[SHEARMAN & STERLING LLP LETTERHEAD]

(212) 848-8519

WRITER’S EMAIL ADDRESS:

jennifer.berman@shearman.com

September 16, 2004

John Ganley, Esq.

Division of Investment Management

Securities and Exchange Commission

450 Fifth Street, N.W.

Washington, D.C. 20549

S&P 500 GEARED Fund Inc. (the “Company”):

Registration Statement File Nos. 333-118070 and 811-21611

Dear Mr. Ganley:

As requested, attached is a copy of the email, including the most recent draft of their N-2, the Company submitted to you Monday, September 13, 2004, via email.

|

| Best regards, |

|

| /s/ JENNIFER E. BERMAN |

| Jennifer E. Berman |

[EMAIL DATED SEPTEMBER 13, 2004, 4:34 PM

FROM: JENNIFER E. BERMAN

TO: GANLEYJ@SEC.GOV

SUBJECT: NEW PROOFS FOR FORM N-2/IQ S&P 500 GEARED FUND ARE ATTACHED]

John,

Thank you so much for taking the time to speak with us today. As discussed on the phone, we are attaching a draft of the N-2 which incorporates the changes we discussed with you - in order to provide the clearest understanding for investors of how the Fund operates. We look forward to talking with you about the document. As discussed, we will be filing this draft of the N-2 as SEC Correspondence. Please feel free to call me at (212) 848-8519 to discuss the draft.

Thank you,

Jennifer Berman

Shearman & Sterling LLP

— Forwarded by Jennifer E Berman/NY/NA/ShS on 09/13/2004 04:33 PM —

[EMAIL DATED SEPTEMBER 13, 2004, 4:31 PM

FROM: RR_DONNELLEY_FINANCIAL@SENDD.COM

TO: JENNIFER.BERMAN@SHEARMAN.COM

SUBJECT: NEW PROOFS FOR FORM N-2/IQ S&P 500 GEARED FUND ARE ATTACHED]

Donnelley Financial has new proofs ready for your review.

Deal Name: Merrill Lynch & Co. Inc.

Job Name: Form N-2 / IQ S&P 500 GEARED Fund

Site Phone: 212.341.7777

Since you have elected to receive your proofs via an e-mailed attachment,

you can view them by simply opening the attached file.

** To avoid delays or deletions of proofs caused by anti-virus and anti-spam software, or to alleviate electronic storage load on your systems, RR Donnelley recommends receiving proofs through direct document hyperlinks rather than attachments.

Try this mode by clicking on the doclink below (beside “File Name:”) which will take you directly to your

document (no login necessary) for reviewing or downloading. **

If you need assistanceor you’d like us to switch your profile to doclinks, please ask your Customer Service Representative.

Type of Proof: Complete Clean Document

File Name: 18980acl.PDF

Cycle Number: 010

Type of Proof: Complete Document w/Composite Blacklines

2

File Name: 18980acp.PDF

Cycle Number: 010

Workgroup members receiving this email:

JENNIFER.BERMAN@SHEARMAN.COM

creynolds@shearman.com

| ** | Non-urgent requests for assistance accessing the SENDD service should be directed to support@sendd.com. URGENT REQUESTS FOR HELP MUST BE DIRECTED TO YOUR DONNELLEY FINANCIAL CUSTOMER SERVICE REPRESENTATIVE. ** |

* * *

3

[THE FIRST ATTACHMENT TITLED “18980ACL.PDF” READS AS FOLLOWS:]

As filed with the Securities and Exchange Commission on September [x], 2004

Securities Act Registration No. 333-118070

Investment Company Act File No. 811-21611

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-2

(CHECK APPROPRIATE BOX OR BOXES)

| x | REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 |

Pre-Effective Amendment No. 1

and

| x | REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 |

Amendment No. 1

S&P 500 GEAREDSMFund Inc.

(Exact name of Registrant as Specified in Charter)

4 World Financial Center, 5th Floor, New York, NY 10080

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code: (212) 449-8118

Allan J. Oster, Esq.

Vice President and Secretary

IQ Investment Advisors LLC

4 World Financial Center, 5th Floor, New York, NY 10080

(Name and address of Agent for Service)

COPY TO:

| | |

Margery K. Neale, Esq. Shearman & Sterling LLP 599 Lexington Avenue New York, NY 10022-6069 | | Leonard B. Mackey, Jr., Esq. Clifford Chance US LLP 31 West 52nd Street New York, NY 10019 |

Approximate Date of Proposed Public Offering:As soon as practicable after the effective date of the Registration Statement.

If any securities being registered on this form will be offered on a delayed or continuous basis in reliance on Rule 415 under the Securities Act of 1933, other than securities offered in connection with a dividend reinvestment plan, check the following box.¨

It is proposed that this filing will become effective (if appropriate, check box)

¨ when declared effective pursuant to section 8(c).

If appropriate, check the following boxes:

¨ This [post-effective] amendment designates a new effective date for a previously filed [post-effective amendment] [registration statement.]

¨ This Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act and the Securities Act registration statement number of the earlier effective registration statement for the same offering is .

CALCULATION OF REGISTRATION FEE UNDER THE SECURITIES ACT OF 1933

| | | | | | | | | |

|

| Title of Securities Being Registered | | Amount Being

Registered | | Proposed

Maximum

Offering Price Per Unit | | Proposed

Maximum

Aggregate

Offering Price(1) | | Amount of

Registration

Fee(2) |

Common Stock ($.001 par value per share) | | 1,000,000 Shares | | $20.00 | | $ | 20,000,000 | | |

|

| (1) | Estimated solely for the purpose of calculating the registration fee. |

| (2) | Transmitted prior to filing. |

The information required to be included in this Registration Statement by Part A and Part B of Form N-2 is contained in the Prospectus that follows. The information required to be in this Registration Statement by Part C of Form N-2 follows the Prospectus.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATES AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

The information contained in this prospectus is not complete and may be changed. The Fund may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any State where the offer or sale is not permitted.

Subject To Completion Preliminary Prospectus Dated September , 2004

| | | | |

| | S&P 500 GEAREDSM Fund Inc. | | |

| | Common Stock | | |

| | $20.00 per share | | |

S&P 500 GEAREDSMFund Inc. (the “Fund”) is a corporation organized under the laws of the State of Maryland and registered with the U.S. Securities and Exchange Commission under the Investment Company Act of 1940 as a closed-end, non-diversified management investment company. The Fund will conduct its investment operations for a fixed term of approximately five years. The Fund has an interval fund structure, pursuant to which the Fund will conduct annual repurchase offers for between 5% and 25% of the Fund’s outstanding shares.

The Fund’s investment objective is to provide returns, exclusive of fees and expenses of the Fund, linked to the annual performance of the S&P 500 Composite Stock Price Index (the “S&P 500 Index” or “Index”), as described below. The investment objective differs depending on whether the S&P 500 Index has positive or negative performance for each annual period (approximately one year). Where the Index has negative returns for an annual period, the Fund’s investment objective is to provide annual returns that track the performance of the Index on a one-for-one basis over the annual period. Where the performance of the Index is positive for an annual period, the Fund’s investment objective is to deliver a “geared” return equal to approximately three times the performance of the Index up to a maximum index participation level (the “Maximum Index Participation”). The Fund will not participate in any Index returns in excess of the Maximum Index Participation, and as a result the Fund’s performance over an annual period will be subject to a maximum annual return cap (the “Annual Return Cap”). The Fund currently anticipates that the Maximum Index Participation for its first annual investment period will be between 3% and 4%, and accordingly that its Annual Return Cap will equal three times this amount, or 9% to 12%, respectively. In instances where the return of the Index exceeds the Annual Return Cap, the Fund will under-perform the Index. See “Investment Strategy — Hypothetical Return Examples” on page of this prospectus. There can be no assurance that the Fund will achieve its investment objective or be able to structure its Transactions as anticipated. The Fund is not intended as a complete investment program.

The Fund will seek to achieve its objective by: (1) purchasing and managing a portfolio consisting of all of the securities that comprise the S&P 500 Index in the same proportions as the Index and/or other investments that track the performance of the Index; and (2) using a series of “option strategies” for each annual period (the “Transactions”). The Fund intends to distribute all net income, if any, generated by the Transactions at least annually. See “Automatic Dividend Reinvestment Plan on page [ ] of this Prospectus.

This Prospectus relates to the offering of securities of the Fund, which the Fund intends to list on the New York Stock Exchange (“NYSE”) under the ticker symbol “GRE”.Shares of closed-end investment companies that are listed on an exchange, such as those of the Fund, frequently trade at prices that reflect a discount from their net asset values. If you purchase the Fund’s shares in its initial public offering or otherwise and sell the shares on the NYSE or otherwise, you may receive an amount that is less than: (1) the amount you paid for the shares; and/or (2) the net asset value of the Fund’s shares at the time of sale. The Fund is a newly formed entity and has no previous operating or trading history upon which you can evaluate the Fund’s performance.

Investing in the Fund involves certain risks. The Fund, by engaging in Transactions, may forego the opportunity to benefit fully from potential increases in the value of the Index, but would continue to bear the risk of declines in the value of the investments purchased to track the performance of the Index. The Fund’s investment strategy involves the use of call options and other derivatives which involve risks different from, and possibly greater than, the risks associated with investing directly in the investments underlying these instruments. The Fund also will be exposed to the risk that counterparties to its investments, for whatever reason, will be unable to meet their obligations.INVESTING IN THE FUND’S SHARES INVOLVES CERTAIN RISKS. SEE “RISK FACTORS AND SPECIAL CONSIDERATIONS” ON PAGE [ ] OF THIS PROSPECTUS.

| | | | | | |

| | | Per Share

| | Total (3)

|

Public Offering Price | | $ | 20.00 | | [$ | ] |

Sales Load (1) | | $ | 0.90 | | [$ | ] |

Proceeds to the Fund (Before Expenses) (2) | | $ | 19.10 | | [$ | ] |

| (1) | The Fund has agreed to pay its underwriters $.00667 per share of common stock as a partial reimbursement of expenses incurred in connection with the offering. See “Underwriting” on page [ ] of this Prospectus. |

| (2) | The total organizational and offering expenses to be incurred by the Fund are estimated to be [$ ]. |

| (3) | The underwriters have an option to purchase up to an additional [ ] shares of the Fund at the Public Offering Price, less the Sales Load, within 45 days of the date of this Prospectus to cover any overallotments. If the underwriters exercise this option in full, the total Public Offering Price, Sales Load, and estimated offering expenses and proceeds, after expenses, to the Fund will be [$ ], [$ ], [$ ], and [$ ], respectively. See “Underwriting” on page [ ] of this Prospectus. |

Neither the Securities and Exchange Commission nor any state securities commission has determined whether this Prospectus is truthful or complete, nor have they made, nor will they make, any determination as to whether anyone should purchase these securities. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities. Any representation to the contrary is a criminal offense.

This Prospectus provides information that you should know about the Fund before investing. Please read this Prospectus carefully and keep it for future reference. Information required to be in the Fund’s Statement of Additional Information is found in this Prospectus.

Merrill Lynch & Co.

The date of this Prospectus is [ ] [ ], 2004.

“GEARED” and “Geared-Equity Accelerated Return” are service marks of Merrill Lynch & Co.

TABLE OF CONTENTS

You should rely only on the information contained or incorporated by reference in this Prospectus. The Fund has not, and the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The Fund is not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information provided by this Prospectus is accurate as of any date other than the date on the front of this Prospectus. The Fund’s business, financial condition and results of operations may have changed since the date of this Prospectus.

Information about the Fund can be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Call 1-202-942-8090 for information on the operation of the public reference room. This information also is available on the SEC’s Internet site at http://www.sec.gov and copies may be obtained upon payment of a duplicating fee by writing the Public Reference Section of the SEC, 450 Fifth Street, NW, Washington, D.C. 20549-0102.

SUMMARY OF TERMS

The following provides a summary of certain information contained in this Prospectus relating to the S&P GEAREDSMFund Inc. and its shares and does not contain all of the information that you should consider before investing in the Fund or purchasing its shares. The information is qualified in all respects by the more detailed information included elsewhere in this Prospectus and in the appropriate Registration Statements filed with the U.S. Securities and Exchange Commission.

| | |

The Fund | | S&P 500 GEAREDSM Fund Inc. (the “Fund”) is a corporation organized under the laws of the State of Maryland and registered with the U.S. Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940 (the “Investment Company Act”) as a closed-end, non-diversified management investment company. The Fund has an interval fund structure, pursuant to which the Fund will conduct annual repurchase offers for between 5% and 25% of the Fund’s outstanding shares. Please see “Annual Repurchases of Securities” on page [ ] of this Prospectus for more information about the interval fund structure. The Fund will conduct its investment operations for a fixed term of approximately five years. The Fund’s termination date is December 15, 2009. In anticipation of the termination date, the Fund will liquidate its positions and satisfy any obligations and liabilities and distribute any remaining proceeds to its stockholders and dissolve in an orderly fashion. The Fund will then seek to deregister with the SEC as an investment company. |

| |

The Offering | | The Fund is offering [ ] shares of its common stock at an initial offering price of $20.00 per share through a group of underwriters led by Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPFS”), an affiliate of Merrill Lynch & Co., Inc. (“Merrill Lynch”). An investor must purchase at least 100 shares of the Fund’s common stock. The underwriters have an option to purchase up to an additional [ ] shares of the Fund within 45 days of the date of this Prospectus to cover any overallotments. |

| |

Investment Objective | | The Fund’s investment objective is to provide returns, exclusive of fees and expenses of the Fund, linked to the annual performance of the S&P 500 Composite Stock Price Index (the “S&P 500 Index” or “Index”), as described below. The investment objective differs depending on whether the S&P 500 Index has positive or negative performance for each annual period (approximately one year). Where the Index has negative returns for an annual period, the Fund’s investment objective is to provide annual returns that track the performance of the Index on a one-for-one basis over the annual period. Where the performance of the Index is positive for an annual period, the Fund’s investment objective is to deliver a “geared” return equal to approximately three times the performance of the Index up to a maximum index participation level (the “Maximum Index Participation”). The Fund will not participate in any Index returns in excess of the Maximum Index Participation, and as a result the Fund’s performance over an annual period will be subject to a maximum annual return cap (the “Annual Return Cap”). The Fund |

1

| | |

| | | currently anticipates that the Maximum Index Participation for its first annual investment period of operations will be between 3% and 4%, and accordingly that its Annual Return Cap will equal three times this amount, or 9% to 12%, respectively. In instances where the return of the Index exceeds the Annual Return Cap, the Fund will under-perform the Index. See “Investment Strategy — Hypothetical Return Examples” on page of this prospectus. There can be no assurance that the Fund will achieve its investment objective or be able to structure its investments as anticipated. The Fund is not intended as a complete investment program. |

| |

Investment Strategy | | General. The Fund will seek to achieve its objective by: (1) purchasing and managing a portfolio consisting of all of the securities that comprise the S&P 500 Index in the same proportions as the Index and/or other investments that enable the Fund to track the performance of the Index (the “long” portfolio); and (2) using a series of “option strategies” (the “Transactions”) for each annual period that in combination with the long S&P 500 Index portfolio are designed to deliver three times the performance of the Index over the course of the annual period (exclusive of the Fund’s fees and expenses) where the value of the Index increases, up to the Maximum Index Participation that is set at the beginning of each annual period through the Transactions. See “Investment Strategy — Calculating the Maximum Index Participation” below and on page [ ] of this Prospectus. |

| |

| | | The Transactions. The Transactions will include: (A) the sale by the Fund of European-style call options on the S&P 500 Index; and (B) with the proceeds of this sale, the purchase of “call spreads,” which have the economic effect of purchasing a European-style call option on the S&P 500 Index and simultaneously selling a European-style call option on the S&P 500 Index. The Fund will structure its investments so that the price received from the sale of the call options will equal (or approximately equal) the price paid for the purchase of the call spreads. European-style call options are options that can be exercised only on their expiration dates rather than at any time during their term. Each year the Fund will seek to distribute the positive gains, if any, resulting from the Transactions, and intends to structure the Transactions to have maturities of approximately one year. At the end of each annual period until the end of the fifth year of operations, the Fund will enter into new Transactions. See “Investment Strategy” on page [x] of this Prospectus and “Automatic Dividend Reinvestment Plan” on page [-] of this Prospectus. |

| |

| | | Calculating the Maximum Index Participation. When the Fund sells (or “writes”) a call option, it structures the option so that the premium received by the Fund will equal (or approximately equal) the cost of the call spreads purchased by the Fund. The Maximum Index Participation is determined at the beginning of each annual period based on prevailing market prices for the option being sold and the call spreads being purchased, and is a function of a number of market |

2

| | |

| | | and economic factors including interest rates and market volatility. The Fund will attempt to structure the Transactions to achieve the highest possible Maximum Index Participation and, accordingly, the highest possible Annual Return Cap. |

| |

| | | As the Maximum Index Participation for any annual period will be determined by the Fund’s investment at the beginning of the annual period, there can be no assurance that the Maximum Index Participation that is set for any subsequent annual period will be higher or lower than the Maximum Index Participation set for the first annual period. |

| |

| | | Investors will be notified of the anticipated Maximum Index Participation range at the time they receive notice of the annual repurchase of securities. In addition, the notice will explain that the actual Maximum Index Participation will be disclosed through a press release and through public information sources on the internet as soon as the contract prices are set for the call options. The Fund currently anticipates that the Maximum Index Participation for its first annual investment period will be in the range of 3% to 4% of the positive performance of the Index, the actual Maximum Index Participation may be higher or lower than this range. |

| |

| | | S&P 500 Index. As stated above, the Fund intends to invest in all of the securities that comprise the S&P 500 Index in the same proportions as the Index and/or other investments that enable the Fund to track the performance of the Index. Under normal circumstances, at least 80% of the value of the Fund’s net assets (including the proceeds of any borrowings) will be invested in common stocks of companies that comprise the S&P 500 Index (or synthetic instruments that have economic characteristics similar to securities that comprise the Index). This 80% policy is not a fundamental policy and therefore may be changed without your approval. However, we may not change or modify this policy unless we provide you with at least 60 days’ prior notice. |

| |

| | | Who Should Invest. The Fund is designed for investors with a moderately bullish view of the S&P 500 Index over each of the next five years. In other words, because the potential upside to Fund stockholders for each annual period is limited to the Annual Return Cap, a stockholder would not benefit if the return of the Index exceeded the Annual Return Cap. Conversely, since there will be no downside limit resulting from the Transactions, if the Index declines over an annual period, Fund stockholders would experience the full decline for the annual period (plus Fund fees and expenses). See “Investment Strategy — Hypothetical Return Example” on page [ ] of this Prospectus. |

| |

| | | There can be no assurance that the investment strategy employed by the Fund will be successful or result in the investment objective of the Fund being achieved. Please refer to the “Investment Strategy” and “Investment Restrictions” sections on pages [ ] and [ ] of this |

3

| | |

| | | Prospectus, respectively, for more information about the Fund’s investment strategy. |

| |

Summary of Risks | | General. Investing in the Fund involves certain risks and the Fund may not be able to achieve its intended results for a variety of reasons, including, among others, the possibility that the Fund may not be able to structure its Transactions as anticipated. |

| |

| | | Index Tracking Errors. One part of the Fund’s investment strategy involves making investments in a manner that seeks to track the performance of the S&P 500 Index. The Fund may not be able to acquire the common stocks of all the companies in the S&P 500 Index, hold these securities in the correct weightings or be able to track the performance of the Index. This may occur when the Index sponsor rebalances the S&P 500 Index (which is expected to occur on an annual basis), or otherwise. This also may occur when, for example, the call options, swap agreements and/or futures and forward contracts the Fund purchases and sells do not, for a variety of reasons, perform as expected or do not result in the Fund receiving returns that are correlated (in any manner) with the performance of the Index. |

| |

| | | The Fund may not be able to achieve returns that track the performance of the S&P 500 Index because the Fund will incur certain fees and expenses that are not applicable to (and not reflected in the performance of) the Index, such as, among others, the costs of managing the Fund and buying and selling investments for the Fund. As a result, the portions of the Fund’s performance that are based on holding investments to track the performance of the Index may be lower than the actual performance of the Index. |

| |

| | | Equities Securities Risk. The values of investments purchased and sold by the Fund will fluctuate — at times dramatically — based on many factors, such as market conditions, interest rate movements, investors’ perceptions of the financial conditions of the companies issuing such investments and other political and economic events. As these investments fluctuate in value, they may cause the net asset value of the Fund’s shares to also vary. When the value of the S&P 500 Index is declining, the value of the Fund’s shares is expected to decrease. |

| |

| | | General Risks Related to Derivatives. The Fund’s investment strategy involves the use of derivatives, such as, among others, the sale of call options and the purchase of “call spreads.” These “call spreads” include the economic equivalent of the purchase of a call option and the simultaneous sale of a call option on the Index that have different strike prices. The Fund also may enter into swap agreements, and futures and forward contracts. The Fund’s use of derivatives involves risks different from, and possibly greater than, the risks associated with investing directly in the investments underlying these derivatives. |

4

| | |

| | | Call Spreads and Call Options. In its Transactions, the Fund will be exposed to the same risks as those of a purchaser (and seller, see below) of call options on the S&P 500 Index. See “Investment Strategy — Call Options Generally.” A purchaser of call options on the S&P 500 Index generally will have to pay premiums to the sellers of these options. Although the Fund will seek to offset, to the extent possible, the amount of premiums paid to the sellers of the call spreads by its sale of call options, there is no assurance that it will be able to offset fully the amount of premiums paid by the amount of premiums received. In addition, if the value of the S&P 500 Index is less than or equal to the strike prices of the call options purchased by the Fund, the Fund generally will not exercise these options and will incur losses equal to the amount of premiums paid to the sellers of the options. In these instances, the call options that the Fund sold with higher strike prices than the purchased call options would also expire worthless and the premiums earned from selling those options would help offset the loss of premium from the purchased calls. |

| |

| | | Because the Fund’s investment strategy involves selling call options on the S&P 500 Index, as well as purchasing call spreads that have embedded within them the same effect, the Fund will be exposed to the risks of a seller of call options on the S&P 500 Index. The Fund, by selling call options on the S&P 500 Index, may forego the opportunity to benefit fully from potential increases in the value of the S&P 500 Index above the strike prices specified in the Fund’s written call options (or otherwise embedded in the call spreads). For example, if the value of the S&P 500 Index is greater than the strike price of the call options that the Fund has sold (which is the Maximum Index Participation), the Fund’s return may be less than the return the Fund would have earned if it had invested solely in the securities underlying the S&P 500 Index or investments designed to track the performance of the Index. The Fund, however, would continue to bear the risk of declines in the values of the investments purchased to track the performance of the Index. |

| |

| | | As part of its Index replication strategy, the Fund also may sell covered call options. In this instance, the Fund may not receive sufficient premiums from selling call options to cover fully or mitigate any losses the Fund may sustain by any increase in the value of the S&P 500 Index over the strike prices in these options. In the event that the Fund sells a call option on the Index but does not own all of the securities that comprise the Index (or investments that enable the Fund to track the performance of the Index), or the securities in the same weightings as the Index, the Fund may be exposed to significant losses if the value of the Index increases substantially over the strike price specified in the written call option. Although the potential risk of loss in such a situation could be substantial, this is not a likely occurrence given that the Fund’s investment strategy involves investing in all of the securities that comprise the Index or |

5

| | |

| | | investments that enable the Fund to track the performance of the Index. In addition, the Fund will segregate liquid assets to cover its net exposure under written call options and the call spreads. |

| |

| | | The Maximum Index Participation. The terms of the call options written by the Fund and the call spreads purchased by the Fund, (and, accordingly, the Maximum Index Participation and Annual Return Cap), will be affected by market conditions at the inception of an annual period. Market conditions may change over time, and for that reason the Maximum Index Participation for an annual period may be higher or lower than it would have been if the Transactions had been entered into at a different time during the annual period. |

| |

| | | Counterparties. The Fund expects to purchase and sell over-the-counter derivatives on the S&P 500 Index and other investments that enable the Fund to track the performance of the Index. The Fund will be exposed to the risk that counterparties to these investments (and derivatives), for whatever reason, will become bankrupt or otherwise fail to honor their obligations. The Fund will attempt to minimize the risk by entering into Transactions with counterparties that are rated Aa3 or better by Moody’s Investors Service Inc. or A or better by Standard & Poor’s (or counterparties whose obligations are guaranteed by other persons meeting such ratings), or those counterparties determined by the Fund to be of comparable credit quality. In addition, counterparties will be required to post collateral at the time they enter into a Transaction for the full amount of their potential obligation to the Fund under the call spreads, thereby limiting the Fund’s exposure to the credit risk of the counterparty. |

| |

| | | Temporary Defensive Positions. The Fund will not engage in temporary defensive positions to hedge against adverse market conditions. In addition, normally the Transactions will be expected to remain in effect for the entirety of the relevant annual period. However, the Fund may decide to sell one or more call spreads when the Adviser determines that the Fund has become exposed to unacceptable risks specific to a particular counterparty. These sale transactions may be effected at inopportune times for the Fund or may cause the Fund to fail to meet its investment objective. As a result, these transactions could result in the Fund’s performance varying dramatically from its intended results. |

| |

| | | Non-Diversification Risk. Because the Fund is non-diversified, the Fund may invest in the securities of a limited number of issuers. To the extent that the Fund invests a significant percentage of its assets in a limited number of issuers, the Fund is subject to the risks of investing in those few issuers, and may be more susceptible to a single adverse economic or regulatory occurrence. |

| |

| | | Annual Repurchases of Securities. The Fund has an interval fund structure pursuant to which the Fund’s required annual repurchases |

6

| | |

| | | are likely to continually decrease the overall size of the Fund, which could over time: (1) harm investment performance by limiting the extent to which the Fund may invest in illiquid securities; (2) increase the Fund’s expense ratio as the Fund’s assets decrease; (3) threaten the Fund’s continued listing on the New York Stock Exchange (“NYSE”), and, consequently, the liquidity of its shares; and (4) jeopardize the Fund’s viability and continued existence. Moreover, there are further risks associated with the Fund’s repurchase offers, including the risk that: (1) if the repurchase offer is over-subscribed, stockholders may be unable to liquidate all or a given percentage of their investment at net asset value during the repurchase offer; (2) due to the potential for pro-ration, if the repurchase offer is over-subscribed, some investors may tender more shares than they wish to have repurchased in order to ensure the repurchase of a specific number of shares; (3) the repurchase offer may not eliminate any discount at which the Fund’s shares trade; and (4) because the Fund expects, in certain circumstances, to liquidate portfolio securities in order to fund repurchase offers, the need to sell such securities may in turn affect the market for such securities and accordingly diminish the value of the Fund’s investments. Furthermore, to the extent the Fund borrows to finance the making of repurchases, interest on such borrowings reduce the Fund’s returns. Please see “Risk Factors and Special Considerations — Annual Repurchases of Securities” on page [ ] of this Prospectus for more information regarding the risks associated with repurchases. |

| |

| | | No Operating History. The Fund is a newly formed entity and has no previous operating or trading history upon which a potential investor can evaluate the Fund’s performance. Shares of closed-end investment companies that trade in a secondary market frequently trade at market prices that are lower than their net asset values. This is commonly referred to as “trading at a discount.” This risk may be greater for investors expecting to sell their shares in a relatively short period after completion of the public offering. As a result, the Fund is designed primarily for long-term investors. The Fund’s total assets will be reduced following this offering by the amount of offering and related expenses to be paid by the Fund. |

| |

| | | As with any security, complete loss of investment is possible. Please see “Risk Factors and Special Considerations” on page [ ] of this Prospectus for more information about the risks of investing in the Fund. |

| |

Listing of Shares | | The Fund intends to list on the NYSE under the ticker symbol “GRE” and will be required to meet the NYSE’s initial and continued listing requirements. |

| |

Board of Directors | | The Fund’s Board of Directors has overall responsibility for directing the management of the Fund’s investment process, and its management and operations. Any vacancy on the Board of Directors |

7

| | |

| | | may be filled by a majority of the remaining directors, except to the extent that the Investment Company Act requires the election of directors by stockholders. All of the directors are currently not “interested persons” (as defined by the Investment Company Act) of the Fund or its investment adviser or subadviser. |

| |

Adviser and Management Fee | | IQ Investment Advisors LLC, a limited liability company organized under the laws of the State of Delaware, serves as the investment adviser to the Fund (the “Adviser”) and is registered as such with the SEC under the Investment Advisers Act of 1940 (the “Advisers Act”). The Adviser provides investment advisory, management and administrative services to the Fund pursuant to a management agreement (the “Management Agreement”). The Adviser has designed the investment strategy for the Fund and has oversight responsibility for the implementation of the strategy by the subadviser (as described below under “Subadviser”). In consideration of the investment advisory, management and administrative services provided by the Adviser to the Fund, the Fund pays the Adviser a management fee equal to an annual rate of 0.82% of the Fund’s average daily net assets (the “Management Fee”). The Adviser intends to pay a portion of the Management Fee it receives from the Fund to MLPFS and other of its affiliates. In addition, the Adviser will compensate the Subadviser. |

| |

| | | The Adviser is an indirect subsidiary of Merrill Lynch. Merrill Lynch is one of the world’s leading financial management and advisory companies, with offices in [ ] countries and private client assets of approximately [$ ] trillion. As an investment bank, it is a leading global underwriter of debt and equity securities and a strategic advisor to corporations, governments, institutions and individuals worldwide. Through its subsidiaries, Merrill Lynch is one of the world’s largest managers of financial assets. |

| |

Subadviser | | The Adviser has entered into a subadvisory agreement (the “Subadvisory Agreement”) with Merrill Lynch Investment Managers, L.P. (the “Subadviser” and, together with the Adviser, the “Advisers”), pursuant to which the Adviser has delegated certain of its investment advisory responsibilities to the Subadviser. The Subadviser is an affiliate of the Adviser. The Subadviser will be responsible for implementing the Fund’s investment strategy. The Subadviser, a limited partnership organized under the laws of the State of Delaware, is registered as an investment adviser with the SEC under the Advisers Act. Under the terms of the Subadvisory Agreement, the Adviser compensates the Subadviser from the Management Fee at an annual rate of 0.35% of the Fund’s average daily net assets. In addition, the Adviser has other economic arrangements with the Subadviser whereby it pays the Subadviser an additional portion of its advisory fee in exchange for certain administrative, legal and support services. |

8

| | |

Tax Aspects | | The Fund intends to qualify for the special tax treatment afforded to regulated investment companies under the Internal Revenue Code of 1986, as amended (the “Code”). As long as the Fund so qualifies, it (but not its stockholders) will not be subject to U.S. federal income tax on the part of its investment company income and net realized capital gains that it distributes to its stockholders. The Fund intends to distribute all or substantially all of such income and gains. |

| |

| | | Please refer to the “U.S. Federal Income Tax Considerations” section on page [ ] of this Prospectus for additional information on the potential U.S. federal income tax effects of an investment in the Fund. You should consult your own tax advisor on any potential state or local income tax effects of an investment in the Fund. |

| |

Anti-Takeover Provisions | | The Fund’s charter and Bylaws include provisions that could limit the ability of other entities or persons to acquire control of the Fund or to change the composition of its Board of Directors. One such provision divides the Fund’s Board of Directors into three classes serving staggered terms. Such provisions may discourage outside parties from acquiring control of the Fund, which could result in stockholders not having the opportunity to realize a price greater than the current market price for their shares at some time in the future. |

| |

Automatic Dividend | | |

Reinvestment Plan | | Pursuant to the Fund’s Automatic Dividend Reinvestment Plan, unless a stockholder is ineligible or elects otherwise, dividends and capital gains distributions to the Fund’s stockholders will be used to purchase additional common stock of the Fund. Fund stockholders may, however, elect to receive such dividends and distributions in cash. Stockholders whose shares of common stock are held in the name of a broker or nominee should contact that broker or nominee to determine whether the broker or nominee will permit participation in the Fund’s Automatic Dividend Reinvestment Plan. |

| |

Conflicts of Interest | | The investment activities of the Advisers and their affiliates for their own accounts and other accounts or funds they manage may give rise to conflicts of interest that may disadvantage the Fund. None of the Adviser, the Subadviser, MLPFS and their affiliates have established any formal procedures for resolving any conflicts of interest. Merrill Lynch, as a diversified global financial services firm involved with a broad spectrum of financial services and asset management activities, may, for example, engage in the ordinary course of business in activities in which its interests or the interests of its affiliates or clients may conflict with those of the Fund and its stockholders. Please refer to the “Conflicts of Interest” section on page [ ] of this Prospectus for additional information. |

| |

Transfer Agent and Custodian | | The Fund has entered into a transfer agency agreement with The Bank of New York (the “Transfer Agent”) under which the Transfer Agent will provide the Fund transfer agency services. The Fund has entered into a custody agreement with State Street Bank and Trust Company (the “Custodian”) under which the Custodian will provide the custodian services to the Fund. |

9

SUMMARY OF FUND EXPENSES

The following Fee Table illustrates the fees and expenses that the Fund expects to incur and that stockholders can expect to bear directly or indirectly.

Stockholder Transaction Expenses:

| | |

Maximum Sales Load (as a percentage of offering price) | | [4.50%] |

Offering Expenses Borne by the Fund (as a percentage of offering price)(1) | | [0.20%] |

[Dividend Reinvestment Plan Fees] | | [none] |

[Repurchase Fee] | | [2.0%](2) |

| | | |

| |

| Annual Fund Expenses(as a percentage of net assets attributable to common shares): | | | |

| |

Management Fee(3) | | [0.82 | %] |

Other Expenses(4) | | [0.11 | %] |

Total Annual Expenses: | | [0.93 | %] |

| | |

|

|

Total Net Annual Expenses: | | [ | ]% |

| (1) | The Fund’s Adviser has agreed to pay all of the Fund’s organizational expenses. Offering costs will be paid by the Fund up to $0.04 per share (.20% of the offering price). The Adviser has agreed to pay the amount by which the offering costs (other than the sales load, but including the [$ ] per share partial reimbursement of expenses to the underwriters) exceed $0.04 per share of common stock (.20% of the offering price). The offering costs to be paid by the Fund are not included in the Total Annual Expenses amount shown in the table. Offering costs borne by the Fund’s shareholders will result in a reduction of capital of the Fund attributable to Fund shares. |

| (2) | The Fund may deduct from the repurchase proceeds a repurchase fee, not to exceed 2% of the proceeds, that is reasonably intended to compensate the Fund for expenses directly related to the repurchase. |

| (3) | The Fund pays the Adviser the Management Fee in consideration of the investment advisory, management and administrative services that the Adviser provides to the Fund. From this Management Fee, the Adviser compensates the Subadviser as well as intends to provide a portion of this fee to MLPFS and other of its affiliates. See the “Investment Advisory and Management Arrangements” and “Underwriting” sections on pages [ ] and [ ], respectively, of this Prospectus. |

| (4) | Other Expenses have been estimated based on estimated asset levels and expenses for the current fiscal year. |

Example

An investor would pay the following expenses (including the sales load of [ ] and estimated offering expenses of this offering of [ ] on a $1,000 investment, assuming total annual expenses of [ ]) and a 5% annual return throughout the periods.

| | | | | | |

1 year

| | 3 years

| | 5 years

| | 10 years

|

[$ ] | | [$ ] | | [$ ] | | [$ ] |

The Fee Table is intended to assist investors in understanding the costs and expenses that a stockholder in the Fund will bear directly or indirectly. The expenses set out under “Other Expenses” are based on estimated amounts through the end of the Fund’s first fiscal year and assume that the Fund issues approximately 1,000,000 shares of common stock. If the Fund issues fewer shares of common stock, all other things being equal, these expenses would increase. The Example set out above assumes reinvestment of all dividends and distributions and utilizes a 5% annual rate of return as mandated by SEC regulations. The Example should not be considered a representation of future expenses or annual rates of return, and actual expenses or annual rates of return may be more or less than those assumed for purposes of the Example.

10

THE FUND

S&P 500 GEAREDSMFund Inc. (the “Fund”) is a corporation organized under the laws of the State of Maryland and registered with the U.S. Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940 (the “Investment Company Act”) as a closed-end, non-diversified management investment company. The Fund has an interval fund structure, pursuant to which the Fund will conduct annual repurchase offers for between 5% and 25% of the Fund’s outstanding shares. Please see “Annual Repurchases of Securities” on page [ ] of this Prospectus for more information about the interval fund structure. The Fund will conduct its investment operations for a fixed term of approximately five years. The Fund’s termination date is December 15, 2009. In anticipation of the termination date, the Fund will liquidate its positions and satisfy any obligations and liabilities and then distribute any remaining proceeds to its stockholders and dissolve. Because the Fund’s investment strategy involves the use of call options with fixed terms, it is likely that the call options in the fifth year of the life of the Fund will expire before the termination date and the Fund will invest its assets in liquid, short-term investments pending the orderly liquidation and dissolution of the Fund. This may have a negative impact on the Fund’s performance for its last year of operations. The Fund will then seek to deregister with the SEC as an investment company and terminate in an orderly fashion. The Fund expects to commence its investment operations on or after October 29, 2004. The Fund’s principal office, including its office for service for process, is located at 4 World Financial Center, 5th Floor, New York, NY 10080.

THE OFFERING

The Fund is offering [ ] shares of its common stock at an initial offering price of $20.00 per share, which price includes an underwriting discount of [ %] per share. These shares have been registered for sale with the SEC under the Securities Act of 1933 (the “Securities Act”) and will be offered through a group of underwriters led by Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPFS”), an affiliate of Merrill Lynch & Co., Inc. (“Merrill Lynch”) and of IQ Investment Advisors LLC, the Fund’s investment adviser (the “Adviser”). An investor must purchase at least 100 shares of the Fund’s common stock. The underwriters have an option to purchase up to an additional [ ] shares of the Fund within 45 days of the date of this Prospectus to cover any overallotments.

USE OF PROCEEDS

The net proceeds of this offering will be approximately [$ ] (or approximately [$ ] assuming the underwriters exercise an overallotment option in full) after payment of offering costs estimated to be [$ ] and the deduction of the underwriting discount. The Adviser has agreed to pay the amount by which the offering costs (other than the underwriting discount, but including the $.00667 per share partial reimbursement of expenses to the underwriters) exceed $0.04 per share of common stock. The Adviser has agreed to pay all the Fund’s organizational expenses.

Under normal conditions, the Fund expects that it will take substantially less than three months (approximately one week) to invest all or substantially all of the proceeds from the offering in accordance with the Fund’s investment objective. Pending such investment, it is anticipated that all or a portion of the proceeds will be invested in U.S. Government securities or high grade, short-term money market instruments. A relatively long initial investment period may have a negative impact on the Fund’s performance and its return to stockholders.

11

INVESTMENT OBJECTIVE

The Fund’s investment objective is to provide returns, exclusive of fees and expenses of the Fund, linked to the annual performance of the S&P 500 Index, as described below. The investment objective differs depending on whether the S&P 500 Index has positive or negative performance for each annual period (approximately one year). Where the Index has negative returns for an annual period, the Fund’s investment objective is to provide annual returns that track the performance of the Index on a one-for-one basis over the annual period. Where the performance of the Index is positive for an annual period, the Fund’s investment objective is to deliver a “geared” return equal to approximately three times the performance of the Index up to a maximum index participation level (the “Maximum Index Participation”). The Fund will not participate in any Index returns in excess of the Maximum Index Participation, and as a result the Fund’s performance over an annual period will be subject to a maximum annual return cap (the “Annual Return Cap”). The Fund currently anticipates that the Maximum Index Participation for its first annual investment period will be between 3% and 4%, and accordingly that its Annual Return Cap will equal three times this amount, or 9% to 12%, respectively. In instances where the return of the Index exceeds the Annual Return Cap, the Fund will under-perform the Index. See “Investment Strategy — Hypothetical Returns Example” on page of this Prospectus. There can be no assurance that the Fund will achieve its investment objective or be able to structure its investments as anticipated. The Fund is not intended as a complete investment program.

INVESTMENT STRATEGY

General.The Fund will seek to achieve its investment objective by: (1) purchasing and managing a portfolio consisting of all of the securities that comprise the S&P 500 Index in the same proportions as the Index and/or other investments that enable the Fund to track the performance of the Index (the “long” portfolio); and (2) using a series of “option strategies” (the “Transactions”) for each annual period that, in combination with the long S&P 500 Index portfolio, are designed to deliver three times the performance of the Index over the course of the annual period (exclusive of the Fund’s fees and expenses) where the value of the Index increases, up to a Maximum Index Participation that is set at the beginning of each annual period through the Transactions.

The Transactions.The Transactions will include: (A) the sale by the Fund of out-of-the-money European-style over-the-counter call options on the S&P 500 Index: and (B) with the proceeds of this sale, the purchase of “call spreads,” which have the economic effect of purchasing an at-the-money European-style over-the-counter call option on the S&P 500 Index and simultaneously selling an out-of-the-money European-style over-the-counter call option on the S&P 500 Index. The Fund will structure its investments so that the price received from the sale of the call options will equal (or approximately equal) the price paid for the purchase of the call spreads. European-style call options are options that can be exercised only on their expiration dates rather than at any time during their term. Each year the Fund will seek to distribute the remaining positive gains, if any, resulting from the Transactions, and intends to structure the Transactions to have maturities of approximately one year. At the end of each annual period until the end of the fifth year of operations, the Fund will to enter into new Transactions. The Fund will measure its returns for purposes of its objective as of the end of each annual period in relation to the value of the Index as of the beginning of that period. See “Automatic Dividend Reinvestment Plan” on page [ ] of this Prospectus.

Calculating the Maximum Index Participation.When the Fund sells (or “writes”) a call option, it structures the option so that the premium received by the Fund will equal (or approximately equal) the cost of the call spreads purchased by the Fund. The Index Participation Level is determined at the beginning of each annual period based on prevailing market prices for the option being sold and the call spreads being purchased, and is a function of a number of market and economic factors including interest rates and market volatility. The Fund will attempt to structure the Transactions to achieve the highest possible Maximum Index Participation and, accordingly, the highest possible Annual Return Cap.

Investors will be notified of the anticipated Maximum Index Participation range at the time they receive notice of the annual repurchase of securities. In addition, the notice will explain that the actual Maximum Index Participation will be disclosed through a press release and through public information sources on the internet as soon as the contract prices are set for the call options. The Fund currently anticipates that the Maximum Index

12

Participation for its first annual investment period will be in the range of 3% to 4% of the positive performance of the Index, the actual Maximum Index Participation may be higher or lower than this range.

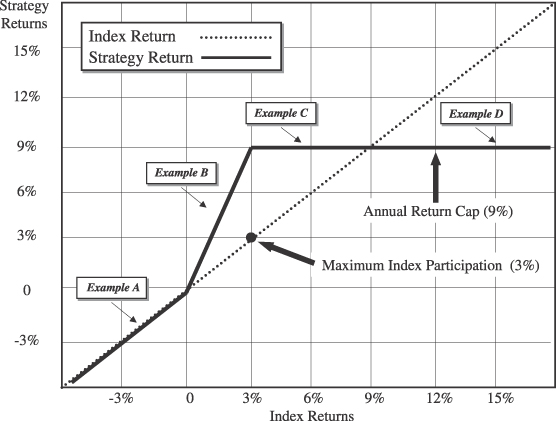

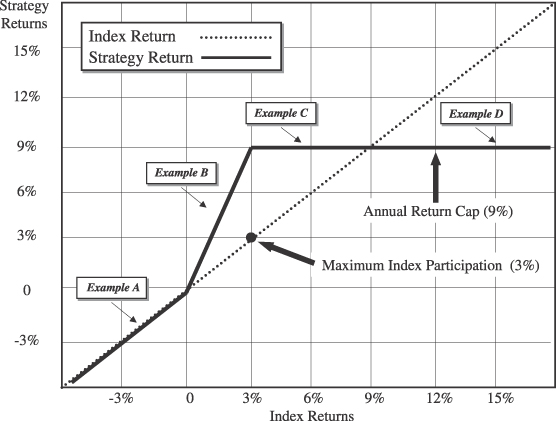

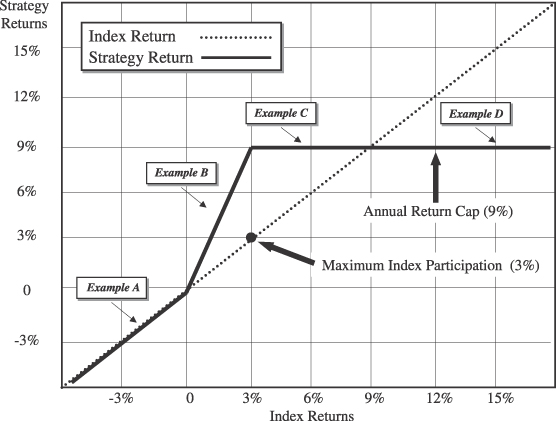

Hypothetical Return Examples. The following chart and Hypothetical Return Examples are intended to illustrate the Fund’s gearing strategy and do not reflect the Fund’s fees, expenses, dividends or dividends on securities in the Index. For purposes of this illustration, the annual Maximum Index Participation is assumed to be 3%, and consequently the Annual Return Cap is 9%. The chart and examples do not represent a guaranty of any level of performance of the Index or the Fund. Please see “Risk Factors—Special Considerations” on page [ ] of this Prospectus.

Example A. Negative Index Returns.

The strategy is designed to provide annual returns that track the performance of the Index on a one-for-one basis in instances where the returns on the Index are negative. Thus, the returns on the strategy in this example should be expected to approximate the returns on the Index (excluding Fund fees and expenses).

Example B. Positive Index Returns up to the Maximum Index Participation Level (i.e., greater than 0 to 3% Index Returns).

The strategy is designed to deliver 3-for-1 returns in instances where the Index performs positively up to the Maximum Index Participation. Thus, the returns on the strategy should outperform the returns on the Index by a factor of 3 (excluding Fund fees and expenses).

Example C. Positive Index Returns in excess of the Maximum Index Participation but less than the Annual Return Cap (i.e., greater than 3% to less than 9% Index Returns).

If the performance of the Index exceeds the Maximum Index Participation, the strategy should not deliver further upside, and instead its return would be limited to the Annual Return Cap. Thus, in instances where

13

the Index exceeds the Maximum Index Participation but does not exceed the Annual Return Cap, the strategy should outperform the Index, but not by a factor of 3 (excluding Fund fees and expenses).

Example D. Positive Index Returns in excess of the Annual Return Cap (i.e., returns of 9% or greater).

In instances where the Index exceeds the Annual Return Cap, the strategy will under-perform the Index in an amount equal to the Index’s performance minus the Annual Return Cap plus Fund fees and expenses.

Who Should Invest.The Fund is designed for investors with a moderately bullish view of the S&P 500 Index over each of the next five years. In other words, because the potential upside to Fund stockholders for each annual period is limited to the Annual Return Cap, a stockholder would not benefit if the return of the S&P 500 Index exceeded the Annual Return Cap. Conversely, since there will be no downside limit resulting from the Transactions, if the Index declines over an annual period, Fund stockholders would experience the full decline for the annual period (plus Fund fees and expenses). See “Investment Strategy — Hypothetical Return Examples on page [ ] of this Prospectus.

There can be no assurance that the investment strategy employed by the Fund will be successful or result in the investment objective of the Fund being achieved.

S&P 500 Index.As stated above, the Fund intends to invest in all of the securities that comprise the S&P 500 Index in the same proportions as the Index and/or other investments that enable the Fund to track the performance of the Index. Under normal circumstances, at least 80% of the value of the Fund’s net assets (including the proceeds of any borrowings) will be invested in common stocks of companies that comprise the S&P 500 Index (or synthetic instruments that have economic characteristics similar to securities that comprise the Index). This 80% policy is not a fundamental policy and therefore may be changed without your approval. However, we may not change or modify this policy unless we provide you with at least 60 days’ prior notice.

Index Replication Strategy.The S&P 500 Index is an index composed of 500 common stocks that are selected by Standard & Poor’s (“S&P”) and may include foreign securities. Most of these 500 stocks trade on the NYSE. These stocks represent approximately 70% of the market value of all U.S. common stocks but do not necessarily represent all of the largest companies. S&P selects the component stocks included in the S&P 500 Index with the aim of achieving a distribution that is representative of the various industry components of the U.S. market for common stocks. S&P also considers aggregate market value and trading activity in the selection process. Each stock in the S&P 500 Index is weighted by its total market value relative to the total market value of all securities in the S&P 500 Index.

The Fund’s investment strategy involves holding the common stocks of all of the 500 companies included in the S&P 500 Index — weighted in the same proportions as the Index — and/or other investments that enable the Fund to track the performance of the Index. By holding the common stocks of all of the 500 companies in the S&P 500 Index, the Fund will be entitled to receive dividends and other distributions from these companies to the extent that they are provided. The Fund also may use derivatives (such as, among others, exchange-traded funds, options contracts, swap agreement and futures and forward contracts) to track the performance of the Index. Derivatives are contracts whose value is based on the performance of an underlying financial asset, index or other investment. To the extent that the Fund uses derivatives, the Fund may not receive dividends and other distributions from the companies in the S&P 500 Index.

Exchange-traded funds, such as Standard and Poor’s Depositary Receipts (commonly known as SPDRs), are unit investment trusts or open-end investment companies that hold the common stocks of all of the companies in the S&P 500 Index. These funds generally are designed to closely track the price performance and dividend yield of the Index and, as their name suggests, trade on exchanges.

14

Call Options Generally.Each call option has a “strike price.” This is the value stated in the option for the S&P 500 Index on the option exercise date. If the value of the Index is actually higher than the strike price on the option exercise date, the holder of the call option is likely to exercise the option and will receive from the writer of the option the difference between the value of the Index on the exercise date and the strike price.

If the value of the Index is the same as, or lower than, the strike price of the option on the option exercise date, the call option will have no value on the exercise date and will not be exercised. Thus, for a call option on the Index to be profitable to its writer, the strike price needs to be the same as or lower than the value of the Index on the exercise date — the writer will then get to keep the premium and will not be required to make any payment under the option to the holder. Conversely, for a call option on the Index to be profitable to its holder, the value of the Index on the exercise date must be higher than the strike price and the difference between these two values must more than offset the premium that the holder paid for the option.

Asset Coverage.As stated above, as part of the Transactions, the Fund will sell a call option which will be “covered” by the Fund’s long portfolio. As the Fund’s call spreads will involve the simultaneous purchase of a lower “strike” call with the sale of a higher “strike” call from the same counterparty, call spreads are intrinsically “covered” assets. Thus, all of the Fund’s options positions will be covered, making it unlikely that the Fund could suffer a significant loss on the call option or call spreads.

Other Transactions.The Fund may invest in swap agreements, and futures and forward contracts, as part of its investment strategy. Swap agreements are two-party contracts entered into primarily by institutional investors for periods ranging from a day to more than one year. In a standard “swap” transaction, two parties agree to exchange the returns (or differentials in rates of return) earned or realized on particular predetermined investments or instruments. The gross returns to be exchanged or “swapped” between the parties are calculated with respect to a “notional amount,”e.g., the return on or increase (or decrease) in value of a particular dollar amount invested in a particular market measure. The Fund may use swap agreements based on or linked to the S&P 500 Index in order to track the performance of the Index.

Futures and forward contracts generally involve an agreement to buy or sell a security or other instrument, index or commodity at a specific price on a specific date. The Fund may purchase futures and forward contracts based on or linked to the S&P 500 Index in order to track the performance of the Index. The Fund intends to comply with the ratings requirements regarding counterparties discussed above when engaging in over-the-counter transactions involving swap agreements, and futures and forward contracts. In connection with the options, swap agreement and futures and forward contracts that the Fund may purchase or sell, the Fund may be required to pay certain transaction and related costs and may be required to maintain assets with the counterparties or other intermediaries. In addition, the derivatives in which the Fund may engage may be illiquid securities.

In seeking its investment objective, the Fund may make certain additional investments. The Fund may invest in illiquid securities. The Fund may purchase securities on a when-issued basis and may purchase or sell securities for delayed delivery. The Fund may lend its portfolio securities to qualified broker-dealers or institutional investors in an amount up to 331/3% of its total assets to earn additional income for the Fund and its stockholders. The Fund may borrow money from banks or through reverse repurchase agreements for temporary or emergency purposes, but not in excess of 331/3% of its total assets. The costs associated with borrowings may reduce the Fund’s net income.

Temporary Defensive Positions.The Fund does not intend to depart from its investment strategy in response to adverse market, economic or political conditions by engaging in transactions or strategies that would act as temporary defensive positions. See “Risk Factors and Special Considerations — Temporary Defensive Positions” on page [x] of this Prospectus.

15

Short-Term Investments.The Fund may use any of its assets, including short-term investments (“Short-Term Investments”), for fund management purposes, including paying fees and expenses of the Fund and meeting repurchase demands. The Fund generally expects to pay its expenses out of the dividend and other income received from its portfolio of assets that replicate the Index. The Fund will invest in Short-Term Transactions during periods following termination of Transactions and, until the fifth year of the Fund’s term, initiation of new Transactions. Short-Term Investments are short-term debt obligations and similar securities, and include: (1) securities issued or guaranteed as to interest and principal by the U.S. government or one of its agencies or instrumentalities; (2) debt obligations of U.S. banks, savings associations, insurance companies and mortgage bankers; (3) commercial paper and other short-term obligations of corporations, partnerships, trusts and similar entities; (4) repurchase agreements; and (5) other investment companies that invest principally in money market instruments. Money market instruments include longer-term bonds that have variable interest rates or other special features that give them the financial characteristics of short-term debt. The Fund also may hold cash and cash equivalents and may invest in participation interests in the money market securities mentioned above without limitation. To the extent the Fund makes Short-Term Investments, the Fund may be unable to achieve its investment objective.

RISK FACTORS AND SPECIAL CONSIDERATIONS

An investment in the Fund’s common stock may be speculative in that it involves a high degree of risk and should not constitute a complete investment program.

Investment Related Risks

General.Investing in the Fund involves certain risks. Because the value of your investment in the Fund will fluctuate, there is a risk that you will lose money. Your investment will decline in value if the value of the Fund’s investments decrease. When the value of the S&P 500 Index is declining, the value of the Fund’s shares is expected to decrease. The value of your shares also will be impacted by the Fund’s ability to successfully implement its investment strategy, and by market, economic and other conditions. As with any security, complete loss of investment is possible.

Index Tracking Errors.A portion of the Fund’s investment strategy involves making investments in a manner that seeks to track the performance of the S&P 500 Index. The Fund may not be able to acquire the common stocks of all the companies in the S&P 500 Index, hold these securities in the correct weightings or be able to track the performance of the Index. This may occur when the Index sponsor rebalances the S&P 500 Index (which is expected to occur on an annual basis), or otherwise. This also may occur when, for example, the call options, swap agreements, exchange-traded funds and/or futures and forward contracts the Fund purchases and sells do not, for a variety of reasons, perform as expected or result in the Fund receiving returns that are correlated (in any manner) with the performance of the Index.

The Fund may not be able to achieve returns that track the performance of the S&P 500 Index because the Fund will incur certain fees and expenses that are not applicable to (and not reflected in the performance of) the Index, such as, among others, the costs of managing the Fund and buying and selling investments for the Fund. As a result, the portions of the Fund’s performance that are based on holding investments to track the performance of the Index may be lower than the actual performance of the Index. When the value of the S&P 500 Index is declining, the value of the Fund’s shares is expected to decrease.

Equity Securities Risk.The Fund may invest in equity securities for the portion of its strategy that involves replicating the S&P 500 Index. An equity security, or stock, represents a proportionate share of the ownership of a company; its value is based on the success of the company’s business, any income paid to shareholders, the value of its assets, and general market conditions. Common stocks are an example of the equity securities in which the Fund invests. Although common stocks have historically generated higher average returns

16

than fixed-income securities over the long term, common stocks also have experienced significantly more volatility in those returns and in recent years have significantly underperformed relative to fixed-income securities. An adverse event, such as an unfavorable earnings report, may depress the value of a particular common stock held by the Fund. Also, the prices of common stocks are sensitive to general movements in the stock market and a drop in the stock market may depress the price of common stocks to which the Fund has exposure. Common stock prices fluctuate for several reasons including changes in investors’ perceptions of the financial condition of an issuer or the general condition of the relevant stock market, or when political or economic events affecting the issuers occur. In addition, common stocks prices may be particularly sensitive to rising interest rates, as the cost of capital rises and borrowing costs increase. The values of certain derivatives are likewise subject to the same factors that influence the values of common stocks because derivative prices may be based on the values of the common stocks to which they are linked.

General Risks Related to Derivatives.The Fund’s investment strategy involves the use of derivatives, such as, among others, “call spreads,” call options, swap agreements and futures and forward contracts. The Fund may use derivatives as a substitute for taking a position in the S&P 500 Index as part of its investment strategy. The Fund also may use derivatives to add leverage to the portfolio. The Fund’s use of derivatives involves risks different from, and possibly greater than, the risks associated with investing directly in the investments underlying these derivatives. The Fund may not be able to purchase or sell derivatives at times or in quantities it believes are necessary to track or offset the performance of the S&P 500 Index. The Fund also may not be able to purchase or sell derivatives on the Index because of, among other things, the lack of market participants that are willing to take contrary positions to that of the Fund.

Derivatives may be volatile and involve significant risk, such as, among other things, credit risk, currency risk, leverage risk, and liquidity risk. They also involve the risk of mispricing or improper valuation and correlation risk (i.e., the risk that changes in the value of the derivative may not correlate perfectly, or to any degree, with the underlying asset, rate or index). Using derivatives can disproportionately increase losses and reduce opportunities for gains when security prices, indices, currency rates or interest rates are changing in unexpected ways. The Fund may suffer disproportionately heavy losses relative to the amount of its investments in derivative contracts.

Changes in the value of derivative contracts may not match or offset fully changes in the values of the hedged portfolio securities or indices. The Fund’s investments in derivatives could result in the Fund losing more than the principal amount invested. The use of derivatives also may increase the amount of taxes payable by stockholders. Also, suitable derivative transactions may not be available in all circumstances and no assurance can be given that the Fund will engage in these transactions to reduce exposure to other risks when that would be beneficial. In addition, derivatives can make the Fund less liquid and harder to value, especially in declining markets.

The Fund may purchase and sell over-the-counter derivatives on the S&P 500 Index. In so doing, the Fund will be exposed to the risk that counterparties to these derivatives, for whatever reason, will be unable or unwilling to meet their obligations under the arrangements. For a discussion of the additional risks associated with over-the-counter derivatives refer to the “Risk Factors and Special Considerations — Illiquid Securities” and the “Risk Factors and Special Considerations — Counterparties” sections on pages[ ]and[ ], respectively, of this Prospectus.

Call Spreads and Call Options.The Fund’s investment strategy involves: (1) purchasing call spreads that have embedded within them the economic effect of purchasing an at-the-money European-style call option on the S&P 500 Index and simultaneously selling an out-of-the-money European-style call option on the S&P 500 Index; and (2) selling out-of-the-money European-style over-the-counter call options on the S&P 500 Index. These portions of the Fund’s strategy subject the Fund to certain additional risks. The Fund may not be able to enter into (or close out) these Transactions, at times or in quantities it believes are necessary to accomplish the

17

Fund’s objective. The Fund also may not be able to enter into (or close out) these Transactions because of, among other things, the lack of market participants that are willing to take contrary positions to that of the Fund.

Through the call spreads the Fund will be exposed to the same risks as those of a purchaser of call options on the S&P 500 Index. As a purchaser of call options on the S&P 500 Index, the Fund will have to pay premiums to the sellers of these options. Although the Fund will seek to offset, to the extent possible, the amount of premiums paid to the sellers of the call spreads by the Fund’s sale of out-of-the-money call options, there is no assurance that the Fund will be able to offset fully (or to any degree) the amount of premiums paid by the amount of premiums received. In addition, if the value of the S&P 500 Index is less than or equal to the strike prices of the at-the-money call options that the Fund has purchased, the Fund generally will not exercise these options and will incur losses equal to the amount of premiums paid to the sellers of the options. In these instances, the out-of-the-money call options that the Fund sold with higher strike prices than the purchased call options would also expire worthless and the premiums earned from selling those options would help offset the cost of premiums paid on the purchased calls. To the extent the Fund purchases call options as part of its strategy to replicate the Index, it will be subject to risks similar to those described with respect to the purchased call options embedded in the call spreads.

The Fund will also be exposed to the risks of a seller of call options on the S&P 500 Index. The Fund, by selling call options on the S&P 500 Index, may forego the opportunity to benefit fully from potential increases in the value of the S&P 500 Index above the strike prices specified in the Fund’s written call options (or otherwise embedded in the call spreads). For example, if the value of the S&P 500 Index is greater than the strike prices of the out-of-the-money call options that the Fund has sold, the Fund’s return may be less than the return the Fund would have earned if it had invested solely in the securities underlying the S&P 500 Index or investments designed to track the performance of the Index. The Fund, however, would continue to bear the risk of declines in the values of the investments purchased to track the performance of the Index. For example, if the value of the S&P 500 Index is lower than the strike prices of the at-the-money call options that the Fund has embedded within the call spreads, the Fund’s performance generally is expected to correspond to the negative performance of the Index plus any Fund expenses, but may not do so for a variety of reasons.

As part of its Index replication strategy, the Fund also may sell covered call options. In this instance, the Fund may not receive sufficient premiums from selling call options to cover fully or mitigate any losses the Fund may sustain by any increase in the value of the S&P 500 Index over the strike prices in these options. In the event that the Fund sells a call option on the Index but does not own all of the securities that comprise the Index (or investments that enable the Fund to track the performance of the Index), or the securities in the same weightings as the Index, the Fund may be exposed to significant losses if the value of the Index increases substantially over the strike price specified in the written call option. The potential risk of loss in such a situation could be substantial.

The Fund expects to purchase over-the-counter call spreads and sell call options on the S&P 500 Index and other investments that enable the Fund to track the performance of the Index. The Fund will be exposed to the risk that counterparties to these investments, for whatever reason, will be unable or unwilling to meet their obligations under the arrangements. For a discussion of the additional risks associated with over-the-counter derivative instruments refer to the “Risk Factors and Special Considerations — Illiquid Securities” and the “Risk Factors and Special Considerations — Counterparties” sections on pages [ ] and [ ], respectively, of this Prospectus.