INVESTOR UPDATE FEBRUARY 2023 LAKE AUSTIN SPA RESORT

FORWARD LOOKING STATEMENTS & USE OF NON-GAAP FINANCIAL MEASURES FORWARD LOOKING STATEMENTS Certain statements made during this presentation are forward-looking statements that are subject to risks and uncertainties. Forward-looking statements generally include the words “believe,” “expect,” “anticipate,” “plan,” “estimate,” “project,” “will,” “intend” or other similar expressions. Forward-looking statements include, without limitation, statements regarding industry outlook, results of operations, cash flows, business strategies, growth and value opportunities, capital and other expenditures, financing plans, expense reduction initiatives and projected dispositions. Factors that could cause actual results to materially differ from those contained in the forward-looking statements include, without limitation, national and local economic and business conditions, including the impact of COVID-19 on occupancy rates at DiamondRock Hospitality Company’s (the "Company“) hotels and the demand for hotel products and services, and those risks and uncertainties discussed in the most recent Annual Report on Form 10-K, which the Company has filed with the Securities and Exchange Commission, and in our other public filings which you should carefully review. The forward-looking statements made are based on our beliefs, assumptions and expectations of future performance, taking into account all information currently available to the Company. Actual results could differ materially from the forward-looking statements made in this presentation. The forward-looking statements made in this presentation are subject to the safe harbor of the Private Securities Litigation Reform Act of 1995. Any forward-looking statement speaks only as of the date on which it is made. Although the Company believes the expectations reflect ed in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that the expectations will be attained or that any deviation will not be material. All information in this presentation is as of the date of this presentation, and the Company undertakes no obligation to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations. This presentation contains statistics and other data that has been obtained or compiled from information made available by third-party service providers and believed to be reliable, but the accuracy and completeness of the information is not assured. The Company has not independently verified any such information. 2 USE OF NON-GAAP FINANCIAL MEASURES We use the following non-GAAP financial measures that we believe are useful to investors as key measures of our operating performance: EBITDA, EBITDAre, Adjusted EBITDA, Hotel EBITDA, Hotel Adjusted EBITDA, FFO and Adjusted FFO. These measures should not be considered in isolation or as a substitute for measures of performance in accordance with U.S. GAAP. EBITDA, EBITDAre, Adjusted EBITDA, Hotel EBITDA, Hotel Adjusted EBITDA, FFO and Adjusted FFO, as calculated by us, may not be comparable to other companies that do not define such terms exactly as the Company. A detailed explanation of these non-GAAP financial measures and the reconciliation of such measures to the most directly comparable financial measures prepared in accordance with U.S. GAAP can be found in the Company’s fourth quarter 2022 earnings press release dated February 21, 2023.

2022 HIGHLIGHTS ROI PROJECTS 3 RECENTLY COMPLETED ROI PROJECTS ■ Hotel Clio, Luxury Collection ■ Embassy Suites by Hilton Bethesda ■ The Hythe, Luxury Collection ■ Margaritaville Beach House Key West ■ The Lodge at Sonoma, Autograph Collection UPCOMING REPOSITIONINGS & CONVERSIONS ■ Repositioning Hilton Boston to an urban lifestyle hotel ■ Converting Hilton Burlington to a Curio MARGARITAVILLE BEACH HOUSE, KEY WEST KEY HIGHLIGHTS ■ Record Total Comparable Revenues Exceed $1B in 2022 ̶ Full-Year Comparable RevPAR +50.6% vs 2021 and +5.5% vs 2019 ■ Record Hotel Profits and Margins ̶ Comparable Hotel Adj. EBITDA +121.9% vs 2021 and +13.6% vs 2019 ̶ Comparable Hotel Adj. EBITDA Margin +947 bps vs 2021 and +184 bps vs 2019 ■ Adj. FFO of $215.9M and $1.01/diluted share KEY EVENTS ■ Acquired 3 High Quality and Unencumbered Hotels Totaling $174M ̶ Average RevPAR of $450+ and stabilized average NOI yield of 9%+ ̶ Lake Austin Spa Resort ̶ Kimpton Shorebreak Fort Lauderdale Beach Resort ̶ Tranquility Bay Beachfront Resort ■ Expanded $1.2B Credit Facility and Eliminated Near Term Maturities ■ Repurchased $12M of Common Stock ■ Reinstated Quarterly Common Dividend ■ Maintained Leadership in ESG Excellence ̶ GRESB Sector Leader (Hotels/America) and ISS ESG Prime Designation Notes: Comparable operating results include all hotels currently owned, except the Kimpton Fort Lauderdale Beach Resort, which opened in April 2021

OPERATIONAL EXCELLENCE THE GWEN, A LUXURY COLLECTION HOTEL

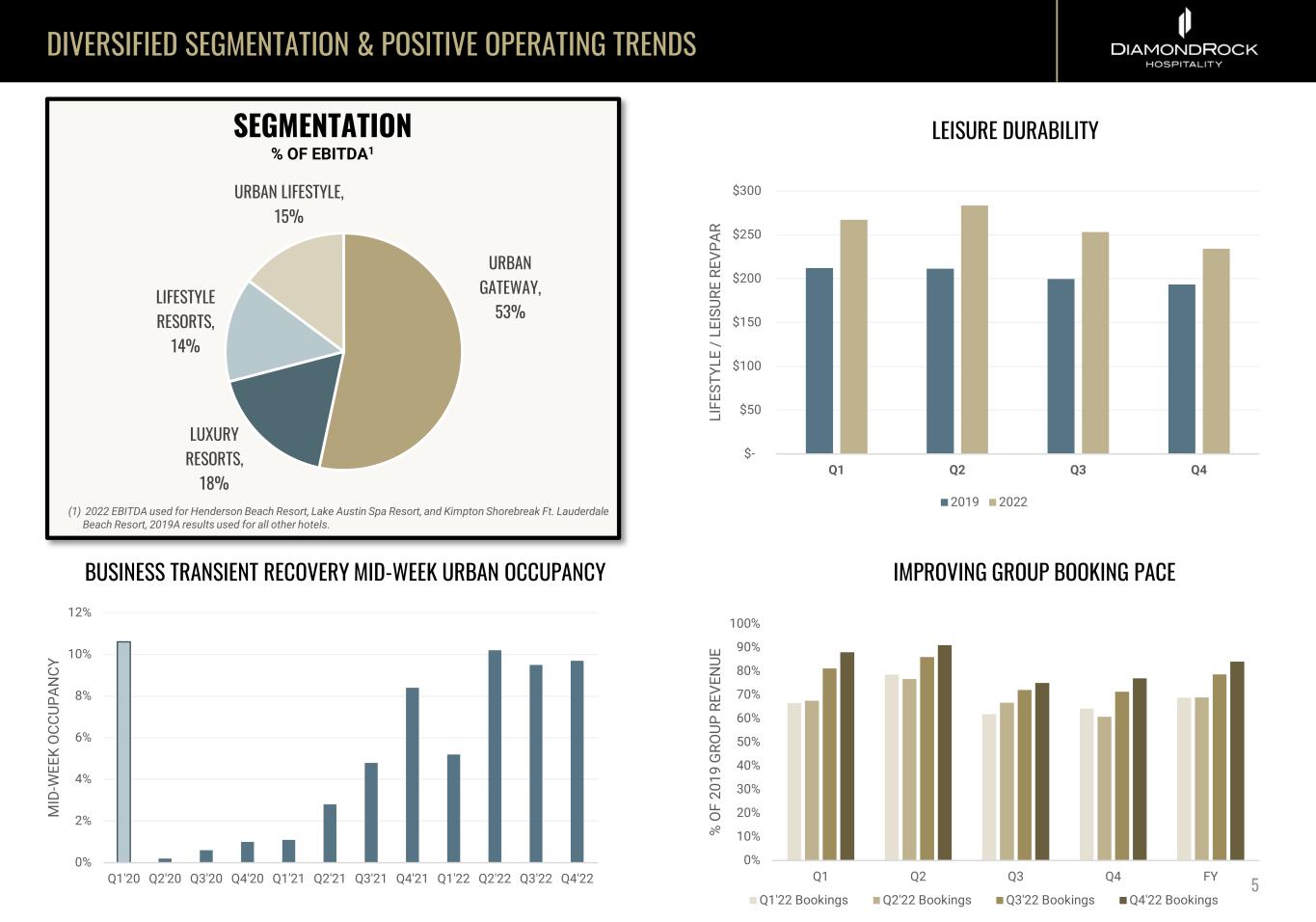

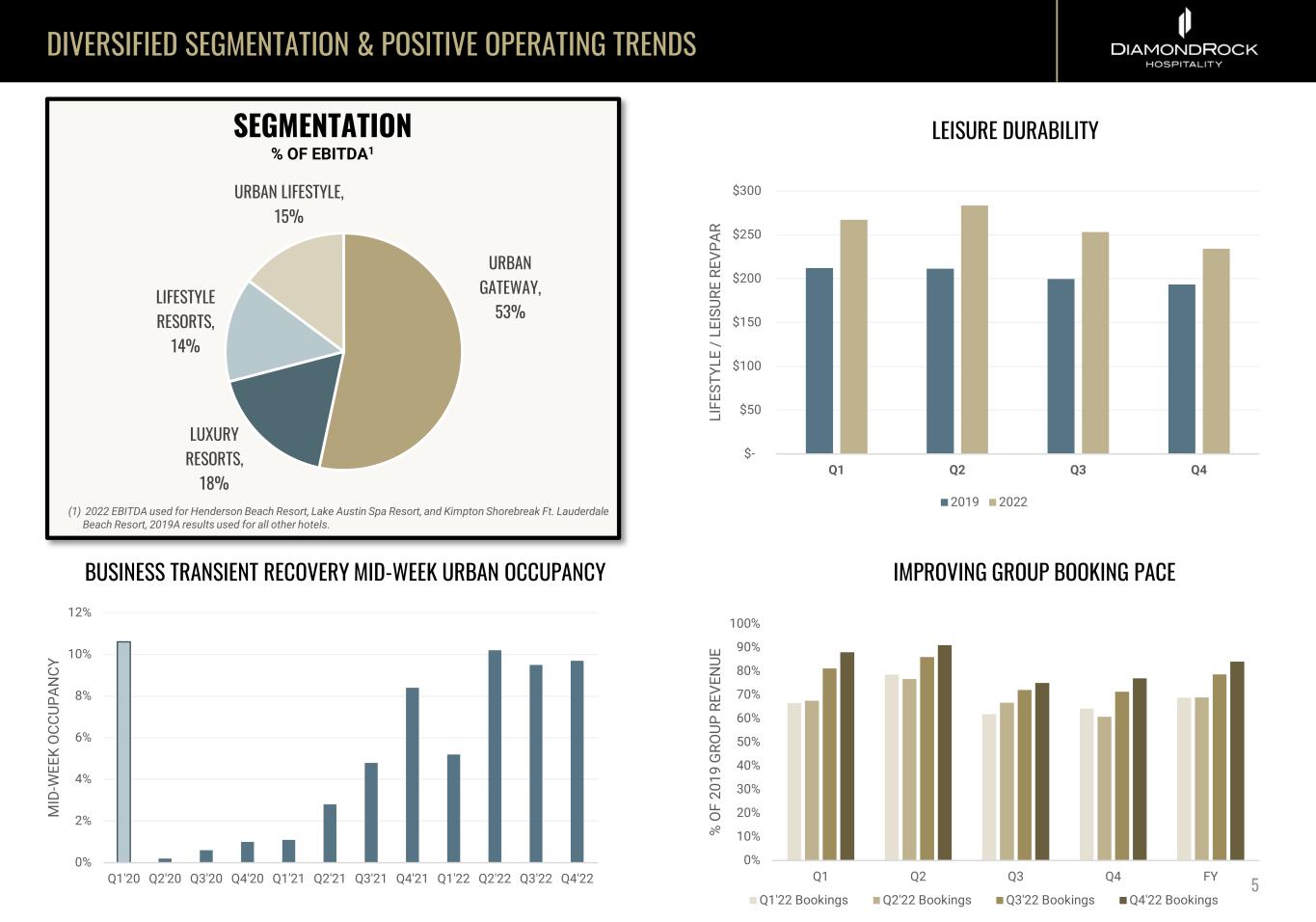

DIVERSIFIED SEGMENTATION & POSITIVE OPERATING TRENDS SEGMENTATION % OF EBITDA1 BUSINESS TRANSIENT RECOVERY MID-WEEK URBAN OCCUPANCY IMPROVING GROUP BOOKING PACE LEISURE DURABILITY 5 $- $50 $100 $150 $200 $250 $300 Q1 Q2 Q3 Q4 LI FE ST YL E / LE IS UR E RE VP AR 2019 2022 0% 2% 4% 6% 8% 10% 12% Q1'20 Q2'20 Q3'20 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 M ID -W EE K O CC UP AN CY 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Q1 Q2 Q3 Q4 FY % O F 20 19 G RO UP R EV EN UE Q1'22 Bookings Q2'22 Bookings Q3'22 Bookings Q4'22 Bookings LUXURY RESORTS, 18% LIFESTYLE RESORTS, 14% URBAN LIFESTYLE, 15% URBAN GATEWAY, 53% (1) 2022 EBITDA used for Henderson Beach Resort, Lake Austin Spa Resort, and Kimpton Shorebreak Ft. Lauderdale Beach Resort, 2019A results used for all other hotels.

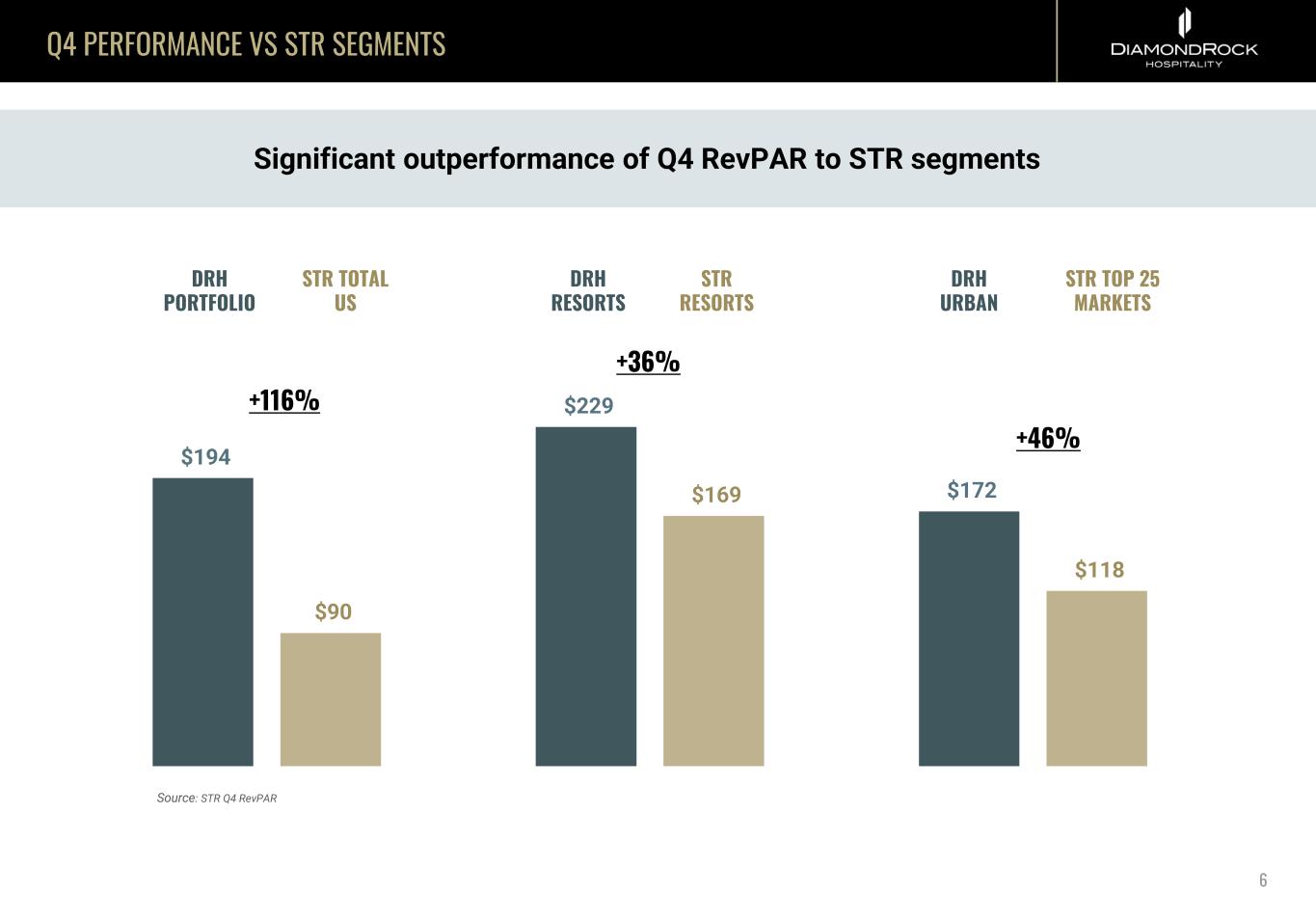

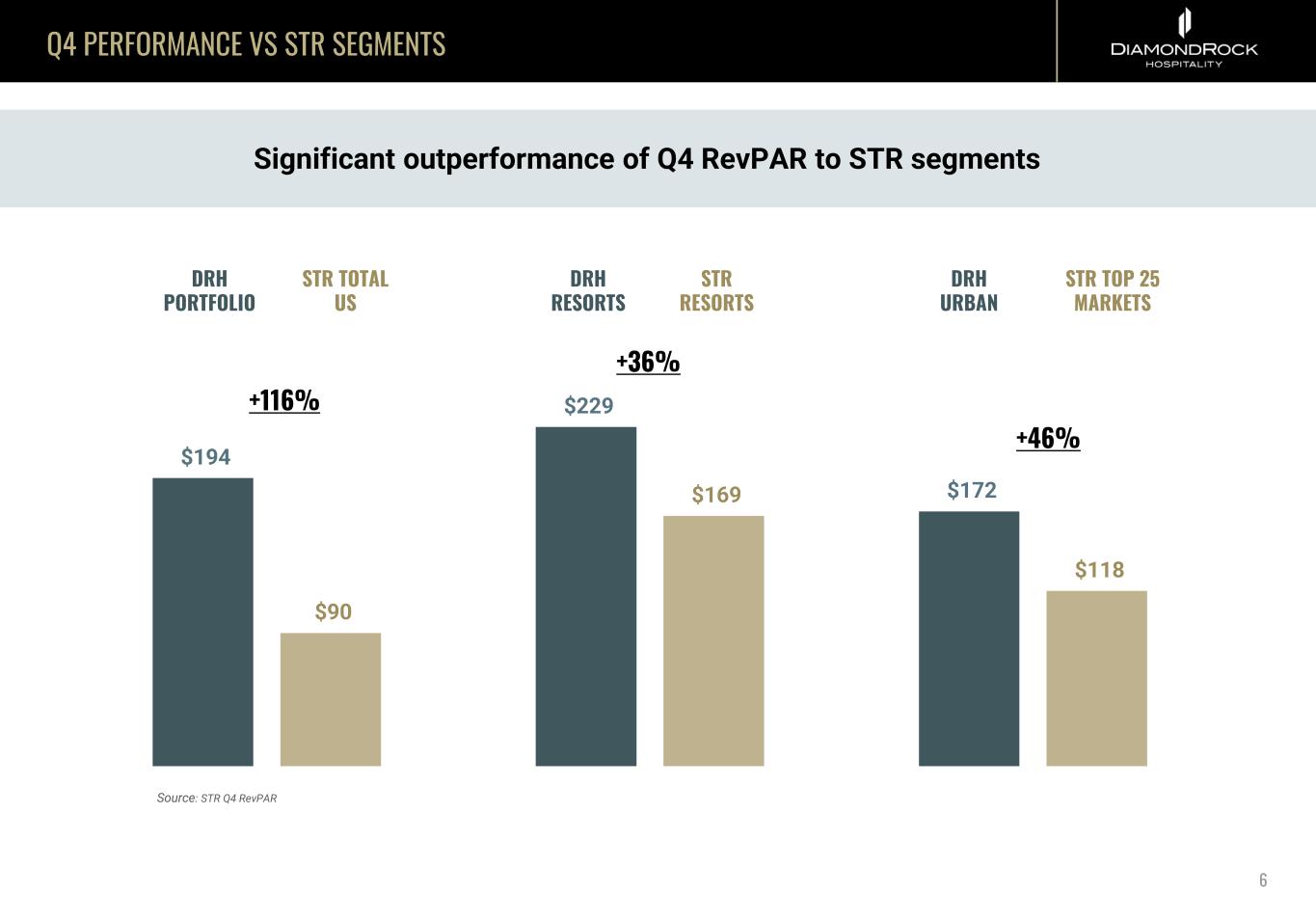

Q4 PERFORMANCE VS STR SEGMENTS 6 $194 $90 $229 $169 $172 $118 Significant outperformance of Q4 RevPAR to STR segments DRH PORTFOLIO STR TOTAL US DRH RESORTS STR RESORTS DRH URBAN STR TOP 25 MARKETS +116% +36% +46% Source: STR Q4 RevPAR

CONSISTENT OUTPERFORMANCE AGAINST PEERS QUARTERLY REVPAR GROWTH (vs. 2019) 7Source: Company filings (1) Excludes DRH -40% -30% -20% -10% 0% 10% Q1'22 Q2'22 Q3'22 DRH HST APLE XHR PEB RLJ SHO PK Q3 2022 YTD PEER PERFORMANCE (vs. 2019) DRH AVG1 PEB XHR HST APLE RLJ SHO PK ADR Growth +20% +11% 20% 13% 15% 7% 2% 14% 6% Occupancy Growth -13% -17% -23% -18% -17% -6% -13% -21% -22% RevPAR Growth +5% -8% -8% -7% -4% 1% -12% -9% -17% Hotel EBITDA Growth +11% -16% -13% -5% -24% -2% -20% -13% -31% Adj. FFO per Share Growth -3% -29% -30% -30% -1% -8% -37% -46% -50%

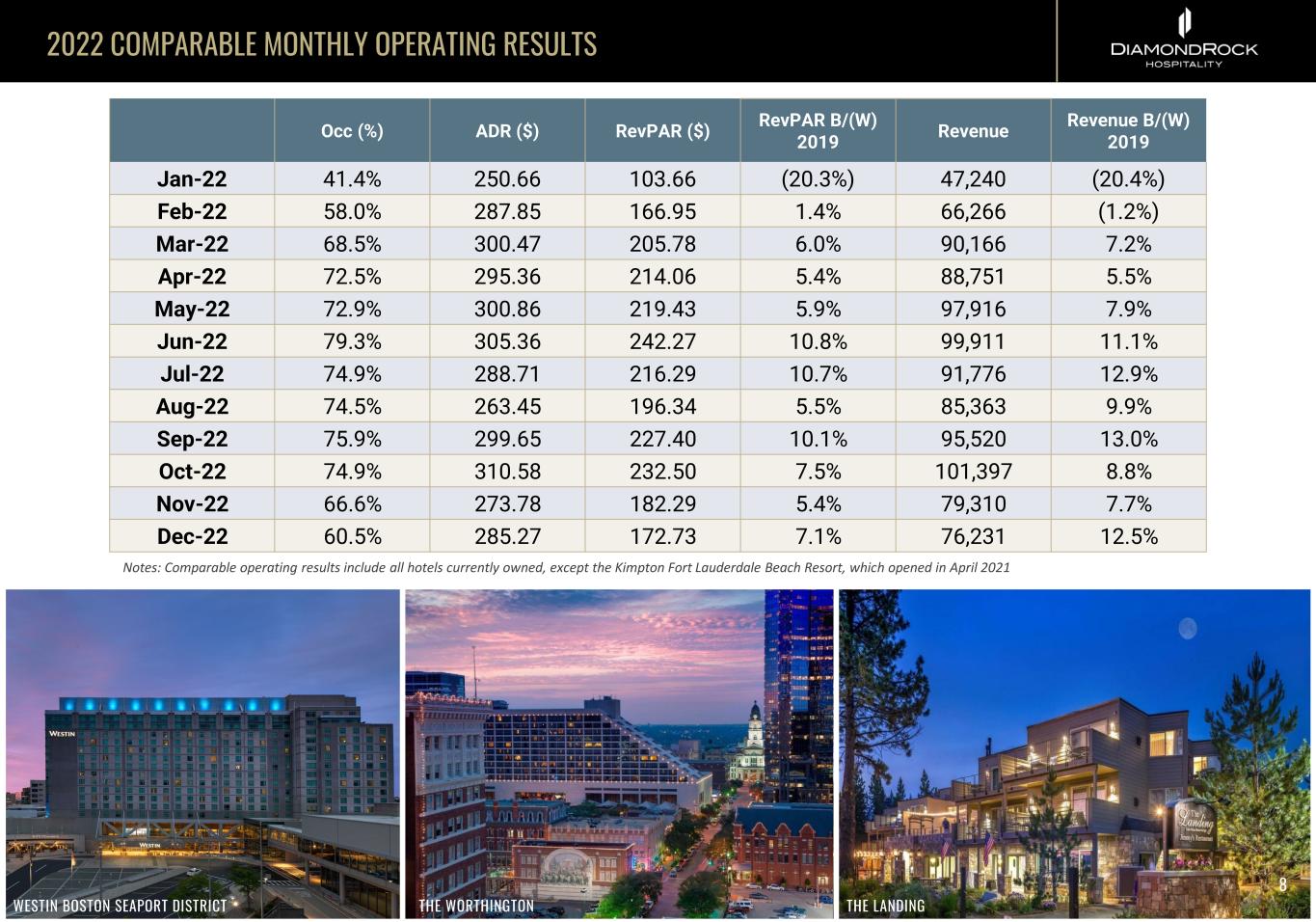

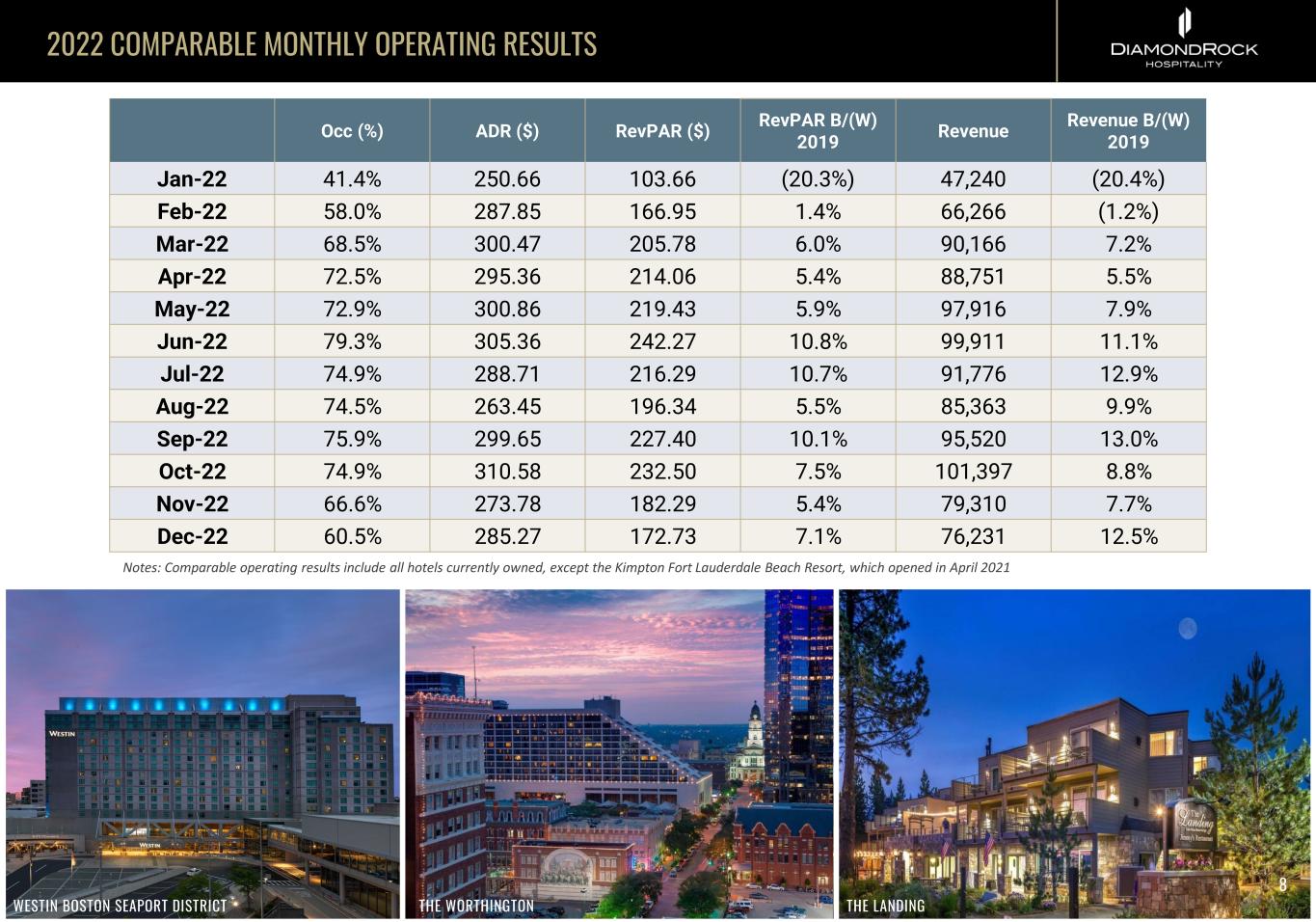

2022 COMPARABLE MONTHLY OPERATING RESULTS Occ (%) ADR ($) RevPAR ($) RevPAR B/(W) 2019 Revenue Revenue B/(W) 2019 Jan-22 41.4% 250.66 103.66 (20.3%) 47,240 (20.4%) Feb-22 58.0% 287.85 166.95 1.4% 66,266 (1.2%) Mar-22 68.5% 300.47 205.78 6.0% 90,166 7.2% Apr-22 72.5% 295.36 214.06 5.4% 88,751 5.5% May-22 72.9% 300.86 219.43 5.9% 97,916 7.9% Jun-22 79.3% 305.36 242.27 10.8% 99,911 11.1% Jul-22 74.9% 288.71 216.29 10.7% 91,776 12.9% Aug-22 74.5% 263.45 196.34 5.5% 85,363 9.9% Sep-22 75.9% 299.65 227.40 10.1% 95,520 13.0% Oct-22 74.9% 310.58 232.50 7.5% 101,397 8.8% Nov-22 66.6% 273.78 182.29 5.4% 79,310 7.7% Dec-22 60.5% 285.27 172.73 7.1% 76,231 12.5% Notes: Comparable operating results include all hotels currently owned, except the Kimpton Fort Lauderdale Beach Resort, which opened in April 2021 8 WESTIN BOSTON SEAPORT DISTRICT THE WORTHINGTON THE LANDING

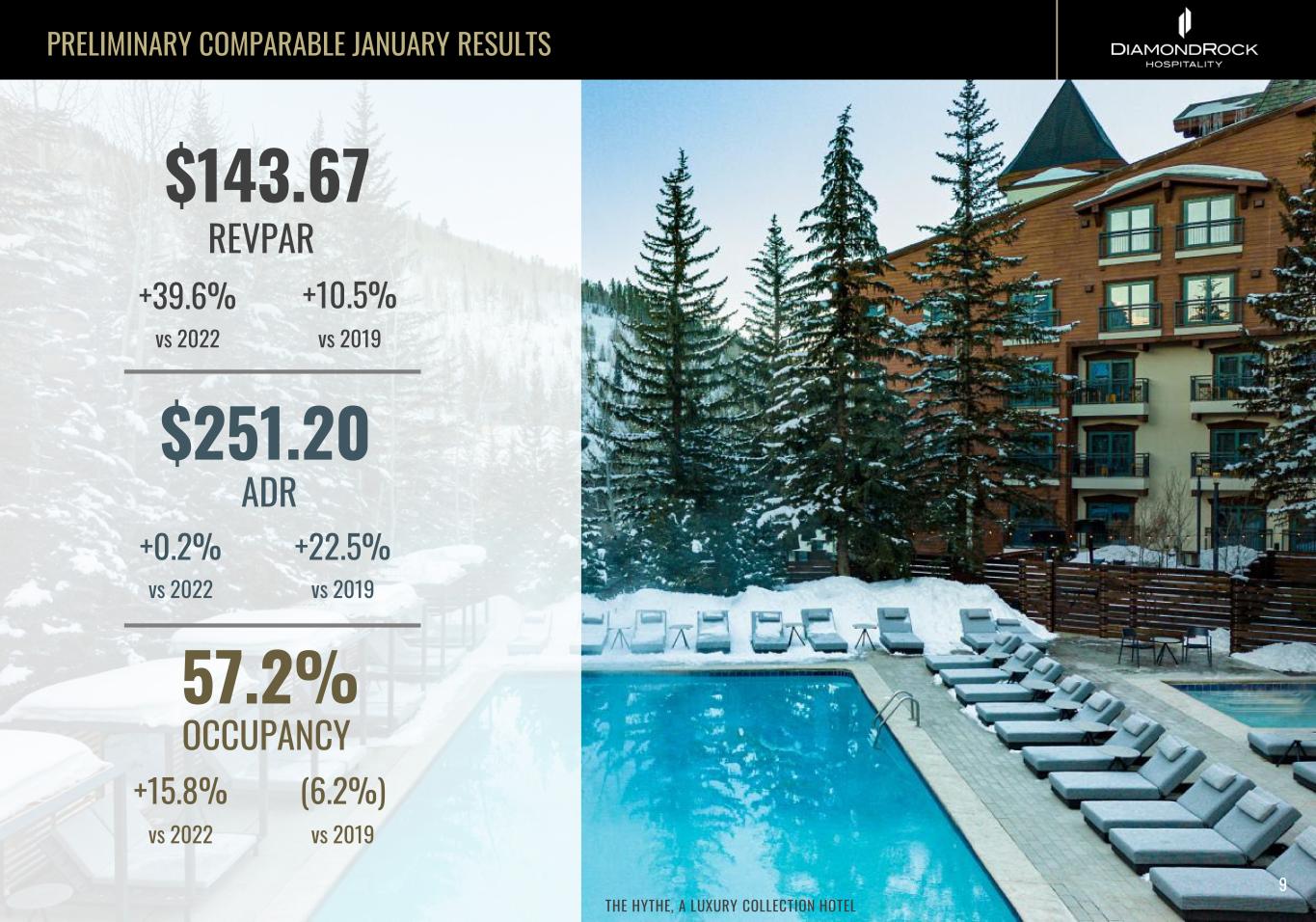

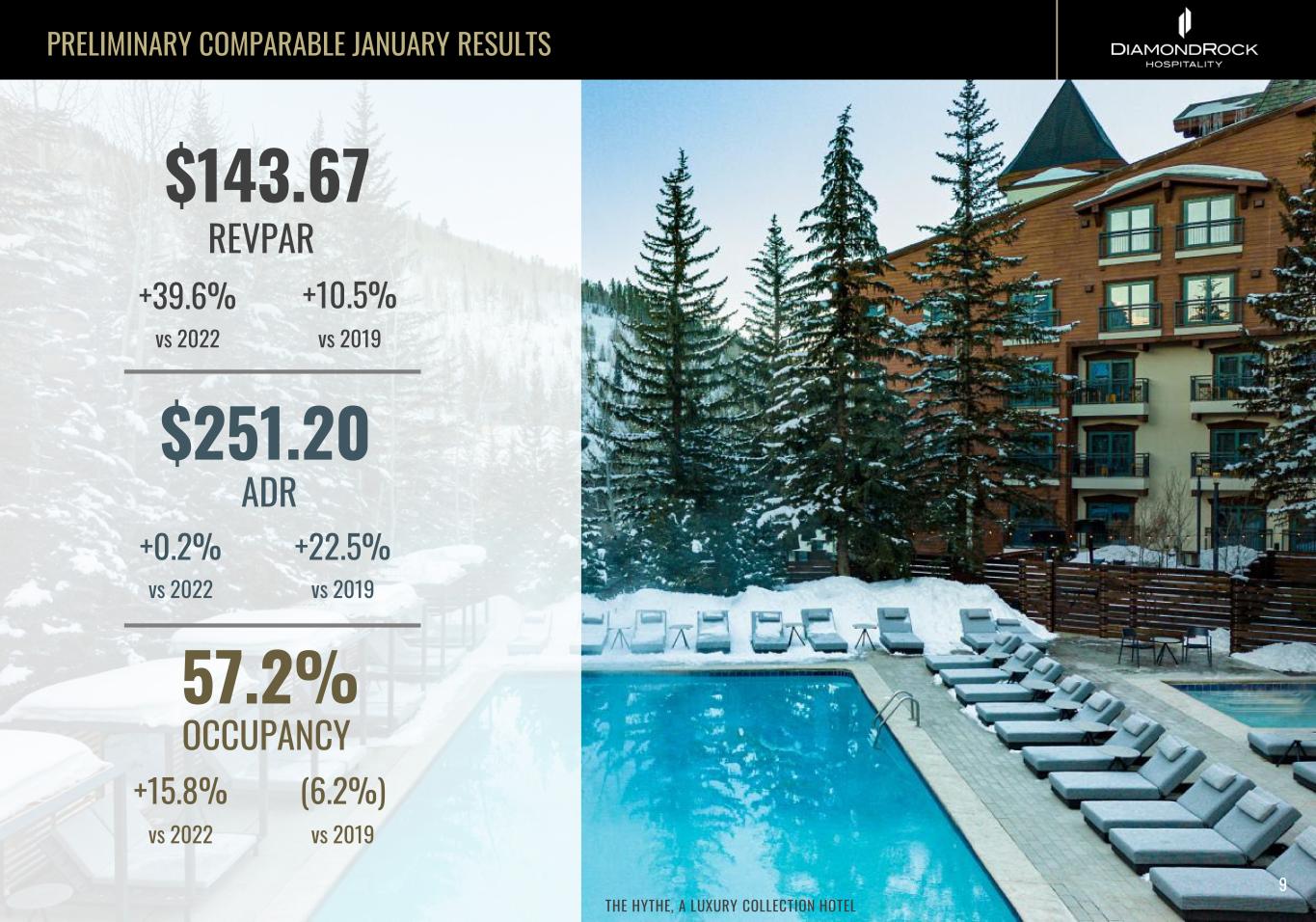

PRELIMINARY COMPARABLE JANUARY RESULTS ADR OCCUPANCY REVPAR +0.2% +22.5% $251.20 vs 2022 vs 2019 57.2% $143.67 +15.8% (6.2%) vs 2022 vs 2019 +39.6% +10.5% vs 2022 vs 2019 THE HYTHE, A LUXURY COLLECTION HOTEL 9

L’Auberge de Sedona CAPACITY FOR GROWTH THE HYTHE, A LUXURY COLLECTION HOTEL

NO NEAR-TERM MATURITIES STRONG LIQUIDITY AND BALANCE SHEET Note: Mortgages reflect balance at scheduled maturity, $300M Term Loan reflects exercise of one-year extension $73 $291 $300 $500 2022 2023 2024 2025 2026 2027 2028 Mortgages Term Loans and Revolver ~$600M Total Available Liquidity 68% Fixed Rate1 89% Unencumbered by Year End2 (1) Includes debt and perpetual preferred capital (2) Percentage of hotels unencumbered by debt LOW LEVERAGE VS PEERS Source: Baird Comp Sheet (2/3/23), Net Debt + Preferred / EBITDA 2022 PEER (NET DEBT + PREFERRED) / EBITDADEBT MATURITY SCHEDULE ($MM) 12.4 9.0 8.2 8.0 7.0 6.4 6.2 5.8 4.6 4.5 4.4 4.3 3.2 2.7 AHT BHR PEB INN HT PK RLJ CLDT RHP XHR DRH SHO APLE HST SIGNIFICANT LIQUIDITY AND DRY POWDER AVAILABLE 11

(1) Excludes recently acquired hotels: Lake Austin Spa (acquired November 2022) and Kimpton Fort Lauderdale (acquired April 2022). RECENT ACQUISITIONS OUTPERFORMING UNDERWRITING BOURBON ORLEANS HOTEL (NEW ORLEANS, LA) HENDERSON PARK INN (DESTIN, FL) HENDERSON BEACH RESORT (DESTIN, FL) TRANQUILITY BAY (MARATHON, FL) KIMPTON FORT LAUDERDALE BEACH (FT LAUDERDALE, FL) 12 LAKE AUSTIN SPA RESORT (AUSTIN, TX) 6 HOTELS ACQUIRED IN THE PAST TWO YEARS $5MM AHEAD OF 2022 HOTEL ADJ. EBITDA UNDERWRITING1 $400M+ CAPITAL DEPLOYED 11.6X 2022 EBITDA MULTIPLE OVER ACQUISITION PRICE

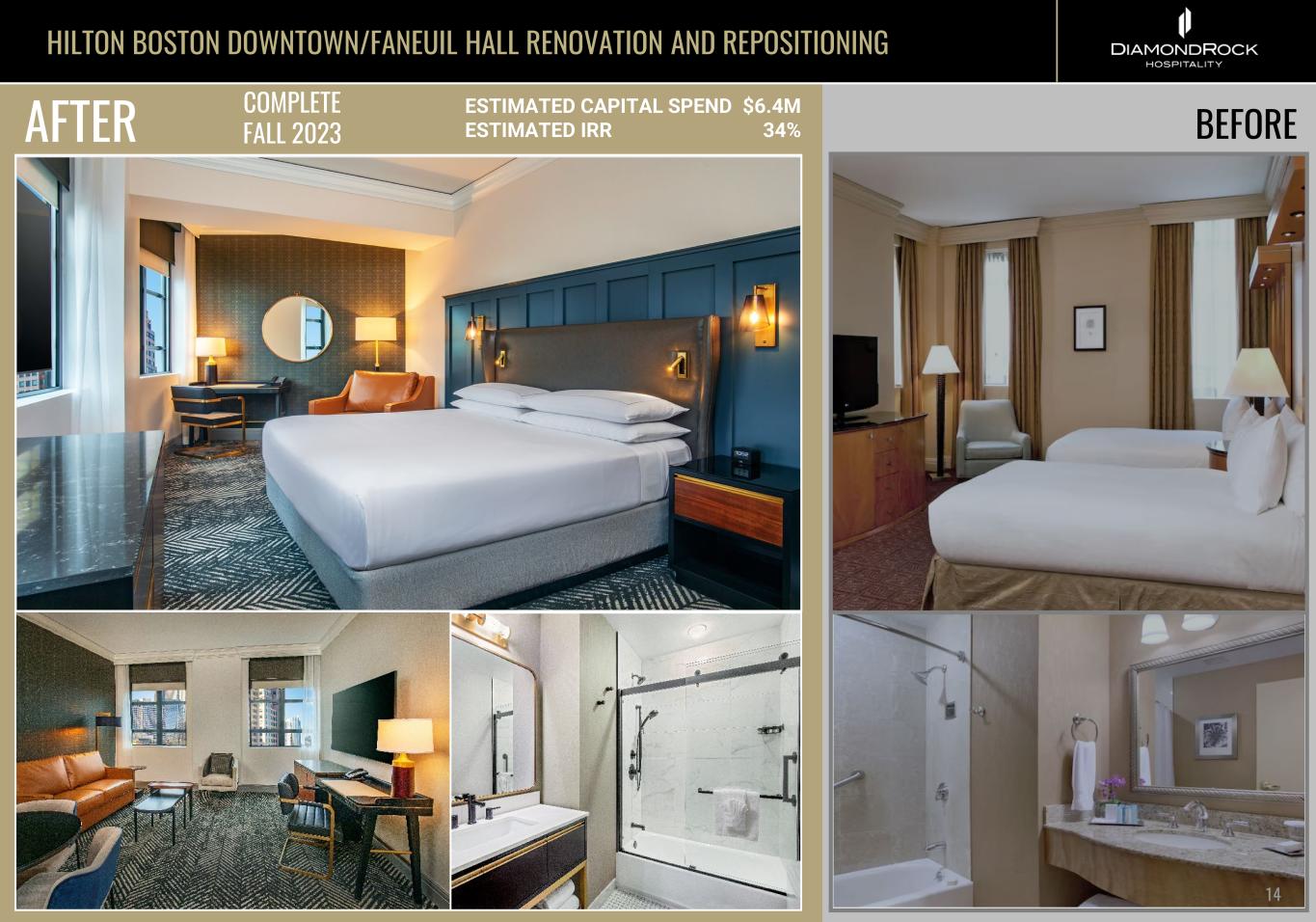

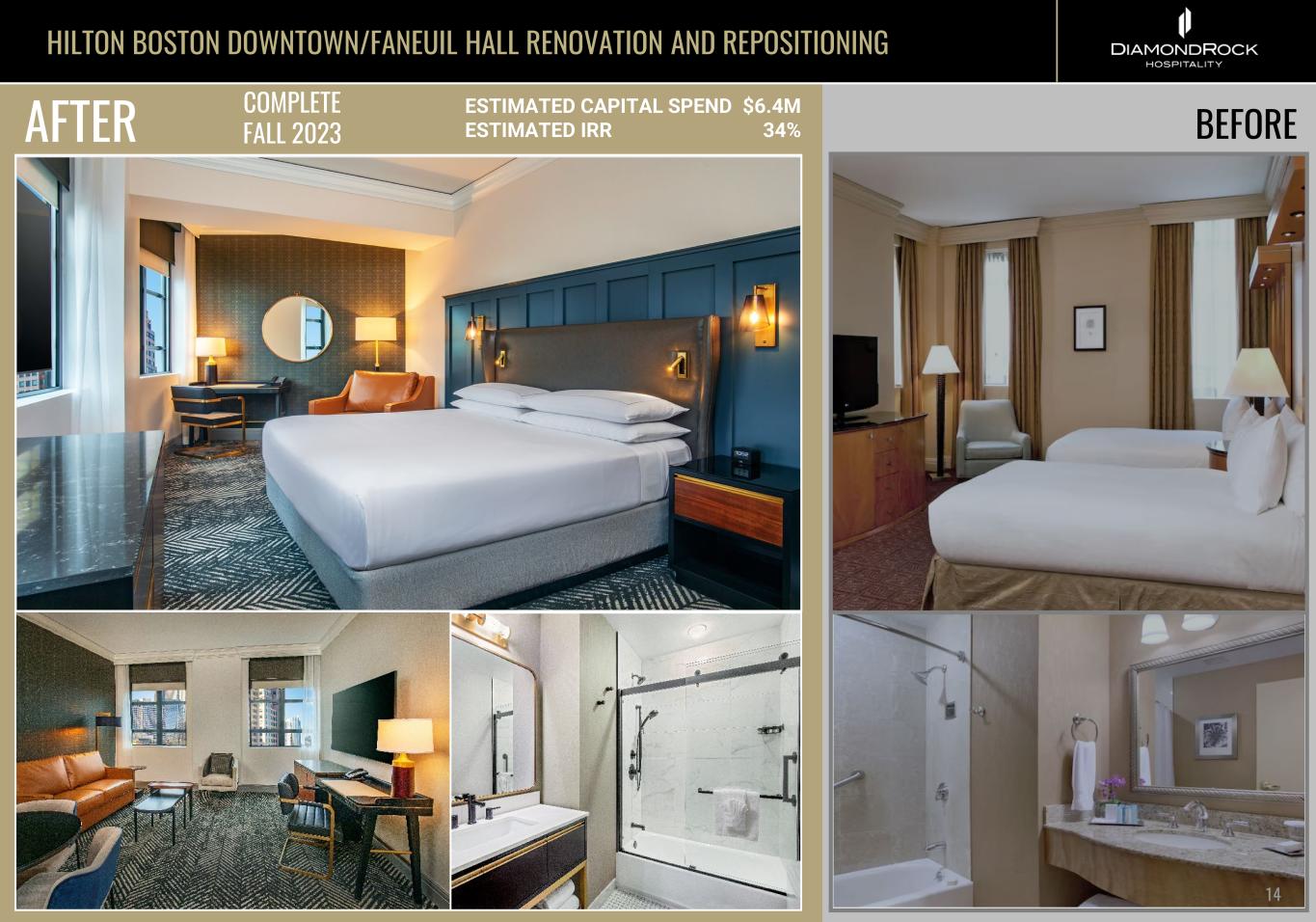

ROBUST ROI PIPELINE: $85MM+ OF ROI PROJECTS AT 40%+ IRR 13(1) Estimated Capital Spend and Estimated Incremental EBITDA based upon management proformas (2) Estimated IRRs are calculated assuming a 3-year stabilization period and a 10.0x terminal multiple PROPERTY PROJECT ESTIMATED CAPITAL SPEND1 UNDERWRITTEN INCREMENTAL EBITDA1 ESTIMATED IRR2 ESTIMATED COMPLETION LODGE AT SONOMA Autograph Collection Conversion $9.8 $1.4 25% Completed THE HYTHE, LUXURY COLLECTION Luxury Collection Conversion $8.4 $3.4 88% Completed HOTEL CLIO, LUXURY COLLECTION F&B and Public Space Renovation $2.5 $0.5 42% Completed Luxury Collection Conversion $3.6 $1.2 74% Completed MARGARITAVILLE BEACH HOUSE Rebranding $3.5 $1.3 82% Completed EMBASSY SUITES BETHESDA Brand Conversion $3.3 $0.5 28% Completed CHARLESTON RENAISSANCE F&B Repositioning $2.1 $0.5 52% Completed THE GWEN Rooftop Conversion $1.5 $0.3 42% Completed Recently Completed $34.7 $9.1 58% BOSTON HILTON Repositioning/Rebranding $6.4 $1.1 34% 2023 BURLINGTON HILTON Curio Brand Conversion $2.6 $0.8 68% 2023 F&B Repositioning $1.3 $0.4 68% 2023 KIMPTON FORT LAUDERDALE Rooftop Conversion $2.2 $0.3 23% 2023 HAVANA CABANA F&B Repositioning $1.1 $0.4 78% 2023 KIMPTON PALOMAR PHOENIX Rooftop Repositioning $3.7 $0.6 32% 2023 BOURBON ORLEANS Lobby/Pool/Retail/F&B Repositioning $8.8 $1.2 23% 2024 THE LANDING Additional 14 Keys $6.1 $1.2 42% 2024 ORCHARDS INN Resort Repositioning $19.8 $2.6 22% 2024 Total in Planning $52.0 $8.6 33% Recently Completed & $86.7 $17.7 44% Active ROI Pipeline

HILTON BOSTON DOWNTOWN/FANEUIL HALL RENOVATION AND REPOSITIONING AFTER BEFORE 14 ESTIMATED CAPITAL SPEND $6.4M ESTIMATED IRR 34% COMPLETE FALL 2023

POSITIVE MARKET OUTLOOK THE LODGE AT SONOMA, AUTOGRAPH COLLECTION

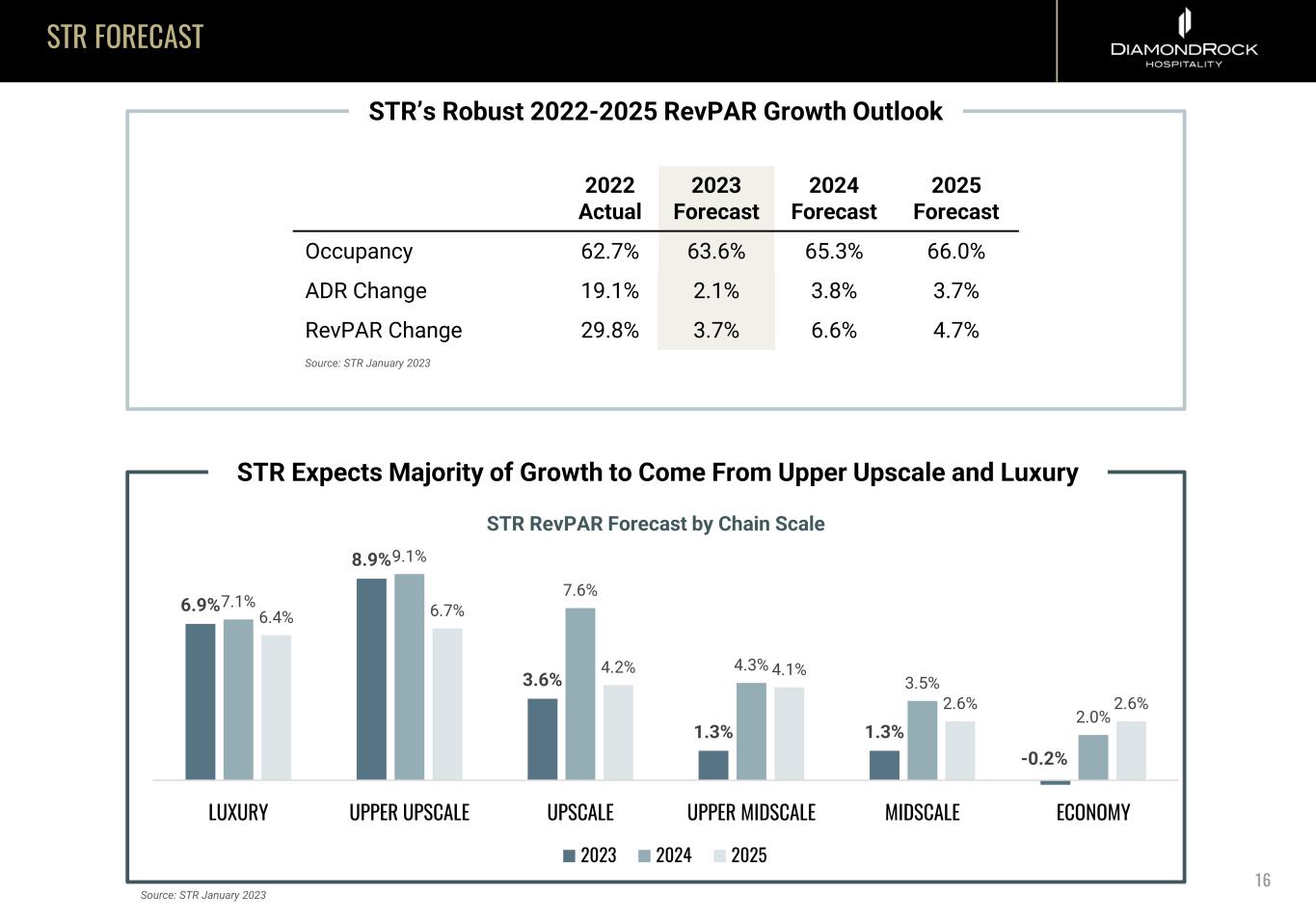

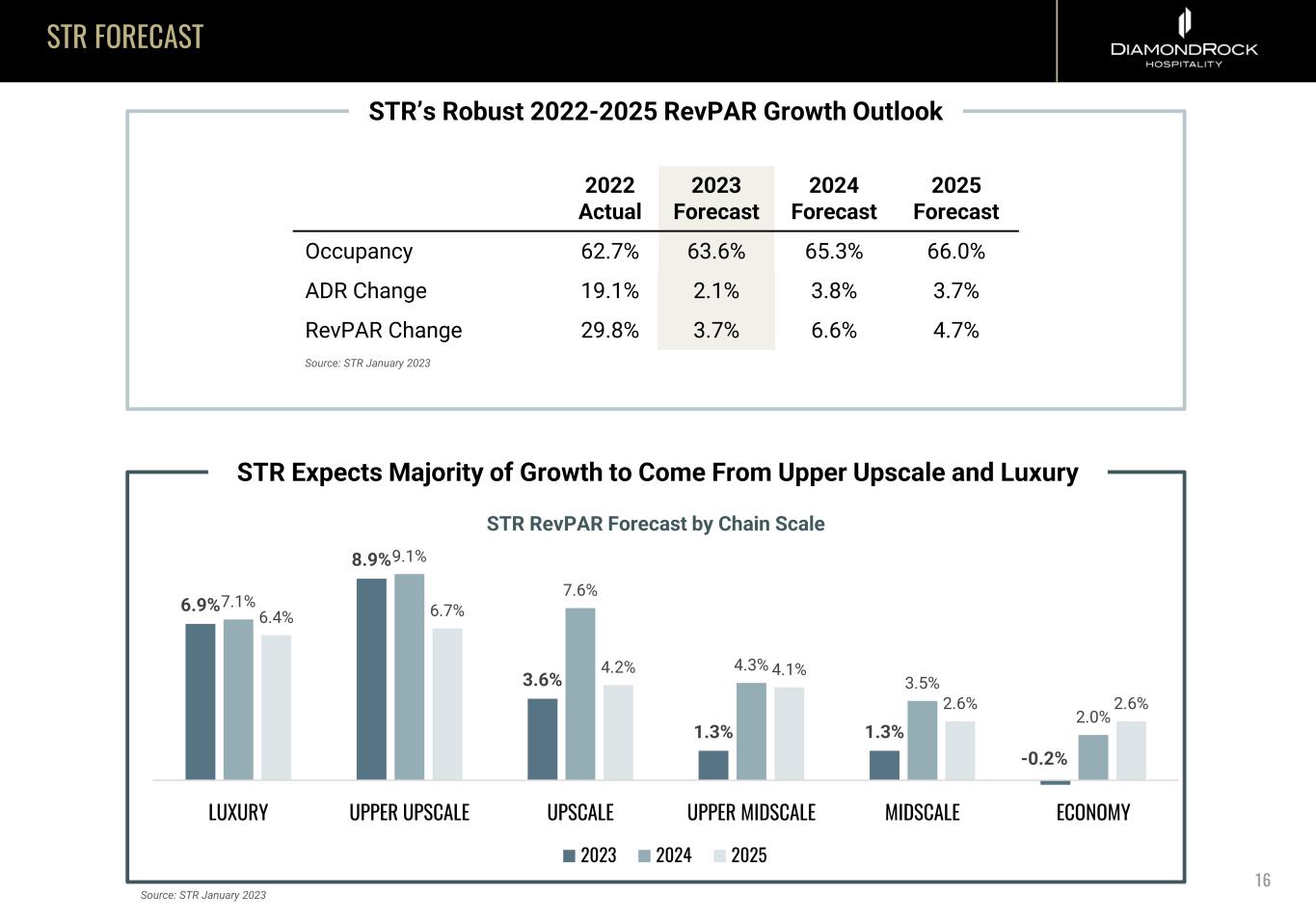

STR FORECAST STR’s Robust 2022-2025 RevPAR Growth Outlook 2022 Actual 2023 Forecast 2024 Forecast 2025 Forecast Occupancy 62.7% 63.6% 65.3% 66.0% ADR Change 19.1% 2.1% 3.8% 3.7% RevPAR Change 29.8% 3.7% 6.6% 4.7% 6.9% 8.9% 3.6% 1.3% 1.3% -0.2% 7.1% 9.1% 7.6% 4.3% 3.5% 2.0% 6.4% 6.7% 4.2% 4.1% 2.6% 2.6% LUXURY UPPER UPSCALE UPSCALE UPPER MIDSCALE MIDSCALE ECONOMY 2023 2024 2025 STR Expects Majority of Growth to Come From Upper Upscale and Luxury STR RevPAR Forecast by Chain Scale 16 Source: STR January 2023 Source: STR January 2023

DIVERSIFIED PORTFOLIO COURTYARD DENVER DOWNTOWN

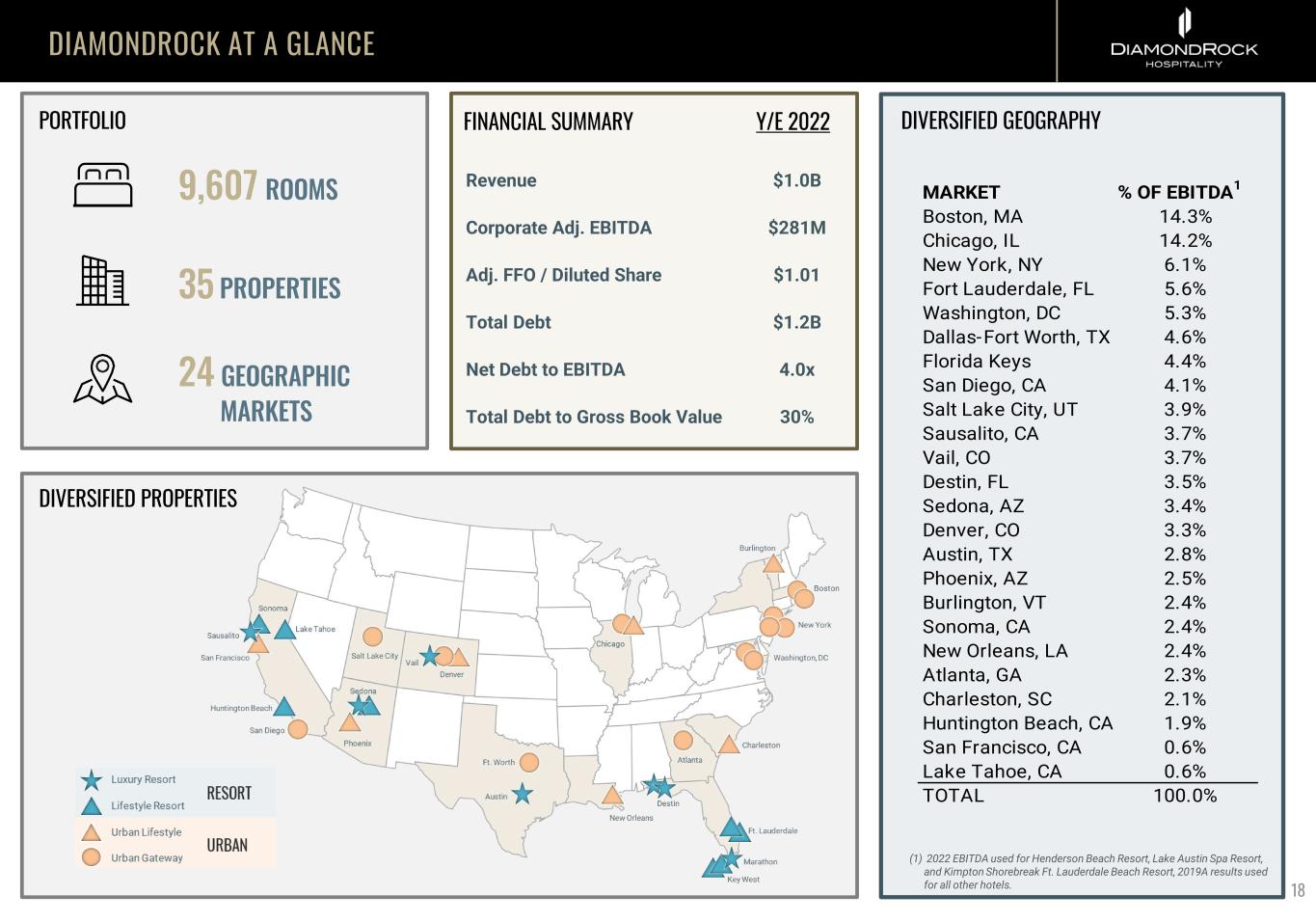

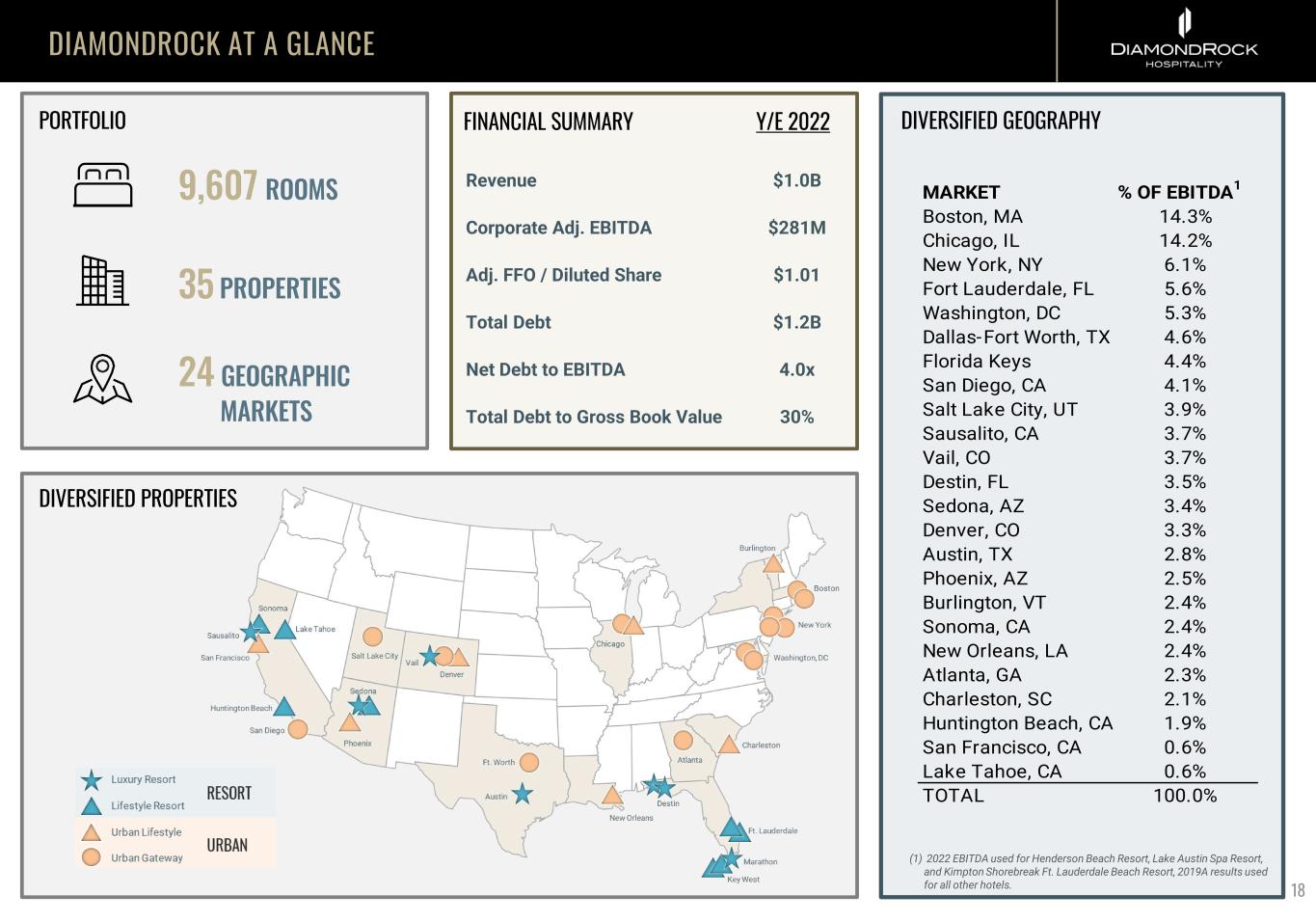

DIAMONDROCK AT A GLANCE 9,607 ROOMS 35 PROPERTIES 24 GEOGRAPHIC MARKETS DIVERSIFIED GEOGRAPHY 18 (1) 2022 EBITDA used for Henderson Beach Resort, Lake Austin Spa Resort, and Kimpton Shorebreak Ft. Lauderdale Beach Resort, 2019A results used for all other hotels. DIVERSIFIED PROPERTIES FINANCIAL SUMMARY Net Debt to EBITDA Total Debt $1.2B 4.0x Total Debt to Gross Book Value 30% Revenue $1.0B Corporate Adj. EBITDA $281M Y/E 2022PORTFOLIO MARKET % OF EBITDA1 Boston, MA 14.3% Chicago, IL 14.2% New York, NY 6.1% Fort Lauderdale, FL 5.6% Washington, DC 5.3% Dallas-Fort Worth, TX 4.6% Florida Keys 4.4% San Diego, CA 4.1% Salt Lake City, UT 3.9% Sausalito, CA 3.7% Vail, CO 3.7% Destin, FL 3.5% Sedona, AZ 3.4% Denver, CO 3.3% Austin, TX 2.8% Phoenix, AZ 2.5% Burlington, VT 2.4% Sonoma, CA 2.4% New Orleans, LA 2.4% Atlanta, GA 2.3% Charleston, SC 2.1% Huntington Beach, CA 1.9% San Francisco, CA 0.6% Lake Tahoe, CA 0.6% TOTAL 100.0% Adj. FFO / Diluted Share $1.01

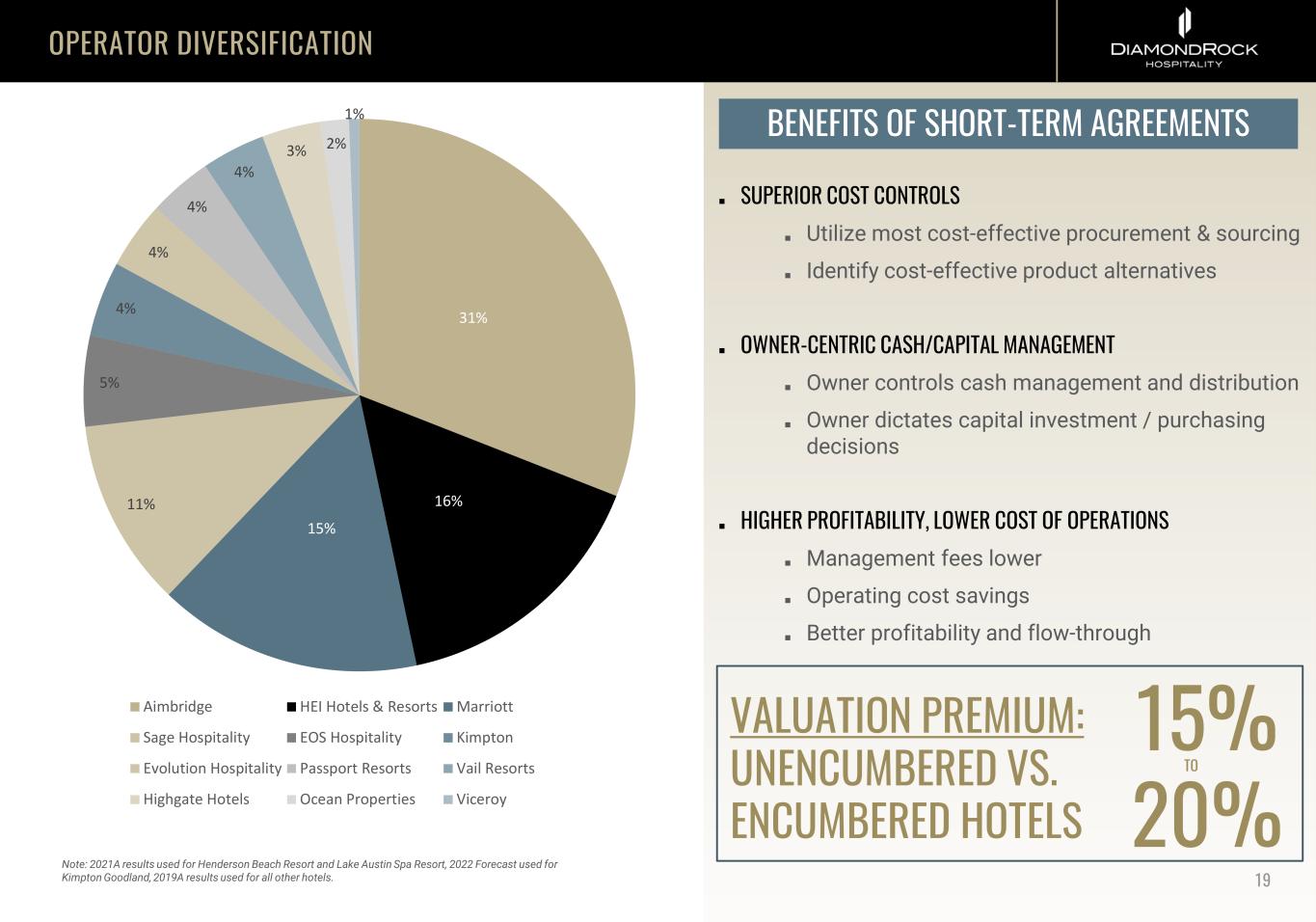

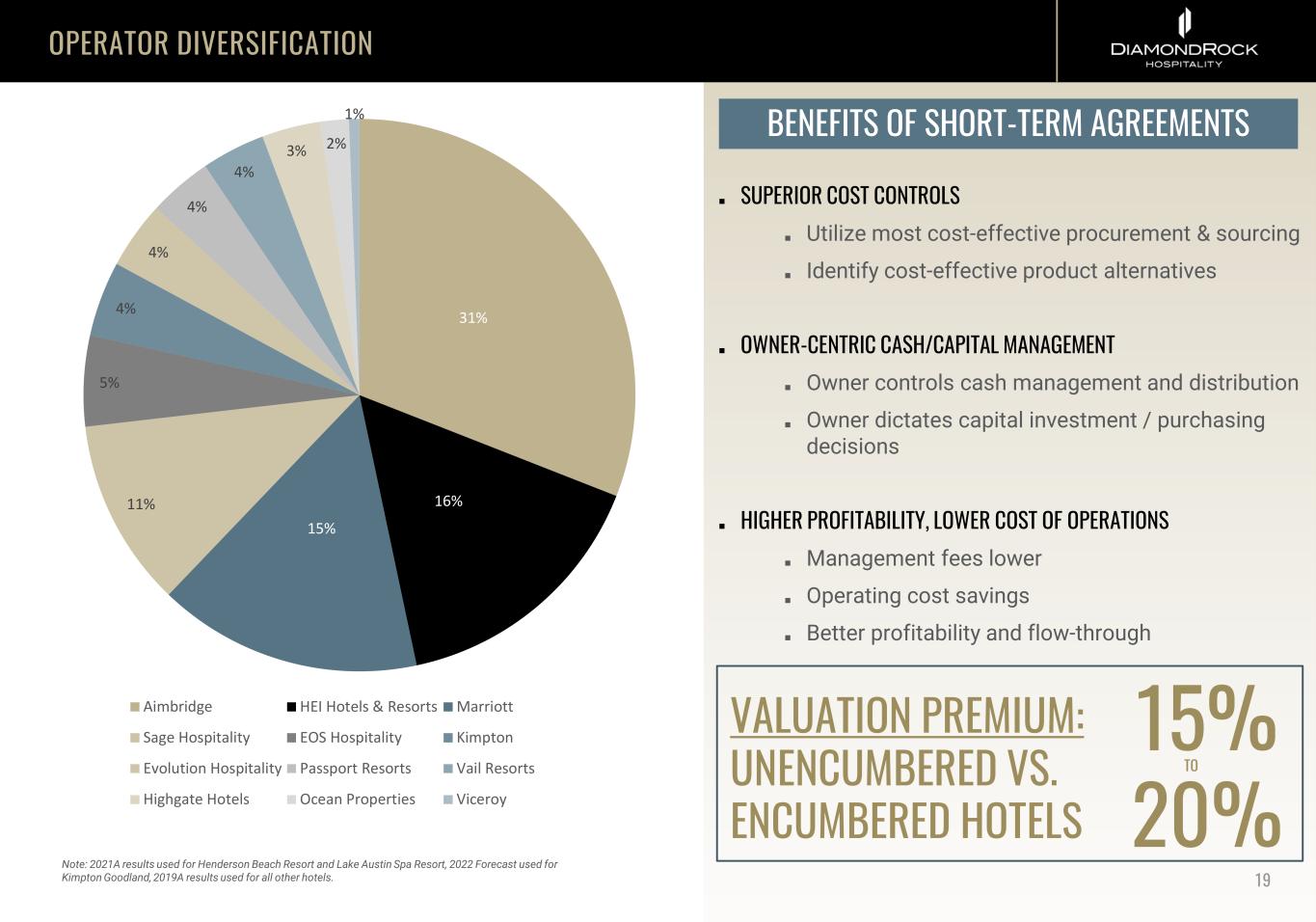

OPERATOR DIVERSIFICATION 19 BENEFITS OF SHORT-TERM AGREEMENTS ■ SUPERIOR COST CONTROLS ■ Utilize most cost-effective procurement & sourcing ■ Identify cost-effective product alternatives ■ OWNER-CENTRIC CASH/CAPITAL MANAGEMENT ■ Owner controls cash management and distribution ■ Owner dictates capital investment / purchasing decisions ■ HIGHER PROFITABILITY, LOWER COST OF OPERATIONS ■ Management fees lower ■ Operating cost savings ■ Better profitability and flow-through VALUATION PREMIUM: UNENCUMBERED VS. ENCUMBERED HOTELS 15% 20% TO 31% 16% 15% 11% 5% 4% 4% 4% 4% 3% 2% 1% Aimbridge HEI Hotels & Resorts Marriott Sage Hospitality EOS Hospitality Kimpton Evolution Hospitality Passport Resorts Vail Resorts Highgate Hotels Ocean Properties Viceroy Note: 2021A results used for Henderson Beach Resort and Lake Austin Spa Resort, 2022 Forecast used for Kimpton Goodland, 2019A results used for all other hotels.

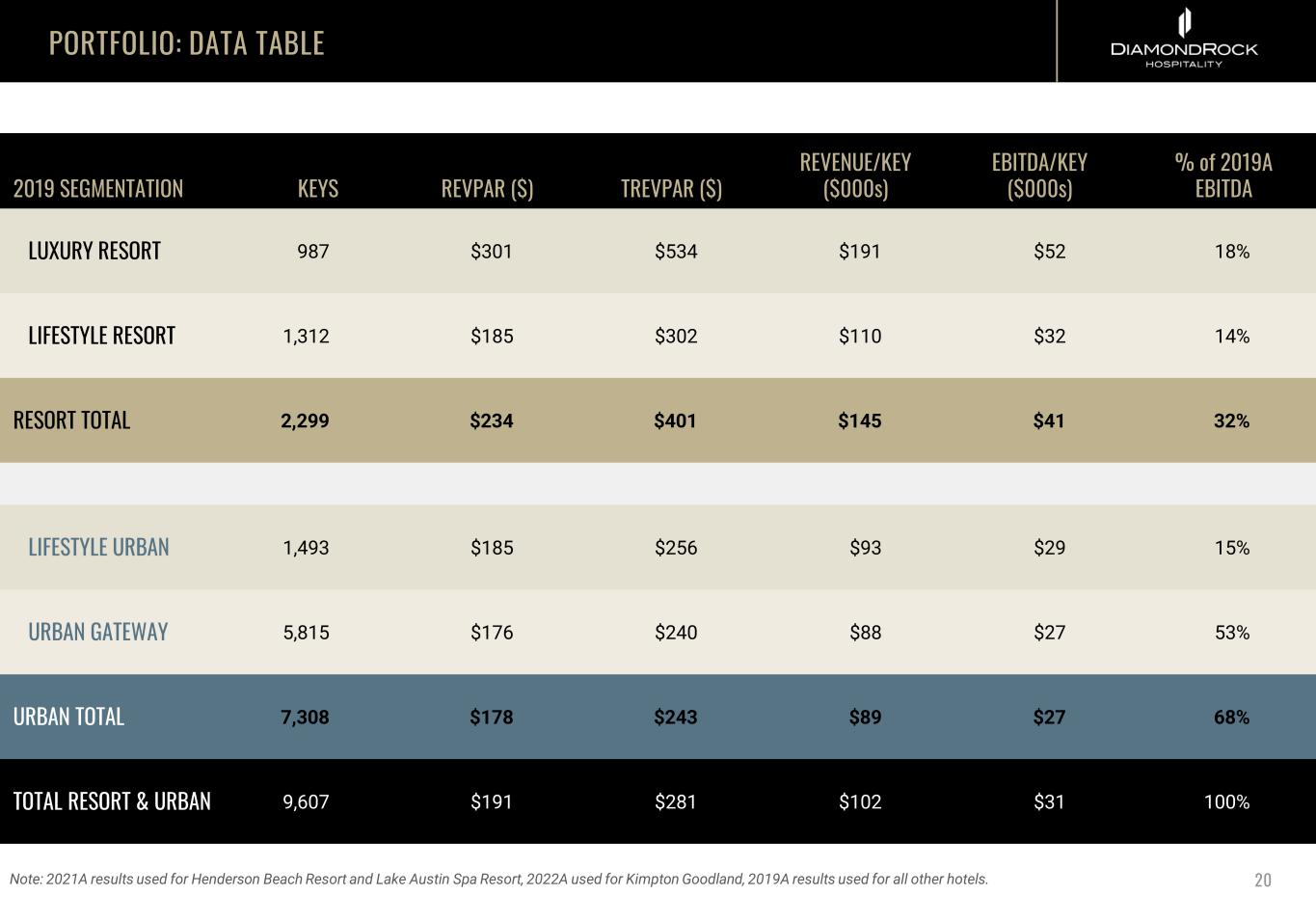

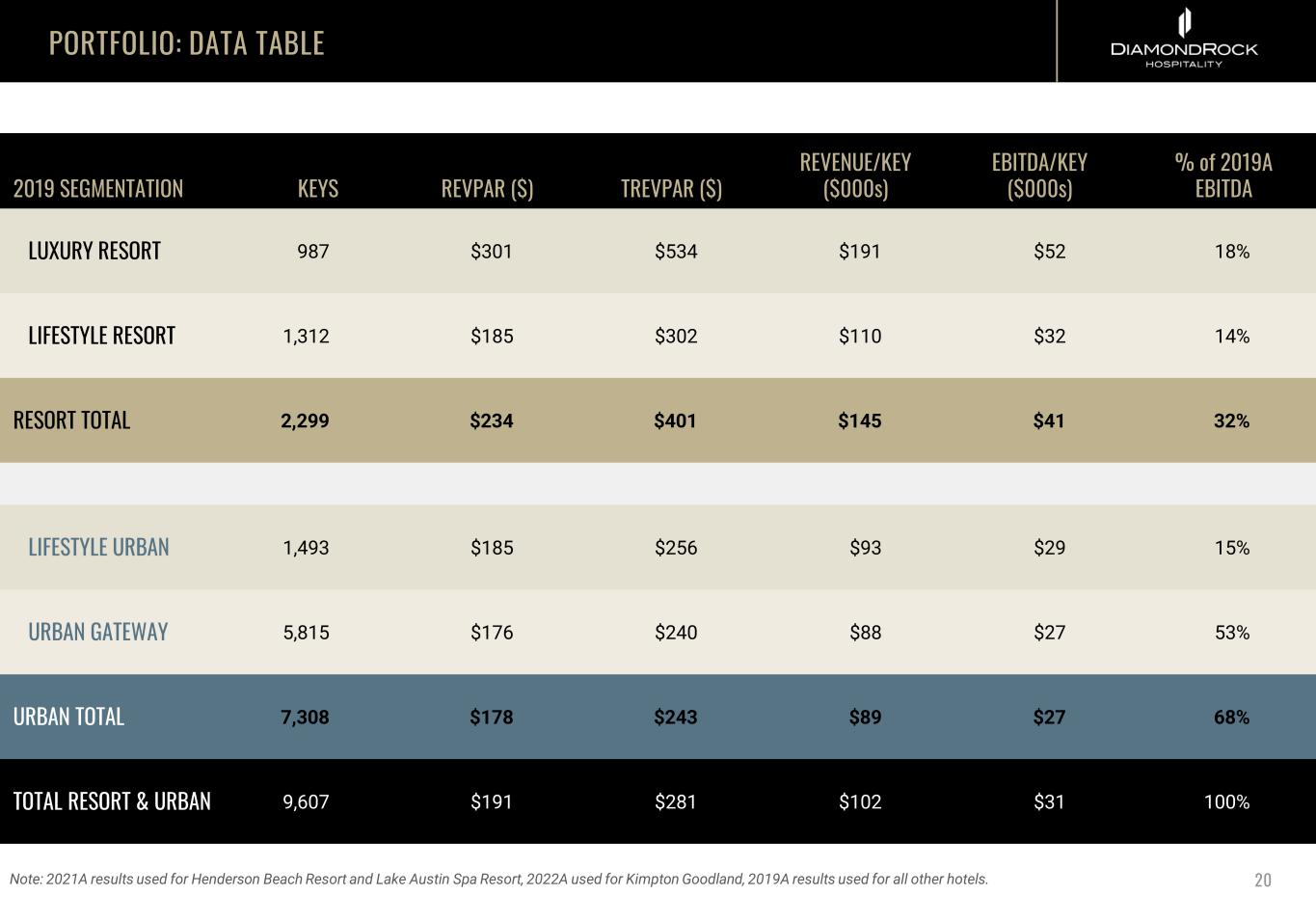

PORTFOLIO: DATA TABLE 20 20Note: 2021A results used for Henderson Beach Resort and Lake Austin Spa Resort, 2022A used for Kimpton Goodland, 2019A results used for all other hotels. 2019 SEGMENTATION KEYS REVPAR ($) TREVPAR ($) REVENUE/KEY ($000s) EBITDA/KEY ($000s) % of 2019A EBITDA LUXURY RESORT 987 $301 $534 $191 $52 18% LIFESTYLE RESORT 1,312 $185 $302 $110 $32 14% RESORT TOTAL 2,299 $234 $401 $145 $41 32% LIFESTYLE URBAN 1,493 $185 $256 $93 $29 15% URBAN GATEWAY 5,815 $176 $240 $88 $27 53% URBAN TOTAL 7,308 $178 $243 $89 $27 68% TOTAL RESORT & URBAN 9,607 $191 $281 $102 $31 100%

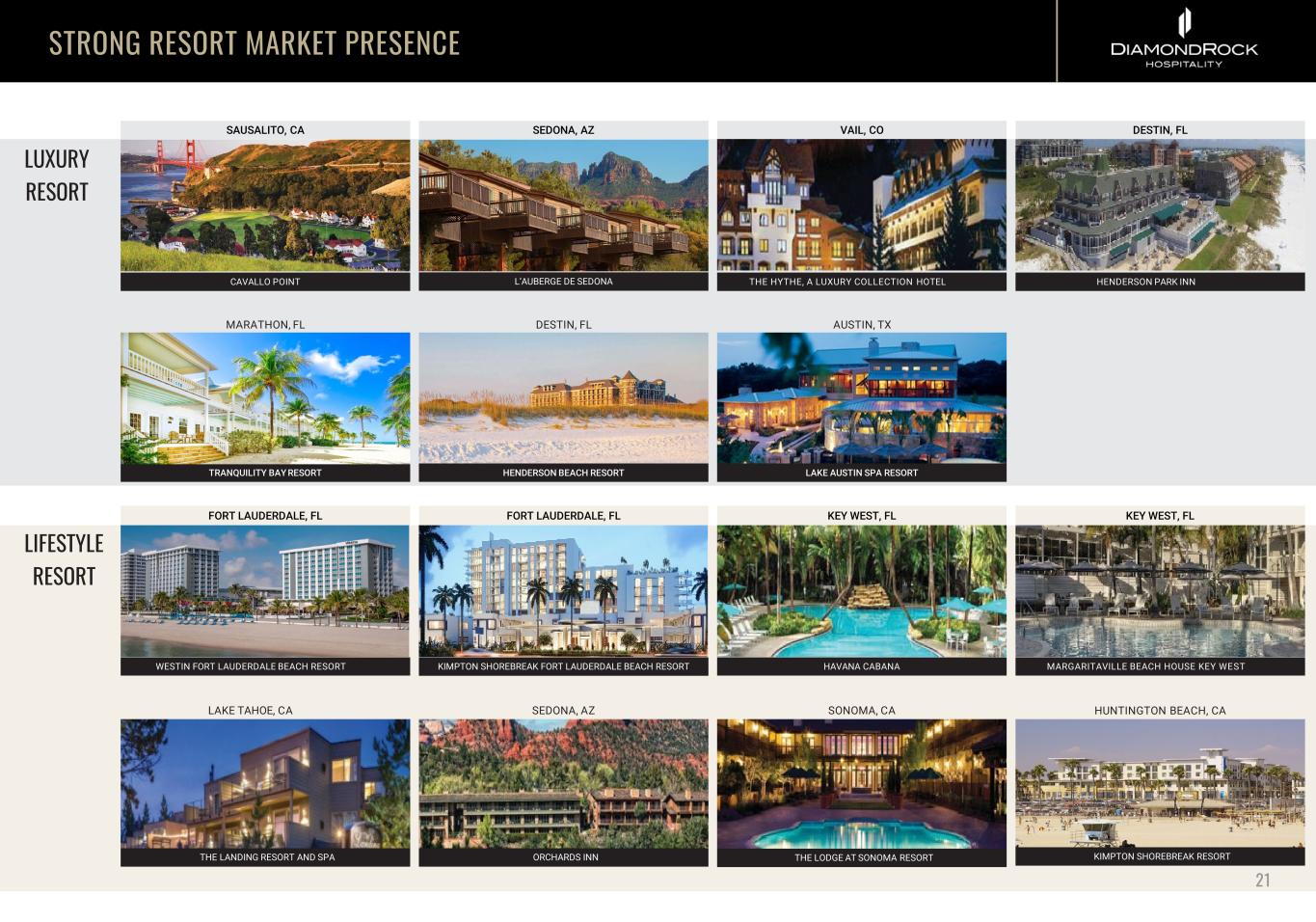

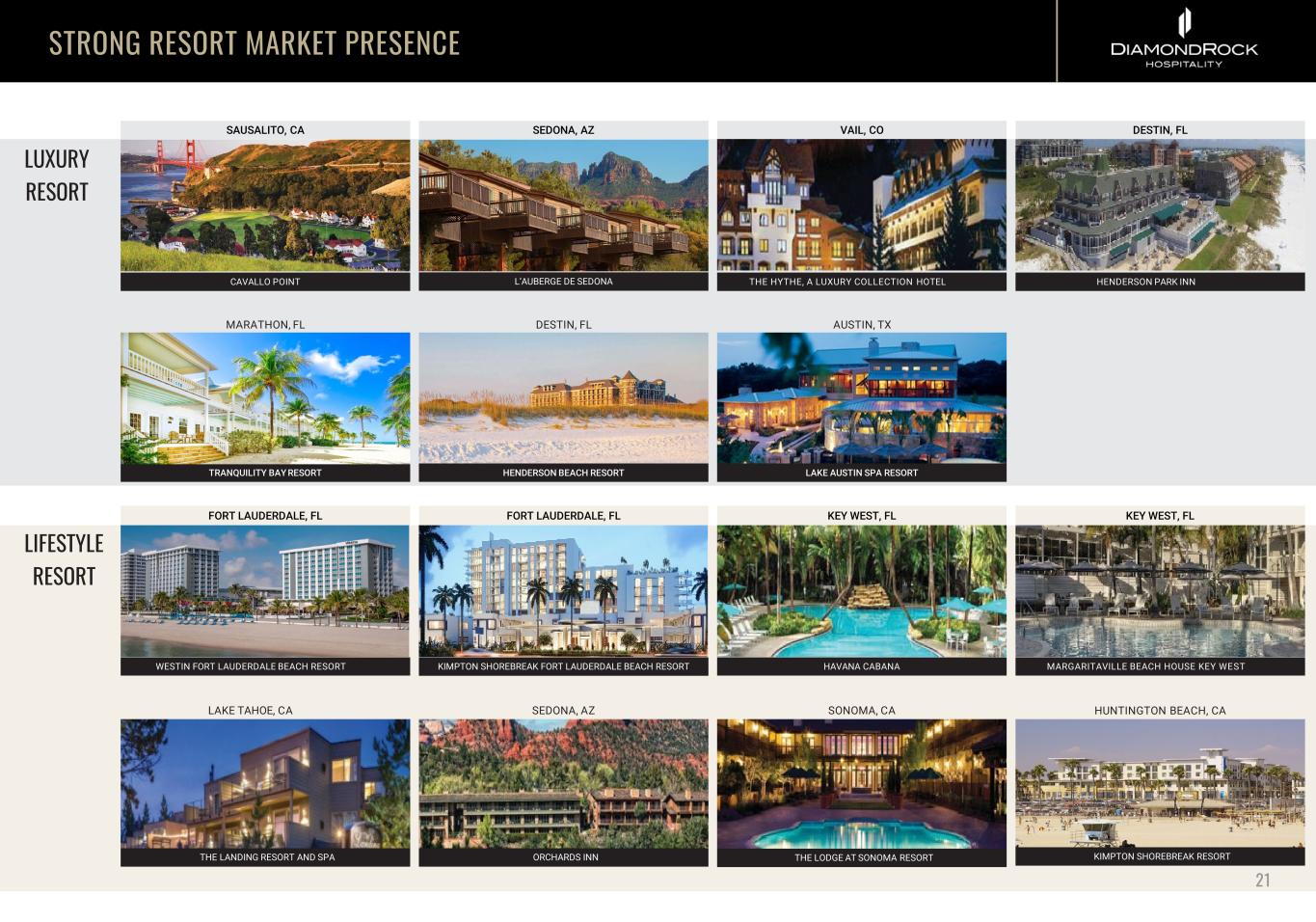

STRONG RESORT MARKET PRESENCE SAUSALITO, CA FORT LAUDERDALE, FL MARATHON, FL SEDONA, AZ DESTIN, FL CAVALLO POINT TRANQUILITY BAY RESORT VAIL, CO DESTIN, FL THE HYTHE, A LUXURY COLLECTION HOTEL HENDERSON PARK INN SEDONA, AZ SONOMA, CALAKE TAHOE, CA LUXURY RESORT LIFESTYLE RESORT THE LODGE AT SONOMA RESORT 21 L’AUBERGE DE SEDONA ORCHARDS INNTHE LANDING RESORT AND SPA KIMPTON SHOREBREAK RESORT HUNTINGTON BEACH, CA AUSTIN, TX WESTIN FORT LAUDERDALE BEACH RESORT HAVANA CABANA MARGARITAVILLE BEACH HOUSE KEY WEST HENDERSON BEACH RESORT LAKE AUSTIN SPA RESORT FORT LAUDERDALE, FL KEY WEST, FL KEY WEST, FL KIMPTON SHOREBREAK FORT LAUDERDALE BEACH RESORT

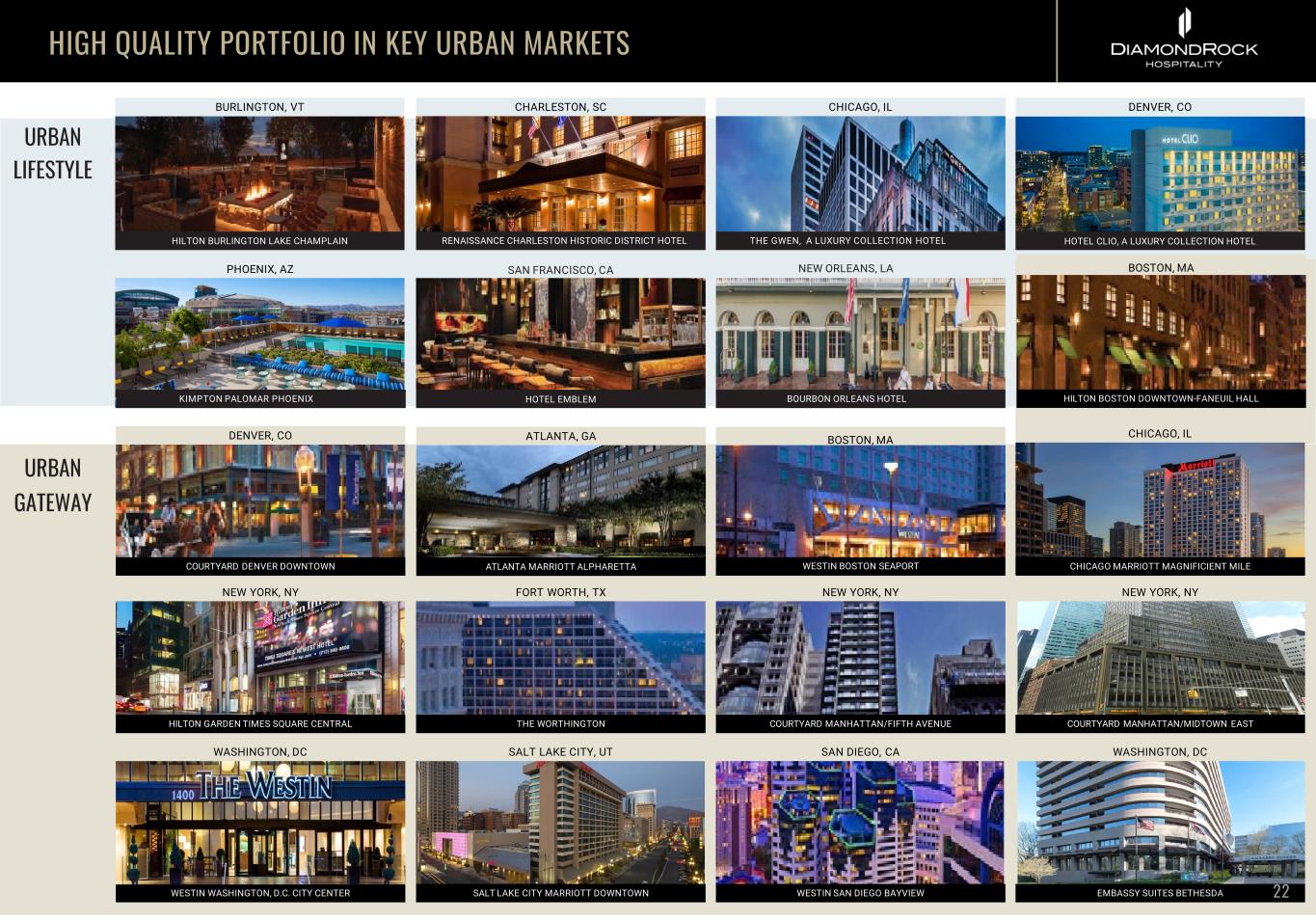

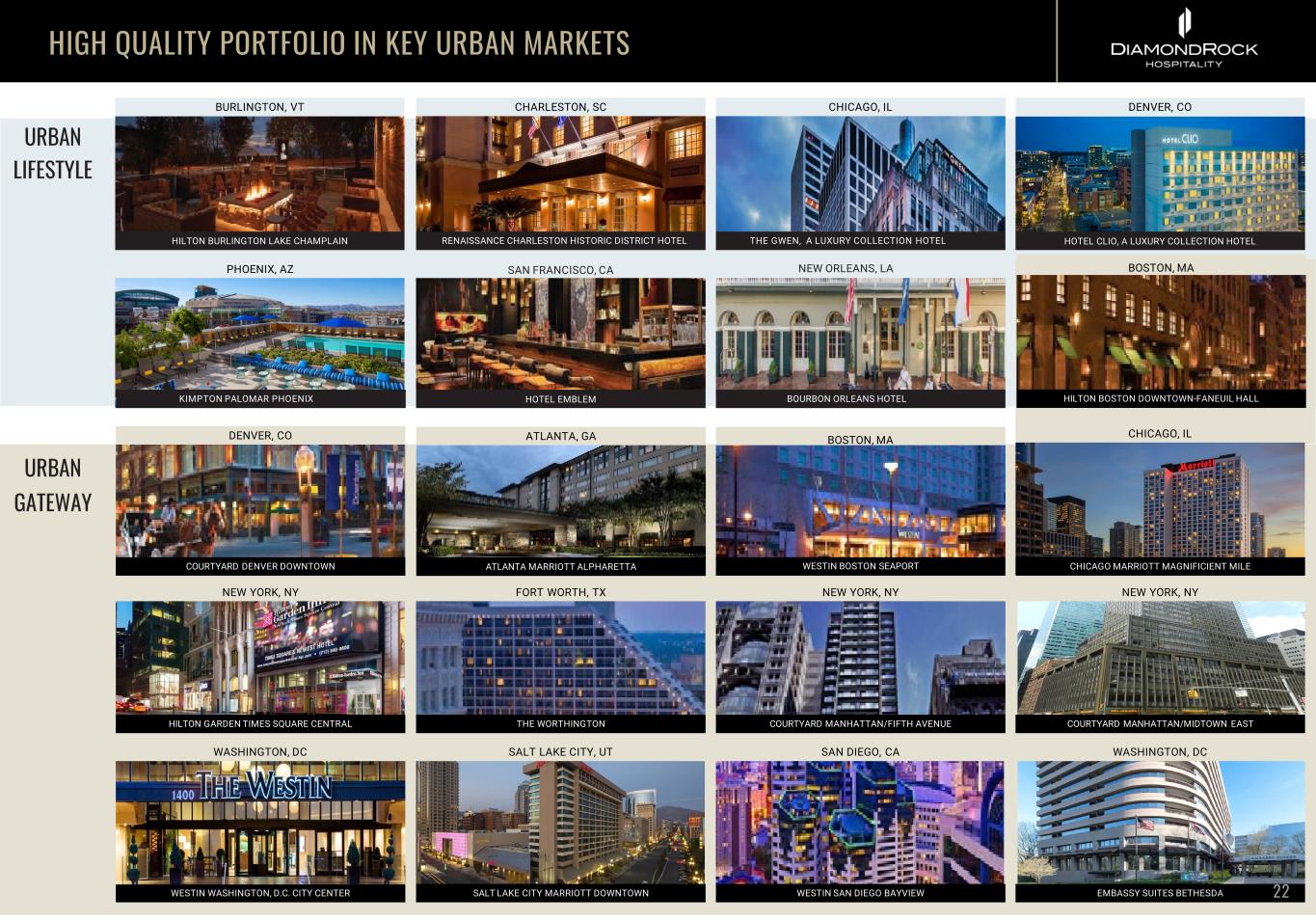

HIGH QUALITY PORTFOLIO IN KEY URBAN MARKETS DENVER, CO SAN DIEGO, CA COURTYARD DENVER DOWNTOWN WESTIN WASHINGTON, D.C. CITY CENTER WESTIN SAN DIEGO BAYVIEW URBAN GATEWAY SALT LAKE CITY, UT SALT LAKE CITY MARRIOTT DOWNTOWN URBAN LIFESTYLE BOURBON ORLEANS HOTELHOTEL EMBLEM HILTON BURLINGTON LAKE CHAMPLAIN KIMPTON PALOMAR PHOENIX NEW YORK, NY HILTON GARDEN TIMES SQUARE CENTRAL WASHINGTON, DC EMBASSY SUITES BETHESDA WASHINGTON, DC RENAISSANCE CHARLESTON HISTORIC DISTRICT HOTEL THE GWEN, A LUXURY COLLECTION HOTEL HOTEL CLIO, A LUXURY COLLECTION HOTEL THE WORTHINGTON COURTYARD MANHATTAN/FIFTH AVENUE COURTYARD MANHATTAN/MIDTOWN EAST FORT WORTH, TX NEW YORK, NYNEW YORK, NY CHICAGO MARRIOTT MAGNIFICIENT MILE BOSTON, MA BOSTON, MA HILTON BOSTON DOWNTOWN-FANEUIL HALL WESTIN BOSTON SEAPORT 22 CHICAGO, IL BURLINGTON, VT CHARLESTON, SC DENVER, COCHICAGO, IL PHOENIX, AZ SAN FRANCISCO, CA NEW ORLEANS, LA ATLANTA MARRIOTT ALPHARETTA ATLANTA, GA

ESG FOCUS THE LANDING LAKE TAHOE

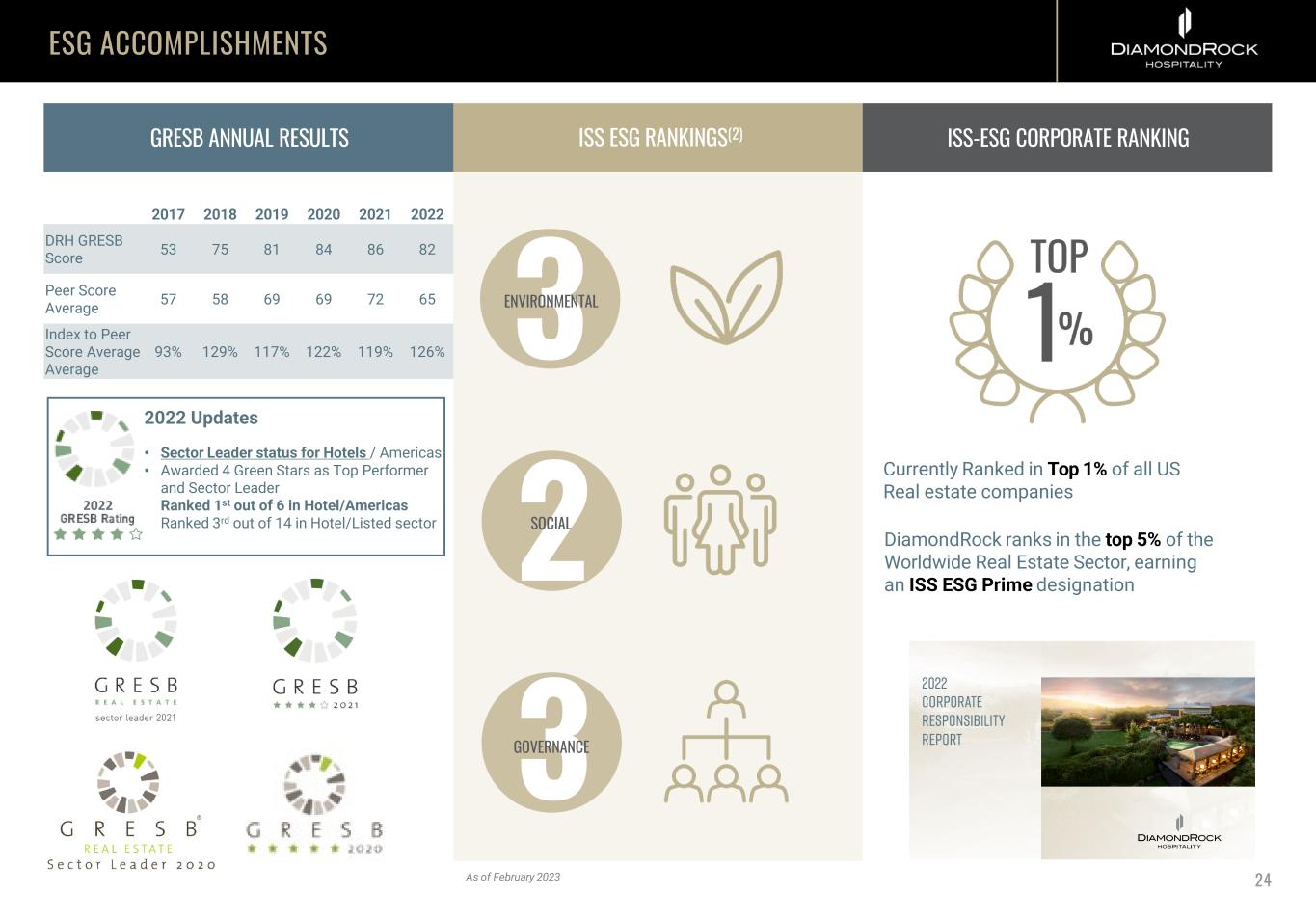

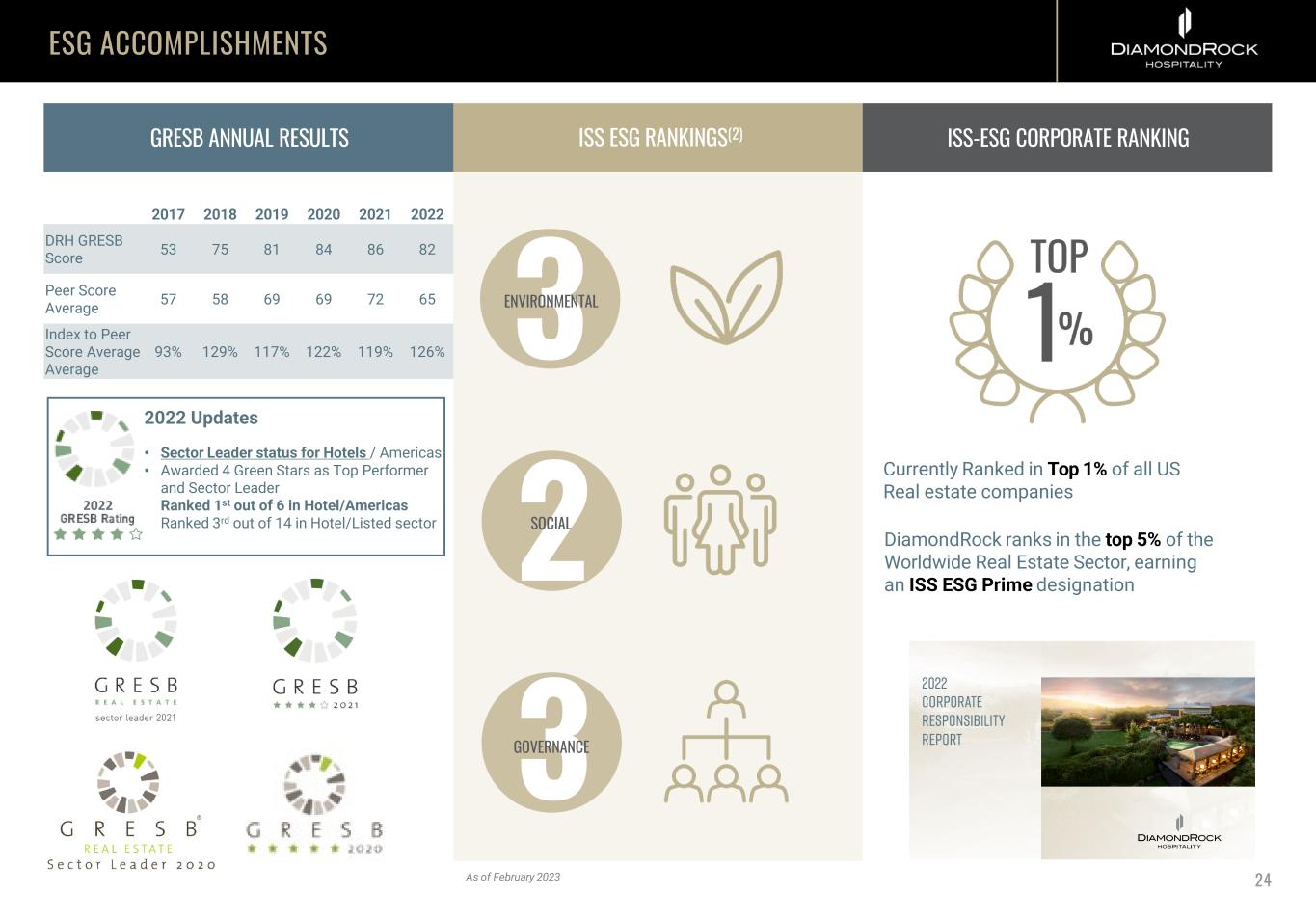

ISS ESG RANKINGS(2) ISS-ESG CORPORATE RANKING Currently Ranked in Top 1% of all US Real estate companies DiamondRock ranks in the top 5% of the Worldwide Real Estate Sector, earning an ISS ESG Prime designation 3ENVIRONMENTAL 2SOCIAL 3GOVERNANCE GRESB ANNUAL RESULTS 2017 2018 2019 2020 2021 2022 DRH GRESB Score 53 75 81 84 86 82 Peer Score Average 57 58 69 69 72 65 Index to Peer Score Average Average 93% 129% 117% 122% 119% 126% ESG ACCOMPLISHMENTS 24As of February 2023 2022 Updates • Sector Leader status for Hotels / Americas • Awarded 4 Green Stars as Top Performer and Sector Leader • Ranked 1st out of 6 in Hotel/Americas • Ranked 3rd out of 14 in Hotel/Listed sector 2022

SEASONED MANAGEMENT TEAM THE HYTHE, A LUXURY COLLECTION HOTEL

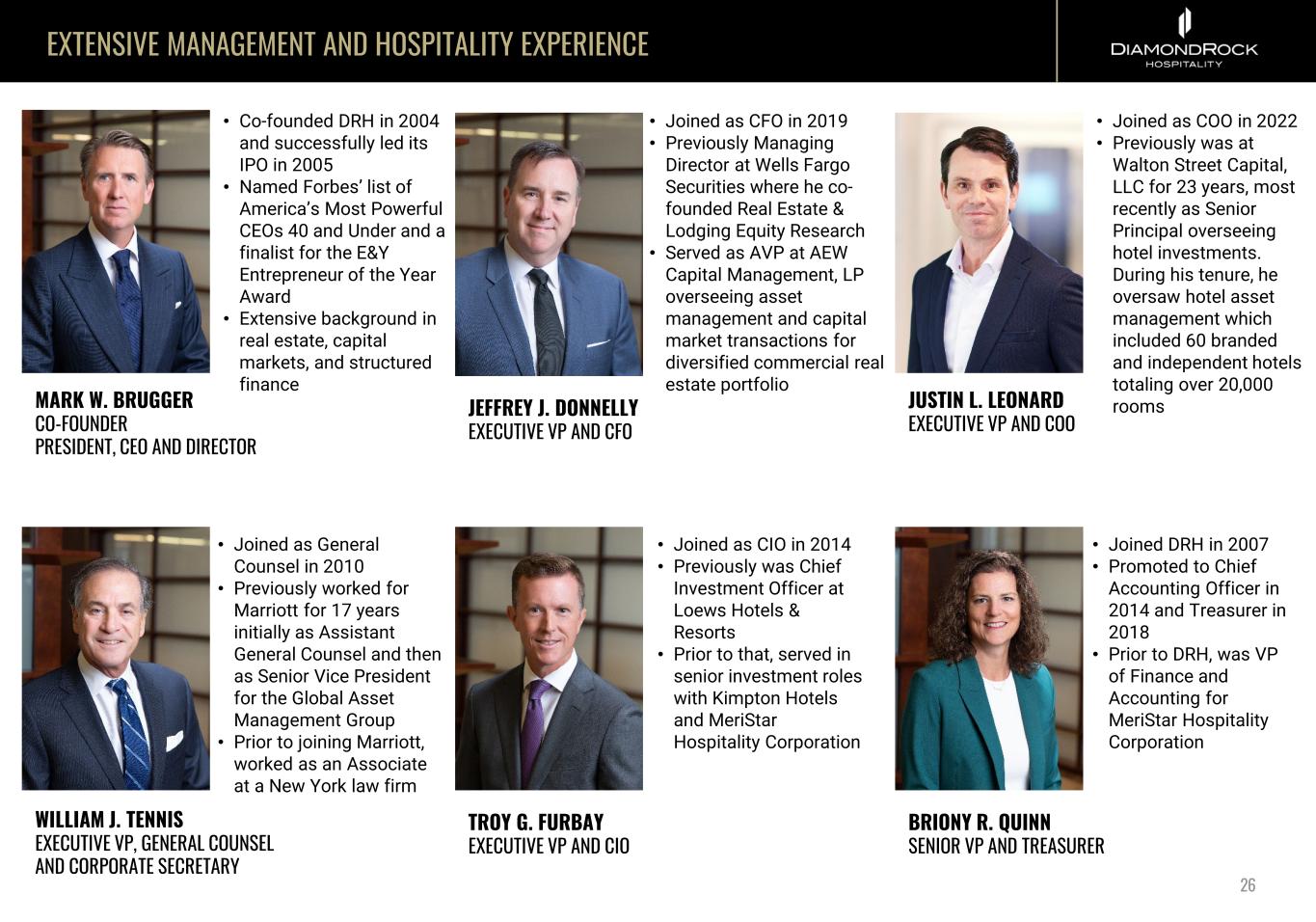

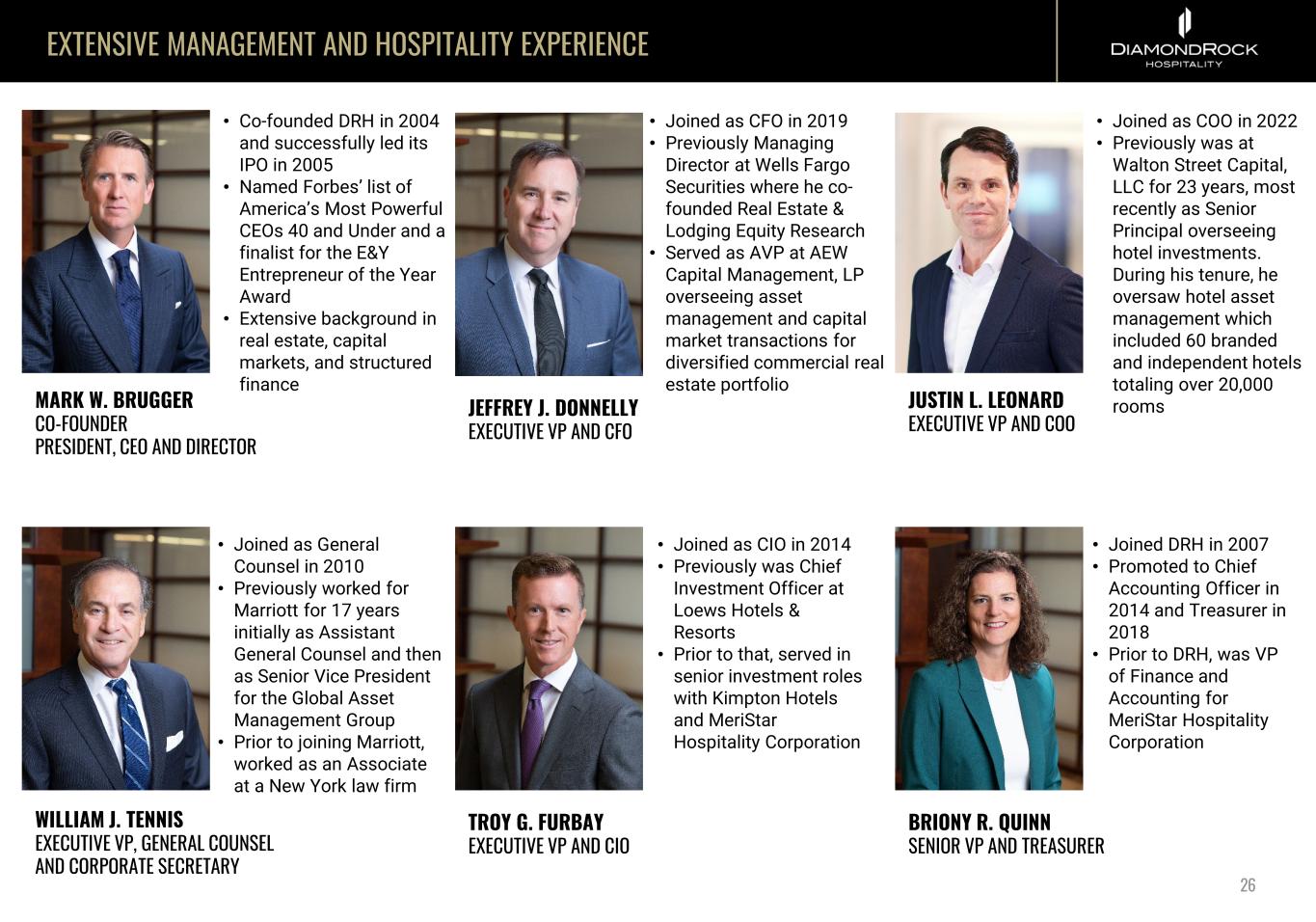

EXTENSIVE MANAGEMENT AND HOSPITALITY EXPERIENCE MARK W. BRUGGER CO-FOUNDER PRESIDENT, CEO AND DIRECTOR • Co-founded DRH in 2004 and successfully led its IPO in 2005 • Named Forbes’ list of America’s Most Powerful CEOs 40 and Under and a finalist for the E&Y Entrepreneur of the Year Award • Extensive background in real estate, capital markets, and structured finance JEFFREY J. DONNELLY EXECUTIVE VP AND CFO JUSTIN L. LEONARD EXECUTIVE VP AND COO WILLIAM J. TENNIS EXECUTIVE VP, GENERAL COUNSEL AND CORPORATE SECRETARY TROY G. FURBAY EXECUTIVE VP AND CIO BRIONY R. QUINN SENIOR VP AND TREASURER 26 • Joined as CFO in 2019 • Previously Managing Director at Wells Fargo Securities where he co- founded Real Estate & Lodging Equity Research • Served as AVP at AEW Capital Management, LP overseeing asset management and capital market transactions for diversified commercial real estate portfolio • Joined as COO in 2022 • Previously was at Walton Street Capital, LLC for 23 years, most recently as Senior Principal overseeing hotel investments. During his tenure, he oversaw hotel asset management which included 60 branded and independent hotels totaling over 20,000 rooms • Joined as General Counsel in 2010 • Previously worked for Marriott for 17 years initially as Assistant General Counsel and then as Senior Vice President for the Global Asset Management Group • Prior to joining Marriott, worked as an Associate at a New York law firm • Joined as CIO in 2014 • Previously was Chief Investment Officer at Loews Hotels & Resorts • Prior to that, served in senior investment roles with Kimpton Hotels and MeriStar Hospitality Corporation • Joined DRH in 2007 • Promoted to Chief Accounting Officer in 2014 and Treasurer in 2018 • Prior to DRH, was VP of Finance and Accounting for MeriStar Hospitality Corporation