UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

TearLab Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

TEARLAB CORPORATION

7360 Carroll Rd., Suite 200

San Diego, California 92121

NOTICE OF ANNUAL MEETING OF

STOCKHOLDERS AND PROXY STATEMENT

To the Stockholders of TearLab Corp.:

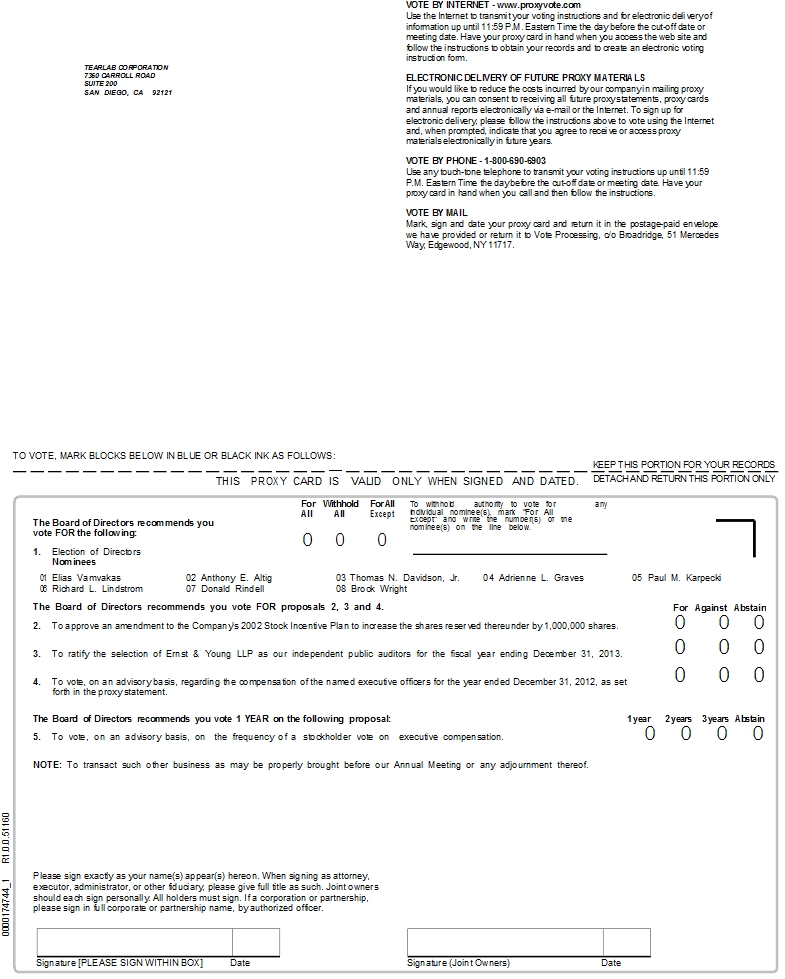

Notice is hereby given that the Annual Meeting of the Stockholders (“Annual Meeting”) of TearLab Corporation, will be held on June 7, 2013 at 8:30 a.m. Eastern Daylight Time at the offices of Torys LLP, 79 Wellington Street West, 33rd Floor, Toronto, Ontario, Canada for the following purposes:

| | 1. | To elect eight directors for a one-year term to expire at the 2014 Annual Meeting of Stockholders. Our present Board of Directors has nominated and recommends for election as director the following persons: |

Elias Vamvakas

Anthony E. Altig

Thomas N. Davidson, Jr.

Adrienne L. Graves

Paul M. Karpecki

Richard L. Lindstrom

Donald Rindell

Brock Wright

| | 2. | To approve an amendment to the 2002 Stock Incentive Plan to increase the shares reserved thereunder by 1,000,000 shares. |

| | 3. | To ratify the selection of Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2013. |

| | 4. | To vote, on an advisory basis, regarding the compensation of the named executive officers for the year ended December 31, 2012, as set forth in this proxy statement. |

| | 5. | To vote, on an advisory basis, on the frequency of a stockholder vote on executive compensation. |

| | 6. | To transact such other business as may be properly brought before our Annual Meeting or any adjournment thereof. |

We have also elected to provide access to our proxy materials over the Internet under the Securities and Exchange Commission's “notice and access” rules. We believe these rules allow us to provide you with the information you need while reducing our delivery costs and the environmental impact of the Annual Meeting. Our Board of Directors has fixed the close of business on April 10, 2013, as the record date for the determination of stockholders entitled to notice of and to vote at our Annual Meeting and at any adjournment or postponement thereof. Our proxy materials were first sent or given on April 26, 2013, to all stockholders as of the record date.

Whether or not you expect to be at our Annual Meeting, please complete, sign and date the Proxy you received in the mail and return it promptly. You may vote over the Internet, by telephone or, if you request to receive printed proxy materials, by mailing a proxy or voting instruction card. You may also vote your shares during the Annual Meeting. Please review the instructions on each of your voting options described in this proxy statement, as well as in the Notice of Internet Availability of Proxy Materials or proxy card you received by mail.

All stockholders are cordially invited to attend the meeting.

| | By Order of the Board of Directors, |

| | |

| | /s/ Elias Vamvakas |

| | Elias Vamvakas |

| | Chairman of the Board |

April 26, 2013

PROXY STATEMENT

FOR 2013 ANNUAL MEETING OF STOCKHOLDERS

TABLE OF CONTENTS

| PROXY STATEMENT | 1 |

| | |

| PROPOSAL 1: ELECTION OF DIRECTORS | 2 |

| | |

| Information Regarding Directors | 2 |

| Board Meetings | 4 |

| Committees of the Board | 4 |

| Director Nomination Process | 6 |

| Communications with the Board of Directors | 6 |

| Code of Business Conduct and Ethics | 7 |

| Corporate Governance Documents | 7 |

| Report of the Audit Committee | 7 |

| Principal Accounting Fees and Services | 9 |

| Director Attendance at Annual Meetings | 9 |

| Director Independence | 9 |

| Board Leadership Structure | 9 |

| Board Role in Risk Oversight | 10 |

| Board of Directors’ Recommendation | 10 |

| | |

| EXECUTIVE COMPENSATION AND OTHER INFORMATION | 11 |

| | |

| Our Executive Officers | 11 |

| Executive Compensation | 11 |

| Outstanding Equity Awards at Fiscal Year-End | 12 |

| Employment Arrangements and Change of Control Arrangements | 13 |

| Compensation of Directors | 13 |

| Compensation Committee Interlocks and Insider Participation | 14 |

| Directors’ and Officers’ Liability Insurance | 14 |

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 14 |

| Equity Compensation Plan Information | 16 |

| Certain Relationships and Related Transactions | 16 |

| | |

| PROPOSAL 2: AMENDMENT OF THE 2002 STOCK INCENTIVE PLAN | 17 |

| | |

| Summary of the 2002 Stock Incentive Plan | 17 |

| Number of Awards Granted to Employees, Directors and Consultants | 20 |

| Federal Tax Aspects | 21 |

| Board of Director’s Recommendation | 22 |

| | |

| PROPOSAL 3: RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS | 23 |

| | |

| Audit Committee Policy Regarding Pre-Approval of Audit and Permissible Non-Audit Services of Our Independent Auditors | 23 |

| Board of Directors’ Recommendation | 23 |

| | |

| PROPOSAL 4: ADVISORY VOTE ON EXECUTIVE COMPENSATION | 24 |

| | |

| Compensation Program and Philosophy | 24 |

| Board of Directors’ Recommendation | 24 |

| | |

| PROPOSAL 5: ADVISORY VOTE ON THE FREQUENCY OF AN ADVISORY VOTE ON EXECUTIVE COMPENSATION | 25 |

| | |

| Board of Directors’ Recommendation | 25 |

| | |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 26 |

| | |

| STOCKHOLDER PROPOSALS | 26 |

| | |

| ANNUAL REPORT | 26 |

| | |

| HOUSEHOLDING OF PROXY MATERIALS | 26 |

| | |

| OTHER BUSINESS | 26 |

TEARLAB CORPORATION

7360 Carroll Rd., Suite 200

San Diego, California 92121

PROXY STATEMENT

The Board of Directors of TearLab Corp., a Delaware corporation, or the Company, is soliciting the Proxy for use at our Annual Meeting of Stockholders to be held on June 7, 2013 at 8:30 a.m. Eastern Daylight Time at the offices of Torys LLP, 79 Wellington Street West, 33rd Floor, Toronto, Ontario, Canada and at any adjournments or postponements thereof.

Details regarding the meeting and the business to be conducted are described in the Notice of Internet Availability of Proxy Materials you received in the mail and in this proxy statement. We have also made available a copy of our 2012 Annual Report to Stockholders with this proxy statement. We encourage you to read our Annual Report. It includes our audited consolidated financial statements and provides information about our business and products.

We have elected to provide access to our proxy materials over the internet under the Securities and Exchange Commission’s “notice and access” rules. We believe that providing our proxy materials over the internet increases the ability of our stockholders to connect with the information they need, while reducing the environmental impact of our Annual Meeting.

All stockholders who find it convenient to do so are cordially invited to attend the meeting in person. In any event, please complete, sign, date and return the Proxy.

A proxy may be revoked by written notice to the Secretary of the Company at any time prior to the voting of the proxy, or by executing a subsequent proxy prior to voting or by attending the meeting and voting in person. Unrevoked proxies will be voted in accordance with the instructions indicated in the proxies, or if there are no such instructions, such proxies will be voted (1) for the election of our Board of Directors’ nominees as directors, (2) to approve an amendment of the Company’s 2002 Stock Incentive Plan to increase the shares reserved thereunder by 1,000,000 shares, (3) for the ratification of the selection of Ernst & Young LLP as our independent auditors, (4) for, on an advisory basis, the compensation of our named executive officers for the year ended December 31, 2012, and (5) for, on an advisory basis, the option of once every year as the frequency with which stockholders are provided an advisory vote on executive compensation. Shares represented by proxies that reflect abstentions or include “broker non-votes” will be treated as present and entitled to vote for purposes of determining the presence of a quorum. Abstentions have the same effect as votes “against” the matters, except in the election of directors. “Broker non-votes” do not constitute a vote “for” or “against” any matter and thus will be disregarded in the calculation of “votes cast.”

Stockholders of record at the close of business on April 10, 2013, or the Record Date, will be entitled to vote at the meeting or vote by proxy using the Proxy Card that was mailed to you with the Notice of Internet Availability of Proxy Materials. As of the Record Date, 28,769,265 shares of our common stock, par value $0.001 per share, were outstanding. Each share of our common stock is entitled to one vote. A majority of the outstanding shares of our common stock entitled to vote, represented in person or by proxy at our Annual Meeting, constitutes a quorum. A majority of the shares present in person or represented by proxy at our Annual Meeting and entitled to vote thereon is required for the election of directors, approval of an amendment of the Company’s 2002 Stock Incentive Plan, ratification of the selection of Ernst & Young LLP as our independent auditors for the fiscal year ending December 31, 2013, approval of the compensation of our named executive officers for the year ending December 31, 2012, and vote on the frequency of a stockholder vote on executive compensation.

The cost of preparing the Notice of Annual Meeting and Proxy Statement, and mailing the Notice of Internet Availability of Proxy Materials and Proxy, will be borne by us. In addition to soliciting proxies by mail, our officers, directors and other regular employees, without additional compensation, may solicit proxies personally or by other appropriate means. It is anticipated that banks, brokers, fiduciaries, other custodians and nominees will forward proxy soliciting materials to their principals, and that, upon request, we will reimburse such persons’ out-of-pocket expenses.

PROPOSAL 1

ELECTION OF DIRECTORS

Our Amended and Restated Bylaws authorize the number of directors to be not less than five and not more than nine. Our Board of Directors currently consists of eight members. Each of our directors is elected for a term of one year to serve until his or her successor is duly elected and qualified or until his or her earlier death, resignation or removal. The eight nominees for election to our Board of Directors at our upcoming Annual Meeting of the Stockholders are Elias Vamvakas, Anthony E. Altig, Thomas N. Davidson, Jr., Adrienne L. Graves, Paul M. Karpecki, Richard L. Lindstrom, Donald Rindell and Brock Wright, each of whom is presently a member of our Board of Directors.

A plurality of the votes of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors is required to elect directors. If no contrary indication is made, Proxies in the accompanying form are to be voted for our Board of Directors’ nominees or, in the event any of such nominees is not a candidate or is unable to serve as a director at the time of the election (which is not currently expected), for any nominee who shall be designated by our Board of Directors to fill such vacancy. Each person nominated for election has agreed to serve if elected and the Board of Directors has no reason to believe that any nominee will be unable to serve.

Information Regarding Directors

The information set forth below as to the nominees for director has been furnished to us by the nominees:

Nominees for Election to the Board of Directors

| Name | | Age | | Position |

| Elias Vamvakas | | 54 | | Chairman of the Board and Chief Executive Officer |

| Anthony E. Altig | | 57 | | Director |

| Thomas N. Davidson, Jr. | | 53 | | Director |

| Adrienne L. Graves | | 59 | | Director |

| Paul M. Karpecki | | 45 | | Director |

| Richard L. Lindstrom | | 65 | | Director |

| Donald Rindell | | 61 | | Director |

| Brock Wright | | 53 | | Director |

Elias Vamvakas co-founded TLC Vision, an eye care services company, where he was the Chairman from 1994 to June 2006 and was the Chief Executive Officer from 1994 to July 2004. He has been the Chairman of the Board of Directors of TearLab Corporation, or the Board, since June 2003 and was the Chief Executive Officer and Secretary of the Company from July 2004 until October 2008 and again since June 2009. Since November 30, 2006, Mr. Vamvakas has been a member of the board of directors of TearLab Research, Inc. formerly known as TearLab, Inc. and OcuSense, Inc. Mr. Vamvakas has been the chairman of the board of Greybrook Capital, a Toronto-based private equity firm. Mr. Vamvakas also serves on the boards of several of Greybrook’s portfolio companies and Jameson Bank. Mr. Vamvakas was named to “Canada’s Top Forty Under Forty” in 1996. In 1999, he was named Ernst & Young’s Entrepreneur of the Year for Ontario in the Emerging Category and Canadian Entrepreneur of the Year for Innovative Partnering. In 2000, Mr. Vamvakas was recognized by Profit Magazine for managing one of Canada’s fastest growing companies. Mr. Vamvakas received a B.Sc. degree from the University of Toronto in 1981. As our Chief Executive Officer, Mr. Vamvakas is specially qualified to serve on the Board because of his detailed knowledge of our operations and market.

Anthony E. Altig has been a member of the Board since January 2009. Mr. Altig is the Chief Financial Officer at Biotix Holdings, Inc., a company that manufactures microbiological and molecularbiological consumables. He has also served as a director of Optimer Pharmaceuticals since November 2007. From December 2004 to June 2007, Mr. Altig served as the Chief Financial Officer of Diversa Corporation (subsequently Verenium Corporation), a public company focused on enzyme technology. Prior to joining Diversa, Mr. Altig served as the Chief Financial Officer of Maxim Pharmaceuticals, Inc., a public biopharmaceutical company, from 2002 to 2004. From 2000 to 2001, Mr. Altig served as the Chief Financial Officer of NBC Internet, Inc., an internet portal company, which was acquired by General Electric. Mr. Altig’s additional experience includes his role as the Chief Accounting Officer at USWeb Corporation, as well as his experience serving biotechnology and other technology companies during his tenure at both PricewaterhouseCoopers and KPMG. In addition, Mr. Altig serves as a director for such public companies as: Optimer Pharmaceuticals, Inc. and Ventrus Biosciences. Mr. Altig is a former member of the board of directors of MultiCell Technologies, Inc. Mr. Altig received a B.A. degree from the University of Hawaii. Mr. Altig’s experience as Chief Financial Officer of several public companies brings to the Board perspective regarding financial and accounting issues.

Thomas N. Davidson, Jr. has been a member of the Board since January 2011. Since 1997, Mr. Davidson has been the Chief Executive Officer and majority shareholder of Nisim International, a manufacturer of hair and skin care products distributed on a worldwide basis. Mr. Davidson has been managing partner of Quarry Hill Partners, a holding company for a diversified group of manufacturing companies, since June 2000. Mr. Davidson has been the principal owner and operator of several other companies including Speedy Printing Centers, Quarry Hill Foundry Supplies, Optiplas Films and Eco II Plastics. Mr. Davidson is currently on the board of Brandimensions Inc., a private company. Mr. Davidson is also on the boards of the YPO Ontario Chapter and the Fishing Forever Foundation. From 1999 until 2010, Mr. Davidson served on the board of directors Synergex International Corporation, previously a Toronto Stock Exchange listed company, where he served as a member of the audit committee. In addition, Mr. Davidson previously served on the board of directors for Balmshell Inc., Clemmer Steelcraft Technologies Inc. and Nu-Tech Precision Metals, all privately held companies. Mr. Davidson has a BSc from Michigan State University in Geological Engineering. Mr. Davidson’s extensive business background makes him a valuable addition to the Board. Mr. Davidson is the son of Thomas N. Davidson, Sr., who retired from the Board in August 2010.

Adrienne L. Graves, Ph.D. has been a member of the Board since April 2005. From 2002 to 2010, Dr. Graves was President and Chief Executive Officer of Santen Inc., the U.S. subsidiary of Santen Pharmaceutical Co., Ltd, Japan’s largest ophthalmic pharmaceutical company. Dr. Graves joined Santen Inc. in 1995 as Vice President of Clinical Affairs to initiate the company’s clinical development in the U.S, and was responsible for three NDA approvals. She was promoted to Senior Vice President of Worldwide Clinical Affairs for Japan, U.S. and Europe, and was subsequently named a global Corporate Officer and CEO of U.S. operations. Prior to joining Santen Inc., Dr. Graves spent nine years with Alcon Laboratories, Inc., beginning in 1986 as a Senior Scientist. She progressed through various roles, including Director of International Ophthalmology. Dr. Graves currently serves as an independent director on the following corporate boards: Alcon Laboratories, Inc., Aerpio and Encore Vision. She is also a director on the following foundation boards: American Society of Cataract and Refractive Surgery Foundation, Glaucoma Research Foundation, American Academy of Ophthalmology Foundation, Himalayan Cataract Project, Pan-American Ophthalmology Foundation and KeepYourSight Foundation; she also serves on the corporation committee for Brown University Medical School and the advisory board for Amach Capital Partners. Dr. Graves co-founded Ophthalmic Women Leaders. She received her A.B. in psychology with honors from Brown University, her Ph.D. in psychobiology from the University of Michigan and completed a postdoctoral fellowship in visual neuroscience at the University of Paris. Dr. Graves brings to the Board a long history of experience in the field of ophthalmology and business strategy.

Paul M. Karpecki O.D., FAAO has been a member of the Board since March 2010 and has been the Director of Ocular Disease Research at Koffler Vision Group in Lexington, Kentucky since March of 2009, where he also works in corneal services. In 2007, Dr. Karpecki accepted a position with the Cincinnati Eye Institute in Corneal Services after five years as Director of Research for the Moyes Eye Clinic in Kansas City. Dr. Karpecki serves on or chairs numerous optometric association committees including Chair of the Refractive Surgery Advisory Committee to the AOA (American Ophthalmology Association) and on the AOA Meetings Executive Committee. He has lectured in more than 300 symposia covering four continents and was the first optometrist to be invited to both the Delphi International Society at Wilmer-John’s Hopkins, which includes the top 25 dry eye experts in the world, and the National Eye Institute’s dry eye committee. This was a task force established by the U.S. Department of Health and Human Services to better understand and treat dry eye disease in women. A noted educator and author, Dr. Karpecki lectures on new technology, surgical advancements and therapeutics with an emphasis on cornea and external disease. He presently serves on eight professional journal editorial boards. Dr. Karpecki received his doctorate of optometry from Indiana University and completed a Fellowship in Cornea and Refractive Surgery at Hunkeler Eye Centers in affiliation with the Pennsylvania College of Optometry in 1994. Dr. Karpecki’s experience in the field of optometry, and in particular his specialty regarding dry eye disease, make him a valuable addition to the Board.

Richard L. Lindstrom, M.D. has been a member of the Board since September 2004 and has served as a director of TLC Vision since May 2002 and, prior to that, was a director of LaserVision Centers, Inc. since November 1995. Since 1979, Dr. Lindstrom has been engaged in the private practice of ophthalmology and is Founder, a director and Attending Surgeon of Minnesota Eye Consultants P.A., a provider of eye care services. Dr. Lindstrom has served as Associate Director of the Minnesota Lions Eye Bank since 1987. He is also a medical advisor for several medical device and pharmaceutical manufacturers. Dr. Lindstrom has been a director on the board of Onpoint Medical Diagnostics, Inc. since 2010. Dr. Lindstrom is also currently on the boards of Acufocus, Inc., Wavetec Vision, RevitalVision, LLC and Lindstrom Environmental, Inc., each of which is a private company. Dr. Lindstrom is a past President of the International Society of Refractive Surgery, the International Intraocular Implant Society, the International Refractive Surgery Club and the American Society of Cataract and Refractive Surgery. From 1980 to 1989, he served as a Professor of Ophthalmology at the University of Minnesota and is currently Adjunct Professor Emeritus in the Department of Ophthalmology at the University of Minnesota. Dr. Lindstrom received his Doctor of Medicine, Bachelor of Arts and Bachelor of Sciences degrees from the University of Minnesota. Dr. Lindstrom’s background in ophthalmology gives him a perspective that is helpful to the Board for understanding the Company’s product market.

Donald Rindell has been a member of the Board since September 2008 and was on the board of TearLab Research, Inc. between March 2006 and December 2010. Mr. Rindell currently serves as Executive Director of Business Development for Amylin Pharmaceuticals, Inc., a position he has held since 2005. Prior to joining Amylin Pharmaceuticals, Inc., Mr. Rindell had a successful consulting practice, during which time he served as Acting President of Medical Device Group, Inc., an acute care and respiratory company, Vice President of Business Development of CardioNet, Inc., a “real-time” 24/7 cardiovascular monitoring company, and Vice President of Business Development of HandyLab, Inc., a molecular diagnostics and pharmacogenomics system company. His responsibilities included corporate marketing, mergers and acquisitions activities, product planning and new strategic initiatives. Prior to his consulting practice, he served as Vice President of Corporate Development & Strategic Planning of Advanced Tissues Sciences, Inc., or ATS, a La Jolla, California-based biotechnology company. Prior to his tenure at ATS, Mr. Rindell was the Vice President for Global Business Management of Braun/Thermoscan, a division of The Gillette Company. At Braun/Thermoscan, he played a major role in building its medical diagnostics business to achieve sales exceeding $170 million. Mr. Rindell was also employed by Hybritech, a division of Eli Lilly and Company as Executive Director of Sales and Marketing. Mr. Rindell received his B.S. degree in Economics from the College of Wooster and an M.B.A. from Pepperdine University Graduate School of Business. Mr. Rindell’s years of experience in the medical device field are very valuable to the Company as it works through regulatory requirements and marketing.

Brock Wright BSc, MD, FRCPC, MBA has been a member of the Board since August 2010 and has been the Senior Vice-President Clinical Services (since October 2008) and Chief Medical Officer (since January 2000) for the Winnipeg Regional Health Authority. Since November 2008, Dr. Wright has been the Associate Dean, Clinical Affairs for the Faculty of Medicine, University of Manitoba and, since 1990, Dr. Wright has been an Assistant Professor in the Department of Community Health Sciences. Dr. Wright is also a member of the board of directors of Diagnostic Services Manitoba, a publically funded organization responsible for laboratory services for the entire province of Manitoba. Dr. Wright served as the Chief Operating Officer for the Health Sciences Centre in Winnipeg from 2004 until 2008. He also served as the Vice-President and Chief Medical Officer of the Winnipeg Regional Health Authority from 2000 to 2008. Dr. Wright served as Vice-President and Chief Medical Officer of the Health Sciences Centre in Winnipeg from 1997 until 2000. He also served in the mid-nineties as Vice-President responsible for the Pathology and Laboratory Division of the Health Sciences Centre and led the development of a successful plan to integrate laboratory services across the Province to form Diagnostic Services Manitoba. Dr. Wright received his Bachelor of Science degree from the University of Winnipeg in 1980. He received his Medical Degree in 1984, Fellowship in Community Medicine in 1990 and MBA in 1992, from the University of Manitoba. Dr. Wright’s extensive medical and public sector experience make him a valuable addition to the Board.

Board Meetings

The Board held eight meetings during 2012. No director who served as a director during the past year attended fewer than 75% of the aggregate of the total number of meetings of the Board and the total number of meetings of committees of the Board on which he or she served.

Committees of the Board

The Board currently has, and appoints members to, three standing committees: our Compensation Committee, our Corporate Governance and Nominating Committee and our Audit Committee. Prior to December 2012, each non-employee director was a member of each the three standing committees. The current members of our committees are identified below:

| Director | | Compensation | | Corporate Governance and Nominating | | Audit |

| Anthony E. Altig (1) | · | | · | P | · | P |

| Thomas N. Davidson, Jr. | · | P | · | | · | P |

| Adrienne L. Graves | | P | | P | | |

| Paul M. Karpecki | · | | · | P | · | |

| Richard L. Lindstrom (2) | · | P | · | | · | |

| Donald Rindell (3) | · | | · | P | · | P |

| Brock Wright | · | P | · | | · | |

| (1) | Audit Committee Chair. |

| (2) | Compensation Committee Chair. |

| (3) | Corporate Governance and Nominating Committee Chair. |

Compensation Committee. The Compensation Committee currently consists of Dr. Wright, Mr. Davidson, Dr. Graves and Dr. Lindstrom, with Dr. Lindstrom serving as chairman. From February 22, 2012 until January 22, 2013, the committee consisted of Dr. Wright, Dr. Lindstrom and Mr. Davidson. On January 22, 2013, Dr. Graves became a member of the committee. The Compensation Committee held two meetings during 2012. All members of the Compensation Committee are independent as determined under the various NASDAQ Stock Market, U.S. Securities and Exchange Commission, or SEC, and Internal Revenue Service qualification requirements. The Compensation Committee is governed by a written charter approved by the Board. The charter is available on our website at www.tearlab.com. The functions of this committee include, among other things:

● to provide oversight of the development and implementation of the compensation policies, strategies, plans and programs for the Company’s key employees and directors, including policies, strategies, plans and programs relating to long-term compensation for the Company’s senior management, and the disclosure relating to these matters;

● to make recommendations regarding the operation of and/or implementation of employee bonus plans and incentive compensation plans;

● to review and approve the compensation of the Chief Executive Officer and the other executive officers of the Company and the remuneration of the Company’s directors; and

● to provide oversight of the selection of officers, management, succession planning, the performance of individual executives and related matters.

Role and Authority of Compensation Committee

The Compensation Committee is responsible for discharging the responsibilities of the Board with respect to the compensation of our executive officers. The Compensation Committee approves all compensation of our executive officers without further Board action. The Compensation Committee reviews and approves each of the elements of our executive compensation program and continually assesses the effectiveness and competitiveness of our program. The Compensation Committee also periodically reviews director compensation.

The Role of our Executives in Setting Compensation

The Compensation Committee meets with our Chief Executive Officer, Mr. Vamvakas, and/or other executives at least once per year to obtain recommendations with respect to Company compensation programs, practices, and packages for executives, directors and other employees. Management makes recommendations to the Compensation Committee on the base salary, bonus targets, and equity compensation for the executive team and other employees. The Compensation Committee considers, but is not bound by and does not always accept, management’s recommendations with respect to executive compensation. The Compensation Committee has the ultimate authority to make decisions with respect to the compensation of our named executive officers, but may, if it chooses, delegate any of its responsibilities to subcommittees.

Mr. Vamvakas attends some of the Compensation Committee’s meetings, but the Compensation Committee also regularly holds executive sessions not attended by any members of management or non-independent directors. The Compensation Committee discusses Mr. Vamvakas’s compensation package with him, but makes decisions with respect to his compensation outside of his presence.

Audit Committee. The Audit Committee consists of Mr. Davidson, Mr. Rindell and Mr. Altig, with Mr. Altig serving as chairman. The Audit Committee held five meetings during 2012. All members of the Audit Committee are independent directors (as independence is currently defined in Rules 5605(a)(2) and 5605(c)(2) of the NASDAQ Listing Rules). Mr. Altig qualifies as an “audit committee financial expert” as that term is defined in the rules and regulations established by the SEC. The Audit Committee is governed by a written charter approved by the Board. The charter is available on our website at www.tearlab.com. The functions of this committee include, among other things:

● to monitor the Company’s financial reporting process and internal control system;

● to appoint and replace the Company’s independent outside auditors from time to time, to determine their compensation and other terms of engagement and to oversee their work;

● to oversee the performance of the Company’s internal audit function; and

● to oversee the Company’s compliance with legal, ethical and regulatory matters.

Both our independent auditors and internal financial personnel regularly meet privately with our Audit Committee and have unrestricted access to this committee. The Audit Committee has the power to investigate any matter brought to its attention within the scope of its duties. It also has the authority to retain counsel and advisors to fulfill its responsibilities and duties.

Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee, or the Corporate Governance Committee, members are Mr. Altig, Dr. Karpecki, Dr. Graves and Mr. Rindell, with Mr. Rindell serving as chairman. From February 22, 2012 until March 6, 2013, the committee consisted of Mr. Rindell, Dr. Karpecki and Mr. Altig. On March 6, 2013, Dr. Graves became a member of the committee. The Corporate Governance Committee did not meet in person during 2012. All members of the Corporate Governance Committee are independent directors, as defined in the NASDAQ Stock Market qualification standards. The Corporate Governance Committee is governed by a written charter approved by the Board. The charter is available on our website at www.tearlab.com. The functions of this committee include, among other things:

● to establish criteria for Board and committee membership and to recommend to the Board proposed nominees for election to the Board and for membership on committees of the Board;

● to ensure that appropriate processes are established by the Board to fulfill its responsibility for (i) the oversight of strategic direction and development and the review of ongoing results of operations of the Company by the appropriate committee of the Board and (ii) the oversight of the Company’s investor relations and public relations activities and ensuring that procedures are in place for the effective monitoring of the stockholder base, receipt of stockholder feedback and responses to stockholder concerns;

● to monitor the quality of the relationship between management and the Board and to recommend improvements for ensuring an effective and appropriate relationship; and

● to make recommendations to the Board regarding corporate governance matters and practices.

Director Nomination Process

Director Qualifications

In evaluating director nominees, the Corporate Governance Committee considers, among others, the following factors:

● experience, skills and other qualifications in view of the specific needs of the Board and the Company;

● diversity of background; and

● demonstration of high ethical standards, integrity and sound business judgment.

The Corporate Governance Committee’s goal is to assemble a Board that brings to the Company a variety of perspectives and skills derived from high quality business and professional experience which are well suited to further the Company’s objectives. In doing so, the Corporate Governance Committee also considers candidates with appropriate non-business backgrounds.

Other than the foregoing, there are no stated minimum criteria for director nominees, although the Corporate Governance Committee may also consider such other facts as it may deem are in the best interests of the Company and its stockholders. The Corporate Governance Committee does, however, believe it appropriate for at least one, and, preferably, several, members of the Board to meet the criteria for an “audit committee financial expert” as defined by SEC rules, and that a majority of the members of the Board meet the definition of an “independent director” under the NASDAQ Stock Market qualification standards. At this time, the Corporate Governance Committee also believes it appropriate for our Chief Executive Officer to serve as the Chairman of the Board.

Identification and Evaluation of Nominees for Directors

The Corporate Governance Committee identifies nominees for Board membership by first evaluating the current members of the Board willing to continue in service. Current members with qualifications and skills that are consistent with the Corporate Governance Committee’s criteria for Board service and who are willing to continue in service are considered for re-nomination, balancing the value of continuity of service by existing members of the Board with that of obtaining a new perspective. If any member of the Board does not wish to continue in service or if the Board decides not to re-nominate a member for re-election, the Corporate Governance Committee identifies the desired skills and experience of a new nominee in light of the criteria above. The Corporate Governance Committee generally polls the Board and members of management for their recommendations. The Corporate Governance Committee may also review the composition and qualification of the boards of directors of our competitors, and may seek input from industry experts or analysts. The Corporate Governance Committee reviews the qualifications, experience and background of the candidates. Final candidates are interviewed by our independent directors and Chief Executive Officer. In making its determinations, the Corporate Governance Committee evaluates each individual in the context of the Board as a whole, with the objective of assembling a group that can best attain success for the Company and represent stockholder interests through the exercise of sound judgment. After review and deliberation of all feedback and data, the Corporate Governance Committee makes its recommendation to the Board. Historically, the Corporate Governance Committee has not relied on third-party search firms to identify Board candidates. The Corporate Governance Committee may in the future choose to do so in those situations where particular qualifications are required or where existing contacts are not sufficient to identify and acquire an appropriate candidate.

The Corporate Governance Committee has not received director candidate recommendations from our stockholders and does not have a formal policy regarding consideration of such recommendations since it believes that the process currently in place for the identification and evaluation of prospective members of the Board is adequate. Any recommendations received from stockholders will be evaluated in the same manner as potential nominees suggested by members of the Board or management. Stockholders wishing to suggest a candidate for director should write to the Company’s Chief Financial Officer.

Communications with the Board of Directors

Our stockholders may send written correspondence to non-management members of the Board to the Chief Financial Officer or Chief Executive Officer at 7360 Carroll Road, Suite 200, San Diego, California 92121. Our Chief Financial Officer or Chief Executive Officer will review the communication, and if the communication is determined to be relevant to our operations, policies, or procedures (and not vulgar, threatening, or of an inappropriate nature not relating to our business), the communication will be forwarded to the Chairman of the Board. If the communication requires a response, our Chief Financial Officer will assist the Chairman of the Board (or other directors) in preparing the response.

Code of Business Conduct and Ethics

We have established a Code of Business Conduct and Ethics that applies to our officers, directors and employees. The Code of Business Conduct and Ethics contains general guidelines for conducting our business consistent with the highest standards of business ethics, and is intended to qualify as a “code of ethics” within the meaning of Section 406 of the Sarbanes-Oxley Act of 2002 and Item 406 of Regulation S-K. The Code of Business Conduct and Ethics is available on our website at www.tearlab.com. If we make any substantive amendments to the Code of Business Conduct and Ethics or grant any waiver from a provision of the Code to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website.

Corporate Governance Documents

Our corporate governance documents, including the Audit Committee Charter, Compensation Committee Charter, Corporate Governance Committee Charter and Code of Business Conduct and Ethics are available free of charge on our website at www.tearlab.com. Please note, however, that the information contained on the website is not incorporated by reference in, or considered part of, this Annual Report. We will also provide copies of these documents free of charge to any stockholder upon written request to Investor Relations, TearLab Corporation, 7360 Carroll Road, Suite 200, San Diego, CA 92121.

Report of the Audit Committee

The following is the report of the Audit Committee with respect to the Company’s audited consolidated financial statements for the year ended December 31, 2012.

The purpose of the Audit Committee is to assist the Board in its general oversight of the Company’s financial reporting, internal controls and audit functions. The Audit Committee Charter describes in greater detail the full responsibilities of the Audit Committee. All of the members of the Audit Committee are independent directors under the NASDAQ and SEC audit committee structure and membership requirements.

The Audit Committee has reviewed and discussed the consolidated financial statements with management and Ernst & Young, LLP, the Company’s independent auditors. Management is responsible for the preparation, presentation and integrity of our consolidated financial statements, accounting and financial reporting principles; establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)); establishing and maintaining internal control over financial reporting (as defined in Exchange Act Rule 13A-15(f)); evaluating the effectiveness of disclosure controls and procedures; evaluating the effectiveness of internal control over financial reporting; and evaluating any change in internal control over financial reporting that has materially affected, or is reasonably likely to materially affect, internal control over financial reporting. Ernst & Young LLP is responsible for performing an independent audit of the consolidated financial statements and expressing an opinion on the conformity of those financial statements with generally accepted accounting principles in the United States of America.

Beginning in fiscal 2004 and continuing through fiscal 2012 (the ninth year of certification), management has implemented a process of documenting, testing and evaluating the Company’s internal control over financial reporting in accordance with the requirements of the Sarbanes-Oxley Act of 2002. The Audit Committee is kept apprised of the progress of the evaluation and provides oversight and advice to management regarding such compliance. In connection with this oversight, the Audit Committee receives periodic updates provided by management at each regularly scheduled Audit Committee meeting. At a minimum, these updates occur quarterly. At the conclusion of the process, management provides the Audit Committee with a report on the effectiveness of the Company’s internal control over financial reporting which is reviewed and commented upon by the Audit Committee. The Audit Committee also holds regular private sessions with Ernst & Young LLP to discuss their audit plan for the year, and the results of their quarterly reviews and the annual audit. The Audit Committee also reviewed Ernst & Young LLP’s Report of Independent Registered Public Accounting Firm included in the Company’s Annual Report on Form 10-K related to our consolidated financial statements and financial statement schedule. The Audit Committee continues to oversee the Company’s efforts and reviews management’s report on the effectiveness of its internal control over financial reporting and management’s preparations for the evaluation.

The Committee met on four occasions in 2012. The Committee met privately in executive session with Ernst & Young LLP as part of each regular meeting. The Committee Chair also held private meetings with the Chief Financial Officer.

The Audit Committee has discussed with Ernst & Young LLP the matters required to be discussed by PCAOB Auditing Standard No. 16, “Communications with Audit Committees.” In addition, Ernst & Young LLP has provided the Audit Committee with the written disclosures and the letter required by PCAOB Rule 3526, “Communication with Audit Committees Concerning Independence.” In connection with the foregoing, the Audit Committee has discussed with Ernst & Young LLP their firm’s independence.

Based on their review of the consolidated financial statements and discussions with, and representations from, management and Ernst & Young LLP referred to above, the Audit Committee recommended to the Board that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012, for filing with the U.S. Securities and Exchange Commission.

In accordance with Audit Committee policy and the requirements of law, the Audit Committee pre-approves all services to be provided by our independent auditors, Ernst & Young LLP. Pre-approval is required for audit services, audit-related services, tax services and other services. In some cases, the full Audit Committee provides pre-approval of services for up to a year, which may be related to a particular defined task or scope of work and subject to a specific budget. In other cases, a designated member of the Audit Committee may have delegated authority from the Audit Committee to pre-approve additional services, and such pre-approval is later reported to the full Audit Committee. See “Fees for Professional Services” for more information regarding fees paid to Ernst & Young LLP for services in fiscal years 2011 and 2012.

| April 26, 2013 | AUDIT COMMITTEE |

| | |

| | Anthony Altig |

| | Thomas N. Davidson |

| | Donald Rindell |

Principal Accounting Fees and Services.

In connection with the audit of the 2012 consolidated financial statements, the Company entered into an engagement agreement with Ernst & Young LLP, which sets forth the terms by which Ernst & Young LLP has performed audit services for the Company.

The following table sets forth the aggregate fees agreed to by the Company for the annual and statutory audits for the fiscal years ended December 31, 2012 and 2011, and all other fees paid by the Company to Ernst & Young LLP during 2012 and 2011:

| | | For the years ended December 31, | |

| | | 2012 | | | 2011 | |

| | | (in thousands) | |

| Audit Fees | | $ | 327.0 | | | $ | 262.5 | |

| Audit-Related Fees | | | 126.0 | | | | 42.5 | |

| Tax Fees | | | 15.0 | | | | 0.0 | |

| All Other Fees | | | 0.0 | | | | 0.0 | |

| Totals | | $ | 468.0 | | | $ | 305.0 | |

Audit Fees. Audit fees for the fiscal years ended December 31, 2012 and 2011 were for professional services provided in connection with the audit of the Company’s annual consolidated financial statements, review of the Company’s quarterly consolidated financial statements, accounting matters directly related to the annual audits, and audit services provided in connection with other statutory or regulatory filings.

Audit-Related Fees. Audit-related fees for 2012 and 2011 were for professional services in connection with SEC registration statements, periodic reports (including Form 8-Ks) and other documents filed with the SEC or other documents issued in connection with securities offerings. Audit-related fees were also incurred for consultations by the Company’s management as to the accounting or disclosure treatment of transactions or events and/or the actual or potential impact of final or proposed rules, standards or interpretations by the SEC, FASB, or other regulatory standard setting bodies.

Tax Fees. Tax fees for 2012 related to IRC Section 382 tax studies.There were no tax fees incurred in 2011.

All Other Fees. Ernst & Young LLP did not provide any services in the last two fiscal years, other than those described above.

All audit fees relating to the audit for the fiscal years ended December 31, 2012 and 2011, were approved in advance by the Audit Committee. All audit and non-audit services to be provided by Ernst & Young LLP were, and will continue to be, pre-approved by the Audit Committee.

Director Attendance at Annual Meetings

Although the Company does not have a formal policy regarding attendance by members of the Board at our Annual Meeting, we encourage all of our directors to attend. All of the Company’s directors attended our 2012 Annual Meeting, our most recent Annual Meeting, in person.

Director Independence

The Board of Directors has determined that each of the director nominees standing for election, except Elias Vamvakas, are independent directors under the NASDAQ Stock Market qualification standards. In determining the independence of our directors, the Board considered all transactions in which the Company and any director had any interest, including those discussed under “Certain Relationships and Related Transactions” below.

Board Leadership Structure

The Board does not have a policy on whether or not the roles of Chief Executive Officer and Chairman of the Board should be separate and, if they are to be separate, whether the Chairman of the Board should be selected from the non-employee directors or be an employee. The offices of Chief Executive Officer and Chairman of the Board have been at times combined and at times separated, and the Board considers such combination or separation in conjunction with, among other things, its succession planning processes. The Board believes that it should be free to make a choice regarding the leadership structure from time to time in any manner that is in our and our stockholders’ best interests.

We currently have combined the roles of Chairman of the Board and Chief Executive Officer. The Board does not have a lead independent director. We believe this is appropriate because the Board includes a number of seasoned independent directors. In concluding that having Mr. Vamvakas serve as Chief Executive Officer and Chairman of the Board represents the appropriate structure for us at this time, the Board considered the benefits of having the Chief Executive Officer serve as a bridge between management and the Board, ensuring that both groups act with a common purpose. The Board also considered Mr. Vamvakas’ knowledge regarding our operations and the industry in which we compete and his ability to promote communication, to synchronize activities between the Board and our senior management and to provide consistent leadership to both the Board and the Company in coordinating our strategic objectives. The Board further concluded that the combined role of Chairman of the Board and Chief Executive Officer ensures there is clear accountability.

Board Role in Risk Oversight

While each of the committees of the Board evaluate risk in their respective areas of responsibility, our Corporate Governance Committee is primarily responsible for overseeing the Company’s risk management processes on behalf of the full Board. We believe that employing a committee specifically focused on our Company’s risk profile is beneficial, given the increased importance of monitoring risks in the current economic and business climate. The Corporate Governance Committee discusses the Company’s risk profile, and the Corporate Governance Committee reports to the full Board on the most significant risk issues. The Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements.

While the Board and the Corporate Governance Committee oversee the Company’s risk management, Company management is ultimately responsible for day-to-day risk management activities. We believe this division of responsibilities is the most effective approach for addressing the risks facing our Company and that the Board leadership structure supports this approach.

Board of Directors’ Recommendation

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE ELECTION AS DIRECTOR OF EACH NOMINEE LISTED ABOVE.

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Our Executive Officers

The following table sets forth the name and position of each of the persons who were serving as our named executive officers as of April 10, 2013.

| Name | | Age | | Position |

| Elias Vamvakas | | 54 | | Chairman of the Board and Chief Executive Officer |

| Michael Berg | | 60 | | Vice President, Regulatory |

| Robert Walder | | 60 | | Vice President, Operations |

Michael Berg, has over 25 years experience introducing new technology into the professional healthcare marketplace, through his own companies and as consultant to the industry. He is experienced in product development and acquisition, finance, manufacturing, marketing and strategic planning, domestic and international distribution, reimbursement and regulatory affairs. Michael, having studied and lived in Japan is an expert in Japanese regulatory and distribution strategies. As 50% joint-venture owner and President of HemoCue, Inc, Michael launched a blood hemoglobin point-of-care analyzer in the U.S. through a unique distribution model he created, the Independent Direct Distribution Organization. This model incorporated an educational approach to convert the healthcare profession from the prevailing spun microhematocrit technology, to a more expensive but accurate and safer hemoglobin test for the diagnosis of classic anemia. This distribution system provided all the advantages of a direct sales force at a fraction of the cost. Under this model, 13,000 HemoCue analyzers were sold into the market in the first 4 years of operation, with continued placement to date of 30,000+ instruments resulting in a business exceeding $50 million in annual revenue. Michael divested all interest in HemoCue, Inc. upon Mallinckrodt's acquisition of the parent company, HemoCue AB, in January 1991 for $100 million. As a consultant to the industry, Michael has repeatedly formulated and implemented successful strategies to obtain CLIA Waiver categorization for point-of-care technology, solicited and obtained CPT coding through the American Medical Association process, and facilitated strong reimbursement for his clients through the Medicare (CMS) system. Focused on market development and physician education, Michael is experienced in the design and coordination of clinical studies, positioning products to meet clinical guidelines, evidence-based medicine and pay-for-performance criteria, and co-promotion with the pharmaceutical industry to link diagnosis and therapy. Michael received his BA from the University of Notre Dame and currently resides in Orange County California.

Robert Walder, PA-C, has over 30 years of healthcare and management experience, both as a caregiver and senior manager. Mr. Walder joined TearLab Corporation as Vice President of Operations in 2008. He is also a principal in The Samaritan Group, a consulting group specializing in medical services. Previously, he was the Vice President of Clinical Operations with Digirad Corp., a leading developer of solid state gamma cameras and the largest provider of in-office cardiology imaging services from 2000 to 2008. In addition, Mr. Walder currently serves on the board of directors for the Country Club of Rancho Bernardo, a privately held company. Prior to Digirad, Mr. Walder was the Business Unit Manager for Abbott Laboratories. Abbott Labs is a global organization that develops, manufactures and distributes healthcare products and pharmaceuticals. Mr. Walder graduated from California State College with Bachelors of Science degree in Electrical Engineering, the University of Southern California with a Baccalaureate degree in Medicine and the University of Phoenix with degrees in Business Administration and Management.

A biography for Elias Vamvakas can be found in the section entitled Information Regarding Directors above.

Executive Compensation

The following table provides information regarding the compensation earned during the fiscal years ended December 31, 2012 and 2011 by our Chief Executive Officer and our other two most highly compensated executive officers who were employed by us as of December 31, 2012. We refer to our Chief Executive Officer and these other executive officers as our “named executive officers” elsewhere in this document.

| Name and Principal Position | | Year | | Salary ($) | | | Bonus ($) | | | Option Awards ($) | | | All Other Compensation ($) | | | Total ($) | |

| Elias Vamvakas | | 2012 | | | 323,368 | | | | 357,804 | | | | — | | | | 36,691 | | | | 717,863 | |

| Chairman and Chief Executive Officer | | 2011 | | | 234,558 | | | | 17,592 | | | | — | | | | 27,076 | | | | 279,226 | |

| Michael Berg, | | 2012 | | | 180,000 | | | | 174,675 | | | | — | | | | 22,239 | | | | 379,914 | |

| Vice President, Regulatory | | 2011 | | | 180,000 | | | | — | | | | — | | | | 28,188 | | | | 208,188 | |

| Robert Walder | | 2012 | | | 180,000 | | | | 173,663 | | | | — | | | | 16,686 | | | | 370,349 | |

| Vice President, Operations | | 2011 | | | 180,000 | | | | 13,950 | | | | — | | | | 22,523 | | | | 216,473 | |

Outstanding Equity Awards at Fiscal Year-End

The following table presents the outstanding equity awards held by each of the named executive officers as of the fiscal year ended December 31, 2012, including the value of the stock awards.

| | | Option Awards |

| Name | | Number of Securities Underlying Unexercised Options | | | Number of Securities Underlying Unexercised Options | | | Option Exercise Price | | Option Expiration Date |

| | | (#) Exercisable | | | (#) Unexercisable | | | ($) | | |

| Elias Vamvakas (1) | | | 20,000 | | | | — | | | | 24.75 | | 7/1/2013 |

| Elias Vamvakas (2) | | | — | | | | 4,500 | | | | 51.25 | | 3/30/2015 |

| Elias Vamvakas (3) | | | 12,000 | | | | — | | | | 47.50 | | 8/3/2016 |

| Elias Vamvakas (4) | | | 4,000 | | | | — | | | | 27.75 | | 7/3/2017 |

| Elias Vamvakas (5) | | | 626,164 | | | | — | | | | 2.63 | | 10/6/2018 |

| Elias Vamvakas (6) | | | 15,000 | | | | — | | | | 2.00 | | 6/18/2019 |

| Elias Vamvakas (7) | | | 14,899 | | | | — | | | | 1.22 | | 9/30/2019 |

| Elias Vamvakas (8) | | | 135,000 | | | | — | | | | 1.22 | | 9/30/2019 |

| Elias Vamvakas (9) | | | 100,000 | | | | — | | | | 1.22 | | 9/30/2019 |

| Elias Vamvakas (10) | | | 200,000 | | | | — | | | | 1.22 | | 9/30/2019 |

| Elias Vamvakas (11) | | | — | | | | 125,000 | | | | 6.43 | | 3/6/2023 |

| Michael Berg (12) | | | 56,129 | | | | — | | | | 2.25 | | 10/1/2016 |

| Michael Berg (13) | | | 25,000 | | | | — | | | | 1.99 | | 3/3/2019 |

| Michael Berg (14) | | | 18,871 | | | | — | | | | 1.22 | | 9/30/2019 |

| Michael Berg (15) | | | — | | | | 30,000 | | | | 6.43 | | 3/6/2023 |

| Robert Walder (16) | | | 13,782 | | | | --- | | | | 3.12 | | 12/8/2018 |

| Robert Walder (17) | | | 30,000 | | | | --- | | | | 1.99 | | 3/3/2019 |

| Robert Walder (18) | | | 56,218 | | | | --- | | | | 1.22 | | 9/30/2019 |

| Robert Walder (19) | | | — | | | | 30,000 | | | | 6.43 | | 3/6/2023 |

| (1) | 20,000 post-split options were granted on July 1, 2003, under the Plan. These time-based options have fully vested. |

| (2) | 4,500 post-split options were granted on March 30, 2005, under the Plan. These performance-based options were to vest as follows: (a) as to 100% when and if the Company receives the approval that it is seeking from the U.S. Food and Drug Administration for the RHEO System for use in the Rheopheresis treatment of non-exudative age-related macular degeneration (the “FDA Approval”), if the FDA Approval is received on or before November 30, 2006; (b) as to 80% when and if the Company receives the FDA Approval, if the FDA Approval is received after November 30, 2006 but on or before January 31, 2007; (c) as to 60% when and if the Company receives the FDA Approval, if the FDA Approval is received after January 31, 2007. |

| (3) | 12,000 post-split options were granted on August 3, 2006, under the Plan. These options vested fully upon the date of grant. |

| (4) | 4,000 post-split options were granted on July 3, 2007, under the Plan. These time-based options have fully vested. |

| (5) | 626,164 post-split options were granted on October 6, 2008, under the Plan. These options vested fully upon the date of grant. |

| (6) | 15,000 options were granted on June 18, 2009, under the Plan. These time-based options have fully vested. |

| (7) | 14,899 options were granted on September 30, 2009, under the Plan. These options vested fully upon the date of grant. |

| (8) | 135,000 options were granted on September 30, 2009, under the Plan. These time-based options vest annually in 1/3 installments, starting on the one year anniversary of the date of grant. |

| (9) | 100,000 options were granted on September 30, 2009, under the Plan. These time-based options vest monthly in 1/6 installments, starting on June 30, 2009. Vesting commencement was subject to stockholder approval of an increase in authorized shares reserved for issuance under the Plan. |

| (10) | 200,000 options were granted on September 30, 2009, under the Plan. These time-based options vest monthly in 1/12 installments, starting on January 1, 2011. Vesting commencement was subject to stockholder approval of an increase in authorized shares reserved for issuance under the Plan. |

| (11) | 125,000 options were granted on March 6, 2013, under the Plan. These time-based options vest annually in 1/3 installments, starting on the one year anniversary of the date of grant. Vesting commencement was subject to stockholder approval of an increase in authorized shares reserved for issuance under the Plan. These option grants are subject to our stockholders approving Proposal 2. |

| (12) | 56,129 post-split options were granted on October 1, 2006, under the Plan. These time-based options are fully vested. |

| (13) | 25,000 options were granted on March 3, 2009, under the Plan. These time-based options vest annually in 1/3 installments, starting on the one year anniversary of the date of grant. |

| (14) | 18,871 options were granted on September 30, 2009, under the Plan. These time-based options vest annually in 1/3 installments, starting on the one year anniversary of the date of grant. |

| (15) | 30,000 options were granted on March 6, 2013, under the Plan. These time-based options vest annually in 1/3 installments, starting on the one year anniversary of the date of grant. Vesting commencement was subject to stockholder approval of an increase in authorized shares reserved for issuance under the Plan. These option grants are subject to our stockholders approving Proposal 2. |

| (16) | 13,782 options were granted on December 8, 2008, under the Plan. These time-based options are fully vested. |

| (17) | 30,000 options were granted on March 3, 2009, under the Plan. These time-based options vest annually in 1/3 installments, starting on the one year anniversary of the date of grant. |

| (18) | 56,218 options were granted on September 30, 2009, under the Plan. These time-based options vest annually in 1/3 installments, starting on the one year anniversary of the date of grant. |

| (19) | 30,000 options were granted on March 6, 2013, under the Plan. These time-based options vest annually in 1/3 installments, starting on the one year anniversary of the date of grant. Vesting commencement was subject to stockholder approval of an increase in authorized shares reserved for issuance under the Plan. These option grants are subject to our stockholders approving Proposal 2. |

Employment Arrangements and Change of Control Arrangements

On December 12, 2008, the Board approved cash bonuses to certain of the Company’s officers, referred to as the 2008 Bonus Plan (“2008 Plan”). Under the terms of the 2008 Plan, a bonus of $50,000 may be payable to each of Michael Berg, Vice President, Clinical and Regulatory Operations, and Robert Walder, Vice President, Operations. Elias Vamvakas, Chief Executive Officer and Chairman of the Board is eligible for a $100,000 bonus under the 2008 Plan. In each case, such bonuses became payable in cash upon the satisfaction of both of the following conditions: (i) the closing of a financing approved by the Board satisfied on July 15, 2009; and (ii) upon receipt of a CLIA waiver related to the Company’s TearLab product which occurred on January 23, 2012. On December 7, 2011, the Board conditionally approved the payment of the CLIA Bonus in the form of equity at a conversion rate of $1.25 per share in lieu of cash payments, subject to consultation with counsel regarding any potential IRS Code 409A compliance issues, any necessary revisions to the CLIA Bonus and any required approvals. As such, individuals with bonus entitlements of $50,000 would receive 40,000 shares and Elias Vamvakas who had a bonus entitlement of $100,000 would receive 80,000 shares subject to the conditions set and the approval of the shareholders of the Company at the Annual Meeting of Stockholders held on June 6, 2012, to increase the option pool by 1,000,000 shares. The shareholders approved the afore-mentioned increase to the option pool, and on September 16, 2012, 40,000 shares were issued to each applicable person mentioned above, subject to applicable tax withholding on the value of $148,800 which was the market value of the shares on September 16, 2012. The shares issued to Elias Vamvakas had a value of $297,600 on September 16, 2012.

On April 17, 2012, the Compensation Committee approved an increase in the annual salary for Elias Vamvakas, the Company’s Chief Executive Officer, from Cdn.$240,000 to Cdn.$360,000, as well as a cash bonus of Cdn.$60,000 to be paid to Mr. Vamvakas. The Committee also recommended to the Board, and on March 6, 2013 the Board approved, the payment of cash bonuses to certain of the Company’s executive officers, referred to as the Bonus.

Under the terms of the Bonus, the Company will pay bonuses to certain of the Company’s executive officers, including our named executive officers, totaling approximately $198,451. The amounts payable under the Bonus to Elias Vamvakas, Michael Berg and Robert Walder are $135,000, $30,938 and $32,513, respectively.

We have no change of control arrangement with any named executive officer.

Compensation of Directors

Directors who are non employees are entitled to receive annual grants of an option to purchase 15,000 shares of the Company’s common stock and annual compensation of $36,000, to be paid quarterly. The following table sets forth summary information concerning compensation paid or accrued for services rendered to us in all capacities to the non-employee members of the Board for the fiscal year ended December 31, 2012.

| Name | | Fees Earned or Paid in Cash ($) | | | Stock Awards ($) | | | Option Awards ($) (1) | | | Non-Equity Incentive Plan Compensation ($) | | | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | | | All Other Compensation ($) | | | Total ($) | |

| Anthony E. Altig | | | 18,000 | | | | — | | | | 50,396 | | | | — | | | | — | | | | — | | | | 68,396 | |

| Thomas N. Davidson, Jr. | | | 18,000 | | | | — | | | | 47,396 | | | | — | | | | — | | | | — | | | | 65,396 | |

| Adrienne L. Graves | | | 18,000 | | | | — | | | | 48,549 | | | | — | | | | — | | | | — | | | | 66,549 | |

| Paul M. Karpecki | | | 18,000 | | | | — | | | | 47,896 | | | | — | | | | — | | | | — | | | | 65,896 | |

| Richard Lindstrom | | | 18,000 | | | | — | | | | 46,783 | | | | — | | | | — | | | | — | | | | 64,783 | |

| Donald Rindell | | | 18,000 | | | | — | | | | 51,896 | | | | — | | | | — | | | | — | | | | 69,896 | |

| Brock Wright | | | 18,000 | | | | — | | | | 48,396 | | | | — | | | | — | | | | — | | | | 66,396 | |

| (1) | The values set forth in this column are based on the full grant date fair value of stock option awards, computed in accordance with the provisions of FASB ASC Topic 718, using the Black-Scholes pricing model, utilizing certain assumptions as outlined in the footnotes to the consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2012. These stock options include time-based stock options earned during the year ended December 31, 2012. |

Compensation Committee Interlocks and Insider Participation

The members of our compensation committee are Dr. Wright, Mr. Davidson, Dr. Graves and Dr. Lindstrom. No member of the Compensation Committee has ever been an officer or employee of the Company. None of the Company’s executive officers currently serves, or has served during the last completed fiscal year, on the compensation committee or the board of directors of any other entity that has one or more executive officers serving as a member of the Board or the Compensation Committee of the Company.

Directors’ and Officers’ Liability Insurance

The Company maintains directors’ and officers’ liability insurance. Under this insurance coverage, the insurer pays, on the Company’s behalf, for losses for which the Company indemnifies its directors and officers and, on behalf of individual directors and officers, losses arising during the performance of their duties for which the Company does not indemnify them. The total limit for the policy is $10,000,000 per policy term, subject to a deductible of $500,000 per claim with respect to corporate indemnity provisions and $500,000 if the claim relates to securities law claims. In addition, the Company has implemented a Side A DIC policy which is additional protection for the directors and officers in the event the company is legally not permitted or financially unable to indemnify. The level of insurance is $5,000,000 in excess of the basic $10,000,000 insurance. The total premiums in respect of the directors’ and officers’ liability insurance paid in the financial year ended December 31, 2012 were approximately $129,000. The directors’ and officers’ liability insurance policy is effective from December 7, 2012 to December 7, 2013. The insurance policy does not distinguish between directors and officers as separate groups.

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

The following table sets forth information as of March 15, 2013 regarding the beneficial ownership of our common stock by (i) each person we know to be the beneficial owner of 5% or more of our common stock, (ii) each of our current executive officers, (iii) each of our directors and (iv) all of our current executive officers and directors as a group. Information with respect to beneficial ownership has been furnished by each director, executive officer or 5% or more stockholder, as the case may be.

Percentage of beneficial ownership is calculated based on 28,765,140 shares of common stock outstanding as of March 15, 2012. Beneficial ownership is determined in accordance with the rules of the SEC which generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities and includes shares of our common stock issuable pursuant to the exercise of stock options, warrants or other securities that are immediately exercisable or convertible or exercisable or convertible within 60 days of March 15, 2013. Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them. Unless otherwise noted, the address for each person set forth on the table below is c/o TearLab Corporation, 7360 Carroll Road, Suite 200, San Diego, California 92121.

| Name of Beneficial Owner | | Shares Beneficially Owned | | | Percentage of Shares Beneficially Owned | |

| 5% Stockholder | | | | | | |

| Eric Donsky (1) | | | 1,547,000 | | | | 5.38 | % |

| Executive Officers and Directors: | | | | | | | | |

| Elias Vamvakas (2) | | | 2,730,585 | | | | 9.10 | % |

| William Dumencu (3) | | | 133,200 | | | | * | |

| Stephen Zmina (4) | | | 100,000 | | | | * | |

| Paul Karpecki (5) | | | 99,269 | | | | * | |

| Richard Lindstrom (6) | | | 295,891 | | | | 1.02 | % |

| Adrienne Graves (7) | | | 98,799 | | | | * | |

| Donald Rindell (8) | | | 138,687 | | | | * | |

| Anthony Altig (9) | | | 162,096 | | | | * | |

| Brock Wright (10) | | | 703,896 | | | | 2.44 | % |

| Thomas N. Davidson, Jr. (11) | | | 430,664 | | | | 1.49 | % |

| Michael Lemp (12) | | | 497,366 | | | | 1.73 | % |

| David C. Eldridge (13) | | | 322,306 | | | | 1.12 | % |

| Duane Morrison (14) | | | 66,666 | | | | * | |

| Michael Berg (15) | | | 148,562 | | | | * | |

| Benjamin Sullivan (16) | | | 219,239 | | | | * | |

| Robert Walder (17) | | | 126,945 | | | | * | |

| Tracy Puckett (18) | | | 161,498 | | | | * | |

| All directors and executive officers as a group (17 people) (19) | | | 6,435,669 | | | | 20.23 | % |

| (*) | Represents beneficial ownership of less than 1%. |

| (1) | Mr. Donsky’s address is 801 W. 5th Street, #2907, Austin, TX 78703. |

| (2) | Includes (a) 1,127,063 shares subject to options exercisable within 60 days of March 15, 2013; (b) 1,283,486 shares held beneficially by Mr. Vamvakas through his relationship with Greybrook Capital Inc., which includes 19,375 shares subject to warrants exercisable within 60 days of March 15, 2013; (c) 44,028 shares held beneficially by Mr. Vamvakas through his relationship with Greybrook Securities Inc.; and (d) 276,008 shares held by Mr. Vamvakas, which includes 104,604 shares subject to warrants. Mr. Vamvakas is the Chairman of Greybrook Capital, Inc., which is located at 5090 Explorer Drive, Suite 203 Mississauga, Ontario Canada L4W 4T9. |

| (3) | Includes 105,200 shares subject to options exercisable within 60 days of March 15, 2013. |

| (4) | Includes 100,000 shares subject to options exercisable within 60 days of March 15, 2013. |

| (5) | Includes 93,769 shares subject to options exercisable within 60 days of March 15, 2013. Includes 4,000 shares of common stock held by Mr. Karpecki’s solely owned consulting company, Visionary Consultants, Inc. |

| (6) | Includes (a) 110,148 shares subject to options exercisable within 60 days of March 15, 2013, and (b) 6,250 shares subject to warrants exercisable within 60 days of March 15, 2013. |

| (7) | Includes 98,670 shares subject to options exercisable within 60 days of March 15, 2013. |

| (8) | Includes 138,687 shares subject to options exercisable within 60 days of March 15, 2013. |

| (9) | Includes (a) 107,096 shares subject to options exercisable within 60 days of March 15, 2013, and (b) 27,500 shares subject to warrants exercisable within 60 days of March 15, 2013. |

| (10) | Includes (a) 61,992 shares subject to options exercisable within 60 days of March 15, 2013, and (b) 6,249 shares subject to warrants exercisable within 60 days of March 15, 2013. |

| (11) | Includes (a) 56,795 shares subject to options exercisable within 60 days of March 15, 2013; (b) 304,079 shares held beneficially by Mr. Davidson through his relationship with Cardinal Crest Partners, 7 Sunrise Cay, Key Largo, Florida 33037, which includes 100,000 shares subject to warrants; (c) 47,390 shares held by Mr. Davidson Jr., which includes 15,000 shares subject to warrants; and (d) 22,400 shares held by Mr. Davidson, Jr.’s spouse. |

| (12) | Includes 75,351 shares subject to options exercisable within 60 days of March 15, 2013. |

| (13) | Includes 137,298 shares subject to options exercisable within 60 days of March 15, 2013. |

| (14) | Includes 66,666 shares subject to options exercisable within 60 days of March 15, 2013. |

| (15) | Includes 100,000 shares subject to options exercisable within 60 days of March 15, 2013. |

| (16) | Includes 194,733 shares subject to options exercisable within 60 days of March 15, 2013. |

| (17) | Includes 100,000 shares subject to options exercisable within 60 days of March 15, 2013. |

| (18) | Includes 100,000 shares subject to options exercisable within 60 days of March 15, 2013. |

| (19) | Includes (a) 2,773,468 shares subject to options exercisable within 60 days of March 15, 2013 held on record by the current directors and executive officers; and (b) 278,978 shares subject to warrants exercisable within 60 days of March 15, 2013held of record by the current directors and executive officers. |

Equity Compensation Plan Information

The following table provides information regarding the equity compensation plans as of December 31, 2012.

| Equity Compensation Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | | | Weighted average exercise price of outstanding options, warrants and rights (b) | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |

| Plans approved by security holders (1) | | | 4,099,342 | | | | 3.54 | | | | 116,607 | |

| Plans not approved by security holders | | | | | | | | | | | | |

| The June 2011 PIPE Warrants (2) | | | 2,095,685 | | | | 1.86 | | | | | |

| The June 2011 Debt Warrants (3) | | | 86,876 | | | | 1.60 | | | | –– | |

| Total | | | 2,182,561 | | | | 1.85 | | | | –– | |

| (1) | For discussion of the 2002 Stock Incentive Plan, which was approved by the security holders, please refer to footnote 10 to the consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2012. |

| (2) | On June 30, 2011, pursuant to a private placement financing, the Company issued warrants to certain investors. The warrants are five-year warrants exercisable into an aggregate of 3,846,154 shares of the Company’s common stock at $1.86 per common share. |