Filed Pursuant to Rule 433 Registration No. 333-223434 Issuer Free Writing Prospectus, dated September 15, 2020 Relating to Preliminary Prospectus Supplement dated September 15, 2020 and Prospectus dated March 2, 2018 Axos Financial, Inc. Investor Presentation September 2020 NYSE: AX

Safe Harbor This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Reform Act”). The words “believe,” “expect,” “anticipate,” “estimate,” “project,” or the negation thereof or similar expressions constitute forward-looking statements within the meaning of the Reform Act. These statements may include, but are not limited to, projections of revenues, income or loss, projected consummation of pending acquisitions, estimates of capital expenditures, plans for future operations, products or services, the effects of the COVID-19 pandemic, and financing needs or plans, as well as assumptions relating to these matters. Such statements involve risks, uncertainties and other factors that may cause actual results, performance or achievements of the Company and its subsidiaries to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. For a discussion of these factors, we refer you to the Company's reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended June 30, 2020. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company or by any other person or entity that the objectives and plans of the Company will be achieved. For all forward-looking statements, the Company claims the protection of the safe-harbor for forward-looking statements contained in the Reform Act. Axos Financial, Inc. (“Axos”) has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement, the preliminary prospectus supplement and other documents that Axos has filed withtheSECformorecompleteinformationabout Axos and this offering. You may access these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, Axos, the underwriters or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Keefe, Bruyette & Woods, A Stifel Company, at (800) 966-1559 or e-mailing USCapitalMarkets@kbw.com, or by calling Raymond James & Associates at (800) 248-8863 or e-mailing Prospectus@RaymondJames.com. 2

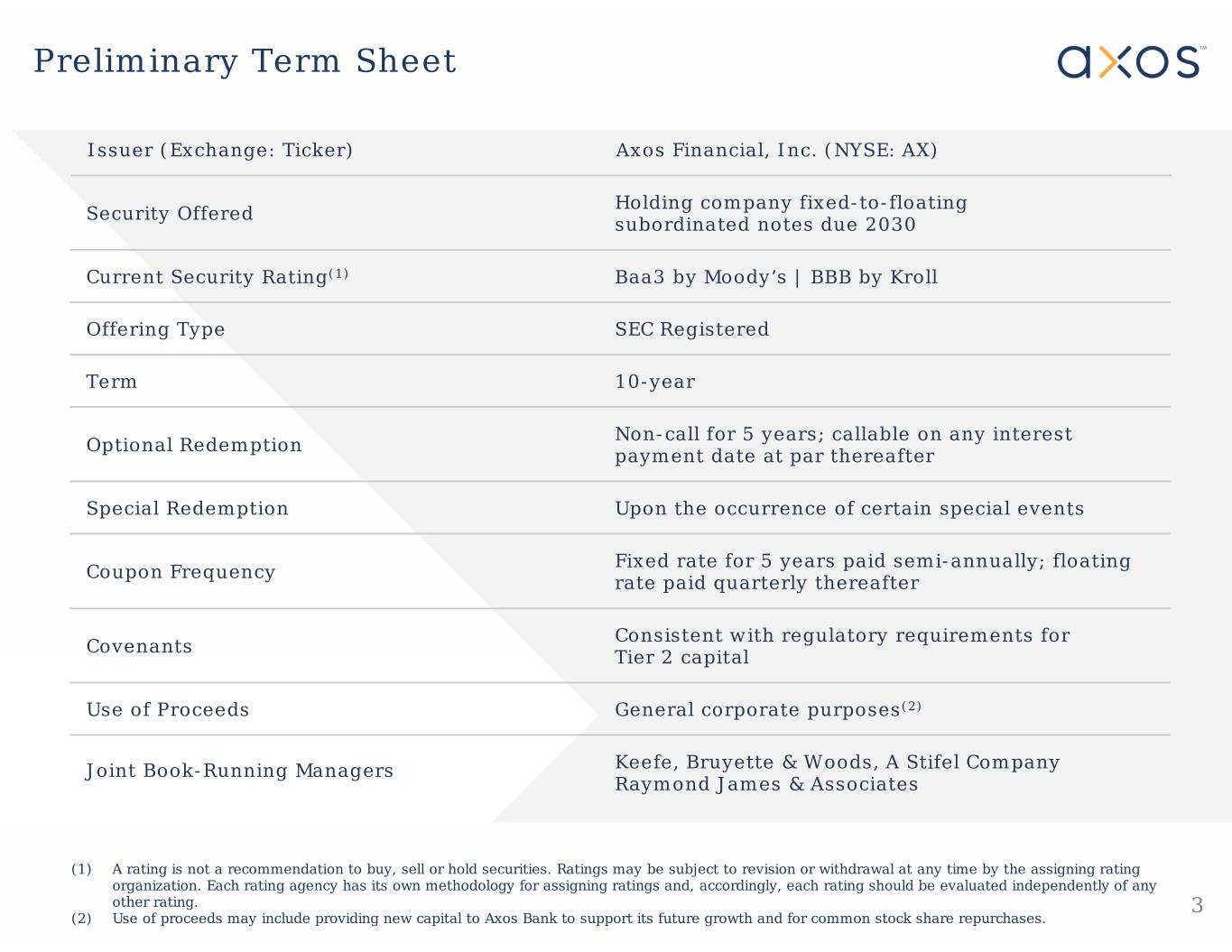

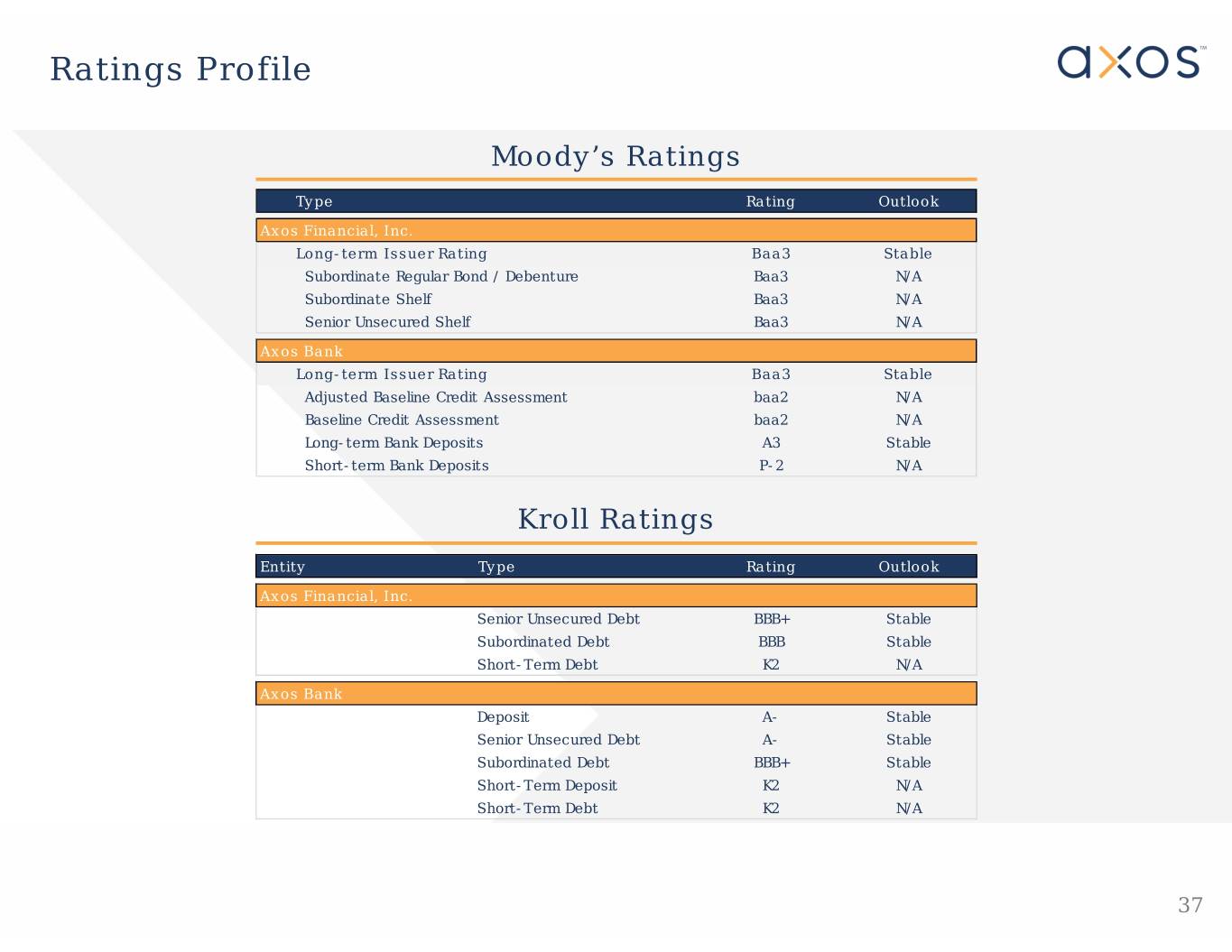

Preliminary Term Sheet Issuer (Exchange: Ticker) Axos Financial, Inc. (NYSE: AX) Holding company fixed-to-floating Security Offered subordinated notes due 2030 Current Security Rating(1) Baa3 by Moody’s | BBB by Kroll Offering Type SEC Registered Term 10-year Non-call for 5 years; callable on any interest Optional Redemption payment date at par thereafter Special Redemption Upon the occurrence of certain special events Fixed rate for 5 years paid semi-annually; floating Coupon Frequency rate paid quarterly thereafter Consistent with regulatory requirements for Covenants Tier 2 capital Use of Proceeds General corporate purposes(2) Joint Book-Running Managers Keefe, Bruyette & Woods, A Stifel Company Raymond James & Associates (1) A rating is not a recommendation to buy, sell or hold securities. Ratings may be subject to revision or withdrawal at any time by the assigning rating organization. Each rating agency has its own methodology for assigning ratings and, accordingly, each rating should be evaluatedindependently of any other rating. 3 (2) Use of proceeds may include providing new capital to Axos Bank to support its future growth and for common stock share repurchases.

Strong and Experienced Management Team Greg Garrabrants | President & CEO | Age: 48 Greg Garrabrants is President and CEO of Axos Bank. Before his senior executive roles at banking institutions, Greg served the financial services industry as an investment banker, management consultant, and attorney for over 15 years. Greg earned his JD from the Northwestern University School of Law and his MBA from Kellogg Graduate School of Management at Northwestern University. He has a BS in Industrial and Systems Engineering from the University of Southern California. Andrew Micheletti | EVP & Chief Financial Officer | Age: 63 Andrew J. Micheletti, Chief Financial Officer, joined Axos Bank in 2001. Before joining the Bank, Andrew was Vice President of Finance for TeleSpectrum Worldwide Inc. From 1990 to 1997, he was Managing Director and Chief Financial Officer of Linsco/Private Ledger Corp (LPL Financial Services). Prior to joining LPL Financial Services, Andrew was Vice President, Controller and Vice President, Financial Reporting for Imperial Savings Association. He holds a B.S. from San Diego State University. Raymond Matsumoto | EVP & Chief Operating Officer | Age: 65 Raymond D. Matsumoto is the Executive Vice President and Chief Operating Officer (COO) of Axos Bank. Prior to joining Axos Bank, Raymond was Executive Vice President and Chief Administrative Officer at CIT Group. He has also held executive positions at OneWest Bank and Indymac Bank. Raymond started his career as a Senior Manager Certified Public Accountant with KPMG. Raymond earned a B.S. in Accounting and Finance from the University of California, Berkeley. Thomas Constantine | EVP & Chief Credit Officer | Age: 58 Thomas Constantine joined Axos Bank in August 2010 as Chief Credit Officer. Previously he was a senior examiner with the Office of Thrift Supervision (OTS), serving his second stint with the agency. Thomas first joined the OTS in 1989, during the Savings and Loan crisis. He has more than 31 years of experience in the banking and financial services industries. Thomas received his B.A. in Business Economics, with an accounting emphasis, from the University of California at Santa Barbara. 4

Axos Financial is Positioned for the Future Axos Financial, Inc. ($ in millions) FY 2020 • Axos Financial, Inc. was founded in 2000 and is a customer‐focused Market Data as of 9/14/2020 diversified financial services company headquartered in Las Vegas, Market Capitalization$ 1,424.0 Nevada Price / Tangible Bo ok Value 1.31 x Price / 2021 Estimated Earnings 9.4 x Dividend Yield 0.0 % • We provide banking and securities products and services to our consumer and business clients through online and low‐cost Selected Balance Sheet Data Total Assets $13,851.9 distribution channels and affinity partners Net Loans 10,631.3 Allowance for Loan Losses 75.8 • Our low‐cost and innovative business model helps us to generate Total Deposits 11,336.7 above‐peer returns while helping to maintain a low‐risk loan Total Stockholders' Equity 1,230.8 portfolio Performance Ratios and Other Data ROAA 1.53 % • We received our Moody’s long‐term corporate investment grade ROAE 15.65 rating amidst the current COVID‐19 pandemic, which we believe is Net Interest Margin 4.12 a testament to our strong results and risk management Net Interest Margin - Banking Segment Only 4.19 Efficiency Ratio 47.50 Efficiency Ratio - Banking Segment Only 39.81 Asset Quality Metrics Nationwide Reach NCOs / Average Loans 0.23 % NPLs / Loans 0.82 NPAs / Assets 0.68 ALLL / Loans HFI 0.71 ALLL / NPLs 86.20 Capital Ratios TCE / TA(1) 7.94 % CET1 Ratio 11.22 Leverage Ratio 8.97 Tier 1 Capital 11.27 Total Capital 12.64 5 (1) Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics.

Axos’ Business Segments Provide the Foundation for Sustained Long-term Growth Commercial: $5.4B deposits $5.5B loans Consumer Banking Consumer: Banking $545M Net Revenue(1) $5.9B deposits $5.0B loans 335,000 consumer and SMB clients (ex-HRB) Clearing and Custody: $6.0B assets under custody $413M client deposits 60 introducing broker dealer clients 110,000 client accounts Securities $159M of customer margin loans $41M Commercial (1) Securities Net Revenue Banking Digital Advisory: 24,000 client accounts $175M AUM 6 (1) Net Revenue defined as net interest income plus noninterest income as reported for segments at or for the year ended June 30, 2020.

Our Business Model is More Profitable Because Our Costs are Lower and Our Assets are Higher-Yielding Banks Greater Than Axos(1) $10bn(2) As % of average assets (%) (%) Net interest income 3.79% 2.42% Salaries and benefits 0.96% 1.07% Premises, equipment and 0.89% 1.23% other non-interest expense Total non-interest expense 1.85% 2.30% Core business margin 1.94% 0.12% (1) For the three months ended 6/30/2020 – the most recent data on FDIC website “Statistics on Depository Institutions Report”. Axos Bank only, excludes Axos Financial, Inc. to compare to FDIC data. Data retrieved 9/8/2020. (2) All Commercial Banks by asset size. FDIC reported for three months ended 6/30/2020. Total of 144 institutions >$10 billion. Data retrieved 7 9/8/2020.

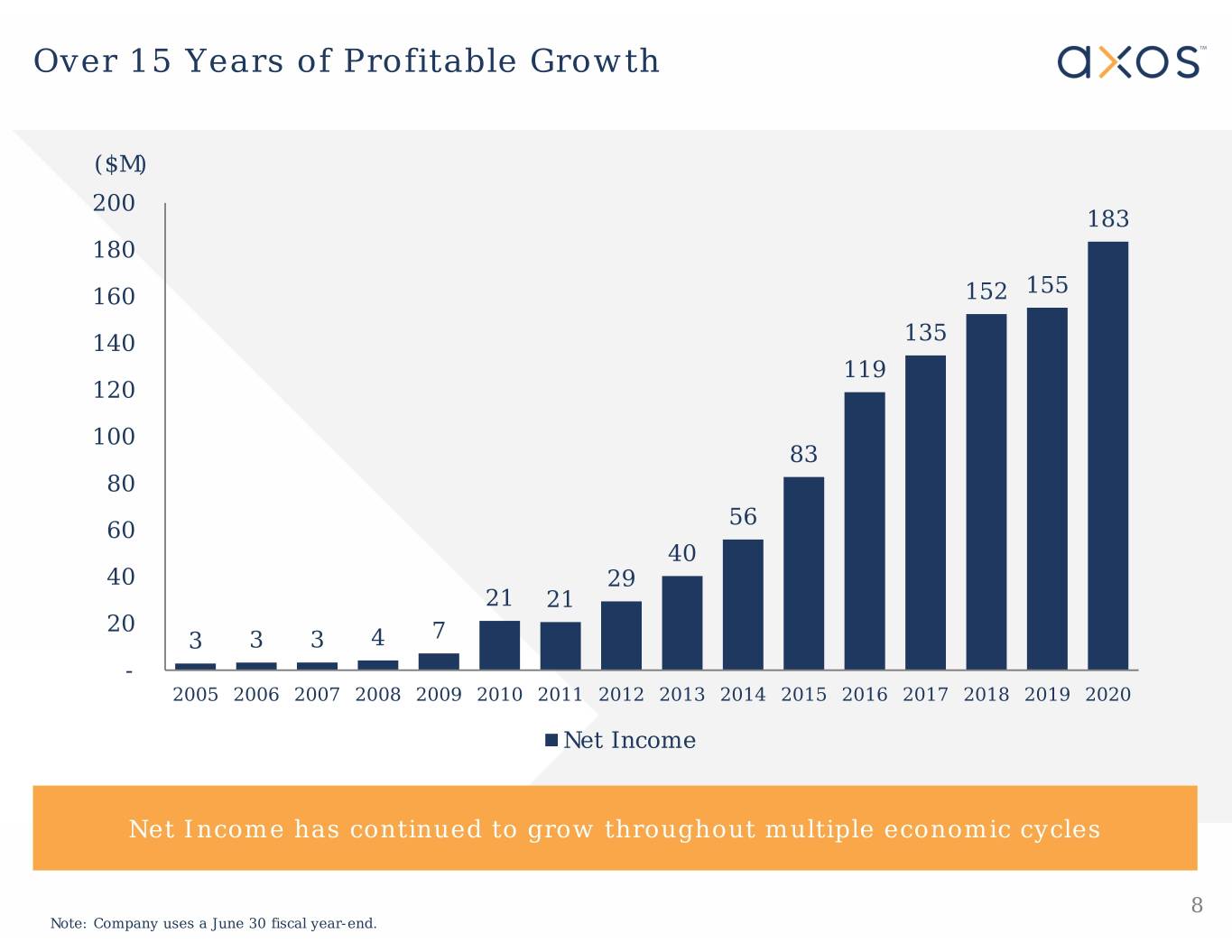

Over 15 Years of Profitable Growth ($M) 200 183 180 155 160 152 140 135 119 120 100 83 80 56 60 40 40 29 21 21 20 3 3 3 4 7 - 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Net Income Net Income has continued to grow throughout multiple economic cycles 8 Note: Company uses a June 30 fiscal year-end.

Strong Efficiency Ratio Leads to Superior Profitability Net Income Efficiency Ratio $ Millions $183 51.12% 47.50% $155 $152 39.58% 36.08% $135 34.44% $119 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 Return on Average Assets Return on Average Equity 19.43% 17.78% 1.75% 1.68% 1.68% 17.05% 1.51% 1.53% 15.40% 15.65% 2016 2017 2018 2019 2020 2016 2017 2018 2019 2020 9 Note: Company uses a June 30 fiscal year-end.

Net Interest Margin Has Been Stable/Rising Through a Variety of Interest Rate Cycles 4.50% 4.11% 4.12% 3.95% 4.07% 4.00% 3.91% 3.50% 3.00% 2.50% 2.00% 1.50% 1.00% 0.50% 0.00% 2016 2017 2018 2019 2020 Axos NIM - reported Fed Funds Rate 10 Note: Company uses a June 30 fiscal year-end.

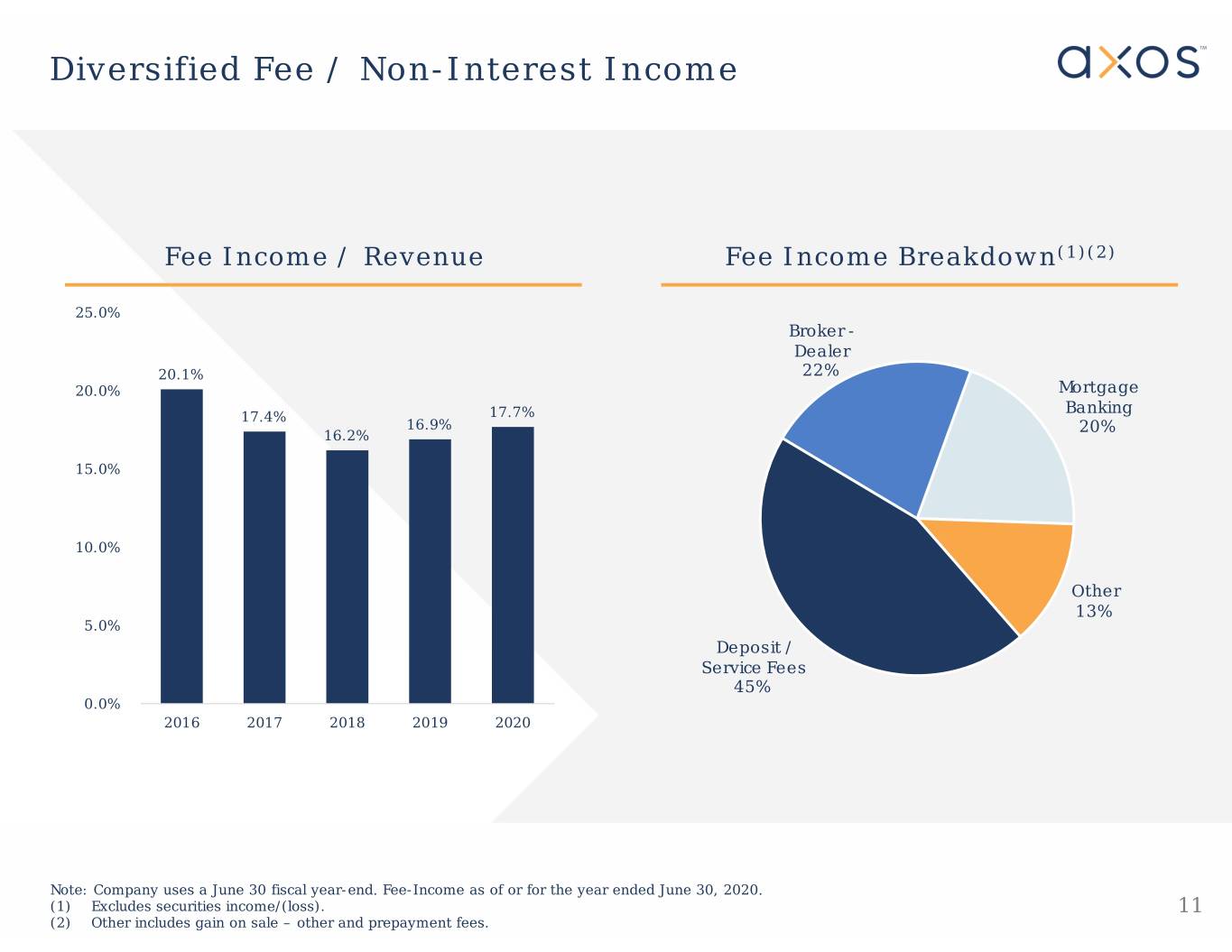

Diversified Fee / Non-Interest Income Fee Income / Revenue Fee Income Breakdown(1)(2) 25.0% Broker - Dealer 20.1% 22% 20.0% Mortgage Banking 17.4% 17.7% 16.9% 20% 16.2% 15.0% 10.0% Other 13% 5.0% Deposit / Service Fees 45% 0.0% 2016 2017 2018 2019 2020 Note: Company uses a June 30 fiscal year-end. Fee-Income as of or for the year ended June 30, 2020. (1) Excludes securities income/(loss). 11 (2) Other includes gain on sale – other and prepayment fees.

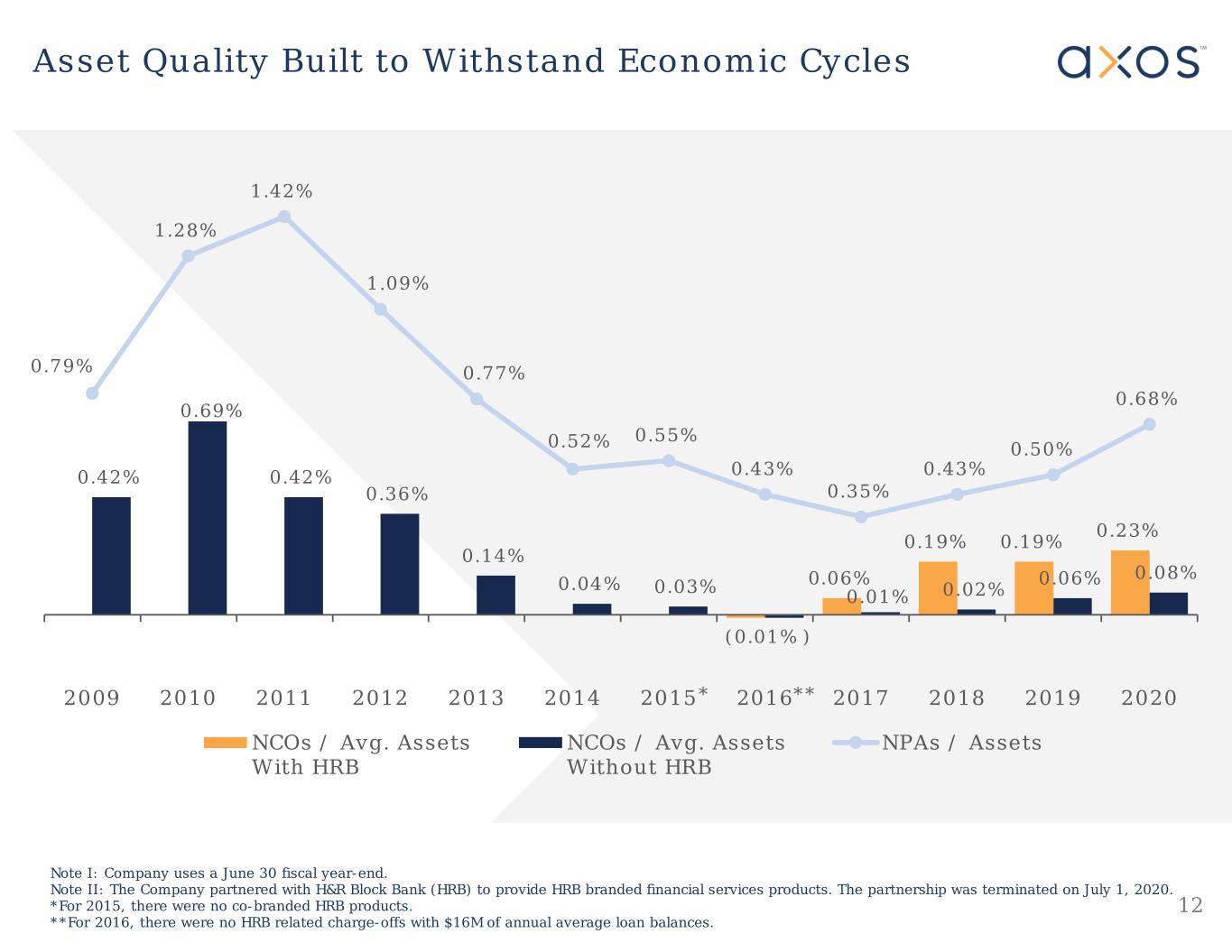

Asset Quality Built to Withstand Economic Cycles 1.42% 1.28% 1.09% 0.79% 0.77% 0.68% 0.69% 0.55% 0.52% 0.50% 0.42% 0.42% 0.43% 0.43% 0.36% 0.35% 0.23% 0.19% 0.19% 0.14% 0.08% 0.04% 0.03% 0.06% 0.06% 0.01% 0.02% (0.01%) 2009 2010 2011 2012 2013 2014 2015*** 2016 2017 2018 2019 2020 NCOs / Avg. Assets NCOs / Avg. Assets NPAs / Assets With HRB Without HRB Note I: Company uses a June 30 fiscal year-end. Note II: The Company partnered with H&R Block Bank (HRB) to provide HRB branded financial services products. The partnership was terminated on July 1, 2020. *For 2015, there were no co-branded HRB products. 12 **For 2016, there were no HRB related charge-offs with $16M of annual average loan balances.

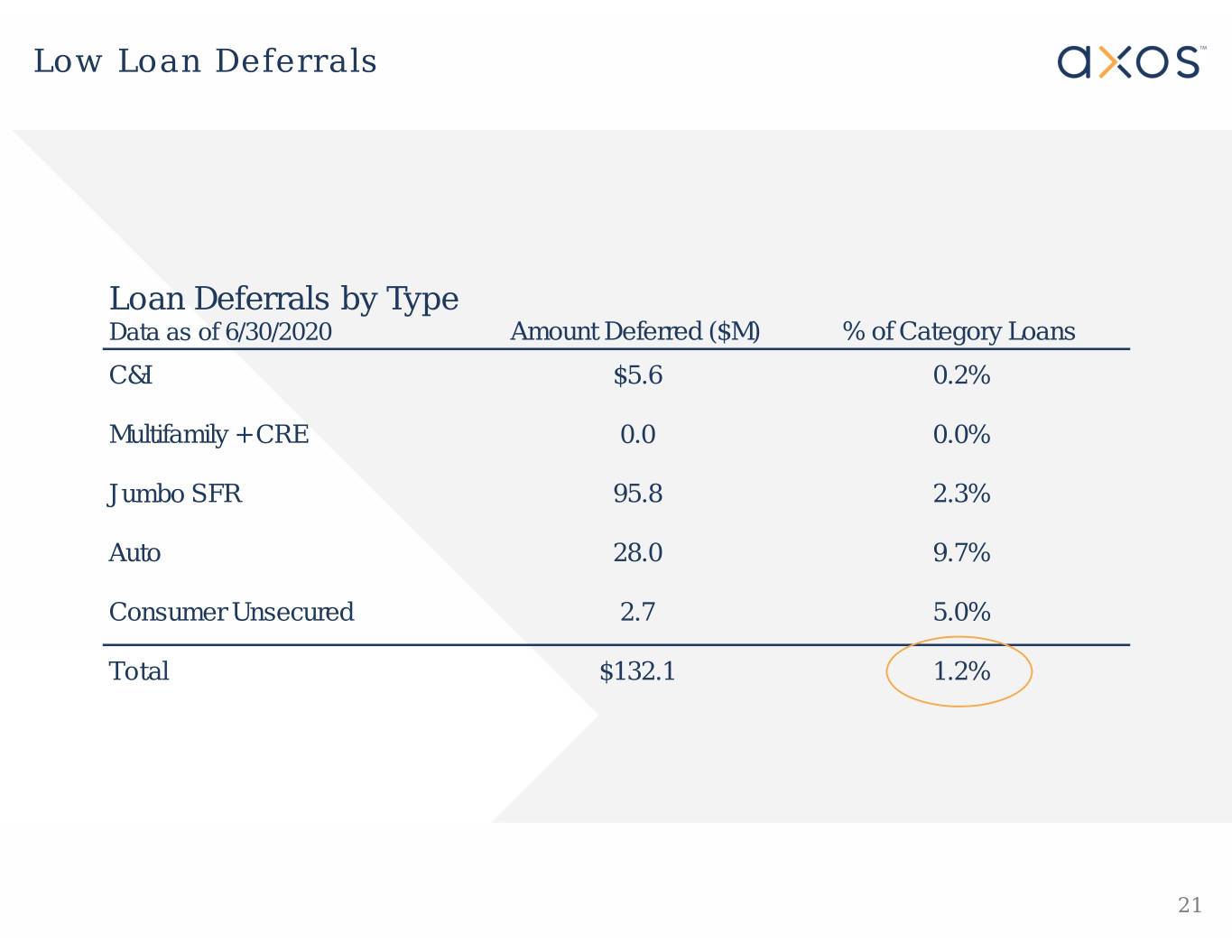

Credit Investor Highlights Experienced and “cycle-tested” management team Track record of credit discipline, risk management and profitability Differentiated digital platform Flexible, cost advantaged operational leverage Built to capitalize on digital financial services adoption Strong credit performance Underlying credit culture of low-LTV, real estate secured lending (94% of loans backed by hard assets) Senior position in all lender finance and commercial specialty RE loans with capital support from sponsors and junior partners Minimal exposure to COVID-19 industries(1) with only 1.2% of loans in deferral as of June 30, 2020 Deposit diversification and growth Continued core deposit transformation and liquidity management 47% checking and other demand deposits as of June 30, 2020 Healthy capital position and capital generation through earnings Tier 1 ratio of 11.27% and total capital ratio of 12.64% Superior profitability (17% CAGR in EPS) that fueled a 19% CAGR in book value in the last five years Pre-tax, pre-provision ROAA of 2.47% for the three months ended June 30, 2020 Corporate ratings profile Baa3 Moody’s and BBB+ Kroll 13 (1) No direct exposure to airlines, casinos, malls or theme parks.

Loan Portfolio and Credit Quality

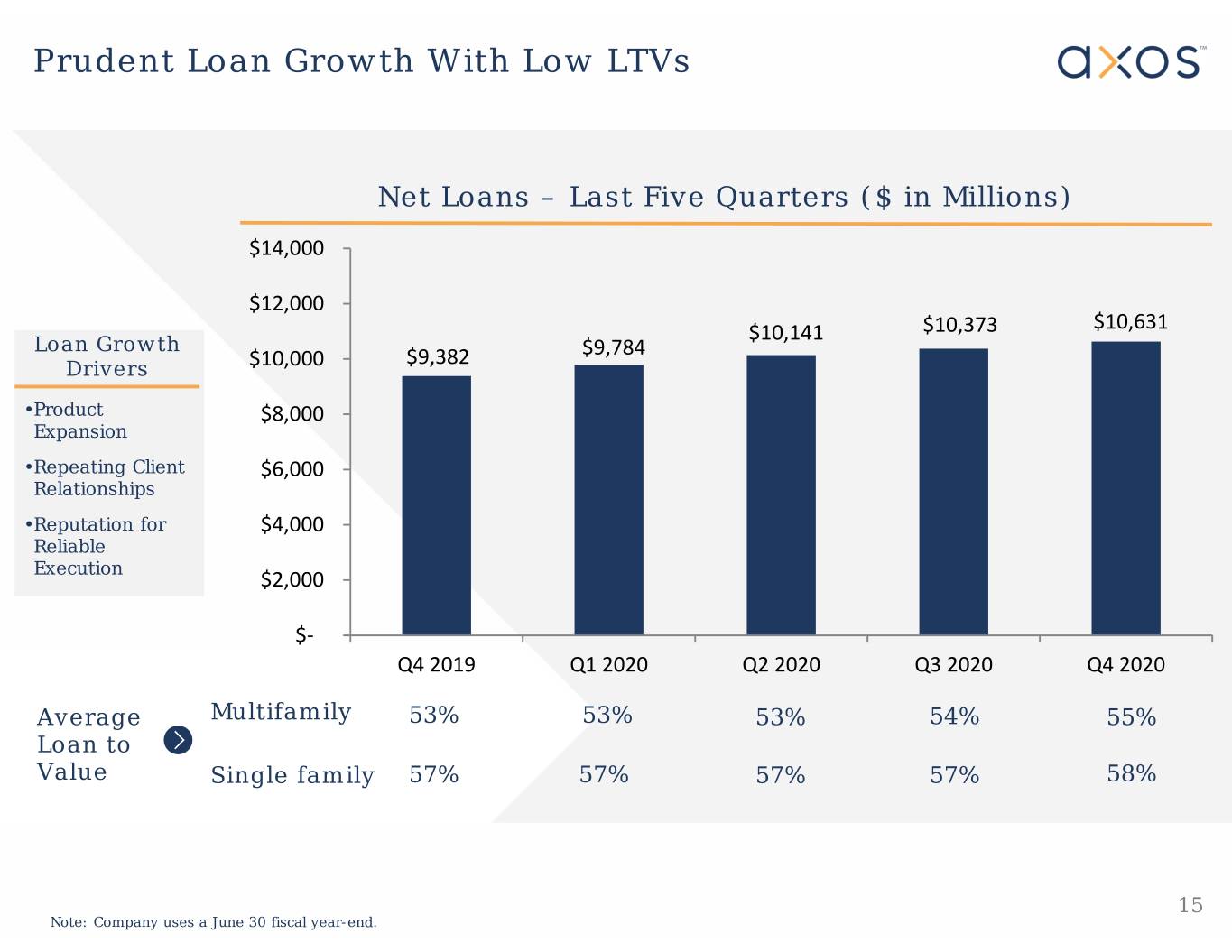

Prudent Loan Growth With Low LTVs Net Loans – Last Five Quarters ($ in Millions) $14,000 $12,000 $10,373 $10,631 Loan Growth $10,141 $9,382 $9,784 Drivers $10,000 • Product $8,000 Expansion • Repeating Client $6,000 Relationships • Reputation for $4,000 Reliable Execution $2,000 $‐ Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Average Multifamily 53% 53% 53% 54% 55% Loan to Value Single family 57% 57% 57% 57% 58% 15 Note: Company uses a June 30 fiscal year-end.

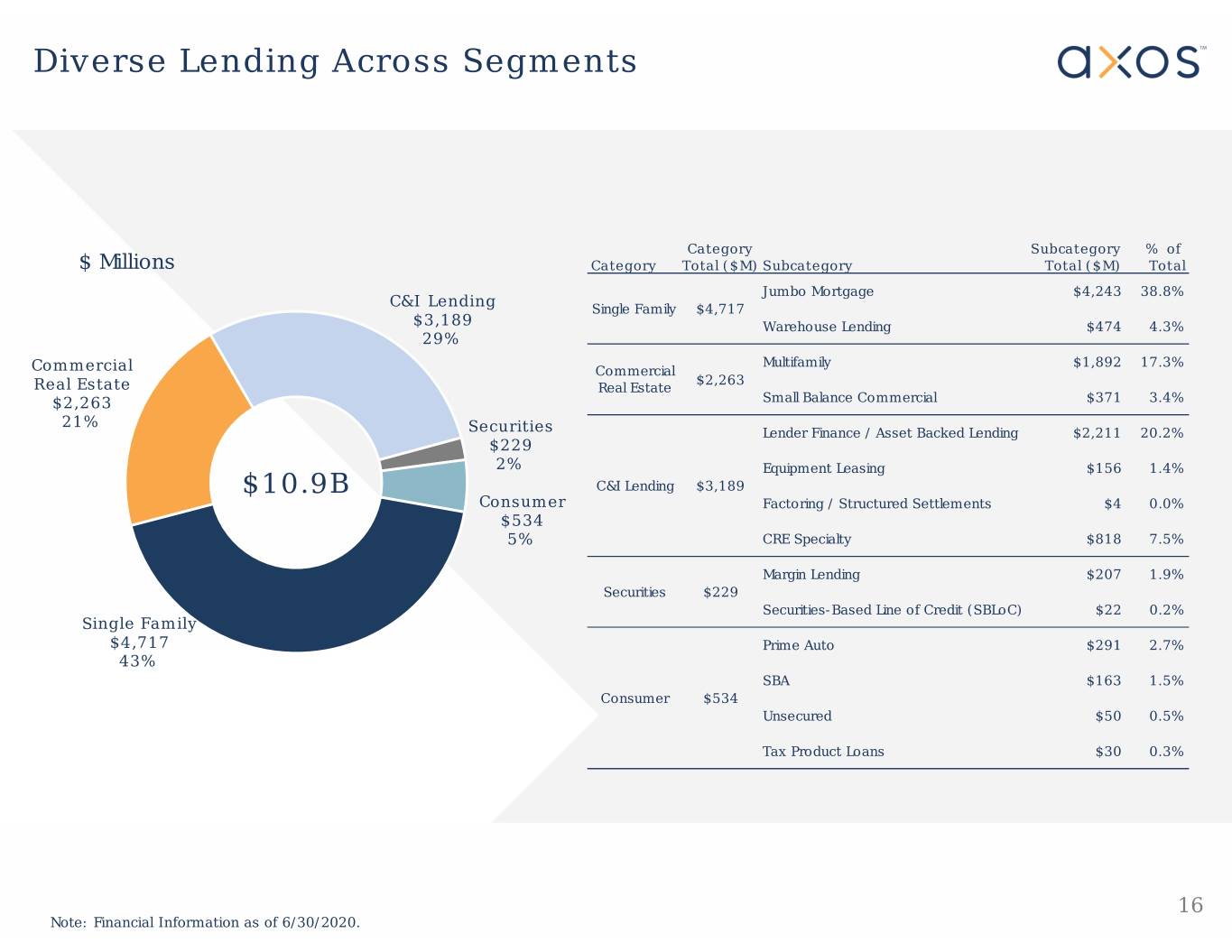

Diverse Lending Across Segments Category Subcategory % of $ Millions Category Total ($M) Subcategory Total ($M) Total Jumbo Mortgage $4,243 38.8% C&I Lending Single Family $4,717 $3,189 Warehouse Lending $474 4.3% 29% Multifamily $1,892 17.3% Commercial Commercial $2,263 Real Estate Real Estate $2,263 Small Balance Commercial $371 3.4% 21% Securities Lender Finance / Asset Backed Lending $2,211 20.2% $229 2% Equipment Leasing $156 1.4% $10.9B C&I Lending $3,189 Consumer Factoring / Structured Settlements $4 0.0% $534 5% CRE Specialty $818 7.5% Margin Lending $207 1.9% Securities $229 Securities-Based Line of Credit (SBLoC) $22 0.2% Single Family $4,717 Prime Auto $291 2.7% 43% SBA $163 1.5% Consumer $534 Unsecured $50 0.5% Tax Product Loans $30 0.3% 16 Note: Financial Information as of 6/30/2020.

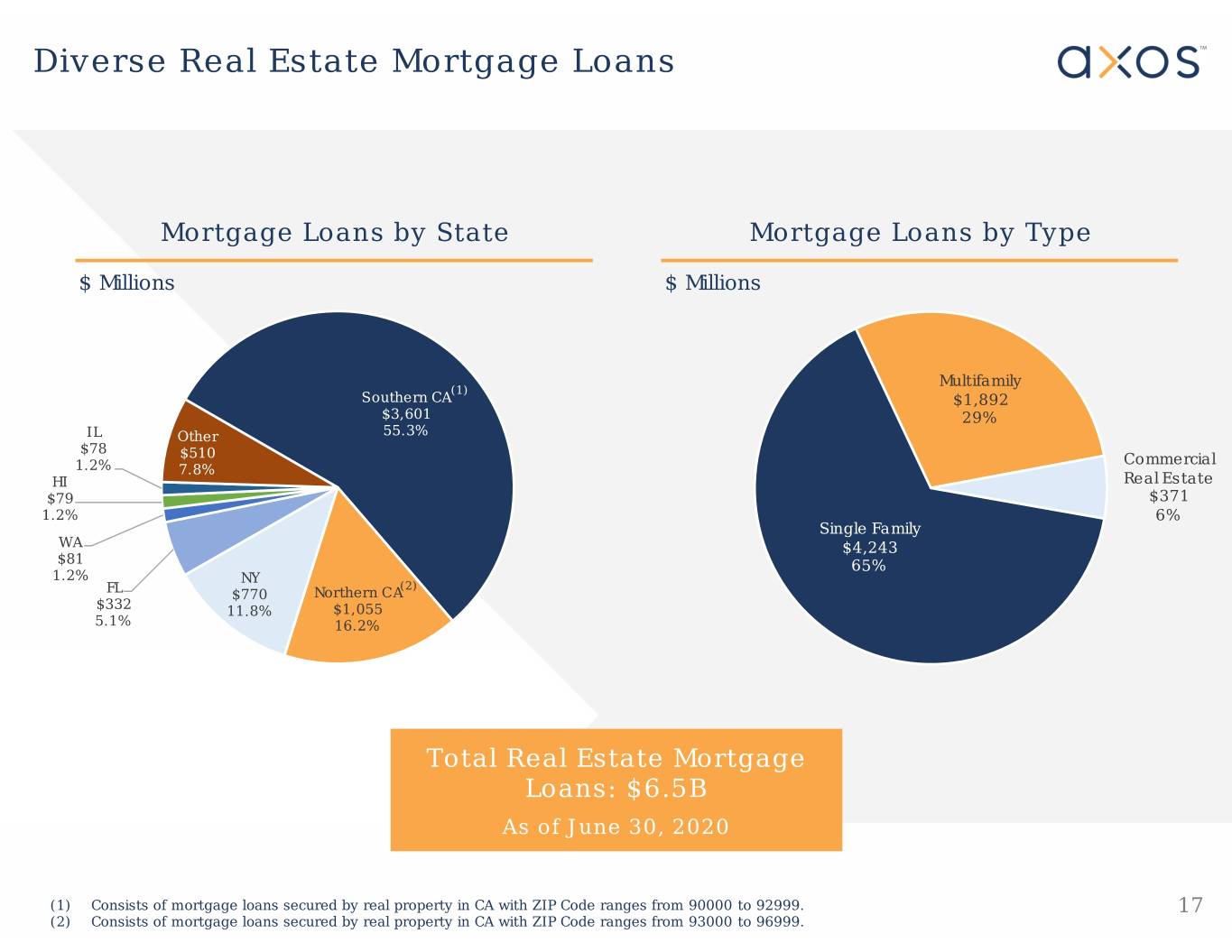

Diverse Real Estate Mortgage Loans Mortgage Loans by State Mortgage Loans by Type $ Millions $ Millions Multifamily (1) Southern CA $1,892 $3,601 29% IL Other 55.3% $78 $510 Commercial 1.2% 7.8% HI Real Estate $79 $371 1.2% 6% Single Family WA $4,243 $81 65% 1.2% NY (2) FL $770 Northern CA $332 11.8% $1,055 5.1% 16.2% Total Real Estate Mortgage Loans: $6.5B As of June 30, 2020 (1) Consists of mortgage loans secured by real property in CA with ZIP Code ranges from 90000 to 92999. 17 (2) Consists of mortgage loans secured by real property in CA with ZIP Code ranges from 93000 to 96999.

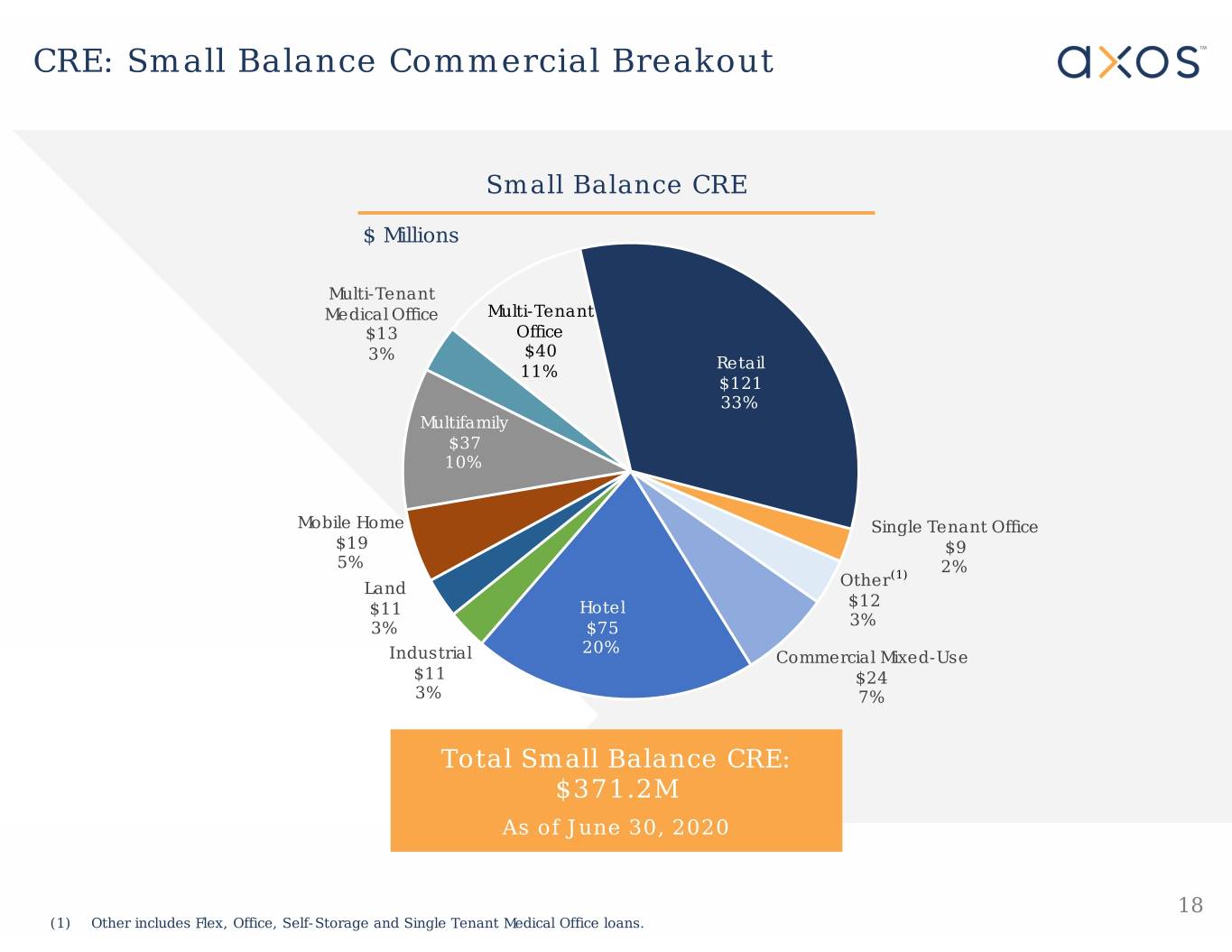

CRE: Small Balance Commercial Breakout Small Balance CRE $ Millions Multi-Tenant Medical Office Multi-Tenant $13 Office 3% $40 Retail 11% $121 33% Multifamily $37 10% Mobile Home Single Tenant Office $19 $9 5% (1) 2% Land Other $11 Hotel $12 3% 3% $75 20% Industrial Commercial Mixed-Use $11 $24 3% 7% Total Small Balance CRE: $371.2M As of June 30, 2020 18 (1) Other includes Flex, Office, Self-Storage and Single Tenant Medical Office loans.

C&I: Lender Finance and CRE Specialty Breakout Lender Finance / Asset Backed Lending CRE Specialty $ Millions $ Millions Capital Call Backed $24 3% Asset-backed Hotel Loans Hotel Land Asset-backed $105 $546 $164 (1) $68 Other Loans 13% 25% 7% 3% $27 $134 3% 16% Retail $92 Single Family Multifamily 11% $678 $597 Land 31% 27% $319 Office 39% $119 15% Retail Office $58 $98 3% 4% Total Lender Finance / Asset Total CRE Specialty: $818.8M Backed Lending: $2.2B As of June 30, 2020 As of June 30, 2020 19 (1) Other includes Investment Security Backed, Single Family, and Structured Settlement and Lotto Receivables.

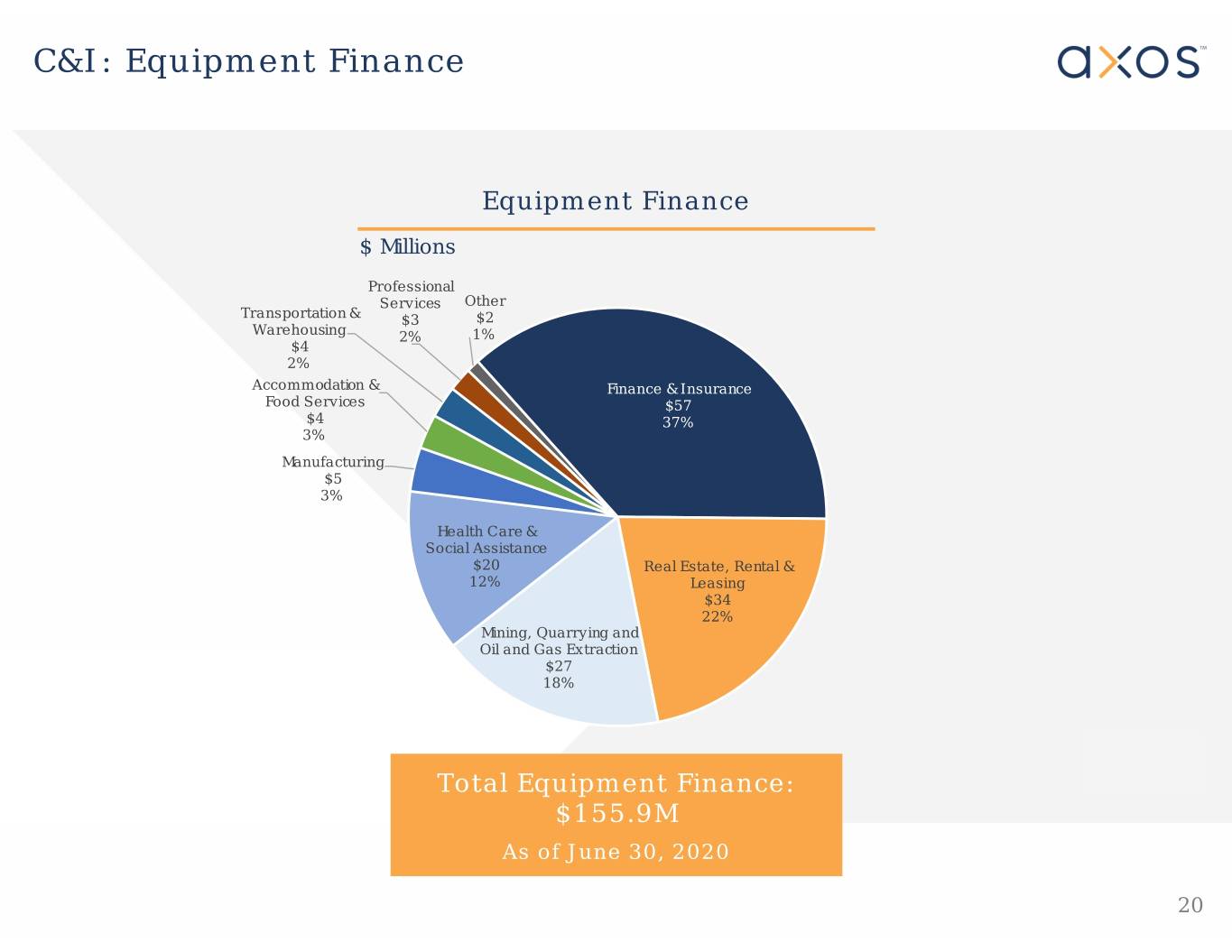

C&I: Equipment Finance Equipment Finance $ Millions Professional Services Other Transportation & $3 $2 Warehousing 2% 1% $4 2% Accommodation & Finance & Insurance Food Services $57 $4 37% 3% Manufacturing $5 3% Health C are & Social Assistance $20 Real Estate, Rental & 12% Leasing $34 22% Mining, Quarrying and Oil and Gas Extraction $27 18% Total Equipment Finance: $155.9M As of June 30, 2020 20

Low Loan Deferrals Loan Deferrals by Type Data as of 6/30/2020 Amount Deferred ($M) % of Category Loans C&I $5.6 0.2% Multifamily + CRE 0.0 0.0% Jumbo SFR 95.8 2.3% Auto 28.0 9.7% Consumer Unsecured 2.7 5.0% Total $132.1 1.2% 21

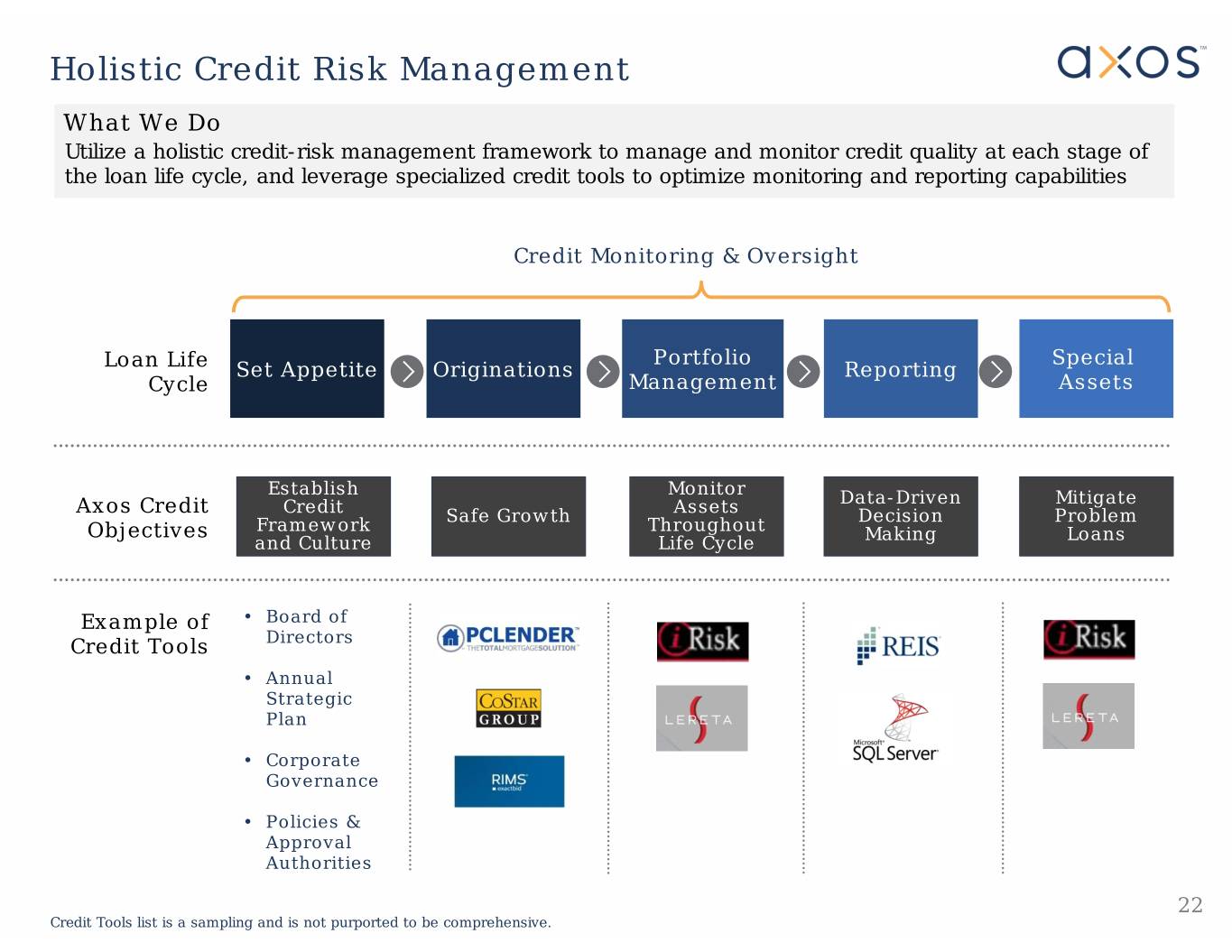

Holistic Credit Risk Management What We Do Utilize a holistic credit-risk management framework to manage and monitor credit quality at each stage of the loan life cycle, and leverage specialized credit tools to optimize monitoring and reporting capabilities Credit Monitoring & Oversight Portfolio Special Loan Life Set Appetite Originations Reporting Cycle Management Assets Establish Monitor Data-Driven Mitigate Credit Assets Axos Credit Safe Growth Decision Problem Framework Throughout Objectives Making Loans and Culture Life Cycle Example of • Board of Credit Tools Directors • Annual Strategic Plan • Corporate Governance • Policies & Approval Authorities 22 Credit Tools list is a sampling and is not purported to be comprehensive.

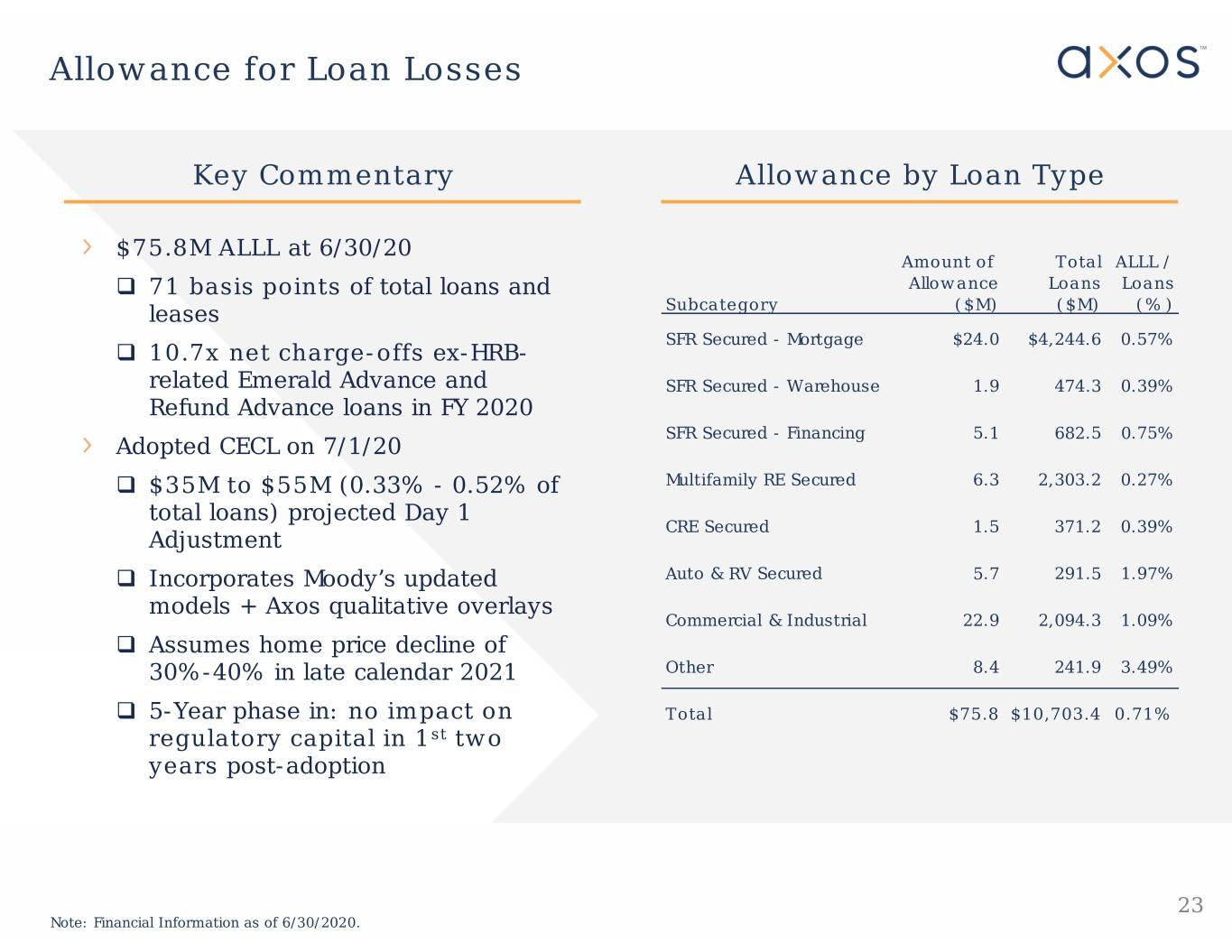

Allowance for Loan Losses Key Commentary Allowance by Loan Type $75.8M ALLL at 6/30/20 Amount of Total ALLL / 71 basis points of total loans and Allowance Loans Loans leases Subcategory ($M) ($M) (%) SFR Secured - Mortgage $24.0 $4,244.6 0.57% 10.7x net charge-offs ex-HRB- related Emerald Advance and SFR Secured - Warehouse 1.9 474.3 0.39% Refund Advance loans in FY 2020 SFR Secured - Financing 5.1 682.5 0.75% Adopted CECL on 7/1/20 $35M to $55M (0.33% - 0.52% of Multifamily RE Secured 6.3 2,303.2 0.27% total loans) projected Day 1 CRE Secured 1.5 371.2 0.39% Adjustment Incorporates Moody’s updated Auto & RV Secured 5.7 291.5 1.97% models + Axos qualitative overlays Commercial & Industrial 22.9 2,094.3 1.09% Assumes home price decline of 30%-40% in late calendar 2021 Other 8.4 241.9 3.49% 5-Year phase in: no impact on Total $75.8 $10,703.4 0.71% regulatory capital in 1st two years post-adoption 23 Note: Financial Information as of 6/30/2020.

Deposit Strategy

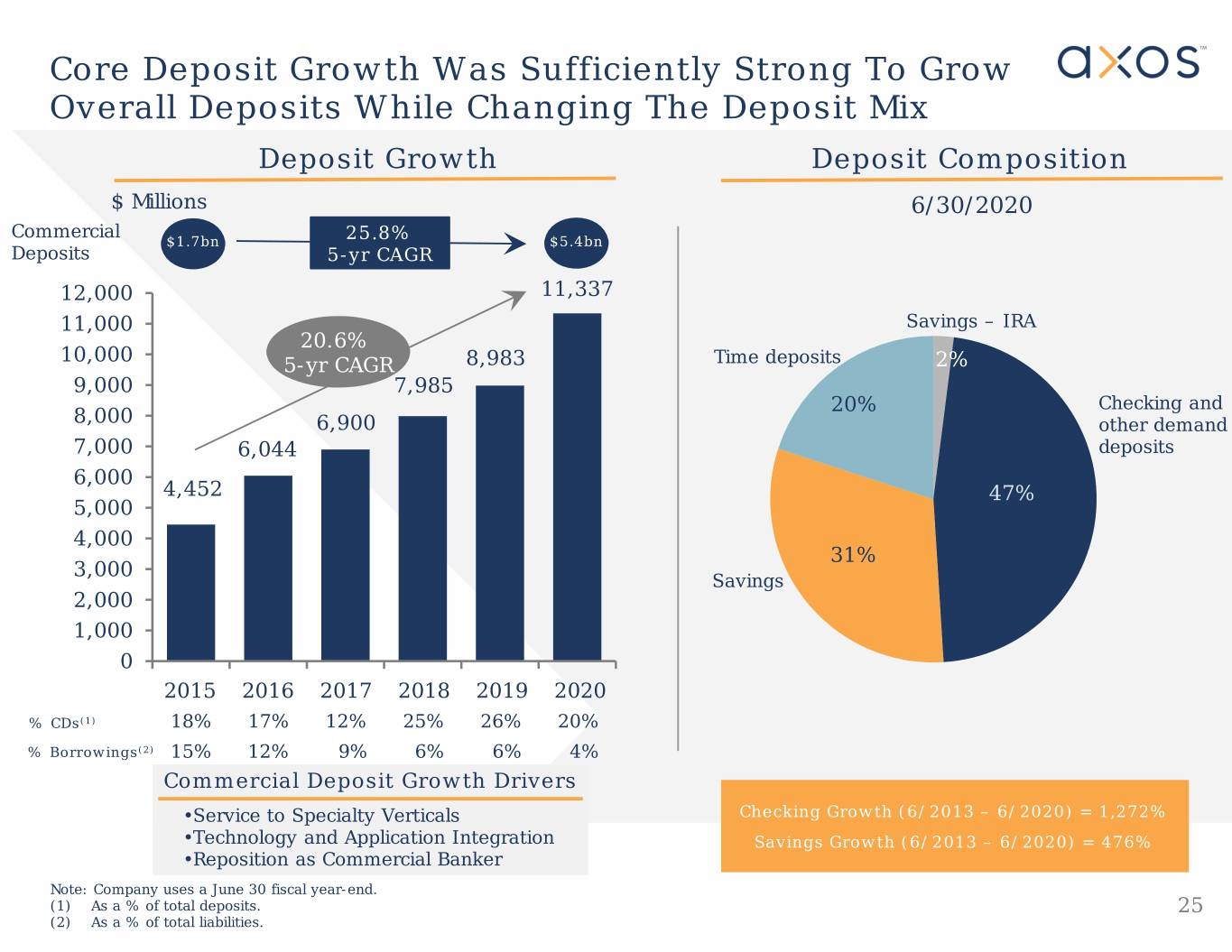

Core Deposit Growth Was Sufficiently Strong To Grow Overall Deposits While Changing The Deposit Mix Deposit Growth Deposit Composition $ Millions 6/30/2020 Commercial $1.7bn 25.8% $5.4bn Deposits 5-yr CAGR 12,000 11,337 11,000 Savings – IRA 20.6% 10,000 5-yr CAGR 8,983 Time deposits 2% 9,000 7,985 20% Checking and 8,000 6,900 other demand 7,000 6,044 deposits 6,000 4,452 47%% 5,000 4,000 31% 3,000 Savings 2,000 1,000 0 2015 2016 2017 2018 2019 2020 % CDs(1) 18% 17% 12% 25% 26% 20% % Borrowings(2) 15% 12% 9% 6% 6% 4% Commercial Deposit Growth Drivers • Service to Specialty Verticals Checking Growth (6/2013 – 6/2020) = 1,272% • Technology and Application Integration Savings Growth (6/2013 – 6/2020) = 476% • Reposition as Commercial Banker Note: Company uses a June 30 fiscal year-end. (1) As a % of total deposits. 25 (2) As a % of total liabilities.

Significant Improvements To Deposits Mix Deposit Initiatives Core Deposits(1) (%) 90.0 Repositioned deposits with focus 80.0 on core deposits driven by 70.0 commercial relationships 60.0 50.0 40.0 2012 2013 2014 2015 2016 2017 2018 2019 2020 Non-Interest Bearing Deposits / Total Deposits (%) Strategic focused on improving 30.0 25.0 quality of deposit mix; 17.1% 20.0 noninterest-bearing deposits 15.0 10.0 5.0 0.0 2012 2013 2014 2015 2016 2017 2018 2019 2020 Loans / Deposits (%) 125.0 Deposits consistently outgrowing 120.0 loans: 20.6% deposit 5-year CAGR 115.0 110.0 versus 16.4% for loans 105.0 100.0 95.0 90.0 2012 2013 2014 2015 2016 2017 2018 2019 2020 Note: Company uses a June 30 fiscal year-end. 26 (1) Deposits, less time deposit accounts with balances over $100,000, foreign deposits and unclassified deposits.

Customer Base and Deposit Volume is Well Distributed Throughout the United States Average Deposit Balance Number of Accounts Axos Deposits Have National Reach With Customers in Every State 27

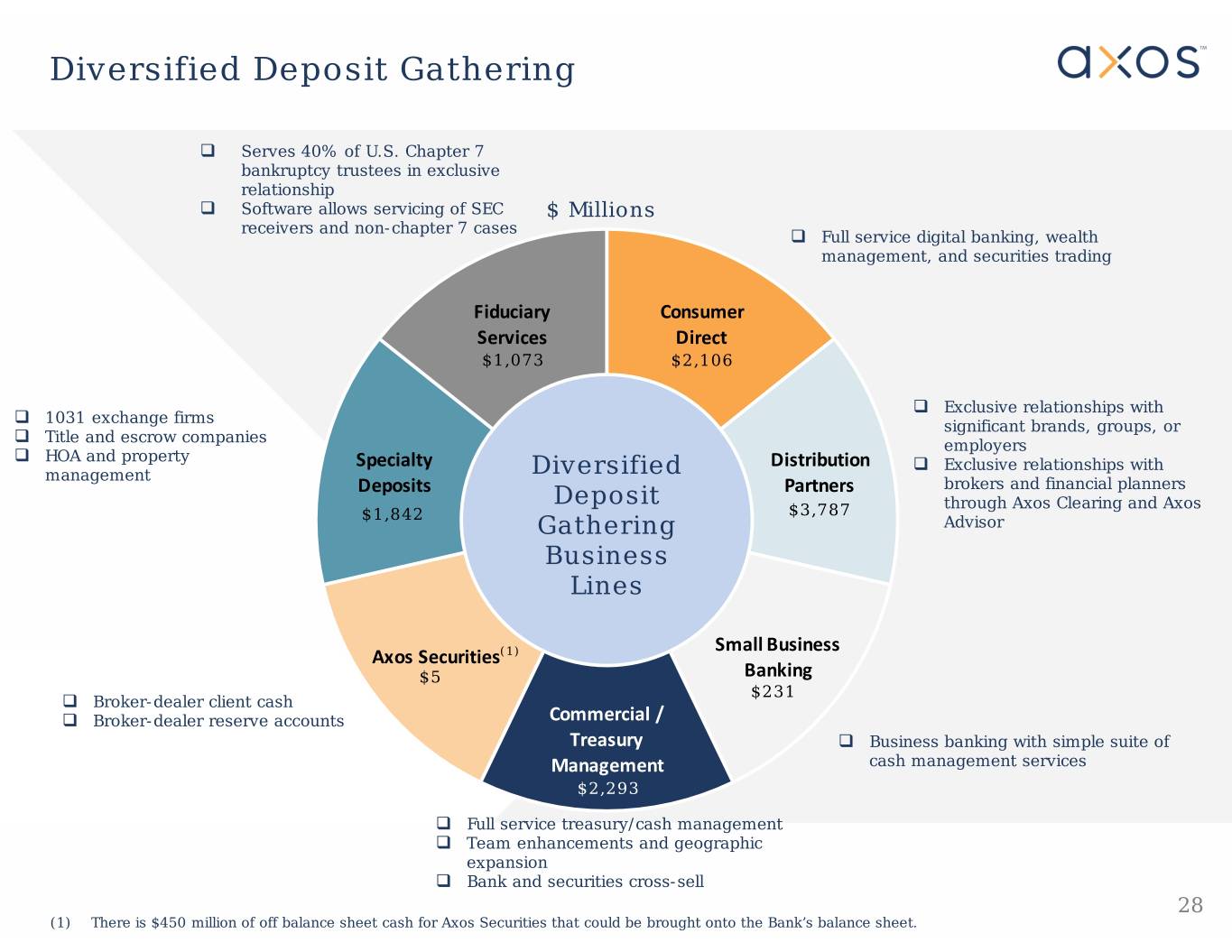

Diversified Deposit Gathering Serves 40% of U.S. Chapter 7 bankruptcy trustees in exclusive relationship Software allows servicing of SEC $ Millions receivers and non-chapter 7 cases Full service digital banking, wealth management, and securities trading Fiduciary Consumer Services Direct $1,073 $2,106 Exclusive relationships with 1031 exchange firms significant brands, groups, or Title and escrow companies employers HOA and property Specialty Distribution Exclusive relationships with management Diversified Deposits Deposit Partners brokers and financial planners $3,787 through Axos Clearing and Axos $1,842 Gathering Advisor Business Lines Small Business Axos Securities(1) $5 Banking $231 Broker-dealer client cash Broker-dealer reserve accounts Commercial / Treasury Business banking with simple suite of Management cash management services $2,293 Full service treasury/cash management Team enhancements and geographic expansion Bank and securities cross-sell 28 (1) There is $450 million of off balance sheet cash for Axos Securities that could be brought onto the Bank’s balance sheet.

Capital, Asset-Liability Management, Interest Rate Management and Liquidity

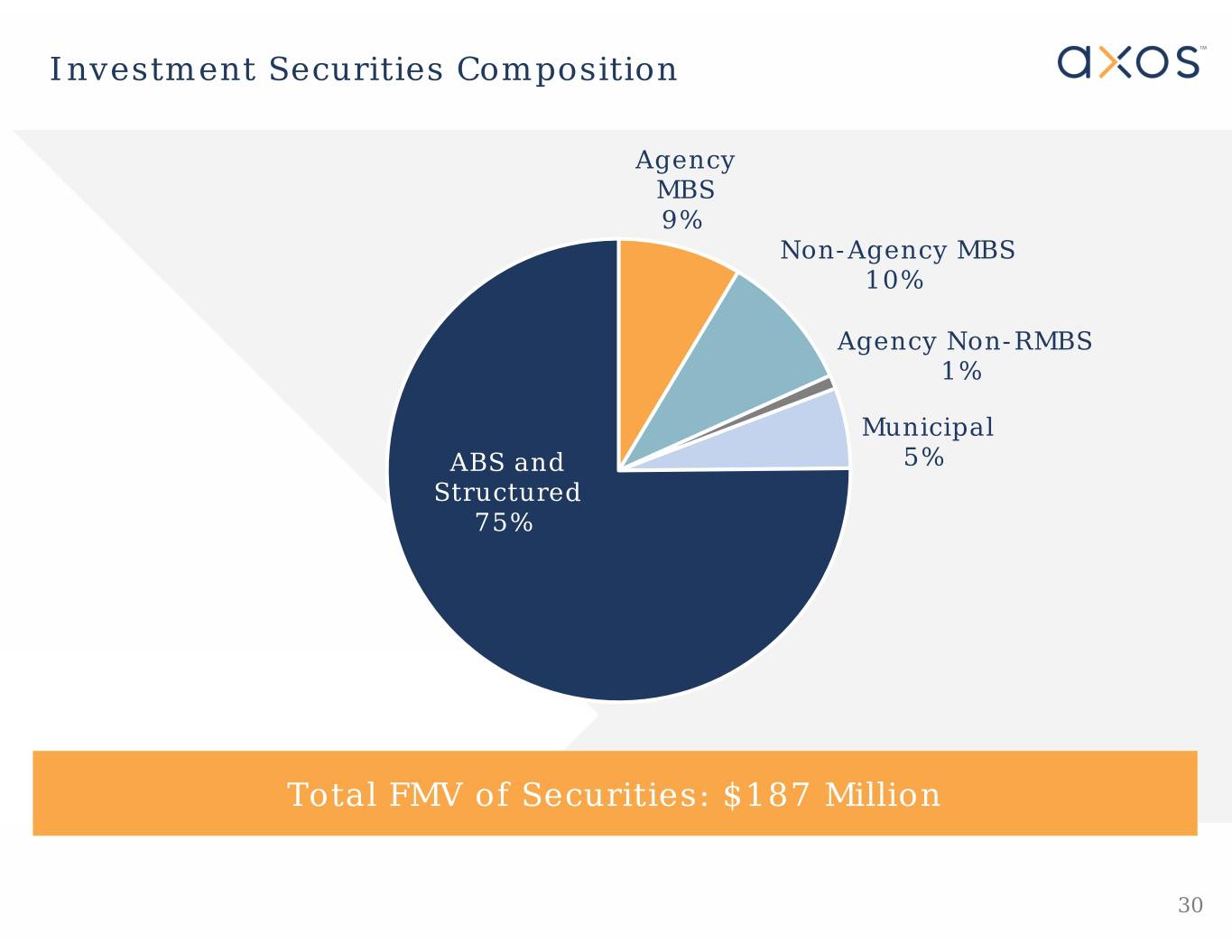

Investment Securities Composition Agency MBS 9% Non-Agency MBS 10% Agency Non-RMBS 1% Municipal ABS and 5% Structured 75% Total FMV of Securities: $187 Million 30

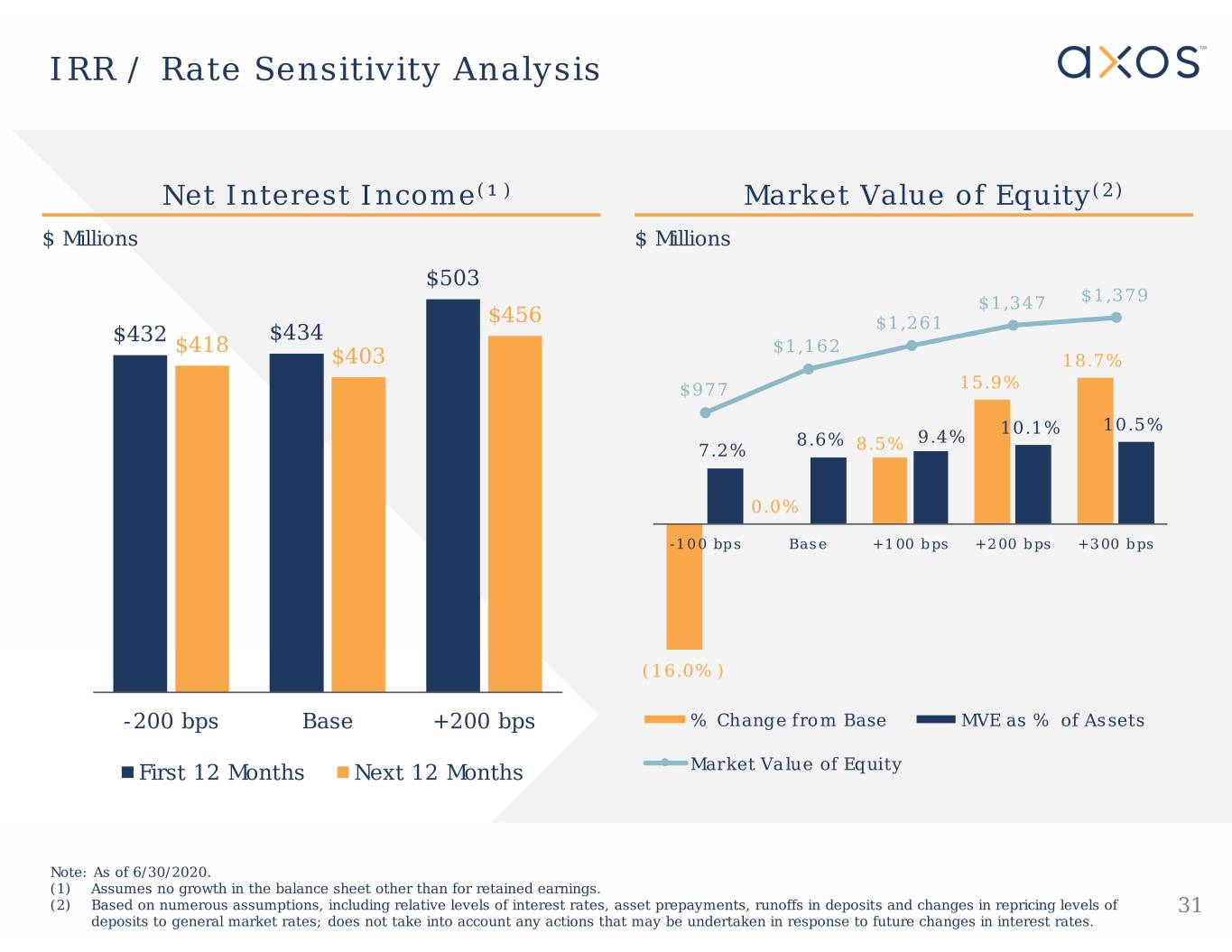

IRR / Rate Sensitivity Analysis Net Interest Income(¹) Market Value of Equity(2) $ Millions $ Millions $503 $1,347 $1,379 $456 $1,261 $432 $434 $418 $1,162 $403 18.7% $977 15.9% 10.1% 10.5% 8.6% 9.4% 7.2% 8.5% 0.0% -100 bps Base +100 bps +200 bps +300 bps (16.0%) -200 bps Base +200 bps % Change from Base MVE as % of Assets First 12 Months Next 12 Months Market Value of Equity Note: As of 6/30/2020. (1) Assumes no growth in the balance sheet other than for retained earnings. (2) Based on numerous assumptions, including relative levels of interest rates, asset prepayments, runoffs in deposits and changes in repricing levels of 31 deposits to general market rates; does not take into account any actions that may be undertaken in response to future changes in interest rates.

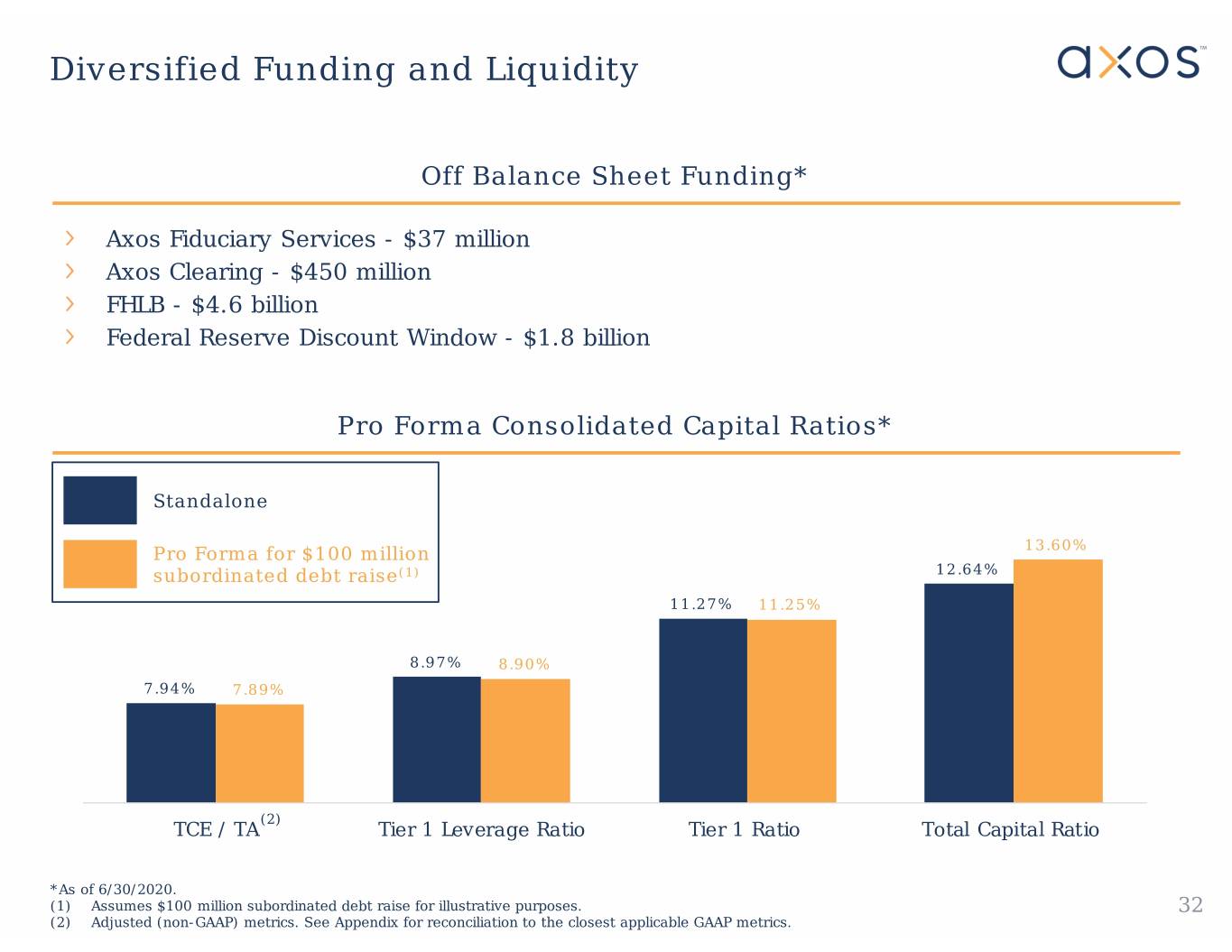

Diversified Funding and Liquidity Off Balance Sheet Funding* Axos Fiduciary Services - $37 million Axos Clearing - $450 million FHLB - $4.6 billion Federal Reserve Discount Window - $1.8 billion Pro Forma Consolidated Capital Ratios* Standalone Pro Forma for $100 million 13.60% subordinated debt raise(1) 12.64% 11.27% 11.25% 8.97% 8.90% 7.94% 7.89% (2) TCE / TA Tier 1 Leverage Ratio Tier 1 Ratio Total Capital Ratio *As of 6/30/2020. (1) Assumes $100 million subordinated debt raise for illustrative purposes. 32 (2) Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics.

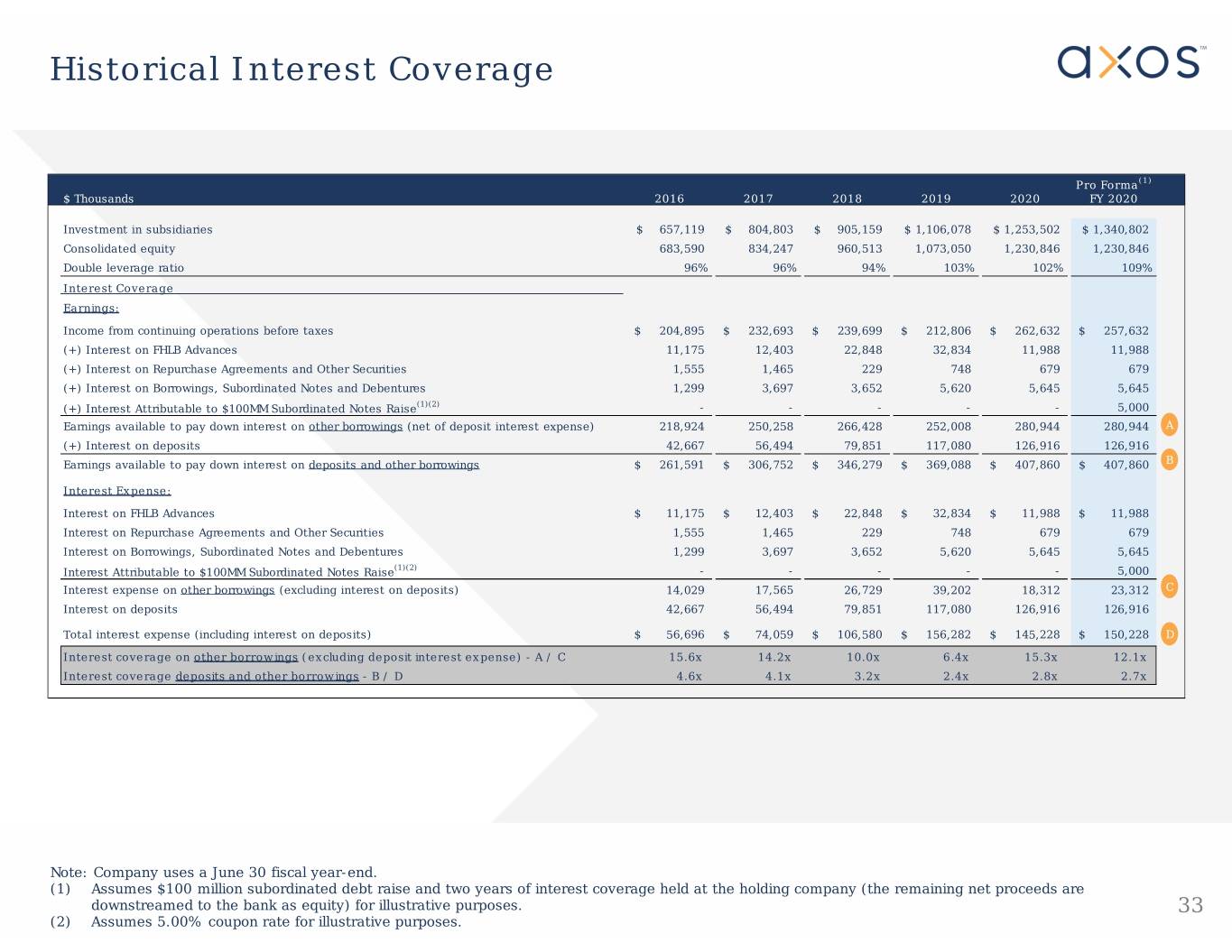

Historical Interest Coverage Pro Forma(1) $ Thousands 2016 2017 2018 2019 2020 FY 2020 Investment in subsidiaries $ 657,119 $ 804,803 $ 905,159 $ 1,106,078 $ 1,253,502 $ 1,340,802 Consolidated equity 683,590 834,247 960,513 1,073,050 1,230,846 1,230,846 Double leverage ratio 96% 96% 94% 103% 102% 109% Interest Coverage Earnings: Income from continuing operations before taxes$ 204,895 $ 232,693 $ 239,699 $ 212,806 $ 262,632 $ 257,632 (+) Interest on FHLB Advances 11,175 12,403 22,848 32,834 11,988 11,988 (+) Interest on Repurchase Agreements and Other Securities 1,555 1,465 229 748 679 679 (+) Interest on Borrowings, Subordinated Notes and Debentures 1,299 3,697 3,652 5,620 5,645 5,645 (+) Interest Attributable to $100MM Subordinated Notes Raise(1)(2) -----5,000 Earnings available to pay down interest on other borrowings (net of deposit interest expense) 218,924 250,258 266,428 252,008 280,944 280,944 A (+) Interest on deposits 42,667 56,494 79,851 117,080 126,916 126,916 Earnings available to pay down interest on deposits and other borrowings $ 261,591 $ 306,752 $ 346,279 $ 369,088 $ 407,860 $ 407,860 B Interest Expense: Interest on FHLB Advances $ 11,175 $ 12,403 $ 22,848 $ 32,834 $ 11,988 $ 11,988 Interest on Repurchase Agreements and Other Securities 1,555 1,465 229 748 679 679 Interest on Borrowings, Subordinated Notes and Debentures 1,299 3,697 3,652 5,620 5,645 5,645 Interest Attributable to $100MM Subordinated Notes Raise(1)(2) -----5,000 Interest expense on other borrowings (excluding interest on deposits) 14,029 17,565 26,729 39,202 18,312 23,312 C Interest on deposits 42,667 56,494 79,851 117,080 126,916 126,916 Total interest expense (including interest on deposits)$ 56,696 $ 74,059 $ 106,580 $ 156,282 $ 145,228 $ 150,228 D Interest coverage on other borrowings (excluding deposit interest expense) - A / C 15.6x 14.2x 10.0x 6.4x 15.3x 12.1x Interest coverage deposits and other borrowings - B / D 4.6x4.1x3.2x2.4x2.8x2.7x Note: Company uses a June 30 fiscal year-end. (1) Assumes $100 million subordinated debt raise and two years of interest coverage held at the holding company (the remaining net proceeds are downstreamed to the bank as equity) for illustrative purposes. 33 (2) Assumes 5.00% coupon rate for illustrative purposes.

Appendix

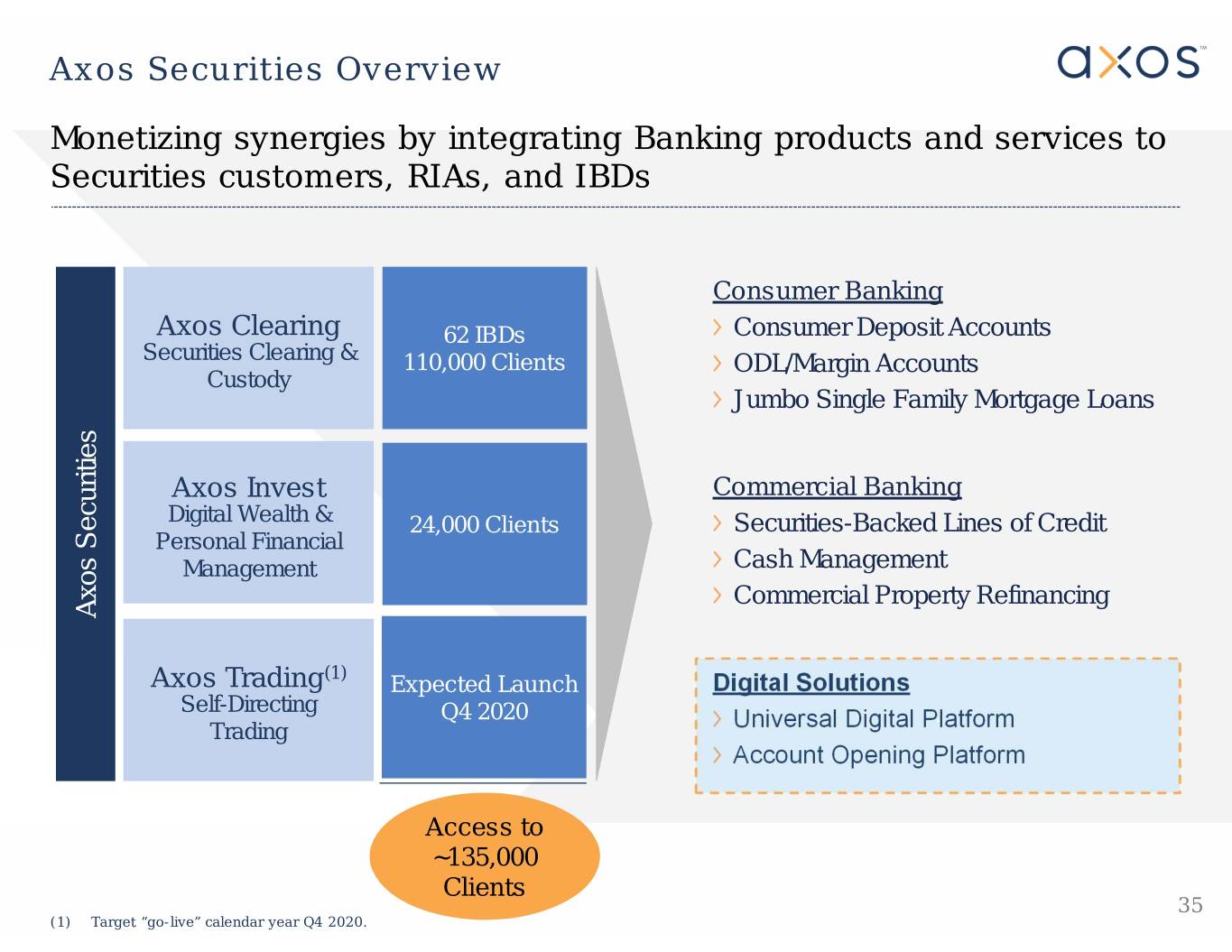

Axos Securities Overview Monetizing synergies by integrating Banking products and services to Securities customers, RIAs, and IBDs Consumer Banking Axos Clearing 62 IBDs Consumer Deposit Accounts Securities Clearing & 110,000 Clients ODL/Margin Accounts Custody Jumbo Single Family Mortgage Loans Axos Invest Commercial Banking Digital Wealth & 24,000 Clients Securities-Backed Lines of Credit Personal Financial Management Cash Management Commercial Property Refinancing Axos Securities (1) Axos Trading Expected Launch Digital Solutions Self-Directing Q4 2020 . Trading Universal Digital Platform Account Opening Platform Access to ~135,000 Clients 35 (1) Target “go-live” calendar year Q4 2020.

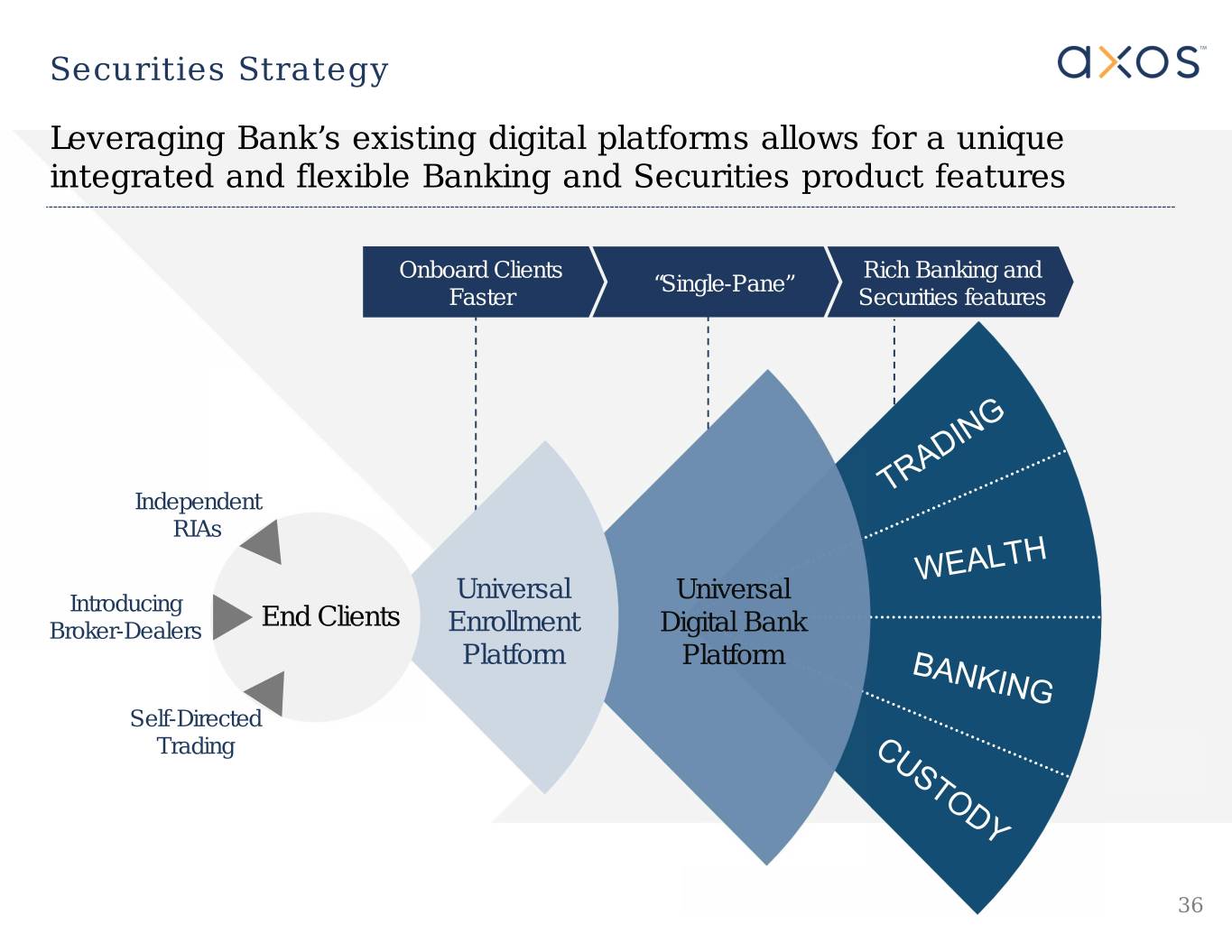

Securities Strategy Leveraging Bank’s existing digital platforms allows for a unique integrated and flexible Banking and Securities product features Onboard Clients Rich Banking and “Single-Pane” Faster Securities features Independent RIAs Universal Universal Introducing End Clients Broker-Dealers Enrollment Digital Bank Platform Platform Self-Directed Trading 36

Ratings Profile Moody’s Ratings Type Rating Outlook Axos Financial, Inc. Long-term Issuer Rating Baa3 Stable Subordinate Regular Bond / Debenture Baa3 N/A Subordinate Shelf Baa3 N/A Senior Unsecured Shelf Baa3 N/A Axos Bank Long-term Issuer Rating Baa3 Stable Adjusted Baseline Credit Assessment baa2 N/A Baseline Credit Assessment baa2 N/A Long-term Bank Deposits A3 Stable Short-term Bank Deposits P-2 N/A Kroll Ratings Entity Type Rating Outlook Axos Financial, Inc. Senior Unsec ured Debt BBB+ St able Subordinated Debt BBB Stable Short-Term Debt K2 N/A Axos Bank Deposit A- Stable Senior Unsecured Debt A- Stable Subordinat ed Debt BBB+ St able Short-Term Deposit K2 N/A Short-Term Debt K2 N/A 37

Select Financials FY 2016-FY 2020 FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 CAGR Selected Balance Sheet Data ($M) Total Assets $7,599.3 $8,501.7 $9,539.5 $11,220.2 $13,851.9 16.2% Loans Held for Sale, at Fair Value 20.9 18.7 35.1 33.3 52.0 25.6% Allowance for Loan Losses 35.8 40.8 49.2 57.1 75.8 20.6% Securities 472.2 272.8 180.3 227.5 187.7 (20.6%) Total Deposits 6,044.1 6,899.5 7,985.4 8,983.2 11,336.7 17.0% Advances from the FHLB 727.0 640.0 457.0 458.5 242.5 (24.0%) Borrowings 56.0 54.5 54.6 168.9 235.8 43.2% Total Stockholders' Equity 683.6 834.2 960.5 1,073.1 1,230.8 15.8% Selected Income Statement Data Net Interest Income $261.0 $313.2 $368.5 $408.6 $477.6 16.3% Provision for Loan and Lease Losses 9.7 11.1 25.8 27.4 42.2 44.4% Non-Interest Income 66.3 68.1 70.9 82.8 103.0 11.6% Non-Interest Expense 112.8 137.6 173.9 251.2 275.8 25.1% Net Income 119.3 134.7 152.4 155.1 183.4 11.4% Per Common Share Data Diluted EPS $1.87 $2.10 $2.37 $2.48 $2.98 12.4% Adjusted Earnings per Common Share (Non-GAAP)(1) N/A N/A 2.39 2.75 3.10 - Book Value Per Common Share 10.73 13.05 15.24 17.47 20.56 17.7% Tangible Bo ok Value per Co mmon Share (Non-GAAP)(1) 10.67 12.94 13.99 15.10 18.28 14.4% Performance Ratios and Other Data Loan and Lease Originations for Investment $3,633.9 $4,182.7 $5,922.8 $6,934.3 $6,798.0 17.0% Loan Originations for Sale $1,363.0 $1,375.4 $1,564.2 $1,471.9 $1,601.6 4.1% ROAA 1.75 % 1.68 % 1.68 % 1.51 % 1.53 % - ROAE 19.43 17.78 17.05 15.40 15.65 - Interest Rate Spread 3.70 3.74 3.79 3.66 3.65 - Net Interest Margin 3.91 3.95 4.11 4.07 4.12 - Net Interest Margin - Banking Segment Only N/A N/A 4.14 4.14 4.19 - Efficiency Ratio 34.44 36.08 39.58 51.12 47.50 - Efficiency Ratio - Banking Segment Only N/A N/A 34.55 40.51 39.81 - Asset Quality Metrics NCOs / Average Loans (0.01) % 0.06 % 0.19 % 0.19 % 0.23 % - NPLs / Loans 0.500.380.370.510.82- NPAs / Assets 0.42 0.35 0.43 0.50 0.68 - ALLL / Loans HFI 0.56 0.55 0.58 0.60 0.71 - ALLL / NPLs 112.45 143.81 157.40 117.84 86.20 - Capital Ratios TCE / TA(1) 8.88 % 9.68 % 9.27 % 8.34 % 7.94 % - CET1 Ratio 14.42 14.66 13.27 11.43 11.22 - Leverage Ratio 9.129.959.458.758.97- Tier 1 Capital 14.53 14.75 13.34 11.49 11.27 - Total Capital 16.36 16.38 14.84 12.91 12.64 - 38 (1) Adjusted (non-GAAP) metrics. See Non-GAAP Reconciliation for the closest applicable GAAP metrics.

Non-GAAP Reconciliation $ Millions, except per share data FY 2016 FY 2017 FY 2018 FY 2019 FY 2020 Total common equity (GAAP) $678.5 $829.2 $955.5 $1,068.0 $1,225.8 Less goodwill and other intangible assets 0.0 0.0 67.8 134.9 125.4 Less mortgage servicing rights, carried at fair value 3.9 7.2 10.8 9.8 10.7 Tangible Common Equity (Non-GAAP) $674.6 $822.0 $876.9 $923.3 $1,089.7 Total Assets (GAAP) $7,599.3 $8,501.7 $9,539.5 $11,220.2 $13,851.9 Less goodwill and other intangible assets 0.0 0.0 67.8 134.9 125.4 Less mortgage servicing rights, carried at fair value 3.9 7.2 10.8 9.8 10.7 Tangible Assets (Non-GAAP) $7,595.4 $8,494.5 $9,460.9 $11,075.5 $13,715.8 Average Common Equity (GAAP) $608.3 $753.6 $884.8 $1,007.7 $1,148.3 Less goodwill and other intangible assets (excluding MSRs) 0.0 0.0 33.9 101.3 130.1 Average tangible common stockholders' equity (Non-GAAP) $608.3 $753.6 $850.9 $906.3 $1,018.1 Common shares outstanding 63,219 63,536 62,688 61,129 59,613 Diluted Common Shares Outstanding --64,147 62,382 61,438 Net income available to common shareholders $119.0 $134.4 $152.1 $154.8 $183.1 Book value per common share (GAAP) $10.73 $13.05 $15.24 $17.47 $20.56 Net Income (GAAP) - - $152.4 $155.1 $183.4 Acquisition-related co sts - - 1.5 6.7 10.1 Excess FDIC expense - - 0.0 1.1 0.0 Other costs --0.015.30.0 Inco me taxes - - (0.5) (6.3) (3.0) Adjusted earnings (Non-GAAP) - - $153.3 $172.0 $190.5 Tangible book value per common share (Non-GAAP) $10.67 $12.94 $13.99 $15.10 $18.28 Tangible common equity to tangible assets (Non-GAAP) 8.88% 9.68% 9.27% 8.34% 7.94% Return on average common tangible equity (Non-GAAP) 19.56% 17.84% 17.88% 17.08% 17.99% Adjusted EPS (Non-GAAP) - - $2.39 $2.75 $3.10 Market data as of 9/14/2020 Stock Price $23.93 Price / Tangible Boo k Value 1.31x 39

Contact Information Greg Garrabrants, President and CEO Andy Micheletti, EVP/CFO investors@axosfinancial.com www.axosfinancial.com Johnny Lai, VP Corporate Development and Investor Relations Phone: 858.649.2218 Mobile: 858.245.1442 jlai@axosfinancial.com