UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM 10-Q

________________

|

| |

| þ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| | FOR THE QUARTERLY PERIOD ENDED: September 30, 2015 |

| | |

| or |

| | |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

Commission File Number: 000-51003

________________

CALAMOS ASSET MANAGEMENT, INC.

(Exact Name of Registrant as Specified in its Charter)

________________

|

| | |

| Delaware | | 32-0122554 |

| (State or Other Jurisdiction of | | (I.R.S. Employer |

| Incorporation or Organization) | | Identification No.) |

| | | |

| 2020 Calamos Court, Naperville, Illinois | | 60563 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(630) 245-7200

(Registrant’s telephone number, including area code)

___________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. þ Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). þ Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer ¨ | Accelerated filer þ | Non-accelerated filer ¨ | Smaller reporting company ¨ |

| | (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes þ No

At October 30, 2015, there were 20,531,826 shares of Class A common stock and 100 shares of Class B common stock outstanding.

TABLE OF CONTENTS

PART I — FINANCIAL INFORMATION

Item 1. Consolidated Financial Statements

CALAMOS ASSET MANAGEMENT, INC.

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION

(in thousands, except share data) |

| | | | | | | |

| | September 30, 2015 | | December 31, 2014 |

| | (unaudited) | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 92,753 |

| | $ | 35,285 |

|

| Receivables: | | | |

| Affiliates and affiliated funds | 13,782 |

| | 16,024 |

|

| Customers | 4,201 |

| | 2,967 |

|

| Investment securities | 258,209 |

| | 339,959 |

|

| Partnership investments | 108,043 |

| | 143,723 |

|

| Prepaid expenses | 3,636 |

| | 3,188 |

|

| Deferred tax assets, net | 7,887 |

| | 9,194 |

|

| Other current assets | 5,249 |

| | 2,508 |

|

| Total current assets | 493,760 |

| | 552,848 |

|

| Non-current assets: | | | |

| Deferred tax assets, net | 29,346 |

| | 31,067 |

|

| Goodwill and intangible assets | 7,351 |

| | 6,380 |

|

| Property and equipment, net of accumulated depreciation and amortization ($60,808 at September 30, 2015 and $61,145 at December 31, 2014) | 13,658 |

| | 14,246 |

|

| Other non-current assets | 1,865 |

| | 2,615 |

|

| Total non-current assets | 52,220 |

| | 54,308 |

|

| Total assets | $ | 545,980 |

| | $ | 607,156 |

|

| LIABILITIES AND EQUITY | | | |

| LIABILITIES | | | |

| Current liabilities: | | | |

| Distribution fees payable | $ | 7,953 |

| | $ | 10,614 |

|

| Accrued compensation and benefits | 23,188 |

| | 24,476 |

|

| Interest payable | 632 |

| | 1,386 |

|

| Liabilities of partnership investments | 631 |

| | 10,117 |

|

| Accrued expenses and other current liabilities | 5,357 |

| | 6,009 |

|

| Total current liabilities | 37,761 |

| | 52,602 |

|

| Non-current liabilities: | | | |

| Long-term debt | 45,955 |

| | 45,955 |

|

| Deferred rent | 8,820 |

| | 8,803 |

|

| Other non-current liabilities | 2,282 |

| | 1,710 |

|

| Total non-current liabilities | 57,057 |

| | 56,468 |

|

| Total liabilities | 94,818 |

| | 109,070 |

|

| | | | |

| Redeemable non-controlling interest in partnership investments | 74,194 |

| | 76,167 |

|

| | | | |

| EQUITY | | | |

| Class A Common Stock, $0.01 par value; authorized 600,000,000 shares; 25,231,667 shares issued and 17,176,142 shares outstanding at September 30, 2015; 24,990,781 shares issued and 17,920,722 shares outstanding at December 31, 2014 | 252 |

| | 250 |

|

| Class B Common Stock, $0.01 par value; authorized 1,000 shares; 100 shares issued and outstanding at September 30, 2015 and December 31, 2014 | — |

| | — |

|

| Additional paid-in capital | 223,334 |

| | 221,208 |

|

| Retained earnings | 83,693 |

| | 89,311 |

|

| Accumulated other comprehensive income (loss) | (788 | ) | | 1,297 |

|

| Treasury stock; 8,055,525 shares at September 30, 2015 and 7,070,059 shares at December 31, 2014 | (111,986 | ) | | (107,129 | ) |

| Calamos Asset Management, Inc. stockholders’ equity | 194,505 |

| | 204,937 |

|

| Non-controlling interest in Calamos Investments LLC (Calamos Interests) | 182,463 |

| | 216,982 |

|

| Total equity | 376,968 |

| | 421,919 |

|

| Total liabilities and equity | $ | 545,980 |

| | $ | 607,156 |

|

See accompanying notes to consolidated financial statements.

CALAMOS ASSET MANAGEMENT, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share data)

(unaudited)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

| REVENUES | | | | | | | |

| Investment management fees | $ | 46,738 |

| | $ | 50,418 |

| | $ | 141,648 |

| | $ | 150,393 |

|

| Distribution and underwriting fees | 10,264 |

| | 12,438 |

| | 31,858 |

| | 38,069 |

|

| Other | 616 |

| | 676 |

| | 1,880 |

| | 2,005 |

|

| Total revenues | 57,618 |

| | 63,532 |

| | 175,386 |

| | 190,467 |

|

| EXPENSES | |

| | |

| | | | |

| Employee compensation and benefits | 23,891 |

| | 21,738 |

| | 70,613 |

| | 65,464 |

|

| Distribution expenses | 10,172 |

| | 12,164 |

| | 31,178 |

| | 37,122 |

|

| Marketing and sales promotion | 4,063 |

| | 3,897 |

| | 21,798 |

| | 12,268 |

|

| General and administrative | 10,865 |

| | 9,880 |

| | 30,583 |

| | 29,050 |

|

| Total operating expenses | 48,991 |

| | 47,679 |

| | 154,172 |

| | 143,904 |

|

| Operating income | 8,627 |

| | 15,853 |

| | 21,214 |

| | 46,563 |

|

| NON-OPERATING INCOME | |

| | |

| | | | |

| Net interest expense | (717 | ) | | (851 | ) | | (2,168 | ) | | (3,776 | ) |

| Investment and other income (loss) | (10,997 | ) | | 4,482 |

| | (4,568 | ) | | 16,529 |

|

| Total non-operating income (loss) | (11,714 | ) | | 3,631 |

| | (6,736 | ) | | 12,753 |

|

| Income (loss) before income taxes | (3,087 | ) |

| 19,484 |

| | 14,478 |

| | 59,316 |

|

| Income tax provision (benefit) | (46 | ) | | 1,870 |

| | 1,694 |

| | 5,278 |

|

| Net income (loss) | (3,041 | ) | | 17,614 |

| | 12,784 |

| | 54,038 |

|

| Net income attributable to non-controlling interest in Calamos Investments LLC (Calamos Interests) | (894 | ) | | (15,936 | ) | | (12,031 | ) | | (43,749 | ) |

| Net (income) loss attributable to redeemable non-controlling interest in partnership investments | 4,298 |

| | 1,691 |

| | 1,744 |

| | (1,553 | ) |

| Net income attributable to Calamos Asset Management, Inc. | $ | 363 |

| | $ | 3,369 |

| | $ | 2,497 |

| | $ | 8,736 |

|

Earnings per share: | |

| | |

| | | | |

| Basic | $ | 0.02 |

| | $ | 0.19 |

| | $ | 0.14 |

| | $ | 0.47 |

|

| Diluted | $ | 0.02 |

| | $ | 0.18 |

| | $ | 0.14 |

| | $ | 0.46 |

|

| Weighted average shares outstanding: | |

| | |

| | | | |

| Basic | 17,316,823 |

| | 17,888,694 |

| | 17,657,669 |

| | 18,399,379 |

|

| Diluted | 18,208,850 |

| | 18,781,856 |

| | 18,445,524 |

| | 19,158,720 |

|

| | | | | | | | |

| Cash dividends declared per share | $ | 0.15 |

| | $ | 0.15 |

| | $ | 0.45 |

| | $ | 0.40 |

|

See accompanying notes to consolidated financial statements.

CALAMOS ASSET MANAGEMENT, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands)

(unaudited)

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

| Net income (loss) | $ | (3,041 | ) | | $ | 17,614 |

| | $ | 12,784 |

| | $ | 54,038 |

|

| Other comprehensive loss, before income tax benefit | |

| | |

| | | | |

| Unrealized gains (losses) on available-for-sale securities: | |

| | |

| | | | |

| Unrealized gains (losses) | (19,871 | ) | | (9,123 | ) | | (7,816 | ) | | 1,531 |

|

| Reclassification adjustment for realized gains included in net income | — |

| | (5,949 | ) | | (2,510 | ) | | (11,559 | ) |

| Other comprehensive loss, before income tax benefit | (19,871 | ) | | (15,072 | ) | | (10,326 | ) | | (10,028 | ) |

| Income tax benefit related to other comprehensive loss | (1,857 | ) | | (1,533 | ) | | (1,225 | ) | | (1,108 | ) |

| Other comprehensive loss, after income tax benefit | (18,014 | ) | | (13,539 | ) | | (9,101 | ) | | (8,920 | ) |

| Comprehensive income (loss) | (21,055 | ) | | 4,075 |

| | 3,683 |

| | 45,118 |

|

| Comprehensive (income) loss attributable to non-controlling interest in Calamos Investments LLC (Calamos Interests) | 13,958 |

| | (5,007 | ) | | (5,015 | ) | | (36,696 | ) |

| Comprehensive (income) loss attributable to redeemable non-controlling interest in partnership investments | 4,298 |

| | 1,691 |

| | 1,744 |

| | (1,553 | ) |

| Comprehensive income (loss) attributable to Calamos Asset Management, Inc. | $ | (2,799 | ) | | $ | 759 |

| | $ | 412 |

| | $ | 6,869 |

|

See accompanying notes to consolidated financial statements.

CALAMOS ASSET MANAGEMENT, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

Nine Months Ended September 30, 2015

(in thousands, except share data)

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Calamos Asset Management, Inc. Stockholders | | | | | | |

| (in thousands) | Common Stock | | Additional Paid-in Capital | | Retained Earnings | | Accumulated Other Comprehensive Income (Loss) | | Treasury Stock | | Non-controlling Interest in Calamos Investments LLC (Calamos Interests) | | Total | | Redeemable Non-controlling Interest in Partnership Investments |

| Balance at December 31, 2014 | $ | 250 |

| | $ | 221,208 |

| | $ | 89,311 |

| | $ | 1,297 |

| | $ | (107,129 | ) | | $ | 216,982 |

| | $ | 421,919 |

| | $ | 76,167 |

|

| Net income (loss) | — |

| | — |

| | 2,497 |

| | — |

| | — |

| | 12,031 |

| | 14,528 |

| | (1,744 | ) |

| Other comprehensive loss | — |

| | — |

| | — |

| | (2,085 | ) | | — |

| | (7,016 | ) | | (9,101 | ) | | — |

|

| Issuance of common stock (240,886 Class A common shares) | 2 |

| | (2 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Repurchase of common stock by Calamos Investments LLC (985,466 Class A common shares) | — |

| | — |

| | — |

| | — |

| | (2,655 | ) | | (9,302 | ) | | (11,957 | ) | | — |

|

| Impact of the redemption of common stock from Calamos Investments LLC by Calamos Asset Management, Inc. (240,886 Class A common shares) | — |

| | 2,202 |

| | — |

| | — |

| | (2,202 | ) | | — |

| | — |

| | — |

|

| Cumulative impact of changes in ownership of Calamos Investments LLC | — |

| | (111 | ) | | — |

| | | | — |

| | (564 | ) | | (675 | ) | | — |

|

| Net purchase of redeemable non-controlling interests in partnership investments | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (229 | ) |

| Compensation expense recognized under stock incentive plans | — |

| | 1,034 |

| | — |

| | — |

| | — |

| | 3,621 |

| | 4,655 |

| | — |

|

| Impact on non-controlling interests as a result of dividends paid to Calamos Investments LLC on repurchased common stock | — |

| | (997 | ) | | — |

| | — |

| | — |

| | 997 |

| | — |

| | — |

|

| Dividend equivalent accrued under stock incentive plans | — |

| | — |

| | (158 | ) | | — |

| | — |

| | (556 | ) | | (714 | ) | | — |

|

| Equity and tax distributions paid to non-controlling interests in Calamos Investments LLC (Calamos Interests) | — |

| | — |

| | — |

| | — |

| | — |

| | (33,730 | ) | | (33,730 | ) | | — |

|

| Dividends declared | — |

| | — |

| | (7,957 | ) | | — |

| | — |

| | — |

| | (7,957 | ) | | — |

|

| Balance at September 30, 2015 | $ | 252 |

| | $ | 223,334 |

| | $ | 83,693 |

| | $ | (788 | ) | | $ | (111,986 | ) | | $ | 182,463 |

| | $ | 376,968 |

| | $ | 74,194 |

|

See accompanying notes to consolidated financial statements.

CALAMOS ASSET MANAGEMENT, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

|

| | | | | | | |

| | Nine Months Ended September 30, |

| | 2015 | | 2014 |

| Cash and cash equivalents at beginning of period | $ | 35,285 |

| | $ | 39,078 |

|

| Cash flows provided by operating activities: | |

| | |

|

| Net income | 12,784 |

| | 54,038 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | |

| | |

|

| Amortization of deferred sales commissions | 1,358 |

| | 1,987 |

|

| Other depreciation and amortization | 3,111 |

| | 3,274 |

|

| (Gain) loss on disposal of property and equipment | 89 |

| | (111 | ) |

| Deferred rent | 17 |

| | (168 | ) |

| Change in unrealized gains on trading securities, derivative assets, derivative liabilities and partnership investments | (1,157 | ) | | (7,785 | ) |

| Net realized (gains) losses on sale of investment securities, derivative assets, derivative liabilities and partnership investments | 6,719 |

| | (3,388 | ) |

| Deferred taxes, net | 4,309 |

| | 7,208 |

|

| Stock-based compensation | 4,655 |

| | 4,650 |

|

| Employee taxes paid on vesting under stock incentive plans | (730 | ) | | (510 | ) |

| (Increase) decrease in assets: | |

| | |

|

| Receivables: | |

| | |

|

| Affiliates and affiliated funds, net | 2,242 |

| | 394 |

|

| Customers | (1,234 | ) | | 2,197 |

|

| Other assets | (3,780 | ) | | (3,233 | ) |

| Decrease in liabilities: | |

| | |

|

| Distribution fees payable | (2,661 | ) | | (226 | ) |

| Accrued compensation and benefits | (1,833 | ) | | (2,613 | ) |

| Accrued expenses and other liabilities | (2,030 | ) | | (5,527 | ) |

| Net cash provided by operating activities | 21,859 |

| | 50,187 |

|

| Cash flows provided by investing activities: | |

| | |

|

| Net additions to property and equipment | (2,574 | ) | | (991 | ) |

| Purchases of investment securities | (20,370 | ) | | (131,478 | ) |

| Proceeds from sale of investment securities | 89,022 |

| | 317,109 |

|

| Contributions to partnership investments | (229 | ) | | (31,400 | ) |

| Distributions from partnership investments | 23,403 |

| | — |

|

| Net cash paid for acquisition | (55 | ) | | — |

|

| Net cash provided by investing activities | 89,197 |

| | 153,240 |

|

| Cash flows used in financing activities: | |

| | |

|

| Repayment of long-term debt | — |

| | (46,160 | ) |

| Deferred tax benefit (expense) on vesting under stock incentive plans | 56 |

| | (14 | ) |

| Repurchase of common stock by Calamos Investments LLC (985,466 at September 30, 2015, and 1,779,670 at September 30, 2014 Class A common shares) | (11,957 | ) | | (21,591 | ) |

| Equity distributions paid to non-controlling interests (Calamos Interests) | (23,338 | ) | | (71,571 | ) |

| Tax distributions paid to non-controlling interests (Calamos Interests) | (10,392 | ) | | (22,023 | ) |

| Cash dividends paid to common stockholders | (7,957 | ) | | (7,406 | ) |

| Net cash used in financing activities | (53,588 | ) | | (168,765 | ) |

| Net increase in cash and cash equivalents | 57,468 |

| | 34,662 |

|

| Cash and cash equivalents at end of period | $ | 92,753 |

| | $ | 73,740 |

|

Supplemental disclosure of cash flow information: | |

| | |

|

| Cash paid (refunded) for: | |

| | |

|

| Income taxes, net | $ | (105 | ) | | $ | (1,416 | ) |

| Interest | $ | 3,032 |

| | $ | 5,954 |

|

See accompanying notes to consolidated financial statements.

CALAMOS ASSET MANAGEMENT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(1) Organization and Description of Business

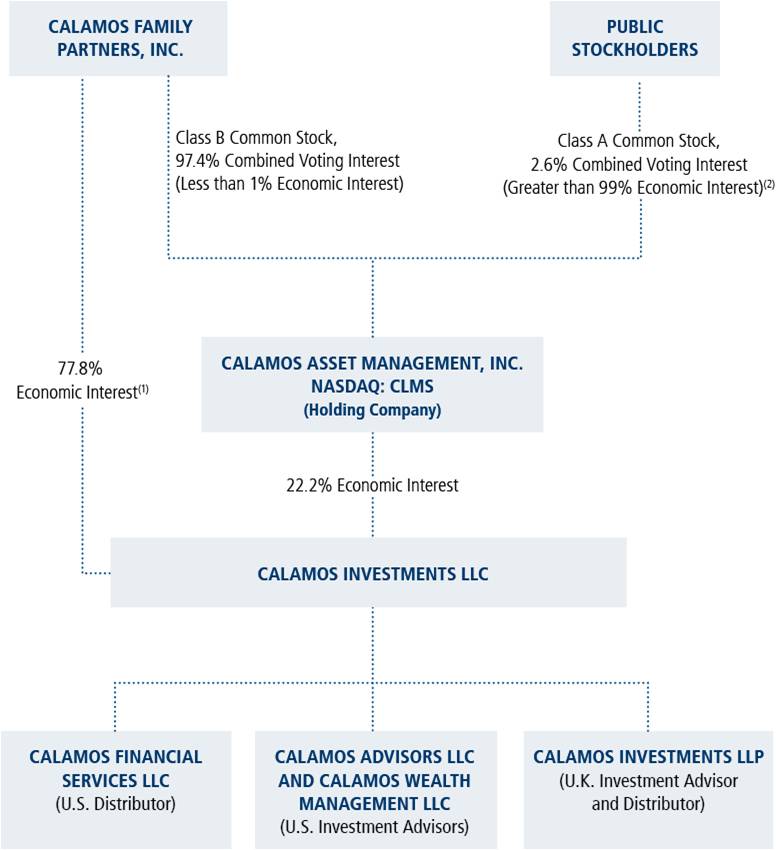

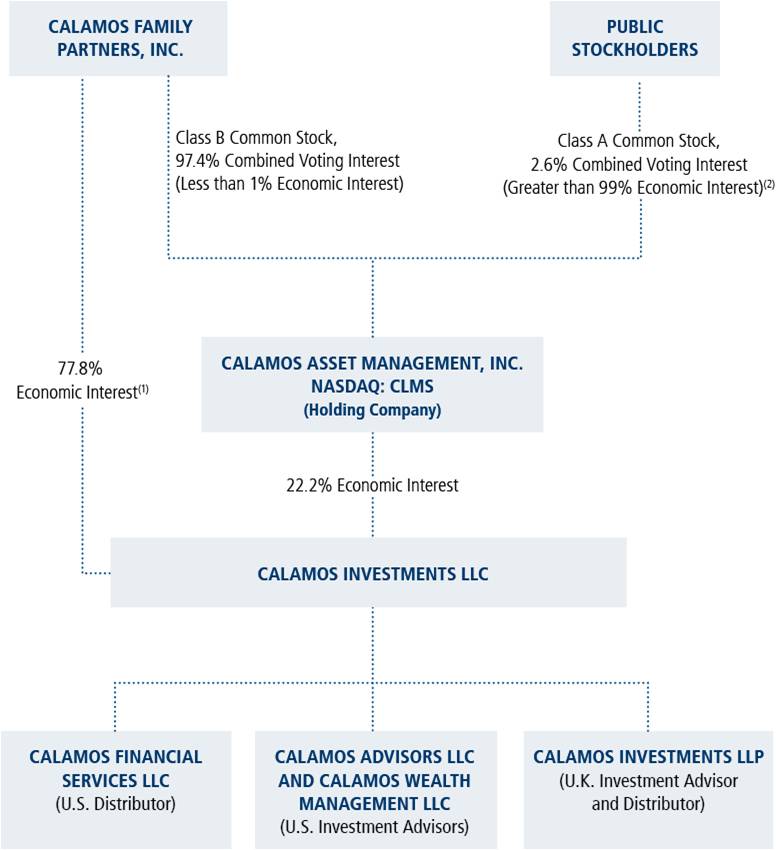

Calamos Asset Management, Inc. (“CAM”), representing the public shares outstanding, as of September 30, 2015, owned 22.2% of the operating company, Calamos Investments LLC (“Calamos Investments”), with the remaining 77.8% privately owned by Calamos Family Partners, Inc. (“CFP”), a Delaware corporation, and John P. Calamos, Sr., the Chairman, Chief Executive Officer and Global Co-Chief Investment Officer of CAM. CAM, together with Calamos Investments and Calamos Investments’ subsidiaries (the “Company”), operates the investment advisory and distribution services businesses reported within these consolidated financial statements. CAM operates and is the sole manager, and thus controls all of the business and affairs of Calamos Investments and, as a result of this control, consolidates the financial results of Calamos Investments with its own financial results. CFP and John P. Calamos, Sr. (collectively "Calamos Interests") ownership interest, in accordance with applicable accounting guidance, is reflected and referred to within these consolidated financial statements as "non-controlling interest in Calamos Investments LLC". As shown in the diagram below, CFP also owns all of CAM’s outstanding Class B common stock, which represents 97.4% of the combined voting power of all classes of CAM’s voting stock. The graphic below illustrates our organizational and ownership structure as of September 30, 2015:

| |

(1) | Represents combined economic interest of Calamos Family Partners, Inc. and John P. Calamos, Sr. who is also a member of Calamos Investments LLC. |

| |

(2) | Represents combined economic interest of all public stockholders, including John P. Calamos, Sr. and John P. Calamos, Jr.’s combined 18.78% ownership interest of Class A common stock. The calculation of ownership interest includes options and restricted stock units ("RSUs") that vest within 60 days, as well as CFP’s indirect ownership interest in Class A common stock purchased by Calamos Investments LLC, pursuant to the Company’s share repurchase plan. |

CALAMOS ASSET MANAGEMENT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

The Company primarily provides investment advisory services to individuals and institutional investors through a number of investment products that include open-end funds and closed-end funds (the “Funds”), separate accounts, offshore funds, an exchange traded fund and partnerships, as well as provides model portfolio design and oversight for separately managed accounts. The subsidiaries through which the Company provides these services include: Calamos Advisors LLC (“CAL”), a Delaware limited liability company and registered investment advisor; Calamos Financial Services LLC (“CFS”), a Delaware limited liability company and registered broker-dealer; Calamos Wealth Management LLC, a Delaware limited liability company and registered investment advisor; and Calamos Investments LLP, a United Kingdom limited liability partnership, registered investment advisor with the Financial Conduct Authority in the United Kingdom, and a global distributor of the offshore funds and Company products. For reporting purposes, the offshore funds are included within the open-end funds.

(2)Summary of Significant Accounting Policies

Basis of Presentation

The consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”), which require the use of estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses, and the disclosure of contingent assets and liabilities. Management believes the accounting estimates are appropriate and reasonably stated; however, due to the inherent uncertainties in making estimates, actual amounts could differ from these estimates.

The consolidated financial statements as of September 30, 2015 and for the three and nine months ended September 30, 2015, and 2014 have not been audited by the Company’s independent registered public accounting firm. In the opinion of management, these statements contain all adjustments, including those of a normal recurring nature, necessary for fair presentation of the financial condition and results of operations. The results for the interim periods presented are not necessarily indicative of the results to be obtained for a full fiscal year. This Form 10-Q filing should be read in conjunction with the Company’s Annual Report on Form 10-K for the year ended December 31, 2014.

Principles of Consolidation

The Company consolidates investments in which the Company’s ownership exceeds 50% or in which the Company operates and controls the business and affairs of the entity or is deemed to be the primary beneficiary. In order to make this determination, an analysis is performed to determine if the investment in an affiliate or partnership is a variable interest entity ("VIE"). The Company has evaluated its investments in affiliates and partnerships and has concluded that they are not VIEs. With respect to partnership investments, the limited partners have no control of the business and affairs of the partnership, no substantive ability to dissolve (liquidate) the partnership, or otherwise remove the general partner (CAL and Calamos Investments) without cause or have other substantive rights.

The consolidated financial statements include the financial statements of CAM, Calamos Investments, Calamos Investments’ wholly-owned subsidiaries, and the Company’s partnerships in which it owns a majority interest or in which it has operating control. The equity method of accounting is used for investments in which the Company has significant influence, but less than 50% ownership. All significant intercompany balances and transactions have been eliminated.

The Calamos Interests’ combined 77.8% interest in Calamos Investments at September 30, 2015 and December 31, 2014, is represented as a non-controlling interest in Calamos Investments LLC in the Company’s consolidated financial statements. Non-controlling interest in Calamos Investments is derived by multiplying the historical equity of Calamos Investments by the Calamos Interests’ aggregate ownership percentage for the periods presented. Issuances and repurchases of CAM’s common stock may result in changes to CAM’s ownership percentage and to the non-controlling interests’ ownership percentage of Calamos Investments with resulting changes reflected in the consolidated statements of changes in equity. Income is allocated based on the average ownership interest during the period in which the income is earned.

CAM owns certain assets to which it has exclusive economic rights. As of September 30, 2015 and December 31, 2014, these assets included cash, cash equivalents and investment securities of $80.1 million and $79.3 million, net current and non-current deferred tax assets of $37.2 million and $40.3 million, net current income taxes receivable of $5.0 million and $2.4 million, and a loan receivable from Calamos Investments of $20.1 million and $21.0 million, respectively, that are reported together with Calamos Investments’ consolidated assets in the consolidated statements of financial condition. Additionally, net income before income taxes of $14.5 million and $59.3 million for the nine months ended September 30, 2015 and 2014, respectively, each included $721,000 and $1.3 million, respectively, of interest income, dividend income and realized gains and losses on cash and cash equivalents held solely by CAM. These portions of CAM’s income and expense are not affected by non-controlling interests.

Calamos Investments, through its wholly owned subsidiaries and affiliates, is indirectly the general partner and controls the operations of Calamos Global Opportunities Fund LP, for which it acquired a majority interest in the partnership during the second

CALAMOS ASSET MANAGEMENT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

quarter of 2014. The results of this partnership are included in the Company's consolidated financial statements for the year ended December 31, 2014 and the nine months ended September 30, 2015. Calamos Investments, through a wholly owned subsidiary, was indirectly the general partner and controlled the operations of Calamos Arista Strategic Fund LP, a U.S. feeder fund, and Calamos Arista Strategic Fund Ltd, an offshore feeder fund, both to Calamos Arista Strategic Master Fund LTD, a hedge fund in the Cayman Islands. As Calamos Investments was the general partner and controlled the operations of Calamos Arista Strategic Fund LP and Calamos Arista Strategic Fund Ltd, the results of these partnerships and the master fund were included in the Company’s consolidated financial results for the year ended December 31, 2014. Calamos Arista Strategic Fund LP was liquidated on December 26, 2014. The partnership redemptions were completed during the first quarter of 2015 for proceeds of $23.1 million. For the year ended December 31, 2014, the amount due to non-controlling interest of $7.7 million related to this partnership investment was presented in liabilities of partnership investments in our consolidated statements of financial condition. The operations of Calamos International Growth Fund LP were controlled by CAL, the general partner. In December 2013, the limited partners of Calamos International Growth Fund LP redeemed all of their interests in the fund. As a result, the Company deconsolidated Calamos International Growth Fund LP and accounted for this partnership investment using the equity method as of December 31, 2014. Calamos International Growth Fund LP was dissolved on April 10, 2014. See Note 6, Partnership Investments, for more discussion regarding these funds.

For the periods the partnerships are consolidated, the assets and liabilities of the partnerships are presented as partnership investments and liabilities of partnership investments, respectively, in the consolidated statements of financial condition. The net income for these partnerships are included in investment and other income in the consolidated statements of operations, and the change in partnership investments is included in contributions to or distributions from partnership investments in the consolidated statements of cash flows. The underlying assets and liabilities that are being consolidated are described in Note 6, Partnership Investments. The combined interests of all of the consolidated partnerships not owned by the Company and that are redeemable at the option of the holder, are presented as redeemable non-controlling interest in partnership investments in the Company’s consolidated financial statements for the periods those partnerships were consolidated.

The Company holds non-controlling interests in certain other partnership investments that are included in partnership investments in the consolidated statements of financial condition. These other partnership investments are accounted for under the equity method.

Restricted Cash

The Company has a $430,000 security deposit that is restricted from the Company’s general corporate use and is being reported in other non-current assets in the consolidated statements of financial condition.

Treasury Stock

On November 13, 2014, the Company announced a repurchase of up to an additional 3 million shares of the Company's outstanding Class A Common Stock primarily to continue to manage the dilution from share issuances under the Company’s incentive compensation plan. During the nine months ended September 30, 2015, Calamos Investments repurchased 985,466 shares of Class A common stock, at an average purchase price of $12.13 and a total cost of $12.0 million under this repurchase program. As Calamos Investments is consolidated with CAM, the repurchased shares are reported as treasury shares. As such, CAM’s 22.2% ownership interest in these shares totaling $2.7 million is reported in treasury stock, with Calamos Interests’ 77.8% ownership interest in these shares totaling $9.3 million reported in non-controlling interest in the consolidated statements of financial condition. The total shares repurchased are not included in the calculation of basic and diluted earnings per share in accordance with GAAP.

During the nine months ended September 30, 2015, CAM redeemed 240,886 Class A common shares from Calamos Investments for a value of $2.8 million, which represents the fair value of the shares on the date of redemption. As Calamos Investments is consolidated with CAM, the impact of the distribution reflecting the non-controlling interest is $2.2 million. CAM did not have any redemptions of Class A common shares from Calamos Investments during the third quarter of 2015.

During the three and nine months ended September 30, 2015, dividends on shares held by Calamos Investments totaled $473,000 and $1.3 million, respectively. The payment of these dividends increased Calamos Investments' equity resulting in a $368,000 adjustment for the third quarter of 2015, and a $997,000 adjustment for the nine months ended September 30, 2015, from additional paid in capital to non-controlling interest in Calamos Investments LLC in the consolidated statement of changes in equity. These adjustments represent Calamos Interests' ownership interest in those dividend payments.

For a comprehensive disclosure of the Company's significant accounting policies, see the Company's Annual Report on Form 10-K for the year ended December 31, 2014.

CALAMOS ASSET MANAGEMENT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(3)Acquisition

On September 30, 2015, Calamos Investments acquired Phineus Partners LP, a long/short equity investment firm located in San Francisco, California for a total purchase price of $1.0 million. The acquisition enhances the Company’s product offerings and role as an innovator in the liquid alternatives space. The purchase price consists of $55,000 cash paid to the selling shareholder with the remaining balance as contingent consideration payable annually over the next three years. This future obligation is reported at fair value in other current and non-current liabilities.

As part of the acquisition, we recognized $596,000 of definite-lived intangible assets related to separately-managed account relationships that will be amortized over three years. The excess of the purchase price over the fair value of identifiable tangible and intangible assets acquired resulted in the recognition of $375,000 of goodwill. Acquisition-related expenses for professional services were expensed as incurred, and recorded in general and administrative expenses.

(4)Investment Securities

The Company is required to carry all investment securities it owns at fair value and record all changes in fair value in current earnings. As such, unrealized gains and losses on trading securities, as well as realized gains and losses on all investment securities, are included in investment and other income in the consolidated statements of operations. Unrealized gains and losses on available-for-sale securities are reported, net of CAM's deferred income tax, as a separate component of accumulated other comprehensive income in equity until realized.

The following table provides a summary of investment securities as of September 30, 2015 and December 31, 2014:

|

| | | | | | | | | | | | | | | | |

| (in thousands) | | | | | | | | |

| September 30, 2015 | | Cost | | Unrealized Gains | | Unrealized Losses | | Fair Value |

| Available-for-sale securities: | | | | | | | | |

| Funds | | | | | | | | |

| Equity | | | | | | | | |

| Global Growth | | $ | 126,908 |

| | $ | 2,961 |

| | $ | (3,443 | ) | | $ | 126,426 |

|

| U.S. Growth | | 63,992 |

| | 2,290 |

| | (2,115 | ) | | 64,167 |

|

| Value | | 5,097 |

| | 35 |

| | (444 | ) | | 4,688 |

|

| Alternative | | 28,209 |

| | 282 |

| | (747 | ) | | 27,744 |

|

| Fixed Income/High Yield | | 17,613 |

| | 29 |

| | (596 | ) | | 17,046 |

|

| Multi-Strategy | | 9,255 |

| | 41 |

| | (1,054 | ) | | 8,242 |

|

| Convertible | | 5,193 |

| | — |

| | (233 | ) | | 4,960 |

|

| Total Funds | | 256,267 |

| | 5,638 |

| | (8,632 | ) | | 253,273 |

|

| Common stock | | 140 |

| | 154 |

| | — |

| | 294 |

|

| Total available-for-sale securities | | $ | 256,407 |

|

| $ | 5,792 |

|

| $ | (8,632 | ) |

| $ | 253,567 |

|

| Trading securities: | | |

| | |

| | |

| | |

|

| Funds | | | | | | | | |

| Equity | | | | | | | | |

| U.S. Growth | | $ | 5,147 |

| | $ | — |

| | $ | (505 | ) | | $ | 4,642 |

|

| Total investment securities | | |

| | |

| | |

| | $ | 258,209 |

|

CALAMOS ASSET MANAGEMENT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

|

| | | | | | | | | | | | | | | | |

| (in thousands) | | | | | | | | |

| December 31, 2014 | | Cost | | Unrealized Gains | | Unrealized Losses | | Fair Value |

| Available-for-sale securities: | | | | | | | | |

| Funds | | | | | | | | |

| Equity | | | | | | | | |

| Global Growth | | $ | 142,610 |

| | $ | 5,275 |

| | $ | (1,872 | ) | | $ | 146,013 |

|

| U.S. Growth | | 64,526 |

| | 3,194 |

| | (410 | ) | | 67,310 |

|

| Value | | 9,979 |

| | 286 |

| | (171 | ) | | 10,094 |

|

| Alternative | | 40,752 |

| | 1,283 |

| | (4 | ) | | 42,031 |

|

| Fixed Income/High Yield | | 17,596 |

| | 1 |

| | (423 | ) | | 17,174 |

|

| Multi-Strategy | | 1,494 |

| | 198 |

| | (9 | ) | | 1,683 |

|

| Convertible | | 10,163 |

| | 15 |

| | (1 | ) | | 10,177 |

|

| Total Funds | | 287,120 |

| | 10,252 |

| | (2,890 | ) | | 294,482 |

|

| Common stock | | 136 |

| | 125 |

| | — |

| | 261 |

|

| Total available-for-sale securities | | $ | 287,256 |

| | $ | 10,377 |

| | $ | (2,890 | ) | | $ | 294,743 |

|

| Trading securities: | | |

| | |

| | |

| | |

|

| Funds | | | | | | | | |

| Equity | | | | | | | | |

| U.S. Growth | | $ | 52,147 |

| | $ | 33 |

| | $ | (6,964 | ) | | $ | 45,216 |

|

| Total investment securities | | |

| | |

| | |

| | $ | 339,959 |

|

The investments in Funds at September 30, 2015 and December 31, 2014, of $257.9 million and $339.7 million, respectively, were invested in affiliated funds and accounts that are separately managed.

The aggregate fair value of available-for-sale investment securities that were in an unrealized loss position at September 30, 2015 and December 31, 2014 was $132.5 million and $98.1 million, respectively. As of September 30, 2015 and December 31, 2014, the Company had no investment securities that had been in a continuous loss position for 12 months or longer.

The Company recorded other-than-temporary impairment charges of $4.5 million and $5.3 million, respectively, for the three and nine months ended September 30, 2015 on certain available-for-sale securities with unrealized losses. No other-than-temporary impairment charges were recorded for the three and nine months ended September 30, 2014. The other-than-temporary impairment charges were reported in non-operating income (loss), in the consolidated statements of operations.

As of September 30, 2015 and December 31, 2014, the Company believes that the remaining $8.6 million and $2.9 million, respectively, in unrealized losses on certain available-for-sale securities are only temporary in nature, as these losses are a result of short-term declines in the net asset value of the funds. Further, the Company has the intent and ability to hold these securities for a period of time sufficient to allow for recovery of the market value. The Company also considered current market conditions and the nature of the securities held when determining the recoverability of those securities' market value.

The following table provides a summary of changes in investment securities for the three and nine months ended September 30, 2015 and 2014:

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended

September 30, |

| (in thousands) | 2015 |

| 2014 | | 2015 | | 2014 |

| Available-for-sale securities: | | | | | | | |

| Proceeds from sales | $ | 8,353 |

| | $ | 84,917 |

| | $ | 48,925 |

| | $ | 279,245 |

|

| Gross realized gains on sales | $ | 291 |

| | $ | 5,539 |

| | $ | 2,849 |

| | $ | 11,011 |

|

| Trading securities: | |

| | |

| | | | |

|

| Change in unrealized gains (losses) | $ | (789 | ) | | $ | (167 | ) | | $ | 6,426 |

| | $ | 8,270 |

|

CALAMOS ASSET MANAGEMENT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

The table below summarizes the tax provision on unrealized gains (losses) and gains reclassified out of accumulated other comprehensive income (loss) on available-for-sale securities for the three and nine months ended September 30, 2015 and 2014:

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, 2015 | | Three Months Ended

September 30, 2014 |

| (in thousands) | Before-Tax Amount | | Tax Provision | | After-Tax

Amount | | Before-Tax Amount | | Tax Provision | | After-Tax

Amount |

| Available-for-sale securities: | | | | | | | | | | | |

| Changes in unrealized gains (losses) | $ | (19,871 | ) | | $ | (1,857 | ) | | $ | (18,014 | ) | | $ | (9,123 | ) | | $ | (912 | ) | | $ | (8,211 | ) |

| Reclassification adjustment for realized gains included in income | — |

| | — |

| | — |

| | (5,949 | ) | | (621 | ) | | (5,328 | ) |

| Other comprehensive loss | $ | (19,871 | ) | | $ | (1,857 | ) | | $ | (18,014 | ) | | $ | (15,072 | ) | | $ | (1,533 | ) | | $ | (13,539 | ) |

|

| | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended

September 30, 2015 | | Nine Months Ended

September 30, 2014 |

| (in thousands) | Before-Tax Amount | | Tax Provision | | After-Tax

Amount | | Before-Tax Amount | | Tax Provision | | After-Tax

Amount |

| Available-for-sale securities: | | | | | | | | | | | |

| Changes in unrealized gains (losses) | $ | (7,816 | ) | | $ | (773 | ) | | $ | (7,043 | ) | | $ | 1,531 |

| | $ | 59 |

| | $ | 1,472 |

|

| Reclassification adjustment for realized gains included in income | (2,510 | ) | | (452 | ) | | (2,058 | ) | | (11,559 | ) | | (1,167 | ) | | (10,392 | ) |

| Other comprehensive loss | $ | (10,326 | ) | | $ | (1,225 | ) | | $ | (9,101 | ) | | $ | (10,028 | ) | | $ | (1,108 | ) | | $ | (8,920 | ) |

Reclassification of realized gains out of accumulated other comprehensive income (loss) are reported in non-operating income (loss), in investment income (loss), in the consolidated statement of operations. See Note 10, Non-Operating Income (Loss).

(5)Derivative Assets and Liabilities

The Company may use exchange-traded option contracts as an economic hedge of price changes in its investment securities portfolio in order to reduce the volatility equity markets have on the fair value of the Company's corporate investment portfolio and that could result in realized or unrealized gains and losses. The Company's investment securities, totaling $258.2 million at September 30, 2015, consist primarily of positions in several Calamos equity and fixed income funds. The equity price risk in the investment portfolio may be hedged using exchange-traded option contracts that correlate most closely with the change in value of the portfolio being hedged. The use of these option contracts are part of a hedge overlay strategy to minimize downside risk in the hedged portfolio. The Company may adjust its hedge position in response to movement and volatility in prices and changes in the composition of the hedged portfolio, but generally is not actively buying and selling contracts.

The Company has elected not to offset its derivative assets with its derivative liabilities even if a right of offset exists. When applicable, the fair value of option contracts is reported on a gross basis in derivative assets and derivative liabilities in the consolidated statements of financial condition. Net gains and losses on these contracts are reported in investment and other income in the consolidated statements of operations. The Company did not record a gain or loss for the three and nine months ended September 30, 2015. The Company recorded net gains of $1.8 million for the three and nine months ended September 30, 2014. The Company may use these derivatives for risk management purposes but does not designate the contracts as hedges for accounting purposes. The Company had no derivative instruments outstanding as of September 30, 2015 and 2014.

CALAMOS ASSET MANAGEMENT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(6)Partnership Investments

Presented below are the underlying assets and liabilities of the partnerships that the Company reports on a consolidated basis, as well as partnership investments that the Company accounts for under the equity method. These investments are presented as partnership investments and liabilities of partnership investments, respectively, in its consolidated statements of financial condition as of September 30, 2015 and December 31, 2014.

|

| | | | | | | |

| (in thousands) | September 30, 2015 | | December 31, 2014 |

| Consolidated partnerships: | | | |

| Assets | | | |

| Securities owned | $ | 102,573 |

| | $ | 103,079 |

|

| Cash and cash equivalents | 3,621 |

| | 39,205 |

|

| Receivables for securities sold | 1,505 |

| | — |

|

| Other current assets | 267 |

| | 1,188 |

|

| Exchange-traded option contracts, net | 47 |

| | 201 |

|

| Total assets of consolidated partnerships | $ | 108,013 |

| | $ | 143,673 |

|

| Liabilities | | | |

| Payables for securities purchased | $ | (537 | ) | | $ | (2,256 | ) |

| Due to non-controlling interest in partnership investments | — |

| | (7,719 | ) |

| Accrued expenses and other current liabilities | (94 | ) | | (142 | ) |

| Total | $ | (631 | ) | | $ | (10,117 | ) |

| | | | |

| Equity method investment in partnerships | $ | 30 |

| | $ | 50 |

|

Profits and losses are allocated to the general partner and limited partners in proportion to their ownership interests at the beginning of each month. Partners' admissions, additional contributions and withdrawals are permitted on a monthly basis.

Calamos Arista Strategic Fund LP was liquidated on December 26, 2014. The partnership redemptions were completed during the first quarter of 2015 for proceeds of $23.1 million. This investment is presented as a consolidated partnership as of the year ended December 31, 2014, in the table above.

During the second quarter of 2014, Calamos Investments, through its wholly owned subsidiaries and affiliates, acquired a majority interest in Calamos Global Opportunities Fund LP. This investment is presented as a consolidated partnership as of December 31, 2014, and September 30, 2015.

(7)Fair Value Measurements

The Company utilizes a three-tier fair value hierarchy which prioritizes the inputs used in measuring fair value as follows: Level 1 — observable inputs such as quoted prices for identical assets and liabilities in active markets; Level 2 — inputs, other than the quoted prices in active markets, that are observable either directly or indirectly (including quoted prices of similar securities, interest rates, credit risk, fair value adjustments to quoted foreign securities, etc.); and Level 3 — unobservable inputs in which there is little or no market data, and require the reporting entity to develop its own assumptions. For each period presented, the Company did not have any assets or liabilities measured at fair value using Level 3 measurements. Transfers between levels are measured at the end of the reporting period. The Company had no transfers between levels during the period.

Investments are presented in the consolidated financial statements at fair value in accordance with GAAP. Investments in open-end funds are stated at fair value based on end of day published net asset values of shares owned by the Company. The fair value of investments in open-end funds was $233.1 million and $312.8 million at the end of September 30, 2015 and December 31, 2014, respectively. There are no unfunded commitments related to these investments. These investments may be redeemed daily with a redemption notice period of up to seven days. Investments in securities traded on a national securities exchange are stated at the last reported sales price on the day of valuation. Other securities, including derivatives, traded in the over-the-counter market and listed securities for which no sale was reported on that date are stated at the last quoted bid price. However, short sales positions and call options written are reported at the last quoted ask price. Convertible bonds, fixed income securities and other securities for which quotations are not readily available are valued at fair value based on observable inputs such as market prices for similar instruments as validated by third party pricing agencies and the Company’s prime broker. Debt securities are valued based upon

CALAMOS ASSET MANAGEMENT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

prices received from an independent pricing service or from a dealer or broker who makes markets in such securities. Pricing services utilize various observable market data and as such, debt securities are generally categorized as Level 2.

The following tables provide the hierarchy of inputs used to derive the fair value of the Company’s assets and liabilities measured at fair value on a recurring basis as of September 30, 2015 and December 31, 2014, respectively. Foreign currency contracts are carried in the Company's partnership investments and are presented on a net basis where the right of offset exists, and had no impact for either period presented.

|

| | | | | | | | | | | | |

| | | | | Fair Value Measurements Using |

(in thousands) Description | | September 30, 2015 | | Quoted Prices in Active Markets for Identical Assets and Liabilities (Level 1) | | Significant Other Observable Inputs (Level 2) |

| Cash and cash equivalents | | | | | | |

| Money market funds | | $ | 25,228 |

| | $ | 25,228 |

| | $ | — |

|

| Investment securities (Note 4) | | |

| | |

| | |

|

| Funds | | |

| | |

| | |

|

| Equity | | | | | | |

| Global Growth | | 126,426 |

| | 126,426 |

| | — |

|

| U.S. Growth | | 68,809 |

| | 68,809 |

| | — |

|

| Value | | 4,688 |

| | 4,688 |

| | — |

|

| Alternative | | 28,197 |

| | 28,197 |

| | — |

|

| Fixed Income/High Yield | | 17,046 |

| | 12,121 |

| | 4,925 |

|

| Multi-Strategy | | 8,242 |

| | 8,242 |

| | — |

|

| Convertible | | 4,960 |

| | 4,960 |

| | — |

|

| Total Funds | | 258,368 |

| | 253,443 |

| | 4,925 |

|

| Common stock | | 294 |

| | 294 |

| | — |

|

| Investment securities | | 258,662 |

| | 253,737 |

| | 4,925 |

|

| Securities and derivatives owned by partnership investments (Note 6) | | | | | | |

| Common stocks | | 48,604 |

| | 25,559 |

| | 23,045 |

|

| Preferred stocks | | 4,694 |

| | 3,760 |

| | 934 |

|

| Convertible bonds | | 47,519 |

| | — |

| | 47,519 |

|

| Corporate bonds | | 1,756 |

| | — |

| | 1,756 |

|

| Money market funds | | 3,606 |

| | 3,606 |

| | — |

|

| Foreign currency | | 15 |

| | 15 |

| | — |

|

| Exchange-traded put option contracts | | 47 |

| | 47 |

| | — |

|

| | | 106,241 |

| | 32,987 |

| | 73,254 |

|

| Securities sold but not yet purchased (Note 4) | | | | | | |

| Common stocks | | (453 | ) | | (453 | ) | | — |

|

| Total | | $ | 389,678 |

| | $ | 311,499 |

| | $ | 78,179 |

|

CALAMOS ASSET MANAGEMENT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

|

| | | | | | | | | | | | |

| | | | | Fair Value Measurements Using |

(in thousands) Description | | December 31, 2014 | | Quoted Prices in Active Markets for Identical Assets and Liabilities (Level 1) | | Significant Other Observable Inputs (Level 2) |

| Cash and cash equivalents | | | | | | |

| Money market funds | | $ | 1,209 |

| | $ | 1,209 |

| | $ | — |

|

| Investment securities (Note 4) | | | | | | |

| Funds | | | | | | |

| Equity | | | | | | |

| Global Growth | | 146,013 |

| | 146,013 |

| | — |

|

| U.S. Growth | | 112,526 |

| | 112,526 |

| | — |

|

| Value | | 12,218 |

| | 12,218 |

| | — |

|

| Alternative | | 42,031 |

| | 42,031 |

| | — |

|

| Fixed Income/High Yield | | 17,174 |

| | 12,174 |

| | 5,000 |

|

| Multi-Strategy |

| 1,683 |

| | 1,683 |

| | — |

|

| Convertible | | 11,021 |

| | 11,021 |

| | — |

|

| Total Funds | | 342,666 |

| | 337,666 |

| | 5,000 |

|

| Common stock | | 261 |

| | 261 |

| | — |

|

| Investment securities | | 342,927 |

| | 337,927 |

| | 5,000 |

|

| Securities and derivatives owned by partnership investments (Note 6) | | | | | | |

| Common stocks | | 51,403 |

| | 26,237 |

| | 25,166 |

|

| Preferred stocks | | 5,736 |

| | 2,281 |

| | 3,455 |

|

| Convertible bonds | | 41,119 |

| | — |

| | 41,119 |

|

| Corporate bonds | | 4,821 |

| | — |

| | 4,821 |

|

| Money market funds | | 37,060 |

| | 7,851 |

| | 29,209 |

|

| Foreign currency | | 513 |

| | 513 |

| | — |

|

| Exchange-traded put option contracts | | 201 |

| | 201 |

| | — |

|

| | | 140,853 |

| | 37,083 |

| | 103,770 |

|

| Securities sold but not yet purchased (Note 4) | | | | | | |

| Common stocks | | (2,968 | ) | | (2,968 | ) | | — |

|

| Total | | $ | 482,021 |

| | $ | 373,251 |

| | $ | 108,770 |

|

The fair value of the Company’s long-term debt, which has a total carrying value of $46.0 million at September 30, 2015 and December 31, 2014, was $52.3 million and $54.2 million, respectively. During the third quarter of 2014, $46.2 million of senior notes outstanding were repaid. During the third quarter of 2015, the Company paid the $1.7 million payment obligation associated with its purchase of Black Capital LLC in 2012. The fair value and carrying value of this payment obligation was $1.7 million at December 31, 2014, reported in other current liabilities in the consolidated statements of financial condition. At September 30, 2015, the Company recorded contingent consideration associated with its purchase of Phineus Partners LLC. The fair value and carrying value of the contingent consideration was $971,000, and is included in other current and non-current liabilities in the consolidated statements of financial condition. These fair value estimates are calculated using discounted cash flows based on the Company’s incremental borrowing rates and market inputs for similar bonds for the debt, and the treasury yield curve plus market spread for the payment obligation. The fair values of the debt, payment obligation and contingent consideration are based on Level 2 inputs within the fair value hierarchy.

The carrying value of all other financial instruments approximates fair value due to the short maturities of these financial instruments.

(8)Loans Payable

The Company has access to margin loans for the settlement of call options, as well as an additional source of liquidity. The interest rate that can be charged on margin loans is 1.5% per annum, based on the brokerage firm’s lending rate. These loans are due on demand. The Company can borrow up to 68% of its marginable securities on deposit with its brokerage firm. The Company had no margin loan balances outstanding at September 30, 2015 and December 31, 2014.

CALAMOS ASSET MANAGEMENT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(9)Stock-Based Compensation

Under the Company’s incentive compensation plan, certain employees of the Company receive stock-based compensation comprised of stock options and restricted stock units (“RSUs”). Historically, RSUs have been settled with newly issued shares so that no cash was used by the Company to settle awards; however, the Company may also use treasury shares upon the exercise of stock options and upon conversion of RSUs. The Company’s Annual Report on Form 10-K for the year ended December 31, 2014 provides details of this plan and its provisions.

During the nine months ended September 30, 2015, the Company granted 780,649 RSUs and there were 654,471 RSUs forfeited. During the same period, the Company granted no stock options and there were 280,682 stock options forfeited.

During the nine months ended September 30, 2015, 298,558 RSUs vested with 57,672 units withheld for taxes and 240,886 RSUs converted into an equal number of shares of CAM’s Class A common stock. The total intrinsic value and the fair value of the converted shares was $3.1 million. The total tax benefit realized in connection with the vesting of the RSUs during the nine months ended September 30, 2015 was $362,000, as the Company receives tax benefits based upon the portion of Calamos Investments’ expense that it recognizes.

During the nine months ended September 30, 2015 and 2014, compensation expense recorded in connection with the RSUs and stock options was $4.7 million, of which $1.0 million was credited as additional paid-in capital after giving effect to the non-controlling interests. The amount of deferred tax asset created was $382,000 during the nine months ended September 30, 2015 and 2014. As of September 30, 2015, $14.5 million of total unrecognized compensation expense related to unvested stock option and RSU awards is expected to be recognized over a weighted-average period of 2.7 years.

(10)Non-Operating Income (Loss)

Non-operating income (loss) was comprised of the following components for the three and nine months ended September 30, 2015 and 2014: |

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended

September 30, |

| (in thousands) | 2015 | | 2014 | | 2015 | | 2014 |

| Interest income | $ | 49 |

| | $ | 34 |

| | $ | 138 |

| | $ | 123 |

|

| Interest expense | (766 | ) | | (885 | ) | | (2,306 | ) | | (3,899 | ) |

| Net interest expense | (717 | ) | | (851 | ) | | (2,168 | ) | | (3,776 | ) |

| Investment income (loss) | (11,332 | ) | | 3,852 |

| | (5,565 | ) | | 14,621 |

|

| Dividend income | 322 |

| | 605 |

| | 848 |

| | 1,615 |

|

| Miscellaneous other income | 13 |

| | 25 |

| | 149 |

| | 293 |

|

| Investment and other income (loss) | (10,997 | ) | | 4,482 |

| | (4,568 | ) | | 16,529 |

|

| Non-operating income (loss) | $ | (11,714 | ) | | $ | 3,631 |

| | $ | (6,736 | ) | | $ | 12,753 |

|

(11)Income Taxes

Calamos Investments is subject to certain income-based state taxes; therefore, income taxes reflect not only the portion attributed to CAM stockholders but also a portion of income taxes attributable to non-controlling interests.

|

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended

September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

| (in thousands) | | | | | | | |

| Income tax provision (benefit) | $ | (46 | ) | | $ | 1,870 |

| | $ | 1,694 |

| | $ | 5,278 |

|

| Income tax (provision) benefit attributable to non-controlling interest in Calamos Investments | 3 |

| | (69 | ) | | (28 | ) | | (148 | ) |

| Income tax provision (benefit) attributable to CAM | (43 | ) | | 1,801 |

| | 1,666 |

| | 5,130 |

|

| Net income attributable to CAM | 363 |

| | 3,369 |

| | 2,497 |

| | 8,736 |

|

| Income before taxes attributable to CAM | $ | 320 |

| | $ | 5,170 |

| | $ | 4,163 |

| | $ | 13,866 |

|

| CAM’s effective income tax rate | (13.4 | )% | | 34.8 | % | | 40.0 | % | | 37.0 | % |

CALAMOS ASSET MANAGEMENT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

CAM's effective income tax rate was (13.4)% for the third quarter of 2015, compared with 34.8% for the third quarter of 2014, a result of $177,000 of provision to return true-ups from the 2014 income tax return. For the first nine months of 2015, CAM's effective income tax rate was 40.0%, compared with 37.0% for the first nine months of 2014.

As of December 31, 2014, the Company's total capital loss carryforward was $237,000 which will expire in 2017, if not used before the expiration date. As of September 30, 2015, the Company did not have a valuation allowance on this deferred tax asset.

(12)Earnings Per Share

The following table reflects the calculation of basic and diluted earnings per share:

|

| | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in thousands, except per share amounts) | 2015 | | 2014 | | 2015 | | 2014 |

| Earnings per share – basic: | | | | | | | |

| Earnings available to common shareholders | $ | 363 |

| | $ | 3,369 |

| | $ | 2,497 |

| | $ | 8,736 |

|

| Weighted average shares outstanding | 17,317 |

| | 17,889 |

| | 17,658 |

| | 18,399 |

|

| Earnings per share – basic | $ | 0.02 |

| | $ | 0.19 |

| | $ | 0.14 |

| | $ | 0.47 |

|

| Earnings per share – diluted: | |

| | |

| | |

| | |

|

| Earnings available to common shareholders | $ | 363 |

| | $ | 3,369 |

| | $ | 2,497 |

| | $ | 8,736 |

|

| Weighted average shares outstanding | 17,317 |

| | 17,889 |

| | 17,658 |

| | 18,399 |

|

| Dilutive impact of restricted stock units | 892 |

| | 893 |

| | 788 |

| | 759 |

|

| Weighted average shares outstanding | 18,209 |

| | 18,782 |

| | 18,446 |

| | 19,158 |

|

| Earnings per share – diluted | $ | 0.02 |

| | $ | 0.18 |

| | $ | 0.14 |

| | $ | 0.46 |

|

When dilutive, diluted shares outstanding are calculated (a) assuming that Calamos Interests exchanged all of their ownership interest in Calamos Investments and their CAM Class B common stock for shares of CAM’s Class A common stock (the "Exchange") and (b) including the effect of outstanding dilutive equity incentive compensation awards. As of September 30, 2015, and 2014, the impact of the Exchange was anti-dilutive and, therefore, excluded from the calculation of diluted earnings per share.

The Company uses the treasury stock method to reflect the dilutive effect of unvested RSUs and unexercised stock options on diluted earnings per share. Under the treasury stock method, if the average market price of common stock increases above the option’s exercise price, the proceeds that would be assumed to be realized from the exercise of the option would be used to acquire outstanding shares of common stock. However, the awards may be anti-dilutive even when the market price of the underlying stock exceeds the option’s exercise price. This result is possible because compensation cost attributed to future services and not yet recognized is included as a component of the assumed proceeds upon exercise. The dilutive effect of such options and RSUs would increase the weighted average number of shares used in the calculation of diluted earnings per share.

The Company amended its certificate of incorporation requiring that the Exchange be based on a fair value approach (details of the amendment are set forth in the Company’s Schedule 14C filed with the Securities and Exchange Commission on January 12, 2009). The amendment results in the same or fewer shares of Class A common stock being issuable at the time of the Exchange.

The shares issuable upon the Exchange as presented are estimated solely on the formula as described in Schedule 14C that does not necessarily reflect all inputs used in a fair valuation. It is critical to note that this formula does not incorporate certain economic factors and as such, in the event of an actual Exchange, the majority of the Company’s independent directors may determine the fair market value of CAM’s net assets and its ownership in Calamos Investments. For example, premiums and/or discounts for control and marketability as well as a different discount rate for future cash flows may be applied. Therefore, the directors’ valuation may result in the actual number of shares being materially different from the shares presented. Further, based upon currently available information, the Company believes it is unlikely that any Exchange would transpire without a fair market valuation of CAM’s net assets and possibly an agreement by Calamos Interests to Exchange, based upon that fair market valuation.

The following table shows the number of shares which were excluded from the computation of diluted earnings per share as they were anti-dilutive:

CALAMOS ASSET MANAGEMENT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

|

| | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| | 2015 | | 2014 | | 2015 | | 2014 |

| Shares of Class A common stock issuable upon an Exchange of Calamos Interests’ ownership in Calamos Investments* | 11,665,798 |

| | 22,592,845 |

| | 11,665,798 |

| | 22,592,845 |

|

| Restricted stock units | — |

| | — |

| | 11,874 |

| | — |

|

| Stock options | 1,148,485 |

| | 1,912,621 |

| | 1,148,485 |

| | 1,912,621 |

|

| Total | 12,814,283 |

| | 24,505,466 |

| | 12,826,157 |

| | 24,505,466 |

|

* Number of shares calculated with the value of Calamos Investments determined by using the closing price of our shares as of September 30, 2015 ($9.48) and September 30, 2014 ($11.27) as well as assuming said closing prices fully reflect all of CAM's assets; including the application of a 12% discount rate to certain deferred tax assets at each of September 30, 2015 and 2014. The value of Calamos Investments is then multiplied by Calamos Interests' percentage ownership in Calamos Investments, with the result divided by the applicable period-end closing price. See Note 2, Summary of Significant Accounting Policies - Principles of Consolidation, for a description of certain assets owned by CAM.

(13)Commitments and Contingencies

On March 31, 2015, the initial public offering of a Calamos-sponsored closed-end fund was completed with underwriters of the closed-end fund subsequently exercising a portion of their over-allotment option, the closing of which over-allotment option occurred on May 13, 2015. As contemplated in the fund's prospectus, CAL, the fund's investment adviser has implemented a share purchase program pursuant to which CAL will, through a plan agent, purchase up to $20 million of common shares of the fund in the open market, subject to applicable federal securities laws as well as to a variety of market and discount conditions and a daily purchase limit. The purchase plan, which seeks to provide increased liquidity for the fund's common shares, commenced on July 7, 2015 and will run through February 25, 2016. CAL purchased $7.6 million of common shares of the fund under this program during the three and nine months ended September 30, 2015.

In the normal course of business, the Company may be party to various legal proceedings from time to time. Management believes that a current complaint filed against CAL and CFS, alleging breaches of fiduciary duties with respect to the receipt of advisory, distribution and servicing fees paid by an open-end investment company advised by CAL, is without merit and CAL and CFS intend to defend themselves vigorously against the allegations. Currently, management believes that the ultimate resolution of this legal proceeding will not materially affect the Company’s business, financial position or results of operations and that the likelihood of a material adverse impact is remote.

(14)Recently Issued Accounting Pronouncements

The Company has reviewed all newly issued accounting pronouncements that are applicable to its business and to the preparation of its consolidated financial statements, including those not yet required to be adopted. The Company does not believe any such pronouncements will have a material effect on the Company’s financial position or results of operations. Accounting guidance that will become effective in future years, with respect to the Company’s consolidated financial statements, is described below:

In February 2015, the Financial Accounting Standards Board ("FASB") issued an accounting update amending the consolidation requirements under GAAP. This standard modifies existing consolidation guidance for reporting organizations that are required to evaluate whether they should consolidate certain legal entities. This guidance is effective for annual and interim periods beginning after December 15, 2015, and requires either a retrospective or a modified retrospective approach to adoption. Early adoption is permitted. The Company is currently evaluating the potential impact of this standard on its results of operations, cash flows or financial position, as well as the available transition methods.

In May 2014, the FASB issued new guidance on revenue from contracts with customers. The new revenue recognition standard provides a five-step analysis of transactions to determine when and how revenue is recognized. The core principle of the guidance is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. In July 2015, the FASB decided to defer the effective date of the new revenue guidance by one year to annual reporting periods beginning after December 15, 2017, with early adoption being permitted for annual periods beginning after December 15, 2016. The Company's effective date is January 1, 2018. The Company is evaluating the effect of adopting this new accounting guidance but does not expect adoption will have a material impact on its results of operations, cash flows or financial position.

CALAMOS ASSET MANAGEMENT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

(15)Subsequent Event

On November 4, 2015, the Board of Directors of CAM approved a distribution of $5.0 million from Calamos Investments to its members, payable on November 6, 2015, of which $1.1 million will be distributed to CAM, and $3.9 million will be distributed to the Calamos Interests. The distribution will be funded from cash on hand.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

We are a firm of 356 full-time associates that primarily provides investment advisory services to institutions and individuals, managing and servicing $22.5 billion and $24.5 billion in assets under management as of September 30, 2015 and 2014, respectively. Assets under management do not include assets under advisement of $612 million and $729 million as of September 30, 2015 and 2014, respectively, for which the Company provides model portfolio design and oversight.

Our operating results fluctuate primarily due to changes in the total value and composition of our assets under management. The value and composition of our assets under management are, and will continue to be, influenced by a variety of factors including: purchases and redemptions of shares of open-end funds; net inflows into and withdrawals from separate accounts that we manage; fluctuations in the financial markets around the world that result in appreciation or depreciation of assets under management; and the number and types of our investment strategies and products.

We market our investment strategies to our clients through a variety of products designed to suit their investment needs. We currently categorize the portfolios that we manage within four investment product types captured in our funds and separate accounts. The following table lists our assets under management by product as of September 30, 2015 and 2014.

|

| | | | | | | |

| | September 30, |

| (in millions) | 2015 | | 2014 |

| Funds | | | |

| Open-end funds | $ | 12,513 |

| | $ | 15,495 |

|

| Closed-end funds | 6,399 |

| | 6,314 |

|

| Total funds | 18,912 |

| | 21,809 |

|

| Separate Accounts | |

| | |

|

| Institutional accounts | 2,525 |

| | 1,801 |

|

| Managed accounts | 1,017 |

| | 904 |

|

| Total separate accounts | 3,542 |

| | 2,705 |

|

| Total assets under management | $ | 22,454 |

| | $ | 24,514 |

|

Our revenues are substantially comprised of investment management fees earned under contracts with funds and separate accounts that we manage or service. Our revenues are also comprised of distribution and underwriting fees, including asset-based distribution and/or service fees received pursuant to Rule 12b-1 plans. Investment management fees and distribution and underwriting fees may fluctuate based on a number of factors including: the total value and composition of our assets under management; market appreciation and depreciation on investments; the level of net inflows and outflows, which represent the sum of new and existing client funding, withdrawals and terminations; and purchases and redemptions of open-end fund shares. The mix of assets under management among our investment products impacts our revenues as our fee schedules vary by product.

Our largest operating expenses are typically related to: employee compensation and benefits expenses, which include salaries, incentive compensation and related benefits costs; distribution expenses, which include open-end funds distribution cost (such as Rule 12b-1 payments) and amortization of deferred sales commissions; and marketing and sales promotion expenses, which include expenses necessary to market products offered by us. Operating expenses may fluctuate due to a number of factors including variations in staffing and compensation, changes in distribution expense as a result of fluctuations in open-end fund net sales and market appreciation or depreciation, and marketing-related expenses that include supplemental distribution payments.

Operating Results

Third Quarter and Nine Months Ended September 30, 2015 Compared with Third Quarter and Nine Months Ended September 30, 2014

Assets Under Management

Assets under management were $22.5 billion and $24.5 billion as of September 30, 2015 and 2014, respectively, and consisted of 84% funds and 16% separate accounts as of September 30, 2015, and 89% funds and 11% separate accounts as of September 30, 2014.

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | | | | Change | | | | | | Change |

| (in millions) | 2015 | | 2014 | | Amount | | Percent | | 2015 | | 2014 | | Amount | | Percent |

| Open-end Funds | | | | | | | | | | | | | | | |

| Beginning assets under management | $ | 13,863 |

| | $ | 16,072 |

| | $ | (2,209 | ) | | (14)% | | $ | 14,790 |

| | $ | 16,128 |

| | $ | (1,338 | ) | | (8)% |

| Sales | 620 |

| | 1,542 |

| �� | (922 | ) | | (60) | | 1,919 |

| | 3,702 |

| | (1,783 | ) | | (48) |

| Redemptions | (1,220 | ) | | (1,912 | ) | | 692 |

| | 36 | | (3,866 | ) | | (4,656 | ) | | 790 |

| | 17 |

| Market appreciation (depreciation) | (750 | ) | | (207 | ) | | (543 | ) | | * | | (330 | ) | | 321 |

| | (651 | ) | | * |

| Ending assets under management | 12,513 |

| | 15,495 |

| | (2,982 | ) | | (19) | | 12,513 |

| | 15,495 |

| | (2,982 | ) | | (19) |

| Average assets under management | 13,324 |

| | 15,854 |

| | (2,530 | ) | | (16) | | 14,040 |

| | 15,901 |

| | (1,861 | ) | | (12) |

| Closed-end Funds | | | | | | | | | | | | | |

| | |

| Beginning assets under management | 6,977 |

| | 6,511 |

| | 466 |

| | 7 | | 6,211 |

| | 6,266 |

| | (55 | ) | | (1) |

| Sales | 10 |

| | 6 |

| | 4 |

| | 67 | | 805 |

| | 58 |

| | 747 |

| | * |

| Redemptions | (29 | ) | | — |

| | (29 | ) | | * | | (29 | ) | | — |

| | (29 | ) | | * |

| Market depreciation | (559 | ) | | (203 | ) | | (356 | ) | | * | | (588 | ) | | (10 | ) | | (578 | ) | | * |

| Ending assets under management | 6,399 |

| | 6,314 |

| | 85 |

| | 1 | | 6,399 |

| | 6,314 |

| | 85 |

| | 1 |

| Average assets under management | 6,809 |

| | 6,437 |

| | 372 |

| | 6 | | 6,694 |

| | 6,353 |

| | 341 |

| | 5 |

| Institutional Accounts | |

| | |

| | |

| | | | | | | | |

| | |

| Beginning assets under management | 2,583 |

| | 2,195 |

| | 388 |

| | 18 | | 1,576 |

| | 3,081 |

| | (1,505 | ) | | (49) |

| Sales | 229 |

| | 17 |

| | 212 |

| | * | | 1,382 |

| | 174 |

| | 1,208 |

| | * |

| Redemptions | (93 | ) | | (390 | ) | | 297 |

| | 76 | | (321 | ) | | (1,546 | ) | | 1,225 |

| | 79 |