Exhibit (a)(5)(vi)

| | | | | | |

| | | | EFiled: Feb 03 2017 01:18PM EST Transaction ID 60150468 Case No. 2017-0083- | |  |

IN THE COURT OF CHANCERY OF THE STATE OF DELAWARE

| | | | |

| JOHN SOLAK, Individually and On | | ) | | |

| Behalf of All Others Similarly Situated, | | ) | | |

| | ) | | |

Plaintiff, | | ) | | |

| | ) | | |

v. | | ) | | Civil Action No. |

| | ) | | |

| JOHN P. CALAMOS, SR., THOMAS F. | | ) | | |

| EGGERS, JOHN KOUDOUNIS, KEITH | | ) | | |

| (KIM) M. SCHAPPERT, WILLIAM N. | | ) | | |

| SHIEBLER, CALAMOS PARTNERS | | ) | | |

| LLC, and CPCM ACQUISITION, INC. | | ) | | |

| | ) | | |

Defendants. | | ) | | |

VERIFIED CLASS ACTION COMPLAINT

Plaintiff, by his undersigned attorneys, for this complaint against defendants, alleges upon personal knowledge with respect to himself, and upon information and belief based upon,inter alia, the investigation of counsel as to all other allegations herein, as follows:

NATURE OF THE ACTION

1. This is a class action brought on behalf of the public stockholders of Calamos Asset Management, Inc. (“CAM” or the “Company”) in connection with a transaction pursuant to which the Company will be taken private through a tender offer (the “Tender Offer”) and second step merger (the “Merger”) by entities that are affiliated with and controlled by the Company’s founder, Chairman, and Global

Investment Officer, John P. Calamos, Sr. (“Calamos”), and CAM’s Chief Executive Officer (“CEO”), John S. Koudounis (“Koudounis”) (collectively, the “Purchaser Group” or “Controllers”), for the unfair price of $8.25 in cash for each share of CAM Class A common stock (the “Merger Consideration”) through a conflicted and tainted evaluation process (the “Proposed Transaction”).

2. Calamos beneficially owns 83.1% of CAM’s Class A common stock through direct and indirect holdings, including his beneficial ownership of 100% of CAM’s Class B common stock, which is exchangeable and convertible on demand for Class A common stock and which represents over 97% of the combined voting power of CAM’s common stock. Because the Proposed Transaction isnot subject to amajority-of-the-minority tender condition, the Proposed Transaction is afait accompli.

3. On January 10, 2017, CAM’s Board of Directors (the “Board” or the “Individual Defendants”) caused the Company to enter into an agreement and plan of merger (the “Merger Agreement”) with Calamos Partners LLC (“Parent”) and CPCM Acquisition, Inc. (“Merger Sub”), entities controlled by Calamos to facilitate the Proposed Transaction. Pursuant to the terms of the Merger Agreement, Merger Sub commenced the Tender Offer on January 18, 2017 to acquire the Company’s Class A shares for $8.25 per share. The Tender Offer is scheduled to expire on February 15, 2017 unless it is extended. Following the

2

completion of the Tender Offer, which is a forgone conclusion, the Merger will be effected pursuant to Section 251(h) of the Delaware General Corporation Law and Merger Sub will be merged with and into the Company, and the Company will continue as the surviving corporation as a wholly owned subsidiary of Parent.

4. The Proposed Transaction is the product of a rushed, conflicted, and unfair process that deprives CAM’s public stockholders of the ability to participate in the Company’s long-term prospects. In approving the Merger Agreement, the Individual Defendants and CAM’s controlling stockholders, the Purchaser Group, breached their fiduciary duties to Plaintiff and the Class (defined herein).

5. The process leading up to the execution of the Merger Agreement was grossly inadequate and conducted in bad faith. Although a special committee (the “Special Committee”) of purportedly independent directors was created to approve the Proposed Transaction, the Special Committee was inept and beholden to Calamos. Indeed, the Special Committee “negotiated” and approved the inadequate Merger Consideration in less than one month, and the principalnon-economic terms of the Merger Agreement in less than a day, before announcing the Proposed Transaction. The terms of the Merger Agreement, which are favorable to Calamos, were dictated by Calamos, and the Special Committee failed to protect CAM’s minority stockholders.

3

6. The Proposed Transaction was not conditioned on the tendering of amajority-of-the-minority shares held by CAM’s public stockholders. The reason for failing to do so is clear: the price offered is inadequate to CAM’s minority stockholders. Calamos wants to ensure that he can take the Company private and does not want CAM’s public minority stockholders to block the Proposed Transaction. In addition, Calamos demanded, and the Special Committee acquiesced, that the Proposed Transaction be conditioned on an“appraisal-out” condition that allows the Purchaser Group to walk away if 15% of the Company’s Class A common stock seeks appraisal.

7. As detailed herein, the Proposed Transaction is subject to entire fairness review and is substantially unfair in terms of process and price. The Special Committee lacked independence and utterly failed to protect CAM’s minority stockholders. In approving the unfair Proposed Transaction, the members of the Special Committee and the Board acted to serve the interests of the controlling stockholders, the Purchaser Group. Moreover, Parent and Merger, which are controlled by the Purchaser Group and created to facilitate the Proposed Transaction, aided and abetted the Individual Defendants’ breaches of fiduciary duties.

8. As set forth herein, plaintiff seeks damages for Defendants’ breaches of fiduciary duties in connection with the Proposed Transaction.

4

PARTIES

9. Plaintiff is, and has been continuously throughout all times relevant hereto, the owner of CAM common stock.

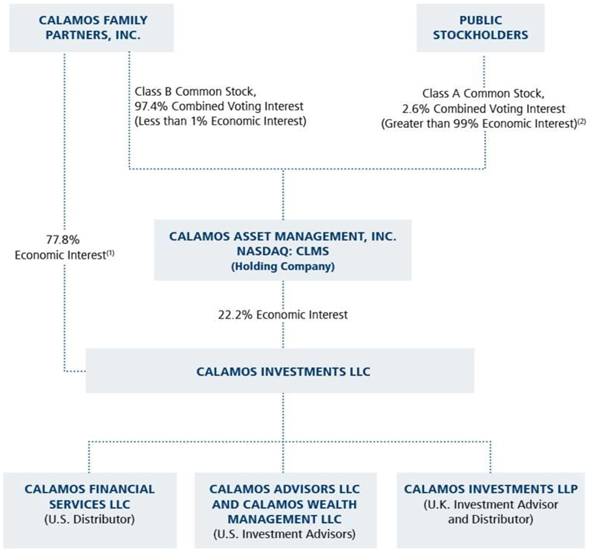

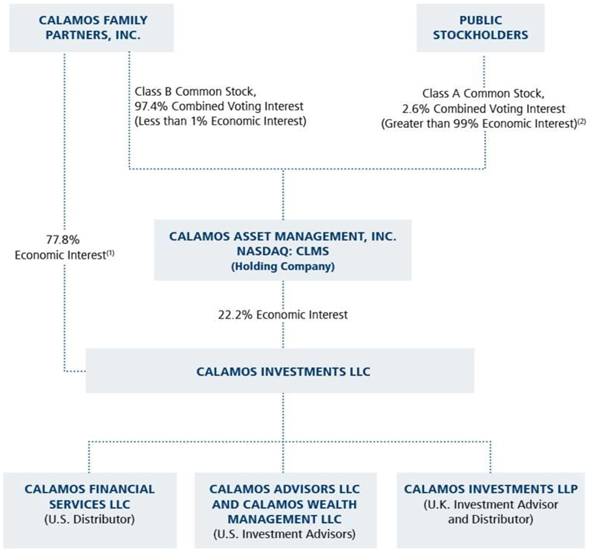

10. CAM is a Delaware corporation and maintains its principal executive offices at 2020 Calamos Court, Naperville, Illinois 60563. CAM’s common stock is traded on the NasdaqGS under the ticker symbol “CLMS.” The Company is the sole manager and 22.2% owner of Calamos Investments LLC (“Calamos Investments”), which through its operating subsidiaries provides investment advisory services to institutions and individuals. As of December 31, 2016, the Company had $18.3 billion in assets under management.

11. Defendant Calamos is the founder, Chairman of the Board, and Global Chief Investment Officer of CAM. Calamos founded the predecessor company to the Company in 1977. He also serves as a director and President of Merger Sub.

12. Defendant Thomas F. Eggers(“Eggers”) has served on the Board since January 2012 and has served as CAM’sNon-Executive Vice Chairman since June 2013. Eggers was a member of the Special Committee and negotiated and approved the Proposed Transaction. From 2006 through 2008, Eggers was the CEO and from 2005 through 2008 the President and a board member of the Dreyfus Corporation. While at Dreyfus, he was a member of the Executive Committee of BNY Mellon Asset Management and served on the Operating

5

Committee of The Bank of New York Mellon. For a three-year period between 2002 and 2005, Eggers was the President and CEO of Scudder Investments. In 1996, he was President of Dreyfus Investments; he was appointed Vice Chairman of the Dreyfus Corporation in 1999 and became President in 2001. Eggers began his financial services career in 1976 at Columbia Savings, moving in 1979 to PaineWebber as a Financial Advisor and later into the asset management area. Eggers is a director and principal investor of Nextalk, Inc., Minyanville Media, Inc. and Archer. He has also held director or advisor positions in the financial services industry.

13. Defendant Koudounis has been the CEO of the Company since April 2016. Koudounis also serves as Executive Vice President of Merger Sub. Koudounis previously served as President and CEO of Mizuho Securities USA, Inc. from February 2008 until March 2016. Prior to that, he served as Managing Director of ABN AMRO Inc. from 1996 to 2008 and Vice President of Merrill Lynch from 1988-1993. Koudounis has also served as a board member of Mizuho Securities USA, Inc. and is a current director of the National Hellenic Museum and The Hellenic Initiative. He is also a Leadership Council member of The Concordia Summit. Mr. Koudounis earned a B.A. from Brown University.

14. Defendant Keith (Kim) M. Schappert(“Schappert”) is a director of CAM since 2012. Schappertwas a member of the Special Committee and

6

negotiated and approved the Proposed Transaction. Since 2008, Schappert has operated his own consulting business and has served as director on a number of financial industry boards including MetLife Series Trust, Commonfund, Trilogy Global Advisors and Mirae Asset Management. Schappert spent nearly thirty years at JP Morgan Investment Management, advancing from Fixed Income Portfolio Manager to President and CEO. In 2001, Schappert became President and CEO of Federated Investment Advisory Companies, later moving to Credit Suisse as Regional Head of the Americas for Asset Management.

15. Defendant William N. Shiebler (“Shiebler”) is a director of CAM since 2012. Shiebler was a member of the Special Committee and negotiated and approved the Proposed Transaction. From 2002 to 2007, Shiebler was CEO of the Americas for Deutsche Asset Management, a division of Deutsche Bank, until his retirement. Prior thereto, Shiebler served as Senior Managing Director of Putnam Investments and President and CEO of Putnam Mutual Funds. He also spent twelve years at Dean Witter Reynolds, departing as President and Chief Operating Officer of the Intercapital Division and the firm’s mutual fund business. Shiebler has served on a number of corporate andnon-profit boards in the U.S. and Europe and is currently active with a variety of business, community and charitable organizations. He was a Trustee of Scudder Mutual Funds, was a member of the Presidential Commission on Medicaid, is a Trustee of the United States Ski and

7

Snowboard Team, the Director of SLM Corporation and its subsidiary, Sallie Mae Bank and is the Chairman of an Advisory Board for medical research at the University of Utah.

16. The defendants identified in paragraphs 11 through 15 are collectively referred to herein as the “Individual Defendants.”

17. Defendant Parent is a Delaware limited liability company. Parent owns directly all of the outstanding shares of Class B common stock of the Company. Calamos Family Partners, Inc. (“Calamos Family Partners”) is the managing member of Parent, and Calamos controls and is the majority stockholder and President of Calamos Family Partners. Koudounis has a minority interest in Parent.

18. Defendant Merger Sub is a Delaware corporation and a wholly-owned subsidiary of Parent that was created to effectuate the Proposed Transaction.

CLASS ACTION ALLEGATIONS

19. Plaintiff brings this action as a class action on behalf of himself and the other public stockholders of CAM (the “Class”). Excluded from the Class are defendants herein and any person, firm, trust, corporation, or other entity related to or affiliated with any defendant.

20. This action is properly maintainable as a class action.

8

21. The Class is so numerous that joinder of all members is impracticable. As of December 30, 2016, there were approximately 20,530,571 shares of CAM Class A common stock outstanding, held by hundreds, if not thousands, of individuals and entities scattered throughout the country.

22. Questions of law and fact are common to the Class, including, among others, whether defendants will irreparably harm plaintiff and the other members of the Class if defendants’ conduct complained of herein continues.

23. Plaintiff is committed to prosecuting this action and has retained competent counsel experienced in litigation of this nature. Plaintiff’s claims are typical of the claims of the other members of the Class and plaintiff has the same interests as the other members of the Class. Accordingly, plaintiff is an adequate representative of the Class and will fairly and adequately protect the interests of the Class.

24. The prosecution of separate actions by individual members of the Class would create the risk of inconsistent or varying adjudications that would establish incompatible standards of conduct for defendants, or adjudications that would, as a practical matter, be dispositive of the interests of individual members of the Class who are not parties to the adjudications or would substantially impair or impede thosenon-party Class members’ ability to protect their interests.

25. Defendants have acted, or refused to act, on grounds generally applicable to the Class as a whole, and are causing injury to the entire Class. Therefore, final injunctive relief on behalf of the Class is appropriate.

9

SUBSTANTIVE ALLEGATIONS

Background of CAM and Calamos’s Control Over CAM

26. Calamos founded the predecessor company to the Company in 1977. In October 2004, Calamos took CAM public, offering Class A shares at $18 per share.

27. The Company primarily provides investment advisory services to individuals and institutional investors through a number of investment products that includeopen-end funds andclosed-end funds, separate accounts, and partnerships, as well as provides model portfolio design and oversight for separately managed accounts. The Company, which had $18.3 billion in assets under management as of December 31, 2016, provides these investment advisory services through subsidiaries of Calamos Investments, including: Calamos Advisors LLC, Calamos Financial Services LLC, Calamos Wealth Management LLC, and Calamos Investments LLP.

28. CAMis the sole manager and owner of approximately 22.2% of the operating company Calamos Investments, with the remaining 77.8% owned by Calamos through Parent.

29. Calamos beneficially owns 83.1% of CAM’s Class A common stock through his direct and indirect ownership of the stock by his controlled

10

subsidiaries, Parent and Calamos Investments. Specifically, Calamos controls and is the majority stockholder and President of Calamos Family Partners, which in turn is the owner and managing member of Parent.

30. Parent (which is ultimately controlled by Calamos) beneficially owns 81.9% of CAM’s Class A common stock through its ownership of all of CAM’s outstanding Class B common stock, which is exchangeable and convertible on demand for Class A common stock, and Parent’s 77.8% ownership of Calamos Investments, which owns approximately 18.4%, of CAM’s outstanding Class A common stock. Calamos’s beneficial ownership of CAM’s Class B common stock represents 97.4% of the combined voting power of all classes of CAM’s voting stock.

11

31. The following chart details part of the above-mentioned entity structure created and controlled by Calamos:

32. Because more than 50% of the Company’s voting power is held by Calamos through Calamos Family Partners, CAM is a “controlled company” within the meaning of the NASDAQ Marketplace Rules. In the Company’s most recent 2016 annual Definitive Proxy Statement, filed with the United States Securities and Exchange Commission (“SEC”) on April 20, 2016, the Company noted that its “founder and controlling stockholder (through Calamos Family Interests), John P. Calamos, Sr., has served in the combined role of Chief Executive Officer and Chairman of the Board since [CAM] went public in 2004[.]”

12

33. Moreover, the Company acknowledged Calamos’s control over the Board in the Company’s most recent10-K, filed with the SEC on March 11, 2016:

As of December 31, 2015, the Calamos Interests owned approximately 77.8% of Calamos Investments and all of our Class B common stock, representing more than 97.4% of the combined voting power of all classes of our voting stock. Pursuant to the terms of our second amended and restated certificate of incorporation, Calamos Family Partners, Inc. retains a majority of the combined voting power of our common stock until its ownership interest in Calamos Investments falls below 15%, at which time all outstanding shares of our Class B common stock automatically will convert into shares of our Class A common stock. Accordingly, as long as Calamos Family Partners, Inc. maintains the requisite ownership interests in Calamos Investments (including through ownership of our common stock),it will continue to have the ability to elect all of the members of our board of directors and thereby control our management and affairs, including determinations with respect to acquisitions, dispositions, borrowings, issuances of common stock or other securities, and the declaration and payment of dividends on our common stock. In addition,it will continue to be able to determine the outcome of all matters requiring stockholder approval on a combined class vote basis, and will continue to be able to cause or prevent a change of control of our Company or a change in the composition of our board of directors. The concentration of ownership could deprive Class A stockholders of an opportunity to receive a premium for their common stock as part of a sale of our Company and might ultimately negatively affect the market price of our Class A common stock.

(emphasis added).

The Unfair Process Leading to the Merger Agreement

34. The Proposed Transaction is the result of an unfair and rushed process that was dictated by the Purchaser Group. As discussed herein, the Special

13

Committee was ineffective in negotiating with CAM’s majority stockholders, and it breached its duties of care and loyalty by repeatedly yielding to the Purchaser Group’s demands to the detriment of the Company’s minority stockholders, for whom they have a duty to protect.

35. According to the Schedule14D-9 Solicitation/Recommendation Statement (the“14D-9”) filed with the SEC on January 19, 2017, in March 2016, Koudounis was appointed as CEO of the Company, effective April 4, 2016. In October 2016, Calamos and Koudounis determined that they would take the Company private and they engaged, through Parent, Merrill Lynch, Pierce, Fenner & Smith Incorporated (“BofA Merrill Lynch”) to act as their financial advisor in connection with the going-private transaction.

36. On October 18, 2016, Calamos and Koudounis informed the Board that they were going to make a proposal to squeeze out the Company’s minority stockholders and take the Company private.

37. On October 26, 2016, the Board, with Calamos apparently participating, adopted initial resolutions establishing the Special Committee and designating Eggers, Schappert, and Shiebler as its members. During the first week of November 2016, the Special Committee engaged Duff & Phelps LLC (“Duff & Phelps”) as its financial advisor and Morris, Nichols, Arsht & Tunnell LLP (“Morris Nichols”) as its legal counsel in connection with the Purchaser Group’s proposed going-private acquisition.

14

38. On November 3, 2016, Duff & Phelps requested from Company management long-term projected financial information for the years ended December 31, 2016, through December 31, 2023. CAM management (each of whom were and are conflicted as a result of their continued employment and receipt of lucrative financial benefits as a result of the Proposed Transaction) provided an initial draft of the management projections to Duff & Phelps on November 7, 2016, and a final version on November 17, 2016. Those management projections assumed for inexplicable reasons (other than to make a transaction appear fair) that there would be a market correction in 2018, followed by a market recovery in 2019.

39. On November 17, 2016, representatives of Morris Nichols sent to Chris Jackson, Senior Vice President and General Counsel of the Company, draft resolutions that would, among other things, authorize the Special Committee to negotiate the terms of the potential transaction. Although the Special Committee was purportedly given the power “to explore the availability and relative costs and benefits of available alternatives,” the Special Committee never considered other alternatives or sought any third party proposals. The proposed resolutions, which were adopted by the Board on November 20, 2016, also provided for a retainer fee of $35,000 to each member of the Special Committee other than the Chairman and $50,000 to the Chairman, and a monthly fee of $10,000 to each member of the Special Committee other than the Chairman and $14,000 to the Chairman.

15

40. Also on November 17, 2016, the Special Committee discussed the Company’s projections that were provided by management, including the assumed market correction and recovery contemplated in those projections, and the Special Committee directed Duff & Phelps to prepare three sensitivity cases to the management projections: one assuming no market correction, but maintaining the expenses reflected in the management projections; one assuming a market correction, but accelerating a decrease in expenses as compared to that projected by management; and one both assuming no market correction and accelerating a decrease in expenses as compared to that projected by management. These sensitivity projections, however, were not disclosed to the Company’s minority stockholders, notwithstanding the fact that they were relied upon Duff & Phelps to perform its valuation analyses.

41. On November 22, 2016, the Special Committee received a letter from Calamos on behalf of the Purchaser Group proposing to acquire all of CAM’s Class A common stock not already owned by them for $7.75 per share. In the letter, the Purchaser Group did not condition the transaction on the tendering of amajority-of-the-minority shares not owned by the Purchaser Group or its affiliates. The letter also stated that the Purchaser Group had no interest in selling any of their CAM Class A or B common stock and would not expect to vote in favor of any alternative transaction.

16

42. On November 29, 2016, the Special Committee met and, recognizing the gross inadequacy of the Purchaser Group’s offer, determined to direct Duff & Phelps to communicate to the Purchaser Group that its offer was insufficient, but not to make a specific counterproposal at this time.

43. In response to the Special Committee’s rejection, on November 30, 2016, “Calamos and Koudounis communicated to the Special Committee that, while they would consider any counterproposal that the Special Committee might wish to make, they would not be revising their proposal in the absence of such a counterproposal,” according to the Schedule TO Tender Offer Statement and Rule13e-3 Transaction Statement filed in connection with the Proposed Transaction (the“13e-3”). Based on the Special Committee’s actions following these statements, it is evident that the Purchaser Group, either explicitly or through body language, signaled to the Special Committee that it was adamant on taking the Company private and that the Special Committee would be required to make a counteroffer and come to an agreement with the Purchaser Group or face the consequences.

44. On December 6, 2016, the Special Committee met without Eggers present or participating and discussed the Purchaser Group’s demand for a

17

counteroffer. Buckling to the Purchaser Group’s pressure and threats, Schappert and Shiebler determined that they would “respond with a price per share that would both leave enough room for negotiations to proceed but would not be too high as to terminate the negotiations.” Without fully informing itself about the Company’s value in a transaction, the Special Committee (without Eggers) determined to counter the Purchaser Group’s initial proposal with a proposal of $8.75 per share. The Special Committee made this counteroffer without waiting to hear the advice of its tax counsel regarding the potential impact and cost savings relating to CAM’sUp-C structure, and without an adequate understanding of the Company’s financial projections. Indeed, according to the13e-3, following the submission of the counteroffer, Duff & Phelps subsequently “requested that management provide certain additional information and clarifications with respect to the projections that management had previously furnished,” which was subsequently provided by CAM management to Duff & Phelps on December 9, 2016.

45. Between December 7 and 18, 2016, the Special Committee and the Purchaser Group traded counteroffers until they settled on $8.25 per share. As discussed herein, the $8.25 per share Merger Consideration is grossly inadequate and unfair to the Company’s minority stockholders.

18

46. During the negotiations over the transaction price, the Purchaser Group sent a draft merger agreement (the “Draft Merger Agreement”) to the Special Committee on Friday, December 15, 2016. The next day, on December 16, the Purchaser Group again attempted to exert its influence and pressure on the Special Committee by indicating that its offer was subject to announcing an agreement in principle prior to the market’s opening on Monday, December 19, 2016 in the hopes of forcing through a favorable deal for the Purchaser Group and not allowing the Special Committee to understand the Company’s true fair market value or obtain a value maximizing deal for CAM’s minority stockholders.

47. The Special Committee met on December 17, 2016 and yet again caved to the Purchaser Group’s demands by agreeing to expedite negotiations over the economic andnon-economic terms of the Merger Agreement. At that meeting, representatives of Morris Nichols reviewed with the Special Committee for the first time the “key provisions” of the Draft Merger Agreement, including those relating to conditionality of the potential transaction once it is publicly announced and the absence of amajority-of-the-minority condition in the Draft Merger Agreement. Following discussion, the Special Committee directed the representatives of Morris Nichols to send a markup of the Draft Merger Agreement to Kramer Levin that would remove many of the provisions that created conditionality to closing, but would include amajority-of-the-minority condition.

19

48. After engaging in incomplete and extremely expedited negotiations over the course of one day, December 18, 2016, the Special Committee and the Purchaser Group reached an “agreement in principle,” which was later memorialized in writing, regarding the key terms of the Draft Merger Agreement. Not surprisingly, theagreed-to terms of the Draft Merger Agreement were dictated by, and favorable to, the Purchaser Group. Notably, the negotiations, which lasted less than a day, resulted in the removal of themajority-of-the-minority tender condition and the inclusion of an “appraisal out” condition. Thus, the Special Committee utterly failed to protect CAM’s minority stockholders despite knowing that the Proposed Transaction would be a foregone conclusion in light of the Purchaser Group’s beneficial ownership of 83% of CAM’s Class A common stock.

49. On December 18, 2016, the Special Committee met and capitulated to the Purchaser Group’s demands to publicly announce the agreement in principle without finalizing significant negotiations over key terms and conditions of the Draft Merger Agreement. Thus, in breach of their fiduciary duties, the Special Committee agreed to announce a transaction that was not yet fully negotiated, after less than a month of negotiations over the price and less than a day of negotiations over certainnon-economic terms of the Merger Agreement, which were favorable to the Purchaser Group. The Special Committee, moreover, never considered other alternatives or reached out to third parties to determine their interest or to test the adequacy of the price offered by the Purchaser Group. Also at the meeting, the members of the Special Committee received a flawed fairness presentation and opinion from representatives of Duff & Phelps.

20

50. Prior to the market opening on December 19, 2016, the Company issued a press release stating that it had reached an agreement in principle to be acquired by the Purchaser Group for $8.25 per share in cash pursuant to a tender offer and second-step merger. The press release also stated that “[t]he agreement in principle is subject to the final negotiation and execution of a mutually satisfactory definitive merger agreement, but is not contingent on the Acquirer obtaining financing.”

51. Knowing that it succeeded in obtaining very favorable terms from the feckless Special Committee, and despite its remarkable rush to negotiate and announce the agreement in principle on December 19, the Purchaser Group proceeded to negotiate the remaining terms at a leisurely pace, and took two days to send the Special Committee a markup of the Draft Merger Agreement on December 21, 2016. In direct contravention of the parties’ memorialized agreement in principle and the press release announcing the agreement in principle, the Purchaser Group’s Draft Merger Agreement conditioned the Proposed Transaction on the Purchaser Group’s ability to obtain financing for the Proposed Transaction, as well as other requested terms and Company representations and warranties that would increase conditionality of the Proposed Transaction.

21

52. Over the course of the succeeding three weeks, representatives of Morris Nichols and Kramer Levin negotiated the Draft Merger Agreement. Consistent with its apathetic behavior throughout the entire, short-lived process, and notwithstanding the Purchaser Group’s blatant misrepresentations in the written agreement in principle, the Special Committee agreed to the Purchaser Group’s demanded conditions and failed to enforce the terms of their agreement in principle or bargain for or obtain any additional consideration for these concessions. Specifically, the Special Committee agreed to the Purchaser Group’s inclusion and scope of a condition to the Tender Offer regarding a banking disruption, and the right of Parent, on or after March 31, 2017, to extend the Tender Offer, even if all conditions are satisfied, in certain circumstances if the debt commitment obtained by Parent in connection with the Proposed Transaction has expired and a substitute debt commitment letter has not been obtained, as well as the requirement for the Company to pay a special dividend up to an amount of $0.65 per share, if, following such an extension, the Proposed Transaction does not close and the Merger Agreement is terminated in certain circumstances.

53. On January 10, 2017, the Special Committee met and representatives of Duff & Phelps noted that, although the Company’s stock price had been trading above the $8.25 transaction price, their conclusions reached in their fairness opinion remained the same. The Special Committee then recommended that the

22

Board approve the Merger Agreement and the transactions contemplated thereby. Later that evening, the Board met, with Calamos, Herman, Jackson attending, and approved the Proposed Transaction. Despite his obvious conflict of interest, Calamos did not abstain from the vote on the Proposed Transaction.

54. The Merger Agreement was finally signed on January 10, 2017,twenty-two days after the parties’ “agreement in principle” was publicly announced, and the Company issued a press release prior to the market opening on January 11, 2017 announcing the entry into the Merger Agreement by the Company.

The Merger Consideration Is Unfair to CAM’s Public Stockholders

55. The Merger Consideration is entirely unfair to CAM’s minority stockholders. The Special Committee therefore was ineffective in negotiating the Merger Consideration and breached its fiduciary duties by facilitating and approving the unfair Merger Consideration.

23

56. Calamos purposely timed the Proposed Transaction to take advantage of the Company’s lower-than-normal stock price, and in an effort to make the unfair Merger Consideration appear fair. Indeed, as indicated in the following chart, the Company’s stock price consistently traded much higher than, andnever below, the $8.25 per share Merger Consideration in 2014 and 2015:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Market Price Range | | | Cash Dividends per Share | |

| | | 2015 | | | 2014 | | | 2015 | | | 2014 | |

| | | High | | | Low | | | High | | | Low | | | | | | | |

First Quarter | | $ | 13.70 | | | $ | 12.22 | | | $ | 13.69 | | | $ | 10.67 | | | $ | 0.15 | | | $ | 0.125 | |

Second Quarter | | $ | 13.61 | | | $ | 11.83 | | | $ | 13.63 | | | $ | 11.84 | | | $ | 0.15 | | | $ | 0.125 | |

Third Quarter | | $ | 12.66 | | | $ | 9.37 | | | $ | 13.90 | | | $ | 11.26 | | | $ | 0.15 | | | $ | 0.15 | |

Fourth Quarter | | $ | 10.18 | | | $ | 8.77 | | | $ | 14.44 | | | $ | 11.15 | | | $ | 0.15 | | | $ | 0.15 | |

57. The Company’s stock’s current52-week high is $9.61 per share, or a 16.5% premium to the $8.25 per share Merger Consideration, and it traded as high as $9.50 per share on April 25, 2016. Since the announcement of the agreement in principle with respect to the Proposed Transaction on December 19, 2016, the Company’s stock has consistently traded above the $8.25 per share Merger Consideration, including closing at $8.67 per share on December 28, 2016, indicating that the market believes the Company’s stock is worth more than the inadequate Merger Consideration.

24

58. Recognizing the value of the Company and the Company’s unusually low stock trading price, Calamos has consistently acquired increasing amounts of CAM Class A common stock for the purpose of taking the Company private at an opportune time for a substantial discount to CAM’s true value, as evidenced by the following chart:

Purchases of Class A Common Stock by John P. Calamos, Sr.

During the Past Two Years

| | | | | | | | |

Calendar Year | | Number of

Shares | | | Price Per

Share | |

2015 | | | | | | | | |

First Quarter | | | 4,248.31 | | | $ | 13.5670 | |

Second Quarter | | | 5,830.305 | | | | 12.2286 | |

Third Quarter | | | 6,900.176 | | | | 10.4593 | |

Fourth Quarter | | | 7,802.735 | | | | 9.3821 | |

2016 | | | | | | | | |

First Quarter | | | 10,121.875 | | | $ | 8.6880 | |

Second Quarter | | | 12,280.392 | | | | 7.8008 | |

Third Quarter | | | 13,585.493 | | | | 7.1870 | |

Fourth Quarter | | | 13,994.631 | | | | 7.1225 | |

59. Additionally, during the years ended December 31, 2015 and 2014, Calamos caused Calamos Investments to repurchase 1,339,103 and 1,849,729, respectively, shares of CAM Class A common stock, at an average purchase price of $11.38 and $12.15, respectively, under its share repurchase programs.

60. The Merger Consideration is also unfair to the Company’s stockholders because it improperly reflects a minority discount as a result of the Purchaser Group’s control over the Company. As indicated in the Company’s most recent10-K, filed with the SEC on March 11, 2016:

The concentration of ownership [by Calamos] could deprive Class A stockholders of an opportunity to receive a premium for their common stock as part of a sale of our Company and might ultimately negatively affect the market price of our Class A common stock.

61. Indeed, the Purchaser Group itself admits in the13e-3 that:

The Offer Price reflects the fact that the Offeror already controls a majority of the voting power of the Company’s stock and,

25

accordingly, the Offer and the Merger do not involve a change of control. As a result, we believe that the Offer Price should not be expected to, and does not, reflect any “control” premium.

(emphasis added).

62. Defendants therefore have acknowledged that the Merger Consideration reflects a minority discount. As such, the Merger Consideration is unfair and the Special Committee breached its fiduciary duties by failing to negotiate atarm’s-length for a fair price that does not contain a minority discount.

The Merger Agreement Contains Unfair Conditions and Preclusive Deal Protection Devices

63. The Proposed Transaction is also unfair because the Special Committee wilted to the Purchaser Group’s demands for numerous,non-customary conditions to the Merger Agreement, but failed to negotiate for conditions that benefit CAM’s minority stockholders, and mostly notably, amajority-of-the-minority tendering provision. The Special Committee also agreed to certain preclusive deal protection devices that ensure that the Proposed Transaction is consummated to the benefit of the Purchaser Group and to the detriment of CAM’s public stockholders. As such, the Special Committee breached its fiduciary duties by failing to effectively negotiate the Proposed Transaction atarm’s-length and agreeing to these onerous provisions in the Merger Agreement.

64. Some of the onerous,non-customary conditions to the Merger Agreement that would allow Merger Sub to reject any shares tendered in the Tender Offer include:

(a) anappraisal-out condition that is triggered if 15% of the Company’s shares seek appraisal;

26

(b) a condition that there has not been a decline in either the Dow Jones Industrial Average or the Standard & Poor’s 500 Index by an amount in excess of 25%, measured from the close of business on the date of the Merger Agreement; and

(c) a condition that there has not been any general suspension of payments in respect of, or extension of credit by, the bank (JP Morgan Chase Bank) providing financing for the Tender Offer.

65. In the event that the Tender Offer has been extended past March 31, 2017 and the Merger Agreement is terminated on or after May 17, 2017, the Company will declare to all holders of record of Class A Common Stock a specialone-time cash dividend in the amount of $0.65 per share.

66. As discussedsupra, the Special Committee acquiesced to the Purchaser Group’s breach of the terms of their memorialized agreement in principle, which was publicly announced on December 19, 2016, by allowing the Proposed Transaction to be conditioned on, among other things, the Purchaser Group’s ability to obtain and maintain financing. In breach of its fiduciary duties and demonstrating its ineffectiveness and beholdeness to the Purchaser Group, the Special Committee did not seek to enforce that agreement or call off the Proposed Transaction, let alone threaten to call off the Proposed Transaction. Additionally, the Special Committee never attempted to negotiate for a higher merger consideration in light of its accession to the Purchaser Group’s demanded conditions that violated the terms of the agreement in principle.

27

67. Moreover, despite agreeing to the Purchaser Group’s slew of conditions to the Proposed Transaction, the Special Committee failed to obtain favorable terms for CAM’s public stockholders in the Merger Agreement, including failing to obtain amajority-of-the-minority tendering condition.

68. Additionally, even though Calamos controls the Company and can reject any competing offers for the Company, the Special Committee agreed to certain preclusive deal protection devices that operate conjunctively to ensure that no competing offers emerge for the Company that would allow the Special Committee to be fully informed about CAM’s true fair market value.

69. For example, Section 6.2(a) of the Merger Agreement broadly provides that neither CAM, nor any of its affiliates or representatives, may solicit or proactively seek a competing and better offer, nor can they provide information to, or engage in discussions with, any potential bidder for the Company. The Section states that the Company or any of its subsidiaries or representatives shall not:

(i) initiate, solicit, or knowingly encourage, induce or assist any inquiry or the making, submission or announcement of any proposal or offer that constitutes, or would reasonably be expected to lead to, any Acquisition Proposal;

(ii) execute or enter into any Contract with respect to an Acquisition Proposal (other than an Acceptable Confidentiality Agreement pursuant to the terms and conditions of Section 6.2(b));

28

(iii) engage in, continue or otherwise participate in any discussions or negotiations regarding, or provide or furnish anynon-public information or data relating to the Company or any of the Company Subsidiaries or afford access to the business, properties, assets, books, records or personnel of the Company or any of the Company Subsidiaries to any Person (other than Parent, Acquisition Sub, or any of their respective Affiliates or Representatives) with the intent to initiate, solicit, encourage, induce or assist the making, submission or commencement of any proposal or offer that constitutes, or would reasonably be expected to lead to, any Acquisition Proposal; or

(iv) otherwise knowingly facilitate any effort or attempt to make an Acquisition Proposal[.]

70. Because potential acquirers know that Calamos is the controlling stockholder of CAM and has made it clear that he is unwilling to sell his CAM shares, third parties are deterred from even making bids to acquire the Company. The Special Committee, moreover, never even attempted to solicit bids from third parties prior to entering into the Merger Agreement to determine the Company’s fair market value in a potential transaction. As such, the Special Committee effectively prevented itself from gaining an actual understanding of the Company’s value. Duff & Phelps’s weak and flawed fairness opinion, moreover, is a pale substitute to the dependable information that a market check can provide.

71. Moreover, notwithstanding the Special Committee’s continuing and ongoing duty to protect CAM’s minority stockholders, Section 6.2(d) provides that the Special Committee cannot make an “Adverse Company Recommendation,”

29

meaning that it “shall not (i) withdraw, modify or amend the Board Recommendation in any manner materially adverse to Parent, (ii) approve, endorse or recommend an Acquisition Proposal or (iii) at any time following receipt of an Acquisition Proposal, fail to reaffirm its approval or recommendation of this Agreement and the Merger as promptly as practicable after a request in writing thereof by Parent[.]”

72. The Merger Agreement provides very limited and narrow exceptions that allow the Special Committee to make an “Adverse Company Recommendation” if it is in response only to an unsolicited “Superior Proposal” or “Intervening Event” and the Special Committee complies with the strict provisions of Sections 6.2(e) and (f), respectively, which generally require that the Special Committee provide Parent with prior written notice, at least three business days in advance, that the Special Committee intends to make an Adverse Company Recommendation and negotiates with Parent in good faith to make adjustments in the terms and conditions of the Merger Agreement so that there is no longer a basis for such Adverse Company Recommendation.

73. As such, the Special Committee has contractually prevented itself from fulfilling it continuing fiduciary obligations to act in CAM’s public stockholders’ best interests by ensuring that it can walk away from the Proposed Transaction.

30

74. Further, pursuant to Sections 8.1 and 8.3 of the Merger Agreement, the Company shall pay Parent a $2.5 million termination fee if the Board effectuates an Adverse Company Recommendation in accordance with Section 6.2 of the Merger Agreement or if another bidder initiates a tender offer to acquire the Company’s stock and the Board either recommends, or fails to recommend a rejection of, the competing tender offer. The Special Committee failed to negotiate for a reverse termination fee in the event that the Purchaser Group terminates the Merger Agreement or otherwise does not go through with the Proposed Transaction, including, for example, failing to satisfy the financing orappraisal-out conditions.

The Special Committee and Company Management are Conflicted and Lack True Independence

75. The Special Committee members are beholden to Calamos, who owns 97.4% of the Company’s voting power. Each of the Special Committee members were hand-picked by Calamos to serve on the Board of his controlled Company. In addition, the Company’s directors and management will receive lucrative benefits as a result of the Proposed Transaction that are not shared with the Company’s public stockholders. As such, the Special Committee and Company management suffer from conflicts of interest and have breached their fiduciary duties of care and loyalty by approving and/or facilitating the Proposed Transaction.

31

76. In the Company’s most recent10-K, filed with the SEC on March 11, 2016, the Company acknowledged Calamos’s control over the Board by stating that he “will continue to have the ability to elect all of the members of our board of directors and thereby control our management and affairs,” and “will continue to be able to determine the outcome of all matters requiring stockholder approval on a combined class vote basis, and will continue to be able to cause or prevent a change of control of our Company or a change in the composition of our board of directors.”

77. The Special Committee members were aware, and were undoubtedly reminded by Calamos during the “negotiation” process, that Calamos had the power to remove the Special Committee members if they did not go along with his plan to take the Company private for cheap. After they were made aware by Calamos that he wanted to take the Company private, the Special Committee directors knew that they would no longer serve on the Board, whether they approved the going-private transaction and lost their Board seat or were removed by Calamos if they did not recommend the approval of the Proposed Transaction.

78. Knowing this, the Special Committee members were motivated to sell the Company to ensure the vesting and payment of their valuable restricted stock units (“RSU”) that they would otherwise lose if they were removed from the Board by Calamos. The guaranteed vesting of their RSUs as a result of the Proposed Transaction served as an incentive, which is not shared with CAM’s minority stockholders, to approve the Proposed Transaction even at an unfair price.

32

79. Specifically, as part of their compensation, CAM’s directors and officers received RSUs, each of which equaled a share of Class A common stock, and would vest if the recipient remains employed by the company for a prescribed period of time. Prior to 2013, the vesting period had generally been six years, withone-third vesting per year beginning four years from the grant date, and full vesting occurring at the end of the sixth year following the date of grant. Since 2013, the time period has been four years withone-fourth of the RSUs vesting on each of the second and third anniversary grant dates, with the remainingone-half vesting on the fourth anniversary of the grant date.

80. Pursuant to the terms of the Merger Agreement, each unvested RSU held by CAM’s directors and officers will vest and entitle the holders of the RSUs to receive $8.25 per share in cash for each RSU, as well as dividends paid during the period from the grant date of the RSU through the effective time of the Proposed Transaction. Accordingly, each director will receive the following amounts in consideration for his RSUs as a result of the Proposed Transaction:

| | | | | | | | |

Name | | Number of RSUs

Vesting at Effective

Time | | | Total

Consideration to Be

Received | |

Thomas F. Eggers | | | 19,607 | | | $ | 190,406.44 | |

Keith M. Schappert | | | 17,005 | | | | 162,018.62 | |

William N. Shiebler | | | 17,005 | | | | 162,018.62 | |

33

81. Additionally, certain of the Company’s executive officers, including Calamos, would be entitled to following amounts for their RSUs:

| | | | |

Name | | Number of RSUs | |

John R. Calamos, Sr. | | | 755,273 | |

Robert F. Behan | | | 419,761 | |

82. Because CAM’s directors would not be entitled to this compensation if they were removed from the Board prior to their respective RSUs vesting, it was in the Special Committee members’ personal interest to approve the Proposed Transaction, even at an unfair price, rather than risk being removed from the Board and losing out on their RSU compensation altogether by standing up to Calamos and negotiating effectively and atarm’s-length.

83. Indeed, the amount of RSU compensation to be earned by the Special Committee members in the Proposed Transaction is far greater than the amount they will earn from their ownership of CAM’s Class A common stock (assuming they are cashed out at the $8.25 per share Merger Consideration):

| | | | | | | | |

Name | | Number of

Shares | | | Cash Consideration

for Shares | |

Non-Employee Directors | | | | | | | | |

Thomas F. Eggers | | | 2,477 | | | $ | 20,435 | |

Keith M. Schappert | | | 1,077 | | | | 8,885 | |

William N. Shiebler | | | 1,077 | | | | 8,885 | |

Executive Officers (Other Than Mr. Calamos) | | | | | | | | |

John S. Koudounis | | | — | | | | — | |

Robert F. Behan | | | 30,642 | | | | 252,797 | |

Thomas E. Herman | | | — | | | | — | |

34

84. Thus, the Special Committee members knew that, if they bargained hard and were removed from the Board, the amount of money they could earn from cashing out their Class A common stock was insignificant compared to the amount of money they could earn by appeasing Calamos and accepting an unfair Merger Consideration to ensure the vesting and receipt of their RSU compensation. As such, the Special Committee was incentivized, and acted in their own best interest, to approve the unfair Merger Consideration, and they failed to bargain hard or reject the unfair Proposed Transaction for fear of being removed from the Board and losing their valuable RSUs.

85. The amount of money to be received by the Special Committee members as a result of the vesting of their RSUs was material to them, as it far surpassed or came close to the amount of cash compensation they earned in an entire year from serving on the Board. Additionally, upon information and belief, serving on the Board is the sole employment of Eggers and Shiebler, thus making the guaranteed vesting and payment of their lucrative RSUs even more important and material to them.

86. These distorting incentives, which were not shared by the Company’s minority stockholders, caused the Special Committee to suffer from a conflict of interest. Because of the Special Committee’s divergent interests and conflicts, the

35

Special Committee consciously failed to protect CAM’s minority stockholders and bargain hard for a value maximizing transaction, and breached its fiduciary duties by approving the unfair Proposed Transaction.

87. Additionally, the Company’s officers will become the officers of the surviving corporation following the Merger. These officers will retain their lucrative salary and other benefits, as well as be able to liquidate their extensive holdings in CAM without a block-sale discount, which benefits are not equally shared with the Company’s minority stockholders. Because of these conflicts, CAM’s officers had an incentive to push for the Proposed Transaction and manipulate the Company’s management projections to ensure that Calamos would take the Company private at a favorable price.

88. Additionally, Schappert has a deep connection with JP Morgan Chase Bank, the bank that has agreed (belatedly) to provide the Purchaser Group with financing because Schappert worked nearly thirty years at the affiliated JP Morgan Investment Management, where he was President and CEO.

89. As such, the Special Committee directors and Company officers stand to receive significant benefits and thus have reason to support the Proposed Transaction, which is otherwise against the best interests of the Company’s stockholders.

36

Defendants Failed to Disclose Material Information to CAM’s Public Stockholders

90. Defendants failed to disclose material information to CAM’s minority stockholders in connection with the Tender Offer. According to the14D-9, in performing its discounted cash flow analyses:

Duff & Phelps used financial projections provided by the Company’s management for the years ending December 31, 2017 to 2023, which are included in the Management Projections (the “Management Base Case”), and considered two scenarios that did not include a market correction (individually, “No Market Correction Case 1” and “No Market Correction Case 2” and collectively, the “No Market Correction Cases”). Duff & Phelps noted that the Management Base Case included an explicit assumption of a market correction in 2018 and ensuing market recovery in 2019. The No Market Correction Cases considered, among other factors, an average market performance in both 2018 and 2019. The difference between No Market Correction Case 1 and No Market Correction Case 2 is a difference in expense assumptions between the two scenarios.

91. Neither the14D-9 nor any other filing including the13e-3 fail to disclose the No Market Correction Cases that were relied upon by Duff & Phelps to perform its discounted cash flow analyses. The disclosure of realistic financial projections, without the impact of an unsupported and hypothetical market correction, is material information to stockholders in determining whether to tender their shares or seek appraisal, particularly when they were relied upon the banker and the Special Committee to approve the Proposed Transaction. As such, the Board breached its fiduciary duties by failing to disclose these projections, and CAM’s minority stockholders are entitled to quasi-appraisal damages for their shares.

37

COUNT I

(Breach of Fiduciary Duties Against the Individual Defendants)

92. Plaintiff repeats and realleges the preceding allegations as if fully set forth herein.

93. As directors and/or officers of CAM, the Individual Defendants owe fiduciary duties to plaintiff and the other minority stockholders of CAM.

94. As members of the Company’s Board, the Individual Defendants have fiduciary obligations to: (a) undertake an appropriate evaluation of CAM’s net worth as a merger/acquisition candidate; (b) take all appropriate steps to enhance CAM’s value and attractiveness as a merger/acquisition candidate; (c) act independently to protect the interests of the Company’s public stockholders; (d) adequately ensure that no conflicts of interest exist between the Individual Defendants’ own interests and their fiduciary obligations, and, if such conflicts exist, to ensure that all conflicts are resolved in the best interests of CAM’s public stockholders; (e) actively evaluate the Proposed Transaction and engage in a meaningful auction with third parties in an attempt to obtain the best value on any sale of CAM; and (f) disclose all material information to the Company’s stockholders.

95. The Individual Defendants have breached their fiduciary duties to plaintiff and the Class.

38

96. The Special Committee did not function or act in any manner to indicate that it had or exercised real bargaining power, was independent, or made an informed decision to approve the Proposed Transaction. The Special Committee repeatedly ceded to the Purchaser Group’s unfair demands and quickly “negotiated” and approved the unfair economic andnon-economic terms of the Proposed Transaction, which were dictated by the Purchaser Group. They also agreed to severalnon-customary terms in the Merger Agreement, as well as several preclusion deal protection devices, but failed to negotiate for amajority-of-the-minority tender provision to protect CAM’s public stockholders. They also failed to reach out to any third parties to test the market and determine CAM’s fair value. The Special Committee members violated their fiduciary duties by accepting the Purchaser Group going-private proposal and recommending its approval to the Board.

97. Additionally, the Special Committee suffered from a conflict of interest. Because CAM’s directors were expected to receive lucrative payments in connection with the vesting of their RSU awards, they had an incentive to approve the Proposed Transaction, even at an unfair price, which they would not have received if they bargained hard or rejected the Purchaser Group’s offer.

39

98. The Individual Defendants failed to take measures to ensure that the interests of CAM’s minority stockholders were protected and failed to secure the best price reasonably available for the minority stockholders. Instead, the Individual Defendants acted to put the interests of the Purchaser Group, and their own interests, ahead of the interests of the Company’s minority stockholders. Thus, each of the Individual Defendants breached their fiduciary duties by facilitating and approving the Proposed Transaction.

99. As a result of the Individual Defendants’ breaches of fiduciary duties, plaintiff and the members of the Class were harmed because they did not receive fair or adequate consideration for their CAM common stock.

100. Plaintiff and the members of the Class have no adequate remedy at law.

COUNT II

(Breach of Fiduciary Duties Against the Purchaser Group)

101. Plaintiff repeats and realleges the preceding allegations as if fully set forth herein.

102. Calamos and Koudounis worked together as one cohesive controlling stockholder unit to take the Company private in a transaction that is in their own best interests, but is unfair to the Company’s minority stockholders. Indeed, the14D-9 states, among other things, that Calamos and Koudounis informed the Board in October 2016 that they “were in the process of evaluating their own strategic alternatives,” and “would acquire all outstanding Shares not owned by them.”

40

103. Calamos is CAM’s controlling stockholder. In the Company’s most recent10-K, filed with the SEC on March 11, 2016, the Company acknowledged Calamos’s control over the Board by stating that he “will continue to have the ability to elect all of the members of our board of directors and thereby control our management and affairs,” and “will continue to be able to determine the outcome of all matters requiring stockholder approval on a combined class vote basis, and will continue to be able to cause or prevent a change of control of our Company or a change in the composition of our board of directors.” As such, Calamos owes CAM’s public stockholders fiduciary duties as CAM’s controlling stockholder.

104. As CAM’s CEO, Koudounis also owes fiduciary duties to CAM’s public stockholders.

105. Calamos and Koudounis acted together for the shared goals of obtaining substantial benefits in the Proposed Transaction, which were not shared by the Company’s public, minority stockholders, and obtaining full control over the Company Calamos founded for an unfairly low price. Indeed, the Purchaser Group purposely timed the Proposed Transaction to take advantage of the Company’s lower-than-normal stock price, and in an effort to make the unfair Merger Consideration appear fair.

41

106. The Purchaser Group also refused to sell their shares, refused to incorporate amajority-of-the-minority tender condition, and demanded a ceiling on the percentage of minority stockholders who could seek appraisal before triggering the right of the Purchaser Group not to close the Proposed Transaction. Additionally, Calamos and Koudounis, as well as the rest of CAM’s management, will continue to serve in their lucrative executive employment roles following the consummation of the Proposed Transaction.

107. Calamos also breached his fiduciary duties to CAM’s stockholders by voting to approve the Proposed Transaction as a member of the Board, rather than recuse himself in light of his obvious conflict of interest.

108. Accordingly, CAM’s controlling stockholders breached their fiduciary duty of loyalty to the Company’s minority stockholders.

109. Plaintiff and the members of the Class have no adequate remedy at law.

COUNT III

(Aiding and Abetting Breaches of Fiduciary Duties

Against Parent and Merger Sub)

110. Plaintiff repeats and realleges the preceding allegations as if fully set forth herein.

111. Defendants Parent and Merger Sub, which were controlled by Individual Defendants Calamos and Koudounis and were parties to the Merger Agreement, knowingly assisted the Individual Defendants’ and the Purchase

42

Group’s breaches of fiduciary duties in connection with the Proposed Transaction, which, without such aid, would not have occurred. Parent and Merger Sub were responsible for making the unfair proposal to take the Company private for $8.25 per share.

112. As a result of Parent’s and Merger Sub’s conduct, plaintiff and the other members of the Class have been damaged in that they have been prevented from obtaining fair and adequate consideration for their CAM shares.

113. Plaintiff and the members of the Class have no adequate remedy at law.

PRAYER FOR RELIEF

WHEREFORE, plaintiff prays for judgment and relief as follows:

A. Ordering that this action may be maintained as a class action and certifying plaintiffs as the Class representatives and plaintiff’s counsel as Class counsel;

B. Directing defendants to account to plaintiff and the Class for their damages sustained because of the wrongs complained of herein;

C. Awarding plaintiff the costs of this action, including reasonable allowance for plaintiff’s attorneys’ and experts’ fees; and

D. Granting such other and further relief as this Court may deem just and proper.

43

| | | | | | |

| Dated: February 3, 2017 | | | | | | RIGRODSKY & LONG, P.A. |

| | | |

| | | | By: | | /s/ Seth D. Rigrodsky |

| | | | | | Seth D. Rigrodsky (#3147) |

| | | | | | Brian D. Long (#4347) |

| OF COUNSEL: | | | | | | Gina M. Serra (#5387) |

| | | | | | Jeremy J. Riley (#5791) |

| WOLF HALDENSTEIN ADLER | | | | | | 2 Righter Parkway, Suite 120 |

| FREEMAN & HERZ LLP | | | | | | Wilmington, DE 19803 |

| Gregory M. Nespole | | | | | | (302)295-5310 |

| 270 Madison Avenue | | | | | | |

| New York, NY 10016 | | | | | | Counsel for Plaintiff |

| (212)545-4600 | | | | | | |

44