Filed by Trulia, Inc.

Pursuant to Rule 425 Under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Market Leader, Inc.

Commission File No.: 000-51032

|

| ||||

truliaR

Investor Presentation

May 2013

Important Information

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern Trulia’s expectations, strategy, plans or intentions. Trulia’s expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected, including but not limited to: the risk that Market Leader shareholders may fail to adopt the merger agreement; the risk that required governmental approvals for the merger will not be obtained; the risk that Trulia and Market Leader will be unable to consummate the merger on the terms set forth in the merger agreement for any reason; the risk that the businesses will not be integrated successfully; the risk that synergies will not be realized or realized to the extent anticipated; the risk that Trulia following merger will not realize on its financing or operating strategies; the risk that litigation in respect of either company or the merger could arise; and the risk that disruption caused by the merger that make it difficult to maintain certain strategic relationships.

The forward-looking statements contained in this presentation are also subject to other risks and uncertainties, including those more fully described in Trulia’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2012, which was filed with the Securities and Exchange Commission on March 4, 2013 and those that will be discussed in the Registration Statement on Form S-4 to be filed by Trulia with the Securities and Exchange Commission at a future date. The forward-looking statements in this presentation are based on information available to Trulia as of the date hereof, and Trulia disclaims any obligation to update any forward-looking statements, except as required by law.

This presentation is being made in respect of a proposed business combination involving Trulia and Market Leader. In connection with the proposed transaction, Trulia will file with the Securities and Exchange Commission a Registration Statement on Form S-4 that includes the preliminary proxy statement of Market Leader and that will also constitute a prospectus of Trulia. The information in the preliminary proxy statement/prospectus is not complete and may be changed. Trulia may not sell the common stock referenced in the preliminary proxy statement/prospectus until the Registration Statement on Form S-4 filed with the Securities and Exchange Commission becomes effective. The preliminary proxy statement/prospectus and this presentation are not offers to sell Trulia securities and are not soliciting an offer to buy Trulia securities in any state where the offer and sale is not permitted.

The definitive proxy statement/prospectus will be mailed to shareholders of Market Leader . TRULIA AND MARKET LEADER URGE INVESTORS AND SECURITY HOLDERS TO READ THE DEFINITIVE PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION.

Investors and security holders will be able to obtain free copies of the Registration Statement on Form S-4 and proxy statement/prospectus (when available) and other documents filed with the Securities and Exchange Commission by Trulia through the web site maintained by the Securities and Exchange Commission at www.sec.gov. Free copies of the Registration Statement on Form S-4 and definitive proxy statement/prospectus (when available) and other documents filed with the Securities and Exchange Commission can also be obtained on Trulia’s website at www.trulia.com.

Trulia, Market Leader and their respective directors, executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding these persons who may, under the rules of the Securities and Exchange Commission, be considered participants in the solicitation of Market Leader shareholders in connection with the proposed transaction will be set forth in the proxy statement/prospectus described above when it is filed with the Securities and Exchange Commission. Additional information regarding Trulia’s executive officers and directors is included in Trulia’s definitive proxy statement, which was filed with the Securities and Exchange Commission on April 29, 2013, and additional information regarding Market Leader’s executive officers and directors is included in Market Leader’s definitive proxy statement, which was filed with the Securities and Exchange Commission on April 15, 2013. You can obtain free copies of these documents from Trulia or Market Leader using the contact information above.

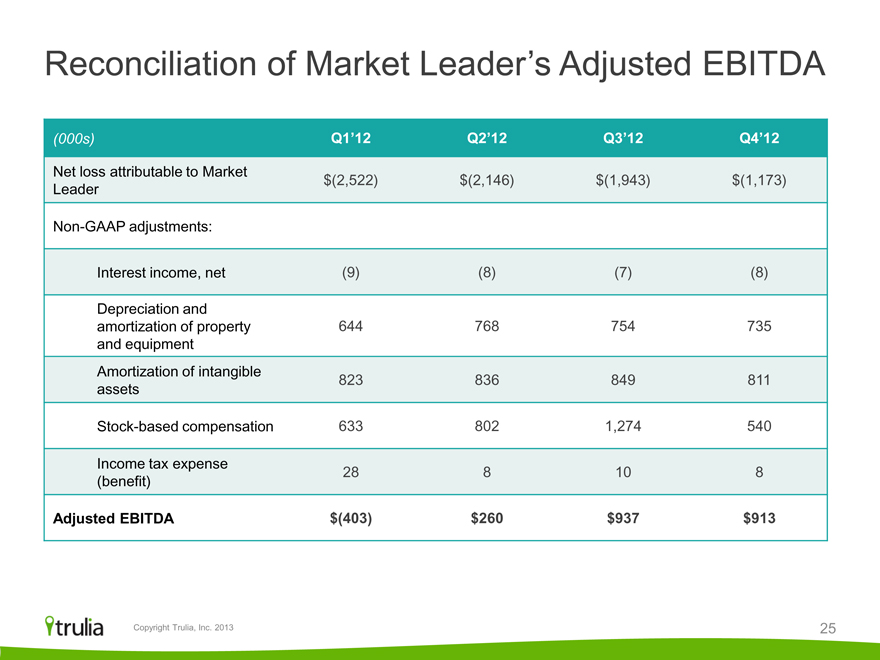

This presentation also contains Adjusted EBITDA of Market Leader, which is a non-GAAP financial measure. Market Leader defines Adjusted EBITDA as net loss available to shareholders adjusted to exclude other income/(expense), depreciation and amortization, loss on asset disposition, contract termination charges, net loss attributable to noncontrolling interest and stock-based compensation. Adjusted EBITDA excludes these items as they are often excluded by other companies to help investors understand the operational performance of their business, and in the case of stock-based compensation, can be difficult to predict. Trulia and Market Leader believe these adjustments provide useful comparative information to investors.

Trulia and Market Leader also consider this non-GAAP financial measure to be important because it provides a useful measure of the operating performance of Market Leader and is used by Trulia and Market Leader’s management for that purpose. In addition, investors often use similar measures to evaluate the operating performance of a company. Non-GAAP results are presented for supplemental informational purposes only for understanding Market Leader’s operating results. The non-GAAP results should not be considered a substitute for financial information presented in accordance with generally accepted accounting principles, and may be different from non- GAAP measures used by other companies. A reconciliation of Adjusted EBITDA to net loss is available in the Appendix to this presentation.

trulia Copyright Trulia, Inc. 2013 2

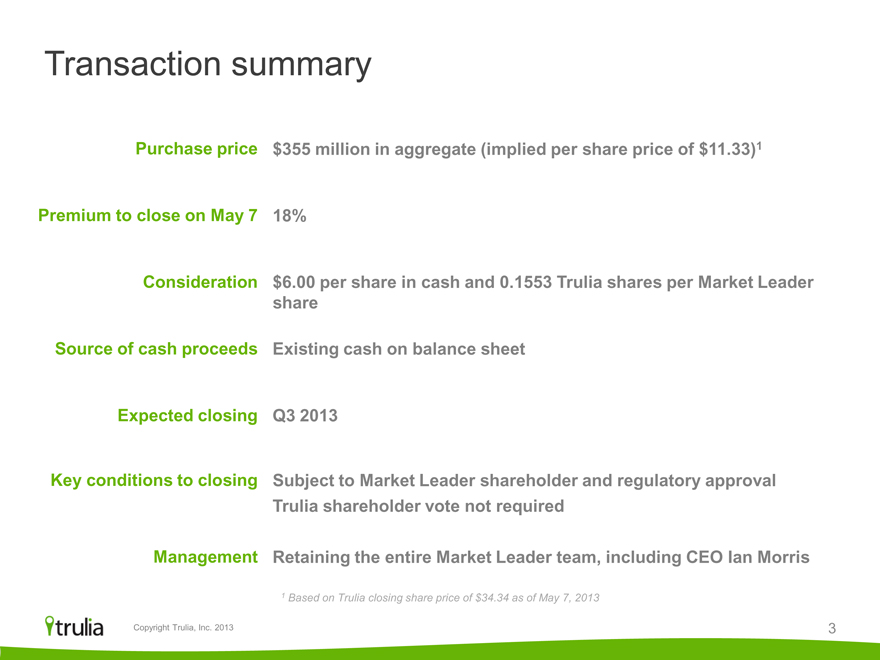

Transaction summary

Purchase price $355 million in aggregate (implied per share price of $11.33)1

Premium to close on May 7 18%

Consideration $6.00 per share in cash and 0.1553 Trulia shares per Market Leader share

Source of cash proceeds Existing cash on balance sheet

Expected closing Q3 2013

Key conditions to closing Subject to Market Leader shareholder and regulatory approval

Trulia shareholder vote not required

Management Retaining the entire Market Leader team, including CEO Ian Morris

1 Based on Trulia closing share price of $34.34 as of May 7, 2013

trulia Copyright Trulia, Inc. 2013 3

Comprehensive platform for consumers and the real estate industry

trulia

Leading marketplace

+

market leaderR

Leading SaaS

operating system

trulia Copyright Trulia, Inc. 2013 4

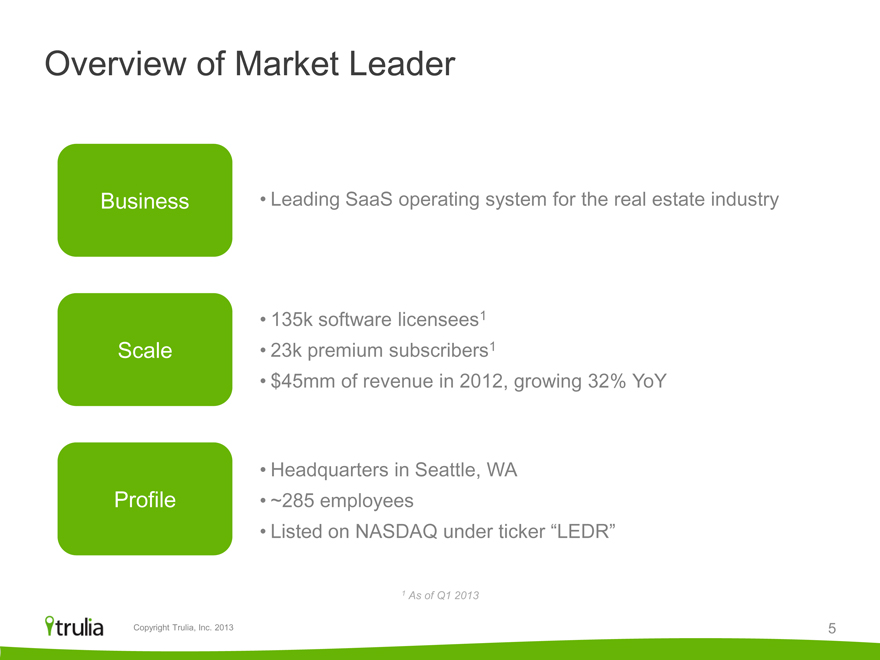

Overview of Market Leader

Business • Leading SaaS operating system for the real estate industry

• 135k software licensees1

Scale • 23k premium subscribers1

• $45mm of revenue in 2012, growing 32% YoY

• Headquarters in Seattle, WA

Profile • ~285 employees

• Listed on NASDAQ under ticker “LEDR”

1 As of Q1 2013

trulia Copyright Trulia, Inc. 2013 5

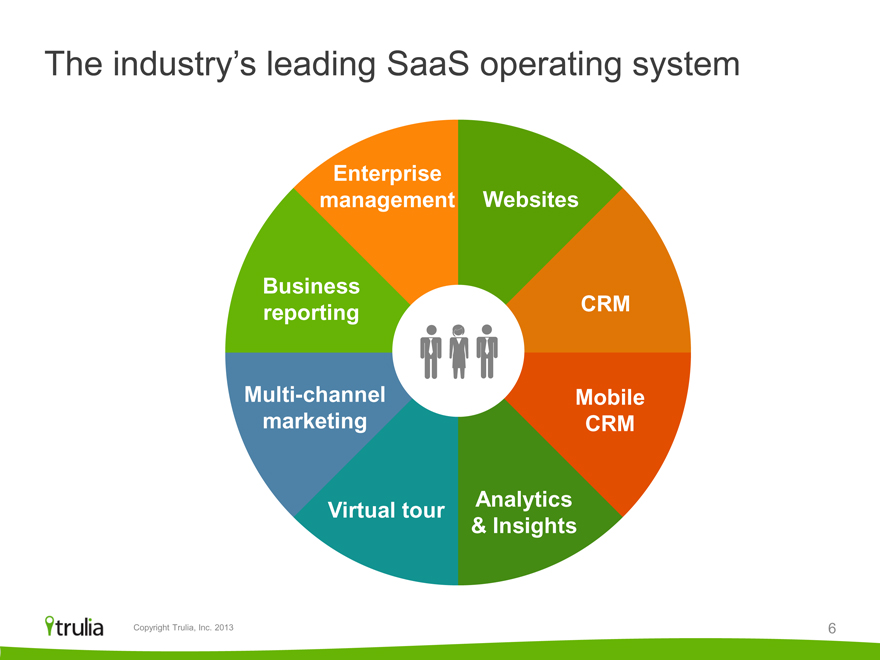

The industry’s leading SaaS operating system

Enterprise management

Business reporting

Multi-channel marketing

Virtual tour

Analytics

& Insights

Mobile CRM

CRM

Websites

trulia Copyright Trulia, Inc. 2013 6

Highly fragmented industry

trulia Copyright Trulia, Inc. 2013 7

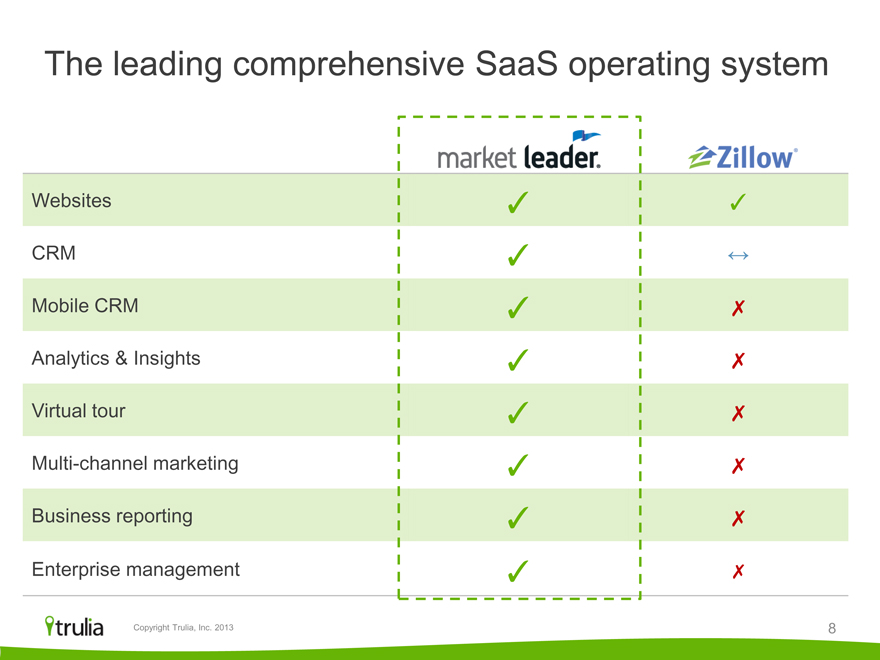

The leading comprehensive SaaS operating system

market leaderR ZillowR

Websites

CRM

Mobile CRM

Analytics & Insights

Virtual tour

Multi-channel marketing

Business reporting

Enterprise management

trulia Copyright Trulia, Inc. 2013 8

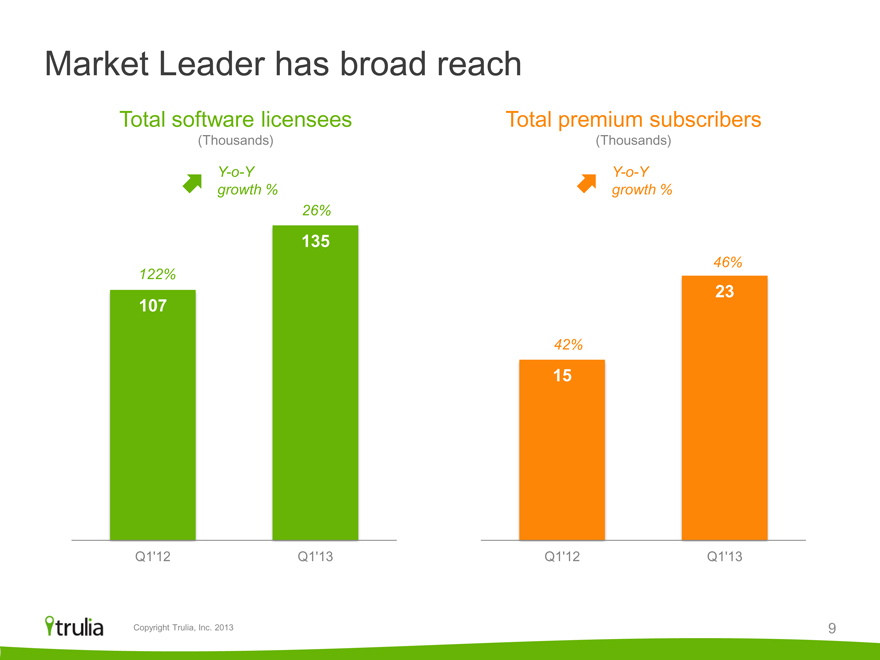

Market Leader has broad reach

Total software licensees

(Thousands)

Y-o-Y growth %

122%

107

26%

135

Q1’12

Q1’13

Total premium subscribers

(Thousands)

Y-o-Y

growth %

42%

15

46%

23

Q1’12

Q1’13

trulia Copyright Trulia, Inc. 2013 9

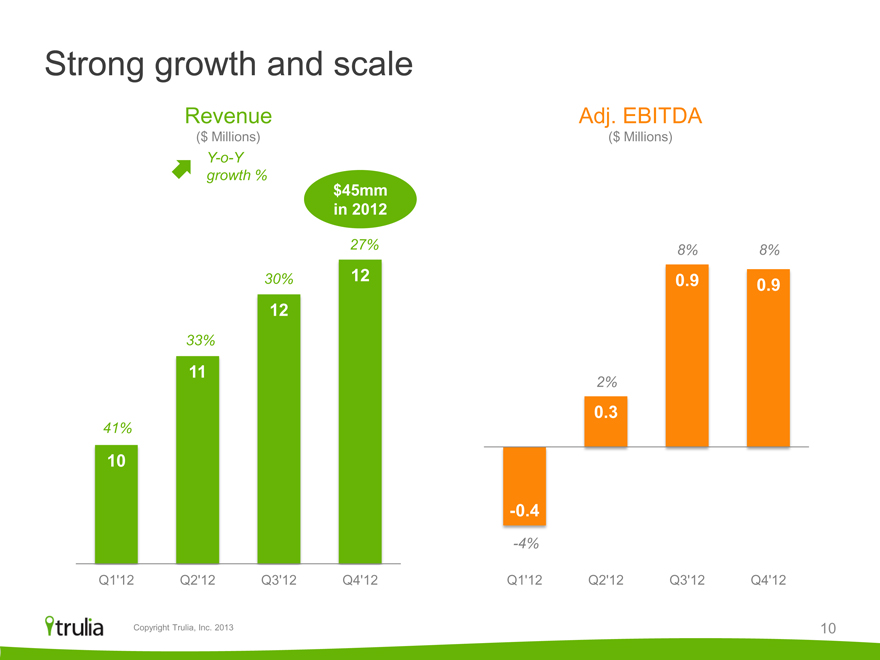

Strong growth and scale

Revenue

($ Millions)

Y-o-Y growth %

$45mm in 2012

41%

10

33%

11

30%

12

27%

12

Q1’12 Q2’12 Q3’12 Q4’12

Adj. EBITDA

($ Millions)

-0.4

-4%

2%

0.3

8%

0.9

8%

0.9

Q1’12 Q2’12 Q3’12 Q4’12

trulia Copyright Trulia, Inc. 2013 10

Transaction rationale

Strategic Combining the industry’s leading marketplace with the industry’s leading SaaS operating system

Operational Integration of complementary assets:

Customers, products, go-to-market

Financial Compelling pro forma financial profile

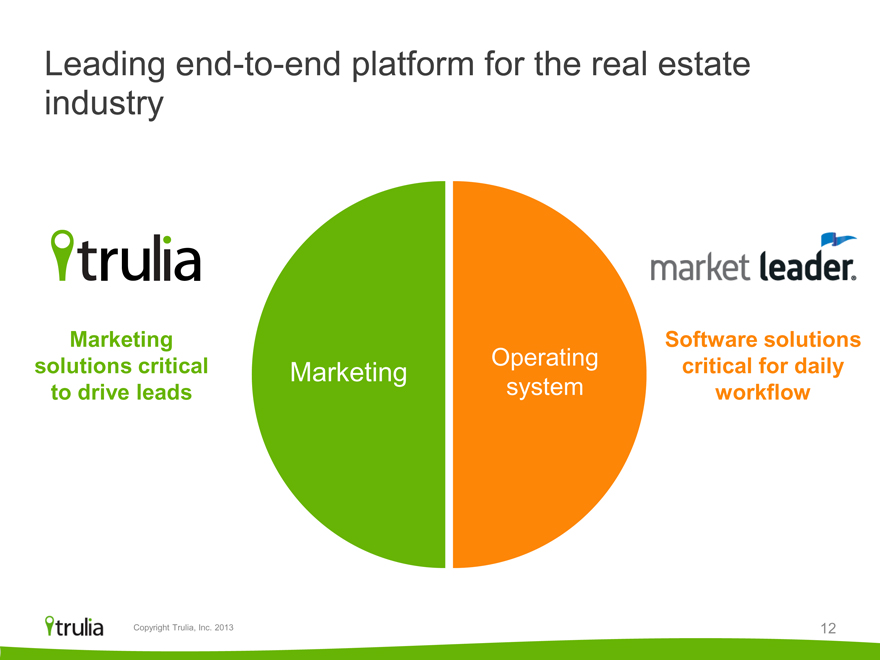

Leading end-to-end platform for the real estate industry

trulia

Marketing solutions critical to drive leads

Marketing

Operating system

market leaderR

Software solutions critical for daily workflow

trulia Copyright Trulia, Inc. 2013 12

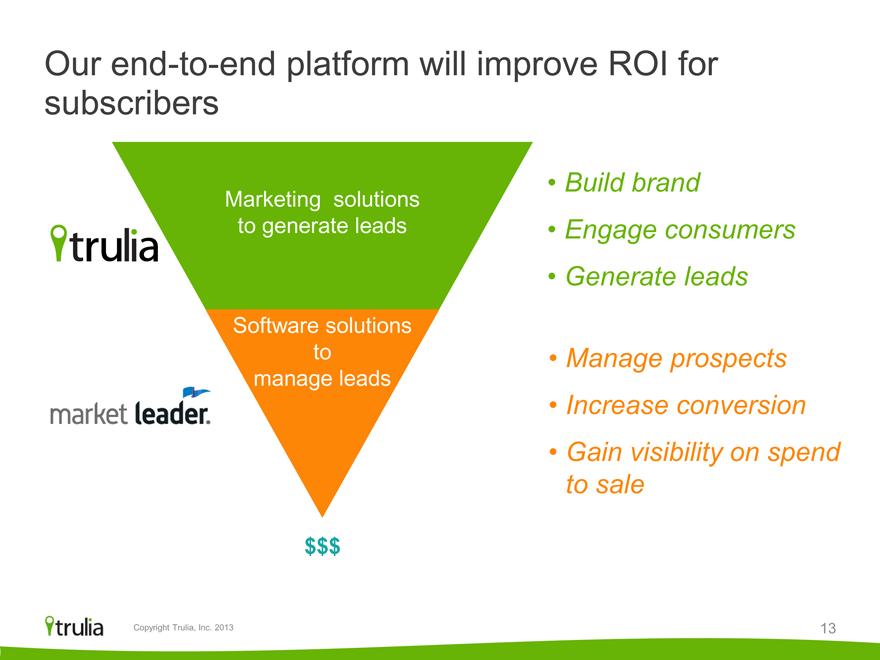

Our end-to-end platform will improve ROI for subscribers

trulia

market leader

Marketing solutions to generate leads

Software solutions to manage leads

$$$

Build brand

Engage consumers

Generate leads

Manage prospects

Increase conversion

Gain visibility on spend to sale

trulia Copyright Trulia, Inc. 2013 13

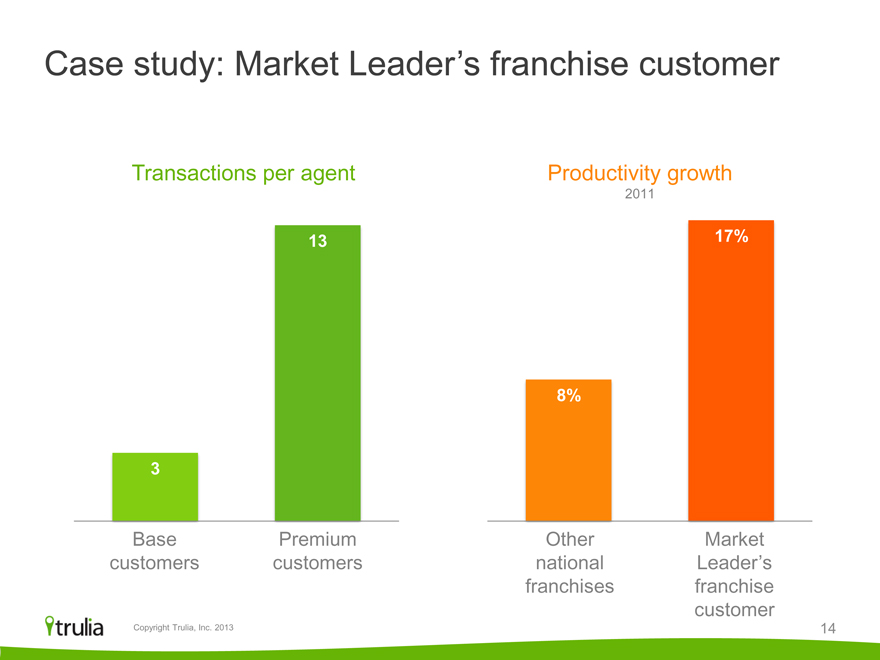

Case study: Market Leader’s franchise customer

Transactions per agent

3

Base customers

13

Premium customers

Productivity growth

2011

8%

Other national franchises

17%

Market Leader’s franchise customer

trulia Copyright Trulia, Inc. 2013 14

Transaction rationale

Strategic

Operational Integration of complementary assets:

Customers, products, go-to-market

Financial

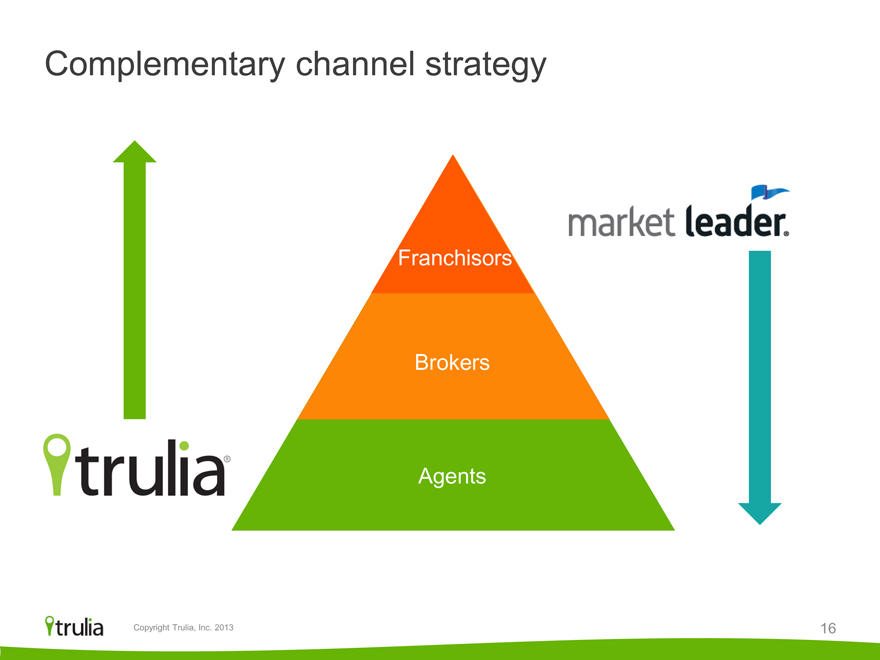

Complementary channel strategy

trulia

Franchisors

Brokers

Agents

market leader

trulia Copyright Trulia, Inc. 2013 16

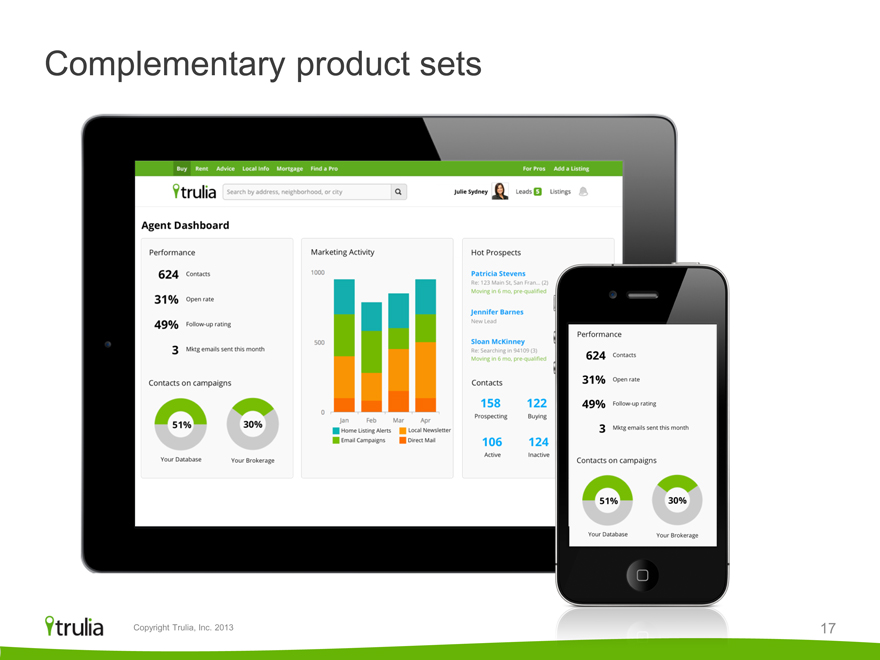

Complementary product sets

Buy Rent Advice Local Info Mortgage Find a Pro For Pros Add a Listing

Trulia Search by address, neighborhood, or city

Agent Dashboard

Performance

624 Contacts

31% Open rate

49% Follow-up rating

3 Mktg emails sent this month

Contacts on campaigns

51% 30%

Your Database Your Brokerage

Marketing Activity

1000

500

0

Jan Feb Mar Apr

Home Listing Alerts Local Newsletter

Email Campaigns Direct Mail

Julia Sydney Leads 5 Listings

Hot Prospects

Patricia Stevens

Re: 123 Main St, San Fran... (2)

Moving in 6 mo, pre-qualified

Jennifer Barnes

New Lead

Sloan McKinney

Re: Searching in 6 mo, pre-qualified

Contacts

158

Prospecting

106

Active

122

Buying

124

Inactive

Performance

624 Contacts

31% Open rate

49% Follow-up rating

3 Mktg emails sent this month

Contacts on campaigns

51%

Your Database

30%

Your Brokerage

trulia Copyright Trulia, Inc. 2013 17

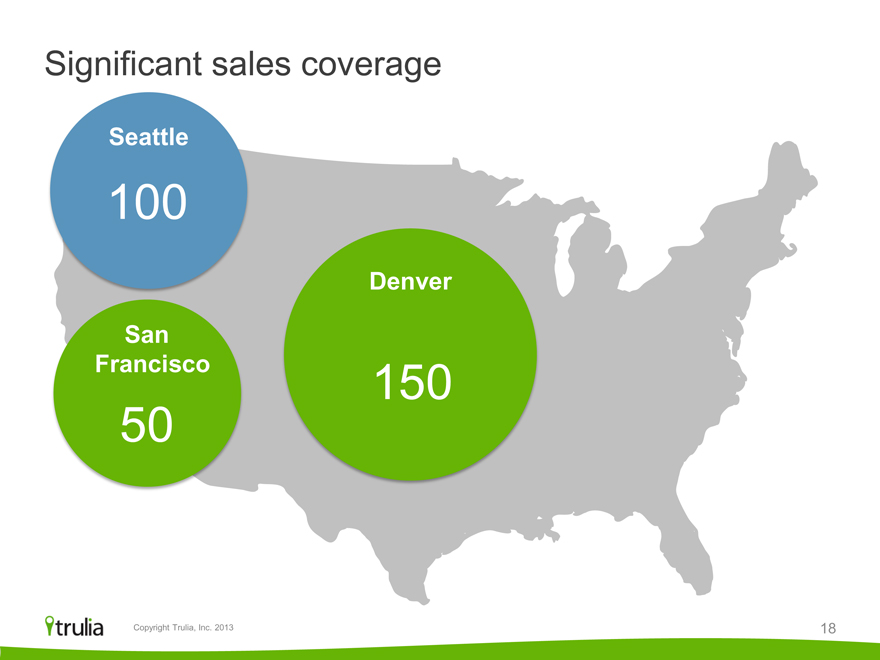

Significant sales coverage

Seattle

100

San Francisco

50

Denver

150

trulia Copyright Trulia, Inc. 2013 18

Transaction rationale

Strategic

Operational

Financial Compelling pro forma financial profile

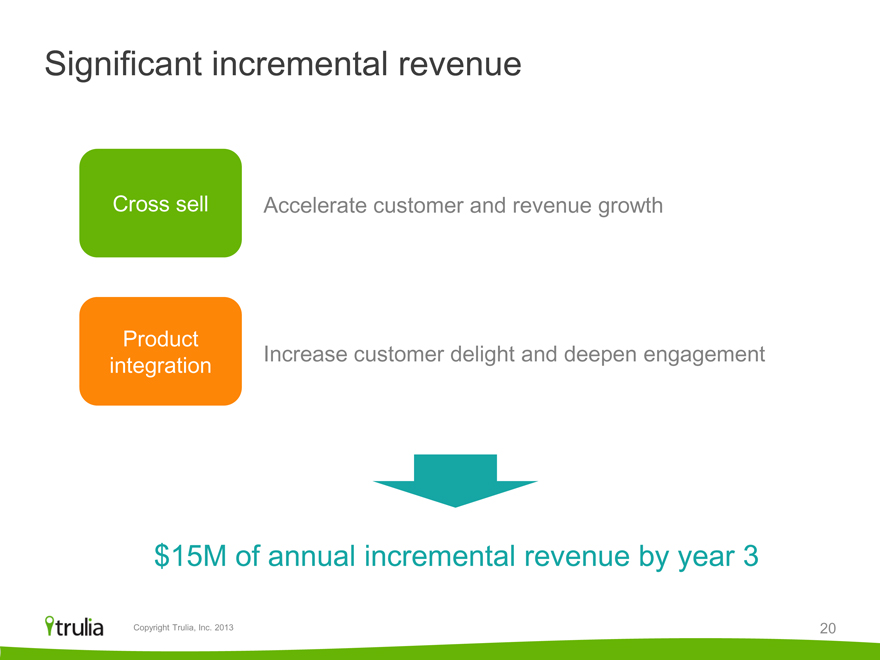

Significant incremental revenue

Cross sell Accelerate customer and revenue growth

Product integration Increase customer delight and deepen engagement

$15M of annual incremental revenue by year 3

trulia Copyright Trulia, Inc. 2013 20

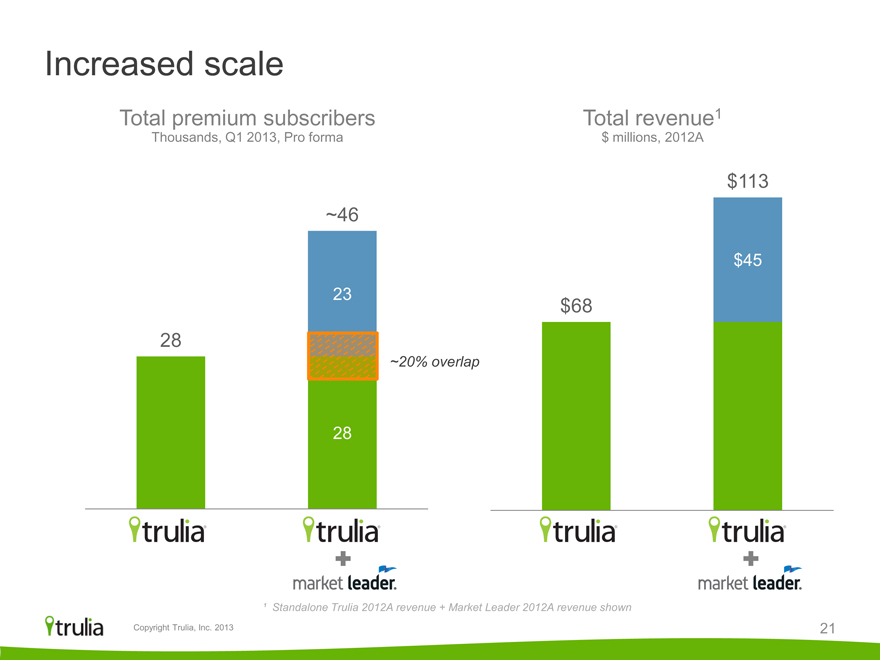

Increased scale

Total premium subscribers

Thousands, Q1 2013, Pro forma

28

trulia

~46

23

~20% overlap

28

trulia

+

market leader.

Total revenue1

$ millions, 2012A

$68

trulia

$113

$45

trulia

+

market leader.

1 Standalone Trulia 2012A revenue + Market Leader 2012A revenue shown

trulia Copyright Trulia, Inc. 2013 21

Transaction rationale

Strategic Combining the industry’s leading marketplace with the industry’s leading SaaS operating system

Operational Integration of complementary assets:

Customers, products, go-to-market

Financial Compelling pro forma financial profile

truliaR

Investor Presentation

May 2013

Appendix

Reconciliation of Market Leader’s Adjusted EBITDA

(000s) Q1’12 Q2’12 Q3’12 Q4’12

Net loss attributable to Market Leader $(2,522) $(2,146) $(1,943) $(1,173)

Non-GAAP adjustments:

Interest income, net (9) (8) (7) (8)

Depreciation and amortization of property and equipment 644 768 754 735

Amortization of intangible assets 823 836 849 811

Stock-based compensation 633 802 1,274 540

Income tax expense (benefit) 28 8 10 8

Adjusted EBITDA $(403) $260 $937 $913

trulia Copyright Trulia, Inc. 2013 25