SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2006

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM ______ TO _____

-------------

COMMISSION FILE NUMBER 000-551030

OccuLogix, Inc. (Exact name of Registrant as specified in its charter) |

DELAWARE (State or other jurisdiction of incorporation or organization) | 59 343 4771 (I.R.S. Employer Identification No.) |

2600 Skymark Avenue, Unit 9, Suite 201 Mississauga, Ontario L4W 5B2 (Address of principal executive offices) |

(905) 602-0887

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT:

COMMON STOCK, $0.001 PAR VALUE

(Title of Class)

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the Registrant is an accelerated filer (as defined in Rule 12b-2 of the Exchange Act). Yes [ X] No [ ]

Indicate by check mark if the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of the voting common stock held by non-affiliates of the Registrant (assuming officers, directors and 10% stockholders are affiliates), based on the last sale price for such stock on June 30, 2006: $42,348,498. The Registrant has no non-voting common stock.

As of March 8, 2007, there were 57,303,895 shares of the Registrant’s Common Stock outstanding.

EXPLANATORY NOTE

This Amendment No. 1 to the Annual Report on Form 10-K filed on March 15, 2007 (the “Original Annual Report”) is being filed in order to replace Exhibits 31.1 and 31.2 to the Original Annual Report.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the 2007 Annual Meeting of Stockholders of the Registrant to be held June 29, 2007 are incorporated by reference into Part III of this Form 10-K.

The Registrant makes available free of charge on or through its website (http://www.occulogix.com) its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. The material is made available through the Registrant’s website as soon as reasonably practicable after the material is electronically filed with or furnished to the U.S. Securities and Exchange Commission, or SEC. All of the Registrant’s filings may be read or copied at the SEC’s Public Reference Room at 100F Street, N.E., Room 1580, Washington D.C. 20549. Information on the hours of operation of the SEC’s Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains a website (http://www.sec.gov) that contains reports and proxy and information statements of issuers that file electronically.

PART I

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements relating to future events and our future performance within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, you can identify forward-looking statements by terms such as “may”, “will”, “should”, “could”, “would”, “expects”, “plans”, “intends”, “anticipates”, “believes”, “estimates”, “projects”, “predicts”, “potential” and similar expressions intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performances, time frames or achievements expressed or implied by the forward-looking statements.

Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements. Information regarding market and industry statistics contained in this Annual Report on Form 10-K is included based on information available to us that we believe is accurate. It is generally based on academic and other publications that are not produced for purposes of securities offerings or economic analysis. We have not reviewed or included data from all sources and cannot assure you of the accuracy of the market and industry data we have included.

Unless the context indicates or requires otherwise, in this Annual Report on Form 10-K, references to the “Company” shall mean OccuLogix, Inc. and its subsidiaries. References to “$” or “dollars” shall mean U.S. dollars unless otherwise indicated. References to “C$” shall mean Canadian dollars.

ITEM 1. BUSINESS.

Overview

We are an ophthalmic therapeutic company in the business of commercializing innovative treatments for age-related eye diseases, including age-related macular degeneration, or AMD. AMD is the leading cause of late onset visual impairment and legal blindness in people over the age of 50 in the United States and other Western industrialized societies. We believe that Dry AMD, the most common form of the disease, afflicts approximately 13.0 to 13.5 million people in the United States, representing approximately 85% to 90% of all AMD cases. Although the exact cause of AMD is not known, researchers have identified several factors that are associated with AMD, including poor microcirculation and the gradual build-up of cellular waste material in the retina. We believe that improved microcirculation increases the supply of oxygen and nutrients to the compromised retina and facilitates the removal of cellular waste material from the retina. We believe that a treatment that improves microcirculation in the retina can help to enhance the metabolic efficiency of the retina and the removal of waste material and thereby aid in the treatment of Dry AMD. We believe there is a significant opportunity for such a treatment.

Our product for Dry AMD, the RHEO™ System, is designed to improve microcirculation in the eye by filtering high molecular weight proteins and other macromolecules from the patient’s plasma. The RHEO™ System is used to perform the Rheopheresis™ procedure, which we refer to under our trade name RHEO™ Therapy. The Rheopheresis™ procedure is a blood filtration process that selectively removes molecules from plasma. The RHEO™ System consists of the OctoNova Pump and a disposable treatment set, containing two filters, through which the patient’s blood circulates. We believe that the RHEO™ System is the only Dry AMD treatment to target what we believe to be the underlying cause of AMD rather than its symptoms and that, based on early data, appeared to demonstrate improved vision in some patients. The only currently accepted treatment option for persons with advanced cases of Dry AMD are over-the-counter vitamins, antioxidants and zinc supplements that can reduce the five-year risk of conversion to Wet AMD, the other form of the disease, by approximately 25%.

We conducted a pivotal clinical trial, called MIRA-1, or Multicenter Investigation of Rheopheresis for AMD, which, if successful, was expected to support our application to the U.S. Food and Drug Administration, or FDA, to obtain approval to market the RHEO™ System in the United States. On February 3, 2006, we announced that, based on a preliminary analysis of the data from MIRA-1, MIRA-1 did not meet its primary efficacy endpoint as it did not demonstrate a statistically significant difference in the mean change of Best Spectacle-Corrected Visual Acuity applying the Early Treatment Diabetic Retinopathy Scale, or ETDRS BCVA, between the treated and placebo groups in MIRA-1 at 12 months post-baseline. As expected, the treated group demonstrated a positive result. An anomalous response of the control group is the principal reason why the primary efficacy endpoint was not met. There were subgroups that did demonstrate statistical significance in their mean change of ETDRS BCVA versus control.

The MIRA-1 protocol required us to obtain a minimum of 150 complete clinical data sets. To that end, we had enrolled a total of 185 patients in MIRA-1 as of December 31, 2004. On November 17, 2005, we announced that we had collected complete 12-month post-treatment data sets for 169 of these patients. As of December 31, 2004, we had also submitted to the FDA the first three of four modules of the Pre-market Approval Application, or PMA, filing, the non-clinical portion. The non-clinical portion of the PMA consisted of technical data relating to components of the RHEO™ System. In late 2001, with the permission of the FDA, we submitted an interim analysis of 36 complete data sets from the first 43 patients enrolled. The remaining seven patients did not complete all of the required follow-up and thus their results did not qualify as a complete data set. Of the 36 data sets analyzed, 11 were from placebo patients. Fifty-eight percent of, or 11 of 19, patients in the MIRA-1 interim analysis entering the clinical trial with worse than legal driving vision, which is defined as best corrected visual acuity, or BCVA, of worse than 20/40, improved to meet or exceed the requirements to regain a driver’s license. Although we had intended to submit the fourth module, which consists of the follow-up clinical data, in two components, following discussions with the FDA, we subsequently elected to file only one PMA clinical module following completion of our 12-month data on at least 150 data sets.

Subsequent to the February 3, 2006 announcement, the Company completed an in-depth analysis of the MIRA-1 study data identifying subjects that were included in the intent-to-treat, or ITT, population but who deviated from the MIRA-1 protocol as well as those patients who had documented losses or gains in vision for reasons not related to retinal disease such as cataracts. Those subjects in the ITT population who met the protocol requirements, and who did not exhibit ophthalmic changes unrelated to retinal disease, comprised the modified per-protocol population.

In the modified per-protocol analysis, eyes treated with RHEO™ Therapy demonstrated a mean vision gain of 0.8 lines of ETDRS BCVA at 12 months post-baseline, compared to a mean vision loss of 0.1 lines of ETDRS BCVA in the eyes in the placebo group. The result was statistically significant (repeated measure p value = 0.0147). The following table presents a summary of the ETDRS BCVA changes observed 12 months post-baseline in the modified per-protocol analysis of MIRA-1:

| | Treatment Group (n=69) | Placebo Group (n=46) |

| Vision improvement greater or equal to: | | |

| 1 line | 46.4% | 19.6% |

| 2 lines | 27.5% | 8.7% |

3 lines | 8.7% | 2.2% |

| Vision loss greater or equal to: | | |

| 1 line | 11.6% | 23.9% |

| 2 lines | 5.8% | 6.5% |

3 lines | 2.9% | 2.2% |

Within the modified per-protocol population with pre-treatment vision worse than 20/40, 50.0% of RHEO™ Therapy-treated eyes improved, after treatment, to 20/40 or better and would be able to qualify for a driver’s license 12 months post-baseline, compared to 20.0% of placebo eyes.

MIRA-1 data support historical clinical and commercial experience with respect to the safety of RHEO™ Therapy, with observed treatment side effects generally being mild, transient and self-limiting.

In light of the MIRA-1 study results, we re-evaluated our PMA submission strategy and then met with representatives of the FDA on June 8, 2006 in order to discuss the impact on our PMA submission strategy of the MIRA-1 study results and the fact of the per-protocol population being fewer than 150. As expected, in light of MIRA-1’s failure to meet its primary efficacy endpoint, the FDA advised us that it would require an additional study of the RHEO™ System to be performed.

At that meeting, the FDA confirmed its willingness to allow the substitution, in the new study, of the new polysulfone Rheofilter™ filter for the older cellulose acetate filter which currently forms part of the RHEO™ System. The immediate replacement of the filter avoids the regulatory uncertainties that would arise, were the replacement to take place following receipt of FDA approval. Furthermore, due to manufacturing constraints on the number of cellulose acetate filters that can be produced by their manufacturer, Asahi Kasei Medical Co., Ltd. (formerly Asahi Medical Co., Ltd.), or Asahi Medical, the replacement of the filter in the new trial eliminates the need to continue to build and maintain adequate inventories of the older cellulose acetate filter that the Company had been building and maintaining in preparation for commercial launch.

On January 29, 2007, the Company announced that it had obtained Investigational Device Exemption clearance from the FDA to commence the new pivotal clinical trial of the RHEO™ System, called RHEO-AMD, or Safety and Effectiveness in a Multi-center, Randomized, Sham-controlled Investigation for Dry, Non-exudative Age-Related Macular Degeneration (AMD) Using Rheopheresis. The company has been actively preparing a protocol, putting in place the required resources and obtaining clinical trial site commitments for RHEO-AMD.

We cannot begin commercialization in the United States until we receive FDA approval. Until we commence patient enrollment in RHEO-AMD and gain a clear understanding of the progress of that clinical trial, we will not be able to anticipate when, if ever, we will receive FDA approval for the RHEO™ System. Accordingly, at this time, we do not know when we can expect to begin to generate revenues in the United States from the commercialization of the RHEO™ System.

In 2003, we received licenses from Health Canada for the components of the RHEO™ System. These licenses allow us to market the RHEO™ System in Canada for use in the treatment of patients suffering from dysproteinemia due, for example, to abnormal plasma viscosity and/or macular disease. Upon receiving our licenses, we began limited commercialization of the RHEO™ System through sales of OctoNova pumps and disposable treatment sets to three clinics in Canada. In September 2004, we signed an agreement with a private Canadian company called Rheo Therapeutics Inc. (now Veris Health Services Inc., or Veris), a provider of RHEO™ Therapy and the Company’s sole commercial customer, which agreed to purchase approximately 8,000 treatment sets and 20 OctoNova pumps by the end of 2005, with an option to purchase up to an additional 2,000 treatment sets, subject to availability. However, due to delays in its plans to open a number of commercial treatment centers in various Canadian cities where RHEO™ Therapy would be performed, Veris no longer required the contracted-for number of treatment sets for such period. We agreed to keep the original pricing for a reduced number of treatment sets. In December 2005, by letter agreement, we agreed to the volume and other terms for the purchase and sale of treatment sets and pumps for the period ending February 28, 2006. During 2006, the Company continued to sell treatment sets to Veris at the discounted price of $200 per treatment set, which is lower than the Company’s cost. On November 6, 2006, the Company amended its agreement with Veris and forgave a certain amount receivable which had been owing to the Company for the sale of treatment sets and pumps, and the provision of related services, to Veris during the period from September 14, 2005 to December 31, 2005. In consideration of the forgiveness of this debt, Veris agreed that the Company did not owe Veris certain specified amounts. In January 2007, the Company further agreed to forgive an amount receivable owing by Veris for the purchase of 348 treatment sets which had been delivered to Veris in November 2006. We have been notified that Veris has initiated restructuring proceedings under the Bankruptcy and Insolvency Act (Canada) but that it is continuing to carry on its operations in the normal course during its restructuring proceedings.

We have exclusive rights to commercialize the RHEO™ System for ophthalmic uses in North America, certain countries in the Caribbean, Australia, New Zealand, Colombia and Venezuela. We have a non-exclusive right to commercialize the RHEO™ System for ophthalmic uses in Italy. In order to sell or export a medical device in the European community, a Conformité Européene or CE Mark, is required. The Rheopheresis™ procedure for the selective removal of molecules from plasma received CE Mark approval in 1998.

Until our announcement on February 3, 2006 of the preliminary analysis of the data from MIRA-1, our primary activities included commercialization of the RHEO™ System in Canada, working to obtain FDA regulatory approval for the RHEO™ System and building an operating infrastructure to support potential U.S. sales following approval by the FDA. Since February 3, 2006, in addition to conducting a full analysis of the MIRA-1 study data, our primary activities have included negotiating the parameters of RHEO-AMD with the FDA, designing the protocol for RHEO-AMD, recruiting clinical trial sites and otherwise preparing for the launch of RHEO-AMD.

In anticipation of the delay in commercialization of the RHEO™ System in the United States, the Company accelerated its diversification plans by acquiring Solx, Inc., or SOLX, a Boston University Photonics Center-incubated company that has developed a system for the treatment of glaucoma, called the SOLX Glaucoma System, and by acquiring 50.1% of the capital stock, on a fully diluted basis, of OcuSense, Inc., or OcuSense, a San Diego-based company that is in the process of developing technologies that will enable eye care practitioners to test, at the point-of-care, for highly sensitive and specific biomarkers using nanoliters of tear film.

The SOLX Glaucoma System is a next-generation glaucoma treatment platform designed to reduce intra-ocular pressure, or IOP, without a bleb (which is a surgically created flap that serves as a drainage pocket underneath the surface of the eye), thus avoiding its related complications. The SOLX Glaucoma System consists of the SOLX 790 Laser, a titanium sapphire laser used in laser trabeculoplasty procedures, and the SOLX Gold Shunt, a 24-karat gold, ultra-thin drainage device designed to bridge the anterior chamber and the suprachoroidal space in the eye, using the pressure differential that exists naturally in the eye in order to reduce IOP.

The SOLX 790 Laser received CE Mark approval in December 2004, and the SOLX Gold Shunt received CE Mark approval in October 2005. The SOLX 790 Laser has a Health Canada license, and we will be seeking the corresponding approval for the SOLX Gold Shunt.

We are in the process of actively training and certifying physicians in the use of the SOLX Gold Shunt, for commercial purposes, in various European and Asian jurisdictions, including Spain, Italy, Germany, Poland, France, the United Kingdom and Thailand. In addition, in order to establish and maintain a reliable distribution network for SOLX’s products, we are continuing to maintain our relationships with distributors in France, Germany, Spain, the United Kingdom and Canada and are engaged actively in pursuing relationships with other distributors in Europe.

Both the SOLX 790 Laser and the SOLX Gold Shunt are currently the subject of randomized, multi-center clinical trials, the purposes of which are to demonstrate equivalency to the argon laser, in the case of the SOLX 790 Laser, and to the Ahmed Glaucoma Valve manufactured by New World Medical, Inc., in the case of the SOLX Gold Shunt. The results of these clinical trials will be used in support of applications to the FDA for a 510(k) clearance for each of the SOLX 790 Laser and the SOLX Gold Shunt, the receipt of which, if any, will enable the Company to market and sell these products in the United States.

OcuSense’s first product, which is currently under development, is a hand-held tear film osmolarity test for the diagnosis and management of dry eye syndrome, or DES, known as the TearLab™ test for DES. The anticipated innovation of the TearLab™ test for DES will be its ability to measure precisely and rapidly certain biomarkers in nanoliter volumes of tear samples, using inexpensive hardware. Historically, eye care researchers have relied on expensive instruments to perform tear biomarker analysis. In addition to their cost, these conventional systems are slow, highly variable in their measurement readings and not waived by the FDA under the Clinical Laboratory Improvement Amendments, or CLIA.

The TearLab™ test for DES will require the development of the following three components: (1) the TearLab™ disposable, which is a single-use microfluidic cartridge; (2) the TearLab™ pen, which is a hand-held interface with the TearLab™ disposable; and (3) the TearLab™ reader, which is a physical housing for the TearLab™ pen connections and measurement circuitry. OcuSense is currently engaged actively in industrial, electrical and software design efforts for the three components of the TearLab™ test for DES and, to these ends, is working with two expert partners, both based in Melbourne, Australia, one of which is a leader in biomedical instrument development and the other of which is a leader in customized microfluidics.

OcuSense’s intention is to seek a 510(k) clearance and a CLIA waiver from the FDA for the TearLab™ test for DES, following its development and subsequent clinical trials.

Our History and Major Relationships

Shortly after our inception, we began commercialization of therapeutic apheresis by opening a therapeutic apheresis center in Florida. This site generated revenues of $900,200 and $1,277,800 for the years ended June 30, 1999 and 1998, respectively. The therapeutic apheresis center was closed in 1999 pursuant to a directive issued by the FDA. After obtaining an FDA investigational device exemption in 1999, we initiated the MIRA-1 pivotal clinical trial to support an application to the FDA for approval to market the RHEO™ System and completed this trial in 2005.

Relationship with TLC Vision Corporation

TLC Vision Corporation, or TLC Vision, beneficially owns approximately 36.08% of our outstanding common stock, or 33.79% on a fully diluted basis. Elias Vamvakas, a director of TLC Vision (and formerly its Chairman and CEO), became our Chairman in 2003 and is now also our CEO. In addition, two of our other directors, Thomas N. Davidson and Richard L. Lindstrom, are also directors of TLC Vision. Mr. Vamvakas beneficially owns 2,827,589 common shares of TLC Vision, representing approximately 4.09% of TLC Vision’s outstanding shares. Mr. Davidson beneficially owns 71,954 common shares of TLC Vision, representing approximately 0.10% of TLC Vision’s outstanding shares, and Dr. Lindstrom does not beneficially own any common shares of TLC Vision.

On December 8, 2004, we purchased TLC Vision’s 50% interest in OccuLogix, L.P. in exchange for which we issued 19,070,234 shares of our common stock to TLC Vision. This resulted in OccuLogix, L.P. becoming our wholly-owned subsidiary. Accordingly, 100% of the results of OccuLogix, L.P.’s operations are included in the consolidated financial statements since that date. We licensed to OccuLogix, L.P. all of the distribution and marketing rights for the RHEO™ System for ophthalmic indications to which we are entitled. Prior to the acquisition, our only profit stream had come from our share of OccuLogix, L.P.’s earnings. Our acquisition of TLC Vision’s 50% ownership interest in OccuLogix, L.P. transferred the earnings potential for sales of the RHEO™ System entirely to us.

As part of the formation of OccuLogix, L.P. in July 2002, we licensed certain patent rights, trademark rights and know-how rights to OccuLogix, L.P. We also provided OccuLogix, L.P. with licenses to our in-house software as well as sublicensing software that we have licensed from TLC Vision. TLC Vision agreed to provide OccuLogix, L.P., upon request, with $200,000 in funding at an annual interest rate equal to the Bank of America prime rate of interest on the date the loan is made, plus two percent. As at December 8, 2004, Occulogix, L.P. had not requested funding from TLC Vision.

On December 31, 2005, OccuLogix, L.P. transferred all of its assets and liabilities, including the licensed patent, trademark and know-how rights and the licensed distribution and marketing rights for the RHEO™ System, to our then newly incorporated subsidiary, OccuLogix Canada Corp. We completed the wind-up of OccuLogix, L.P. on February 6, 2006. We believe that going forward, our value with respect to the RHEO™ System resides solely in OccuLogix Canada Corp.

Until June 2005, one of Occulogix, L.P.’s primary customers was RHEO Clinic Inc., or RHEO Clinic, a subsidiary of TLC Vision, for which Occulogix, L.P. has reported revenues of $81,593, $401,236, $459,730 and nil for the years ended December 31, 2005, 2004, 2003 and 2002, respectively. RHEO Clinic used the RHEO™ System to treat patients, for which it charged its customers (the patients) a per-treatment fee. RHEO Clinic has advised us that all of its revenues, in Canadian dollars, of $192,430, $595,275, $836,696 and nil for the years ended December 31, 2005, 2004, 2003 and 2002, respectively, are derived from sales to unrelated third parties. The revenues reported from RHEO Clinic are unaudited and have not been independently verified by us. However, management believes the amounts to be accurate.

Since it has ceased the treatment of commercial patients in 2005, RHEO Clinic has not been a source of revenue for us, nor will it be a source of revenue for us in the future. On July 29, 2005, the Company entered into an agreement with RHEO Clinic to purchase fixed assets and intellectual property valued at C$61,812 to be used for the Company’s clinical trial activities and other purposes. The Company agreed to share equally in losses incurred by RHEO Clinic, to a maximum of C$28,952, for assets that RHEO Clinic is not able to dispose of as at December 31, 2005. In addition, the Company reimbursed RHEO Clinic C$281,581, which amount represented that proportion of the costs incurred by RHEO Clinic deemed applicable to our clinical trial activities from October 1, 2004 to June 30, 2005. On May 1, 2006, the Company paid RHEO Clinic C$31,859, which amount included the amount owing for losses incurred for assets that RHEO Clinic was not able to dispose of as at December 31, 2005.

Other Major Relationships

The components of the RHEO™ System were developed by our suppliers, Diamed Medizintechnik GmbH, or Diamed, and Asahi Kasei Medical Co., Ltd., or Asahi Medical.

In 2002, Apheresis Technologies, Inc., or Apheresis Technologies, which is managed by John Cornish, one of our stockholders, our Vice President of Operations and one of our directors from April 1997 to September 2004, was spun off from us. The purpose of the spin-off was to allow us to focus on our clinical trials. This spin-off was accomplished by our transferring all the assets we had in connection with our plasma filter distribution business to our then wholly-owned subsidiary, Apheresis Technologies. In consideration for the transfer of those assets, Apheresis Technologies agreed to pay us $25,000. The full amount of this consideration was applied to amounts owing by us to Apheresis Technologies. Following this transfer, we distributed the stock we owned in Apheresis Technologies to our stockholders, such that the identity and relative ownership of our stockholders and Apheresis Technologies’ stockholders were the same. We did not assume any liabilities in connection with this transfer. Shortly after the spin-off, we entered into a distribution services agreement with Apheresis Technologies to provide us with logistical support, including warehousing, order fulfillment, shipping and billing services. We had the right to terminate this agreement at any time and terminated it on March 28, 2005.

In June 2003, we entered into a reimbursement agreement with Apheresis Technologies whereby we reimbursed it for the applicable percentage of time that its employees provided services to us. One of these employees was John Cornish, our Vice President of Operations. Effective April 1, 2005, the Company terminated its reimbursement agreement with Apheresis Technologies such that the Company no longer compensates Apheresis Technologies in respect of any salary paid to, or benefits provided to, Mr. Cornish by Apheresis Technologies. On April 1, 2005, the Company and Mr. Cornish entered into an employment agreement, which has been amended several times. Effective April 13, 2006, Mr. Cornish is paid an annual base salary of $68,660, representing compensation to him for devoting 50% of his time to the business and affairs of the Company. Mr. Cornish participates in the Company’s bonus plan and is entitled to receive, and has received, stock options pursuant to the Company’s stock option plan.

Prior to the Company’s acquisition of SOLX, Doug P. Adams served as the President and Chief Executive Officer of SOLX and was a significant stockholder of SOLX. As of September 1, 2006, the closing date of the acquisition, Mr. Adams became an executive officer of the Company. The Company paid Mr. Adams a total of $1,005,791 and issued to him 1,309,329 shares of our common stock in consideration of his proportionate share of the purchase price of SOLX. Mr. Adams is owed an additional amount of up to $2,663,084 by the Company in consideration of his proportionate share of the outstanding balance of the purchase price of SOLX.

In addition, the Company paid Peter M. Adams, Doug P. Adams’ brother, a total of $229,967 and issued to him and his spouse an aggregate of 300,452 shares of our common stock in consideration of his proportionate share of the purchase price of SOLX. The Company owes Mr. Adams an additional amount of up to $615,983 in consideration of his proportionate share of the outstanding balance of the purchase price of SOLX.

On November 30, 2006, Mr. Vamvakas agreed to provide the Company with a standby commitment to purchase convertible debentures of the Company in an aggregate maximum principal amount of up to $8 million. When the Company raised gross proceeds in the amount of $10,016,000 on February 6, 2007 in a private placement of shares of its common stock and warrants, the commitment amount under Mr. Vamvakas’ standby commitment was reduced to zero, thus effectively terminating the standby commitment. No portion of the standby commitment was ever drawn down by the Company, and the Company has paid Mr. Vamvakas a total of $29,808 in commitment fees.

Industry (Retina)

Overview of the Human Eye

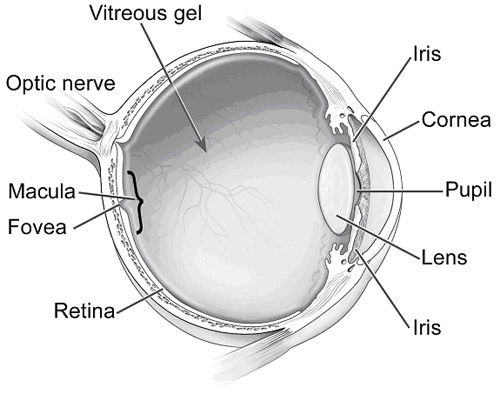

The human eye is composed of focusing elements in the front, the cornea and lens, and a light-sensing element in the back, the retina. Light falls on the photoreceptors that are part of the retina and is converted into electrical energy, which travels via the optic nerve to the brain. The brain processes the complex signals sent from the retina into vision. The central 5% of the area of the retina is the macula, the region responsible for seeing color and for the central vision necessary for activities such as reading, face recognition, watching television and driving. Due to its extremely small size, any damage to the macula can result in significant visual impairment, including legal blindness. In the Western World, the major diseases that usually result in blindness in adults are those affecting the retina, including AMD.

Age-Related Macular Degeneration (AMD)

AMD is a chronic, progressive disease of the macula that results in the loss of central vision. The most common symptoms include central distortion, loss of contrast sensitivity and loss of color vision, none of which can be corrected by refractive means, including glasses, contact lenses or laser eye surgery. Peripheral vision usually remains unaffected so that patients are often forced to look to the side of objects to see them but are still unable to see detail. AMD typically affects people initially in one eye, with a high probability of occurrence in the second eye over time. People with AMD often have difficulty living independently and performing routine daily activities.

We believe that approximately 15 million people in the United States suffer from AMD. According to a ten-year study published in Ophthalmology in October 2002, the prevalence of AMD among a selected sample of U.S. residents increased sharply with age, from 28.2% among people 65 to 74 years of age to 46.2% among people 75 years and older. A study by Duke University published in 2003 reported that the prevalence of AMD among a selected sample of U.S. residents aged 65 and older was 27% in 1999. According to the U.S. Census Bureau, the number of people in the United States aged 50 or older is approximately 80 million and is expected to increase by approximately 40% over the next two decades. We expect that this increase in the number of elderly people will result in a significant increase in the number of cases of AMD in the United States.

AMD occurs in two forms — a non-exudative ‘‘dry’’ form and an exudative ‘‘wet’’ form.

Dry AMD. Dry AMD is the most common form of the disease. We believe that Dry AMD affects approximately 13.0 to 13.5 million people in the United States, or approximately 85% to 90% of all AMD cases. Dry AMD is characterized by a gradual decrease of visual acuity, by pigment abnormalities on the macula and by the build-up of protein and lipid deposits, called drusen. This build-up of macromolecules affects the microcirculation in the eye. Research suggests that the retinal cells, overwhelmed by the lack of oxygen and nutrients and the build-up of debris, enter into a dysfunctional state of dormancy. Without treatment, the retinal cells ultimately die and do not regenerate, leading to irreversible vision loss either through the progression of Dry AMD or conversion to Wet AMD. Patients with Dry AMD are classified at the time of diagnosis into four categories of worsening severity. The higher the category, the greater the risk of progression, or conversion, to Wet AMD within five years.

The following table contains the principal characteristics of each category as described by the Age Related Eye Disease Report, or AREDS Report, No. 8:

Category | Risk of Wet AMD in Five Years | | Key Characteristics |

Category 1 | No Risk | | • no pigment changes and less than five small drusen |

| | | | • BCVA better than 20/32 in each eye |

| | | | • neither eye with Wet AMD |

| Category 2 | Low Risk (Less than 2%) | | • any combination of multiple small drusen, one isolated intermediate drusen or mild pigment abnormalities in one or both eyes |

| | | | • BCVA better than 20/32 in each eye |

| | | | • neither eye with Wet AMD |

Category 3(1) | Moderate Risk (18%) | | • any combination of at least one large drusen, extensive intermediate drusen or geographic atrophy not involving the central macula |

| | | | • neither eye with Wet AMD |

| | | | • BCVA better than 20/32 in at least one eye |

Category 4(1) | High Risk | | • one eye with no signs of Wet AMD |

| | (42%) | | • other eye with either Wet AMD or BCVA worse than 20/32 due to Dry AMD |

__________

(1) Categories 3 and 4 are commonly referred to as “Advanced Dry AMD”.

Wet AMD. We believe that Wet AMD affects approximately 1.5 to 2.0 million people in the United States, representing approximately 10% to 15% of all cases of AMD in the United States. Wet AMD occurs when new blood vessels grow into the macular tissues of the eye. This abnormal blood vessel growth generally is known as neovascularization. These new blood vessels tend to be fragile and often bleed, leaking fluid into the macula, resulting in loss of vision. Untreated, this blood vessel growth and leakage can lead to scarring, atrophy and, eventually, macular cell death. Wet AMD patients experience vision loss more rapidly than Dry AMD patients, usually within months of diagnosis. If treatment is not received in this small window of time, the damage is usually irreversible. As a result, the number of people who have Wet AMD that are considered ‘‘potentially treatable’’, or hoping for significant, positive visual outcomes, will stay relatively small each year as opposed to the number of people who have Dry AMD.

Treatment Alternatives for Wet and Dry AMD

Wet AMD

There is currently no cure for Wet AMD. However, retinal specialists may treat the symptoms in an attempt to reduce blood vessel growth and leakage, using one of a few approved therapies currently available — thermal laser treatment, photodynamic therapy and drug therapies. In addition, there are currently more than 30 therapies being evaluated in U.S. clinical studies for the treatment of Wet AMD. These treatments may slow the progression of the disease but do not prevent the reoccurrence of abnormal blood vessel growth and do not restore lost vision.

| · | Thermal Laser Treatment and Photodynamic Therapy. Thermal laser treatment of Wet AMD entails the use of a high-energy laser to destroy the abnormal blood vessels that are growing and leaking in the macula. This is a surgical procedure involving a medical device that was approved more than two decades ago by the FDA. Because the laser-treated portions of the retina are irreversibly destroyed due to collateral damage from intense heat, thermal laser treatment generally is now used only for the minority of Wet AMD patients whose abnormal blood vessel growth and vessel leakage occur away from the center of the macula. A more targeted approach, photodynamic therapy, involves the use of a light-activated drug named Visudyne, which was developed by QLT Inc. This therapy involves a two-step process in which the drug is administered systemically by intravenous infusion, after which a dose of low energy light is delivered to the target site to activate the drug and destroy the newly grown abnormal blood vessels. |

| · | Drug Therapies. Rather than attempting to destroy abnormal blood vessels, many drug therapies are designed to slow or stop the proliferation of abnormal blood vessels before they can further damage the retina. Genentech, Inc.’s Lucentis received FDA approval in June 2006 and appears to be gaining significant momentum in the ophthalmic community. Lucentis, as well as other drug therapies in clinical trials for Wet AMD, including ones sponsored by Regeneron Pharmaceuticals, Inc., Sirna Therapeutics, Inc. and Acuity Pharmaceuticals, is believed to block the effect of vascular endothelial growth factor, or VEGF, a natural protein that stimulates the production and growth of blood vessels, using different mechanisms of action. Avastin, a cancer drug of Genentech, Inc. which is molecularly similar to Lucentis, is reported to be the subject of much off-label use by physicians for the treatment of Wet AMD. Alcon Laboratories, Inc.’s Retaane is a modified steroid targeting enzymes produced by stimulated blood vessels by blocking the effects of multiple growth factors. Eyetech Pharmaceuticals, Inc.’s Macugen is a pegylated anti-VEGF aptamer, which binds to VEGF. Eyetech Pharmaceuticals, Inc. is owned by OSI Pharmaceuticals, Inc. Sirna Therapeutics, Inc. was recently acquired by Merck & Co., Inc. |

Dry AMD

Dry AMD is not a well understood disease, and there is no medical consensus regarding its underlying cause. As a result, there have been few resources devoted to developing a therapy for Dry AMD. However, there is some research that suggests a vascular component to the disease. This ‘‘vascular model’’ suggests that Dry AMD results from a disorder of the vascular microcirculation in the retina which leads to a reduction in the amount of oxygen and nutrients that reach the retina. This disorder also results in the accumulation of debris between the cellular layers of the retina and the subsequent formation of drusen. In addition, studies have shown that AMD progression may be related to the presence of elevated blood levels of certain macromolecules. Current research has identified a number of high molecular weight blood components that may have a detrimental effect on normal cellular functions and microcirculation.

There is currently no FDA-approved therapy for Dry AMD. Dry AMD is diagnosed and monitored by a primary eye care doctor, such as an optometrist or ophthalmologist, through a routine retinal exam. The AREDS Report provides evidence that vitamin, antioxidant and zinc supplements only reduce the five-year risk of conversion into Wet AMD by up to 25% for Category 3 and Category 4 Dry AMD cases. Regardless of the supplement treatments, Dry AMD may ultimately lead to irreversible vision loss, whether or not it converts into Wet AMD.

Potential Causes of AMD

The precise cause of AMD is not known. However, researchers have identified certain factors that are associated with AMD:

| · | Reduced Metabolic Efficiency of Retina. The macula must be able to function at an extremely high rate of metabolic efficiency to provide sharp vision. The macula, therefore, has an unusually high nutrient and oxygen requirement. Intact cell transport mechanisms are required to supply the necessary nutrients and oxygen. In addition to blood vessels in the retina, the macula receives its blood supply from a tiny meshwork of blood vessels, called the choroid, which lies underneath the retina. The blood supply in this network decreases in older people but even more so in some AMD patients. It has been proposed that the decreased blood flow in the retina of AMD patients reduces the metabolism in the retina, resulting in significant degradation of visual function. |

| · | Poor Waste Material Disposal. Conversion of light in the retina into electrical energy is a photochemical process which produces a large quantity of cellular waste materials. Some researchers believe that life-long environmental, oxidative and chemical stresses progressively injure eye tissues, making it more difficult to clear away the waste material generated by the vision-producing cells. This may explain why waste products like drusen are often seen in the retinas of AMD patients and why their presence is associated with an increased risk of progressive vision loss. |

We believe that a treatment that improves microcirculation in the retina can help to enhance the metabolic efficiency of the retina and the removal of waste material and thereby aid in the treatment of Dry AMD. We continue to believe there is a significant market opportunity for such a treatment.

Our Solution (Retina)

The RHEO™ System, which consists of a pump and a disposable treatment set, containing two filters, is designed to filter high molecular weight proteins and macromolecules from the patient’s plasma, leading to improved microcirculatory function. Researchers involved in MIRA-1 believe that blood filtered with the RHEO™ System is able to flow more easily through the tiny capillaries of the eye and that the resulting improved microcirculation more effectively supplies the macular cells with oxygen and nutrients which facilitates removal of cellular waste materials. The RHEO™ System represents a fundamentally new approach to the treatment of Dry AMD and offers the following potential benefits:

| · | Addresses a large AMD patient population with limited current treatment options. Current Wet AMD treatments are effective only on patients who are newly diagnosed with Wet AMD, of which there are approximately 200,000 in the United States each year. RHEO™ Therapy, however, is a treatment for most patients in the Category 3 and Category 4 Dry AMD populations, which, according to the AREDS Report, represent approximately 54% of the total U.S. AMD patients, or currently approximately 8 million people. RHEO™ Therapy is not appropriate for everyone in the Category 3 and Category 4 Dry AMD population. For example, RHEO™ Therapy would not be appropriate for potential patients who may have existing ailments that would make it unsafe for them to receive any blood transfusion type procedure. |

| · | Preserves or improves vision of Dry AMD patients. Success in treating AMD is generally measured by the ability to slow or halt progression of the disease. We believe that RHEO™ Therapy is currently the only Dry AMD therapy that, based on an interim analysis of 36 complete data sets from the first 43 patients enrolled in MIRA-1 and the modified per-protocol analysis of the final MIRA-1 study data, appears to demonstrate improved vision in some patients. However, MIRA-1 did not meet its primary efficacy endpoint as it did not demonstrate a statistically significant difference in the mean change of ETDRS BCVA between the treated and placebo groups in MIRA-1 at 12 months post-baseline. |

| · | Patient-friendly procedure. RHEO™ Therapy is a form of therapeutic apheresis, a procedure that selectively removes molecules from the plasma. Apheresis has been used safely for more than twenty years in the United States and Europe to treat various diseases, including leukemia, rheumatoid arthritis, sickle cell disease and several other medical conditions. Although RHEO™ Therapy is a patient-friendly procedure, it is time consuming, with an initial course of RHEO™ Therapy requiring eight procedures over a 10- to 12-week period, with each procedure lasting between two and four hours depending on patient weight and height. Patients recline in a comfortable chair and typically listen to music or otherwise relax during the procedure. As with any medical procedure, there are potential side effects associated with RHEO™ Therapy, which are all temporary and generally mild, including drops in blood pressure, abnormal heart rate, nausea, chills and localized bleeding, swelling, pain and numbness in the area of the arms where the needles are inserted. |

| · | Limited barriers to adoption for eye care professionals and health care service providers. We believe that the RHEO™ System requires lower capital expenditures and less physical space than equipment used in many other procedures performed by eye care professionals, including laser vision correction and cataract surgery. The RHEO™ System requires no special installation and minimal maintenance costs. We believe that RHEO™ Therapy, which can be administered by a nurse, can be easily integrated into our potential customers’ workflow and offers an attractive source of additional revenues for both facilities and providers. However, our success is dependent upon achieving widespread acceptance of RHEO™ Therapy among ophthalmologists and optometrists who may be reluctant to accept RHEO™ Therapy. |

| · | Cost-effective procedure. The initial course of RHEO™ Therapy is initially expected to cost between $16,000 and $25,600. We believe that Medicare and third-party payors will determine that the benefits of RHEO Therapy™ will justify the cost of reimbursement. However, should Medicare and third-party payors decline to provide coverage of RHEO™ Therapy or set broad restrictions on patient coverage or on treatment settings in which RHEO™ Therapy is covered, our potential revenues may be significantly limited, particularly if potential patients deem our treatment to be too expensive. Nonetheless, we believe that to the extent that RHEO™ Therapy is not reimbursed by the government or private third-party payors, some patients with the economic means to do so will be willing to pay for RHEO™ Therapy themselves in order to avoid the consequences of uncorrectable impaired vision, including, but not limited to, the inability to drive. |

Our Strategy (Retina)

Our goal is to establish RHEO™ Therapy as the leading treatment for Dry AMD in North America. To date, key elements of our strategy have included creating a plan to develop market awareness of RHEO™ Therapy by educating eye care professionals and patients, establishing third-party reimbursement for RHEO™ Therapy, securing relationships with key multi-facility health care service providers, ensuring sufficient manufacturing capacity and inventory to support our commercialization plan and maintaining our intellectual property portfolio and other barriers to entry. However, as a result of our discussions with the FDA following the full analysis of the MIRA-1 study results and the FDA’s requirement that a follow-up clinical trial of the RHEO™ System be conducted, the timetable for the achievement of our goal to establish RHEO™ Therapy as the leading treatment for Dry AMD in North America and the implementation of our strategy for achieving this goal have been delayed for at least the duration of the RHEO-AMD clinical trial. To the extent that it makes sound business sense, we will continue to lay the foundation for the achievement of our goal and the implementation of our strategy.

Our Product (Retina)

The RHEO™ System

The RHEO™ System employs a double filtration apheresis process, whereby a pair of single-use blood and plasma filters sequentially separate and partially remove the targeted plasma components. The system removes macromolecules greater than a specified size from the plasma. The RHEO™ System consists of two primary components:

| · | OctoNova Pump. The OctoNova pump is a microprocessor-controlled device used to circulate blood and plasma from the patient, through the filter and back to the patient. The OctoNova pump is complemented by single-use sterilized tubing which creates a closed-loop system. Blood is pumped through the tubing with small gear-like sprockets that create a peristaltic action in the tube similar to that which occurs in our intestines. The smooth-edged teeth of the sprockets press against the outside surface of the tube pushing the blood along the length of the tube as the wheels turn all at the same rate and direction. No blood ever leaves the closed-loop system. The OctoNova pump was developed in the 1990s by Diamed and licensed to us in 2002. We will be seeking FDA approval of the OctoNova pump as part of the RHEO™ System PMA. |

| · | Disposable Treatment Sets. Disposable treatment sets consist of the tubing and two filters, the Plasmaflo filter and the Rheofilter filter. One treatment set is used for each treatment undertaken by the patient. The Plasmaflo filter performs the initial function of separating the blood cells from the plasma. The Rheofilter filter is a single-use, hollow-fiber nanopore membrane, which is used to filter specific high molecular weight proteins and other macromolecules from the plasma. Following this, the filtered plasma is reconstituted with the blood cells and returned into the patient. The tubing and the filters are easily disposed of after each patient procedure by the administering nurse, providing us with a recurring source of revenue. The Rheofilter filter was developed in the early 1980s by Asahi Medical. We will be seeking FDA approval of the tubing and two filters as part of the RHEO™ System PMA and will be working with Asahi Medical on preparing the PMA following the completion of RHEO-AMD. Upon FDA approval of the PMA, we have an agreement to transfer this FDA approval to a special purpose corporation which will be owned as to 51% by Asahi Medical and as to 49% by us. In that same agreement, Asahi Medical agreed to us being the exclusive distributor of the Plasmaflo filter and the Rheofilter filter in North America, certain countries in the Caribbean, Australia, New Zealand, Colombia and Venezuela and a non-exclusive distributor in Italy. With respect to the United States, subject to early termination under certain circumstances, this agreement has a term which will end ten years following the date on which the FDA approval is received, if ever, and contemplates successive one-year renewal terms thereafter. The Rheofilter filter is currently made of a cellulose acetate filter material. We had been working with Asahi Medical to develop a new filter made of polysulfone to replace the older cellulose acetate filter, and the FDA has confirmed its willingness to allow the substitution, in RHEO-AMD, of the new polysulfone filter. |

The disposable treatment sets received Health Canada regulatory approval in 2002. The OctoNova pump received a Health Canada license in 2003. The RHEO™ System components have also been granted a CE Mark in Europe, where, other than in Italy, the commercialization rights for the Rheopheresis™ procedure are exclusively held by Diamed, one of our principal stockholders and suppliers. Although we had been conducting clinical studies with the goal of obtaining FDA approval as well as with a view to gaining widespread physician acceptance of RHEO™ Therapy, our clinical study efforts with respect to the RHEO™ System, in the near future, will be focused principally on RHEO-AMD.

The RHEO™ Procedure

Each RHEO™ Therapy procedure typically takes between two and four hours to complete and begins by placing one intravenous line in each forearm of the patient. Blood is pumped from a large vein in one arm and circulated through the filtration system where the whole blood is separated from the plasma by the Plasmaflo filter. The plasma is filtered through the Rheofilter filter, which filters high molecular weight proteins and other macromolecules from the patient’s plasma. The plasma is then remixed with the blood and is returned to the patient intravenously. Only approximately 1.25 pints of blood are outside the patient’s body, and, at all times, blood remains in a sterile closed circuit. Throughout the RHEO™ Therapy procedure, the attending nurse monitors the blood pressure, heart rate, oxygen saturation, cardiac rhythm and activated clotting time of the patient. The attending nurse also gauges the flow rates, temperature and pressures of the filters. No blood products or medications are added, other than a small amount of heparin to prevent clotting in the tubing system. We believe the initial course of eight procedures of RHEO™ Therapy given over a 10- to 12-week period provides the best results for patients with Dry AMD. Typically, one or two booster procedures are given each 12 to 18 months thereafter to maintain the clinical benefits derived from the initial course of RHEO™ Therapy. The referring physician monitors post-procedure follow-up. The following graphic shows the RHEO™ Therapy process:

Background of Rheopheresis™

Researchers discovered Rheopheresis™ for AMD during the search for a blood treatment for elevated cholesterol levels in the mid-1980s. Asahi Medical developed a filter aimed at selectively removing the low-density lipid, or LDL, macromolecules known as the ‘‘bad’’ cholesterol in an apheresis procedure. Although the filter successfully removed LDL, it also removed several other large molecules, including von Willebrand’s factor, fibrinogen, lipoprotein A and C reactive protein. Researchers have confirmed that apheresis, a plasma filtering or exchange procedure, is a relatively safe procedure and that there do not appear to be negative consequences to also filtering out these large molecules. At approximately the same time, however, the first statin drug was proven to be effective in lowering LDL levels in the blood, thereby eliminating the need for an apheresis procedure to remove LDL. Shortly thereafter, Asahi Medical ceased its efforts to develop and commercialize apheresis treatment for elevated LDL levels.

In the late 1980s, researchers at the University of Cologne in Germany were searching for a treatment for a small group of patients referred to the university with a condition known as refractory uveitis, a chronic inflammatory eye condition that was not responding to conventional therapy. Having learned that the Asahi Medical filters had the ability to remove large molecules from the blood and that the eye condition was related to significant levels of many of the same molecules, the researchers performed a small pilot study. The filtration procedure was effective for uveitis but also showed preliminary success in improving the vision of two patients in the study who also had AMD. This led the researchers to conduct several years of clinical research to develop apheresis for AMD in Germany. The research suggested that eight procedures over a 10- to 12-week period was the optimal treatment regime.

Clinical Studies (Retina)

In 2006, we completed our FDA clinical trial, MIRA-1, or Multicenter Investigation of Rheopheresis for AMD, which, if successful, was expected to support our application to the FDA to obtain approval to market the RHEO™ System in the United States. On February 3, 2006, we announced that, based on a preliminary analysis of the data from MIRA-1, MIRA-1 did not meet its primary efficacy endpoint. Two other clinical trials have been conducted by third parties: MAC-1, which was conducted in Germany from 1995 to 1998; and the Rheopheresis™ pilot study which was conducted by the University of Utah from 1997 to 1998. While the protocols of these three clinical trials were not identical, the interim results of MIRA-1 and results of each of these other two studies have been generally consistent.

As expected, in light of MIRA-1’s failure to meet its primary efficacy endpoint, the FDA advised us that it would require an additional study of the RHEO™ System to be performed. On January 29, 2007, the Company announced that it had obtained Investigational Device Exemption clearance from the FDA to commence the new pivotal clinical trial of the RHEO™ System, called RHEO-AMD, or Safety and Effectiveness in a Multi-center, Randomized, Sham-controlled Investigation for Dry, Non-exudative Age-Related Macular Degeneration (AMD) Using Rheopheresis.

RHEO-AMD

RHEO-AMD is a randomized, placebo-controlled trial designed to evaluate the safety and efficacy of RHEO™ Therapy in patients with intermediate-to-late stage, or Category 3 and Category 4 (as defined in the AREDS Report), Dry AMD.

To be included in RHEO-AMD, a patient’s study eye must demonstrate intermediate-to-late stage Dry AMD, with three or more large, or ten or more intermediate, drusen. Primary eyes in the study must show no signs of active Wet AMD and must have demonstrated best corrected visual acuity, or BCVA, between 20/40 and 20/100 inclusive. Potential study subjects who demonstrate central geographic atrophy within 250 µm of the fovea of the eye being studied or with any serious pigment epithelium detachments within 500 µm of the fovea will not qualify to participate in the study. Other ophthalmic exclusion criteria of RHEO-AMD, among others, will require potential study subjects to not require cataract surgery, to not have had cataract surgery during the three-month period prior to screening and to not have had a Yag capsulotomy during the six-week period prior to screening. RHEO-AMD will not apply any inclusion or exclusion criteria based on blood factors.

Two out of every three patients will be treated in the trial, while the third will be a placebo, or control, patient. Patients will receive eye exams prior to treatment and at three-, six-, nine- and 12-month follow-up intervals. Patients in the placebo-control group will be made to believe that they are receiving RHEO™ Therapy. All subjects, including those randomized to the placebo group, will be shrouded from the neck down to prevent them from observing their treatment and will receive actual needle sticks in both arms. Additionally, a partition will be positioned in front of the OctoNova pump in order to prevent the patient from seeing the system. The machine will be activated so that patients can hear the background noise of the machine, but those patients in the placebo group will not be connected to the tubing circuit. In addition, all subjects, including those randomized to the placebo group, will be required to take the same dose of antioxidant vitamins that are commonly recommended for Dry AMD patients as a possible inhibitor of conversion into Wet AMD.

Vision research typically uses a “standard measurement” called the “change in BCVA”, which is measured using the Early Treatment Diabetic Retinopathy Study, or ETDRS, eye chart, which is the standard eye chart used in ophthalmic trials and which provides five letters per line of decreasing size or increasing difficulty. Each letter has a relative value of 0.2 or 20% of the entire line. A patient entering the study who gains two lines of vision will be able to read ten additional letters or two complete lines of vision. “Mean change” is the cumulative averaging of all patient results in a specific category. For example, a patient entering the study with 20/40 vision and gaining 1.4 lines following treatment would have improved to 20/32 plus two letters on the 20/25 line. This number, 1.4, would be included in the calculation with all other individual patient results when calculating the cumulative average.

RHEO-AMD’s primary endpoint will be the mean change in BCVA and will be achieved if there is demonstrated a statistically significant difference in the proportion of study eyes achieving a ten-letter (two-line) or greater improvement in BCVA between actively treated patients and placebo patients. RHEO-AMD will have various secondary and tertiary endpoints.

The protocol for RHEO-AMD was designed with the input of members of our Scientific Advisory Board, and the protocol design specifically takes into account the learnings derived from MIRA-1.

It is anticipated that up to 25 ophthalmic clinical trial sites and up to 20 apheresis clinical trial sites will participate in RHEO-AMD. The initiation of clinical trial sites has been underway and is continuing.

MIRA-1

MIRA-1 was a randomized, placebo-controlled trial designed to evaluate the safety and efficacy of RHEO™ Therapy in patients with intermediate-to-late stage, or Category 3 and Category 4 (as defined in the AREDS Report), Dry AMD.

In September 1999, we received an Investigational Device Exemption from the FDA to begin MIRA-1. Between early 2000 and August 2001, we enrolled 98 patients in MIRA-1. In August 2001, due to financial constraints, we temporarily suspended the new enrollment of patients but continued to pursue follow-up with the remaining patients in MIRA-1. In late 2001, with the permission of the FDA, we submitted the data sets of the 43 patients who had reached their full 12-month follow-up in MIRA-1 for independent third-party analysis. Over the course of the next several months, the FDA addressed a number of matters relating to MIRA-1. First, the FDA allowed us to submit the PMA in modules. Second, it acknowledged that MIRA-1 is intended to be the pivotal trial for obtaining FDA approval for RHEO™ Therapy. Third, the FDA allowed us to treat the patients in the placebo group with RHEO™ Therapy free of charge once their full 12-month follow-up data had been obtained. Fourth, it confirmed that we would be required to submit at least 150 full data sets from the 180 patients that were to be enrolled in the trial. Following disclosure of the interim results of MIRA-1 and these changes to the MIRA-1 protocol, we were able to obtain new financing. As a result of the new financing, in October 2003, we began screening additional patients for enrollment in MIRA-1 and then opened five additional MIRA-1 sites and, at the completion of the study, were operating 12 MIRA-1 sites.

As of December 31, 2004, we had enrolled a total of 185 patients in MIRA-1 and had also submitted to the FDA the first three of four modules of the PMA filing, the non-clinical portion. These first three modules contained non-clinical results of bench tests and quality assurance and document manufacturing processes on the components of the RHEO™ System. Although we had intended to submit the fourth module, which consists of the follow-up clinical data, in two components, following discussions with the FDA, we elected to file only one PMA clinical module following completion of our 12-month data on at least 150 data sets.

To be included in MIRA-1, a patient’s eyes must have demonstrated intermediate-to-late stage Dry AMD, with ten or more intermediate or large drusen. Additionally, patients must have shown elevated serum levels of at least two out of three macromolecules associated in previous studies that suggested the best positive treatment outcomes. Primary eyes in the study must have shown no signs of Wet AMD and must have demonstrated BCVA between 20/32 and 20/125 inclusive.

Two out of every three patients were treated in the trial, while the third was a placebo or control patient. Patients received eye exams prior to treatment and at three-, six-, nine-, and 12-month follow-up intervals. Each patient received either eight RHEO™ Therapy or eight placebo procedures over ten weeks. Patients in the placebo-control group were made to believe that they were receiving RHEO™ Therapy. All subjects, including those randomized to the placebo group, were shrouded from the neck down to prevent them from observing their treatment and received actual needle sticks in both arms. Additionally, a partition was positioned in front of the OctoNova pump so that the patient could not see the system. The machine was activated so that the patients could hear the background noise of the machine, but those patients in the placebo group were not connected to the tubing circuit. In addition, all subjects, including those randomized to the placebo group, were required to take the same dose of antioxidant vitamins that are commonly recommended for Dry AMD patients as a possible inhibitor of conversion into Wet AMD.

The study’s primary endpoint was the mean change in BCVA. In this trial, visual acuity was measured as the number of letters that the patient can read on the ETDRS eye chart. Secondary and tertiary endpoints included:

| · | the ability to pass a vision test in order to regain a driver’s license; |

| · | the Pepper Visual Skills for Reading Test, which is a measure of reading ability; |

| · | the National Eye Institute visual functioning questionnaire; and |

| · | progression to legal blindness. |

On February 3, 2006, we announced that, based on a preliminary analysis of the data from MIRA-1, MIRA-1 did not meet its primary efficacy endpoint as it did not demonstrate a statistically significant difference in the mean change of ETDRS BCVA between the treated and placebo groups in MIRA-1 at 12 months post-baseline. As expected, the treated group demonstrated a positive result. An anomalous response of the control group is the principal reason why the primary efficacy endpoint was not met. There were subgroups that did demonstrate statistical significance in their mean change of ETDRS BCVA versus control.

Subsequent to the February 3, 2006 announcement, the Company completed an in-depth analysis of the MIRA-1 study data identifying subjects that were included in the intent-to-treat, or ITT, population but who deviated from the MIRA-1 protocol as well as those patients who had documented losses or gains in vision for reasons not related to retinal disease such as cataracts. Those subjects in the ITT population who met the protocol requirements, and who did not exhibit ophthalmic changes unrelated to retinal disease, comprised the modified per-protocol population.

In the modified per-protocol analysis, eyes treated with RHEO™ Therapy demonstrated a mean vision gain of 0.8 lines of ETDRS BCVA at 12 months post-baseline, compared to a mean vision loss of 0.1 lines of ETDRS BCVA in the eyes in the placebo group. The result was statistically significant (repeated measure p value = 0.0147). The following table presents a summary of the ETDRS BCVA changes observed 12 months post-baseline in the modified per-protocol analysis of MIRA-1:

| | Treatment Group (n=69) | Placebo Group (n=46) |

| Vision improvement greater or equal to: | | |

| 1 line | 46.4% | 19.6% |

| 2 lines | 27.5% | 8.7% |

3 lines | 8.7% | 2.2% |

| Vision loss greater or equal to: | | |

| 1 line | 11.6% | 23.9% |

| 2 lines | 5.8% | 6.5% |

3 lines | 2.9% | 2.2% |

Within the modified per-protocol population with pre-treatment vision worse than 20/40, 50.0% of RHEO™ Therapy-treated eyes improved, after treatment, to 20/40 or better and would be able to qualify for a driver’s license 12 months post-baseline, compared to 20.0% of placebo eyes.

MIRA-1 data support historical clinical and commercial experience with respect to the safety of RHEO™ Therapy, with observed treatment side effects generally being mild, transient and self-limiting.

LEARN Studies

On February 28, 2005, we announced that the FDA had completed a review of the Long-term Efficacy in AMD from Rheopheresis in North America, or LEARN, protocols submitted to it by us on January 21, 2005 and had given us permission to initiate two studies.

LEARN-1 is an open-label multi-center study that enrolled 50 subjects who were treated in the MIRA-1 study. At nine investigational sites, subjects were randomized in a 1:1 fashion to receive either two or four RHEO™ Therapy “booster” procedures. The results between the groups will be compared after three, six, nine and 12 months of follow-up from baseline.

LEARN-2 is an open-label multi-center study that enrolled 29 subjects who had been placebo patients in the MIRA-1 study. At nine investigational sites, subjects received eight RHEO Therapy procedures and will have a three-, six-, nine- and 12-month follow-up from baseline evaluation.

The screening and treatment phases of both LEARN-1 and LEARN-2 have been completed, and both clinical trials are currently in the follow-up phase.

OMER

We have been conducting a small clinical study, called OMER, or Objective Measurement of the Effect of Rheopheresis, with the assistance of Columbia University, New York Presbyterian Hospital and New York Blood Center. OMER is an open-label study of ten patients, the objective of which is to evaluate any change, from baseline evaluation to post-treatment, in the multi-focal electrophysiological activity of their macula and in the thickness of their retina. Each patient participating in the study has been, or will be, receiving a series of eight RHEO™ Therapy treatments over a ten- to 12-week period, and clinical data will be collected at three-, six- and 12-month intervals following the baseline evaluation. Although a number of patients have already been treated or will commence treatment shortly, OMER is still in the enrollment phase and is recruiting patients.

Among other things, it is hypothesized that an increase in electrophysiological activity in the macula may be indicative of an improvement in the functioning of the macula.

MAC-1

The MAC-1 trial was a 40-patient study conducted in Germany by the University of Cologne from 1995 to 1998 and resulted in the Rheopheresis™ procedure for Dry AMD achieving the CE Mark. The patients were randomized into two groups, a treatment group and a placebo-control group. The treatment group was treated ten times over a period of 21 weeks.

Unlike in RHEO-AMD and MIRA-1, the investigators and each patient knew whether that patient was in the treatment group or the control group, because the 20 patients in the control group did not receive placebo treatments but were simply examined at the designated follow-up intervals. The MAC-1 study also included patients with signs of Wet AMD and included patients with significant soft drusen. 18 of the patients in the study had signs of Wet AMD and would be excluded from RHEO-AMD under the RHEO-AMD protocol and also would have been excluded from MIRA-1 under the MIRA-1 protocol.

The main parameter of the study was BCVA. Electrical activity in the eye was also recorded. Plasma and whole-blood speed and volume in the macular region were also measured. The results of MAC-1 were similar to the interim results that have been seen in MIRA-1: statistically significant relative improvement of 1.6 lines of BCVA immediately following the course of treatment, with the same level of benefit seen at 12 months. For patients with soft drusen, the average difference was 2.3 lines (p<0.01); for patients without soft drusen, the difference was only 0.64 lines (p=0.43). In the treated group, improvement in electrical activity was statistically significant, indicating that the cells of the retina were functioning more efficiently. The speed and volume of blood flow in the choridial arteries which supply blood to the retina were found to be decreased by 37% and 33%, respectively, in patients with AMD. Following treatment of those patients, blood flow increased by 22%. There were no serious adverse events noted.

Rheopheresis™ Pilot Study

The study was conducted from 1997 to 1998 by physicians at the University of Utah Health Sciences Center in Salt Lake City, Utah, under an Investigational Device Exemption from the FDA. The University of Utah’s Institutional Review Board also provided approval for human experimentation prior to enrollment. The study involved 30 patients. The trial measured electrical activity in the cells of the macula before and after treatment. The results of this study were used to support the application for the Investigational Device Exemption to conduct MIRA-1.

PERC Study

In April 2004, RHEO Clinic, a subsidiary of TLC Vision, received Institutional Review Board approval for and launched a new study called the Prospective Evaluation of Rheopheresis in Canada, or PERC.

PERC is a single center study in Canada designed to examine the effect of RHEO™ Therapy on 60 patients with Dry AMD to gain a greater understanding of the treatment’s method of action. Although at the outset PERC was contemplated to study the outcome variables for 60 patients, it was subsequently decided to limit the enrollment in PERC to 20 patients. Each patient received a series of eight RHEO™ Therapy treatments over a 10- to 12-week period. Clinical data were collected at three-month intervals for one year following the initial treatments.

One objective of the study is to develop a complete description of the physiological changes produced by RHEO™ Therapy. This will be done using structural and functional objective tests and subjective measures of vision in its broad context. This includes measurements of the size and shape of the retina, retinal electrical activity and vascular function as well as general visual performance using standard measurements of acuity, reading speed, and color and contrast sensitivity. Subjective vision assessments using the National Eye Institute Visual Functioning Questionnaire 25 were evaluated to gain understanding about general quality of life and AMD-specific visual symptoms.

Early analysis of the visual acuity of the 20 patients in PERC showed findings similar to those shown by the interim analysis conducted on 36 complete data sets from the first 43 patients enrolled in MIRA-1. Further analysis of the other parameters measured in the PERC study will continue to be conducted.

RHEONET Registry

The RHEONET Registry is a collaborative effort between the Apheresis Research Institute in Cologne, Germany, and us. The registry contains a database of Rheopheresis™ procedures from centers and clinics performing the Rheopheresis™ procedure commercially in Germany, using systems sold by Diamed or provided by Diamed for some local research projects and, in Canada, using systems sold by us. In January 2007, a total of 6,726 Rheopheresis™ procedures (5,272 in Germany and 1,454 in Canada) on 1,005 patients were registered, including 739 patients with AMD. Ophthalmological data of 322 eyes of 218 patients with Dry AMD could be analyzed from the registry as of January 2007. Results of RHEONET Registry analyses will be presented, when available, at scientific meetings in 2007.

Supplier Relationships (Retina)

We have three key supplier arrangements — with Asahi Medical, who manufactures the treatment sets, including the Rheofilter filter and the Plasmaflo filter, and with Diamed and MeSys GmbH, or MeSys, the designer and the manufacturer, respectively, of the OctoNova pump. The Rheofilter filter, the Plasmaflo filter and the OctoNova pump are all key components of the RHEO™ System.

Rheofilter Filter and Plasmaflo Filter. We purchase the Rheofilter filter and the Plasmaflo filter from Asahi Medical. We make these purchases pursuant to a distribution agreement which appoints us Asahi Medical’s exclusive distributor of the Rheofilter filter and the Plasmaflo filter for use in treating AMD in North America, certain countries in the Caribbean, Australia, New Zealand, Colombia and Venezuela, subject to us obtaining necessary regulatory approvals in those agreed countries where we choose to sell the filters. The distribution agreement appoints us a non-exclusive distributor of the Rheofilter filter and the Plasmaflo filter in Italy where we are also obligated to obtain regulatory approval therefor. Under this agreement:

| · | we may not market or sell any product that is similar to or competitive with the filters; |

| · | we must use our best efforts to support providers in their efforts to secure reimbursement from public and private health insurers, in those territories where we have exclusive distribution rights, on behalf of patients whose Dry AMD treatment involves utilization of these filters; |