Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| | |

| (Mark One) | | |

ý |

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2008 |

OR |

o |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

|

COMMISSION FILE NUMBER 001-32363

ADVANCE AMERICA, CASH ADVANCE CENTERS, INC.

(Exact name of registrant as specified in its charter)

| | |

Delaware

(State or other jurisdiction of

incorporation or organization) | | 58-2332639

(I.R.S. Employer

Identification No.) |

135 North Church Street

Spartanburg, South Carolina

(Address of principal executive offices) |

|

29306

(Zip Code) |

Registrant's telephone number, including area code:864-342-5600

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Title of Each Class | | Name of Each Exchange on which Registered |

|---|

| Common Stock, par value $.01 per share | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer o | | Accelerated filer ý | | Non-accelerated filer o

(Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by a check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes o No ý

As of June 30, 2008, the aggregate market value of voting stock (based upon the last reported sales price on the New York Stock Exchange) held by nonaffiliates of the registrant was $260,056,914.

At February 27, 2009, there were 61,643,538 shares of the registrant's Common Stock, par value $.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain information required by Part III of this report is incorporated herein by reference from the registrant's proxy statement for the registrant's Annual Meeting of Stockholders to be held on May 21, 2009.

Table of Contents

ADVANCE AMERICA, CASH ADVANCE CENTERS, INC.

Form 10-K

For the year ended December 31, 2008

| | | | |

PART I | | |

Item 1. | | Business | | 4 |

Item 1A. | | Risk Factors | | 18 |

Item 1B. | | Unresolved Staff Comments | | 29 |

Item 2. | | Properties | | 29 |

Item 3. | | Legal Proceedings | | 30 |

Item 4. | | Submission of Matters to a Vote of Security Holders | | 34 |

PART II | | |

Item 5. | | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | | 35 |

Item 6. | | Selected Financial Data | | 38 |

Item 7. | | Management's Discussion and Analysis of Financial Condition and Results of Operations | | 42 |

Item 7A. | | Quantitative and Qualitative Disclosures About Market Risk | | 71 |

Item 8. | | Financial Statements and Supplementary Data | | 72 |

Item 9. | | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | | 111 |

Item 9A. | | Controls and Procedures | | 111 |

Item 9B. | | Other Information | | 112 |

PART III | | |

Item 10. | | Directors, Executive Officers and Corporate Governance | | 113 |

Item 11. | | Executive Compensation | | 114 |

Item 12. | | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 114 |

Item 13. | | Certain Relationships and Related Transactions, and Director Independence | | 114 |

Item 14. | | Principal Accountant Fees and Services | | 114 |

PART IV | | |

Item 15. | | Exhibits and Financial Statement Schedules | | 114 |

SIGNATURES | |

118 |

2

Table of Contents

FORWARD-LOOKING STATEMENTS

The matters discussed in this Annual Report on Form 10-K that are forward-looking statements are based on current management expectations that involve substantial risks and uncertainties, which could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements. These statements can be identified by the fact that they do not relate strictly to historical or current facts. They use words such as "expect," "intend," "plan," "believe," "project," "anticipate," "may," "will," "should," "would," "could," "estimate," "continue" and other words and terms of similar meaning in conjunction with a discussion of future operating or financial performance. You should read statements that contain these words carefully, because they discuss our future expectations, contain projections of our future results of operations or of our financial position or state other "forward-looking" information.

The factors listed in "Item 1A. Risk Factors," as well as any cautionary language in this Annual Report, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Although we believe that our expectations are based on reasonable assumptions, actual results may differ materially from those in the forward-looking statements as a result of various factors, including, but not limited to, those described in "Item 1A. Risk Factors."

Forward-looking statements speak only as of the date of this Annual Report. Except as required under federal securities laws and the rules and regulations of the U.S. Securities and Exchange Commission, we do not have any intention, and do not undertake, to update any forward-looking statements to reflect events or circumstances arising after the date of this Annual Report, whether as a result of new information, future events or otherwise. As a result of these risks and uncertainties, readers are cautioned not to place undue reliance on the forward-looking statements included in this Annual Report or that may be made elsewhere from time to time by, or on behalf of, us. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

3

Table of Contents

PART I

ITEM 1. BUSINESS.

Overview

We are the largest provider of cash advance services in the United States, as measured by the number of centers operated. As of December 31, 2008, we operated 2,767 centers in 33 states in the United States, 20 centers in the United Kingdom and 10 centers in Canada, and had 79 limited licensees in the United Kingdom. We do not franchise any of our centers in the United States. Cash advances are small-denomination, short-term, unsecured advances that are typically due on the customer's next payday. We focus primarily on providing cash advance services to middle-income working individuals and do not provide pawn lending, title lending or similar services.

In 2005, we began to expand the manner in which we offered cash advance and short-term loan products and services, primarily in response to increasing legislative and regulatory restrictions. We previously marketed, processed and serviced installment loans made by lending banks under our former agency business model, which we discontinued in 2006. During 2006, we began offering installment loans directly to customers in Illinois and prepaid debit cards in most of our centers as an agent of an Office of Thrift Supervision ("OTS") regulated bank. In the fall of 2007, we began selling money orders and providing money transfer services as an agent of a registered money transmitter. In 2008, we began facilitating the offering of tax preparation services provided by a third party to customers. In the fall of 2008, we began offering small loans to customers in Ohio and open-ended lines of credit to customers in Virginia. In addition, in 2008, we implemented an online application process pursuant to which customers visiting our website may apply for cash advances from us and come to one of our centers to complete their transaction, or apply for a cash advance from a third party that will be directly deposited into their bank accounts in accordance with the laws of the state where the customer resides. In the future we intend to expand our product and service offerings. The table below shows selected demographics of the customers we serve:

| | | | | | | |

| | Customers (1) | | U.S. Census 2000 | |

|---|

Average age (years) | | | 40 | | | 36 | |

Median household income | | $ | 40,984 | | $ | 41,994 | |

Percentage homeowners | | | 48 | % | | 66 | % |

Percentage with high school degrees | | | 87 | % | | 81 | % |

- (1)

- Based on a study performed for us of over 1.0 million customers served during the twelve months ended December 31, 2008 for whom this information was available.

Our goal is to attract customers by offering straightforward, rapid access to short-term funding, while providing high-quality, professional customer service. We believe that our products and services represent a competitive source of liquidity to the customer relative to other alternatives, which typically include overdraft privileges or bounced check protection, late bill payments, checks returned for insufficient funds and short-term collateralized loans.

Our centers, which we design to have the appearance of mainstream financial institutions, are typically located in middle-income shopping areas with high retail activity. As of December 31, 2008, we operated 2,661 centers under the "Advance America" brand and 136 centers under the "National Cash Advance" brand.

4

Table of Contents

The following table presents key operating data for our business:

| | | | | | | | | | |

| | Year Ended December 31, | |

|---|

| | 2006 | | 2007 | | 2008 | |

|---|

Number of centers open at end of period | | | 2,853 | | | 2,832 | | | 2,797 | |

Number of customers served—all credit products (thousands) | | | 1,494 | | | 1,524 | | | 1,419 | |

Number of cash advances originated (thousands) | | | 11,539 | | | 11,979 | | | 11,762 | |

Aggregate principal amount of cash advances originated (thousands) | | $ | 4,082,865 | | $ | 4,317,980 | | $ | 4,296,493 | |

Average amount of each cash advance originated | | $ | 353 | | $ | 361 | | $ | 366 | |

Average charge to customers for providing and processing a cash advance | | $ | 55 | | $ | 55 | | $ | 55 | |

Average duration of a cash advance (days) | | | 16.2 | | | 16.5 | | | 16.8 | |

Average number of lines of credit outstanding during the period (thousands) (1) | | | 20 | | | 24 | | | 10 | |

Average amount of aggregate principal on lines of credit outstanding during the period (thousands) (1) | | $ | 8,963 | | $ | 10,377 | | $ | 6,946 | |

Average principal amount on each line of credit outstanding during the period (1) | | $ | 448 | | $ | 429 | | $ | 672 | |

Number of installment loans originated (thousands) (2) | | | 29 | | | 31 | | | 32 | |

Aggregate principal amount of installment loans originated (thousands) (2) | | $ | 13,905 | | $ | 12,997 | | $ | 14,841 | |

Average principal amount of each installment loan originated (2) | | $ | 486 | | $ | 417 | | $ | 462 | |

- (1)

- We offered lines of credit in Pennsylvania from June 2006 through July 2007. We began offering lines of credit in Virginia in November 2008.

- (2)

- For the year ended December 31, 2006, the installment loan activity reflects a) loans we originated as agent for lending banks in Arkansas and Pennsylvania; and b) loans we originated directly as the lender in Illinois. The loans originated as an agent contained fixed payment terms and no discounts for early repayment. These originations ceased during 2006. The loans we originated directly as the lender in Illinois had a stated term of approximately 5 months, required monthly payments that amortized the loan to zero over the term and contained rebating provisions. During early 2008, the installment loan product in Illinois was converted to allow for multiple payment frequencies, interest only payments and simple interest rate calculations.

Our Industry

The cash advance services industry grew significantly from the early 1990s through the middle of this decade in response to a shortage of available short-term consumer credit alternatives from traditional banking institutions. The high charges associated with having insufficient funds in one's bank account, as well as other late/penalty fees charged by financial institutions and merchants, helped create customer demand for cash advances. A cash advance typically involves a single charge, unlike other alternatives that often require collateral, origination and administration fees, interest payments, additional incremental charges and prepayment penalties and charges for other services, such as credit life insurance. Other alternatives, such as bounced checks and late bill payments, may also have negative credit consequences. We believe customers use cash advances as a simple, quick and confidential way to meet short-term cash needs between paydays while avoiding the potentially higher costs and negative credit consequences of other alternatives. Our industry has largely stopped growing in the United States. Federal and state legislative and regulatory challenges could cause our industry to become economically unviable.

5

Table of Contents

We believe many banks and other traditional financial institutions reduced or eliminated their provision of small-denomination, short-term consumer loans, in part due to the costs associated with originating these loans. As a result, a significant number of companies now offer short-term consumer loans, or cash advances, to lower-income and middle-income individuals. The providers of these types of services are fragmented and range from specialty finance offices, like our centers, to retail stores in other industries that offer short-term consumer loans as ancillary services. Because of the relatively low cost of entry and the regulatory safe harbor that many state statutes provide for cash advances, the industry experienced significant growth during the last decade. Some providers offer cash advances and short-term loans over the internet as well as by telephone.

Competitive Strengths

Market Leader with Economies of Scale. With 2,767 centers located in 33 states as of December 31, 2008, we are the largest provider of cash advance services in the United States, as measured by the number of centers operated, with approximately twice as many centers as the next largest provider of cash advance services. We believe our size provides us with a leadership position in the industry, allows us to leverage our brand name and enables us to benefit from economies of scale and to enter favorable relationships with landlords, strategic vendors and other suppliers. We have centralized most center support functions, including marketing and advertising, accounting and finance, treasury management, human resources, regulatory compliance, information technology support and customer support systems.

Continued Focus on Government Affairs. We have experience with the legislative and regulatory environment in all of the states in which we operate as well as at the federal level. We are a founding member of the Community Financial Services Association of America ("CFSA"), an industry trade group comprised of our company and more than 100 other companies engaged in the cash advance services industry. Our internal government affairs team, together with the CFSA, seeks to encourage favorable legislation that permits us to operate profitably within a balanced regulatory framework. In 2008, 2007 and 2006, cash advance legislation we supported was adopted in five states, 10 states and three states, respectively. Our approach is to continue to work with policymakers and grassroots organizations to provide a predictable and favorable legislative environment for the cash advance services industry.

Rigorous Implementation of Center-Level Controls. We believe that our management information systems, our cash management systems and our internal compliance systems are critical to our success. We employ a proprietary point-of-sale system used to record transactions in our centers. This information is recorded daily and analyzed at our centers and at our headquarters. We also employ a third-party cash reconciliation software system to balance and monitor cash receipts and disbursements. The principal benefits from our use of these two systems are our quick recognition of variances from expected operating results, our early detection of theft and fraud and our ability to monitor compliance with various federal and state laws.

Geographical Diversification of Our Centers. With centers located in 33 states as of December 31, 2008, we believe we have developed a significant presence throughout the United States. We now also operate centers in Canada and the United Kingdom. This geographic diversification helps mitigate the risk and possible financial impact of unfavorable legislative changes or the economic environment of a particular region and allows us to take advantage of competitive opportunities in those markets. For the year ended December 31, 2008, California, Texas and Florida, which accounted for approximately 11.2%, 10.6% and 10.4%, respectively, of our total revenues, were the only states that accounted for more than 10% of our total revenues.

6

Table of Contents

Business Strategy

Maintain Position as the Market Leader. A principal component of our strategy is being a leading provider of cash advance services in each market where we operate. We believe that by offering the convenience of multiple locations, as well as exceptional customer service, we will maintain a high level of customer satisfaction. In general, we believe that new market opportunities in the United States have decreased and we have adjusted our roll-out of new centers accordingly. In the United States, we opened 202 centers in 2007 and 40 centers in 2008. We currently expect to open fewer centers during 2009. We may consider opportunities to acquire cash advance companies or businesses in select markets.

Improve Profitability of Existing Centers. As the competitive environment has shifted away from new center openings, we are now focusing on opportunities to improve the profitability of our existing centers, including by selectively consolidating centers. We believe we can combine certain centers that are near each other and maintain the majority of the customers and revenues of both centers while reducing operating costs. We may also attempt to acquire new customers from competitors who are exiting certain markets where we operate and therefore increase the average number of customers per center. By selectively consolidating centers and increasing the average number of customers served per center, we hope to reduce operating costs and increase center gross profit.

Continue to Drive New Center Operating Performance. In our operating centers that opened in 2008 and 2007, we are striving to match the operating performance of our centers that have been open at least 24 months. To do this, our employees are evaluated and compensated, in part, based on their achievement of operational goals, which we adjust each year to account for the continued improvement in our business. The three key metrics we reward are: (1) maintaining a high level of compliance with applicable laws and regulations; (2) meeting stated growth objectives; and (3) meeting loss targets. We believe that by focusing on these specific goals and tying them to employee compensation, we can achieve operating performance in our newer centers comparable to the operating performance at our mature centers.

Support Improvement of the Legislative and Regulatory Environment. As of December 31, 2008, 35 states and the District of Columbia had specific laws that permitted cash advances or related services. We remain committed to working with policymakers and grassroots organizations to facilitate the implementation of a balanced, viable and predictable regulatory framework that protects the interests of the customers we serve while allowing us to operate profitably in every state.

Further Expand Our Product and Service Offerings. While our primary focus will continue to be on cash advance services, we are actively exploring complementary product and service offerings to take advantage of our brand name and national footprint. Over the last three years, we began to offer prepaid debit cards, money transfer services, and tax preparation services as an agent for third-party vendors. We believe these products increase customer satisfaction and enhance revenue. During 2008, we began accepting online applications through Advance America websites, where customers may either (1) apply for cash advances from us, and come to a center to complete their transactions; or (2) apply for cash advances from a third party that will be deposited directly to their bank account.

Our Services

In most states where we operate, we originate cash advance services under the authority of different state-governed enabling statutes that allow for cash advances ranging from single and multiple installment closed-end terms to revolving lines of credit with open-ended terms (which we refer to as our standard business model). We refer to these products and services collectively as cash advance services. The particular cash advance services offered in any given location may change from time to time depending upon changes in state law and federal law. For instance, changes in Ohio laws caused

7

Table of Contents

us to begin offering single installment cash advances under Ohio's Small Loan Act. Additionally, where permitted by applicable law, we may assume the responsibility of serving as an agent to a regulated lender. For instance, prior to 2007, we conducted business in certain states as a marketing, processing and servicing agent for Federal Deposit Insurance Corporation ("FDIC") supervised, state-chartered banks that made cash advances and installment loans to their customers pursuant to the authority of the laws of the states in which they were located and federal interstate banking laws, regulations and guidelines (which we refer to as the agency business model). We refer to the banks for which we acted as an agent under the agency business model as lending banks. We currently operate all of our centers under the standard business model.

In Texas, where we operate as a Credit Services Organization ("CSO"), we offer a fee-based credit services package to assist customers in trying to improve their credit and in obtaining an extension of consumer credit through a third-party lender. Under the terms of our agreement with this lender, we process customer applications and are contractually obligated for all losses.

Under our standard business model, we provide cash advance services as specified by the laws of the jurisdiction where we operate. In the states where we previously operated under the agency business model, the lending banks provided cash advances and installment loans and charged fees and/or interest as specified by the laws of the states in which they were located and consistent with the regulatory authority of the FDIC and federal banking law. Loans made by the third-party lender in Texas are governed by Texas law. Online cash advances made by a third-party lender are governed by the laws of the state where the customer resides. The permitted size of a cash advance varies by jurisdiction and ranges from $50 to $5,000. However, our typical cash advance will range from $50 to $1,000. The finance charges on cash advance services currently offered by us also vary by jurisdiction and range up to 22% of the amount of a cash advance.

Additional fees that we may charge and collect include origination fees, annual participation fees, fees for returned checks, late fees and other fees as permitted by applicable law. Presently, none of the cash advance services we offer include annual participation fees. Origination fees on cash advance services currently offered by us range from $15 to $30, but future cash advance services may have higher or lower origination fees depending on applicable state law. Fees for returned checks or electronic debits that are denied for non-sufficient funds ("NSF") vary by state and range up to $30 and late fees vary by state and range up to $50. For the years ended December 31, 2008 and 2007, total NSF fees collected were approximately $3.3 million and $3.5 million, respectively, and total late fees collected were approximately $373,000 and $313,000, respectively. In Texas, the third-party lender charges an NSF fee and a late fee on its loans in accordance with Texas law.

A customer may obtain a cash advance in one of three ways: (1) by visiting one of our centers in-person and completing an application; (2) by visiting our website, beginning the application process online, then visiting one of our centers in person to complete the application and receive funding; or (3) by visiting our website, completing an application online and receiving a cash advance from a third-party lender that is directly deposited in the customer's bank account. Each new customer must provide us with certain personal information such as his or her name, address, phone number, employment information or source of income, and references. This information is entered into our information system and that of the applicable lender. The customer's identification, proof of income and/or employment and proof of bank account are verified. In order for a new customer to be approved for a cash advance, we must be able to verify his or her identification and he or she is required to have a bank account and a regular source of income, such as a job.

Except for cash advances completed by third-party lenders, we determine whether to approve a cash advance to our customers in every jurisdiction. The third-party lenders decide whether to approve the loan or cash advance and establish all of the underwriting criteria and terms, conditions and features of the customer agreement. We require proof of identification, bank account and income

8

Table of Contents

source, as described above, and primarily consider the customer's income in determining the amount of a cash advance. We do not perform credit checks through consumer reporting agencies.

After the documents presented by the customer have been reviewed for completeness and accuracy, copied for record-keeping purposes and the cash advance has been approved, the customer enters into an agreement governing the terms of the cash advance. The customer then provides a personal check or an Automated Clearing House ("ACH") authorization, which enables electronic payment from the customer's account, to cover the amount of the cash advance plus charges for applicable fees and/or interest and/or the balance due under the agreement, and makes an appointment to return on a specified due date, typically his or her next payday, to repay the cash advance plus the applicable charges. However, in some states, customers are not required to provide us with a personal check or ACH authorization, and payment cycles may vary depending upon state law and product type. At the specified due date, the customer is required to make the applicable payment, usually payment in full of the cash advance plus fees and interest if applicable. Payment is usually made in person, in cash at the center where the cash advance was initiated or issued unless the cash advance was completed on the internet, in which case the customer makes payment by ACH authorization.

Upon payment in full, the customer's check is returned and/or his or her ACH authorization is deemed to be revoked. If the customer does not repay the outstanding amount in full on or before the due date, we will seek to collect from the customer the outstanding amount and any applicable fees, including late and NSF fees due, and may deposit the customer's personal check or initiate the electronic payment from the customer's bank account.

We may offer alternative products and services to our customers where permissible under applicable law. For instance, in Ohio we currently offer check cashing services at state authorized rates. We may also offer the products or services of a third party that we market, process and/or service at our centers pursuant to an agreement with the third party. For instance, we currently offer (1) pre-paid debit cards; (2) money orders, money transmission and bill payment services; and (3) facilitation of a third party's tax preparation services. Our Advance America branded pre-paid Visa debit card is issued by an Office of Thrift Supervision ("OTS") regulated bank. The card allows a cardholder to load cash onto the card and use the card wherever VISA debit cards are accepted. We are compensated under an agreement with the bank based on a number of factors related to the bank's revenue from purchases and subsequent cardholder activity, such as charges for loads, ATM withdrawals, account maintenance/plan charges and point of sale purchases. In the third and fourth quarters of 2007, we began selling money orders, providing money transfer services and bill payment services as an agent of a licensed third-party money transmitter. We are compensated by the money transmitter based upon the number and value of money transfers, money orders and bill payments made by our centers. Finally, in 2008, we began facilitating the offering of tax preparation services by a third-party tax preparation provider. We receive a percentage of the tax preparation provider's fees from customers related solely to the tax preparation services.

Seasonality

Our business is seasonal due to the impact of fluctuating demand for cash advances services and fluctuating collection rates throughout the year. Demand has historically been higher in the third and fourth quarters of each year, corresponding to the back-to-school and holiday seasons, and lowest in the first quarter of each year, corresponding to our customers' receipt of income tax refunds.

Credit Facility

We depend on borrowings under our revolving credit facility to fund our products and services and our other liquidity needs. Our day-to-day balances under our revolving credit facility, as well as our cash balances, vary because of seasonal and day-to-day requirements resulting from making and

9

Table of Contents

collecting cash advances. Our borrowings under our revolving credit facility will also increase as the demand for cash advances increases during our peak periods such as the back-to-school and holiday seasons. Conversely, our borrowings typically decrease during the tax refund season when cash receipts from customers peak and customer demand for new cash advances decreases.

Collection Procedures

Repayment terms vary depending upon state law, the type of cash advance service offered, and whether the cash advance was completed online or in one of our centers. Generally, as part of the closing process, we explain the customer's repayment obligations and establish the expectation that the customer will pay us in cash on or before the due date in accordance with their agreement with us. The day before the due date, we generally call the customer to confirm their payment.

If a customer does not pay the amount due, then our management has the discretion to either (1) commence past-due collection efforts, which typically may proceed for up to 14 days in most states, or (2) deposit the customer's personal check or debit their bank account in accordance with their ACH authorization. If management decides to commence past-due collection efforts, employees typically contact the customer by telephone or in person to obtain a payment or a promise to pay and, in cases where we hold a check, attempt to exchange the customer's check for a cashier's check, if funds are available.

If unable to meet his or her payment obligations, the customer may qualify for an extended payment plan ("Payment Plan"). In most states, the terms of our Payment Plan conform to the CFSA Best Practices for extended payment plans. Certain states have specified their own terms and eligibility requirements for Payment Plans. Generally, a customer may enter into a Payment Plan for no additional fee once every twelve months and the Payment Plan will call for scheduled payments that coincide with the customer's next four paydays. In some states, a customer may enter into a Payment Plan more frequently. We do not engage in collection efforts while a customer is enrolled in a Payment Plan. If a customer misses a scheduled payment under a Payment Plan, we may resume our normal collection procedures. We do not offer a Payment Plan for multiple installment loans or lines of credit. Nor does the third-party lender in Texas offer a Payment Plan for advances to its customers. The third-party internet lender offers Payment Plans as required by state law.

If, at the end of this past-due collection period or Payment Plan, the center has been unable to collect the amount due, the customer's check is deposited or their ACH authorization is processed. Additional collection efforts are not required if the customer's deposited check or our ACH debit clears. If the customer's check or the ACH debit does not clear and is returned because of non-sufficient funds in the customer's account or because of a closed account or a stop-payment order, we begin additional collection efforts. These additional collection efforts are carried out by center employees and typically include contacting the customer by telephone or in person to obtain payment or a promise to pay and attempting to exchange the customer's check for a cashier's check, if funds become available. We also send out a series of collection letters, which are automatically distributed from a central location based on a set of pre-determined criteria.

In the case of cash advances in the form of lines of credit, if a customer fails to make payment when due in accordance with the terms of their agreement with us, then management may close the line of credit, accelerate the maturity date and take the steps outlined above or work with the customer to bring his or her payments current. If we close the line of credit and accelerate the maturity date, we stop charging interest on the outstanding amount and begin collection efforts as described above.

10

Table of Contents

Center Operations

We operate the largest network of cash advance centers in the United States. The following table illustrates the composition of our center network by geographic area as of the specified dates:

| | | | | | | | | | | |

| | As of December 31, | |

|---|

State | | 2006 | | 2007 | | 2008 | |

|---|

Alabama | | | 140 | | | 145 | | | 144 | |

Arizona | | | 60 | | | 56 | | | 53 | |

Arkansas (1) | | | 30 | | | 30 | | | — | |

California | | | 302 | | | 286 | | | 290 | |

Colorado | | | 67 | | | 72 | | | 68 | |

Delaware | | | 14 | | | 15 | | | 16 | |

Florida | | | 248 | | | 261 | | | 257 | |

Idaho | | | 15 | | | 11 | | | 10 | |

Illinois | | | 72 | | | 81 | | | 80 | |

Indiana | | | 123 | | | 117 | | | 113 | |

Iowa | | | 37 | | | 36 | | | 35 | |

Kansas | | | 56 | | | 59 | | | 59 | |

Kentucky | | | 43 | | | 42 | | | 44 | |

Louisiana | | | 76 | | | 85 | | | 85 | |

Michigan | | | 137 | | | 150 | | | 152 | |

Mississippi | | | 53 | | | 61 | | | 61 | |

Missouri | | | 84 | | | 90 | | | 91 | |

Montana | | | 8 | | | 7 | | | 5 | |

Nebraska | | | 24 | | | 24 | | | 24 | |

Nevada | | | 11 | | | 14 | | | 14 | |

New Hampshire (2) | | | 20 | | | 24 | | | 24 | |

New Mexico (1) | | | 12 | | | 10 | | | — | |

North Dakota | | | 8 | | | 8 | | | 8 | |

Ohio | | | 231 | | | 244 | | | 244 | |

Oklahoma | | | 67 | | | 65 | | | 68 | |

Oregon (3) | | | 53 | | | — | | | — | |

Pennsylvania (3) | | | 99 | | | — | | | — | |

Rhode Island | | | 15 | | | 18 | | | 21 | |

South Carolina | | | 129 | | | 136 | | | 138 | |

South Dakota | | | 12 | | | 12 | | | 12 | |

Tennessee | | | 65 | | | 63 | | | 63 | |

Texas | | | 231 | | | 256 | | | 252 | |

Utah | | | — | | | 6 | | | 6 | |

Virginia | | | 142 | | | 150 | | | 151 | |

Washington | | | 110 | | | 103 | | | 102 | |

Wisconsin | | | 52 | | | 66 | | | 67 | |

Wyoming | | | 7 | | | 10 | | | 10 | |

| | | | | | | | |

| | Total United States | | | 2,853 | | | 2,813 | | | 2,767 | |

Canada | | | — | | | 7 | | | 10 | |

United Kingdom | | | — | | | 12 | | | 20 | |

| | | | | | | | |

| | Total | | | 2,853 | | | 2,832 | | | 2,797 | |

| | | | | | | | |

- (1)

- We closed all of our centers in Arkansas and New Mexico during 2008.

- (2)

- We plan to close all our centers in New Hampshire during 2009.

- (3)

- We closed all of our centers in Oregon and Pennsylvania during 2007.

11

Table of Contents

Our domestic and international revenues and long-lived assets as of and for the three years ended December 31, 2006, 2007, and 2008 are as follows (in thousands):

| | | | | | | | | | | | | | | | | | | |

| | Domestic | | International | |

|---|

| | 2006 | | 2007 | | 2008 | | 2006 | | 2007 | | 2008 | |

|---|

| Revenues | | $ | 672,294 | | $ | 708,832 | | $ | 673,567 | | $ | — | | $ | 725 | | $ | 2,869 | |

| Long-lived assets | | | 191,214 | | | 183,136 | | | 171,525 | | | — | | | 5,815 | | | 5,991 | |

We have a staff of internal regulatory auditors based throughout the United States whose function is to monitor compliance by our centers with applicable federal and state laws and regulations, the CFSA Best Practices and our internal policies and procedures. The auditors conduct periodic unannounced audits of our centers. They typically spend one to two days in each center, although the time may vary if a more extensive investigation is needed. The auditors typically review customer files, reports, held checks, cash controls and compliance with state specific legal requirements and disclosures. Upon completion of an audit, the auditor will conduct an exit interview with the center personnel and/or the divisional director and discuss issues found during the review. As part of the internal audit program, reports for management regarding audit results are prepared to help identify compliance issues that need to be addressed and areas for further training.

Prior Relationships with the Lending Banks

Prior to December 31, 2006, we operated in certain states under marketing, processing and servicing agreements with the lending banks for which we were compensated by the lending banks for marketing, processing and servicing the cash advances and installment loans the lending banks made to their customers. Approximately 1.8% of our total revenues in the year ended December 31, 2006 were derived from our former agency business model. None of our revenues during the years ended December 31, 2008 and 2007 were generated from the agency business model.

Competition

We believe that the principal competitive factors in the cash advance services industry are location, customer service, convenience, speed and confidentiality. We face intense competition in an industry with low barriers to entry, and we believe that competition is increasing as our industry matures and consolidates. We also compete with services offered by traditional financial institutions, such as overdraft protection, and with other cash advance providers, small loan providers, credit unions, short-term consumer lenders and other financial services entities and retail businesses that offer consumer loans or other products and services that are similar to ours. Businesses offering cash advances and short-term loans over the internet as well as by phone also compete with us.

The cash advance services industry is highly fragmented. In March 2008, Stephens, Inc. estimated that there were approximately 23,600 outlets (including our own centers) in the United States. Our network of 2,767 centers in the United States as of December 31, 2008 represents the largest network of such centers in the United States. We believe that our two largest single-service cash advance company competitors, Check 'n Go and Check into Cash, have over 1,350 and 1,270 cash advance centers, respectively. Also, we believe QC Holdings, Inc. has nearly 600 locations in the United States. The remaining competitors are primarily local chains and single-unit operators.

To a lesser extent, we compete with other companies that offer cash advance services as an ancillary financial product to complement their primary business of cashing checks, selling money orders, providing pawn lending, title lending, money transfer services or offering similar financial services. These competitors include Dollar Financial Corp., ACE Cash Express, Inc., Cash America International, Inc. and Rent-A-Center, Inc.

Our centers also have been facing increased competition from banks and credit unions that offer their account holders cash advance services as well as other products and services such as overdraft privileges and bounced check protection, which are similar to our cash advance services.

12

Table of Contents

Because of the relatively low cost of entry and the regulatory safe harbor that many state statutes provide for cash advance services, our industry continues to experience significant competition.

Marketing and Advertising

The goal of our marketing strategy is to maximize revenues by attracting new customers and cross-selling all our products and services to existing customers. We utilize the results of data analysis from our customer database to target prospects who have characteristics similar to the customers we serve.

Our mass media advertising (primarily through television, direct mail, radio, internet and the yellow pages) increases awareness, acceptance and, ultimately, the use of our products and services. We utilize marketing promotions at our centers with high-impact, consumer-relevant, point-of-purchase materials such as brochures, flyers and posters. Local marketing also includes attendance at, or sponsorship of, community events such as food drives, voter registration programs and other events.

Our advertising expenditures fluctuate from quarter to quarter based on our perception of market opportunities and customer needs.

Information Systems

We employ a proprietary point-of-sale system that is used to record transactions in our centers. The point-of-sale system is also used at our headquarters to develop information for management. We also employ a third-party cash reconciliation software system to reconcile bank accounts and monitor cash receipts and disbursements.

The point-of-sale system is designed to facilitate customer service and speed the dissemination of information for cash flow purposes. This system records and monitors the details of every transaction, reduces the risk of transaction errors, and provides automated, integrated transactions that are designed to ensure standardization and compliance with applicable state and federal regulations.

Transaction data gathered by our point-of-sale system is integrated into our management information system, general ledger and cash reconciliation software. Our point-of-sale system and cash reconciliation software systems allow us to:

- •

- monitor daily revenue, deposits and disbursements on a company, state and center basis;

- •

- monitor and manage daily exception reports, which record cash shortages, late deposits, unusual disbursements and other items;

- •

- determine, on a daily basis, the amount of cash needed at each center, enabling centralized treasury personnel to maintain an optimum amount of cash in each location; and

- •

- facilitate compliance with regulatory requirements and company policies and procedures.

We maintain and test a disaster recovery plan for our critical networked systems, the documentation for which is hosted on a third-party vendor website. Our back-up data tapes are housed by a third party at an off-site location. We also own back-up computer equipment and real-time data storage that is housed at an off-site facility to provide us with access to needed systems in the event of an emergency that disables our headquarters' equipment.

Security

Security and loss prevention play a critical role in the daily operations of our centers. Each center is provided with 24-hour third-party monitoring. Physical security provided to each center includes: digital safes, wired hold-up alarm buttons and secure locking systems. Additionally, most of our centers are equipped with 24-hour security cameras.

Because our business requires us to maintain a significant supply of cash in each of our centers, we are subject to the risk of cash shortages resulting from employee and third-party theft and errors. Cash shortages from employee and third-party theft and errors were approximately $2.1 million (0.31% of

13

Table of Contents

total revenues) in 2008, $2.4 million (0.34% of total revenues) in 2007 and $2.0 million (0.29% of total revenues) in 2006.

Human Resources

Our North American operations are divided into zones, regions and divisions, which we believe allows for a more effective management process. A zone has approximately 425 to 850 centers and includes centers in more than one state. We currently have four North American zones, each with a zone director responsible for the operations, administration, staffing and general supervision of the centers in his or her zone. Regions include 10 to 180 centers organized into two to 13 divisions and are supervised by regional directors who report to a zone director. Divisions include three to 21 centers and are supervised by divisional directors who report to a regional director. Determination of region and division alignment is usually based upon geographic considerations. Our four zones in North America currently include 25 regions and 199 divisions. Our 20 centers in the United Kingdom represent a separate zone with its own zone director.

A typical center is staffed with a manager and an assistant manager. Managers are responsible for the daily operations of the center. As volume increases, additional personnel, called customer service representatives, are added. Our policy is to add a customer service representative once a center has approximately 350 advances outstanding at one time. Thereafter, one additional customer service representative is added for every 100 to 150 additional outstanding advances at a particular center.

Employees

We currently have approximately 6,700 employees, including approximately 6,200 center employees, 194 divisional directors, 22 regional directors, two state directors, five zone directors and 232 corporate employees and support personnel.

We consider our employee relations to be satisfactory. Our employees are not covered by a collective-bargaining agreement and we have never experienced any organized work stoppage, strike or labor dispute.

Intellectual Property and Other Proprietary Rights

We use a number of trademarks, logos and slogans in our business. AARC, Inc., one of our subsidiaries, owns all of our intellectual property and has entered into a trademark license agreement with each of our operating subsidiaries to use this intellectual property. Unauthorized use of our intellectual property by third parties may damage our brand and our reputation and could result in a loss of customers. It may be possible for third parties to obtain and use our intellectual property without our authorization. Third parties have in the past infringed or misappropriated our intellectual property or similar proprietary rights. For example, competitors of ours have used our name and other trademarks of ours on their websites to advertise their financial services. We believe infringements and misappropriations will continue to occur in the future.

Other

Advance America, Cash Advance Centers, Inc. is a Delaware corporation that was incorporated on August 11, 1997. Our principal executive offices are located at 135 North Church Street, Spartanburg, South Carolina 29306. Our telephone number at that location is (864) 342-5600. We maintain an internet website athttp://www.advanceamerica.net. We make available free of charge on our website our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission (the "SEC"). Information on our website is not incorporated by reference into this Annual Report. The SEC also maintains a website that contains reports, proxy and information statements, and other information regarding us atwww.sec.gov. In addition, any materials we file with the SEC may be read and copied at the SEC's

14

Table of Contents

Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

Government Regulation

Our products and services are subject to extensive state, federal and foreign regulation. The regulation of our industry is intended primarily for the protection of consumers rather than investors in our common stock and our creditors and is constantly changing as new regulations are introduced at the foreign, federal, state and local level and existing regulations are repealed, amended and modified. This evolving regulatory landscape creates various uncertainties and risks for the operation of our business, any of which could have a material adverse effect on our business, prospects, results of operations or financial condition. See "Item 1A. Risk Factors" and "Item 3. Legal Proceedings."

Federal Regulation

Various anti-cash advance legislation has been proposed or introduced in the U.S. Congress. Congressional members continue to receive pressure from consumer advocates and other industry opposition groups to adopt such legislation. Most recently, on February 26, 2009, U.S. Senator Richard Durbin introduced a bill in Congress to establish a federal cap of 36% on the effective annual percentage rate ("APR") on all consumer loan transactions. Likewise, U.S. Representative Luis Gutierrez introduced a bill on the same day that would, among other things, place a 15 cent per dollar borrowed ($.15/$1.00) cap on fees for cash advances, ban rollovers (payment of a fee to extend the term of a cash advance or other short-term financing), and require us to offer an extended payment plan that severely restricts our cash advance product. In addition to these bills, the Obama Administration agenda states that U.S. President Barack Obama and Vice President Joseph Biden seek to extend a 36% APR limit to all consumer credit transactions. Any federal legislative or regulatory action that severely restricts or prohibits cash advance and similar services, like the Gutierrez bill, if enacted, could have a material adverse impact on our business, prospects, results of operations and financial condition. Any federal law that would impose a national 36% APR limit on our services, like that proposed in the Durbin bill, if enacted, would likely eliminate our ability to continue our current operations.

Our products and services are subject to a variety of federal laws and regulations, such as the Truth-in-Lending Act ("TILA"), the Equal Credit Opportunity Act ("ECOA"), the Fair Credit Reporting Act ("FCRA"), the Fair Debt Collection Practices Act ("FDCPA"), the Gramm-Leach-Bliley Act ("GLBA"), the Bank Secrecy Act, the Money Laundering Act, and the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act (the "PATRIOT Act") and the regulations promulgated for each. Among other things, these laws require disclosure of the principal terms of each transaction to every customer, prohibit misleading advertising, protect against discriminatory lending practices and proscribe unfair credit practices. TILA and Regulation Z, adopted under TILA, require disclosure of, among other things, the pertinent elements of consumer credit transactions, including the dollar amount of the finance charge and the charge expressed in terms of an annual percentage rate ("APR").

Our marketing efforts and the representations we make about our advances also are subject to federal and state unfair and deceptive practices statutes. The Federal Trade Commission ("FTC") enforces the Federal Trade Commission Act and the state attorneys general and private plaintiffs enforce the analogous state statutes.

State Regulation

Our business is regulated under a variety of enabling state statutes, including cash advance, deferred presentment, check-cashing, money transmission, small loan and credit services organization state laws, all of which are subject to change and which may impose significant costs or limitations on the way we conduct or expand our business. As of December 31, 2008, 38 states and the District of Columbia had specific laws that permitted cash advances or similar forms of short-term consumer

15

Table of Contents

loans. As of December 31, 2008, we operated in 33 of these 38 states. We do not currently conduct business in the remaining five states or in the District of Columbia and will stop conducting business in New Hampshire in early 2009, because we do not believe it is economically attractive to operate in these jurisdictions due to specific legislative restrictions, such as interest rate ceilings, an unattractive population density or unattractive location characteristics. However, we may open centers in any of these states or the District of Columbia if we believe doing so may become economically attractive because of a change in any of these variables. The remaining 12 states do not have laws specifically authorizing cash advances or short-term consumer finance business. Despite the lack of specific laws, other laws may permit us to offer products and services in these states.

The scope of state regulation, including the fees and terms of our products and services, varies from state to state. Most states with laws that specifically regulate our products and services establish allowable fees and/or interest and other charges to consumers. In addition, many states regulate the maximum amount, maturity and renewal or extension of cash advances or loans. The terms of our products and services vary from state to state in order to comply with the laws and regulations of the states in which we operate.

The states with laws that specifically regulate our products and services typically limit the principal amount of a cash advance or loan and set maximum fees and interest rates that customers may be charged. Some states also limit a customer's ability to renew a cash advance and require various disclosures to consumers. State statutes often specify minimum and maximum maturity dates for cash advances and, in some cases, specify mandatory cooling-off periods between transactions. Our collection activities regarding past due amounts are subject to consumer protection laws and state regulations relating to debt collection practices. In addition, some states restrict the advertising content of our marketing materials.

During the last few years, legislation has been adopted in some states that prohibits or severely restricts our products and services. For example, legislation became effective in 2007 in both Oregon and New Mexico that limited fees and interest on cash advances and other consumer loan products. As a result, we determined that it was not economically viable to continue operating in Oregon or New Mexico and closed all of our centers in Oregon and New Mexico in 2007 and 2008, respectively. Many similarly restrictive bills recently have been introduced. In 2008, bills that would severely restrict or effectively prohibit our products and services if adopted as law were introduced in 21 states. In addition, two states, Arizona and Mississippi, have sunset provisions in their current cash advance laws that require renewal by these state legislatures at periodic intervals. In 2008, in Ohio and New Hampshire, legislation passed that effectively prohibits cash advances in those states. As a result, we decided to close all of our centers in New Hampshire in early 2009. In Ohio, we now offer a small loan product to customers; however, this small loan product will not be as profitable to us as the former cash advance product. In 2008, legislation was passed in Virginia that restricts the amount of fees that can be charged on cash advances. As a result, we now offer a new cash advance product and an open-ended line of credit product to customers in Virginia. However, on February 25, 2009, the Virginia legislature passed a bill that would restrict us from offering both the cash advance product and the open-ended line of credit product at the same center. If the bill is signed by the Virginia governor and becomes law, we will be prohibited from offering the open-ended line of credit product to customers in Virginia. This will cause us to offer only our new cash advance product, which may not be as profitable to us as the cash advance product we offered prior to January 1, 2009. Laws prohibiting our products and services or making them unprofitable could be passed in any other state at any time or existing enabling laws could expire or be amended.

Statutes authorizing our products and services typically provide the state agencies that regulate banks and financial institutions with significant regulatory powers to administer and enforce the law. In most states, we are required to apply for a license, file periodic written reports regarding business operations and undergo comprehensive state examinations to ensure that we comply with applicable laws. Under statutory authority, state regulators have broad discretionary power and may impose new licensing requirements, interpret or enforce existing regulatory requirements in different ways or issue

16

Table of Contents

new administrative rules, even if not contained in state statutes, that impact the way we conduct business and may force us to terminate or modify our operations in particular states. Regulators may also impose rules that are generally adverse to our industry.

In some cases, we rely on the interpretations of the staff of state regulatory bodies with respect to the laws and regulations of their respective jurisdictions. These staff interpretations generally are not binding legal authority and may be subject to challenge in administrative or judicial proceedings. Additionally, as the staff of state regulatory bodies change, it is possible that the interpretations of applicable laws and regulations also may change and negatively affect our business.

Additionally, state attorneys general and banking regulators are scrutinizing our products and services and taking actions that could require us to modify, suspend or cease operations in their respective states. For example, in March 2008, the Arkansas Attorney General demanded that our Arkansas subsidiary immediately cease offering deferred presentment transactions. As a result, we closed all of our centers in Arkansas in October 2008. Similarly, as a result of an adverse ruling in July 2007 in a case brought by the Pennsylvania Department of Banking, we closed all of our centers in Pennsylvania. See "Item 3. Legal Proceedings." Other actions could be taken against our industry in the future by other state attorneys general and banking regulators requiring us to suspend or cease operations in such jurisdictions and have a negative effect on our financial condition and prospects.

State-specific legislative or regulatory action can reduce our revenues and/or margins in a state, cause us to temporarily operate at a loss in a state, or even cause us to cease or suspend our operations in a state. From time to time, we may also choose to operate in a state even if legislation or regulations cause us to operate at a loss in that state.

Local Regulation

In addition to state and federal laws and regulations, our business is subject to various local rules and regulations such as local zoning regulations. These local rules and regulations are subject to change and vary widely from state to state and city to city.

Foreign Regulation

In the United Kingdom, consumer lending is governed by the Consumer Credit Act of 1974, which was amended by the Consumer Credit Act of 2006, and related rules and regulations. Our subsidiaries in the United Kingdom must maintain licenses from the Office of Fair Trading, which is responsible for regulating consumer credit and competition, for policy and for consumer protection. The United Kingdom also has rules regarding the presentation, form and content of loan agreements, including statutory warnings and the layout of financial information. In Canada, the Canadian Parliament amended the federal usury law to transfer jurisdiction and the development of laws and regulation of our industry to the respective provinces. To date, four provinces have proposed substantive regulation of our industry. In general, the proposed regulations require lenders to be licensed, set maximum fees and regulate collection practices. However, the proposed regulations may undergo significant additional revisions.

Environmental, Health and Safety Matters

We are subject to general provisions of federal laws and regulations to ensure a safe and healthful work environment for employees. In addition, we comply with those state laws that require a written health and safety program or other mandated safety requirements. To reduce the possibility of physical injury or property damage resulting from robberies, our Loss Prevention department has established operational procedures, conducts periodic safety training and awareness programs for employees, hires security guards as needed and regularly monitors the marketplace for new technology or methods of improving workplace safety.

Other than standard cleaning products, we do not use chemicals or other agents governed by federal, state or local environmental laws in conducting business operations. Based upon these measures, we believe that our centers are in substantial compliance with all applicable environmental, health and safety requirements.

17

Table of Contents

ITEM 1A. RISK FACTORS.

Risks Related to Our Business and Industry

Our business is highly regulated. Changes in applicable laws and regulations, or our failure to comply with such laws and regulations, could have a material adverse effect on our business, prospects, results of operations and financial condition.

Our business is subject to numerous foreign, federal, state and local laws and regulations, which are subject to change and which may impose significant costs, limitations or prohibitions on the way we conduct or expand our business. These regulations govern or affect, among other things, interest rates and other fees, check cashing fees, lending practices, recording and reporting of certain financial transactions, privacy of personal consumer information and collection practices. As we develop new product and service offerings, we may become subject to additional federal, state and local regulations. State and local governments may also seek to impose new licensing requirements or interpret or enforce existing requirements in new ways. In addition, changes in current laws and future laws or regulations may restrict or eliminate our ability to continue our current methods of operation or expand our operations, such laws are regularly proposed, introduced or adopted at the state and federal level. Changes in laws or regulations, or our failure to comply with applicable laws and regulations, may have a material adverse effect on our business, prospects, results of operations and financial condition.

A federal law that imposes a national cap on our fees and interest would likely eliminate our ability to continue our current operations.

Various anti-cash advance legislation has been proposed or introduced in the U.S. Congress. Congressional members continue to receive pressure from consumer advocates and other industry opposition groups to adopt such legislation. Most recently, on February 26, 2009, U.S. Senator Richard Durbin introduced a bill in Congress to establish a federal cap of 36% on the effective annual percentage rate ("APR") on all consumer loan transactions. Likewise, U.S. Representative Luis Gutierrez introduced a bill on the same day that would, among other things, place a 15 cent per dollar borrowed ($.15/$1.00) cap on fees for cash advances, ban rollovers (payment of a fee to extend the term of a cash advance or other short-term financing), and require us to offer an extended payment plan that severely restricts our cash advance product. Also, the Obama Administration agenda states that U.S. President Barack Obama and Vice President Joseph Biden seek to extend a 36% APR limit to all consumer credit transactions. Any federal legislative or regulatory action that severely restricts or prohibits cash advance and similar services, like the Guterrez bill, if enacted, could have a material adverse impact on our business, prospects, results of operations and financial condition. Any federal law that would impose a national 36% APR limit on our services, like that proposed in the Durbin bill, if enacted, would likely eliminate our ability to continue our current operations.

Our industry is regulated under federal law and subject to federal and state unfair and deceptive practices statutes. Our failure to comply with these regulations and statutes could have a material adverse effect on our business, prospects, results of operations and financial condition.

Although states provide the primary regulatory framework under which we offer advances, certain federal laws also impact our business. See "Item 1. Business—Federal Regulation." We must comply with the federal Truth-in-Lending Act and Regulation Z adopted under that Act. Additionally, we are subject to the Equal Credit Opportunity Act, the Fair Debt Collection Practices Act, the Fair Credit Reporting Act and the Gramm-Leach-Bliley Act. We are also subject to the Bank Secrecy Act, the Money Laundering Act, and the PATRIOT Act. Any failure to comply with any of these federal laws and regulations could have a material adverse effect on our business, prospects, results of operations and financial condition.

18

Table of Contents

Our marketing efforts and the representations we make about our products and services also are subject to federal and state unfair and deceptive practices statutes. The FTC enforces the Federal Trade Commission Act and the state attorneys general and private plaintiffs enforce the analogous state statutes. If we are found to have violated any of these statutes, that violation could have a material adverse effect on our business, results of operations and financial condition.

Our industry is highly regulated under state law. Changes in state laws and regulations, or our failure to comply with such laws and regulations, could have a material adverse effect on our business, prospects, results of operations and financial condition.

Our business is regulated under a variety of enabling state statutes, including cash advance, deferred presentment, check cashing, money transmission, small loan and credit services organization laws, all of which are subject to change and which may impose significant costs, limitations or prohibitions on the way we conduct or expand our business. As of December 31, 2008, 38 states and the District of Columbia had specific laws that permitted cash advances or a similar form of short-term consumer loans. As of December 31, 2008, we operated in 33 of these 38 states. Currently, we do not conduct business in the five remaining states or in the District of Columbia, and will stop conducting business in New Hampshire in early 2009, because we do not believe it is economically attractive to operate in these jurisdictions due to specific legislative restrictions, such as interest rate ceilings, an unattractive population density or unattractive location characteristics. However, we may open centers in any of these states or the District of Columbia if we believe doing so may become economically attractive because of a change in any of these variables. The remaining 12 states do not have laws specifically authorizing the cash advance or short-term consumer finance business, however other laws may permit us to offer products and services in these states.

During the last few years, legislation has been introduced or adopted in some states that prohibits or severely restricts our products and services. In 2008, bills that would severely restrict or effectively prohibit cash advances if adopted as law were introduced in 21 states. Such new or modified legislation could have a material adverse impact on our results of operations. For example, in response to new legislation in Virginia, we have developed an open-ended line of credit product and made changes to our cash advance product. On February 25, 2009, the Virginia legislature passed a bill that would restrict us from offering both the cash advance product and the open-ended line of credit product at the same center. If the bill is signed by the Virginia governor and becomes law, we will be prohibited from offering the open-ended line of credit product to customers in Virginia, which may lower our revenues and profits in that state. As a result of legislation in New Hampshire that became effective in January 2009, we concluded that operating in that state was no longer economically viable and intend to close all of our New Hampshire centers in 2009. In addition, Arizona and Mississippi have sunset provisions in their cash advance laws that require renewal of the laws by these state legislatures at periodic intervals and will expire in 2010 in Arizona and 2012 in Mississippi, respectively, if no further action is taken.

Laws prohibiting cash advances and similar products and services or making them less profitable, or even unprofitable, could be passed in any other state at any time or existing enabling laws could expire or be amended, any of which would have a material adverse effect on our business, prospects, results of operations and financial condition. For instance, in November 2008, a new Ohio law became effective that capped interest rates on cash advances and limited the number of advances a customer may take in any one year. In response to this legislation, we now offer a small loan product that is not as profitable as our former cash advance product, which could have a material adverse effect on our business, prospects, results of operations and financial condition.

Statutes authorizing cash advance and similar products and services typically provide the state agencies that regulate banks and financial institutions with significant regulatory powers to administer and enforce the law. In most states, we are required to apply for a license, file periodic written reports regarding business operations and undergo comprehensive state examinations to ensure that we comply

19

Table of Contents

with applicable laws. Under statutory authority, state regulators have broad discretionary power and may impose new licensing requirements, interpret or enforce existing regulatory requirements in different ways or issue new administrative rules, even if not contained in state statutes, that affect the way we do business and may force us to terminate or modify our operations in particular states. They may also impose rules that are generally adverse to our industry. Any new licensing requirements or rules, or new interpretations of existing licensing requirements or rules, or failure to follow licensing requirements or rules could have a material adverse effect on our business, prospects, results of operations and financial condition.

In some cases, we rely on the interpretations of the staff of state regulatory bodies with respect to the laws and regulations of their respective jurisdictions. These staff interpretations generally are not binding legal authority and may be subject to challenge in administrative or judicial proceedings. Additionally, as the staff of state regulatory bodies change, it is possible that their interpretations of applicable laws and regulations also may change to the detriment of our business. As a result, our reliance on staff interpretations could have a material adverse effect on our business, results of operations and financial condition.

Additionally, state attorneys general and banking regulators are scrutinizing cash advances and other alternative financial products and services and taking actions that require us to modify, suspend or cease operations in their respective states. For example, as a result of an adverse ruling in July 2007 in a case brought by the Pennsylvania Department of Banking, we suspended our operations and subsequently closed all of our centers in Pennsylvania. See "Item 8. Financial Statements and Supplementary Data—Note 12. Commitments and Contingencies." The closures in Pennsylvania have had an adverse effect on our results of operations and financial condition. Also, in March 2008, the Attorney General of Arkansas distributed letters to 60 companies operating under the Check Cashers Act. The letter demanded that we cease and desist offering deferred presentment transactions within the State of Arkansas. As a result, we agreed to close all of our centers in Arkansas in October 2008 and the Arkansas Attorney General agreed not to bring suit against us. Similar or additional actions could have a material adverse effect on our business, prospects, results of operations and financial condition.

Our industry is subject to various local rules and regulations. Changes in these local regulations could have a material adverse effect on our business, prospects, results of operations and financial condition.

In addition to state and federal laws and regulations, our business can be subject to various local rules and regulations such as local zoning regulations. Any actions taken in the future by local zoning boards or other local governing bodies to require special use permits for, or impose other restrictions on providers of cash advance and similar services could have a material adverse effect on our business, results of operations and financial condition.

From time to time, we may also choose to operate in a location even if applicable legislation or regulations cause us to lose money on our operations in that location. For example, we currently operate at a loss in Canada. Any similar actions or events could have a material adverse effect on our business, prospects, results of operations and financial condition.

Our foreign operations are subject to additional laws and regulations. Our inability to operate in the United Kingdom or Canada in compliance with applicable laws and regulations could have a material adverse effect on our business, prospects, results of operations and financial condition.

In the United Kingdom, consumer lending is governed by the Consumer Credit Act of 1974, which was amended by the Consumer Credit Act of 2006, and related rules and regulations. Our subsidiaries in the United Kingdom must maintain licenses from the Office of Fair Trading, which is responsible for regulating consumer credit and competition, for policy-making, and for consumer protection. The United Kingdom also has strict rules regarding the presentation, form and content of loan agreements,

20

Table of Contents

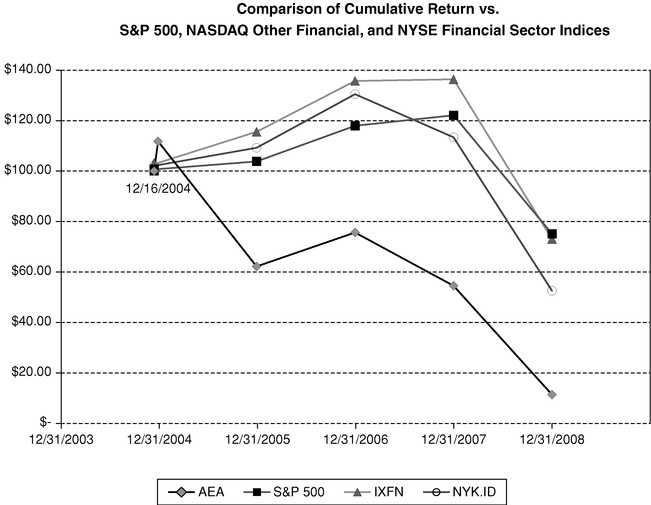

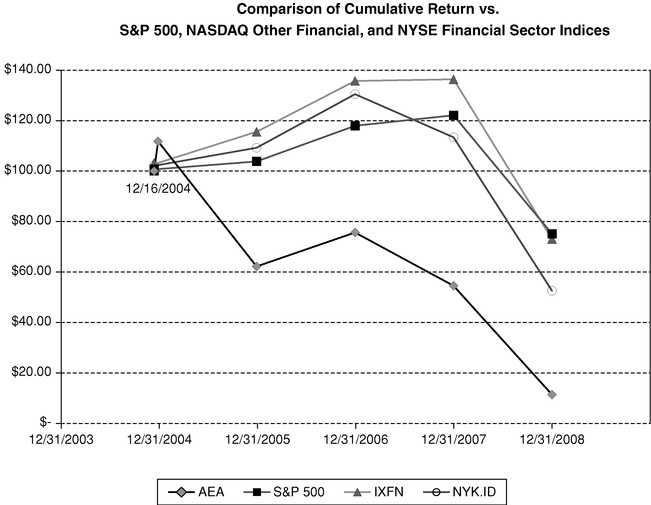

including statutory warnings and the layout of financial information. Our non-compliance with these rules could render a loan agreement unenforceable. Our inability to obtain and maintain the required licenses or to comply with the applicable rules or regulations in the United Kingdom could limit our expansion opportunities and/or could result in a material adverse effect on our business, results of operations and financial condition.