UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 1, 2006

Capital Resource Funding, Inc.

(Exact Name of Registrant as Specified in Charter)

North Carolina

(State or Other Jurisdiction of Incorporation)

333-118259

(Commission File Number)

54-2142880

(I.R.S. Employer Identification No.)

17111 Kenton Drive, Suite 100B, Cornelius

North Carolina 28031

(Address of Principal Executive Offices) (Zip Code)

(704) 564-1676

(Registrant's Telephone Number, Including Area Code)

Copies to:

Greentree Financial Group, Inc.

2610 N. Palm Aire Drive

Pompano Beach, FL 33069

(954) 975-9601 Tel

(954) 979-6695 Fax

This Current Report on Form 8-K is filed by Capital Resource Funding, Inc., a North Carolina corporation (the “Registrant”), in connection with the items set forth below.

ITEM 8.01 OTHER EVENTS.

We are providing the following disclosure voluntarily.

DA LIAN XIN YANG HIGH-TECH DEVELOPMENT CO., LTD

(Formerly A Development Stage Company)

INDEX TO FINANCIAL STATEMENTS

| | | Page | | |

| | | | | |

| Report of Independent Registered Public Accounting Firm | | 3 | | |

| Balance Sheets | | 4 | | |

| Statements of Operations | | 5 | | |

| Statements of Cash Flows | | 6 | | |

| Statements of Owners’ Equity and Comprehensive Income | | 7 | | |

| Notes to Financial Statements | | 8-17 | | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Stockholders of Da Lian Xin Yang High-Tech Development Co., Ltd (Formerly a development stage company) We have audited the accompanying balance sheets of Da Lian Xin Yang High-Tech Development Co., Ltd (formerly a development stage company) (the “Company”) as of December 31, 2004 and 2005 and August 31, 2006 and the related statements of operations, statements of owners’ equity and comprehensive income, and cash flows for the years ended December 31, 2004 and 2005 and eight months period ended August 31, 2006. The financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits include consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Da Lian Xin Yang High-Tech Development Co., Ltd (formerly a development stage company) as of December 31, 2004 and 2005 and August 31, 2006 and the results of operations and cash flows for the years ended December 31, 2004 and 2005 and eight months period ended August 31, 2006 and in conformity with accounting principles generally accepted in the United States of America.

/s/ Zhong Yi (Hong Kong) C.P.A. Company Limited

Zhong Yi (Hong Kong) C.P.A. Company Limited Certified Public Accountants Hong Kong, China

October 9, 2006 |

DA LIAN XIN YANG HIGH-TECH DEVELOPMENT CO., LTD

(Formerly A Development Stage Company)

BALANCE SHEETS

AS OF DECEMBER 31, 2004, 2005 AND AUGUST 31, 2006

(Currency expressed in United States Dollars (“US$”))

| | | As of | |

| | | August 31, 2006 | | December 31, 2005 | | December 31, 2004 | |

ASSETS | | | | | | | |

| | | | | | | | |

| Current assets: | | | | | | | |

| Cash and cash equivalents | | $ | 688,928 | | $ | 1,598,425 | | $ | 597,372 | |

| Accounts receivable, trade | | | 1,217,916 | | | - | | | - | |

| Amount due from related parties | | | 683,587 | | | - | | | - | |

| Inventories | | | 104,967 | | | - | | | - | |

| Prepaid expenses and other current assets | | | 12,050 | | | 1,093 | | | 1,033 | |

| | | | | | | | | | | |

| Total current assets | | | 2,707,448 | | | 1,599,518 | | | 598,405 | |

| | | | | | | | | | | |

| Property, plant and equipment, net | | | 10,987,526 | | | 11,091,039 | | | 7,334 | |

| | | | | | | | | | | |

TOTAL ASSETS | | $ | 13,694,974 | | $ | 12,690,557 | | $ | 605,739 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

LIABILITIES AND OWNERS’ EQUITY |

| | | | | | | | | | | |

| Current liabilities: | | | | | | | | | | |

| Accounts payable, trade | | $ | 503,163 | | $ | - | | $ | - | |

| Other payables and accrued liabilities | | | 266,401 | | | 173,930 | | | 48,791 | |

| VAT payable | | | 128,013 | | | - | | | - | |

| Income tax payable | | | 1,948 | | | - | | | - | |

| | | | | | | | | | | |

| Total current liabilities | | | 899,525 | | | 173,930 | | | 48,791 | |

| | | | | | | | | | | |

| Owners’ equity: | | | | | | | | | | |

| Registered capital | | | 13,126,609 | | | 13,126,609 | | | 665,037 | |

| Accumulated other comprehensive income (loss) | | | 165,328 | | | (8,571 | ) | | (5 | ) |

| Accumulated deficits | | | (496,488 | ) | | (601,411 | ) | | (108,084 | ) |

| | | | | | | | | | | |

| Total owners’ equity | | | 12,795,449 | | | 12,516,627 | | | 556,948 | |

| | | | | | | | | | | |

TOTAL LIABILITIES AND OWNERS’ EQUITY | | $ | 13,694,974 | | $ | 12,690,557 | | $ | 605,739 | |

See accompanying notes to financial statements.

DA LIAN XIN YANG HIGH-TECH DEVELOPMENT CO., LTD

(Formerly A Development Stage Company)

STATEMENTS OF OPERATIONS

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2005 AND

EIGHT MONTHS PERIOD ENDED AUGUST 31, 2006

(Currency expressed in United States Dollars (“US$”))

| | Eight months period ended August 31, 2006 | | Year ended December 31, 2005 | | Year ended December 31, 2004 | | From inception of the development stage on August 8, 2000 through March 31, 2006 | |

| | | | | | | | | | |

Revenue, net | | $ | 1,581,960 | | $ | - | | $ | - | | $ | - | |

| | | | | | | | | | | | | | |

| Cost of revenue | | | 798,509 | | | - | | | - | | | - | |

| Cost of revenue - related parties | | | 258,784 | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Gross profit | | | 524,667 | | | - | | | - | | | - | |

| | | | | | | | | | | | | | |

Operating expenses: | | | | | | | | | | | | | |

| General and administrative | | | 185,133 | | | 207,092 | | | 25,062 | | | 278,912 | |

| Research and development | | | 71,708 | | | 164,437 | | | 38,092 | | | 260,670 | |

| Depreciation | | | 156,147 | | | 121,798 | | | 4,159 | | | 194,597 | |

| | | | | | | | | | | | | | |

| Total operating expenses | | | 412,988 | | | 493,327 | | | 67,313 | | | 734,179 | |

| | | | | | | | | | | | | | |

Income (loss) from operations and before tax | | | 111,679 | | | (493,327 | ) | | (67,313 | ) | | (734,179 | ) |

| | | | | | | | | | | | | | |

| Income tax expense | | | (6,756 | ) | | - | | | - | | | - | |

| | | | | | | | | | | | | | |

Net income (loss) | | $ | 104,923 | | $ | (493,327 | ) | $ | (67,313 | ) | $ | (734,179 | ) |

See accompanying notes to financial statements.

DA LIAN XIN YANG HIGH-TECH DEVELOPMENT CO., LTD

(Formerly A Development Stage Company)

STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2005 AND

EIGHT MONTHS PERIOD ENDED AUGUST 31, 2006

(Currency expressed in United States Dollars (“US$”))

| | | Eight months period ended August 31, 2006 | | Year ended December 31, 2005 | | Year ended December 31, 2004 | | From inception of the development stage on August 8, 2000 through March 31, 2006 | |

| | | | | | | | | | |

Cash flows from operating activities: | | | | | | | | | |

| Net income (loss) | | $ | 104,923 | | $ | (493,327 | ) | $ | (67,313 | ) | $ | (734,179 | ) |

| Adjustments to reconcile net income (loss): | | | | | | | | | | | | | |

| Depreciation | | | 264,957 | | | 121,798 | | | 4,160 | | | 197,440 | |

| Changes in assets and liabilities: | | | | | | | | | | | | | |

| Accounts receivable, trade | | | (1,217,916 | ) | | - | | | - | | | - | |

| Inventories | | | (104,967 | ) | | - | | | - | | | - | |

| Prepaid expenses and other current asset | | | (10,957 | ) | | (60 | ) | | - | | | (1,426 | ) |

| Accounts payable, trade | | | 503,163 | | | - | | | - | | | - | |

| Other payables and accrued liabilities | | | 92,471 | | | 125,139 | | | 24,747 | | | 211,906 | |

| VAT payable | | | 128,013 | | | - | | | - | | | - | |

| Income tax payable | | | 1,948 | | | - | | | - | | | - | |

| Net cash used in operating activities | | | (238,365 | ) | | (246,450 | ) | | (38,406 | ) | | (326,259 | ) |

| | | | | | | | | | | | | | |

Cash flows from investing activities: | | | | | | | | | | | | | |

| Purchase of plant and equipment | | | (161,444 | ) | | (5,836 | ) | | - | | | (28,257 | ) |

| Net cash used in investing activities | | | (161,444 | ) | | (5,836 | ) | | - | | | (28,257 | ) |

| | | | | | | | | | | | | | |

Cash flows from financing activities: | | | | | | | | | | | | | |

| Advances to related parties | | | (683,587 | ) | | - | | | - | | | - | |

| Capital contribution | | | - | | | 1,261,905 | | | - | | | 1,261,905 | |

| Net cash (used in) provided by financing activities | | | (683,587 | ) | | 1,261,905 | | | - | | | 1,261,905 | |

| | | | | | | | | | | | | | |

Foreign currency translation adjustment | | | 173,899 | | | (8,566 | ) | | (5 | ) | | (10,667 | ) |

| | | | | | | | | | | |

NET CHANGE IN CASH AND CASH EQUIVALENTS | | | (909,497 | ) | | 1,001,053 | | | (38,411 | ) | | 896,722 | |

| | | | | | | | | | | | | | |

CASH AND CASH EQUIVALENTS, BEGINNING OF YEAR/PERIOD | | $ | 1,598,425 | | $ | 597,372 | | $ | 635,783 | | $ | - | |

| | | | | | | | | | | | | | |

CASH AND CASH EQUIVALENTS, END OF YEAR/PERIOD | | $ | 688,928 | | $ | 1,598,425 | | $ | 597,372 | | $ | 896,722 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Supplemental disclosure of cash flow information: | | | | | | | | | |

| Cash paid for income taxes | | $ | 4,854 | | $ | - | | $ | - | | $ | - | |

| Cash paid for interest expenses | | $ | - | | $ | - | | $ | - | | $ | - | |

| | | | | | | | | | | | | | |

Non-cash transactions from investing activities: | | | | | | | | | |

| Property and equipment transferred by owners | | $ | - | | $ | 11,199,667 | | $ | - | | $ | - | |

See accompanying notes to financial statements.

DA LIAN XIN YANG HIGH-TECH DEVELOPMENT CO., LTD

(Formerly A Development Stage Company)

STATEMENTS OF OWNERS’ EQUITY AND COMPREHENSIVE INCOME

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2005 AND

EIGHT MONTHS PERIOD ENDED AUGUST 31, 2006

(Currency expressed in United States Dollars (“US$”))

| | Registered Capital | | Accumulated Deficits | | Accumulated Other Comprehensive Income (Loss) | | Total |

| | | | | | | | | |

| Balance at January 1, 2004 | $ | 665,037 | | $ | (40,771) | | $ | - | | $ | 624,266 |

| | | | | | | | | | | | |

| Comprehensive loss: | | | | | | | | | | | |

| Foreign currency translation | | - | | | - | | | (5) | | | (5) | |

| Net loss for the year | | - | | | (67,313) | | | - | | | (67,313) |

| Total comprehensive income | | | | | | | | | | | (67,318) |

| Balance at December 31, 2004 | | 665,037 | | | (108,084) | | | (5) | | | 556,948 |

| | | | | | | | | | | | |

| Additional capital contribution | | 12,461,572 | | | - | | | - | | | 12,461,572 |

| | | | | | | | | | | | |

| Comprehensive loss: | | | | | | | | | | | |

| Foreign currency translation | | - | | | - | | | (8,566) | | | (8,566) |

| Net loss for the year | | - | | | (493,327) | | | - | | | (493,327) |

| Total comprehensive income | | | | | | | | | | | (501,893) |

| Balance at December 31, 2005 | | 13,126,609 | | | (601,411) | | | (8,571) | | | 12,516,627 |

| | | | | | | | | | | | |

| Comprehensive income: | | | | | | | | | | | |

| Foreign currency translation | | - | | | - | | | 173,899 | | | 173,899 | |

| Net income for the period | | - | | | 104,923 | | | - | | | 104,923 |

| Total comprehensive income | | | | | | | | | | | 278,822 |

| Balance at August 31, 2006 | $ | 13,126,609 | | $ | (496,488) | | $ | 165,328 | | $ | 12,795,449 |

See accompanying notes to financial statements.

DA LIAN XIN YANG HIGH-TECH DEVELOPMENT CO., LTD

(Formerly A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2005 AND

EIGHT MONTHS PERIOD ENDED AUGUST 31, 2006

(Currency expressed in United States Dollars (“US$”))

| 1. | ORGANIZATION AND BUSINESS BACKGROUND |

Da Lian Xin Yang High-Tech Development Co., Ltd (“the Company”) is formerly known as Sun Group Da Lian High-Tech Development Co., Ltd, which was incorporated as a limited liability company in the People’s Republic of China (“the PRC”) on August 8, 2000 with its principal place of business in Da Lian City, Liaoning Province, the PRC. Its registered capital was Renminbi Yuan (“RMB”) 5,500,000 (equivalent to US$665,037) and contributed by Sun Group High Technology Development Co., Ltd (“Sun Group High-Tech Ltd”), a limited liability company registered in Da Lian City, Liaoning Province, the PRC and Mr. Li Zhi, a citizen of the PRC.

From inception to March 31, 2006, the Company was operated as a research center to develop the technological feasibility of nanometer on lithium battery and generated no revenue during the period. It was considered as a development stage company in accordance with the provisions of Statement of Financial Accounting Standards (“SFAS”) No. 7, “Accounting and Reporting by Development Stage Enterprises”. Starting from April 1, 2006, the Company commenced the production and sales of its own product, the cobalt tetroxide which is used as the anode of high capacity lithium ion rechargeable battery.

Pursuant to a special resolution passed on June 6, 2005, the registered capital was approved to increase to $13,126,609 (RMB106,000,000) by an injection of additional capital of $12,461,572 (RMB100,500,000) by the existing owners and a new investor, Ms. Wang Jiao. On October 18, 2005, Mr. Li Zhi and Ms. Wang Jiao entered an Equity Exchange Agreement to transfer some of their interests in the Company to Mr. Wang Bin.

On May 10, 2006, Sun Group High-Tech Ltd, Mr. Li Zhi, Ms. Wang Jiao and Mr. Wang Bin collectively entered into an Equity Exchange Agreement to transfer all the equity interest in the Company to Ms. Feng Guimei, Mr. Li Gang and Mr. Kan Yang who are all citizens of the PRC, for a consideration of $13,126,609 (RMB106,000,000). Also, the Company changed its company name to Da Lian Xin Yang High-Tech Development Co., Ltd.

All the Company’s customers are located in PRC.

| 2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

These accompanying financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America.

In preparing these financial statements, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheets and revenues and expenses during the year reported. Actual results may differ from these estimates.

Revenue is recognized when products are delivered to customers. Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded. In instances where products are configured to customer requirements, revenue is recorded upon the successful completion of the Company’s final test procedures and the customer’s acceptance.

DA LIAN XIN YANG HIGH-TECH DEVELOPMENT CO., LTD

(Formerly A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2005 AND

EIGHT MONTHS PERIOD ENDED AUGUST 31, 2006

(Currency expressed in United States Dollars (“US$”))

Cost of revenue primarily includes purchase of raw materials, direct labor and manufacturing overhead.

| l | Cash and cash equivalents |

Cash and cash equivalents are carried at cost and represent cash on hand, demand deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months or less as of the purchase date of such investments.

| l | Accounts receivable, trade |

Accounts receivable are recorded at the invoiced amount and do not bear interest. The Company extends unsecured credit to its customers in the ordinary course of business but mitigates the associated risks by performing credit checks and actively pursuing past due accounts. An allowance for doubtful accounts is established and determined based on managements’ assessment of known requirements, aging of receivables, payment history, the customer’s current credit worthiness and the economic environment. For the two years and eight months period ended August 31, 2006, the Company did not record an allowance for doubtful accounts, nor have there been any write-offs since inception.

Inventories are stated at the lower of cost or market value. Cost is determined using the first-in, first-out (“FIFO”) method for all inventories. Inventories mainly consist of the raw materials and finished goods.

| l | Property, plant and equipment |

Plant and equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. Depreciation is calculated on the straight-line basis over the following expected useful lives from the date on which they become fully operational and after taking into account their estimated residual values:

| | Depreciable Life | | Residual Value |

| Building | 40 years | | 5% |

| Plant and machinery | 5-40 years | | 5% |

| Office equipment | 5 years | | 5% |

| Motor vehicle | 5 years | | 5% |

Expenditure for maintenance and repairs is expensed as incurred.

DA LIAN XIN YANG HIGH-TECH DEVELOPMENT CO., LTD

(Formerly A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2005 AND

EIGHT MONTHS PERIOD ENDED AUGUST 31, 2006

(Currency expressed in United States Dollars (“US$”))

| l | Impairment of long lived assets |

In accordance with SFAS No. 121, “Accounting for the impairment of Long-Lived Assets and for Long-Lived Assets to be Disposed of”, a long-lived assets and certain identifiable intangible assets held and used by the Company are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. For the purposes of evaluating the recoverability of long-lived assets, the recoverability test is performed using undiscounted net cash flows related to the long-lived assets. The Company reviews long-lived assets, if any, to determine the carrying values are not impaired.

| l | Research and development costs |

Research and development costs which are not subject to capitalization under SFAS No. 86, are expensed as incurred and relate mainly labor cost incurred in the development of new products, new applications, new features or enhancements for existing products or applications. The Company incurred $38,092, $164,437 and $71,708 for the years ended December 31, 2004 and 2005 and eight months period ended August 31, 2006, respectively.

The Company expenses advertising costs as incurred in accordance with SOP 93-7 “Reporting for Advertising Costs”. No advertising expenses were incurred for the years ended December 31, 2004 and 2005. The Company incurred $707 for eight months period ended August 31, 2006.

| l | Comprehensive income (loss) |

SFAS No. 130, “Reporting Comprehensive Income”, establishes standards for reporting and display of comprehensive income, its components and accumulated balances. Comprehensive income as defined includes all changes in equity during a period from non-owner sources. Accumulated comprehensive income, as presented in the accompanying statement of changes in stockholders’ equity consists of changes in unrealized gains and losses on foreign currency translation. This comprehensive income is not included in the computation of income tax expense or benefit.

The Company accounts for income tax using SFAS No. 109 “Accounting for Income Taxes”, which requires the asset and liability approach for financial accounting and reporting for income taxes. Under this approach, deferred income taxes are provided for the estimated future tax effects attributable to temporary differences between financial statement carrying amounts of assets and liabilities and their respective tax bases, and for the expected future tax benefits from loss carry-forwards and provisions, if any. Deferred tax assets and liabilities are measured using the enacted tax rates expected in the years of recovery or reversal and the effect from a change in tax rates is recognized in the statement of operations and comprehensive (loss) income in the period of enactment. A valuation allowance is provided to reduce the amount of deferred tax assets if it is considered more likely than not that some portion of, or all of the deferred tax assets will not be realized.

DA LIAN XIN YANG HIGH-TECH DEVELOPMENT CO., LTD

(Formerly A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2005 AND

EIGHT MONTHS PERIOD ENDED AUGUST 31, 2006

(Currency expressed in United States Dollars (“US$”))

| l | Foreign currencies translation |

The functional currency of the Company is Renminbi Yuan (“RMB”). The accompanying financial statements have been expressed in United States dollars, the reporting currency of the Company. The balance sheet is translated into United States dollars based on the rates of exchange ruling at the balance sheet date. The statement of operations is translated using a weighted average rate for the year. Translation adjustments are reflected as cumulative translation adjustments in owners’ equity.

SFAS No. 131 “Disclosures about Segments of an Enterprise and Related Information” establishes standards for reporting information about operating segments on a basis consistent with the Company’s internal organization structure as well as information about geographical areas, business segments and major customers in financial statements. The Company operates in one reportable segment.

For the purposes of these financial statements, parties are considered to be related if one party has the ability, directly or indirectly, to control the party or exercise significant influence over the party in making financial and operating decisions, or vice versa, or where the Company and the party are subject to common control or common significant influence. Related parties may be individuals or other entities.

| l | Fair value of financial instruments |

The carrying value of the Company’s financial instruments, which include cash and cash equivalents, accounts receivables, other payable and accrued liabilities, approximate their fair values due to the short-term maturity of these instruments.

| l | Recently issued accounting standard |

In December 2004, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 123R, "Share-Based Payment" ("SFAS 123R"). SFAS 123R revises FASB Statement No. 123 "Accounting for Stock-Based Compensation" and supersedes APB Opinion No. 25 "Accounting for Stock Issued to Employees". SFAS 123R requires all public and non-public companies to measure and recognize compensation expense for all stock-based payments for services received at the grant-date fair value, with the cost recognized over the vesting period (or the requisite service period). SFAS 123R is effective for small business issuers for all interim periods beginning after December 15, 2005. The adoption of SFAS 123R did not have a material impact on the Company's financial statements or results of operations.

SFAS No. 123R permits public companies to adopt its requirements using one of two methods. A “modified prospective” method in which compensation cost is recognized beginning with the effective date (a) based on the requirements of SFAS 123R for all share-based payments granted after the effective date and (b) based on the requirements of SFAS No. 123 for all awards granted to employees prior to the effective date of SFAS No. 123R that remain unvested on the effective date. A “modified retrospective” method which includes the requirements of the modified prospective method described above, but also permits entities to restate based on the amounts previously recognized under SFAS No. 123 for purposes of pro forma disclosures either (a) all prior periods presented or (b) prior interim periods of the year of adoption. The Company has yet to determine which method to use in adopting SFAS 123R.

DA LIAN XIN YANG HIGH-TECH DEVELOPMENT CO., LTD

(Formerly A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2005 AND

EIGHT MONTHS PERIOD ENDED AUGUST 31, 2006

(Currency expressed in United States Dollars (“US$”))

In November 2004, the FASB issued SFAS No. 151 "Inventory Costs - an amendment of ARB No. 43, Chapter 4" ("SFAS 151"). This statement amends the guidance in ARB No. 43, Chapter 4, "Inventory Pricing" to clarify the accounting for abnormal amounts of idle facility expense, freight, handling costs, and wasted material (spoilage). SFAS 151 requires that those items be recognized as current-period charges. In addition, this Statement requires that allocation of fixed production overheads to costs of conversion be based upon the normal capacity of the production facilities. The provisions of SFAS 151 are effective for fiscal years beginning after June 15, 2005. As such, the Company has adopted these provisions, if any, at the beginning of the fiscal year 2006.

In December 2004, the FASB issued SFAS No. 153, "Exchanges of Non-monetary Assets - an amendment of APB Opinion No.29" ("SFAS 153"). SFAS 153 replaces the exception from fair value measurement in APB Opinion No. 29 for non-monetary exchanges of similar productive assets with a general exception from fair value measurement for exchanges of non-monetary assets that do not have commercial substance. A non-monetary exchange has commercial substance if the future cash flows of the entity are expected to change significantly as a result of the exchange. SFAS 153 is effective for all interim periods beginning after June 15, 2005. The adoption of SFAS 153 did not have a material impact on the Company's financial statements or results of operations.

In May 2005, the FASB issued SFAS No. 154, "Accounting Changes and Error Corrections - a replacement of APB Opinion No. 20 and FASB Statement No. 3" ("SFAS 154"). SFAS 154 changes the requirements for the accounting for and reporting of a change in accounting principle. These requirements apply to all voluntary changes and changes required by an accounting pronouncement in the unusual instance that the pronouncement does not include specific transition provisions. SFAS 154 is effective for fiscal years beginning after December 15, 2005. As such, the Company has adopted these provisions, if any, at the beginning of the fiscal year ended December 31, 2006.

In February 2006, the FASB issued SFAS No. 155, “Accounting for Certain Hybrid Financial Instruments—an amendment of FASB Statements No. 133 and 140” ("SFAS 155"). This Statement amends FASB Statements No. 133, “Accounting for Derivative Instruments and Hedging Activities”, and No. 140, “Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities”. This Statement resolves issues addressed in Statement 133 Implementation Issue No. D1, “Application of Statement 133 to Beneficial Interests in Securitized Financial Assets”. This Statement permits fair value re-measurement for any hybrid financial instrument that contains an embedded derivative that otherwise would require bifurcation, clarifies which interest-only strips and principal-only strips are not subject to the requirements of Statement 133, establishes a requirement to evaluate interests in securitized financial assets to identify interests that are freestanding derivatives or that are hybrid financial instruments that contain an embedded derivative requiring bifurcation, clarifies that concentrations of credit risk in the form of subordination are not embedded derivatives and amends Statement 140 to eliminate the prohibition on a qualifying special-purpose entity from holding a derivative financial instrument that pertains to a beneficial interest other than another derivative financial instrument. SFAS 155 is effective for all financial instruments acquired or issued for the Company for fiscal year begins after September 15, 2006. The adoption of this standard is not expected to have a material effect on the Company’s results of operations or financial position.

| 3. | AMOUNT DUE FROM RELATED PARTIES |

The amount is temporary advances made to a former owner, Sun Group High-Tech Ltd. The balance is unsecured, and non-interest bearing and was repayable within 12 months.

DA LIAN XIN YANG HIGH-TECH DEVELOPMENT CO., LTD

(Formerly A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2005 AND

EIGHT MONTHS PERIOD ENDED AUGUST 31, 2006

(Currency expressed in United States Dollars (“US$”))

| 4. | PREPAID EXPENSES AND OTHER CURRENT ASSETS |

A summary of prepaid expenses and other current assets as of August 31, 2006, December 31, 2005 and 2004 was:

| | | As of | |

| | | August 31, | | December 31, | | December 31, | |

| | 2006 | | 2005 | | 2004 | |

| | | | | | | | |

| Prepaid expenses | | | 35 | | | 1,093 | | | 1,033 | |

| Prepayment for equipment | | | 12,015 | | | - | | | - | |

| | | | 12,050 | | | 1,093 | | | 1,033 | |

| 5. | PROPERTY, PLANT AND EQUIPMENT, NET |

A summary of property, plant and equipment as of August 31, 2006, December 31, 2005 and 2004 was:

| | | As of | |

| | | August 31, | | December 31, | | December 31, | |

| | 2006 | | 2005 | | 2004 | |

| | | | | | | | |

| Building | | | 6,271,004 | | | 6,151,995 | | | - | |

| Plant and machinery | | | 4,945,247 | | | 4,907,061 | | | - | |

| Office equipment | | | 149,349 | | | 145,918 | | | - | |

| Motor vehicle | | | 23,239 | | | 22,421 | | | 21,892 | |

| | | | | | | | | | | |

| | | | 11,388,839 | | | 11,227,395 | | | 21,892 | |

| | | | | | | | | | | |

| Less: accumulated depreciation | | | 401,313 | | | 136,356 | | | 14,558 | |

| Net book value | | | 10,987,526 | | | 11,091,039 | | | 7,334 | |

Depreciation expense for the years ended December 31, 2004 and 2005 and eight months period ended August 31, 2006 were $4,160, $121,798 and $264,957 respectively.

DA LIAN XIN YANG HIGH-TECH DEVELOPMENT CO., LTD

(Formerly A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2005 AND

EIGHT MONTHS PERIOD ENDED AUGUST 31, 2006

(Currency expressed in United States Dollars (“US$”))

6. OTHER PAYABLES AND ACCRUED LIABILITIES

A summary of other payables and accrued liabilities as of August 31, 2006, December 31, 2005 and 2004 was:

| | | As of | |

| | | August 31, | | December 31, | | December 31, | |

| | 2006 | | 2005 | | 2004 | |

| | | | | | | | |

| Rental payable | | | 41,850 | | | 37,150 | | | 30,230 | |

| Payroll payable | | | 2,022 | | | 1,994 | | | - | |

| Accrued welfare | | | 136,219 | | | 84,605 | | | 17,759 | |

| Levy payable | | | 81,250 | | | 42,458 | | | - | |

| Other payable | | | 5,060 | | | 7,723 | | | 802 | |

| | | | 266,401 | | | 173,930 | | | 48,791 | |

7. TAXATION

The Company is subject to taxes in PRC. Pursuant to the Income Tax Laws, the Company is generally subject to enterprise income tax (“EIT”) at a statutory rate of 33% (30% national income tax plus 3% local income tax).

The following is reconciliation between the EIT statutory rate and the effective tax rate for the years ended December 31, 2004 and 2005 and eight months period ended August 31, 2006:

| | | Eight months period ended August 31, | | Years ended December 31, | |

| | 2006 | | 2005 | | 2004 | |

| | | | | | | | |

| EIT statutory rate | | | 33 | % | | 33 | % | | 33 | % |

| Effect of non-deductible expenses | | | (27 | %) | | (33 | %) | | (33 | %) |

| | | | 6 | % | | - | | | - | |

The tax losses for the years ended December 31, 2004 and 2005 were not yet allowed by the relevant tax authorities and so the Company decided not to carry forward these tax losses to calculate the current tax for the period ended June 30, 2006.

DA LIAN XIN YANG HIGH-TECH DEVELOPMENT CO., LTD

(Formerly A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2005 AND

EIGHT MONTHS PERIOD ENDED AUGUST 31, 2006

(Currency expressed in United States Dollars (“US$”))

8. OWNERS’ EQUITY

In accordance with the Company’s Articles of Association, the registered capital of the Company was $665,037. The registered capital was fully paid up at the date of incorporation of August 8, 2000. Pursuant to a special resolution passed on July 6, 2005, the registered capital was approved to increase to $13,126,609 by the injection of additional $12,461,572 capital by the existing owners and the new investors.

9. STATUTORY RESERVES

The Company is required to make appropriations to reserves funds, comprising the statutory surplus reserve, statutory public welfare fund and discretionary surplus reserve, based on after-tax net income determined in accordance with generally accepted accounting principles of the People’s Republic of China (the “PRC GAAP”). Appropriation to the statutory surplus reserve should be at least 10% of the after-tax net income determined in accordance with the PRC GAAP until the reserve is equal to 50% of the Company’s registered capital. Appropriation to the statutory public welfare fund is 10% of the after-tax net income determined in accordance with the PRC GAAP. Appropriations to the discretionary surplus reserve are made at the discretion of the Board of Directors. The statutory public welfare fund is established for the purpose of providing employee facilities and other collective benefits to the employees and is non-distributable other than in liquidation. The Company made no appropriations to the statutory reserve before December 31, 2005 as it did not have a pre-tax profit. For eight months period ended August 31, 2006, the Company made a pre-tax profit and decided to make the appropriation by the end of 2006.

10. CHINA CONTRIBUTION PLAN

Full-time employees of the Company are entitled to staff welfare benefits including medical care, welfare subsidies, unemployment insurance and pension benefits through a China government-mandated multi-employer defined contribution plan. The Company is required to accrue for these benefits based on certain percentages of the employees’ salaries. The total contributions made for such employee benefits were $17,759, $66,288 and $50,544 for the years ended December 31, 2004, 2005 and eight months period ended August 31, 2006.

11. RELATED PARTY TRANSACTIONS

| | | | | Eight months period ended August 31, | | Years ended December 31, | |

| | | | | 2006 | | 2005 | | 2004 | |

| | | | | | | | | | |

| Property and equipment transferred to the Company from its owners | | | (a | ) | | - | | | 11,199,667 | | | - | |

| | | | | | | | | | | | | | |

| Purchase of raw materials from its former owner | | | (b | ) | | 258,784 | | | - | | | - | |

| (a) | Property and equipment were transferred to the Company during 2005 from its former owner, Sun Group High-Tech Ltd at the historical cost and were treated as an additional capital to the Company. |

| (b) | The Company purchased raw material from its former owner, Sun Group High-Tech Ltd at the current market price. |

DA LIAN XIN YANG HIGH-TECH DEVELOPMENT CO., LTD

(Formerly A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2005 AND

EIGHT MONTHS PERIOD ENDED AUGUST 31, 2006

(Currency expressed in United States Dollars (“US$”))

12. CONCENTRATIONS OF RISKS

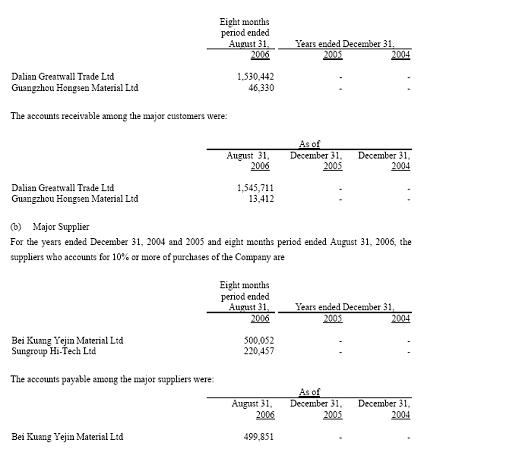

(a) Major customers

100% of the Company’s assets were located in China and 100% of the Company’s revenues were generated from customers located in China. For the years ended December 31, 2004 and 2005 and eight months period ended August 31, 2006, the customers who account for 10% or more of revenues of the Company were:

| | | Eight months period ended August 31, | | Years ended December 31, | |

| | | 2006 | | 2005 | | 2004 | |

| | | | | | | | |

| Dalian Greatwall Trade Ltd | | | 1,535,480 | | | - | | | - | |

The accounts receivable among the major customers were:

| | | As of | |

| | | August 31, | | December 31, | | December 31, | |

| | 2006 | | 2005 | | 2004 | |

| | | | | | | | |

| Dalian Greatwall Trade Ltd | | | 1,204,419 | | | - | | | - | |

(b) Major vendors

For the years ended December 31, 2004 and 2005 and eight months period ended August 31, 2006, the vendors who account for 10% or more of purchases of the Company were:

| | | Eight months period ended August 31, | | Years ended December 31, | |

| | | 2006 | | 2005 | | 2004 | |

| | | | | | | | |

| Bei Kuang Yejin Material Ltd | | | 679,702 | | | - | | | - | |

| Sun Group Hi-Tech Ltd | | | 258,784 | | | - | | | - | |

The accounts payable among the major vendors were:

| | | As of | |

| | | August 31, | | December 31, | | December 31, | |

| | 2006 | | 2005 | | 2004 | |

| | | | | | | | |

| Bei Kuang Yejin Material Ltd | | | 503,163 | | | - | | | - | |

DA LIAN XIN YANG HIGH-TECH DEVELOPMENT CO., LTD

(Formerly A Development Stage Company)

NOTES TO FINANCIAL STATEMENTS

FOR THE YEARS ENDED DECEMBER 31, 2004 AND 2005 AND

EIGHT MONTHS PERIOD ENDED AUGUST 31, 2006

(Currency expressed in United States Dollars (“US$”))

(c) Credit Risk

Financial instruments that potentially subject the Company to significant concentrations of credit risk consist principally of cash and trade account receivables. The Company performs ongoing credit evaluations of its customers' financial condition, but does not require collateral to support such receivables.

13. COMMITMENT

The Company leases an office premise under a non-cancelable operating lease. Costs incurred under this operating lease are recorded as rental expense and totaled approximately $6,046, $6,118 and $4,156 for the years ended December 31, 2004 and 2005 and eight months period ended August 31, 2006

Future minimum rental payments due under a non-cancelable operating lease are as follows:

| Years ending August 31: | | | |

| | | | |

| 2007 | | $ | 6,329 | |

| 2008 | | $ | 6,329 | |

14. SUBSEQUENT EVENT

As of September 6, 2006, the Company entered into the Plan of Exchange with Capital Resource Funding Inc. (“CRFU”), a corporation organized and existing under the laws of the State of North Carolina, which mainly engages in the business of commercial finance brokerage and consulting. CRFU is now trading under the same name and ticket symbol CRFU on the Over-the-Counter Bulletin Board in the United States. Upon completion of the exchange, Sun Group will become a 70% owned subsidiary of CRFU. The effectiveness of the plan of Exchange will be subjected to the approval by the Chinese Government.

DESCRIPTION OF THE BUSINESS

Dalian Sun Group High-Tech Development Co., Ltd (the “Company” or "Sun Group High-tech") was registered as a limited liability company in the People’s Republic of China (the “PRC”) on August 16, 2000 with its principal place of business in Dalian City, Liaoning Province, the PRC. Its registered capital was Reiminbi Yuan (“RMB”) 5,500,000 (equivalent to US$665,037) and contributed by Sun Group High Technology Development Co., Ltd (a limited liability company registered in Dalian City, Liaoning Province, the PRC) and Mr. Li Zhi, a citizen of the PRC. Prior to April, 2006, the Company’s principal activity was acting as a research center to develop the technologic feasibility of nanometer on lithium batteries and generated no revenue. It was considered as a development stage company. From April 2006 onwards, the Company started the production and sales of its own product, cobaltosic oxide which is used as the anode of high capacity lithium ion rechargeable batteries. On July 6, 2005, an additional capital of $12,461,572 (RMB100,500,000) was contributed by its two existing investors and one new investor (Ms. Wang Jiao) by the means of the cash and the production facilities located in Dalian City. On May 10, 2006, the three existing shareholders transferred their whole shareholdings in the Company to Ms Feng Guimei, Mr Li Gang and Mr Kan Yang who are all citizens of the PRC. All the Company’s customers are located in PRC

Sun Group High-tech Development Co., Ltd. is the second largest non-governmental manufacturer of hi-tech cobalt salt products in Asia with 122 full-time employees. The company was established in the year 2000 in the Peoples' Republic of China. Sun Group's products and processing capabilities include the production of cobalt ore, cobalt carbonate, nanometer-sized cobaltosic oxide and high-crystalline spherical lithium cobalt oxide which is used lithium batteries. In addition, Sun Group specializes in:

• Hi-pressure leaching technology of raw materials

• Hi-performance extraction technology of soluble cobalt salts

• Chemical precipitation technology of soluble cobalt salts

• Mesh-belt metallurgical powder calcination

• Multilevel selecting technology

• Stable sol and gel technology

The Company’s target market is primarily anode materials for lithium ion batteries and cobalt products. and the downstream one of lithium ion battery, and provide the whole-line products such as battery anode cobaltous carbonate, nano-level cobalto cobaltic oxide, high-crystallinity ball lithium cobalt oxide and lithium ion battery as well as upgrading and substitute products including lithium iron phosphate (LiFePO4) via R&D and innovation. The Company will focus on their advantages in the domestic market, human resources and raw materials. In addition we will develop our industrial transfer systems and offer the OEM service. Our target market covers lithium ion battery manufacturers, end product users and lithium series product manufacturers throughout the world. The focus of the first stage of our business model is the development of domestic market, the improvement of market share and the substitution of imported products; and that second stage of our business model is the development of international markets and the export of raw materials and refined/completed products.

Market core competitiveness

• The technological indicators of Sun Group High-tech’s products belong to the domestic third quality standard (and are still at the first-generation product level domestically at present), which boasts a long-lasting reserve of technological content.

• Sun Group High-tech’s products with “Three Major Technologies” can be supplied to the domestic and foreign markets as independent finished products respectively, and all meet different demands of varied clients and while still seizing market initiative. The product structure of Sun High-tech should enable enterprises to be either a product supplier or a consumer of raw materials, with flexibility in market supply.

• The market orientation of Sun Group High-tech can meet the production demands of domestic clients and boasts an advantage in mass export.

Quality assurance and follow-up development capability

• Sun Group High-tech will align itself with many industry elites and partners and cooperate with research teams in national scientific research institutes and universities.

• Sun High-tech has already invested (see attached financials and information below), and will continue to invest great capital in the construction of a highly advanced R&D test and detection center, equipped with top detection and test apparatus and instruments. Thanks to the diligent efforts of Sun Group High-tech's staff, Sun Group High-tech has created brand recognition in China as a domestic trade leader. We are currently starting the second-phase of construction on a top-grade lithium-ion power battery production line with an annual production capacity of 50 million pieces, which we expect to be completed and go on-line prior to June 2006. Investment Estimate and Financing.

Financial Outlook

The Company hopes to raise an additional 80 million Yuan in external financing by December, 2006.

Utilization

Unit: Ten thousand Yuan

Utilization schedual of newly added funds

| Utilization content | Utilization time | Self-financing | Equity financing |

March to Dec., 2006 | 2007 |

Total | 500 | Total | 8000 |

| 1 | R&D Center project | March, 2006 | 100 | |

| 2 | Working capital for trial run | May, 2006 | 100 | |

| 3 | Newly added equipments for LiFePO4 | Feb., 2007 | 200 | 1400 |

| 4 | Lithium iron power battery project | May, 2007 | | 4800 |

| 5 | Intangible asset contingency cost | | 100 | |

| 6 | Working capital | | | 1800 |

Assumptions

Assumption One: Government preferential policies such as tax exemption and reduction etc. remain valid and the market continues to sustain its current development without any catastrophic occurrences;

Assumption Two: There are no material changes either in the supply and prices of key energy resources and raw and auxiliary materials necessary for production or in the market and clients of respective businesses as well as product selling prices within the profit forecast period;

Assumption Three: The prices of products and raw materials from 2007 to 2010 are calculated pursuant to those unchanged in 2006;

Assumption Four: The sales expenses from 2007-2008 accounts for 1% of the sales income and other expenses account for only 0.5% of the sales income.

Assumption Five: The Company’s business in the international market is not taken into account.

Estimation Sheet for Production Cost & Expenses

In 10 thousand Yuan

No. | Item | Amount | 2006 | 2007 | 2008 | 2009 | 2010 |

| 1 | Production cost | 138638.86 | 2248.58 | 5944.88 | 27339.20 | 44331.80 | 58774.40 |

| 2 | Sales cost | 1460.20 | 32.60 | 74.60 | 322.40 | 455.60 | 575.00 |

| 3 | Financial expenses | 829.92 | 102.43 | 133.4 | 184.37 | 204.86 | 204.86 |

| 4 | Management expenses | 3879.00 | 486.00 | 611.00 | 734.00 | 923.00 | 1125.00 |

| 4.1 | Incl.: fees to amortize | 1480.00 | 296.00 | 296.00 | 296.00 | 296.00 | 296.00 |

| 4.2 | Technical research expenses | 2250.00 | 150.00 | 280.00 | 420.00 | 600.00 | 800.00 |

| 5 | Total cost | 144807.98 | 2869.61 | 6763.88 | 28579.97 | 45915.26 | 60679.26 |

| 6 | Operating cost | 155182.45 | 19229.58 | 26608.99 | 33988.16 | 37677.86 | 37677.86 |

| 7 | Fixed cost | 12439.87 | 2238.48 | 2394.15 | 2550.42 | 2628.41 | 2628.41 |

| 8 | Variable cost | 148920.75 | 18161.03 | 25425.74 | 32689.86 | 36322.06 | 36322.06 |

The sales price is conservatively calculated with the lowest price. The price of LiCoO2 is 360,000 Yuan/ton, cobaltosic oxide is 230,000 Yuan/ton, lithium iron phosphate is 90,000 Yuan/ton and dynamo-battery is 700Yuan/10Ah.

Forecast of Sales Income

In 10 thousand Yuan

| No. | Name of Product | Unit | 2006 | 2007 | 2008 | 2009 | 2010 | Total |

Income (in 10 thousand Yuan) | Income (in 10 thousand Yuan) | Income (in 10 thousand Yuan) | Income (in 10 thousand Yuan) | Income (in 10 thousand Yuan) | Sales income |

| I | Income of product sales (operating) | | | | | | | |

| 1 | Cobaltosic oxide | Ton | 2300 | 4600 | 13800 | 18400 | 23000 | 62100 |

| 2 | LiCoO2 | Ton | 1080 | 2880 | 7200 | 10800 | 14400 | 36360 |

| 3 | Lithium iron phosphate | Ton | | 1350 | 3150 | 4050 | 4500 | 13050 |

| 4 | Dynamo-lithium-ion Battery | 10000 pc | | | 35000 | 70000 | 98000 | 203000 |

| | Total | | 3380 | 8830 | 59150 | 103250 | 139900 | 314510 |

| II | Sales tax and others | Taxation Rate | | | | | | |

| 1 | VAT | 17% | 236.60 | 909.49 | 6210.75 | 10841.25 | 14829.40 | 45698.03 |

| 2 | Urban maintenance & construction tax | 7% | 16.56 | 63.66 | 434.75 | 758.89 | 1038.06 | 3198.86 |

| 3 | Educational tax and others | 3% | 7.10 | 27.28 | 186.32 | 325.24 | 444.88 | 1370.94 |

| 4 | Total | | 260.26 | 1000.44 | 6831.83 | 11925.38 | 16312.34 | 50267.84 |

Summary of Financial & Economic Evaluation Indexes

In 10 thousand Yuan

No. | Item | Unit | Index | Remark |

| 1 | Total investment of the project | in 10 thousand Yuan | 18600.00 | Investment for construction + Basis working capital |

| 1.1 | Capital the enterprise owns | in 10 thousand Yuan | 10600.00 | |

| 1.2 | Capital the enterprise finances | in 10 thousand Yuan | 8000.00 | |

| 2 | Average annual sales income | in 10 thousand Yuan | 62902.00 | |

| 3 | Average annual total cost | in 10 thousand Yuan | 28961.60 | |

| 4 | Average annual sales tax | in 10 thousand Yuan | 10053.57 | |

| 5 | Average annual total profit | in 10 thousand Yuan | 26674.36 | |

| 6 | Average annual tax of income | in 10 thousand Yuan | 3961.68 | |

| 7 | Average annual net profit | in 10 thousand Yuan | 22712.68 | |

| 8 | Investment profit rate | | 143.41% | |

| 9 | Cost profit rate | | 92.10% | |

| 10 | Sales Profit rate | | 42.41% | |

| 11 | Internal profit rate (total investment) after-taxation | | 33.44% | |

| 12 | Net present value (total investment) after-taxation | in 10 thousand Yuan | 78463.32 | |

| 13 | Profit- loss balance point (capability) | | 49.34% | |

Statement of Cash Flow

In 10 thousand Yuan

| No. | Year Item | Total | 2006 | 2007 | 2008 | 2009 | 2010 |

| 1 | Cash inflow | 316000.00 | 3380.00 | 8830.00 | 59150.00 | 103250.00 | 141390.00 |

| 1.1 | Income for sales of products (operating) | 314510.00 | 3380.00 | 8830.00 | 59150.00 | 103250.00 | 139900.00 |

| 1.2 | Residual value recovery of fixed assets and intangible assets | 1490.00 | | | | | 1490.00 |

| 2 | Cash outflow | 228121.08 | 19489.84 | 27609.43 | 44380.72 | 56414.64 | 63426.46 |

| 2.1 | Investment of fixed assets (incl. adjustment tax) | 16800.00 | | | | | |

| 2.2 | Operating cost | 155182.45 | 19229.58 | 26608.99 | 33988.16 | 37677.86 | 37677.86 |

| 2.3 | Sales tax and others | 36330.24 | 260.26 | 1000.44 | 6831.83 | 11925.38 | 16312.34 |

| 2.4 | Tax of income | 19808.40 | | | 3560.73 | 6811.40 | 9436.26 |

| 3 | Net cash flow (1-2) | 87878.92 | -16109.84 | -18779.43 | 14769.28 | 46835.36 | 77963.54 |

| | Accumulated net cash flow | | -32909.84 | -51689.27 | -36919.98 | 9915.38 | 87878.92 |

| | Net present value | 78463.32 | -14383.79 | -16767.35 | 13186.86 | 41817.29 | 69610.30 |

| | Accumulated net present value | | -29383.79 | -46151.13 | -32964.27 | 8853.01 | 78463.32 |

| 4 | Net cash flow before-tax | 107687.31 | -16109.84 | -18779.43 | 18330.02 | 53646.77 | 87399.80 |

| | Accumulated net cash flow before-tax | | -32909.84 | -51689.27 | -33359.25 | 20287.51 | 107687.31 |

| | Net present value before-tax | 96149.38 | -14383.79 | -16767.35 | 16366.08 | 47898.90 | 78035.54 |

| | Accumulated net present value before-tax | | -29383.79 | -46151.13 | -29785.05 | 18113.85 | 96149.38 |

Profit and Loss Statement

In 10 thousand Yuan

| No. | Year Item | Total | 2006 | 2007 | 2008 | 2009 | 2010 |

| 1 | Income for sales of products (operating) | 314510.00 | 3380.00 | 8830.00 | 59150.00 | 103250.00 | 139900.00 |

| 2 | Sales tax and others | 36330.24 | 260.26 | 1000.44 | 6831.83 | 11925.38 | 16312.34 |

| 3 | Total cost | 144807.98 | 2869.61 | 6763.88 | 28579.97 | 45915.26 | 60679.26 |

| 4 | Total profit | 133371.78 | 250.13 | 1065.68 | 23738.21 | 45409.37 | 62908.40 |

| 5 | Tax of income | 19808.40 | | | 3560.73 | 6811.40 | 9436.26 |

| 6 | Profit after-tax | 113563.39 | 250.13 | 1065.68 | 20177.47 | 38597.96 | 53472.14 |

| 7 | Profit available for distribution | 113563.39 | 250.13 | 1065.68 | 20177.47 | 38597.96 | 53472.14 |

| 8 | Total undistributed profits | 196713.86 | 250.13 | 1315.81 | 21493.29 | 60091.25 | 113563.39 |

Balance Sheet

In 10 thousand Yuan

| No. | Year Item | 2006 | 2007 | 2008 | 2009 | 2010 |

| 1 | Assets | 22320.39 | 23073.45 | 44629.42 | 83918.55 | 137395.15 |

| 1.1 | Total current assets | 6542.82 | 8917.98 | 32096.05 | 73007.28 | 128105.98 |

| 1.11 | Accounts receivable | 2510.53 | 3473.95 | 4437.34 | 4919.05 | 4919.05 |

| 1.12 | Inventories | 2756.64 | 1478.28 | 1888.23 | 2093.21 | 2093.21 |

| 1.13 | Cash | 3.09 | 5.41 | 10.56 | 15.04 | 19.50 |

| 1.14 | Total surplus fund | 1272.56 | 3960.34 | 25759.92 | 65979.98 | 121074.22 |

| 1.3 | Net fixed assets | 14109.57 | 12719.47 | 11329.37 | 9939.27 | 8549.17 |

| 1.4 | Net amount of intangible and deferred assets | 1668.00 | 1436.00 | 1204.00 | 972.00 | 740.00 |

| 2 | Liability and owner’s equity | 22320.39 | 23073.45 | 44629.42 | 83918.55 | 137395.15 |

| 2.3 | Owner’s equity | 20122.69 | 22603.59 | 61892.86 | 118911.31 | 187257.63 |

| 2.31 | Capital self-owns | 18600.00 | 18600.00 | 18600.00 | 18600.00 | 18600.00 |

| 2.32 | Surplus accumulation fund | 1272.56 | 2687.78 | 21799.57 | 40220.06 | 55094.24 |

| 2.33 | Total undistributed profits | 250.13 | 1315.81 | 21493.29 | 60091.25 | 113563.39 |

| | | | | | | |

DESCRIPTION OF PROPERTY

Sun Group's principal plants are located in Dalian High-Tech Park Ganjingzi Zone in the Peoples' Republic of China. The plant covers a 258,240 square foot area, and the construction area is 236,720 square feet. We pay $ 625,000 million to use the land of 355,080 square footages.

Note: The following building descriptions refer to the building together with the underlying land.

Building 1: 48,420 square feet.

Building 2: 21,520 square feet.

Building 3: 26,900 square feet.

Building 4: 32,280 square feet.

Building 5: 43,040 square feet.

Building 6: 15,064 square feet.

Building 7: 44,116 square feet.

EQUIPMENT: (The total percentage of equipment utilized is 30%.)

Electric Net-Belt Kiln to make Cobalto cobaltic oxide, rated productivity is 187.5 T/Year, total 8 kilns.

Electric Net-Belt Kiln to make Lithium cobalt oxide, rated productivity is 250 T/Year, total 4 kilns.

Airflow Disintegratorôrated productivity is 1500 T/Year, total 1 set.

Scanning Electronic Microscope (SEM), total 1 set.

X-ray Diffractometer (XRD), total 1 set.

Carbon-Sulfur Analyzer, total 1 set.

Carbon Sorption Property Surface Area Analyzer, total 1 set.

Atomic-Absorption Spectrograph, total 1 set.

Laser Particle Size Analyzer, total 1 set.

Potentiometric Titrimeter, total 1 set.

Electronic Balance, total 1 set.

RISK FACTORS

An investment in our securities involves a high degree of risk. You should carefully consider the following risks and the other information set forth elsewhere in this prospectus, including our financial statements and related notes, before you decide to purchase shares of our common stock.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains certain statements that may be deemed to be "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by the use in those statements of terminology such as "may," "will," "could," "expect," "plan," "intend," "anticipate," "believe," "estimate," "predict," "potential," or "continue," or the negative of such terms or other comparable terminology. The forward-looking statements included in this prospectus address activities, events or developments that we expect or anticipate will or may occur in the future, including:

s our ability to maintain our gross profit on our products at certain levels;

s our ability to increase sales in the higher profit margin OEM market;

s our ability to continue to achieve cost savings through vertical integration of the manufacturing process, increased production efficiencies and low labor costs.

Although we believe the expectations expressed in the forward-looking statements included in this prospectus are based on reasonable assumptions within the bounds of our knowledge of our business, a number of factors outside of our control could cause actual results to differ materially from those expressed in any of the forward-looking statements included in this prospectus. Any one, or a combination, of these factors could materially affect our financial performance, business strategy, business operations, plans, goals and objectives. These factors include:

s costs of raw materials;

s costs of energy, including electricity;

s competitive pressures, including the impact on our market of competitive products introduced into the marketplace;

s price resistance among consumers to products using our batteries;

s changes in the design of products that use rechargeable batteries to require batteries different from those we produce;

s changes in the laws and regulations applicable to us and our operations;

s rates of taxation applicable to our Chinese operations and our effective rate of taxation in the United States;

s cost and availability of capital and debt financing;

s product liability claims against us;

s the adequacy of our products liability insurance coverage;

s casualty losses to our manufacturing and other facilities, which are uninsured;

s interest rate fluctuations;

s demand for our products by existing and new customers;

s inflation;

s currency exchange rate fluctuations;

s changes in freight rates;

s labor costs; and

s other capital market, economic and geo-political conditions.

Forward-looking statements that we make or that are made by others on our behalf are based on a knowledge of our business and the environment in which we operate, but because of the factors listed above, actual results may differ from those in the forward-looking statements. Consequently, these cautionary statements qualify all of the forward-looking statements we make herein. The results or developments we anticipate may not be realized. Even if substantially realized, those results or developments may not result in the expected consequences for us or affect us, our business or our operations in the ways we expect. We caution readers not to place undue reliance on any of these forward-looking statements in this prospectus, which speak only as of their dates. We assume no obligation to update any of the forward-looking statements.

Risks Related to Our Business

We have significant short-term debt obligations, which mature in less than one year. Failure to extend those maturities of, or to refinance, that debt could result in defaults, in certain instances, and foreclosures on our assets.

Our indebtedness adversely affects our ability to fund our operations and to compete effectively.

The amount of our indebtedness to lenders, is substantial compared to our assets, stockholders' equity and our operating cash flow. That indebtedness limits our ability to fund our operations through our operating cash flow and to compete effectively. Among other things, our indebtedness:

o requires us to dedicate a substantial portion of our cash flow from operations to debt service payments, reducing our working capital and adversely affecting our ability to fund capital expenditures through operating cash flow;

o places us at a disadvantage compared with competitors that have proportionately less debt; and

o limits our ability to borrow additional funds in the future, if we need them, due to financial and restrictive covenants in our debt agreements.

Our manufacturing facilities are not insured against damage or loss.

Our operations and financial condition are dependent on the success of Sun Group's operations in China. As is the case with many manufacturing companies in the PRC, we conduct those operations in manufacturing facilities, and using machinery and other related property, that we do not insure against damage or loss. We do not carry business interruption insurance. If we suffer any business interruption or material damage to, or the loss of, any of our manufacturing facilities, due to any cause, the loss would not be offset by any insurance proceeds, and if large enough, that loss could threaten the continued viability of our business.

We are and will continue to be under downward pricing pressures on our products from our customers and competitors.

We face downward pricing pressures from our customers and competitors, especially in the sales of replacement batteries. To retain our existing customers and gain new ones, we must continue to keep our unit prices low. In view of our need to maintain low prices on our products, our growth, profit margins and net income will suffer if we cannot effectively continue to control our manufacturing and other costs.

Our contracts with our customers are generally short-term and do not require the purchase of a minimum amount.

Our customers generally do not provide us with firm, long-term volume purchase commitments. Although we enter into manufacturing contracts with our customers who have continuing demand for a certain product, these contracts state terms such as payment method, payment period, quality standard and inspection and similar matters rather than provide firm, long-term commitments to purchase products from us. As a result of the absence of the long term contracts, we could have periods during which we have no or only limited orders for our products, but will continue to have to pay the costs to maintain our work force and our manufacturing facilities and to service our indebtedness without the benefit of current revenues.

We consistently face short lead times for delivery of products to customers. Failure to meet delivery deadlines in our production agreements could result in the loss of customers and damage to our reputation and goodwill.

We enter into production agreements with our customers prior to commencing production, which reduces our risk of cancellations. However, these production agreements typically contain short lead times for delivery of products, leading to production schedules that can strain our resources and reduce our profit margins on the products produced. Although we have increased our manufacturing capacity, we may lack sufficient capacity at any given time to meet all of our customers' demands if they exceed our production capacity levels. We strive for rapid response to customer demand, which can lead to reduced purchasing efficiency and increased material costs. If we are unable to sufficiently meet our customers' demands, we may lose our customers. Moreover, failure to meet customer demands may damage our reputation and goodwill.

Because of the short lead times in our production agreements, we may not be able to accurately or effectively plan our production or supply needs.

We make significant decisions, including determining the levels of business that we will seek and accept, production schedules, component procurement commitments, facility requirements, personnel needs, and other resource requirements, based on our production agreements with our customers. Short lead times of our customers' commitments to their own customers and the possibility of rapid changes in demand for their products reduce our ability to estimate accurately the future requirements of those customers for our products. Because many of our costs and operating expenses are fixed, a reduction in customer demand can harm our gross margins and operating results. We may also occasionally acquire raw materials without having customer orders based on a customer's forecast or in anticipation of an order and to secure more favorable pricing, delivery or credit terms in view of the short lead times we often have under our customers' orders. These purchases can expose us to losses from inventory carrying costs or inventory obsolescence.

We face intense competition from other battery manufacturers, many of whom have significantly greater resources than do we.

We are subject to intense competition from manufacturers of traditional rechargeable batteries, such as nickel-cadmium batteries, from manufacturers of rechargeable batteries of more recent technologies, such as nickel-metal hydride and liquid electrolyte, other manufacturers of lithium ion batteries, as well as from companies engaged in the development of batteries incorporating new technologies. Other manufacturers of lithium ion batteries currently include Sanyo Electric Co., Sony Corp., Matsushita Electric Industrial Co., Ltd. (Panasonic), GS Group, NEC Corporation, Hitachi Ltd., LG Chemical Ltd., Samsung Electronics Co., Ltd., BYD Co. Ltd., Tianjin Lishen Battery Joint-Stock Co., Ltd., Henan Huanyu Group, China Bak Battery, Inc. and Harbin Coslight Technology International Group Co., Ltd.

Several of these existing competitors have greater financial, personnel and capacity resources than we do and, as a result, these competitors may be in a stronger position to respond quickly to market opportunities, new or emerging technologies and changes in customer requirements. Many of our competitors are developing a variety of battery technologies, such as lithium polymer and fuel cell batteries, which are expected to compete with our existing product lines. Other companies undertaking research and development activities of solid-polymer lithium ion batteries have developed prototypes and are constructing commercial scale production facilities. The introduction of new products that are perceived as having more desirable qualities than our products and that gain market acceptance would lead to price erosion for our products, require greater marketing and advertising of our products or require greater research and development costs to develop competing products. If competitors develop manufacturing processes that are more efficient than ours, we may face downward pressure on pricing with resulting reductions in our gross profit for our products. Any such developments may require us to increase our research and development and related expenditures to develop competing technology or more efficient manufacturing processes.

We are dependent on a single line of products.

Our revenues are derived solely from the sale of our lithium ion batteries. The market for these products is characterized by changing technology and evolving industry standards, often resulting in product obsolescence or short product lifecycles. Although we believe our products are based on state-of-the-art technology, other technologies may become the standard for manufacturers of cellular telephones and other devices that use our batteries. In that instance, our products could be obsolete, requiring us to develop new products that compete effectively with the other products on the market. Our failure to identify and develop a commercially viable number of product lines that are sought by the market could adversely affect our growth opportunities and, ultimately, our viability. Because we do not have a diverse product offering that would enable us to sustain our business while seeking to develop new types of products, our business may not be able to recover if we experience a steep decline in demand for our current product offerings.

Our operations depend highly on Mr. Wang Bin, our President and Chief Executive Officer and a small number of other executives.

The success of operations depends greatly on a small number of key managers, including Mr. Wang Bin, the President, Chief Executive Officer and Chairman of the Board of Directors of CRFU and the chief executive officer and sole director of Sun Group. The loss of the services of Mr. Wang Bin or any of the other senior executives of CRFU or Sun Group could adversely affect our ability to conduct our business. Although we believe we would be able to find other managers to replace any of these managers, the search for such managers and the integration of such managers into our business will inevitably occur only over an extended period of time. During that time the lack of senior leadership could affect adversely our sales and manufacturing, as well as our research and development efforts. Mr. Wang Bin has held his positions with Sun Group since the inception of its business, and our future growth and success very much depends on his continued involvement with our company. All of our senior managers have an employment agreement with CRFU and Sun Group.

Our operations depend on our ability to attract and retain a highly skilled group of managers and other personnel.

Because of the highly specialized, technical nature of our business, we must attract and retain a highly skilled group of managers and a sizeable workforce of technically competent employees. Although we do not experience unacceptable attrition among our technical staff and sales force, if we were to lose a substantial portion of such persons, our ability to effectively pursue our business strategy could be materially and negatively affected. Although we believe the pool of managers and workers having the necessary education, training and technical skills to fill any positions that may become open is sufficient for our needs, the labor market for such managers and workers is becoming more competitive and we could have to pay higher salaries and wages and provide greater benefits in order for us to attract the necessary workers.

We may not be able to effectively respond to rapid growth in demand for our products and of our manufacturing operations.

If we are successful in obtaining rapid market growth of our batteries, we will be required to deliver large volumes of quality products to customers on a timely basis at a reasonable cost to those customers. Meeting such increased demands will require us to expand our manufacturing facilities, to increase our ability to purchases of raw materials, to increase the size of our work force, to expand our quality control capabilities and to increase the scale upon which we produce products. Such demands would require more capital and working capital than we currently have available.

We extend relatively long payment terms for accounts receivable.

As is customary in the PRC, we extend relatively long payment terms and provide liberal return policies to our customers. As a result of the size of many of our orders, these extended terms adversely affect our cash flow and our ability to fund our operations out of our operating cash flow. In addition, although we attempt to establish appropriate reserves for our receivables, those reserves may not prove to be adequate in view of actual levels of bad debts. The failure of our customers to pay us timely would negatively affect our working capital, which could in turn adversely affect our cash flow.

Our customers often place large orders for products, requiring fast delivery, which impacts our working capital. If our customers do not incorporate our products into their products and sell them in a timely fashion, for example, due to excess inventories, sales slowdowns or other issues, they may not pay us in a timely fashion, even on our extended terms. This failure to pay timely may defer or delay further product orders from us, which may adversely affect our cash flows, sales or income in subsequent periods.

We may not be able to finance the development of new products.

Our future operating results will depend to a significant extent on our ability to continue to provide new products that compare favorably on the basis of cost and performance with the products of our competitors, many of whom have design and manufacturing capabilities and technologies that compete well with our products. We are currently conducting research and development on a number of new products, activities requiring a substantial outlay of capital. To remain competitive, we must continue to incur significant costs in product development, equipment, facilities and invest in research and development of new products. These costs may increase, resulting in greater fixed costs and operating expenses. All of these factors create pressures on our working capital and ability to fund our current and future manufacturing activities and the expansion of our business.

Lithium ion batteries pose certain safety risks that could affect our financial condition and results of operations.

Due to the high energy density inherent in lithium batteries, our batteries can pose certain safety risks, including the risk of fire. Although through our research, design, development and manufacturing processes we attempt to minimize safety risks related to our batteries, should an accident occur, whether at the manufacturing facilities or from the use of the products, it could result in significant production delays or product liability claims for damages resulting from injuries. As a result of limits imposed in our product liability insurance policy, such losses might not be covered by our insurance policy, and if large enough, could have a material and negative effect on our financial condition and results of operations.

We depend on certain suppliers of raw materials for the production of our products, and any disruption with those suppliers could delay product shipments and adversely affect our relationships with customers.

Certain materials used in our products are available to us only from a limited number of suppliers. We currently maintain volume purchase agreements with our major suppliers. However, any interruption in deliveries from any such supplier could delay our product shipments and adversely affect our relationships with customers. We believe, however, that alternative suppliers could supply raw materials that could replace the materials currently used and that, if necessary, we would be able to redesign our products to make use of such alternatives.

We receive a significant portion of our revenues from a small number of customers all located in China.

100% of the Company's assets are located in China and 100% of the Company’s revenues are derived from customers located in China.

For the years ended December 31, 2004 and 2005 and the eight months ending August 31, 2006, the customers who account for 10% or more of the revenues of the Company were:

Our business depends on our ability to protect our intellectual property effectively.

The success of our business depends in substantial measure on the legal protection of the patents and other proprietary rights in technology we hold. We hold patents in China and have patent applications pending in China and other countries regarding technologies important to our business. If (i) our pending patent applications do not result in the issuance of patents, (ii) the claims allowed under any existing patents are not sufficiently broad to protect our technology, or (iii) any patents issued to us are challenged, invalidated or circumvented, then the resulting ability of third parties to utilize the subject technology will adversely affect our business. We do not hold similar patents in other countries with respect to these technologies. Consequently, our ability to protect against the unauthorized use of those technologies outside of China is limited.

We claim proprietary rights in various unpatented technologies, know-how, trade secrets and trademarks relating to products and manufacturing processes. We protect our proprietary rights in our products and operations through contractual obligations, including nondisclosure agreements. If these contractual measures fail to protect our proprietary rights, any advantage those proprietary rights provided to us would be negated.