UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F/A

(Amendment No. 1)

| [ ] | | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| X | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year endedJune 30, 2005 |

OR

| [ ] | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the transition period from __________ to _______________ |

OR

| [ ] | | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | Date of event requiring this shell company report __________ |

Commission file number: 0-50880

White Knight Resources Ltd.

(Exact name of Registrant as specified in its charter)

Province of British Columbia, Canada

(Jurisdiction of incorporation or organization)

#922, 510 West Hastings Street, Vancouver, British Columbia, Canada V6B 1L8

(Address of principal executive offices)

| | Securities registered or to be registered pursuant to Section 12(b) of the Act. |

Title of each class

N/A | Name of each exchange on which registered

N/A |

| | Securities registered or to be registered pursuant to Section 12(g) of the Act. |

Common Stock, No Par Value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. N/A

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by this annual report, June 30, 2005: 54,089,386 Common Shares

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. X Yes [_] No

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [_] Yes X No

Indicate by check mark which financial statement item the registrant has elected to follow. X Item 17 [_] Item 18

WHITE KNIGHT RESOURCES LTD.

FORM 20-F/A ANNUAL REPORT

TABLE OF CONTENTS

| |

|---|

| NOTE REGARDING FORWARD LOOKING STATEMENTS | | 2 | |

| GLOSSARY OF TERMS | | 2 | |

| ITEM 1: | IDENTITY OF OFFICERS AND DIRECTORS | | 6 | |

| ITEM 2: | OFFER STATISTICS AND EXPECTED TIMETABLE | | 6 | |

| ITEM 3: | KEY INFORMATION | | 6 | |

| ITEM 4: | INFORMATION ON THE COMPANY | | 12 | |

| ITEM 5: | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | | 34 | |

| ITEM 6: | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | | 38 | |

| ITEM 7: | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | | 43 | |

| ITEM 8: | FINANCIAL INFORMATION | | 44 | |

| ITEM 9: | OFFER AND LISTING DETAILS | | 44 | |

| ITEM 10: | ADDITIONAL INFORMATION | | 45 | |

| ITEM 11: | DISCLOSURES ABOUT MARKET RISK | | 53 | |

| ITEM 12: | DESCRIPTION OF OTHER SECURITIES | | 53 | |

| ITEM 13: | DEFAULTS, DIVIDEND ARREARAGES AND DELIQUENCIES | | 53 | |

| ITEM 14: | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | | 53 | |

| ITEM 15: | CONTROLS AND PROCEDURES | | 54 | |

| ITEM 16: | AUDIT COMMITTEE FINANCIAL EXPERT; CODE OF ETHICS; PRINCIPAL

ACCOUNTANT FEES AND SERVICES; EXEMPTIONS FROM LISTING

STANDARDS FOR AUDIT COMMITTEES; PURCHASEES OF EQUTY SECURITIES BY

THE ISSUER AND AFFILIATED PURCHASERS | | 54 | |

| ITEM 17: | FINANCIAL STATEMENTS | | 55 | |

| ITEM 18: | FINANCIAL STATEMENTS | | 85 | |

| ITEM 19: | EXHIBITS | | 85 | |

| SIGNATURE | | 86 | |

NOTE REGARDING FORWARD LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 concerning plans for the properties, operations and other matters of White Knight Resources Ltd. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management. In this Annual Report, unless the context otherwise requires, the terms “White Knight”, “Company”, “Issuer”, “Registrant” and “we” refer collectively to White Knight Resources Ltd. and its subsidiaries.

Statements concerning reserves, if any, and mineral resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that will be encountered if the property is developed, and in the case of mineral reserves, such statements reflect the conclusion based on certain assumptions that the mineral deposit can be economically exploited. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are subject to a variety of risks and uncertainties, which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation:

| | • | | Risks related to gold price and other commodity price fluctuations; |

| | • | | Risks and uncertainties relating to the interpretation of drill results, and the geology, grade and continuity of mineral deposits; |

| | • | | Risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; |

| | • | | Results of initial feasibility, prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company’s expectations; |

| | • | | Mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes or other unanticipated difficulties with or interruptions in production; |

| | • | | The potential for delays in exploration or development activities or the completion of feasibility studies; |

| | • | | The uncertainty of profitability based upon the Company's history of losses; |

| | • | | Risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; |

| | • | | Risks related to environmental regulation and liability; |

| | • | | Risks related to hedging activities; |

| | • | | Political and regulatory risks associated with mining and exploration; and |

| | • | | Other risks and uncertainties related to the Company’s prospects, properties and business strategy. |

Some of the important risks and uncertainties that could affect forward looking statements are described in this Annual Report under Item 3 D. – Risk Factors. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Forward looking statements are made based on management’s beliefs, estimates and opinions on the date the statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.

GLOSSARY OF TERMS

The following terms have the following meanings in this Annual Report on Form 20-F

| Adit | A horizontal or nearly horizontal tunnel made for exploration or mining with one opening. |

| Alluvial | Material deposited by the action of running water. |

| Alteration | Any change in the mineral composition of a rock brought about by physical or chemical means. |

| Argillization | Alteration of the rock which produces clay minerals. |

| Audiomagnetotelluric | Geophysical technique which measures variations in the earth’s own electromagnetic field. |

2

| Basalt | A general term for dark-colored mafic igneous rocks, commonly extrusive but locally intrusive. |

| Bioclastic Turbidites | Submarine debris flows. |

| BLM | Bureau of Land Management of the State of Nevada. |

| Breccia | A rock in which angular fragments are surrounded by a mass of fine-grained matrix. |

| Carbonate | A sediment formed by the organic or inorganic precipitation from aqueous solution of carbonates of calcium, magnesium, or iron; e.g., limestone and dolomite. |

| Chert | A hard, dense, sedimentary rock, consisting primarily of cryptocrystaline quartz. |

| CSAMT | Controlled Source Audio Magnetotelluric – geophysical method which measures the decay of an induced electromagnetic field. |

| Devonian | Geologic era 360 million years to 410 million years. |

| Dolomite | A carbonate sedimentary rock consisting of carbonate and magnesium. Often associated with and interbedded with limestone. |

| Embayment | Indentation in the profile of a coastline. |

| Facies | Environment in which a certain sedimentary rock unit is deposited. |

| Felsic | Intrusive or volcanic rock with a high silica content. |

| g/t | Grams per metric tonne. |

| Geophysical Survey | A scientific method of prospecting that measures the physical properties of rock formations. Common properties investigated include magnetism, specific gravity, electrical conductivity and radioactivity. |

| Greenstone | Metamorphosed intermediate to basic volcanics. |

| Hematite | An oxide of iron, and one of iron’s most common ore minerals. |

| Horst | A relatively uplifted rock unit or block that is bounded by faults on its long sides. |

| Hydrothermal | The products or the actions of heated waters in a rock mass such as a mineral deposit precipitating from a hot solution. |

| Induced Polarization | Geophysical exploration method which measures decay of an induced charge. |

| Jasperiod | A dense, usually gray, siliceous rock which contains quartz instead of limestone or dolomite. |

| Lower-plate | Generally refers to the eastern assemblage of northeastern Nevada. |

| Magnetotelluric Survey | An electromagnetic survey in which natural electric and magnetic fields are measured. |

| Miocene | Geologic era 23.7 Million years to 6.2 million years. |

| Micritic | Fine-grained carbonate rock. |

| NSR | Net Smelter Royalty, or, the amount payable from the precious metal produced by the mine after smeltering has removed most of the impurities. |

| Paleozoic | Geologic era 570 million years to 245 million years. |

3

| Pod | A roughly cylindrically-shaped body of ore that decreases at the ends. |

| QP | Qualified Person as defined by National Instrument 43-101. |

| Quarternary | The period of Earth’s history from about 2 million years ago to the present; also, the rocks and deposits of that age. |

| Refractory | A type of ore which it is difficult or expensive to treat to release or recover its valuable minerals. |

| Rhyolite | A group of extrusive igneous rocks, typically porphyritic and commonly exhibiting flow texture, with phenocrysts of quartz and alkali feldspar in a glassy to cryptocrystalline groundmass; also, any rock in that group; the extrusive equivalent of granite. |

| Sediments | Solid fragmental material that originates from weathering of rocks and is transported or deposited by air, water, or ice, or that accumulates by other natural agents, such as chemical precipitation from solution or secretion by organisms, and that forms in layers on the Earth’s surface at ordinary temperatures in a loose, unconsolidated form; e.g., sand, gravel, silt, mud, alluvium. |

| Siliclastic | Sedimentary rock with a high silica content. |

| Silification | The in situ alteration of a rock, which involves an increase in the proportion of silica minerals. |

| Siltstone | An indurated silt having the texture and composition of shale but lacking its fine lamination or fissility; a massive mudstone in which the silt predominates over clay. |

| Tertiary | Geologic era 57 million years to recent. |

| Upper-plate | Generally refers to the western assemblage of northeastern Nevada. |

RESERVE AND RESOURCE DISCLOSURE

Terms used in this Annual Report relating to mineral reserves and mineral resources are Canadian mining terms as defined in accordance with National Instrument 43-101 under the guidelines set out in Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Standards on Mineral Resources and Mineral Reserves Definitions and Guidelines as adopted by the CIM Council. Under CIM Standards, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” have the following meanings:

| Mineral reserve | The term “mineral reserve”, under CIM Standards, refers to the economically mineable part of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. The study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that might occur when the material is mined. Under CIM Standards, mineral reserves are categorized as follows on the basis of the degree of confidence in the estimate of the quantity and grade of the deposit. |

| | Proven mineral reserve means, under CIM Standards, for the part of a deposit which is being mined, or which is being developed and for which there is a detailed mining plan, the estimated quantity and grade or quality of that part of a measured mineral resource for which the size, configuration and grade or quality and distribution of values are so well established, and for which economic viability has been demonstrated by adequate information on engineering, operating, economic and other relevant factors, so that there is the highest degree of confidence in the estimate. |

| | Probable mineral reserve means, under CIM Standards, the estimated quantity and grade or quality of that part of an indicated mineral resource for which economic viability has been demonstrated by adequate information on engineering, operating, economic and other relevant factors, at a confidence level which would serve as a basis for decisions on major expenditures. The degree of assurance, although lower than that for proven mineral reserves, is high enough to assume continuity between points of observation. |

4

| Mineral resource | The term “mineral resource”, under CIM Standards, refers to a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted form specific geological evidence and knowledge. Under CIM Standards, mineral resources are categorized as follows: |

| | Measured mineral resourcerefers to that part of a mineral resource for which a quantity grade or quality, density, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity. |

| | Indicated mineral resource refers to that part of a mineral resource for which quantity grade or quality, density, shape and physical characteristics can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed. |

| | Inferred mineral resource refers to that part of a mineral resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. |

Cautionary Note to U.S. Investors Concerning Estimates of Mineral Reserves and Mineral Resources:

We advise U.S. investors that the definitions of the terms “mineral reserve,” “proven mineral reserve” and “probable mineral reserve” under CIM Standards are different than the definitions adopted to the U.S. Securities and Exchange Commission (the “SEC”) and applicable to U.S. companies filing reports with the SEC pursuant to Guide 7. It is the view of the SEC’s staff that:

| | • | | A “final” or “bankable” feasibility study is required to meet the requirements to designate reserves under Guide 7. |

| | • | | A historic three year average price is to be used in any reserve or cash flow analysis to designate reserves. |

| | • | | To meet the “legal” part of the reserve definition, the primary environmental analysis or document should have been submitted to governmental authorities. |

In addition, while the terms “mineral resource,” “measured mineral resource,” “indicated mineral resource,” and “inferred mineral resource” are recognized and required to be reported by Canadian regulations, the SEC does not recognize them. As such, information contained in this Annual Report concerning descriptions of mineralization, resources and reserves under Canadian standards may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements of the SEC. “Indicated mineral resource” and “inferred mineral resource” have a great amount of uncertainty as to their existence and a great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “indicated mineral resource” or “inferred mineral resource” will ever be upgraded to a higher category.U.S. investors are cautioned not to assume that any part or all of an inferred resource exists, or is economically or legally mineable.

METRIC EQUIVALENTS

For ease of reference, the following factors for converting metric measurements into imperial equivalents are provided:

| To Convert from Metric | To Imperial | Multiply by |

|---|

Hectares | |

Acres | |

2.471 | |

| Meters | | Feet (ft.) | | 3.281 | |

| Kilometers (km) | | Miles | | 0.621 | |

| Tonnes | | Tons (2000 pounds) | | 1.102 | |

| Grams/tonne | | Ounces (troy/ton) | | 0.029 | |

5

ITEM 1: IDENTITY OF OFFICERS AND DIRECTORS

Not Applicable.

ITEM 2: OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

ITEM 3: KEY INFORMATION

3 A. SELECTED FINANCIAL DATA

The selected financial data of the Company for the Years Ended June 30, 2005, 2004 and 2003 were derived from the consolidated financial statements of the Company that were audited by Davidson & Company, Chartered Accountants (“Davidson & Company”), as indicated in their audit report which is included elsewhere in this Annual Report. The selected financial data of the Company for the Years Ended June 30, 2002 and 2001 was derived from the consolidated financial statements of the Company that were audited by Davidson & Company; these consolidated financial statements are not included herein.

The selected financial data should be read in conjunction with the consolidated financial statements and other financial information included elsewhere in the Annual Report.

The Company has not declared any dividends on its common shares since incorporation and does not anticipate that it will do so in the foreseeable future. The present policy of the Company is to retain any future earnings for use in its operations and the expansion of its business.

The following table is derived from the consolidated financial statements of the Company, which have been prepared in accordance with Canadian Generally Accepted Accounting Principles (GAAP), the application of which, in the case of the Company, conforms in all material respects for the years presented with US GAAP, except as disclosed in Note 15 to the consolidated financial statements.

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in Canadian Dollars (CAD$).

| Year

Ended

6/30/05 | Year

Ended

6/30/04 | Year

Ended

6/30/03 | Year

Ended

6/30/02 | Year

Ended

6/30/01 |

|---|

Revenue | |

$ 0 | |

$ 0 | |

$ 0 | |

$ 0 | |

$ 0 | |

| Net Loss | | (1,063 | ) | (1,664 | ) | (357 | ) | (1,679 | ) | (642 | ) |

| Net Loss Per Share | | (0.02 | ) | (0.04 | ) | (0.01 | ) | (0.06 | ) | (0.02 | ) |

| Dividends Per Share | | 0 | | 0 | | 0 | | 0 | | 0 | |

| Weighted Avg. Shares (000) | | 53,091 | | 39,038 | | 28,958 | | 26,577 | | 26,519 | |

| As at

6/30/05 | As at

6/30/04 | As at

6/30/03 | As at

6/30/02 | As at

6/30/01 |

|---|

Working Capital | |

11,216 | |

9,804 | |

(87 |

) |

384 | | 633 | |

| Mineral Property Interests | | 2,456 | | 1,754 | | 1,104 | | 959 | | 1,519 | |

| Deferred Exploration Costs | | 1,509 | | 733 | | 506 | | 407 | | 911 | |

| Long-Term Debt | | 0 | | 0 | | 0 | | 0 | | 0 | |

| Shareholders' Equity | | 15,517 | | 12,590 | | 1,677 | | 1,993 | | 3,338 | |

| Total Assets | | 15,697 | | 12,720 | | 1,911 | | 2,133 | | 3,389 | |

6

Had the consolidated financial statements of the Company been prepared in accordance with U.S. GAAP, certain selected financial data would have been reported as follows, (CAD$ in 000 except per share amounts).

| Year

Ended

6/30/05 | Year

Ended

6/30/04 | Year

Ended

6/30/03 | Year

Ended

6/30/02 | Year

Ended

6/30/01 |

|---|

Loss Per Share | |

(0.05 |

) |

(0.07 |

) |

(0.02 |

) |

(0.03 |

) |

(0.03 |

) |

| Weighted Avg. Shares | | 53,091 | | 39,038 | | 28,958 | | 26,577 | | 26,519 | |

| Shareholders' Equity | | 11,588 | | 10,102 | | 66 | | 626 | | N/A | |

| As at

6/30/05 | As at

6/30/04 | As at

6/30/03 | As at

6/30/02 | As at

6/30/01 |

|---|

Deferred Exploration Costs | |

0 | |

0 | |

0 | |

0 | |

N/A | |

| Total Assets | | 11,768 | | 10,232 | | 300 | | 766 | | N/A | |

The Government of Canada permits a floating exchange rate to determine the value of the CAD$ against the U.S. Dollar (US$).

The following table sets forth the high and low rate of exchange for the CAD$ for each month during the previous six months, and for the five most recent fiscal years of the Company. The average rate for each such fiscal year is calculated using the average of the rate of exchange on the last day of each month during the year.

For purposes of this table, the rate of exchange means the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. The table sets forth the number of CAD$ required under that formula to buy one US$.

Canadian Dollar/US Dollar

| Average |

|---|

Year Ended June 30, 2005 | |

1.2500 | |

| Year Ended June 30, 2004 | | 1.3440 | |

| Year Ended June 30, 2003 | | 1.5106 | |

| Year Ended June 30, 2002 | | 1.5686 | |

| Year Ended June 30, 2001 | | 1.5195 | |

| High | Low |

|---|

| November 2005 | | 1.1960 | | 1.1656 | |

| October 2005 | | 1.1887 | | 1.1657 | |

| September 2005 | | 1.1880 | | 1.1607 | |

| August 2005 | | 1.2185 | | 1.1888 | |

| July 2005 | | 1.2437 | | 1.2048 | |

| June 2005 | | 1.2578 | | 1.2256 | |

On December 16, 2005, the rate of exchange was US$1.00 = CAD$1.156.

3 B. CAPITALIZATION AND INDEBTEDNESS

Not Applicable.

3 C. REASONS FOR THE OFFER AND USE OF PROCEEDS

Not Applicable.

7

3 D. RISK FACTORS

An investment in the common shares of the Company involves a high degree of risk and must be considered highly speculative due to the nature of the Company’s business and the present stage of exploration and development of its mineral resource properties. In particular, the following risk factors apply:

Risks Relating to Our Business and Industry

We have a history of losses, and we expect to incur losses in the future

The Company has no mineral producing properties and no operating revenues. The Company has had a history of losses and there is no assurance that it can generate operating revenues or reach profitability in the future. The Company could require significant additional funding to meet its business objectives.

Mineral exploration is speculative and frequently unsuccessful

Resource exploration is a speculative business, characterized by a number of significant risks including, among other things, unprofitable efforts resulting not only from the failure to discover resource deposits but from finding resource deposits which, though present, are insufficient in quantity and quality to return a profit from production. The marketability of resources acquired or discovered by the Company may be affected by numerous factors which are beyond the control of the Company and which cannot be accurately predicted, such as market fluctuations, the proximity and capacity of refining facilities, resource markets and processing equipment, and such other factors as government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environment protection, the combination of which factors may result in the Company not receiving an adequate return on investment capital.

The Company is at the exploration stage on all of its properties and substantial additional work will be required in order to determine if any economic deposits occur on the Company’s properties. Resource exploration is highly risky, and most exploration properties do not contain any economic deposits of minerals. If a property is determined to not contain any economic reserves of minerals, the entire amount spent on exploration will be lost.

Despite exploration work on its mineral claims, no known bodies of commercial ore have been established on any of the Company’s resource properties. Finding resource deposits is dependent on a number of factors, not the least of which is the technical skill of exploration personnel involved. Even in the event commercial quantities of resources are discovered, the exploration properties might not be brought into a state of commercial production. The commercial viability of a resource deposit once discovered is also dependent on a number of factors, some of which are particular attributes of the deposit, such as size, grade and proximity to infrastructure, as well as commodity prices. Most of these factors are beyond the control of the entity conducting such resource exploration. The Company is an exploration stage company with no history of pre-tax profit and no income from its operations. Even if the Company’s properties are brought into production, operations may not be profitable.

We could be harmed by a decline in gold or other metal prices

The economics of developing metal and mineral properties are affected by many factors including, without limitation, the cost of operations, variations in the grade of ore or resource mined and the price of such resources. Depending on the price of gold and other metals, the Company may determine that it is impractical to commence or continue commercial production. The prices of gold and other metals have fluctuated in recent years.

Since the Company’s properties are gold prospects, the prices of gold and other metals significantly affect the Company’s ability to explore and develop its properties, and to obtain financing and its future prospects generally. The prices of gold and other metals are affected by several factors beyond the control of the Company, including, without limitation, international economic and political trends, expectations of inflation, interest rates and global or regional consumption patterns, speculative activities, increased production due to improved mining and production methods, and changes in primary production capacity and utilization and in the recycling of secondary material. There can be no assurance that the prices of gold will remain stable or that such prices will be at levels that will make it feasible to continue the Company’s exploration activities, or, if applicable, begin development of its properties or commence or, if commenced, continue commercial production.

The titles to some of our properties may be uncertain or defective, or we may lose rights to properties if we fail to meet payment requirements

Certain of our mineral rights consist of “unpatented” mining claims created and maintained in accordance with the U.S. General Mining Law of 1872. Unpatented mining claims are unique property interests granted in lands owned by the U.S. federal government. No land ownership is conveyed to the holders of the claims. Unpatented mining claims are generally

8

considered to be subject to greater title risk than other real property interests because the validity of unpatented mining claims is often uncertain. This uncertainty arises, in part, out of the complex federal and state laws and regulations that supplement the General Mining Law. Also, unpatented mining claims and related rights, including rights to use the surface, are subject to possible challenges by third parties or contests by the federal government. The validity of an unpatented mining claim, in terms of both its location and its maintenance, is dependent on strict compliance with a complex body of federal and state statutory and decisional law. In addition, there are few public records that definitively control the issues of validity and ownership of unpatented mining claims. In recent years, the U.S. Congress has considered a number of proposed amendments to the General Mining Law. Although no such legislation has been adopted to date, there can be no assurance that such legislation will not be adopted in the future. If ever adopted, such legislation could, among other things, impose royalties on gold production from unpatented mining claims located on federal lands or impose fees on production from patented mining claims. If such legislation is ever adopted, it could have an adverse impact on earnings from our operations, could reduce estimates of our reserves and could curtail our future exploration and development activity on federal lands or patented claims.

We hold rights in certain of our properties pursuant to unpatented mining claims, leaseholds, joint ventures, purchase option agreements and other rights which require the payment of maintenance fees, rents, or purchase price installments, exploration expenditures, or other fees. If we fail to make these payments when they are due, our rights to the property may lapse. There can be no assurance that we will always make payments by the requisite payment dates. There can be no assurance that we will be able to meet any or all of the development or production schedules. Our ability to transfer or sell our rights to some of our mineral properties requires government approvals or third party consents, which may not be granted.

While we have no reason to believe that the existence and extent of any of our property rights are in doubt, we have done only a preliminary legal survey of the boundaries of some of our properties, and therefore, their existence and area could be in doubt. We have not obtained formal title reports on any of our properties and title may be in doubt. If title is disputed, we will have to defend our ownership through the courts. In the event of an adverse judgment, we would lose our property rights.

We may be unable to comply with the substantial governmental regulation to which our business is subject

The Company’s exploration operations are affected to varying degrees by government regulations relating to resource operations, the acquisition of land, pollution control and environmental protection, safety, production and expropriation of property. Changes in these regulations or in their application are beyond the control of the Company and may adversely affect its operations, business and results of operations. Failure to comply with the conditions set out in any permit or failure to comply with the applicable statutes and regulations may result in orders to cease or curtail operations or to install additional equipment. The Company may be required to compensate those suffering loss or damage by reason of its operating or exploration activities. Operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, foreign exchange controls, income taxes, expropriation of property, environmental legislation and mine safety.

On the Federal and State of Nevada level, the Company must comply with exploration permitting requirements which require sound operating and reclamation plans to be approved by the applicable government body prior to the start of exploration. Depending upon the type and extent of the exploration activities, the Company may be required to post reclamation bonds and/or assurances that the affected areas will be reclaimed. The Company has posted bonds with various government bodies for exploration work on several of its properties, but if the reclamation requires funds in addition to those already allocated, the Company could be forced to pay for the extra work and it could have a significant negative effect upon the Company’s financial position and operations.

In connection with its operations and properties, the Company is subject to extensive and changing environmental legislation, regulation and actions. The Company cannot predict what environmental legislation, regulation or policy will be enacted or adopted in the future or how future laws and regulations will be administered or interpreted. The recent trend in environmental legislation and regulation generally is toward stricter standards and this trend is likely to continue in the future. The recent trend includes, without limitation, laws and regulations relating to air and water quality, mine reclamation, waste handling and disposal, the protection of certain species and the preservation of certain lands. These regulations may require obtaining permits or other authorizations for certain activities. These laws and regulations may also limit or prohibit activities on certain lands lying within wetland areas, area providing for habitat for certain species or other protected areas. Compliance with more stringent laws and regulations, as well as potentially more vigorous enforcement policies or stricter interpretation of existing laws, may necessitate significant capital outlays, may materially affect the Company’s results of operations and business, or may cause material changes or delays in the Company’s intended activities.

9

We rely on key management personnel

The success of the operations and activities of the Company is dependent to a significant extent on the efforts and abilities of its management team. See Item 6 — Directors, Senior Management and Employees for details of Company’s current management. Investors must be willing to rely to a significant extent on their discretion and judgment. The Company does not maintain key employee insurance on any of its employees.

We face strong competition from other mining companies for the acquisition of new properties

The Company will be required to compete in the future directly with other corporations that may have greater resources. Such corporations could outbid the Company for potential projects or produce commodities at lower costs, which would have a negative effect on the Company’s operations.

Currency fluctuations may affect the costs of doing business

The Company’s activities are currently located in Canada and the United States. Any appreciation of the US$ could increase the Company’s cost of doing business in the United States. The Company does not utilize hedging programs to any degree to mitigate the effect of currency movements.

Our insurance coverage may be inadequate

The mining industry is subject to significant risks that could result in:

| • | | Damage to or destruction of property and facilities; |

| • | | Personal injury or death; |

| • | | Environmental damage and pollution; and |

| • | | Expropriation of assets and loss of title to mining claims. |

While where applicable the Company has purchased property and liability insurance that it believes is appropriate for the level of risk incurred, it does not carry insurance for political risk, nor environmental damage or pollution because such coverage cannot be purchased at reasonable costs. This lack of insurance coverage could result in material economic harm to the Company if a significant claim against the Company should occur.

Our directors and officers may have conflicts of interest

The Company’s directors and officers may serve as directors or officers of other resource companies or have significant shareholdings in other resource companies and, to the extent that such other companies may participate in ventures in which the Company may participate, the directors of the Company may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. In the event that such a conflict of interest arises at a meeting of the Company’s directors, a director who has such a conflict will abstain from voting for or against the approval of such participation or such terms. From time to time several companies may participate in the acquisition, exploration and development of natural resource properties thereby allowing for their participation in larger programs, permitting involvement in a greater number of programs and reducing financial exposure in respect of any one program. It may also occur that a particular company will assign all or a portion of its interest in a particular program to another of these companies due to the financial position of the company making the assignment. In accordance with the laws of the British Columbia, the directors of the Company are required to act honestly, in good faith and in the best interests of the Company. In determining whether or not the Company will participate in a particular program and the interest therein to be acquired by it, the directors will primarily consider the degree of risk to which the Company may be exposed and its financial position at that time. See Item 6.

We will require additional financing, which may not be available on favorable terms, or at all

While the Company believes it has sufficient funds to undertake its planned current exploration projects, future exploration will require additional funds. The exploration of the Company’s mineral properties is, therefore, dependent upon the Company’s ability to obtain financing through the joint venturing of projects, debt financing, equity financing or other means. Such sources of financing may not be available on acceptable terms, if at all. Failure to obtain such financing may result in delay or indefinite postponement of exploration work on the Company’s mineral properties, as well as the possible loss of such properties. Any transaction involving the issuance of previously authorized but unissued common shares or securities convertible into common shares could result in dilution, possibly substantial, to present and prospective holders of common shares. These financings may be on terms less favorable to the Company than those obtained previously.

10

Risks Relating to an Investment in Our Securities

The market price of our securities may be volatile

The market for the common shares of the Company may be highly volatile for reasons both related to the performance of the Company or events pertaining to the industry (ie, gold exploration/commodity prices/accidents) as well as factors unrelated to the Company or its industry. In particular, market demand for products incorporating minerals in their manufacture fluctuates from one business cycle to the next, resulting in change of demand for the mineral and an attendant change in the price for the mineral. The Company’s common shares can be expected to be subject to volatility in both price and volume arising from market expectations, announcements and press releases regarding the Company’s business, and changes in estimates and evaluations by securities analysts or other events or factors. In recent years the securities markets in the United States and Canada have experienced a high level of price and volume volatility, and the market price of securities of many companies, particularly small-capitalization companies such as the Company, have experienced wide fluctuations that have not necessarily been related to the operations, performances, underlying asset values, or prospects of such companies. For these reasons, the price of the Company’s common shares can also be expected to be subject to volatility resulting from purely market forces over which the Company will have no control. Further, despite the existence of a market for trading the Company’s common shares in Canada, shareholders of the Company may be unable to sell significant quantities of common shares in the public trading markets without a significant reduction in the share price.

There may be certain tax risks associated with investments in our company

The Company could be classified as a Passive Foreign Investment Company (“PFIC”) under the United States tax code. If the Company is declared a PFIC, then owners of the Company’s common shares who are U.S. taxpayers generally will be required to treat any so-called “excess distribution” received on its common shares, or any gain realized upon a disposition of common shares, as ordinary income and to pay an interest charge on a portion of such distribution or gain, unless the taxpayer makes a qualified electing fund (“QEF”) election or a mark-to-market election with respect to the Company’s shares. A U.S. taxpayer who makes a QEF election generally must report on a current basis its share of the Company’s net capital gain and ordinary earnings for any year in which the Company is classified as a PFIC, whether or not the Company distributes any amounts to its shareholders.

You could have difficulty or be unable to enforce certain civil liabilities against us and certain of our directors and officers

It may be difficult to bring and enforce suits against the Company. The Company is a corporation incorporated in Canada under the laws of British Columbia. Most of the Company’s directors and officers are residents of Canada and certain of the Company’s assets are located outside of the United States. Consequently, it may be difficult for United States investors to effect service of process in the United States upon those directors or officers who are not residents of the United States, or to realize in the United States upon judgments of United States courts predicated upon civil liabilities under United States securities laws.. There is substantial doubt whether an original action could be brought successfully in Canada against any of such persons or the Company predicated solely upon such civil liabilities under the United States laws. The Company also has indemnity agreements with all of its officers and directors which would likely cause further difficulty in the enforcement of any judgment against those persons and the Company maintains no liability insurance for its officers and directors.

Brokers may be discouraged from engaging in transactions in our securities because it is a “penny stock”

Rules 15g-1 through 15g-9 promulgated under the Securities Exchange Act of 1934, as amended, impose sales practice and disclosure requirements on NASD broker-dealers who make a market in “a penny stock”. A penny stock generally includes any non-NASDAQ equity security that has a market price of less than $5.00 per share. The additional sales practice and disclosure requirements imposed upon broker-dealers may discourage broker-dealers from effecting transactions in the Company’s shares, which could severely limit the market liquidity of the shares and impede the sale of the Company’s shares in the secondary market.

Under the penny stock regulations, a broker-dealer selling penny stock to anyone other than an established customer or “accredited investor” (generally, an individual with net worth in excess of US$1,000,000 or an annual income exceeding US$200,000, or US$300,000 together with his or her spouse) must make a special suitability determination for the purchaser and must receive the purchaser’s written consent to the transaction prior to sale, unless the broker-dealer or the transaction is otherwise exempt.

In addition, the penny stock regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a disclosure schedule prepared by the US Securities and Exchange Commission relating to the penny stock market, unless the broker-dealer or the transaction is otherwise exempt. A broker-dealer is also required to disclose commissions payable to the broker-dealer and the registered representative and current quotations for the securities. Finally, a broker-dealer is required to send monthly statements disclosing recent price information with respect to the penny stock held in a customer’s account and information with respect to the limited market in penny stocks.

11

ITEM 4: INFORMATION ON THE COMPANY

4 A. HISTORY AND DEVELOPMENT OF THE COMPANY

The legal and commercial name of the Company is White Knight Resources Ltd.

The Company was incorporated under the Company Act of British Columbia under the name White Knight Resources Ltd. on December 18, 1986. The Company’s articles were amended on January 31, 1995 to increase the authorized share capital from 10,000,000 common shares to 100,000,000 common shares without par value.

On March 29, 2004, the British Columbia legislature enacted theBusiness Corporations Act(the “New Act”) and repealed the former act, which previously governed the Company. The New Act removed many of the restrictions contained in the former act, including restrictions on the residency of directors, the place of annual general meetings and limits on authorized share capital. The New Act also uses new forms and terminology. Under the New Act, every company incorporated, amalgamated or continued under the former act must complete a mandatory transition rollover under the New Act to substitute a Notice of Articles for its Memorandum within two years of March 29, 2004, after which existing articles could be altered to take advantage of new provisions contained in the New Act. Under the New Act, the directors of the Company were permitted to approve and complete this mandatory transition rollover, and accordingly the Company filed a transition application with the Registrar of Companies effective June 20, 2005. At an annual general meeting held on November 26, 2005, the Company’s shareholders approved, by a three-quarter majority vote cast by those shareholders of the Company who, being entitled to do so, vote in person or by proxy at the Meeting in respect of such resolutions, the removal of pre-existing company provisions that applied to the Company relating to restrictions in the former act and no longer required under the New Act, and certain amendments to its Notice of Articles and to its authorized share capital. In addition, the shareholders approved new articles (the “New Articles”) to bring the Company’s charter documents into line with the New Act and, as permitted by the New Act, altered the authorized capital of the Company from 100,000,000 common shares without par value to an unlimited number of common shares without par value and the alteration of the Notice of Articles. The changes were effected and the Registrar issued a new Notice of Articles on December 21, 2005.

The Company is domiciled in British Columbia, Canada and is a valid company in good standing and operating under the British Columbia Corporations Act. The Company’s principal place of business is located at Suite 922, 510 West Hastings Street, Vancouver, British Columbia, Canada, V6B 1L8, telephone (604) 681-4462, E-Mail info@whiteknightres.com. The Company through its subsidiary has a technical office in Reno, Nevada.

Since inception, the Company has been active in the mineral exploration sector. From 1986 to 1993, the Company explored various properties in British Columbia and the Northwest Territories, Canada. In 1993, the Company began to acquire gold exploration properties in Nevada and has focused solely on exploration of properties in Nevada since that time.

See Item 5 – Operating and Financial Review and Prospects for important events that have occurred in the development of the Company’s business during the last full financial year from July 1, 2004 to June 30, 2005, and subsequent thereto to November 30, 2005 being the latest practicable date. Also see Item 5 for information on the Company’s principal expenditures during the past three years. There are ongoing drilling programs on the McClusky Pass, Cottonwood, Gold Pick and Indian Ranch properties. The Company anticipates spending US$2,000,000 or more during the next year on further exploration of its properties.

4 B. BUSINESS OVERVIEW

The Company is a British Columbia based mineral resource exploration company engaged, through its subsidiaries, in the acquisition and exploration of precious metals properties, primarily gold.

All of the Company’s mineral exploration operations are located in the State of Nevada, United States. The Company continues to explore for projects to acquire in Nevada.

To date, the Company has no revenue from its operations, nor is it dependent upon any patents, licenses or manufacturing processes. The Company’s operations are dependent upon mineral exploration and mining rights and claims as well as the terms of option and/or joint venture agreements on those properties. The Company currently holds interests in 18 properties located in Nevada.

The exploration operations of the Company are subject to regulation by several government agencies at the Federal, State, and local levels. These regulations are a fundamental aspect of operations for any resource company in North America. Management believes it is in compliance with all current requirements and does not anticipate any significant changes to these regulations which will have a material effect on the Company’s operations.

12

See Item 3D – Risk Factors, for a summary of certain risks related to the Company’s business and an investment in the Company’s securities.

See Item 4D – Mineral Properties, for an overview of the Company’s properties.

See Item 5 – Operating and Financial Review and Prospects, for an overview of the Company’s financial position and past expenditures.

4 C. ORGANIZATIONAL STRUCTURE

The following is a listing of the Company’s subsidiaries including name, country of incorporation or residence and the Company’s respective proportion of ownership interest and, if different, proportion of voting power held.

| | (1) | | CUN Minerals, Inc., Nevada, USA, 100% directly owned by the Company. |

| | (2) | | White Knight Gold (U.S.) Inc., Delaware, USA, 100% directly owned by the Company. |

| | (3) | | Quito Gold Corporation, Nevada, USA, 100% directly owned by the Company. |

4 D. MINERAL PROPERTIES

The following is a description of the Company’s properties and the nature of the Company’s interests in such properties. This Item 4 D. was reviewed and the contents have been verified by the Company’s Qualified Person, John M. Leask, P.Eng.

Indian Ranch Property

The Indian Ranch property (the “Indian Ranch Property”) is located in Eureka County, Nevada and consists of 544 unpatented mining claims totaling 10,008 acres. The Company currently has a 75% undivided interest in the Indian Ranch Property. However, the Company’s interest is subject to an option agreement with Placer Dome U.S. Inc. (“Placer Dome”) whereupon Placer Dome can earn up to a 75% interest (thus reducing the Company’s interest to 18.75%). The Indian Ranch Property is without known mineral reserves and is at the exploration stage. The Company’s current efforts are exploratory in nature.

13

Acquisition

The Company entered into an option agreement dated February 10, 1994 with the Damele Family (“the Vendor”) on the Indian Ranch Property. The agreement was subsequently amended through 5 separate amendments with the Vendor. Under the agreement and its amendments, the Company earned a 100% leasehold interest in the Indian Ranch Property by issuing to the Vendor 100,000 common shares and an annual work commitment of 5,000 feet of drilling. The drill commitment was waived for the year ended February 10, 1996 in consideration of a US$15,000 cash payment. Additionally, the original NSR held by the vendor was amended for consideration of a US$15,000 cash payment; currently, the vendor retains a 6% NSR, but the Company may reduce the NSR to 3% in consideration of a US$500,000 payment. The Company’s lease on the Indian Ranch Property extends through February 10, 2014 or for so long thereafter as exploration, development or mining activity is being conducted on a continuous annual basis. The Company has met all the required terms under the agreement to date.

Under an agreement with Chapleau Resources Ltd. (“Chapleau”) dated May 26, 1997 and amended June 18, 2001, the Company granted Chapleau the right to earn an interest in the Indian Ranch Property by making payments to the Company totaling US$400,000 and incurring exploration expenditures of US$1,500,000. On June 25, 2001, Chapleau vested a 25% interest, thus reducing the Company’s interest to 75%.

Under an agreement dated March 26, 2003 between the Company, Chapleau and Placer Dome, the Company granted Placer Dome the right to earn an initial 60% interest in the Indian Ranch Property by paying US$55,000 and incurring a minimum of US$2,000,000 in work expenditures over a four-year period under the following schedule:

Expenditure

Due Date | Minimum Work

Expenditures (US$) |

|---|

March 25, 2004 | |

$ 100,000 | |

| March 25, 2005 | | $ 300,000 | |

| March 25, 2006 | | $ 600,000 | |

| March 25, 2007 | | $1,000,000 | |

| Total | | $2,000,000 | |

Upon vesting its initial 60% interest, Placer Dome can elect to earn an extra 15% by financing a feasibility study on the Indian Ranch Property. Placer Dome has met all the required terms under the agreement to date.

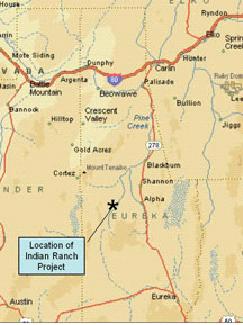

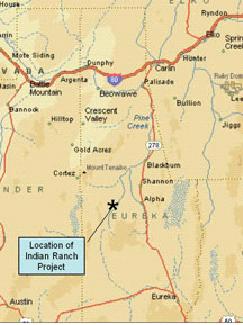

Location and Access

The Indian Ranch Property lies 10 miles southeast of the Gold Acres-Cortez Window and is located 17 air miles southeast of the Pipeline/South Pipeline gold mines and 38 air miles northwest of Eureka, Nevada. Access is achieved via Nevada State Highway 278 south from Carlin for 48 miles, west on the JD Ranch Road for 4 1/2 miles, south for 12 miles to the Tonkin Ranch site, and then northwest for 5 miles. The south and central portions of the Indian Ranch Property can be traversed by unimproved dirt roads, and new roads are planned to provide drilling access to the north.

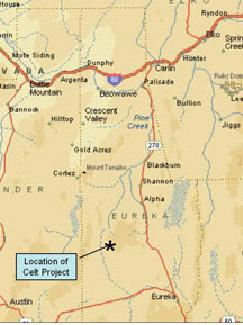

Regional and Property Geology

The Indian Ranch Property is located on the Cortez Trend. Lower-plate Paleozoic sediments (“the Indian Ranch window”) underlies shallow volcanic and alluvial cover on much of the central and eastern portions of the Indian Ranch Property. Lower-plate carbonate rocks are not exposed at the surface, but drilling and mapping thus far indicate that about 10 square miles of the Indian Ranch Property is underlain by Lower-plate Paleozoic carbonate rocks of the Roberts Mountains Formation, Rabbit Hill Limestone, Nevada Group, or underlying dolomites of the Hanson Creek Formation. This covered window of Lower Plate rocks is present in the form of several uplifted or horsted blocks. Roberts Mountains Formation rocks occur in the window and have been intersected in drill holes within 35 feet of the surface. Hydrothermal alteration is present over large areas of the property, and thick (up to 600 feet or more) zones of intense alteration in the form of silicification, decalcification (sanding), and argillization are present, as well as amorphous carbon or fine-grained sulfides. Anomalous gold and associated hydrothermal alteration is present across Indian Ranch in both Upper and Lower Plate rocks.

Previous Exploration History

Prior to the Company’s acquisition of its interest in the Indian Ranch Property, Northern Dynasty Exploration Ltd. (“Northern Dynasty”) explored it in 1987. Northern Dynasty prepared a preliminary geologic map and drilled 4 holes totaling 1,130 feet. Hycroft Resources and Development Corporation then acquired the property and drilled 90 additional holes from 1988 to 1990 to an average depth of 114 feet. After the Company acquired the Indian Ranch Property in 1994, exploration was conducted by Delta Gold Mining Corp. (“Delta Gold”) under an earn-in joint venture agreement on a combined land package

14

comprised of the Indian Ranch Property and the Imperial property. Delta Gold completed an IP survey, a CSAMT survey, and drilled 10 holes to an average depth of 501 feet. This drilling resulted in the discovery of an 80 foot wide zone of gold mineralization averaging 0.012 oz/ton gold. Delta Gold also intersected a higher-grade zone of 10 feet averaging 0.22 oz/ton gold. Delta Gold subsequently terminated the agreement. Under the Chapleau option agreement, 20 holes were drilled during 1997, 12 holes were drilled in 1998, four holes were drilled in 1999, and 11 holes were drilled in 2000 for a total of 45,100 feet in 47 holes. During 1999, a detailed gravity survey and a soil sampling grid program were also completed. Exploration expenditures under the Chapleau agreement totaled US$1,500,000.

In 2001, Kennecott Exploration Company (“Kennecott”) entered an option agreement with the Company and Chapleau. Kennecott drilled 11 reverse circulation holes which intersected low-grade gold mineralization three miles south of the previously identified gold zones. Kennecott expended US$531,100 before terminating the agreement.

Current and Planned Exploration

During the 2005 field season, Placer Dome executed a three-hole RC drilling program comprising 1,830 metres. As part of this campaign, Hole PIR 05-10 intersected a broad zone of Carlin-type mineralization grading 0.32 grams/tonne over a thickness of 102 metres which included 9.1 metres grading 1.58 grams/tonne. Placer Dome is currently following up on this discovery with further drilling.

Slaven Canyon Property

The Slaven Canyon property (the “Slaven Canyon Property) is located in Lander County, Nevada, and totals 6,600 acres. The Company has a 100% interest in 258 unpatented mining claims comprising 5,174 acres of the Slaven Canyon Property and has a lease on the remaining 1,426 acres, which are subject to NSR royalties. The Slaven Canyon Property is without known mineral reserves and is at the exploration stage. The Company’s current efforts are exploratory in nature.

Acquisition

Since September 2001, the Company has staked 258 unpatented mining claims comprising 5,174 acres (the “Gordo Claims”). Since fiscal 2003, the Company has signed lease agreements on 1,425 acres adjacent to the Company’s staked claims. The leases called for the payment of approximately US$32,430 on signing and escalating lease payments thereafter. The owners retain net smelter returns ranging from ½ percent to 3½% with a buy down to 1% for US$1,500,000. 2006 annual holding costs for the property are estimated to be US$81,865, which includes US$47,418 for the lease payments and US$34,447 in federal and county fees.

15

Location and Access

The Slaven Canyon Property is located in the Northern Shoshone Range, Lander County, Nevada, approximately 14 miles southeast of Battle Mountain. The Slaven Canyon Property is traversed by numerous unimproved dirt roads traveling south from Battle Mountain.

Regional and Property Geology

Rock units on the Slaven Canyon Property are dominated by chert, siltstone and limestone of the Ordovician Vinini Formation and Devonian Slaven Chert, both units of the Upper Plate Roberts Mountains Allochthon. These units are overlain on the east by Miocene basalt of the Northern Nevada Rift. Major northeast trending faults cut through the area and are believed to be a regional control to the localization of gold mineralization. The main zone of gold mineralization on the property measures about 2400 feet east-west by 300 feet – 500 feet north-south. Select drill intercepts include:

|

| Interval (feet) | Gold (opt) |

|---|

|

| 60 | | 0.059 | |

| 35 | | 0.096 | |

| 60 | | 0.052 | |

| 100 | | 0.049 | |

| 40 | | 0.050 | |

| 45 | | 0.063 | |

| 25 | | 0.083 | |

|

Mineralization is open on the east and west end and to some degree down dip. A second area of gold mineralization occurs on the northern portion of the claims. The primary exploration target is a Carlin-type gold deposit in Lower-plate carbonate rocks or in carbonate units of the Upper-plate. Select drill hole intercepts from here include:

|

| Interval (feet) | Gold (opt) |

|---|

|

| 25 | | 0.066 | |

| 25 | | 0.054 | |

| 10 | | 0.063 | |

|

The zone of mineralization is a shallow, mostly oxide, shallowly dipping tabular body hosted in Upper-plate siliclastic rocks. Gold mineralization is probably controlled by a shallow angle thrust fault. Alteration is dominantly argillization and sanding. Most holes in the vicinity of the main zone are between 200 feet to 300 feet deep with the deepest being 700 feet.

Previous Exploration History

After the discovery of gold-bearing breccia outcrops, Resource Associates of Alaska (“RAA”) staked claims at Slaven Canyon in 1984. RAA conducted geologic mapping, rock and soil sampling, and trenching from 1984 to 1987. Nerco Exploration Company (“Nerco”) acquired RAA in 1988 and Alta Gold Company (“Alta”) joint-ventured the claims with Nerco later that year. Alta began an aggressive drilling program and completed 59 shallow holes in 1988. An additional eight holes were drilled in 1989. Cyanide-shake metallurgical tests were conducted in 1990, followed by the drilling of 17 holes in 1991. Uranerz Exploration and Mining Limited (“Uranerz”) leased the property in 1991 and completed a 57-hole drilling program in 1992. Bottle-roll tests were completed in 1993 after which a resource estimate was completed. Cameco acquired Uranerz in 1994 and terminated the lease. Cyprus Minerals Corp. (“Cyprus”) leased the claims from Alta Gold later that year and drilled nine holes in the northwest part of the property before terminating the lease in 1995. Following Cyprus’ withdrawal, Alta Gold retained the claims from 1996 through 1999 but performed no further work on the Slaven Canyon Property. Alta Gold filed for bankruptcy in 2000 and relinquished the claims shortly thereafter.

Current and Future Exploration

Work on the Slaven Canyon Property during the 2004 and 2005 field seasons included 24 shallow Reverse Circulation holes and one deep core hole (SL-21). The shallow drilling encountered scattered zones of gold mineralization in the Upper-plate. Significant gold intercepts from the Reverse Circulation drill holes are shown in the table below. Drill hole SL-21 intersected a unit of carbonaceous micritic limestone at a depth of 750 metres (2,460 feet). This carbonate may be thrust bounded and has strong similarities to eastern assemblage lower plate carbonate. SL-21 bottomed at a depth of 789 metres. Further drilling is warranted for both shallow and deep targets.

16

|

Recent Drill Results

Slaven Canyon Property |

|

| Drill Hole | From

(metres) | To

(metres) | Intercept* (metres) | Intercept*

(feet) | Au

(g/t) | Au

(opt) |

|---|

|

| SL-5 | | 94.5 | | 102.1 | | 7.6 | | 25 | | 2.10 | | 0.070 | |

| incl. | | 96.0 | | 97.5 | | 1.5 | | 5 | | 5.21 | | 0.170 | |

|

| SL-6 | | 42.7 | | 45.7 | | 3.0 | | 10 | | 1.24 | | 0.040 | |

|

| SL-10 | | 50.3 | | 54.9 | | 4.6 | | 15 | | 1.13 | | 0.036 | |

|

| SL-12 | | 128.0 | | 132.6 | | 4.6 | | 15 | | 0.53 | | 0.017 | |

|

| SL-13 | | 121.9 | | 129.5 | | 7.6 | | 25 | | 0.68 | | 0.022 | |

| incl. | | 125.0 | | 126.5 | | 1.5 | | 5 | | 1.07 | | 0.034 | |

|

| SL-13 | | 135.6 | | 147.8 | | 12.2 | | 40 | | 0.55 | | 0.019 | |

| incl. | | 137.2 | | 138.7 | | 1.5 | | 5 | | 1.34 | | 0.043 | |

|

| SL-14 | | 86.9 | | 97.5 | | 10.6 | | 35 | | 1.00 | | 0.032 | |

| | (end of hole) | | | | | | | | | |

|

| Sl-17 | | 97.5 | | 103.6 | | 6.1 | | 20 | | 0.71 | | 0.023 | |

|

| * True widths are unknown |

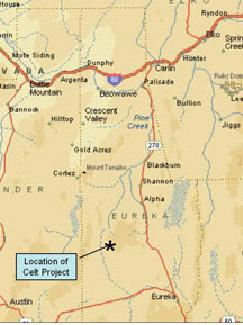

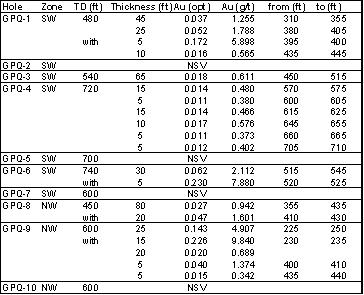

Celt Property

The Company’s 100% owned Celt property (the “Celt Property”) is located in Eureka County, Nevada, and consists of 608 unpatented mining claims totaling 12,569 acres. Teck Cominco American Incorporated (“TCAI”) has an option to earn an initial 51% interest in the Celt Property. The Celt Property is without known economic mineral reserves and is at the exploration stage. The Company’s current efforts are exploratory in nature.

17

Acquisition

The Company has staked 608 unpatented mining claims located on Bureau of Land Management land since September 2003.

In October 2004, the Company entered into a Property Acquisition Agreement with TCAI whereby TCAI was granted the option to earn an initial 51% interest in the Celt Property. The terms of the agreement provide for exploration expenditures of US$4,000,000 and cash payments of US$750,000 which must be incurred and paid to the Company’s U.S. subsidiary in annual increments prior to December 31, 2008. TCAI has made a firm commitment to incur US$500,000 in exploration expenditures by December 31, 2005. Upon TCAI vesting its 51% interest, TCAI and the Company will form a joint venture to further develop the Celt Property. When the joint venture completes the earlier of US$8.0 million in expenditures or a preliminary feasibility study, TCAI will have a one-time option to elect to earn an additional 9% interest by funding and completing a feasibility study. Upon TCAI earning its additional interest and the approval of a production plan, the Company will have the option to request that TCAI arrange financing for the Company’s share of the capital costs required to develop the property. If the Company exercises this option TCAI shall commit to use its best efforts to arrange or provide project debt financing for not less than 60% of projected capital costs on a limited recourse basis after technical completion. If project costs exceed the amount available for debt financing and the parties elect nonetheless to put the property into production then at the Company’s election TCAI shall also arrange or provide the Company’s share of equity financing on a subordinate loan basis at LIBOR plus 4%.

Under the agreement with TCAI, TCAI is responsible for all property holding costs during the earn-in period.

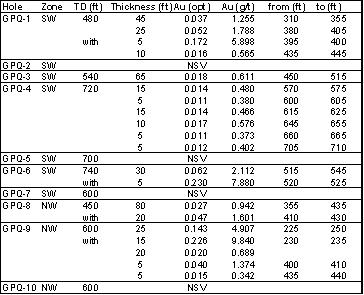

Location and Access

The Celt Property lies along the southern portion of the Cortez Trend. It is situated along the western edge of the Roberts Mountains. Access is by a network of all-weather roads.

Regional and Property Geology

The Celt Property lies over the Ordovician Vinini Formation which is dominantly chert and shale, but includes some limestone and greenstone units. The Celt Property follows more than four miles of strike length of a north-northwest trending fault zone where anomalous gold and pathfinder elements occur. The claims were staked to cover the gravel-covered area to the west of the fault.

Previous Exploration History

Gold was discovered in jasperoids along the eastern edge of the Celt Property in 1972 which led to prospecting and the staking of blocks of claims between 1972 and 1978. After the discovery of the nearby Gold Bar deposit in 1984, Atlas Precious Metals (“Atlas”) staked the entire area, but the property was not drilled. Cordex Syndicate (“Cordex”) leased Atlas’ claims in the area in 1994. Cordex conducted geologic mapping and grid rock and soil sampling, and drilled one exploration hole of less than 600 feet along the range front of the property before dropping the claims.

Current and Planned Exploration

During the 2005 field season, TCAI undertook a program of geological mapping and sampling, infill gravity and Induced Polarization surveys and Reverse Circulation drilling. To date, the Company has received results from 26 surface grab samples with gold values ranging from no gold detected to 6.17 grams/tonne. The five highest values were 6.17 grams/tonne, 5.07 grams/tonne, 2.28 grams/tonne, 0.82 grams/tonne and 0.26 grams/tonne.

Cottonwood Property

The Cottonwood property (the “Cottonwood Property”) is located in Eureka County, Nevada, and consists of 98 unpatented mining claims totaling 1,885 acres. The Company currently has a 100% interest in 92 unpatented mining claims and has an option to purchase 100% interest in the other 6 unpatented mining claims. The Cottonwood Property is without known economic mineral reserves and is at the exploration stage. The Company’s current efforts are exploratory in nature.

18

Acquisition

The Company has staked 92 unpatented mining claims since October 2001. Under an agreement dated February 1, 2002, the Company has leased from Gregory McN. French (the “Jam Vendor”) 6 adjacent unpatented mining claims known as the Jam Claims. Under the agreement, the Company is required make cash payments and issue common shares to the Jam Vendor under the following schedule:

Payment

Due Date | Cash Option Payments

(US Dollars) | Common Share

Issuances |

|---|

Initial Payment | |

$1,000 (paid) | |

None | |

| February 1, 2003 | | $1,000 (paid) | | 20,000 (issued) | |

| February 1, 2004 | | $2,000 (paid) | | 20,000 (issued) | |

| February 1, 2005 | | $2,000 (paid) | | 20,000 (issued) | |

| February 1, 2006 | | $ 3,000 | | 20,000 | |

| February 1, 2007 and each year thereafter | | $ 5,000 | | None | |

The Jam Vendor also retains a NSR on the Jam Claims which varies by ounces produced and the price of gold. On production greater than 50,000 ounces but less than 150,000 ounces, the NSR is 4%. For production of less than 50,000 ounces and greater than 150,000 ounces, the NSR varies from between 1% to 2%, depending upon the price of gold. The Jam Vendor also retains a 1.5% NSR on minerals other than gold. The Company has the option to acquire the NSR and purchase the Jam Claims from the Jam Vendor for US$50,000 at any time before the 10th anniversary date of the lease.

2006 annual holding costs for the Cottonwood Property are estimated to be US$12,083 for federal and county fees in addition to the lease payments listed above.

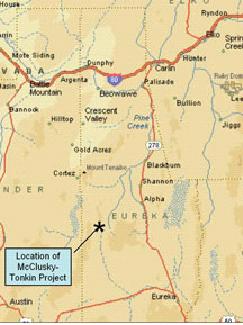

Location and Access

The Cottonwood Property is located at the headwaters of Cottonwood Creek in the central Roberts Mountains, approximately 30 miles northwest of the town of Eureka, Nevada. Access is by a network of improved all-weather roads.

19

Regional and Property Geology

The Cottonwood Property lies on the Cortez Trend and encompasses a major north-northwest trending window-bounding fault where it is intersected by a west-northwest trending belt of mineralization which crosses the Roberts Mountains. The fault places a block of thick Ordovician Vinini Formation on the west in juxtaposition with Lower Plate Devonian carbonates on the east. Gold bearing jasperoid is developed on the southeast extension of this window bounding fault.

The Cottonwood Property contains the Pot Canyon mineralized zone, the French Trail and South French Trail mineralized zones, and the Wall mineralized zone. The Pot Canyon zone is still open for expansion in two directions. Significant intercepts from previous drilling at Pot Canyon include:

|

| Drill Hole | Interval (feet) | Gold (opt) |

|---|

|

| 114-29 | | 80 | | 0.049 | |

| 114-34 | | 125 | | 0.022 | |

| 114-36 | | 130 | | 0.029 | |

|

At the South French Trail zone, about 3000 feet north of Gold Canyon, Atlas intersected gold mineralization grading 0.015 opt gold to 0.044 opt gold over widths of 10 feet to 20 feet in five holes. Follow-up drilling was not conducted. At the Wall prospect south of Pot Canyon, Barrick intersected 30 feet of 0.048 opt gold in a window-bounding fault and did no follow-up drilling.

The target is a large Carlin-type deposit hosted in Devonian carbonate rocks along or east of the major window-bounding fault. The convergence of the window-bounding fault, the Roberts Mountains thrust fault, the east-west anticlinal axis, and the west-northwest-trending belt of gold mineralization produces an ideal exploration setting. Expansion of the Pot Canyon resource and South French Trail mineralization are also targets.

Previous Exploration History

Barite occurrences in the area were prospected in the late 1970‘s and in 1980, N.L Baroid Division of N.L. Industries, Inc. (“N.L. Baroid”) located claims for barite in the central Cottonwood area. Prospecting during the gold boom of the early 1980‘s led to claim groups being located by Chevron Resources Company (“Chevron”) in 1980 and by Mapco Minerals Corporation (“Mapco”)/Nerco in 1983 in the northern and southern parts of the Cottonwood area respectively. Chevron’s claims lapsed in 1983 and were restaked by Nerco. ACNC and Phelps Dodge later leased and explored the claims staked by N.L. Baroid and Nerco. N.L. Baroid discovered the Pot Canyon gold zone in 1985. The property was acquired by Phelps Dodge in 1986 who continued to explore the property through 1990 until Atlas acquired their holdings in 1991. Atlas acquired the Nerco claims in 1990. The French Trail and South French Trail mineralized zones were drilled by Atlas in 1993.

Cordex leased the northern part of the Cottonwood area in 1995 and drilled a few holes. In 1997, Barrick leased most of Atlas’ claims in the area. Barrick drilled eight fairly deep holes in 1998 and intersected gold mineralization at the Wall prospect. Atlas’ claims were leased by Vengold (American Bonanza) in 1999 after Barrick terminated its lease but conducted no work before relinquishing the property.

Current and Planned Exploration

Drilling on the Cottonwood Property by previous operators identified several gold zones, but little follow-up work was ever conducted. The Pot Canyon deposit remains open in two directions, and gold mineralization discovered by drilling the South French Trail and Wall prospect were never followed-up. The Company is currently drilling on the Cottonwood Property.

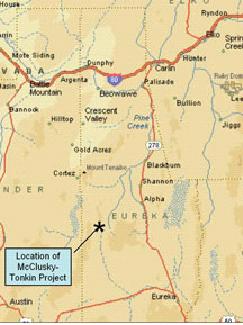

Fye Canyon Property

The Fye Canyon property (the “Fye Canyon Property”) is located in Eureka County, Nevada and comprises 345 unpatented mining claims on 6,320 acres. The Company currently has a 100% interest, although TCAI has an option to earn an initial 51% interest. The Fye Canyon Property is without known economic mineral reserves and is at the exploration stage. The Company’s current efforts are exploratory in nature.

20

Acquisition

The Company staked 231 unpatented mining claims after acquiring 114 unpatented mining claims upon the execution of a mining lease agreement. Under the terms of the agreement, the Company must pay annual advance royalty payments starting at US$5,000 upon execution, and increasing by US$5,000 per year to a maximum of US$50,000 per year. The Company must expend a minimum of US$20,000 on exploration work on the property per year. The vendor retains a 2% NSR payable on production up to US$1,000,000 after which it is reduced to 1% to a maximum of US$5,000,000.