During 2005, the Company granted restricted stock awards totaling 285,080 shares of stock to 25 employees and 6,000 vested shares (2,000 each) to the three independent directors. Executive officers receiving restricted stock awards were as following: Thomas Wirth – 76,923 shares (the stock was awarded in 2004 and issued during 2005); Jeffrey Erhart – 6,154 shares; Lloyd Miller – 77,500 shares, and Wayne Snyder – 50,000 shares. No stock options were granted in 2005.

The members of the Compensation Committee are Bruce E. Moore (Chairman), Lawrence S. Kaplan, and Paul H. McDowell. No member of the Compensation Committee is or was formerly an officer or an employee of the Company. No executive officer of the Company serves as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving as a member of the Company’s Board, nor has such interlocking relationship existed in the past.

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors, executive officers and persons who own more than 10.00% of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other of our equity securities. Directors, officers and greater than 10% stockholders are required to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of such reports furnished to us, during the fiscal year ended December 31, 2005, all Section 16(a) filing requirements applicable to our directors, officers and greater than 10% beneficial owners were met.

Back to Contents

Mr. Feldman and Mr. Bourg do not receive any compensation from us for their services as directors. The Company pays non-employee directors an annual retainer of $50,000, paid in quarterly installments of $12,500. The chairman of the Audit Committee receives an additional $30,000 per annum, paid in quarterly installments of $7,500 and the chairmen of the Compensation Committee and the Nominating and Corporate Governance Committee each receive an additional $2,500 per annum. In addition, non-employee directors were entitled to receive 1,000 shares of stock upon completion of the Company’s initial public offering and an additional 1,000 shares upon each annual meeting of stockholders; 2,000 shares of stock were issued to each of the non-employee directors in 2005 in satisfaction of such obligations. Each stock grant to non-employee directors is non-contingent and vests immediately upon issuance.

The Company and each of our directors and executive officers have entered into indemnification agreements. The indemnification agreements provide that we will indemnify the directors and the executive officers to the fullest extent permitted by our Amended and Restated Charter and Maryland law against certain liabilities (including settlements) and expenses actually and reasonably incurred by them in connection with any threatened or pending legal action, proceeding or investigation to which any of them is, or is threatened to be, made a party by reason of their status as our director, officer or agent, or by reason of their serving as a director, officer or agent of another company at our request. We will not indemnify the directors and executive officers if it is established that: (1) the act or omission was material to the matter giving rise to the proceeding and was committed in bad faith or the result of active and deliberate dishonesty, (2) the director or officer actually received an improper personal benefit, or (3) in the case of a criminal proceeding, the director or officer had reasonable cause to believe the act or omission was unlawful. In addition, we will not indemnify the directors and executive officers for a proceeding brought by a director or officer against us, except to enforce indemnification. If an amendment to the Amended and Restated Charter or Maryland law with respect to removal of limitations on indemnification is approved, the indemnification agreements will be amended accordingly. We are not required to indemnify any director or executive officer for liabilities: (1) for which he or she has already been unconditionally reimbursed from other sources, or (2) resulting from an accounting of profits under Section 16(b) of the Securities Exchange Act of 1934, as amended. In addition, we have obtained director and officer insurance for our directors and executive officers.

As discussed in the Report of our Compensation Committee, the Company has a written employment agreement with Larry Feldman, our Chairman of the Board and Chief Executive Officer. If Mr. Feldman’s employment is terminated (i) by Mr. Feldman for a good reason, generally defined as material reduction of authority, duties or responsibility, reduction in annual salary below $250,000, relocation of his office more than 25 miles from Long Island, New York, failure of the Company to provide an office, equipment and secretarial assistance, failure of the Company to pay any amounts owing under the employment agreement, or the Company’s breach of the employment agreement, or (ii) by the Company other than as a result of Mr. Feldman’s death, disability, conviction (or pleading nolo contendere to) a felony, or engagement in the performance of his duties in willful misconduct, willful or gross neglect, fraud, misappropriation or embezzlement, Mr. Feldman also will be entitled to (a) a lump sum cash payment equal to 2.99 multiplied by the sum of Mr. Feldman’s then current annual base salary and Mr. Feldman’s maximum potential bonus for the year (subject to certain minimum amounts) in which termination occurs (e.g. three times Mr. Feldman’s then current annual base salary), (b) full vesting of all outstanding equity-based awards held by Mr. Feldman, (c) three years of continuing coverage under group health plans, and (d) any additional tax gross-up payment necessary for Mr. Feldman to pay any excise tax imposed on “excess parachute payments” under Section 4999 of the Internal Revenue Code. Mr. Feldman’s employment agreement also provides that, during the term of his employment and for 12 months thereafter, he will not engage in the business that competes with us or provide any services to any other company that does so, he will not solicit or hire any of our employees, and he will not interfere with the Company’s relationship with any customer or client of the Company.

In December 2004, we entered into three-year employment agreements with James E. Bourg, an Executive Vice President and our Chief Operating Officer, Thomas Wirth, an Executive Vice President and

13

Back to Contents

our Chief Financial Officer, and Jeffrey Erhart, an Executive Vice President and our General Counsel. In addition to the compensation provisions described in the table above labeled “Summary of Executive Compensation,” these agreements provide that if the executive’s employment is terminated (i) by the executive for a good reason, generally defined as material reduction of authority, duties or responsibility, reduction in annual salary below $225,000, relocation of his office, failure of the Company to provide an office, equipment and secretarial assistance, failure of the Company to pay any amounts owing under the employment agreement, or the Company’s breach of the employment agreement, or (ii) by the Company other than as a result of the executive’s death, disability, conviction (or pleading nolo contendere to) a felony, or engagement in the performance of his duties in willful misconduct, willful or gross neglect, fraud, misappropriation or embezzlement, the executive also will be entitled to (a) a lump sum cash payment of equal to 2.99 multiplied by the sum of the executive’s then current annual base salary and the executive’s bonus for the year in which termination occurs (but assuming a minimum $150,000 bonus), (b) full vesting of all outstanding equity-based awards held by the executive and, for those executives holding limited partnership units in Feldman Equities Operating Partnership, LP (the operating partnership through which the Company conducts business), the immediate right to convert such units to common stock in the Company and sell the common stock, and (c) three years of continuing coverage under group health plans. Each executive’s employment agreement also provides that, during the term of his employment and for 12 months thereafter, he will not engage in the business that competes with us or provide any services to any other company that does so, he will not engage in the business that competes with us or provide any services to any other company that does so, he will not solicit or hire any of our employees, and he will not interfere with the Company’s relationship with any customer or client of the Company.

In November, 2005, we entered into an employment agreement with Wayne Snyder, our Executive Vice President of Development and in December 2005, we entered into an employment agreement with Lloyd Miller, our Executive Vice President of Leasing. In addition to the compensation provisions described in the notes to the table above labeled “Summary of Executive Compensation,” these agreements provide that if the executive’s employment is terminated prior to the expiration of two years from commencement of employment (i) by the executive for a good reason, generally defined as material reduction of authority, duties or responsibility, reduction in annual salary below $225,000, relocation of his office, failure of the Company to provide an office, equipment and secretarial assistance, failure of the Company to pay any amounts owing under the employment agreement, or the Company’s breach of the employment agreement, or (ii) by the Company other than as a result of the executive’s death, disability, conviction (or pleading nolo contendere to) a felony, or engagement in the performance of his duties in willful misconduct, willful or gross neglect, fraud, misappropriation or embezzlement, the executive also will be entitled to (a) a lump sum cash payment equal to the salary that the executive would have received if the executive had remained employed for the remainder of the two year term following commencement of employment, (b) a prorated portion of the executive’s bonus for the year in which termination occurs, (b) full vesting of all outstanding equity-based awards held by the executive, and (c) two years of continuing coverage under group health plans. Each executive’s employment agreement also provides that, during the term of his employment and for 12 months thereafter, he will not engage in the business that competes with us or provide any services to any other company that does so, he will not engage in the business that competes with us or provide any services to any other company that does so, he will not solicit or hire any of our employees, and he will not interfere with the Company’s relationship with any customer or client of the Company.

Independent Auditors’ Fees and Services |

The following summarizes the fees paid to KPMG LLP for the years ended December 31, 2005 and 2004:

| | | 2005 | | 2004 | |

| | |

|

| |

|

| |

| Audit Fees | | $ | 1,586,000 | (1) | $ | 1,069,000 | (2) |

| | |

|

| |

|

| |

Audit-Related Fees (3) | | | 141,800 | | | 140,300 | |

| | |

|

| |

|

| |

Tax Fees (4) | | | 46,000 | | | 52,200 | |

| | |

|

| |

|

| |

| All Other Fees | | | — | | | — | |

| | |

|

| |

|

| |

| Total Fees | | $ | 1,773,800 | | $ | 1,261,500 | |

| | |

|

| |

|

| |

14

Back to Contents

| (1) | “Audit fees” are the aggregate fees billed by KPMG LLP for professional services rendered in connection with the Company’s annual audit, review of unaudited financial information and audit of the Company’s internal controls over financial reporting (only applicable in 2005) for the years ended December 31, 2005 and 2004. |

| (2) | “2004 Audit fees” are the aggregate fees billed by KPMG LLP for professional services rendered in connection with the Company’s initial public offering (including but not limited to audits of the 2003 and 2002 consolidated financial statements of the Company’s predecessor, comfort letters, consents, review of unaudited interim financial statements of our predecessor, and review of the registration statements on Form S-11 and amendments thereto), and the audit of the Company’s and our predecessor’s financial statements for the year ended December 31, 2004. |

| (3) | “Audit-related fees” include fees relating to audits of unconsolidated joint ventures, and audits and limited reviews of unaudited financial information relating to statements of revenues and expenses for acquired properties. |

| (4) | “Tax fees” are fees related to tax advice and consultation relating to REIT compliance. |

The Company’s Audit Committee is responsible for retaining and terminating the Company’s independent auditors (subject, if applicable, to stockholder ratification) and for approving the performance of any non-audit services by the independent auditors. In addition, the Audit Committee is responsible for reviewing and evaluating the qualifications, performance and independence of the lead partner of the independent auditors and for presenting its conclusions with respect to the independent auditors to the full Board.

Pre-Approval Policies and Procedures of our Audit Committee |

The Audit Committee Charter provides that our Audit Committee must pre-approve all audit services and permissible non-audit services provided by our independent auditors, except for any de minimis non-audit services. Non-audit services are considered de minimis if (i) the aggregate amount of all such non-audit services constitutes less than 5% of the total amount of revenues we paid to our independent auditors during the fiscal year in which they are provided; (ii) we did not recognize such services at the time of the engagement to be non-audit services; and (iii) such services are promptly brought to our Audit Committee’s attention and approved prior to the completion of the audit by our Audit Committee or any of its member(s) who has authority to give such approval. None of the fees reflected above were approved by our Audit Committee pursuant to this de minimis exception. Our Audit Committee may delegate to one or more of its members who is an independent director the authority to grant pre-approvals. All fees for services performed during 2005 were approved by the Audit Committee.

15

Back to Contents

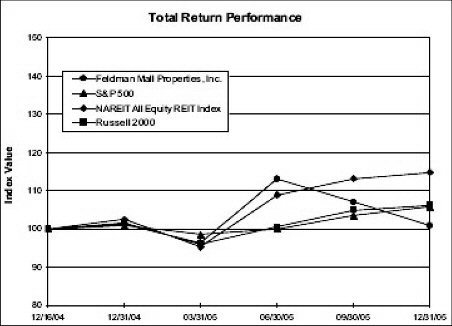

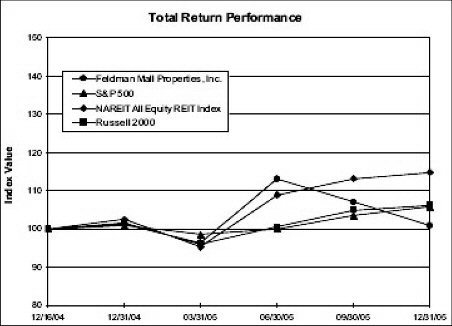

PERFORMANCE GRAPH

The graph below compares the cumulative total stockholder return assuming the investment of $100 on December 16, 2004 (and the reinvestment of dividends thereafter) in each of Feldman Mall Properties’ common stock, the S&P 500 Stock Index and the NAREIT All Equity REIT Index. The comparisons in the graph below are not intended to forecast the possible future performance of our stock.

| | | Period Ending

| |

Index | | 12/16/04 | | 12/31/04 | | 03/31/05 | | 06/30/05 | | 09/30/05 | | 12/31/05 | |

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| Feldman Mall Properties, Inc. | | | 100.00 | | | 101.25 | | | 96.32 | | | 112.88 | | | 107.03 | | | 100.79 | |

| S&P 500 | | | 100.00 | | | 100.78 | | | 98.62 | | | 99.97 | | | 103.57 | | | 105.73 | |

| Russell 2000 | | | 100.00 | | | 101.55 | | | 96.13 | | | 100.28 | | | 104.98 | | | 106.17 | |

| NAREIT All Equity REIT Index | | | 100.00 | | | 102.35 | | | 95.14 | | | 108.88 | | | 113.06 | | | 114.80 | |

| | | | | | | | | | | | | | | | | | | | |

Source: SNL Financial LC, Charlottesville, VA |

16

Back to Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information available to us as of April 17, 2006 with respect to any common stock of the Company or operating partnership units of Feldman Equities Operating Partnership LP owned by our continuing directors and executive officers, and any individual or group of stockholders known to be the beneficial owner of more than 5% of the issued and outstanding common stock. This table reflects options that are exercisable within 60 days of the date of this proxy statement. There are no other of our directors, nominees for director or executive officers who beneficially own common stock.

Name and Address of Beneficial Owner(1) | | Common Stock

Beneficially Owned | | % of Basic

Common Stock

Outstanding | | Operating

Partnership Units

Owned | | % of Common Stock

If All OP Units

Converted to Stock | |

| |

|

| |

|

| |

|

| |

|

| |

Larry Feldman(2) | | | 169,381 | | | 1.3 | % | | 966,456 | (13) | | 7.7 | % |

James C. Bourg (3) | | | 9,615 | | | * | | | 233,504 | | | 1.7 | % |

Wayne Snyder(2) | | | 50,000 | (11) | | * | | | 0 | | | * | |

Thomas Wirth(2) | | | 86,538 | (12) | | * | | | 0 | | | * | |

Jeffrey Erhart(3) | | | 5,000 | (14) | | * | | | 160,000 | (13) | | 1.1 | % |

Lloyd Miller(2) | | | 77,500 | (15) | | * | | | 0 | | | * | |

Lawrence S. Kaplan(4) | | | 2,000 | | | * | | | 0 | | | * | |

Bruce E. Moore(5) | | | 2,000 | | | * | | | 0 | | | * | |

Paul H. McDowell(6) | | | 3,000 | | | * | | | 0 | | | * | |

Teachers Insurance and Annuity Association of America(7) | | | 1,950,000 | | | 14.9 | % | | 0 | | | 13.3 | % |

Deutsche Bank AG(8) | | | 1,495,700 | | | 11.4 | % | | 0 | | | 10.2 | % |

Inland American Real Estate Trust, Inc.(16) | | | 1,145,300 | | | 8.7 | % | | 0 | | | 7.8 | % |

Morgan Stanley Capital Services, Inc.(17) | | | 769,800 | | | 5.9 | % | | 0 | | | 5.2 | % |

Mercury Real Estate Advisors LLC(18) | | | 1,225,700 | | | 9.4 | % | | 0 | | | 8.3 | % |

Third Avenue Management LLC(19) | | | 938,000 | | | 7.2 | % | | 0 | | | 6.4 | % |

All executive officers, directors

and nominees for director as a group(9) | | | 405,034 | | | 3.1 | % | | 1,873,536 | | | 12.0 | % |

| (1) | Except as otherwise indicated and subject to applicable community property laws and similar statutes, the person listed as the beneficial owner of shares has sole voting power and dispositive power with respect to the shares. |

| (2) | c/o Feldman Mall Properties, Inc., 1010 Northern Avenue, Suite 314, Great Neck, NY 11021. |

| (3) | c/o Feldman Mall Properties, Inc., 3225 North Central Avenue, Suite 1205, Phoenix, Arizona 85012. |

| (4) | 1561 Dolington Rd., Yardley, PA 19067 |

| (5) | c/o Brandywine Financial Services Corp., 2 Pond’s Edge Drive - POB 500, Chadds Ford, PA 19397. |

| (6) | c/o Capital Lease Funding, Inc., 110 Maiden Lane, New York, NY 10005. |

| (7) | This information was obtained from Schedule 13G filed with the SEC on December 17, 2004. This stockholder’s address is 730 Third Avenue, New York, New York 10017. |

| (8) | This information was obtained from Schedule 13G filed with the SEC on February 7, 2006. This stockholder’s address is Taunusanlage 12, D-60325, Frankfurt am Main, Federal Republic of Germany. |

| (9) | This group is composed of the five directors (Larry Feldman, James Bourg, Lawrence Kaplan, Bruce Moore and Paul McDowell) and the four executive officers who are not directors (Thomas Wirth, Lloyd Miller, Wayne Snyder and Jeffrey Erhart). |

| (10) | Includes operating partnership units of Feldman Equities Operating Partnership LP issued to Feldman Partners, LLC, an Arizona limited liability company (“Feldman Partners”), excluding that portion of such units attributable to Jeffrey Erhart’s ownership of a profits interest in Feldman Partners equivalent to 18,461 units in Feldman Equities Operating Partnership LP. Feldman Partners is controlled by Larry |

17

Back to Contents

| | Feldman and, excluding the ownership interest of Jeffrey Erhart, is owned by Larry Feldman and his brother, sisters, children, nieces and nephews. |

| (11) | All of Mr. Snyder’s shares are restricted stock that will vest over five years, commencing from November 2005. |

| (12) | Includes 76,923 shares of restricted stock that will vest over five years, with the first vesting occurring January 1, 2006. |

| (13) | Jeffrey Erhart also holds a profits interest in Feldman Partners that may, depending on future profits of Feldman Partners, result in Jeffrey Erhart receiving 18,461 additional operating partnership units in Feldman Equities Operating Partnership, LP from Larry Feldman’s membership interest in Feldman Partners. That profits interest is not reflected in the above table. |

| (14) | Includes 3,077 shares of restricted stock that will vest on January 1, 2007. |

| (15) | All of Mr. Miller’s shares are restricted stock that will vest over five years, commencing from December 2005. |

| (16) | This information was obtained from Schedule 13D filed with the SEC on March 31, 2006. The stockholder’s address is 2901 Butterfield Road, Oak Brook, Illinois 60523. |

| (17) | This information was obtained from Schedule 13G filed with the SEC on February 15, 2006. The stockholder’s address is 1585 Broadway, New York, New York 10036 |

| (18) | This information was obtained from Schedule 13G filed with the SEC on February 14, 2006. The stockholder’s address is 100 Field Point Road, Greenwich, Connecticut 06830. |

| (19) | This information was obtained from Schedule 13G filed with the SEC on February 14, 2006. The stockholder’s address is 622 Third Avenue, 32nd Floor, New York, New York, 10017. |

| |

Certain Relationships and Related Transactions |

| |

When Are Stockholder Proposals Due for the 2007 Annual Meeting? |

Under SEC rules, proposals from our eligible stockholders for presentation for action at the 2007 annual meeting of stockholders must be received by us no later than December 26, 2006, in order to be considered for inclusion in the Proxy Statement and Proxy for the 2007 annual meeting. Any such proposals, as well as any questions relating thereto, should be directed to the Secretary of the Company at the Company’s principal executive offices. Proposals we receive after December 26, 2006 will not be included in the Proxy Statement or acted upon at the 2007 annual meeting.

Under our Bylaws, and as SEC rules permit, stockholders must follow certain procedures to nominate a person for election as a director at an annual or special meeting, or to introduce an item of business at an annual meeting. A stockholder must notify the Secretary of the Company in writing of the director nominee or the other business. The notice must include the required information and be delivered to the Secretary at the principal executive offices of the Company not earlier than the 150th day and not later than 5:00 p.m., Eastern Standard Time, on the 120th day prior to the first anniversary of the date of mailing of the notice for the preceding year’s annual meeting.

If the date of the Annual Meeting is advanced or delayed by more than 30 days from the first anniversary of the date of the preceding year’s annual meeting, notice by the stockholder must be delivered as described above not earlier than the 150th day prior to the date of mailing of the notice for such annual meeting and not later than 5:00 p.m., Eastern Standard time, on the later of the 120th day prior to the date of such annual meeting or the 10th day following the day on which disclosure of the date of such meeting is first made. The public announcement of a postponement or adjournment of an annual meeting does not change or create a new opportunity for notice as described above.

18

Back to Contents

The stockholder’s notice shall set forth the following, as applicable:

(1) as to each individual whom the stockholder proposes to nominate for election or reelection as a director, (a) the name, age, business address and residence address of such individual, (b) the class, series and number of any shares of our stock that are beneficially owned by such individual, (c) the date such shares were acquired and the investment intent of such acquisition, and (d) all other information relating to such individual that is required to be disclosed in solicitations of proxies for election of directors in an election contest (even if an election contest is not involved), or is otherwise required, in each case pursuant to Regulation 14A and Schedule 14A (or any successor provision) under the Securities Exchange Act of 1934 and the rules thereunder (including such individual’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected);

(2) as to any other business that the stockholder proposes to bring before the meeting, a description of such business, the reasons for proposing such business at the meeting and any material interest in such business of such stockholder and any Stockholder Associated Person (as defined below) individually or in the aggregate, (including any anticipated benefit to the stockholder and the Stockholder Associated Person therefrom);

(3) as to the stockholder giving the notice and any Stockholder Associated Person, the class, series and number of all shares of stock of the Corporation which are owned by such stockholder and by such Stockholder Associated Person, if any, and the nominee holder for, and number of, shares owned beneficially but not of record by such stockholder and by any such Stockholder Associated Person;

(4) as to the stockholder giving the notice and any Stockholder Associated Person covered by clauses (2) or (3) above, the name and address of such stockholder, as they appear on the Company’s stock ledger and current name and address, if different, and of such Stockholder Associated Person; and

(5) to the extent known by the stockholder giving the notice, the name and address of any other stockholder supporting the nominee for election or reelection as a director or the proposal of other business on the date of such stockholder’s notice.

“Stockholder Associated Person” of any stockholder means (1) any person controlling, directly or indirectly, or acting in concert with, such stockholder, (2) any beneficial owner of shares of stock of the Company owned of record or beneficially by such stockholder and (3) any person controlling, controlled by or under common control with such Stockholder Associated Person.

Are there any other matters coming before the 2006 Annual Meeting? |

Our management does not intend to bring any other matters before the Annual Meeting and knows of no other matters that are likely to come before the meeting. In the event any other matters properly come before the Annual Meeting, the persons named in the accompanying proxy will vote the shares represented by such proxy in accordance with their best judgment on such matters.

We urge you to submit your vote on the accompanying proxy card by completing, signing, dating and returning it in the accompanying postage-paid return envelope at your earliest convenience, whether or not you presently plan to attend the meeting in person.

By Order of the Board of Directors

Jeffrey Erhart

Secretary

Great Neck, New York

May 4, 2006

19