,254,000 (net of applicable tax benefit of $1,502,000) relating to the write-off of unamortized loan costs associated with the refinanced senior debt.

- (13)

- As adjusted to reflect the amendment and restatement of our credit facility described in note 12 above and our sale of shares of common stock at a price of $ per share, the midpoint of the range set forth on the cover page of this prospectus, and our use of proceeds, net of the underwriting discounts and commissions, to repay $ of outstanding indebtedness, including a prepayment fee of $392,500. In connection with the repayment of debt, we will write off deferred financing costs of $171,200 resulting from the early extinguishment of the subordinated notes. As a result of the prepayment fee and the write off, we will incur a charge of $338,200 (net of applicable tax benefit of $225,500). The increase in stockholders' equity also includes $17,930,000, which represents the carrying value of the put price for the warrants described in note 6 above, which put right expires upon the closing of this offering. See "Use of Proceeds" and "Capitalization."

- (14)

- Net of unamortized discount of $2,583,000 with respect to our subordinated notes that are being repaid with the proceeds of this offering.

- (15)

- Each share of our preferred stock is convertible into shares of common stock at any time after issuance, subject to adjustment. Each share of preferred stock outstanding will, upon the closing of this offering, automatically convert into the number of shares of common stock equal to the sum of (a) shares of common stock converted at the original conversion rate plus (b) the number of shares of common stock equal to the liquidation value per share divided by the initial public offering price of our common stock (the "adjustment feature"). The adjustment feature represents a beneficial conversion option to the existing holders of convertible preferred stock that will be recorded as a preferred stock dividend of approximately $ upon the closing of this offering (assuming an initial public offering price of $ , the midpoint of the range set forth on the cover page of this prospectus).

9

RISK FACTORS

You should carefully consider the risks described below before investing in our common stock. Although the risks described below are all of the risks that we believe are material, they are not the only risks relating to our business and our common stock. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business operations. Any of the following risks could materially adversely affect our business, financial condition or results of operations. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment.

Risks Relating to Our Business

Our business is subject to general economic and other factors that are largely out of our control and could affect our operations and profitability.

Our business is dependent on various economic and other factors over which we have no control, such as the availability of qualified drivers, changes in fuel and insurance prices, including changes in fuel taxes, excess capacity in the trucking industry, changes in license and regulation fees, changes in regulatory requirements, rising healthcare costs, interest rate fluctuations and downturns in our customers' business cycles. As a result, we may experience periods of overcapacity, declining prices and lower profit margins in the future. Our revenues and operating income could be materially adversely affected if we are unable to pass through to our customers the full amount of increased transportation costs. Our ten largest customers accounted for approximately 56.3% and 49.3% of our revenues in 2003 and the three months ended March 31, 2004, respectively, and we expect that they will continue to account for a significant portion of our revenues in the future. If these customers experience fluctuations in their business activity due to an economic downturn, work stoppages or other factors over which we have no control, the volume of petroleum products transported by us on behalf of those customers may decrease and our operating results could be adversely affected. Furthermore, customers encountering adverse economic conditions may have difficulty in paying for our services, and if they file for protection under the bankruptcy laws we may have to return certain payments they made to us.

We operate in a highly competitive industry, and competitive pressures may adversely affect our operations and profitability.

Numerous competitive factors could impair our ability to maintain our current level of revenues and profitability and adversely affect our financial condition. These factors include the following:

- •

- we compete with many other fuels delivery service providers, particularly smaller regional competitors, some of which may have more equipment in, or stronger ties to, the geographic regions in which they operate or other competitive advantages;

- •

- some of our competitors periodically reduce their prices to gain business, which may limit our ability to maintain or increase prices, implement new pricing strategies or maintain significant growth in our business;

- •

- many customers periodically accept bids from multiple carriers, and this process may depress prices or result in the loss of some business to competitors;

- •

- many customers are looking to reduce the number of carriers they use, and in some instances we may not be selected to provide services;

- •

- the current trend of consolidation in the fuels delivery industry could create other large carriers with greater financial resources than we have and other competitive advantages relating to their size;

10

- •

- the development of alternative power sources for cars and trucks could reduce demand for gasoline; and

- •

- advances in technology require increased investments to maintain competitiveness, and we may not have the financial resources to invest in technology improvements or our customers may not be willing to accept higher prices to cover the cost of these investments.

If we are unable to address these competitive pressures, our operations and profitability may be adversely affected.

Our continued growth is dependent upon major oil companies and other petroleum marketers continuing to outsource petroleum delivery to retail outlets.

Historically, major oil companies and other petroleum marketers have delivered petroleum to their service stations through proprietary fleets. With the advent of deregulation, which eliminated tariff rates and promoted price competition, and facing high labor costs, these companies have begun over the past several years to outsource delivery of refined petroleum products to retail outlets. Our strategy is to grow in part by taking advantage of continued outsourcing opportunities. However, we estimate that major oil companies and other petroleum marketers still deliver 60% to 70% of all refined petroleum products delivered in the United States using in-house fleets. These companies may choose not to continue to outsource delivery of petroleum products to retail outlets in the future. If these companies do not continue to expand their outsourcing of delivery of refined petroleum products, or if they reduce the amount of refined petroleum product delivery currently outsourced, our business, results of operations and financial condition could be materially adversely affected.

Our growth will depend in part upon making acquisitions, which are subject to the uncertainties of evaluating potential liabilities, integration risks and other difficulties.

Our recent growth is due in part to acquisitions of regional fuels delivery companies. We expect our continued growth to depend in part upon our ability to acquire regional competitors in strategically desirable locations and to integrate them successfully into our existing operations.

Successful acquisitions require an assessment of a number of factors, many of which are beyond our control. These factors include operating costs and potential environmental and other liabilities of acquired companies and the extent to which such acquired companies would retain existing customers and add profitable routes to our geographic scope of coverage. Such assessments are inexact and their accuracy is inherently uncertain. In connection with our assessments, we perform a review, which we believe is generally consistent with industry practices, of the companies to be acquired. However, such a review will not reveal all existing or potential problems. In addition, our review may not permit us to become sufficiently familiar with the companies to fully assess their deficiencies and capabilities.

In seeking acquisitions, we may be required to compete with other potential acquirors, some of which may have substantially greater financial and other resources than those available to us. We are unable to predict whether and when any prospective acquisition candidate will become available or the likelihood that any acquisition will be completed on acceptable terms. Further, if we make future acquisitions, we may issue shares of capital stock that dilute other stockholders, incur debt, assume significant liabilities and create additional expenses related to intangible assets, any of which might reduce our reported earnings or earnings per share. In addition, any financing that we might need for these acquisitions may only be available to us on terms that restrict our business and acquisition-related accounting charges may adversely affect our balance sheet and results of operations.

Additionally, we may encounter difficulties in integrating acquired companies into our existing operations and business because they may have substantially different operating characteristics or be in different geographic locations than our existing operations. Once integrated, acquired businesses may

11

not achieve levels of revenues, profitability or productivity comparable to our existing business or otherwise perform as expected. Also, acquisitions may involve difficulties in the retention of personnel, diversion of management's attention, risks of the customers of acquired companies allocating all or a portion of their business to our competitors while they evaluate the impact of the acquisition, unexpected legal liabilities, and tax and accounting issues. Any inability on our part to consummate and integrate future acquisitions successfully may have a material adverse effect on our results of operations and financial condition.

Our debt levels may limit our flexibility in obtaining additional financing and in pursuing other business opportunities.

We have a significant amount of debt. As of March 31, 2004, on a pro forma basis after giving effect to the amendment and restatement of our credit agreement in July 2004, this offering and our use of the proceeds to repay outstanding indebtedness, our consolidated indebtedness would have been $130.0 million, consisting principally of obligations under our secured credit facility. In addition to the amount then outstanding, we could have borrowed an additional $34.1 million in revolving loans under our credit facility (net of outstanding letters of credit). Following this offering, we will continue to have the ability to incur new debt, subject to limitations in our credit facility. Our level of indebtedness could have important consequences to us, including the following:

- •

- our ability to obtain additional financing, if necessary, for working capital, capital expenditures, acquisitions or other purposes may be impaired or such financing may not be available on favorable terms;

- •

- we will need a substantial portion of our cash flow to make principal and interest payments on our indebtedness, reducing the funds that would otherwise be available for our operations and future business opportunities;

- •

- our debt level may make us more vulnerable than our competitors with less debt to competitive pressures or a downturn in our business or the economy generally;

- •

- our debt level may limit our flexibility in responding to changing business and economic conditions; and

- •

- substantially all of our debt has a variable rate of interest, which increases our vulnerability to interest rate fluctuations.

Our ability to service our indebtedness will depend upon, among other things:

- •

- our future financial and operating performance and cash flows, which will be affected by prevailing economic conditions and financial, business, regulatory and other factors, some of which are beyond our control; and

- •

- the future availability of borrowings under our credit facility or any successor facility, the availability of which may depend on, among other things, our complying with certain covenants.

If our operating results and cash flows are not sufficient to service our current or future indebtedness, we will be forced to take actions such as reducing or delaying our business activities, acquisitions, investments and/or capital expenditures, selling assets, restructuring or refinancing our indebtedness, or seeking additional equity capital or bankruptcy protection. We may not be able to effect any of these remedies on satisfactory terms, or at all.

If new debt is added to our current debt levels, the related risks that we now face could intensify.

12

Our debt agreements contain operating and financial restrictions which may restrict our business and financing activities.

The operating and financial restrictions and covenants in our credit facility and any future financing agreements could adversely affect our ability to finance future operations or capital needs or to engage, expand or pursue our business activities. For example, our credit facility restricts our ability to:

- •

- declare dividends and redeem or repurchase capital stock;

- •

- prepay, redeem or purchase debt;

- •

- make loans and investments;

- •

- incur additional indebtedness or amend our debt and other material agreements;

- •

- make capital expenditures; and

- •

- engage in mergers, acquisitions and asset sales.

Our ability to comply with the covenants and restrictions contained in our debt instruments may be affected by events beyond our control, including prevailing economic, financial and industry conditions. If market or other economic conditions deteriorate, our ability to comply with these covenants may be impaired. If we breach any of the restrictions, covenants, ratios or tests in our debt agreements, a significant portion of our indebtedness may become immediately due and payable, and our lenders' commitments to make further loans to us may terminate. We might not have, or be able to obtain, sufficient funds to make these accelerated payments. In addition, our obligations under our credit facility are secured by substantially all of our assets, and if we are unable to repay our indebtedness under our credit facility, the lenders could seek to foreclose on such assets. Any of these outcomes could have a negative impact on our results of operations.

We may be adversely impacted by fluctuations in the price and availability of fuel.

We require large amounts of diesel fuel to operate our tractors. In 2001, 2002 and 2003 and the three months ended March 31, 2003 and 2004, fuel (including fuel taxes but net of fuel surcharge) represented approximately 6.9%, 8.0%, 7.8%, 8.5% and 7.8%, respectively, of our total operating costs. The market price for fuel, which is currently at its highest price in over a decade, can be extremely volatile and can be affected by a number of economic and political factors. In particular, the continued deterioration of the political climate in the Middle East and certain parts of Africa have contributed to significant increases in fuel prices. In addition, changes in federal or state regulations can impact the price of fuel, as well as increase the amount we pay in fuel taxes. We incorporate a fuel surcharge clause in substantially all of our customer contracts to pass most additional fuel costs above a specified level on to our customers. However, we may not be able to do so in the future. Even where we are able to include fuel surcharges in our customer contracts, such surcharges only apply when the price of fuel exceeds specified levels. The amount of the fuel surcharge each month is typically based on the average price of fuel for the prior month; accordingly, our recovery of fuel costs in excess of the levels specified in our contracts lags the actual increase in fuel prices, and we may never be fully reimbursed for increases in fuel prices above the levels specified in our contracts. We currently do not hedge our fuel purchases to protect against fluctuations in fuel prices that are not covered by fuel surcharges, and therefore are at risk to the extent that changes in the market price of fuel are not covered by the fuel surcharge provisions of our customer contracts. In addition, our customers may negotiate rates or contracts that minimize or eliminate our ability to continue passing on fuel price increases to our customers. If fuel prices increase and we are unable to pass the increased cost to our customers, the additional expense could have a material adverse effect on our business, results of operations and financial condition.

13

Our operations may also be adversely affected by any limit on the availability of fuel. Continued disruptions in the political climate in key oil producing regions in the world, particularly in the event of wars or other armed conflicts, could severely limit the availability of fuel in the United States. In the event our customers face significant difficulty in obtaining fuel, our business, results of operations and financial condition would be materially adversely affected.

We have exposure to certain claims not covered by insurance, and we may not be able to pass on to our customers any increases in the costs of our insurance.

The primary insurable risks associated with our business are bodily injury and property damage, workers' compensation claims, medical claims and cargo loss and damage. We currently self-insure for the first $1,000,000 of our claims exposure resulting from these risks, except for medical claims and cargo loss and damage, where our self-retention is $150,000 per individual (in the case of medical claims) and $150,000 per claim (in the case of cargo loss and damage). In general, the maximum value of the cargo we haul per vehicle is approximately $20,000 and, therefore, we are effectively self-insured for cargo loss and damage. Prior to May 1, 2004, our $1,000,000 self-insurance was $500,000. If the number or severity of claims for which we are self-insured increases, our operating results could be adversely affected. Our self-insured retentions require us to make estimates of expected loss amounts and accrue such estimates as expenses. Changes in estimates may materially and adversely affect our financial results. In addition, our insurance does not cover claims for punitive damages. As a result of the increase in our self-insured retention, it is likely that we will increase our claims accrual as a result of a possible increase in our claims expense.

We also maintain insurance with third party insurance carriers above the amounts for which we self-insure, and we are therefore subject to changing conditions and pricing in the insurance marketplace. Insurance carriers have recently begun to raise rates for many transportation companies. The cost or availability of various types of insurance may change dramatically in the future. If our insurance carriers were to increase our premiums, we would be required to either absorb the increase in premium costs and/or raise our self-insured retention, which could significantly increase our insurance and claims expense. To the extent these costs cannot be passed on to our customers in increased rates or insurance surcharges in customer contracts, increases in our insurance and claims expense could reduce our future profitability.

In addition, our insurance carriers and the states in which we operate require us to post either letters of credit or surety bonds to collateralize our self-insured retention. We currently have letters of credit of $15.9 million outstanding to satisfy these obligations. If our insurance carriers or the states in which we operate require us to increase the amount of collateral we provide in the future, we could face increased costs, including the payment of additional fees to the providers of letters of credit. Since our letters of credit are considered debt under the financial covenants for our financing arrangements, increases in the amount of letters of credit we have outstanding to collateralize our self-insurance obligations will reduce borrowing availability under our credit agreement and reduce our capacity for additional borrowings.

We have significant ongoing capital requirements.

Our business requires substantial ongoing capital investment, particularly for tractors, trailers, terminals and technology. Our capital expenditures were approximately $12.8 million, $18.4 million and $4.0 million in 2002, 2003 and the first quarter of 2004, respectively, and we expect to make capital expenditures of approximately $18.0 million during the remainder of 2004. We expect that operating leases, borrowings under our revolving credit facility, proceeds from this offering and cash flow from operations will be our primary sources of financing for capital expenditures. If we are unable to enter into leases, raise sufficient capital, borrow sufficient funds on terms that are acceptable to us or generate sufficient cash from operations to finance our capital expenditures, we may be forced to limit

14

our growth and operate existing equipment for significant periods of time, each of which could have a material adverse effect on our business, results of operations and financial condition.

We may face difficulty in purchasing new equipment on a timely basis. Any delay in delivery of equipment could impair our ability to serve our customers, and, to the extent that we must obtain equipment from alternative sources at increased prices, could result in a significant increase in our anticipated capital expenditures and, accordingly, have a material adverse effect on our business, results of operations and financial condition.

Our business may be adversely affected by seasonal factors and harsh weather conditions.

Our business is subject to seasonal trends common in the refined petroleum products delivery industry. We typically face reduced demand for refined petroleum products delivery services in the northern portion of the United States during the winter months and on the west coast during the first five months of the calendar year. At the same time, we face increased demand for fuels delivery services in Florida during the winter months. Further, operating costs and earnings are generally adversely affected by inclement weather conditions. These factors generally result in lower operating results during the first and fourth quarters of the year and cause our operating results to fluctuate from quarter to quarter. Our operating expenses also have been somewhat higher in the winter months, primarily due to decreased fuel efficiency, increased utility costs and increased maintenance costs for tractors and trailers in colder months. An occurrence of unusually harsh or long-lasting inclement weather could have an adverse effect on our operations and profitability.

We operate in a highly regulated industry, and increased costs of compliance with, or liability for violation of, existing or future regulations could significantly increase our costs of doing business.

As an interstate motor carrier, we are subject to regulation by the U.S. Department of Transportation (the "DOT"). To a large degree, intrastate motor carrier operations are subject to state regulations that mirror federal regulations. Federal and state regulatory authorities exercise broad powers, governing activities such as the authorization to engage in motor carrier operations, safety, financial reporting and certain mergers, consolidations and acquisitions. There are additional regulations specifically relating to the trucking industry, including testing and specification of equipment and product handling requirements. Our industry is also subject to regulatory and legislative changes, such as increasingly stringent environmental regulations, regulations which govern the amount of time a driver may drive in any specific period, regulations mandating modification of trailers to eliminate wetlines, regulations requiring on-board black box recording devices, occupational safety and health regulations, limits on vehicle weight and size, regulations relating to security and ergonomics and regulations mandating drug testing of drivers. Compliance with current and future regulations could substantially impair equipment productivity, require changes in our operating practices, negatively affect the level of service we provide our customers and increase our costs. New, more restrictive laws and regulations may be adopted that materially and adversely affect our productivity and efficiency. Additionally, we may not be able to recover any or all increased costs of compliance from our customers and our business and financial condition may be materially and adversely affected by future changes in applicable laws and regulations.

Our failure to maintain required certificates, permits or licenses, or to comply with applicable laws or regulations, could result in substantial fines or possible revocation of our authority to conduct our operations. An incurrence of such fines or the revocation of such authority in turn could restrict our ability to conduct our business effectively and to provide competitive customer services, which could have an adverse impact on our business, results of operations and financial condition.

The U.S. Environmental Protection Agency has issued regulations that require progressive reductions in exhaust emissions from certain diesel engines through 2007. New emissions standards

15

under the regulations and a judicial consent decree went into effect for certain engines beginning in October 2002. In addition, the regulations require subsequent reductions in the sulfur content of diesel fuel beginning in June 2006 and the introduction of emissions after-treatment devices on newly-manufactured engines and vehicles beginning with the model year 2007. Each of these requirements could result in higher prices for tractors and diesel engines and increased fuel and maintenance costs. These adverse effects, combined with the uncertainty as to the reliability of the vehicles equipped with newly-designed diesel engines and the residual values that will be realized from the disposition of these vehicles, could increase our costs and have a material adverse effect on our business, results of operations and financial condition.

From time to time, various additional legislative proposals, including proposals to increase federal, state or local taxes applicable to motor fuels, have been proposed and we expect that additional initiatives will be introduced in the future. We cannot predict whether, or in what form, any increase in such taxes applicable to us will be enacted and whether any such increase would materially adversely affect our business, results of operations and financial condition.

Our operations involve hazardous materials and could result in significant environmental liabilities and costs.

Our activities, which involve the transportation, storage and disposal of fuels and other hazardous substances and wastes, are subject to various federal, state and local health and safety laws and regulations relating to the protection of the environment, including, among others, those governing the transportation, management and disposal of hazardous materials, vehicle emissions, underground and above ground storage tanks and the cleanup of contaminated sites. Our operations involve risks of fuel spillage or seepage, hazardous waste disposal and other activities that are potentially damaging to the environment. If we are involved in a spill or other accident involving hazardous substances, or if we are found to be in violation of or liable under applicable laws or regulations, it could significantly increase our cost of doing business.

Most of our truck terminals are located in industrial areas, where groundwater or other forms of environmental contamination may have occurred. Contaminants have been detected at some of our present or former sites in connection with historical operations. Under environmental laws, we could be held responsible for the costs relating to any contamination at those or other of our past or present facilities and at third-party waste disposal sites, including cleanup costs, fines and penalties and personal injury and property damages. Under some of these laws, such as the Comprehensive Environmental Response Compensation and Liability Act (also known as the Superfund law) and comparable state statutes, liability for the entire cost of the cleanup of contaminated sites can be imposed upon any current or former owner or operator, or upon any party who sent waste to the site, regardless of the lawfulness of any disposal activities or whether a party owned or operated a contaminated property at the time of the release of hazardous substances. From time to time, we have incurred remedial costs and regulatory penalties with respect to spills and releases at our facilities and, notwithstanding the existence of our environmental management program, we cannot assure you that such obligations will not be incurred in the future. The discovery of additional contamination or the imposition of additional obligations or liabilities in the future could result in a material adverse effect on our financial condition, results of operations or our business reputation.

Environmental laws and regulations are complex, change frequently and have tended to become more stringent over time. If we fail to comply with applicable environmental laws and regulations, we could also be subject to substantial fines or penalties and to civil and criminal liability. As a result, our costs of complying with current or future environmental laws or liabilities arising from such laws may have a material adverse affect on our business, results of operations or financial condition.

16

Our reputation and financial results could be harmed in the event of accidents or incidents.